NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

| 1. |

To elect John J. Amore, Juan C. Andrade, William F. Galtney, Jr., John A. Graf, Meryl Hartzband, Gerri Losquadro, Roger M. Singer, Joseph V. Taranto and John A. Weber as directors of the Company, each to serve for a one-year period to

expire at the 2023 Annual General Meeting of Shareholders or until such director’s successor shall have been duly elected or appointed or until such director’s office is otherwise vacated.

|

| 2. |

To appoint PricewaterhouseCoopers LLP, an independent registered public accounting firm, as the Company’s independent auditor for the year ending December 31, 2022 and authorize the Company’s Board of Directors, acting through its Audit

Committee, to determine the independent auditor’s remuneration.

|

| 3. |

To approve, by non-binding advisory vote, 2021 compensation paid to the Company’s Named Executive Officers.

|

| 4. |

To consider and act upon such other business, if any, as may properly come before the meeting and any and all adjournments thereof.

|

|

By Order of the Board of Directors

|

|

|

Sanjoy Mukherjee

|

|

|

Executive Vice President,

|

|

|

General Counsel and Secretary

|

|

|

April 8, 2022

|

|

|

Hamilton, Bermuda

|

|

GENERAL INFORMATION

|

1

|

THE COMPANY’S COMPENSATION

|

||

|

PHILOSOPHY AND OBJECTIVES

|

61

|

|||

|

EXECUTIVE SUMMARY

|

3

|

Components of the Company’s

|

||

|

Compensation Program

|

62

|

|||

|

ENVIRONMENTAL, SOCIAL AND

|

The Role of Peer Companies and Benchmarking

|

63

|

||

|

GOVERNANCE

|

5

|

Incentive Based Bonus Plans

|

64

|

|

|

Executive Performance Annual Incentive Plan

|

64

|

|||

|

PROPOSAL NO. 1 – ELECTION OF DIRECTORS

|

19

|

Long-Term Compensation Determinations

|

66

|

|

|

Information Concerning Director Nominees

|

21

|

Time-Vested Share Awards

|

66

|

|

|

Information Concerning Executive Officers

|

30

|

Performance Share Units

|

66

|

|

|

Named Executive Officer Compensation

|

71

|

|||

|

THE BOARD OF DIRECTORS AND ITS

|

Company Financial Performance Assessment

|

71

|

||

|

COMMITTEES

|

34

|

Link Between Pay and Performance for 2021

|

72

|

|

|

Director Independence

|

36

|

Investor Day Financial Targets

|

73

|

|

|

Enhanced Audit Committee Independence

|

2021 versus 2020 Results

|

73

|

||

|

Requirements

|

37

|

Individual Performance Assessment Factors

|

74

|

|

|

Enhanced Compensation Committee

|

Summary of Direct Compensation Awarded

|

|||

|

Independence Requirements

|

37

|

in 2021

|

74

|

|

|

Incentive Cash Bonus

|

74

|

|||

|

BOARD STRUCTURE AND RISK OVERSIGHT

|

39

|

Other Forms of Compensation

|

83

|

|

|

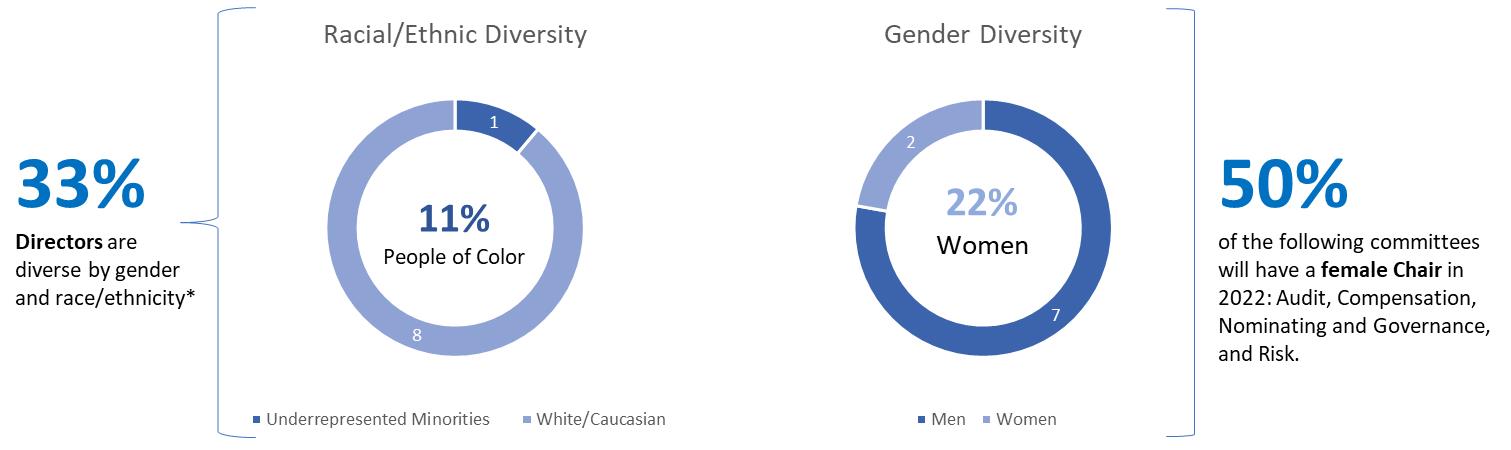

Board Diversity

|

39

|

Clawback Policy

|

83

|

|

|

Leadership Structure

|

40

|

Perquisites and Other Benefits

|

83

|

|

|

Board Role in Risk Oversight

|

41

|

Tax and Accounting Implications

|

83

|

|

|

Cybersecurity

|

42

|

|||

|

Climate Risk

|

43

|

COMPENSATION OF EXECUTIVE OFFICERS

|

84

|

|

|

Summary Compensation Table

|

84

|

|||

|

BOARD COMMITTEES

|

44

|

2021 Grants of Plan-Based Awards

|

85

|

|

|

Audit Committee

|

44

|

Outstanding Equity Awards at Fiscal Year-End

|

||

|

Audit Committee Report

|

44

|

2021

|

86

|

|

|

Compensation Committee

|

46

|

Share Option Exercises and Shares Vested

|

87

|

|

|

Compensation Committee Report

|

46

|

2021 Pension Benefits Table

|

88

|

|

|

Nominating and Governance Committee

|

47

|

2021 Non-Qualified Deferred Compensation

|

||

|

Risk Committee

|

49

|

Table

|

89

|

|

|

Code of Ethics for CEO and Senior Financial

|

||||

|

Officers

|

50

|

CEO PAY RATIO DISCLOSURE

|

90

|

|

|

Shareholder and Interested Party

|

||||

|

Communications with Directors

|

50

|

EMPLOYMENT, CHANGE OF

|

||

|

CONTROL AND OTHER AGREEMENTS

|

91

|

|||

|

COMMON SHARE OWNERSHIP BY

|

Potential Payments Upon Termination or

|

|||

|

DIRECTORS AND EXECUTIVE OFFICERS

|

51

|

Change in Control

|

93

|

|

|

Termination or Change of Control

|

94

|

|||

|

PRINCIPAL BENEFICIAL OWNERS OF

|

||||

|

COMMON SHARES

|

53

|

COMPENSATION COMMITTEE

|

||

|

INTERLOCKS AND INSIDER PARTICIPATION

|

96

|

|||

|

DIRECTORS’ COMPENSATION

|

54

|

|||

|

2021 Director Compensation Table

|

55

|

PROPOSAL NO. 2 – APPOINTMENT

|

||

|

OF INDEPENDENT AUDITORS

|

97

|

|||

|

COMPENSATION DISCUSSION AND ANALYSIS

|

56

|

|||

|

Executive Summary

|

56

|

PROPOSAL NO 3. – NON-BINDING ADVISORY

|

||

|

VOTE ON EXECUTIVE COMPENSATION

|

98

|

|||

|

COMPENSATION PRACTICES

|

59

|

|||

|

MISCELLANEOUS – GENERAL MATTERS

|

99

|

|||

Held on May 10, 2022 at Fairmont Hamilton Princess, 76 Pitts Bay Road, Hamilton, Bermuda at 10:00 a.m. local time.

https://investors.everestre.com/shareholder-proxy-materials

This summary highlights certain information contained in the Company’s proxy statement. The summary does not contain all of the information that you should consider, and we encourage you to read the entire proxy statement carefully.

