DEF 14Afalse000109355700010935572023-01-012023-12-31iso4217:USD00010935572022-01-012022-12-3100010935572021-01-012021-12-3100010935572020-01-012020-12-310001093557ecd:PeoMemberdxcm:DeductionsForAmountsReportedUnderTheStockAwardsColumnInTheSummaryCompensationTableMember2023-01-012023-12-310001093557ecd:NonPeoNeoMemberdxcm:DeductionsForAmountsReportedUnderTheStockAwardsColumnInTheSummaryCompensationTableMember2023-01-012023-12-310001093557dxcm:YearEndFairValueOfEquityAwardsGrantedDuringTheYearThatRemainedUnvestedAsOfTheEndOfTheCoveredYearMemberecd:PeoMember2023-01-012023-12-310001093557dxcm:YearEndFairValueOfEquityAwardsGrantedDuringTheYearThatRemainedUnvestedAsOfTheEndOfTheCoveredYearMemberecd:NonPeoNeoMember2023-01-012023-12-310001093557ecd:PeoMemberdxcm:VestingDateFairValueForAwardsGrantedAndVestedInTheSameFiscalYearMember2023-01-012023-12-310001093557ecd:NonPeoNeoMemberdxcm:VestingDateFairValueForAwardsGrantedAndVestedInTheSameFiscalYearMember2023-01-012023-12-310001093557dxcm:ChangeInYearEndFairValueOfEquityAwardsGrantedDuringPriorYearsThatRemainedUnvestedAsOfTheEndOfTheCoveredYearMemberecd:PeoMember2023-01-012023-12-310001093557ecd:NonPeoNeoMemberdxcm:ChangeInYearEndFairValueOfEquityAwardsGrantedDuringPriorYearsThatRemainedUnvestedAsOfTheEndOfTheCoveredYearMember2023-01-012023-12-310001093557ecd:PeoMemberdxcm:ChangeInFairValueFromPriorYearEndToVestingDateForAwardsGrantedInPriorYearsThatVestedInCoveredFiscalYearMember2023-01-012023-12-310001093557ecd:NonPeoNeoMemberdxcm:ChangeInFairValueFromPriorYearEndToVestingDateForAwardsGrantedInPriorYearsThatVestedInCoveredFiscalYearMember2023-01-012023-12-310001093557ecd:PeoMemberdxcm:PriorYearEndFairValueForAwardsGrantedInPriorYearsThatAreForfeitedDuringTheCoveredYearMember2023-01-012023-12-310001093557ecd:NonPeoNeoMemberdxcm:PriorYearEndFairValueForAwardsGrantedInPriorYearsThatAreForfeitedDuringTheCoveredYearMember2023-01-012023-12-310001093557dxcm:NetIncreasesForTheInclusionOfRule402vEquityValuesMemberecd:PeoMember2023-01-012023-12-310001093557dxcm:NetIncreasesForTheInclusionOfRule402vEquityValuesMemberecd:NonPeoNeoMember2023-01-012023-12-31000109355712023-01-012023-12-31000109355722023-01-012023-12-31000109355732023-01-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ý

Filed by a party other than the Registrant ☐

| | | | | |

| Check the appropriate box: |

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material under §240.14a-12 |

DexCom, Inc. | | | | | | | | | | | | | | |

| (Name of Registrant as Specified In Its Charter) |

|

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | | | | |

| Payment of Filing Fee (Check all boxes that apply): |

ý | No fee required |

| | |

☐ | Fee paid previously with preliminary materials |

| | |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | | | | | | | |

| | |

| Our Mission: Empowering People to Take Control of Health | |

| | |

Corporate OverviewDexCom, Inc. empowers people to take control of diabetes through innovative continuous glucose monitoring ("CGM") systems. Headquartered in San Diego, California, Dexcom has emerged as a leader of diabetes care technology. By listening to the needs of users, caregivers, and providers, Dexcom simplifies and improves diabetes management around the world.

| | | | | |

|

| April 22, 2024 |

| To Our Stockholders |

| |

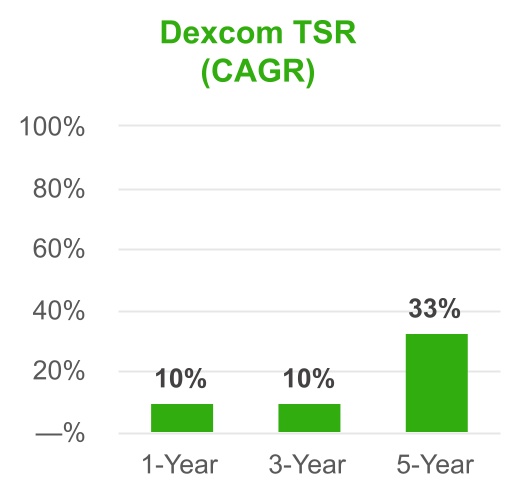

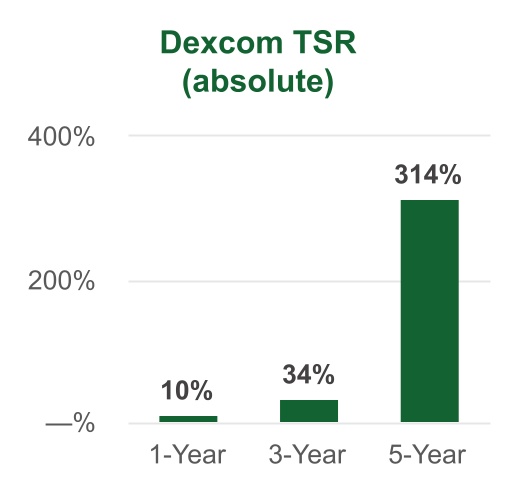

| You are cordially invited to attend the 2024 Annual Meeting of Stockholders of DexCom, Inc. online on May 22, 2024, at 2:00 p.m. Pacific Time (the "Annual Meeting"). As we approach the Annual Meeting, I would like to share with you some of our business and financial highlights from 2023, as well as some of our recent corporate sustainability initiatives. Business and Financial Highlights During 2023 we delivered another year of strong customer growth while enhancing the scale and efficiency of our operations. Demand for Dexcom CGM remained high behind the rollout of our newest generation product, Dexcom G7, and we significantly expanded access globally. Through our dedicated efforts, we also delivered significant improvements in our financial results as compared to 2022. Our financial highlights included $3.62 billion in revenue, up 24% from 2022, and $2.29 billion in gross profit, up 22% from 2022. We had $597.7 million in operating income, up 53% from 2022, and $541.5 million in net income, up 59% from 2022. We also had $748.5 million in operating cash flow, up 12% from 2022, and ended fiscal 2023 with cash, cash equivalents and short-term marketable securities totaling $2.72 billion. Our operational highlights included expanded access across our product portfolio driven by our key strategic initiatives and a growing market share globally. This past year, we increased our prescriber base by approximately 40% in the United States as Dexcom G7’s ease of use and leading performance attracted new clinicians to our ecosystem. We also completed the largest expansion of coverage in our company’s history with new reimbursement for people with type 2 diabetes using basal-insulin only, as well as for certain non-insulin using individuals that experience hypoglycemia. To support this growing demand, we initiated production at our new Malaysia manufacturing facility around mid-year 2023, which meaningfully expanded our capacity potential and further diversified our production footprint. Corporate Sustainability Initiatives In 2023, we further developed Dexcom’s approach to corporate sustainability by (i) engaging an independent expert to conduct an adjusted pay gap analysis of our workforce with respect to gender globally and race/ethnicity in the United States; and (ii) adding additional disclosure to our 2024 sustainability report concerning new emissions data and cybersecurity risk management. We also continued to provide disclosures aligned to the Sustainability Accounting Standards Board Index for the Medical Equipment and Supplies industry and the Task Force on Climate-Related Financial Disclosures in our 2024 sustainability report. We continue to work as an organization to advance our strategic corporate sustainability roadmap by pursuing key corporate sustainability workstreams.

|

| | | | | |

| |

| 2024 Annual Meeting We are pleased to provide stockholders with an opportunity to participate in the Annual Meeting online via the Internet to facilitate stockholder attendance and provide a consistent experience to all stockholders regardless of location. We will provide a live webcast of the Annual Meeting at www.proxydocs.com/DXCM, where you will also be able to submit questions and vote online. The matters expected to be acted upon at the Annual Meeting are described in detail in the following Notice of Annual Meeting of Stockholders and Proxy Statement. Your vote is very important to us. We strongly encourage you to read both our Proxy Statement and 2023 Annual Report on Form 10-K in their entirety and ask that you support our recommendations. We sincerely appreciate your continued support of Dexcom, and we look forward to seeing you at the meeting. |

| | | | | | | | |

Sincerely, |

| | |

|

| Kevin R. Sayer Chairperson, President and Chief Executive Officer DexCom, Inc. April 22, 2024 |

| | | | | | | | |

| | |

| YOUR VOTE IS IMPORTANT

Whether or not you plan to attend the Annual Meeting virtually via the internet, we strongly encourage you to vote your shares. In order to ensure your representation at the Annual Meeting, you may submit your proxy and voting instructions via the Internet at www.proxydocs.com/DXCM, by telephone, or you may vote your shares by completing, signing and dating the proxy card as promptly as possible and returning it in the enclosed envelope (to which no postage need be affixed if mailed in the United States). The Proxy Statement, the Annual Report and the accompanying proxy card are being mailed and made available to each stockholder entitled to vote at the Annual Meeting on or about April 22, 2024.

