UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

Commission File Number:

(Name of registrant in its charter)

| ||

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| ||

(Address of principal executive offices) | (Zip Code) |

( |

| |

(Issuer’s telephone number) |

(Former name, former address and former fiscal year, if changed since last report) |

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

| Trading Symbol(s) |

| Name of each exchange on which registered |

The |

Indicate by check mark whether the registrant (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by checkmark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” accelerated filer”, “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ | |

☒ | Smaller reporting company | |||

Emerging growth company | ||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

The registrant had

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

MARKER THERAPEUTICS, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

| June 30, |

| December 31, | |||

| 2024 | 2023 | ||||

ASSETS | ||||||

Current assets: | ||||||

Cash and cash equivalents | $ | | $ | | ||

Prepaid expenses and deposits | | | ||||

Other receivables | | | ||||

Total current assets |

| |

| | ||

Total assets | $ | | $ | | ||

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

| ||

Current liabilities: |

|

|

|

| ||

Accounts payable and accrued liabilities | $ | | $ | | ||

| | |||||

Total current liabilities | | | ||||

Total liabilities |

| |

| | ||

Stockholders’ equity: |

|

| ||||

Preferred stock, $ | ||||||

Common stock, $ | | | ||||

Additional paid-in capital |

| |

| | ||

Accumulated deficit |

| ( |

| ( | ||

Total stockholders’ equity |

| |

| | ||

Total liabilities and stockholders’ equity | $ | | $ | | ||

See accompanying notes to these unaudited condensed consolidated financial statements.

1

MARKER THERAPEUTICS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(UNAUDITED)

| For the Three Months Ended |

| For the Six Months Ended | |||||||||

June 30, |

| June 30, | ||||||||||

| 2024 |

| 2023 |

| 2024 |

| 2023 | |||||

Revenues: | ||||||||||||

Grant income | $ | | $ | | $ | | $ | | ||||

Total revenues |

| |

| |

| |

| | ||||

Operating expenses: | ||||||||||||

Research and development | | | | | ||||||||

General and administrative |

| |

| |

| |

| | ||||

Total operating expenses |

| |

| |

| |

| | ||||

Loss from operations |

| ( |

| ( |

| ( |

| ( | ||||

Other income (expenses): |

|

|

|

| ||||||||

Interest income |

| |

| |

| |

| | ||||

Loss from continuing operations | ( | ( | ( | ( | ||||||||

Discontinued operations: |

| |||||||||||

Loss from discontinued operations, net of tax | — | ( | — | ( | ||||||||

Gain on disposal of discontinued operations before income taxes |

| — |

| |

| — |

| | ||||

Income from discontinued operations | — | | — | | ||||||||

Net (loss) income | $ | ( | $ | | $ | ( | $ | ( | ||||

|

|

| ||||||||||

Net (loss) earnings per share: |

|

| ||||||||||

Loss from continuing operations, basic and diluted | $ | ( | $ | ( | $ | ( | $ | ( | ||||

Income from discontinued operations, basic and diluted | $ | — | $ | | $ | — | $ | | ||||

Net (loss) earnings per share | $ | ( | $ | | $ | ( | $ | ( | ||||

|

|

| ||||||||||

Weighted average number of common shares outstanding: | ||||||||||||

Basic | | | | | ||||||||

Diluted | | | | | ||||||||

See accompanying notes to these unaudited condensed consolidated financial statements.

2

MARKER THERAPEUTICS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(UNAUDITED)

For the Three Months Ended June 30, 2024 | ||||||||||||||

|

|

|

| Total | ||||||||||

Common Stock | Additional Paid- | Accumulated | Stockholders’ | |||||||||||

Shares |

| Par value | in Capital | Deficit | Equity | |||||||||

Balance at April 1, 2024 |

| | $ | | $ | | $ | ( | $ | | ||||

Shares purchased pursuant to ATM agreement | | | | — | | |||||||||

Issuance of common stock from exercise of stock options | | | | — | | |||||||||

Stock-based compensation |

| — |

| — |

| |

| — |

| | ||||

Net loss | — | — | — | ( | ( | |||||||||

Balance at June 30, 2024 |

| | $ | | $ | | $ | ( | $ | | ||||

For the Six Months Ended June 30, 2024 | ||||||||||||||

Total | ||||||||||||||

Common Stock | Additional Paid- | Accumulated | Stockholders’ | |||||||||||

| Shares |

| Par value |

| in Capital |

| Deficit |

| Equity | |||||

Balance at January 1, 2024 | | $ | | $ | | $ | ( | $ | | |||||

Shares purchased pursuant to ATM agreement | | | | — | | |||||||||

Issuance of common stock from exercise of stock options | | | | — | | |||||||||

Stock-based compensation | — | — | | — | | |||||||||

Net loss | — | — | — | ( | ( | |||||||||

Balance at June 30, 2024 | | $ | | $ | | $ | ( | $ | | |||||

For the Three Months Ended June 30, 2023 | ||||||||||||||

Total | ||||||||||||||

Common Stock | Additional Paid- | Accumulated | Stockholders’ | |||||||||||

| Shares |

| Par value |

| in Capital |

| Deficit |

| Equity | |||||

Balance at April 1, 2023 | | $ | | $ | | $ | ( | $ | | |||||

Issuance of common stock from exercise of stock options | | — | | — | | |||||||||

Stock-based compensation | — | — | | — | | |||||||||

Net loss | — | — | — | | | |||||||||

Balance at June 30, 2023 | | $ | | $ | | $ | ( | $ | | |||||

For the Six Months Ended June 30, 2023 | ||||||||||||||

| Total | |||||||||||||

Common Stock | Additional Paid- | Accumulated | Stockholders’ | |||||||||||

| Shares |

| Par value |

| in Capital |

| Deficit |

| Equity | |||||

Balance at January 1, 2023 |

| | $ | | $ | | $ | ( | $ | | ||||

Issuance of common stock for cash | | | | — | | |||||||||

Issuance of common stock as commitment fee for future financing | | | ( | — | — | |||||||||

Issuance of common stock from exercise of stock options | | — | | — | | |||||||||

Stock-based compensation | — |

| — |

| |

| — |

| | |||||

Net loss |

| — |

| — |

| — |

| ( |

| ( | ||||

Fractional shares adjustment due to reverse split | ( | — | — | — | — | |||||||||

Balance at June 30, 2023 |

| | $ | | $ | | $ | ( | $ | | ||||

See accompanying notes to these unaudited condensed consolidated financial statements.

3

MARKER THERAPEUTICS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

For the Six Months Ended | ||||||

June 30, | ||||||

| 2024 |

| 2023 | |||

Cash Flows from Operating Activities: | ||||||

Net loss | $ | ( | $ | ( | ||

Less: gain from discontinued operations, net of tax | — | | ||||

Net loss from continuing operations | ( | ( | ||||

Reconciliation of net loss to net cash used in operating activities: |

|

|

|

| ||

Stock-based compensation | | | ||||

Changes in operating assets and liabilities: |

|

| ||||

Prepaid expenses and deposits |

| ( |

| ( | ||

Other receivables | ( | | ||||

Related party payable |

| ( |

| — | ||

Accounts payable and accrued expenses | ( | | ||||

Net cash used in operating activities - continuing operations | ( | ( | ||||

Net cash used in operating activities - discontinued operations | — | ( | ||||

Net cash used in operating activities |

| ( |

| ( | ||

Cash Flows from Investing Activities: |

|

|

|

| ||

Net cash provided by investing activities - discontinued operations | — | | ||||

Net cash provided by investing activities | — | | ||||

Cash Flows from Financing Activities: |

|

|

|

| ||

Proceeds from issuance of common stock, net |

| |

| | ||

Proceeds from stock options exercise | | | ||||

Net cash provided by financing activities |

| |

| | ||

Net (decrease) increase in cash and cash equivalents |

| ( |

| | ||

Cash and cash equivalents at beginning of the period |

| |

| | ||

Cash and cash equivalents at end of the period | $ | | $ | | ||

| For the Six Months Ended | |||||

June 30, | ||||||

| 2024 |

| 2023 | |||

Supplemental schedule of non-cash financing and investing activities: | ||||||

Changes between assets and liabilities in discontinued operations | $ | — | $ | | ||

Issuance of common stock as commitment fee for future financing | $ | — | | |||

See accompanying notes to these unaudited condensed consolidated financial statements.

