As filed with the Securities and Exchange Commission on July 27, 2021

Registration No. 333-256142

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 3

to

FORM S-1

REGISTRATION STATEMENT

Under

The Securities Act of 1933

| WORKSPORT LTD. |

| (Exact name of Registrant as specified in its charter) |

| Nevada | 3714 | 65-0782227 | ||

(State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

414-3120 Rutherford Rd.

Vaughan, Ontario, Canada L4K 0B1

(888) 554-8789

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

American Corporate Enterprises, Inc.

123 West Nye Ln, Ste 129

Carson City, NV 89706

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Please send copies of all communications to:

Ross Carmel, Esq. Philip Magri, Esq. Carmel, Milazzo & Feil LLP 55 W 39th Street, 18th Floor New York, NY 10018 Tel: 212-658-0458 Fax: 646-838-1314 |

Joseph Lucosky, Esq. Steven A. Lipstein, Esq. Lucosky Brookman LLP 101 Wood Avenue South Woodbridge, NJ 08830 Tel: 732-395-4400 Fax: 732-395-4401 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. [X]

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

| Large accelerated filer | [ ] | Accelerated filer | [ ] |

| Non-accelerated filer | [X] | Smaller reporting company | [X] |

| Emerging growth company | [ ] |

If an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. [ ]

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered (1) | Proposed Maximum Aggregate Offering Price | Amount of Registration Fee | ||||||

| Units consisting of shares of Common Stock, par value $0.0001 per share, and Warrants to purchase shares of Common Stock, par value $0.0001 per share (2) | $ | 17,250,000 | $ | 1,882 | ||||

| Common Stock included as part of the Units (3) | $ | - | - | |||||

| Warrants to purchase shares of Common Stock included as part of the Units (3)(4) | $ | - | - | |||||

| Shares of Common Stock issuable upon exercise of the Warrants (5) | $ | 18,975,000 | $ | 2,071 | ||||

| Representative’s Warrants (6) | - | - | ||||||

| Shares of Common Stock issuable upon exercise of the Representative’s Warrants (7) | $ | 660,000 | $ | 72 | ||||

| Total | $ | 36,885,000 | $ | 4,025 | (8) | |||

| (1) | In the event of a stock split, stock dividend, or similar transaction involving our Common Stock, the number of shares registered shall automatically be increased to cover the additional shares of Common Stock issuable pursuant to Rule 416 under the Securities Act. |

| (2) | Includes Common Stock and/or Warrants that may be issued upon exercise of a 45-day option granted to the underwriters to cover over-allotments, if any. |

| (3) | In accordance with Rule 457(i) under the Securities Act, because the shares of the Registrant’s Common Stock underlying the Warrants are registered hereby, no separate registration fee is required with respect to the Warrants registered hereby. |

| (4) | There will be issued Warrants to purchase one share of Common Stock for every one share of Common Stock offered. The Warrants are exercisable at a per share price equal to 110% of the Common Stock public offering price. |

| (5) | Includes shares of Common Stock which may be issued upon exercise of additional Warrants which may be issued upon exercise of 45-day option granted to the underwriters to cover over-allotments, if any. |

| (6) | No additional registration fee is payable pursuant to Rule 457(g) under the Securities Act. |

| (7) | The Representative’s Warrants are exercisable into a number of shares of Common Stock equal to 4% of the number of shares of Common Stock underlying the Units sold in this offering, excluding shares issuable upon the exercise the underwriters’ option to purchase additional securities, at an exercise price equal to 110% of the public offering price per share. |

| (8) | Previously paid. |

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and the Company is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION JULY , 2021 |

1,500,000 Units

Each Unit Consisting of

One Share of Common Stock and

One Warrant to Purchase One Share of Common Stock

WORKSPORT LTD.

This is a firm commitment underwritten public offering of 1,500,000 units (the “Units”), based on an assumed public offering price of $10.00 per Unit, of Worksport Ltd., a Nevada corporation (the “Company,” “we,” “us,” “our”). Each Unit consists of one share of common stock, $0.0001 par value per share (“Common Stock”), and one warrant (each, a “Warrant” and collectively, the “Warrants”) to purchase one share of Common Stock at an assumed exercise price of $11.00 per share (constituting 110% of the assumed $10.00 per Unit offering price). The Units have no stand-alone rights and will not be certificated or issued as stand-alone securities. The shares of Common Stock and the Warrants underlying the Units are immediately separable and will be issued separately in this offering. Each Warrant offered hereby is immediately exercisable on the date of issuance and will expire three years from the date of issuance.

We are a fully reporting company under Section 12(g) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Our Common Stock is currently quoted on the OTCQB Marketplace (the “OTCQB”) under the symbol “WKSP.” As of July 26, 2021, the reported closing price for our Common Stock as quoted on the OTCQB was approximately $0.42 per share ($8.40 per share, assuming a reverse stock split of 1-for-20). There is currently no public market for the offered Warrants. We have applied to list our Common Stock and Warrants on the Nasdaq Capital Market under the symbol “WKSP,” and “WKSPW,” respectively. There can be no assurance that we will be successful in listing our Common Stock or Warrants on the Nasdaq Capital Market. Prices of our Common Stock as reported on the OTCQB may not be indicative of the prices of our Common Stock if our Common Stock were traded on the Nasdaq Capital Market.

The offering price of the Units will be determined by us and Maxim Group LLC (“Maxim”), the representative (“Representative”) of the underwriters in connection with this offering, taking into consideration several factors as described between the underwriters and us at the time of pricing, considering our historical performance and capital structure, prevailing market conditions, and overall assessment of our business, and will not be based upon the price of our Common Stock on the OTCQB. Therefore, the assumed public offering price used throughout this prospectus may not be indicative of the actual public offering price for our Common Stock and the Warrants.

Unless otherwise noted and other than in our financial statements and the notes thereto, the share and per share information in this prospectus reflects a proposed 1-for-20 reverse stock split of our outstanding Common Stock and treasury stock to occur concurrently with the effective date of the registration statement of which this prospectus is a party and prior to the closing of this offering.

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 7 of this prospectus. You should carefully consider these risk factors, as well as the information contained in this prospectus, before you invest.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| Per Unit | Total | |||||||

| Offering price | $ | $ | ||||||

| Underwriting discount and commissions (1) | $ | $ | ||||||

| Proceeds to us before offering expenses (2) | $ | $ |

| (1) | We have also agreed to issue Warrants to purchase shares of our Common Stock to the underwriters and to reimburse the underwriters for certain expenses. See “Underwriting” on page 57 for additional information regarding total underwriter compensation. |

| (2) | The amount of offering proceeds to us presented in this table does not give effect to any exercise of the: (i) Underwriters’ Over-Allotment Option) we have granted to the underwriters as described below and (ii)the Representative’s Warrants being issued to the underwriters in this offering. |

We have granted a 45-day option to the underwriters, exercisable one or more times in whole or in part, to purchase up to an additional 225,000 shares of Common Stock and/or 225,000 Warrants at a price from us in any combination thereof at the public offering price per share of Common Stock and per Warrant, respectively, less, in each case, the underwriting discounts payable by us, in any combination solely to cover over-allotments, if any (the “Underwriters’ Over-Allotment Option”).