Environmental and Corporate Social Responsibility

|

January 2022

|

Everest becomes a signatory to the United Nations Principles for Sustainable Insurance (“PSI”), a global framework for the insurance industry to address ESG risks and

opportunities sponsored by the United Nations Environment Programme’s Finance Initiative.

|

|

1st Quarter 2022

|

Completion of first greenhouse gas inventory project for our U.S. operations, including capturing scope 1, 2 and 3 emissions data to determine a carbon footprint baseline

and support us in developing emission reduction targets and goals throughout our business operations.

|

|

April 2022

|

Publication of Everest’s second comprehensive Corporate Responsibility Report, in accordance with the Global Reporting Initiative (“GRI”) standards and in alignment with the

TCFD recommendations.

The report is available at:

https://www.everestre.com/Corporate-Responsibility

|

|

3rd and 4th

Quarter 2022

|

Everest will expand its greenhouse gas inventory project beyond its U.S. operations and begin to capture scope 1, 2 and 3 emissions from Everest’s world-wide operations.

|

|

2022-23

|

Continue to design investment, underwriting and supply chain strategies to incorporate ESG and climate-related risks and opportunities into our core business operations.

|

|

2022-23

|

Expand Everest Cares program to invest in three philanthropic pillars aligned with United Nations Sustainable Development Goals – climate, hunger and justice by developing

partnerships with select organizations and developing targeted giving programs.

|

|

1. Global Reporting Initiative (“GRI”) Standards

|

The GRI standards are one of the most widely adopted, and one of the broadest in scope, global and recognized standards for sustainability reporting.

|

|

2. Sustainability Accounting Standards Board (“SASB”)

|

SASB publishes a set of standards for 77 different industries (including insurance), which identify the minimal set of financially material sustainability topics and their

associated metrics for a typical company in a given industry.

|

|

3. Task Force on Climate-related Financial Disclosures (“TCFD”)

|

The TCFD was set up by the Financial Stability Board of the G20 to develop recommendations for companies to use when disclosing climate-related risks and opportunities to

their stakeholders.

|

|

4. Principles for Responsible Investment (“PRI”)

|

The United Nations-supported PRI is a global leading proponent of responsible investment, with over 4,000 signatories representing more than U.S. $120 trillion in AUM.

|

|

5. Principles for Sustainable Insurance (“PSI”)

|

Endorsed by the UN Secretary-General, these principles have led to the largest collaborative initiative between the UN and the insurance industry.

|

|

Increasing Cultural Intelligence & Bias Awareness Training

|

Cultural intelligence refers to the ability to relate and function effectively in culturally diverse settings. We have helped to increase cultural intelligence through the

development and enhancement of our employee resources. This includes DEI education and tools made available through bias awareness and reduction training offered through Blue Ocean Brain – our interactive and immersive online learning

platform. In addition, bias awareness and reduction content has been incorporated across existing Everest development programs.

Over 30,000 bias reduction lessons were completed in Blue Ocean Brain in 2021. Specifically, Everest employees completed an average of 16 Blue Ocean Brain lessons per

employee.

|

|

Everest-NJ LEEP Partnership

|

Everest, along with more than 25 Everest employee volunteers from various disciplines across the company, partnered with NJ LEEP to sponsor four high school students and

support their academic and professional careers. Through interactive sessions about business and industry, mentoring support, developmental workshops and educating through Constitutional debates, we provided this next generation with an

invaluable leg-up on their future.

|

|

Diversity Considerations for Mentorship Program

|

Employee participation in the Everest mentorship program continues to expand as new colleagues join the Everest team and utilize the program to encourage diverse

participation across the company. The DEI council through its ERGs took advantage of the mentorship program in proactively matching under-represented mentees with senior and executive level managers as mentors for underrepresented colleagues.

|

|

Management Training, Leadership Programs and Networking

|

Our management and leadership training programs have been revised to include bias awareness and reduction education. We have piloted leadership development programs focused

on underrepresented groups, which are now under consideration for incorporation into the leadership development curriculum. There has also been a focus on developing networking opportunities for underrepresented colleagues to have more

frequent and direct access to senior management.

|

|

Employee Resource Groups

|

Everest supports several ERGs to support our Black, Latino, LGBTQ+ and Pan Asian colleagues by leveraging networking events, professional development opportunities and the

promotion of cultural traditions and awareness at Everest. These new ERGs joined our existing Women’s Networking Group and the Everest Charitable Outreach team.

These ERGs carried out various successful events and programs in 2021, including celebrations of Women’s History, Pride Awareness and Black History Months; leadership

coffee hours and fireside chats; community involvement events, offering colleagues the opportunity to support businesses in underrepresented communities; and strategic sponsorship events. Everest’s U.S. offices are now also closed in honor of

Juneteenth, also known as “Freedom Day,” to commemorate the effective end of slavery in the U.S.

|

|

ARBOR DAY FOUNDATION

|

As part of Earth Day, ECO supported the Arbor Day Foundation’s reforestation efforts to plant 5,000 new trees in Florida’s Econfina Creek and Chipola River watersheds,

which were devastated by Hurricane Michael in 2018.

|

|

GROW-A-ROW

|

Everest partnered with Grow-A-Row for two successful events in 2021. First, a team of 23 employees helped harvest cucumbers, peppers and plums at Grow-A-Row’s Pittstown,

New Jersey, farm. The team harvested approximately 4,000 pounds of fresh produce, which provided more than 15,000 servings to neighbors struggling with food insecurity. Second, a team of 30 Everest employees volunteered in Grow-A-Row’s

Apple Gleaning event in New Jersey. This group gleaned 3,000 pounds of apples, which also provided 12,000 servings to our neighbors struggling with food insecurity.

|

|

CAMP JOTONI

|

Over 21 Everest employees participated in a clean-up day at Camp Jotoni to prepare the camp for summer sessions. Camp Jotoni is a special needs summer camp for children

and adults with disabilities. It is located on 15 acres in Warren, New Jersey, less than five miles from our U.S. headquarters.

|

|

“THANK YOU” LETTER WRITING

|

ECO and WNG co-hosted a “thank you” letter writing campaign to our U.S. Military veterans around the world. Everest employees from 15 different offices penned 2,000

cards, filling each with a personalized message of thanks.

|

|

AKHIL AUTISM FOUNDATION

|

Everest employees participated in the Akhil Autism Foundation Walk in Woodbridge, New Jersey.

|

|

RISE AGAINST HUNGER

|

Everest employees volunteered with Rise Against Hunger to pack 35,400 nutritious meals that were distributed to Rise Against Hunger’s partners throughout the world.

|

|

UNITED WAY TOOLS FOR SCHOOLS

|

Everest held annual school supplies drive in collaboration with United Way Tools for Schools, resulting in the donation of nearly 5,000 school supply items.

|

|

UN-PRI Signatory

|

• Everest continually assesses the

impact of climate risks on our investment portfolio and identifies investment opportunities in the shift to a low-carbon global economy.

• We review and update our

investment guidelines to reflect the PRI, and employ a principles-based investment strategy designed to diversify our global portfolio by identifying emerging opportunities across various sectors that contribute long-term value to society.

Our investment strategy assumes a proactive and measured approach in transitioning investment from declining heavy carbon-emitting industries to eco-friendly and value generating opportunities including renewable energy, government sponsored

green bonds and public works projects.

• We review the investment

guidelines and actions of our pertinent third-party asset managers to ensure their compliance with the PRI in the context of the portfolios that they manage. Our main fixed income asset manager has had a policy in place since 2019 restricting

any further purchase of bonds on behalf of Everest issued by companies that generate more than 25% of revenue from coal. As of year-end 2021, less than $50 million of our fixed income portfolio is exposed to companies that derive greater than

25% of their revenues from coal-related businesses, while our public equity portfolio had approximately $2 million of coal-related exposure, and our private equity portfolio had less than $100,000 of exposure, which represent a significant

decrease in investment exposures to coal over the past few years.

|

|

• Our Investment Division also

recently expanded its staff, including an analyst and an additional senior portfolio manager vice president whose job functions will include monitoring and ensuring compliance with the PRI and reporting.

• Everest will be working toward

formulating an expanded responsible investment policy, in addition to utilizing ESG analytical services to help further measure the ESG qualities and carbon intensity of Everest’s investment portfolio, which we will aim to report on in our

next TCFD report.

