Table of Contents

As filed with the Securities and Exchange Commission on June 8, 2012

Registration No. 333-180331

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

BGC PARTNERS, INC.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 13-4063515 | |

| (State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) |

499 Park Avenue

New York, New York 10022

(212) 610-2200

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Stephen M. Merkel

BGC Partners, Inc.

499 Park Avenue

New York, New York 10022

(212) 610-2200

(212) 829-4708 fax

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

Copies to:

Christopher T. Jensen

Howard Kenny

Morgan, Lewis & Bockius LLP

101 Park Avenue

New York, New York 10178

(212) 309-6000

(212) 309-6001 fax

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this Registration Statement, as determined by market conditions.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ¨

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, please check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ¨

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 under the Securities Exchange Act of 1934:

| Large accelerated filer | ¨ | Accelerated filer | x | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of Each Class of Securities to be Registered |

Proposed Maximum Aggregate |

Amount of Fee(1)(2) | ||

| Debt securities |

$300,000,000 | $34,380(3) | ||

| Class A Common Stock, par value $0.01 per share |

— | (4) | ||

|

| ||||

|

| ||||

| (1) | We are registering an indeterminate aggregate amount of debt securities up to a proposed aggregate offering price of $300,000,000, which may be offered from time to time in unspecified amounts and at indeterminate prices. We are also registering an indeterminate number of shares of our Class A Common Stock that may be issuable upon conversion or exchange of any convertible or exchangeable debt securities that provide for such issuance; no separate consideration will be received for the issuance of such shares of Class A Common Stock. |

| (2) | Calculated pursuant to Rule 457(o) under the Securities Act. |

| (3) | Previously paid. |

| (4) | Pursuant to Rule 457(i) under the Securities Act, no additional registration fee is payable with respect to the Class A Common Stock. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to such Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed without notice. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities, nor a solicitation of an offer to buy these securities, in any jurisdiction where the offering is not permitted.

Preliminary Prospectus

Subject to Completion, dated June 8, 2012

BGC PARTNERS, INC.

$300,000,000

Debt Securities

Class A Common Stock Issuable Upon Conversion or Exchange of Debt Securities

We are offering up to $300,000,000 aggregate principal amount of our debt securities. The debt securities may be offered in one or more series, in amounts, at prices and on terms to be determined at the time of the offering. The debt securities may be convertible into or exchangeable for shares of our Class A common stock.

We will provide the specific terms of the debt securities in supplements to this prospectus. You should read this prospectus and the applicable prospectus supplement carefully before you invest.

Our Class A common stock is traded on the Nasdaq Global Select Market under the symbol “BGCP.” On June 7, 2012, the last reported sales price of our Class A common stock was $6.23 per share.

An investment in our debt securities and Class A common stock involves risks. See the “Risk Factors” section on page 5 of this prospectus and in our latest Annual Report on Form 10-K filed with the Securities and Exchange Commission, which we refer to as the “SEC,” and any updates to those risk factors or new risk factors contained in our subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K filed with the SEC, all of which we incorporate by reference herein.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2012.

Table of Contents

| Page | ||||

| ii | ||||

| iii | ||||

| v | ||||

| 1 | ||||

| 5 | ||||

| 6 | ||||

| 7 | ||||

| 8 | ||||

| 21 | ||||

| 26 | ||||

| 29 | ||||

| 30 | ||||

| 30 | ||||

| 30 | ||||

| 30 | ||||

| 32 | ||||

| 32 | ||||

You should rely only on the information provided in this prospectus, in any prospectus supplement that we provide to you in connection with an offering of the securities described in this prospectus or in any document incorporated by reference into this prospectus or any applicable prospectus supplement. We have not authorized anyone to provide you with different information. No offer of the securities described in this prospectus is being made in any jurisdiction where the offer is not permitted. You should not assume that the information in this prospectus, or in any prospectus supplement that we provide to you in connection with an offering of the securities described in this prospectus, or in any document incorporated by reference into this prospectus or any applicable prospectus supplement is accurate as of any date other than the date of the applicable document. Since the respective dates of this prospectus, any prospectus supplement that we provide to you in connection with an offering of the securities described in this prospectus, or any documents incorporated by reference into this prospectus or any applicable prospectus supplement, our businesses, financial condition, results of operations, cash flows and prospects might have changed.

i

Table of Contents

This prospectus is part of a registration statement that we filed with the SEC using a shelf registration process. Under the shelf registration process, we may offer and sell our debt securities and any Class A common stock that may be issuable upon conversion or exchange of such debt securities as described in this prospectus in one or more offerings. Each time we sell a series of debt securities, we will provide a prospectus supplement containing a description of the debt securities we will offer and specific information about the terms of that series of debt securities and the related offering. Any such prospectus supplement may also add, update or change information contained in this prospectus. If there is any inconsistency between the information in this prospectus and the applicable prospectus supplement, you should rely on the information in such prospectus supplement.

ii

Table of Contents

This prospectus and the documents incorporated by reference into this prospectus contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, which we refer to as the “Securities Act,” and Section 21E of the Securities Exchange Act of 1934, as amended, which we refer to as the “Exchange Act.” Such statements are based upon current expectations that involve risks and uncertainties. Any statements contained herein or in documents incorporated by reference that are not statements of historical fact may be deemed to be forward-looking statements. For example, words such as “may,” “will,” “should,” “estimates,” “predicts,” “potential,” “continue,” “strategy,” “believes,” “anticipates,” “plans,” “expects,” “intends” and similar expressions are intended to identify forward-looking statements.

Our actual results and the outcome and timing of certain events may differ significantly from the expectations discussed in the forward-looking statements. Factors that might cause or contribute to such a discrepancy include, but are not limited to:

| • | pricing and commissions and market position with respect to any of our products and services and those of our competitors; |

| • | the effect of industry concentration and reorganization, reduction of customers and consolidation; |

| • | liquidity, regulatory and clearing capital requirements and the impact of credit market events; |

| • | market conditions, including trading volume and volatility, potential deterioration of the equity and debt capital markets, and our ability to access the capital markets; |

| • | our relationships with Cantor Fitzgerald, L.P., which we refer to as “Cantor,” and its affiliates, including Cantor Fitzgerald & Co., which we refer to as “CF&Co,” any related conflicts of interest, competition for and retention of brokers and other managers and key employees, support for liquidity and capital and other relationships, including Cantor’s holding of our 8.75% convertible notes, CF&Co’s acting as our sales agent under our controlled equity or other offerings, and CF&Co’s acting as our financial advisor in connection with one or more business combinations or other transactions; |

| • | economic or geopolitical conditions or uncertainties; |

| • | extensive regulation of our businesses, changes in regulations relating to the financial services and other industries, and risks relating to compliance matters, including regulatory examinations, inspections, investigations and enforcement actions, and any resulting costs, fines, penalties, sanctions, enhanced oversight, increased financial and capital requirements, and changes to or restrictions or limitations on specific activities, operations, compensatory arrangements, and growth opportunities, including acquisitions, hiring, and new business, products, or services; |

| • | factors related to specific transactions or series of transactions, including credit, performance and unmatched principal risk, counterparty failure, and the impact of fraud and unauthorized trading; |

| • | costs and expenses of developing, maintaining and protecting our intellectual property, as well as employment and other litigation and their related costs, including judgments or settlements paid or received; |

