UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

OR

For the fiscal year ended

OR

OR

Date of event requiring this shell company report ______________

For the transition period from ______________ to ______________

Commission file number:

(Exact name of Registrant as specified in its charter)

N/A

(Translation of Registrant's name into English)

British Virgin Islands

(Jurisdiction of incorporation or organization)

(Address of principal executive offices)

c/o Portage Development Services Inc.,

(Name, telephone, e-mail and/or facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol | Name of each exchange on which registered |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

Not applicable

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

Not applicable

(Title of Class)

Indicate the number of outstanding shares of each of the Issuer's classes of capital or common stock (ordinary shares) as of the close of the period covered by the annual report. Ordinary shares without par value – as at March 31, 2024

Indicate by check mark if the registrant is a well-known seasoned issuer,

as defined in Rule 405 of the Securities Act. Yes ☐

If this report is an annual or transition report, indicate by check mark

if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports

required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter

period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically

every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the

preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of " large accelerated filer,” large accelerated filer," and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | Emerging growth company |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and

attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b)

of the Sarbanes-Oxley Act (15 U.S.C. 7262(b) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate

by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously

issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ☐ |

by the International Accounting Standards Board ☒ |

Other ☐ |

If "Other" has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant

is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No

ii

TABLE OF CONTENTS

iii

FORWARD-LOOKING STATEMENTS

This annual report on Form 20-F (“Annual Report”) includes “forward-looking statements.” All statements, other than statements of historical facts, included herein or incorporated by reference herein, including without limitation, statements regarding our business strategy, plans and objectives of management for future operations and those statements preceded by, followed by or that otherwise include the words “believe,” “expects,” “anticipates,” “intends,” “estimates,” “will,” “may,” “should,” “could,” “targets,” “projects,” “predicts,” “plans,” “potential,” or “continue,” or similar expressions or variations on such expressions are forward-looking statements. We can give no assurances that such forward-looking statements will prove to be correct.

Each forward-looking statement reflects our current view of future events and is subject to risks, uncertainties and other factors that could cause actual results to differ materially from any results expressed or implied by our forward-looking statements.

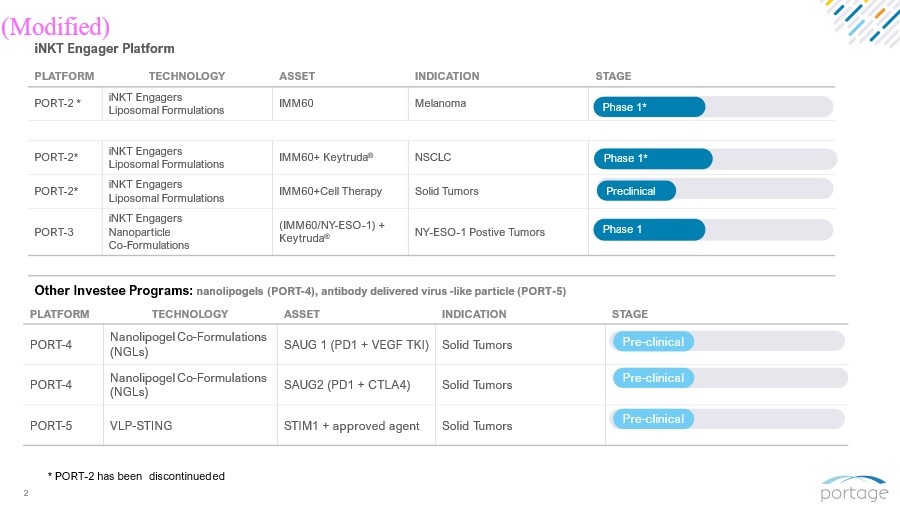

We have made the decision to discontinue our sponsored trial for the invariant natural killer T-cell (“iNKT”) program and pause further accrual to our sponsored adenosine program for both PORT-6 and PORT-7. In the event that we resume these clinical trials and further development of our programs, our risks and uncertainties include, but are not limited to:

| · | our plans and ability to develop and commercialize product candidates and the timing of these development programs; |

| · | clinical development of our product candidates, including the timing for availability and release of results of current and future clinical trials; |

| · | our expectations regarding regulatory communications, submissions or approvals; |

| · | the potential functionality, capabilities, benefits and risks of our product candidates as compared to others; |

| · | our maintenance and establishment of intellectual property rights in our product candidates; |

| · | our need for financing and our estimates regarding our capital requirements and future revenues and profitability; |

| · | our estimates of the size of the potential markets for our product candidates; and |

| · | our selection and licensing of product candidates. |

Our business focus has been that of a pharmaceutical development business subject to all of the risks of a pharmaceutical development business. In the event that we resume enrollment in the clinical trials and further development of our programs, we do not anticipate directly engaging in the commercialization of the product candidates we develop.

These statements are based on assumptions and analyses made by us in light of our experience and our perception of historical trends, current conditions and expected future developments based on the focus of our business activities on biotechnology, as well as other factors we believe are appropriate in particular circumstances. However, whether actual results and developments will meet our expectations and predictions depends on a number of risks and uncertainties, which could cause actual results to differ materially from our expectations, including the risks set forth in Item 3 “Key Information – Risk Factors.”

Consequently, all of the forward-looking statements made in this Annual Report are qualified by these cautionary statements. We cannot assure you that the actual results or developments anticipated by us will be realized or, even if substantially realized, that they will have the expected effect on us or our business or operations.

Unless the context indicates otherwise the terms “Portage Biotech Inc.,” “the Company,” “our Company,” “Portage,” “we,” “us” or “our” are used interchangeably in this Annual Report and mean Portage Biotech Inc. and its subsidiaries.

| 1 |

FOREIGN PRIVATE ISSUER STATUS AND REPORTING CURRENCY

Foreign Private Issuer Status

Portage Biotech Inc. is a British Virgin Islands (“BVI”) business company pursuant to the Certificate of Continuance issued by the Registrar of Corporate Affairs of the BVI on July 5, 2013. More than 50% of our ordinary shares were held by non-United States residents as of the last measurement date. As a result, we believe that we qualify as a "foreign private issuer" for continuing to report regarding the registration of our ordinary shares using this Form 20-F annual report format.

Currency

The financial information presented in this Annual Report is expressed in United States dollars ("US $"), except where otherwise indicated, and the financial data in this Annual Report is presented in accordance with the International Financial Reporting Standards ("IFRS") as issued by the International Accounting Standards Board ("IASB") and interpretations of the International Financial Reporting Interpretations Committee.

PART I

ITEM 1 – IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORS

Not required because this is an annual report under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

ITEM 2 – OFFER STATISTICS AND EXPECTED TIMETABLE

Not required because this is an annual report under the Exchange Act.

