UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2013

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 000-51222

DEXCOM, INC.

(Exact name of Registrant as specified in its charter)

Delaware | 33-0857544 | |

(State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) | |

6340 Sequence Drive San Diego, California | 92121 | |

(Address of Principal Executive Offices) | (Zip Code) | |

Registrant’s Telephone Number, including area code: (858) 200-0200

Securities registered pursuant to Section 12(b) of the Exchange Act:

Title of Each Class | Name of Each Exchange on Which Registered | |

Common Stock, $0.001 Par Value Per Share | The NASDAQ Stock Market LLC (Nasdaq Global Select Market) | |

Preferred Stock Purchase Rights | The NASDAQ Stock Market LLC (Nasdaq Global Select Market) | |

Securities registered pursuant to Section 12(g) of the Exchange Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ý No ¨

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act.

Yes ¨ No ý

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

1

Yes ý No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Rule 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definite proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “Smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one)

Large accelerated Filer ý Accelerated Filer ¨ Non-accelerated Filer ¨ Smaller reporting company ¨

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ¨ No ý

As of June 30, 2013, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was approximately $1,564,116,891 based on the closing sales price as reported on the NASDAQ Global Select Market.

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

Class | Outstanding at February 14, 2014 | |

Common stock, $0.001 par value per share | 72,810,396 shares | |

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the documents listed below have been incorporated by reference into the indicated parts of this report, as specified in the responses to the item numbers involved.

Designated portions of the Proxy Statement relating to the 2014 Annual Meeting of the Stockholders (the “Proxy Statement”): Part III (Items 9, 10, 11, 12, and 13). Except with respect to information specifically incorporated by reference in the Form 10-K, the Proxy Statement is not deemed to be filed as part hereof.

2

DexCom, Inc.

Table of Contents

Page Number | ||

PART I | ||

ITEM 1. | Business | |

ITEM 1A. | Risk Factors | |

ITEM 1B. | Unresolved Staff Comments | |

ITEM 2. | Properties | |

ITEM 3. | Legal Proceedings | |

ITEM 4. | Mine Safety Disclosures | |

PART II | ||

ITEM 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | |

ITEM 6. | Selected Financial Data | |

ITEM 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | |

ITEM 7A. | Quantitative and Qualitative Disclosures about Market Risk | |

ITEM 8. | Consolidated Financial Statements and Supplementary Data | |

ITEM 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | |

ITEM 9A. | Controls and Procedures | |

ITEM 9B. | Other Information | |

PART III | ||

ITEM 10. | Directors, Executive Officers and Corporate Governance | |

ITEM 11. | Executive Compensation | |

ITEM 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholders Matters | |

ITEM 13. | Certain Relationships and Related Transactions, and Director Independence | |

ITEM 14. | Principal Accounting Fees and Services | |

PART IV | ||

ITEM 15. | Exhibits, Financial Statement Schedules | |

2

PART I

Except for historical financial information contained herein, the matters discussed in this Form 10-K may be considered forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and subject to the safe harbor created by the Securities Litigation Reform Act of 1995. Such statements include declarations regarding our intent, belief, or current expectations and those of our management. Prospective investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve a number of risks, uncertainties and other factors, some of which are beyond our control; actual results could differ materially from those indicated by such forward-looking statements. Important factors that could cause actual results to differ materially from those indicated by such forward-looking statements include, but are not limited to: (i) that the information is of a preliminary nature and may be subject to further adjustment; (ii) those risks and uncertainties identified under “Risk Factors;” and (iii) the other risks detailed from time-to-time in our reports and registration statements filed with the Securities and Exchange Commission, or SEC. Except as required by law, we undertake no obligation to revise or update publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

ITEM 1. | BUSINESS |

Overview

DexCom, Inc. is a medical device company focused on the design, development and commercialization of continuous glucose monitoring systems for ambulatory use by people with diabetes and for use by healthcare providers in the hospital for the treatment of patients with and without diabetes. Unless the context requires otherwise, the terms “we,” “us,” “our,” the “company,” or “DexCom” refer to DexCom, Inc. and its subsidiaries.

Ambulatory Product Line: SEVEN® PLUS, DexCom G4® and DexCom G4® PLATINUM

We received approval from the Food and Drug Administration (“FDA”) and commercialized our first product in 2006. In 2007, we received approval and began commercializing our second generation system, the DexCom SEVEN. We no longer market or provide support for the DexCom SEVEN system. In 2009 we received approval for our third generation system, the DexCom SEVEN PLUS, which is designed for up to seven days of continuous use, and we began commercializing this product in the first quarter of 2009. On June 14, 2012, we received Conformité Européene Marking (“CE Mark”) approval for our fourth generation continuous glucose monitoring system, the DexCom G4 system, enabling commercialization of the DexCom G4 system in the European Union, Australia, New Zealand and the countries in Asia and Latin America that recognize the CE Mark. On October 5, 2012, we received approval from the FDA for the DexCom G4 PLATINUM, which is designed for up to seven days of continuous use by adults with diabetes, and we began commercializing this product in the U.S. in the fourth quarter of 2012. On February 14, 2013, we received CE Mark approval for a pediatric indication for our DexCom G4 system, enabling us to market and sell this system in the European Union, Australia, New Zealand and the countries in Asia and Latin America that recognize the CE Mark to persons two years old and older who have diabetes (hereinafter referred to as the "Pediatric Indication"), and we initiated a limited commercial launch in the second quarter of 2013. In connection with our receipt of CE Mark approval for the Pediatric Indication, we changed the name of the DexCom G4 system to the DexCom G4 PLATINUM system. In the first quarter of 2013, we submitted a PMA supplement to the FDA seeking approval of a Pediatric Indication for the DexCom G4 PLATINUM system in the United States and on February 3, 2014, we received approval from the FDA. During the third quarter of 2013, we submitted a PMA supplement to the FDA seeking an expanded indication for the DexCom G4 PLATINUM for professional use. This expanded indication would allow healthcare professionals to purchase DexCom G4 PLATINUM devices for use with multiple patients. Healthcare professionals can use the insights gained from a DexCom G4 PLATINUM professional session to adjust therapy and to educate and motivate patients to modify their behavior after viewing the effects that specific foods, exercise, stress, and medications have on their glucose levels. Unless the context requires otherwise, the term "G4 PLATINUM" shall refer to the DexCom G4 and DexCom G4 PLATINUM systems that are commercialized by us in and outside of the United States.

As compared to the SEVEN PLUS, the G4 PLATINUM offers:

• | an improved sensor wire design that allows more scalable manufacturing; |

• | a smaller, sleeker receiver that is capable of displaying data in color; |

• | a new transmitter design that offers improved communication range with the receiver that allows for improved data capture; |

• | additional user interface and algorithm enhancements that are intended to make the user experience more customizable and to make its glucose monitoring function more accurate especially in the hypoglycemic range; and |

3

• | the ability to market and sell to an expanded customer population due to the approval by the FDA of, and our obtaining a CE Mark for, a Pediatric Indication, |

The approval of the G4 PLATINUM and the Pediatric Indication, by the FDA allows for the use of the G4 PLATINUM by persons two years old and older with diabetes to detect trends and track glucose patterns, to aid in the detection of hypoglycemia and hyperglycemia and to facilitate acute and long-term therapy adjustments. With the approval of the G4 PLATINUM systems in the United States, we have reduced marketing and sales efforts related to SEVEN PLUS.