The underwriters expect to deliver the securities against payment to the investors in this offering on or about ______, 2021.

| Sole Book-Running Manager |

| Maxim Group LLC |

The date of this prospectus is , 2021.

TABLE OF CONTENTS

You should rely only on information contained in this prospectus. We have not, and the underwriters have not, authorized anyone to provide you with additional information or information different from that contained in this prospectus. Neither the delivery of this prospectus nor the sale of our securities means that the information contained in this prospectus is correct after the date of this prospectus. This prospectus is not an offer to sell or the solicitation of an offer to buy our securities in any circumstances under which the offer or solicitation is unlawful or in any state or other jurisdiction where the offer is not permitted.

For investors outside the United States: Neither we nor the underwriters have taken any action that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the securities covered hereby and the distribution of this prospectus outside of the United States.

The information in this prospectus is accurate only as of the date on the front cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since those dates.

No person is authorized in connection with this prospectus to give any information or to make any representations about us, the securities offered hereby or any matter discussed in this prospectus, other than the information and representations contained in this prospectus. If any other information or representation is given or made, such information or representation may not be relied upon as having been authorized by us.

Neither we nor the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than the United States. You are required to inform yourself about, and to observe any restrictions relating to, this offering and the distribution of this prospectus.

| i |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements discuss matters that are not historical facts. Because they discuss future events or conditions, forward-looking statements may include words such as “anticipate,” “believe,” “estimate,” “intend,” “could,” “should,” “would,” “may,” “seek,” “plan,” “might,” “will,” “expect,” “anticipate,” “predict,” “project,” “forecast,” “potential,” “continue” negatives thereof or similar expressions. Forward-looking statements speak only as of the date they are made, are based on various underlying assumptions and current expectations about the future and are not guarantees of future performance. Such statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, level of activity, performance or achievement to be materially different from the results of operations or plans expressed or implied by such forward-looking statements. You are cautioned to not place undue reliance on these forward-looking statements, which speak only as of their dates.

We cannot predict all the risks and uncertainties that may impact our business, financial condition or results of operations. Accordingly, the forward-looking statements in this prospectus should not be regarded as representations that the results or conditions described in such statements will occur or that our objectives and plans will be achieved, and we do not assume any responsibility for the accuracy or completeness of any of these forward-looking statements. These forward-looking statements are found at various places throughout this prospectus and include information concerning possible or projected future results of our operations, including statements about potential acquisition or merger targets, strategies or plans; business strategies; prospects; future cash flows; financing plans; plans and objectives of management; any other statements regarding future acquisitions, future cash needs, future operations, business plans and future financial results; and any other statements that are not historical facts.

These forward-looking statements represent our intentions, plans, expectations, assumptions and beliefs about future events and are subject to a variety of factors and risks, including, but not limited to, those set forth under “Risk Factors” starting page 7 of this prospectus.

Many of those risks and factors are outside of our control and could cause actual results to differ materially from the results expressed or implied by those forward-looking statements. Considering these risks, uncertainties and assumptions, the events described in the forward-looking statements might not occur or might occur to a different extent or at a different time than we have described. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this prospectus. All subsequent written and oral forward-looking statements concerning other matters addressed in this prospectus and attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this prospectus.

Except to the extent required by law, we undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, a change in events, conditions, circumstances or assumptions underlying such statements, or otherwise.

All references to “Worksport,” “WKSP,” or “the Company” as used herein refers to the consolidated operations of the Company and its wholly-owned subsidiary, Worksport Ontario.

We express all amounts in this prospectus in U.S. dollars, except where otherwise indicated. References to “$” and “US$” are to U.S. dollars and references to “CAD$” are to Canadian dollars.

CAUTIONARY NOTE REGARDING INDUSTRY DATA

Unless otherwise indicated, information contained in this prospectus concerning our Company, our business, the services we provide and intend to provide, our industry and our general expectations concerning our industry are based on management estimates. Such estimates are derived from publicly available information released by third party sources, as well as data from our internal research, and reflect assumptions made by us based on such data and our knowledge of the industry, which we believe to be reasonable.

| ii |

This summary highlights certain information appearing elsewhere in this prospectus. Because this is only a summary, it does not contain all of the information you should consider before investing in our securities and it is qualified in its entirety by, and should be read in conjunction with, the more detailed information included elsewhere in this prospectus. Before you make an investment decision, you should read this entire prospectus carefully, including the risks of investing in our securities discussed under the section of this prospectus entitled “Risk Factors” and similar headings. You should also carefully read our financial statements, and the exhibits to the registration statement of which this prospectus is a part.

Overview

The Company designs and distributes pickup truck covers called tonneau covers throughout the United States and Canada. Tonneau covers, described below are useful aftermarket accessories that provide security and protection for cargo to personal pickup truck owners.

The Company, Franchise Holdings International, Inc. (“FNHI”), was incorporated in the state of Nevada on April 2, 2003.

Worksport Ltd. was formed in 2011 in Ontario, Canada (“Worksport Ontario”).

In December 2014, FNHI acquired 100% of the outstanding equity of Worksport Ontario pursuant to which Worksport Ontario became a wholly-owned subsidiary of FNHI. Since acquiring Worksport Ontario, the Company has abandoned all previous business plans and has focused on developing the tonneau business.

In May 2020, FNHI changed its name to Worksport Ltd.

Products

We have developed soft vinyl tonneau covers and hard aluminum tonneau covers. Covers are offered in three or four-panel options. Once installed, our tonneau covers latch against the bed of the truck and fold up against the back window of the truck cab.

Our current products include the SC (Soft Cover) SC3 (Tri-panel), SC3pro (Tri-panel with cable latching system) and TC (Tough Cover) TC3 lines.

We are currently developing the SC4 (Soft Cover, Four-Panel), TC4 (Hard Cover, Four-Panel with cable latching system) and the TerraVis System.

TerraVis is being developed as a two-component system that consists of a solar tonneau cover and portable core battery, chargeable by the solar cover.

All of our products are manufactured in China according to our specifications, schematics and blueprints.

Intellectual Property

The Company currently holds a collection of intellectual property rights relating to certain aspects of its parts and accessories, and services. This includes patents, trademarks, service marks, and trade secrets in the U.S. and various foreign countries.

The Market and Competition

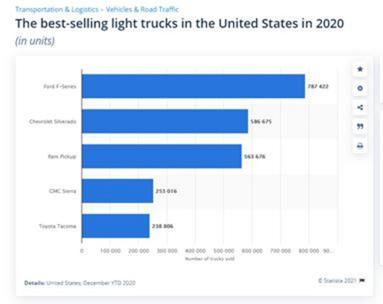

Our revenue is directly proportional to sales of pickup trucks. We distribute our tonneau covers through wholesalers and online retail channels in Canada and the United States. We will also provide our tonneau covers for private labels and Original Equipment Manufacturers.

| 1 |

Our largest competitor is Truck Hero which has acquired upwards of 13 independent tonneau cover brands in North America. Truck Hero’s products directly compete with our products.