• Currently, Everest has invested

over $200 million in green bonds, which are fixed-income instruments specifically designed to fund projects with environmental and/or climate or other social benefits. We also hold nearly $20 million of investments in three ESG-related

exchanged-traded funds (“ETFs”) helping enable the production of renewable energy in various areas of the world.

|

|

|

UN-PSI Signatory

|

• Everest is a signatory to the PSI,

a global sustainability framework of the United Nations Environment Programme’s Finance Initiative.

• The PSI serves as a global

framework for the insurance industry to better understand, prevent and reduce ESG risks and better manage opportunities to provide quality and reliable risk protection. The PSI has led to the largest collaboration between the UN and the

insurance industry and has steadily grown to represent about 30% of world premium volume.

• Everest is proud to have already

reported initial disclosures in accordance with the PSI framework, contained within Everest’s recently published Corporate Responsibility Report, within four months of officially becoming a signatory to the PSI.

• Going forward, Everest will

continue to support the PSI by among other actions: working with communities to develop insurance solutions to help transition to renewables; supporting government sponsored green initiative programs; providing market leading project credit

coverages; and providing coverage to protect against defaults by renewable energy developers.

|

|

Providing Insurance Protection for Clean Energy Programs

|

As the renewable energy industry rapidly grows, Everest is committed to helping lead the transition to a clean energy future. Renewable energy sources recently accounted

for about 13% of total U.S. energy consumption and about 20% of electricity generation.1 The share of generation from

renewable sources is expected to increase from 20% in 2021 to 23% in 2022 and to 24% in 2023.2 This dramatic growth

presents an excellent insurance growth opportunity, with some recent highlights and initiatives by Everest in this area listed below:

• A growing portion of our global

project finance credit insurance segment relates to allocating capacity to renewable energy projects, enabling financers to provide additional credit for renewable energy development. Among other projects, we have provided credit risk

insurance for wind energy projects in the North Sea and Taiwan, hydropower projects in South America and solar energy projects across the globe, with a specific focus on emerging economies.

• A growing percentage of our excess

casualty energy portfolio is comprised of electric power generation from clean energy sources. Recent examples include providing capacity to Vineyard Wind in connection with a significant off-shore wind project development on the outer

continental shelf south of Massachusetts which will be among the first utility-scale offshore wind energy projects in the U.S., as well as providing capacity to SOLV Energy, a leading solar services provider serving the utility, high voltage

and energy storage markets in North America, which has helped build over 8 GW of solar energy projects since 2008.

|

|

• Everest provides reinsurance

support for the New Energy Risk program, which provides insurance coverage for companies developing breakthrough technologies, including fuel cells, energy storage, carbon capture, renewable fuels and waste-to-energy solutions. This coverage

helps project developers access capital to accelerate the deployment of these technologies to address global challenges.

• We also provide reinsurance

support for the Clean Energy Risk Solutions program, which provides performance warranties for renewable energy projects and enables debt financing. This protects the development and global distribution of clean energy technologies that

deliver value to the renewable energy markets, including solar, waste-to-energy and energy storage.

• We partnered with Associated

Electric & Gas Insurance Services, a mutual insurance company, to offer an array of property and casualty products designed for the renewable energy industry, including solar energy, battery storage facilities and wind assets.

• Everest Insurance® has partnered with one of the largest underwriters of renewable energy projects in North America to provide property coverages for wind and solar energy

facilities.

• Finally, Everest has written an

expanding amount of tax liability insurance coverage in recent years, which can protect against the loss of investment or production tax credits for renewable energy projects and can potentially mean the difference between a project receiving

sufficient investment and commencing start-up or not. We expect further opportunities in this area as governments encourage the growth of the renewable energy sector.

Through this support for clean energy development, Everest is adapting its business to confront the challenges posed by climate change. We intend to help advance the

transition to a low-carbon economy, while protecting communities against the harms that could be caused by a haphazard transition. Everest will continue to work with its partners and stakeholders to seize opportunities to invest in this

transition and address the threats posed by climate change.

|

|

|

Influencing Societal Behavior to Mitigate Climate Change Risk

|

• We also seek to influence change

in behavior to improve the environment and mitigate the human impact on climate change.

• We have reduced our capacity and

exposure to regions more susceptible to increased severity of climate change, thereby, proactively helping to curb the expansion of human activity into environmentally sensitive locations.

• We work with our insureds to

consider the impact of climate risk on their operations and property in conjunction with underwriting, engineering and loss mitigation services we provide.

• We provide insurance premium

credits to policyholders that demonstrate sound environmental practices and adopt loss mitigating measures to protect their facilities and operations as an economic incentive to reduce their exposure to risk of loss associated with climate

change.

|

|

Location

|

ESG Features

|

|

Warren, New Jersey (U.S. Headquarters)

|

• LEED Silver certified

• Green roof

• Charging stations for electric vehicles

• Natural light-maximizing workspaces

|

|

Hamilton, Bermuda (Corporate Headquarters)

|

• Double-glazed solar controlled glass

• Seawater air conditioning system

• Energy-conserving lighting

|

|

Chicago, IL

|

• LEED Gold certified

|

|

Houston, TX

|

• LEED Gold certified

|

|

Los Angeles, CA

|

• LEED Platinum certified

|

|

New York, NY

|

• LEED Gold certified

|

|

San Francisco, CA

|

• LEED Platinum certified

|

|

Tampa, FL

|

• LEED Gold certified

|

|

Walnut Creek, CA

|

• LEED Gold certified

|

|

• We are committed to ensuring that we

understand our shareholders’ issues and potentials concerns, and that our shareholders understand our corporate governance and executive compensation programs. This includes how our executive compensation program rewards the achievement of

our strategic objectives and aligns the interests of our Named Executive Officers with those of the Company’s shareholders.

• Overall, our shareholders generally

expressed support for our long-term strategy, Investor Day and ESG initiatives. There was universal appreciation for the opportunity to engage in the outreach discussions and our willingness to consider shareholder input into our governance

protocols.

|

|

What We Heard

|

Everest Actions

|

|

Publication of Equal Employment Opportunity Commission (EEO-1) employee demographic

data and board diversity data. |

Everest publishes EEO-1 employee demographic data and board diversity data within the “Corporate Responsibility” section of Everest’s website.

|

|

Board commitment to expand ethnic and gender diversity.

|

The Board is committed to expanding the director candidate pool to assure wider inclusion of highly qualified women and persons of color.

|

|

Increased diversity among key committee leadership positions on the Board.

|

Everest’s Risk Committee is led by a female Chair.

|

|

Board Leadership – Some shareholders

expressed a preference for an independent Chairman of the Board. |

The Board noted that Mr. Taranto’s decades of leadership experience, industry expertise and institutional knowledge regarding the Company, provides invaluable insight and resource to the

Company’s management and his colleagues on the Board more than compensates for the fact that he serves as a non-independent Chairman.

|

|

ESG Disclosure – We received very positive feedback on our ESG initiatives and reporting disclosures. Some shareholders recommended expanding our ESG reporting to comply with the TCFD framework.

|

In 2022, Everest will include additional disclosures in areas such as employee training and development while also expanding our climate risk reporting in compliance with the TCFD framework to

be presented in addition to our current GRI and SASB framework reporting.