ITEM 3 – KEY INFORMATION

| (A) | SELECTED FINANCIAL DATA |

The selected financial data set forth below should be read in conjunction with our Consolidated Financial Statements and Notes thereto appearing elsewhere in this Annual Report. The selected Operations Data for each of the three fiscal years ended March 31, 2024, 2023 and 2022, and the Balance Sheet data as of March 31, 2024 and 2023 are derived from our audited Consolidated Financial Statements appearing elsewhere in this Annual Report. The selected Operations Data for the years ended March 31, 2021 and 2020 and the Balance Sheet data as of March 31, 2022, 2021 and 2020 are derived from our audited Consolidated Financial Statements, which are not included in this Annual Report.

| 2 |

SUMMARY OF FINANCIAL INFORMATION IN THE COMPANY’S FINANCIAL STATEMENTS (U.S. DOLLARS)

Operating Data

| Years ended March 31, | 2024 | 2023 | 2022 | 2021 | 2020 | |||||||||||||||

| All amounts in 000'$ (except for per share amounts) | ||||||||||||||||||||

| Net loss before non-controlling interests | $ | (75,382 | ) | $ | (104,666 | ) | $ | (19,169 | ) | $ | (17,189 | ) | $ | (7,249 | ) | |||||

| Net loss attributable to owners of the Company | $ | (75,339 | ) | $ | (104,611 | ) | $ | (16,870 | ) | $ | (15,833 | ) | $ | (5,333 | ) | |||||

| Comprehensive loss | $ | (75,420 | ) | $ | (109,949 | ) | $ | (19,169 | ) | $ | (17,189 | ) | $ | (6,373 | ) | |||||

| Comprehensive loss attributable to the owners of the Company | $ | (75,377 | ) | $ | (109,894 | ) | $ | (16,870 | ) | $ | (15,833 | ) | $ | (4,457 | ) | |||||

| Working capital | $ | 4,816 | $ | 11,811 | $ | 24,049 | $ | 1,738 | $ | 1,226 | ||||||||||

| Total assets | $ | 7,779 | $ | 99,129 | $ | 194,662 | $ | 174,860 | $ | 173,174 | ||||||||||

| Capital stock | $ | 219,499 | $ | 218,782 | $ | 158,324 | $ | 130,649 | $ | 117,817 | ||||||||||

| Warrant liability | $ | 1,564 | $ | - | $ | 33 | $ | 1,120 | $ | - | ||||||||||

| Stock option reserves | $ | 23,841 | $ | 21,204 | $ | 16,928 | $ | 7,977 | $ | 58 | ||||||||||

| Equity attributable to owners of the Company | $ | 4,022 | $ | 76,045 | $ | 121,205 | $ | 101,449 | $ | 96,531 | ||||||||||

| Weighted average number of shares outstanding - Basic | 19,343 | 16,119 | 13,060 | 11,733 | 10,952 | |||||||||||||||

| Weighted average number of shares outstanding - Diluted | 19,343 | 16,119 | 13,060 | 11,733 | 10,952 | |||||||||||||||

| Net loss per share - Basic | $ | (3.89 | ) | $ | (6.49 | ) | $ | (1.29 | ) | $ | (1.35 | ) | $ | (0.49 | ) | |||||

| Net loss per share - Diluted | $ | (3.89 | ) | $ | (6.49 | ) | $ | (1.29 | ) | $ | (1.35 | ) | $ | (0.49 | ) | |||||

| 1. | The effect of potential share issuances pursuant to the exercise of options and warrants would be anti-dilutive and, therefore, basic and diluted loss per share are the same for the fiscal years presented. |

| 2. | The per share data has been adjusted to reflect the reverse split of the ordinary shares effective June 5, 2020. |

The Company has not declared or paid any dividends in any of the reporting periods presented herein.

Exchange Rates

In this Annual Report on Form 20-F, unless otherwise specified, all monetary amounts are expressed in United States dollars. The Company's subsidiaries have transactions in Canadian dollars, British pound sterling (“GBP”) and European Union (“EU”) euros. Currencies other than the United States dollar have been translated into United States dollars using rates available on Bank of Canada and the Bank of England websites.

On July 31, 2024, the exchange rate, based on the noon buying rates, for the conversion of Canadian dollars into United States dollars (the "Noon Rate of Exchange") was approximately US$1 = CDN$1.38, for the conversion of British pound sterling into United States dollars was approximately US$1 = £0.78 and for the conversion of EU euros into United States dollars was approximately US$1 = €0.92.

The following table sets out the high and low exchange rates in Canadian dollar, British pounds and EU euros for one United States dollar for each of the last six months of the fiscal year.

| Year ended March 31, 2024 | October | November | December | January | February | March | ||||||||||||||||||

| Canadian Dollar | ||||||||||||||||||||||||

| High | 1.39 | 1.39 | 1.36 | 1.35 | 1.36 | 1.36 | ||||||||||||||||||

| Low | 1.36 | 1.36 | 1.32 | 1.33 | 1.34 | 1.35 | ||||||||||||||||||

| British Pounds | ||||||||||||||||||||||||

| High | 0.83 | 0.82 | 0.80 | 0.79 | 0.80 | 0.79 | ||||||||||||||||||

| Low | 0.81 | 0.79 | 0.78 | 0.78 | 0.79 | 0.78 | ||||||||||||||||||

| EU Euros | ||||||||||||||||||||||||

| High | 0.96 | 0.95 | 0.93 | 0.92 | 0.93 | 0.93 | ||||||||||||||||||

| Low | 0.94 | 0.91 | 0.90 | 0.91 | 0.92 | 0.91 | ||||||||||||||||||

The following table sets out the average exchange rates in Canadian dollar, British pounds and EU euros for one United States dollar for the five most recent financial years.

| 3 |

| Years ended March 31, | 2024 | 2023 | 2022 | 2021 | 2020 | |||||||||||||||

| Average for the Fiscal Year | ||||||||||||||||||||

| Canadian Dollar | 1.35 | 1.32 | 1.25 | 1.32 | 1.33 | |||||||||||||||

| British Pounds | 0.80 | 0.83 | 0.73 | 0.77 | 0.79 | |||||||||||||||

| EU Euros | 0.92 | 0.96 | 0.86 | 0.86 | 0.90 | |||||||||||||||

We operate in various jurisdictions and are subject to exchange rates for the Canadian dollar, British pound and the Euro. We are subject to currency risk with respect to certain liabilities settleable in foreign currency, as well as invoices payable in foreign currency. While the rates have changed period to period, the overall effect of exchange rates on our financial statements have historically not been significant.

| (B) | CAPITALIZATION AND INDEBTEDNESS |

Not applicable.

| (C) | REASONS FOR THE OFFER AND USE OF PROCEEDS |

Not applicable.

| (D) | RISK FACTORS |

Risks Related to our Decision to Discontinue our iNKT Program and Pause Further Accrual in our Adenosine Program

After a review of our future funding needs for clinical development of our programs as well as the current capital raising market for biotechnology companies, we made the decision to discontinue our sponsored clinical trial for the iNKT program and pause further accrual to our sponsored adenosine program. We are exploring strategic alternatives, which may include finding a partner for one or more of our assets, a sale of our company, a merger, restructurings, both in and out of court, a company wind down, further financing efforts or other strategic action.

There can be no assurance that our evaluation of strategic alternatives will result in any agreements or transactions, or that, if completed, any agreements or transactions will be successful or on attractive terms. Any potential transaction would be dependent on a number of factors that may be beyond our control, including, among other things, market conditions, industry trends, the interest of third parties in a potential transaction with us and the availability of financing to us or third parties in a potential transaction with us on reasonable terms. The process of reviewing strategic alternatives may require us to incur additional costs and expenses. It could negatively impact our ability to attract, retain and motivate key employees, and expose us to potential litigation in connection with this process or any resulting transaction. If we are unable to effectively manage the process, our financial condition and results of operations could be adversely affected. In addition, any strategic alternative that may be pursued and completed ultimately may not deliver the anticipated benefits or enhance shareholder value. There can be no guarantee that the process of evaluating strategic alternatives will result in our company entering into or completing a potential transaction within the anticipated timing or at all. There is no set timetable for this evaluation and we do not intend to disclose developments with respect to this evaluation unless and until we determine that further disclosure is appropriate or legally required. As of July 31, 2024, we had approximately $3.1 million of cash and cash equivalents on hand, which we expect is only sufficient to cover our operating needs through December 2024.