Please refer to the proxy card you received in the mail and the section of this Proxy Statement entitled “Information about the Proxy Materials and the Annual Meeting" for a description of these voting methods. If your shares are held by a bank, brokerage firm or other holder of record (your record holder), please follow the instructions you receive from such firm, bank or other nominee to vote your shares. | |

| | |

NOTICE OF 2024 ANNUAL MEETING OF STOCKHOLDERS

| | | | | |

| |

| Location | Date and Time |

Attend the Annual Meeting Online at: | Wednesday, May 22, 2024 |

www.proxydocs.com/DXCM | 2:00 p.m. Pacific Time |

| | | | | | | | | | | | | | | | | |

| Company Proposals | | Board Recommendation | Page |

| | | | | |

| (1) | To elect ten nominees for director, each to hold office until our 2025 annual meeting of stockholders. The nominees are: | þ | FOR each nominee | |

•Kevin R. Sayer •Steven R. Altman •Nicholas Augustinos •Richard A. Collins •Karen Dahut | •Rimma Driscoll •Mark G. Foletta •Bridgette P. Heller •Kyle Malady •Eric J. Topol, M.D. |

| | | | | |

| (2) | To ratify the selection by the Audit Committee of our Board of Directors of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024. | þ | FOR | |

| | | | | |

| (3) | To provide a non-binding advisory vote on the compensation of our named executive officers for the fiscal year ended December 31, 2023 | þ | FOR | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Stockholder Proposals | | Board Recommendation | Page |

| | | | | |

| (4) | To provide a non-binding, advisory vote on pay equity disclosure. | ☒ | AGAINST | |

| | | | | |

| (5) | To provide a non-binding, advisory vote on transparency in lobbying. | ☒ | AGAINST | |

We may also transact any other business properly brought before the 2024 Annual Meeting of Stockholders (the "Annual Meeting"). The Annual Meeting will be held in a virtual meeting format only. You will not be able to attend the Annual Meeting in-person. The accompanying proxy materials include instructions on how to participate in the Annual Meeting and how you may vote your shares.

You are entitled to notice of and to vote at the Annual Meeting if you were a stockholder of record as of the close of business on March 27, 2024 (the "Record Date"). A complete list of stockholders of record will be available for the examination of any stockholder, for any purpose germane to the meeting, for a period of 10 calendar days prior to the Annual Meeting at our principal executive offices, located at 6340 Sequence Drive, San Diego, California, 92121 between the hours of 9:00 a.m. and 4:00 p.m. Pacific Time. If you are interested in viewing the list, please contact Investor Relations by email at investor-relations@dexcom.com. The list will also be open to the examination of any stockholder during the Annual Meeting.

| | | | | | | | | | | |

| Voting Methods |

| | | |

| Internet | Telephone | Mail |

| | | |

| For detailed information regarding voting instructions, please refer to the proxy card you received in the mail and the section of this Proxy Statement entitled "Information about the Proxy Materials and the Annual Meeting”. You may revoke a previously delivered proxy at any time prior to the Annual Meeting. If you decide to virtually attend the Annual Meeting and wish to change your proxy vote, you may do so automatically by voting online at the Annual Meeting. |

| | | |

Important Notice Regarding the Availability of Proxy Materials for the

Annual Meeting of Stockholders to be Held on May 22, 2024

The Proxy Statement, the Annual Report and the form of proxy card are available at www.proxydocs.com/DXCM after entering the control number printed on your proxy card.

| | |

| By Order of the Board of Directors, |

|

|

|

| Kevin R. Sayer |

| Chairperson, President and Chief Executive Officer |

April 22, 2024 |

| | | | | | | | |

| TABLE OF CONTENTS | | | |

| | | | |

| | Page | | | |

| PROPOSAL NO. 1 - ELECTION OF DIRECTORS | | | | |

| Board Demographics | | | | |

| Board Diversity | | | | |

| Nominee Director Biographies | | | | |

| CORPORATE GOVERNANCE | | | | |

| Corporate Governance Highlights | | | | |

| Board Leadership Structure and the Role of the Lead Independent Director | | | | |

| Director Independence | | | | |

| Director Selection Process | | | | |

| Board Evaluation Process | | | | |

| Director Orientation and Continuing Education | | | | |

| Code of Conduct and Business Ethics | | | | |

| Insider Trading Policy; Anti-Hedging | | | | |

| Stockholder Engagement | | | | |

| Stockholder Communications with the Board | | | | |

| Committees of the Board and Meetings | | | | |

| Meetings of the Board of Directors; Director Attendance | | | | |

| Board of Directors' Role in Risk Oversight | | | | |

| Corporate Sustainability Matters | | | | |

| NON-EMPLOYEE DIRECTOR COMPENSATION | | | | |

| Non-Employee Director Compensation Arrangements | | | | |

| Non-Employee Director Stock Ownership Guidelines | | | | |

| 2023 Director Compensation Table | | | | |

| PROPOSAL NO. 2 - RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | | | | |

| Principal Accountant Fees and Services | | | | |

| Pre-Approval Policies and Procedures | | | | |

| Report of the Audit Committee of the Board | | | | |

PROPOSAL NO. 3 - ADVISORY VOTE TO APPROVE NAMED EXECUTIVE OFFICER COMPENSATION | | | | |

| EXECUTIVE OFFICERS | | | | |

| EXECUTIVE COMPENSATION | | | | |

| Compensation Discussion and Analysis | | | | |

| Fiscal 2023 Corporate Performance | | | | |

| Fiscal 2023 Compensation Overview | | | | |

| Compensation Philosophy and Objectives | | | | |

| 2023 Executive Compensation Policies and Practices at a Glance | | | | |

| Stockholder Advisory Vote on Executive Compensation | | | | |

| Compensation Decision-Making Process | | | | |

| Compensation Peer Group | | | | |

| Competitive Positioning | | | | |

| Fiscal 2023 Compensation Elements | | | | |

| Post-Employment Compensation | | | | |

| Stock Ownership Guidelines and CEO Holding Requirement | | | | |

| Insider Trading Policy; Anti-Hedging | | | | |

| Compensation Risk Controls | | | | |

| Compensation Recovery Policy | | | | |

| | | | | | | | |

| Tax and Accounting Considerations | | | | |

| Compensation Committee Report | | | | |

| SUMMARY OF EXECUTIVE COMPENSATION | | | | |

| 2023 Summary Compensation Table | | | | |

| Grants of Plan-Based Awards for 2023 | | | | |

| Outstanding Equity Awards at December 31, 2023 | | | | |

| 2023 Option Exercises and Stock Vested | | | | |

| Executive Nonqualified Deferred Compensation Plan | | | | |

| Severance and Change in Control Arrangements | | | | |

| Pay versus Performance | | | | |

| Chief Executive Officer Pay Ratio | | | | |

| Equity Compensation Plan Information | | | | |

| Risks from Compensation Policies and Practices | | | | |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | | | | |

| DELINQUENT SECTION 16(a) REPORTS | | | | |

| CERTAIN TRANSACTIONS WITH RELATED PERSONS | | | | |

| STOCKHOLDER PROPOSALS FOR ANNUAL MEETING | | | | |

| HOUSEHOLDING OF PROXY MATERIALS | | | | |

PROPOSAL NO. 4 - STOCKHOLDER PROPOSAL: PAY EQUITY DISCLOSURE | | | | |

| Stockholder Proposal and Supporting Statement | | | | |

| Dexcom’s Statement in Opposition to Proposal No. 4 | | | | |

PROPOSAL NO. 5 - STOCKHOLDER PROPOSAL: TRANSPARENCY IN LOBBYING | | | | |

| Stockholder Proposal and Supporting Statement | | | | |

| Dexcom’s Statement in Opposition to Proposal No. 5 | | | | |

| OTHER MATTERS | | | | |

| INFORMATION ABOUT THE PROXY MATERIALS AND THE ANNUAL MEETING | | | | |

| ANNUAL REPORTS | | | | |

ANNEX A - RECONCILIATION BETWEEN GAAP AND NON-GAAP FINANCIAL MEASURES | | | | |

| PROXY CARD | | | | |

| | | | | |

| |

| PROPOSAL NO. 1 |

| Election of Directors |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Our Board recommends a vote "FOR" the following ten nominees for election to our Board, each to hold office until our 2025 annual meeting of stockholders: | |