DexCom SHARETM

During the third quarter of 2013, we submitted a PMA supplement to the FDA seeking approval of the DexCom SHARE remote monitoring system. Through secure wireless connections, DexCom SHARE notifies another person of a user's G4 PLATINUM sensor glucose information when the G4 PLATINUM Receiver is docked in the DexCom SHARE Cradle. DexCom SHARE provides secondary notification and does not replace real time continuous glucose monitoring or standard home blood glucose monitoring.

In-Hospital Product Line: GlucoClear®

To address the in-hospital patient population, we entered into an exclusive agreement with Edwards to develop jointly and market a specific product platform for the in-hospital glucose monitoring market, with an initial focus on the development of an intravenous sensor specifically for the critical care market. On October 30, 2009, we received CE Mark approval for our first generation blood-based in-vivo automated glucose monitoring system, which we have branded the GlucoClear, for use by healthcare providers in the hospital, and in January 2013, Edwards received CE Mark approval for the second generation system. In partnership with Edwards, we initiated a very limited launch of the GlucoClear system in Europe in 2009, and Edwards initiated another limited launch in Europe of the second generation GlucoClear in 2013.

SweetSpot

Through our acquisition of SweetSpot in 2012, we have a software platform that enables our customers to aggregate and analyze data from certain diabetes devices and to share it with their healthcare providers. In November 2011, SweetSpot received 510(k) clearance from the FDA to market to clinics a data management service, which helps healthcare providers and patients see, understand and use blood glucose meter data to diagnose and manage diabetes. SweetSpot’s data transfer service is registered with the FDA as a Medical Device Data System (“MDDS”) and allows researchers to control the transfer of data from certain diabetes devices to research tools and databases according to their own research workflows. SweetSpot’s software provides an advanced cloud-based platform for uploading, processing and delivering health data and transforms raw output from certain medical devices into useful information for healthcare providers, individuals and researchers.

Background

From inception to 2006, we devoted substantially all of our resources to start-up activities, raising capital and research and development, including product design, testing, manufacturing and clinical trials. Since 2006, we have devoted considerable resources to the commercialization of our ambulatory continuous glucose monitoring systems, including the SEVEN PLUS and G4 PLATINUM, as well as the continued research and clinical development of our technology platform.

The International Diabetes Federation (“IDF”) estimates that in 2012, 371 million people around the world had diabetes, and the Centers for Disease Control (“CDC”) estimates that in 2010, diabetes affected 25.8 million people in the United States, of which 7.0 million were undiagnosed. IDF estimates that by 2035, the worldwide incidence of people suffering from diabetes will reach 592 million. The increased prevalence of diabetes is believed to be the result of an aging population, unhealthy diets and increasingly sedentary lifestyles. According to the CDC's National Vital Statistics Reports for 2010, diabetes was the seventh leading cause of death by disease in the United States. According to the Congressional Diabetes Caucus, diabetes is the leading cause of kidney failure, adult-onset blindness, lower-limb amputations, and significant cause of heart disease and stroke, high blood pressure and nerve damage. According to the IDF, there were an estimated 4.8 million deaths attributable to diabetes globally in 2012. The American Diabetes Association (“ADA”) Fast Facts, revised in March 2013, states that diabetes is the primary cause of death for more than 71,000 Americans each year, and contributes to the death of more than 231,000 Americans annually.

According to the Congressional Diabetes Caucus, in the United States, another individual is diagnosed with diabetes every 17 seconds. Each day approximately 5,082 people are diagnosed with diabetes, and about 1.9 million people will be diagnosed this year. In addition to those newly diagnosed, every 24 hours there are: 238 amputations in people with diabetes, 120 people who enter end-stage kidney disease programs, and 48 people who go blind.

4

According to the ADA one in every five healthcare dollars was spent on treating diabetes in 2012, and the direct medical costs and indirect expenditures attributable to diabetes in the United States were an estimated $245 billion, an increase of $71 billion, or approximately 41%, since 2007. Of the $245 billion in overall expenses, the ADA estimated that approximately $176 billion were direct costs associated with diabetes care, chronic complications and excess general medical costs, and $69 billion were indirect medical costs. The ADA also found that average medical expenditures among people with diagnosed diabetes were 2.3 times higher than for people without diabetes in 2012. According to the IDF, expenditures attributable to diabetes were an estimated $471 billion globally in 2012. The IDF estimates that expenditures attributable to diabetes will grow to $627 billion globally by 2035.

We believe continuous glucose monitoring has the potential to enable more people with diabetes to achieve and sustain tight glycemic control. The Diabetes Control and Complications Trial (“DCCT”) demonstrated that improving blood glucose control lowers the risk of developing diabetes-related complications by up to 50%. The study also demonstrated that people with Type 1 diabetes achieved sustained benefits with intensive management. Yet, according to an article published in the Journal of the American Medical Association (“JAMA”) in 2004, less than 50% of diabetes patients were meeting ADA standards for glucose control (A1c), and only 37% of people with diabetes were achieving their glycemic targets. The CDC estimated that as of 2006, 63.4% of all adults with diabetes were monitoring their blood glucose levels on a daily basis, and that 86.7% of insulin-requiring patients with diabetes monitored daily.

Various clinical studies also demonstrate the benefits of continuous glucose monitoring and that continuous glucose monitoring is equally effective in patients who administer insulin through multiple daily injections or through use of continuous subcutaneous insulin infusion pumps. Results of a Juvenile Diabetes Research Foundation (“JDRF”) study published in the New England Journal of Medicine in 2008, and the extension phase of the study, published in Diabetes Care in 2009, demonstrated that continuous glucose monitoring improved A1c levels and reduced incidence of hypoglycemia for patients over the age of 25 and for all patients of all ages who utilized continuous glucose monitoring regularly.

Our initial target market in the United States consists of an estimated 30% of people with Type 1 diabetes who utilize insulin pump therapy and an estimated 50% of people with Type 1 diabetes who utilize multiple daily insulin injections. Our broader target market in the United States consists of our initial target market plus an estimated 20% of people with Type 1 diabetes using conventional insulin therapy and the estimated 27% of people with Type 2 diabetes who require insulin. Although our initial focus is within the United States, our CE Mark approval also enables us to commercialize our system in those European, Asian and Latin American countries that recognize the CE Mark.

We have built a direct sales organization to call on endocrinologists, physicians and diabetes educators who can educate and influence patient adoption of continuous glucose monitoring. The approval by the FDA of a Pediatric Indication for our G4 PLATINUM system in February 2014 will now allow our sales organization to call on pediatric endocrinologists and pediatricians who can educate and influence adoption of continuous glucose monitoring by parents who have children aged two years or older with diabetes. We believe that focusing efforts on these participants is important given the instrumental role they each play in the decision-making process for diabetes therapy. To complement our direct sales efforts, we have entered into a limited number of U.S. and international distribution arrangements that allow distributors to sell our products. We believe our direct, highly specialized and focused sales organization is sufficient for us to support our sales efforts.

We are leveraging our technology platform to enhance the capabilities of our current products and to develop additional continuous glucose monitoring products. In 2008 and 2012, we entered into development agreements with Animas Corporation (“Animas”), a subsidiary of Johnson & Johnson, and with Tandem Diabetes Care, Inc. (“Tandem”), respectively. The purpose of each of these development relationships is to integrate our technology into the insulin pump product offerings of the respective partner, enabling the partner's insulin pump to receive glucose readings from our transmitter and display this information on the pump's screen. The Animas insulin pump product augmented with our sensor technology has been branded the Vibe®, and received CE Mark approval in May 2011, which allows Animas to market the Vibe in the countries that recognize CE Mark approvals.