4

MARKER THERAPEUTICS, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

June 30, 2024

(Unaudited)

NOTE 1: NATURE OF OPERATIONS

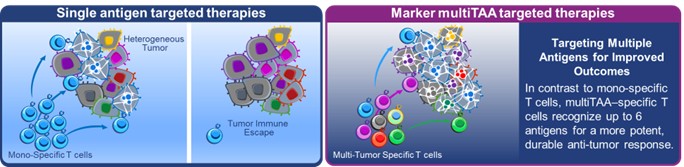

Marker Therapeutics, Inc., a Delaware corporation (the “Company” or “we”), is a clinical-stage immuno-oncology company specializing in the development and commercialization of novel T cell-based immunotherapies for the treatment of hematological malignancies and solid tumor indications. The Company’s multi tumor associated antigen (multiTAA”)-specific T cell technology is based on the selective expansion of non-engineered, tumor-specific T cells that recognize tumor associated antigens, which are tumor targets, and kill tumor cells expressing those targets. These T cells are designed to recognize multiple tumor targets to produce broad spectrum anti-tumor activity. The Company was incorporated in Nevada in 1992 and reincorporated in Delaware in October 2018.

Purchase Agreement with Cell Ready

On June 26, 2023, the Company completed the previously announced transaction with Cell Ready, LLC (“Cell Ready”) pursuant to a Purchase Agreement (the “Cell Ready Purchase Agreement), dated May 1, 2023, by and between the Company and Cell Ready. Mr. John Wilson is a member of the Company’s board of directors and is serving as the CEO of Cell Ready, therefore Cell Ready is a related party. Pursuant to the Cell Ready Purchase Agreement, effective as of the Closing Date, the Company (i) assigned to Cell Ready the leases for the Company’s two manufacturing facilities in Houston, Texas (the “Manufacturing Facilities”), (ii) sold to Cell Ready all of the equipment and leasehold improvements at the Manufacturing Facilities and (iii) assigned to Cell Ready its rights, title and interest in the Company’s Master Services Agreement for Product Supply (the “MSA”), dated April 7, 2023, by and between the Company, Cell Ready and Indapta Therapeutics, Inc., as well as its rights, title and interest in any contracts related to the equipment and Manufacturing Facilities (collectively, the “Purchased Assets”). Cell Ready acquired the Purchased Assets for total consideration of $

The Purchased Assets constituted a significant disposition. Based upon the magnitude of the disposition and because the Company is exiting certain manufacturing operations, the disposition represents a significant strategic shift that will have a material effect on the Company’s operations and financial results. Accordingly, the assets sold meet the definition of a discontinued operation, as defined by Accounting Standards Codification (“ASC”) 205-20 – Discontinued Operations, and prior comparative periods have been retroactively adjusted to reflect the current presentation. See additional discussion at Note 7.

On February 22, 2024, we entered into a Master Services Agreement for Product Supply (the “MSA”) with Cell Ready to provide outsourced services previously performed by the Company prior to its asset sale to Cell Ready. Cell Ready, which is owned by one of our directors and shareholders, Mr. John Wilson, is a contract development and manufacturing organization (CDMO). Under the MSA, it is anticipated Cell Ready will perform a wide variety of services for us, including research and development, and manufacturing in support of our clinical trials. Pursuant to the MSA, the Company may contract with Cell Ready for the provision of various products and services from time to time by entering into work orders with Cell Ready. If the services involve the supply of product, Cell Ready is required to supply such product in conformance with the product requirements set forth in the applicable work order(s). Under the MSA, Cell Ready is to use only personnel with sufficient qualifications and experience to supply the services contemplated by the MSA, provide its personnel with adequate training and assume full responsibility for its personnel’s compliance with the MSA. Further, Cell Ready is required to provide the Company with assistance and cooperation in order for the Company to obtain and maintain all necessary regulatory approvals, at the Company’s expense.

5

Organizational Changes

In 2023, the Company implemented changes to its organizational structure due to the transaction with Cell Ready and to reduce operational costs. In connection with these changes, the Company reduced headcount, including the separation of its former Chief Executive Officer, Peter Hoang, in May 2023, and its former Chief Accounting Officer, Michael Loiacono, in June 2023. During the second quarter of 2023, the Company recorded $

Effective June 30, 2023, the board of directors appointed Eliot M. Lurier as the Company’s Interim Chief Financial Officer, whereby Mr. Lurier provided consulting services to the Company pursuant to a consulting agreement between the Company and Danforth Advisors, LLC (“Danforth”) and received no compensation directly from the Company. On November 17, 2023, the Company terminated the consulting agreement between the Company and Danforth, effective January 16, 2024.

On November 17, 2023, Mr. Lurier ceased serving as the Company’s Interim Chief Financial Officer and Dr. Vera was appointed as the Company’s Principal Financial and Accounting Officer.

Reverse Stock Split

On January 26, 2023, the Company effected a one-for-ten (

NOTE 2: BASIS OF PRESENTATION

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with the accounting principles generally accepted in the United States of America (“U.S. GAAP”) for interim financial information and pursuant to the instructions to Form 10-Q and Article 8 of Regulation S-X of the Securities and Exchange Commission (“SEC”) and on the same basis as the Company prepares its annual audited consolidated financial statements. In the opinion of management, the accompanying unaudited condensed consolidated financial statements reflect all adjustments, consisting of normal recurring adjustments, considered necessary for a fair presentation of such interim results (see Note 7 for information on discontinued operations).

The results for the unaudited condensed consolidated statement of operations are not necessarily indicative of results to be expected for the year ending December 31, 2024, or for any future interim period. The condensed consolidated balance sheet at December 31, 2023 has been derived from audited financial statements, however, it does not include all of the information and notes required by U.S. GAAP for complete financial statements. The accompanying condensed consolidated financial statements should be read in conjunction with the consolidated financial statements for the year ended December 31, 2023 and notes thereto included in the Company’s annual report on Form 10-K filed on March 26, 2024.

6

NOTE 3: LIQUIDITY AND FINANCIAL CONDITION

As of June 30, 2024, the Company had cash and cash equivalents of approximately $

In August 2021, the Company received notice of a Product Development Research award totaling approximately $

In September 2022, the Company received notice from the U.S. Food and Drug Administration (the “FDA”) that it had awarded the Company a $

In May 2023, the Company received notice of a $

In June 2024, the Company received notice of a $

As described in Note 1, on June 26, 2023, the Company completed the transaction with Cell Ready pursuant to the Cell Ready Purchase Agreement for total consideration of $

7

of our clinical trials. Pursuant to the MSA, the Company may contract with Cell Ready for the provision of various products and services from time to time by entering into work orders with Cell Ready (See Note 13).

The Company expects to continue to incur substantial losses over the next several years during its development phase.

Based on the Company’s clinical and research and development plans and its timing expectations related to the progress of its programs, the Company expects that its cash and cash equivalents as of June 30, 2024, including drawdowns of available grant funds, will enable the Company to fund its operating expenses and capital expenditure requirements into the fourth quarter of 2025. Prior to the Cell Ready transaction, there was substantial doubt regarding the Company’s ability to continue as a going concern, which was alleviated by the proceeds from the transaction.