| | | | | | | | | | | | | | | |

| | 1) | | Kevin R. Sayer | 2) | | Steven R. Altman | 3) | | Nicholas Augustinos | | 4) | | Richard A. Collins | |

| | | | | | | | | | | | | | | |

| | 5) | | Karen Dahut | 6) | | Rimma Driscoll | 7) | | Mark G. Foletta | | 8) | | Bridgette P. Heller | |

| | | | | | | | | | | | | | | |

| | 9) | | Kyle Malady | 10) | | Eric J. Topol, M.D. | | | | | | | | |

| | | | | | | | | | | | | | | |

| þ | | | | | | | | | | | | | |

| | THE BOARD RECOMMENDS A VOTE FOR THE ELECTION OF THE NOMINEES NAMED ABOVE. | |

| | | | | | | | | | | | | |

At each annual meeting of stockholders, the terms of each of our incumbent directors expire and all members of our Board are elected. Ten directors are to be elected at this Annual Meeting, each to serve until our 2025 annual meeting of stockholders or until such director’s earlier death, resignation or removal. On the Nominating and Governance Committee’s recommendation, the Board has nominated each of the above listed nominees for election at the Annual Meeting. Each of the nominees is a current director of the company. Each nominee has consented to being named in this Proxy Statement and has agreed to continue to serve as a director if elected, and we have no reason to believe that any nominee will be unable to serve. For more information concerning the nominees, see the section entitled “Nominee Director Biographies”.

As of the date of mailing of this Proxy Statement, the Board consists of eleven members. Barbara E. Kahn, who has served as a director of the company since 2011, was not nominated for re-election to the Board and her term as a director will expire at the Annual Meeting. Effective upon the Annual Meeting, the Board has approved a reduction in the size of the Board from eleven to ten directors.

Directors are elected by a majority of the votes cast in uncontested elections, meaning that the number of votes cast “For” a nominee must exceed the number of votes cast “Against” that nominee. Abstentions and broker non-votes are not counted as votes “For” or “Against” a director nominee and have no effect on the outcome of the proposal for the election of directors. Pursuant to Dexcom’s Corporate Governance Principles (“Governance Principles”), the Board of Directors expects a director to tender his or her resignation if he or she fails to receive the required number of votes for re-election. If any nominee that is an incumbent director fails to receive the required votes for re-election at the Annual Meeting, the Nominating and Governance Committee will determine on an expedited basis, and in any event within 90 days following certification of the stockholder vote, whether to accept or reject the resignation, and will submit such recommendation for prompt consideration by the Board. The Board will promptly act on the Nominating and Governance Committee’s recommendation and will publicly disclose its decision-making process and decision regarding whether to accept or reject the resignation offer (including, if it rejects the resignation offer, the rationale behind its decision).

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF EACH DIRECTOR NOMINEE. PROXIES RECEIVED BY THE COMPANY WILL BE VOTED FOR EACH DIRECTOR NOMINEE UNLESS OTHERWISE INSTRUCTED.

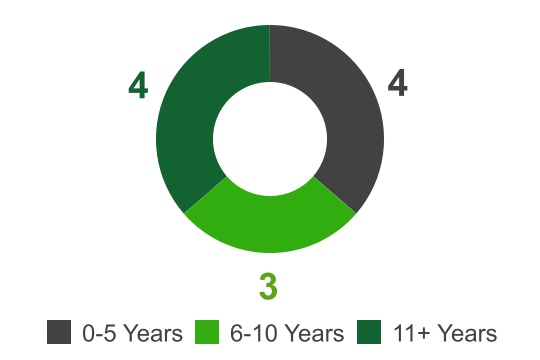

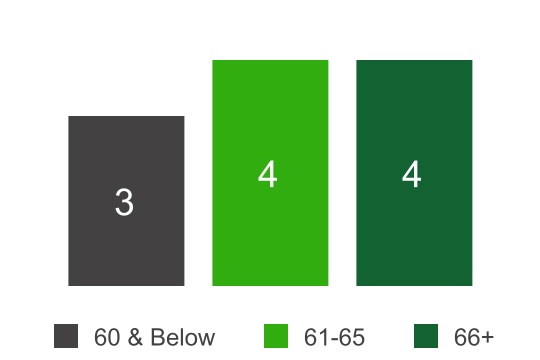

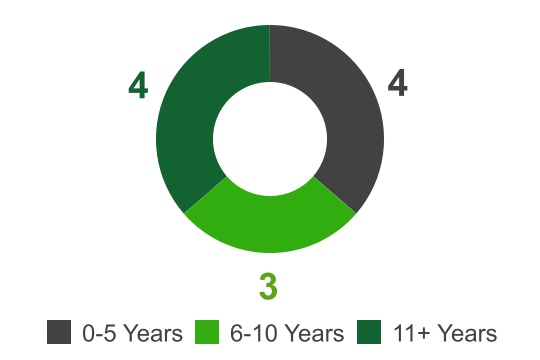

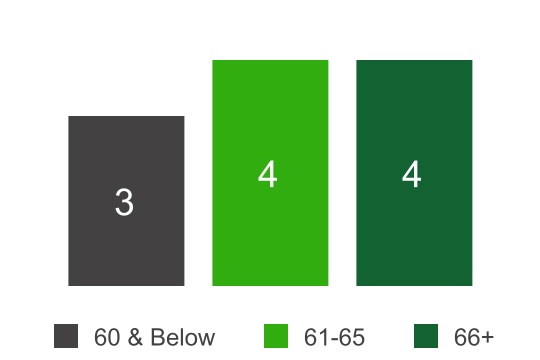

The following table shows the composition of our Board, including each director's position, age, and duration of service as of the Record Date.

| | | | | | | | | | | | | | | | | | | | |

| Director Name | | Position(s) | | Age | | Director Since |

| Director Nominees: | | | | | | |

| Kevin R. Sayer | | Chairperson of the Board, President and CEO | | 66 | | 2007 |

| Steven R. Altman | | Director | | 62 | | 2013 |

| Nicholas Augustinos | | Director | | 65 | | 2009 |

| Richard A. Collins | | Director | | 67 | | 2017 |

| Karen Dahut | | Director | | 60 | | 2020 |

| Rimma Driscoll | | Director | | 51 | | 2023 |

| Mark G. Foletta | | Lead Independent Director | | 63 | | 2014 |

| Bridgette P. Heller | | Director | | 62 | | 2019 |

| Kyle Malady | | Director | | 57 | | 2020 |

| Eric J. Topol, M.D. | | Director | | 69 | | 2009 |

| Non-Continuing Director: | | | | | | |

| Barbara E. Kahn | | Director | | 71 | | 2011 |

We believe our Board nominees bring a variety of backgrounds, qualifications, skills and experiences that contribute to a well-rounded Board uniquely positioned to effectively guide our strategy and oversee our operations. The following sets forth the biographical information of our Board as of March 27, 2024. Please note that one of our current directors, Barbara E. Kahn, has not been renominated for election and will no longer serve on the Board following the date of the Annual Meeting.

| | | | | | | | | | | | | | |

| Highly Independent | | Balanced Tenure | | New Directors |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

10 of 11 |

All independent,

except the CEO |

| | | | | | | | |

| 4 |

|

|

|

|

|

|

| | |

| New directors hired in the last five years |

| | | | | | | | | | | | | | |

| Board Engagement | | Age Distribution | | Gender Diversity |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 100% | |

| |

| |

| |

| |

| |

| | | | | | | | | |

Attendance rate for each director for the four board meetings held in 2023 |

Due to the global and complex nature of our business, the Board believes it is important to consider diversity of professional experiences, race, ethnicity, gender, sexual orientation, age, education, and cultural background in evaluating board candidates in order to provide practical insights and diverse perspectives. Representation of gender, race, ethnic, geographic, cultural, or other diverse perspectives expands the Board’s understanding of the needs and viewpoints of our customers, partners, employees, governments, and other stakeholders worldwide. As part of our ongoing commitment to creating a balanced Board with diverse viewpoints and deep industry expertise, we periodically add new directors to infuse new ideas and fresh perspectives in the boardroom.

