cent55592-ncsr.htm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-09561

Century Capital Management Trust

(Exact name of registrant as specified in charter)

c/o Century Capital Management, LLC

100 Federal Street, Boston, Massachusetts 02110

(Address of principal executive offices) (Zip code)

Maureen Kane

Century Capital Management, LLC

100 Federal Street, Boston, Massachusetts 02110

(Name and address of agent for service)

Registrant's telephone number, including area code: (617) 482-3060

Date of fiscal year end: October 31

Date of reporting period: October 31, 2012

Item 1. Reports to Shareholders.

| |

|

|

Table of Contents

|

|

| |

Page

|

|

Letter to Shareholders

|

1

|

| |

|

|

Fund Summaries

|

|

|

Century Small Cap Select Fund

|

5

|

|

Century Shares Trust

|

9

|

|

Century Growth Opportunities Fund

|

13

|

| |

|

|

Portfolio of Investments

|

|

|

Century Small Cap Select Fund

|

18

|

|

Century Shares Trust

|

20

|

|

Century Growth Opportunities Fund

|

22

|

| |

|

| |

|

|

Financial Statements

|

24

|

| |

|

|

Notes to the Financial Statements

|

32

|

| |

|

|

Report of Independent Registered Public Accounting Firm

|

40

|

| |

|

|

Disclosure of Fund Expenses

|

41

|

| |

|

|

Tax Information

|

42

|

| |

|

|

Approval of Investment Management Agreements

|

43

|

| |

|

|

Trustees and Officers

|

47

|

This report is submitted for the general information of the shareholders of Century Small Cap Select Fund, Century Shares Trust, and Century Growth Opportunities Fund (each a “Fund” and collectively, the “Funds”). It is not authorized for distribution to prospective investors in a Fund unless it is preceded by or accompanied by the Fund’s current prospectus. The prospectus includes important information about the Fund’s objective, risks, charges and expenses, experience of its management, and other information. Please read the prospectus carefully before you invest.

The views expressed in this report are those of the Funds’Portfolio Managers as of October 31, 2012, the end of the reporting period. Any such views are subject to change at any time and may not reflect the Portfolio Managers’views on the date that this report is first published or anytime thereafter. These views are intended to assist shareholders in understanding their investments and do not constitute investment advice. There is no assurance that the Funds will continue to invest in the securities mentioned in this report.

|

Century Funds

|

Letter to Shareholders

|

October 31, 2012 (Unaudited)

Dear Fellow Shareholders,

The equity markets rewarded patient investors over the Funds’ latest fiscal year, which ended October 31, 2012. In general, domestic U.S. equities outperformed most other asset classes, despite limited Congressional progress on the same structural issues (taxes and spending) that we outlined in last year’s Annual Report.

During the fiscal year ended October 31, 2012, Century Small Cap Select Fund’s Institutional Shares outperformed the Fund’s benchmark, while the Fund’s Investor Shares, Century Shares Trust and Century Growth Opportunities Fund underperformed their benchmarks. We review each Fund’s performance, positioning and outlook following this letter.

Despite the near-term “fiscal cliff” concerns, we view the outlook for stock valuations and growth prospects as favorable over the next decade. The third quarter earnings season (just completed) reveals that most companies continue to deliver reasonable revenue and earnings growth, but we believe the 2013 outlook for many companies may require growth and margin expectations to come down, especially if global growth concerns in Europe and Asia are not resolved.

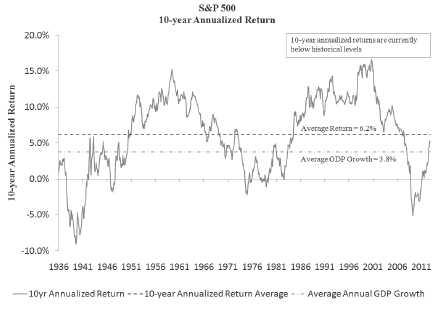

Favorable Horizon

Why are we optimistic on the long-term outlook for equities and the economy? We continue to see 1) moderate economic growth, 2) improving consumer confidence, 3) low inflation and 4) increasing employment, which combine to drive long-term corporate profit growth. We think it is important to keep a long-term investment perspective, and long-term equity returns have risen a resounding 7%-8% annually since 1926, which is more than double the rate of Gross Domestic Product (GDP) or economic growth in the US during this timeframe. However, I should note that annual growth results may be highly variable and sometimes negative. In summary, we believe the equity return opportunity remains very attractive, assuming shareholders are willing to tolerate some degree of risk. Our goal is to invest in companies with high expected returns and below average risk exposure to your portfolio.

Source: Bloomberg (Data as of 10/31/2012; Data range is 1/1/1936 through 10/31/2012)

|

Annual Report | October 31, 2012

|

1

|

|

Century Funds

|

Letter to Shareholders

|

October 31, 2012 (Unaudited)

In addition, we are confident that the US’ democratic system of free-market capitalism and regulatory transparency remains the most robust and dynamic foundation on which to nurture great ideas into innovative and efficient businesses. This stimulating environment of constant change and analysis is the reason why our Century investment team comes to work each day. We are constantly trying to identify the best companies to own in our Fund portfolios, from the 4,000 stocks in our investable universe.

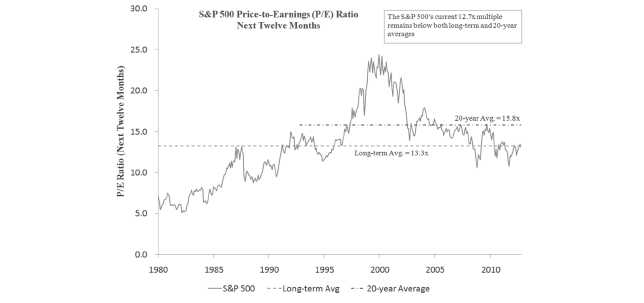

With interest rates declining to their lowest levels since World War I and the Federal Reserve committed to keeping rates low until 2015, we believe that owning common equity shares in these entrepreneurial companies will provide solid investor returns over the next 10-20 years, especially with current price-to-earnings (P/E) valuations at attractive levels of 12.7x next-twelve months (NTM) earnings’ estimates versus long-term historical average of 13.3x NTM P/E and 25.6x back in 2000.

Source: Bloomberg (Data as of 11/28/2012; Data range is 1/1/1980 through 11/18/2012)

Past performance does not guarantee future results.

Price-to-earnings ratio is the value of a company’s stock price relative to company earnings. Estimated earnings growth is the year over year growth in earnings per share.

Superpower Transitions

As I write this letter, the two largest world economies (America & China) have just selected their political leaders for the next few years. In many respects, these world powers are facing equal challenges from opposite sides of the same coin. How each country addresses these challenges will greatly impact their standards of living. The Chinese are struggling with how to sustain their torrid economic growth, while expanding middle class opportunities, without

|

Century Funds

|

Letter to Shareholders

|

October 31, 2012 (Unaudited)

imperiling their Communist party system. Meanwhile, Americans are struggling with the finite limits of government in society (expanding taxes, social spending programs and federal deficits) while trying to break free from the last vestiges of the Great Recession of 2008-2009, which inhibited job growth and kept the unemployment rate above 7.7% for the last four years.

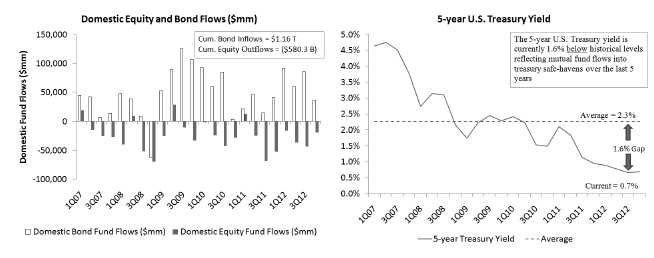

These challenges are delicate balancing acts for both nations, and the recent volatility in the capital markets reflects these investor concerns, along with similar geopolitical challenges in Europe, Middle East and North Africa. This global uncertainty has contributed to the steady withdrawal of fund flows from domestic equity mutual funds over the last five years. (see equity & bond fund chart below.) There is always some degree of geopolitical uncertainty in the world, but we think that these crisis situations also provide tremendous growth opportunity in corporate profits, if we resolve some of these questions over the next several years.