On October 5, 2012, we received FDA approval for the G4 PLATINUM system. On June 14, 2012, we received CE Mark approval for the G4 system, enabling commercialization of the DexCom G4 system in the European Union, Australia, New Zealand and the countries in Asia and Latin America that recognize the CE Mark. Our G4 PLATINUM system features improved sensor reliability, stability and accuracy over the useful life of the sensor, and is suitable for large scale manufacturing. On February 14, 2013, we received CE Mark approval of a Pediatric Indication for the G4 PLATINUM, enabling us to market and sell that system in the European Union, Australia, New Zealand and the countries in Asia and Latin America that recognize the CE Mark to persons two years old and older who have diabetes. On February 3, 2014, we obtained approval from the FDA of a Pediatric Indication for the DexCom G4 PLATINUM system in the United States. We also intend to seek a pregnancy indication (women who develop gestational diabetes during pregnancy) for our product platform in the future.

5

In March 2012, we acquired SweetSpot and SweetSpot became a wholly-owned subsidiary of DexCom. SweetSpot is a healthcare-focused information technology company with a platform for uploading and processing data from certain diabetes devices to advance the treatment of diabetes. SweetSpot specializes in turning raw output from certain devices into information for healthcare providers, users and researchers. Through our acquisition of SweetSpot, we have a software platform that enables our customers to aggregate and analyze data from certain diabetes devices and share it with their healthcare providers.

Our development timelines are highly dependent on our ability to achieve clinical endpoints and regulatory requirements and to overcome technology challenges, and our development timelines may be delayed due to extended regulatory approval timelines, scheduling issues with patients and investigators, requests from institutional review boards, sensor performance and manufacturing supply constraints, among other factors. In addition, support of these clinical trials requires significant resources from employees involved in the production of our products, including research and development, manufacturing, quality assurance, and clinical and regulatory personnel. Even if our development and clinical trial efforts are successful, the FDA may not approve our products, and even if approved, we may not achieve acceptance in the marketplace by physicians and people with diabetes.

As a medical device company, reimbursement from Medicare and private third-party healthcare payors is an important element of our success. Although the Centers for Medicare and Medicaid (“CMS”) released 2008 Alpha-Numeric Healthcare Common Procedure Coding System (“HCPCS”) codes applicable to each of the three components of our continuous glucose monitoring systems, to date, our approved products are not reimbursed by virtue of a national coverage decision by Medicare. It is not known when, if ever, Medicare will adopt a national coverage decision with respect to continuous glucose monitoring devices. Until any such coverage decision is adopted by Medicare, reimbursement of our products will generally be limited to those customers covered by third-party payors that have adopted coverage policies for continuous glucose monitoring devices that includes our devices. As of February 2014, the seven largest private third-party payors, in terms of the number of covered lives, have issued coverage policies for the category of continuous glucose monitoring devices. In addition, we have negotiated contracted rates with six of those third-party payors for the purchase of our SEVEN PLUS and G4 PLATINUM systems by their members. Many of these coverage policies are restrictive in nature and require the patient to comply with extensive documentation and other requirements to demonstrate medical necessity under the policy. In addition, customers who are insured by payors that do not offer coverage for our devices will have to bear the financial cost of the products. We currently employ in-house reimbursement expertise to assist customers in obtaining reimbursement from private third-party payors. We also maintain a field-based reimbursement team charged with calling on third-party private payors to obtain coverage decisions and contracts. We have had formal meetings and have increased our efforts to create and liberalize coverage policies with third-party payors and expect to continue to do so in 2014. However, unless government and other third-party payors provide adequate coverage and reimbursement for our products, people with diabetes may not use them on a widespread basis.

We plan to develop future generations of technologies focused on improved performance and convenience and that will enable intelligent insulin administration. Over the longer term, we plan to develop networked platforms with open architecture, connectivity and transmitters capable of communicating with other devices. As an example, during the third quarter of 2013, we submitted a PMA supplement to the FDA for the DexCom SHARE System. Through secure wireless connections, DexCom SHARE notifies another person of a user's DexCom G4 PLATINUM sensor glucose information when the G4 PLATINUM Receiver is docked in the DexCom SHARE Cradle.

Market Opportunity

Diabetes

Diabetes is a chronic, life-threatening disease for which there is no known cure. The disease is caused by the body’s inability to produce or effectively utilize the hormone insulin. This inability prevents the body from adequately regulating blood glucose levels. Glucose, the primary source of energy for cells, must be maintained at certain concentrations in the blood in order to permit optimal cell function and health. Normally, the pancreas provides control of blood glucose levels by secreting the hormone insulin to decrease blood glucose levels when concentrations are too high. In people with diabetes, the body does not produce sufficient levels of insulin, or fails to utilize insulin effectively, causing blood glucose levels to rise above normal. This condition is called hyperglycemia and often results in chronic long-term complications such as heart disease, limb amputations, loss of kidney function and blindness. When blood glucose levels are high, people with diabetes often administer insulin in an effort to decrease blood glucose levels. Unfortunately, insulin administration can drive blood glucose levels below the normal range, resulting in hypoglycemia. In cases of severe hypoglycemia, people with diabetes risk acute complications, such as loss of consciousness or death. Due to the drastic nature of acute complications associated with hypoglycemia, many people with diabetes are reluctant to reduce blood glucose levels. Consequently, these individuals often remain in a hyperglycemic state, increasing their odds of developing long-term chronic complications.

Diabetes is typically classified into two major groups: Type 1 and Type 2. According to the ADA and JDRF, respectively, there are an estimated 1.3 million to 3.0 million Type 1 diabetes patients in the United States. Type 1 diabetes is an autoimmune

6

disorder that usually develops during childhood and is characterized by an absence of insulin, resulting from destruction of the insulin producing cells of the pancreas. Individuals with Type 1 diabetes must rely on frequent insulin injections in order to regulate and maintain blood glucose levels. According to the ADA, there are approximately 25.8 million people with diabetes in the United States, of which approximately 24.5 million people have Type 2 diabetes. Type 2 diabetes is a metabolic disorder which results when the body is unable to produce sufficient amounts of insulin or becomes insulin resistant. Depending on the severity of Type 2 diabetes, individuals may require diet and nutrition management, exercise, oral medications or insulin injections to regulate blood glucose levels. We estimate that approximately 3.6 million Type 2 patients must use insulin to manage their diabetes.

There are various subgroups of people with diabetes, including in-hospital patients, who present significant management challenges. According to the ADA, diabetes related hospitalizations totaled 24.3 million days in 2007, an increase of 7.4 million days from 2002. Additionally, studies show that many hospital patients without diabetes suffer episodes of hyperglycemia. According to a Diabetes Care article, as of 1998, as many as 1.5 million hospitalized patients had significant hyperglycemia without a history of diabetes. A November 2001 article in the New England Journal of Medicine summarized a study of over 1,500 hospitalized patients, of which only 13% had diabetes, which concluded that intensive insulin therapy to maintain blood glucose levels within a target range reduced mortality among critically ill patients in the surgical intensive care unit and improved patient outcomes. An August 2010 Healthcare Cost and Utilization Project report on hospital utilization by patients with diabetes in 2008 reported there were over 7.7 million hospital stays for patients with diabetes as a principal or secondary diagnosis and 540,000 hospitals stays for patients with diabetes as a primary diagnosis. The mean length of stay for patients with diabetes was almost one day longer than for patients without diabetes contributing to a 25% increase in the mean cost of hospitalization. Stays involving patients with diabetes contributed almost $83.0 billion of hospital costs in the United States, which represents 23% of the total hospital costs in the United States.

