UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________________________________

FORM 10-Q

_________________________________________________

| QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the Quarterly Period Ended June 30, 2023

OR

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

Commission File Numbers: 001-35591

_________________________________________________

(Exact name of registrant as specified in its charter)

_________________________________________________

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | ||||

| (Address of principal executive offices) | (Zip Code) | ||||

(212 ) 610-2200

(Registrant’s telephone number, including area code)

___________________________________________________

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||||||||

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| ☒ | Accelerated filer | ☐ | ||||||||||||

| Non-accelerated filer | ☐ | Smaller Reporting Company | ||||||||||||

| Emerging growth company | ||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒ No

On August 7, 2023, the registrant had 389,359,293 shares of Class A common stock, $0.01 par value, and 109,452,953 shares of Class B common stock, $0.01 par value, outstanding.

BGC GROUP, INC.

TABLE OF CONTENTS

| Page | ||||||||

Condensed Consolidated Statements of Financial Condition—At June 30, 2023 and December 31, 2022 | ||||||||

Condensed Consolidated Statements of Operations—For the Three and Six Months Ended June 30, 2023 and June 30, 2022 | ||||||||

Condensed Consolidated Statements of Comprehensive Income (Loss)—For the Three and Six Months Ended June 30, 2023 and June 30, 2022 | ||||||||

Condensed Consolidated Statements of Cash Flows—For the Six Months Ended June 30, 2023 and June 30, 2022 | ||||||||

Condensed Consolidated Statements of Changes in Equity—For the Three and Six Months Ended June 30, 2023 and June 30, 2022 | ||||||||

Except as otherwise indicated or the context otherwise requires, as used herein, the terms “BGC,” the “Company,” “we,” “our,” and “us” refer to: (i) following the closing of the Corporate Conversion, effective July 1, 2023, BGC Group and its consolidated subsidiaries, including BGC Partners; and (ii) prior to the effective time of the Corporate Conversion, BGC Partners and its consolidated subsidiaries. See Note 26—“Subsequent Events” to the unaudited Condensed Consolidated Financial Statements herein for more information regarding the Corporate Conversion, and refer to the “Glossary of Terms, Abbreviations and Acronyms” for the definitions of terms used above and throughout the remainder of this Quarterly Report on Form 10-Q.

GLOSSARY OF TERMS, ABBREVIATIONS AND ACRONYMS

The following terms, abbreviations and acronyms are used to identify frequently used terms and phrases that may be used in this report:

| TERM | DEFINITION | ||||

| 3.750% Senior Notes | BGC Partners’ $300.0 million principal amount of 3.750% senior notes maturing on October 1, 2024 and issued on September 27, 2019 | ||||

| 4.375% Senior Notes | BGC Partners’ $300.0 million principal amount of 4.375% senior notes maturing on December 15, 2025 and issued on July 10, 2020 | ||||

| 5.375% Senior Notes | BGC Partners’ $450.0 million principal amount of 5.375% senior notes which matured on July 24, 2023 and were issued on July 24, 2018 | ||||

| 8.000% Senior Notes | BGC Partners’ $350.0 million principal amount of 8.000% senior notes maturing on May 25, 2028 and issued on May 25, 2023 | ||||

| Adjusted Earnings | A non-GAAP financial measure used by the Company to evaluate financial performance, which primarily excludes (i) certain non-cash items and other expenses that generally do not involve the receipt or outlay of cash and do not dilute existing stockholders, and (ii) certain gains and charges that management believes do not best reflect the ordinary results of BGC | ||||

| ADV | Average daily volume | ||||

| Algomi | Algomi Limited, a wholly owned subsidiary of the Company, acquired on March 6, 2020 | ||||

| API | Application Programming Interface | ||||

| April 2008 distribution rights shares | Cantor’s deferred stock distribution rights provided to current and former Cantor partners on April 1, 2008 | ||||

| Aqua | Aqua Securities L.P., an alternative electronic trading platform, which offers new pools of block liquidity to the global equities markets and is a 49%-owned equity method investment of the Company and 51% owned by Cantor | ||||

| ASC | Accounting Standards Codification | ||||

| ASU | Accounting Standards Update | ||||

| Audit Committee | Audit Committee of the Board | ||||

| August 2022 Sales Agreement | CEO Program sales agreement, by and between the Company and CF&Co, dated August 12, 2022, pursuant to which the Company can offer and sell up to an aggregate of $300.0 million of shares of BGC Class A common stock | ||||

| Besso | Besso Insurance Group Limited, formerly a wholly owned subsidiary of the Company, acquired on February 28, 2017. Sold to The Ardonagh Group on November 1, 2021 as part of the Insurance Business Disposition | ||||

| BGC | (i) Following the closing of the Corporate Conversion, BGC Group and, where applicable, its consolidated subsidiaries, including BGC Partners, and (ii) prior to the closing of the Corporate Conversion, BGC Partners and, where applicable, its consolidated subsidiaries. | ||||

| BGC or our Class A common stock | BGC Class A common stock, par value $0.01 per share | ||||

| BGC or our Class B common stock | BGC Class B common stock, par value $0.01 per share | ||||

| BGC Credit Agreement | Agreement between BGC Partners and Cantor, dated March 19, 2018, that provides for each party or its subsidiaries to borrow up to $250.0 million, as amended on August 6, 2018 to increase the facility to $400.0 million | ||||

| BGC Entity Group | BGC Partners, BGC Holdings, BGC U.S. OpCo and their respective subsidiaries (other than, prior to the Spin-Off, the Newmark Group), collectively, and in each case as such entities existed prior to the Corporate Conversion | ||||

2

| TERM | DEFINITION | ||||

| BGC Financial or BGCF | BGC Financial, L.P. | ||||

| BGC Global OpCo | BGC Global Holdings, L.P., an operating partnership, which holds the non-U.S. businesses of BGC and which is owned jointly, following the closing of the Corporate Conversion, by BGC Partners and Holdings Merger Sub | ||||

| BGC Group | BGC Group, Inc., and where applicable its consolidated subsidiaries | ||||

| BGC Group Equity Plan | Eighth Amended and Restated BGC Partners Long-Term Incentive Plan, as amended and restated and renamed the “BGC Group, Inc. Long Term Incentive Plan” and assumed by BGC Group in connection with the Corporate Conversion | ||||

| BGC Group Incentive Plan | Second Amended and Restated BGC Partners Incentive Bonus Compensation Plan, as amended and restated and renamed the “BGC Group, Inc. Incentive Bonus Compensation Plan” and assumed by BGC Group in connection with the Corporate Conversion | ||||

| BGC Holdings | BGC Holdings, L.P., an entity which, prior to the Corporate Conversion, was owned by Cantor, Founding Partners, BGC employee partners and, after the Separation, Newmark employee partners | ||||

| BGC Holdings Distribution | Pro-rata distribution, pursuant to the Separation and Distribution Agreement, by BGC Holdings to its partners of all of the exchangeable limited partnership interests of Newmark Holdings owned by BGC Holdings immediately prior to the distribution, completed on the Distribution Date | ||||

| BGC OpCos | BGC U.S. OpCo and BGC Global OpCo, collectively | ||||

| BGC Partners | BGC Partners, Inc. and, where applicable, its consolidated subsidiaries | ||||

| BGC Partners Equity Plan | Eighth Amended and Restated Long Term Incentive Plan, approved by BGC Partners’ stockholders at the annual meeting of stockholders on November 22, 2021 | ||||

| BGC Partners Incentive Plan | BGC Partners’ Second Amended and Restated Incentive Bonus Compensation Plan, approved by BGC Partners’ stockholders at the annual meeting of stockholders on June 6, 2017 | ||||

| BGC U.S. OpCo | BGC Partners, L.P., an operating partnership, which holds the U.S. businesses of BGC and which is owned jointly, following the closing of the Corporate Conversion, by BGC Partners and Holdings Merger Sub | ||||

| Board | Board of Directors of the Company | ||||

| Brexit | Exit of the U.K. from the EU | ||||

| Cantor | Cantor Fitzgerald, L.P. and, where applicable, its consolidated subsidiaries | ||||

| Cantor group | Cantor and its subsidiaries other than BGC, including Newmark | ||||

| Cantor units | Limited partnership interests, prior to the Corporate Conversion, of BGC Holdings, held by the Cantor group, which BGC Holdings units were exchangeable into shares of BGC Class A common stock or BGC Class B common stock, as applicable | ||||

| CCRE | Cantor Commercial Real Estate Company, L.P. | ||||

| CECL | Current Expected Credit Losses | ||||

| CEO Program | Controlled equity offering program | ||||

| CF&Co | Cantor Fitzgerald & Co., a wholly owned broker-dealer subsidiary of Cantor | ||||

| CFGM | CF Group Management, Inc., the general partner of Cantor | ||||

| CFS | Cantor Fitzgerald Securities, a wholly owned broker-dealer subsidiary of Cantor | ||||

| CFTC | Commodity Futures Trading Commission | ||||

| Charity Day | BGC’s annual event held on September 11th where employees of the Company raise proceeds for charity | ||||

