Bontan Corporation Inc.

Consolidated Financial Statements

For the Three Months Ended June 30, 2011 and 2010

(Canadian Dollars)

(UNAUDITED – see Notice to Reader dated September 26, 2011)

|

Index

|

|

| |

|

|

Notice to Reader issued by the Management

|

2

|

| |

|

|

Consolidated Balance Sheets

|

3

|

| |

|

|

Consolidated Statements of Operations and Comprehensive Income (Loss)

|

4

|

| |

|

|

Consolidated Statements of Shareholders’ Equity

|

5

|

| |

|

|

Consolidated Statement of Cash Flows

|

6

|

|

Notes to Consolidated Financial Statements

|

7-32

|

BONTAN CORPORATION INC.

NOTICE TO READER OF THE INTERIM CONSOLIDATED FINANCIAL STATEMENTS

The accompanying consolidated financial statements for Bontan Corporation Inc. for the three months ended June 30, 2011 have been prepared by management in accordance with International Financial Reporting Standards, consistently applied. These consolidated financial statements have not been reviewed by the auditors of the Company.

These financial statements are presented on the accrual basis of accounting. Accordingly, a precise determination of many assets and liabilities is dependent upon future events. Therefore, estimates and approximations have been made using careful judgement. Recognizing that the management is responsible for both the integrity and objectivity of the financial statements, management is satisfied that these financial statements have been fairly presented.

September 26, 2011

Bontan Corporation Inc.

Consolidated Balance Sheets (Unaudited)

(Canadian Dollars)

(Unaudited – see Notice to Reader dated September 26, 2011)

|

As at,

|

|

|

|

Note

|

June 30, 2011

|

March 31, 2011

|

April 1, 2010

|

|

Assets

|

|

|

|

|

|

|

|

|

Current

|

|

|

|

|

|

|

|

|

Cash

|

|

|

|

|

$100,304

|

$348,464

|

$2,350,526

|

|

Short term investments

|

|

4,12(vii)

|

1,219,111

|

1,900,400

|

1,359,431

|

|

Prepaid consulting services

|

|

|

-

|

7,171

|

50,792

|

|

Other receivables

|

|

|

|

127,254

|

114,069

|

129,869

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

$1,446,669

|

$2,370,104

|

$3,890,618

|

|

Office equipment and furniture

|

|

|

$8,396

|

$8,956

|

$8,802

|

|

Exploration and evaluation expenditures

|

5

|

$6,972,740

|

$6,972,740

|

$6,520,367

|

| |

|

|

|

|

$8,427,805

|

$9,351,800

|

$10,419,787

|

|

Liabilities and shareholders' equity

|

|

|

|

|

|

Current liabilities

|

|

|

|

|

|

|

|

Accounts payable and accrued liabilities

|

12(vi)

|

$690,926

|

$663,577

|

$2,453,910

|

|

Short term loans

|

|

|

|

-

|

-

|

1,065,578

|

|

Total current liabilities

|

|

|

$690,926

|

$663,577

|

$3,519,488

|

|

Shareholders' Equity

|

|

|

|

|

|

|

|

Capital stock

|

|

|

6

|

$36,078,140

|

$36,078,140

|

$35,298,257

|

|

Warrants

|

|

|

|

8

|

8,677,551

|

8,677,551

|

7,343,886

|

|

Contributed surplus

|

|

|

|

4,755,077

|

4,755,077

|

4,573,748

|

|

Accumulated other comprehensive loss

|

|

90,548

|

168,347

|

(2,696,213)

|

|

Deficit

|

|

|

|

|

(41,864,437)

|

(40,990,892)

|

(37,262,565)

|

| |

|

|

|

|

(41,773,889)

|

(40,822,545)

|

(39,958,778)

|

|

Total shareholders' equity

|

|

|

$7,736,879

|

$8,688,223

|

$7,257,113

|

|

Non-controlling interests

|

|

|

$ -

|

$ -

|

$(356,814)

|

|

Total equity

|

|

|

|

$7,736,879

|

$8,688,223

|

$6,900,299

|

| |

|

|

|

|

$8,427,805

|

$9,351,800

|

$10,419,787

|

|

Going concern (note 2(c))

|

|

|

|

|

|

|

Commitments and Contingent Liabilities (Note 11)

|

|

|

|

|

Related Party Transactions (Note 12)

|

|

|

|

|

Approved by the Board ”Kam Shah” Director ”Dean Bradley” Director

(signed) (signed)

The accompanying notes are an integral part of these consolidated financial statements.

Bontan Corporation Inc.

Consolidated Statements of Operations and Comprehensive Income (Loss)

(Canadian Dollars)

(Unaudited – see Notice to Reader dated September 26, 2011)

|

For the three months ended June 30,

|

Note

|

2011

|

2010

|

|

Income

|

|

|

|

| |

|

|

|

| |

|

-

|

-

|

|

Expenses

|

|

|

|

|

Professional fees

|

|

338,388

|

239,987

|

|

Consulting fees

|

10,11(b,( c),(d) & (f),12(v)

|

113,236

|

208,689

|

|

Shareholders information

|

11(a),12(i)

|

30,739

|

43,273

|

|

Travel, meals and promotions

|

12(iv)

|

6,258

|

32,669

|

|

Office and general

|

|

8,050

|

28,649

|

|

Payroll

|

|

9,251

|

12,412

|

|

Rent

|

|

6,335

|

6,390

|

|

Communication

|

|

3,133

|

5,475

|

|

Transfer agents fees

|

|

1,193

|

4,817

|

|

Bank charges and interest

|

|

396

|

4,235

|

|

Amortization

|

|

560

|

580

|

|

Write down of short term investments

|

|

343,750

|

-

|

|

Loss on disposal of short term investments

|

|

14,540

|

-

|

|

Exchange gain

|

|

(2,284)

|

(43,345)

|

| |

|

873,545

|

543,831

|

| |

|

(873,545)

|

(543,831)

|

|

Non-controlling interest

|

|

-

|

58,170

|

|

Net loss for the period

|

|

(873,545)

|

(485,661)

|

| |

|

|

|

|

Other comprehensive income (loss):

|

|

|

|

|

Unrealized gain for the period on short term investments, net of tax considered available for sale

|

|

265,951

|

21,737

|

|

Impairment loss on short term investments transferred to net income

|

|

(343,750)

|

-

|

|

Other comprehensive income (loss)

|

|

(77,799)

|

21,737

|

|

Comprehensive loss for the period

|

|

(951,344)

|

(463,924)

|

|

Basic and diluted loss per share information

|

|

|

|

|

Net Loss per share

|

9

|

$(0.01)

|

$(0.01)

|

The accompanying notes are an integral part of these consolidated financial statements.

Bontan Corporation Inc.