The Board Diversity Matrix (Table A below) presents our Board diversity information as of March 27, 2024. Each of the categories listed in the table below has the meaning set forth in The Nasdaq Stock Market LLC (“Nasdaq”) Listing Standards Rule 5605(f).

| | | | | | | | |

Table A |

| | |

Board Diversity Matrix as of March 27, 2024 |

| | |

| | |

| Total Number of Directors | 11 |

| | |

| Part I: Gender Identity | Female | Male |

| Directors | 4 | 7 |

| Part II: Demographic Background | | |

| African American or Black | 1 | — |

| | |

| | |

| | |

| | |

| White | 3 | 7 |

| | |

| LGBTQ+ | 1 |

| |

Table B below presents diversity information for the director nominees.

| | | | | | | | |

| Table B |

| | |

| Nominee and Continuing Director Demographics |

| | |

| | |

| Total Number of Directors | 10 |

| | |

| Part I: Gender Identity | Female | Male |

| Directors | 3 | 7 |

| Part II: Demographic Background | | |

| African American or Black | 1 | — |

| | |

| | |

| | |

| | |

| White | 2 | 7 |

| | |

| LGBTQ+ | 1 |

| |

| | | | | | | | | | | | | | |

Nominee Director Biographies |

| | | | | | | | | | | | | | |

| Kevin R. Sayer |

Chairperson of the Board, President and CEO | | |

| | | | |

| | | | |

| Age: | Joined the Board: | Committees: | | Other Current Public Company Boards or Officer Experience: |

| 66 | 2007 | None | | None |

| | | | |

Kevin R. Sayer has served on our Board since November 2007, as our President and Chief Executive Officer (“CEO”) since January 2015 and as our Chairperson of the Board (“Chairperson”) since July 2018. Mr. Sayer has been our President since 2011, and from January 2013 until January 2015, Mr. Sayer also served as our Chief Operating Officer. From April 2007 to December 2010, Mr. Sayer served as Chief Financial Officer of Biosensors International Group, Ltd. (“Biosensors”), a medical technology company developing, manufacturing and commercializing medical devices used in interventional cardiology and critical care procedures. Prior to joining Biosensors, from May 2005 to April 2007, Mr. Sayer served as an independent healthcare and medical technology industry consultant. From March 2004 to May 2005, Mr. Sayer was Executive Vice President and Chief Financial Officer of Specialty Laboratories, Inc., a company offering clinical reference laboratory services. From August 2002 to March 2004, Mr. Sayer worked as an independent healthcare and medical technology industry consultant. Mr. Sayer served as Chief Financial Officer of MiniMed, Inc. from May 1994 until it was acquired by Medtronic, Inc. in August 2001. Mr. Sayer served as Vice President and General Manager of Medtronic MiniMed after the acquisition until August 2002. Mr. Sayer is a Certified Public Accountant (inactive) and received his Master's Degree in Accounting and Information Systems concurrently with a B.A., both from Brigham Young University. As CEO, Mr. Sayer has direct responsibility for our strategy and operations.

| | | | | | | | | | | | | | |

| Steven R. Altman |

| Independent Director | | |

| | | | |

| | | | |

| Age: | Joined the Board: | Committees: | | Other Current Public Company Boards or Officer Experience: |

| 62 | 2013 | Compensation, Nominating and Governance | | None |

| | | | |

Steven R. Altman has served on our Board since November 2013. From January 2021 to December 2023, Mr. Altman served as the Chairman of the Board of Directors of Prospector Capital Corporation, a publicly-traded blank check company, prior to the completion of a business combination between Prospector Capital and LeddarTech Holdings Inc. in December 2023. From November 2011 through January 2014, Mr. Altman served as the Vice Chairman of Qualcomm Incorporated (“Qualcomm”) and a member of Qualcomm’s Executive Committee. Mr. Altman previously served as President of Qualcomm from July 2005 to November 2011, as Executive Vice President from November 1997 to June 2005 and as President of Qualcomm Technology Licensing from September 1995 to April 2005. Mr. Altman was the chief architect of Qualcomm’s strategy for licensing its broad intellectual property portfolio for wireless communications, which has accelerated the growth of CDMA technology. Mr. Altman received a B.S. from Northern Arizona University in Political Science and Administration and a J.D. from the University of San Diego. Mr. Altman brings to the Board significant senior leadership, and technical and global experience. Mr. Altman’s experiences with Qualcomm allow him to provide Dexcom with valuable insights on corporate strategy and initiatives that are critical to the continued growth and maturation of Dexcom.

| | | | | | | | | | | | | | |

| Nicholas Augustinos |

Independent Director | | |

| | | | |

| | | | |

| Age: | Joined the Board: | Committees: | | Other Current Public Company Boards or Officer Experience: |

| 65 | 2009 | Nominating and Governance | | None |

| | | | |

Nicholas Augustinos has served on our Board since November 2009. From December 2015 through December 2018, Mr. Augustinos served as President and CEO of Aver, Inc. dba Enlace Health, a company specializing in Value-Based Reimbursement, Analytics and Payment Solutions. He has served on the Board of Directors of Aver since September 2014, and was Chairman of the Board of Directors of Aver during 2019. From November 2011 until

December 2015, Mr. Augustinos was with Cardinal Health, Inc. (NYSE: CAH) as its Senior Vice President for Health Information Services and Strategy. From March 2005 through October 2011, Mr. Augustinos worked at Cisco Systems, Inc. (NASDAQ: CSCO), the global leader in networking and cloud solutions. At Cisco, he held various positions, including Director of Cisco’s Internet Business Solutions Group, Senior Director, Global Healthcare Solutions Group, and Senior Director of Global Healthcare Operations. In January 2015, Mr. Augustinos was appointed to the Board of Directors of the California Health Care Foundation (“CHCF”), an endowed foundation which seeks to improve care for all Californians through innovations that improve quality, increase efficiency, and lower the cost of care. He serves at the Finance & Investment Committee and the Governance Committee which he chaired for three years. Prior to CHCF, he served on the Board of Directors of the SCAN Foundation, an endowed foundation dedicated to advancing the development of a sustainable continuum of quality care for seniors, from June 2011 until December 2014. Mr. Augustinos served on the Board of Directors of Audax Health, now Rally, from March 2012 until February 2014. Rally was acquired by UnitedHealthcare. In 1992 Mr. Augustinos joined Deloitte Consulting where he was instrumental establishing the healthcare practice for Northern California. In 1998 Mr. Augustinos joined Healtheon/WebMd (NASDAQ: HLTH), a newly founded healthcare information technology company leading the Customer Experience team. With a 38-year career in healthcare and healthcare technology, Mr. Augustinos has broad managerial, consulting and business development experience in the private and public sectors. Mr. Augustinos has worked with a diverse range of leading healthcare delivery systems, healthcare insurers and government organizations globally and brings to the Board significant business and market development and technology experience with growth companies.

| | | | | | | | | | | | | | |

| Richard A. Collins |

| Independent Director | | |

| | | | |

| | | | |

| Age: | Joined the Board: | Committees: | | Other Current Public Company Boards or Officer Experience: |

| 67 | 2017 | Audit, Nominating and Governance | | None |

| | | | |

Richard A. Collins has served on our Board since March 2017. Mr. Collins has been a self-employed consultant since October 2013. From March 2011 to October 2013 Mr. Collins was the Chief Executive Officer for UnitedHealthcare’s Northeast Region and was President, Director, and/or Chairman of numerous UnitedHealthcare subsidiaries including Oxford Health Plans, Mid Atlantic Medical Services and UHC Insurance Company of New York. From July 2005 through December of 2012 Mr. Collins served as the President – Individual Line of Business for UnitedHealthcare and the Chairman and Chief Executive Officer of Golden Rule Financial Corporation. Prior to 2011, Mr. Collins also held leadership positions in pricing, underwriting and healthcare economics with UnitedHealthcare. Mr. Collins has previously served on the Boards of Fairbanks Hospital in Indianapolis, Indiana, The Nature Conservancy – Indiana, United Healthcare Children’s Foundation and the Council for Affordable Health Insurance. Mr. Collins received a B.S. from Maine Maritime Academy and completed the executive development program at Harvard University’s John F. Kennedy School of Government. Mr. Collins was formerly a National Association of Corporate Directors (NACD) Board Leadership Fellow. The NACD Fellowship is a comprehensive and continuous program of study that empowers directors with the latest insights, intelligence, and leading boardroom practices. Mr. Collins' significant experience in healthcare insurance and administration, including his tenure during a period in which UnitedHealth Group grew from a mid-cap health insurer into one of the largest public corporations in America, qualify him to serve on the Board.

