|

TABLE OF CONTENTS

|

|

|

Page

|

|

|

Letter to Shareholders

|

1

|

|

Fund Summaries

|

|

|

Century Small Cap Select Fund

|

3

|

|

Century Shares Trust

|

6

|

|

Century Growth Opportunities Fund

|

9

|

|

Portfolio of Investments and Financial Statements

|

|

|

Century Small Cap Select Fund

|

12

|

|

Century Shares Trust

|

20

|

|

Century Growth Opportunities Fund

|

26

|

|

Notes to the Financial Statements

|

32

|

|

Report of Independent Registered Public Accounting Firm

|

39

|

|

Shareholder Expense Example

|

40

|

|

Tax Information

|

42

|

|

Trustees and Officers

|

43

|

|

Ten Largest Holdings*

|

|

|

J2 GLOBAL COMMUNICATIONS, INC.

|

4.35%

|

|

Electronic communications

|

|

|

HEALTHSPRING, INC.

|

3.63%

|

|

Managed care services

|

|

|

DSW, INC. CLASS A

|

3.11%

|

|

Footwear retailer

|

|

|

SOLARWINDS, INC.

|

2.97%

|

|

IT management software

|

|

|

EVERCORE PARTNERS, INC.

|

2.75%

|

|

Investment advisory services

|

|

|

RIGHTNOW TECHNOLOGIES, INC.

|

2.65%

|

|

Cloud-based software services.

|

|

|

CAI INTERNATIONAL, INC.

|

2.61%

|

|

Marine cargo container leasing

|

|

|

SELECT COMFORT CORP.

|

2.38%

|

|

Bedding retailer

|

|

|

BRUKER CORP.

|

2.37%

|

|

Scientific instruments

|

|

|

JAZZ PHARMACEUTICALS, INC.

|

2.35%

|

|

Specialty pharmaceuticals

|

|

|

Portfolio Composition*

|

|

|

Information Technology

|

27.3%

|

|

Health Care

|

19.6%

|

|

Industrials

|

14.9%

|

|

Consumer Discretionary

|

12.6%

|

|

Financials

|

8.8%

|

|

Materials

|

4.7%

|

|

Energy

|

4.6%

|

|

Telecommunication Services

|

2.0%

|

|

Consumer Staples

|

1.0%

|

|

Short-term Investment

|

|

|

plus net other liabilities

|

4.5%

|

|

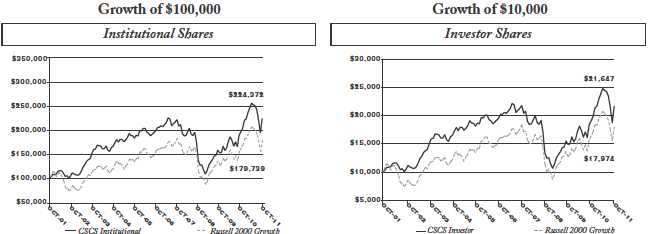

Average Annual Total Returns as of 10/31/11 (%)

|

||||

|

1 Year

|

3 Years

|

5 Years

|

10 Years

|

|

|

Century Small Cap Select Institutional Shares

|

13.86

|

17.79

|

2.41

|

8.42

|

|

Russell 2000 Growth Index

|

9.84

|

16.31

|

2.68

|

6.04

|

|

1 Year

|

3 Years

|

5 Years

|

10 Years

|

|

|

Century Small Cap Select Investor Shares

|

13.47

|

17.37

|

2.06

|

8.03

|

|

Russell 2000 Growth Index

|

9.84

|

16.31

|

2.68

|

6.04

|

|

Sources: Century Capital Management, LLC and Russell

|

|

Ten Largest Holdings*

|

|

|

APPLE, INC.

|

5.64%

|

|

Worldwide technology company

|

|

|

ALEXION PHARMACEUTICALS, INC.

|

4.60%

|

|

Biopharmaceutical company

|

|

|

TEMPUR-PEDIC INTERNATIONAL, INC.

|

4.34%

|

|

Bedding manufacturer

|

|

|

MASTERCARD, INC.

|

4.13%

|

|

Transaction processor

|

|

|

GOODRICH CORP.

|

4.02%

|

|

Aerospace systems and services

|

|

|

TIFFANY & CO.

|

3.96%

|

|

Fine jewelry designer and retailer

|

|

|

CBS CORP.

|

3.91%

|

|

Mass media company

|

|

|

ORACLE CORP.

|

3.75%

|

|

Enterprise software provider

|

|

|

FASTENAL CO.

|

3.37%

|

|

Construction Supplies

|

|

|

COSTCO WHOLESALE CORP.

|

3.30%

|

|

Warehouse retailer

|

|

|

Portfolio Composition*

|

|

|

Information Technology

|

30.7%

|

|

Consumer Discretionary

|

15.8%

|

|

Industrials

|

15.1%

|

|

Health Care

|

11.6%

|

|

Energy

|

8.4%

|

|

Consumer Staples

|

6.1%

|

|

Financials

|

4.2%

|

|

Telecommunication Services

|

3.8%

|

|

Materials

|

2.7%

|

|

Short-term Investment plus

|

|

|

net other liabilities

|

1.6%

|

|

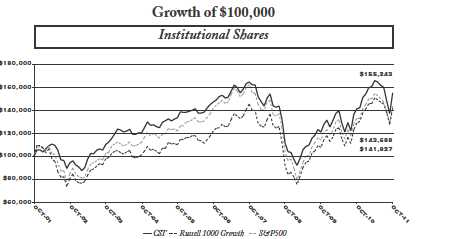

Average Annual Total Returns as of 10/31/11 (%)

|

||||

|

1 Year

|

3 Years

|

5 Years

|

10 Years

|

|

|

CST Institutional Shares

|

9.79

|

11.64

|

1.05

|

4.50

|

|

Russell 1000 Growth Index

|

9.92

|

15.62

|

3.04

|

3.56

|

|

S&P 500 Index

|

8.09

|

11.41

|

0.25

|

3.69

|

|

Sources: Century Capital Management, LLC, S&P and Russell

|

|

Ten Largest Holdings*

|

|

|

SOLARWINDS, INC.

|

2.70%

|

|

IT management software

|

|

|

F5 NETWORKS, INC.

|

2.41%

|

|

Network equipment manufacturer

|

|

|

QUESTCOR PHARMACEUTICALS, INC.

|

2.22%

|

|

Biopharmaceutical company

|

|

|

KANSAS CITY SOUTHERN

|

2.20%

|

|

Freight rail transportation

|

|

|

TEMPUR-PEDIC INTERNATIONAL, INC.

|

2.18%

|

|

Bedding manufacturer

|

|

|

SALIX PHARMACEUTICALS LTD.

|

2.15%

|

|

Pharmaceutical company

|

|

|

CARBO CERAMICS, INC.

|

2.13%

|

|

Energy products and services

|

|

|

VERIFONE SYSTEMS, INC.

|

2.13%

|

|

Point of sale systems

|

|

|

BE AEROSPACE, INC.

|

2.11%

|

|

Aerospace systems

|

|

|

HERBALIFE LTD.

|

2.09%

|

|

Direct marketer of health products

|

|

|

Portfolio Composition*

|

|

|

Information Technology

|

24.6%

|

|

Health Care

|

19.5%

|

|

Consumer Discretionary

|

16.0%

|

|

Industrials

|

15.1%

|

|

Energy

|

6.1%

|

|

Consumer Staples

|

4.6%

|

|

Financials

|

4.0%

|

|

Telecommunication Services

|

1.8%

|

|

Materials

|

1.7%

|

|

Short-term Investment plus

|

|

|

net other assets

|

6.6%

|

|

Total Returns as of 10/31/11 (%)

|

||

|

Since

|

||

|

Inception*

|

||

|

Century Growth Opportunities Fund Institutional Shares

|

6.70 | |

|

Russell 2500 Growth Index

|

10.67 | |

|

Shares

|

Value

|

|

|

COMMON STOCK - 95.5%

|

||

|

Consumer Discretionary - 12.6%

|

||

|

Auto Components - 0.8%

|

||

|

200,000

|

China Zenix Auto International

|

|

|

Ltd. ADR*

|

$ 962,000

|

|

|

200,500

|

Modine Manufacturing Co.*

|

2,119,285

|

|

3,081,285

|

||

|

Specialty Retail - 11.8%

|

||

|

220,550

|

DSW, Inc. Class A

|

11,543,587

|

|

303,850

|

Express, Inc.