3

| TERM | DEFINITION | ||||

| Class B Issuance | Issuance by BGC Partners of 10,323,366 and 712,907 shares of BGC Class B common stock to Cantor and CFGM, respectively, in exchange for an aggregate of 11,036,273 shares of BGC Class A common stock under the Exchange Agreement, completed on November 23, 2018 | ||||

| CLOB | Central Limit Order Book | ||||

| CME | CME Group Inc., is a leading derivatives marketplace, made up of four exchanges: CME, CBOT, NYMEX and COMEX | ||||

| Company | Refers to (i) from after the effective time of the Corporate Conversion, BGC Group and its consolidated subsidiaries, including BGC Partners; and (ii) prior to the effective time of the Corporate Conversion, BGC Partners and its consolidated subsidiaries | ||||

| Company Debt Securities | The 5.375% Senior Notes, 3.750% Senior Notes, 4.375% Senior Notes, 8.000% Senior Notes and any future debt securities issued by the Company | ||||

| Company Equity Securities | BGC Group stock or other equity securities | ||||

| Compensation Committee | Compensation Committee of the Board | ||||

| Contribution Ratio | Equal to a BGC Holdings limited partnership interest multiplied by one, divided by 2.2 (or 0.4545) | ||||

| Corant | Corant Global Limited, BGC’s former Insurance brokerage business | ||||

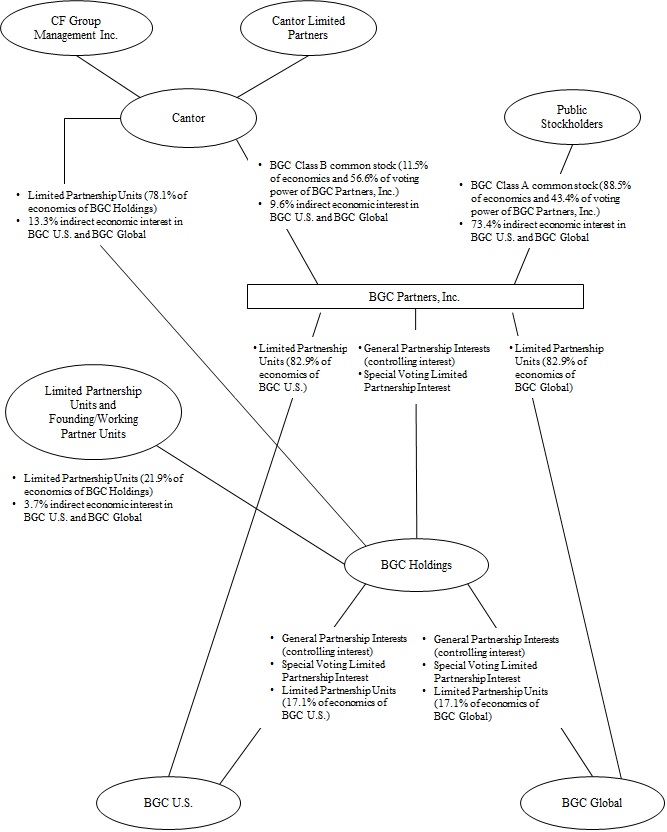

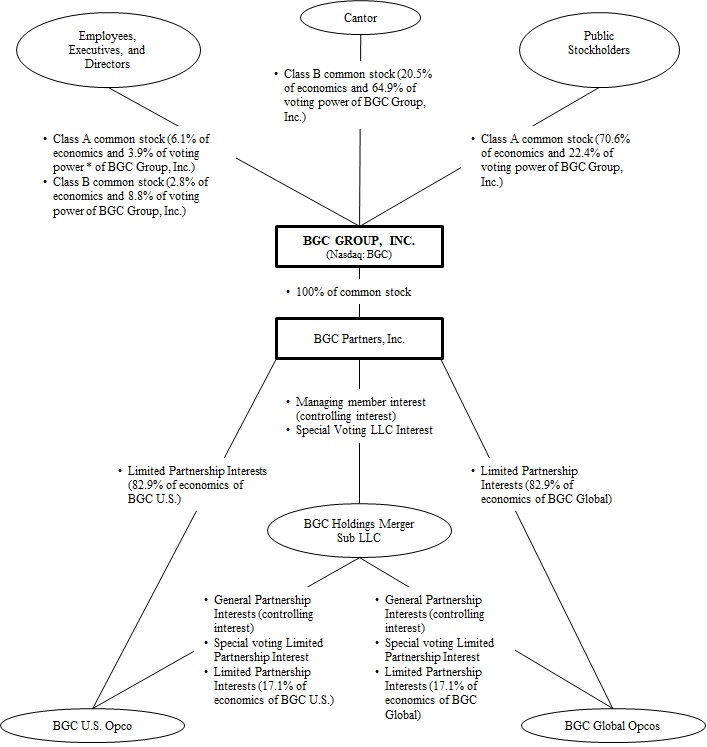

| Corporate Conversion | A series of mergers and related transactions pursuant to which, effective at 12:02 AM Eastern Time on July 1, 2023, BGC Partners and BGC Holdings became wholly owned subsidiaries of BGC Group, transforming the organizational structure of the BGC businesses from an “Up-C” structure to a simplified “Full C-Corporation” structure | ||||

| Corporate Conversion Agreement | The Corporate Conversion Agreement entered into on November 15, 2022, and as amended on March 29, 2023, by and among BGC Partners, BGC Holdings, BGC Group, Inc. and other affiliated entities, and, solely for the purposes of certain provisions therein, Cantor, that provides for the Corporate Conversion of the BGC businesses | ||||

| Corporate Conversion Transactions | The Corporation Conversion Transactions refers to the series of mergers described in the Corporate Conversion Agreement and related transactions | ||||

| Corporate Conversion Mergers | The Holdings Reorganization Merger, the Corporate Merger, and the Holdings Merger, collectively | ||||

| Corporate Merger | The merger of Merger Sub 2 with and into Holdings Merger Sub on July 1, 2023 | ||||

| COVID-19 | Coronavirus Disease 2019 | ||||

| CRD | Capital Requirements Directive | ||||

| Credit Facility | A $150.0 million credit facility between BGC Partners and an affiliate of Cantor entered into on April 21, 2017, which was terminated on March 19, 2018 | ||||

| DCM | Designated Contract Market | ||||

| DCO | Derivatives Clearing Organization | ||||

| Distribution Date | November 30, 2018, the date that BGC Partners and BGC Holdings completed the Spin-Off and the BGC Holdings Distribution, respectively | ||||

| Dodd-Frank Act | Dodd-Frank Wall Street Reform and Consumer Protection Act | ||||

| DRIP | Dividend Reinvestment and Stock Purchase Plan | ||||

| ECB | European Central Bank | ||||

| Ed Broking | Ed Broking Group Limited, formerly a wholly owned subsidiary of the Company, acquired on January 31, 2019 and sold to The Ardonagh Group on November 1, 2021 as part of the Insurance Business Disposition | ||||

4

| TERM | DEFINITION | ||||

| EMIR | European Market Infrastructure Regulation | ||||

| EPS | Earnings Per Share | ||||

| ESG | Environmental, social and governance, including sustainability or similar items | ||||

| eSpeed | Various assets comprising the Fully Electronic portion of the Company’s former benchmark on-the-run U.S. Treasury brokerage, market data and co-location service businesses, sold to Nasdaq on June 28, 2013 | ||||

| EU | European Union | ||||

| Exchange Act | Securities Exchange Act of 1934, as amended | ||||

| Exchange Agreement | A letter agreement by and between BGC Partners, Cantor and CFGM, dated June 5, 2015, that, prior to the Corporate Conversion, granted Cantor and CFGM the right to exchange shares of BGC Class A common stock into shares of BGC Class B common stock on a one-to-one basis up to the limits described therein, and which agreement was terminated in connection with the Corporate Conversion | ||||

| Exchange Ratio | Ratio by which a Newmark Holdings limited partnership interest can be exchanged for shares of Newmark Class A or Class B common stock | ||||

| FASB | Financial Accounting Standards Board | ||||

| FCA | Financial Conduct Authority of the U.K. | ||||

| FCM | Futures Commission Merchant | ||||

| FDIC | Federal Deposit Insurance Corporation | ||||

| February 2012 distribution rights shares | Cantor’s deferred stock distribution rights provided to current and former Cantor partners on February 14, 2012 | ||||

| Fenics | BGC’s group of electronic brands, offering a number of market infrastructure and connectivity services, Fully Electronic marketplaces, and the Fully Electronic brokerage of certain products that also may trade via Voice and Hybrid execution, including market data and related information services, Fully Electronic brokerage, connectivity software, compression and other post-trade services, analytics related to financial instruments and markets, and other financial technology solutions; includes Fenics Growth Platforms and Fenics Markets | ||||