Source: Investment Company Institute (Data as of 11/14/2012) Source: Bloomberg (Data as of 11/23/2012)

Corporate balance sheets remain high in cash and relatively unlevered by debt. Management teams are hesitating to invest in new hiring and production, until the economic and partisan political climate improves. We hope that the recent November election results facilitate a quick bipartisan compromise and some measure of clarity to the markets, setting the stage for accelerating GDP growth in 2013. We believe that this confluence of factors will eventually renew interest in domestic equities. We anticipate a return to positive and more normalized equity mutual fund flows as investors withdraw from their overextended allocations to low-yielding, fixed income investments and seek out inflation protecting returns of equities over the long-term.

|

Annual Report | October 31, 2012

|

3

|

|

Century Funds

|

Letter to Shareholders

|

October 31, 2012 (Unaudited)

Investing amidst low interest rates

With interest rates at such low levels (see 5-yr US Treasury Bond yield chart on the prior page), investors are struggling to find decent investment returns that exceed future inflation expectations, which are likely to rise from current levels. The Federal Reserve is trying to push these investors toward more risky asset classes. We encourage investors to be prudent and thrifty in their investment choices, while maintaining a “quality bias” and a disciplined research process.

We also emphasize our collective need to increase the savings rate and the tremendous power of long-term compounding interest, enabling investors to increase their investment returns over long periods of time (please see Einstein’s quote below.) This compounding concept of the time value of money is best exemplified by the “Rule of 72,”which helps explain how much faster an amount will double in value for a given interest rate, if its investment return is reinvested and compounds annually. For instance, $100 will double in approximately 8.1 years if compounding at 9% returns versus approximately 11.2 years (3.1 years longer) if using simple interest returns and not reinvesting gains.

“Compound Interest is the eighth wonder of the world. He who understands it, earns it…he who doesn’t, pays it.” – Albert Einstein

This arithmetic formula is a powerful investment and savings motivator in the low interest rate environment we find ourselves in today. This key takeaway point reinforces the need to save more and allow the long term compounding of reinvested returns to work to your advantage. Great investors are rewarded by the patience and discipline in the mathematical power of compounding.

It is our hope to find great companies that compound earnings at a faster rate than their peers over the next several years and deliver superior risk-adjusted returns to your Funds over time. We view a quality-bias and long-term investment horizon as strategic advantages in our investment process.

In the meantime, we reiterate that success starts with demanding our political leaders to 1) think beyond the next couple elections and 2) be courageous about choosing long-term goals above short-term popularity.

We thank you for your continued support, and we wish you all a happy holiday season.

Respectfully Submitted,

Alexander L. Thorndike

Chairman of the Century Funds

|

Century Small Cap Select Fund

|

Fund Commentary

|

October 31, 2012 (Unaudited)

HOW DID THE PORTFOLIO PERFORM?

For the one-year period ended October 31, 2012, Century Small Cap Select Fund’s Institutional Shares returned +9.87% and the Investor Shares returned +9.46%, versus the +9.70% return for the Russell 2000 Growth Index, the Fund’s benchmark.

WHAT FACTORS INFLUENCED PERFORMANCE?

Good stock selection was the primary driver of the Fund’s performance during the one-year period ended October 31, 2012. In general, companies with healthy growth rates and improving margins propelled the market higher. Stocks such as Beacon Roofing Supply (roofing distributor), Hain Celestial Group Inc. (organic consumer products), Catamaran Corp. (pharmacy benefit manager), and NPS Pharmaceuticals Inc. (biopharmaceuticals) were the top contributors to the Fund’s performance during the period. Underperforming stocks included Pioneer Energy Services Corp. (Exploration & Production), Express, Inc. (specialty retailer), Questcor Pharmaceuticals Inc. (biopharmaceuticals) and Log MeIn Inc. (cloud-based services).

Sector allocation for Fiscal Year 2012. Underweighting Energy and Consumer Staples benefitted Fund performance, while overweighting Technology and underweighting Consumer Discretionary was a drag on performance.

DESCRIBE RECENT PORTFOLIO ACTIVITY

Over the last six months, we have made small increases in the Industrial and Financial Services sectors, while reducing Technology and Consumer Staples sectors slightly. The Fund is diversified across most sectors, except Utilities.

The Fund is positioned with an overweight in Financial Services, Technology and Telecommunication Services stocks. In contrast, the Fund is meaningfully underweight Consumer Discretionary and Consumer Staple stocks. We continue to focus on revenue growth, profitability and financial strength when evaluating securities. While we remain vigilant regarding the near-term fiscal cliff and international concerns mentioned elsewhere in this report, we are optimistic about the long-term future of the U.S. economy and the potential for domestic equity returns. We believe the portfolio is properly positioned to benefit from the slow, sustained improvements within the U.S. and global economies.

|

Annual Report | October 31, 2012

|

5

|

|

Century Small Cap Select Fund

|

Fund Commentary

|

October 31, 2012 (Unaudited)

Risks: The Fund concentrates its investments in the financial services and health care group of industries. Concentration in a particular industry subjects the Fund to the risks associated with that industry, and as a result, the Fund may be subject to greater price volatility than funds with less concentrated portfolios. In addition, the Fund invests in smaller companies which pose greater risks than those associated with larger, more established companies. Please read the Fund’s prospectus for details regarding the Fund’s risk profile.

| |

|

|

|

|

|

Ten Largest Holdings*

|

|

|

Portfolio Composition*

|

|

|

J2 GLOBAL, INC.

|

4.00%

|

|

Information Technology

|

23.6%

|

|

Internet Software & Services

|

|

|

Health Care

|

20.3%

|

|

CAI INTERNATIONAL, INC.

|

3.78%

|

|

Industrials

|

18.7%

|

|

Trading Companies & Distributors

|

|

|

Financials

|

11.3%

|

|

BEACON ROOFING SUPPLY, INC.

|

2.87%

|

|

Consumer Discretionary

|

10.5%

|

|

Trading Companies & Distributors

|

|

|

Energy

|

4.8%

|

|

DSW, INC., CLASS A

|

2.86%

|

|

Materials

|

3.6%

|

|

Specialty Retail

|

|

|

Telecommunication Services

|

2.4%

|

|

BROOKDALE SENIOR LIVING, INC.

|

2.63%

|

|

Consumer Staples

|

2.0%

|

|

Health Care Providers & Services

|

|

|

Cash, Cash Equivalents, & Other Net Assets

|

2.8%

|

|

SIGNATURE BANK

|

2.60%

|

|

|

|

|

Commercial Banks

|

|

|

|

|

|

DFC GLOBAL CORP.

|

2.53%

|

|

|

|

|

Consumer Finance

|

|

|

|

|

|

COGENT COMMUNICATIONS GROUP, INC.

|

2.45%

|

|

|

|

|

Diversified Telecommunication Services

|

|

|

|

|

|

WINTRUST FINANCIAL CORP.

|

2.43%

|

|

|

|

|

Commercial Banks

|

|

|

|

|

|

ATLAS AIR WORLDWIDE HOLDINGS, INC.

|

2.27%

|

|

|

|

|

Air Freight & Logistics

|

|

|

|

|

| |

|

|

|

|

|

*Based on the Fund’s net assets at October 31, 2012 and subject to change.

|

|

|

Century Small Cap Select Fund

|

Performance Summary

|

October 31, 2012 (Unaudited)

Institutional Shares and Investor Shares

The returns shown below represent past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance may be higher or lower than the Fund’s past performance. For the most recent month-end performance, please call 800-303-1928.