| • | certain financial risks, including the possibility of future losses and negative cash flows from operations, an increased need for short-term borrowings, potential liquidity and other risks relating to our ability to obtain financing or refinancing of existing debt on terms acceptable to us, if at all, and risks of the resulting leverage, including potentially causing a reduction in our credit ratings and/or the associated outlooks given by the rating agencies to those credit ratings, increased borrowing costs, as well as interest and currency rate fluctuations; |

| • | our ability to enter new markets or develop new products, trading desks, marketplaces or services and to induce customers to use these products, trading desks, marketplaces or services and to secure and maintain market share; |

iii

Table of Contents

| • | our ability to enter into marketing and strategic alliances and business combination or other transactions in the financial services, real estate and other industries, including acquisitions, dispositions, reorganizations, partnering opportunities and joint ventures and to meet our financial reporting obligations with respect thereto, and the integration of any completed transactions; |

| • | our ability to hire and retain personnel; |

| • | our ability to expand the use of technology for hybrid and fully electronic trading; |

| • | our ability to effectively manage any growth that may be achieved, while ensuring compliance with all applicable regulatory requirements; |

| • | our ability to identify and remediate any material weaknesses in our internal controls that could affect our ability to prepare financial statements and reports in a timely manner, control our policies, procedures, operations and assets, assess and manage our operational, regulatory and financial risks, and integrate our acquired businesses; |

| • | the effectiveness of our risk management policies and procedures, and the impact of unexpected market moves and similar events; |

| • | the fact that the prices at which shares of our Class A common stock are sold in one or more of our controlled equity offerings or in other offerings or other transactions may vary significantly, and purchasers of shares in such offerings or transactions, as well as existing stockholders, may suffer significant dilution if the price they paid for their shares is higher than the price paid by other purchasers in such offerings or transactions; |

| • | our ability to meet expectations with respect to payments of dividends and distributions and repurchases of shares of our Class A common stock and purchases of limited partnership interests of BGC Holdings, L.P., which we refer to as “BGC Holdings,” or other equity interests of our subsidiaries, including from Cantor, our executive officers, other employees, partners, and others, and the net proceeds to be realized by us from offerings of our shares of Class A common stock; |

| • | the effect on the market for and trading price of our Class A common stock of various offerings and other transactions, including our controlled equity and other offerings of our Class A common stock and convertible or exchangeable debt securities, our repurchases of shares of our Class A common stock and purchases of BGC Holdings limited partnership interests or other equity interests of our subsidiaries, our payment of dividends on our Class A common stock and distributions on BGC Holdings limited partnership interests, convertible arbitrage, hedging, and other transactions engaged in by holders of our 4.50% convertible notes and counterparties to our capped call transactions, and resales of shares of our Class A common stock acquired from us or Cantor, including pursuant to our employee benefit plans, conversion of our convertible notes, conversion or exchange of our convertible or exchangeable debt securities, and distributions from Cantor pursuant to Cantor’s distribution rights obligations and other distributions to Cantor partners, including deferred distribution rights shares; and |

| • | the risk factors described in our latest Annual Report on Form 10-K filed with the SEC and any updates to those risk factors or new risk factors contained in our subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K filed with the SEC, all of which we incorporate by reference herein. |

The foregoing risks and uncertainties, as well as those risks and uncertainties referred to under the heading “Risk Factors” and those incorporated by reference into this prospectus, may cause actual results to differ materially from the forward-looking statements. The information included or incorporated by reference into this prospectus is given as of the respective dates of this prospectus or the documents incorporated by reference into this prospectus, and future events or circumstances could differ significantly from such information. We do not undertake to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

iv

Table of Contents

Unless we otherwise indicate or unless the context requires otherwise, any reference in this prospectus to:

| • | “4.50% convertible notes” refers to the BGC Partners 4.50% convertible senior notes due 2016, which are convertible into shares of Class A common stock; |

| • | “8.75% convertible notes” refers to the BGC Partners 8.75% convertible senior notes due 2015, which are convertible into shares of Class A common stock; |

| • | “April 2008 distribution rights shares” refers to shares of Class A common stock distributed, or to be distributed on a deferred basis, by Cantor to certain current and former partners of Cantor pursuant to distribution rights provided to such partners on April 1, 2008; |

| • | “BGC Global” refers to BGC Global Holdings, L.P., which holds the non-U.S. businesses of BGC Partners; |

| • | “BGC Holdings” refers to BGC Holdings, L.P.; |

| • | “BGC Partners” refers to BGC Partners, Inc. and its consolidated subsidiaries; |

| • | “BGC Partners OldCo” refers to BGC Partners, LLC (formerly known as BGC Partners, Inc.) before the merger; |

| • | “BGC U.S.” refers to BGC Partners, L.P., which holds the U.S. businesses of BGC Partners; |

| • | “Cantor” or the “Cantor group” refers to Cantor Fitzgerald, L.P. and its subsidiaries other than BGC Partners; |

| • | “Cantor units” refers to exchangeable limited partnership interests of BGC Holdings held by Cantor entities; |

| • | “CF&Co” refers to Cantor Fitzgerald & Co.; |

| • | “CFGM” refers to CF Group Management, Inc., the managing general partner of Cantor; |

| • | “Class A common stock” refers to BGC Partners Class A common stock, par value $0.01 per share; |

| • | “Class B common stock” refers to BGC Partners Class B common stock, par value $0.01 per share; |

| • | “common stock” refers to Class A common stock and Class B common stock, collectively; |

| • | “convertible notes” refers to the 4.50% convertible notes and the 8.75% convertible notes, collectively; |

| • | “debt securities” refers to the debt securities of BGC Partners included in this prospectus; |

| • | “deferred distribution rights shares” refers to distribution rights shares to be distributed by Cantor on a deferred basis; |

| • | “distribution rights” refers to the obligation of Cantor to distribute to certain current and former partners of Cantor shares of Class A common stock; |

| • | “distribution rights shares” refers to the April 2008 distribution rights shares and the February 2012 distribution rights shares, collectively; |

| • | “eSpeed” refers to eSpeed, Inc.; |

| • | “February 2012 distribution rights shares” refers to shares of Class A common stock to be distributed on a deferred basis to certain partners of Cantor in payment of previous quarterly partnership distributions pursuant to distribution rights provided to such partners on February 14, 2012; |

| • | “February 2012 sales agreement” refers to the controlled equity offeringSM sales agreement, dated February 15, 2012, between BGC Partners and CF&Co; |

| • | “founding partners” refers to the individuals who became limited partners of BGC Holdings in the mandatory redemption of interests in Cantor in connection with the separation and merger and who provide services to BGC Partners (provided that members of the Cantor group and Howard W. Lutnick |

v

Table of Contents

| (including any entity directly or indirectly controlled by Mr. Lutnick or any trust with respect to which he is a grantor, trustee or beneficiary) are not founding partners); |

| • | “founding/working partners” refers to founding partners and/or working partners of BGC Holdings; |

| • | “founding/working partner units” refers to partnership units of BGC Holdings held by founding/working partners; |

| • | “GAAP” refers to accounting principles generally accepted in the United States of America; |

| • | “limited partners” refers to holders of limited partnership units; |

| • | “limited partnership interests” refers to founding/working partner units, limited partnership units and Cantor units, collectively; |