Business Strategy

Our business plan moving forward is to sell our products to the 60,000 existing auto parts retailers throughout the United States. Our products are currently being distributed to 17,000 of these stores. We also plan to eventually expand to other markets outside the United States and Canada.

Listing on the Nasdaq Capital Market

Our Common Stock is currently quoted on the OTC Market’s OTCQB under the symbol “WKSP.” In connection with this offering, we have applied to list our Common Stock and the Warrants on the Nasdaq Capital Market (“Nasdaq”) under the symbols “WKSP” and “WKSPW,” respectively. If Nasdaq approves our listing application, we expect to list our Common Stock and Warrants upon consummation of the offering, at which point our Common Stock will cease to be traded on the OTCQB. Nasdaq’s listing requirements for the Nasdaq Capital Market include, among other things, a stock price threshold. As a result, prior to effectiveness of our registration statement of which this prospectus is a part, we will need to take the necessary steps to meet Nasdaq’s listing requirements, including, but not limited to effectuating a reverse split of our Common Stock (as further discussed below). If Nasdaq does not approve the listing of our Common Stock and the Warrants, we will not proceed with this offering. There can be no assurance that our Common Stock or Warrants will be listed on Nasdaq.

Reverse Stock Split

We intend to effect a 1-for-20 reverse stock split of our outstanding Common Stock concurrently with the effectiveness of the registration statement, of which this prospectus is a part, and prior to the closing of this offering. No fractional shares will be issued in connection with the reverse stock split and all such fractional shares resulting from the reverse stock split will be rounded up to the nearest whole number. The shares issuable upon the exercise of our outstanding warrants and the exercise prices of such warrants will be adjusted to reflect the reverse stock split. Unless otherwise noted, the share and per share information in this prospectus reflects, other than in our financial statements and the notes thereto, the intended 1-for-20 reverse stock split. There will be no effect on the number of shares of Common Stock or preferred stock authorized for issuance under our articles of incorporation or the par value of such securities.

Principal Risks

We are subject to various risks discussed in detail under “Risk Factors” starting on page 7 of this prospectus and which include risks related to the following:

| ● | our going concern and history of losses; | |

| ● | the ongoing COVID-19 pandemic; | |

| ● | our ability to compete; | |

| ● | our reliance on a small number of customers for the majority of our sales; | |

| ● | our ability to successfully protect our intellectual property rights, and claims of infringement by others; | |

| ● | the effectiveness of our sales and marketing efforts; | |

| ● | our ability to retain key management personnel; | |

| ● | failure to remedy material weaknesses in internal accounting controls and failure to implement proper and effective internal controls; | |

| ● | our need to raise additional capital; | |

| ● | cybersecurity threats and incidents; | |

| ● | the dilution of our shares as a result of the issuance of additional shares in connection with financing arrangements; | |

| ● | the volatility of our stock price; | |

| ● | the decline in the price of our stock due to offers or sales of substantial number of shares; | |

| ● | limited trading volume and price fluctuations of our stock; | |

| ● | the immediate and substantial dilution of the net tangible book value of our Common Stock; | |

| ● | the speculative nature of Warrants; | |

| ● | provisions in the Warrants may discourage a third party from acquiring us; and | |

| ● | our ability to meet the initial or continuing listing requirements of the Nasdaq Capital Market. |

Corporate Information

Our executive offices are located at 414-3120 Rutherford Rd., Vaughan, Ontario, Canada L4K 0B1. Our main telephone number is (888) 554-8789. Our main website is www.worksport.com, the contents of which are not incorporated by reference into this prospectus.

| 2 |

| Issuer: | Worksport Ltd., a Nevada corporation | |

| Offered Securities (1): | 1,500,000 Units, each Unit consisting of one share of our Common Stock and one Warrant to purchase one share of our Common Stock from the date of issuance until the third anniversary of such date for an assumed $11.00 per share (110% of the assumed $10.00 public offering price of one Unit). The Units will not be certificated or issued in stand-alone form. The shares of our Common Stock and the Warrants underlying the Units are immediately separable upon issuance and will be issued separately in this offering. | |

| Offering Price per Unit (1): | $10.00 per Unit, based on $8.40, the closing price of our Common Stock on the OTCQB on July 26, 2021 (assuming a 1-for-20 reverse stock split of our outstanding Common Stock). | |

| Over-Allotment Option: | We have granted a 45-day option to the underwriters to purchase up to 225,000 additional shares of Common Stock and/or 225,000 additional Warrants at the public offering price per share of Common Stock and per Warrant, respectively, less, in each case, the underwriting discounts payable by us, in any combination solely to cover over-allotments, if any. | |

| Description of the Warrants: | Each Warrant is exercisable for one share of Common Stock for an assumed $11.00 per share (110% of the assumed $10.00 public offering price of one Unit) subject to adjustment in the event of stock dividends, stock splits, stock combinations, reclassifications, reorganizations or similar events affecting our Common Stock as described herein. A holder may not exercise any portion of a Warrant to the extent that the holder, together with its affiliates and any other person or entity acting as a group, would beneficially own more than 4.99% of our outstanding Common Stock after exercise, as such percentage ownership is determined in accordance with the terms of the Warrants, except that upon notice from the holder to us, the holder may waive such limitation up to a percentage, not in excess of 9.99%. Each Warrant will be exercisable immediately upon issuance and will expire three (3) years after the initial issuance date. The terms of the Warrants will be governed by a Warrant Agent Agreement, dated as of the effective date of this offering, between us and EQ Shareowner Services, as the warrant agent (the “Warrant Agent”). This prospectus also relates to the offering of the shares of Common Stock issuable upon exercise of the Warrants. For more information regarding the Warrants, you should carefully read the section titled “Description of Securities-Warrants” on page 49 of this prospectus. | |

| Shares of Common Stock Outstanding before the Offering (2): | 11,416,656 | |

| Shares of Common Stock Outstanding after the Offering (2)(3): | 12,916,656 | |

| Use of Proceeds: | We estimate that we will receive net proceeds of approximately $13,375,000 from our sale of Units in this offering, after deducting underwriting discounts and estimated offering expenses payable by us. We intend to use the net proceeds of this offering to provide funding for the following purposes: production, marketing and sales and working capital. See “Use of Proceeds.” |

| 3 |

| Representative’s Warrants: | The registration statement on Form S-1, of which this prospectus is a part, also registers 60,000 shares of Common Stock issuable upon the exercise of warrants issued to the Representative for an assumed $11.00 per share (110% of the assumed $10.00 offering price per Unit) as a portion of the underwriting compensation in connection with this offering (the “Representative’s Warrants”). The Representative’s Warrants will be exercisable at any time, and from time to time, in whole or in part, during the period commencing 180 days following the commencement of sales of the offering and expiring three years following the commencement of such sales. Please see “Underwriting-Representative’s Warrants.” | |

| Underwriters’ Compensation: | In connection with this offering, the underwriters will receive an underwriting discount equal to seven percent (7%) of the gross proceeds from the sale of Units in the offering. We will also reimburse the underwriters for certain out-of-pocket actual expenses related to the offering and the Representative shall be entitled to a non-accountable expense allowance equal to one percent (1%) of the gross proceeds. See “Underwriting.” | |