The Company has based this estimate on assumptions that may prove to be wrong, and the Company could utilize its available capital resources sooner than it currently expects. Furthermore, the Company’s operating plan may change, and it may need additional funds sooner than planned in order to meet operational needs and capital requirements for product development and commercialization. Because of the numerous risks and uncertainties associated with the development and commercialization of the Company’s product candidates and the extent to which the Company may enter into additional collaborations with third parties to participate in their development and commercialization, the Company is unable to estimate the amounts of increased capital outlays and operating expenditures associated with its current and anticipated clinical trials. The Company’s future funding requirements will depend on many factors, as it:

| ● | initiates or continues clinical trials of its product candidates; |

| ● | continues the research and development of its product candidates and seeks to discover additional product candidates; |

| ● | seeks regulatory approvals for any product candidates that successfully complete clinical trials; |

| ● | maintains and enforces intellectual property rights; |

| ● | enters into contract manufacturing arrangements with Cell Ready or other contract manufacturing organizations for clinical manufacturing supply; |

| ● | establishes sales, marketing and distribution infrastructure and scale-up manufacturing capabilities to commercialize any product candidates that may receive regulatory approval; |

| ● | evaluates strategic transactions the Company may undertake; and |

| ● | enhances operational, financial and information management systems and hires additional personnel, including personnel to support development of product candidates and, if a product candidate is approved, commercialization efforts. |

The Company has sufficient cash available to meet its operating requirements for at least the next twelve months from the issuance of these financial statements. However, the Company does not have sufficient sources of revenue to provide incoming cash flows to sustain its future operations beyond the third quarter of 2025. As outlined above, its ability to pursue its long-term planned business activities is dependent upon its successful efforts to raise additional capital and grant income.

The current macro-economic environment of decades-high inflation and concerns about an economic recession in the United States or other major markets have resulted in, among other things, volatility in the capital markets that may have the effect of reducing the Company’s ability to access capital, which could in the future negatively affect the Company’s liquidity. In addition, a recession or market correction due to these factors could materially affect the Company’s business and the value of its common stock.

8

NOTE 4: SIGNIFICANT ACCOUNTING POLICIES

Principles of Consolidation

These consolidated financial statements include the accounts of the Company and its wholly-owned subsidiaries, Marker Cell Therapy, Inc. and GeneMax Pharmaceuticals Inc. – a dormant subsidiary that wholly owns GeneMax Pharmaceuticals Canada, Inc. All significant intercompany balances and transactions are eliminated upon consolidation.

Use of Estimates

Preparation of the Company’s consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of expenses during the reporting period. Accordingly, actual results may differ materially from those estimates. Management considers many factors in selecting appropriate financial accounting policies, controls, and in developing the estimates and assumptions that are used in the preparation of these financial statements. Management must apply significant judgment in this process. In addition, other factors may affect estimates, including expected business and operational changes, sensitivity and volatility associated with the assumptions used in developing estimates, and whether historical trends are expected to be representative of future trends. The estimation process often may yield a range of potentially reasonable estimates of the ultimate future outcomes, and management must select an amount that falls within that range of reasonable estimates. Estimates are used in the following areas, among others: stock-based compensation expense and income taxes.

Cash, Cash Equivalents and Credit Risk

The Company considers highly liquid investments with a maturity of three months or less when purchased to be cash equivalents. Cash and cash equivalents at June 30, 2024 consisted of cash and certificates of deposit in institutions in the United States. Balances at certain institutions have exceeded Federal Deposit Insurance Corporation insured limits and U.S. government agency securities.

The Company maintains cash in accounts which are in excess of the Federal Deposit Insurance Corporation (“FDIC”) insured limits of $250,000. As of June 30, 2024, the Company had approximately $

In the event cash is received from grants in advance of incurring qualifying costs, it is recorded as restricted cash until it is earned and recorded to grant income.

Discontinued Operations

The Purchased Assets sold to Cell Ready pursuant to the Cell Ready Purchase Agreement constituted a significant disposition and as such, the Company concluded that the disposition of its Purchased Assets represented a strategic shift that had a major effect on its operations and financial results. Therefore, the Purchased Assets, related party revenue, service revenue and related expenses are classified as discontinued operations for all periods presented herein. See Note 7 for further information.

Recently Issued Accounting Standards Not Yet Adopted

Improvements to Reportable Segment Disclosures

In November 2023, the Financial Accounting Standards Board (the “FASB”) issued Accounting Standards Update (“ASU”) No. 2023-07, Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures. The ASU requires disclosures to include significant segment expenses that are regularly provided to the chief operating decision maker, among other provisions. The ASU is effective for fiscal year periods beginning after December15, 2023, and interim periods within fiscal years beginning after December 15, 2024. Early adoption is permitted, and the ASU requires retrospective application to all prior periods presented in the financial statements. The Company is currently evaluating the standard to determine the impact of adoption to its consolidated financial statements and disclosures.

9

Improvements to Income Tax Disclosures

In December 2023, the FASB issued ASU No. 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures (ASU 2023-09), which improves the transparency of income tax disclosures by requiring consistent categories and greater disaggregation of information in the effective tax rate reconciliation and income taxes paid disaggregated by jurisdiction. It also includes certain other amendments to improve the effectiveness of income tax disclosures. This guidance will be effective for the annual periods beginning the year ended December 31, 2025. Early adoption is permitted. Upon adoption the guidance can be applied prospectively or retrospectively. We do not expect the adoption of this guidance to have a material impact on the Company's consolidated financial statements.

From time to time, new accounting pronouncements are issued by the Financial Accounting Standards Board (“FASB”) or other standard setting bodies that the Company adopts as of the specified effective date. Unless otherwise discussed, the Company does not believe that the impact of recently issued standards that are not yet effective will have a material impact on its consolidated financial position or results of operations upon adoption.

There have been no material changes in the Company’s significant accounting policies to those previously disclosed in the Annual Report on Form 10-K for the year ended December 31, 2023 filed on March 26, 2024.

NOTE 5: NET LOSS PER SHARE

Basic loss per common share is computed by dividing net loss by the weighted average number of common shares outstanding during the reporting period. Diluted loss per common share is computed similarly to basic loss per common share except that it reflects the potential dilution that could occur if dilutive securities or other obligations to issue common stock were exercised or converted into common stock.

The following table sets forth the computation of net loss per share for the three and six months ended June 30, 2024 and 2023, respectively:

| For the Three Months Ended |

| For the Six Months Ended | |||||||||

June 30, |

| June 30, | ||||||||||

| 2024 |

| 2023 |

| 2024 |

| 2023 | |||||

Numerator: | ||||||||||||

Loss from continuing operations | $ | ( | $ | ( | $ | ( | $ | ( | ||||

Income from discontinued operations | $ | — | $ | | $ | — | $ | | ||||

Net (loss) income | $ | ( | $ | | $ | ( | $ | ( | ||||

|

| |||||||||||

Denominator: |

|

|

|

|

|

| ||||||

Weighted average common shares outstanding, basic |

| |

| |

| |

| | ||||

Weighted average common shares outstanding, diluted |

| |

| |

| |

| | ||||

|

| |||||||||||

Net earnings (loss) per share: |

|

|

|

|

|

| ||||||

Loss from continuing operations, basic and diluted | $ | ( | $ | ( | $ | ( | $ | ( | ||||

Income from discontinued operations, basic and diluted | $ | — | $ | | $ | — | $ | | ||||

Net (loss) income per share, basic and diluted | $ | ( | $ | | $ | ( | $ | ( | ||||

The following securities, rounded to the nearest thousand, were not included in the diluted net loss per share calculation because their effect was anti-dilutive for the periods presented:

For the Six Months Ended | ||||

June 30, | ||||

| 2024 |

| 2023 | |

Common stock options | |

| | |

Common stock purchase warrants | — |

| | |

Potentially dilutive securities | |

| | |

10

NOTE 6: OTHER RECEIVABLE

Qualifying grant income earned in advance of cash received from grants is recognized as revenue and recorded as other receivable. The Company recorded $