Additionally, the Nasdaq Stock Market LLC (“Nasdaq”) may take the position that we are a “public shell” under Nasdaq rules, which could have negative consequences, including the potential delisting of our ordinary shares from the Nasdaq Capital Market. We have no current plans to delist our ordinary shares from Nasdaq. However, following the decision to discontinue our sponsored clinical trial for the INKT program and pause further accrual to our sponsored adenosine program, we may be treated as a public shell under Nasdaq rules. Although Nasdaq evaluates whether a listed company is a public shell company based on a facts and circumstances determination, a Nasdaq-listed company with no or nominal operations and either no or nominal assets, assets consisting solely of cash and cash equivalents, or assets consisting of any amount of cash and cash equivalents and nominal other assets is generally considered to be a public shell company.

The following is a brief discussion of the most significant risk factors that are specific to our operations and industry and that may have a material impact on, or constitute the most significant risk factors in respect of, our future financial performance in the event that we were to raise additional capital to fund the clinical development of our programs.

| 4 |

Risks Related to our Business

We have current and future capital needs, and, if we decide to resume enrollment in our clinical trials, there are uncertainties as to our ability to raise additional funding.

Our current cash resources will not cover all of our operational costs and the needs of our subsidiaries to progress towards clinical trials, if we decide to resume enrollment in our clinical programs. Additional capital would be needed to test product candidate in human trials, obtain regulatory approvals and ultimately to commercialize such product candidates if approved.

In addition, our future cash requirements may vary materially from those now expected. For example, our future capital requirements may increase if:

| · | we experience scientific progress sooner than expected in our future discovery, research and development projects, if we expand the magnitude and scope of these activities, or if we modify our focus as a result of our discoveries; |

| · | we experience setbacks in our progress with pre-clinical studies and clinical trials are delayed; |

| · | we experience delays or unexpected increased costs in connection with obtaining regulatory approvals, particularly in light of the current inflationary environment; |

| · | we are required to perform additional pre-clinical studies and/or clinical trials; |

| · | we experience unexpected or increased costs relating to preparing, filing, prosecuting, maintaining, defending and enforcing patent claims; or |

| · | we elect to develop, acquire or license new technologies and products. |

We have incurred, and, if we decide to resume enrollment in our clinical programs, we expect to continue to incur substantial costs related to the development of our product candidates, including costs related to the clinical trials for our adenosine platform. If sufficient capital is not available and we decide to resume enrollment in our clinical programs, we may be required to delay, reduce the scope of, eliminate or divest of one or more of our research or development projects, any of which could have a material adverse effect on our business, financial condition, prospects or results of operations.

Furthermore, under General Instruction I.B.5 to Form F-3 (the “Baby Shelf Rule”), the amount of funds we can raise through primary public offerings of securities in any 12-month period using a registration statement on Form F-3 is limited to one-third of the aggregate market value of the ordinary shares held by non-affiliates of our company, which limitation may change over time based on our stock price, number of ordinary shares outstanding and the percentage of ordinary shares held by non-affiliates. We therefore are limited by the Baby Shelf Rule as of the filing of this Annual Report, until such time as our non-affiliate public float exceeds $75 million.

We have a history of operating losses and may never achieve profitability in the future.

Historically, we have generated only a limited amount of business income, notwithstanding a highly valued asset distribution to our shareholders share ownership of Biohaven.

Prior to our decision to discontinue our iNKT program and pause further accrual in our adenosine program, our objective was to enable research and development so as to create early- to mid-stage, first- and best-in-class therapies for a variety of cancers, by providing funding, strategic business and clinical counsel, and shared services, with the goal of creating viable products that may be monetized through licensing, manufacturing and distribution or outright sale. Our principal activities were engaging in research and development to identify and validate new drug targets that could become marketed drugs in the future. If we decide to resume enrollment in our clinical programs, we will require significant financial resources without any income, and we expect to continue incurring operating losses for the foreseeable future.

| 5 |

Our ability to generate revenue in the future or achieve profitable operations is largely dependent upon our ability to attract and maintain experienced management and know-how to develop new drug candidates and to partner with major pharmaceutical companies to successfully commercialize any successful drug candidates. It takes many years and significant financial resources to successfully develop pre-clinical or early clinical drug candidates into marketable drugs, and we cannot assure you that we will be able to achieve these objectives. Although, we were successful in achieving significant value growth in an investment made in Biohaven, which resulted in the distribution of Biohaven shares as an asset dividend to our shareholders with a then market value of approximately $153 million in fiscal 2018, we cannot guarantee that we will be able to achieve any similar success in our future business activities.

We are in the pharmaceutical development business and will be subject to all of the risks of a pharmaceutical research and development business.

Our business must be evaluated in light of the risks, delays, uncertainties and complications encountered in connection with establishing and carrying on a pharmaceutical research and development business.

If we decide to resume enrollment in our clinical programs, there is a possibility that only a few or none of our drug candidates that may be developed in the future, will be determined to be safe and effective by the governing regulatory bodies, will be able to receive and maintain necessary regulatory approvals in order to be commercialized, or will be commercially viable. Any failure to successfully develop and obtain regulatory approval for our product candidates would have a material adverse effect on our business, financial condition and results of operations.

Rapidly changing medical technology within the life sciences industry could make the product candidates that we may develop in the future obsolete or less attractive to pursue.

The medical industry is characterized by rapid and significant medical technological and therapy changes, frequent new product candidates and product introductions and enhancements and evolving industry standards. If we decide to resume enrollment in our clinical programs, our future success will depend on our ability to continually develop and then improve our product candidates and to develop and introduce new product candidates that address the evolving needs of the physicians and patients on a timely and cost-effective basis. Our new product candidates and products may not be accepted in the intended markets, and our inability to gain market acceptance of new products could harm our future operating results.

Clinical trials for our product candidates will be expensive if we decide to resume enrollment in our clinical programs and will take a considerable amount of time, and the outcomes of such clinical trials are by their nature uncertain.

If we decide to resume enrollment in our clinical programs, we will be required to complete extensive clinical trials to demonstrate safety and efficacy before we can obtain regulatory approval for the commercial sale of any product candidate or attract major pharmaceutical companies to collaborate with us. Clinical trials are very expensive and are difficult to design and implement. The clinical trial process also takes a long time and can often be subject to unexpected delays or have unexpected results.