| • | “limited partnership units” refers to REUs, RPUs, PSUs and PSIs, collectively; |

| • | “merger” refers to the merger of BGC Partners OldCo with and into eSpeed on April 1, 2008 pursuant to the Agreement and Plan of Merger, dated as of May 29, 2007, as amended as of November 5, 2007 and February 1, 2008, by and among eSpeed, BGC Partners OldCo, Cantor, BGC U.S., BGC Global and BGC Holdings; |

| • | “OpCos” refers to BGC U.S. and BGC Global, collectively; |

| • | “PSIs” refers to certain working partner units of BGC Holdings held by certain employees of BGC Partners and other persons who provide services to BGC Partners; |

| • | “PSUs” refers to certain working partner units of BGC Holdings held by certain employees of BGC Partners and other persons who provide services to BGC Partners; |

| • | “REUs” refers to certain limited partnership units of BGC Holdings held by certain employees of BGC Partners and other persons; |

| • | “RPUs” refers to certain limited partnership units of BGC Holdings held by certain employees of BGC Partners and other persons; |

| • | “RSUs” refers to BGC Partners’ unvested restricted stock units held by certain employees of BGC Partners and other persons who provide services to BGC Partners; |

| • | “separation” refers to the transfer by Cantor of certain assets and liabilities to BGC Partners OldCo and/or its subsidiaries pursuant to the Separation Agreement, dated as of March 31, 2008, by and among Cantor, BGC Partners OldCo, BGC U.S., BGC Global and BGC Holdings; |

| • | “September 2011 sales agreement” refers to the controlled equity offeringSM sales agreement, dated September 9, 2011, between BGC Partners and CF&Co; |

| • | “short-term borrowings” refers to borrowings under our revolving credit agreement, dated June 23, 2011, which provides for up to $130.0 million of unsecured revolving credit through June 23, 2013; |

| • | “working partners” refers holders of working partner units; and |

| • | “working partner units” refers to partnership units of BGC Holdings held by working partners. |

vi

Table of Contents

This summary highlights selected information from this prospectus, but may not contain all information that may be important to you. The following summary is qualified in its entirety by the more detailed information included in or incorporated by reference into this prospectus. For a more complete understanding of the terms of our debt securities and our Class A common stock that may be issuable upon conversion or exchange of such debt securities, and before making your investment decision, you should carefully read this entire prospectus, the prospectus supplement provided in connection with an offering of the debt securities and the documents referred to in “Where You Can Find More Information” and “Document Incorporated by Reference.” See the “Certain Defined Terms” section beginning on page v of this prospectus for the definition of certain terms used in this prospectus.

When we use the words “BGC Partners,” “we,” “us,” “our” or the “Company,” we are referring to BGC Partners, Inc. and its consolidated subsidiaries.

The Company

We are a leading global brokerage company primarily servicing the wholesale financial and property markets, specializing in the brokering of a broad range of products, including fixed income securities, interest rate swaps, foreign exchange, equities, equity derivatives, credit derivatives, commercial real estate, commodities, futures, and structured products. We also provide a full range of services, including trade execution, broker-dealer services, clearing, processing, information, and other back-office services to a broad range of financial and non-financial institutions. Our integrated platform is designed to provide flexibility to customers with regard to price discovery, execution and processing of transactions, and enables them to use voice, hybrid, or, in many markets, fully electronic brokerage services in connection with transactions executed either over-the-counter or through an exchange. Through our eSpeed, BGC TraderTM, and BGC Market Data brands, we offer financial technology solutions, market data, and analytics related to select financial instruments and markets.

In the second quarter of 2012, we completed the acquisition of substantially all of the assets of Grubb & Ellis Company and its direct and indirect subsidiaries (“Grubb & Ellis”) and have been integrating the Grubb & Ellis assets with our Newmark Knight Frank brand. The resulting brand, Newmark Grubb Knight Frank, is a full-service commercial real estate platform. Through this Newmark Grubb Knight Frank brand, we offer a wide range of services, including leasing and corporate advisory, investment sales and financial services, consulting, project and development management, and property and facilities management.

Our customers include many of the world’s largest banks, broker-dealers, investment banks, trading firms, hedge funds, governments, corporations, property owners, real estate developers and investment firms.

We have offices in dozens of major markets, including New York and London, as well as in Atlanta, Beijing, Boston, Chicago, Copenhagen, Dubai, Hong Kong, Houston, Istanbul, Johannesburg, Los Angeles, Mexico City, Miami, Moscow, Nyon, Paris, Rio de Janeiro, São Paulo, Seoul, Singapore, Sydney, Tokyo, Toronto, Washington, D.C. and Zurich. We expect to have additional offices as we integrate the Grubb & Ellis business. As of March 31, 2012, we had 2,170 brokers and salespeople across more than 220 desks.

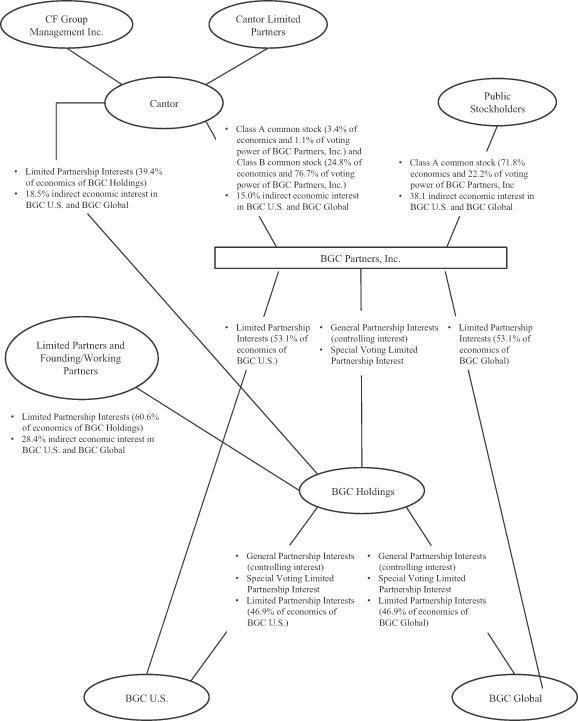

Our Organizational Structure

We are a holding company, and our businesses are operated through two operating partnerships, which we refer to as the “OpCos”: BGC U.S., which holds our U.S. businesses, and BGC Global, which holds our non-U.S. businesses.

The limited partnership interests of the OpCos are held by us and BGC Holdings, and the limited partnership interests of BGC Holdings are currently held by the founding/working partners, holders of limited

1

Table of Contents

partnership units and Cantor. We hold the BGC Holdings general partnership interest and the BGC Holdings special voting limited partnership interest, which entitle us to remove and appoint the general partner of BGC Holdings, and serve as the general partner of BGC Holdings, which entitles us to control BGC Holdings. BGC Holdings, in turn, holds the BGC U.S. general partnership interest and the BGC U.S. special voting limited partnership interest, which entitle the holder thereof to remove and appoint the general partner of BGC U.S., and the BGC Global general partnership interest and the BGC Global special voting limited partnership interest, which entitle the holder thereof to remove and appoint the general partner of BGC Global, and serves as the general partner of BGC U.S. and BGC Global, all of which entitle BGC Holdings (and thereby us) to control each of BGC U.S. and BGC Global. BGC Holdings holds its BGC Global general partnership interest through a company incorporated in the Cayman Islands, BGC Global Holdings GP Limited.