| Fenics Growth Platforms | Consists of Fenics UST, Fenics GO, Lucera, Fenics FX and other newer standalone platforms | ||||

| Fenics Integrated | Represents Fenics businesses that utilize sufficient levels of technology such that significant amounts of their transactions can be, or are, executed without broker intervention and have expected pre-tax margins of at least 25% | ||||

| Fenics Markets | Consists of the Fully Electronic portions of BGC’s brokerage businesses, data, network and post-trade revenues that are unrelated to Fenics Growth Platforms, as well as Fenics Integrated revenues | ||||

| FINRA | Financial Industry Regulatory Authority | ||||

| FMX | BGC’s combined U.S. Treasury and Futures electronic marketplace | ||||

| Founding Partners | Individuals who became limited partners of BGC Holdings in the mandatory redemption of interests in Cantor in connection with the 2008 separation and merger of Cantor’s BGC division with eSpeed, Inc. (provided that members of the Cantor group and Howard W. Lutnick (including any entity directly or indirectly controlled by Mr. Lutnick or any trust with respect to which he is a grantor, trustee or beneficiary) are not founding partners) and became limited partners of Newmark Holdings in the Separation | ||||

| Founding/Working Partners | Holders of FPUs | ||||

| FPUs | Founding/Working Partners units, in BGC Holdings, prior to the Corporate Conversion, or Newmark Holdings, generally redeemed upon termination of employment | ||||

5

| TERM | DEFINITION | ||||

| Freedom | Freedom International Brokerage Company, a 45%-owned equity method investment of the Company | ||||

| Fully Electronic | Broking transactions intermediated on a solely electronic basis rather than by Voice or Hybrid broking | ||||

Futures Exchange Group | CFLP CX Futures Exchange Holdings, LLC, CFLP CX Futures Exchange Holdings, L.P., CX Futures Exchange Holdings, LLC, CX Clearinghouse Holdings, LLC, CX Futures Exchange, L.P. and CX Clearinghouse, L.P. | ||||

| FX | Foreign exchange | ||||

| GDPR | General Data Protection Regulation | ||||

| GFI | GFI Group Inc., a wholly owned subsidiary of the Company, acquired on January 12, 2016 | ||||

| GILTI | Global Intangible Low-Taxed Income | ||||

| GUI | Graphical User Interface | ||||

| HDUs | LPUs with capital accounts, which are liability awards recorded in “Accrued compensation” in the Company’s Consolidated Statements of Financial Condition | ||||

| Holdings Merger | The merger of Merger Sub 2 with and into Holdings Merger Sub | ||||

| Holdings Reorganization Merger | The reorganization of BGC Holdings from a Delaware limited partnership into a Delaware limited liability company through a merger with and into Holdings Merger Sub | ||||

| Holdings Merger Sub | BGC Holdings Merger Sub, LLC, a Delaware limited liability company, wholly owned subsidiary of the Company, and successor to BGC Holdings | ||||

| Hybrid | Broking transactions executed by brokers and involving some element of Voice broking and electronic trading | ||||

| ICAP | ICAP plc, a part of TP ICAP group, and a leading markets operator and provider of execution and information services | ||||

| ICE | Intercontinental Exchange | ||||

| Insurance brokerage business | The insurance brokerage business of BGC, including Corant, Ed Broking, Besso, Piiq Risk Partners, Junge, Cooper Gay, Global Underwriting and Epsilon, which business was sold to The Ardonagh Group on November 1, 2021 | ||||

| Insurance Business Disposition | The sale of the Insurance brokerage business for $534.9 million in gross cash proceeds after closing adjustments, subject to limited post-closing adjustments, completed on November 1, 2021 | ||||

| IR Act | Inflation Reduction Act of 2022 | ||||

| July 2023 Sales Agreement | CEO Program sales agreement, by and between the Company and CF&Co, dated July 3, 2023, pursuant to which the Company can offer and sell up to an aggregate of $300.0 million of shares of BGC Class A common stock | ||||

| LCH | London Clearing House | ||||

| Legacy BGC Holdings Units | BGC Holdings LPUs outstanding immediately prior to the Separation | ||||

| Legacy Newmark Holdings Units | Newmark Holdings LPUs issued in connection with the Separation | ||||

| LIBOR | London Interbank Offering Rate | ||||

6

| TERM | DEFINITION | ||||

| LPUs | Certain limited partnership units, of BGC Holdings prior to the Corporate Conversion, or Newmark Holdings, held by certain employees of BGC and Newmark and other persons who have provided services to BGC or Newmark, which units may include APSIs, APSUs, AREUs, ARPSUs, HDUs, U.K. LPUs, N Units, PLPUs, PPSIs, PPSUs, PSEs, PSIs, PSUs, REUs, and RPUs, along with future types of limited partnership units in Newmark Holdings | ||||

| Lucera | A wholly owned subsidiary of the Company, also known as “LFI Holdings, LLC” or “LFI,” which is a software defined network offering the trading community direct connectivity | ||||

| March 2018 Form S-3 | CEO Program shelf Registration Statement on Form S-3 filed on March 9, 2018 | ||||

| March 2018 Sales Agreement | CEO Program sales agreement, by and between BGC Partners and CF&Co, dated March 9, 2018, pursuant to which BGC Partners could offer and sell up to an aggregate of $300.0 million of shares of BGC Class A common stock, which agreement expired in September 2021 | ||||

| March 2021 Form S-3 | CEO Program shelf Registration Statement on Form S-3 filed on March 8, 2021 | ||||

| Merger Sub 1 | BGC Partners II, Inc., a Delaware corporation and wholly owned subsidiary of BGC Group | ||||

| Merger Sub 2 | BGC Partners II, LLC, a Delaware limited liability company and wholly owned subsidiary of BGC Group | ||||

| MiFID II | Markets in Financial Instruments Directive II, a legislative framework instituted by the EU to regulate financial markets and improve protections for investors by increasing transparency and standardizing regulatory disclosures | ||||

| Mint Brokers | A wholly owned subsidiary of the Company, acquired on August 19, 2010, registered as an FCM with both the CFTC and the NFA | ||||

| Nasdaq | Nasdaq, Inc., formerly known as NASDAQ OMX Group, Inc. | ||||

| NDF | Non-deliverable forwards | ||||

| Newmark | Newmark Group, Inc. (NASDAQ symbol: NMRK), a publicly traded and former majority-owned subsidiary of BGC until the Distribution Date, and, where applicable, its consolidated subsidiaries | ||||

| Newmark Class A common stock | Newmark Class A common stock, par value $0.01 per share | ||||

| Newmark Class B common stock | Newmark Class B common stock, par value $0.01 per share | ||||

| Newmark Group | Newmark, Newmark Holdings, and Newmark OpCo and their respective consolidated subsidiaries, collectively | ||||

| Newmark Holdings | Newmark Holdings, L.P. | ||||

| Newmark IPO | Initial public offering of 23 million shares of Newmark Class A common stock by Newmark at a price of $14.00 per share in December 2017 | ||||

| Newmark OpCo | Newmark Partners, L.P., an operating partnership, which is owned jointly by Newmark and Newmark Holdings and holds the business of Newmark | ||||

| NEX | NEX Group plc, an entity formed in December 2016, formerly known as ICAP | ||||

| NFA | National Futures Association | ||||

| Non-GAAP | A financial measure that differs from the most directly comparable measure calculated and presented in accordance with U.S. GAAP, such as Adjusted Earnings and Adjusted EBITDA | ||||

| N Units | Non-distributing partnership units, of BGC Holdings, prior to the Corporate Conversion, or Newmark Holdings, that may not be allocated any item of profit or loss, and may not be made exchangeable into shares of Class A common stock, including NREUs, NPREUs, NLPUs, NPLPUs, NPSUs, and NPPSUs | ||||