Consolidated Statement of Shareholders’ Equity

(Canadian Dollars)

For the three months ended June 30, 2011

(Unaudited – see Notice to Reader dated September 26, 2011)

| |

Number of Shares

|

Capital Stock

|

Warrants

|

Contributed surplus

|

Accumulated Deficit

|

Accumulated other comprehensive loss

|

Shareholders' Equity

|

|

Balance April 1, 2010

|

65,229,076

|

$35,298,257

|

$7,343,886

|

$4,573,748

|

$(37,262,565)

|

$(2,696,213)

|

$7,257,113

|

|

subscription received in fiscal 2010 reversed on issuance of shares

|

|

(303,480)

|

|

|

|

|

(303,480)

|

|

Issued under private placement

|

12,700,000

|

2,564,925

|

|

|

|

|

2,564,925

|

|

Finder fee

|

|

(256,493)

|

|

|

|

|

(256,493)

|

|

Value of warrants issued under private placement

|

|

(1,232,145)

|

1,232,145

|

|

|

|

-

|

|

Value of warrants issued as finder’s fee

|

|

(123,214)

|

123,214

|

|

|

|

-

|

|

Issued under 2009 Consultant stock compensation plan

|

135,000

|

48,093

|

|

|

|

|

48,093

|

|

Issued on exercise of warrants

|

600,000

|

60,503

|

|

|

|

|

60,503

|

|

Value of warrants exercised

|

|

21,694

|

(21,694)

|

|

|

|

-

|

|

Unrealised gain on short term investments ,net of tax, considered available for sale

|

|

|

|

|

|

2,864,560

|

2,864,560

|

|

Value of options issued

|

|

|

|

181,329

|

|

|

181,329

|

|

Net loss for period

|

|

|

|

|

(3,728,327)

|

|

(3,728,327)

|

|

Balance, March 31, 2011

|

78,664,076

|

$36,078,140

|

$8,677,551

|

$4,755,077

|

$(40,990,892)

|

$168,347

|

$8,688,223

|

|

Unrealised loss on short term investments ,net of tax, considered available for sale

|

|

|

|

|

|

(77,799)

|

(77,799)

|

|

Net loss for period

|

|

|

|

|

(873,545)

|

|

(873,545)

|

|

Balance, June 30, 2011

|

78,664,076

|

$36,078,140

|

$8,677,551

|

$4,755,077

|

$(41,864,437)

|

$90,548

|

$7,736,879

|

The accompanying notes are an integral part of these consolidated financial statements.

Bontan Corporation Inc.

Consolidated Statements of Cash Flows

(Canadian Dollars)

(Unaudited – see Notice to Reader dated September 26, 2011)

|

For the three months ended June 30,

|

Note

|

2011

|

2010

|

|

Cash flows from operating activities

|

|

|

|

|

Net loss for period

|

|

$(873,545)

|

$(485,661)

|

|

non-controlling interests

|

|

-

|

(58,170)

|

|

Amortization of office equipment and furniture

|

|

560

|

580

|

|

Write down of short term investments

|

|

343,750

|

-

|

|

Loss on disposal of short term investments

|

|

14,540

|

-

|

|

Consulting fees settled for common shares

|

10

|

7,171

|

22,868

|

|

Net change in working capital components

|

|

|

|

|

Other receivables

|

|

(13,185)

|

(441,216)

|

|

Accounts payable and accrued liabilities

|

|

27,349

|

(574,824)

|

| |

|

$(493,360)

|

$(1,536,423)

|

|

Cash flow from(into) investing activities

|

|

|

|

|

Purchase of office equipment and furniture

|

|

-

|

(1,897)

|

|

Acquisition of oil & gas properties

|

|

-

|

(658,279)

|

|

Net proceeds from sale of short term investments

|

|

245,200

|

-

|

| |

|

$245,200

|

$(660,176)

|

|

Cash flow from financing activities

|

|

|

|

|

Short term loan

|

|

-

|

(1,239,531)

|

|

Common shares issued net of issuance costs

|

|

-

|

2,029,855

|

| |

|

$-

|

$790,324

|

|

Decrease in cash during period

|

|

(248,160)

|

(1,406,275)

|

|

Cash at beginning of period

|

|

348,464

|

2,350,526

|

|

Cash at end of period

|

|

$100,304

|

$944,251

|

|

Supplemental disclosures

|

|

|

|

|

Non-cash operating activities

|

|

|

|

|

Consulting fees settled for common shares and

|

10

|

(7,171)

|

(22,868)

|

|

options and expensed during the period

|

|

Consulting fees prepaid in shares

|

|

-

|

(68,029)

|

| |

|

$(7,171)

|

$(90,897)

|

The accompanying notes are an integral part of these consolidated financial statements.

Bontan Corporation Inc.

Notes to Consolidated Financial Statements

(Canadian Dollars)

June 30, 2011 and 2010

(Unaudited – see Notice to Reader dated September 26, 2011)

1. NATURE OF OPERATIONS

Bontan Corporation Inc. (“the Company”) is incorporated in Ontario and its head office is located at 47 Avenue Road, Suite 200, Toronto, Ontario, Canada. The Company is a diversified natural resource company that invests in oil and gas exploration and development.

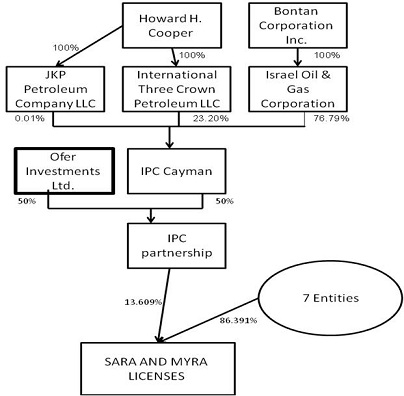

The Company holds an indirect 5.23% working interest in two off-shore drilling licenses in the Levantine Basin, approximately forty kilometres off the West coast of Israel.

The Company does not currently own any oil and gas properties with proven reserves.

2. BASIS OF PRESENTATION AND ADOPTION OF IFRS

|

(a)

|

Statement of compliance

|

These consolidated interim financial statements are unaudited and have been prepared in accordance with IAS 34 ‘Interim Financial Reporting’ (“IAS 34”) using accounting policies consistent with the International Financial Reporting Standards (“IFRS”) issued by the International Accounting Standards Board (“IASB”) and Interpretations of the International Financial Reporting Interpretations Committee (“IFRIC”) in which the Company expects to adopt for its annual 2012 consolidated financial statements. Subject to certain transition elections disclosed in Note 16, the Company has consistently

applied the same accounting policies in its opening IFRS Balance Sheet at April 1, 2010 and throughout all periods presented, as if these policies had always been in effect. Note 16 discloses the impact of the transition to IFRS on the Company‘s reported financial position, financial performance and cash flows, including the nature and effect of significant changes in accounting policies from those used in the Company‘s consolidated financial statements for the year ended March 31, 2011.

The policies applied in these condensed interim consolidated financial statements are based on IFRS issued and outstanding as of September 26, 2011, the date the Board of Directors approved the statements. Any subsequent changes to IFRS that are given effect in the Company’s annual consolidated financial statements for the year ending March 31, 2012 could result in restatement of these interim consolidated financial statements, including the transition adjustments recognized on change-over to IFRS.

The condensed interim consolidated financial statements should be read in conjunction with the Company’s previous Canadian GAAP annual consolidated financial statements for the year ended March 31, 2011.

The Company has no requirement to report on segments as it operates as only one segment.

(b) Basis of presentation

The financial statements have been prepared on the historical cost basis except for certain non-current assets and financial instruments, which are measured at fair value, as explained in the significant accounting policies set out in Note 3. The comparative figures presented in these interim consolidated financial statements are in accordance with IFRS and have not been audited.

Bontan Corporation Inc.

Notes to Consolidated Financial Statements

(Canadian Dollars)

June 30, 2011 and 2010

(Unaudited – see Notice to Reader dated September 26, 2011)

2. BASIS OF PRESENTATION AND ADOPTION OF IFRS - continued

(c) Going concern

Management has prepared these consolidated interim financial statements on an assumption of a going concern, which contemplates that assets will be realized and liabilities discharged in the normal course of business as they come due. To this point, all operational activities and the overhead costs have been funded from the available cash and short term investments and by equity issuances.