| | | | | | | | | | | | | | |

| Karen Dahut |

| Independent Director | | |

| | | | |

| | | | |

| Age: | Joined the Board: | Committees: | | Other Current Public Company Boards or Officer Experience: |

| 60 | 2020 | Compensation, Technology | | None |

| | | | |

Karen Dahut has served on our Board since August 2020. In October 2022, Ms. Dahut was selected as the CEO of Google Public Sector, responsible for helping public sector clients digitally transform with the Google suite of products. Prior to this role, Ms. Dahut was the Sector President for Booz Allen's Global Defense business. Ms. Dahut held several leadership positions throughout the organization, including Chief Innovation Officer; Leader, Analytics and Data Science Business; and Leader, Economic and Business Analytics Capability. Before joining Booz Allen in 2002, Ms. Dahut served as comptroller for the Navy’s premier biomedical research institute and as a United States Naval Officer. Ms. Dahut also actively serves on the Board of Directors for the National Air and Space Museum and the Center for New American Security. Additionally, Ms. Dahut has served as a Director of EisnerAmper LLP since August 2021. She previously served on the Board of Directors of Tech Data Corporation, an end-to-end technology distributor and Fortune 100 company, prior to its acquisition by Apollo Global Management in June 2020. Ms. Dahut received a Bachelor’s degree in Finance from Mount Saint Mary’s University and a Master's of Science degree from the University of Southern California’s Viterbi School of Engineering. Ms. Dahut’s considerable leadership experience qualifies her to serve on the Board.

| | | | | | | | | | | | | | |

| Rimma Driscoll |

| Independent Director | | |

| | | | |

| | | | |

| Age: | Joined the Board: | Committees: | | Other Current Public Company Boards or Officer Experience: |

| 51 | 2023 | Audit, Technology | | Zoetis Inc. |

| | | | |

Rimma Driscoll has served on our Board since August 2023. Ms. Driscoll currently serves as Executive Vice President and Head of Global Strategy, Commercial and Business Development, and Global BioDevices of Zoetis, the world’s leading animal health company and a member of the Fortune 500. In this role, Ms. Driscoll oversees the company’s global business strategy, the execution of commercial launch plans, external business development (M&A) and integration efforts, and has oversight for Zoetis’ Global BioDevices business. She joined Zoetis in 2016 and previously held the titles of Senior Vice President, Business Development from January 2020 to November 2022; and Vice President, Business Development and Commercial Alliances from 2016 to January 2020. Prior to joining Zoetis, Ms. Driscoll spent 21 years at Procter & Gamble where she led global business development and strategic alliances across multiple businesses in pharmaceuticals, consumer healthcare, beauty care, and new business ventures. Ms. Driscoll is a board member of Pumpkin Insurance, a preventive care and pet insurance company. Ms. Driscoll completed her Master of Business Administration from Xavier University, Williams College of Business, and her Bachelor of Science in Chemistry from Bowling Green State University. Ms. Driscoll is qualified to serve on our Board of Directors because of her significant experience leading business development initiatives and corporate strategy.

| | | | | | | | | | | | | | |

| Mark G. Foletta |

Lead Independent Director | | |

| | | | |

| | | | |

| Age: | Joined the Board: | Committees: | | Other Current Public Company Boards or Officer Experience: |

| 63 | 2014 | Audit | | AMN Healthcare Services, Inc., & Enanta Pharmaceuticals, Inc. |

| | | | |

Mark G. Foletta has served on our Board since November 2014 and has served as our Lead Independent Director since November 2015. From February 2017 to June 2020, Mr. Foletta was the Chief Financial Officer and Executive Vice President of Tocagen, Inc., a publicly traded biotech company. From August 2015 to July 2016, Mr. Foletta served as the interim CFO of Biocept, Inc., an early commercial-stage publicly traded molecular oncology diagnostics company. Mr. Foletta previously served as Senior Vice President, Finance and Chief Financial Officer of Amylin Pharmaceuticals, Inc., a publicly traded pharmaceutical company, from March 2006 through Amylin’s

acquisition by Bristol Myers-Squibb Company in August 2012, and as Vice President, Finance and Chief Financial Officer of Amylin from 2000 to 2006. Prior to joining Amylin in 2000, Mr. Foletta held a number of management positions with Intermark, Inc. and Triton Group Ltd. from 1986 to 2000 and served as an Audit Manager with Ernst & Young. Mr. Foletta is currently a member of the Board of Directors and Audit Committee of AMN Healthcare Services, Inc., a publicly traded healthcare workforce solutions provider. He also is a member of the Board of Directors and Audit Committee of Enanta Pharmaceuticals, Inc. since July 2020. Mr. Foletta received a B.A. in Business Economics from the University of California, Santa Barbara and is a member of the Corporate Directors Forum. Mr. Foletta’s considerable audit and financial experience in the biotechnology and pharmaceutical sectors qualifies him to serve on the Board.

| | | | | | | | | | | | | | |

| Bridgette P. Heller |

Independent Director | | |

| | | | |

| | | | |

| Age: | Joined the Board: | Committees: | | Other Current Public Company Boards or Officer Experience: |

| 62 | 2019 | Compensation | | Aramark Corporation, Integral Ad Science, & Novartis AG |

| | | | |

Bridgette P. Heller has served on our Board since September 2019. Ms. Heller is currently leading a small nonprofit, the Shirley Proctor Puller Foundation, committed to generating better educational outcomes for underserved children in St. Petersburg, Florida. Previously, Ms. Heller served as the Executive Vice President and President of Nutricia, the Specialized Nutrition Division of Danone from July 2016 to August 2019. From 2010 to 2015, she served as Executive Vice President of Merck & Co., Inc. and President of Merck Consumer Care. Prior to joining Merck, Ms. Heller was President of Johnson & Johnson’s Global Baby Business Unit from 2007 to 2010 and President of its Global Baby, Kids, and Wound Care business from 2005 to 2007. She also worked for Kraft Foods from 1985 to 2002, ultimately serving as Executive Vice President and General Manager for the North American Coffee Portfolio. Ms. Heller serves on the Board of Directors of Novartis, a global pharmaceuticals manufacturer and Fortune 200 company. She also serves on the Board of Directors of Newman’s Own, a privately held social business and food manufacturer. Since February 2021, Ms. Heller has served on the Board of Directors of Aramark Corporation, a U.S. publicly traded food service and facilities provider and on the Board of Directors for Integral Ad Science, a U.S. publicly traded global media measurement and optimization company. Ms. Heller received her Bachelor’s degree in Economics and Computer Studies from Northwestern University and an MBA from Northwestern University’s Kellogg Graduate School of Management, where she is also a member of the school’s Advisory Board. Ms. Heller brings to our Board considerable experience in business, specifically as it relates to technology and manufacturing, and she is a strong addition to the Board as Dexcom continues to expand and scale its operations.

| | | | | | | | | | | | | | |

| Kyle Malady |

| Independent Director | | |

| | | | |

| | | | |

| Age: | Joined the Board: | Committees: | | Other Current Public Company Boards or Officer Experience: |

| 57 | 2020 | Nominating and Governance, Technology | | Verizon Communications, Inc. |

| | | | |

Kyle Malady has served on our Board since October 2020. Currently, Mr. Malady serves as EVP and CEO of the Verizon Business Group, a unit of Verizon Communications Inc., a telecommunications company. Previously Mr. Malady served as Executive Vice President of Global Networks and Technology and Chief Technology Officer at Verizon since August 2018. Prior to assuming this role, Mr. Malady was head of the Core Engineering and Operations organization within the Global Network and Technology organization at Verizon from May 2012 to July 2018. He has also served as Verizon’s Vice President of New Product Development from June 2005 to April 2012. Mr. Malady is currently on the board of the CTIA, the wireless industry's trade association. Mr. Malady also serves on the President's National Security Telecommunications Advisory Council (NSTAC). Mr. Malady received a B.S. in Mechanical Engineering from the University of Bridgeport and an MBA in Finance from the NYU Stern School of Business. Mr. Malady’s experience in numerous fields at Verizon provides him with insights and guidance that qualify him to serve on the Board.

| | | | | | | | | | | | | | |

Eric J. Topol, M.D. |

| Independent Director | | |

| | | | |

| | | | |

| Age: | Joined the Board: | Committees: | | Other Current Public Company Boards or Officer Experience: |

| 69 | 2009 | Technology | | None |

| | | | |

Eric J. Topol, M.D. has served on our Board since July 2009. Since January 2007, Dr. Topol has served as the Director of the Scripps Translational Science Institute, a National Institutes of Health funded program of the Clinical and Translational Science Award Consortium. He is Executive Vice President and Professor of Molecular Medicine at the Scripps Research Institute, and a senior consulting cardiologist at Scripps Clinic. Prior to Scripps, Dr. Topol served on the faculty of Case Western Reserve University as a professor in genetics, chaired the Department of Cardiovascular Medicine at Cleveland Clinic for 15 years and founded the Cleveland Clinic Lerner College of Medicine. Dr. Topol serves as a digital medical advisor to Blue Cross Blue Shield Association. In April 2009, he co-founded the West Wireless Health Institute, a non-profit foundation for applied medical research and policy on the prevention of aging. As a practicing physician, academic and thought leader in wireless healthcare technologies, Dr. Topol is uniquely situated to provide the Board with guidance on its technology, clinical and market development.