As stated in the Fund’s current prospectus, the total (gross) operating expenses are 1.11% for the Institutional Shares and 1.48% for the Investor Shares. Returns would have been lower during the 10-year period if certain fees had not been waived or expenses reimbursed. The Fund’s total returns include the reinvestment of dividend and capital gain distributions, but have not been adjusted to reflect the deduction of taxes that a shareholder would pay on these distributions or the redemption of Fund shares. Shares held less than 90 days may be subject to a 1% redemption fee.

|

Average Annual Total Returns October 31, 2012

|

|

|

|

|

| |

1 Year

|

3 Years

|

5 Years

|

10 Years

|

|

Century Small Cap Select Fund –

|

|

|

|

|

|

Institutional Shares

|

9.87%

|

17.15%

|

2.09%

|

8.83%

|

|

Century Small Cap Select Fund –

|

|

|

|

|

|

Investor Shares

|

9.46%

|

16.73%

|

1.71%

|

8.44%

|

|

Russell 2000 Growth Index

|

9.70%

|

15.74%

|

1.41%

|

9.66%

|

|

Annual Report | October 31, 2012

|

7

|

|

Century Small Cap Select Fund

|

Performance Summary

|

October 31, 2012 (Unaudited)

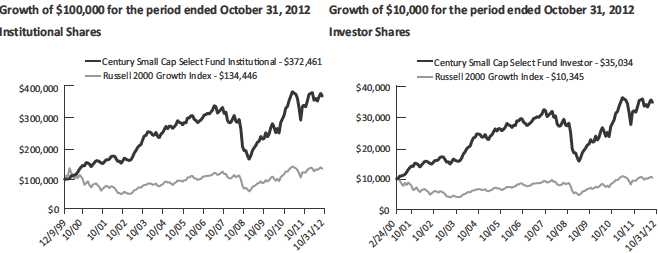

The graphs and table reflect the change in value of a hypothetical investment in the Fund, including reinvest of dividends and distributions, compared with the index. Index returns assume reinvestment of dividends and, unlike Fund returns, do not reflect any fees or expenses. It is not possible to invest directly in an index. Minimum initial investment for Institutional Shares is $100,000.

The Russell 2000® Growth Index measures the performance of the small-cap growth segment of the U.S. equity universe. It includes those Russell 2000® companies with higher price-to-value ratios and higher forecasted growth values. Index returns assume reinvestment of dividends but, unlike Fund returns, do not reflect fees or expenses. One cannot invest directly in an index.

|

Century Shares Trust

|

Fund Commentary

|

October 31, 2012 (Unaudited)

HOW DID THE PORTFOLIO PERFORM?

For the one-year period ended October 31, 2012, Century Shares Trust returned +7.63%, underperforming the Russell 1000 Growth Index, the Fund’s benchmark, which returned +13.02%. The S&P 500 Index gained +15.21% during the period.

WHAT FACTORS INFLUENCED PERFORMANCE?

The Fund benefitted from the strong performance of domestic equity markets. 2012 saw stock markets build on gains from 2011, with the S&P 500 index +15% and the Russell 1000 Growth index +13% for the one-year period ended October 31, 2012. In fact the overall market, as measured by the S&P 500 Index, is up a cumulative +59% since October 31, 2008. The stock market performance reflects the return to 2.0-2.5% US Gross Domestic Product (GDP) growth after the ‘Great Recession’. However, rising equity prices have come with rising volatility and corrections of 10% or so, roughly twice a year.

While Century Shares Trust participated in the rising stock market, the Fund’s performance was negatively impacted by four stocks that experienced sharp corrections. Green Mountain Coffee Roasters Inc. (specialty coffee), Tempur-Pedic International Inc. (premium mattress manufacturer), Tiffany & Co. (jewelry retailer), and Cognizant Technology Solutions Corp. (IT outsourcing) all declined materially upon announcing weak financial results. Since the Fund invests in a relatively limited number of companies, the impact that each investment has on the Fund’s performance can be significant. Stocks that partially offset the weak performers included LyondellBasell Industries (chemicals), Alexion Pharmaceuticals (biotechnology), ResMed Inc. (sleep-disorder breathing equipment) and CBS Corp. (mass media).

The Fund’s performance did benefit slightly from sector allocation decisions. The Fund was positively impacted by overweighting the Energy and Health Care sectors; this outperformance was partially offset by weakness in the Consumer Staples and Telecommunication Services sectors.

DESCRIBE RECENT PORTFOLIO ACTIVITY

Stock selection is driven by our bottom-up, fundamental investment process. We increased investments in Health Care and Energy stocks due to our belief in their steady, long-term growth prospects and their attractive valuations. We decreased investments in Consumer Staples, primarily because appreciation in the stock prices of some of our holdings resulted in high valuations.

The portfolio remains diversified across most sectors with a modest overweight in Health Care and Energy and a modest underweight in Consumer Staples and Discretionary. The Fund is positioned in anticipation of slow growth over the next year in light of the many challenges still facing investors, including tensions in the Middle East, fiscal challenges in Europe and the U.S., and slowing growth in China. Given our expectations for a slow growth world economy, we seek to invest in companies that we believe have strong secular growth opportunities, solid profitability, and reasonable valuations.

|

Annual Report | October 31, 2012

|

9

|

|

Century Shares Trust

|

Fund Commentary

|

October 31, 2012 (Unaudited)

Risks: The Fund may invest a significant portion of assets in a limited number of companies or in companies within the same market sector. As a result, the Fund may be more susceptible to financial, market and economic events affecting particular companies or sectors and therefore may experience greater price volatility than funds with more diversified portfolios. Please read the Fund’s prospectus for details regarding the Fund’s risk profile.

|

Ten Largest Holdings*

|

|

|

APPLE, INC.

|

7.62%

|

|

Computers & Peripherals

|

|

|

EXPRESS SCRIPTS HOLDING CO.

|

4.27%

|

|

Health Care Providers & Services

|

|

|

LYONDELLBASELL INDUSTRIES NV, CLASS A

|

4.08%

|

|

Chemicals

|

|

|

GOOGLE, INC., CLASS A

|

3.86%

|

|

Internet Software & Services

|

|

|

QUALCOMM, INC.

|

3.81%

|

|

Communications Equipment

|

|

|

RESMED, INC.

|

3.70%

|

|

Health Care Equipment & Supplies

|

|

|

ORACLE CORP.

|

3.63%

|

|

Software

|

|

|

ADOBE SYSTEMS, INC.

|

3.53%

|

|

Software

|

|

|

TIFFANY & CO.

|

3.33%

|

|

Specialty Retail

|

|

|

MARRIOTT INTERNATIONAL, INC., CLASS A

|

3.30%

|

|

Hotels Restaurants & Leisure

|

|

|

Portfolio Composition*

|

|

|

Information Technology

|

29.9%

|

|

Health Care

|

15.0%

|

|

Consumer Discretionary

|

13.2%

|

|

Industrials

|

12.2%

|

|

Consumer Staples

|

8.5%

|

|

Energy

|

8.2%

|

|

Financials

|

6.1%

|

|

Materials

|

4.1%

|

|

Cash, Cash Equivalents, & Other Net Assets

|

2.8%

|

*Based on the Fund’s net assets at October 31, 2012 and subject to change.

|

Century Shares Trust

|

Performance Summary

|

October 31, 2012 (Unaudited)

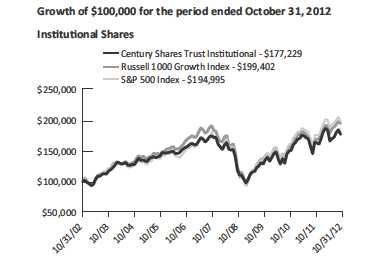

Institutional Shares

The returns shown below represent past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance may be higher or lower than the Fund’s past performance. For the most recent month-end performance, please call 800-303-1928.

