| [ ] | Preliminary Proxy Statement |

| [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| [x] | Definitive Proxy Statement |

| [ ] | Definitive Additional Materials |

| [ ] | Soliciting Material under § 204.14a-12 |

| [x] | No fee required. |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| 5) | Total fee paid: |

| [ ] | Fee paid previously with preliminary materials. |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: |

|

2)

|

Form, Schedule or Registration Statement No.:

|

| 3) | Filing Party: |

| 4) | Date Filed: | [_______________] |

CENTURY CAPITAL MANAGEMENT TRUST

Century Shares Trust

Century Small Cap Select Fund

Century Growth Opportunities Fund

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

Notice is hereby given that a Special Meeting (the “Meeting”) of the shareholders of Century Shares Trust, Century Small Cap Select Fund and Century Growth Opportunities Fund (each a “Fund” and, together, the “Funds”), each a series of Century Capital Management Trust (the “Trust”), will be held at 11:30 a.m. Eastern time on October 1, 2015 at the offices of Century Capital Management, LLC, 100 Federal Street, 29th Floor, Boston, Massachusetts 02110. The purposes of the Meeting are as follows:

|

1. |

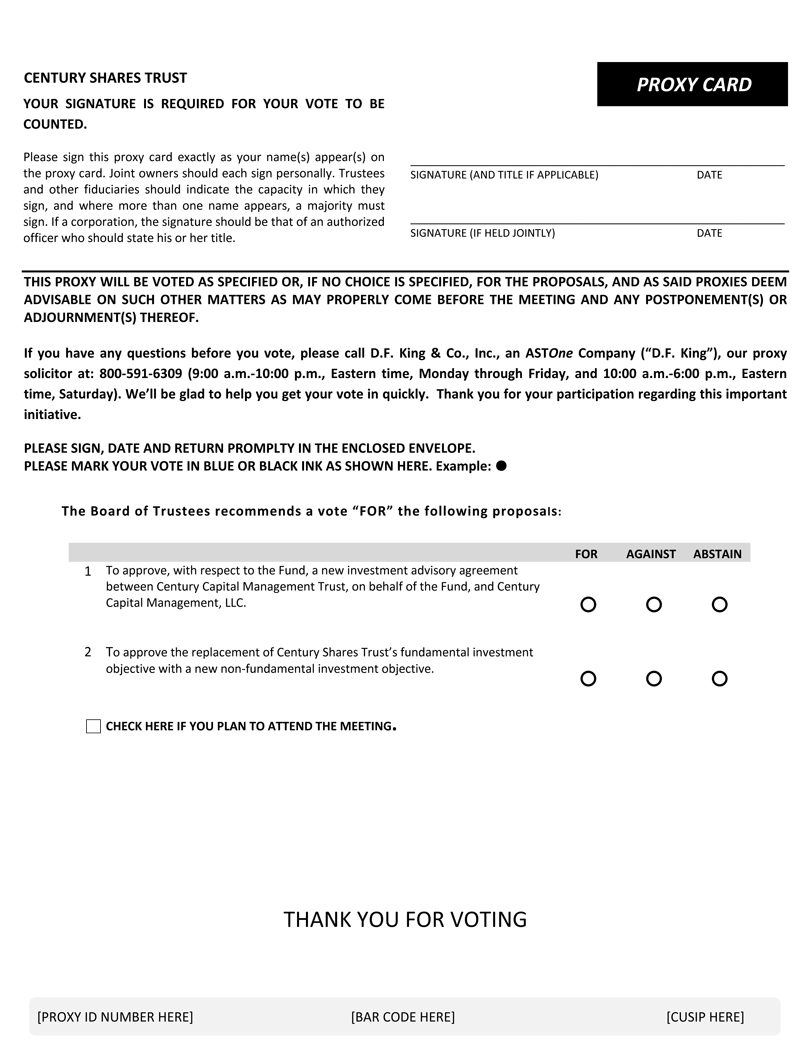

(a) To approve, with respect to Century Shares Trust, a new investment advisory agreement between the Trust, on behalf of the Fund, and Century Capital Management, LLC (the “Adviser”). |

|

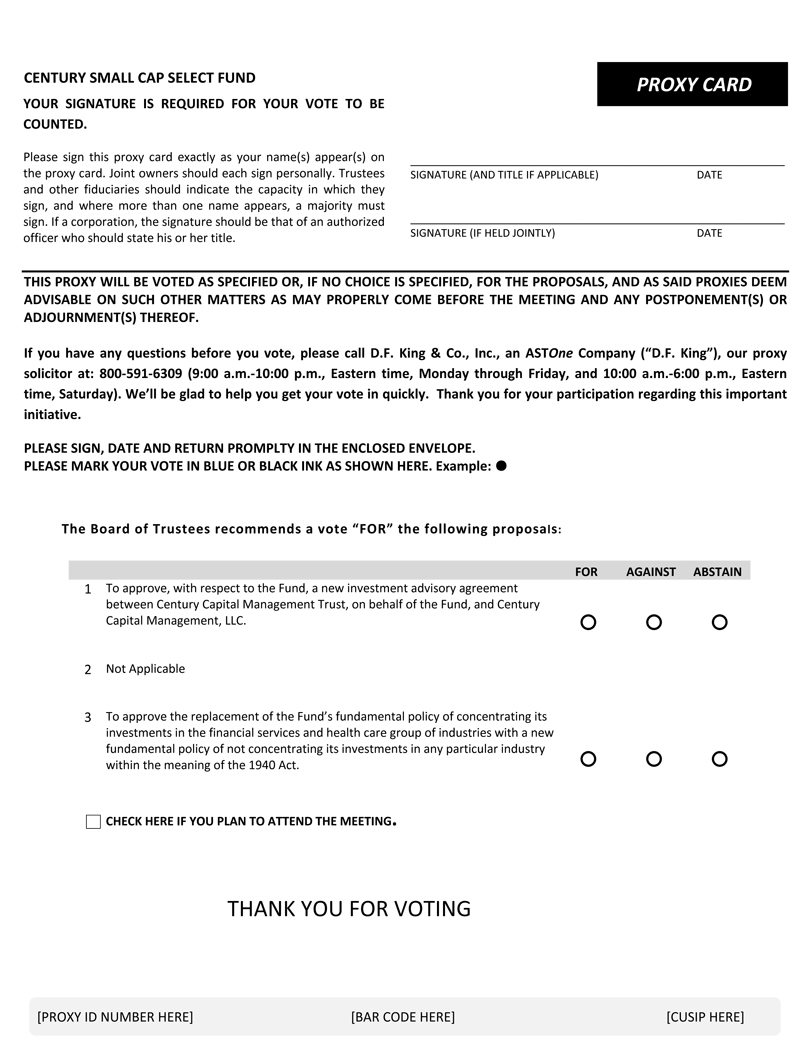

(b) To approve, with respect to Century Small Cap Select Fund, a new investment advisory agreement between the Trust, on behalf of the Fund, and the Adviser. |

|

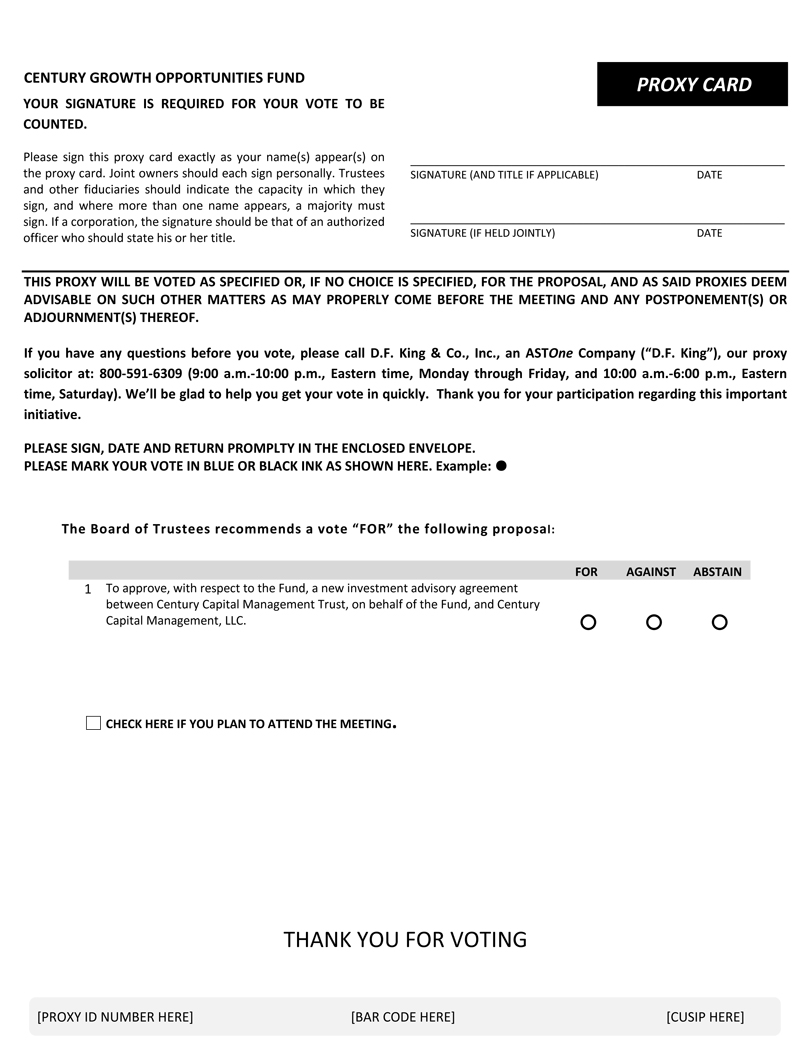

(c) To approve, with respect to Century Growth Opportunities Fund, a new investment advisory agreement between the Trust, on behalf of the Fund, and the Adviser. |

|

2. |

To approve the replacement of Century Shares Trust’s fundamental investment objective with a new non-fundamental investment objective. |

|

3. |

To approve the replacement of Century Small Cap Select Fund’s fundamental policy of concentrating its investments in the financial services and health care group of industries with a new fundamental policy of not concentrating its investments in any particular industry within the meaning of the 1940 Act. |