|

6,863,971

|

|

107,675

|

Monro Muffler Brake, Inc.

|

3,993,666

|

|

197,800

|

Sally Beauty Holdings, Inc.*

|

3,795,782

|

|

426,150

|

Select Comfort Corp.*

|

8,851,135

|

|

155,300

|

The Men’s Wearhouse, Inc.

|

4,795,664

|

|

420,450

|

West Marine, Inc.*

|

3,821,891

|

|

43,665,696

|

||

|

46,746,981

|

||

|

Consumer Staples - 1.0%

|

||

|

Food Products - 1.0%

|

||

|

106,750

|

The Hain Celestial Group, Inc.*

|

3,582,530

|

|

Energy - 4.6%

|

||

|

Energy Equipment & Services - 1.6%

|

||

|

595,700

|

Pioneer Drilling Co.*

|

5,891,473

|

|

Oil, Gas & Consumable Fuels - 3.0%

|

||

|

194,800

|

Berry Petroleum Co. Class A

|

6,730,340

|

|

169,950

|

Carrizo Oil & Gas, Inc.*

|

4,622,640

|

|

11,352,980

|

||

|

17,244,453

|

||

|

Financials - 8.8%

|

||

|

Capital Markets - 6.7%

|

||

|

277,950

|

Cohen & Steers, Inc.

|

7,551,901

|

|

372,050

|

Evercore Partners, Inc. Class A

|

10,209,052

|

|

646,600

|

HFF, Inc. Class A*

|

7,112,600

|

|

24,873,553

|

||

|

Commercial Banks - 2.1%

|

||

|

143,350

|

Signature Bank*

|

7,991,763

|

|

32,865,316

|

||

|

Shares

|

Value

|

|

|

Health Care - 19.6%

|

||

|

Biotechnology - 0.8%

|

||

|

569,350

|

NPS Pharmaceuticals, Inc.*

|

$ 2,943,540

|

|

Health Care Providers & Services - 8.0%

|

||

|

23,250

|

Air Methods Corp.*

|

1,879,065

|

|

385,200

|

Brookdale Senior Living, Inc.*

|

6,386,616

|

|

250,000

|

Healthspring, Inc.*

|

13,485,000

|

|

195,350

|

IPC The Hospitalist Co., Inc.*

|

8,191,025

|

|

29,941,706

|

||

|

Health Care Technology - 2.8%

|

||

|

152,700

|

Quality Systems, Inc.

|

5,941,557

|

|

92,350

|

SXC Health Solutions Corp.*

|

4,323,827

|

|

10,265,384

|

||

|

Life Sciences Tools & Services - 3.9%

|

||

|

609,350

|

Bruker Corp.*

|

8,792,920

|

|

446,850

|

WuXi PharmaTech (Cayman),

|

|

|

Inc. ADR*

|

5,554,346

|

|

|

14,347,266

|

||

|

Pharmaceuticals - 4.1%

|

||

|

224,200

|

Jazz Pharmaceuticals, Inc.*

|

8,734,832

|

|

157,550

|

Questcor Pharmaceuticals, Inc.*

|

6,398,106

|

|

15,132,938

|

||

|

72,630,834

|

||

|

Industrials - 14.9%

|

||

|

Aerospace & Defense - 1.6%

|

||

|

103,600

|

Triumph Group, Inc.

|

6,019,160

|

|

Commercial Services & Supplies - 0.8%

|

||

|

218,250

|

Interface, Inc. Class A

|

2,845,980

|

|

Electrical Equipment - 3.9%

|

||

|

138,750

|

General Cable Corp.*

|

3,890,550

|

|

264,150

|

II-VI, Inc.*

|

5,021,492

|

|

163,850

|

Woodward, Inc.

|

5,551,238

|

|

14,463,280

|

||

|

Machinery - 3.2%

|

||

|

104,500

|

Chart Industries, Inc.*

|

5,905,295

|

|

261,950

|

Titan International, Inc.

|

5,893,875

|

|

11,799,170

|

||

|

Shares

|

Value

|

|

|

Industrials (Continued)

|

||

|

Professional Services - 0.7%

|

||

|

209,850

|

Kforce, Inc.*

|

$ 2,677,686

|

|

Trading Companies & Distributors - 4.7%

|

||

|

435,150

|

Beacon Roofing Supply, Inc.*

|

8,019,814

|

|

620,000

|

CAI International, Inc.*

|

9,678,200

|

|

17,698,014

|

||

|

55,503,290

|

||

|

Information Technology - 27.3%

|

||

|

Communications Equipment - 2.2%

|

||

|

83,500

|

Acme Packet, Inc.*

|

3,023,535

|

|

186,700

|

Radware Ltd.*

|

4,936,348

|

|

7,959,883

|

||

|

Internet Software & Services - 9.9%

|

||

|

525,300

|

j2 Global Communications, Inc.

|

16,168,734

|

|

159,850

|

Liquidity Services, Inc.*

|

5,204,716

|

|

140,300

|

LogMeIn, Inc.*

|

5,706,001

|

|

228,950

|

RightNow Technologies, Inc.*

|

9,847,139

|

|

36,926,590

|

||

|

IT Services - 4.0%

|

||

|

349,900

|

Echo Global Logistics, Inc.*

|

5,402,456

|

|

793,200

|

Online Resources Corp.*

|

2,125,776

|

|

605,550

|

Sapient Corp.

|

7,484,598

|

|

15,012,830

|

||

|

Semiconductors & Semiconductor Equipment - 4.2%

|

||

|

67,450

|

Hittite Microwave Corp.*

|

3,547,870

|

|

210,600

|

Power Integrations, Inc.

|

7,503,678

|

|

109,800

|

Silicon Laboratories, Inc.*

|

4,693,950

|

|

15,745,498

|

||

|

Software - 7.0%

|

||

|

121,050

|

CommVault Systems, Inc.*

|

5,154,309

|

|

90,450

|

Informatica Corp.*

|

4,115,475

|

|

66,750

|

Pegasystems, Inc.

|

2,522,483

|

|

108,750

|

QLIK Technologies, Inc.*

|

3,106,987

|

|

382,300

|

Solarwinds, Inc.*

|

11,033,178

|

|

25,932,432

|

||

|

101,577,233

|

||

|

Shares

|

Value

|

||

|

Materials - 4.7%

|

|||

|

Chemicals - 2.8%

|

|||

|

194,500

|

Balchem Corp.

|

$ 7,171,215

|

|

|

113,200

|

Intrepid Potash, Inc.*

|

3,150,356

|

|

|

10,321,571

|

|||

|

Metals & Mining - 1.9%

|

|||

|

148,650

|

Schnitzer Steel Industries,

|

||

|

Inc. Class A

|

6,956,820

|

||

|

17,278,391

|

|||

|

Telecommunication Services - 2.0%

|

|||

|

Diversified Telecommunication Services - 2.0%

|

|||

|

456,900

|

Cogent Communications

|

||

|

Group, Inc.*

|

7,333,245

|

||

|

Total Investment in Common Stocks - 95.5%

|

|||

|

(Identified cost, $302,722,630)

|

354,762,273

|

||

|

Short-Term Investment - 4.7%

|

|||

|

17,549,302

|

State Street Institutional U.S.