7

| TERM | DEFINITION | ||||

| OCI | Other comprehensive income (loss), including gains and losses on cash flow and net investment hedges, unrealized gains and losses on available for sale securities (in periods prior to January 1, 2018), certain gains and losses relating to pension and other retirement benefit obligations and foreign currency translation adjustments | ||||

| OTC | Over-the-Counter | ||||

| OTF | Organized Trading Facility, a regulated execution venue category introduced by MiFID II | ||||

| PCD assets | Purchased financial assets with deterioration in credit quality since origination | ||||

| Period Cost Method | Treatment of taxes associated with the GILTI provision as a current period expense when incurred rather than recording deferred taxes for basis differences | ||||

| Poten & Partners | Poten & Partners Group, Inc., a wholly owned subsidiary of the Company, acquired on November 15, 2018 | ||||

| Preferred Distribution | Allocation of net profits of BGC Holdings or Newmark Holdings to holders of Preferred Units, at a rate of either 0.6875% (i.e., 2.75% per calendar year) or such other amount as set forth in the award documentation | ||||

| Preferred Units | Preferred partnership units, of BGC Holdings prior to the Corporate Conversion, or Newmark Holdings, such as PPSUs, which are settled for cash, rather than made exchangeable into shares of Class A common stock, are only entitled to a Preferred Distribution, and are not included in BGC’s or Newmark’s fully diluted share count | ||||

| Real Estate L.P. | CF Real Estate Finance Holdings, L.P., a commercial real estate-related financial and investment business controlled and managed by Cantor | ||||

| Record Date | Close of business on November 23, 2018, in connection with the Spin-Off | ||||

| Repurchase Agreements | Securities sold under agreements to repurchase that are recorded at contractual amounts, including interest, and accounted for as collateralized financing transactions | ||||

| Reverse Repurchase Agreements | Agreements to resell securities, with such securities recorded at the contractual amount, including accrued interest, for which the securities will be resold, and accounted for as collateralized financing transactions | ||||

| Revolving Credit Agreement | BGC Partners’ unsecured senior revolving credit agreement with Bank of America, N.A., as administrative agent, and a syndicate of lenders, dated as of November 28, 2018, that provides for a maximum revolving loan balance of $350.0 million, bearing interest at either LIBOR or a defined base rate plus additional margin, amended on December 11, 2019 to extend the maturity date to February 26, 2021 and further amended on February 26, 2020 to extend the maturity date to February 26, 2023. On March 10, 2022, the agreement was amended and restated to increase the size of the credit facility to $375.0 million, bearing interest at either SOFR or a defined base rate plus additional margin, and extend the maturity date to March 10, 2025 | ||||

| ROU | Right-of-Use | ||||

| RSUs | BGC or Newmark restricted stock units, payable in shares of BGC Class A common stock or Newmark Class A common stock, respectively, held by certain employees of BGC or Newmark and other persons who have provided services to BGC or Newmark, or issued in connection with certain acquisitions | ||||

| RSU Tax Account | RSU Tax Accounts were issued by BGC in connection with the Corporate Conversion in the place of certain non-exchangeable Preferred Units. The RSU Tax Accounts are settled for cash, rather than vesting into shares of Class A common stock, may be entitled to a preferred return, and are not included in BGC’s fully diluted share count. The RSU Tax Accounts were issued in connection with RSUs and are to cover any withholding taxes to be paid when the RSUs vest into shares of BGC Class A common stock | ||||

| Russia’s Invasion of Ukraine | Russia’s invasion of Ukraine, which led to imposed sanctions by the U.S., U.K., EU, and other countries on Russian counterparties | ||||

| SaaS | Software as a Service | ||||

| SBSEF | Security-based Swap Execution Facility | ||||

8

| TERM | DEFINITION | ||||

| SEC | U.S. Securities and Exchange Commission | ||||

| Securities Act | Securities Act of 1933, as amended | ||||

| SEF | Swap Execution Facility | ||||

| Separation | Principal corporate transactions pursuant to the Separation and Distribution Agreement, by which BGC Partners, BGC Holdings and BGC U.S. OpCo and their respective subsidiaries (other than the Newmark Group) transferred to Newmark, Newmark Holdings and Newmark OpCo and their respective subsidiaries the assets and liabilities of the BGC Entity Group relating to BGC’s real estate services business, and related transactions, including the distribution of Newmark Holdings units to holders of units in BGC Holdings and the assumption and repayment of certain BGC indebtedness by Newmark | ||||

| Separation and Distribution Agreement | Separation and Distribution Agreement, by and among the BGC Entity Group, the Newmark Group, Cantor and BGC Global OpCo, originally entered into on December 13, 2017, as amended on November 8, 2018 and amended and restated on November 23, 2018 | ||||

| SOFR | Secured Overnight Financing Rate | ||||

| SPAC | Special Purpose Acquisition Company | ||||

SPAC Investment Banking Activities | Aurel’s investment banking activities with respect to SPACs | ||||

| Spin-Off | Pro-rata distribution, pursuant to the Separation and Distribution Agreement, by BGC Partners to its stockholders of all the shares of common stock of Newmark owned by BGC Partners immediately prior to the Distribution Date, with shares of Newmark Class A common stock distributed to the holders of shares of BGC Class A common stock (including directors and executive officers of BGC Partners) of record on the Record Date, and shares of Newmark Class B common stock distributed to the holders of shares of BGC Class B common stock (Cantor and CFGM) of record on the Record Date, completed on the Distribution Date | ||||

| Tax Act | Tax Cuts and Jobs Act enacted on December 22, 2017 | ||||

| TDRs | Troubled Debt Restructurings | ||||

| The Ardonagh Group | The Ardonagh Group Limited, the U.K.’s largest independent insurance broker and purchaser of BGC’s Insurance brokerage business completed on November 1, 2021 | ||||

| Tower Bridge | Tower Bridge International Services L.P., a subsidiary of the Company, which is 52%-owned by the Company and 48%-owned by Cantor | ||||

| TP ICAP | TP ICAP plc, an entity formed in December 2016, formerly known as Tullett | ||||

| Tradition | Compagnie Financière Tradition (which is majority owned by Viel & Cie) | ||||

| Trident | Trident Brokerage Service LLC, a wholly owned subsidiary of the Company, acquired on February 28, 2023 | ||||

| Tullett | Tullett Prebon plc, a part of TP ICAP group and an interdealer broker, primarily operating as an intermediary in the wholesale financial and energy sectors | ||||

| U.K. | United Kingdom | ||||

| U.S. GAAP or GAAP | Generally Accepted Accounting Principles in the United States of America | ||||

| UBT | Unincorporated Business Tax | ||||

| VIE | Variable Interest Entity | ||||

| Voice | Voice-only broking transactions executed by brokers over the telephone | ||||

9

SPECIAL NOTE ON FORWARD-LOOKING INFORMATION

This Quarterly Report on Form 10-Q contains forward-looking statements. Such statements are based upon current expectations that involve risks and uncertainties. Any statements contained herein that are not statements of historical fact may be deemed to be forward-looking statements. For example, words such as “may,” “will,” “should,” “estimates,” “predicts,” “possible,” “potential,” “continue,” “strategy,” “believes,” “anticipates,” “plans,” “expects,” “intends,” and similar expressions are intended to identify forward-looking statements.

Our actual results and the outcome and timing of certain events may differ significantly from the expectations discussed in the forward-looking statements. Factors that might cause or contribute to such a discrepancy include, but are not limited to, the factors set forth below:

•macroeconomic and other challenges and uncertainties resulting from Russia’s Invasion of Ukraine, downgrades of U.S. Treasuries, rising global interest rates, inflation and the Federal Reserve’s responses thereto, including increasing interest rates, fluctuations in the U.S. dollar, liquidity concerns regarding and changes in capital requirements for banking and financial institutions, changes in the U.S. and global economies and financial markets, including economic activity, employment levels, supply chain issues and market liquidity, and increasing energy costs, as well as the various actions taken in response to the challenges and uncertainties by governments, central banks and others, including consumer and corporate clients and customers;

•market conditions, including rising interest rates, fluctuations in the U.S. dollar, trading volume, turmoil across regional banks and certain global investment banks, currency fluctuations and volatility in the demand for the products and services we provide, possible disruptions in trading, potential deterioration of equity and debt capital markets and cryptocurrency markets, the impact of significant changes in interest rates generally and on our ability to access the capital markets as needed or on reasonable terms and conditions;

•pricing, commissions and fees, and market position with respect to any of our products and services and those of our competitors;

•the effect of industry concentration and reorganization, reduction of customers, and consolidation;

•liquidity, regulatory, cash and clearing capital requirements and the impact of credit market events, rising interest rates, fluctuations in the U.S. dollar, and market uncertainty, and political events and conflicts and actions taken by governments and businesses in response thereto on the credit markets and interest rates;

•our relationships and transactions with Cantor and its affiliates, including CF&Co, and CCRE, our structure, the timing and impact of any actual or future changes to our structure, including the Corporate Conversion, any related transactions, conflicts of interest or litigation, including with respect to executive compensation matters, any impact of Cantor’s results on our credit ratings and associated outlooks, any loans to or from us or Cantor, including the balances and interest rates thereof from time to time and any convertible or equity features of any such loans, CF&Co’s acting as our sales agent or underwriter under our CEO Program or other offerings, Cantor’s holdings of the Company’s Debt Securities, CF&Co’s acting as a market maker in the Company’s Debt Securities, CF&Co’s acting as our financial advisor in connection with potential acquisitions, dispositions, or other transactions, and our participation in various investments, stock loans or cash management vehicles placed by or recommended by CF&Co;

•the integration of acquired businesses and their operations and back office functions with our other businesses;

•the effect on our businesses of any extraordinary transactions, including potential dilution, taxes, costs, and other impacts;