Shareholders of record as of the end of business on August 14, 2015 are entitled to notice of, and to vote at, the Meeting and any adjourned session or postponement thereof.

|

By order of the Trustees of the Trust, |

|

|

|

|

Jennifer J. Mortimer |

|

|

Secretary, Century Capital Management Trust |

|

|

August 21, 2015 |

In order for you to be represented at your Fund’s special shareholder meeting, we urge you to record your voting instructions over the Internet or by telephone or to mark, sign, date, and mail the enclosed proxy card(s) in the postage-paid envelope provided.

CENTURY CAPITAL MANAGEMENT TRUST

Century Shares Trust

Century Small Cap Select Fund

Century Growth Opportunities Fund

100 Federal Street, 29th Floor

Boston, Massachusetts 02110

PROXY STATEMENT

This document gives you the information you need to vote on the proposals. Much of the information is required under rules of the Securities and Exchange Commission; some of it is technical. If there is anything you don’t understand, please call toll-free (800) 591-6309 or call your financial advisor.

Important Notice Regarding the Internet Availability of Proxy Materials for the Special Meeting of the Shareholders To Be Held on October 1, 2015

The Notice of a Special Meeting, the proxy card and this proxy statement are being mailed beginning on or about August 21, 2015. This Proxy Statement is also available on the Trust’s website at www.centuryfunds.com.

APPROVAL OF THE NEW INVESTMENT ADVISORY AGREEMENTS WITH CENTURY CAPITAL MANAGEMENT, LLC (PROPOSAL 1)

Overview of Investment Advisory Agreements

The Trust is an open-end management investment company that is a Massachusetts business trust organized under the laws of the Commonwealth of Massachusetts on August 27, 1999. The Trust consists of three series (each a “Fund”): Century Shares Trust, Century Small Cap Select Fund and Century Growth Opportunities Fund. The Adviser currently serves as investment adviser to each Fund pursuant to separate agreements with the Trust dated January 29, 2004 with respect to Century Shares Trust (the “Existing Century Shares Trust Agreement”), dated January 29, 2004 with respect to Century Small Cap Select Fund (the “Existing Century Small Cap Select Fund Agreement”) and dated November 1, 2010 with respect to Century Growth Opportunities Fund (the “Existing Century Growth Opportunities Fund Agreement”). Collectively, these three agreements constitute the “Existing Advisory Agreements.”

The Existing Century Shares Trust Agreement was last submitted to a shareholder vote for approval on January 29, 2004. Under the terms of the Existing Century Shares Trust Agreement, the Adviser furnishes continuously an investment program for the Fund, and the Adviser is entitled to receive an investment advisory fee based on the Fund’s average daily net assets computed at the following annual rates: 0.80% of the first $500 million and 0.70% of the amounts exceeding $500 million. The aggregate amount of the Adviser’s fee under the Existing Century Shares Trust Agreement during the last fiscal year ending October 31, 2014 was $1,712,967.

1

The Existing Century Growth Opportunities Fund Agreement has not been submitted to a shareholder vote for approval since the Fund’s initial shareholder approved the Agreement prior to the Fund’s launch on November 17, 2010. Under the terms of the Existing Century Growth Opportunities Fund Agreement, the Adviser furnishes continuously an investment program for the Fund, and the Adviser is entitled to receive an investment advisory fee based on the Fund’s average daily net assets at the following annual rates: 0.80% of the first $500 million and 0.75% thereafter. The aggregate amount of the Adviser’s fee under the Existing Century Growth Opportunities Fund Agreement during the last fiscal year ended October 31, 2014 was $714,361.

Under Administration Agreements between the Adviser and the Trust, on behalf of Century Shares Trust and Century Growth Opportunities Fund, the Adviser also performs (or arranges for the performance of) certain management and administrative services necessary for the operation of those Funds at an annual rate of 0.10% of the Fund’s average daily net assets. These Administration Agreements would remain in effect after the Restructuring (as defined below).

The Existing Small Cap Select Fund Agreement was last submitted to a shareholder vote for approval on January 29, 2004. Under the terms of the Existing Small Cap Select Fund Agreement, the Adviser furnishes investment advisory, management and administrative services, and the Adviser is entitled to receive a monthly investment advisory fee at an annual rate of 0.95% of the average net assets of the Fund. The aggregate amount of the Adviser’s fee under the Existing Small Cap Select Fund Agreement during the last fiscal year ended October 31, 2014 was $3,931,983.

In performing its duties under each Existing Advisory Agreement, the Adviser is subject to the supervision of the Trustees and to the policies determined by the Trustees, as well as to the provisions of the Trust’s Agreement and Declaration of Trust, its By-Laws and the investment objectives, policies and restrictions of the applicable Fund stated in the Trust’s Prospectus and Statement of Additional Information, each as amended. At a meeting held on June 30, 2015, based on their evaluation of the information provided by the Adviser, the Trustees, including the Trustees who are not “interested persons” (as defined in the 1940 Act) of the Trust, (the “Independent Trustees”) voting separately, unanimously approved the continuation of each Existing Advisory Agreement for another year.

The Adviser has agreed to waive all or a portion of the advisory fees payable to it with respect to the Century Growth Opportunities Fund under that Fund’s Existing Advisory Agreement, and to reimburse the Century Growth Opportunities Fund for operating expenses that the Century Growth Opportunities Fund incurs to the extent necessary to ensure that annual expenses (exclusive of taxes, interest, brokerage commissions, acquired fund fees and expenses and extraordinary expenses) do not exceed 1.10% of the Century Growth Opportunities Fund’s average daily net assets allocable to its Institutional Shares until February 28, 2016. This arrangement would not change as a result of the Restructuring.

2

Each Existing Advisory Agreement provides that it may be terminated by the Trust upon 60 days’ written notice. In accordance with the 1940 Act, each Existing Advisory Agreement provides for automatic termination in the event of its assignment. In addition, the Adviser may terminate the Existing Advisory Agreements upon 60 days’ written notice to the Trust.

The Existing Advisory Agreements provide that the Adviser shall not be subject to any liability in connection with the performance of its services thereunder in the absence of willful misfeasance, bad faith, gross negligence or reckless disregard of its obligations and duties.

Information About the Proposed Restructuring

The Adviser has entered into an agreement to restructure its ownership (the “Restructuring”). The proposed Restructuring and new investment advisory contracts provide for a continuous investment program for the Funds with no changes to the personnel responsible for managing the Funds or in the services the Adviser provides to the Funds. It is expected that all of the Adviser’s employees who currently provide services to the Funds will continue to be employed by the Adviser after the Restructuring. The new contracts, if approved, will not affect the contractual advisory fee rates payable by the Funds.

The Management Board of the Adviser has unanimously determined that it is appropriate and desirable to divide the Adviser into two separate companies. The Adviser currently has two distinct business units: the Public Securities Group (“PSG”) which provides investment advisory services to Century Shares Trust, Century Small Cap Select Fund and Century Growth Opportunities Fund and other institutional investors, and the Private Equity Group (“PEG”) which provides investment management services to investment vehicles exempt from registration under the 1940 Act. Under the current structure Alexander L. Thorndike, and the Management Committee consisting of PSG employees, is responsible for the day to day management of PSG and Davis R. Fulkerson is responsible for the day to day management of PEG. If the Restructuring is consummated, Alexander L. Thorndike and the Management Committee will be responsible for the day-to-day management of the Adviser. After the Restructuring, Alexander L. Thorndike would have the ability to exercise voting control over the Adviser and Davis R. Fulkerson would cease exercising voting control over the Adviser.

The Restructuring is anticipated to occur on or about December 31, 2015 only if shareholders of each Fund approve a new investment advisory contract with the Adviser and other conditions are satisfied.