| Trading Symbols and Listing Application: | Our Common Stock is currently quoted on the OTCQB under the symbol “WKSP.” We have applied to have our Common Stock and the Warrants underlying the Units listed on the Nasdaq Capital Market under the symbols “WKSP” and “WKSPW,” respectively. No assurance can be given that such listings will be approved or that a trading market will develop for our Common Stock and the Warrants. | |

| Lock-Up Agreements: | We and our directors, officers and certain stockholders have agreed with the Representative not to offer for sale, issue, sell, contract to sell, pledge or otherwise dispose of any Common Stock or securities convertible into Common Stock for a period of 180 days from the closing date. See “Underwriting-Lock-Up Agreements.” | |

| Dividends: | We have never declared or paid cash dividends on our Common Stock. We currently intend to retain all available funds and any future earnings for use in the operation of our business and do not anticipate paying any non-compulsory dividends on our preferred stock or common stock in the foreseeable future, if at all. Any future determination to declare dividends will be made at the discretion of our Board of Directors and will depend on our financial condition, results of operations, capital requirements, general business conditions and other factors that our Board of Directors may deem relevant. See “Dividend Policy.” | |

| Risk Factors: | Investing in our securities involves a high degree of risk and purchasers of our securities may lose their entire investment. See “Risk Factors” starting on page 7 and the other information included and incorporated by reference into this prospectus for a discussion of risk factors you should carefully consider before deciding to invest in our securities. |

| (1) | The actual number of Units we will offer and the actual price per Unit will be determined based on the actual public offering. |

| (2) | Does not include: |

| ● | 397,228 shares of Common Stock underlying warrants issued pursuant to our offering statement on Form 1-A (File No: 024-11271) and exercisable for $4.00 per share, subject to adjustment; and | |

| ● | 4,081,980 shares of Common Stock underlying outstanding warrants issued in one or more private placements under Section 4(a)(2)/Rule 506(b) of Regulation D of the Securities Act of 1933, as amended, and exercisable for $4.00 per share, subject to adjustment. |

| (3) | Does not include: | |

| ● | 1,500,000 shares of Common Stock issuable upon the exercise of the Warrants underlying the Units sold in this offering; | |

| ● | 225,000 shares of Common Stock issuable upon the exercise of the Underwriters’ Over-Allotment Option; | |

| ● | 225,000 shares of Common Stock issuable upon the exercise of 225,000 Warrants issuable upon the exercise of the Underwriters’ Over-Allotment Option; and | |

| ● | 60,000 shares of Common Stock issuable upon exercise of the Representative’s Warrants. | |

| 4 |

Except as otherwise indicated, all information in this prospectus assumes that:

| ● | None of the Warrants underlying the Units in this offering have been exercised; | |

| ● | No shares have been issued pursuant to any outstanding warrants; | |

| ● | No shares of Common Stock or Warrants have been issued pursuant to the Underwriters’ Over-Allotment Option; | |

| ● | No shares of Common Stock have been issued pursuant to the Representative’s Warrants; and | |

| ● | No awards have been issued pursuant to the Company’s 2015 Equity Incentive Plan or 2021 Equity Incentive Plan. |

The following tables summarize our financial data. We derived the summary financial statement data for the three months ended March 31, 2021 and 2020 and the years ended December 31, 2020 and 2019 set forth below from our audited financial statements and related notes contained in this prospectus. Our historical results are not necessarily indicative of the results that may be expected in the future. You should read the information presented below together with “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” our financial statements, the notes to those statements and the other financial information contained in this prospectus.

Summary of Operations in U.S. Dollars

Three Months Ended March 31, (Unaudited) | Year Ended December 31, | |||||||||||||||||||

| 2021 | 2020 | 2020 | 2019 | |||||||||||||||||

| Net Sales | $ | 7,650 | $ | 41,027 | $ | 346,144 | $ | 1,926,405 | ||||||||||||

| OPERATING EXPENSES | ||||||||||||||||||||

| General and administrative | 134,284 | 33,906 | 201,929 | 238,841 | ||||||||||||||||

| Sales and marketing | 162,651 | 2,826 | 148,008 | 50,159 | ||||||||||||||||

| Professional fees | 647,114 | 109,465 | 679,654 | 515,279 | ||||||||||||||||

| Loss (gain) on foreign exchange | 5,206 | (7,726 | ) | 3,796 | (27,881 | ) | ||||||||||||||

| Operating loss | (1,001,826 | ) | (124,455 | ) | (986,239 | ) | (537,851 | ) | ||||||||||||

| OTHER INCOME | (221,693 | ) | (27,811 | ) | (201,381 | ) | 178,817 | |||||||||||||

| NET LOSS | (1,223,519 | ) | (152,266 | ) | (1,187,620 | ) | (359,034 | ) | ||||||||||||

| Loss per common share (basic and diluted) | $ | (0.01 | ) | $ | (0.00 | ) | $ | (0.02 | ) | $ | (0.01 | ) | ||||||||

| 5 |

Balance Sheet in U.S. Dollars

| (unaudited) | ||||||||

| As of March 31, 2021 | As of December 31, 2020 | |||||||

| Actual | Actual | |||||||

| Cash | $ | 9,311,878 | $ | 1,107,812 | ||||

| Total Current Assets | 9,811,800 | 1,684,764 | ||||||

| Total Assets | 10,209,894 | 1,902,152 | ||||||

| Total Current Liabilities | 1,373,616 | 1,718,053 | ||||||

| Total Liabilities | 1,381,888 | 1,732,677 | ||||||

| Working Capital (Deficit) | 8,438,184 | (33,289 | ) | |||||

| Additional paid-in capital | 22,539,306 | 12,658,596 | ||||||

| Accumulated Deficit | (14,089,552 | ) | (12,866,033 | ) | ||||

| Total Stockholders’ Equity (Deficit) | $ | 8,828,006 | $ | 169,475 | ||||

| 6 |

Any investment in our securities involves a high degree of risk. You should consider carefully the risks and uncertainties described below and all information contained in this prospectus, before you decide whether to purchase our securities. If any of the following risks or uncertainties actually occurs, our business, financial condition, results of operations and prospects would likely suffer, possibly materially. In addition, the trading price of our securities could decline due to any of these risks or uncertainties, and you may lose part or all of your investment.

Risks Related to Our Business:

Our business, results of operations and financial condition may be adversely impacted by the recent COVID-19 pandemic.

The novel strain of the coronavirus (COVID-19) has spread globally and has resulted in authorities imposing, and businesses and individuals implementing, numerous unprecedented measures to try to contain the virus, such as travel bans and restrictions, quarantines, shelter-in-place/stay-at-home and social distancing orders, and shutdowns. Due to the impact of COVID-19 around the world, the Company’s sales decreased significantly for the first and second quarter of 2020 as governments around the world entered a lockdown to prevent the spread of COVID-19.

Increased current unemployment and loss of income, as well as any further disruptions from an uptick in new infections related to COVID-19 may materially harm out business prospects. As COVID-19 confirmed cases increase, the Company will have difficulty acquiring new customers, sales and growth. The loss of a significant customer during late 2019 had contributed to the Company’s significant decrease in sales in 2020. Due to this significant loss the Company’s sales and expenses decreased before the COVID-19 pandemic was declared.