2

Table of Contents

The following diagram illustrates our ownership structure as of May 31, 2012. The following diagram does not reflect the various subsidiaries of us, BGC U.S., BGC Global, BGC Holdings or Cantor, or the noncontrolling interests in our consolidated subsidiaries, other than Cantor’s units in BGC Holdings.

3

Table of Contents

| * | Shares of our Class B common stock are convertible into shares of our Class A common stock at any time in the discretion of the holder on a one-for-one basis. Accordingly, if Cantor converted all of its Class B common stock into Class A common stock, Cantor would hold 28.2% of the voting power, and the public stockholders would hold 71.8% of the voting power (and the indirect economic interests in BGC U.S. and BGC Global would remain unchanged). The diagram reflects (i) 1,010,655 shares of Class A common stock that Cantor distributed to its partners on February 14, 2012 and 282,023 shares of Class A common stock that Cantor distributed to its partners on March 21, 2012 (but not the 1,928,103 February 2012 distribution rights shares that remain to be distributed by Cantor); (ii) an aggregate of 721,679 April 2008 distribution rights shares that Cantor has distributed since September 2011, including the 498,960 shares of Class A common stock that Cantor distributed on February 14, 2012 (but not the 15,545,606 April 2008 distribution rights shares that remain to be distributed by Cantor); (iii) 75,000 shares of Class A common stock that Cantor donated to The Cantor Fitzgerald Relief Fund on March 9, 2012 and that may be included in the prospectus under our separate resale Registration Statement on Form S-3 (Registration No. 333-175034); (iv) an aggregate of 1,050,000 shares of Class A common stock that we donated to The Cantor Fitzgerald Relief Fund on February 3, 2012 and March 9, 2012, all of which shares may in the future be offered and sold under our separate shelf Registration Statement on Form S-3 (Registration No. 333-180391); (v) an aggregate of 5,150,000 shares of Class A common stock that we have sold under the September 2011 sales agreement since January 1, 2012 (but not the 140,090 shares that remain to be sold under that sales agreement), pursuant to our shelf Registration Statement on Form S-3 (Registration No. 333-176523); (vi) an aggregate of 886,569 Cantor units that Cantor purchased from BGC Holdings on March 13, 2012 in connection with the redemption and/or grant of exchangeability of founding/working partner units; (vii) an aggregate of 34,160 Cantor units that Cantor purchased from BGC Holdings on May 4, 2012 in connection with the redemption of non-exchangeable founding/working partner units; (viii) an aggregate of 44,013 shares of Class A common stock that we repurchased, including an aggregate of 41,523 shares from Mr. Merkel and certain family trusts, on March 13, 2012; and (ix) 895,141 exchangeable founding/working partner units that we repurchased from a founding/working partner on April 5, 2012. The diagram does not reflect Cantor’s economic interest in the 8.75% convertible notes or the 22,959,124 shares of Class A common stock acquirable by Cantor upon conversion thereof. If Cantor converted all of the 8.75% convertible notes into shares of Class A common stock, Cantor would hold 78.9% of the voting power, and the public stockholders would hold 21.1% of the voting power (and Cantor’s indirect economic interests in each of BGC U.S. and BGC Global would be 38.8%). Further, the diagram does not reflect (i) 10,000,000 shares of Class A common stock that may be sold under the February 2012 sales agreement, pursuant to our shelf Registration Statement on Form S-3 (Registration No. 333-176523); (ii) 9,961,596 shares of Class A common stock that remain available to be sold pursuant to the BGC Partners, Inc. Dividend Reinvestment and Stock Purchase Plan under our shelf Registration Statement on Form S-3 (Registration No. 333-173109); (iii) 19,208,090 shares of Class A common stock that may be sold under our acquisition shelf Registration Statement on Form S-4 (Registration No. 333-169232); (iv) 16,260,160 shares of Class A common stock that may be issued upon conversion of the 4.50% convertible notes; or (v) any shares of Class A common stock that may become issuable upon the conversion or exchange of any convertible or exchangeable debt securities that may in the future be sold under our shelf Registration Statement on Form S-3 (Registration No. 333-180331). For purposes of the diagram and this paragraph, Cantor’s percentage ownership also includes CFGM’s percentage ownership. |

Executive Offices

Our executive offices are located at 499 Park Avenue, New York, New York 10022, while our international headquarters are located at 1 Churchill Place, Canary Wharf, London E14 5RD, United Kingdom. Our telephone number is (212) 610-2200. Our website is located at www.bgcpartners.com, and our e-mail address is info@bgcpartners.com. The information contained on, or that may be accessed through, our website is not part of, and is not incorporated into, this prospectus.

4

Table of Contents

An investment in our debt securities and any shares of our Class A common stock that may be issuable upon conversion or exchange of the debt securities involves risks. You should consider carefully the “Risk Factors” section of our latest Annual Report on Form 10-K filed with the SEC, and any updates to those risk factors or new risk factors contained in our subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K filed with the SEC, all of which we incorporate by reference herein, and in the prospectus supplement that we will provide to you in connection with an offering of securities described in this prospectus, as well as the other information included in this prospectus and in any applicable prospectus supplement before making an investment decision. Any of the risk factors could significantly and negatively affect our businesses, financial condition, results of operations, cash flows, and prospects and the value and trading prices of the debt securities and Class A common stock. You could lose all or part of your investment in our debt securities and Class A common stock.

5

Table of Contents

Unless otherwise set forth in the applicable prospectus supplement, we intend to use the net proceeds from the sale of the debt securities included in this prospectus for general corporate purposes, which may include, among other things:

| • | additions to working capital; |

| • | the repurchase, purchase or redemption of our outstanding equity and debt securities, BGC Holdings limited partnership interests or other equity interests in our subsidiaries, including from Cantor, our executive officers, other employees, partners and others; |

| • | the repayment of our indebtedness, including our short-term borrowings; and |

| • | the expansions of our business through internal growth or acquisitions. |

6

Table of Contents

RATIO OF EARNINGS TO FIXED CHARGES

The following table presents the ratios of earnings to fixed charges for us and our consolidated subsidiaries for the periods indicated. For the purposes of calculating the ratio of earnings to fixed charges, “earnings” consist of income before income taxes and fixed charges, net. “Fixed charges” consist of interest expense incurred on all indebtedness, amortized premiums, discounts and capitalized expenses relating to indebtedness and interest within rental expense. Neither we nor any of our consolidated subsidiaries had any preferred shares outstanding for any of the periods reflected in this table.

| Quarter Ended March 31, |

Year Ended December 31, | |||||||||||||||||||||||

| 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | |||||||||||||||||||

| (dollars in thousands) | ||||||||||||||||||||||||

| Earnings: |

||||||||||||||||||||||||

| Income before income taxes(1) |

$ | 21,368 | $ | 60,964 | $ | 63,855 | $ | 73,175 | $ | 16,843 | $ | 43,389 | ||||||||||||

| Add: Fixed charges, net |

7,958 | 25,606 | 15,409 | 10,363 | 18,950 | 26,251 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Income before income taxes and fixed charges, net |