The New Investment Advisory Agreements

At their June 30, 2015 meeting, the Trustees, including the Independent Trustees voting separately, approved new investment advisory agreements for the Funds with the Adviser (the “New Advisory Agreements”). The New Advisory Agreements are identical to the Existing Advisory Agreements, except that the New Advisory Agreements will have different effective dates and will continue until June 29, 2017 and, like the Existing Advisory Agreements, from year to year thereafter so long as the continuance is approved in the manner described below. The New Advisory Agreements will become effective upon consummation of the Restructuring.

3

The New Advisory Agreements are described generally below. The description below is qualified entirely by reference to the New Advisory Agreements. Please refer to Appendix A for the complete terms of the New Advisory Agreements.

Fees. There is no change in the rate of the fees that any Fund will pay the Adviser under the New Advisory Agreements. The current fee schedule for investment management services and administrative services for each Fund is described above in the section titled “Overview of Investment Advisory Agreements.” The current expense limitation arrangement in effect for Century Growth Opportunities Fund will not change as a result of the Restructuring.

Investment Management Services. The New Advisory Agreement for your Fund provides that the Adviser will furnish continuously an investment program for the Fund, determining what investments to purchase, hold, sell or exchange and what portion of the Fund’s assets will be held uninvested, in compliance with the Fund’s governing documents, investment objectives, policies and restrictions, and subject to the supervision of the Trustees. As indicated above, the Adviser’s responsibilities under the proposed New Advisory Agreements are identical to those under the Existing Advisory Agreements.

The Adviser is authorized under the New Advisory Agreements to place orders for the purchase and sale of portfolio investments for your Fund with brokers, dealers or others that the Adviser selects. In placing orders for each Fund, the Adviser will use its best efforts to seek to obtain for the Fund the most favorable price and execution available. The Adviser is authorized to pay higher brokerage commissions if it determines in good faith that the commission is reasonable in relation to the value of brokerage and research services provided by the broker or dealer (a practice commonly known as “soft dollars”). The Adviser may make this determination in terms of either the particular transaction or the Adviser’s overall responsibilities with respect to a Fund and to other clients of the Adviser for which the Adviser exercises investment discretion.

Administrative Services (Century Small Cap Select Fund only). Like the Existing Advisory Agreement, the New Advisory Agreement for Century Small Cap Select Fund provides that the Adviser will provide the Fund with (or arrange for the performance of) management and administrative (i.e., non-investment) services necessary for the operation of the Fund.

Limitation of Liability. As with the Existing Advisory Agreements, the New Advisory Agreements provide that the Adviser shall not be subject to any liability in connection with the performance of its services thereunder in the absence of willful misfeasance, bad faith, gross negligence or reckless disregard of its obligations and duties.

As required under the Funds’ Declaration of Trust, the New Advisory Agreements contain a notice provision stating that the Fund’s Declaration of Trust is on file with the Secretary of The Commonwealth of Massachusetts and that the contract is executed on behalf of the Trustees as Trustees of the Fund and not individually or by officers of the Trust as officers and not individually. Also, each Fund’s obligations arising out of the contract are limited only to the assets and property of the Fund and are not binding on any of the Trustees, officers or shareholders individually.

4

Term and Termination. If approved by shareholders, each New Advisory Agreement will have an initial term of two years, and thereafter may be renewed on an annual basis, like the Existing Advisory Agreements, by a vote of (1) the Board of Trustees or a “majority of outstanding voting securities” (as defined in the 1940 Act) of the Fund and (2) a majority vote of the Trustees who are not parties to the contract or “interested persons” (as defined in the 1940 Act) of the Trust. Each New Advisory Agreement provides that it may be terminated by the Trust upon 60 days’ written notice. In accordance with the 1940 Act, each New Advisory Agreement provides for automatic termination in the event of its assignment. In addition, the Adviser may terminate each New Advisory Agreement upon 60 days’ written notice to the Trust.

The Trustees’ Considerations

The Trustees considered and approved the New Advisory Agreements at the same time they considered and approved the annual continuation of all of the Existing Advisory Agreements for the Trust (together with the New Advisory Agreements, the “Advisory Agreements”). Those approvals, on which the Trustees voted at their meeting held in person on June 30, 2015, followed a process during which the Trustees considered a variety of factors, including, for example, the nature and quality of services that the Funds receive, the fees that the Funds pay under the Advisory Agreements and the Funds’ investment performance and as well as a wide range of other matters that the Trustees considered to have a bearing upon the Advisory Agreements. Appendix B contains a general description of the Trustees’ deliberations. Because the fees, terms, and conditions under the New Advisory Agreements are substantially identical to those in the Existing Advisory Agreements and the same investment personnel at the Adviser would continue to provide advisory services to the Funds under the New Advisory Agreements, the Trustees determined that the materials they reviewed and the conclusions they reached in considering the continuation of the Existing Advisory Agreements were directly relevant to their deliberations with respect to the New Advisory Agreements.

In the meeting where the Trustees considered the Funds’ Advisory Agreements, the Trustees took into account current and anticipated market and economic conditions, the financial condition of the Adviser generally and, in connection with the New Advisory Agreements, the likely effect of the Restructuring on the financial condition of the Adviser. In general, the Trustees considered that the proposed Restructuring would not impact the financial condition of the Adviser and determined that the Adviser would have the appropriate resources to provide continuing services to the Trust. The Trustees also noted that the terms of the New Advisory Agreements were substantially identical to the Existing Advisory Agreements.

5

As part of their review, the Trustees also considered:

|

● |

Their understanding that the Restructuring was not expected to result in any adverse effect on the Funds, on the quality and level of services that the Adviser would provide to the Funds, or on the resources available to the Funds and to the Adviser, and that the Adviser is committed to continue providing the Funds with high quality services; |

|

● |

Information about the likelihood that the Restructuring would result in improved organizational stability for the Adviser, benefiting the Funds; |

|

● |

That the possible benefits include a singular focus on the PSG business, including the Funds; |

|

● |

The Adviser would become 100% owned by the employees of PSG; |

|

● |

That the Adviser has stated that there is no present intention to change the Funds’ existing advisory fees, fee waivers or expense limitations; |

|

● |

It is expected that all of the key personnel of the Adviser who currently work with the Funds would be employed with the Adviser after the Restructuring; |

|

● |

The stated intention of the Adviser that the Restructuring will not change the investment approach or process used in managing the Funds; |

|

● |

The experience of the key personnel of the Adviser in advising and administering mutual funds and similar investment products, including related regulatory or compliance matters; |

|

● |

That if the New Advisory Agreements are not approved, the Existing Advisory Agreements will likely remain in effect and the Restructuring would not occur as planned; |

|

● |

That the Adviser’s management supports the Restructuring; and |

|

● |

That representatives of the Adviser have committed that the Funds will not bear the expenses relating to the Restructuring, including the costs of soliciting the Funds’ shareholders to approve the New Advisory Agreements. |

In light principally of these considerations and their continuation of the Funds’ Existing Investment Advisory Agreements, at their meeting on June 30, 2015 the Trustees, including all of the Independent Trustees (none of whom are party to the New Advisory Agreements), unanimously approved the New Advisory Agreements and determined to recommend the approval of the New Advisory Agreements to shareholders of the Funds.

6

Shareholder Voting Regarding the New Advisory Agreements

With respect to each Fund, the approval of the applicable New Advisory Agreement requires the affimative vote of a “majority of the outstanding voting securities” of the Fund as defined in the 1940 Act. The 1940 Act defines the vote of a majority of the oustanding voting securities of the Fund to mean the lesser of (i) 67% of the shares of the Fund that are present at the Meeting, if the holders of more than 50% of the shares of such Fund outstanding as of August 14, 2015 (the “Record Date”) are present or represented by proxy at the Meeting, or (ii) more than 50% of the shares of the Fund outstanding on the Record Date. If the required vote is not obtained for the Fund, it is expected that the Restructuring will not occur as planned and that the Adviser will continue to provide investment advisory services to the Funds under the Existing Advisory Agreements pending a determination by the Adviser and the Board of Trustees about what other action, if any, to take.

THE BOARD OF TRUSTEES UNANIMOUSLY RECOMMENDS THAT THE SHAREHOLDERS OF EACH FUND VOTE IN FAVOR OF THE NEW INVESTMENT ADVISORY AGREEMENT WITH CENTURY CAPITAL MANAGEMENT, LLC.

7

APPROVAL OF THE REPLACEMENT OF CENTURY SHARES TRUST’S FUNDAMENTAL INVESTMENT OBJECTIVE WITH A NEW NON-FUNDAMENTAL INVESTMENT OBJECTIVE (PROPOSAL 2)

|

Current “Fundamental” Investment Objective |

Proposed “Non-Fundamental” Investment Objective |

|

Century Shares Trust (CST) seeks long-term growth of principal and income. |

Century Shares Trust (CST) seeks long-term capital growth. |

The investment objective of Century Shares Trust is “fundamental,” meaning that it may be changed only by a vote of shareholders of the Fund. The Fund’s current investment objective is to seek “long-term growth of principal and income.” The Board unanimously recommends that shareholders approve the proposal to replace the Fund’s fundamental investment objective with a new non-fundamental investment objective of seeking “long-term capital growth.” If approved, this change would enable the Board, in the future, to further change the Fund’s investment objective without the necessity of an additional shareholder vote.