Additionally, the Company recorded $

In July 2024, the Company received payments of $

NOTE 7: DISCONTINUED OPERATIONS

As discussed in Note 1, on June 26, 2023, the Company completed the previously announced transaction with Cell Ready for cash consideration of $

The Company had no activity related to discontinued operations for the three and six months ended June 30, 2024. Net loss from discontinued operations for the three and six months ended June 30, 2023, was as follows:

| For the Three Months |

| For the Six Months | |||

Ended June 30, | Ended June 30, | |||||

2023 | 2023 | |||||

Revenues: | ||||||

Service Revenue | $ | | $ | | ||

Related party service revenue | — | | ||||

Total revenues |

| |

| | ||

Operating expenses: |

|

|

| |||

Research and development |

| |

| | ||

General and administrative | | | ||||

Total operating expenses | | | ||||

Loss from discontinued operations | $ | ( | $ | ( | ||

The following table summarizes our cash flows related to discontinued operations for the six months ended June 30, 2023:

For the Six Months | |||

Ended June 30, | |||

| 2023 | ||

Discontinued operations: |

| ||

Net cash used in operating activities |

| ( | |

Net cash provided by investing activities |

| | |

Net increase (decrease) in cash and cash equivalents | $ | | |

Related Party Service Revenue

In April 2022, the Company entered into a binding services agreement (“Wilson Wolf Agreement”) with Wilson Wolf Manufacturing Corporation (“Wilson Wolf”). Mr. John Wilson is a member of the Company’s board of directors and is serving as the CEO of Wilson Wolf. Wilson Wolf is in the business of creating products and services intended to simplify and expedite the transition of cell therapies and gene-modified cell therapies to mainstream society (the “Wilson Wolf Mission”). Pursuant to the Wilson Wolf Agreement, Wilson Wolf made a cash payment to the Company in the amount of $

11

In March 2023, the Company recognized the final $

NOTE 8: ACCOUNTS PAYABLE, ACCRUED LIABILITIES AND RELATED PARTY PAYABLE

Accounts payable, accrued liabilities, and related party payable consist of the following as of June 30, 2024 and December 31, 2023, respectively:

| June 30, |

| December 31, | |||

2024 | 2023 | |||||

Accounts payable | $ | | $ | | ||

Compensation and benefits |

| |

| | ||

Professional fees | | | ||||

Related party payable |

| |

| | ||

Tax fees |

| |

| | ||

Other |

| |

| | ||

Total accounts payable, accrued liabilities and related party payable | $ | | $ | | ||

The $

NOTE 9: STOCKHOLDERS’ EQUITY

Reverse Stock Split

On January 26, 2023, the Company effected the Reverse Stock Split and a corresponding reduction in the total number of authorized shares of its common stock from

Common Stock Transactions

Issuance of Stock Pursuant to ATM Agreement

During the six months ended June 30, 2024, the Company sold

Stock Purchase Agreement

In December 2022, the Company entered into a purchase agreement (the “Purchase Agreement”) with Lincoln Park which provides that, upon the terms and subject to the conditions of the agreement, the Company had the right, but not the obligation, to sell to Lincoln Park up to $

12

Exercise of Stock Options

During the six months ended June 30, 2024, certain outstanding options were exercised for

NOTE 10: STOCK-BASED COMPENSATION

Stock Options

2024 Equity Incentive Awards

There were

A summary of the Company’s stock option activity for the six months ended June 30, 2024 is as follows:

|

|

| Weighted Average | |||||||

Remaining | ||||||||||

Weighted Average | Contractual | |||||||||

| Number of Shares |

| Exercise Price |

| Total Intrinsic Value |

| Life (in years) | |||

Outstanding as of January 1, 2024 |

| | $ | | $ | | ||||

Exercised | ( | | — | — | ||||||

Canceled/Expired |

| ( | | — | — | |||||

Outstanding as of June 30, 2024 |

| | $ | | $ | | ||||

Options vested and exercisable |

| | $ | | $ | | ||||

The following table sets forth stock-based compensation expenses recorded during the respective periods:

| For the Three Months Ended |

| For the Six Months Ended | |||||||||

June 30, |

| June 30, | ||||||||||

| 2024 |

| 2023 |

| 2024 |

| 2023 | |||||

Stock Compensation expenses: |

|

|

|

|

|

|

| |||||

Research and development | $ | | $ | | $ | | $ | | ||||

General and administrative |

| |

| |

| |

| | ||||

Stock compensation in continuing operations | | | | | ||||||||

Stock compensation in discontinued operations | — | | — | | ||||||||

Total stock compensation expenses | $ | | $ | | $ | | $ | | ||||

As of June 30, 2024, the total stock-based compensation cost related to unvested awards not yet recognized was $

NOTE 11: GRANT INCOME

CPRIT

In August 2021, the Company received notice of a Product Development Research award totaling approximately $

If restricted cash received from grants in advance of incurring qualifying costs, it is recorded as deferred revenue and recognized as revenue when qualifying costs are incurred. There was

The Company recorded $

13

income earned in advance of funds to be received from CPRIT. In July 2024, the Company received $

FDA

In September 2022, the Company received notice from the FDA that it had awarded the Company a $

SBIR

In May 2023, the Company announced it had received a $

NOTE 12: LEGAL PROCEEDINGS

From time to time, the Company may be party to ordinary, routine litigation incidental to their business. The Company knows of no material, active or pending legal proceedings against the Company, nor is the Company involved as a plaintiff in any material proceeding or pending litigation. There are no proceedings in which any of the Company’s directors, officers or affiliates, or any registered or beneficial shareholder, is an adverse party or has a material interest adverse to the Company’s interest.

NOTE 13: RELATED PARTY EXPENSES

The following table sets forth related party transaction expenses recorded for the three and six months ended June 30, 2024 and 2023, respectively.

For the Three Months Ended |

| For the Six Months Ended | ||||||||||

June 30, |

| June 30, | ||||||||||

| 2024 |

| 2023 |

| 2024 |

| 2023 | |||||

Baylor College of Medicine | $ | | $ | | $ | | $ | | ||||

Cell Ready | | — | | — | ||||||||

Wilson Wolf Manufacturing Corporation | — | | — | | ||||||||

Total Research and development | $ | |

| $ | | $ | |

| $ | | ||

$

Agreements with The Baylor College of Medicine (“BCM”)

In November 2018, January 2020 and February 2020, the Company entered in Sponsored Research Agreements with BCM, which provided for the conduct of research for the Company by credentialed personnel at BCM’s Center for Cell and Gene Therapy.

In September 2019, May 2020 and July 2021, the Company entered into Clinical Supply Agreements with BCM, which provided for BCM to provide to the Company multi tumor antigen specific products.

In October 2019, the Company entered in a Workforce Grant Agreement with BCM, which provided for BCM to provide to the Company manpower costs of projects for manufacturing, quality control testing and validation run activities.

14

In August 2020, the Company entered into a Clinical Trial Agreement with BCM, which provided for BCM to provide to the Company investigator-initiated research studies.

The Company has also entered into a Clinical Site Agreement with BCM, which provided for BCM to conduct clinical trials for the Company and is a part of continuing operations.

BCM owns shares of the Company’s common stock.

Purchases from Wilson Wolf

In 2023, the Company utilized Wilson Wolf for the purchases of cell culture devices called G-Rexes. Mr. John Wilson is a member of the Company’s board of directors and is serving as the CEO of Wilson Wolf Manufacturing Corporation.