According to the National Diabetes Education Program, about 75% of all newly diagnosed cases of Type 1 diabetes in the United States occur in juveniles younger than 18 years of age. According to JDRF, the incidence of Type 1 diabetes among children under the age of 14 is estimated to increase by approximately 3% annually worldwide. In addition, Type 2 diabetes is occurring with increasing frequency in young people. The increase in prevalence is related to an increase in obesity amongst children. According to the CDC, as of 2010, approximately one-third of children and adolescents in the United States were overweight or obese and childhood obesity has more than doubled in children and tripled in adolescents in the past 30 years.

Importance of Glucose Monitoring

Blood glucose levels can be affected by many factors, including the carbohydrate and fat content of meals, exercise, stress, illness or impending illness, hormonal releases, variability in insulin absorption and changes in the effects of insulin in the body. Given the many factors that affect blood glucose levels, maintaining glucose within a normal range is difficult, resulting in frequent and unpredictable excursions above or below normal blood glucose levels. People with diabetes manage their blood glucose levels by administering insulin or ingesting carbohydrates throughout the day in order to maintain blood glucose within normal ranges. People with diabetes frequently overcorrect and fluctuate between hyperglycemic and hypoglycemic states, often multiple times during the same day. As a result, many people with diabetes are routinely outside the normal blood glucose range. People with diabetes are often unaware that their glucose levels are either too high or too low, and their inability to completely control blood glucose levels and the associated serious complications can be frustrating and, at times, overwhelming.

In an attempt to maintain blood glucose levels within the normal range, people with diabetes must first measure their blood glucose levels. Often after measuring their blood glucose levels, people with diabetes make therapeutic adjustments. As adjustments are made, additional blood glucose measurements may be necessary to gauge the individual’s response to the adjustments. More frequent testing of blood glucose levels provides people with diabetes with information that can be used to better understand and manage their diabetes. The ADA recommends that most people with Type 1 diabetes test their blood glucose levels at least three or more times per day, and that significantly more frequent testing may be required to reach A1c targets safely without hypoglycemia.

Clinical outcomes data support the notion that an important component of effective diabetes management is frequent monitoring of blood glucose levels. The landmark 1993 DCCT consisting of patients with Type 1 diabetes, and the 1998 UK Prospective Diabetes Study, consisting of patients with Type 2 diabetes, demonstrated that people with diabetes who intensely managed blood glucose levels delayed the onset and slowed the progression of diabetes-related complications. In the DCCT, a major component of intensive management was monitoring blood glucose levels at least four times per day using conventional single-point blood glucose meters. The DCCT demonstrated that intensive management reduced the risk of complications by 76% for eye disease, 60% for nerve disease and 50% for kidney disease. However, the DCCT also found that intensive management led to a three-fold increase in the frequency of hypoglycemic events. In the December 2005 edition of the New England Journal of Medicine, the authors of a peer-reviewed study concluded that intensive diabetes therapy has long-term

7

beneficial effects on the risk of cardiovascular disease in patients with Type 1 diabetes. The study showed that intensive diabetes therapy reduced the risk of cardiovascular disease by 42% and the risk of non-fatal heart attack, stroke or death from cardiovascular disease by 57%.

Limitations of Existing Glucose Monitoring Products

Single-point finger stick devices are the most prevalent devices for glucose monitoring. These devices require taking a blood sample with a finger stick, placing a drop of blood on a test strip and inserting the strip into a glucose meter that yields a single point in time blood glucose measurement. We believe that these devices suffer from several limitations, including:

• | Limited Information. Even if people with diabetes test several times each day, each measurement represents a single blood glucose value at a single point in time. Given the many factors that can affect blood glucose levels, excursions above and below the normal range often occur between these discrete measurement points in time. Because people with diabetes only have single-point data, they do not gain sufficient information to indicate the direction or rate of change in their blood glucose levels. Without the ability to determine whether their blood glucose level is rising, falling or holding constant, and the rate at which their blood glucose level is changing, the individual’s ability to effectively manage and maintain blood glucose levels within normal ranges is severely limited. Further, people with diabetes cannot test themselves during sleep, when the risk of hypoglycemia is significantly increased. In addition, existing technology generally limits individuals’ ability to store their glucose data in servers or systems independent of the blood glucose meter. |

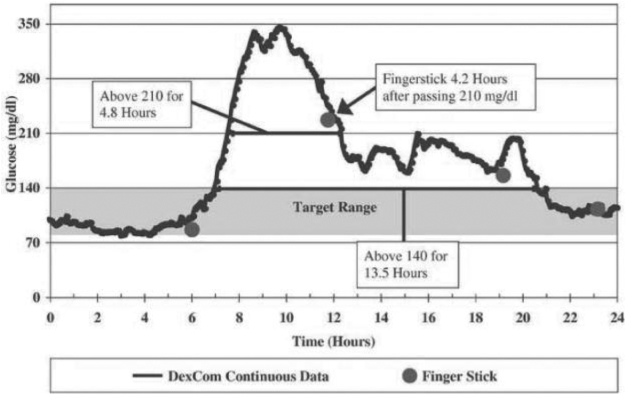

The following graph shows the limited information provided by four single-point measurements during a single day using a traditional single-point finger stick device, compared to the data provided by our continuous sensor. The data presented in the graph is from a clinical trial we completed in 2003 with a continuous glucose monitoring system, where the patient was blinded to the continuous glucose data. The continuous data indicates that, even with four finger sticks in one day, the patient’s blood glucose levels were above the target range of 80-140 milligrams per deciliter (“mg/dl”) for a period of 13.5 hours.

Single Day Continuous Data

• | Inconvenience. The process of measuring blood glucose levels with single-point finger stick devices can cause significant disruption in the daily activities of people with diabetes and their families. People with diabetes using single- |

8

point finger stick devices must stop whatever they are doing several times per day, self-inflict a painful prick and draw blood to measure blood glucose levels. To do so, people with diabetes must always carry a fully supplied kit that may include a spring-loaded needle, or lancet, disposable test strips, cleansing wipes, and the meter, and then safely dispose of the used supplies. This process is inconvenient and may cause uneasiness in social situations.

• | Difficulty of Use. To obtain a sample with single-point finger stick devices, people with diabetes generally prick one of their fingertips or, occasionally, a forearm with a lancet. They then squeeze the area to produce the blood sample and another prick may be required if a sufficient volume of blood is not obtained the first time. The blood sample is then placed on a disposable test strip that is inserted into a blood glucose meter. This task can be difficult for individuals with decreased tactile sensation and visual acuity, which are common complications of diabetes. |

• | Pain. Although the fingertips are rich in blood flow and provide a good site to obtain a blood sample, they are also densely populated with highly sensitive nerve endings. This makes the lancing and subsequent manipulation of the finger to draw blood painful. The pain and discomfort are compounded by the fact that fingers offer limited surface area, so tests are often performed on areas that are sore from prior tests. People with diabetes may also suffer pain when the finger prick site is disturbed during regular activities. |

We believe a market opportunity exists for a glucose monitoring system that provides continuous glucose information, including trends, and that is convenient and easy to use. Several companies have attempted to address the limitations of single-point finger stick devices by developing continuous glucose monitoring systems. To date, in addition to DexCom, we are aware of two other companies, Medtronic, Inc. (“Medtronic”) and Abbott Diabetes Care, Inc. (“Abbott”), that have received approval from the FDA to market, and actively market, continuous glucose monitors. Abbott has discontinued selling its Freestyle Navigator glucose monitoring system in the United States; however, Abbott filed a clinical study for home use of the Navigator II system in the United States and in October 2012 they initiated a limited launch of the Navigator II system in Europe. In addition, we believe others, including Roche and Becton, Dickinson and Company, are developing invasive and non-invasive continuous glucose monitoring systems. Except for our SEVEN, SEVEN PLUS, and G4 PLATINUM, we believe that none of the products that have received FDA approval are labeled for more than six days of use. We also believe that none of the products that have received FDA approval are labeled for use as a replacement for single-point finger stick devices.