|

|

Governance Profile Best Practice

|

Company Practice

|

|

|

✔

|

Size of Board

|

9

|

|

✔

|

Number of Independent Directors

|

7

|

|

✔

|

Board Independence Standards

|

The Board has adopted director independence standards stricter than the listing standards of the NYSE

|

|

✔

|

Director Independence on Key Committees

|

The Board’s Audit, Compensation and Nominating and Governance Committees are composed entirely of independent directors

|

|

✔

|

Separate Chairman and CEO

|

Yes

|

|

✔

|

Independent Lead Director

|

Yes

|

|

✔

|

Annual Election of All Directors

|

Yes

|

|

✔

|

Majority Voting for Directors

|

Yes

|

|

✔

|

Board Meeting Attendance

|

Each director or appointed alternate director attended 100% of Board meetings in 2021

|

|

✔

|

Annual General Meeting Attendance

|

Director attendance expected at Annual General Meeting per Governance Guidelines, and 100% of directors attended the 2021 Annual General Meeting

|

|

✔

|

No Over-Boarding

|

Directors are prohibited from sitting on the boards of competitors

|

|

✔

|

Regular Executive Sessions of Non-Management Directors

|

Yes

|

|

✔

|

Shareholder Access

|

No minimum share ownership or holding thresholds necessary to nominate qualified director to Board

|

|

✔

|

Policy Prohibiting Insider Pledging or Hedging of Company’s Stock

|

Yes

|

|

✔

|

Annual Equity Grant to Non-Employee Directors

|

Yes

|

|

✔

|

Annual Board and Individual Director Performance Evaluations

|

Yes

|

|

✔

|

Clawback Policy

|

Clawback Policy covering current and former employees, including Named Executive Officers, providing for forfeiture and repayment of any incentive based compensation

granted or paid to an individual during the period in which he or she engaged in material willful misconduct including, but not limited to fraudulent misconduct

|

|

✔

|

Code of Business Conduct and Ethics for Directors and Executive Officers

|

Yes

|

|

✔

|

No Separate Change in Control Agreement for the CEO

|

CEO participates in the Senior Executive Change in Control Plan (“CIC Plan”) along with the other Named Executive Officers

|

|

✔

|

No Automatic Accelerated Vesting of Equity Awards

|

Accelerated equity vesting provisions are not and will not be incorporated in the employment agreements of any Named Executive Officer

|

|

Governance Profile Best Practice

|

Company Practice

|

|

|

✔

|

Double Trigger for Change-in-Control

|

Yes

|

|

✔

|

No Excise Tax Assistance

|

No “gross-up” payments by the Company of any “golden parachute” excise taxes upon a change-in-control

|

|

✔

|

Say on Pay Frequency

|

Say on Pay Advisory Vote considered by Shareholders annually

|

|

✔

|

No Re-pricing of Options and SARs

|

The Board adheres to a strict policy of no re-pricing of Options and SARs

|

|

✔

|

Minimum Vesting Period of Options and Restricted Shares

|

Minimum 1-year vesting period for equity awards

However, the Board has always instituted a 5-year vesting period for equity awards to executive officers except for performance shares which must meet key performance metrics over the course of 3 years prior to

settlement

3-year vesting period for equity awards to Directors

|

|

✔

|

Share Recycling

|

No liberal share recycling

|

|

✔

|

Stock Ownership Guidelines for Executive Officers

|

Six times base salary for CEO; three times base salary for other Named Executive Officers

|

|

✔

|

Stock Ownership Guidelines for Non-Management Directors

|

Five times annual retainer

|

|

✔

|

Use of Performance Shares as Element of Long-Term Incentive Compensation

|

Yes

|

|

Proposal

|

Board’s Voting Recommendations

|

Page

|

|

Election of Director Nominees

(Proposal 1) |

FOR ALL DIRECTOR NOMINEES

|

19

|

|

Appointment of PricewaterhouseCoopers LLP as

Company Auditor (Proposal 2) |

FOR

|

97

|

|

Non-Binding Advisory Vote on Executive

Compensation (Proposal 3) |

FOR

|

98

|

| • |

Leadership: Demonstrated ability to hold significant leadership positions and effectively manage complex

organizations is important to evaluating and developing key management talent.

|

| • |

Insurance and/or Reinsurance Industry Experience: Experience in the insurance and/or reinsurance markets is

critical to strategic planning and oversight of our business operations.

|

| • |

Risk Management: Experience in identifying, assessing and managing risks is critical to oversight of current and emerging

organizational and systemic risks in order to inform and adapt the Company’s strategic planning.

|

| • |

Regulatory: Understanding of the laws and regulations that impact our heavily regulated

industry, as well as understanding the impact of government actions and public policy. Both areas are important to oversight of insurance operations.

|

| • |

Finance and Accounting: Financial experience and literacy are essential for understanding and overseeing our financial reporting,

investment performance and internal controls to ensure transparency and accuracy.

|

| • |

Corporate Governance: Understanding of corporate governance matters is essential to

ensuring effective governance of the Company and protecting shareholder interests.

|

| • |

Business Operations: A practical understanding of developing, implementing and assessing our business operations and processes,

and experience making strategic decisions, are critical to the oversight of our business, including the assessment of our operating plan, risk management and long-term sustainability strategy.

|

| • |

Information Technology/Cybersecurity: A practical understanding of information systems and technology use in our business

operations and processes, as well as a recognition of the risk management aspects of cyber risks and cyber security.

|

| • |

International: Experience and knowledge of global insurance and financial markets

is especially important in understanding and reviewing our business and strategy.

|

Proxy Statement 20

|

Age: 73

Director Since: September 19, 2012

Independent

Committees:

• Audit

• Compensation (Chair)

• Nominating and Governance

• Underwriting

|

| • |

Executive Leadership

|

| • |

Insurance/Reinsurance Industry Experience

|

| • |

Finance and Accounting

|

| • |

Corporate Governance

|

| • |

Business Operations

|

| • |

International

|

| • |

Risk Management

|

| • |

Claims

|

|

Age: 56

Director Since: February 26, 2020

Non-Independent

Committees:

• Investment Policy

• Underwriting

• Executive

|

|

•

|

Executive Leadership

|

•

|

Corporate Governance

|

|

•

|

Insurance/Reinsurance Industry Experience

|

•

|

International

|

|

•

|

Finance and Accounting

|

•

|

Risk Management

|

|

•

|

Business Operations

|

•

|

Regulatory

|

|

•

|

Mergers and Acquisitions

|

•

|

Claims

|

|

•

|

Marketing and Branding

|

||

|

Age: 69

Director Since: March 12, 1996

Independent

Committees:

• Audit

• Compensation

• Executive

• Nominating and Governance (Chair)

• Underwriting

|

| • |

Executive Leadership

|

| • |

Insurance/Reinsurance Industry Experience

|

| • |

Finance and Accounting

|

| • |

Investments

|

| • |

Merger & Acquisition

|

| • |

Corporate Governance

|

| • |

Business Operations

|

| • |

Risk Management

|

| • |

Claims

|

| • |

Marketing and Branding

|

|

Age: 62

Director Since: May 18, 2016

Independent

Committees:

• Audit

• Compensation

• Nominating and Governance

• Investment Policy

|

| • |

Executive Leadership

|

| • |

Insurance/Reinsurance Industry Experience

|

| • |

Corporate Governance

|

| • |

Risk Management

|

| • |

Finance and Accounting

|

| • |

Investments

|

| • |

International

|

| • |

Business Operations

|

| • |

Regulatory

|

|

Age: 67

Director Since: May 23, 2019

Independent

Committees:

• Audit

• Compensation

• Investment Policy

• Nominating and Governance

|

| • |

Executive Leadership

|

| • |

Insurance/Reinsurance Industry Experience

|

| • |

Finance and Accounting

|

| • |

Investments

|

| • |

Merger & Acquisition

|

| • |

Corporate Governance

|

| • |

Business Operations

|

| • |

Risk Management

|

|

Age: 71

Director Since: May 14, 2014

Independent

Committees:

• Audit

• Compensation

• Nominating and Governance

• Underwriting (Chair)

|

| • |

Executive Leadership

|

| • |

Insurance/Reinsurance Industry Experience

|

| • |

Corporate Governance

|

| • |

Finance and Accounting

|

| • |

Risk Management

|

| • |

Business Operations

|

| • |

International

|

| • |

Information Technology/Cyber Security

|

| • |

Claims

|

|

Age: 75

Director Since: February 24, 2010

Independent

Committees:

• Audit (Chair)

• Compensation

• Nominating and Governance

|

| • |

Executive Leadership

|

| • |

Insurance/Reinsurance Industry Experience

|

| • |

Corporate Governance

|

| • |

Finance and Accounting

|

| • |

Regulatory

|

| • |

International

|

| • |

Legal

|

| • |

Mergers & Acquisitions

|

|

Age: 73

Director Since: March 12, 1996

Non-Independent

Committees:

• Executive

• Investment Policy

|

| • |

Executive Leadership

|

| • |

Insurance/Reinsurance Industry Experience

|

| • |

Business Operations

|

| • |

Corporate Governance

|

| • |

Finance and Accounting

|

| • |

Mergers & Acquisitions

|

| • |

Investments

|

| • |

Regulatory

|

| • |

International

|

| • |

Risk Management

|

| • |

Marketing and Branding

|

|

Age: 77

Director Since: May 22, 2003

Independent

Committees:

• Audit

• Compensation

• Executive

• Investment Policy

• Nominating and Governance

|

| • |

Executive Leadership

|

| • |

Insurance/Reinsurance Industry Experience

|

| • |

Business Operations

|

| • |

Finance and Accounting

|

| • |

Investments

|

| • |

International

|

| • |

Mergers & Acquisitions

|

| • |

Corporate Governance

|

| • |

Risk Management

|

SANJOY MUKHERJEE

|

Board of Directors

|

|||||||||

|

John J.