The timing of the commencement, continuation and completion of clinical trials has been, and may continue to be subject to significant delays relating to various causes, including:

| · | our inability to manufacture or obtain sufficient quantities of materials for use in clinical trials; |

| · | measures related to the COVID-19 pandemic or other similar circumstances; |

| · | delays arising from our collaborative partnerships; |

| · | delays in obtaining regulatory permission to commence a clinical trial, or government intervention to delay, suspend or terminate a clinical trial; |

| · | delays in approving, or refusal to approve, or suspension, or termination of a clinical trial by the institutional review board or independent ethics board responsible for overseeing the trial; |

| · | delays in identifying and reaching agreement on acceptable terms with prospective clinical trial sites, clinical research organizations, laboratories and testing facilities, or other vendors providing clinical trial services; |

| 6 |

| · | slower than expected rates of patient recruitment and enrollment or patients’ early withdrawal from participation; |

| · | uncertain dosing issues; |

| · | inability or unwillingness of medical investigators to follow our clinical protocols; |

| · | variability in the number and types of subjects available for each trial and resulting difficulties in identifying and enrolling subjects who meet trial eligibility criteria; |

| · | scheduling conflicts with participating clinicians and clinical institutions; |

| · | difficulty in maintaining contact with subjects after treatment, which could result in incomplete data; |

| · | unforeseen safety issues or side effects; |

| · | lack of demonstrated efficacy during the clinical trials; |

| · | our reliance on clinical trial sites, clinical research organizations, laboratories and testing facilities and other vendors to conduct clinical trials or provide clinical trial services, which may not conduct those trials in compliance with applicable laws and regulations, or current good clinical or laboratory practices; |

| · | changes in laws or regulations applicable to clinical trial requirements; or |

| · | other regulatory delays. |

If we decide to resume enrollment in our clinical programs, we will rely on third parties to manufacture our preclinical and clinical drug supplies, and we intend to rely on third parties to produce commercial supplies of any product candidate if approved by a regulatory authority.

We have limited personnel with experience in manufacturing, and we do not own facilities for manufacturing product candidates for the potential clinical trials and/or commercial manufacturing of product candidates if approved. If we decide to resume enrollment in our clinical programs, we will depend on our collaboration partners and other third parties to manufacture and provide analytical services with respect to our most advanced product candidates.

If our product candidates are approved, then in order to produce the quantities necessary to meet anticipated market demand, we and our collaboration partners will need to secure sufficient manufacturing capacity with third-party manufacturers. If we and our collaboration partners are unable to produce, or obtain the materials necessary to produce, any approved product in sufficient quantities to meet the requirements for the launch of any such product or to meet future demand, our revenues and gross margins could be adversely affected. To be successful, any approved product must be manufactured in commercial quantities in compliance with regulatory requirements and at acceptable costs. We and our collaboration partners will regularly need to secure access to third-party facilities to manufacture our product candidates commercially. All of this will require additional funds and inspection and approval by the Competent Authorities of the Member States of the European Economic Area (“EEA”), the United States Food and Drug Administration (“FDA”) and other regulatory authorities. If we and our collaboration partners are unable to establish and maintain a manufacturing capacity within our planned time and cost parameters, the development of our product candidates and future sales of any product candidates, if approved, as well as our business, results of operations and prospects, and the value of our ordinary shares could be materially adversely affected.

| 7 |

We and our collaboration partners may encounter problems with aspects of manufacturing our product candidates or any approved products, including the following:

| · | production yields; |

| · | quality control and assurance; |

| · | shortages of qualified personnel; |

| · | compliance with FDA and EEA regulations; |

| · | production costs; and |

| · | development of advanced manufacturing techniques and process controls. |

Prior to our decision to discontinue our iNKT program and pause further accrual in our adenosine program, we evaluated our options for clinical trial supplies and commercial production for our product candidates on a regular basis, including use of third-party manufacturers, or entering into a manufacturing joint venture relationship with a third party. We are aware of only a limited number of companies on a worldwide basis that operate manufacturing facilities in which our product candidates can be manufactured under current Good Manufacturing Practice ("cGMP”) regulations, a requirement for all pharmaceutical products in the U.S. We cannot be certain that we and our collaboration partners will be able to contract with any of these companies on acceptable terms to us, if at all, if we decide to resume enrollment in our clinical programs, which could harm our business, results of operations and prospects, and the value of our ordinary shares.

In addition, if we decide to resume enrollment in our clinical programs, any manufacturing facility that we utilize will be required to be registered with the FDA (and have a U.S. agent for the facility, if outside the United States), the Competent Authorities of the Member States of the EEA, and other regulatory authorities. The facilities will be subject to inspections confirming compliance with the FDA, the Competent Authorities of the Member States of the EEAs, or other regulatory authority cGMP requirements. We have not directly controlled the manufacturing process of our product candidates, and, if we decide to resume enrollment in our clinical programs, we would be dependent on our contract manufacturing partners for compliance with cGMP regulations for the manufacture of both active drug substances and finished drug products. If we or our collaboration partners or any third-party manufacturer fail to maintain regulatory compliance, the FDA, the Competent Authorities of the Member States of the EEA, or other regulatory authorities may take enforcement action that may include issuing a warning letter, instituting a clinical hold, withdrawing regulatory approval, seeking product seizures or injunctions and, where appropriate, pursuing criminal prosecution, any of which could have an adverse effect on our business, financial condition and results of operations.

The results of pre-clinical studies and initial clinical trials may not be predictive of future results, if we decide to resume enrollment in our clinical programs, and our product candidates may not have favorable results in later trials or in the commercial setting.

Pre-clinical tests and Phase 1 and Phase 2 clinical trials are primarily designed to test safety, to study pharmacokinetics and pharmacodynamics, to understand the side effects of product candidates, and to explore efficacy at various doses and schedules. Favorable results in early trials may not be repeated in later trials. Any success that we may experience in pre-clinical or animal studies and early clinical trials if we decide to resume enrollment in our clinical programs does not ensure that later large-scale efficacy trials will be successful, and does not predict final trial results, which could have an adverse effect on our business, financial condition and results of operations.

A number of companies in the life sciences industry have suffered significant setbacks in advanced clinical trials, even after positive results in earlier trials. Clinical results are frequently susceptible to varying interpretations that may delay, limit or prevent regulatory approvals. Negative or inconclusive results or adverse medical events during a clinical trial could cause a clinical trial to be delayed, repeated or terminated. In addition, failure to construct appropriate clinical trial protocols could result in the test or control group experiencing a disproportionate number of adverse events, which could also cause a clinical trial to be repeated or terminated.

There is typically a high rate of attrition for product candidates proceeding through clinical and post-approval trials.

| 8 |

We may face difficulty in enrolling patients in our clinical trials if we decide to resume enrollment in our clinical programs.

If we decide to resume enrollment in our clinical programs, we may find it difficult to enroll qualifying patients in our clinical trials. The timing of our current and future clinical trials depends, in part, on the speed at which we can recruit qualifying patients to participate in testing our therapeutic candidates. If qualifying patients are unwilling to participate in our trials because of negative publicity from adverse reactions or for other reasons, including competitive clinical trials for similar patient populations, then the timeline for recruiting patients, conducting trials and obtaining regulatory approval of potential products may be delayed. These delays could result in increased costs, delays in advancing our product development, delays in testing the effectiveness of our technology or termination of the clinical trials altogether. We may not be able to identify, recruit and enroll a sufficient number of qualifying patients, or those with required or desired characteristics to achieve sufficient diversity in a given trial in order to complete our clinical trials in a timely manner. If we have difficulty enrolling a sufficient number of qualifying patients to conduct our clinical trials as planned, we may need to delay, limit or terminate ongoing or planned clinical trials, any of which could have an adverse effect on our business.