$ | 29,326 | $ | 86,570 | $ | 79,264 | $ | 83,538 | $ | 35,793 | $ | 69,640 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Fixed charges: |

||||||||||||||||||||||||

| Total interest expense(2) |

$ | 6,476 | $ | 22,798 | $ | 14,080 | $ | 9,920 | $ | 18,950 | $ | 26,251 | ||||||||||||

| Amortized premiums, discounts and capitalized expenses related to indebtedness |

1,082 | 1,808 | 129 | 43 | — | — | ||||||||||||||||||

| Interest within rental expense |

400 | 1,000 | 1,200 | 400 | — | — | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total fixed charges |

$ | 7,958 | $ | 25,606 | $ | 15,409 | $ | 10,363 | $ | 18,950 | $ | 26,251 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Ratio of earnings to fixed charges |

3.7 | 3.4 | 5.1 | 8.1 | 1.9 | 2.7 | ||||||||||||||||||

| (1) | Income before income taxes does not include income or loss from equity investees. |

| (2) | Includes interest expense of $0.1 million for the three months ended March 31, 2012 and $0.1 million for the year ended December 31, 2011 related to short-term borrowings. |

7

Table of Contents

DESCRIPTION OF THE DEBT SECURITIES

General

The debt securities included in this prospectus may be issued in one or more series under an indenture to be entered into by and between us and U.S. Bank, National Association, as trustee. References herein to the “Indenture” refer to such indenture and references to the “Trustee” refer to such trustee or any other trustee for any particular series of debt securities issued under the Indenture. The terms of the debt securities of any series will be those specified in or pursuant to the Indenture and in the applicable debt securities of that series and those made part of the Indenture by the Trust Indenture Act of 1939, as amended. In the event that we issue subordinated debt securities, we may issue such securities under a separate indenture.

The following description of selected provisions of the Indenture and the debt securities is not complete, and the description of selected terms of the debt securities of a particular series included in the applicable prospectus supplement also will not be complete. You should review the form of the Indenture and the form of the applicable debt securities, which forms have been or will be filed as exhibits to the registration statement of which this prospectus forms a part or as exhibits to documents which have been or will be incorporated by reference in this prospectus and the applicable prospectus supplement. To obtain a copy of the Indenture or the form of the applicable debt securities, see “Where You Can Find More Information” in this prospectus. The following description of debt securities is, and the description of the debt securities of the particular series in the applicable prospectus supplement will be, qualified in its entirety by reference to all of the provisions of the Indenture and the applicable debt securities, which provisions, including defined terms, are incorporated by reference in this prospectus and any applicable prospectus supplement. Capitalized terms used but not defined in this section shall have the meanings assigned to those terms in the Indenture.

The following description of debt securities describes general terms and provisions of the series of debt securities to which any prospectus supplement may relate. When the debt securities of a particular series are offered for sale, the specific terms of such debt securities will be described in the applicable prospectus supplement. If any particular terms of such debt securities described in an applicable prospectus supplement differ from any of the terms of the debt securities generally described in this prospectus, then the terms described in the prospectus supplement will supersede the terms described in this prospectus.

General

The debt securities of each series will constitute either our senior or subordinated indebtedness. We may issue an unlimited principal amount of debt securities under the Indenture. The Indenture provides that debt securities of any series may be issued up to the aggregate principal amount which may be authorized from time to time by us. Please read the applicable prospectus supplement relating to the debt securities of the particular series being offered thereby for the specific terms of such debt securities, including, where applicable:

| • | the title of the series of debt securities; |

| • | any limit on the aggregate principal amount of debt securities of the series; |

| • | the date or dates on which we will pay the principal of and premium, if any, on debt securities of the series, or the method or methods, if any, used to determine such date or dates; |

| • | the rate or rates, which may be fixed or variable, at which debt securities of the series will bear interest, if any, or the method or methods, if any, used to determine such rate or rates; |

| • | the basis used to calculate interest, if any, on the debt securities of the series if other than a 360-day year of twelve 30-day months; |

| • | whether the debt securities will be senior or subordinated obligations of ours and, if subordinated, the subordination provisions thereof; |

8

Table of Contents

| • | the date or dates, if any, from which interest on the debt securities of the series will accrue, or the method or methods, if any, used to determine such date or dates; |

| • | the date or dates, if any, on which the interest on the debt securities of the series will be payable and the record dates for any such payment of interest; |

| • | the manner in which, or the person to whom, any interest on any bearer security of the series of debt securities will be payable, if different than upon presentation and surrender of the coupons relating to the bearer security; |

| • | the terms and conditions on which the debt securities may be convertible into or exchangeable for Class A common stock, if any; |

| • | the terms and conditions, if any, upon which we are required to, or may, at our option, redeem debt securities of the series; |

| • | the terms and conditions, if any, upon which we will be required to repurchase debt securities of the series at the option of the holders of debt securities of the series; |

| • | the terms of any sinking fund or analogous provision; |

| • | the portion of the principal amount of the debt securities of the series which will be payable upon acceleration if other than the full principal amount; |

| • | the authorized denominations in which the series of debt securities will be issued, if other than minimum denominations of $2,000 and any integral multiple of $1,000 in excess thereof, in the case of registered securities, or minimum denominations of $5,000, in the case of bearer securities; |

| • | the place or places where (1) amounts due on the debt securities of the series will be payable, (2) the debt securities of the series may be surrendered for registration of transfer and exchange and, if applicable, for exchange for other securities or property, and (3) notices or demands to or upon us in respect of the debt securities of the series or the Indenture may be served, if different than the corporate trust office of the Trustee; |

| • | if other than U.S. dollars, the currency or currencies in which purchases of, and payments on, the debt securities of the series must be made and the ability, if any, of us or the holders of debt securities of the series to elect for payments to be made in any other currency or currencies; |

| • | whether the amount of payments on the debt securities of the series may be determined with reference to an index, formula, or other method or methods (any of those debt securities being referred to as “Indexed Securities”) and the manner used to determine those amounts; |

| • | any addition to, modification, or deletion of, any covenant or Event of Default with respect to debt securities of the series; |

| • | whether the debt securities of the series will be issuable in registered or bearer form, or both, and whether any debt securities of the series will be issued in temporary or permanent global form and, if so, the identity of the depositary for the global debt securities; |

| • | whether and under what circumstances we will pay Additional Amounts on the debt securities of the series to any holder who is a United States Alien in respect of any tax, assessment, or other governmental charge and, if so, whether we will have the option to redeem such debt securities rather than pay the Additional Amounts; and |

| • | any other terms of debt securities of the series. |

As used in this prospectus and any applicable prospectus supplement relating to an offering of debt securities, references to the principal of and premium, if any, and interest, if any, on the debt securities of a series include Additional Amounts, if any, payable on the debt securities of such series in that context.

9

Table of Contents

We may issue debt securities as original issue discount securities to be sold at a substantial discount below their principal amount. In the event of an acceleration of the maturity of any original issue discount security, the amount payable to the holder upon acceleration will be determined in the manner described in the applicable prospectus supplement. Material federal income tax and other considerations applicable to original issue discount securities will be described in the applicable prospectus supplement.

The terms of the debt securities of any series may differ from the terms of the debt securities of any other series, and the terms of particular debt securities within any series may differ from each other. Unless otherwise specified in the applicable prospectus supplement, we may, without the consent of, or notice to, the holders of the debt securities of any series, reopen an existing series of debt securities and issue additional debt securities of that series.