As stated in the Fund’s current prospectus, the total (gross) operating expenses are 1.13% for the Fund’s Institutional Shares. The Fund’s total returns include the reinvestment of dividend and capital gain distributions, but have not been adjusted to reflect the deduction of taxes that a shareholder would pay on these distributions or the redemption of Fund shares. Shares held less than 90 days may be subject to a 1% redemption fee.

|

Average Annual Total Returns October 31, 2012

|

|

|

|

|

| |

1 Year

|

3 Years

|

5 Years

|

10 Years

|

|

Century Shares Trust Institutional Shares

|

7.63%

|

11.31%

|

0.27%

|

5.89%

|

|

Russell 1000 Growth Index

|

13.02%

|

14.12%

|

1.95%

|

7.15%

|

|

S&P 500 Index

|

15.21%

|

13.21%

|

0.36%

|

6.91%

|

|

Annual Report | October 31, 2012

|

11

|

|

Century Shares Trust

|

Performance Summary

|

October 31, 2012 (Unaudited)

The graph and table reflect the change in value of a hypothetical investment in the Fund, including reinvest of dividends and distributions, compared with the listed indices. Index returns assume reinvestment of dividends and, unlike Fund returns, do not reflect any fees or expenses. It is not possible to invest directly in an index. Minimum initial investment for Institutional Shares is $100,000.

The Russell 1000® Growth Index measures the performance of the large-cap growth segment of the U.S. equity universe. It includes those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values. The S&P 500® Index is a broad based unmanaged index representing the performance of 500 widely held common stocks.

|

Century Growth Opportunities Fund

|

Fund Commentary

|

October 31, 2012 (Unaudited)

HOW DID THE PORTFOLIO PERFORM?

For the one-year period ended October 31, 2012, Century Growth Opportunities Fund returned +1.31%, underperforming the +10.08% Russell 2500 Growth Index, the Fund’s benchmark.

WHAT FACTORS INFLUENCED PERFORMANCE?

The Fund underperformed over the past year due to negative stock selection and allocation decisions in seven of eleven sectors. In addition, the Fund failed to benefit from stock market rallies that were triggered by actions taken by the Federal Reserve. In the late spring/early summer, we oriented the portfolio towards domestic companies in the healthcare and consumer sectors. Some of these names were defensive in nature and lagged during the market rally.

The Fund’s performance was boosted by contributions from SolarWinds, Inc. (software), Cyberonics, Inc. (medical devices), and D.R. Horton, Inc. (homebuilding). Performance was hindered by poor performance from Green Mountain Coffee Roasters Inc. (specialty coffee), Berry Petroleum Company (energy) and Intrepid Potash, Inc. (fertilizers). Additionally, significant one-day declines in three holdings - Green Mountain Coffee Roasters Inc., Tempur-Pedic International Inc. (premium mattress manufacturer), and Herbalife Ltd. (nutritional supplements) - hurt performance. All three holdings have been sold.

DESCRIBE RECENT PORTFOLIO ACTIVITY

The portfolio continues to remain focused on domestically-oriented holdings that we believe can generate organic growth in a slow growth world economy. This positioning was initiated in the late Spring, in response to our fear of a European recession and concerns that the Chinese and Brazilian economies were slowing. Although these slowdowns have indeed occurred, the equity markets have risen in response to Federal Reserve Bank and European Central Bank operations. Looking ahead on the domestic front, homebuilding and auto sales have seen fairly strong recoveries over the year. However, unemployment continues to be a drag on the economy. In Europe, a recession seems to be taking hold with few signs of recovery. The Chinese and Brazilian economies have slowed with recent signs of stabilization.

|

Annual Report | October 31, 2012

|

13

|

|

Century Growth Opportunities Fund

|

Fund Commentary

|

October 31, 2012 (Unaudited)

Risks: The Fund invests mainly in small-cap and mid-cap companies, which, historically, have been more volatile in price than the stocks of large-cap companies. The Fund may invest in foreign companies, which involves risks not associated with investing solely in U.S. companies, such as currency fluctuations, unfavorable political developments, or economic instability. These risks are magnified in emerging markets. Please read the Fund’s prospectus for details regarding the Fund’s risk profile.

|

Ten Largest Holdings*

|

|

|

B/E AEROSPACE, INC.

|

2.27%

|

|

Aerospace & Defense

|

|

|

ALLIANCE DATA SYSTEMS CORP.

|

2.26%

|

|

IT Services

|

|

|

KANSAS CITY SOUTHERN

|

2.25%

|

|

Road & Rail

|

|

|

MOODY’S CORP.

|

2.23%

|

|

Diversified Financial Services

|

|

|

AO SMITH CORP.

|

2.19%

|

|

Building Products

|

|

|

NEWMARKET CORP.

|

2.16%

|

|

Chemicals

|

|

|

HANESBRANDS, INC.

|

2.16%

|

|

Textiles Apparel & Luxury Goods

|

|

|

CABOT OIL & GAS CORP.

|

2.14%

|

|

Oil Gas & Consumable Fuels

|

|

|

MSC INDUSTRIAL DIRECT CO., INC., CLASS A

|

2.13%

|

|

Trading Companies & Distributors

|

|

|

ASSOCIATED BANC CORP.

|

2.11%

|

|

Commercial Banks

|

|

|

Portfolio Composition*

|

|

|

Consumer Discretionary

|

20.8%

|

|

Information Technology

|

19.9%

|

|

Health Care

|

18.2%

|

|

Industrials

|

15.1%

|

|

Financials

|

8.4%

|

|

Energy

|

6.0%

|

|

Materials

|

5.9%

|

|

Consumer Staples

|

2.3%

|

|

Telecommunication Services

|

2.0%

|

|

Utilities

|

0.5%

|

|

Cash, Cash Equivalents, & Other Net Assets

|

0.9%

|

*Based on the Fund’s net assets at October 31, 2012 and subject to change.

|

Century Growth Opportunities Fund

|

Performance Summary

|

October 31, 2012 (Unaudited)

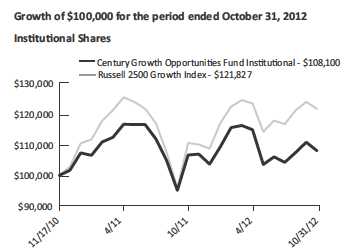

Performance Summary – Institutional Shares

The returns shown below represent past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance may be higher or lower than the Fund’s past performance. For the most recent month-end performance, please call 800-303-1928.

As stated in the Fund’s current prospectus, the total (gross) annual operating expenses are 1.88% for the Fund’s Institutional Shares. The Adviser has agreed contractually to limit the operating expenses for the Fund’s Institutional Shares to 1.10% through June 30, 2013. Returns would have been lower during all periods if certain fees had not been waived or expenses reimbursed. The Fund’s total returns include the reinvestment of dividend and capital gain distributions, but have not been adjusted to reflect the deduction of taxes that a shareholder would pay on these distributions or the redemption of Fund shares. Shares held less than 90 days may be subject to a 1% redemption fee.

|

Average Annual Total Returns October 31, 2012

|

|

|

| |

|

Since

|

| |

1 Year

|

Inception*

|

|

Century Growth Opportunities Fund –

|

|

|

|

Institutional Shares

|

1.31%

|

4.07%

|

|

Russell 2500 Growth

|

10.08%

|

10.64%

|

|

* Fund Inception date of November 17, 2010.

|

|

|

|

Annual Report | October 31, 2012

|

15

|

|

Century Growth Opportunities Fund

|

Performance Summary

|

The graph and table reflect the change in value of a hypothetical investment in the Fund, including reinvest of dividends and distributions, compared with the listed indices. Index returns assume reinvestment of dividends and, unlike Fund returns, do not reflect any fees or expenses. It is not possible to invest directly in an index.

The Russell 2500 Growth® Index measures the performance of the small- to mid-cap growth segment of the U.S. equity universe. It includes those Russell 2500 companies with higher price-to-book ratios and higher forecasted growth values. Index returns assume reinvestment of dividends but, unlike Fund returns, do not reflect fees or expenses. One cannot invest directly in an index.