Purchases from Cell Ready, LLC

The Company is currently utilizing Cell Ready, LLC for its clinical manufacturing supply and product development. Mr. John Wilson is a member of the Company’s board of directors and is serving as the CEO of Cell Ready, LLC. On February 22, 2024, we entered into a Master Services Agreement for Product Supply (the “MSA”) with Cell Ready. Cell Ready, which is owned by one of our directors and shareholders, Mr. John Wilson, is a contract development and manufacturing organization (CDMO). Under the MSA, it is anticipated Cell Ready will perform a wide variety of services for us, including research and development, and manufacturing in support of our clinical trials. Pursuant to the MSA, the Company may contract with Cell Ready for the provision of various products and services from time to time by entering into work orders with Cell Ready. If the services involve the supply of product, Cell Ready is required to supply such product in conformance with the product requirements set forth in the applicable work order(s). Under the MSA, Cell Ready is to use only personnel with sufficient qualifications and experience to supply the services contemplated by the MSA, provide its personnel with adequate training and assume full responsibility for its personnel’s compliance with the MSA. Further, Cell Ready is required to provide the Company with assistance and cooperation in order for the Company to obtain and maintain all necessary regulatory approvals, at the Company’s expense.

During the six months ended June 30, 2024, the Company entered into Work Order #1 under the MSA, pursuant to which Cell Ready agreed to provide the Company with GMP drug product for Marker MT-401 and/or MT-601. The services include the delivery of final drug product and quality control testing. The Company also requested Cell Ready to provide general support services in connection therewith. During the three and six months ended June 30, 2024, the Company incurred $

NOTE 14: SUBSEQUENT EVENTS

On August 12, 2024, the Company issued a press release announcing it was awarded a $

15

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

This Quarterly Report on Form 10-Q contains forward-looking statements within the meaning of Section 21E of the Securities and Exchange Act of 1934, as amended, that involve risks and uncertainties. All statements other than statements relating to historical matters including statements to the effect that we “believe”, “expect”, “anticipate”, “plan”, “target”, “intend” and similar expressions should be considered forward-looking statements. Our actual results could differ materially from those discussed in the forward-looking statements as a result of a number of important factors, including factors discussed in this section and elsewhere in this Quarterly Report on Form 10-Q, and the risks discussed in our other filings with the SEC. Such risks and uncertainties may be amplified by the COVID-19 pandemic and its potential impact on our business and the global economy. Readers are cautioned not to place undue reliance on these forward-looking statements, which reflect management’s analysis, judgment, belief, or expectation only as the date hereof. We assume no obligation to update these forward-looking statements to reflect events or circumstance that arise after the date hereof.

As used in this quarterly report: (i) the terms “we”, “us”, “our”, “Marker” and the “Company” mean Marker Therapeutics, Inc. and its wholly owned subsidiaries, Marker Cell Therapy, Inc. and GeneMax Pharmaceuticals Inc. which wholly owns GeneMax Pharmaceuticals Canada Inc., unless the context otherwise requires; (ii) “SEC” refers to the Securities and Exchange Commission; (iii) “Securities Act” refers to the Securities Act of 1933, as amended; (iv) “Exchange Act” refers to the Securities Exchange Act of 1934, as amended; and (v) all dollar amounts refer to United States dollars unless otherwise indicated.

The following should be read in conjunction with our unaudited condensed consolidated interim financial statements and related notes included in this Quarterly Report on Form 10-Q.

Company Overview

We are a clinical-stage immuno-oncology company specializing in the development and commercialization of novel T cell-based immunotherapies for the treatment of hematological malignancies and solid tumor indications. Harnessing millions of years of immunologic evolution, Marker’s multi tumor associated antigen (“multiTAA”)-specific T cell technology is designed to recognize and kill highly heterogeneous tumors without the need for genetic modifications. This approach selectively expands natural tumor-specific T cells from a patient’s/donor’s blood that are capable of recognizing a broad range of tumor associated antigens, or TAAs. Unlike other T cell therapies, multiTAA-specific T cells are able to recognize hundreds of different epitopes within up to six tumor-specific antigens to produce broad spectrum anti-tumor activity. Targeting multiple antigens simultaneously exploits the natural capacity of T cells to recognize and kill tumor targets via native T cell receptors (“TCR”), while limiting tumor adaptation/escape by antigen-negative selection or antigen down-regulation. When infused into a patient with cancer, the multiTAA-specific T cells are designed to kill cancer cells expressing the TAA and potentially recruit the patient’s immune system to participate in the cancer killing process.

We licensed the underlying technology for multiTAA-specific T cell therapy from Baylor College of Medicine, or BCM, in March 2018. BCM had utilized the therapy in seven exploratory clinical trials. In these studies, BCM treated over 150 patients suffering from a variety of cancers including lymphoma, multiple myeloma, acute myeloid leukemia, or AML, acute lymphoblastic leukemia, or ALL, pancreatic cancer, breast cancer and various sarcomas. In those studies, BCM saw evidence of clinical benefit, expansion of infused cells, and decreased toxicity compared to other cellular therapies.

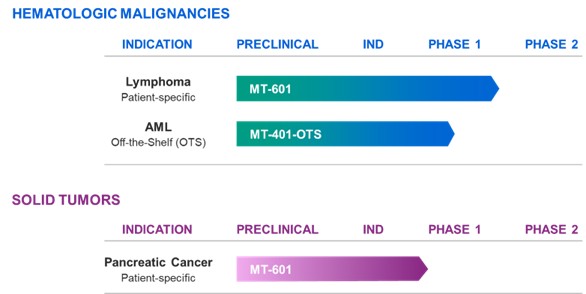

We are advancing two product candidates for 3 clinical indications as part of our multiTAA-specific T cell program for:

| ● | Autologous multiTAA product for the treatment of lymphoma and pancreatic cancer (MT-601) |

| ● | Off-the-Shelf (OTS) product in various indications (e.g., MT-401-OTS) |

We do not genetically engineer our multiTAA-specific T cell therapies and we believe that our product candidates are superior to T cells engineered with chimeric antigen receptors, or CAR-T, for several reasons including:

| ● | Multiple targets → enhanced tumoricidal effect→ minimized tumor immune escape |

16

| ● | Clinical safety → no treatment-related side effects, including cytokine release syndrome (CRS) or other severe adverse effects (SAEs), were attributed to the use of multiTAA-specific T cell therapies to date |

| ● | Non-genetically engineered T cell products → selective expansion of tumor-specific T cells from a patient’s or donor’s blood capable of recognizing a broad range of tumor antigens → no risk of mutagenesis and reduced manufacturing complexity → lower cost |

For these reasons, we believe our endogenous T cell receptor-based therapies may provide meaningful clinical benefit and safety to patients with both hematological and solid tumors.

We believe that the simplicity of our manufacturing process allows additional modifications to expand multiTAA-specific T cell recognition of cancer targets. For example, we are assessing the potential of combining multiTAA-specific T cell products with other products.

On April 8, 2024, we issued a press release announcing that Geoffrey Shouse, D.O., Ph.D., the Principal Investigator at City of Hope National Medical Center in Duarte, CA, was invited to present his clinical experience from the APOLLO study at the 11th Global Summit on Hematologic Malignancies in Whistler, BC, Canada (April 2-7, 2024). Dr. Shouse provided an overview on the clinical observations obtained at City of Hope on Saturday, April 6, 2024, and reported that study participants tolerated initial dose level well and demonstrated durable objective responses after MT-601 treatment.

17

Pipeline

Our clinical-stage pipeline is set forth below:

Recent Developments

On February 22, 2024, we entered into a Master Services Agreement for Product Supply (the “MSA”) with Cell Ready LLC (“Cell Ready”) to provide services previously performed by the company until the disposition of its contract development and manufacturing operations. Cell Ready, which is owned by one of our directors and shareholders, Mr. John Wilson, is a contract development and manufacturing organization (CDMO).

Pursuant to the MSA, the Company may contract with Cell Ready for the provision of various products and services from time to time by entering into work orders with Cell Ready. If the services involve the supply of product, Cell Ready is required to supply such product in conformance with the product requirements set forth in the applicable work order(s). The MSA contains customary representations, warranties and indemnification provision. The initial term of the MSA is three years and may be extended upon the mutual written agreement of the parties. Either party may terminate the MSA (a) for material breach by the other party if such breach has not been cured within 30 days following notice of termination or (b) if the other party is the subject of an insolvency event.