| | | | | | | | | | | | | | |

| Corporate Governance Highlights |

Our commitment to good corporate governance practices and accountability to stockholders is described below:

| | |

|

What We Do and Have Done |

|

•Amended our certificate of incorporation to declassify our Board of Directors •Implemented a proxy access bylaw provision •Enable our stockholders to amend our bylaws by majority vote •Apply a majority voting standard in uncontested director elections •All directors are independent except for our CEO •Enhance Board independence through regular meetings of independent directors and committees without the presence of management •Equip our Lead Independent Director with broad authority and responsibility •All members of our standing Board committees – the Audit Committee, the Compensation Committee, the Nominating and Governance Committee, and Technology Committee – are independent •Annual Board of Directors, standing committee, and individual director self-evaluations •Stockholders may recommend director nominees to the Nominating and Governance Committee •Established Board oversight of our corporate sustainability practices through our Nominating and Governance Committee •Charters of each committee of the Board clearly establish the committees’ respective roles and responsibilities •Maintain a compliance helpline available to all employees •Our Audit Committee has procedures in place for the anonymous submission of employee complaints on accounting, internal accounting control or auditing matters •Adopted a Code of Conduct and Business Ethics (the "Code of Conduct") that applies to all of our directors, officers and employees worldwide •Our internal audit function maintains critical oversight over the key areas of our business and financial processes and controls, and reports directly to our Audit Committee •We have adopted stock ownership guidelines for our non-employee directors and executive officers |

|

|

What We Don't Do |

|

•No pledging or hedging of Company securities •No multi-voting or non-voting stock |

|

| | | | | | | | | | | | | | |

| Board Leadership Structure and the Role of the Lead Independent Director |

Our Board selects its Chairperson based on what our Board believes is in the best interests of our company and our stockholders. The Nominating and Governance Committee periodically considers the leadership structure of our Board and makes recommendations related to the same to the Board. Our Corporate Governance Principles ("Governance Principles") also provide that, if the Chairperson is also the CEO or if the Chairperson is a former employee, the Board will designate a “lead independent director.”

| | | | | | | | | | | | | | |

| | | | |

| Lead Independent Director | | Chairperson |

| | | | |

•Presides over executive sessions of independent directors; •Serves as a liaison between the Chairperson and the independent directors and communicates to the Chairperson and management, as appropriate, any decisions reached, suggestions, views or concerns expressed by the independent directors in executive sessions or outside of meetings of the Board; •Coordinates with the Chairperson to set the agenda for meetings of the Board, taking into account input from other independent directors; •Provides leadership to the Board if circumstances arise in which the role of the Chairperson may be, or may be perceived to be, in conflict; •Available, under appropriate circumstances, for consultation and direct communication with stockholders; and •Encourages direct dialogue between all directors (particularly those with dissenting views) and management. | | | •Schedules and sets the agenda for meetings of the Board, in coordination with the lead independent director; •Presides over meetings of the full Board; •Contributes to Board governance and Board processes; •Communicates with all directors on key issues and concerns outside of Board meetings; and •Presides over meetings of stockholders. | |

| | | | |

Our Board believes that our stockholders and Dexcom currently are best served by having Kevin R. Sayer, our CEO, also serve as Chairperson of the Board, and Mark G. Foletta serve as lead independent director. Our Board believes that the current Board leadership structure, coupled with a strong emphasis on Board independence, provides effective independent oversight of management while allowing the Board and management to benefit from Mr. Sayer’s extensive executive leadership and operational experience, including familiarity with our business. Our independent directors bring experience, oversight and expertise from outside of our company, while our Chairperson and CEO brings company and industry specific experience and expertise.

Our Board believes that this governance structure provides strong leadership, creates clear accountability, and enhances our ability to communicate our message and strategy clearly and consistently to stockholders. Our Board believes that its independence and oversight of management is maintained effectively through this leadership structure, the composition of the Board and sound corporate governance policies and practices.

Under Nasdaq listing standards, a majority of the members of a listed company’s board of directors must qualify as “independent,” as affirmatively determined by its board of directors. Under the rules of Nasdaq, a director will only qualify as an “independent director” if, in the opinion of that company’s board of directors, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. In addition, the Nasdaq rules require that, subject to specified exceptions, each member of our Audit, Compensation, and Nominating and Governance committees be independent. Our Nominating and Governance consults with our legal counsel and evaluates director independence and qualifications under relevant SEC and Nasdaq rules, as well as under our corporate governance policies, as in effect from time to time.

Consistent with these considerations, after review of all relevant transactions and relationships and based upon the recommendation of the Nominating and Governance Committee, our Board has affirmatively determined that each of Steven R. Altman, Nicholas Augustinos, Richard A. Collins, Karen Dahut, Rimma Driscoll, Mark G. Foletta, Bridgette P. Heller, Barbara E. Kahn, Kyle Malady, and Eric J. Topol, M.D., are independent directors within the meaning of the applicable Nasdaq listing standards. Mr. Sayer is not considered an independent director because of his employment as our President and CEO.

As required under applicable Nasdaq listing standards, our independent directors meet in regularly scheduled executive sessions at which only independent directors are present to promote open and honest discussion. All of the committees of our Board are comprised entirely of directors determined by the Board to be independent within the meaning of applicable Nasdaq listing standards and as required by the SEC rules and regulations.

There are no family relationships among any of our directors or executive officers.

| | | | | | | | | | | | | | |

| Director Selection Process |

Considerations in Identifying and Evaluating Director Nominees

| | | | | | | | |

| 1 | Identify Director Nominees | The Nominating and Governance Committee considers director nominees recommended by sitting directors, officers, employees, stockholders, third-party search firms and others using the same criteria to evaluate all candidates. |

| | |

| 2 | Review Candidate Pool | The Nominating and Governance Committee reviews candidates to determine whether candidates warrant further consideration. |

| | |

| 3 | Evaluate Candidates | The Nominating and Governance Committee meets with and evaluates each potential candidate for the Board, in the context of the Board as a whole, and the specific needs of the Board at that time, with the objective of establishing a Board that is comprised of members that can best further stockholder interests through the exercise of sound judgment, using the diversity of its experience. |

| | |

| 4 | Recommend Director | Upon selection of a qualified candidate, the Nominating and Governance Committee recommends the candidate for appointment or election to our Board. |

| | |

| 5 | Appointment or Election to the Board | Since 2019, four new independent Directors have been added to our Board, each bringing a diverse set of skills and perspectives that add significant value to our governance and oversight. |

| | |

| | |

Nominees for the Board should be committed to enhancing long-term stockholder value and must possess a high level of personal and professional ethics, sound business judgment and integrity. The Board’s policy is to encourage selection of directors who will contribute to the Company’s overall corporate goals.

In evaluating potential candidates to the Board, the Nominating and Governance Committee may also consider such factors as:

•Professional experience in health care, medical technology, finance, marketing, international business, financial reporting and other areas that are expected to contribute to an effective Board

•Personal skills

•Diversity (including with respect to race, ethnicity, gender identity and sexual orientation)

Stockholder Recommendations for Nominations to the Board

The Nominating and Governance Committee will consider director candidates recommended by stockholders. The Nominating and Governance Committee does not intend to alter the manner in which it evaluates candidates, including the criteria set forth above, based on whether or not the candidate was recommended by a stockholder. Stockholder recommendations for candidates to the Board must include the candidate's name and qualifications and be directed in writing to DexCom, Inc., Attn: Corporate Secretary (Dexcom Legal Department), 6340 Sequence Drive, San Diego, CA 92121.

Additional information regarding the process for properly submitting stockholder nominations for candidates for membership on our Board of Directors is set forth in the section entitled “Stockholder Proposals for Annual Meeting”.

The Board and each standing Board committee conducts a self-evaluation of their performance, composition, leadership structure, and governance at least annually. The evaluation format and process is supervised by the Nominating and Governance Committee. The evaluation is typically conducted as an interview with a third-party advisor. A summary of the results is presented to the Board on a “no-names” basis identifying any themes or issues that have emerged. The Board considers the results and ways in which Board processes and effectiveness may be enhanced. Based upon the assessment results, the Board agrees on improvement goals and tracks its progress against those goals over time.

| | | | | | | | | | | | | | |

Director Orientation and Continuing Education |

Management provides each new director with materials, briefings and educational opportunities to permit the director to become familiar with our business and to enable the director to better perform his or her duties. In addition, the Board receives periodic updates on regulatory and other developments relevant to the Board from management and third-party service providers. Board members are also encouraged to attend accredited director education programs.

| | | | | | | | | | | | | | |

| Code of Conduct and Business Ethics |

We have adopted a Code of Conduct that is an essential resource for all of our officers, directors and employees. It outlines our values on a number of issues affecting our business, sets requirements for business conduct, and serves as the basis for our compliance program. The Nominating and Governance Committee reviews and assesses the adequacy of the Code of Conduct on at least an annual basis, and may recommend that the Board establish special committees as may be desirable or necessary from time to time in order to address ethical, legal or other matters that may arise.