This Page Intentionally Left Blank.

|

Annual Report | October 31, 2012

|

17

|

|

Century Small Cap Select Fund

|

Portfolio of Investments

|

October 31, 2012

|

COMMON STOCKS - 97.2%

|

|

|

Consumer Discretionary - 10.5%

|

|

|

Distributors - 1.1%

|

|

|

89,393

|

|

Core-Mark Holding Co., Inc.

|

$ 4,279,243

|

| |

|

|

Household Durables - 0.8%

|

|

|

91,488

|

|

The Ryland Group, Inc.

|

3,098,699

|

| |

|

|

Leisure Equipment & Products - 1.3%

|

|

|

106,950

|

|

Sturm Ruger & Co., Inc.

|

5,051,248

|

| |

|

|

Specialty Retail - 7.3%

|

|

|

179,550

|

|

DSW, Inc., Class A

|

11,238,034

|

|

178,825

|

|

The Men’s Wearhouse, Inc.

|

5,863,672

|

|

116,600

|

|

Sally Beauty Holdings, Inc.(a)

|

2,807,728

|

|

132,618

|

|

Select Comfort Corp.(a)

|

3,690,759

|

|

519,973

|

|

West Marine, Inc.(a)

|

5,376,521

|

| |

|

|

28,976,714

|

|

Total Consumer Discretionary

|

41,405,904

|

| |

|

|

Consumer Staples - 2.0%

|

|

|

Food Products - 1.5%

|

|

|

100,657

|

|

The Hain Celestial Group, Inc.(a)

|

5,817,975

|

| |

|

|

Personal Products - 0.5%

|

|

|

116,475

|

|

Prestige Brands Holdings, Inc.(a)

|

2,025,500

|

|

Total Consumer Staples

|

7,843,475

|

| |

|

|

Energy - 4.8%

|

|

|

Energy Equipment & Services - 2.7%

|

|

|

383,300

|

|

Matrix Service Co.(a)

|

4,020,817

|

|

996,466

|

|

Pioneer Energy Services Corp.(a)

|

6,576,675

|

| |

|

|

10,597,492

|

|

Oil, Gas & Consumable Fuels - 2.1%

|

|

|

316,496

|

|

Carrizo Oil & Gas, Inc.(a)

|

8,488,423

|

|

Total Energy

|

19,085,915

|

| |

|

|

Financials - 11.3%

|

|

|

Capital Markets - 3.7%

|

|

|

258,190

|

|

Cohen & Steers, Inc.

|

7,226,738

|

|

528,701

|

|

HFF, Inc., Class A(a)

|

7,364,805

|

| |

|

|

14,591,543

|

| Financials (continued) |

|

|

Commercial Banks - 5.0%

|

|

|

143,350

|

|

Signature Bank(a)

|

$ 10,212,254

|

|

258,450

|

|

Wintrust Financial Corp.

|

9,549,728

|

| |

|

|

19,761,982

|

|

Consumer Finance - 2.6%

|

|

|

591,065

|

|

DFC Global Corp.(a)

|

9,959,445

|

|

Total Financials

|

44,312,970

|

| |

|

|

Health Care - 20.3%

|

|

|

Biotechnology - 2.2%

|

|

|

940,333

|

|

NPS Pharmaceuticals, Inc.(a)

|

8,688,677

|

| |

|

|

Health Care Equipment & Supplies - 1.8%

|

|

|

196,891

|

|

Thoratec Corp.(a)

|

7,029,009

|

| |

|

|

Health Care Providers & Services - 9.6%

|

|

|

336,347

|

|

Acadia Healthcare Co., Inc.(a)

|

6,918,658

|

|

47,100

|

|

Air Methods Corp.(a)

|

5,163,573

|

|

440,700

|

|

Brookdale Senior Living, Inc.(a)

|

10,338,822

|

|

167,600

|

|

Catamaran Corp.(a)

|

7,904,016

|

|

67,458

|

|

Centene Corp.(a)

|

2,562,055

|

|

145,129

|

|

IPC The Hospitalist Co., Inc.(a)

|

5,005,499

|

| |

|

|

37,892,623

|

|

Health Care Technology - 1.1%

|

|

|

233,511

|

|

MedAssets, Inc.(a)

|

4,140,150

|

| |

|

|

Life Sciences Tools & Services - 3.4%

|

|

|

569,555

|

|

Bruker Corp.(a)

|

6,885,920

|

|

446,850

|

|

WuXi PharmaTech (Cayman),

|

|

| |

|

Inc., ADR(a)

|

6,340,801

|

| |

|

|

13,226,721

|

|

Pharmaceuticals - 2.2%

|

|

|

163,740

|

|

Jazz Pharmaceuticals PLC(a)

|

8,797,750

|

|

Total Health Care

|

79,774,930

|

| |

|

|

Industrials - 18.7%

|

|

|

Aerospace & Defense - 2.0%

|

|

|

120,450

|

|

Triumph Group, Inc.

|

7,879,839

|

| |

|

|

Air Freight & Logistics - 2.8%

|

|

|

162,648

|

|

Atlas Air Worldwide Holdings, Inc.(a)

|

8,944,013

|

|

120,048

|

|

Echo Global Logistics, Inc.(a)

|

2,018,007

|

| |

|

|

10,962,020

|

See notes to financial statements

|

Century Small Cap Select Fund

|

Portfolio of Investments

|

October 31, 2012

|

Shares

|

|

Description

|

Value

|

|

Industrials (continued)

|

|

|

Commercial Services & Supplies - 0.6%

|

|

|

133,443

|

|

Heritage-Crystal Clean, Inc.(a)

|

$ 2,361,941

|

|

Electrical Equipment - 0.5%

|

|

|

57,699

|

|

Polypore International, Inc.(a)

|

2,035,621

|

| |

|

|

Machinery - 6.1%

|

|

|

26,624

|

|

Chart Industries, Inc.(a)

|

1,884,713

|

|

151,790

|

|

Graco, Inc.

|

7,295,027

|

|

100,483

|

|

Lindsay Corp.

|

7,673,887

|

|

175,159

|

|

Titan International, Inc.

|

3,674,836

|

|

105,221

|

|

Woodward, Inc.

|

3,524,903

|

| |

|

|

24,053,366

|

| |

|

|

Trading Companies & Distributors - 6.7%

|

|

|

348,613

|

|

Beacon Roofing Supply, Inc.(a)

|

11,274,145

|

|

670,300

|

|

CAI International, Inc.(a)

|

14,853,848

|

| |

|

|

26,127,993

|

|

Total Industrials

|

73,420,780

|

| |

|

|

Information Technology - 23.6%

|

|

|

Communications Equipment - 2.7%

|

|

|

235,438

|

|

Aruba Networks, Inc.(a)

|

4,277,908

|

|

194,111

|

|

Radware Ltd.(a)

|

6,366,841

|

| |

|

|

10,644,749

|

| |

|

|

Internet Software & Services - 10.7%

|

|

|

215,581

|

|

DealerTrack Holdings, Inc.(a)

|

5,891,829

|

|

524,296

|

|

j2 Global, Inc.

|

15,749,852

|

|

170,360

|

|

Liquidity Services, Inc.(a)

|

7,023,943

|

|

325,950

|

|

LivePerson, Inc.(a)

|

5,114,155

|

|

302,449

|

|

Stamps.com, Inc.(a)

|

8,323,396

|

| |

|

|

42,103,175

|

| |

|

|

IT Services - 2.2%

|

|

|

793,200

|

|

Online Resources Corp.(a)

|

2,284,416

|

|

605,550

|

|

Sapient Corp.(a)

|

6,225,054

|

| |

|

|

8,509,470

|

| |

|

Semiconductors & Semiconductor Equipment - 3.3%

|

|

99,459

|

|

Hittite Microwave Corp.(a)

|

5,633,358

|

|

180,150

|

|

Silicon Laboratories, Inc.(a)

|

7,281,663

|

| |

|

|

12,915,021

|

| |

|

|

Software - 4.7%

|

|

|

63,375

|

|

CommVault Systems, Inc.(a)

|

3,959,036

|

|

332,714

|

|

NetScout Systems, Inc.(a)

|

8,228,017

|

|

127,501

|

|

SolarWinds, Inc.(a)

|

6,450,276

|

| |

|

|

18,637,329

|

|

Total Information Technology

|

92,809,744

|

|

Materials - 3.6%

|

|

|

Chemicals - 2.6%

|

|

|

93,316

|

|

LSB Industries, Inc.(a)

|

$ 3,757,835

|

|

141,500

|

|

TPC Group, Inc.(a)

|

6,364,670

|

| |

|

|

10,122,505

|

| |

|

|

Metals & Mining - 1.0%

|

|

|

259,684

|

|

Globe Specialty Metals, Inc.