Other than to the extent provided with respect to the debt securities of a particular series and described in the applicable prospectus supplement, the Indenture will not contain any provisions that would limit our ability to incur indebtedness or to substantially reduce or eliminate our consolidated assets, which may have an adverse effect on the ability of us to service our indebtedness (including the debt securities) or that would afford holders of the debt securities protection in the event of:

| • | a highly leveraged or similar transaction involving us, our management, or any affiliate of any of those parties; |

| • | a change of control; or |

| • | a reorganization, restructuring, merger, or similar transaction involving us or our affiliates that may adversely affect the holders of our debt securities. |

Ranking

The applicable prospectus supplement will indicate the classification of the debt securities as senior debt or subordinated debt. Senior debt will rank on an equal basis with all our other unsecured debt except subordinated debt. Subordinated debt will rank subordinated and junior in right of payment, to the extent set forth in the applicable prospectus supplement, to all our senior debt.

Any senior debt that is unsecured will be effectively subordinated to our secured indebtedness to the extent of the security and all debt securities will be effectively subordinated to all liabilities of our subsidiaries. In the event of any insolvency, bankruptcy, liquidation or other similar proceeding with respect to any such subsidiary, we, as an equity owner of such subsidiary, and therefore holders of our debt will be subject to the prior claims of such subsidiary’s creditors, including trade creditors, and any preferred equity holders.

If we default in the payment of any principal of, or premium, if any, or interest on any senior debt when it becomes due and payable after any applicable grace period, then, unless and until the default is cured or waived or ceases to exist, we cannot make a payment on account of or redeem or otherwise acquire the subordinated debt securities.

If there is any insolvency, bankruptcy, liquidation or other similar proceeding relating to us or our property, then all senior debt must be paid in full before any payment may be made to any holders of subordinated debt securities.

Furthermore, if we default in the payment of the principal of and accrued interest on any subordinated debt securities that is declared due and payable upon an event of default under the subordinated debt indenture, holders of all our senior debt will first be entitled to receive payment in full in cash before holders of such subordinated debt can receive any payments.

10

Table of Contents

Registration, Transfer, Payment and Paying Agent

Unless otherwise specified in the applicable prospectus supplement, each series of debt securities will be issued in registered form only, without coupons. The Indenture, however, provides that we may also issue debt securities in bearer form only, or in both registered and bearer form. Purchasers of bearer securities will be subject to certification procedures and may be affected by limitations under United States tax laws. The terms of the bearer securities of the particular series and the applicable procedures and limitations will be described in the applicable prospectus supplement.

Unless otherwise specified in the applicable prospectus supplement, registered securities will be issued in minimum denominations of $2,000 or any integral multiple of $1,000 in excess thereof, and bearer securities will be issued in minimum denominations of $5,000.

Unless otherwise specified in the applicable prospectus supplement, the debt securities will be payable and may be surrendered for registration of transfer or exchange and, if applicable, for conversion into or exchange for shares of our Class A common stock or other securities or property, at an office or agency maintained by the Trustee in New York, New York. However, we may, at our option, may make payments of interest on any interest payment date on any registered security by check mailed to the address of the person entitled to receive that payment or by wire transfer to an account maintained by the payee with a bank located in the United States.

Any interest not punctually paid or duly provided for on any interest payment date with respect to the debt securities of any series will forthwith cease to be payable to the holders of those debt securities on the applicable regular record date and may either be paid to the persons in whose names those debt securities are registered at the close of business on a special record date for the payment of the interest not punctually paid or duly provided for to be fixed by the Trustee, notice whereof shall be given to the holders of those debt securities not less than 10 days prior to the special record date, or may be paid at any time in any other lawful manner, all as completely described in the Indenture.

Subject to certain limitations imposed on debt securities issued in book-entry form, the debt securities of any series will be exchangeable for other debt securities of the same series and of a like aggregate principal amount and tenor of different authorized denominations upon surrender of those debt securities at the designated place or places. In addition, subject to certain limitations imposed upon debt securities issued in book-entry form, the debt securities of any series may be surrendered for registration of transfer or exchange thereof at the designated place or places if duly endorsed or accompanied by a written instrument of transfer. No service charge shall be made for any registration of transfer or exchange, redemption or repayment of debt securities, or for any exchange of debt securities for other securities or property, but we may require payment of a sum sufficient to cover any tax or other governmental charge that may be imposed in connection with certain of those transactions.

Unless otherwise specified in the applicable prospectus supplement, we will not be required to:

| • | issue, register the transfer of or exchange debt securities of any series during a period beginning at the opening of business 15 days before any selection of debt securities of that series of like tenor and terms to be redeemed and ending at the close of business on the day of that selection; |

| • | register the transfer of or exchange any registered security, or portion of any registered security, called for redemption, except the unredeemed portion of any registered security being redeemed in part; or |

| • | issue, register the transfer of or exchange a debt security which has been surrendered for repurchase at the option of the holder, except the portion, if any, of the debt security not to be repurchased. |

Calculation Agents

Calculations relating to floating rate debt securities and Indexed Securities will be made by the calculation agent, an institution that we appoint as our agent for this purpose. We may appoint one of our affiliates as

11

Table of Contents

calculation agent. We may appoint a different institution to serve as calculation agent from time to time after the original issue date of the debt security without your consent and without notifying you of the change. The initial calculation agent, if any, will be identified in the applicable prospectus supplement.

Book-Entry Debt Securities

The debt securities of a series may be issued in whole or in part in the form of one or more global debt securities. Global debt securities will be deposited with, or on behalf of, a depositary identified in the applicable prospectus supplement. Global debt securities may be issued in either registered or bearer form and in either temporary or permanent form. Unless and until it is exchanged in whole or in part for individual certificates evidencing debt securities, a global debt security may not be transferred except as a whole by the depositary to its nominee or by the nominee to the depositary or by the depositary or its nominee to a successor depositary or to a nominee of the successor depositary.

We anticipate that global debt securities will be deposited with, or on behalf of, The Depository Trust Company, which we refer to as “DTC,” New York, New York, and that global debt securities will be registered in the name of DTC’s nominee, Cede & Co. We also anticipate that the following provisions will apply to the depository arrangements with respect to global debt securities. Additional or differing terms of the depository arrangements will be described in the applicable prospectus supplement.

DTC has advised us that it is:

| • | a limited-purpose trust company organized under the New York Banking Law; |

| • | a “banking organization” within the meaning of the New York Banking Law; |

| • | a member of the Federal Reserve System; |

| • | a “clearing corporation” within the meaning of the New York Uniform Commercial Code; and |

| • | a “clearing agency” registered pursuant to the provisions of Section 17A of the Exchange Act. |

DTC holds securities that its participants deposit with DTC. DTC also facilitates the settlement among its participants of securities transactions, including transfers and pledges, in deposited securities through electronic computerized book-entry changes in participants’ accounts, which eliminates the need for physical movement of securities certificates. Direct participants include securities brokers and dealers, banks, trust companies, clearing corporations, and other organizations. DTC is a wholly owned subsidiary of The Depository Trust & Clearing Corporation, which we refer to as “DTCC.” DTCC is the holding company for DTC, National Securities Clearing Corporation and Fixed Income Clearing Corporation, all of which are registered clearing agencies. DTCC is owned by the users of its regulated subsidiaries. Access to the DTC system is also available to others, which we refer to in this prospectus as indirect participants, that clear transactions through or maintain a custodial relationship with a direct participant either directly or indirectly. Indirect participants include securities brokers and dealers, banks and trust companies. The rules applicable to DTC and its participants are on file with the SEC.