|

||

|

Government Money

|

|||

|

Market Fund

|

|||

|

(Identified cost, $17,549,302)

|

17,549,302

|

||

|

Total Investments - 100.2%

|

|||

|

(Identified cost, $320,271,932)

|

372,311,575

|

||

|

Liabilities in Excess of

|

|||

| Other Assets - (0.2)% |

(910,132)

|

||

|

Net Assets - 100%

|

$371,401,443

|

||

|

*

|

Non-income producing security

|

||

|

ADR

|

American Depositary Receipt

|

||

|

CENTURY SMALL CAP SELECT FUND

|

||||

|

STATEMENT OF ASSETS AND LIABILITIES - OCTOBER 31, 2011

|

||||

|

Assets:

|

||||

|

Investments, at value (Note 1A) (Identified cost of $320,271,932)

|

$ | 372,311,575 | ||

|

Dividends receivable

|

3,028 | |||

|

Receivable for investments sold

|

1,766,703 | |||

|

Receivable for Fund shares sold

|

788,211 | |||

|

Prepaid expenses

|

9,107 | |||

|

Total Assets

|

374,878,624 | |||

|

Liabilities:

|

||||

|

Payable to Affiliates:

|

||||

|

Investment adviser fee (Note 4)

|

280,224 | |||

|

Administration fees (Note 5)

|

271 | |||

|

Distribution and service fees (Note 6)

|

30,474 | |||

|

Accrued expenses and other liabilities

|

174,689 | |||

|

Payable for investments purchased

|

2,659,984 | |||

|

Payable for Fund shares repurchased

|

331,539 | |||

|

Total Liabilities

|

3,477,181 | |||

|

Net Assets

|

$ | 371,401,443 | ||

|

At October 31, 2011, net assets consisted of:

|

||||

|

Paid-in capital

|

$ | 396,698,816 | ||

|

Accumulated net realized loss on investments

|

(77,337,016 | ) | ||

|

Unrealized appreciation in value of investments

|

52,039,643 | |||

|

Net assets applicable to outstanding capital stock

|

$ | 371,401,443 | ||

|

Net Assets consist of:

|

||||

|

Institutional shares

|

$ | 254,723,553 | ||

|

Investor shares

|

$ | 116,677,890 | ||

|

Shares Outstanding consist of (Note 2):

|

||||

|

Institutional shares

|

10,654,802 | |||

|

Investor shares

|

5,019,132 | |||

|

Net Asset Value Per Share

|

||||

|

(Represents both the offering and redemption price*)

|

||||

|

Institutional shares

|

$ | 23.91 | ||

|

Investor shares

|

$ | 23.25 | ||

|

*

|

In general, shares of the Fund may be redeemed at net asset value. However, upon the redemption of shares held less than 90 days, a redemption fee of 1% of the current net asset value of the shares may be assessed and retained by each share class of the Fund for the benefit of remaining shareholders. The redemption fee is accounted for as an addition to paid-in-capital.

|

|

CENTURY SMALL CAP SELECT FUND

|

||||

|

STATEMENT OF OPERATIONS - YEAR ENDED OCTOBER 31, 2011

|

||||

|

Investment Income:

|

||||

|

Dividends (net of foreign withholding tax of $7,256)

|

$ | 2,154,883 | ||

|

Other income

|

773,804 | |||

|

Total investment income

|

2,928,687 | |||

|

Expenses:

|

||||

|

Investment adviser fee (Note 4)

|

3,732,479 | |||

|

Non-interested trustees’ remuneration

|

169,174 | |||

|

Transfer agent

|

||||

|

Institutional Shares

|

58,797 | |||

|

Investor Shares

|

226,999 | |||

|

Custodian

|

79,512 | |||

|

Insurance

|

29,680 | |||

|

Professional fees

|

100,167 | |||

|

Registration

|

26,253 | |||

|

Distribution and service fees (Note 6)

|

240,249 | |||

|

Printing and other expenses

|

130,513 | |||

|

Total expenses

|

4,793,823 | |||

|

Net investment loss

|

(1,865,136 | ) | ||

|

Realized and unrealized gain/(loss) on investments:

|

||||

|

Net realized gain from investment transactions

|

79,336,385 | |||

|

Decrease in unrealized appreciation on investments

|

(29,175,691 | ) | ||

|

Net realized and unrealized gain on investments

|

50,160,694 | |||

|

Net increase in net assets resulting from operations

|

$ | 48,295,558 | ||

|

CENTURY SMALL CAP SELECT FUND

|

||||||||

|

STATEMENT OF CHANGES IN NET ASSETS

|

||||||||

|

INCREASE (DECREASE)

|

Year Ended

|

Year Ended

|

||||||

|

IN NET ASSETS:

|

October 31, 2011

|

October 31, 2010

|

||||||

|

Operations:

|

||||||||

|

Net investment loss

|

$ | (1,865,136 | ) | $ | (1,106,577 | ) | ||

|

Net realized gain from investment transactions

|

79,336,385 | 40,471,216 | ||||||

|

Change in net unrealized appreciation on investments

|

(29,175,691 | ) | 40,930,084 | |||||

|

Net increase in net assets resulting from operations

|

48,295,558 | 80,294,723 | ||||||

|

Capital share transactions - net (Note 2)

|

(18,974,857 | ) | (46,355,327 | ) | ||||

|

Redemption fees

|

32,775 | 4,353 | ||||||

|

Total increase

|

29,353,476 | 33,943,749 | ||||||

|

Net Assets:

|

||||||||

|

Beginning of year

|

342,047,967 | 308,104,218 | ||||||

|

End of year

|

$ | 371,401,443 | $ | 342,047,967 | ||||

|

CENTURY SMALL CAP SELECT FUND

|

||||||||||||||||||||

|

FINANCIAL HIGHLIGHTS - INSTITUTIONAL SHARES

|

||||||||||||||||||||

| Year Ended October 31, | ||||||||||||||||||||

|

2011

|

2010

|

2009

|

2008

|

2007

|

||||||||||||||||

|

Net Asset Value, beginning of period

|

$ | 20.99 | $ | 16.34 | $ | 14.62 | $ | 26.13 | $ | 25.74 | ||||||||||

|

Income/(loss) from Investment Operations:

|

||||||||||||||||||||

|

Net investment loss(a)

|

(0.09 | ) | (0.05 | ) | (0.01 | ) | (0.12 | ) | 0.00 | † | ||||||||||

|

Net realized and unrealized gain/(loss) on investments

|

3.01 | 4.70 | 1.73 | (9.00 | ) | 2.75 | ||||||||||||||

|

Total income/(loss) from investment operations

|

2.92 | 4.65 | 1.72 | (9.12 | ) | 2.75 | ||||||||||||||

|

Less Distributions From:

|

||||||||||||||||||||

|

Net investment income

|

(0.00 | ) | (0.00 | ) | (0.00 | ) | (0.10 | ) | (0.35 | ) | ||||||||||

|

Tax return of capital

|

(0.00 | ) | (0.00 | ) | (0.00 | ) | (0.19 | ) | (0.00 | ) | ||||||||||

|

Net realized gain on investment transactions

|

(0.00 | ) | (0.00 | ) | (0.00 | ) | (2.10 | ) | (2.01 | ) | ||||||||||

|

Total distributions

|

(0.00 | ) | (0.00 | ) | (0.00 | ) | (2.39 | ) | (2.36 | ) | ||||||||||

|

Redemption fees

|

0.00 | † | 0.00 | † | 0.00 | † | 0.00 | † | 0.00 | † | ||||||||||

|

Net Asset Value, end of period

|

$ | 23.91 | $ | 20.99 | $ | 16.34 | $ | 14.62 | $ | 26.13 | ||||||||||

|

Total Return

|

13.86 | % | 28.52 | % | 11.69 | % | (38.24 | )% | 11.61 | % | ||||||||||

|

Ratios and supplemental data

|

||||||||||||||||||||

|

Net assets, end of period (000 omitted)

|

$ | 254,724 | $ | 249,429 | $ | 216,295 | $ | 262,793 | $ | 575,027 | ||||||||||

|

Ratio of expenses to average net assets

|

1.11 | % | 1.13 | % | 1.14 | % | 1.11 | % | 1.08 | % | ||||||||||

|

Ratio of net investment loss to

|

||||||||||||||||||||

|

average net assets

|

(0.37 | )% | (0.25 | )% | (0.08 | )% | (0.57 | )% | 0.02 | % | ||||||||||

|

Portfolio Turnover Rate

|

75 | % | 85 | % | 133 | % | 104 | % | 100 | % | ||||||||||

|

(a)

|

Calculated based on average shares outstanding during the period.