•the rebranding of our current businesses or risks related to any potential dispositions of all or any portion of our existing or acquired businesses;

•market volatility as a result of the effects of rising interest rates, fluctuations in the U.S. dollar, global inflation rates, changes in sovereign credit ratings, potential economic downturns, including recessions, and similar effects, which may not be predictable in future periods;

•the ongoing impact of the COVID-19 pandemic, the combined impact of the flu, other seasonal illnesses and other world or regional health crises, governmental and public reactions thereto, and the impact of a return to office for our employees, hiring and operations;

10

•economic or geopolitical conditions or uncertainties, the actions of governments or central banks, including the pursuit of trade, border control or other related policies by the U.S. and/or other countries (including U.S.-China trade relations), recent economic and political volatility in the U.K., rising political and other tensions between the U.S. and China, political and labor unrest, conflict in the Middle East, Russia, Ukraine or other jurisdictions, the impact of U.S. government shutdowns, elections, political unrest, boycotts, stalemates or other social and political developments, and the impact of terrorist acts, acts of war or other violence or political unrest, as well as natural disasters or weather-related or similar events, including hurricanes and heat waves as well as power failures, communication and transportation disruptions, and other interruptions of utilities or other essential services and the impacts of pandemics and other international health emergencies;

•risks inherent in doing business in international markets, and any failure to identify and manage those risks, as well as the impact of Russia’s ongoing Invasion of Ukraine and additional sanctions and regulations imposed by governments and related counter-sanctions, including any related reserves;

•the effect on our businesses, our clients, the markets in which we operate and the economy in general of changes in the U.S. and foreign tax and other laws, including changes in tax rates, repatriation rules, and deductibility of interest, potential policy and regulatory changes in other countries, sequestrations, uncertainties regarding the debt ceiling and the federal budget, responses to rising global inflation rates, and other potential political policies;

•our dependence upon our key employees, our ability to build out successful succession plans, the impact of absence due to illness or leave of certain key executive officers or employees and our ability to attract, retain, motivate and integrate new employees, as well as the competing demands on the time of certain of our executive officers who also provide services to Cantor, Newmark and various other ventures and investments sponsored by Cantor and the impact of post termination covenants on awards previously granted to key employees and future awards;

•the effect on our businesses and revenues of changes in interest rates and changes in benchmarks, the fluctuating U.S. dollar, rising interest rates and market uncertainty, the level of worldwide governmental debt issuances, austerity programs, government stimulus packages, increases and decreases in the federal funds interest rate and other actions to moderate inflation, increases or decreases in deficits and the impact of changing government tax rates, and other changes to monetary policy, and potential political impasses or regulatory requirements, including increased capital requirements for banks and other institutions or changes in legislation, regulations and priorities;

•extensive regulation of our businesses and customers, the timing of regulatory approvals, changes in regulations relating to financial services companies and other industries, and risks relating to compliance matters, including regulatory examinations, inspections, investigations and enforcement actions, and any resulting costs, increased financial and capital requirements, enhanced oversight, remediation, fines, penalties, sanctions, and changes to or restrictions or limitations on specific activities, including potential delays in accessing markets, including due to our regulatory status and actions, operations, and compensatory arrangements, and growth opportunities, including acquisitions, hiring, and new businesses, products, or services;

•factors related to specific transactions or series of transactions, including credit, performance, and principal risk, trade failures, counterparty failures, and the impact of fraud and unauthorized trading;

•costs and expenses of developing, maintaining, and protecting our intellectual property, as well as employment, regulatory, and other litigation and proceedings, and their related costs, including judgments, indemnities, fines, or settlements paid and the impact thereof on our financial results and cash flows in any given period;

•certain financial risks, including the possibility of future losses, indemnification obligations, assumed liabilities, reduced cash flows from operations, increased leverage, reduced availability under our credit agreements, and the need for short- or long-term borrowings, including from Cantor, our ability to refinance our indebtedness on acceptable rates, and changes to interest rates and liquidity or our access to other sources of cash relating to acquisitions, dispositions, or other matters, potential liquidity and other risks relating to our ability to maintain continued access to credit and availability of financing necessary to support our ongoing business needs, on terms acceptable to us, if at all, and risks associated with the resulting leverage, including potentially causing a reduction in our credit ratings and the associated outlooks and increased borrowing costs as well as interest rate and foreign currency exchange rate fluctuations;

11

•risks associated with the temporary or longer-term investment of our available cash, including in the BGC OpCos, defaults or impairments on our investments, joint venture interests, stock loans or cash management vehicles and collectability of loan balances owed to us by employees, the BGC OpCos or others;

•our ability to enter new markets or develop new products, offerings, trading desks, marketplaces, or services for existing or new clients, including our ability to develop new Fenics platforms and products, to successfully launch our FMX initiative and to attract investors thereto, the risks inherent in operating our cryptocurrency business and in safekeeping cryptocurrency assets, and efforts to convert certain existing products to a Fully Electronic trade execution, to incorporate artificial intelligence into our products and efforts by our competitors to do the same, and to induce such clients to use these products, trading desks, marketplaces, or services and to secure and maintain market share;

•the impact of any restructuring or similar transactions, on our ability to enter into marketing and strategic alliances and business combinations, attract investors or partners or engage in other transactions in the financial services and other industries, including acquisitions, tender offers, dispositions, reorganizations, partnering opportunities and joint ventures, the failure to realize the anticipated benefits of any such transactions, relationships or growth, and the future impact of any such transactions, relationships or growth on our other businesses and our financial results for current or future periods, the integration of any completed acquisitions and the use of proceeds of any completed dispositions, the impact of amendments and/or terminations of strategic arrangements, and the value of and any hedging entered into in connection with consideration received or to be received in connection with such dispositions and any transfers thereof;

•our estimates or determinations of potential value with respect to various assets or portions of our businesses, such as Fenics, including with respect to the accuracy of the assumptions or the valuation models or multiples used;

•our ability to manage turnover and hire, train, integrate and retain personnel, including brokers, salespeople, managers, technology professionals and other front-office personnel, back-office and support services, and departures of senior personnel;

•our ability to expand the use of technology and maintain access to the intellectual property of others for Hybrid and Fully Electronic trade execution in our product and service offerings, and otherwise;

•our ability to effectively manage any growth that may be achieved, including outside the U.S., while ensuring compliance with all applicable financial reporting, internal control, legal compliance, and regulatory requirements;

•our ability to identify and remediate any material weaknesses or significant deficiencies in our internal controls which could affect our ability to properly maintain books and records, prepare financial statements and reports in a timely manner, control our policies, practices and procedures, operations and assets, assess and manage our operational, regulatory and financial risks, and integrate our acquired businesses and brokers, salespeople, managers, technology professionals and other front-office personnel;

•the impact of unexpected market moves and similar events;

•information technology risks, including capacity constraints, failures, or disruptions in our systems or those of the clients, counterparties, exchanges, clearing facilities, or other parties with which we interact, including increased demands on such systems and on the telecommunications infrastructure from remote working, cyber-security risks and incidents, compliance with regulations requiring data minimization and protection and preservation of records of access and transfers of data, privacy risk and exposure to potential liability and regulatory focus;

•the effectiveness of our governance, risk management, and oversight procedures and impact of any potential transactions or relationships with related parties;

•the impact of our ESG or “sustainability” ratings on the decisions by clients, investors, ratings agencies, potential clients and other parties with respect to our businesses, investments in us, our borrowing opportunities or the market for and trading price of BGC Class A common stock, Company Debt Securities, or other matters;

•the fact that the prices at which shares of our Class A common stock are or may be sold in offerings, acquisitions, or other transactions may vary significantly, and purchasers of shares in such offerings or other transactions, as well as existing stockholders, may suffer significant dilution if the price they paid for their shares is higher than the price paid by other purchasers in such offerings or transactions;

12

•the impact of reductions to our dividends and the timing and amounts of any future dividends, including our ability to meet expectations with respect to payments of dividends and repurchases of shares of our Class A common stock, or other equity interests in us or any of our other subsidiaries, including from Cantor, our executive officers, other employees, partners, and others, and the net proceeds to be realized by us from offerings of shares of BGC Class A common stock and Company Debt Securities, and our ability to pay any excise tax that may be imposed on the repurchase of shares; and

•the effect on the markets for and trading prices of our Class A common stock and Company Debt Securities of various offerings and other transactions, including offerings of our Class A common stock and convertible or exchangeable debt or other securities, our repurchases of shares of our Class A common stock or other equity interests in us or in our subsidiaries, our payment of dividends on our Class A common stock, convertible arbitrage, hedging, and other transactions engaged in by us or holders of our outstanding shares, Company Debt Securities or other securities, share sales and stock pledges, stock loans, and other financing transactions by holders of our shares (including by Cantor or others), including of shares acquired pursuant to our employee benefit plans, corporate restructurings, acquisitions, conversions of shares of our Class B common stock and our other convertible securities into shares of our Class A common stock, and distributions of our Class A common stock by Cantor to its partners.