The Company has a working capital of approximately $ 0.7 million and accumulated deficit of approximately $ 41.9 million. While the Company’s commitment to meet its share of the exploration and development obligations under its current project is covered to the extent of US $28 million, it is still responsible for its share of any cost overruns. Further, the Company has entered into extensive litigation with the minority shareholder and manager of its subsidiary, IPC Cayman, to protect its interest in the project. Litigations are still in progress and may involve further substantial legal costs, which cannot be reasonably estimated at this stage.

The Company will have to secure new cash resources to meet these obligations. Management is currently evaluating and pursuing funding alternatives, including additional farm-out agreements and new equity issuances. While the management has so far been successful in raising the required equity financing, there is no assurance that these initiatives will continue to be successful. Uncertainty in global capital markets and pending litigations could have a negative impact on the Company’s ability to access capital in the future.

The Company's ability to continue as a going concern is dependent upon its ability to access sufficient capital to defend its interest, complete exploration and development activities, identify commercial oil and gas reserves and to ultimately have profitable operations. These financial statements do not reflect the adjustments to the carrying values of assets and liabilities and the reported expenses and balance sheet classifications that would be necessary if the Company was unable to realize its assets and settle its liabilities as a going concern, in the normal course of operations. Such adjustments could be material.

(d) Consolidation

The consolidated interim financial statements include the accounts of the Company and of the following subsidiaries:

|

a.

|

Israel Oil & Gas Corporation, a wholly owned subsidiary

|

|

b.

|

1843343 Ontario Inc., a wholly owned subsidiary incorporated in Ontario on January 31, 2011 and has no activity since its inception.

|

Israel Oil & Gas Corporation owns 76.79% equity interest in Israel Petroleum Company Limited (“IPC Cayman”), a Cayman Island limited company incorporated on November 12, 2009. Effective May 18, 2010, the Company deconsolidated IPC Cayman financials due to loss of control and power to govern the financial and operating policies.

All inter-company balances and transactions have been eliminated on consolidation.

Bontan Corporation Inc.

Notes to Consolidated Financial Statements

(Canadian Dollars)

June 30, 2011 and 2010

(Unaudited – see Notice to Reader dated September 26, 2011)

2. BASIS OF PRESENTATION AND ADOPTION OF IFRS - continued

(e) Functional and presentation currency

The consolidated interim financial statements are presented in Canadian dollar which is also the functional currency of the Company and its subsidiaries.

(f) Use of Estimates and judgments

The preparation of financial statements in conformity with IFRS requires management to make judgments, estimates and assumptions that affect the application of accounting policies and the reported amounts of assets, liabilities, income and expenses. Actual results may differ from these estimates.

Estimates and underlying assumptions are reviewed on an ongoing basis. Revisions to accounting estimates are recognized in the year in which the estimates are revised and in any future years affected. Significant areas where estimation uncertainty and critical judgments are applied include valuation of financial instruments, valuation of property, plant and equipment, impairment losses, depletion and depreciation, and measurement of stock based compensation.

|

3.

|

SIGNIFICANT ACCOUNTING POLICIES

|

The accounting policies set out below are expected to be adopted for the year ending March 31, 2012 and have been applied consistently to all periods presented in these condensed interim financial statements, and in preparing the opening IFRS balance sheet at April 1, 2010 for the purpose of transition to IFRS, unless otherwise indicated.

Cash and cash equivalents

Cash and cash equivalents comprise of cash at banks, brokerage firms, on hand and short-term deposits with an original maturity of 90 days or less, readily convertible into a known amount of cash.

Financial instruments

Financial assets

All financial assets are initially recorded at fair value and are designated upon inception into one of the following four categories: held-to-maturity, available-for-sale, loans-and-receivables or at fair value through profit or loss (“FVTPL”).

Financial assets classified as FVTPL are measured at fair value with unrealized gains and losses recognized through earnings. The Company’s cash and cash equivalents are classified as FVTPL.

Financial assets classified as loans-and-receivables are measured at amortized cost. The Company’s trade and other receivables are classified as loans-and-receivables.

Short term investments which consist of marketable securities are designated as “available-for-sale” and are measured at fair value with unrealized gains and losses recorded in other comprehensive income until the security is sold, or if an unrealized loss is considered permanent.

Bontan Corporation Inc.

Notes to Consolidated Financial Statements

(Canadian Dollars)

June 30, 2011 and 2010

(Unaudited – see Notice to Reader dated September 26, 2011)

.

|

3.

|

SIGNIFICANT ACCOUNTING POLICIES -

|

Financial instruments - continued

|

The purchase or sale of financial assets that require delivery of assets within a time frame established by regulation or convention in the marketplace (regular way trades) are recognized on the settlement date.

Common shares are classified as equity. Incremental costs directly attributable to the issue of common shares and stock options are recognized as a deduction from equity, net of any tax effects.

Transactions costs associated with FVTPL financial assets are expensed as incurred, while transaction costs associated with all other financial assets are included in the initial carrying amount of the asset.

Financial liabilities

All financial liabilities are initially recorded at fair value and designated upon inception as FVTPL or other-financial-liabilities.

Financial liabilities classified as other-financial-liabilities are initially recognized at fair value less directly attributable transaction costs. After initial recognition, other-financial-liabilities are subsequently measured at amortized cost using the effective interest method. The effective interest method is a method of calculating the amortized cost of a financial liability and of allocating interest expense over the relevant period. The effective interest rate is the rate that exactly discounts estimated future cash payments through the expected life of the financial liability, or, where appropriate, a shorter period. The Company’s trade and other payables are classified as

other-financial-liabilities.

Financial liabilities classified as FVTPL include financial liabilities held-for-trading and financial liabilities designated upon initial recognition as FVTPL. Derivatives, including separated embedded derivatives are also classified as held-for-trading unless they are designated as effective hedging instruments. Fair value changes on financial liabilities classified as FVTPL are recognized through the statement of comprehensive income. At June 30, 2011 the Company has not classified any financial liabilities as FVTPL.

Impairment of financial assets

The Company assesses at each date of the statement of financial position whether a financial asset is impaired.

Assets carried at amortized cost

If there is objective evidence that an impairment loss on assets carried at amortized cost has been incurred, the amount of the loss is measured as the difference between the asset’s carrying amount and the present value of estimated future cash flows discounted at the financial asset’s original effective interest rate. The carrying amount of the asset is then reduced by the amount of the impairment. The amount of the loss is recognized in profit or loss.

Bontan Corporation Inc.

Notes to Consolidated Financial Statements

(Canadian Dollars)

June 30, 2011 and 2010

(Unaudited – see Notice to Reader dated September 26, 2011)

.

|

3.

|

SIGNIFICANT ACCOUNTING POLICIES -

|

Financial instruments - continued

|

If, in a subsequent period, the amount of the impairment loss decreases and the decrease can be related objectively to an event occurring after the impairment was recognized, the previously recognized impairment loss is reversed to the extent that the carrying value of the asset does not exceed what the amortized cost would have been had the impairment not been recognized. Any subsequent reversal of an impairment loss is recognized in profit or loss.

In relation to trade receivables, a provision for impairment is made and an impairment loss is recognized in profit and loss when there is objective evidence (such as the probability of insolvency or significant financial difficulties of the debtor) that the Company will not be able to collect all of the amounts due under the original terms of the invoice. The carrying amount of the receivable is reduced through use of an allowance account. Impaired debts are written off against the allowance account when they are assessed as uncollectible.

If an available-for-sale asset is impaired, an amount comprising the difference between its cost and its current fair value, less any impairment loss previously recognized in profit or loss, is transferred from equity to profit or loss. Reversals in respect of equity instruments classified as available-for-sale are not recognized in profit or loss.

|

|

Oil and natural gas exploration and development expenditures

|

Exploration and evaluation costs (“E&E” assets)

All costs incurred prior to obtaining the legal right to explore an area are expensed when incurred.