Our future growth may be limited.

The Company’s ability to achieve its expansion objectives and to manage its growth effectively depends upon a variety of factors, including the Company’s ability to internally develop products, to attract and retain skilled employees, to successfully position and market its products, to protect its existing intellectual property, to capitalize on the potential opportunities it is pursuing with third parties, and sufficient funding. To accommodate growth and compete effectively, the Company will need working capital to maintain adequate inventory levels, develop additional procedures and controls and increase, train, motivate and manage its work force. There is no assurance that the Company’s personnel, systems, procedures and controls will be adequate to support its potential future operations. There is no assurance that the Company will generate revenues from its prospective sales partners and be able to capitalize on additional third party manufacturers.

| 7 |

We rely on third parties for our production which may hinder our ability to grow.

The Company purchases all of its inventory from one supplier source in China. The Company has no written agreement with this supplier. The Company carries significant strategic inventories of these materials to reduce the risk associated with this concentration of suppliers. Strategic inventories are managed based on demand. To date, the Company has been able to obtain adequate supplies of the materials used in the production of its products in a timely manner from existing sources. The loss of this key supplier or a delay in shipments could have an adverse effect on its business.

We rely on a small number of customers for the majority of our sales.

The following table includes the percentage of the Company’s sales to significant customers for the year ended December 31, 2020 and 2019, as well as the balance included in revenue and accounts receivable for each significant customer as at December 31, 2020 and 2019. A customer is considered to be significant if they account for greater than 10% of the Company’s annual sales.

| Customer | 2020 | 2019 | ||||||||||||||

| A | $ | 0 | - | $ | 1,912,401 | 89 | % | |||||||||

| B | 190,313 | 51 | % | 0 | - | |||||||||||

| C | 97,514 | 26 | % | 67,018 | 3 | % | ||||||||||

| Total | $ | 287,827 | 77 | % | $ | 1,979,419 | 92 | % | ||||||||

The loss of any of these key customers could have an adverse effect on the Company’s business. Fifty-one percent (51%) and twenty-six percent (26%) of our total revenue for the year ended December 31, 2020 were from sales to, respectively, Customers B and C. The loss of one or both of these customers would have a material adverse effect on the Company’s revenue.

We will need additional financing in order to grow our business.

From time to time, in order to expand operations to meet customer demand, the Company will need to incur additional capital expenditures. These capital expenditures are intended to be funded from third party sources, including the incurring of debt and/or the sale of additional equity securities. In addition to requiring additional financing to fund capital expenditures, the Company may require additional financing to fund working capital, research and development, sales and marketing, general and administrative expenditures and operating losses. The incurrence of debt creates additional financial leverage and therefore an increase in the financial risk of the Company’s operations. The sale of additional equity securities will be dilutive to the interests of current equity holders. In addition, there can be no assurance that such additional financing, whether debt or equity, will be available to the Company or that it will be available on acceptable commercial terms. Any inability to secure such additional financing on appropriate terms could have a materially adverse impact on the business, financial condition and operating results of the Company.

| 8 |

We rely on key personnel.

The Company’s success also will depend in large part on the continued service of its key operational and management personnel, including executive staff, research and development, engineering, marketing and sales staff. Most specifically, this includes Steven Rossi, the Company’s President and Chief Executive Officer, who oversees new product development (in lieu of a research and development department) as well as implementation of new products developed, key customer acquisition and retention, overall management and future growth. The Company faces intense competition from its competitors, customers and other companies throughout the industry. Any failure on the Company’s part to hire, train and retain a sufficient number of qualified professionals could impair the business of the Company.

Our CEO and Chairman, Steven Rossi, has significant control over stockholder matters and the minority stockholder will have little or no control over our affairs.

Steven Rossi currently owns 100% of our outstanding Series A Preferred Stock which entitles him to 51% of the voting power of our outstanding voting equity. Subject to any fiduciary duties owed to our other stockholders under Nevada law, Mr. Rossi is able to exercise significant influence over matters requiring stockholder approval, including the election of directors and approval of significant corporate transactions, and will have some control over our management and policies. Mr. Rossi may have interests that are different from yours. For example, Mr. Rossi may support proposals and actions with which you may disagree. The concentration of ownership could delay or prevent a change in control of our Company or otherwise discourage a potential acquirer from attempting to obtain control of our Company, which in turn could reduce the price of our stock. In addition, Mr. Rossi could use his voting influence to maintain our existing management and directors in office, delay or prevent changes in control of our Company, or support or reject other management and Board proposals that are subject to stockholder approval, such as amendments to our employee stock plans and approvals of significant financing transactions.

We depend on intellectual property rights that may be infringed upon or infringe upon the intellectual property rights of others.

The Company’s success depends to a significant degree upon its ability to develop, maintain and protect proprietary products and technologies. As of the date of this prospectus, we own five patents (including four U.S. and one in Canada) and six pending patent applications. However, patents provide only limited protection of the Company’s intellectual property. The assertion of patent protection involves complex legal and factual determinations and is therefore uncertain and potentially expensive. The Company cannot provide assurance that patents will be granted with respect to its pending patent application, that the scope of any patents it might obtain will be sufficiently broad to offer meaningful protection, or that it will develop additional proprietary products that are patentable. In fact, any patents which might issue from the Company’s pending provisional patent applications with the USPTO could be successfully challenged, invalidated or circumvented. This could result in the Company’s pending patent rights failing to create an effective competitive barrier. Losing a significant patent or failing to get a patent issued from a pending patent application the Company considers significant, could have a material adverse effect on the Company’s business.

We may not be able to protect our intellectual property rights throughout the world, which could negatively impact our business.

Filing, prosecuting and defending patents covering our current and any future product candidates and technology platforms in all countries throughout the world would be prohibitively expensive. Competitors may use our technologies in jurisdictions where we have not obtained patent protection to develop their own products and, further, may export otherwise infringing products to territories where we may obtain patent protection but where patent enforcement is not as strong as that in the United States. These products may compete with our products in jurisdictions where we do not have any issued or licensed patents, and any future patent claims or other intellectual property rights may not be effective or sufficient to prevent them from so competing.

Many companies have encountered significant problems in protecting and defending intellectual property rights in foreign jurisdictions. The legal systems of certain countries, particularly certain developing countries, do not favor the enforcement of patents, trade secrets and other intellectual property protection which could make it difficult for us to stop the infringement of our patents or marketing of competing products in violation of our intellectual property and proprietary rights generally. Proceedings to enforce our intellectual property and proprietary rights in foreign jurisdictions could result in substantial costs and divert our efforts and attention from other aspects of our business, could put our patents at risk of being invalidated or interpreted narrowly, could put our patent applications at risk of not issuing, and could provoke third parties to assert claims against us. We may not prevail in any lawsuits that we initiate, and the damages or other remedies awarded, if any, may not be commercially meaningful. Accordingly, our efforts to enforce our intellectual property and proprietary rights around the world may be inadequate to obtain a significant commercial advantage from the intellectual property that we develop or license.