|

|

†

|

Amount represents less than $0.005 per share.

|

|

CENTURY SMALL CAP SELECT FUND

|

||||||||||||||||||||

|

FINANCIAL HIGHLIGHTS - INVESTOR SHARES

|

||||||||||||||||||||

| Year Ended October 31, | ||||||||||||||||||||

|

2011

|

2010

|

2009

|

2008

|

2007

|

||||||||||||||||

|

Net Asset Value, beginning of period

|

$ | 20.49 | $ | 16.00 | $ | 14.37 | $ | 25.72 | $ | 25.40 | ||||||||||

|

Income/(loss) from Investment Operations:

|

||||||||||||||||||||

|

Net investment loss(a)

|

(0.17 | ) | (0.11 | ) | (0.07 | ) | (0.20 | ) | (0.06 | ) | ||||||||||

|

Net realized and unrealized gain/(loss) on investments

|

2.92 | 4.60 | 1.70 | (8.86 | ) | 2.71 | ||||||||||||||

|

Total income/(loss) from investment operations

|

2.75 | 4.49 | 1.63 | (9.06 | ) | 2.65 | ||||||||||||||

|

Less Distributions From:

|

||||||||||||||||||||

|

Net investment income

|

(0.00 | ) | (0.00 | ) | (0.00 | ) | (0.00 | ) | (0.32 | ) | ||||||||||

|

Tax return of capital

|

(0.00 | ) | (0.00 | ) | (0.00 | ) | (0.19 | ) | (0.00 | ) | ||||||||||

|

Net realized gain on investment transactions

|

(0.00 | ) | (0.00 | ) | (0.00 | ) | (2.10 | ) | (2.01 | ) | ||||||||||

|

Total distributions

|

(0.00 | ) | (0.00 | ) | (0.00 | ) | (2.29 | ) | (2.33 | ) | ||||||||||

|

Redemption fees

|

0.01 | 0.00 | † | 0.00 | † | 0.00 | † | 0.00 | † | |||||||||||

|

Net Asset Value, end of period

|

$ | 23.25 | $ | 20.49 | $ | 16.00 | $ | 14.37 | $ | 25.72 | ||||||||||

| Total Return | 13.47 | % | 28.06 | % | 11.27 | % | (38.49 | )% | 11.34 | % | ||||||||||

|

Ratios and supplemental data

|

||||||||||||||||||||

|

Net assets, end of period (000 omitted)

|

$ | 116,678 | $ | 92,618 | $ | 91,809 | $ | 102,252 | $ | 257,750 | ||||||||||

|

Ratio of expenses to average net assets

|

1.48 | % | 1.50 | % | 1.53 | % | 1.50 | % | 1.36 | % | ||||||||||

|

Ratio of net investment loss to average net assets

|

(0.71 | )% | (0.61 | )% | (0.47 | )% | (0.96 | )% | (0.24 | )% | ||||||||||

|

Portfolio Turnover Rate

|

75 | % | 85 | % | 133 | % | 104 | % | 100 | % | ||||||||||

|

(a)

|

Calculated based on average shares outstanding during the period.

|

|

†

|

Amount represents less than $0.005 per share.

|

|

Shares

|

Value

|

|

|

COMMON STOCK - 98.4%

|

||

|

Consumer Discretionary - 15.8%

|

||

|

Household Durables - 4.3%

|

||

|

113,650

|

Tempur-Pedic International, Inc.*

|

$ 7,735,019

|

|

Internet & Catalog Retail - 0.7%

|

||

|

5,800

|

Amazon.com, Inc.*

|

1,238,358

|

|

Media - 3.9%

|

||

|

269,750

|

CBS Corp. Class B

|

6,962,248

|

|

Specialty Retail - 6.9%

|

||

|

67,650

|

O’Reilly Automotive, Inc.*

|

5,144,782

|

|

88,500

|

Tiffany & Co.

|

7,056,105

|

|

12,200,887

|

||

|

28,136,512

|

||

|

Consumer Staples - 6.1%

|

||

|

Food & Staples Retailing - 3.3%

|

||

|

70,550

|

Costco Wholesale Corp.

|

5,873,287

|

|

Food Products - 2.8%

|

||

|

102,350

|

McCormick & Co.Inc.

|

4,970,116

|

|

10,843,403

|

||

|

Energy - 8.4%

|

||

|

Oil, Gas & Consumable Fuels - 8.4%

|

||

|

52,600

|

Chevron Corp.

|

5,525,630

|

|

74,850

|

ConocoPhillips

|

5,213,302

|

|

53,550

|

Exxon Mobil Corp.

|

4,181,720

|

|

14,920,652

|

||

|

Financials - 4.2%

|

||

|

Commercial Banks - 1.3%

|

||

|

68,450

|

CIT Group, Inc.*

|

2,385,483

|

|

Insurance - 2.9%

|

||

|

4

|

Berkshire Hathaway, Inc. Class A*

|

467,800

|

|

87,650

|

Prudential Financial, Inc.

|

4,750,630

|

|

5,218,430

|

||

|

7,603,913

|

||

|

Shares

|

Value

|

|

|

Health Care - 11.6%

|

||

|

Biotechnology - 4.6%

|

||

|

121,300

|

Alexion Pharmaceuticals, Inc.*

|

$ 8,188,963

|

|

Health Care Equipment & Supplies - 2.8%

|

||

|

195,000

|

CareFusion Corp.*

|

4,992,000

|

|

Health Care Providers & Services - 4.2%

|

||

|

96,700

|

Cardinal Health, Inc.

|

4,280,909

|

|

69,850

|

Express Scripts, Inc.*

|

3,194,240

|

|

7,475,149

|

||

|

20,656,112

|

||

|

Industrials - 15.1%

|

||

|

Aerospace & Defense - 4.0%

|

||

|

58,450

|

Goodrich Corp.

|

7,167,723

|

|

Construction & Engineering - 3.2%

|

||

|

154,350

|

Chicago Bridge & Iron Co. NV

|

5,646,123

|

|

Machinery - 1.7%

|

||

|

71,950

|

Timken Co.

|

3,030,534

|

|

Road & Rail - 2.8%

|

||

|

225,350

|

CSX Corp.

|

5,005,024

|

|

Trading Companies & Distributors - 3.4%

|

||

|

157,600

|

Fastenal Co.

|

6,002,984

|

|

26,852,388

|

||

|

Information Technology - 30.7%

|

||

|

Communications Equipment - 6.0%

|

||

|

54,750

|

F5 Networks, Inc.*

|

5,691,263

|

|

99,400

|

QUALCOMM, Inc.