The foregoing risks and uncertainties, as well as those risks and uncertainties set forth in this Quarterly Report on Form 10-Q and in our Annual Report on Form 10-K for the year ended December 31, 2022, may cause actual results and events to differ materially from the forward-looking statements. The information included herein is given as of the filing date of this Quarterly Report on Form 10-Q with the SEC, and future results or events could differ significantly from these forward-looking statements. The Company does not undertake to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

13

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the SEC. These filings are available to the public from the SEC’s website at www.sec.gov.

Our website address is www.bgcg.com. Through our website we make available, free of charge, the following documents as soon as reasonably practicable after they are electronically filed with, or furnished to, the SEC: our Annual Reports on Form 10-K; our proxy statements for our annual and special stockholder meetings; our Quarterly Reports on Form 10-Q; our Current Reports on Form 8-K; Forms 3, 4 and 5 and Schedules 13D with respect to our securities filed on behalf of Cantor, CFGM, our directors and our executive officers; and amendments to those documents. Our website also contains additional information with respect to our industry and businesses. The information contained on, or that may be accessed through, our website is not part of, and is not incorporated into, this Quarterly Report on Form 10-Q.

14

PART I—FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

BGC GROUP, INC.

CONDENSED CONSOLIDATED STATEMENTS OF FINANCIAL CONDITION

(in thousands, except per share data)

(unaudited)

| June 30, 2023 | December 31, 2022 | ||||||||||

| Assets | |||||||||||

| Cash and cash equivalents | $ | $ | |||||||||

| Cash segregated under regulatory requirements | |||||||||||

| Financial instruments owned, at fair value | |||||||||||

| Reverse repurchase agreements | |||||||||||

| Receivables from broker-dealers, clearing organizations, customers and related broker-dealers | |||||||||||

| Accrued commissions and other receivables, net | |||||||||||

| Loans, forgivable loans and other receivables from employees and partners, net | |||||||||||

| Fixed assets, net | |||||||||||

| Investments | |||||||||||

| Goodwill | |||||||||||

| Other intangible assets, net | |||||||||||

| Receivables from related parties | |||||||||||

| Other assets | |||||||||||

| Total assets | $ | $ | |||||||||

| Liabilities, Redeemable Partnership Interest, and Equity | |||||||||||

| Short-term borrowings | $ | $ | |||||||||

| Accrued compensation | |||||||||||

| Payables to broker-dealers, clearing organizations, customers and related broker-dealers | |||||||||||

| Payables to related parties | |||||||||||

| Accounts payable, accrued and other liabilities | |||||||||||

| Notes payable and other borrowings | |||||||||||

| Total liabilities | |||||||||||

| Commitments, contingencies and guarantees (Note 19) | |||||||||||

| Redeemable partnership interest | |||||||||||

| Equity | |||||||||||

| Stockholders’ equity: | |||||||||||

Class A common stock, par value $ | |||||||||||

Class B common stock, par value $ | |||||||||||

| Additional paid-in capital | |||||||||||

Treasury stock, at cost: | ( | ( | |||||||||

| Retained deficit | ( | ( | |||||||||

| Accumulated other comprehensive income (loss) | ( | ( | |||||||||

| Total stockholders’ equity | |||||||||||

| Noncontrolling interest in subsidiaries | |||||||||||

| Total equity | |||||||||||

| Total liabilities, redeemable partnership interest, and equity | $ | $ | |||||||||

The accompanying Notes to the unaudited Condensed Consolidated Financial Statements are an integral part of these financial statements.

15

BGC GROUP, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share data)

(unaudited)

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

| 2023 | 2022 | 2023 | 2022 | ||||||||||||||||||||

| Revenues: | |||||||||||||||||||||||

| Commissions | $ | $ | $ | $ | |||||||||||||||||||

| Principal transactions | |||||||||||||||||||||||

| Fees from related parties | |||||||||||||||||||||||

| Data, network and post-trade | |||||||||||||||||||||||

| Interest and dividend income | |||||||||||||||||||||||

| Other revenues | |||||||||||||||||||||||

| Total revenues | |||||||||||||||||||||||

| Expenses: | |||||||||||||||||||||||

| Compensation and employee benefits | |||||||||||||||||||||||

| Equity-based compensation and allocations of net income to limited partnership units and FPUs | |||||||||||||||||||||||

| Total compensation and employee benefits | |||||||||||||||||||||||

| Occupancy and equipment | |||||||||||||||||||||||

| Fees to related parties | |||||||||||||||||||||||

| Professional and consulting fees | |||||||||||||||||||||||

| Communications | |||||||||||||||||||||||

| Selling and promotion | |||||||||||||||||||||||

| Commissions and floor brokerage | |||||||||||||||||||||||

| Interest expense | |||||||||||||||||||||||

| Other expenses | |||||||||||||||||||||||

| Total expenses | |||||||||||||||||||||||

| Other income (losses), net: | |||||||||||||||||||||||

| Gains (losses) on equity method investments | |||||||||||||||||||||||

| Other income (loss) | ( | ( | |||||||||||||||||||||

| Total other income (losses), net | |||||||||||||||||||||||

| Income (loss) from operations before income taxes | ( | ||||||||||||||||||||||

| Provision (benefit) for income taxes | ( | ||||||||||||||||||||||

| Consolidated net income (loss) | $ | ( | $ | $ | ( | $ | |||||||||||||||||

| Less: Net income (loss) attributable to noncontrolling interest in subsidiaries | ( | ( | |||||||||||||||||||||

| Net income (loss) available to common stockholders | $ | ( | $ | $ | ( | $ | |||||||||||||||||

| Per share data: | |||||||||||||||||||||||

| Basic earnings (loss) per share | |||||||||||||||||||||||

| Net income (loss) available to common stockholders | $ | ( | $ | $ | ( | $ | |||||||||||||||||

| Basic earnings (loss) per share | $ | ( | $ | $ | $ | ||||||||||||||||||

| Basic weighted-average shares of common stock outstanding | |||||||||||||||||||||||

| Fully diluted earnings (loss) per share | |||||||||||||||||||||||

| Net income (loss) for fully diluted shares | $ | ( | $ | $ | ( | $ | |||||||||||||||||

| Fully diluted earnings (loss) per share | $ | ( | $ | $ | $ | ||||||||||||||||||

| Fully diluted weighted-average shares of common stock outstanding | |||||||||||||||||||||||

The accompanying Notes to the unaudited Condensed Consolidated Financial Statements

are an integral part of these financial statements.

16

BGC GROUP, INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(in thousands)

(unaudited)

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

| 2023 | 2022 | 2023 | 2022 | ||||||||||||||||||||

| Consolidated net income (loss) | $ | ( | $ | $ | ( | $ | |||||||||||||||||

| Other comprehensive income (loss), net of tax: | |||||||||||||||||||||||

| Foreign currency translation adjustments | ( | ( | |||||||||||||||||||||

| Total other comprehensive income (loss), net of tax | ( | ( | |||||||||||||||||||||

| Comprehensive income (loss) | ( | ||||||||||||||||||||||

| Less: Comprehensive income (loss) attributable to noncontrolling interest in subsidiaries, net of tax | ( | ||||||||||||||||||||||

| Comprehensive income (loss) attributable to common stockholders | $ | ( | $ | $ | $ | ||||||||||||||||||

The accompanying Notes to the unaudited Condensed Consolidated Financial Statements

are an integral part of these financial statements.

17

BGC GROUP, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

(unaudited)

| Six Months Ended June 30, | |||||||||||

| 2023 | 2022 | ||||||||||

| CASH FLOWS FROM OPERATING ACTIVITIES: | |||||||||||

| Consolidated net income (loss) | $ | ( | $ | ||||||||

| Adjustments to reconcile consolidated net income (loss) to net cash provided by (used in) operating activities: | |||||||||||

| Fixed asset depreciation and intangible asset amortization | |||||||||||

| Employee loan amortization and reserves on employee loans | |||||||||||

| Equity-based compensation and allocations of net income to limited partnership units and FPUs | |||||||||||

| Deferred compensation expense | |||||||||||

| Losses (gains) on equity method investments | ( | ( | |||||||||

| Unrealized/realized losses (gains) on financial instruments owned, at fair value and other investments | ( | ||||||||||

| Amortization of discount (premium) on notes payable | |||||||||||

| Impairment of fixed assets, intangible assets and investments | |||||||||||

| Deferred tax provision (benefit) | ( | ||||||||||

| Change in estimated acquisition earn-out payables | ( | ||||||||||

| Forfeitures of Class A common stock | ( | ( | |||||||||

| Other | |||||||||||

| Consolidated net income (loss), adjusted for non-cash and non-operating items | |||||||||||

| Decrease (increase) in operating assets: | |||||||||||

| Reverse repurchase agreements | ( | ||||||||||

| Financial instruments owned, at fair value | ( | ||||||||||

| Receivables from broker-dealers, clearing organizations, customers and related broker-dealers | ( | ( | |||||||||

| Accrued commissions receivable, net | ( | ( | |||||||||

| Loans, forgivable loans and other receivables from employees and partners, net | ( | ( | |||||||||

| Receivables from related parties | ( | ( | |||||||||

| Other assets | ( | ( | |||||||||

| Increase (decrease) in operating liabilities: | |||||||||||

| Repurchase agreements | |||||||||||

| Accrued compensation | ( | ( | |||||||||

| Payables to broker-dealers, clearing organizations, customers and related broker-dealers | |||||||||||

| Payables to related parties | ( | ||||||||||

| Accounts payable, accrued and other liabilities | ( | ( | |||||||||

| Net cash provided by (used in) operating activities | $ | ( | $ | ||||||||

The accompanying Notes to the unaudited Condensed Consolidated Financial Statements

are an integral part of these financial statements.