Many countries have compulsory licensing laws under which a patent owner may be compelled to grant licenses to third parties. In addition, many countries limit the enforceability of patents against government agencies or government contractors. In these countries, the patent owner may have limited remedies, which could materially diminish the value of such patent. If we or any of our licensors is forced to grant a license to third parties with respect to any patents relevant to our business, our competitive position may be impaired, and our business, financial condition, results of operations and prospects may be adversely affected.

| 9 |

Our patents might not protect our technology from competitors, in which case we may not have any advantage over competitors in selling any products that we may develop.

Our commercial success will depend in part on our ability to obtain additional patents and protect our existing patent position, as well as our ability to maintain adequate intellectual property protection for our technologies, product candidates, and any future products in the United States and other countries. If we do not adequately protect our technology, product candidates and future products, competitors may be able to use or practice them and erode or negate any competitive advantage we may have, which could harm our business and ability to achieve profitability. The laws of some foreign countries do not protect our proprietary rights to the same extent or in the same manner as U.S. laws, and we may encounter significant problems in protecting and defending our proprietary rights in these countries. We will be able to protect our proprietary rights from unauthorized use by third parties only to the extent that our proprietary technologies, product candidates and any future products are covered by valid and enforceable patents or are effectively maintained as trade secrets.

Certain aspects of our technologies are protected by the U.S. and Canadian patents, and Patent Cooperation Treaty filings. In addition, we have a number of new patent applications pending. There is no assurance that the applications still pending or which may be filed in the future will result in the issuance of any patents. Furthermore, there is no assurance as to the breadth and degree of protection any issued patents might afford us. Disputes may arise between us and others as to the scope and validity of these or other patents. Any defense of the patents could prove costly and time-consuming and there can be no assurance that we will be in a position, or will deem it advisable, to carry on such a defense. A suit for patent infringement could result in increasing costs, delaying or halting development. Other private and public concerns, including universities, may have filed applications for, may have been issued, or may obtain additional patents and other proprietary rights to technology potentially useful or necessary to us. We are not currently aware of any such patents, but the scope and validity of such patents, if any, and the cost and availability of such rights are impossible to predict.

Any trademarks we may obtain may be infringed or successfully challenged, resulting in harm to our business.

We expect to rely on trademarks as one means to distinguish any of our products that are approved for marketing from the products of our competitors. Once we select trademarks and apply to register them, our trademark applications may not be approved. Third parties may oppose our trademark applications or otherwise challenge our use of the trademarks. In the event that our trademarks are successfully challenged, we could be forced to rebrand our products, which could result in loss of brand recognition and could require us to devote resources to advertising and marketing new brands. Our competitors may infringe our trademarks, and we may not have adequate resources to enforce our trademarks.

Much of our intellectual property is protected as trade secrets or confidential know-how, not as a patent.

We consider proprietary trade secrets to be important to our business. This type of information must be protected diligently by us to protect its disclosure to competitors, since legal protections after disclosure may be minimal or non-existent. Accordingly, much of the value of this intellectual property is dependent upon our ability to keep our trade secrets.

To protect this type of information against disclosure or appropriation by competitors, our policy is to require our employees, consultants, contractors and advisors to enter into confidentiality agreements with us. However, current or former employees, consultants, contractors and advisers may unintentionally or willfully disclose our confidential information to competitors, and confidentiality agreements may not provide an adequate remedy in the event of unauthorized disclosure of confidential information. Enforcing a claim that a third party obtained illegally, and is using, trade secrets is expensive, time-consuming and unpredictable. The enforceability of confidentiality agreements may vary from jurisdiction to jurisdiction.

| 10 |

Failure to obtain or maintain trade secret protection could adversely affect our competitive position. Moreover, our competitors may independently develop substantially equivalent proprietary information and may even apply for patent protection in respect of the same. If successful in obtaining such patent protection, our competitors could limit our use of such trade secrets.

We may be subject to claims challenging the inventorship or ownership of our patents and other intellectual property.

We may also be subject to claims that former employees, suppliers, collaborators or other third parties have an ownership interest in our patents or other intellectual property. We may be subject to ownership disputes in the future arising, for example, from conflicting obligations of suppliers, consultants or others who are involved in developing our products. Litigation may be necessary to defend against these and other claims challenging inventorship or ownership. If we fail in defending any such claims, in addition to paying monetary damages, we may lose valuable intellectual property rights, such as exclusive ownership of, or right to use, valuable intellectual property. Such an outcome could have a material adverse effect on our business. Even if we are successful in defending against such claims, litigation could result in substantial costs and be a distraction to management and employees.

Intellectual property rights do not necessarily address all potential threats to our business.

The degree of future protection afforded by our intellectual property rights is uncertain because intellectual property rights have limitations and may not adequately protect our business. The following examples are illustrative:

| ● | others may be able to develop technologies that are similar to our technology platforms but that are not covered by the claims of any patents, should they issue, that we own or license; | |

| ● | we or our licensors might not have been the first to make the inventions covered by the issued patents or pending patent applications that we own or license; | |

| ● | we or our licensors might not have been the first to file patent applications covering certain of our inventions; | |

| ● | others may independently develop similar or alternative technologies or duplicate any of our technologies without infringing our intellectual property rights; | |

| ● | it is possible that our pending patent applications will not lead to issued patents; | |

| ● | issued patents that we own or license may not provide us with any competitive advantages, or may be held invalid or unenforceable as a result of legal challenges; | |

| ● | our competitors might conduct research and development activities in the United States and other countries that provide a safe harbor from patent infringement claims for certain research and development activities, as well as in countries where we do not have patent rights, and then use the information learned from such activities to develop competitive products for sale in our major commercial markets; | |

| ● | we may not develop additional proprietary technologies that are patentable; and | |

| ● | the patents of others may have an adverse effect on our business. |

| 11 |

We may need to defend ourselves against patent or trademark infringement claims, which may be time-consuming and cause us to incur substantial costs.

Companies, organizations or individuals, including our competitors, may own or obtain patents, trademarks or other proprietary rights that would prevent or limit our ability to make, use, develop or sell our products or components, which could make it more difficult for us to operate our business. The automotive aftermarket has been characterized by significant litigation and other proceedings regarding patents, patent applications and other intellectual property rights. The situations in which we may become parties to such litigation or proceedings may include:

| ● | litigation or other proceedings we may initiate against third parties to enforce our patent rights or other intellectual property rights; | |

| ● | litigation or other proceedings we or our licensee(s) may initiate against third parties seeking to invalidate the patents held by such third parties or to obtain a judgment that our products do not infringe such third parties’ patents; and | |

| ● | litigation or other proceedings, third parties may initiate against us to seek to invalidate our patents. |

If third parties initiate litigation claiming that our products infringe their patent or other intellectual property rights, we will need to defend against such proceedings.