The Adviser recommended this change to the Board. If shareholders approve this proposal the Fund’s investment objective would change in three ways, each of which is described below.

Eliminate Income from the Objective. The proposed change would eliminate “income” from the Fund’s current investment objective of seeking “long-term growth of principal and income.” The Fund primarily receives income by investing in stocks that pay dividends.

A lot has changed since this objective was adopted in 1973. In 1973, the Fund principally invested in common stocks of insurance companies and banks. Today, the Fund is more diversified, being invested across 8 of the 10 sectors defined by Standard & Poor’s. The ten year Treasury note, which yielded about 6.8% in 1973, now yields about 2.15%. And the dividend yield on the S&P 500 has declined from over 3% in 1973 to 1.95% today.

In addition to changes in the macro environment, public companies’ attitudes toward dividends and share repurchase activity has changed over the last 40 years. Dividends used to be the primary method for returning excess capital to shareholders. Today, companies pursue some combination of paying dividends and/or repurchasing their shares. To the degree that companies repurchase their shares, there is less money left to pay dividends. This has resulted in lower dividend yields.

In light of the change in the macroeconomic environment and public companies’ attitudes toward dividends and share repurchases, the Adviser recommended changing the Fund’s investment objective largely because it believes, and the Board agrees, that removal of the “income” component of the Fund’s investment objective will provide greater flexibility for the Fund’s portfolio managers to make investments that provide the opportunity for capital growth regardless of whether or not the portfolio holdings generate dividends.

8

Additionally, the Fund is generally categorized by mutual fund analysis companies as a “large-cap growth” fund and, in the modern mutual fund landscape, it is not typical for a large-cap growth fund to have an income component as part of its investment objective. In a recent survey of other funds categorized as “large-cap growth” by Morningstar, Inc., a well-known provider of mutual fund information that is unaffiliated with the Adviser, more than 90% of those funds did not include “income” as part of their investment objectives. This change in the Fund’s investment objective would more closely align the Fund with investor expectations for a large-cap growth fund and avoid potential confusion among investors.

Change from “Growth of Principal” to “Capital Growth.” This proposal would replace the Fund’s investment objective of seeking “long-term growth of principal” with seeking “long-term capital growth.” The change is recommended to more closely align the Fund’s investment objective with current industry terminology. Simply put, “capital growth” is a more commonly used phrase than “growth of principal.” The Adviser and the Board view the meanings of both phrases as substantially identical. The Adviser recommends this change primarily to make the Fund’s investment objective easier for potential investors to understand. Although the two phrases may have substantively identical meanings, “capital growth” is a much more common term used within the mutual fund industry. If the Fund’s investment objective were solely to seek long-term growth of principal, when potential investors compare the Fund to other mutual funds they may incorrectly believe that the Fund’s investment objective is different from the far more common investment objective of its competitors to seek capital growth. As with the proposed elimination of the income component of the Fund’s investment objective, management believes that a change from “growth of principal” to “capital growth” would bring the Fund more in line with typical language used by other mutual funds with similar investment styles to the Fund.

Changing from Fundamental to Non-Fundamental. The investment objective of the Fund is currently a “fundamental” policy, meaning that it may only be changed by a vote of shareholders of the Fund. Non-fundamental policies may be changed only with the approval of the Trustees of the Fund. The Adviser and Trustees recommend this change to bring the Fund in line with other similar funds and general current industry practice. If approved, the Fund’s investment objective can be changed in the future by action of the Fund’s Trustees. Such a change could occur in response to changing market conditions or other developments without the delay and expense of a shareholder vote. If the Trustees were to approve a change to the Fund’s non-fundamental investment objective in the future, shareholders would be notified and the prospectus would be modified accordingly. If this proposal is approved, shareholders will not be required to vote on any future change to a Fund’s investment objective.

The Adviser has informed the Board that approval of this proposal is not expected to affect the manner in which the Fund’s investment program is being conducted at this time as reflected in the Fund’s current prospectus and statement of additional information.

9

In making their recommendation to shareholders, after careful consideration, the Board determined that the change in the Fund’s investment objective as described above is in the best interest of the Fund. The Trustees considered that the new policy permits the Board to change the Fund’s investment objective, if circumstances change in the future, without the expense of a shareholder vote.

Shareholder Voting Regarding the Replacement of the Fund’s Fundamental Investment Objective With a New Non-Fundamental Investment Objective

With respect to the Fund, the approval of the new non-fundamental investment objective requires the affimative vote of a “majority of the outstanding voting securities” of the Fund as defined in the 1940 Act. The 1940 Act defines the vote of a majority of the oustanding voting securities of the Fund to mean the lesser of (i) 67% of the shares of the Fund that are present at the Meeting, if the holders of more than 50% of the shares of such Fund outstanding as of the Record Date are present or represented by proxy at the Meeting, or (ii) more than 50% of the shares of the Fund outstanding on the Record Date. If the required vote is not obtained for the Fund, it is expected that the replacement of the Fund’s investment objective will not occur as planned and that the Adviser will continue to provide investment advisory services to the Funds under the existing investment objective pending a determination by the Adviser and the Board of Trustees about what other action, if any, to take.

THE BOARD OF TRUSTEES UNANIMOUSLY RECOMMENDS THAT THE SHAREHOLDERS OF CENTURY SHARES TRUST VOTE IN FAVOR OF THE REPLACEMENT OF THE FUND’S FUNDAMENTAL INVESTMENT OBJECTIVE WITH A NEW NON-FUNDAMENTAL INVESTMENT OBJECTIVE.

10

APPROVAL OF THE REPLACEMENT OF CENTURY SMALL CAP SELECT FUND’S FUNDAMENTAL POLICY OF CONCENTRATING ITS INVESTMENTS IN THE FINANCIAL SERVICES AND HEALTH CARE GROUP OF INDUSTRIES WITH A NEW FUNDAMENTAL POLICY OF NOT CONCENTRATING ITS INVESTMENTS IN ANY PARTICULAR INDUSTRY WITHIN THE MEANING OF THE 1940 ACT (PROPOSAL 3)

|

Current Fundamental Policy |

Proposed Fundamental Policy |

|

The Fund concentrates its investments in the financial services and health care group of industries, which means that at least 25% of the Fund’s assets (in the aggregate) are invested in financial services and health care companies. Otherwise, as a matter of fundamental policy, the Fund will not concentrate its investments in any other industry or group of industries. |

The Fund may not purchase any security if, as a result, 25% or more of the Fund’s total assets (taken at current value) would be invested in a particular industry. |

Under applicable law, an investment company may not concentrate its investments in any particular industry or particular group of industries unless it does so pursuant to a fundamental policy that can only be changed with shareholder approval. In addition, the investment company must concentrate its investments consistent with any policy to do so. Although “concentration” is not defined in the 1940 Act, the SEC has generally regarded a fund as concentrating its investments in an industry if the fund invests 25% or more of its assets in securities of issuers in that industry.

The existing fundamental concentration policy of Century Small Cap Select Fund requires the Fund to concentrate its investments in the financial services and health care group of industries, which means that at least 25% of the Fund’s assets (in the aggregate) are invested in financial services and health care companies. The new policy would not require the Fund to concentrate its investments in any particular industry and the Fund would no longer be required to invest (although it may continue to do so) at least 25% of its assets (in the aggregate) in the financial services and health care industries.

The Adviser believes that the proposed change will allow the Adviser greater flexibility in seeking attractive investment opportunities for the Fund, while pursuing the Fund’s investment objective. The Adviser believes that the current investment requirement is not necessary for the Fund to achieve its investment objective and that the proposed change will give the Adviser additional flexibility to seek to achieve the Fund’s investment objective rather than having to meet a strict investment allocation requirement.

The Adviser believes, and the Board agrees, that the proposed change in concentration policy will benefit the Century Small Cap Select Fund and its shareholders.

11

The proposed change to the industry concentration policy does not have any impact on the Century Small Cap Select Fund’s existing classification as a diversified company under the 1940 Act.

For purposes of applying the terms of this fundamental investment policy, the Adviser will, on behalf of the Fund, make reasonable determinations as to the appropriate industry classification to assign to each issuer of securities in which the Fund invests. As a general matter, an industry is considered to consist of those companies whose principal activities, products or services offered give them a similar economic risk profile vis à vis issuers active in other segments of the economy. The definition of what constitutes a particular industry is therefore an evolving one, particularly for issuers in industries or segments within industries that are new or are undergoing rapid development. Some issuers could reasonably fall within more than one industry category. For example, some companies that sell goods over the Internet (including issuers of securities in which the Fund invests) may initially have been classified as Internet companies, but over time have evolved into the economic risk profiles of retail companies. The Adviser will use its reasonable efforts to assign each issuer to the category which the Adviser believes is most appropriate.