Purchases of debt securities within the DTC system must be made by or through direct participants, which will receive a credit for the debt securities on DTC’s records. The ownership interest of the actual purchaser or beneficial owner of a debt security is, in turn, recorded on the direct and indirect participants’ records. Beneficial owners will not receive written confirmation from DTC of their purchases, but beneficial owners are expected to receive written confirmations providing details of the transactions, as well as periodic statements of their holdings, from the direct or indirect participants through which they purchased the debt securities. Transfers of ownership interests in debt securities are to be accomplished by entries made on the books of participants acting on behalf of beneficial owners. Beneficial owners will not receive certificates representing their ownership interests in the debt securities except in the limited circumstances described below.

12

Table of Contents

To facilitate subsequent transfers, all debt securities deposited by participants with DTC will be registered in the name of DTC’s nominee, Cede & Co. The deposit of debt securities with DTC and their registration in the name of Cede & Co. will not change the beneficial ownership of the debt securities. DTC has no knowledge of the actual beneficial owners of the debt securities. DTC’s records reflect only the identity of the direct participants to whose accounts the debt securities are credited. Those participants may or may not be the beneficial owners. The participants are responsible for keeping account of their holdings on behalf of their customers.

Conveyance of notices and other communications by DTC to direct participants, by direct participants to indirect participants and by direct and indirect participants to beneficial owners will be governed by arrangements among them, subject to any legal requirements in effect from time to time.

Redemption notices shall be sent to DTC or its nominee. If less than all of the debt securities of a series are being redeemed, DTC will reduce the amount of the interest of direct participants in the debt securities in accordance with its procedures.

A beneficial owner of debt securities shall give notice to elect to have its debt securities repurchased or tendered, through its participant, to the Trustee and shall effect delivery of such debt securities by causing the direct participant to transfer the participant’s interest in such debt securities, on DTC’s records, to the Trustee. The requirement for physical delivery of debt securities in connection with a repurchase or tender will be deemed satisfied when the ownership rights in such debt securities are transferred by direct participants on DTC’s records and followed by a book-entry credit of such debt securities to the Trustee’s DTC account.

In any case where a vote may be required with respect to the debt securities of any series, neither DTC nor Cede & Co. will give consents for or vote such global debt securities. Under its usual procedures, DTC will mail an omnibus proxy to us as soon as possible after the record date. The omnibus proxy assigns the consenting or voting rights of Cede & Co. to those direct participants to whose accounts the debt securities are credited on the record date identified in a listing attached to the omnibus proxy.

Principal of and premium, if any, and interest, if any, on the global debt securities will be paid to Cede & Co., as nominee of DTC. DTC’s practice is to credit direct participants’ accounts on the relevant payment date unless DTC has reason to believe that it will not receive payments on the payment date. Payments by direct and indirect participants to beneficial owners will be governed by standing instructions and customary practices, as is the case with securities held for the account of customers in bearer form or registered in “street name.” Those payments will be the responsibility of participants and not of DTC or us, subject to any legal requirements in effect from time to time. Payment of principal, premium, if any, and interest, if any, to Cede & Co. is our responsibility, disbursement of payments to direct participants is the responsibility of DTC, and disbursement of payments to the beneficial owners is the responsibility of direct and indirect participants.

Except as described in this prospectus and any applicable prospectus supplement, owners of beneficial interests in a global debt security will not be entitled to have debt securities registered in their names and will not receive physical delivery of debt securities. Accordingly, each beneficial owner must rely on the procedures of DTC to exercise any rights under the debt securities and the Indenture.

The laws of some jurisdictions may require that some purchasers of securities take physical delivery of securities in definitive form. These laws may impair the ability to transfer or pledge beneficial interests in global debt securities.

DTC is under no obligation to provide its services as depositary for the debt securities of any series and may discontinue providing its services at any time. Neither we nor the Trustee will have any responsibility for the performance by DTC or its direct or indirect participants under the rules and procedures governing DTC. As noted above, owners of beneficial interests in a global debt security will not receive certificates representing their

13

Table of Contents

interests. However, we will prepare and deliver certificates for the debt securities of that series in exchange for beneficial interests in the global debt securities if:

| • | DTC notifies us that it is unwilling or unable to continue as a depositary for the global debt securities of any series or if DTC ceases to be a clearing agency registered under the Exchange Act and a successor depositary is not appointed by us within 90 days after the notification or of our becoming aware of DTC’s ceasing to be so registered, as the case may be; |

| • | we determine, in our sole discretion, not to have the debt securities of any series represented by one or more global debt securities; or |

| • | an Event of Default has occurred and is continuing with respect to the debt securities of any series, and DTC wishes to exchange such global debt securities for definitive certificated debt securities. |

Any beneficial interest in a global debt security that is exchangeable under the circumstances described in the preceding sentence will be exchangeable for debt securities in definitive certificated form registered in the names that the depositary shall direct. It is expected that these directions will be based upon directions received by the depositary from its participants with respect to ownership of beneficial interests in the global debt securities.

We obtained the information in this section and elsewhere in this prospectus concerning DTC and DTC’s book-entry system from sources that we believe to be reliable, but neither we nor any applicable underwriters, agents or dealers take any responsibility for the accuracy of this information.

Outstanding Debt Securities

In determining whether the holders of the requisite principal amount of outstanding debt securities have given any request, demand, authorization, direction, notice, consent, or waiver under the Indenture:

| • | the principal amount of an original issue discount security that shall be deemed to be outstanding for these purposes shall be that portion of the principal amount of the original issue discount security that would be due and payable upon acceleration of the original issue discount security as of the date of the determination; |

| • | the principal amount of any Indexed Security that shall be deemed to be outstanding for these purposes shall be the principal amount of the Indexed Security determined on the date of its original issuance; |

| • | the principal amount of a debt security denominated in a foreign currency shall be the U.S. dollar equivalent, determined on the date of its original issuance, of the principal amount of the debt security; and |

| • | a debt security owned by us or any obligor on the debt security or any affiliate of ours or such other obligor shall be deemed not to be outstanding. |

Redemption and Repurchase

The debt securities of any series may be redeemable at our option or may be subject to mandatory redemption by us as required by a sinking fund or otherwise. In addition, the debt securities of any series may be subject to repurchase by us at the option of the holders. The applicable prospectus supplement will describe the terms and conditions regarding any optional or mandatory redemption or option to repurchase the debt securities of the related series.

Exchange

The terms and conditions, if any, on which debt securities of any series are convertible into or exchangeable for shares of our Class A common stock or other securities or property will be set forth in the applicable prospectus supplement.

14

Table of Contents

Certain Covenants

Any material covenants applicable to the debt securities of any series will be specified in the applicable prospectus supplement.