The costs of resolving any patent litigation or other intellectual property proceeding, even if resolved in our favor, could be substantial. Many of our potential competitors will be able to sustain the cost of such litigation and proceedings more effectively than we can because of their substantially greater resources. In some instances, competitors may proceed with litigation or other proceedings pertaining to infringement of their intellectual property as a means to hinder or devaluate the target defendant company, with no intention of the matter being resolved in their favor. Uncertainties resulting from the initiation and continuation of patent litigation or other intellectual property proceedings could have a material adverse effect on our ability to compete in the marketplace. Patent litigation and other intellectual property proceedings may also consume significant management time and costs. Substantial additional costs may be evident in the event that litigation or other proceedings were initiated against the Company because Worksport would have to seek legal defense or counsel in the province (Canada) or state (U.S.) where the litigation or legal proceedings were filed. Failure to adequately protect our intellectual property rights could result in our competitors offering similar products, potentially resulting in the loss of some of our competitive advantage, and a decrease in our revenue which would adversely affect our business, prospects, financial condition and operating results.

Confidentiality agreements with employees and others may not adequately prevent disclosure of trade secrets and other proprietary information.

In order to protect our proprietary technology and processes, we also rely in part on confidentiality agreements with our employees, consultants, outsource manufacturers and other advisors. These agreements may not effectively prevent disclosure of confidential information and may not provide an adequate remedy in the event of unauthorized disclosure of confidential information. In addition, others may independently discover trade secrets and proprietary information. Costly and time-consuming litigation could be necessary to enforce and determine the scope of our proprietary rights, and failure to obtain or maintain trade secret protection could adversely affect our competitive business position.

There are risks associated with outsourced production that may result in decrease in our profit.

The possibility of delivery delays, product defects and other production-side risks stemming from outsourcers cannot be eliminated. In particular, inadequate production capacity among outsourced manufacturers could result in the Company being unable to supply enough product amid periods of high product demand, the opportunity costs of which could be substantial.

| 12 |

We may not be successful in our potential business combinations.

The Company may, in the future, pursue acquisitions of other complementary businesses and technology licensing arrangements. We have been approached by competitors to license one or more of our tonneau cover products. The Company may also pursue strategic alliances and joint ventures that leverage its core products and industry experience to expand its product offerings and geographic presence. The Company has limited experience with respect to acquiring other companies and limited experience with respect to forming collaborations, strategic alliances and joint ventures. If the Company were to make any acquisitions, it may not be able to integrate these acquisitions successfully into its existing business and could assume unknown or contingent liabilities. Integrating an acquired company also may require management resources that otherwise would be available for ongoing development of the Company’s existing business.

We have competition for our market share which could harm our sales.

We participate in the automotive aftermarket equipment industry which is highly competitive for a relatively limited customer base. Companies that compete in this market are Truck Hero Group, Tonno Pro and Rugged Liner. Our current competitors are significantly better funded and have a longer operating history than us.

In addition, some of our competitors sell their products at prices lower than ours and we compete primarily on the basis of product quality, features, value, service, and customer relationships. Our competitive success also depends on our ability to maintain a strong brand and the belief that customers will need our products and services to meet their growth requirements. Alternatively, in the case of generic competition, they may be of equal or better quality and are sold at substantially lower prices than the Company’s products. At times, competitors may also release a generic or re-branded version of a current and successful product at a substantially reduced price in efforts to increase revenues or market share. As a result, if the Company fails to maintain its competitive position, this could have a material adverse effect on its business, cash flow, results of operations, financial position and prospects.

We may not have sufficient product liability insurance to cover potential damages.

The existence of any defects, errors or failures in our products or the misuse of our products could also lead to product liability claims or lawsuits against us. While we had insurance coverage of $2,000,000 for the year ended December 31, 2020 we have no assurance this insurance will be adequate to protect us from all material judgments and expenses related to potential future claims or that these levels of insurance will be available at economical prices, if at all. To that extent, product liability insurance is conditional and up for further investigation. A successful product liability claim could result in substantial costs for us. Even if we are fully insured as it relates to a claim, a claim could nevertheless diminish our brand and divert management’s attention and resources, which could have a negative impact on our business, financial condition and results of operations.

We may produce products of inferior quality which would cause us to lose customers.

Although we make an effort to ensure the quality of our light truck tonneau cover products, they could from time to time contain defects, anomalies or malfunctions that are undetectable at the time of shipment. These defects, anomalies or malfunctions could be discovered after our products are shipped to customers, resulting in the return or exchange of our products, customers’ claims for compensatory damages or discontinuation of the use of our products, which could negatively impact our operating results. We do not presently have product recall (or similar function) insurance that protects a company against broad-scale product manufacturing defects, engineering defects and the costs related to a broad product recall such as shipping, replacement or repairs. Even if in place, there is no guarantee that the full costs of any reimbursements or claims, lawsuits or litigation would be covered by such insurance.

| 13 |

Risks Associated with Manufacturing in China

Evolving U.S. trade regulations and policies with China may in the future have a material and adverse effect on our business, financial condition and results of operations.

Our products are sourced from China. Any restrictions or tariffs imposed on products that we or our suppliers import for sale in the United States would adversely and directly impact our cost of goods sold. In addition, changes in U.S. trade regulations and policies could have an adverse impact on trade relations between the United States and certain foreign countries, which could materially and adversely affect our relationships with our international suppliers and reduce the supply of goods available to us. Further, we cannot predict the extent to which the United States will adopt changes to existing trade regulations and policies, which creates uncertainties in planning our sourcing strategies and forecasting our margins. If additional tariffs are imposed on our products, or other retaliatory trade measures are taken, our costs could increase and we may be required to raise our prices, which could materially and adversely affect our results.

There are risks associated with outsourced production in China and their laws which may have a material adverse effect on our financial stability.

The Company purchases all of its inventory from one supplier source in China. Changes in Chinese laws and regulations, or their interpretation, or the imposition of confiscatory taxation or restrictions are matters over which the Company has no control. While the current leadership, (and the Chinese government), have been pursuing economic reform policies that encourage private economic activity and greater economic decentralization, there is no assurance, however, that the Chinese government will continue to pursue these policies, or that it will not significantly alter these policies from time to time without notice.

For example, the Chinese government has enacted some laws and regulations dealing with matters such as corporate organization and governance, foreign investment, commerce, taxation and trade. However, their experience in implementing, interpreting and enforcing these laws and regulations is limited and, in turn, our ability to enforce commercial claims or to resolve commercial disputes is unpredictable. If our business ventures with Chinese manufacturers were unsuccessful, or other adverse circumstances arise from these transactions, we face the risk that the parties to these ventures may seek ways to terminate the transactions. The resolution of these matters may be subject to the exercise of considerable discretion by agencies of the Chinese government and forces unrelated to the legal merits of a particular matter or dispute may influence their determination.

Any rights we may have to specific performance, or to seek an injunction under Chinese law are severely limited, and without a means of recourse by virtue of the Chinese legal system, we may be unable to prevent these situations from occurring. The occurrence of any such events could have a material adverse effect on our business, financial condition and results of operations, in such guises as currency conversion, imports and sources of supply, devaluations of currency or the nationalization or other expropriation of private enterprises.