For purposes of this restriction, investment companies are not considered to constitute a particular industry and the Fund is permitted to invest without limit in “government securities” (as defined in the 1940 Act) and tax-exempt securities issued by a U.S. territory or possession, a state or local government, or a political subdivision of any of the foregoing.

Shareholder Voting Regarding the Replacement of the Fund’s Concentration Policy

With respect to the Fund, the approval of replacement of the Fund’s fundamental concentration policy requires the affimative vote of a “majority of the outstanding voting securities” of the Fund as defined in the 1940 Act. The 1940 Act defines the vote of a majority of the oustanding voting securities of the Fund to mean the lesser of (i) 67% of the shares of the Fund that are present at the Meeting, if the holders of more than 50% of the shares of such Fund outstanding as of the Record Date are present or represented by proxy at the Meeting, or (ii) more than 50% of the shares of the Fund outstanding on the Record Date. If the required vote is not obtained for the Fund, it is expected that the replacement of the Fund’s concentration policy will not occur as planned and that the Adviser will continue to provide investment advisory services to the Funds under the existing concentration policy pending a determination by the Adviser and the Board of Trustees about what other action, if any, to take.

THE BOARD OF TRUSTEES UNANIMOUSLY RECOMMENDS THAT THE SHAREHOLDERS OF CENTURY SMALL CAP SELECT FUND VOTE IN FAVOR OF THE REPLACEMENT OF THE FUND’S CONCENTRATION POLICY AS DESCRIBED ABOVE.

12

Information About the Adviser

The Adviser is a Delaware limited liability company and is registered as an investment adviser under the Investment Advisers Act of 1940. The principal place of business of the Adviser is 100 Federal Street, 29th Floor, Boston, Massachusetts 02110.

The Adviser does not act as investment adviser to any registered funds that have similar investment objectives and strategies as the Funds. The table below lists the Funds’ net assets as of July 31, 2015 and annual advisory fee rates. The Investment Advisory and Management Services Agreement for Century Small Cap Select Fund covers administrative services described in that agreement, which are not covered by the Investment Advisory Agreements for Century Shares Trust or Century Growth Opportunities Fund. Each of Century Shares Trust and Century Growth Opportunities Fund has entered into a separate Administration Agreement with the Adviser under which the Adviser provides administrative services to those Funds and is paid an annual rate of 0.10% of the Fund’s average daily net assets.

|

Fund |

Net Assets as of |

Annual Advisory Fee Rate as a Percentage of Average Daily Assets |

|

Century Shares Trust |

$231,735,307 |

0.80% of the first $500 million and 0.70% of the amounts exceeding $500 million |

|

Century Small Cap Select Fund |

$309,505,978 |

0.95% |

|

Century Growth Opportunities Fund |

$94,575,290 |

0.80% of the first $500 million and 0.75% of the amounts exceeding $500 million |

The Adviser has entered into a contractual agreement with Century Growth Opportunities Fund to limit the operating expenses of the Institutional Shares to 1.10%. This agreement will remain in effect through February 28, 2016 and may not be terminated prior to that date without the approval of the Board of Trustees. The Adviser is permitted to recoup amounts of prior fee reductions or expense reimbursements within three years after the day on which the Adviser earned the fee or incurred the expense if the class’s total annual operating expenses have fallen to a level below the lower of the limit described above or any limit then in effect. This arrangement would not change as a result of the Restructuring.

Century Shares Trust and Century Growth Opportunities Fund offer one class of shares and, accordingly, the investment advisory fees are paid by that class. Century Small Cap Select Fund offers two classes of shares. The investment advisory fees are allocated to each class of shares based upon the relative portion of the Fund’s net assets represented by that class, as are other Fund expenses unless allocations can be made directly to a class, as with the expenses of distributing and servicing shares of the Fund’s Investor Class under the Distribution and Service (12b-1) Plan, transfer and shareholder servicing agent fees and expenses, and the costs of holding shareholder meetings (to the extent such expenses pertain only to a specific class). The Adviser has committed that the Funds will not bear the expenses relating to the Restructuring, including the costs of soliciting the Funds’ shareholders to approve the New Advisory Agreements at the Meeting.

13

The current principal executive officer and directors of the Adviser and their principal occupations are set forth below. The address of each such person is 100 Federal Street, 29th Floor, Boston, Massachusetts 02110.

|

Name |

Position |

|

Alexander L. Thorndike |

Managing Partner |

|

Davis R. Fulkerson |

Managing Partner |

|

Julie A. Smith |

Chief Financial Officer |

|

Jennifer J. Mortimer |

Chief Compliance Officer |

As of the date of this Proxy Statement, Davis R. Fulkerson and Alexander L. Thorndike exercise voting control over the Adviser. Mr. Fulkerson and Mr. Thorndike act as the Managing Partners of the Adviser, and Mr. Thorndike serves as a Trustee of the Trust. After the Restructuring, Mr. Fulkerson will not be an officer, director or employee of the Adviser. He will cease to have voting control over the Adviser.

On December 31, 2014, as part of the Restructuring, Mr. Thorndike surrendered to the Adviser limited liability company units that had entitled him to participate in the profits and losses of the Adviser’s PEG business. Mr. Thorndike received no payment from the Adviser in connection with the surrender. Also on December 31, 2014, as part of the Restructuring, members of the PEG group surrendered to the Adviser limited liability company units that had entitled them to the participate in the profit and losses of the Adviser’s PSG business. These units, representing 15% of the PSG business, are being held in reserve and subject to future re-allocation to PSG employees including Mr. Thorndike. There is no arrangement or understanding with respect to the composition of the Board of Trustees of Century Capital Management Trust in connection with the Restructuring. Under the current structure Alexander L. Thorndike, and a Management Committee consisting of PSG employees, is responsible for the day to day management of PSG and Davis R. Fulkerson is responsible for the day to day management of PEG. If the Restructuring is consummated, Alexander L. Thorndike and the Management Committee will be responsible for the day-to-day management of the Adviser. After the Restructuring, Alexander L. Thorndike would have the ability to exercise voting control over the Adviser and Davis R. Fulkerson would cease exercising voting control over the Adviser.

14

Additional Information About the Trust and the Funds

A copy of the Trust’s most recent annual report and semi-annual report are available on the EDGAR Database on the SEC’s Internet site at http://www.sec.gov. If you would like a hard copy of the annual report and most recent semi-annual report, the Trust will furnish such copies without charge upon request via first-class mail within three business days of such request. Please direct requests for hard copies of the reports to the following address:

Century Funds

P.O. Box 588

Portland, ME 04112

www.centuryfunds.com

Tel: 800-303-1928

A copy of the Agreement and Declaration of Trust of the Trust is on file with the Secretary of State of The Commonwealth of Massachusetts.

The Funds paid no brokerage commissions to affiliated broker/dealers for the fiscal year ended October 31, 2014.

The address of the principal office of the Trust is 100 Federal Street, 29th Floor, Boston, Massachusetts 02110.

Information About Voting Instructions and the Conduct of the Meeting

Solicitation of Voting Instructions. Voting instructions will be solicited primarily by mailing this Proxy Statement and its enclosures, but voting instructions may also be solicited through further mailings, telephone calls, personal interviews or e-mail by officers of the Trust or by its agents. The Adviser has agreed to bear all of the costs of the Meeting related to the approval of the New Advisory Agreements, including the costs of printing and mailing this proxy statement and soliciting voting instructions.

Voting Process. Record owners of the shares of a Fund as of the Record Date will be entitled to vote on the proposal with respect of such Fund and may cast one vote for each share held. Shares representing 30% of a Fund outstanding as of the Record Date, present in person or represented by proxy, constitutes a quorum for the transaction of business by the shareholders of a Fund at the Meeting. The quorum for proposals 1, 2 and 3 is 50% of a Fund’s outstanding shares as of the Record Date, present in person or represented by proxy.

Votes cast by proxy or in person at the Meeting will be counted by persons your Fund appoints as tellers for the Meeting. The tellers will count the total number of votes cast for approval of a proposal for purposes of determining whether sufficient affirmative votes have been cast. Shares represented by proxies that reflect abstentions and broker non-votes (i.e., shares held by brokers or nominees as to which (i) instructions have not been received from the beneficial owners or the persons entitled to vote and (ii) the broker or nominee does not have the discretionary voting power on a particular matter) will be counted as shares that are present and entitled to vote on the matter for purposes of determining the presence of a quorum. Abstentions and broker non-votes, if any, have the effect of votes against the proposals. Treating broker non-votes as negative votes may result in a proposal not being approved, even though the votes cast in favor would have been sufficient to approve the proposal if some or all of the broker non-votes had been withheld. In certain circumstances in which a Fund has received sufficient votes to approve a matter being recommended for approval by the Fund’s Trustees, the Fund may request that brokers and nominees, in their discretion, withhold submission of broker non-votes in order to avoid the need for solicitation of additional votes in favor of the proposal. A Fund may also request that selected brokers and nominees, in their discretion, submit broker non-votes, if doing so is necessary to obtain a quorum.