The outcomes of clinical trials are uncertain and our clinical trials may fail to demonstrate adequately the safety or efficacy of a particular therapeutic candidates if we decide to resume enrollment in our clinical programs, which would prevent or delay regulatory approval and commercialization.

There is a risk in any clinical trial that side effects from our product candidates will require a hold on, or termination of, our clinical program(s) or further adjustments to our clinical program(s) in order to progress our product candidates if we decide to resume development of our clinical programs. We will need to demonstrate that the product candidate are safe and effective for use in each target indication. Each product candidate must demonstrate an acceptable risk versus benefit profile in its intended patient population and for its intended use. The risk/benefit profile required for product licensure will vary depending on these factors.

If we decide to resume enrollment in our clinical programs, our success will be dependent upon our collaborations with third parties in connection with services we will need for the development, marketing and commercialization of our products candidates, if approved.

If we decide to resume enrollment in our clinical programs, the success of our business will be largely dependent on our ability to enter into collaborations regarding the development, clinical testing, regulatory approval and commercialization of our product candidates. We may not be able to find collaborative partners to support the future development, marketing and commercialization of our product candidates, which may require us to undertake research and development and/or commercialization activities ourselves and may result in a material adverse effect on our business, financial condition, prospects and results of operations.

Even if we are able to find new collaborative partners, our success is highly dependent upon the performance of these new collaborators. The amount and timing of resources to be devoted to activities by future collaborators, if any, are not within our direct control and, as a result, we cannot assure you that any future collaborators will commit sufficient resources to our research and development projects or the commercialization of our product candidates if approved. Any future collaborators might not perform their obligations as expected and might pursue existing or other development-stage products or alternative technologies in preference to those being developed in collaboration with us, or may terminate particular development programs, or the agreement governing such development programs which could have a material adverse effect on our business, financial condition, prospects and results of operations.

In addition, if any future collaborators fail to comply with applicable regulatory requirements, the FDA, the European Medicines Agency ("EMA"), the Therapeutic Products Directorate of Canada ("TPD") or other authorities could take enforcement action that could jeopardize our ability to develop and commercialize our product candidates. Despite our best efforts to limit them, disputes may arise with respect to ownership of technology developed under any such corporate collaboration which could have a material adverse effect on our business, financial condition, prospects and results of operations.

| 9 |

We will rely on proprietary technology, the protection of which can be unpredictable and costly.

Our success will depend in part upon our ability to obtain and maintain patent protection or patent licenses for our current and future technology related to our product candidates. Obtaining patent protection or patent licenses can be costly and the outcome of any application for patent protection and patent licenses can be unpredictable. In addition, any breach of confidentiality by a third party by premature disclosure may preclude us from obtaining appropriate patent protection, thereby affecting the development and commercial value of our technology and products.

The issuance of a patent is not conclusive as to its inventorship, scope, validity or enforceability, and our owned and licensed patents may be challenged in the courts or patent offices in the United States and abroad. Such challenges may result in loss of exclusivity or freedom to operate or in patent claims being narrowed, invalidated or held unenforceable, in whole or in part, which could limit our ability to stop others from using or commercializing similar or identical technology and products, or limit the duration of the patent protection of our technology and products. Given the amount of time required for the development, testing and regulatory review of new product candidates, patents protecting such candidates might expire before or shortly after such candidates are commercialized. As a result, our owned and licensed patent portfolio may not provide us with sufficient rights to exclude others from commercializing products similar or identical to ours.

The patent prosecution process is expensive and time-consuming, and we may not be able to file and prosecute all necessary or desirable patent applications in jurisdictions of interest at a reasonable cost or in a timely manner. It is also possible that we will fail to identify patentable aspects of our research and development output before it is too late to obtain patent protection. Moreover, in some circumstances, such as with respect to the LICR License described below, we do not have the right to control the preparation, filing and prosecution of patent applications, or to maintain the patents, covering technology that we license from third parties. Therefore, these patents and applications may not be prosecuted and enforced in a manner consistent with the best interests of our business. If such licensors fail to maintain such patents, or lose rights to those patents, the rights we have licensed may be reduced or eliminated. Moreover, changes in either the patent laws or interpretation of the patent laws in the United States and other countries may diminish the value of our patents or narrow the scope of our patent protection.

Some of our future products rely on licenses of proprietary technology owned by third parties and we may not be able to maintain these licenses on favorable terms or at all.

The development, manufacture and sale of some of the products we develop if we decide to resume enrollment in our clinical programs will involve the use of processes, products, or information, the rights to which are owned by third parties. For example, we rely on certain in-licenses for the development and commercialization of our adenosine receptor antagonists platforms, respectively. If we are unable to obtain and maintain patent protection for technology related to our product candidates, or if our licensors are unable to obtain and maintain patent protection for the technology or products that we license from them, or if the scope of the patent protection obtained is not sufficiently broad, our competitors could develop and commercialize technology and products similar or identical to ours, and our ability to successfully commercialize our technology and products may be impaired. In addition, if the breadth or strength of protection provided by our patents and patent applications is threatened, it could dissuade companies from collaborating with us to license, develop or commercialize current or future product candidates. In addition, invalidation of our patent rights by third parties could jeopardize the anticipated revenue streams from current licensees.

The patent position of biotechnology and pharmaceutical companies generally is highly uncertain, involves complex legal and factual questions and has in recent years been the subject of much litigation. As a result, the issuance, scope, validity, enforceability and commercial value of our and our licensors’ patent rights are highly uncertain. Any of the abovementioned risks could have a material adverse on us and our business.

| 10 |

We may not be able to successfully identify, consummate or integrate acquisitions or to successfully manage the impacts of such transactions on our operations.

Part of our business strategy has included pursuing synergistic acquisitions, such as our recent acquisition of Tarus Therapeutics. We have expanded, and may plan to continue to expand, our business by making strategic acquisitions and regularly seeking suitable acquisition targets to enhance our growth though we do not have any plans to do so at this time due to our current liquidity. Material acquisitions, dispositions and other strategic transactions involve a number of risks, including: (i) the potential disruption of our ongoing business; (ii) the distraction of management away from the ongoing oversight of our existing business activities; (iii) finding equity funding and incurring additional indebtedness; (iv) issuing additional equity which may have a dilutive effect on our capital, (v) the anticipated benefits and cost savings of those transactions not being realized fully, or at all, or taking longer to realize than anticipated; (vi) an increase in the scope and complexity of our operations; and (vii) the loss or reduction of control over certain of our assets.

The pursuit of acquisitions may pose certain risks to us. We may not be able to identify acquisition candidates that fit our criteria for growth and profitability. Even if we are able to identify such candidates, we may not be able to acquire them on terms or financing satisfactory to us. We will incur expenses and dedicate attention and resources associated with the review of acquisition opportunities, whether or not we consummate such acquisitions.

We rely on information technology and security systems and any damage, interruption or compromise of our information technology and security systems or data could disrupt and harm our business.