In that context, we may have to evaluate the feasibility of acquiring alternative or fallback manufacturing capabilities to support the production of our existing and future tonneau cover products. Such development could adversely affect our cost structure inasmuch as we would be required to support sales at an acceptable cost—and might have relatively limited time to so adapt. We have not manufactured these products in the past—and are not expecting to do so in the foreseeable future. That is because developing these technological capabilities and building or purchasing a facility will increase our expenses with no guarantee that we will be able to recover our investment in our manufacturing capabilities.

We engage in cross border sales transactions which present tax risks among other obstacles.

Cross border sales transactions carry a risk of changes in import tax and/or duties related to the import and export of our product, which can result in pricing changes, which will affect revenues and earnings. Cross border sales transactions carry other risks including, but not limited to, changing regulations, wait times, customs inspection and lost or damaged product

| 14 |

We are subject to foreign currency risk which may adversely affect our net profit.

The Company is subject to foreign exchange risk as it manufactures its products in China, markets extensively in both Canadian and U.S. markets, most of the Company’s employees reside in Canada and, to date, the Company has raised funds in Canadian Dollars. Meanwhile, the Company reports results of operations in U.S. Dollars (USD or US$). Since our Canadian customers pay in Canadian Dollar, the Company is subject to gains and losses due to fluctuations in the USD relative to the Canadian Dollar. While having our products manufactured in China, our manufacturers are paid in USD to better avoid the relatively greater fluctuation of the Chinese Yuan (RMB). Any large fluctuations in the exchange between the RMB and USD may cause product costs to increase, therefore affecting revenues and profits, potentially adversely.

Risks Related to Our Stockholders and Purchasing Units.

We have identified material weaknesses in our internal control over financial reporting. Failure to maintain effective internal controls could cause our investors to lose confidence in us and adversely affect the market price of our common stock. If our internal controls are not effective, we may not be able to accurately report our financial results or prevent fraud.

Section 404 of the Sarbanes-Oxley Act of 2002, or Section 404, requires that we maintain internal control over financial reporting that meets applicable standards. We may err in the design or operation of our controls, and all internal control systems, no matter how well designed and operated, can provide only reasonable assurance that the objectives of the control system are met. Because there are inherent limitations in all control systems, there can be no assurance that all control issues have been or will be detected.

In prior periods we identified certain material weaknesses in our internal controls. Specifically, we did not maintain effective controls over the control environment. Our weaknesses related to a lack of a sufficient number of personnel with appropriate training and experience in accounting principles generally accepted in the United States of America. Furthermore, we have not developed and effectively communicated to our employees the accounting policies and procedures necessary to maintain effective controls over the control environment. and lack staffing in accounting and finance operations.

If we are unable, or are perceived as unable, to produce reliable financial reports due to internal control deficiencies, investors could lose confidence in our reported financial information and operating results, which could result in a negative market reaction and a decrease in our stock price.

We have a large number of authorized but unissued shares of our Common Stock which will dilute your ownership position when issued.

Our authorized capital stock consists of 299,000,000 shares of Common Stock, of which approximately 287,000,000 remain available for issuance, including shares of Common Stock issuable upon the exercise of outstanding warrants. Our management will continue to have broad discretion to issue shares of our Common Stock in a range of transactions, including capital-raising transactions, mergers, acquisitions and other transactions, without obtaining stockholder approval, unless stockholder approval is required under law or, if our Common Stock is listed on Nasdaq, under Nasdaq Rule 5635(b) which requires stockholder approval for change of control transactions where a stockholder acquires 20% of a Nasdaq-listed company’s common stock or securities convertible into common stock, calculated on a post-transaction basis. If our management determines to issue shares of our common stock from the large pool of authorized but unissued shares for any purpose in the future and is not required to obtain stockholder approval, your ownership position would be diluted without your further ability to vote on that transaction.

| 15 |

An active, liquid, and orderly market for our Common Stock or Warrants may not develop.

Our Common Stock and Warrants are expected to trade on Nasdaq as of the effective date of the registration statement of which this prospectus forms a part. An active trading market for our Common Stock or Warrants may never develop or be sustained. If an active market for our Common Stock or Warrants does not continue to develop or is not sustained, it may be difficult for investors to sell shares of their shares of Common Stock or Warrants without depressing the market price and investors may not be able to sell their securities at all. An inactive market may also impair our ability to raise capital by selling our securities and may impair our ability to acquire other businesses, applications, or technologies using our securities as consideration, which, in turn, could materially adversely affect our business and the market prices of your shares of Common Stock and Warrants.

While we are seeking to list our Common Stock and Warrants on Nasdaq, there is no assurance that either of such securities will be listed on Nasdaq.

While we are seeking to list our Common Stock and Warrants on the Nasdaq Capital Market, we cannot ensure that either of such securities will be accepted for listing on Nasdaq. Should our Warrants be rejected for listing on Nasdaq, we will seek to have our Warrants quoted on the OTC Markets, in which event the trading price of our Warrants could suffer, the trading market for our Warrants may be less liquid, and our Warrant price may be subject to increased volatility. If we fail to have our Warrants quoted on the OTC Markets, there will be no public market for our Warrants.

The Warrants may not have any value.

Each Warrant will have an assumed exercise price equal to $11.00 (110% of the assumed $10.00 offering price per Unit) and will be exercisable from the date of issuance until the third anniversary of the issue date. In the event our Common Stock price does not exceed the exercise price of the Warrants during the period when the Warrants are exercisable, the Warrants may not have any value.

Shares of our Common Stock may continue to be subject to illiquidity because our shares may continue to be thinly traded and may never become eligible for trading on a national securities exchange.

While we have applied to have our Common Stock and Warrants listed for trading on the Nasdaq Capital Market in connection with this offering, we cannot assure you that our application will be approved or even if approved, that we will maintain listing on Nasdaq or another national exchange. Our Common Stock is currently quoted on the OTCQB, which is not an exchange. Initial listing on a national securities exchange is subject to a variety of requirements, including minimum trading price and minimum public “float” requirements, and could also be affected by the general skepticism of such markets concerning companies that are the result of mergers with inactive publicly-held companies. There are also continuing eligibility requirements for companies listed on public trading markets. If we are unable to satisfy the initial or continuing eligibility requirements of any such market, then our Common Stock and Warrants may not be listed or could be delisted. This could result in a lower trading price for our Common Stock and may limit your ability to sell your shares, any of which could result in you losing some or all of your investments.

| 16 |

The market valuation of our business may fluctuate due to factors beyond our control and the value of your investment may fluctuate correspondingly.

The market valuation of smaller reporting companies, such as us, frequently fluctuate due to factors unrelated to the past or present operating performance of such companies. Our market valuation may fluctuate significantly in response to a number of factors, many of which are beyond our control, including:

| ● | changes in securities analysts’ estimates of our financial performance, although there are currently no analysts covering our stock; | |

| ● | fluctuations in stock market prices and volumes, particularly among securities of smaller reporting companies; | |

| ● | changes in market valuations of similar companies; | |

| ● | announcements by us or our competitors of significant contracts, new technologies, acquisitions, commercial relationships, joint ventures or capital commitments; | |

| ● | variations in our quarterly operating results; | |

| ● | fluctuations in related commodities prices; and | |

| ● | additions or departures of key personnel. |

As a result, the value of your investment in us may fluctuate.