The DexCom Solution

Our G4 PLATINUM system offers the following advantages to people with diabetes:

• | Improved Outcomes. Data published in a peer-reviewed article based on our approval support trial for our first system demonstrated that patients using the system showed statistically significant improvements in maintaining their glucose levels within the target range when compared to patients relying solely on single-point finger stick measurements. Additional peer-review published data from our trial for the SEVEN demonstrated that patients with access to seven days of continuous glucose data statistically improved glucose control by further increasing their time spent with glucose levels in the target range, thereby reducing time spent in both hyperglycemic and hypoglycemic ranges. Peer-review published data from our repeated use trial demonstrated a statistically significant reduction in hemoglobin A1c levels, a measure of the average amount of glucose in the blood over the prior three months, in patients using our system compared to patients relying solely on single-point finger stick measurements. Finally, results of a major multicenter clinical trial funded by the Juvenile Diabetes Research Foundation demonstrated that patients with Type 1 diabetes who used continuous glucose monitoring devices to help manage their disease experienced significant improvements in glucose control. |

• | Access to Real-Time Values, Trend Information and Alerts. At the push of a button, people with diabetes can view their current glucose value, along with a graphical display of one-, three-, six-, twelve- or twenty-four-hour trend information. Without continuous monitoring, the individual is often unaware if his or her glucose is rising, declining or remaining constant. Access to continuous real-time glucose measurements provides people with diabetes information that may aid in attaining better glucose control. Additionally, our G4 PLATINUM alerts people with diabetes when their glucose levels approach inappropriately high or low levels so that they may intervene. |

• | Intuitive User Interface. We have developed a user interface that we believe is intuitive and easy to use. The G4 PLATINUM receiver’s compact design includes user-friendly buttons, an easy-to-read color display, simple navigation tools, audible alerts and graphical display of trend information. |

• | Convenience and Comfort. Our G4 PLATINUM provides people with diabetes with the benefits of continuous monitoring, without having to perform finger stick tests for every measurement. Additionally, the disposable sensor electrode that is inserted under the skin is a very thin wire, minimizing potential discomfort associated with inserting or wearing the disposable sensor. The external portion of the sensor, including the transmitter, is small, has a low profile and is designed to be easily worn under clothing. The wireless receiver is the size of a small digital music player and |

9

can be carried discreetly in a pocket or purse. We believe that convenience is an important factor in achieving widespread adoption of a continuous glucose monitoring system.

While we believe the G4 PLATINUM offers these advantages, people with diabetes may not perceive the benefits of continuous glucose monitoring and may be unwilling to change their current treatment regimens. Furthermore, we do not expect that our G4 PLATINUM will appeal to all types of people with diabetes. The G4 PLATINUM prompts a person with diabetes to insert a disposable sensor electrode under their skin at least every seven days, although we are aware of reports from the field that some individuals have been able to use sensors for periods longer than seven days. People with diabetes could find this process to be uncomfortable or inconvenient, and may be unwilling to insert a disposable sensor in their body, especially if their current diabetes management involves no more than two finger sticks per day. Additionally, the G4 PLATINUM (and our predecessor products) is not approved as a replacement device for single-point finger stick devices, must be calibrated initially using measurements from two single-point finger stick tests, and thereafter at least every 12 hours using single-point finger stick tests, and may be more costly to use.

Our Strategy

Our objective is to become the leading provider of continuous glucose monitoring systems and related products to enable people with diabetes to more effectively and conveniently manage their disease. We also seek to develop and commercialize products that integrate our continuous glucose monitoring technologies into the insulin pump delivery systems of Animas and Tandem, respectively. In addition, we designed, developed and commercialized, in collaboration with Edwards, the GlucoClear, which is a blood-based in-vivo automated glucose monitoring system for use by healthcare providers in the hospital for the treatment of patients with and without diabetes. To achieve these objectives, we are pursuing the following business strategies:

• | Establish our technology platform as the leading approach to continuous glucose monitoring and leverage our development expertise to rapidly bring products to market. We have developed proprietary core technology and expertise that provides a broad platform for the development of innovative products for continuous glucose monitoring. We received approval from the FDA and commercialized our first product in 2006. In 2007, we received approval and began commercializing our second generation system, the SEVEN. In 2009 we received approval for our third generation system, the SEVEN PLUS, which is designed for up to seven days of continuous use, and we began commercializing this product in the first quarter of 2009. On October 5, 2012, we received approval from the FDA for our fourth generation system, the DexCom G4 PLATINUM, which is designed for up to seven days of continuous use, and we began commercializing this product in the U.S. in the fourth quarter of 2012. We plan to continue to invest in the development of our technology platform and to obtain additional FDA approvals for our continuous glucose monitoring systems for both the ambulatory and in-hospital markets as well as for our integrated insulin pump delivery systems. We expect to continue to provide performance improvements, expanded indications and introduce new products to establish and maintain a leadership position in the market. In the future, we may develop our technology to support applications beyond glucose sensing. |

• | Drive the adoption of our ambulatory products through a direct sales and marketing effort. We have a small direct field sales force to call on endocrinologists, physicians and diabetes educators who can educate and influence patient adoption of continuous glucose monitoring. In addition, the FDA’s approval of a Pediatric Indication for the G4 PLATINUM in February 2014 will allow our direct field sales force to call on pediatric endocrinologists and pediatricians who can educate and influence parents to adopt continuous glucose monitoring for their children aged two years or older with diabetes. We believe that focusing efforts on these participants is important given the instrumental role they each play in the decision-making process for diabetes therapy. To complement our sales efforts, we have entered into distribution arrangements that allow distributors to sell our G4 PLATINUM. We currently sell the G4 PLATINUM only in the United States, Australia, New Zealand and in portions of Europe, Latin America and the Middle East, but plan to expand our sales elsewhere in the future. |

• | Drive additional adoption through technology integration partnerships. We have development agreements with Animas and Tandem to develop products that will integrate our ambulatory product technology into the Animas conventional insulin pump, and the Tandem t:slim system, as applicable, enabling the partner’s insulin pump to receive glucose readings from our transmitter and display this information on the pump’s screen. We believe people with diabetes who have adopted continuous subcutaneous insulin infusion (“CSII”) are individuals who more aggressively manage their diabetes and may be more inclined to utilize our continuous glucose monitoring systems. |

• | Seek broad coverage policies and reimbursement for our products. Our approved products are not reimbursed by virtue of a national coverage decision by Medicare. As of February 2014, the seven largest private third-party payors, in terms of the number of covered lives, have issued coverage policies for the category of continuous glucose monitoring devices. Many of these coverage policies, however, are restrictive in nature and require the policy holder to comply with extensive documentation and other requirements to demonstrate medical necessity under the policy. We have |

10

negotiated contracted rates with six of those third-party payors for the purchase of our products by their members. We currently employ in-house reimbursement expertise to assist people with diabetes in obtaining reimbursement from private third-party healthcare payors. We also maintain a field-based reimbursement team charged with calling on third-party private payors to obtain coverage decisions and both durable medical equipment contracts and pharmacy benefit contracts.