15

If an enclosed voting instruction form is completed, executed and returned, it may nevertheless be revoked at any time before the Meeting by a written revocation or later voting instruction form.

For instructions on how to attend the meeting and vote in person, please contact D.F. King & Co., an ASTOne Company, our proxy solicitor by calling toll-free (800) 591-6309.

Adjournments; Other Business. The Meeting may, by action of the Chair of the Meeting, be adjourned from time to time without notice other than announcement at the meeting at which the adjournment is taken with respect to one or more matters to be considered at such meeting to a designated time and place within a reasonable time after the date set for the original meeting, whether or not a quorum is present with respect to such matter.

The Meeting has been called to transact any business that properly comes before it. The only business that management of the Trust intends to present or knows that others will present are the Proposals described in the Meeting Notice. If any other matters properly come before the Meeting, and on all matters incidental to the conduct of the Meeting, the persons named as proxies intend to vote the proxies in accordance with their judgment, unless the Secretary of the Trust has previously received written contrary instructions from the shareholder entitled to vote the shares. Any proposal for which sufficient favorable votes have been received by the time of the Meeting may be acted upon and considered final regardless of whether the Meeting is adjourned to permit additional solicitation with respect to any other proposal.

Shareholder Proposals at Future Meetings. The Trust is not required to hold an annual meeting of shareholders in any year in which the election of Trustees is not required to be acted upon under the 1940 Act. Shareholder proposals to be presented at any future meeting of shareholders of the Fund or the Trust must be received by the Trust in writing a reasonable amount of time before the Trust solicits proxies for that meeting in order to be considered for inclusion in the proxy materials for that meeting.

16

Instructions for Executing Proxy Card. The following general rules for signing proxy cards may be of assistance to you and may help to avoid the time and expense involved in validating your vote if you fail to sign your proxy card properly.

1. INDIVIDUAL ACCOUNTS: Sign your name exactly as it appears in the Registration on the proxy card.

2. JOINT ACCOUNTS: Either party may sign, but the name of the party signing should conform exactly to a name shown in the Registration on the proxy card.

3. ALL OTHER ACCOUNTS: The capacity of the individual signing the proxy card should be indicated unless it is reflected in the form of Registration. For example:

|

REGISTRATION CORPORATE ACCOUNTS |

VALID SIGNATURE |

|

(1) ABC Corp. |

ABC Corp. |

|

(2) ABC Corp. |

John Doe, Treasurer |

|

(3) ABC Corp. c/o John Doe, Treasurer |

John Doe |

|

(4) ABC Corp. Profit Sharing Plan |

John Doe, Trustee |

|

TRUST ACCOUNTS |

|

|

(1) ABC Trust |

Jane B. Doe, Trustee |

|

(2) Jane B. Doe, Trustee u/t/d 12/28/78 |

Jane B. Doe |

|

CUSTODIAL OR ESTATE ACCOUNTS |

|

|

(1) John B. Smith, Cust. f/b/o John B. Smith, Jr. UGMA |

John B. Smith |

|

(2) John B. Smith |

John B. Smith, Jr., Executor |

After completing your proxy card, return it in the enclosed postage-paid envelope.

Ownership of Shares

As of the Record Date, the following number of shares of each Fund were outstanding and entitled to vote:

|

Fund and Class |

Outstanding Shares |

|

Century Shares Trust – Institutional Shares |

|

|

Century Small Cap Select Fund – Investor Shares Institutional Shares |

|

|

Century Growth Opportunities Fund – Institutional Shares |

|

17

5% Beneficial Ownership as of the Record Date

The following chart sets forth the names, addresses, and percentage ownership of those shareholders known by the Trust to own beneficially or of record 5% or more of the outstanding shares of a class of a Fund as of August 14, 2015:

|

CENTURY SHARES TRUST/ INSTITUTIONAL SHARES |

National Financial Services LLC 499 Washington Blvd Jersey City, NJ 07310* |

9.37% |

|

Charles Schwab & Co. Inc. Reinvestment Account Mutual Fund Operations 9601 E. Panorama Circle Mail Stop DEN 2 02 052 Englewood, CO 80112-3441* |

9.13% |

|

|

CENTURY SMALL CAP SELECT FUND/ INVESTOR SHARES |

Charles Schwab & Co. Inc. Reinvest Account Mutual Fund Operations 9601 E. Panorama Circle Mail Stop DEN 2 02 052 Englewood, CO 80112-3441* |

33.78% |

|

National Financial Services LLC 499 Washington Blvd Jersey City, NJ 07310* |

25.19% |

|

|

Vanguard Fiduciary Trust Company 400 Devon Park Drive Wayne, PA 19087* |

18.94% |

|

|

CENTURY SMALL CAP SELECT FUND/ INSTITUTIONAL SHARES |

Mercer Trust Company, Custodian One Investors Way MS N-4-L Norwood, MA 02062* |

38.43% |

|

Charles Schwab & Co. Inc. Reinvest Account Mutual Fund Operations 9601 E. Panorama Circle Mail Stop DEN 2 02 052 Englewood, CO 80112-3441* |

30.13% |

|

|

National Financial Services LLC 499 Washington Blvd Jersey City, NJ 07310* |

7.36% |

18

|

CENTURY GROWTH OPPORTUNITIES FUND/ INSTITUTIONAL SHARES |

Bay Area Rapid Transit – Deferred Comp c/o ICMA Retirement Corporation 777 North Capitol Street NE Washington, DC 20002 |

56.42% |

|

Bay Area Rapid Transit – Money Purchase c/o ICMA Retirement Corporation 777 North Capitol Street NE Washington, DC 20002 |

27.27% |

|

|

National Financial Services LLC 499 Washington Blvd Jersey City, NJ 07310* |

12.03% |

|

* |

Believed to be record owner. |

Interests of Officers and Trustees

As of July 31, 2015, the officers and Trustees of each Fund as a group beneficially owned 3.25% of the outstanding Institutional Shares of Century Shares Trust, 3.14% of the outstanding Institutional Shares of Century Small Cap Select Fund, 1.23% of the outstanding Institutional Shares of Century Growth Opportunities Fund, and less than 1% of the outstanding Investor Shares of Century Small Cap Select Fund.

19

Appendix A

INVESTMENT ADVISORY AGREEMENT (form of)

(CENTURY SHARES TRUST)

AGREEMENT made as of this ____ day of __________, 2015 by and between Century Capital Management Trust, a Massachusetts business trust that may issue one or more series of shares of beneficial interest (the “Trust”), on behalf of Century Shares Trust, a series of the Trust (the “Fund”), and Century Capital Management, LLC, a Delaware limited liability company (the “Adviser”).

W I T N E S S E T H

WHEREAS, the Trust is registered with the Securities and Exchange Commission as an open-end management investment company under the Investment Company Act of 1940, as amended (the “1940 Act”); and

WHEREAS, the Trust is authorized to issue shares of beneficial interest in separate series, including with each such series representing interests in a separate portfolio of securities and other assets; and

WHEREAS, the Trust has established the Fund as a series of the Trust; and

WHEREAS, the Adviser is engaged in the business of rendering investment advisory services and is registered as an investment adviser under the Investment Advisers Act of 1940; and

WHEREAS, the Trust desires to retain the Adviser to furnish investment advisory services to the Fund;

NOW, THEREFORE, the parties hereby agree as follows:

1. Appointment of Adviser. The Fund hereby appoints the Adviser to act as investment adviser of the Fund for the period and on the terms herein set forth. The Adviser accepts such appointment and agrees to render the investment advisory services herein set forth, for the compensation herein provided.

2. Duties of Adviser.

(a) The Adviser, at its expense, will furnish continuously an investment program for the Fund, will determine, subject to the overall supervision of the Trustees of the Fund, what investments shall be purchased, held, sold or exchanged by the Fund and what portion, if any, of the assets of the Fund will be held uninvested, and shall, on behalf of the Fund, make changes in the investments of the Fund. The Adviser, and any affiliate thereof, shall be free to render similar services to other investment companies and other clients and to engage in other activities, so long as the services rendered to the Fund hereunder are not impaired. The Adviser or an affiliate may enter into a separate agreement with the Fund, pursuant to which it may agree to manage, supervise and conduct the other affairs and business of the Fund and matters incidental thereto, subject always to the provisions of the Trust’s Declaration of Trust and of the 1940 Act.