We encourage employees to keep open lines of communication with their supervisor and/or department management. Our compliance Intranet website provides additional information, including a global directory of compliance personnel; links to our compliance helpline; current policies, procedures, and resources; and training materials. The compliance helpline is hosted by a third-party helpline provider. Reports through the compliance helpline may remain anonymous.

When required by the rules of Nasdaq, or the SEC, we will disclose any future amendment to, or waiver of, any provision of the Code of Conduct for our principal executive officer and principal financial officer or any member or members of our Board on our website within four business days following the date of such amendment or waiver.

| | | | | | | | | | | | | | |

Insider Trading Policy; Anti-Hedging |

Our Procedures and Guidelines Governing Securities Trades by Company Personnel (our “Insider Trading Policy”) expressly prohibits trading in securities of the Company while in possession of material non-public information about the Company. All of our employees, officers and directors (and their respective immediate family and household members) are prohibited from “tipping” or trading on inside information. In addition, our Insider Trading Policy establishes periods of time during which employees, executive officers, and non-employee directors may and may not trade shares of our common stock. It also prohibits our employees, executive officers and non-employee directors from acquiring, selling, or trading in any interest or position relating to the future price of Dexcom securities, such as a put option, a call option or a short sale (including a short sale “against the box”).

During 2023, as part of the Nominating and Governance Committee’s oversight responsibilities, the Nominating and Governance Committee undertook an extensive review of our then-existing policy to address, among other things, the SEC’s amendments to Rule 10b5-1 promulgated under the U.S. Securities Exchange Act of 1934, as amended (the "Exchange Act"). As a result of this review by the Nominating and Governance Committee, the policy was amended by the Board to, among other things, clarify the procedures with respect to the adoption, amendment or termination of any Rule 10b5-1 trading plan by the Company’s insiders in accordance with the terms of the Company’s Rule 10b5-1 Guidelines.

Clawback Policy

In August 2023, our Board adopted a new compensation recovery policy (the “Clawback Policy”) intended to comply with the requirements of the Dodd-Frank Wall Street Reform and Consumer Protection Act, as implemented by Nasdaq rules and the SEC’s rules and regulations. The Clawback Policy requires us to recover certain incentive-based compensation (as defined in the Clawback Policy) paid or granted to our officers, and such additional

employees as may be identified from time to time, in the event we are required to prepare an accounting restatement due to our material noncompliance with any financial reporting requirement under the securities laws. For additional information, see the section entitled “Executive Compensation—Compensation Discussion and Analysis—Compensation Recovery Policy.”

Our Board values the input of our stockholders, and we are committed to maintaining constructive dialogue with our stockholders.

Stockholder Engagement Process

| | | | | | | | | | | | | | |

| | | | |

| Before the Annual Meeting | | At the Annual Meeting |

| | | | |

•Discuss stockholder proposals (if any) •Publish our Annual Report, Proxy Statement, and Sustainability Report | | | •Conduct engagements with stockholders (as necessary) •Receive voting results for Board and stockholder proposals (if any) | |

| | | | |

| | | | |

| | | | |

| After the Annual Meeting | | Off-Season Engagement |

| | | | |

•Discuss voting results from the Annual Meeting •Review corporate governance trends, recent regulatory developments, and the Company’s own corporate governance documents, policies, and procedures •Consider topics for discussions during off-season stockholder engagements | | | •One-on-one meetings between stockholders, our directors (if appropriate), and members of management •Attend and participate in investor and corporate governance-related events •Evaluate potential changes to the Board, corporate governance, and other relevant matters given stockholder feedback | |

| | | | |

In addition to our regular stockholder engagement efforts, we periodically hold discussions with many of our largest stockholders during scheduled events, including several investor conferences hosted throughout the year.

| | | | | | | | | | | | | | |

| Stockholder Communications with the Board |

Should stockholders wish to communicate with the Board, such correspondences should be sent to the attention of the Corporate Secretary (Dexcom Legal Department), at 6340 Sequence Drive, San Diego, California 92121. All stockholder communications we receive that are addressed to our Board of Directors will be reviewed and compiled by our Corporate Secretary and provided to the members of our Board of Directors, as appropriate and in accordance with our internal policies. Sales materials, abusive, threatening, or otherwise inappropriate materials and items unrelated to the duties and responsibilities of our Board of Directors will not be provided to our directors.

| | | | | | | | | | | | | | |

| Committees of the Board and Meetings |

Our Board maintains four standing committees: the Audit Committee, the Compensation Committee, the Nominating and Governance Committee, and the Technology Committee. Each Committee operates pursuant to a written charter outlining the principal responsibilities of the committee that are available at https://investors.dexcom.com/corporate-governance.

Only directors deemed to be “independent” serve on the Audit Committee, Compensation Committee, Nominating and Governance Committee, and Technology Committee. However, our Board may create special committees from time to time and our current employee directors or those deemed not to be independent under applicable rules and guidelines may be appointed to serve on those special committees, as our Board may determine.

The following is a chart showing membership of each committee as of March 27, 2024, and meeting information for each of these committees during the fiscal year ended December 31, 2023, as well as a description of each committee and its functions.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Name | | Age | | Dexcom Director Since | | Independent | | Audit

Committee | | Compensation

Committee | | Nominating

and Governance

Committee | | Technology

Committee |

| Directors | | | | | | | | | | | | | | |

| Kevin R. Sayer | | 66 | | 2007 | | | | | | | | | | |

| Steven R. Altman | | 62 | | 2013 | | ü | | | | l | | l | | |

| Nicholas Augustinos | | 65 | | 2009 | | ü | | | | | | u | | |

| Richard A. Collins | | 67 | | 2017 | | ü | | l | | | | l | | |

| Karen Dahut | | 60 | | 2020 | | ü | | | | l | | | | l |

| Rimma Driscoll | | 51 | | 2023 | | ü | | l | | | | | | l |

| Mark G. Foletta | | 63 | | 2014 | | n | | u | | | | | | |

| Bridgette P. Heller | | 62 | | 2019 | | ü | | | | u | | | | |

| Barbara E. Kahn | (1) | 71 | | 2011 | | ü | | l | | l | | | | |

| Kyle Malady | | 57 | | 2020 | | ü | | | | | | l | | l |

| Eric J. Topol, M.D. | | 69 | | 2009 | | ü | | | | | | | | u |

| | | | | | | | | | | | | | | |

Total meetings in fiscal year 2023 | | 8 | | 5 | | 5 | | 4 |

| n | Lead Independent Director | | u | | Committee Chairperson | | | | | | | | |

| ü | Independent Director | | l | | Committee Member | | | | | | | | |

(1) Dr. Kahn was not re-nominated for election to the Board at the Annual Meeting, and her term as a director will end on the date of the Annual Meeting.

| | |

| Meetings of the Board of Directors; Director Attendance |

| | | | | | | | | | | |

Our Board met four times during fiscal 2023. Each director attended 75% or more of the aggregate total of the Board and committee meetings for the period for which he or she was a director or committee member, as applicable, for fiscal year 2023. In addition, pursuant to our Governance Principles, we encourage all of our directors and nominees for director to attend our annual meeting of stockholders. Eight out of ten directors serving at that time attended our annual meeting of stockholders in 2023. | | 2023 Average Board Meeting Attendance: 100% | |

| |

| |

| |

| | | | | | | | |

| | Audit Committee |

| | |

Current Members: Mark G. Foletta (Chair) Richard A. Collins Rimma Driscoll Barbara E. Kahn

Independence: The members of our Audit Committee meet the independence requirements under Nasdaq and SEC rules and regulations.

Meetings: 8 meetings during 2023.

Attendance: The average attendance for members of the Audit Committee in 2023 was 91%. | | Responsibilities: Our Audit Committee is responsible for, among other things: •Overseeing our accounting and financial reporting processes and the audits of our financial statements; •Monitoring the periodic reviews of the adequacy of our accounting and financial reporting processes and systems of internal control that are conducted by our independent auditors and our financial and senior management; •Reviewing and evaluating the independence and performance of our independent auditors; •Reviewing with management our major financial risk exposures and the steps management has taken to monitor or mitigate such exposures; and •Facilitating communication among our independent auditors, our financial and senior management and the Board. Audit Committee Qualifications Our Board has determined that Mr. Foletta qualifies as an “audit committee financial expert,” as defined in applicable SEC rules. In addition, each member of our Audit Committee possesses the financial qualifications required of audit committee members set forth in applicable Nasdaq listing standards. |

| | | | | | | | |

| | Compensation Committee |

| | |

Current Members: Bridgette P. Heller (Chair) Steven R. Altman Karen Dahut Barbara E. Kahn

Independence: The members of our Compensation Committee meet the independence requirements under Nasdaq and SEC rules and regulations.