Generally, costs directly associated with the exploration and evaluation of crude oil and natural gas reserves are initially capitalized. Exploration and evaluation costs are those expenditures for an area where technical feasibility and commercial viability has not yet been demonstrated. These costs generally include unproved property acquisition costs, geological and geophysical costs, sampling and appraisals, drilling and completion costs and capitalized decommissioning costs.

Costs are held in exploration and evaluation until the technical feasibility and commercial viability of the project is established. Amounts are generally reclassified to petroleum and natural gas properties once probable reserves have been assigned to the field. If probable reserves have not been established through the completion of exploration and evaluation activities and there are no future plans for activity in that field, then the exploration and evaluation expenditures are determined to be impaired and the amounts are charged to earnings (loss).

Impairment

|

E&E assets are assessed for impairment when facts and circumstances suggest that the carrying amount exceeds the recoverable amount and when they are reclassified as Development and Production (“D&P”) assets. For the purpose of impairment testing, E&E assets are grouped by concession or field with other E&E and D&P assets belonging to the same concession or field. The impairment loss will be calculated as the excess of the carrying value over the recoverable amount of the E&E impairment grouping and any resulting impairment loss is recognized in profit and loss. The recoverable amount is generally determined by reference to the value-in-use, or fair value less costs to sell. In assessing value in use, the estimated future cash flows are discounted to

their present value using a pre-tax discount rate that reflects current market assessments of the time value of money and the risks specific to the asset.

|

Notes to Consolidated Financial Statements

(Canadian Dollars)

June 30, 2011 and 2010

(Unaudited – see Notice to Reader dated September 26, 2011)

.

|

3.

|

SIGNIFICANT ACCOUNTING POLICIES -

|

Oil and natural gas exploration and development expenditures - continued

|

Petroleum and natural gas properties

Carrying value

Costs incurred subsequent to the determination of technical feasibility and commercial viability are recognized as petroleum and natural gas properties in the specific asset to which they relate. Petroleum and natural gas properties are stated at cost less accumulated depreciation and depletion and accumulated impairment losses. The initial cost of a petroleum and natural gas property is comprised of its purchase price or construction cost, any costs directly attributable to bringing the asset into operation, the initial estimate of the decommissioning obligation, and for qualifying assets, borrowing costs. The purchase price or construction cost is the aggregate amount paid and the fair value of any other

consideration given up to acquire the asset

Depreciation

The net book value of producing assets are depleted on a field-by-field basis using the unit of production method with reference to the ratio of production in the year to the related proved and probable reserves, taking into account estimated future development costs necessary to bring those reserves into production. For purposes of these calculations, production and reserves of natural gas are converted to barrels on an energy equivalent basis.

Other assets are depreciated on a declining basis at rates ranging from 20% to 33%.

Impairment

At the end of each reporting period, the Company reviews the petroleum and natural gas properties for circumstances that indicate that the assets may be impaired. Assets are grouped together into Cash Generating Units (“CGUs”) for the purpose of impairment testing, which is the lowest level at which there are identifiable cash flows that are largely independent of the cash flows of other groups of assets. If any such indication of impairment exists, the Company makes an estimate of its recoverable amount. A CGUs recoverable amount is the higher of its fair value less selling costs and its value in use. In assessing value in use, the estimated future cash flows are discounted to their present value using

a pre-tax discount rate that reflects current market assessments of the time value of money and the risks specific to the asset. Value in use is generally computed by reference to the present value of future cash flows expected to be derived from the production of proved and probable reserves.

Fair value less cost to sell is determined as the amount that would be obtained from the sale of a CGU in an arm’s length transaction between knowledgeable and willing parties. The fair value less cost to sell of oil and gas assets is generally determined as the net present value of the estimated future cash flows expected to arise from the continued use of the CGU, including any expansion prospects, and its eventual disposal, using assumptions that an independent market participant may take into account. These cash flows are discounted by an appropriate discount rate which would be applied by such a market participant to arrive at a net present value of the CGU. Where the carrying amount of a CGU exceeds its

recoverable amount, the CGU is considered impaired and is written down.

Bontan Corporation Inc.

Notes to Consolidated Financial Statements

(Canadian Dollars)

June 30, 2011 and 2010

(Unaudited – see Notice to Reader dated September 26, 2011)

.

|

3.

|

SIGNIFICANT ACCOUNTING POLICIES -

|

Oil and natural gas exploration and development expenditures - Petroleum and natural gas properties - continue

|

When the recoverable amount is less than the carrying amount, the asset or CGU is impaired. For impairment losses identified based on a CGU or a group of CGUs, the loss is allocated on a pro rata basis to the assets within the CGU(s). The impairment loss is recognized as an expense in the statement of operations and loss.

At the end of each subsequent reporting period these impairments are assessed for indicators of reversal. Where an impairment loss subsequently reverses, the carrying amount of the asset or CGU is increased to the revised estimate of its recoverable amount, but so that the increased carrying amount does not exceed the carrying amount that would have been determined had no impairment loss been recognized for the asset or CGU in prior years. A reversal of an impairment loss is recognized immediately in the consolidated statement of operations and loss.

Gains and losses on disposal of an item of property, plant and equipment, including oil and natural gas interests, are determined by comparing the proceeds from disposal with the carrying amount of property, plant and equipment and are recognized as separate line items in the consolidated statement of operations.

Foreign currency translation

The functional and presentation currency of the Company is the Canadian dollar. Monetary assets and liabilities are translated at exchange rates in effect at the balance sheet date. Non-monetary assets are translated at exchange rates in effect when they were acquired. Revenue and expenses are translated at the approximate average rate of exchange for the year, except that amortization is translated at the rates used to translate related assets.

The Company’s subsidiaries use the US Dollar as a functional currency. However, these subsidiaries are not self-sustaining but are integrated with Bontan Corporation Inc. since they rely on the Company to fund their operations. Hence, translation gains and losses of these subsidiaries are charged to the consolidated statement of operations.

|

|

The Company accounts for stock-based compensation granted to directors, officers, employees and consultants using the Black-Scholes option-pricing model to determine the fair value of the plan at grant date. An estimated forfeiture rate is incorporated into the fair value calculated and adjusted to reflect the actual number of options that vest. Stock-based compensation expense is recorded and reflected as stock-based compensation expense over the vesting period with a corresponding amount reflected in contributed surplus. At exercise, the associated amounts previously recorded as contributed surplus are reclassified to common share capital.

|

|

|

The quoted market price of the Company’s shares on the date of issuance under any stock compensation plan is considered as fair value of the shares issued.

|

Bontan Corporation Inc.

Notes to Consolidated Financial Statements

(Canadian Dollars)

June 30, 2011 and 2010

(Unaudited – see Notice to Reader dated September 26, 2011)

.

|

3.

|

SIGNIFICANT ACCOUNTING POLICIES - continued

|

Warrants

When the Company issues Units under a private placement comprising common shares and warrants, the Company follows the relative fair value method of accounting for warrants attached to and issued with common shares of the Company. Under this method, the fair value of warrants issued is estimated using a Black-Scholes option pricing model which is added to fair value of the common shares determined using the stock price at the date of issuance and the percentage relative to the fair values determined. The fair value of the common shares and the warrants are proportionately adjusted to the net proceeds received. The fair value is then related to the total of the net proceeds received on issuance of the Common

shares.

Revenue from the sale of natural gas, natural gas liquids and crude oil is recognized when the significant risks and rewards of ownership is transferred, which is when title passes to the customer in accordance with the terms of the sales contract. This generally occurs when the product is physically transferred into a pipe, truck or other delivery mechanism.