|

5,129,040

|

|

10,820,303

|

||

|

Computers & Peripherals - 8.5%

|

||

|

24,850

|

Apple, Inc.*

|

10,058,783

|

|

206,350

|

EMC Corp.*

|

5,057,638

|

|

15,116,421

|

||

|

CENTURY SHARES TRUST (CONTINUED)

|

|

PORTFOLIO OF INVESTMENTS – AS OF OCTOBER 31, 2011

|

|

Shares

|

Value

|

||

|

Information Technology (Continued)

|

|||

|

Internet Software & Services - 2.8%

|

|||

|

8,400

|

Google, Inc. Class A*

|

$ 4,978,176

|

|

|

IT Services - 6.9%

|

|||

|

68,300

|

Cognizant Technology Solutions

|

||

|

Corp. Class A*

|

4,968,825

|

||

|

21,200

|

MasterCard, Inc. Class A

|

7,361,488

|

|

|

12,330,313

|

|||

|

Software - 6.5%

|

|||

|

166,300

|

Adobe Systems, Inc.*

|

4,890,883

|

|

|

204,000

|

Oracle Corp.

|

6,685,080

|

|

|

11,575,963

|

|||

|

54,821,176

|

|||

|

Materials - 2.7%

|

|||

|

Chemicals - 2.7%

|

|||

|

146,700

|

LyondellBasell Industries

|

||

|

NV Class A

|

4,820,562

|

||

|

Telecommunication Services - 3.8%

|

|||

|

Wireless Telecommunication Services - 3.8%

|

|||

|

323,700

|

MetroPCS Communications, Inc.*

|

2,751,450

|

|

|

170,850

|

NII Holdings, Inc.*

|

4,020,101

|

|

|

6,771,551

|

|||

|

Total Investment in Common Stocks - 98.4%

|

|||

|

(Identified cost, $136,122,844)

|

175,426,269

|

||

|

Short-Term Investment - 1.7%

|

|||

|

2,932,962

|

State Street Institutional U.S.

|

||

|

Government Money

|

|||

|

Market Fund

|

|||

|

(Identified cost, $2,932,962)

|

2,932,962

|

||

|

Value

|

|

|

Total Investments - 100.1%

|

|

|

(Identified cost, $139,055,806)

|

$178,359,231

|

|

Liabilities in Excess of

|

|

|

Other Assets - (0.1)%

|

(158,184)

|

|

Net Assets - 100%

|

$178,201,047

|

|

* Non-income producing security

|

|

CENTURY SHARES TRUST

|

||||

|

STATEMENT OF ASSETS AND LIABILITIES - OCTOBER 31, 2011

|

||||

|

Assets:

|

||||

|

Investments, at value (Note 1A) (Identified cost of $139,055,806)

|

$ | 178,359,231 | ||

|

Dividends receivable

|

86,899 | |||

|

Receivable for Fund shares sold

|

3,877 | |||

|

Prepaid expenses

|

3,416 | |||

|

Total Assets

|

178,453,423 | |||

|

Liabilities:

|

||||

|

Payable to Affiliates:

|

||||

|

Investment adviser fee (Note 4)

|

115,262 | |||

|

Administration fees (Note 5)

|

14,408 | |||

|

Accrued expenses and other liabilities

|

106,144 | |||

|

Payable for Fund shares repurchased

|

16,562 | |||

|

Total Liabilities

|

252,376 | |||

|

Net Assets

|

$ | 178,201,047 | ||

|

At October 31, 2011, net assets consisted of:

|

||||

|

Paid-in capital

|

$ | 120,726,081 | ||

|

Accumulated undistributed net realized gains on investments

|

18,171,541 | |||

|

Unrealized appreciation in value of investments

|

39,303,425 | |||

|

Net assets applicable to outstanding capital stock

|

$ | 178,201,047 | ||

|

Net Assets consist of:

|

||||

|

Institutional shares

|

$ | 178,201,047 | ||

|

Shares Outstanding consist of (Note 2):

|

||||

|

Institutional shares

|

8,625,480 | |||

|

Net Asset Value Per Share

|

||||

|

(Represents both the offering and redemption price*)

|

||||

|

Institutional shares

|

$ | 20.66 | ||

|

*

|

In general, shares of the Fund may be redeemed at net asset value. However, upon the redemption of shares held less than 90 days, a redemption fee of 1% of the current net asset value of the shares may be assessed and retained by the Fund for the benefit of remaining shareholders. The redemption fee is accounted for as an addition to paid-in-capital.

|

|

CENTURY SHARES TRUST

|

||||

|

STATEMENT OF OPERATIONS - YEAR ENDED OCTOBER 31, 2011

|

||||

|

Investment Income:

|

||||

|

Dividends (net of foreign withholding tax of $8,528)

|

$ | 1,883,006 | ||

|

Total investment income

|

1,883,006 | |||

|

Expenses:

|

||||

|

Investment adviser fee (Notes 4 and 7)

|

1,467,318 | |||

|

Non-interested trustees' remuneration

|

76,407 | |||

|

Transfer agent

|

||||

|

Institutional shares

|

112,278 | |||

|

Investor shares

|

6,684 | |||

|

Custodian

|

52,184 | |||

|

Administration fees (Note 5)

|

183,415 | |||

|

Insurance

|

15,410 | |||

|

Professional fees

|

77,089 | |||

|

Registration

|

24,213 | |||

|

Printing and other expenses

|

57,263 | |||

|

Total expenses

|

2,072,261 | |||

|

Adviser reimbursements (Note 7)

|

(2,341 | ) | ||

|

Net expenses

|

2,069,920 | |||

|

Net investment loss

|

(186,914 | ) | ||

|

Realized and unrealized gain/(loss) on investments:

|

||||

|

Net realized gain from investment transactions

|

18,620,958 | |||

|

Decrease in unrealized appreciation on investments

|

(1,153,307 | ) | ||

|

Net realized and unrealized gain on investments

|

17,467,651 | |||

|

Net increase in net assets resulting from operations

|

$ | 17,280,737 | ||

|

CENTURY SHARES TRUST

|

||||||||

|

STATEMENT OF CHANGES IN NET ASSETS

|

||||||||

|

INCREASE/(DECREASE)

|

Year Ended

|

Year Ended

|

||||||

|

IN NET ASSETS:

|

October 31, 2011

|

October 31, 2010

|

||||||

|

Operations:

|

||||||||

|

Net investment loss

|

$ | (186,914 | ) | $ | (85,141 | ) | ||

|

Net realized gain on investment transactions

|

18,620,958 | 20,112,837 | ||||||

|

Change in net unrealized appreciation

|

(1,153,307 | ) | 7,033,491 | |||||

|

Net increase in net assets resulting from operations

|

17,280,737 | 27,061,187 | ||||||

|

Distributions to shareholders from:

|

||||||||

|

Net investment income

|

||||||||

|

Institutional shares

|

(51,630 | ) | (47,060 | ) | ||||

|

Net realized gain from investment transactions

|

||||||||

|

Institutional shares

|

(7,888,685 | ) | — | |||||

|

Investor shares

|

(73,860 | ) | — | |||||

|

Capital share transactions - net (Note 2)

|

(9,736,363 | ) | (15,968,796 | ) | ||||

|

Redemption fees

|

424 | 43 | ||||||

|

Total increase/(decrease)

|

(469,377 | ) | 11,045,374 | |||||

|

Net Assets:

|

||||||||

|

Beginning of year

|

178,670,424 | 167,625,050 | ||||||

|

End of year

|

$ | 178,201,047 | $ | 178,670,424 | ||||

|

CENTURY SHARES TRUST

|

||||||||||||||||||||

|

FINANCIAL HIGHLIGHTS - INSTITUTIONAL SHARES

|

||||||||||||||||||||

|

Year Ended October 31,

|

||||||||||||||||||||

|

2011

|

2010

|

2009

|

2008

|

2007

|

||||||||||||||||

|

Net Asset Value, beginning of period

|

$ | 19.65 | $ | 16.84 | $ | 15.51 | $ | 29.52 | $ | 35.69 | ||||||||||

|

Income/(loss) from Investment Operations:

|

||||||||||||||||||||

|

Net investment income/(loss)(a)