• | Drive increased utilization and adoption of our products through a cloud-based data repository platform. Through our acquisition of SweetSpot, we hope to develop a software platform that enables people with diabetes to aggregate and analyze data from numerous diabetes devices and share the data with their healthcare providers. We believe that by producing reports detailing metrics such as the individual’s glycemic variability that may be shared with physicians and caregivers will lead to better health outcomes, and we expect that as more people with diabetes adopt our system, that utilization of our sensors will increase. |

• | Expand the use of our products to other patient care settings and patient demographics. On February 3, 2014, the FDA approved a Pediatric Indication for the G4 PLATINUM, enabling us to market and sell that system in the United States to persons two years old and older who have diabetes. We believe our sensor technology may also be beneficial to women who develop gestational diabetes during their pregnancy and we intend to seek approval for a pregnancy indication in the future. We believe there is an unmet medical need for continuous glucose monitoring in the hospital setting. According to the ADA, diabetes related hospitalizations totaled 24.3 million days in 2007, an increase of 7.4 million days from 2002. In addition, studies show that many hospital patients without diabetes suffer episodes of hyperglycemia. As of 1998, as many as 1.5 million hospitalized patients in the United States had significant hyperglycemia without a history of diabetes. A study of over 1,500 hospitalized patients, of which only 13% had a history of diabetes, concluded that intensive insulin therapy to maintain blood glucose levels reduced mortality among critically ill patients in the surgical intensive care unit and improved patient outcomes. To address this patient population, we entered into an exclusive agreement with Edwards to develop jointly and market a specific product platform for the in-hospital critical care glucose monitoring market. |

• | Provide a high level of customer support, service and education. We support our sales and marketing efforts with a customer service program that includes customer training and support. We provide direct technical support by telephone 24 hours a day in the U.S. and Canada to customers, endocrinologists, physicians and diabetes educators to promote safe and successful use of our products. |

• | Pursue the highest safety and quality levels for our products. We have established an organization that is highly focused on product quality and customer safety. We have developed in-house engineering, quality assurance, clinical and regulatory expertise, and data analysis capabilities. Additionally, we seek to continue to establish credible and open relationships with regulatory bodies, physician opinion leaders and scientific experts. These capabilities and relationships will assist us in designing products that we believe will meet or exceed expectations for reliable, safe performance. |

Our Technology Platform

The development of a continuous glucose monitor requires successful coordination and execution of a wide variety of technology disciplines, including biomaterials, membrane systems, electrochemistry, low power microelectronics, telemetry, software, algorithms, implant tools and sealed protective housings. We have developed in-house expertise in each of these disciplines. We believe we have a broad technology platform that will support the development of multiple products for glucose monitoring.

Sensor Technology

The key enabling technologies for our sensors include biomaterials, membrane systems, electrochemistry and low power microelectronics. Our membrane technology consists of multiple polymer layers configured to selectively allow the appropriate mix of glucose and oxygen to travel through the membrane and react with a glucose specific enzyme to create an extremely low level electrical signal, measured in pico-amperes. This electrical signal is then translated into glucose values. We believe that the capability to measure very low levels of an electrical signal and to accurately translate those measurements into glucose values is also a unique and distinguishing feature of our technology. We have also developed technology to allow sensitive electronics to be packaged in a small, fully contained, lightweight sealed unit that minimizes inconvenience and discomfort for the user.

Receiver and Transmitter Technology

Our ambulatory glucose monitoring systems use radiofrequency telemetry to wirelessly transmit information from the transmitter, which sits in a pod atop the sensor, to our receiver. We have developed the technology for reliable transmission and

11

reception and have consistently demonstrated a high rate of successful transmissions from sensor to receiver in our clinical trials. Our receiver then processes and displays real-time and trended glucose values, and provides alerts. We have used our extensive database of continuous glucose data from our clinical trials to create software and algorithms for the display of data to customers.

In March 2009, the Federal Communications Commission (“FCC”) established a bifurcated Medical Implant Communications System (“MICS”) band which requires device manufacturers whose products will operate in the main MICS band to either manufacture their devices using listen-before-transmit technology, or to transmit on a side band outside the main MICS band at lower power. Although the SEVEN PLUS does not comply with existing MICS band listen-before-transmit requirements, the FCC granted a waiver to allow us to continue marketing and operating our SEVEN PLUS. Our G4 PLATINUM system does not operate within the MICS band and does not require a waiver.

Other Technology Applications

Additionally, we have gained our technology expertise by learning to design implants that can withstand the rigors of functioning within the human body for extended periods of time. In addition to the foreign body response, we have overcome other problems related to operating within the human body, such as device sealing, miniaturization, durability and sensor geometry. We believe that, over time, the expertise gained in overcoming these problems may support the development of additional products beyond glucose monitoring.

Our Primary Commercial Products

Ambulatory Product Line: SEVEN PLUS, G4 and DexCom G4 PLATINUM

In 2009 we received approval for our third generation system, the DexCom SEVEN PLUS, which is designed for up to seven days of continuous use, and we began commercializing this product in the first quarter of 2009. On June 14, 2012, we received Conformité Européene Marking (“CE Mark”) approval for our fourth generation continuous glucose monitoring system, the DexCom G4 system, enabling commercialization of the DexCom G4 system in the European Union, Australia, New Zealand and the countries in Asia and Latin America that recognize the CE Mark. On October 5, 2012, we received approval from the FDA for the DexCom G4 PLATINUM, which is designed for up to seven days of continuous use by adults with diabetes, and we began commercializing this product in the U.S. in the fourth quarter of 2012. On February 14, 2013, we received CE Mark approval for a Pediatric Indication, and we initiated a limited commercial launch in the second quarter of 2013. In connection with our receipt of CE Mark approval for the Pediatric Indication, we changed the name of the DexCom G4 system to the DexCom G4 PLATINUM system. On February 3, 2014, the FDA approved a Pediatric Indication for the DexCom G4 PLATINUM system in the United States. Unless the context requires otherwise, the term "G4 PLATINUM" shall refer to the DexCom G4 and DexCom G4 PLATINUM systems that are commercialized by us in and outside of the United States.

As compared to the SEVEN PLUS, the G4 PLATINUM offers:

• | an improved sensor wire design that allows more scalable manufacturing, |

• | a smaller, sleeker receiver that is capable of displaying data in color, |

• | a new transmitter design that offers improved communication range with the receiver which allows for improved data capture, |

• | additional user interface and algorithm enhancements that are intended to make the user experience more customizable and to make its glucose monitoring function more accurate especially in the hypoglycemic range, and |

• | the ability to market and sell to an expanded patient population due to the approval by the FDA of, and our obtaining a CE Mark for, a Pediatric Indication. |

With the approval of the G4 PLATINUM systems, we have reduced marketing and sales efforts related to SEVEN PLUS. Each of the G4 PLATINUM and SEVEN PLUS systems must be prescribed by a physician and each includes a disposable sensor, a transmitter and a small handheld receiver. The SEVEN PLUS and G4 PLATINUM systems are indicated for use as adjunctive devices to complement, not replace, information obtained from standard home blood glucose monitoring devices and must be calibrated periodically using a standard home blood glucose monitor. The sensor is inserted by the user and is intended to be used continuously for up to seven days after which it is removed by the user and may be replaced by a new sensor. Our transmitter and receiver are reusable.