No member of the Compensation Committee has accepted directly or indirectly any consulting, advisory or other compensatory fee from Dexcom or any subsidiary thereof.

Meetings: 5 meetings during 2023.

Attendance: The average attendance for members of the Compensation Committee in 2023 was 100%. | | Responsibilities: The Compensation Committee is responsible for, among other things, overseeing: •The review and approval, or recommendation to the Board for approval, of all forms of compensation (including, without limitation, equity, incentive and non-equity compensation, and perquisites) of our executive officers and directors; •Administration of our equity-based compensation plans; and •The production of an annual report on executive compensation for use in our proxy statement. In addition, the Compensation Committee evaluates the potential risks related to our compensation programs and periodically reviews the succession plans for senior management positions, concurrent with the authority of the Board with respect to succession planning. For a discussion of policies and procedures of the Compensation Committee, please see "Executive Compensation". Compensation Committee Interlocks and Insider Participation None of the current members of our Compensation Committee, or any member that served during the fiscal year ended December 31, 2023, is or has been at any time an officer or employee of Dexcom. None of our executive officers currently serves, or in the past fiscal year has served, as a member of the board of directors or compensation committee (or other board committee performing equivalent functions) of any entity that has one or more of its executive officers serving on our Board of Directors or Compensation Committee.

|

| | |

| | |

| | |

| | |

| | |

| | |

| | | | | | | | |

| | Nominating and Governance Committee |

| | |

Current Members: Nicholas Augustinos (Chair) Steven R. Altman Richard A. Collins Kyle Malady

Independence: The members of our Nominating and Governance Committee meet the independence requirements under Nasdaq and SEC rules and regulations.

Meetings: 5 meetings during 2023.

Attendance: The average attendance for members of the Nominating and Governance Committee in 2023 was 95%. | | Responsibilities: The Nominating and Governance Committee is responsible for, among other things: •Developing and recommending policies regarding the director nomination processes, including the desired qualifications, expertise and characteristics of Board members, with a goal of developing a diverse, experienced and highly qualified Board; •Reviewing and assessing on at least an annual basis the adequacy of our Code of Conduct; •Reviewing with management our major legal and compliance risk exposures and the steps management has taken to monitor or mitigate such exposures; •Overseeing our risk management policies and procedures dealing with risk identification and risk assessment regarding enterprise and other principal operational and business risks we face; •Overseeing and reviewing (i) our policies and programs concerning corporate social responsibility and our participation and visibility as a global corporate citizen; (ii) our sustainability performance; and (iii) the assessment and management of environmental, sustainability and governance risks affecting our business. |

| | | | | | | | |

| | Technology Committee |

| | |

Current Members: Eric J. Topol, M.D. (Chair) Karen Dahut Rimma Driscoll Kyle Malady

Independence: All members of our Technology Committee are independent under Nasdaq and SEC rules and regulations.

Meetings: 4 meetings during 2023.

Attendance: The average attendance for members of the Technology Committee in 2023 was 94%.

| | Responsibilities: The Technology Committee is responsible for, among other things: •Reviewing, evaluating and making recommendations to the Board regarding our major technology plans and strategies, including our research and development activities, as well as technical and market risks associated with product development and investment; •Reviewing our research and development activities and product pipeline, and timelines for achievement of activities and pipeline; and •Regularly reviewing the cybersecurity, privacy, data protection and other major information technology risk exposures of the company, the steps management has taken to monitor and control such exposures, and our compliance with applicable information security and data protection laws and industry standards. |

| | | | | | | | | | | | | | |

| Board of Directors' Role in Risk Oversight |

The Board is ultimately responsible for overseeing our risk assessment and risk management. In fulfilling this oversight role, our Board focuses on understanding the nature of our enterprise risks, including our operations and strategic direction, as well as the adequacy of our risk management process and overall risk management system. While the full Board has overall responsibility for risk oversight, the Board has delegated oversight responsibility related to certain risks to the standing committees of the Board.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| The Board | |

| | | | | | | | |

| At its regularly scheduled meetings, the Board receives management updates and committee reports regarding business operations, financial results, committee activities, strategy, and discusses risks related to the business. Through management updates and committee reports, the Board monitors our risk management activities, including the enterprise risk management process and cybersecurity risks, risks relating to our compensation programs, and financial, legal and operational risks. | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Audit Committee | | Compensation Committee |

| | | | | | | | |

| | The Audit Committee assists the Board in its oversight of risk management by discussing with management our guidelines and policies regarding financial risk management, including major risk exposures, and the steps management has taken to monitor or mitigate such exposure. | | | | | The Compensation Committee assists the Board by evaluating potential risks related to our compensation policies and practices, and human capital management programs, including but not limited to talent recruiting, development, progression and retention, diversity, equity and inclusion, culture, human health and safety and total rewards. | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Nominating and Governance Committee | | Technology Committee |

| | | | | | | | |

| | The Nominating and Governance Committee assists the Board in its oversight of our legal compliance policies, including our Insider Trading Policy, enterprise risk management, operating and compliance risk exposures and the steps management has taken to monitor or mitigate such exposures, and assessment and management of environmental, sustainability and governance risks affecting our business. | | | | | The Technology Committee assists the Board in its oversight of our technology plans and strategies, cybersecurity and major information technology risk exposures and the steps management has taken to monitor or mitigate such exposures. | |

| | | | | | | | |

Our Information Security and Privacy Oversight Structure

Our Board is responsible for exercising oversight of management’s identification and management of, and planning for, risks from cybersecurity threats. While the full Board has overall responsibility for risk oversight, the Board has delegated oversight responsibility related to risks from cybersecurity threats to the Technology Committee. The Technology Committee reports to the Board as necessary with respect to its activities, including making such reports and recommendations to the Board and its other committees as necessary and appropriate and consistent with its purpose, described above. The Technology Committee, comprised of independent Board members, is responsible for reviewing cybersecurity, privacy, data protection and other major technology risk exposures of the Company, the steps management has taken to monitor and control such exposures, and the Company’s compliance with applicable cybersecurity and data privacy laws and industry standards. These reviews are provided at least quarterly. The Technology Committee receives management updates and reports, primarily through the Company’s Cybersecurity and Privacy Committee, a multidisciplinary management team responsible for the overall governance, decision-making, risk management, awareness and compliance for cybersecurity and privacy activities across the Company.

We have established cybersecurity and privacy programs to maintain the confidentiality, integrity, availability, and privacy of protected information and ensure compliance with relevant security/privacy regulations, contractual requirements, and industry-standard frameworks. Our cybersecurity program includes annual review and assessment by external, independent third parties, who certify and report on these programs. For example, our Information Security Management System (ISMS) is certified as being in conformity with ISO/IEC 27001 by SRI Quality System Registrar. We maintain cybersecurity and privacy policies and procedures in accordance with industry-standard control frameworks and applicable regulations, laws, and standards. All corporate cybersecurity policies are reviewed and approved by senior leadership at least annually as part of our ISMS. Our cybersecurity controls, which are the mechanisms in place to prevent, detect and mitigate threats in accordance with our policies and procedures, are based on the regulatory requirements to which we are subject and are monitored and tested both internally and externally by third parties at least annually. These controls include regular system updates and patches, employee training on cybersecurity and privacy requirements, incident reporting, and the use of encryption to secure sensitive information. In addition, we also regularly perform phishing tests of our employees and update our training plan at least annually. We maintain business continuity and disaster recovery capabilities to mitigate interruptions to critical information systems and/or the loss of data and services from the effects of natural or man-made disasters to Dexcom locations. We also provide annual privacy and security training for all employees. Our security training incorporates awareness of cyber threats (including but not limited to malware, ransomware and social engineering attacks), password hygiene, incident reporting process, as well as physical security best practices. These measures also include escalation protocols through which the Cybersecurity and Privacy Committee is informed about cybersecurity and incidents by our ISO and PSO, who are informed through our business units.

Our Corporate Strategy Oversight Structure

Our Board actively oversees management’s establishment and execution of corporate strategy, including major business and organizational initiatives, annual budget and long-term strategic plans, capital allocation priorities, potential corporate development opportunities, and risk management. Our objective is to remain a leading provider of CGM systems and related products to enable people with diabetes to more effectively and conveniently manage their condition. We are also developing and commercializing products that integrate our CGM technologies into the insulin delivery systems or data platforms of our respective partners. In addition, we continue to pursue development partnerships with other insulin delivery companies, including automated insulin delivery systems, as well as other players in the disease management sector. The Board actively oversees our business strategies as we pursue these objectives.