|

(0.02 | ) | (0.01 | ) | 0.00 | † | (0.01 | ) | 0.16 | |||||||||||

|

Net realized and unrealized gain/(loss) on investments

|

1.93 | 2.82 | 1.36 | (7.44 | ) | 2.95 | ||||||||||||||

|

Total income/(loss) from investment operations

|

1.91 | 2.81 | 1.36 | (7.45 | ) | 3.11 | ||||||||||||||

|

Less Distributions From:

|

||||||||||||||||||||

|

Net investment income

|

(0.01 | ) | (0.00 | )† | (0.03 | ) | (0.30 | ) | (0.43 | ) | ||||||||||

|

Net realized gain on investment transactions

|

(0.89 | ) | (0.00 | ) | (0.00 | ) | (6.26 | ) | (8.85 | ) | ||||||||||

|

Total distributions

|

(0.90 | ) | (0.00 | )† | (0.03 | ) | (6.56 | ) | (9.28 | ) | ||||||||||

|

Redemption fees

|

0.00 | † | 0.00 | † | 0.00 | † | 0.00 | † | 0.00 | † | ||||||||||

|

Net Asset Value, end of period

|

$ | 20.66 | $ | 19.65 | $ | 16.84 | $ | 15.51 | $ | 29.52 | ||||||||||

|

Total return

|

9.79 | % | 16.72 | % | 8.59 | % | (32.31 | )% | 11.86 | % | ||||||||||

|

Ratios and supplemental data

|

||||||||||||||||||||

|

Net assets, end of period (000 omitted)

|

$ | 178,201 | $ | 177,042 | $ | 166,574 | $ | 168,199 | $ | 287,670 | ||||||||||

|

Ratio of expenses to average net assets

|

1.13 | % | 1.15 | % | 1.20 | % | 1.17 | % | 1.10 | % | ||||||||||

|

Ratio of net investment income/(loss) to average

|

||||||||||||||||||||

|

net assets

|

(0.10 | )% | (0.05 | )% | 0.03 | % | (0.02 | )% | 0.56 | % | ||||||||||

|

Portfolio Turnover Rate

|

72 | % | 67 | % | 79 | % | 91 | % | 38 | % | ||||||||||

|

(a)

|

Calculated based on average shares outstanding during the period.

|

|

†

|

Amount represents less than $0.005 per share.

|

|

Shares

|

Value

|

|

|

COMMON STOCK - 93.4%

|

||

|

Consumer Discretionary - 16.0%

|

||

|

Hotels, Restaurants & Leisure - 3.8%

|

||

|

2,300

|

Buffalo Wild Wings, Inc.*

|

$ 152,306

|

|

8,500

|

Texas Roadhouse, Inc.

|

121,805

|

|

274,111

|

||

|

Household Durables - 3.8%

|

||

|

2,350

|

Tempur-Pedic International, Inc.*

|

159,941

|

|

2,050

|

Tupperware Brands Corp.

|

115,907

|

|

275,848

|

||

|

Multiline Retail - 1.9%

|

||

|

1,750

|

Dollar Tree, Inc.*

|

139,930

|

|

Specialty Retail - 5.6%

|

||

|

10,700

|

Chico’s FAS, Inc.

|

132,252

|

|

2,650

|

DSW, Inc. Class A

|

138,701

|

|

1,850

|

O’Reilly Automotive, Inc.*

|

140,692

|

|

411,645

|

||

|

Textiles, Apparel & Luxury Goods - 0.9%

|

||

|

1,200

|

lululemon Athletica, Inc.*

|

67,776

|

|

1,169,310

|

||

|

Consumer Staples - 4.6%

|

||

|

Food & Staples Retailing - 1.8%

|

||

|

3,700

|

United Natural Foods, Inc.*

|

135,087

|

|

Food Products - 0.7%

|

||

|

800

|

Diamond Foods, Inc.

|

52,600

|

|

Personal Products - 2.1%

|

||

|

2,450

|

Herbalife Ltd.

|

152,782

|

|

340,469

|

||

|

Energy - 6.1%

|

||

|

Energy Equipment & Services - 4.1%

|

||

|

1,150

|

CARBO Ceramics, Inc.

|

156,227

|

|

2,250

|

Dril-Quip, Inc.*

|

146,475

|

|

302,702

|

||

|

Oil, Gas & Consumable Fuels - 2.0%

|

||

|

3,050

|

Whiting Petroleum Corp.*

|

141,978

|

|

444,680

|

||

|

Shares

|

Value

|

||

|

Financials - 4.0%

|

|||

|

Diversified Financial Services - 2.0%

|

|||

|

4,150

|

Moody’s Corp.

|

$ 147,284

|

|

|

Real Estate Investment Trusts (REITs) - 2.0%

|

|||

|

1,000

|

Essex Property Trust, Inc.

|

142,760

|

|

|

290,044

|

|||

|

Health Care - 19.5%

|

|||

|

Biotechnology - 1.8%

|

|||

|

2,000

|

Alexion Pharmaceuticals, Inc.*

|

135,020

|

|

|

Health Care Equipment & Supplies - 7.6%

|

|||

|

5,100

|

CareFusion Corp.*

|

130,560

|

|

|

5,250

|

Cyberonics, Inc.*

|

151,200

|

|

|

2,800

|

Sirona Dental Systems, Inc.*

|

134,120

|

|

|

2,000

|

The Cooper Cos., Inc.

|

138,600

|

|

|

554,480

|

|||

|

Health Care Providers & Services - 4.3%

|

|||

|

1,850

|

Catalyst Health Solutions, Inc.*

|

101,694

|

|

|

4,500

|

Coventry Health Care, Inc.*

|

143,145

|

|

|

950

|

MWI Veterinary Supply, Inc.*

|

71,725

|

|

|

316,564

|

|||

|

Health Care Technology - 1.4%

|

|||

|

5,200

|

Allscripts Healthcare Solutions, Inc.* |

99,580

|

|

|

Pharmaceuticals - 4.4%

|

|||

|

4,000

|

Questcor Pharmaceuticals, Inc.*

|

162,440

|

|

|

4,600

|

Salix Pharmaceuticals Ltd.*

|

157,573

|

|

|

320,013

|

|||

|

1,425,657

|

|||

|

Industrials - 15.1%

|

|||

|

Aerospace & Defense - 2.1%

|

|||

|

4,100

|

BE Aerospace, Inc.*

|

154,693

|

|

|

Electrical Equipment - 3.9%

|

|||

|

1,850

|

Roper Industries, Inc.

|

150,035

|

|

|

4,450

|

Sensata Technologies Holding NV* |

133,233

|

|

|

283,268

|

|||

|

Shares

|

Value

|

|

|

Industrials (Continued)

|

||

|

Machinery - 6.9%

|

||

|

3,300

|

AGCO Corp.*

|

$ 144,639

|

|

2,600

|

Chart Industries, Inc.*

|

146,926

|

|

900

|

Gardner Denver, Inc.

|

69,597

|

|

3,750

|

Kennametal, Inc.

|

145,837

|

|

506,999

|

||

|

Road & Rail - 2.2%

|

||

|

2,550

|

Kansas City Southern*

|

161,084

|

|

1,106,044

|

||

|

Information Technology - 24.6%

|

||

|

Communications Equipment - 5.1%

|

||

|

1,450

|

Acme Packet, Inc.*

|

52,504

|

|

1,700

|

F5 Networks, Inc.*

|

176,715

|

|

5,200

|

Riverbed Technology, Inc.*

|

143,416

|

|

372,635

|

||

|

Electronic Equipment, Instruments &

|

||

|

Components - 0.9%

|

||

|

1,200

|

IPG Photonics Corp.*

|

63,432

|

|

Internet Software & Services - 3.3%

|

||

|

2,550

|

Akamai Technologies, Inc.*

|

68,697

|

|

2,150

|

LogMeIn, Inc.*

|

87,441

|

|

2,000

|

OpenTable, Inc.*

|

87,720

|

|

243,858

|

||

|

IT Services - 5.6%

|

||

|

6,100

|

Cardtronics, Inc.*

|

152,073

|

|

2,100

|

Syntel, Inc.