Under the MSA, Cell Ready is to use only personnel with sufficient qualifications and experience to supply the services contemplated by the MSA, provide its personnel with adequate training and assume full responsibility for its personnel’s compliance with the MSA. Further, Cell Ready is required to provide the Company with assistance and cooperation in order for the Company to obtain and maintain all necessary regulatory approvals, at the Company’s expense.

With regard to intellectual property, the MSA provides that each party will solely and exclusively own all right, title and interest in and to their Background IP and all inventions derived from such background IP (such invention being referred to as Foreground IP). Background IP means all intellectual property either (a) owned or controlled by a party prior to the effective date of the MSA or (b) developed or acquired by a party independently from performance under the MSA without the use of, reliance on, or access to the other parties confidential information. Furthermore, pursuant to the MSA, Cell Ready grants to the Company a non-exclusive, perpetual, irrevocable, transferable, assignable, fully-paid up, royalty-free, worldwide license to and under any of Cell Ready’s Background IP and Foreground IP to the extent they are incorporated or embedded in any deliverables provided to the Company or in the process of generating or manufacturing such deliverables and reasonably necessary or useful for the Company to make, have made, manufacture, have manufactured, use, have used, offer for sale, sell, import, and otherwise exploit such deliverables. The Company grants to Cell Ready until the termination or expiry of any applicable Work Order and for a period not exceeding the term of the MSA, a non-exclusive,

18

fully paid-up, non-transferable, non-sublicensable limited license under and to the Company’s Background IP made available to Cell Ready pursuant to a Work Order solely to the extent required for Cell Ready to provide the services under such Work Order.

During the three and six months ended June 30, 2024, the Company incurred $0.7 million and $1.8 million in expenses related to the services and manufacturing costs, and paid $0.7 million and $2.9 million related to invoices received, respectively. Additional Work Orders are expected to be generated for the remainder of 2024.

The above description of the MSA does not purport to be complete and is qualified in their entirety by reference to the full text of the MSA and Work Oder #1, copies of which are attached hereto as Exhibits 10.8 and 10.9 and are incorporated herein by reference. The MSA has been filed as an exhibit to the Company’s Annual Report on Form 10-K filed with the SEC on March 26, 2024, to provide investors with information regarding the terms of the MSA and is not intended to modify or supplement any factual disclosures about the Company in its public reports filed with the SEC. In particular, the MSA is not intended to be, and should not be relied upon as, disclosure regarding any facts and circumstances relating to the Company. The representations, warranties, and covenants contained in the MSA have been made solely for the purposes of the MSA and as of specific dates; were solely for the benefit of the parties to the MSA; are not intended as statements of fact to be relied upon by the parties’ shareholders; may no longer be true as of a given date; and may apply standards of materiality in a way that is different from what may be viewed as material by shareholders. Security holders are not third-party beneficiaries under the MSA and should not rely on the representations, warranties, and covenants or any descriptions thereof as characterizations of any actual state of facts or of the condition of the Company.

Organizational Changes

In 2023, the Company implemented changes to its organizational structure due to the transaction with Cell Ready and to reduce operational costs. In connection with these changes, the Company reduced headcount, including the separation of its former Chief Executive Officer, Peter Hoang, in May 2023 and its former Chief Accounting Officer, Michael Loiacono, in June 2023. During the second quarter of 2023, the Company recorded $0.9 million of severance and termination-related costs. The payments of these costs were completed in July of 2023. Effective May 1, 2023, the Company’s board of directors appointed Dr. Juan Vera as the Company’s President and Chief Executive Officer.

Effective June 30, 2023, the board of directors appointed Eliot M. Lurier as the Company’s Interim Chief Financial Officer, whereby Mr. Lurier provided consulting services to the Company pursuant to a consulting between the Company and Danforth Advisors, LLC (“Danforth”) and received no compensation directly from the Company. On November 17, 2023, the Company terminated the consulting agreement between the Company and Danforth, effective January 16, 2024.

On November 17, 2023, Mr. Lurier ceased serving as the Company’s Interim Chief Financial Officer and Dr. Vera was appointed as the Company’s Principal Financial and Accounting Officer.

Reverse Stock Split

On January 26, 2023, the Company effected a one-for-ten (1-for-10) reverse stock split of its common stock (the “Reverse Stock Split”) and a corresponding reduction in the total number of authorized shares of its common stock from 300,000,000 to 30,000,000. The Reverse Stock Split, which was approved by stockholders at an annual stockholder meeting on May 24, 2022, was consummated pursuant to a Certificate of Amendment filed with the Secretary of State of Delaware on January 26, 2023. The Reverse Stock Split was effective on January 26, 2023. All references to common stock, warrants to purchase common stock, options to purchase common stock, share data, per share data and related information contained in the consolidated financial statements have been retrospectively adjusted to reflect the effect of the Reverse Stock Split for all periods presented.

Results of Operations

In this discussion of our results of operations and financial condition, amounts in financial tables, other than per-share amounts, have been rounded to the nearest thousand.

Comparison of the Three months Ended June 30, 2024 and 2023

The following table summarizes the results of our continuing operations for the three months ended June 30, 2024 and 2023:

19

For the Three Months Ended | ||||||||||||

June 30, |

|

| ||||||||||

| 2024 |

| 2023 |

| Change |

| ||||||

Revenues: |

|

|

|

|

|

|

| |||||

Grant income | $ | 1,169,000 | $ | 763,000 | $ | 406,000 |

| 53 | % | |||

Total revenues |

| 1,169,000 |

| 763,000 |

| 406,000 |

| 53 | % | |||

Operating expenses: |

|

|

|

|

|

| ||||||

Research and development |

| 2,335,000 |

| 2,378,000 |

| (43,000) |

| (2) | % | |||

General and administrative |

| 1,142,000 |

| 2,519,000 |

| (1,377,000) |

| (55) | % | |||

Total operating expenses |

| 3,477,000 |

| 4,897,000 |

| (1,420,000) |

| (29) | % | |||

Loss from operations |

| (2,308,000) |

| (4,134,000) |

| 1,826,000 |

| (44) | % | |||

Other income (expenses): |

|

|

|

|

|

|

| |||||

Interest income |

| 115,000 |

| 35,000 |

| 80,000 |

| 229 | % | |||

Loss from continuing operations | $ | (2,193,000) | (4,099,000) | $ | 1,906,000 |

| (46) | % | ||||

Revenue

We did not generate any revenue during the three months ended June 30, 2024 and 2023, respectively, from the sales or licensing of our product candidates.

In August 2021, we received notice of a Product Development Research award totaling approximately $13.1 million from the Cancer Prevention and Research Institute of Texas (“CPRIT”) to support the clinical investigation of MT-401. During the three months ended June 30, 2024 and 2023, we recognized $0.7 million and $0.7 million of revenue, respectively, associated with the CPRIT grant.

In September 2022, we received notice from the FDA that it had awarded us a $2.0 million grant from the FDA’s Orphan Products Grant program to support the clinical investigation of MT-401 for the treatment of post-transplant AML. During the three months ended June 30, 2024 and 2023, we recognized $0.2 million and $0.1 million of revenue, respectively associated with the FDA grant.

In May 2023, we received notice of a $2.0 million grant from the National Institutes of Health Small Business Innovation Research (“SBIR”) program to support the development and investigation of MT-401 for the treatment of AML patients following standard-of-care therapy with hypomethylating agents. During the three months ended June 30, 2024, we recognized $0.2 million of revenue associated with the SBIR grant. During the three months ended June 30, 2023, no revenue was recognized associated with the SBIR grant.