We use information technology and security systems to process, transmit and store electronic information in connection with the operation of our business. We also use such systems to protect proprietary and confidential information, including that of physicians, patients, and other individuals involved in clinical trials, suppliers, and employees. We face risks associated with cybersecurity incidents and other significant disruptions of such systems, including denial of service or other similar attacks, to our facilities or systems; unauthorized access to or acquisition of personal information, confidential information or other data we process or maintain; or viruses, loggers, or other malfeasant code, including ransomware, in our data or software. These cybersecurity incidents or other significant disruptions could be caused by persons inside our organization, persons outside our organization with authorized access to systems inside our organization, or by individuals outside our organization. The risk of a cybersecurity incident or disruption, particularly through cyber-attack or cyber-intrusion, has generally increased as the number, intensity and sophistication of attempted attacks and intrusions from around the world have increased. Although we have not experienced any cybersecurity incidents to date, and have not been affected by any incidents incurred by third-party partners, such incidents could have a material adverse effect on our business, financial condition or results of operations in the future. Additionally, future or past business transactions (such as acquisitions or integrations) could expose us to additional cybersecurity risks, as our information technology and systems could be negatively affected by vulnerabilities present in acquired or integrated entities’ systems and technologies. Furthermore, we may learn of cybersecurity issues that were not identified during due diligence of such entities, and it may be difficult to integrate entities into our information technology environment and security program.

We also rely on a number of third-party service providers to host, store or otherwise process information for us, or to provide other facilities or infrastructure that we make use of, including “cloud-based” providers of corporate infrastructure services relating to, among other things, human resources, communication services and some financial functions, and we are therefore dependent on the security systems of these providers. These third-party entities are subject to similar risks as we are relating to cybersecurity, business interruption and systems and employee failures and a cybersecurity incident or other significant disruption affecting such third parties could have a material adverse effect on our business. While we may be entitled to damages if our third-party service providers fail to satisfy their security-related obligations to us, any award may be insufficient to cover our damages, or we may be unable to recover such award.

| 11 |

Because the techniques used to obtain unauthorized access to or sabotage security systems change frequently and are often not recognized until after an attack, we and our third-party service providers may be unable to anticipate the techniques or implement adequate preventative measures, thereby exposing us to material adverse effects on our business, financial condition, results of operations and growth prospects. In order to address risks to our information systems, we continue to make investments in personnel, technologies and training. Data protection laws and regulations around the world, including in jurisdictions where operate, like the U.S. and EU, often require “reasonable,” “appropriate,” or “adequate” technical and organizational security measures, and the interpretation and application of those laws and regulations are often uncertain and evolving; there can be no assurance that our security measures will be deemed adequate, appropriate or reasonable by a regulator or court. Moreover, even security measures that are deemed appropriate, reasonable and/or in accordance with applicable legal requirements may not be able to protect the information we maintain. A cybersecurity incident or other significant disruption impacting us or our third-party service providers could require a substantial level of financial resources to rectify and otherwise respond to, may be difficult to identify or address in a timely manner, may compromise our research, the therapies we are developing or other intellectual property or trade secrets, and may divert management’s attention and require the expenditure of significant time and resources. Such cybersecurity incidents or other significant disruptions could result in claims, increased regulatory scrutiny or investigations, and may cause us to incur substantial fines, penalties or other liability and related legal and other costs. Any actual or perceived cybersecurity incident or significant disruption may also interfere with our ability to comply with financial reporting requirements and harm our reputation and market position, especially given that we handle sensitive information, including clinical trial data. Any of the foregoing matters could harm our operating results and financial condition.

While we have purchased cybersecurity insurance, there are no assurances that the coverage would be adequate in relation to any incurred losses. Moreover, as cyber-attacks increase in frequency and magnitude, we may be unable to obtain cybersecurity insurance in amounts and on terms we view as adequate for our operations.

Any actual or perceived failure by us to comply with government or other obligations related to privacy or data protection could adversely affect our business.

We are subject to compliance risks and uncertainties under a variety of global laws and regulations governing privacy, data protection and the collection, storage, transfer, use, retention, sharing, disclosure, protection and processing of personal data, including personal data of physicians, patients, and other individuals involved in clinical trials. These laws may include sector-specific requirements, including laws or regulations that govern health or clinical trial data. In addition, we may obtain health data from third parties (including research institutions from which we obtain clinical trial data) that is subject to privacy and security requirements. For example, the U.S. Health Insurance Portability and Accountability Act of 1996 (“HIPAA”), as amended by the Health Information Technology for Economic and Clinical Health Act (“HITECH”) imposes obligations on certain types of individuals and entities, including mandatory contractual terms, with respect to safeguarding the privacy, security and transmission of individually identifiable health information. Privacy and data protection laws may be interpreted and applied differently depending on the jurisdiction and continue to evolve, making it difficult to predict how they may develop and apply to us. The regulatory frameworks for these issues worldwide are rapidly evolving and are likely to remain uncertain for the foreseeable future. Federal, state, or non-U.S. government bodies or agencies have in the past adopted, and may in the future adopt, new laws and regulations or may make amendments to existing laws and regulations affecting data privacy or data protection. In addition to government regulation, industry groups have established or may establish new and different self-regulatory standards that may legally or contractually apply to us or our prospective customers. Failure to comply with these varying laws and standards may subject us to investigations, enforcement actions, civil litigation, fines, claims for damages by third parties or affected individuals, damage to our reputation and loss of goodwill, impact our ability to conduct our research and produce therapies and result in other civil or criminal penalties, all of which may generate negative publicity and have a negative impact on our business, financial condition, results of operations or prospects.

In the United States, there are numerous federal and state laws and regulations related to the privacy and security of personal data that may be applicable to our current and future activities. Numerous federal and state laws and regulations protect the confidentiality, privacy, availability, integrity and security of personal data in the United States. Legal requirements vary from state to state, and these laws and regulations in many cases are more restrictive than, and may not be preempted by, federal privacy laws and regulations. These laws and regulations are often uncertain, contradictory, and subject to changing or differing interpretations. Certain state laws may include a private right of action for certain data breaches or noncompliance with privacy obligations, may provide for penalties and other remedies, and may require us to incur substantial costs and expenses and liabilities in connection with our compliance. Other U.S. states and the U.S. federal government are considering or have enacted similar privacy legislation.

| 12 |

Outside the United States, an increasing number of laws, and regulations may govern data privacy and security. As a company doing business in Europe, we are also subject to European data protection laws and regulations. The European Union General Data Protection Regulation (“GDPR”) imposes stringent requirements regarding how we collect and process personal data and provides for significant penalties for noncompliance. Several other countries have passed laws that require personal data relating to their citizens to be maintained on local servers and impose additional data transfer restrictions. In addition, the United Kingdom has adopted a framework similar to the GDPR. The EU has confirmed the UK data protection framework as being “adequate” to receive EU personal data. Although there are currently various mechanisms that may be used to transfer personal data from the EEA and UK to the United States in compliance with law, these mechanisms are subject to legal challenges, and there is no assurance that we can satisfy or rely on these measures to lawfully transfer personal data to the United States. For example, there have been recent updates to laws and regulations governing transfers of EU data, including updates to Standard Contractual Clauses and a proposed EU-US data transfer adequacy agreement. In light of these and other ongoing developments relating to cross-border data transfers, we may experience additional costs associated with increased compliance burdens, and this regulation may impact our ability to transfer personal data across our organization, to clinical trial physicians or patients, to our customers, or to third parties.

We are subject to risks associated with doing business globally.