18

BGC GROUP, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS—(Continued)

(in thousands)

(unaudited)

| Six Months Ended June 30, | |||||||||||

| 2023 | 2022 | ||||||||||

| CASH FLOWS FROM INVESTING ACTIVITIES: | |||||||||||

| Purchases of fixed assets | $ | ( | $ | ( | |||||||

| Capitalization of software development costs | ( | ( | |||||||||

| Purchase of equity method investments | ( | ||||||||||

| Proceeds from equity method investments | |||||||||||

| Payments for acquisitions, net of cash and restricted cash acquired | ( | ||||||||||

| Purchase of assets | ( | ||||||||||

| Net cash provided by (used in) investing activities | $ | ( | $ | ( | |||||||

| CASH FLOWS FROM FINANCING ACTIVITIES: | |||||||||||

| Repayments of long-term debt and collateralized borrowings | $ | ( | $ | ( | |||||||

| Issuance of long-term debt and collateralized borrowings, net of deferred issuance costs | ( | ||||||||||

| Earnings distributions to limited partnership interests and other noncontrolling interests | ( | ( | |||||||||

| Redemption and repurchase of limited partnership interests | ( | ( | |||||||||

| Dividends to stockholders | ( | ( | |||||||||

| Repurchase of Class A common stock | ( | ( | |||||||||

| Proceeds from sale of Cantor Units in BGC Holdings | |||||||||||

| Short term borrowings, net of repayments | ( | ||||||||||

| Payments on acquisition earn-outs | ( | ( | |||||||||

| Net cash provided by (used in) financing activities | $ | $ | ( | ||||||||

| Effect of exchange rate changes on Cash and cash equivalents and Cash segregated under regulatory requirements | ( | ||||||||||

Net increase (decrease) in Cash and cash equivalents, and Cash segregated under regulatory requirements | ( | ||||||||||

Cash and cash equivalents and Cash segregated under regulatory requirements at beginning of period | |||||||||||

| Cash and cash equivalents and Cash segregated under regulatory requirements at end of period | $ | $ | |||||||||

| Supplemental cash information: | |||||||||||

| Cash paid during the period for taxes | $ | $ | |||||||||

| Cash paid during the period for interest | |||||||||||

| Supplemental non-cash information: | |||||||||||

| Issuance of Class A common stock upon exchange of limited partnership interests | $ | $ | |||||||||

| Issuance of Class A and contingent Class A common stock and limited partnership interests for acquisitions | |||||||||||

| ROU assets and liabilities | |||||||||||

The accompanying Notes to the unaudited Condensed Consolidated Financial Statements

are an integral part of these financial statements.

19

BGC GROUP, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

For the Three Months Ended June 30, 2023

(in thousands, except share and per share amounts)

(unaudited)

| BGC Group, Inc. Stockholders | Noncontrolling Interest in Subsidiaries | Total | |||||||||||||||||||||||||||||||||||||||||||||

| Class A Common Stock | Class B Common Stock | Additional Paid-in Capital | Treasury Stock | Retained Deficit | Accumulated Other Comprehensive Income (Loss) | ||||||||||||||||||||||||||||||||||||||||||

| Balance, April 1, 2023 | $ | $ | $ | $ | ( | $ | ( | $ | ( | $ | $ | ||||||||||||||||||||||||||||||||||||

| Consolidated net income (loss) | — | — | — | — | ( | — | ( | ( | |||||||||||||||||||||||||||||||||||||||

| Other comprehensive income (loss), net of tax | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||

Equity-based compensation, | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||

| Dividends to common stockholders | — | — | — | — | ( | — | — | ( | |||||||||||||||||||||||||||||||||||||||

| Earnings distributions to limited partnership interests and other noncontrolling interests | — | — | — | — | — | — | ( | ( | |||||||||||||||||||||||||||||||||||||||

Grant of exchangeability and redemption of limited partnership interests, issuance of | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||

Issuance of Class A common stock (net of costs), | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||

Redemption of FPUs, | — | — | — | — | — | — | ( | ( | |||||||||||||||||||||||||||||||||||||||

Repurchase of Class A common stock, | — | — | — | ( | — | — | ( | ( | |||||||||||||||||||||||||||||||||||||||

Forfeiture of Class A common stock, | — | — | ( | — | — | ( | ( | ||||||||||||||||||||||||||||||||||||||||

| Contributions of capital to and from Cantor for equity-based compensation | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||

Grant of exchangeability, redemption of limited partnership interests and issuance of Class A common stock and RSUs for acquisitions, | — | ( | — | — | — | ( | |||||||||||||||||||||||||||||||||||||||||

Cantor purchase of Cantor units from BGC Holdings upon redemption of FPUs, | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||

| Corporate Conversion (Note 26) | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||

| Other | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||

Balance, June 30, 2023 | $ | $ | $ | $ | ( | $ | ( | $ | ( | $ | $ | ||||||||||||||||||||||||||||||||||||

The accompanying Notes to the unaudited Condensed Consolidated Financial Statements are an integral part of these financial statements.

20

BGC GROUP, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

For the Six Months Ended June 30, 2023

(in thousands, except share and per share amounts)

(unaudited)

| BGC Group, Inc. Stockholders | Noncontrolling Interest in Subsidiaries | Total | |||||||||||||||||||||||||||||||||||||||||||||

| Class A Common Stock | Class B Common Stock | Additional Paid-in Capital | Treasury Stock | Retained Deficit | Accumulated Other Comprehensive Income (Loss) | ||||||||||||||||||||||||||||||||||||||||||

| Balance, January 1, 2023 | $ | $ | $ | $ | ( | $ | ( | $ | ( | $ | $ | ||||||||||||||||||||||||||||||||||||

| Consolidated net income (loss) | — | — | — | — | ( | — | ( | ( | |||||||||||||||||||||||||||||||||||||||

| Other comprehensive income (loss), net of tax | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||

Equity-based compensation, | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||

| Dividends to common stockholders | — | — | — | — | ( | — | — | ( | |||||||||||||||||||||||||||||||||||||||

| Earnings distributions to limited partnership interests and other noncontrolling interests | — | — | — | — | — | — | ( | ( | |||||||||||||||||||||||||||||||||||||||

Grant of exchangeability and redemption of limited partnership interests, issuance of | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||

Issuance of Class A common stock (net of costs), | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||

Redemption of FPUs, | — | — | — | — | — | — | ( | ( | |||||||||||||||||||||||||||||||||||||||

Repurchase of Class A common stock, | — | — | — | ( | — | — | ( | ( | |||||||||||||||||||||||||||||||||||||||

Forfeiture of Class A common stock, | — | — | ( | — | — | ( | ( | ||||||||||||||||||||||||||||||||||||||||

| Contributions of capital to and from Cantor for equity-based compensation | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||

Grant of exchangeability, redemption of limited partnership interests and issuance of Class A common stock and RSUs for acquisitions, | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||

Cantor purchase of Cantor units from BGC Holdings upon redemption of FPUs, | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||

| Corporate Conversion (Note 26) | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||

| Other | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||

Balance, June 30, 2023 | $ | $ | $ | $ | ( | $ | ( | $ | ( | $ | $ | ||||||||||||||||||||||||||||||||||||

| For the three months ended June 30, | For the six months ended June 30, | ||||||||||||||||||||||||||||||||||||||||||||||

| 2023 | 2022 | 2023 | 2022 | ||||||||||||||||||||||||||||||||||||||||||||

| Dividends declared per share of common stock | $ | $ | $ | $ | |||||||||||||||||||||||||||||||||||||||||||

| Dividends declared and paid per share of common stock | $ | $ | $ | $ | |||||||||||||||||||||||||||||||||||||||||||

The accompanying Notes to the unaudited Condensed Consolidated Financial Statements are an integral part of these financial statements.