A-1

(b) The Adviser, at its own expense, shall place all orders for the purchase and sale of portfolio securities for the account of the Fund with issuers, brokers or dealers selected by the Adviser. In executing portfolio transactions and selecting brokers or dealers, the Adviser will use its best efforts to seek, on behalf of the Fund, the best overall terms available. In assessing the best overall terms available for any transaction, the Adviser shall consider all factors it deems relevant, including the breadth of the market in the security, the financial condition and execution capabilities of the broker or dealer, and the reasonableness of the commission, if any (for the specific transaction and on a continuing basis). In evaluating the best overall terms available and in selecting the broker or dealer to execute a particular transaction, the Adviser may also consider the brokerage and research services (as those terms are defined in Section 28(e) of the Securities Exchange Act of 1934) provided by such broker or dealer to the Fund or other accounts over which the Adviser or any affiliate of the Adviser exercises investment discretion. The Adviser is authorized to pay to a broker or dealer who provides such brokerage and research services a commission for executing a portfolio transaction for the Fund which is in excess of the amount of commission another broker or dealer would have charged for effecting that transaction, if, but only if, the Adviser determines in good faith that such commission is reasonable in relation to the value of the brokerage and research services provided by such broker or dealer, viewed in terms of either that particular transaction or in terms of all of the accounts over which the Adviser or any affiliate of the Adviser exercises investment discretion.

3. Compensation of Adviser.

(a) As full compensation for the services furnished by the Adviser under this Agreement, the Fund agrees to pay to the Adviser a fee at the annual rate of (i) 0.80% of the Fund’s average daily net asset value up to an aggregate asset level of $500 million and (ii) 0.70% of the Fund’s average daily net asset value in excess of $500 million. Such fee shall be accrued daily and payable monthly. For purposes of calculating such fee, such net asset value shall be determined by taking the average of all determinations of net asset value made in the manner provided in the Fund’s current prospectus and Statement of Additional Information.

(b) For any period less than a full month during which this Agreement is in effect the compensation payable to the Adviser hereunder shall be prorated according to the proportion which such period bears to a full month.

4. Limitation of Liability of Adviser. The Adviser shall not be liable for any error of judgment or mistake of law or for any loss suffered by the Fund in connection with any investment policy or the purchase, sale, or retention of any security on the recommendation of the Adviser; provided, however, that nothing herein contained shall be construed to protect the Adviser against any liability to the Fund by reason of willful misfeasance, bad faith or gross negligence in the performance of its duties, or by reason of reckless disregard of its obligations and duties under this Agreement.

5. Term and Termination.

(a) This Agreement shall become effective on the date first written above. Unless terminated as herein provided, this Agreement shall remain in full force and effect as to the Fund for two years from the date hereof and shall continue in full force and effect for successive periods of one year thereafter, but only so long as each continuance is approved (i) by either the Trustees of the Fund or by vote of a majority of the outstanding voting securities (as defined in the 1940 Act) of the Fund, and, in either event, (ii) by vote of a majority of the Trustees of the Fund who are not parties to this Agreement or interested persons (as defined in the 1940 Act) of any such party.

A-2

(b) This Agreement may be terminated at any time without the payment of any penalty by vote of the Trustees of the Fund or by vote of a majority of the outstanding voting securities (as defined in the 1940 Act) of the Fund or by the Adviser, on sixty days’ written notice to the other party.

(c) This Agreement shall automatically terminate in the event of its assignment (as defined in the 1940 Act).

IN WITNESS WHEREOF the parties hereto have caused this Agreement to be duly executed as of the date first written above.

|

CENTURY CAPITAL MANAGEMENT TRUST, on behalf of its CENTURY SHARES TRUST series |

|||

|

By: |

|

||

|

CENTURY CAPITAL MANAGEMENT, LLC |

|||

|

By: |

|

||

NOTICE

A copy of the Agreement and Declaration of Trust of the Trust is on file with the Secretary of State of The Commonwealth of Massachusetts and notice is hereby given that this Agreement is executed with respect to the Fund by officers of the Trust as officers and not individually and that the obligations of this Agreement are not binding upon the Trustees, officers or holders of shares individually but are binding only upon the assets and property of the Fund.

A-3

INVESTMENT ADVISORY AND MANAGEMENT SERVICES AGREEMENT

(CENTURY SMALL CAP SELECT FUND) (form of)

AGREEMENT made as of this ____ day of _________, 2015 by and between Century Capital Management Trust, a Massachusetts business trust that may issue one or more series of shares of beneficial interest (the “Trust”), on behalf of Century Small Cap Select Fund, a series of the Trust (the “Fund”), and Century Capital Management, LLC, a Delaware limited liability company (the “Adviser”).

RECITALS

WHEREAS, the Trustees of the Trust (the “Trustees”) desire to employ an investment adviser and management services provider for the Fund, and the Adviser desires to be so employed;

NOW THEREFORE, the parties hereto intending to be legally bound hereby agree as follows:

1. Services Undertaken By Adviser.

(a) Investment Advisory Services. The Adviser undertakes to act as investment adviser to the Fund and shall, subject to the supervision of the Trustees, invest and reinvest the Fund’s property and otherwise direct the investments of the Fund in accordance with the Fund’s investment objectives, policies and limitations as provided in the Trust’s registration statement filed on Form N-1A or other governing instruments, as amended or supplemented from time to time, the Investment Company Act of 1940 and rules thereunder, as amended from time to time (the “1940 Act”), and such other limitations as the Fund may impose by notice in writing to the Adviser. The Adviser shall furnish for the use of the Fund office space and all necessary office facilities, equipment and personnel for servicing the investments of the Fund; and the Adviser shall pay the salaries and fees of all officers (if any) of the Fund who are simultaneously employees of the Adviser, of all Trustees who are simultaneously employees of the Adviser and of all personnel of the Fund (if any) or the Adviser performing services relating to research, statistical and investment activities. The Adviser is authorized, in its discretion and without prior consultation with the Fund to buy, sell, exchange, convert, lend and otherwise trade in any stocks, bonds, convertible instruments, and other securities, assets and investment instruments on behalf of the Fund, or to hold assets uninvested in cash. The investment policies and all other actions of the Fund are and shall at all times be subject to the control and direction of the Trustees.

(b) Management Services. The Adviser shall perform (or arrange for the performance of) the management and administrative services necessary for the operation of the Fund. The Adviser shall, subject to the supervision of the Trustees, perform various services for the Fund, including but not limited to: (i) providing the Fund with office space, equipment and facilities (which may be its own) for maintaining its organization; (ii) on behalf of the Fund, supervising relations with, and monitoring the performance of, custodians, depositories, pricing agents, transfer agents, accountants, attorneys, underwriters, brokers and dealers, insurers and other persons in any capacity deemed to be necessary or desirable; (iii) preparing all general shareholder communications, including shareholder reports; (iv) conducting shareholder relations; (v) maintaining the Fund’s existence and its records; and (vi) during such times as shares are publicly offered, maintaining the registration and qualification of the Fund’s shares under applicable federal and state securities laws.

A-4

(c) Other Services and Undertakings. The Adviser shall furnish such reports, evaluations, information or analyses to the Fund as the Trustees may request from time to time or as the Adviser may deem to be desirable. The Adviser shall make recommendations to the Trustees as to policies regarding the Fund and shall carry out such policies as are adopted by the Trustees. The Adviser shall, subject to review by the Trustees, furnish such other services as the Adviser shall from time to time determine to be necessary or desirable.

(d) Brokerage. The Adviser shall place orders and negotiate the commissions (if any) for the execution of transactions in securities with or through such brokers, dealers, underwriters, agents, issuers or others as the Adviser may select, which may (subject to applicable requirements of the 1940 Act) include brokers or dealers affiliated with the Adviser. The Adviser shall use its best efforts to seek to execute Fund transactions at prices that are advantageous to the Fund and at commission rates that are reasonable in relation to the benefits received. In selecting brokers or dealers qualified to execute a particular transaction, brokers or dealers may be selected who also provide brokerage and research services (as those terms are defined in Section 28(e) of the Securities Exchange Act of 1934) to the Fund and/or the other accounts over which the Adviser or its affiliates exercise investment discretion. The Adviser is authorized to pay a broker or dealer who provides such brokerage and research services a commission for executing a portfolio transaction for the Fund that is in excess of the amount of commission another broker or dealer would have charged for effecting that transaction if the Adviser determines in good faith that such amount of commission is reasonable in relation to the value of the brokerage and research services provided by such broker or dealer. This determination may be viewed in terms of either that particular transaction or the overall responsibilities that the Adviser and its affiliates have with respect to accounts over which they exercise investment discretion. The Trustees may periodically review the commissions paid by the Fund to determine if the commissions paid over representative periods of time were reasonable in relation to the benefits to the Fund.

2. Interested Persons; Status. It is understood that Trustees, officers, employees and shareholders of the Fund are or may become interested in the Adviser as directors, officers, employees, managers, members or otherwise, and that directors, officers, employees, managers or members of the Adviser are or may become similarly interested in the Trust, and that the Adviser may be or become interested in the Trust as a shareholder or otherwise. In acting hereunder, the Adviser shall be an independent contractor. The Adviser shall not be an agent of the Trust.

3. Compensation.

(a) For the services to be performed hereunder, the Adviser shall receive an investment advisory fee (the “Investment Advisory Fee”) at an annual rate of 0.95% of the net asset value of the Fund. The Investment Advisory Fee shall be paid to the Adviser in arrears as soon as practicable following the last business day of each calendar month.