|

3,903,051

|

|

Total Materials

|

14,025,556

|

| |

|

|

Telecommunication Services - 2.4%

|

|

|

Diversified Telecommunication Services - 2.4%

|

|

|

443,276

|

|

Cogent Communications Group, Inc.

|

9,623,522

|

| |

|

|

TOTAL COMMON STOCKS

|

|

|

(Cost $325,211,925)

|

382,302,796

|

| |

|

|

SHORT-TERM INVESTMENTS - 3.0%

|

|

|

Money Market Mutual Funds - 3.0%

|

|

|

11,759,750

|

|

State Street Institutional U.S.

|

|

| |

|

Government Money Market Fund

|

|

| |

|

(0.00%(b) 7 Day Yield)

|

11,759,750

|

| |

|

|

TOTAL SHORT-TERM INVESTMENTS

|

|

|

(Cost $11,759,750)

|

11,759,750

|

| |

|

|

Total Investments - 100.2%

|

|

|

(Cost, $336,971,675)

|

394,062,546

|

| |

|

|

Liabilities in Excess of Other Assets - (0.2%)

|

(618,302)

|

| |

|

|

Net Assets - 100%

|

$393,444,244

|

(a) Non-income producing security.

(b) Less than 0.005%.

Abbreviations:

ADR - American Depositary Receipt

Ltd. - Limited

PLC - Public Limited Liability

See notes to financial statements

|

Annual Report | October 31, 2012

|

19

|

|

Century Shares Trust

|

Portfolio of Investments

|

October 31, 2012

|

COMMON STOCKS - 97.2%

|

|

|

Consumer Discretionary - 13.2%

|

|

|

Auto Components - 1.6%

|

|

|

64,435

|

|

Lear Corp.

|

$ 2,744,931

|

| |

|

|

Hotels, Restaurants & Leisure - 3.3%

|

|

|

158,050

|

|

Marriott International, Inc., Class A

|

5,765,664

|

| |

|

|

Media - 5.0%

|

|

|

130,966

|

|

CBS Corp., Class B

|

4,243,298

|

|

88,055

|

|

DIRECTV(a)

|

4,500,491

|

| |

|

|

8,743,789

|

| |

|

|

Specialty Retail - 3.3%

|

|

|

91,943

|

|

Tiffany & Co.

|

5,812,637

|

|

Total Consumer Discretionary

|

23,067,021

|

| |

|

|

Consumer Staples - 8.5%

|

|

|

Beverages - 2.9%

|

|

|

73,639

|

|

PepsiCo, Inc.

|

5,098,764

|

| |

|

|

Food & Staples Retailing - 1.5%

|

|

|

56,955

|

|

CVS Caremark Corp.

|

2,642,712

|

| |

|

|

Food Products - 4.1%

|

|

|

140,900

|

|

Green Mountain Coffee

|

|

| |

|

Roasters, Inc.(a)

|

3,404,144

|

|

60,566

|

|

McCormick & Co., Inc.

|

3,732,077

|

| |

|

|

7,136,221

|

|

Total Consumer Staples

|

14,877,697

|

| |

|

|

Energy - 8.2%

|

|

|

Energy Equipment & Services - 4.4%

|

|

|

116,124

|

|

Halliburton Co.

|

3,749,644

|

|

53,514

|

|

Oil States International, Inc.(a)

|

3,911,873

|

| |

|

|

7,661,517

|

| |

|

|

Oil, Gas & Consumable Fuels - 3.8%

|

|

|

60,850

|

|

Apache Corp.

|

5,035,338

|

|

34,262

|

|

Phillips 66

|

1,615,796

|

| |

|

|

6,651,134

|

|

Total Energy

|

14,312,651

|

| |

|

|

Financials - 6.1%

|

|

|

Diversified Financial Services - 2.9%

|

|

|

121,974

|

|

JPMorgan Chase & Co.

|

5,083,876

|

| Financials (continued) |

|

|

| Insurance - 3.2% |

|

|

|

|

4

|

|

Berkshire Hathaway, Inc., Class A(a)

|

$ 518,020

|

|

87,650

|

|

Prudential Financial, Inc.

|

5,000,433

|

| |

|

|

5,518,453

|

|

Total Financials

|

10,602,329

|

| |

|

|

Health Care - 15.0%

|

|

|

Biotechnology - 3.3%

|

|

|

62,620

|

|

Alexion Pharmaceuticals, Inc.(a)

|

5,659,596

|

| |

|

|

Health Care Equipment & Supplies - 3.7%

|

|

|

161,714

|

|

ResMed, Inc.

|

6,458,857

|

| |

|

|

Health Care Providers & Services - 8.0%

|

|

|

121,150

|

|

Express Scripts Holding Co.(a)

|

7,455,571

|

|

59,121

|

|

Humana, Inc.

|

4,390,917

|

|

51,139

|

|

Universal Health Services, Inc.,

|

|

| |

|

Class B

|

2,116,643

|

| |

|

|

13,963,131

|

|

Total Health Care

|

26,081,584

|

| |

|

|

Industrials - 12.2%

|

|

|

Aerospace & Defense - 3.2%

|

|

|

123,550

|

|

B/E Aerospace, Inc.(a)

|

5,570,869

|

| |

|

|

Air Freight & Logistics - 2.0%

|

|

|

57,755

|

|

C.H. Robinson Worldwide, Inc.

|

3,484,359

|

| |

|

|

Commercial Services & Supplies - 3.1%

|

|

|

57,183

|

|

Stericycle, Inc.(a)

|

5,418,661

|

| |

|

|

Construction & Engineering - 3.0%

|

|

|

92,954

|

|

Fluor Corp.

|

5,191,481

|

| |

|

|

Industrial Conglomerates - 0.9%

|

|

|

19,156

|

|

3M Co.

|

1,678,066

|

|

Total Industrials

|

21,343,436

|

| |

|

|

Information Technology - 29.9%

|

|

|

Communications Equipment - 8.4%

|

|

|

296,607

|

|

Cisco Systems, Inc.

|

5,083,844

|

|

35,722

|

|

F5 Networks, Inc.(a)

|

2,946,351

|

|

113,550

|

|

QUALCOMM, Inc.

|

6,651,191

|

| |

|

|

14,681,386

|

| |

|

|

Computers & Peripherals - 10.5%

|

|

|

22,353

|

|

Apple, Inc.

|

13,302,270

|

|

206,350

|

|

EMC Corp.(a)

|

5,039,067

|

| |

|

|

18,341,337

|

See notes to financial statements

|

Century Shares Trust

|

Portfolio of Investments

|

October 31, 2012

|

Shares

|

|

Description

|

Value

|

|

Information Technology (continued)

|

|

|

Internet Software & Services - 3.8%

|

|

|

9,900

|

|

Google, Inc., Class A(a)

|

$ 6,729,723

|

| |

|

|

Software - 7.2%

|

|

|

181,350

|

|

Adobe Systems, Inc.(a)

|

6,165,900

|

|

204,000

|

|

Oracle Corp.

|

6,334,200

|

| |

|

|

12,500,100

|

|

Total Information Technology

|

52,252,546

|

| |

|

|

Materials - 4.1%

|

|

|

Chemicals - 4.1%

|

|

|

133,504

|

|

LyondellBasell Industries NV,

|

|

| |

|

Class A

|

7,127,778

|

| |

|

|

TOTAL COMMON STOCKS

|

|

|

(Cost $139,166,743)

|

169,665,042

|

| |

|

|

SHORT-TERM INVESTMENTS - 5.7%

|

|

|

Money Market Mutual Funds - 5.7%

|

|

|

9,860,726

|

|

State Street Institutional U.S.

|

|

| |

|

Government Money Market Fund

|

|

| |

|

(0.00%(b) 7 Day Yield)

|

9,860,726

|

| |

|

|

TOTAL SHORT-TERM INVESTMENTS

|

|

|

(Cost $9,860,726)

|

9,860,726

|

| |

|

|

Total Investments - 102.9%

|

|

|

(Cost, $149,027,469)

|

179,525,768

|

| |

|

|

Liabilities in Excess of Other Assets - (2.9%)

|

(4,991,439)

|

| |

|

|

Net Assets - 100.0%

|

$174,534,329

|

(a) Non-income producing security.