Amore |

Juan C. Andrade

|

William F.

Galtney, Jr. |

John A.

Graf |

Meryl

Hartzband |

Gerri

Losquadro |

Roger M.

Singer |

Joseph V.

Taranto |

John A.

Weber |

|

|

Skills & Experience

|

|||||||||

|

Executive Leadership

|

X

|

X

|

X

|

X

|

X

|

X

|

X

|

X

|

X

|

|

Insurance Industry Experience

|

X

|

X

|

X

|

X

|

X

|

X

|

X

|

X

|

X

|

|

Reinsurance Industry Experience

|

X

|

X

|

X

|

X

|

X

|

X

|

X

|

X

|

X

|

|

Claims

|

X

|

X

|

X

|

X

|

|||||

|

Risk Management

|

X

|

X

|

X

|

X

|

X

|

X

|

X

|

X

|

|

|

Regulatory

|

X

|

X

|

X

|

X

|

|||||

|

Finance/Capital Management and Accounting

|

X

|

X

|

X

|

X

|

X

|

X

|

X

|

X

|

X

|

|

Corporate Governance

|

X

|

X

|

X

|

X

|

X

|

X

|

X

|

X

|

X

|

|

Business Operations

|

X

|

X

|

X

|

X

|

X

|

X

|

X

|

X

|

|

|

International

|

X

|

X

|

X

|

X

|

X

|

X

|

X

|

||

|

Investments

|

X

|

X

|

X

|

X

|

X

|

||||

|

Merger & Acquisition

|

X

|

X

|

X

|

X

|

X

|

X

|

|||

|

Information Technology/Cyber Security

|

X

|

||||||||

|

Legal

|

X

|

||||||||

|

Marketing & Branding

|

X

|

X

|

X

|

||||||

| • |

Audit Committee

|

| • |

Nominating and Governance

|

| • |

Compensation Committee

|

| • |

Executive Committee

|

| • |

Investment Policy Committee

|

| • |

Risk Committee

|

|

Name

|

Audit

|

Compensation

|

Executive

|

Investment

Policy |

Nominating

and Governance |

Risk

Committee |

Independent

|

|

John J. Amore

|

X

|

Chair

|

X

|

X

|

X

|

||

|

Juan C. Andrade

|

X

|

X

|

X

|

||||

|

William F. Galtney, Jr.

|

X

|

X

|

X

|

Chair

|

X

|

X

|

|

|

John A. Graf

|

X

|

X

|

X

|

X

|

X

|

||

|

Meryl Hartzband

|

X

|

X

|

X

|

X

|

X

|

||

|

Gerri Losquadro

|

X

|

X

|

X

|

Chair

|

X

|

||

|

Roger M. Singer

|

Chair

|

X

|

X

|

X

|

|||

|

Joseph V. Taranto

|

X

|

X

|

|||||

|

John A. Weber

|

X

|

X

|

X

|

X

|

X

|

X

|

|

|

Meetings

|

4

|

4

|

0

|

4

|

4

|

4

|

|

| • |

no director who is an employee, or whose immediate family member is an executive officer of the Company, is deemed independent until three years after the end of such employment relationship;

|

| • |

no director is independent who:

|

| (i) |

is a current partner or employee of a firm that is the Company’s internal or external auditor;

|

| (ii) |

has an immediate family member who is a current partner of such firm;

|

| (iii) |

has an immediate family member who is a current employee of such firm and personally works on the Company’s audit; or

|

| (iv) |

was or had an immediate family member who was within the last three years a partner or employee of such firm and personally worked on the Company’s audit within that time;

|

| • |

no director who is employed, or whose immediate family member is employed, as an executive officer of another company where any of our present executives serve on that company’s compensation committee is deemed independent until three

years after the end of such service or the employment relationship;

|

| • |

no director who is an executive officer or an employee, or whose immediate family member is an executive officer, of a company that makes payments to, or receives payments from, the Company for property or services in an amount that, in

any single year, exceeds $10,000 is deemed independent;

|

| • |

no director who has a personal services contract with the Company, or any member of the Company’s senior management, is independent;

|

| • |

no director who is affiliated with a not-for-profit entity that receives significant contributions from the Company is independent; and

|

| • |

no director who is employed by a public company at which an executive officer of the Company serves as a director is independent.

|

| • |

no director who is a member of the Audit Committee shall be deemed independent if such director is affiliated with the Company or any of its subsidiaries in any capacity, other than in such director’s capacity as a member of our Board of

Directors, the Audit Committee or any other Board committee or as an independent subsidiary director; and

|

| • |

no director who is a member of the Audit Committee shall be deemed independent if such director receives, directly or indirectly, any consulting, advisory or other compensatory fee from the Company or any of its subsidiaries, other than

fees received in such director’s capacity as a member of our Board of Directors, the Audit Committee or any other Board committee, or as an independent subsidiary director, and fixed amounts of compensation under a retirement plan, including

deferred compensation, for prior service with the Company (provided such compensation is not contingent in any way on continued service).

|

| • |

no director shall be considered independent who:

|

| (i) |

is currently an officer (as defined in Rule 16a-1(f) of the Securities Exchange Act of 1934 (the “Exchange Act”)) of the Company or a subsidiary of the Company, or otherwise employed by the Company or subsidiary of the Company;

|

| (ii) |

receives compensation, either directly or indirectly, from the Company or a subsidiary of the Company, for services rendered as a consultant or in any capacity other than as a director, except for an amount that does not exceed the dollar

amount for which disclosure would be required pursuant to Item 404(a) of Regulation S-K; or

|

| (iii) |

possesses an interest in any other transaction for which disclosure would be required pursuant to Item 404(a) of Regulation S-K.

|

| • |

Coordinating executive sessions of the independent members of the Board without management present;

|

| • |

Authorization to call meetings of the independent directors;

|

| • |

Serving as a liaison between the Chairman and the independent directors and providing a forum for independent director feedback at executive sessions;

|

| • |

Communicating regularly with the CEO and the other directors on matters of Board governance;

|

| • |

Assisting in Board meeting agenda preparation in consultation with the Chairman;

|

| • |

Overseeing the annual Board review and evaluation process including individual director evaluations and facilitating discussion of the results;

|

| • |

Leading board discussions on oversight of Environmental, Social and Governance reporting;

|

| • |

Assuring that all Board members carry out their responsibilities as directors;

|

| • |

If requested and, when appropriate, consultation and direct communication with shareholders as the independent representative of the Board.

|

|

2021

|

2020

|

|

|

Audit Fees(1)

|

$6,173,801

|

$6,293,428

|

|

Audit-Related Fees(2)

|

591,138

|

366,887

|

|

Tax Fees(3)

|

614,200

|

691,000

|

|

All Other Fees(4)

|

37,200

|

25,000

|

| (1) |

Audit fees include the annual audit and quarterly financial statement reviews, internal control audit (as required by the Sarbanes Oxley Act of 2002), subsidiary audits and procedures required to be performed by the independent auditors to

be able to form an opinion on the Company’s consolidated financial statements. Audit fees also include statutory audits or financial audits of subsidiaries or affiliates of the Company and services associated with SEC registration statements,

periodic reports and other documents filed with the SEC or other documents issued in connection with securities offerings.

|

| (2) |

Audit-related fees include assurance and related services that are reasonably related to the performance of the audit or review of the Company’s financial statements; accounting consultations related to accounting, financial reporting or

disclosure matters not classified as “audit services”; assistance with understanding and implementing new accounting and financial reporting guidance from rulemaking authorities; financial audits of employee benefit plans; agreed-upon or

expanded audit procedures related to accounting and/or billing records required to respond to or comply with financial, accounting or regulatory reporting matters and assistance with internal control reporting requirements.

|

| (3) |

Tax fees include tax compliance, tax planning and tax advice and may be granted general pre-approval by the Audit Committee.

|

| (4) |

All other fees are for accounting and research subscriptions.

|

|

Roger M. Singer, Chairman

|

|

|

John J. Amore

|

|

|

William F. Galtney, Jr.

|

|

|

John A. Graf

|

|

|

Meryl Hartzband

|

|

|

Gerri Losquadro

|

|

|

John A. Weber

|

|

John J. Amore, Chairman

|

|

|

William F. Galtney, Jr.

|

|

|

John A. Graf

|

|

|

Meryl Hartzband

|

|

|

Gerri Losquadro

|

|

|

Roger M. Singer

|

|

|

John A. Weber

|

|

William F. Galtney, Jr., Chairman

|

|

|

John J. Amore

|

|

|

John A. Graf

|

|

|

Meryl Hartzband

|

|

|

Gerri Losquadro

|

|

|

Roger M. Singer

|

|

|

John A. Weber

|

|

Gerri Losquadro, Chairwoman

|

|

|

Juan C. Andrade

|

|

|

John J. Amore

|

|

|

William F. Galtney, Jr.

|

c/o Everest Global Services, Inc.