Revenues from the production of oil and natural gas properties in which the Company has an interest with joint venture partners, are recognized on the basis of the Company’s working interest in those properties (the entitlement method), on receipt of a statement of account from the operators of the properties.

Loss per Share

Basic loss per share is calculated by dividing net loss (the numerator) by the weighted average number of common shares outstanding (the denominator) during the period. Diluted loss per share reflects the dilution that would occur if outstanding stock options and share purchase warrants were exercised or converted into common shares using the treasury stock method and are calculated by dividing net loss applicable to common shares by the sum of the weighted average number of common shares outstanding and all additional common shares that would have been outstanding if potentially dilutive common shares had been issued.

The inclusion of the Company’s stock options and share purchase warrants in the computation of diluted loss per share would have an anti-dilutive effect on loss per share and are therefore excluded from the computation. Consequently, there is no difference between basic loss per share and diluted loss per share.

Income tax expense comprises current and deferred tax. Income tax expense is recognized in profit or loss except to the extent that it relates to items recognized directly in equity, in which case it is recognized in equity.

Current tax is the expected tax payable on the taxable income for the year, using tax rates enacted or substantively enacted at the reporting date, and any adjustments to tax payable in respect of previous years.

Bontan Corporation Inc.

Notes to Consolidated Financial Statements

(Canadian Dollars)

June 30, 2011 and 2010

(Unaudited – see Notice to Reader dated September 26, 2011)

.

|

3.

|

SIGNIFICANT ACCOUNTING POLICIES - Income taxes - continued

|

Deferred tax is recognized using the balance sheet method, providing for temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for taxation purposes. Deferred tax is not recognized on the initial recognition of assets or liabilities in a transaction that is not a business combination. In addition, deferred tax is not recognized for taxable temporary differences arising on the initial recognition of goodwill. Deferred tax is measured at the tax rates that are expected to be applied to temporary differences when they reverse, based on the laws that have been enacted or substantively enacted by the reporting date. Deferred tax assets and

liabilities are offset if there is a legally enforceable right to offset, and they relate to income taxes levied by the same tax authority on the same taxable entity, or on different tax entities, but they intend to settle current tax liabilities and assets on a net basis or their tax assets and liabilities will be realized simultaneously.

|

|

A deferred tax asset is recognized to the extent that it is probable that future taxable profits will be available against which the temporary difference can be utilized. Deferred tax assets are reviewed at each reporting date and are reduced to the extent that it is no longer probable that the related tax benefit will be realized.

|

|

|

Determination of fair value

|

A number of the Company’s accounting policies and disclosures required the determination of fair value, both for financial and non-financial assets and liabilities. Fair values have been determined for measurement and/or disclosure purposes based on the following methods. When applicable, further information about the assumptions made in determining fair values is disclosed in the notes specific to that asset or liability.

a ) Property, plant and equipment are recognized at fair value in a business combination. The fair value of property, plant and equipment is the estimated amount for which the property, plant and equipment could be exchanged on the acquisition date between a willing buyer and a willing seller in an arm’s length transaction after proper marketing wherein the parties had each acted knowledgeably, prudently and without compulsion. The fair value of oil and natural gas interests (included in property, plant and equipment) is estimated with reference to the discounted cash flows expected to be derived from oil and gas

production based on externally prepared reserve reports. The risk-adjusted discount rate is specific to the asset with reference to general market conditions, being 10% for fiscal 2012 (2011 – 10%).

The market value of other items of property, plant and equipment is based on the quoted market prices for similar items.

b) The fair value of cash and cash equivalents, accounts receivable and accruals and accounts payable and accruals is estimated as the present value of future cash flows, discounted at the market rate of interest at the reporting date. At June 30, 2011 and March 31, 2011 the fair value of these balances approximated their carrying value due to their short term to maturity.

c) The fair value of stock options is measured using a Black Scholes option pricing model. Measurement inputs include share price on measurement date, exercise price of the instrument, expected volatility (based on weighted average historic volatility adjusted for changes expected due to publicly available information), weighted average expected life of the instruments (based on historical experience and general option holder behavior), expected dividends, and the risk-free interest rate (based on government bonds).

Bontan Corporation Inc.

Notes to Consolidated Financial Statements

(Canadian Dollars)

June 30, 2011 and 2010

(Unaudited – see Notice to Reader dated September 26, 2011)

.

|

3.

|

SIGNIFICANT ACCOUNTING POLICIES - Determination of fair value - continued

|

The preparation of these financial statements requires management to make judgments and estimates and form assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and reported amounts of revenues and expenses during the reporting period. On an ongoing basis, management evaluates its judgments and estimates in relation to assets, liabilities, revenue and expenses. Management uses historical experience and various other factors it believes to be reasonable under the given circumstances as the basis for its judgments and estimates. Actual outcomes may differ from these estimates under different assumptions and conditions. The most significant estimates relate to

recoverability of trade and other receivables, valuation of deferred income tax amounts, impairment testing, assessing accruals and the calculation of share-based payments.

New standards and interpretations not yet adopted

Standards issued but not yet effective up to the date of issuance of the Company‘s consolidated financial statements are listed below. This listing is of standards and interpretations issued which the Company reasonably expects to be applicable at a future date. The Company intends to adopt those standards when they become effective.

IFRS 7 Financial Instruments: Disclosures

In October 2010, the IASB amended IFRS 7 to enhance the disclosure about transfers of financial assets. This improvement is to assist users in understanding the possible effects of any risks that remain in an entity after the asset has been transferred. In addition, if disproportionate amounts are transferred near year end, additional disclosures would be required. The effective date of the amendment is July 1, 2011. The Company has determined that the adoption of this amendment will not have a material impact on the consolidated financial statements.

IFRS 9 Financial Instruments: Classification and Measurement

In November 2009, the IASB issued IFRS 9, which covers classification and measurement as the first part of its project to replace IAS 39. In October 2010, the Board also incorporated new accounting requirements for liabilities. The standard introduces new requirements for measurement and eliminates the current classification of loans and receivables, available-for-sale and held-to-maturity, currently in IAS 39. There are new requirements for the accounting of financial liabilities as well as carryover of requirements from IAS 39. The Company does not anticipate early adoption and will adopt the standard on the effective date of January 1, 2013. The Company has not determined the impact of the new standard on the

consolidated financial statements.

IFRS 10 - Consolidation

IFRS 10 requires an entity to consolidate an investee when it is exposed, or has rights, to variable returns from its involvement with the investee and has the ability to affect those returns through its power over the investee. Under existing IFRS, consolidation is required when an entity has the power to govern the financial and operating policies of an entity so as to obtain benefits from its activities. IFRS 10 replaces SIC-12 Consolidation—Special Purpose Entities and parts of IAS 27 Consolidated and Separate Financial Statements. IFRS 10 is effective for annual periods beginning on or after

January 1, 2013 and early adoption is permitted. The Corporation has not determined the impact of

the new standard on the consolidated financial statements.

Bontan Corporation Inc.

Notes to Consolidated Financial Statements

(Canadian Dollars)

June 30, 2011 and 2010

(Unaudited – see Notice to Reader dated September 26, 2011)

.

|

3.

|

SIGNIFICANT ACCOUNTING POLICIES - New standards and interpretations not yet adopted – continued

|

IFRS 11 - Joint Arrangements

IFRS 11 requires a venturer to classify its interest in a joint arrangement as a joint venture or joint operation. Joint ventures will be accounted for using the equity method of accounting whereas for a joint operation, the venturer will recognize its share of the assets, liabilities, revenue and expenses of the joint operation. Under existing IFRS, entities have the choice to proportionately consolidate or equity account for interests in joint ventures. IFRS 11 supersedes IAS 31, Interests in Joint Ventures, and SIC-13, Jointly Controlled Entities—Non-monetary Contributions by Venturers. These amendments are effective for annual periods beginning on or after January 1, 2013 and early adoption is permitted.