(b) Less than 0.005%.

Abbreviations:

NV - Naamloze Vennootschap (Dutch: Limited Liability Company)

See notes to financial statements

|

Annual Report | October 31, 2012

|

21

|

|

Century Growth Opportunities Fund

|

Portfolio of Investments

|

October 31, 2012

|

COMMON STOCKS - 99.1%

|

|

|

Consumer Discretionary - 20.8%

|

|

|

Hotels, Restaurants & Leisure - 3.8%

|

|

|

23,862

|

|

Buffalo Wild Wings, Inc.(a)

|

$ 1,812,319

|

|

43,467

|

|

Penn National Gaming, Inc.(a)

|

1,757,371

|

| |

|

|

3,569,690

|

| |

|

|

Household Durables - 5.8%

|

|

|

83,717

|

|

DR Horton, Inc.

|

1,754,708

|

|

36,161

|

|

Jarden Corp.

|

1,800,818

|

|

19,913

|

|

Whirlpool Corp.

|

1,945,102

|

| |

|

|

5,500,628

|

| |

|

|

Specialty Retail - 7.5%

|

|

|

92,023

|

|

American Eagle Outfitters, Inc.

|

1,920,520

|

|

37,232

|

|

Dick’s Sporting Goods, Inc.

|

1,861,600

|

|

28,798

|

|

DSW, Inc., Class A

|

1,802,467

|

|

25,381

|

|

Vitamin Shoppe, Inc.(a)

|

1,452,808

|

| |

|

|

7,037,395

|

| |

|

|

Textiles, Apparel & Luxury Goods - 3.7%

|

|

|

60,722

|

|

Hanesbrands, Inc.(a)

|

2,032,365

|

|

47,558

|

|

Vera Bradley, Inc.(a)

|

1,417,704

|

| |

|

|

3,450,069

|

|

Total Consumer Discretionary

|

19,557,782

|

| |

|

|

Consumer Staples - 2.3%

|

|

|

Food Products - 1.4%

|

|

|

44,705

|

|

B&G Foods, Inc.

|

1,353,220

|

| |

|

|

Household Products - 0.9%

|

|

|

16,133

|

|

Church & Dwight Co., Inc.

|

818,911

|

|

Total Consumer Staples

|

2,172,131

|

| |

|

|

Energy - 6.0%

|

|

|

Energy Equipment & Services - 1.9%

|

|

|

25,693

|

|

Dril-Quip, Inc.(a)

|

1,779,497

|

| |

|

|

Oil, Gas & Consumable Fuels - 4.1%

|

|

|

42,922

|

|

Cabot Oil & Gas Corp.

|

2,016,476

|

|

29,465

|

|

Gulfport Energy Corp.(a)

|

977,649

|

|

20,961

|

|

Whiting Petroleum Corp.(a)

|

880,781

|

| |

|

|

3,874,906

|

|

Total Energy

|

5,654,403

|

|

Financials - 8.4%

|

|

|

Commercial Banks - 2.1%

|

|

| 154,426 |

|

Associated Banc-Corp.

|

$ 1,990,551

|

| |

|

|

Diversified Financial Services - 2.2%

|

|

|

43,581

|

|

|

Moody’s Corp.

|

2,098,861

|

| |

|

|

Insurance - 1.9%

|

|

|

69,637

|

|

|

Brown & Brown, Inc.

|

1,779,226

|

| |

|

|

Real Estate Investment Trusts (REITs) - 2.2%

|

|

|

6,611

|

|

|

Essex Property Trust, Inc.

|

991,650

|

|

46,480

|

|

|

Omega Healthcare Investors, Inc.

|

1,066,251

|

| |

|

|

|

2,057,901

|

|

Total Financials

|

7,926,539

|

| |

|

|

Health Care - 18.2%

|

|

|

Health Care Equipment & Supplies - 7.3%

|

|

|

19,892

|

|

|

The Cooper Cos., Inc.

|

1,909,234

|

|

38,683

|

|

|

Cyberonics, Inc.(a)

|

1,789,089

|

|

46,689

|

|

|

ResMed, Inc.

|

1,864,758

|

|

37,524

|

|

|

Thoratec Corp.(a)

|

1,339,607

|

| |

|

|

|

6,902,688

|

| |

|

|

Health Care Providers & Services - 4.8%

|

|

|

45,191

|

|

|

Hanger, Inc.(a)

|

1,145,592

|

|

10,358

|

|

|

MWI Veterinary Supply, Inc.(a)

|

1,087,797

|

|

25,088

|

|

|

Universal Health Services, Inc., Class B

|

1,038,393

|

|

26,012

|

|

|

WellCare Health Plans, Inc.(a)

|

1,238,171

|

| |

|

|

|

4,509,953

|

| |

|

|

Health Care Technology - 1.0%

|

|

|

54,765

|

|

|

MedAssets, Inc.(a)

|

970,983

|

| |

|

|

Life Sciences Tools & Services - 1.4%

|

|

|

42,695

|

|

|

PAREXEL International Corp.(a)

|

1,310,310

|

| |

|

|

Pharmaceuticals - 3.7%

|

|

|

34,964

|

|

|

Jazz Pharmaceuticals PLC(a)

|

1,878,615

|

|

40,318

|

|

|

Salix Pharmaceuticals Ltd.(a)

|

1,574,015

|

| |

|

|

|

3,452,630

|

|

Total Health Care

|

17,146,564

|

| |

|

|

Industrials - 15.1%

|

|

|

Aerospace & Defense - 2.3%

|

|

|

47,445

|

|

|

B/E Aerospace, Inc.(a)

|

2,139,295

|

See notes to financial statements

|

Century Growth Opportunities Fund

|

Portfolio of Investments

|

October 31, 2012

|

Shares

|

|

Description

|

Value

|

|

Industrials (continued)

|

|

|

Building Products - 2.2%

|

|

|

33,990

|

|

AO Smith Corp.

|

$ 2,065,572

|

| |

|

|

Electrical Equipment - 2.1%

|

|

|

17,754

|

|

Roper Industries, Inc.

|

1,938,204

|

| |

|

|

Machinery - 2.1%

|

|

|

33,507

|

|

Nordson Corp.

|

1,977,918

|

| |

|

|

Road & Rail - 2.2%

|

|

|

26,347

|

|

Kansas City Southern

|

2,119,880

|

| |

|

|

Trading Companies & Distributors - 4.2%

|

|

|

26,915

|

|

MSC Industrial Direct Co., Inc., Class A

|

2,007,859

|

|

48,316

|

|

United Rentals, Inc.(a)

|

1,964,529

|

| |

|

|

3,972,388

|

|

Total Industrials

|

14,213,257

|

| |

|

|

Information Technology - 19.9%

|

|

|

Communications Equipment - 3.4%

|

|

|

89,993

|

|

Aruba Networks, Inc.(a)

|

1,635,173

|

|

19,697

|

|

F5 Networks, Inc.(a)

|

1,624,608

|

| |

|

|

3,259,781

|

|

Electronic Equipment Instruments & Components - 1.8%

|

|

31,532

|

|

IPG Photonics Corp.(a)

|

1,673,718

|

| |

|

|

Internet Software & Services - 2.0%

|

|

|

49,413

|

|

Akamai Technologies, Inc.(a)

|

1,877,200

|

| |

|

|

IT Services - 4.2%

|

|

|

14,864

|

|

Alliance Data Systems Corp.(a)

|

2,126,295

|

|

63,616

|

|

Cardtronics, Inc.(a)

|

1,807,331

|

| |

|

|

3,933,626

|

| |

|

Semiconductors & Semiconductor Equipment - 2.1%

|

|

80,096

|

|

NXP Semiconductor NV(a)

|

1,943,129

|

| |

|

|

Software - 6.4%

|

|

|

26,944

|

|

ANSYS, Inc.(a)

|

1,909,791

|

|

47,019

|

|

BroadSoft, Inc.(a)

|

1,797,066

|

|

57,730

|

|

NetScout Systems, Inc.(a)

|

1,427,663

|

|

18,332

|

|

SolarWinds, Inc.(a)

|

927,416

|

| |

|

|

6,061,936

|

|

Total Information Technology

|

18,749,390

|

|

Materials - 5.9%

|

|

|

Chemicals - 4.0%

|

|

|

79,578

|

|

Intrepid Potash, Inc.(a)

|

$ 1,729,230

|

|

7,518

|

|

NewMarket Corp.