|

102,690

|

|

3,700

|

VeriFone Systems, Inc.*

|

156,177

|

|

410,940

|

||

| Semiconductors & Semiconductor Equipment - 2.0% | ||

|

4,200

|

Power Integrations, Inc.

|

149,646

|

|

Software - 7.7%

|

||

|

2,800

|

ANSYS, Inc.*

|

152,208

|

|

3,450

|

Pegasystems, Inc.

|

130,375

|

|

2,950

|

QLIK Technologies, Inc.*

|

84,282

|

|

6,850

|

Solarwinds, Inc.*

|

197,691

|

|

564,556

|

||

|

1,805,067

|

||

| Shares |

|

Value

|

|

| Materials - 1.7% | |||

| Chemicals - 1.7% | |||

| 4,600 |

Intrepid Potash, Inc.*

|

$ 128,018

|

|

| Telecommunication Services - 1.8% | |||

| Diversified Telecommunication Services - 1.8% | |||

| 2,200 |

AboveNet, Inc.

|

130,570

|

|

| Total Investment in Common Stocks - 93.4% | |||

| (Identified cost, $6,486,741) |

6,839,859

|

||

| Short-Term Investment - 2.5% | |||

| 182,447 |

State Street Institutional

|

||

|

U.S. Government Money

|

|||

|

Market Fund

|

|||

| (Identified cost, $182,447) |

182,447

|

||

| Total Investments - 95.9% | |||

| (Identified cost, $6,669,188) |

7,022,306

|

||

| Other Assets in Excess | |||

| of Liabilities - 4.1% |

301,142

|

||

| Net Assets - 100% |

$ 7,323,448

|

||

| * Non-income producing security | |||

|

CENTURY GROWTH OPPORTUNITIES FUND

|

||||

|

STATEMENT OF ASSETS AND LIABILITIES - OCTOBER 31, 2011

|

||||

|

Assets:

|

||||

|

Investments, at value (Note 1A) (Identified cost of $6,669,188)

|

$ | 7,022,306 | ||

|

Dividends receivable

|

327 | |||

|

Receivable for investments sold

|

131,526 | |||

|

Receivable for Fund shares sold

|

363,000 | |||

|

Receivable from investment adviser

|

15,196 | |||

|

Prepaid expenses

|

143 | |||

|

Total Assets

|

7,532,498 | |||

|

Liabilities:

|

||||

|

Payable to Affiliates:

|

||||

|

Investment advisor fee (Note 4)

|

4,432 | |||

|

Administration fees (Note 5)

|

554 | |||

|

Accrued expenses and other liabilities

|

46,891 | |||

|

Payable for investments purchased

|

157,173 | |||

|

Total Liabilities

|

209,050 | |||

|

Net Assets

|

$ | 7,323,448 | ||

|

At October 31, 2011, net assets consisted of:

|

||||

|

Paid-in capital

|

$ | 7,507,779 | ||

|

Accumulated net realized loss on investments

|

(537,449 | ) | ||

|

Unrealized appreciation in value of investments

|

353,118 | |||

|

Net assets applicable to outstanding capital stock

|

$ | 7,323,448 | ||

|

Net Assets consist of:

|

||||

|

Institutional shares

|

$ | 7,323,448 | ||

|

Shares Outstanding consist of (Note 2):

|

||||

|

Institutional shares

|

686,369 | |||

|

Net Asset Value Per Share

|

||||

|

(Represents both the offering and redemption price*)

|

||||

|

Institutional shares

|

$ | 10.67 | ||

|

*

|

In general, shares of the Fund may be redeemed at net asset value. However, upon the redemption of shares held less than 90 days, a redemption fee of 1% of the current net asset value of the shares may be assessed and retained by the Fund for the benefit of remaining shareholders. The redemption fee is accounted for as an addition to paid-in-capital.

|

|

Investment Income:

|

||||

|

Dividends

|

$ | 21,895 | ||

|

Total investment income

|

21,895 | |||

|

Expenses:

|

||||

|

Investment adviser fee (Notes 4 and 7)

|

38,034 | |||

|

Non-interested trustees' remuneration

|

2,462 | |||

|

Transfer agent

|

12,962 | |||

|

Custodian

|

57,683 | |||

|

Administration fees (Note 5)

|

4,754 | |||

|

Insurance

|

152 | |||

|

Professional fees

|

31,305 | |||

|

Registration

|

21,650 | |||

|

Printing and other expenses

|

3,354 | |||

|

Total expenses

|

172,356 | |||

|

Adviser reimbursements (Note 7)

|

(120,059 | ) | ||

|

Net expenses

|

52,297 | |||

|

Net investment loss

|

(30,402 | ) | ||

|

Realized and unrealized gain/(loss) on investments:

|

||||

|

Net realized loss from investment transactions

|

(537,714 | ) | ||

|

Increase in unrealized appreciation on investments

|

353,118 | |||

|

Net realized and unrealized loss on investments

|

(184,596 | ) | ||

|

Net decrease in net assets resulting from operations

|

$ | (214,998 | ) | |

|

* For the period from the Fund’s inception, November 17, 2010, to October 31, 2011.

|

||||

|

CENTURY GROWTH OPPORTUNITIES FUND

|

||||

|

STATEMENT OF CHANGES IN NET ASSETS

|

||||

|

For the Period Ended

|

||||

|

INCREASE/(DECREASE)

|

October 31,

|

|||

|

IN NET ASSETS:

|

2011(a)

|

|||

|

Operations:

|

||||

|

Net investment loss

|

$ | (30,402 | ) | |

|

Net realized loss on investment transactions

|

(537,714 | ) | ||

|

Change in net unrealized appreciation

|

353,118 | |||

|

Net decrease in net assets resulting from operations

|

(214,998 | ) | ||

|

Capital share transactions - net (Note 2)

|

7,538,090 | |||

|

Redemption fees

|

356 | |||

|

Total increase

|

7,323,448 | |||

|

Net Assets:

|

||||

|

Beginning of period

|

0 | |||

|

End of period

|

$ | 7,323,448 | ||

|

(a) For the period from the Fund’s inception, November 17, 2010, to October 31, 2011.

|

|

For the Period Ended

|

||||

|

October 31,

|

||||

|

2011(a)

|

||||

|

Net Asset Value, beginning of period

|

$ | 10.00 | ||

|

Income/(loss) from Investment Operations:

|

||||

|

Net investment loss(b)

|

(0.07) | |||

|

Net realized and unrealized gain on investments

|

0.74 | |||

|

Total income from investment operations

|

0.67 | |||

|

Redemption fees

|

0.00 | † | ||

|

Net Asset Value, end of period

|

$ | 10.67 | ||

|

Total Return

|

6.70% | ** | ||

|

Ratios and supplemental data

|

||||

|

Net assets, end of period (000 omitted)

|

$ | 7,323 | ||

|

Ratio of expenses to average net assets

|

1.10% | * | ||

|

Ratio of expenses to average net assets without

|

||||

|

giving effect to contractual expense agreement

|

3.62% | * | ||

|

Ratio of net investment loss to average net assets

|

(0.64)% | * | ||

|

Portfolio Turnover Rate

|

119% | ** | ||

|

(a)

|

For the period from the Fund’s inception, November 17, 2010, to October 31, 2011.

|

|

(b)

|

Calculated based on average shares outstanding during the period.

|

|

†

|

Amount represents less than $0.005 per share.

|

|

**

|

Not annualized

|

|

*

|

Annualized

|

|

·

|

Level 1 – quoted prices in active markets for identical investments

|

|

·

|

Level 2 – significant other observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.)