21

BGC GROUP, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

For the Three and Six Months Ended June 30, 2022

(in thousands, except share amounts)

(unaudited)

| BGC Group, Inc. Stockholders | |||||||||||||||||||||||||||||||||||||||||||||||

| Class A Common Stock | Class B Common Stock | Additional Paid-in Capital | Treasury Stock | Retained Deficit | Accumulated Other Comprehensive Income (Loss) | Noncontrolling Interest in Subsidiaries | Total | ||||||||||||||||||||||||||||||||||||||||

| Balance, April 1, 2022 | $ | $ | $ | $ | ( | $ | ( | $ | ( | $ | $ | ||||||||||||||||||||||||||||||||||||

| Consolidated net income (loss) | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive gain, net of tax | — | — | — | — | — | ( | ( | ( | |||||||||||||||||||||||||||||||||||||||

Equity-based compensation, | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||

| Dividends to common stockholders | — | — | — | — | ( | — | — | ( | |||||||||||||||||||||||||||||||||||||||

| Earnings distributions to limited partnership interests and other noncontrolling interests | — | — | — | — | — | — | ( | ( | |||||||||||||||||||||||||||||||||||||||

Grant of exchangeability and redemption of limited partnership interests, issuance of | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||

Issuance of Class A common stock (net of costs), | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||

Redemption of FPUs, | — | — | — | — | — | — | ( | ( | |||||||||||||||||||||||||||||||||||||||

Repurchase of Class A common stock, | — | — | — | ( | — | — | ( | ( | |||||||||||||||||||||||||||||||||||||||

Forfeiture of Class A common stock, | — | — | ( | ( | — | — | ( | ( | |||||||||||||||||||||||||||||||||||||||

| Contributions of capital to and from Cantor for equity-based compensation | — | — | ( | — | — | — | ( | ( | |||||||||||||||||||||||||||||||||||||||

Grant of exchangeability, redemption of limited partnership interests and issuance of Class A common stock and RSUs for acquisitions, | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||

Cantor purchase of Cantor units from BGC Holdings upon redemption of FPUs, | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||

| Other | — | — | ( | — | — | — | — | ( | |||||||||||||||||||||||||||||||||||||||

Balance, June 30, 2022 | $ | $ | $ | $ | ( | $ | ( | $ | ( | $ | $ | ||||||||||||||||||||||||||||||||||||

| BGC Group, Inc. Stockholders | |||||||||||||||||||||||||||||||||||||||||||||||

| Class A Common Stock | Class B Common Stock | Additional Paid-in Capital | Treasury Stock | Retained Deficit | Accumulated Other Comprehensive Income (Loss) | Noncontrolling Interest in Subsidiaries | Total | ||||||||||||||||||||||||||||||||||||||||

| Balance, January 1, 2022 | $ | $ | $ | $ | ( | $ | ( | $ | ( | $ | $ | ||||||||||||||||||||||||||||||||||||

| Consolidated net income (loss) | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive gain, net of tax | — | — | — | — | — | ( | ( | ( | |||||||||||||||||||||||||||||||||||||||

Equity-based compensation, | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||

| Dividends to common stockholders | — | — | — | — | ( | — | — | ( | |||||||||||||||||||||||||||||||||||||||

| Earnings distributions to limited partnership interests and other noncontrolling interests | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||

Grant of exchangeability and redemption of limited partnership interests, issuance of | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||

Issuance of Class A common stock (net of costs), | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||

Redemption of FPUs, | — | — | — | — | — | — | ( | ( | |||||||||||||||||||||||||||||||||||||||

Repurchase of Class A common stock, | — | — | — | ( | — | — | ( | ( | |||||||||||||||||||||||||||||||||||||||

Forfeiture of Class A common stock, | — | — | ( | ( | — | — | ( | ( | |||||||||||||||||||||||||||||||||||||||

| Contributions of capital to and from Cantor for equity-based compensation | — | — | ( | — | — | — | ( | ( | |||||||||||||||||||||||||||||||||||||||

Grant of exchangeability, redemption of limited partnership interests and issuance of Class A common stock and RSUs for acquisitions, | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||

Cantor purchase of Cantor units from BGC Holdings upon redemption of FPUs, | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||

| Other | — | — | ( | — | — | — | — | ( | |||||||||||||||||||||||||||||||||||||||

Balance, June 30, 2022 | $ | $ | $ | $ | ( | $ | ( | $ | ( | $ | $ | ||||||||||||||||||||||||||||||||||||

The accompanying Notes to the unaudited Condensed Consolidated Financial Statements are an integral part of these financial statements.

22

BGC GROUP, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

| Page | ||||||||

23

1. Organization and Basis of Presentation

Business Overview

BGC Group, Inc., holding company for and successor to BGC Partners, Inc. following the closing of the Corporate Conversion on July 1, 2023, is reporting the results as of and for the period ended June 30, 2023 of BGC Partners, Inc., its wholly owned subsidiary, and throughout this Quarterly Report on Form 10-Q, other than as indicated. See Note 26—“Subsequent Events” for more information.

BGC is a leading global brokerage and financial technology company servicing the global financial markets. Through brands including BGC®, Fenics®, GFI®, Sunrise Brokers™, Poten & Partners®, and RP Martin®, among others, the Company’s businesses specialize in the brokerage of a broad range of products, including fixed income such as government bonds, corporate bonds, and other debt instruments, as well as related interest rate derivatives and credit derivatives. Additionally, the Company provides brokerage products across FX, Equities, Energy and Commodities, Shipping, and Futures and Options. The Company’s businesses also provide a wide variety of services, including trade execution, connectivity and network solutions, brokerage services, clearing, trade compression, and other post-trade services, and information and other back-office services to a broad assortment of financial and non-financial institutions.

BGC’s integrated platform is designed to provide flexibility to customers with regard to price discovery, execution and processing, creating marketplaces and enabling them to use the Company’s Voice, Hybrid, or, in many markets, Fully Electronic brokerage services in connection with transactions executed either OTC or through an exchange. Through the Company’s Fenics® group of electronic brands, BGC Group offers a number of market infrastructure and connectivity services, including the Company’s Fully Electronic marketplaces, market data and related information services, network, trade compression and other post-trade services, analytics related to financial instruments and markets, and other financial technology solutions. Fenics® brands also operate under the names Fenics®, FMX™, FMX Futures Exchange™, Fenics Markets Xchange™, Fenics Futures Exchange™, Fenics UST™, Fenics FX™, Fenics Repo™, Fenics Direct™, Fenics MID™, Fenics Market Data™, Fenics GO™, Fenics PortfolioMatch™, kACE2®, and Lucera®.

BGC, BGC Partners, BGC Trader, GFI, GFI Ginga, CreditMatch, Fenics, Fenics.com, FMX, Sunrise Brokers, Poten & Partners, RP Martin, kACE2, Capitalab, Swaptioniser, CBID, and Lucera are trademarks/service marks, and/or registered trademarks/service marks of BGC Group and/or its affiliates.

The Company promotes the efficiency of the global capital markets, acting as market infrastructure to the world’s largest banks, broker-dealers, investment banks, trading firms, hedge funds, governments, corporations, and investment firms. BGC has an extensive number of offices globally in major markets including New York and London, as well as in Bahrain, Beijing, Bogotá, Brisbane, Cape Town, Chicago, Copenhagen, Dubai, Dublin, Frankfurt, Geneva, Hong Kong, Houston, Johannesburg, Madrid, Manila, Melbourne, Mexico City, Miami, Milan, Monaco, Nyon, Paris, Perth, Rio de Janeiro, Santiago, São Paulo, Seoul, Shanghai, Singapore, Sydney, Tel Aviv, Tokyo, Toronto, Wellington, and Zurich.

Corporate Conversion

In connection with the Corporate Conversion, the Company completed various transactions in the three months ended June 30, 2023 which included:

•the redemption of certain non-exchangeable limited partnership units in connection with the issuance of shares of BGC Partners Class A common stock and the accompanying tax payments, which led to an equity-based compensation charge of $60.9 million;

•the exchange of the remaining 1.5 million exchangeable limited partnership units of BGC Holdings held by employees on June 30, 2023, for 1.0 million shares, after tax withholding, of BGC Partners Class A common stock;

•the redemption of certain non-exchangeable limited partnership units of BGC Holdings held by employees and issuance of 16.9 million BGC Partners RSUs on a one -for-one basis on June 30, 2023;

•the redemption of certain non-exchangeable Preferred Units of BGC Holdings held by employees and issuance of $49.2 million of BGC Partners RSU Tax Accounts on June 30, 2023, based on the fixed cash value of the Preferred Units redeemed;

•the redemption of the remaining 5.6 million non-exchangeable FPUs and issuances of BGC Partners RSUs on a one -for-one basis on June 30, 2023, which in turn reduced the “Redeemable Partnership Interest” to zero with an offsetting impact to “Total equity” in the Company’s unaudited Condensed Consolidated Statements of Financial Condition as of June 30, 2023; and

24