|

2,039,709

|

| |

|

|

3,768,939

|

| |

|

|

Metals & Mining - 1.9%

|

|

|

49,286

|

|

Allied Nevada Gold Corp.(a)

|

1,819,639

|

|

Total Materials

|

5,588,578

|

| |

|

|

Telecommunication Services - 2.0%

|

|

|

Diversified Telecommunication Services - 2.0%

|

|

|

73,871

|

|

tw telecom, Inc.(a)

|

1,881,494

|

| |

|

|

Utilities - 0.5%

|

|

|

Water Utilities - 0.5%

|

|

|

19,423

|

|

Aqua America, Inc.

|

493,150

|

| |

|

|

TOTAL COMMON STOCKS

|

|

|

(Cost $88,159,093)

|

93,383,288

|

| |

|

|

SHORT-TERM INVESTMENTS - 0.7%

|

|

|

Money Market Mutual Funds - 0.7%

|

|

|

672,761

|

|

State Street Institutional U.S.

|

|

| |

|

Government Money Market Fund

|

|

| |

|

(0.00%(b) 7 Day Yield)

|

672,761

|

| |

|

|

TOTAL SHORT-TERM INVESTMENTS

|

|

|

(Cost $672,761)

|

672,761

|

| |

|

|

Total Investments - 99.8%

|

|

|

(Cost, $88,831,854)

|

94,056,049

|

| |

|

|

Other Assets in Excess of Liabilities - 0.2%

|

229,402

|

| |

|

|

Net Assets - 100.0%

|

$ 94,285,451

|

(a) Non-income producing security.

(b) Less than 0.005%.

Abbreviations:

Ltd. - Limited

NV - Naamloze Vennootschap (Dutch: Limited Liability Company)

PLC - Public Limited Liability

See notes to financial statements

|

Annual Report | October 31, 2012

|

23

|

|

Century Funds

|

Statement of Assets and Liabilities

|

October 31, 2012

| |

|

Century Small

|

|

|

Century

|

|

|

Century Growth

|

|

| |

|

Cap Select

|

|

|

Shares

|

|

|

Opportunities

|

|

| |

|

Fund

|

|

|

Trust

|

|

|

Fund

|

|

|

ASSETS:

|

|

|

|

|

|

|

|

|

|

|

Investments, at value (Note 1) (cost - see below)

|

|

$ |

394,062,546 |

|

|

$ |

179,525,768 |

|

|

$ |

94,056,049 |

|

|

Receivable for investments sold

|

|

|

– |

|

|

|

1,414,601 |

|

|

|

701,700 |

|

|

Receivable for fund shares subscribed

|

|

|

498,926 |

|

|

|

637 |

|

|

|

111,829 |

|

|

Dividends receivable

|

|

|

34,234 |

|

|

|

68,615 |

|

|

|

27,252 |

|

|

Prepaid expenses

|

|

|

8,208 |

|

|

|

3,558 |

|

|

|

578 |

|

|

Total Assets

|

|

|

394,603,914 |

|

|

|

181,013,179 |

|

|

|

94,897,408 |

|

|

LIABILITIES:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Payable to Affiliates:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investment adviser fee (Note 4)

|

|

|

318,428 |

|

|

|

122,047 |

|

|

|

55,744 |

|

|

Administration fees (Note 5)

|

|

|

– |

|

|

|

15,256 |

|

|

|

8,114 |

|

|

Distribution and service fees (Note 6)

|

|

|

18,467 |

|

|

|

– |

|

|

|

– |

|

|

Payable for investments purchased

|

|

|

178,268 |

|

|

|

6,023,255 |

|

|

|

356,669 |

|

|

Payable for shares redeemed

|

|

|

474,657 |

|

|

|

201,235 |

|

|

|

98,466 |

|

|

Accrued expenses and other liabilities

|

|

|

169,850 |

|

|

|

117,057 |

|

|

|

92,964 |

|

|

Total Liabilities

|

|

|

1,159,670 |

|

|

|

6,478,850 |

|

|

|

611,957 |

|

|

NET ASSETS

|

|

$ |

393,444,244 |

|

|

$ |

174,534,329 |

|

|

$ |

94,285,451 |

|

|

NET ASSETS CONSIST OF:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Paid-in capital

|

|

$ |

382,277,431 |

|

|

$ |

122,799,641 |

|

|

$ |

97,962,452 |

|

|

Accumulated net investment loss

|

|

|

(1,927,740 |

) |

|

|

(129,905 |

) |

|

|

(117,847 |

) |

|

Accumulated net realized gain/(loss) on investments

|

|

|

(43,996,318 |

) |

|

|

21,366,294 |

|

|

|

(8,783,349 |

) |

|

Unrealized appreciation in value of investments

|

|

|

57,090,871 |

|

|

|

30,498,299 |

|

|

|

5,224,195 |

|

|

NET ASSETS

|

|

$ |

393,444,244 |

|

|

$ |

174,534,329 |

|

|

$ |

94,285,451 |

|

|

Net Assets:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Institutional Shares

|

|

$ |

281,479,510 |

|

|

$ |

174,534,329 |

|

|

$ |

94,285,451 |

|

|

Investor Shares

|

|

$ |

111,964,734 |

|

|

|

N/A |

|

|

|

N/A |

|

|

Shares Outstanding (Note 2):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Institutional Shares

|

|

|

10,713,856 |

|

|

|

8,809,172 |

|

|

|

8,724,642 |

|

|

Investor Shares

|

|

|

4,398,713 |

|

|

|

N/A |

|

|

|

N/A |

|

|

Net Asset Value Per Share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Represents both the offering and redemption price)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Institutional Shares

|

|

$ |

26.27 |

|

|

$ |

19.81 |

|

|

$ |

10.81 |

|

|

Investor Shares

|

|

$ |

25.45 |

|

|

|

N/A |

|

|

|

N/A |

|

|

Cost of investments

|

|

$ |

336,971,675 |

|

|

$ |

149,027,469 |

|

|

$ |

88,831,854 |

|

See notes to financial statements

|

Century Funds

|

Statement of Operations

|

October 31, 2012

| |

|

Century Small

|

|

|

Century

|

|

|

Century Growth

|

|

| |

|

Cap Select

|

|

|

Shares

|

|

|

Opportunities

|

|

| |

|

Fund

|

|

|

Trust

|

|

|

Fund

|

|

|

INVESTMENT INCOME:

|

|

|

|

|

|

|

|

|

|

|

Dividends

|

|

$ |

2,446,060 |

|

|

$ |

2,557,536 |

|

|

$ |

667,502 |

|

|

Foreign taxes withheld

|

|

|

– |

|

|

|

(130,566 |

) |

|

|

– |

|

|

Total Investment Income

|

|

|

2,446,060 |

|

|

|

2,426,970 |

|

|

|

667,502 |

|

|

EXPENSES:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investment adviser fees (Notes 4 and 7)

|

|

|

3,722,243 |

|

|

|

1,435,223 |

|

|

|

580,495 |

|

|

Distribution and service fees - (Note 6)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investor Shares

|

|

|

227,307 |

|

|

|

– |

|

|

|

– |

|

|

Administration fees

|

|

|

– |

|

|

|

179,403 |

|

|

|

72,562 |

|

|

Transfer agency fees:

|

|

|

|

|

|

|

|

|

|

|

|

|

|