All funding agencies have agreed to continue their financial support and to shift funds to the MT-401-OTS program.

Operating Expenses

Operating expenses incurred during the three months ended June 30, 2024 were $3.5 million compared to $4.9 million during the same period ended June 30, 2023.

Significant changes and expenditures in operating expenses are outlined as follows:

Research and Development Expenses

Research and development expenses decreased by 2% to $2.3 million for the three months ended June 30, 2024, compared to $2.4 million for the three months ended June 30, 2023.

The decrease of $0.1 million in 2024 was primarily attributable to the following:

| ● | decrease of $0.3 million in process development expenses, |

| ● | decrease of $0.3 million in headcount-related expenses, |

| ● | decrease of $0.7 million in other expenses, offset by |

20

| ● | increase of $0.5 million in clinical trial expenses, |

| ● | increase of $0.7 million in Cell Ready (outsourced) clinical manufacturing costs and process development expenses. |

General and Administrative Expenses

General and administrative expenses decreased by 55% to $1.1 million for the three months ended June 30, 2024, compared to $2.5 million during the same period ended June 30, 2023.

The decrease of $1.4 million in 2024 was primarily attributable to the following:

| ● | decrease of $1.1 million in headcount-related expenses, including stock-based compensation expense and net of severance expense, |

| ● | decrease of $0.1 million in legal and professional fees, |

| ● | decrease of $0.1 million in insurance expense, |

| ● | decrease of $0.2 million in other expenses, offset by |

| ● | increase of $0.1 million in consulting expenses. |

Other Income (Expense)

Interest Income

Interest income was $0.1 million and $35,000 for the three months ended June 30, 2024 and 2023, respectively, and was attributable to interest income relating to funds that are held in U.S. Treasury notes and U.S. government agency-backed securities.

Net Loss from continuing operations

The decrease in our net loss from continuing operations during the three months ended June 30, 2024 compared to the three months ended June 30, 2023 was primarily due to cost reductions in our general and administrative expenses, as well as higher grant income. We anticipate that we will continue to incur net losses in the future as we continue to invest in research and development activities, including clinical development of our multiTAA T cell product candidates.

Comparison of the Six months Ended June 30, 2024 and 2023

The following table summarizes the results of our continuing operations for the six months ended June 30, 2024 and 2023:

For the Six Months Ended |

|

|

| |||||||||

June 30, |

| |||||||||||

2024 |

| 2023 | Change |

| ||||||||

Revenues: |

|

|

|

| ||||||||

Grant income | $ | 2,413,000 | $ | 1,997,000 | $ | 416,000 |

| 21 | % | |||

Total revenues |

| 2,413,000 |

| 1,997,000 |

| 416,000 |

| 21 | % | |||

Operating expenses: |

|

|

|

|

|

|

|

| ||||

Research and development |

| 4,910,000 |

| 5,754,000 |

| (844,000) |

| (15) | % | |||

General and administrative |

| 2,360,000 |

| 4,686,000 |

| (2,326,000) |

| (50) | % | |||

Total operating expenses |

| 7,270,000 |

| 10,440,000 |

| (3,170,000) |

| (30) | % | |||

Loss from operations |

| (4,857,000) |

| (8,443,000) |

| 3,586,000 |

| (42) | % | |||

Other income (expenses): |

|

|

|

|

|

|

|

| ||||

Interest income |

| 272,000 |

| 120,000 |

| 152,000 |

| 127 | % | |||

Loss from continuing operations | $ | (4,585,000) |

| (8,323,000) | $ | 3,738,000 |

| (45) | % | |||

21

Revenue

We did not generate any revenue during the six months ended June 30, 2024 and 2023, respectively, from the sales or licensing of our product candidates.

In August 2021, we received notice of a Product Development Research award totaling approximately $13.1 million from the Cancer Prevention and Research Institute of Texas (“CPRIT”) to support the clinical investigation of MT-401. During the six months ended June 30, 2024 and 2023, we recognized $1.5 million and $1.8 million of revenue, respectively, associated with the CPRIT grant.

In September 2022, we received notice from the FDA that it had awarded us a $2.0 million grant from the FDA’s Orphan Products Grant program to support the clinical investigation of MT-401 for the treatment of post-transplant AML. During the six months ended June 30, 2024 and 2023, we recognized $0.5 million and $0.2 million of revenue, respectively associated with the FDA grant.

In May 2023, we received notice of a $2.0 million grant from the National Institutes of Health Small Business Innovation Research (“SBIR”) program to support the development and investigation of MT-401 for the treatment of AML patients following standard-of-care therapy with hypomethylating agents. During the six months ended June 30, 2024, we recognized $0.4 million of revenue associated with the SBIR grant. During the six months ended June 30, 2023, there was no revenue recognized associated with the SBIR grant.

All funding agencies have agreed to continue their financial support and to shift funds to the MT-401-OTS program.

Operating Expenses

Operating expenses incurred during the six months ended June 30, 2024 were $7.3 million compared to $10.4 million during the same period ended June 30, 2023.

Significant changes and expenditures in operating expenses are outlined as follows:

Research and Development Expenses

Research and development expenses decreased by 15% to $4.9 million for the six months ended June 30, 2024, compared to $5.7 million for the six months ended June 30, 2023.

The decrease of $0.8 million in 2024 was primarily attributable to the following:

| ● | decrease of $1.0 million in process development expenses, |

| ● | decrease of $1.0 million in headcount-related expenses, |

| ● | decrease of $1.5 million in other expenses, offset by |

| ● | increase of $0.9 million in clinical trial expenses, |

| ● | increase of $1.8 million in Cell Ready (outsourced) clinical manufacturing costs and process development expenses. |

General and Administrative Expenses

General and administrative expenses decreased by 50% to $2.4 million for the six months ended June 30, 2024, compared to $4.7 million during the same period ended June 30, 2023.

The decrease of $2.3 million in 2024 was primarily attributable to the following:

| ● | decrease of $1.5 million in headcount-related expenses, including stock-based compensation expense and net of severance expense, |

| ● | decrease of $0.5 million in legal and professional fees, |

| ● | decrease of $0.2 million in insurance expense, |

| ● | decrease of $0.3 million in other expenses, offset by |

| ● | increase of $0.2 million in consulting expenses. |

22

Other Income (Expense)

Interest Income

Interest income was $0.3 million and $0.1 million for the six months ended June 30, 2024 and 2023, respectively, and was attributable to interest income relating to funds that are held in U.S. Treasury notes and U.S. government agency-backed securities.

Net Loss from continuing operations

The decrease in our net loss from continuing operations during the six months ended June 30, 2024 compared to the six months ended June 30, 2023 was primarily due to cost reductions in our general and administrative expenses, cost reductions in our research and development activities, and higher grant income. We anticipate that we will continue to incur net losses in the future as we continue to invest in research and development activities, including clinical development of our multiTAA T cell product candidates.

Liquidity and Capital Resources

We have not generated any revenues from the sales or licensing of our product candidates since inception and only have limited revenue associated with grants to fund research. We have financed our operations primarily through public and private offerings of our stock and debt including warrants and the exercise thereof, grants, and more recently through the cash proceeds received from the Cell Ready transaction and additional grants to fund research.

Based on the Company’s clinical and research and development plans and its timing expectations related to the progress of its programs, the Company expects that its cash and cash equivalents as of June 30, 2024, including drawdowns of available grant funds, will enable the Company to fund its operating expenses and capital expenditure requirements into the fourth quarter of 2025.