Products in Development

We are leveraging our technology platform to enhance the capabilities of our current products (including obtaining expanded indications of use) and to develop additional continuous glucose monitoring products. We plan to develop future

12

generations of technologies focused on improved performance and convenience and that will enable intelligent insulin administration. Over the longer term, we plan to develop networked platforms with open architecture, connectivity and transmitters capable of communicating with other devices. We intend to seek a pregnancy indication for women who develop gestational diabetes during pregnancy in the future.

In 2008 and 2012, we entered into development agreements with Animas and Tandem. The purpose of each of these development relationships is to integrate our technology into the insulin pump product offerings of the respective partner, enabling the partner’s insulin pump to receive glucose readings from our transmitter and display this information on the pump’s screen.

Continuous Glucose Monitoring Disposable Sensor & Reusable Transmitter

Our sensor includes a tiny wire-like electrode coated with our sensing membrane system. This disposable sensor comes packaged with an integrated insertion device and is contained in a small plastic housing platform, or pod. The base of the pod has adhesive that attaches it to the skin. The sensor is intended to be easily and reliably inserted by the user by exposing the adhesive, placing the pod against the surface of the skin of the abdomen and pushing down on the insertion device. The insertion device first extends a narrow gauge needle containing the sensor into the subcutaneous tissue and then retracts the needle, leaving behind the sensor in the tissue and the pod adhered to the skin. The user then disposes of the insertion device and snaps the reusable transmitter to the pod. After a stabilization period of a few hours, the user is required to calibrate the receiver with two measurements from a single-point finger stick device and the disposable sensor begins wirelessly transmitting the continuous glucose data at specific intervals to the handheld receiver. Users are prompted by the receiver to calibrate the system twice per day with finger stick measurements throughout the seven day usage period to ensure reliable operation, which calibration may be accomplished by using any FDA approved blood glucose meter. Currently, the SEVEN PLUS and G4 PLATINUM are indicated for use as adjunctive devices to complement, not replace, information obtained from standard home blood glucose monitoring devices, although in the future we may seek replacement claim labeling from the FDA for the use of future generation sensors as the sole basis for making therapeutic adjustments.

The disposable sensor contained in the SEVEN PLUS and G4 PLATINUM is intended to function for up to seven days after which it may be replaced. After seven days, the user simply removes the pod and attached sensor from the skin and discards them while retaining the reusable transmitter. A new sensor and pod can then be inserted and used with the same receiver and transmitter for a subsequent seven day period. We are aware of reports from the field, however, that customers have been able to use sensors for periods longer than seven days.

Handheld Receiver

Our small handheld receiver is carried by the user and wirelessly receives continuous glucose values from the sensor. Proprietary algorithms and software, developed from our extensive database of continuous glucose data from clinical trials, are programmed into the receiver to process the glucose data from the sensor and display it on a user-friendly graphical user interface. With a push of a button, the user can access their current glucose value and one-, three-, six-, twelve- and twenty-four-hour trended data. Additionally, when glucose values are inappropriately high or low, the receiver provides an audible alert or vibrates. The receiver is a self-contained, durable unit with a rechargeable battery.

Sales and Marketing

We have built a direct sales organization to call on endocrinologists, physicians and diabetes educators who can educate and influence patient adoption of continuous glucose monitoring. We believe that focusing efforts on these participants is important given the instrumental role they each play in the decision-making process for diabetes therapy. We employ approximately 96 direct sales personnel and continue to add to our sales and marketing organization as necessary to support the commercialization of our products. We believe that referrals by physicians and diabetes educators, together with self-referrals by customers, have driven and will continue to drive adoption of our G4 PLATINUM. We directly market our products in the United States primarily to endocrinologists, physicians and diabetes educators. The approval by the FDA of a Pediatric Indication for our G4 PLATINUM system in February 2014 will also allow our direct sales personnel to call on pediatric endocrinologists and pediatricians who can educate and influence adoption of continuous glucose monitoring by parents who have children aged two years or older with diabetes. Although the number of diabetes patients is significant, the number of physicians and educators influencing these patients is relatively small. As of 2008, there were an estimated 4,000 clinical endocrinologists in the United States. As a result, we believe our direct, highly specialized and focused sales organization is sufficient for us to support our sales efforts for the foreseeable future.

We use a variety of marketing tools to drive adoption, ensure continued usage and establish brand loyalty for our continuous glucose monitoring systems by:

13

• | creating awareness of the benefits of continuous glucose monitoring and the advantages of our technology with endocrinologists, physicians, diabetes educators and people with diabetes; |

• | providing strong and simple educational and training programs to healthcare providers and people with diabetes to ensure easy, safe and effective use of our systems; and |

• | maintaining a readily accessible telephone and web-based technical and customer support infrastructure, which includes clinicians, diabetes educators and reimbursement specialists, to help referring physicians, diabetes educators and people with diabetes as necessary. |

Our sales organization competes with the experienced and well-funded marketing and sales operations of our competitors. We have relatively limited experience developing and managing a direct sales organization and we may be unsuccessful in our attempt to manage and expand the sales force. Developing a direct sales organization is a difficult, expensive and time consuming process. To be successful we must:

• | recruit and retain adequate numbers of effective sales personnel; |

• | effectively train our sales personnel in the benefits of our products; |

• | establish and maintain successful sales, marketing, training and education programs that encourage endocrinologists, physicians and diabetes educators to recommend our products to their patients; and |

• | manage geographically disbursed operations. |

Competition

The market for blood glucose monitoring devices is intensely competitive, subject to rapid change and significantly affected by new product introductions. Four companies, Roche Disetronic, a division of Roche Diagnostics; LifeScan, Inc., a division of Johnson & Johnson; the MediSense and TheraSense divisions of Abbott Laboratories; and Bayer Corporation, currently account for substantially all of the worldwide sales of self-monitored glucose testing systems. These competitors’ products use a meter and disposable test strips to test blood obtained by pricking the finger or, in some cases, the forearm. In addition, other companies are developing or marketing minimally invasive or noninvasive glucose testing devices and technologies that could compete with our devices. There are also a number of academic and other institutions involved in various phases of our industry’s technology development.

Several companies have attempted to address the limitations of single-point finger stick devices by developing continuous glucose monitoring systems. To date, in addition to DexCom, we are aware that two other companies, Medtronic, and Abbott, have received approval from the FDA to market, and actively market, continuous glucose monitors. Abbott has discontinued selling its Freestyle Navigator glucose monitoring system in the United States; however, Abbott filed a clinical study for home use of the Navigator II system in the United States and in October 2012 they initiated a limited launch of the Navigator II system in Europe. Except for our SEVEN, SEVEN PLUS, and G4 PLATINUM, we believe that none of the products that have received FDA approval are labeled for more than six days of use. We also believe that none of the FDA approved products are labeled for use as a replacement for single-point finger stick devices.

A number of companies, including Roche and Becton, Dickinson and Company, are developing next generation real-time continuous glucose monitoring or sensing devices and technologies as well as several other companies that are developing non-invasive continuous glucose monitoring products to measure the patient’s glucose level. The majority of these non-invasive technologies do not pierce the skin, but instead typically analyze signatures reflected back from energy that has been directed into the patient’s skin, tissue or bodily fluids.