As a pharmaceutical research and development company, if we decide to resume enrollment in our clinical programs, our operations are likely to expand in the European Union and many other developed countries worldwide, and we will be subject to political, economic, operational, legal, regulatory and other risks that are inherent in conducting business globally. For example, we currently have ongoing clinical operations in the U.K. and are contemplating expanding to other countries. These risks include foreign exchange fluctuations, exchange controls, capital controls, requirements to comply with new laws or regulations or changes in the interpretation or enforcement of existing laws or regulations, political instability, macroeconomic changes, including recessions and inflationary or deflationary pressures, increases in prevailing interest rates by central banks or financial services companies, economic uncertainty, which may adversely affect our research and development, reduce the demand for our potential products and reduce the prices that our potential customers will be willing to pay for our potential products, import or export restrictions, tariff increases, price controls, nationalization and expropriation, changes in taxation, diminished or insufficient protection of intellectual property, lack of access to impartial court systems, violations of law, including the U.S. Foreign Corrupt Practices Act and the United Kingdom (“U.K.”) Bribery Act, disruption or destruction of operations or changes to our business position, regardless of cause, including pandemic, war, terrorism, riot, civil insurrection, social unrest, strikes and natural or man-made disasters, including famine, flood, fire, earthquake, storm or disease. The impact of any of these developments or events, either individually or cumulatively, could have a material adverse effect on our business, financial condition and results of operations.

We may face exposure to adverse movements in foreign currency exchange rates.

We intend to generate revenue and expenses internationally that are likely to be primarily denominated in U.S. dollars, Euros and British pound sterling. Our intended international business will be subject to risks typical of an international business including, but not limited to, differing tax structures, a myriad of regulations and restrictions and general foreign exchange rate volatility. A decrease in the value of such foreign currencies relative to the United States dollar could result in losses in revenues from currency exchange rate fluctuations. Conversely, an increase in the value of such foreign currencies relative to the United States dollar could negatively impact our operating expenses. To date, we have not hedged against risks associated with foreign exchange rate exposure. We cannot be sure that any hedging techniques we may implement in the future will be successful or that our business, results of operations, financial condition and cash flows will not be materially adversely affected by exchange rate fluctuations.

The loss of key personnel could have an adverse effect on our business.

We are highly dependent upon the efforts of our senior management. The loss of the services of one or more members of senior management could have a material adverse effect on us as a small company with a streamlined management structure, and would be potentially disruptive to our business until such time as a suitable replacement is hired. We do not carry any key person insurance on our senior management.

| 13 |

The U.K.’s withdrawal from the EU, commonly referred to as Brexit, continues to result in regulatory uncertainty which may have a negative effect on global economic conditions, financial markets and our business.

Brexit created significant uncertainty concerning the future relationship between the U.K. and the EU. From a regulatory perspective, there is uncertainty about which laws and regulations will apply. A significant portion of the regulatory framework in the U.K. is derived from EU laws. However, it is unclear which EU laws the U.K. will decide to replace or replicate in connection with its withdrawal from the EU. In particular, the regulatory regime applicable to our operations, including with respect to conduct of clinical trials and the approval of our product candidates if we decide to resume development of our clinical programs, may change, potentially significantly, and the impact of these changes is difficult to quantify until new regulation and guidance is published.

A basic requirement related to the grant of a marketing authorization for a medicinal product in the EU is the requirement that the applicant be established in the EU. Following the expiry of the Brexit transitional arrangements, separate applications for marketing authorizations for Great Britain (England, Scotland and Wales) are required to place medicinal products on the market in Great Britain. The European Commission Decision Reliance Procedure, which allowed the U.K. regulatory to “rely” on EU centralized marketing authorization decisions, expired on December 31, 2023. The EU mutual recognition and decentralized procedures no longer apply to Great Britain. From January 1, 2024, under the Windsor Framework, the EU no longer has jurisdiction over medicines placed on the market in Northern Ireland and all medicines intended for Northern Ireland (or the U.K. market more generally) will require a U.K. marketing authorisation. Additional regulation and guidance is anticipated to govern how this new regime will operate, including as to labelling of medicines in Northern Ireland.

To replace EU based mutual recognition procedures, the U.K. has announced plans to introduce an international reliance route for the approval of medicinal products in the U.K. From January 1, 2024, the U.K. intends to recognize approvals of medicinal products from: Australia, Canada, the European Union, Japan, Switzerland, Singapore and the United States. This approach may benefit out strategy and operations if we decide to resume development of our clinical programs as it could lead to approval in the U.K. of “cutting-edge medicines” more quickly and through a more streamlined regulatory process. However, the procedure will not come into effect until new regulations are introduced and these have not yet been published. Delays in implementing this new legislation may lead to regulatory uncertainty and delays.

In addition, the laws and regulations that apply since the U.K.’s withdrawal from the EU may have implications for manufacturing sites that hold certifications issued by the U.K. competent authorities. If batch release and quality control testing sites for our product candidates are located only in the U.K., manufacturers will need to use sites in other EU member states for EU batch release. All of these changes, if they occur, could increase our costs and otherwise adversely affect our business.

Currency exchange rates for the British pound and the Euro, with respect to each other and to the U.S. dollar, were affected by Brexit, and could be affected in the future by other global events.

Risks Related to Ownership of our Shares

We may not be able to regain, or maintain, compliance with the continued listing requirements of The Nasdaq Capital Market.

Our ordinary shares are listed on the Nasdaq Capital Market, and we are therefore subject to its continued listing requirements, including requirements with respect to the market value of our publicly-held shares, market value of our listed shares, minimum bid price per share, and minimum shareholders' equity, among others. If we fail to satisfy one or more of the requirements, we may be delisted from the Nasdaq Capital Market.

On March 7, 2024, we received notice (the “Notice”) from Nasdaq that we are not currently in compliance with the $1.00 minimum bid price requirement for continued listing on the Nasdaq Capital Market, as set forth in Nasdaq Listing Rule 5550(a)(2). The Notice indicated that, consistent with Nasdaq Listing Rule 5810(c)(3)(A), we have 180 calendar days, or until September 3, 2024, to regain compliance with the minimum bid price requirement by having the closing bid price of our ordinary shares meet or exceed $1.00 per share for at least ten consecutive business days. The notification had no immediate effect on the listing of our ordinary shares, and our ordinary shares will continue to trade on the Nasdaq Capital Market under the symbol “PRTG” at this time.

| 14 |

If we do not regain compliance by September 3, 2024, we may be eligible for an additional 180 calendar day grace period. If we fail to regain compliance during the applicable period, we will receive notification from Nasdaq that our ordinary shares are subject to delisting. Such notification will have no immediate effect on our listing on the Nasdaq Capital Market, nor will it have an immediate effect on the trading of our ordinary shares pending such hearing. At that time, we may then appeal the delisting determination to a Nasdaq hearings panel. There can be no assurance, however, that we will be able to regain compliance with Nasdaq’s minimum bid price requirement. If we regain compliance with Nasdaq’s minimum bid price requirement, there can be no assurance that we will be able to maintain compliance with the continued listing requirements for the Nasdaq Capital Market or that our ordinary shares will not be delisted from the Nasdaq Capital Market in the future. In addition, we may be unable to meet other applicable listing requirements of the Nasdaq Capital Market, including maintaining minimum levels of shareholders’ equity or market values of our ordinary shares in which case, our ordinary shares could be delisted notwithstanding our ability to demonstrate compliance with the minimum bid price requirement.