Warren Corporate Center

100 Everest Way

Warren, NJ 07059

|

Name of Beneficial Owner

|

Amount and Nature of

Beneficial Ownership |

Percent

of Class(14) |

||

|

John J. Amore

|

21,446

|

(1)

|

*

|

|

|

William F. Galtney, Jr.

|

65,818

|

(2)

|

*

|

|

|

John A. Graf

|

14,206

|

(3)

|

*

|

|

|

Meryl Hartzband

|

7,320

|

(4)

|

*

|

|

|

Gerri Losquadro

|

12,103

|

(5)

|

*

|

|

|

Roger M. Singer

|

17,068

|

(6)

|

*

|

|

|

Joseph V. Taranto

|

311,188

|

(7)

|

*

|

|

|

John A. Weber

|

16,231

|

(8)

|

*

|

|

|

Juan C. Andrade

|

50,664

|

(9)

|

*

|

|

|

Mike Karmilowicz

|

8,637

|

(10)

|

*

|

|

|

Mark Kociancic

|

26,466

|

(11)

|

*

|

|

|

Sanjoy Mukherjee

|

43,493

|

(12)

|

*

|

|

|

Jim Williamson

|

10,456

|

(13)

|

*

|

|

|

All directors, nominees and executive officers as a group (13 persons)

|

605,096

|

1.4

|

||

| * |

Less than 1%

|

| (1) |

Includes 454 shares issuable upon the exercise of share options within 60 days of March 11, 2022. Also includes 2,410 restricted shares issued to Mr. Amore under the Company’s 2003 Non-Employee Director Equity

Compensation Plan (“2003 Directors Plan”) which may not be sold or transferred until the vesting requirements are satisfied.

|

| (2) |

Includes 37,606 shares owned by various family related investments in which Mr. Galtney maintains a beneficial ownership and for which he serves as the General Partner. Also includes 2,410 restricted shares issued

to Mr. Galtney under the 2003 Directors Plan which may not be sold or transferred until the vesting requirements are satisfied.

|

| (3) |

Includes 2,410 restricted shares issued to Mr. Graf under the 2003 Directors Plan which may not be sold or transferred until the vesting requirements are satisfied.

|

| (4) |

Includes 2,677 restricted shares issued to Ms. Hartzband under the 2003 Directors Plan which may not be sold or transferred until the vesting requirements have been satisfied.

|

| (5) |

Includes 2,410 restricted shares issued to Ms. Losquadro under the 2003 Directors Plan which may not be sold or transferred until the vesting requirements have been satisfied.

|

| (6) |

Includes 2,410 restricted shares issued to Mr. Singer under the 2003 Directors Plan which may not be sold or transferred until the vesting requirements are satisfied.

|

| (7) |

Includes 19,330 shares owned by various family related trusts and investments in which Mr. Taranto maintains a beneficial ownership. Also, includes 391 restricted shares issued to Mr. Taranto under the Company’s

2010 Stock Incentive Plan and 2,019 restricted shares issued to Mr. Taranto under the Company’s 2020 Stock Incentive Plan which may not be sold or transferred until the vesting requirements are satisfied.

|

| (8) |

Includes 6,096 shares owned through family investments in which Mr. Weber maintains a beneficial ownership. Also, includes 2,410 restricted shares issued to Mr. Weber under the 2003 Directors Plan which may not be

sold or transferred until the vesting requirements are satisfied.

|

| (9) |

Includes 27,090 restricted shares issued to Mr. Andrade under the Company’s 2010 Stock Incentive Plan and 13,658 shares issued to Mr. Andrade under the Company’s 2020 Stock Incentive Plan which may not be sold or

transferred until the vesting requirements have been satisfied.

|

| (10) |

Includes 1,965 restricted shares issued to Mr. Karmilowicz under the company’s 2010 stock incentive plan and 4,889 restricted shares issued under the Company’s 2020 Stock Incentive Plan which may not be sold or

transferred until the vesting requirements have been satisfied.

|

| (11) |

Includes 23,595 restricted shares issued to Mr. Kociancic under the Company’s 2020 Stock Incentive Plan which may not be sold or transferred until the vesting requirements have been satisfied.

|

| (12) |

Includes 3,954 restricted shares issued to Mr. Mukherjee under the Company’s 2010 Stock Incentive Plan and 3,972 shares issued to Mr. Mukherjee under the Company’s 2020 Stock Incentive Plan which may not be sold or

transferred until the vesting requirements have been satisfied.

|

| (13) |

Includes 9,517 restricted shares issued to Mr. Williamson under the Company’s 2020 Stock Incentive Plan which may not be sold or transferred until the vesting requirements have been satisfied.

|

| (14) |

Based on 44,285,719 total Common Shares outstanding and entitled to vote as of March 11, 2022.

|

To the best of the Company’s knowledge, the only beneficial owners of 5% or more of the outstanding Common Shares as of December 31, 2021 are set forth below. This table is based on information provided in Schedule 13G Information Statements filed with the SEC by the parties listed in the table.

|

Name and Address of Beneficial Owner

|

Number of Shares Beneficially Owned

|

Percent of

Class |

||

|

Everest Preferred International Holdings, Ltd.

|

9,719,971

|

(1)

|

19.8%

|

|

|

Seon Place, 141 Front Street, 4th Floor

|

||||

|

Hamilton HM 19, Bermuda

|

||||

|

The Vanguard Group

|

4,391,743

|

(2)

|

9.0%

|

|

|

100 Vanguard Boulevard

|

||||

|

Malvern, Pennsylvania 19355

|

||||

|

BlackRock, Inc.

|

2,792,385

|

(3)

|

5.7%

|

|

|

55 East 52nd Street

|

||||

|

New York, New York 10022

|

||||

| (1) |

Everest Preferred International Holdings (“EPIH”) a direct wholly-owned subsidiary of the company had sole power to vote and direct the disposition of 9,719,971 Common Shares as of December 31, 2021. According to

the Company’s Bye-laws, the total voting power of any Shareholder owning more than 9.9% of the Common Shares will be reduced to 9.9% of the total voting power of the Common Shares.

|

| (2) |

The Vanguard Group reports in its Schedule 13G that it has sole dispositive power with respect to 4,226,952 Common Shares and shared dispositive power with respect to 164,791 Common Shares.

|

| (3) |

BlackRock, Inc. reports in its Schedule 13G that it has sole power to vote or direct the vote of 2,477,945 Common Shares and sole dispositive power with respect to 2,792,385 Common Shares.

|

Each member of the Board who is not otherwise affiliated with the Company as an employee and/or officer (“Non-Employee Director” or “Non-Management Director”) was compensated in 2021 for services as a director and was also reimbursed for out-of-pocket expenses associated with each meeting attended. Each Non-Employee Director is compensated in the form of an annual retainer and a discretionary equity grant.

|

Change in

|

|||||||

|

Pension Value

|

|||||||

|

and Nonqualified

|

|||||||

|

Fees

|

Non-Equity

|

Deferred

|

|||||

|

Earned or

|

Share

|

Option

|

Incentive Plan

|

Compensation

|

All Other

|

||

|

Name

|

Paid in Cash(1)

|

Awards(2)

|

Awards(3)

|

Compensation

|

Earnings

|

Compensation(4)

|

Total

|

|

John J. Amore

|

125,000

|

325,601

|

—

|

—

|

—

|

16,207

|

466,808

|

|

William F. Galtney, Jr.