The Company has not determined the impact of the new standard on the consolidated financial statements.

|

|

IFRS 12 - Disclosure of Interests in Other Entities

|

IFRS 12 establishes disclosure requirements for interests in other entities, such as joint arrangements, associates, and special purpose vehicles and off balance sheet vehicles. The standard carries forward existing disclosures and also introduces significant additional disclosure requirements that address the nature of, and risks associated with, an entity‘s interests in other entities. This standard is effective for annual periods beginning on or after January 1, 2013. Entities will be permitted to apply any of the disclosure requirements in IFRS 12 before the effective date. The Company has not determined the impact of the new standard on the consolidated financial statements.

IFRS 13 - Fair Value Measurement

IFRS 13 is a comprehensive standard for fair value measurement and disclosure requirements for use across all IFRS standards. The new standard clarifies that fair value is the price that would be received to sell an asset, or paid to transfer a liability in an orderly transaction between market participants, at the measurement date. It also establishes disclosures about fair value measurement. Under existing IFRS, guidance on measuring and disclosing fair value is dispersed among the specific standards requiring fair value measurements and in many cases does not reflect a clear measurement basis or consistent disclosures. IFRS 13 is effective for annual periods beginning on or after January 1, 2013 and early

adoption is permitted. The Company has not determined the impact of the new standard on the consolidated financial statements.

Amendments to Other Standards

In addition, there have been amendments to existing standards, including IAS 27, Separate Financial Statement (IAS 27), and IAS 28, Investments in Associates and Joint Ventures (IAS 28). IAS 27 addresses accounting for subsidiaries, jointly controlled entities and associates in non-consolidated financial statements. IAS 28 has been amended to include joint ventures in its scope and to address the changes in IFRS 10 – 13.

|

4.

|

SHORT TERM INVESTMENTS

|

| |

Marketable securities

|

| |

Carrying average costs

|

fair market value

|

|

June 30, 2011

|

$1,128,562

|

$1,219,111

|

|

March 31, 2011

|

$2,118,724

|

$1,900,400

|

|

April 1, 2010

|

$4,007,574

|

$1,359,431

|

Bontan Corporation Inc.

Notes to Consolidated Financial Statements

(Canadian Dollars)

June 30, 2011 and 2010

(Unaudited – see Notice to Reader dated September 26, 2011)

|

4.

|

SHORT TERM INVESTMENTS - continued

|

Marketable securities are designated as “available-for-sale”.

Marketable securities are stated at fair value based on quoted market prices on the balance sheet as at June 30, 2011. A net unrealized loss of $77,799 for the quarter ended on that date was included in the consolidated statement of comprehensive loss and accumulated other comprehensive income.

As at June 30, 2011, the management concluded that certain marketable securities had suffered a decline in their values which were unlikely to be recovered in the near future. The loss of $343,750 has been removed from other comprehensive income and recognized in net income even though these investments have not been de-recognized.

As at June 30, 2011, the Company held warrants in certain marketable securities which are exercisable at its option to convert into an equal number of common shares of the said securities. The total exercise price of these warrants was $75,215 (as at March 31, 2011: $75,800, April 1, 2010: $119,217) and the market value of the underlying securities was $8,023 (as at March 31, 2011:$14,655, April 1, 2010: $19,506). These warrants and the underlying unrealized gains and losses have not been accounted for in the financial statements since the Company has not yet determined if it would exercise these warrants when they become exercisable. The warrants expire between March 26, 2012 and April 26, 2012.

5. EXPLORATION AND EVALUATION EXPENDITURES

Effective May 18, 2010, the Company decided to de-consolidate the results of its subsidiary; IPC Cayman wherein it holds 76.79% equity, due to loss of effective control over IPC Cayman’s financial reporting process as explained in Note 25 of the fiscal 2011 annual financial statements.

IPC Cayman was incorporated solely for the purpose of managing exploration and development of two offshore drilling licenses in Israel – petroleum license 347 (‘Myra”) and 348 (“Sara”) covering approximately 198,000 acres, 40 kilometres off the West coast of Israel (“Israeli project”).

IPC Cayman holds a 50% partnership interest in IPC Oil and Gas (Israel) Limited Partnership (“IPC Israel”) which is the registered holder of 13.609% interest in the Israeli project. Thus the Company’s working interest in the Israeli project works out to 5.23%.

The funds provided by the Company towards exploration activities of the Israeli project either direct to the consortium or though IPC Cayman, have been capitalized as exploration and evaluation expenditures.

There was no further expenditure during the three months ended June 30, 2011.

|

Balance as at April 1, 2010

|

$6,520,367

|

|

incurred during the year

|

452,373

|

|

Balance as at March 31, 2011

|

$6,972,740

|

|

Balance, as at June 30, 2011

|

$6,972,740

|

The management carried out an impairment tests, involving (a) an independent geologist‘s evaluation of the prospective resources on the two prospects in accordance with NI 51-101, Sec 5-9 updated at December 1, 2010, and as further updated by the operator on June 15, 2011 (b) a review of definite

Bontan Corporation Inc.

Notes to Consolidated Financial Statements

(Canadian Dollars)

June 30, 2011 and 2010

(Unaudited – see Notice to Reader dated September 26, 2011)

5. EXPLORATION AND EVALUATION EXPENDITURES - continued

work plan, prepared by the steering committee of the joint venture partners and its acceptance by the Israeli Ministry of National Infrastructure, (c) an assessment of the likely outcome of the current disputes with Shaldieli and IPC Cayman management and concluded that there was no permanent impairment.

6. CAPITAL STOCK

(a) Authorized: Unlimited number of common shares

(b) Issued

| |

Common

|

|

| |

Shares

|

Amount

|

|

Balance at April 1, 2010

|

65,229,076

|

$35,298,257

|

|

Issued under 2009 Consultant Stock Compensation Plan

|

135,000

|

48,093

|

|

Issued under private placements

|

12,700,000

|

2,564,925

|

|

Finder's fee

|

-

|

(256,493)

|

|

Value assigned to warrants issued under private placements

|

-

|

(1,232,145)

|

|

Value assigned to warrants issued as finder’s fee under private placements

|

|

(123,214)

|

|

Issued on exercise of warrants

|

600,000

|

60,503

|

|

Value of warrants exercised transferred from warrants

|

|

21,694

|

|

Subscriptions received in fiscal 2010 reversed on issuance of shares

|

|

(303,480)

|

|

Balance at March 31, 2011

|

78,664,076

|

$36,078,140

|

|

Balance at June 30, 2011

|

78,664,076

|

$36,078,140

|

7. STOCK OPTION PLANS

(a) The following is a summary of all Stock Option Plans as at June 30, 2011:

|

Plan

|

Date of registration *

|

# of Options

|

| |

|

Registered

|

Issued

|

Expired

|

Exercised

|

Outstanding

|

|

1999 Stock option Plan

|

April 30, 2003

|

3,000,000

|

3,000,000

|

(70,000)

|

(1,200,000)

|

1,730,000

|

|

2003 Stock Option Plan

|

July 22, 2004

|

2,500,000

|

2,500,000

|

(155,000)

|

(400,000)

|

1,945,000

|

|

The Robinson Plan

|

December 5, 2005

|

1,100,000

|

1,100,000

|

-

|

-

|

1,100,000

|

|

2005 Stock Option Plan

|

December 5, 2005

|

1,000,000

|

1,000,000

|

-

|

-

|

1,000,000

|

| |

|

7,600,000

|

7,600,000

|

(225,000)

|

(1,600,000)

|

5,775,000

|

|

|

* Registered with the Securities and Exchange Commission of the United States of America (SEC) as required under the Securities Act of 1933.

|

All options were fully vested on the dates of their grant.