Additionally, Nasdaq Listing Rule 5550(b)(1) requires companies listed on the Nasdaq Capital Market to maintain shareholders’ equity of at least $2.5 million for continued listing. As of March 31, 2024, our shareholders’ equity was $3.3 million and there can be no assurance that we will be able to maintain or increase our shareholders’ equity in the future. If our shareholders’ equity falls below $2.5 million, as a result of operating losses or for other reasons, or if we are unable to demonstrate to Nasdaq’s satisfaction that we subsequently regained compliance with this requirement, Nasdaq will notify us of such non-compliance. If we receive such notice from Nasdaq, in accordance with the Nasdaq Listing Rules, we will have 45 calendar days from the date of the notification to submit a plan to regain compliance with Nasdaq Listing Rule 5550(b)(1). If our compliance plan is accepted, we may be granted up to 180 calendar days from the date of the initial notification to evidence compliance. If our compliance plan is not accepted or we are otherwise unable to evidence compliance within Nasdaq’s allotted timeframe, Nasdaq may take steps to delist our ordinary shares.

Delisting from the Nasdaq Capital Market may adversely affect our ability to raise additional financing through the public or private sale of equity securities, may significantly affect the ability of investors to trade our securities and may negatively affect the value and liquidity of our ordinary shares. Delisting also could have other negative results, including the potential loss of employee confidence, the loss of institutional investors or interest in business development opportunities.

If we are delisted from Nasdaq and we are not able to list our ordinary shares on another exchange, our ordinary shares could be quoted on the OTC Bulletin Board or in the “pink sheets.” As a result, we could face significant adverse consequences including, among others:

| · | a limited availability of market quotations for our securities; |

| · | a determination that our shares are a “penny stock” which will require brokers trading in our ordinary shares to adhere to more stringent rules and possibly result in a reduced level of trading activity in the secondary trading market for our securities; |

| · | a limited amount of news and little or no analyst coverage for us; |

| · | we would no longer qualify for exemptions from state securities registration requirements, which may require us to comply with applicable state securities laws; and |

| · | a decreased ability to issue additional securities (including pursuant to short-form Registration Statements on Form F-3) due to the Baby Shelf Rule or obtain additional financing in the future. |

The issuance of additional ordinary shares, including upon the exercise of our outstanding stock options, will dilute the ownership interest of our existing shareholders and increase the number of ordinary shares eligible for future resale.

As of March 31, 2024, we had 369,340 vested restricted stock units outstanding, which are subject to certain restrictions. Additionally, as of March 31, 2024, we had an aggregate of 1,805,620 stock options to acquire ordinary shares outstanding. During the year ended March 31, 2024 (“Fiscal 2024”), we issued shares as follows: 1,970,000 ordinary shares (along with 1,187,895 pre-funded warrants and four tranches totaling 9,631,580 detachable warrants) relating to the Registered Direct Offering (as defined below); 186,604 ordinary shares sold pursuant to our “at-the-market” (“ATM”) offering program; 15,872 ordinary shares issued to a service provider for services rendered; and 6,165 shares issued pursuant to the exercise of restricted stock units.

| 15 |

Our principal shareholders and senior management own a significant percentage of our ordinary shares and are able to exert significant control over matters subject to shareholder approval.

As of August 14, 2024, our senior management, board members, holders of 5% or more of our share capital and their respective affiliates beneficially owned approximately 41.5% of our outstanding voting securities. As a result, these security holders may have the ability either alone or voting together as a group to determine and/or significantly influence the outcome of matters submitted to our shareholders for approval, including the election and removal of board members, payment of dividends, amendments to our articles of association, including changes to our share capital, or certain mergers, demergers, liquidations and similar transactions. This may prevent or discourage unsolicited acquisition proposals or offers for our ordinary shares that our shareholders may feel are in their best interest as a shareholder. In addition, this group of shareholders generally has the ability to control our management and business affairs and direction of our business. Such control and concentration of ownership may affect the market price of our ordinary shares and may discourage certain types of transactions, including those involving actual or potential change of control of us (whether through merger, consolidation, take-over or other business combination), which might otherwise have a positive effect on the market price of the shares.

We are currently a foreign private issuer, which may limit information about us and legal rights that you as an investor may desire and are different from those of a United States domestic reporting company.

We currently are a "foreign private issuer," as such term is defined in Rule 405 under the U.S. Securities Act 1933, as amended (the “Securities Act”) and, therefore, we are not required to file annual reports on Form 10-K, quarterly reports on Form 10-Q or current reports on Form 8-K with the United States Securities and Exchange Commission (“SEC”). In addition, the proxy rules and Section 16 reporting and short-swing profit rules are not applicable to us. If we lose our status as a foreign private issuer by our election or otherwise and we become subject to the full reporting regime of the United States securities laws, we will be subject to additional reporting obligations and proxy solicitation obligations under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and our officers, directors and 10% shareholders would become subject to the short-swing profit rules. The imposition of these reporting rules would increase our costs associated with legal and accounting compliance and the obligations of those affected by the short-swing rules.

Complex United States taxation rules apply to holders of our ordinary shares if we have too much passive income compared to ordinary income and we are considered a PFIC.

Generally, if, for any taxable year, at least 75% of our gross income is passive income or at least 50% of the value of our assets is attributable to assets that produce passive income or are held for the production of passive income, including cash, we will be classified as a passive foreign investment company (a “PFIC”), for U.S. federal income tax purposes. For purposes of these tests, passive income includes dividends, interest and gains from the sale or exchange of investment property and rents and royalties other than certain rents and royalties which are received from unrelated parties in connection with the active conduct of a trade or business. We believe that we were a PFIC for our fiscal year ended March 31, 2018 and that we were a PFIC for the year ended March 31, 2024 (“Fiscal 2024”). In addition, we may have been a PFIC in other years and may continue to be a PFIC in the future.

If we are classified as a PFIC, our U.S. tax-resident shareholders could be liable for additional taxes and interest charges upon certain distributions by us and any gain recognized on a sale, exchange or other disposition, including a pledge, of our ordinary shares (and such gain would generally be treated as ordinary income, rather than capital gain, for U.S. federal income tax purposes), whether or not we continue to be a PFIC. In addition, U.S. tax residents who own an interest in a PFIC are required to comply with certain reporting requirements.

A U.S. tax-resident shareholder may in certain circumstances be able to mitigate some of the adverse U.S. federal income tax consequences of us being classified as a PFIC if our ordinary shares qualify as "marketable stock" under the PFIC rules and the shareholder is eligible to make, and successfully makes, a "mark-to-market" election. A U.S. tax-resident shareholder could also mitigate some of the adverse U.S. federal income tax consequences by making a qualified electing fund (“QEF”) election, provided that we provide the information necessary for our U.S. tax-resident shareholders to make such an election, but we are not required to make this information available. We made the information available for the fiscal years 2018 and 2019 to those shareholders who requested it and can make this information available for our fiscal years 2020, 2021, 2022, 2023 or 2024, if requested.

| 16 |

U.S. tax-resident shareholders are strongly urged to consult their tax advisors about the PFIC rules, including tax return filing requirements and the eligibility, manner and consequences to them of making a QEF or mark-to-market election with respect to our ordinary shares if we should be classified as a PFIC.

U.S. shareholders may not be able to enforce civil liabilities against us.

We are a company incorporated under the laws of the British Virgin Islands. Many of our directors and executive officers are non-residents of the United States. Because a substantial portion of their assets and currently most of our assets are located outside the United States, it may be difficult for investors to effect service of process within the United States upon us or those persons.