|

125,000

|

325,601

|

—

|

—

|

—

|

16,207

|

466,808

|

|

John A. Graf

|

125,000

|

325,601

|

—

|

—

|

—

|

16,207

|

466,808

|

|

Meryl Hartzband

|

125,000

|

325,601

|

—

|

—

|

—

|

15,176

|

465,777

|

|

Gerri Losquadro

|

125,000

|

325,601

|

—

|

—

|

—

|

16,207

|

466,808

|

|

Roger M. Singer

|

125,000

|

325,601

|

—

|

—

|

—

|

26,207

|

476,808

|

|

Joseph V. Taranto(5)

|

425,000

|

325,601

|

—

|

—

|

—

|

16,207

|

766,808

|

|

John A. Weber

|

125,000

|

325,601

|

—

|

—

|

—

|

26,207

|

476,808

|

| (1) |

During 2021, all of the directors elected to receive their compensation in cash except for Ms. Hartzband who received 506 shares in compensation for her services during the 1st, 2nd, 3rd and 4th quarter of 2021.

|

| (2) |

The amount shown is the aggregate grant date fair value of the 2021 grant computed in accordance with Financial Accounting Standards Board Statement Accounting Standards Codification Topic 718 (“FASB ASC Topic 718”)

calculated by multiplying the number of shares by the fair market value (the average of the high and low of the Company’s stock price on the NYSE on the date of grant) (“FMV”). Each of the Non-Employee Directors was awarded 1,332 restricted

shares on February 24, 2021 at FMV of $244.4450. The aggregate number of restricted stock outstanding at year-end 2021 was 2,614 for all such directors, except for Meryl Hartzband who had 2,381 shares of restricted stock outstanding.

|

| (3) |

As of December 31, 2021, Mr. Amore has outstanding options to purchase 454 shares all of which are exercisable. This grant was awarded upon his appointment to the Board on September 19, 2012.

|

| (4) |

Dividends paid on each director’s restricted shares. For Messrs. Singer and Weber, also includes $10,000 in director fees for meetings attended as directors of both Bermuda Re and International Re.

|

| (5) |

Mr. Taranto’s compensation reflects his salary and share awards received as a non-executive employee of Everest Global.

|

Proxy Statement 55

Executive Summary

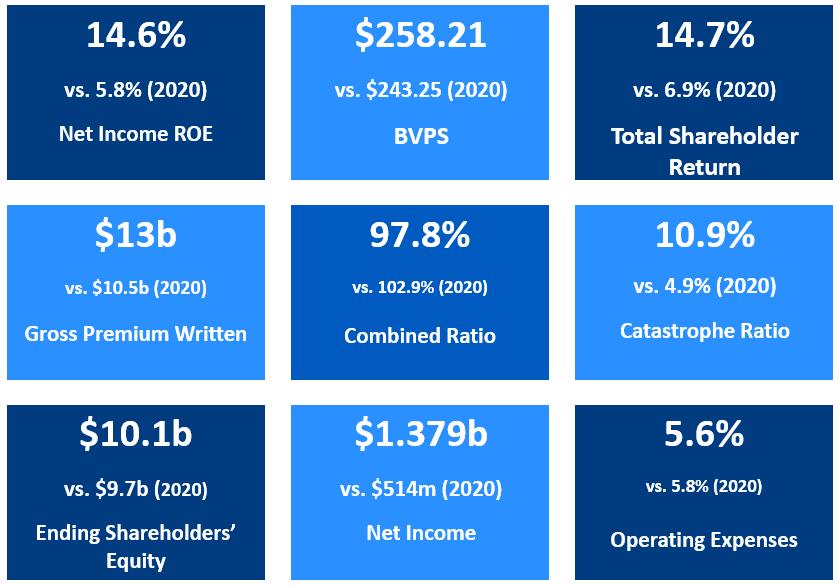

| • |

Gross written premiums grew to $13 billion from $10.5 billion in 2020.

|

| • |

The Company earned $1,154 million in after-tax operating income4 representing a 12.2% after tax operating return on equity (“ROE”)5.

|

| • |

The Company returned $472 million in capital to shareholders during 2021 as follows:

|

|

➢

|

We paid quarterly dividends totaling $247 million in 2021.

|

|

➢

|

We returned $225 million to shareholders through share repurchases.

|

Proxy Statement 56

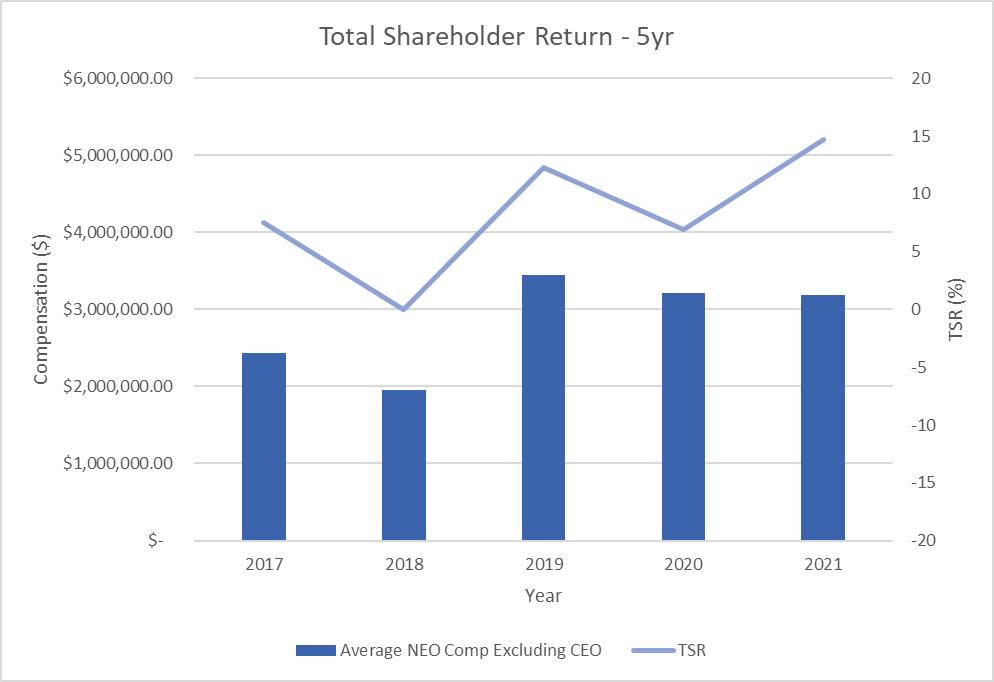

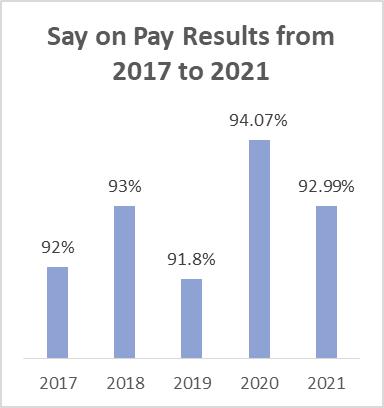

Compensation Practices and 2021 Say-On-Pay Vote

|

Say on Pay

|

|

|

Everest received 92.99% approval for the Say on Pay advisory vote at its 2021 Annual General Meeting. Accordingly, the Committee did not make any significant changes to the structure of the

Company’s compensation program.

|

| • |

No separate change-in-control (“CIC”) agreement for the CEO

|

| • |

CEO and all participants in the CIC Plan are subject to double-trigger provisions

|

| • |

No “gross-up” payments by the Company of any “golden parachute” excise taxes upon a change-in-control

|

| • |

No accelerated equity vesting in CEO’s employment agreement, except in the limited circumstance of a change-in-control followed by a termination (i.e. double trigger)

|

| • |

Incentive cash bonuses for all Named Executive Officers tied to specific Company financial performance metrics

|

| • |

For 2021, approximately 42% of Named Executive Officers’ long-term incentive compensation (excluding any Named Executive Officers no longer employed with the Company) is in the form of performance share units that can only be earned upon

satisfaction of specific Company financial performance metrics over a 3 year period

|

| • |

Say on Pay Advisory Vote considered by shareholders annually

|

| • |

Stock ownership and retention guidelines for executive vice presidents and above

|

| • |

Compensation of executive officers is based on the level of job responsibility, contribution to the performance of the Company, individual performance in light of general economic and industry conditions, teamwork, resourcefulness and

ability to manage our business.