Events of Default

Unless otherwise specified in the applicable prospectus supplement, an Event of Default with respect to the debt securities of any series is defined in the Indenture as being:

| (1) | failure to pay interest for 30 days after the date payment is due and payable on any debt security of that series; |

| (2) | failure to pay principal or premium, if any, on any debt security of that series when due, either at maturity, upon any redemption, by declaration or otherwise; |

| (3) | failure to make any sinking fund payment or payment under any analogous provision when due with respect to any debt security of that series; |

| (4) | failure to perform any other covenant for 60 days after notice of such performance was required; |

| (5) | specified events of bankruptcy, insolvency, or reorganization with respect to us; or |

| (6) | any other Event of Default established for the debt securities of that series. |

No Event of Default with respect to any particular series of debt securities necessarily constitutes an Event of Default with respect to any other series of debt securities. The Trustee is required to give notice to holders of the debt securities of any series within 90 days after the Trustee has knowledge of a default relating to such debt securities; provided, however, that the Trustee may withhold such notice except a default in payment of principal, premium, if any, interest, if any, Additional Amounts, if any, or sinking fund payments, if any, in respect of such debt securities or a default or in the delivery of securities or property upon exchange of such debt securities in accordance with their terms, if the Trustee, in good faith, determines it is in the best interest of such holders to do so.

If an Event of Default specified in clause (5) above occurs with respect to us and is continuing, then the principal of all the debt securities and interest, if any, thereon shall automatically become immediately due and payable. If any other Event of Default with respect to the debt securities of any series occurs and is continuing, either the Trustee or the holders of at least 25% in aggregate principal amount of the debt securities of that series then outstanding may declare the principal of, or if debt securities of that series are original issue discount securities, such lesser amount as may be specified in the terms of that series of debt securities, and interest, if any, thereon to be due and payable immediately. However, upon specified conditions, the holders of a majority in aggregate principal amount of the debt securities of that series then outstanding may rescind and annul any such acceleration and its consequences.

The Indenture provides that no holders of debt securities of any series may institute any proceedings, judicial or otherwise, with respect to the Indenture, or for the appointment of a receiver or Trustee, or for any remedy thereunder, except in the case of failure of the Trustee, for 60 days, to act after it has received a written request to institute proceedings in respect of an Event of Default from the holders of at least 25% in aggregate principal amount of the outstanding debt securities of that series, as well as an offer of indemnity reasonably satisfactory to it, and no inconsistent direction has been given to the Trustee during such 60-day period by the holders of a majority in aggregate principal amount of the debt securities of that series. Notwithstanding any other provision of the Indenture, the holder of a debt security will have the right, which is absolute and unconditional, to receive payment of the principal of and premium, if any, and interest, if any, and Additional Amounts, if any, on that debt security on the respective due dates for those payments and, in the case of any debt security which is convertible into or exchangeable for shares of our Class A common stock or other securities or

15

Table of Contents

property, to convert or exchange that debt security in accordance with its terms, and to institute suit for the enforcement of those payments and any right to effect such conversion or exchange, and this right shall not be impaired without the consent of such holder.

Subject to the provisions of the Trust Indenture Act requiring the Trustee, during the continuance of an Event of Default under the Indenture, to act with the requisite standard of care, the Trustee is under no obligation to exercise any of its rights or powers under the Indenture at the request or direction of any of the holders of debt securities of any series unless those holders have offered the Trustee indemnity reasonably satisfactory to it. The holders of a majority in aggregate principal amount of the outstanding debt securities of any series will have the right to direct the time, method and place of conducting any proceeding for any remedy available to the Trustee, or of exercising any trust or power conferred upon the Trustee.

Within 120 days after the close of each fiscal year, we must deliver to the Trustee an officers’ certificate stating whether or not each certifying officer has knowledge of any default under the Indenture and, if so, specifying each such default and the nature and status thereof.

Modification, Waivers, and Meetings

The Indenture permits us and the Trustee, with the consent of the holders of a majority in aggregate principal amount of the outstanding debt securities of each series issued under the Indenture and affected by a modification or amendment (voting as separate classes), to modify or amend any of the provisions of the Indenture or of the debt securities of the applicable series or the rights of the holders of the debt securities of the applicable series under the Indenture. However, without, in each case, obtaining the consent of the holder of each outstanding debt security affected by a modification or amendment, no such modification or amendment shall:

| • | change the stated maturity of the principal of, or premium, if any, or any installment of interest, if any, on, or any Additional Amounts, if any, with respect to any debt securities; |

| • | reduce the principal of or any premium on any debt securities or reduce the rate (or modify the calculation of such rate) of interest on or the redemption or repurchase price of any debt securities, or any Additional Amounts, if any, with respect to any debt securities, or change our obligation to pay any Additional Amounts; |

| • | reduce the amount of principal of any original issue discount securities that would be due and payable upon acceleration of the maturity of any debt securities; |

| • | adversely affect any right of repayment or repurchase at the option of any holder; |

| • | change any subordination provisions applicable to any debt securities; |

| • | change any place where or the currency in which any debt securities are payable; |

| • | adversely affect the right, if any, of holders to convert or exchange any debt securities for shares of our Class A common stock or other securities or property in accordance with their terms; |

| • | impair the holder’s right to institute suit to enforce the payment of any debt securities on or after their stated maturity or the right to convert or exchange any debt securities for shares of our Class A common stock or other securities or property in accordance with their terms; |

| • | reduce the percentage of the outstanding debt securities of any series whose holders must consent to any modification or amendment or any waiver of compliance with specific provisions of the Indenture or specified defaults under the Indenture and their consequences; or |

| • | reduce the requirements for a quorum or voting at a meeting of holders of the applicable debt securities. |

16

Table of Contents

The Indenture also contains provisions permitting us and the Trustee, without the consent of the holders of any debt securities, to modify or amend the Indenture, among other things:

| • | to add to the Events of Default or covenants in a manner that benefits the holders of all or any series of debt securities issued under the Indenture; |

| • | to provide for security of debt securities of any series or add guarantees; |

| • | to add to or change any provisions of the Indenture to facilitate the issuance of bearer securities; |

| • | to establish the form or terms of debt securities of any series and any related coupons; |

| • | to cure any ambiguity or correct or supplement any provision in the Indenture which may be defective or inconsistent with other provisions in the Indenture, or to make any other provisions with respect to matters or questions arising under the Indenture, or to make any change necessary to comply with any requirement of the SEC in connection with the Indenture under the Trust Indenture Act, in each case which shall not adversely affect the interests of the holders of any series of debt securities; |

| • | to amend or supplement any provision contained in the Indenture, provided that the amendment or supplement does not apply to any outstanding debt securities issued before the date of the amendment or supplement and entitled to the benefits of that provision; or |

| • | to conform the terms of the Indenture or the debt securities to the description thereof contained in any prospectus or any applicable prospectus supplement relating to the offer and sale of those debt securities. |

The holders of a majority in aggregate principal amount of the outstanding debt securities of any series may waive our compliance with some of the restrictive provisions of the Indenture, which may include covenants, if any, which are specified in the applicable prospectus supplement. The holders of a majority in aggregate principal amount of the outstanding debt securities of any series may, on behalf of all holders of debt securities of that series, waive any past default under the Indenture with respect to the debt securities of that series and its consequences, except a default (i) in the payment of the principal of, or premium, if any, or interest, if any, on the debt securities of that series, (ii) in the delivery of shares of our Class A common stock or other securities or property upon the conversion or exchange of any debt securities of that series in accordance with their terms, or (iii) in respect of a covenant or provision which cannot be modified or amended without the consent of the holder of each outstanding debt security of the affected series.