Bontan Corporation Inc.

Notes to Consolidated Financial Statements

(Canadian Dollars)

June 30, 2011 and 2010

(Unaudited – see Notice to Reader dated September 26, 2011)

7. STOCK OPTION PLANS - continued

|

(b)

|

There were no movements during the three months ended June 30, 2011. The weighted average exercise price of the outstanding stock options is US$0.18 (March 31, 2011: US$0.18 and April 1, 2010: $0.15)

|

(c) Details of weighted average remaining life of the options granted and outstanding are as follows:

| |

June 30, 2011

|

|

Number of options oustanding and excercisable

|

5,775,000

|

|

Exercise price in US$

|

0.18

|

|

Weighted average remaining contractual life (years)

|

3.37

|

The options can be exercised at any time after vesting within the exercise period in accordance with the applicable option agreement. The exercise price was more than the market price on the date of the grants for 2,945,000 options and less than the market price for the balance of 2,830,000 options.

|

(a)

|

Movements in warrants during the period are as follows:

|

| |

# of warrants

|

Weighted average exercise price

|

Fair value

|

|

Issued and outstanding, April 1, 2010

|

59,701,420

|

0.28

|

7,343,886

|

|

Issued under 2009-10 Private Placement

|

12,700,000

|

0.35

|

1,232,145

|

|

Issued as finder’s fee under 2009-10 private placement

|

1,270,000

|

0.35

|

123,214

|

|

Exercised

|

(600,000)

|

(0.10)

|

(21,694)

|

|

Issued and outstanding, March 31, 2011

|

73,071,420

|

$0.26

|

$8,677,551

|

|

Issued and outstanding, June 30, 2011

|

73,071,420

|

$0.26

|

$8,677,551

|

Bontan Corporation Inc.

Notes to Consolidated Financial Statements

(Canadian Dollars)

June 30, 2011 and 2010

(Unaudited – see Notice to Reader dated September 26, 2011)

|

|

(b) Details of weighted average remaining life of the warrants granted and outstanding are as follows:

|

| |

June 30, 2011

|

| |

|

|

| |

Warrants outstanding & exercisable

|

|

Exercise price in US$

|

Number

|

Weighted average remaining contractual life (years)

|

|

0.10

|

10,400,000

|

2.75

|

|

0.25

|

12,846,420

|

2.75

|

|

0.35

|

49,825,000

|

3.68

|

|

0.46

|

73,071,420

|

3.35

|

9. LOSS PER SHARE

Loss per share is calculated on the weighted average number of common shares outstanding during the period, which were 78,664,076 shares for the three months ended June 30, 2011 (three months ended June 30, 2010– 78,270,743).

The Company had approximately 73 million (June 30, 2010:73.4 million) warrants and 5.8 million options (June 30, 2010: 4.8 million), which were not exercised as at June 30, 2011. Inclusion of these warrants and options in the computation of diluted loss per share would have an anti-dilutive effect on loss per share and are therefore excluded from the computation. Consequently, there is no difference between loss per share and diluted loss per share.

|

For the three months ended June 30,

|

2011

|

2010

|

|

Fees settled in stocks and options

|

7,171

|

22,868

|

|

Fees settled for cash

|

106,065

|

185,821

|

| |

|

|

| |

$113,236

|

$208,689

|

Bontan Corporation Inc.

Notes to Consolidated Financial Statements

(Canadian Dollars)

June 30, 2011 and 2010

(Unaudited – see Notice to Reader dated September 26, 2011)

11. COMMITMENTS AND CONTINGENT LIABILITIES

|

(a)

|

The Company entered into media and investor relations contracts, with Current Capital Corp., a shareholder corporation, effective July 1, 2004, initially for a period of one year and renewed automatically unless cancelled in writing by a 30-day notice, for a total monthly fee of US$10,000.

|

|

(b)

|

The Company entered into a consulting contract with Mr Kam Shah, the Chief Executive Officer and Chief Financial Officer on April 1, 2005 for a five-year term. This term was extended to another five years to March 31, 2015 by the audit committee on April 1, 2010. Mr Shah’s monthly fee is $15,000 plus taxes. Further, the contract provides for a lump sum compensation of US$250,000 for early termination of the contract without cause. The contract also provides for entitlement to stock compensation and stock options under appropriate plans as may be decided by the board of directors from time to time.

|

|

(c)

|

The Company entered into a consulting contract with Mr Terence Robinson, a key consultant and a former Chief Executive Officer, on April 1, 2003 for a six-year term up to March 31, 2009. On August 4, 2009, this contract was renewed for another five years effective April 1, 2009. The renewed contract provides for a fixed monthly fee of $10,000 plus taxes. The Consultant will also be entitled to stock compensation and stock options under appropriate plans as may be decided by the board of directors from time to time.

|

|

(d)

|

The Company has a consulting contract with Mr John Robinson. Mr John Robinson is the sole owner of Current Capital Corp., a firm with which the Company has an on-going contract for media and investor relations, and is a brother of Mr Terence Robinson who is a key consultant to the Company and a former Chief Executive Officer of the Company. Mr Robinson provides services that include assisting the management in evaluating new projects and monitoring short term investment opportunities that the Company may participate in from time to time. A new Consulting Contract was signed with Mr John Robinson on July 1, 2009 for period covering up to March 31, 2014. The Contract provides for a fixed monthly fee of $8,500 plus taxes. The

Consultant will also be entitled to stock compensation and stock options under appropriate plans as may be decided by the board of directors from time to time.

|

|

(e)

|

The Company has agreed to the payment of a finder’s fee to Current Capital Corp., a related party, at the rate of 10% of the proceeds from the exercise of any of the outstanding warrants. The likely fee if all the remaining warrants are exercised will be approximately $ 1.8 million.

|

|

(f)

|

The Company is currently in litigation with the management of its subsidiary, IPC Cayman and has retained lawyers in various jurisdictions. The Company is committed to continue its legal actions until disputes surrounding its indirect working interest in the Israeli oil and gas properties are resolved satisfactorily. The final outcome and costs of these actions cannot be reasonably estimated.

|

Bontan Corporation Inc.