|

| • |

Compensation awards and levels are intended to be reasonably competitive with compensation paid by organizations of similar stature to both motivate the Company’s key employees and minimize the potential for disruptive and costly key

employee turnover.

|

| • |

Compensation is intended to align the interests of the executive officers with those of the Company’s shareholders by basing a significant part of total compensation on our executives’ contributions over time to the generation of

shareholder value.

|

|

At-Risk Pay

|

Compensation Component

|

Description

|

Key Features

|

|||

Base Salary

15%

23%

CEO

Other NEOs

|

Fixed component of compensation intended to attract and retain top talent

|

Generally positioned near the median of our pay level peer group, but varies with individual skills, experience, responsibilities and performance

|

||||

|

Long Term

Short Term

|

Annual Incentive

Bonus

35%

CEO

37%

Other NEOs

|

Performance goals established at the beginning of each fiscal year that support long-term growth and operational efficiencies

Intended to motivate annual performance with respect to key financial measures, coupled with individual performance factors

|

For 2021, the maximum potential bonus was tied to the Company Adjusted ROE. Final awards also consider achievement of individual goals

All applicable Named Executive Officers (“NEOs”) were selected as participants in the Executive Performance Annual Incentive Plan (“Executive Incentive Plan”) for 2021 with the maximum bonus potential available

for award to any participant in the Plan not to exceed $3.5 million

The total bonus determination for a participant in 2021 is arrived at by application of two independent components based upon a 70% and 30% weighting for all Named

Executive Officers: (1) Company financial performance criteria and (2) individual performance criteria as set forth further herein.

No guaranteed minimum award

|

|||

|

Long-Term Incentive Awards

|

At-risk, long-term, equity-based compensation to encourage multi-year performance and retention

|

|||||

|

Performance Shares

25%

CEO

14%

Other NEOs

|

Intended to motivate long-term performance with respect to key financial measures and align our NEOs’ interests with those of our shareholders

|

Tied to the rate of annual operating ROE and cumulative growth in book value per share relative to our peer group over a three-year period, along with annual growth in

book value per share against targets for the 2021 PSU

Payouts range from 0% of target payout to 175% of target payout, depending on performance after 3 years

|

||||

|

Time-Vested Restricted Shares

Other NEOs

25%

26%

CEO

|

Intended to motivate long-term performance and value creation, align our NEOs’ interests with shareholders’ interests and promote retention

|

Vests at the rate of 20% per year after anniversary of grant over a five-year period

|

Proxy Statement 63

|

Alleghany Corporation

|

W. R. Berkley Corp.

|

Arch Capital Group, Ltd.

|

|

AXIS Capital Holdings, Limited

|

Cincinnati Financial Corp.

|

Chubb Limited

|

|

The Hanover Insurance Group, Inc.

|

Markel Corp.

|

The Hartford Financial Services Group, Inc.

|

|

Renaissance Re

|

Fairfax Financial Holdings

|

|

2021 INCENTIVE-BASED BONUS TARGETS AND AWARDS

|

|||||||||||||

|

Named Executive Officer

|

Target

Incentive Bonus (% Base Salary) |

Target

Incentive Bonus |

Potential

Maximum Incentive Bonus |

Actual

Bonus Award |

|||||||||

|

Juan C. Andrade

CEO |

200%

|

$

|

2,500,000

|

$

|

3,500,000

|

$

|

3,000,000

|

||||||

|

Mike Karmilowicz

Executive Vice President and CEO of Everest Insurance®

|

130%

|

861,900

|

1,326,000

|

$

|

1,060,800

|

||||||||

|

Mark Kociancic

Executive Vice President & Chief Financial Officer

|

130%

|

1,137,500

|

1,750,000

|

$

|

1,401,400

|

||||||||

|

Sanjoy Mukherjee

Executive Vice President, General Counsel & Secretary |

130%

|

845,000

|

1,300,000

|

$

|

975,000

|

||||||||

|

Jim Williamson

Executive Vice President, Chief Operating Officer and Head of Reinsurance

|

130%

|

910,000

|

1,400,000

|

$

|

1,210,000

|

||||||||

|

TOTAL

|

$

|

6,254,400

|

$

|

9,276,000

|

$

|

7,647,200

|

|||||||

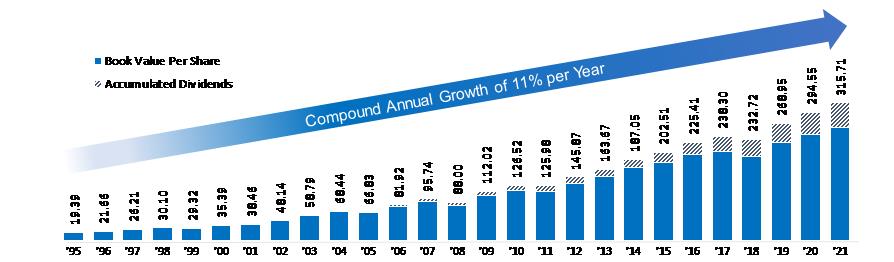

Each PSU gives the participant the right to receive up to 1.75 shares upon settlement at the end of the three-year performance period based upon satisfaction of certain financial performance targets. For the 2019 and 2020 PSU, the shares represented by the PSU may only be earned upon the satisfactory achievement of two financial performance metrics: cumulative Book Value Per Share (“BVPS”) growth measured against peers over a three-year period and Operating Return on Equity. For the 2021 PSU, a third performance metric was introduced: annual BVPS growth measured against targets set by the Compensation Committee. The Compensation Committee elected to use BVPS as one of the financial metrics for the PSU because this metric correlates with long-term shareholder value. Book Value Per Share is defined as the tangible book value of a share as determined under GAAP, adjusted for dividends paid to shareholders during the performance period. For purposes of calculating the new third metric for the 2021 PSU, annual BVPS growth measured against targets set by the Compensation Committee, BVPS is calculated in the same manner, except excluding any adjustment for dividends paid to shareholders.

|

NAMED EXECUTIVE OFFICERS

|

||||||

|

Target Award

|

Juan C. Andrade

|

John Doucette

|

Mike Karmilowicz

|

Mark Kociancic

|

Sanjoy Mukherjee

|

Jim Williamson

|

|

2019 PSU

|

1,980

|

1,290

|

||||

|

2020 PSU

|

6,770

|

1,895

|

780

|

1,150

|

||

|

2021 PSU

|

8,260

|

2,170

|

1,355

|

2,045

|

1,610

|

1,435

|

|

2019 PSU TARGET MEASURES

|

|||||||

|

Award Multiplier

|

|||||||

|

Weight

|

Performance

Year |

Target

ROE |

0%

|

25%

|

100%

|

175%

|

|

|

Operating ROE

|

60.0%

|

||||||

|

2019

|

12.2%

|

<5.2%

|

5.2%

|

12.2%

|

>=17.2%

|

||

|

2020

|

11.1%

|

<4.1%

|

4.1%

|

11.1%

|

>=16.1%

|

||

|

2021

|

11.1%

|

<4.1%

|

4.1%

|

11.1%

|

>=16.1%

|

||

|

Award Multiplier

|

|||||||

|

Weight

|

Performance

Period |

Target

|

0.0%

|

25%

|

100%

|

175%

|

|

|

3Yr Relative Change in BVPS to Peers

|

40.0%

|

2019 - 2021

|

Median

|

<26th%tile

|

26th%tile

|

Median

|

>=75th%tile

|

|

2020 PSU TARGET MEASURES

|

|||||||

|

Award Multiplier

|

|||||||

|

Weight

|

Performance

Year |

Target

ROE |

0%

|

25%

|

100%

|

175%

|

|

|

Operating ROE

|

60.0%

|

||||||

|

2020

|

11.1%

|

<4.1%

|

4.1%

|

11.1%

|

>=16.1%

|

||

|

2021

|

11.1%

|

<4.1%

|

4.1%

|

11.1%

|

>=16.1%

|

||

|

Award Multiplier

|

|||||||

|

Weight

|

Performance

Period |

Target

|

0.0%

|

25%

|

100%

|

175%

|

|

|

3Yr Relative Change in BVPS to Peers

|

40.0%

|

2020 - 2022

|

Median

|

<26th %tile

|

26th %tile

|

Median

|

>=75th %tile

|

|

2021 PSU TARGET MEASURES

|

|||||||

|

Award Multiplier

|

|||||||

|

Weight

|

Performance

Year |

Target

ROE |

0%

|

25%

|

100%