Many of our competitors are either publicly traded or are divisions of publicly traded companies, and they enjoy several competitive advantages, including:

• | significantly greater name recognition; |

• | established relations with healthcare professionals, customers and third-party payors; |

• | established distribution networks; |

• | additional lines of products, and the ability to offer rebates or bundle products to offer higher discounts or incentives to gain a competitive advantage; |

• | greater experience in conducting research and development, manufacturing, clinical trials, obtaining regulatory approval for products and marketing approved products; and |

• | greater financial and human resources for product development, sales and marketing, and patent litigation. |

As a result, we may be unable to compete effectively against these companies or their products.

14

We believe that the principal competitive factors in our market include:

• | safe, reliable and high quality performance of products; |

• | cost of products and eligibility for reimbursement; |

• | comfort and ease of use; |

• | effective sales, marketing and distribution; |

• | brand awareness and strong acceptance by healthcare professionals and people with diabetes; |

• | customer service and support and comprehensive education for people with diabetes and diabetes care providers; |

• | speed of product innovation and time to market; |

• | regulatory expertise; and |

• | technological leadership and superiority. |

Manufacturing

We currently manufacture our devices at our headquarters in San Diego, California. These facilities have more than 13,000 square feet of laboratory space and approximately 10,000 square feet of controlled environment rooms. In July 2012, the FDA completed an inspection of our facilities, and did not identify any observations or require any other types of corrective action. During a routine FDA post-approval facility inspection ending on November 7, 2013, the FDA issued a Form 483 with several observations regarding DexCom Medical Device Reporting (MDR) procedures and complaint reportability determinations. DexCom responded to the observations on November 26, 2013.

There are technical challenges to increasing manufacturing capacity, including equipment design and automation, material procurement, problems with production yields, and quality control and assurance. We have focused significant effort on continual improvement programs in our manufacturing operations intended to improve quality, yields and throughput. We have made progress in manufacturing to enable us to supply adequate amounts of product to support our commercialization efforts, however there can be no assurances that supply will not be constrained going forward. Additionally, the production of our continuous glucose monitoring systems must occur in a highly controlled and clean environment to minimize particles and other yield- and quality-limiting contaminants. Developing commercial-scale manufacturing facilities has and will continue to require the investment of substantial additional funds and the hiring and retaining of additional management, quality assurance, quality control and technical personnel who have the necessary manufacturing experience. Manufacturing is subject to numerous risks and uncertainties described in detail in “Risk Factors” below.

We manufacture our G4 PLATINUM systems with components supplied by outside vendors and with parts manufactured by us internally. Key components that we manufacture internally include our wire-based sensors for our G4 PLATINUM systems. The remaining components and assemblies are purchased from outside vendors. We then assemble, test, package and ship the finished G4 PLATINUM systems, which include a reusable transmitter, a receiver, and disposable sensors.

We purchase certain components and materials from single sources due to quality considerations, costs or constraints resulting from regulatory requirements. Currently, those single sources are OnCore Manufacturing Services, which manufactures and supplies circuit boards for our receiver and transmitter; ON Semiconductor Corp, which produces the application specific integrated circuits used in our transmitters; DSM PTG, Inc., which manufactures certain polymers used to synthesize our polymeric membranes for our sensors; and The Tech Group, which produces injection molded components. In some cases, agreements with these and other suppliers can be terminated by either party upon short notice. We may not be able to quickly establish additional or replacement suppliers for our single-source components, especially after our products are commercialized, in part because of the FDA approval process and because of the custom nature of the parts we designed. Any supply interruption from our vendors or failure to obtain alternate vendors for any of the components would limit our ability to manufacture our systems, and could have a material adverse effect on our business.

Third-Party Reimbursement

As a medical device company, reimbursement from Medicare and private third-party healthcare payors is an important element of our success. Although the CMS in 2008 released Alpha-Numeric HCPCS codes applicable to each of the three components of our continuous glucose monitoring systems, to date, our approved products are not reimbursed due to a national coverage decision by Medicare. It is not known when, if ever, Medicare will adopt a national coverage decision with respect to continuous glucose monitoring devices. Until any such coverage decision is adopted by Medicare, reimbursement of our products will generally be limited to people with diabetes covered by third-party payors that have adopted coverage policies for continuous glucose monitoring devices. As of February 2014, the seven largest private third-party payors, in terms of the

15

number of covered lives, have issued policies for the category of continuous glucose monitoring devices allowing for coverage of these devices if certain conditions are met. In addition, we have negotiated contracted rates with six of those third-party payors for the purchase of our SEVEN PLUS and G4 PLATINUM systems by their members. Many of these coverage policies are restrictive in nature and require the policy holder to comply with extensive documentation and other requirements to demonstrate medical necessity under the policy. In addition, people with diabetes who are insured by payors that do not offer coverage for our devices will have to bear the financial cost of the products. We currently employ in-house reimbursement expertise to assist people with diabetes in obtaining reimbursement from private third-party payors. We also maintain a field-based reimbursement team charged with calling on third-party private payors to obtain coverage decisions and contracts. We have had formal meetings and have increased our efforts to create and liberalize coverage policies with third-party payors and expect to continue to do so throughout 2014. However, unless government and other third-party payors provide adequate coverage and reimbursement for our products, people without coverage who have diabetes may not use them on a widespread basis.

Medicare, Medicaid, health maintenance organizations and other third-party payors are increasingly attempting to contain healthcare costs by limiting both coverage and the level of reimbursement of new medical devices, and, as a result, their coverage policies may be restrictive, or they may not cover or provide adequate payment for our products. In order to obtain reimbursement arrangements, we may have to agree to a net sales price lower than the net sales price we might charge in other sales channels. Our revenue may be limited by the continuing efforts of government and third-party payors to contain or reduce the costs of healthcare through various increasingly sophisticated means, such as requiring prospective reimbursement and second opinions, purchasing in groups, or redesigning benefits. Our initial dependence on the commercial success of our SEVEN PLUS and G4 PLATINUM systems makes us particularly susceptible to any cost containment or reduction efforts. Accordingly, unless government and other third-party payors provide adequate coverage and reimbursement for our products, our financial performance may be harmed.

In some foreign markets, pricing and profitability of medical devices are subject to government control. In the United States, we expect that there will continue to be federal and state proposals for similar controls. Also, the trends toward managed healthcare in the United States and proposed legislation intended to reduce the cost of government insurance programs could significantly influence the purchase of healthcare services and products and may result in lower prices for our products or the exclusion of our products from reimbursement programs.

Intellectual Property

Protection of our intellectual property is a strategic priority for our business. We rely on a combination of patent, copyright and other intellectual property laws, trade secrets, nondisclosure agreements and other measures to protect our proprietary rights. As of February 2014, we had obtained 244 issued U.S. patents, and had 239 additional U.S. patent applications pending. We believe it will take up to five years, and possibly longer, for these pending U.S. patent applications to result in issued patents. As of February 2014, we have 20 international applications filed under the Patent Cooperation Treaty, 10 granted European patents, 52 European patent applications pending, 8 granted Japanese patents, 3 Japanese patent applications pending, 15 registered U.S. trademarks, 13 pending U.S. trademark applications, 9 registered European trademarks, 1 pending European trademark application, and 3 registered Japanese trademarks. We also have one pending trademark application in each of a number of countries in Asia, Latin America and the Middle East. In addition, a Madrid Protocol Trademark Registration is pending in each of a number of countries in Asia, Latin America, Europe and the Middle East. Our patents begin expiring in 2017.