Notes to Consolidated Financial Statements

(Canadian Dollars)

June 30, 2011 and 2010

(Unaudited – see Notice to Reader dated September 26, 2011)

12. RELATED PARTY TRANSACTIONS

Transactions with related parties are incurred in the normal course of business and are measured at the exchange amount, which is the amount of consideration established and agreed to between the related parties. Related party transactions and balances have been listed below, unless they have been disclosed elsewhere in the consolidated financial statements. Amounts are for three months ended June 30, 2011 and balances are at June 30, 2011. Comparative amounts are for the three months ended June 30, 2010 and balances as at June 30, 2010.

|

|

(i)

|

Included in shareholders information expense is $28,835 (2010 – $30,688) to Current Capital Corp, (CCC) for media relations services. CCC is a shareholder corporation and a director of the Company provides accounting services as a consultant.

|

|

|

(ii)

|

CCC charged $ nil for rent (2010: $6,061). $ nil of office expenses were charged by the entity controlled by the sole director of IPC Cayman (2010: $ 8,319)

|

|

|

(iii)

|

A finder’s fee of $ nil (2010: $312,469) was charged by CCC in connection with the private placement. The fee included a cash fee of $ nil (2010:$189,255 and 1,270,000 warrants valued at $123,214 using the black-Scholes option price model).

|

|

|

(iv)

|

Business expenses of $6,293 (2010: $5,540) were reimbursed to directors of the corporation and $5,936 (2010 - $21,901) to a key consultant and a former chief executive officer of the Company. Travel and related expenses of $ nil (2010: $48,375) were charged by the sole director of IPC Cayman. $ nil (2010: $45,392) of these charges has been included in oil & gas properties and related expenditure. Further, sole director of IPC Cayman also charged $nil for book keeping services (2010: $ 17,880).

|

|

(v)

|

Consulting fees include cash fee paid to directors for services of $47,500 (2010: $ 47,500), $30,000 (2010: $ 30,000) paid to a key consultant and a former chief executive officer of the Company, $25,500 paid to a consultant who controls CCC (2010: $25,500) and $ nil (2010: $61,656) was paid to the sole director of IPC Cayman.

|

|

|

(vi)

|

Accounts payable includes $49,839 (2010: $59,983) due to CCC, $11,964 (2010: $nil) due to directors, $97,194 (2010: $34,754) due to a key consultant and a former chief executive officer of the Company, and due to a consultant who controls CCC $76,840 (2010; $ 17,850).

|

|

(vii)

|

Included in short term investments is an investment of $434,168 carrying cost and $240,000 fair value (2010: $1,869,381 carrying cost and $529,597 fair value) in a public corporation controlled by a key shareholder of the Company. This investment represents common shares acquired in open market or through private placements and represents less than 1% of the said Corporation.

|

Bontan Corporation Inc.

Notes to Consolidated Financial Statements

(Canadian Dollars)

June 30, 2011 and 2010

(Unaudited – see Notice to Reader dated September 26, 2011)

|

|

Note 20 of the fiscal 2011 audited financial statements, provides details of various lawsuits being filed against Shaldieli, its key shareholders, Mr. Howard Cooper and his company, International Three Crown Petroleum LLC.

|

|

|

The following are additional actions taken since April 1, 2011

|

Actions taken in Israel

On April 14, 2011, Bontan filed an amended Statement of Claim to the Statement of Claim initially filed on January 12, 2011. The amended Statement of Claim includes a claim in the amount of NIS 25 million (approximately US$7 million) against all of the Defendants, a claim for a declaratory remedy and permanent injunctions, a claim for the production of accounts and other remedies relating to the governance of IPC Cayman and Shaldieli; the Shaldieli transaction should go through remedies against Mr Cooper’s position in IPC Cayman, and other remedies.

A first pre-trial hearing in this case was held on June 5, 2011. The Court was informed of the following:

a. Shaldieli’s lawyer informed that Shaldieli encountered certain problems with the Israeli SEC “due to pressures by Bontan,” but that they had now overcome these problems and were ready to prepare the necessary new documents required and call for a shareholders’ meeting.

b. IPC’s lawyer informed that there was one capital call which required IPC to put about US$ 220,000. The capital call was in connection with a decision to conduct a third drilling test. The Judge asked if more funding was expected and was told that it was not known at the moment.

c. Bontan’s lawyer told the judge that all this was news to us because we have not been provided with any information and we did not receive any request for a cash call.

The judge set 90 days for discovery and interrogatory proceedings and the next pre-trial is scheduled for October 9, 2011.

On July 5, 2011, we filed another application for the temporary injunction against Shaldieli Ltd., Mr Yaron Yenni, Upswing Capital Ltd., Asia Development (A.D.B.M.) Ltd, International Three Crown Petroleum LLC (ITC) and Howard Cooper. The application sought an injunction against the planned transaction and in the alternative, an injunction against the payment of US$4 million out of the fundraising which is planned to take place by Shaldieli towards coverage of IPC Cayman’s costs (including US$2 million return of loan to ITC). We asked the court to order that funds raised by Shaldieli could only be used for the purposes of the drilling in the licenses, or set in escrow pending other resolution of the court and

should not be used to fund private litigation costs.

In the hearing on the above renewed application held on July 25, 2011, the court did not grant a temporary injunction against the Shaldieli transaction. However, with respect to the proposed payment to ITC or Howard Cooper in an amount of US$4 million out of Shaldieli’s future fund raising, the court ruled that no distribution is permitted until either Bontan agrees or the court so orders. In any case, the court ruled that Bontan may object to any proposed distribution to ITC or Howard Cooper within 30 days of being notified of an intention to do so. The court also ruled that Bontan is entitled to audit the financial books and records of IPC Cayman, including the

details of the US$4 million claimed by ITC as owed to it by IPC Cayman.

Bontan Corporation Inc.

Notes to Consolidated Financial Statements

(Canadian Dollars)

June 30, 2011 and 2010

(Unaudited – see Notice to Reader dated September 26, 2011)

|

13.

|

PENDING DISPUTES - continued

|

Actions taken in Cayman Islands

On April 28, 2011, we filed a summons against IPC Cayman and ITC for unreasonably withholding the consent and refusing to register two share transfer requests and asking court to pass an order for such transfers. The purpose of this action is to enable Bontan to call for a shareholders’ meeting of IPC Cayman to discuss among other things, the management of IPC Cayman. The hearing of this was originally scheduled on August 18, 2011. However, ITC and Mr Cooper’s lawyer requested a hearing on August 8, 2011 and asked the judge to postpone all hearings until lawsuits in Israel were decided. The judge however was not convinced and asked them to present full arguments on October 3, 2011. The hearing of our

application is postponed until after October 3, 2011.

14. FINANCIAL INSTRUMENTS AND RISK MANAGEMENT

Fair value

| |

June 30, 2011

|

March31, 2011

|

| |

Carrying value

|

Fair value

|

Carrying value

|

Fair value

|

|

Financial assets

|

|

|

|

|

|

Cash

|

100,304

|

100,304

|

348,464

|

348,464

|

|

Other receivable

|

127,254

|

127,254

|

114,069

|

114,069

|

|

Short term investments

|

1,128,562

|

1,219,111

|

2,118,724

|

1,359,431

|

|

Financial liabilities

|

|

|

|

|

|

Accounts payable and accrued liabilities

|

690,926

|

690,926

|

663,577

|

663,577

|

Fair value estimates are made at a specific point in time, based on relevant market information and information about financial instruments. These estimates are subject to and involve uncertainties and matters of significant judgment, therefore cannot be determined with precision. Changes in assumptions could significantly affect the estimates.

A summary of the Company’s risk exposures as it relates to financial instruments are reflected below:

i) Credit risk

Credit risk is the risk of loss associated with a counter-party’s inability to fulfill its payment obligations. The credit risk is attributable to various financial instruments, as noted below. The credit risk is limited to the carrying value amount carried on the statement of financial position.

|

a.

|

Cash and cash equivalents – Cash and cash equivalents are held with major financial institutions in Canada and therefore the risk of loss is minimal.

|

|

b.

|

Trade and other receivables – The Company is not exposed to major credit risk attributable to customers. A significant portion of this amount is due from the Canadian government.

|

c. Short term Investments – The Company has exposure for this balance at June 30, 2011 of approximately $1.2 million (March 31, 2011 - $1.9 million). These investments are in junior Canadian public companies and are valued at their quoted market prices on reporting dates.

Bontan Corporation Inc.

Notes to Consolidated Financial Statements

(Canadian Dollars)

June 30, 2011 and 2010

(Unaudited – see Notice to Reader dated September 26, 2011)

14. FINANCIAL INSTRUMENTS AND RISK MANAGEMENT - continued

ii) Liquidity risk