A-5

The initial fee payment under this Agreement shall be made as soon as practicable following the last business day of the calendar month in which falls the effective date of this Agreement and shall be prorated as set forth below.

(b) The fee to the Adviser shall be prorated for the portion of any calendar month in which this Agreement is in effect that is not a complete month according to the proportion that the number of calendar days in the month during which the Agreement is in effect bears to the number of calendar days in the month. The final payment hereunder shall be payable within ten (10) days after the date of termination. The Adviser in its sole discretion shall retain the right at any time to forego and waive any monthly fee or part thereof.

4. Fund Expenses.

(a) General Expenses. It is understood that the Fund will pay all its expenses other than those expressly stated to be payable by the Adviser under Section 1 above, which expenses payable by the Fund shall include, without limitation, (i) interest and taxes; (ii) brokerage commissions and other costs in connection with the purchase or sale of securities and other investment instruments; (iii) fees and expenses of the Trustees other than those who are employees of the Adviser; (iv) legal and audit expenses; (v) custodian, accounting services and registrar fees and expenses; (vi) fees, expenses and costs related to transfer agent and shareholder services functions, whether performed by the Fund, the Adviser, related persons or independent parties; (vii) fees and expenses related to the registration and qualification of the Trust and the Fund’s shares for distribution under state and federal securities laws; (viii) expenses of printing and mailing reports and notices and proxy material (if any) to shareholders of the Fund; (ix) all other expenses incidental to holding meetings of, or soliciting consents from, the Fund’s shareholders (if and whenever required), including proxy solicitations therefor; (x) all expenses of bond, liability, fidelity and other insurance coverage required by law or deemed advisable by the Trustees; (xi) any fees, dues, or expenses related to the Fund’s membership in any industry association or other investment organization; (xii) expenses of preparing, printing and mailing Prospectuses and Statements of Additional Information and supplements thereto; (xiii) expenses incurred pursuant to the Fund’s Distribution and Service Plan; and (xiv) such non-recurring or extraordinary expenses as may arise, including those relating to actions, suits or proceedings to which the Fund is a party and the legal obligation which the Fund may have to indemnify the Fund’s officers and the Trustees with respect thereto. The Fund shall reimburse the Adviser, on demand, for any of such expenses that are borne by it, the amount of which shall not constitute any part of, and shall be paid in addition to, the Investment Advisory Fee.

(b) Transfer Agent and Shareholder Services Functions. Personnel of the Adviser may assist the Fund in performing transfer agent and shareholder Services functions with respect to shares of the Fund. In this event, such personnel would remain employees of the Adviser, and the Fund would reimburse the Adviser, on demand, for an amount of salary, payroll tax and personnel benefit payments made by the Adviser proportionate to the level of transfer agent and shareholder services functions performed by such personnel. The amount of such reimbursement shall not constitute any part of, and shall be paid in addition to, the Investment Advisory Fee.

A-6

(c) Financial, Accounting, Administrative and Clerical Services. Personnel of the Adviser may assist the Fund in performing financial, accounting, administrative and clerical services. In this event, such personnel would remain employees of the Adviser, and the Fund would reimburse the Adviser, on demand, for an amount of salary, payroll tax and personnel benefit payments made by the Adviser proportionate to the level of such services performed by such personnel. The amount of such reimbursement shall not constitute any part of, and shall be paid in addition to, the Investment Advisory Fee.

5. Non-Exclusivity. The services of the Adviser to the Fund are not to be deemed exclusive, the Adviser being free to render services to others and engage in other activities; provided, however, that such other services and activities do not interfere, in a material manner, with the Adviser’s ability to meet all of its obligations hereunder.

6. Permitted Uses. The Trust acknowledges that the word “Century” as used in the name of the Trust and the Fund is a property right the use of which is licensed to the Adviser by a third party. The Adviser hereby grants to the Trust and the Fund the right to use the word “Century” in their corporate names. The Trust agrees that, at the written request of the Adviser, the Trust will take or cause to be taken all action necessary to change its and the Fund’s respective corporate names to eliminate the word “Century”.

7. Term.

(a) Subject to prior termination as provided in sub-paragraph d) of this paragraph 7, this Agreement shall continue in force through the date that is two years after the date of this Agreement and indefinitely thereafter, but only so long as the continuance after such date shall be specifically approved at least annually by vote of the Trustees or by vote of a majority of the outstanding voting securities of the Fund.

(b) This Agreement may be modified by mutual consent, subject to the provisions of Section 15 of the 1940 Act, as modified by or interpreted by any applicable order or orders of the Securities and Exchange Commission (the “Commission”), or any rules or regulations adopted by, or interpretative releases of, the Commission.

(c) In addition to the requirements of sub-paragraphs (a) and (b) of this paragraph 7, the terms of any continuance or modification of this Agreement must have been approved by the vote of a majority of those Trustees who are not parties to the Agreement or interested persons of any such party, cast in person at a meeting called for the purpose of voting on such approval.

(d) Either party hereto may at any time on sixty (60) days’ prior written notice to the other, terminate this Agreement without payment of any penalty by action of the Trustees or vote of a majority of the outstanding voting securities of the Fund (in the case of the Fund) or by action of the Board of Directors of the Adviser (in the case of the Adviser). This Agreement shall terminate automatically in the event of its assignment.

8. Limitation of Liability of Trustees and Shareholders. A copy of the Trust’s Agreement and Declaration of Trust is on file with the Secretary of The Commonwealth of Massachusetts, and notice is hereby given that this instrument is executed on behalf of the Trustees of the Trust as Trustees and not individually and that the obligations of this instrument are not binding upon any of the Trustees or shareholders individually but are binding only upon the assets and property of the Fund. The Adviser shall not seek satisfaction of any such obligation from the shareholders or any shareholder of the Fund, from any other series of the Trust or from the Trustees or any individual Trustee. The Adviser understands that the rights and obligations of any series under the Agreement and Declaration of Trust or other organizational document are separate and distinct from those of any and all other series.

A-7

9. Limitation of Liability of Adviser. In the absence of willful misfeasance, bad faith, gross negligence or reckless disregard of its obligations or duties hereunder on the part of the Adviser, the Adviser shall not be subject to liability to the Fund or to any shareholder of the Fund or to any other person for any act or omission or any mistake in judgment in the course of, or connected with, rendering services hereunder or for any losses that may be sustained in the purchase, holding or sale of any security or other investment instrument.

10. Definitions. The terms “vote of a majority of the outstanding voting securities,” “assignment,” and “interested persons,” when used herein, shall have the respective meanings specified in the 1940 Act and rules thereunder, as now in effect or as hereafter amended, and subject to such orders as may be granted by the Commission.

11. Miscellaneous.

(a) This Agreement represents the entire understanding and agreement between the parties and shall not be modified or amended except by an instrument in writing signed by the parties.

(b) This Agreement shall be governed by and construed and enforced in accordance with the laws of The Commonwealth of Massachusetts.

IN WITNESS WHEREOF the parties have caused this instrument to be signed in their behalf by their respective officers thereunto duly authorized, and their respective seals to be hereunto affixed, all as of the date written above.

|

CENTURY CAPITAL MANAGEMENT TRUST, On behalf of its CENTURY SMALL CAP SELECT FUND series |

|||

|

By: |

|||

|

Name: |

|||

|

Title: |

|||

|

CENTURY CAPITAL MANAGEMENT, LLC |

|||

|

By: |

|||

|

Name: |

|||

|

Title: |

|||

A-8

INVESTMENT ADVISORY AGREEMENT

(CENTURY GROWTH OPPORTUNITIES FUND) (form of)

AGREEMENT made as of the _______ day of ____________, 2015, by and between Century Capital Management Trust, a Massachusetts business trust that may issue one or more series of shares of beneficial interest (the “Trust”), on behalf of Century Growth Opportunities Fund, a series of the Trust (the “Fund”), and Century Capital Management, LLC, a Delaware limited liability company (the “Adviser”).

W I T N E S S E T H

WHEREAS, the Trust is registered with the Securities and Exchange Commission as an open-end management investment company under the Investment Company Act of 1940, as amended (the “1940 Act”); and

WHEREAS, the Trust is authorized to issue shares of beneficial interest in separate series, including with each such series representing interests in separate portfolios of securities and other assets;

WHEREAS, the Trust has established the Fund as a series of the Trust; and

WHEREAS, the Adviser is engaged in the business of rendering investment advisory services and is registered as an investment adviser under the Investment Advisers Act of 1940; and

WHEREAS, the Trust desires to retain the Adviser to furnish investment advisory services to the Fund;

NOW, THEREFORE, the parties hereby agree as follows:

1. Appointment of Adviser. The Trust hereby appoints the Adviser to act as investment adviser of the Fund for the period and on the terms herein set forth. The Adviser accepts such appointment and agrees to render the investment advisory services herein set forth, for the compensation herein provided.

2. Duties of the Adviser.