Cash and Working Capital

The following table sets forth our cash and cash equivalents and working capital as of June 30, 2024 and December 31, 2023:

| June 30, |

| December 31, | |||

2024 | 2023 | |||||

Cash and cash equivalents | $ | 7,800,000 | $ | 15,111,000 | ||

Working capital | $ | 9,703,000 | $ | 14,053,000 | ||

Cash Flows

The following table summarizes our cash flows for the six months ended June 30, 2024 and 2023:

For the Six Months Ended | ||||||

June 30, | ||||||

| 2024 |

| 2023 | |||

Continuing operations: |

|

|

|

| ||

Net cash used in operating activities | $ | (7,405,000) | $ | (7,169,000) | ||

Net cash provided by financing activities |

| 94,000 |

| 621,000 | ||

Discontinued operations |

|

| ||||

Net cash used in operating activities | — | (5,776,000) | ||||

Net cash provided by investing activities | $ | — | $ | 18,664,000 | ||

Net increase (decrease) in cash and cash equivalents | $ | (7,311,000) | $ | 6,340,000 | ||

23

Continuing Operations

Operating Activities

Net cash used in operating activities from continuing operations during the six months ended June 30, 2024 was $7.4 million. The use of cash primarily related to our net loss from continuing operations of $4.5 million and a $3.0 million decrease from changes in assets and liabilities, offset by $0.1 million of stock-based compensation.

Net cash used in operating activities from continuing operations during the six months ended June 30, 2023 was $7.2 million. The changes in cash flow from operating activities during the six months ended June 30, 2023 were due to $8.3 million of net losses from continuing operations, offset by a $0.6 million increase from changes in operating assets and liabilities and a $0.5 million increase from stock-based compensation.

Financing Activities

Net cash provided by financing activities was $0.1 million and $0.6 million during the six months ended June 30, 2024 and 2023, respectively, due to the net proceeds from sale of common stock as well as the exercise of stock options.

Discontinued Operations

Operating Activities

Net cash used in operating activities from discontinued operations during the six months ended June 30, 2023 was $5.8 million, which represents the reclassification of operating activities of the discontinued operations from continuing operations.

Investing Activities

Net cash provided by investing activities from discontinued operations during the six months ended June 30, 2023 was $18.7 million, which related to the sale of assets in discontinued operations.

Future Capital Requirements

To date, we have not generated any revenues from the commercial sale of approved drug products, and we do not expect to generate substantial revenue for at least the next several years. If we fail to complete the development of our product candidates in a timely manner or fail to obtain their regulatory approval, our ability to generate future revenue will be compromised. We do not know when, or if, we will generate any revenue from our product candidates, and we do not expect to generate significant revenue unless and until we obtain regulatory approval of, and commercialize, our product candidates. We expect our expenses to increase in connection with our ongoing activities, particularly as we continue the research and development of, continue or initiate clinical trials of and seek marketing approval for our product candidates. In addition, if we obtain approval for any of our product candidates, we expect to incur significant commercialization expenses related to sales, marketing, manufacturing and distribution. We anticipate that we will need substantial additional funding in connection with our continuing operations. If we are unable to raise capital when needed or on attractive terms, we could be forced to delay, reduce or eliminate our research and development programs or future commercialization efforts.

In August 2021, the Company received notice of a Product Development Research award totaling approximately $13.1 million from the CPRIT to support the Company’s clinical investigation of MT-401. Through the date of this filing, the Company has received $9.7 million of funds from the CPRIT grant. The Company recorded $0.7 million and $1.5 million of grant income related to the CPRIT grant as revenue during the three and six months ended June 30, 2024, respectively. At June 30, 2024, the Company recorded $1.9 million of grant income receivable.

On September 13, 2022, the Company received notice from the FDA that it had awarded the Company a $2.0 million grant from the FDA’s Orphan Products Grant program to support the clinical investigation of MT-401 for the treatment of post-transplant AML. Through the date of this filing, the Company has received $1.0 million from the FDA grant. The Company recorded $0.2 million and $0.5 million of grant income related to the FDA grant as revenue during the three and six months ended June 30, 2024. At June 30, 2024, the Company recorded $0.2 million of grant income receivable.

24

In May 2023, the Company announced that it had received a $2.0 million grant from the National Institutes of Health Small Business Innovation Research (“SBIR”) program to support the development and investigation of MT-401 for the treatment of AML patients following standard-of-care therapy with hypomethylating agents. Through the date of this filing, the Company has received $0.6 million from SBIR. The Company recorded $0.2 million and $0.4 million of grant income related to the SBIR grant as revenue during the three and six months ended June 30, 2024. At June 30, 2024, the Company recorded $0.2 million of grant income receivable.

In June 2024, the Company received notice of a $2.0 million grant over a 2-year period from the National Institutes of Health – National Cancer Institute to support control over tumor immune escape in pancreatic cancer using a dual T cell product strategy. Through the date of this filing, the Company has nor received any funds from this grant.

All funding agencies have agreed to continue their financial support and to shift funds to the MT-401-OTS program.

As of June 30, 2024, we had working capital of $9.7 million, compared to working capital of $14.1 million as of December 31, 2023. Operating expenses incurred during the three and six months ended June 30, 2024 were $3.4 million and $7.2 million, respectively, compared to $4.9 million and $10.4 million during the equivalent prior year periods. Based on our clinical plans and our timing expectations related to the progress of our programs, we expect that, together with drawdowns of available grant funds, our cash and cash equivalents as of June 30, 2024 will enable us to fund our operating expenses and capital expenditure requirements into the fourth quarter of 2025. We have based this estimate on assumptions that may prove to be wrong, and we could utilize our available capital resources sooner than we currently expect. Furthermore, our operating plan may change, and we may need additional funds sooner than planned in order to meet operational needs and capital requirements for product development and commercialization. Because of the numerous risks and uncertainties associated with the development and commercialization of our product candidates and the extent to which we may enter into additional collaborations with third parties to participate in their development and commercialization, we are unable to estimate the amounts of increased capital outlays and operating expenditures associated with our current and anticipated clinical trials. Our future funding requirements will depend on many factors, as we:

| ● | initiate or continue clinical trials of our product candidates; |

| ● | continue the research and development of our product candidates and seek to discover additional product candidates; seek regulatory approvals for our product candidates if they successfully complete clinical trials; |

| ● | continue development of our manufacturing capabilities and our manufacturing facility; |

| ● | establish sales, marketing and distribution infrastructure and scale-up manufacturing capabilities to commercialize any product candidates that may receive regulatory approval; |

| ● | evaluate strategic transactions we may undertake; and |

| ● | enhance operational, financial and information management systems and hire additional personnel, including personnel to support development of our product candidates and, if a product candidate is approved, our commercialization efforts. |

Because all of our product candidates are in the early stages of clinical and preclinical development and the outcome of these efforts is uncertain, we cannot estimate the actual amounts necessary to successfully complete the development and commercialization of product candidates or whether, or when, we may achieve profitability. Until such time, if ever, that we can generate substantial product revenue, we expect to finance our cash needs through a combination of equity or debt financings and collaboration arrangements.

We plan to continue to fund our operations and capital funding needs through equity and/or debt financing. We may also consider new collaborations or selectively partner our technology. To the extent that we raise additional capital through the sale of equity or convertible debt securities, the ownership interests of our stockholders will be diluted, and the terms may include liquidation or other preferences that adversely affect the rights of our existing stockholders’ common stock. The incurrence of indebtedness would result in increased fixed payment obligations and could involve certain restrictive covenants, such as limitations on our ability to incur additional debt, limitations on our ability to acquire or license intellectual property rights and other operating restrictions that could adversely impact our ability to conduct our business. If we raise additional funds through strategic partnerships and alliances and licensing arrangements with third parties, we may have to relinquish valuable rights to our technologies or product candidates or grant licenses on terms

25

unfavorable to us. We may also be required to pay damages or have liabilities associated with litigation or other legal proceedings involving our company.

In addition to the foregoing, high inflation and concerns about an economic recession in the United States or other major markets have resulted in, among other things, volatility in the capital markets that may have the effect of reducing our ability to access capital, which could in the future negatively affect our liquidity. In addition, a recession or market correction due to these factors could materially affect our business and the value of our common stock.

ATM Agreement