|

|

·

|

Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments)

|

|

Quoted Prices

|

Significant

|

|||||||||||||||

|

In Active

|

Other

|

Significant

|

||||||||||||||

|

Markets for

|

Observable

|

Unobservable

|

||||||||||||||

|

Identical Assets

|

Inputs

|

Inputs

|

||||||||||||||

|

(Level 1)

|

(Level 2)

|

(Level 3)

|

Total

|

|||||||||||||

|

Century Shares Trust

|

||||||||||||||||

|

Common Stock*

|

$ | 175,426,269 | $ | — | $ | — | $ | 175,426,269 | ||||||||

|

Money Market Funds

|

2,932,962 | — | — | 2,932,962 | ||||||||||||

|

Total Investments

|

$ | 178,359,231 | $ | — | $ | — | $ | 178,359,231 | ||||||||

|

Century Small Cap Select Fund

|

||||||||||||||||

|

Common Stock*

|

$ | 354,762,273 | $ | — | $ | — | $ | 354,762,273 | ||||||||

|

Money Market Funds

|

17,549,302 | — | — | 17,549,302 | ||||||||||||

|

Total Investments

|

$ | 372,311,575 | $ | — | $ | — | $ | 372,311,575 | ||||||||

|

Quoted Prices

|

Significant

|

|||||||||||||||

|

In Active

|

Other

|

Significant

|

||||||||||||||

|

Market for

|

Observable

|

Unobservable

|

||||||||||||||

|

Identical Assets

|

Inputs

|

Inputs

|

||||||||||||||

|

(Level 1)

|

(Level 2)

|

(Level 3)

|

Total

|

|||||||||||||

|

Century Growth Opportunities Fund

|

||||||||||||||||

|

Common Stock*

|

$ | 6,839,859 | $ | — | $ | — | $ | 6,839,859 | ||||||||

|

Money Market Funds

|

182,447 | — | — | 182,447 | ||||||||||||

|

Total Investments

|

$ | 7,022,306 | $ | — | $ | — | $ | 7,022,306 | ||||||||

|

Paid-In

|

Accumulated

|

|||||||||||

|

Capital

|

UNII

|

gain/loss

|

||||||||||

|

Century Shares Trust

|

$ | — | $ | 238,544 | $ | (238,544 | ) | |||||

|

Century Small Cap Select Fund

|

$ | (2,638,940 | ) | $ | 1,865,136 | $ | 773,804 | |||||

|

Century Growth Opportunities Fund

|

$ | (30,667 | ) | $ | 30,402 | $ | 265 | |||||

|

Century Shares Trust

|

||||

|

Gross unrealized appreciation

|

$ | 43,265,408 | ||

|

Gross unrealized depreciation

|

(3,961,983 | ) | ||

|

Unrealized net appreciation

|

$ | 39,303,425 | ||

|

Cost for federal income tax purposes

|

$ | 139,055,806 | ||

|

Undistributed ordinary income

|

$ | 621,899 | ||

|

Undistributed capital gains

|

17,549,643 | |||

|

Unrealized appreciation

|

39,303,425 | |||

|

Total

|

$ | 57,474,967 | ||

|

The tax character of distributions paid were as follows:

|

||||||||

|

Year Ended October 31,

|

||||||||

|

2011

|

2010

|

|||||||

|

Ordinary income

|

||||||||

|

Institutional Shares

|

$ | 51,630 | $ | 47,060 | ||||

|

Long-term capital gain

|

||||||||

|

Institutional Shares

|

$ | 7,888,685 | $ | — | ||||

|

Investor Shares

|

$ | 73,860 | $ | — | ||||

|

Century Small Cap Select Fund

|

||||

|

Gross unrealized appreciation

|

$ | 77,489,122 | ||

|

Gross unrealized depreciation

|

(25,884,847 | ) | ||

|

Unrealized net appreciation

|

$ | 51,604,275 | ||

|

Cost for federal income tax purposes

|

$ | 320,707,300 | ||

|

Capital loss carryforward

|

$ | (76,901,648 | ) | |

|

Unrealized appreciation

|

51,604,275 | |||

|

Total

|

$ | (25,297,373 | ) | |

|

Century Growth Opportunities Fund

|

||||

|

Gross unrealized appreciation

|

$ | 550,273 | ||

|

Gross unrealized depreciation

|

(232,589 | ) | ||

|

Unrealized net appreciation

|

$ | 317,684 | ||

|

Cost for federal income tax purposes

|

$ | 6,704,622 | ||

|

Capital loss carryforward

|

$ | (502,015 | ) | |

|

Unrealized appreciation

|

317,684 | |||

|

Total

|

$ | (184,331 | ) | |

| Year Ended October 31, 2011 | ||||||||||||||||

| Institutional Shares | Investor Shares | |||||||||||||||

|

Shares

|

Amount

|

Shares

|

Amount

|

|||||||||||||

|

Sold

|

187,391 | $ | 3,869,392 | 5,111 | $ | 105,667 | ||||||||||

|

Issued to shareholders in reinvestment of

|

||||||||||||||||

|

distributions from:

|

||||||||||||||||

|

Net investment income and capital gains

|

348,040 | 7,019,974 | 3,523 | 70,955 | ||||||||||||

| 535,431 | 10,889,366 | 8,634 | 176,622 | |||||||||||||

|

Repurchased

|

(978,916 | ) | (20,173,913 | ) | (29,936 | ) | (628,438 | ) | ||||||||

|

Shares converted*

|

61,436 | 1,331,322 | (61,614 | ) | (1,331,322 | ) | ||||||||||

|

Net increase (decrease)

|

(382,049 | ) | $ | (7,953,225 | ) | (82,916 | ) | $ | (1,783,138 | ) | ||||||

| Year Ended October 31, 2010 | ||||||||||||||||

| Institutional Shares | Investor Shares | |||||||||||||||

|

Shares

|

Amount

|

Shares

|

Amount

|

|||||||||||||

|

Sold.

|

173,736 | $ | 3,164,426 | 34,109 | $ | 654,481 | ||||||||||

|

Issued to shareholders in reinvestment of

|

||||||||||||||||

|

distributions from:

|

||||||||||||||||

|

Net investment income

|

2,175 | 39,358 | — | — | ||||||||||||

| 175,911 | 3,203,784 | 34,109 | 654,481 | |||||||||||||

|

Repurchased

|

(1,062,442 | ) | (19,576,908 | ) | (13,509 | ) | (250,153 | ) | ||||||||

|

Net increase (decrease)

|

(886,531 | ) | $ | (16,373,124 | ) | 20,600 | $ | 404,328 | ||||||||

| Year Ended October 31, 2011 | ||||||||||||||||

| Institutional Shares | InvestorShares | |||||||||||||||

|

Shares

|

Amount

|

Shares

|

Amount

|

|||||||||||||

|

Sold

|

2,529,433 | $ | 61,015,656 | 2,015,598 | $ | 48,942,430 | ||||||||||

|

Repurchased

|

(3,756,263 | ) | (93,461,220 | ) | (1,517,651 | ) | (35,471,723 | ) | ||||||||

|

Net increase (decrease)

|

(1,226,830 | ) | $ | (32,445,564 | ) | 497,947 | $ | 13,470,707 | ||||||||

| Year Ended October 31, 2010 | ||||||||||||||||

|

Institutional Shares

|

Investor Shares

|

|||||||||||||||

|

Shares

|

Amount

|

Shares

|

Amount

|

|||||||||||||

|

Sold

|

2,490,612 | $ | 44,991,279 | 524,604 | $ | 9,706,292 | ||||||||||

|

Repurchased

|

(3,847,595 | ) | (69,892,481 | ) | (1,740,681 | ) | (31,160,417 | ) | ||||||||

|

Net (decrease)

|

(1,356,983 | ) | $ | (24,901,202 | ) | (1,216,077 | ) | $ | (21,454,125 | ) | ||||||

|

The Period Ended October 31, 2011*

|

||||||||

|

Institutional Shares

|

||||||||

|

Shares

|

Amount

|

|||||||

|

Sold

|

712,248 | $ | 7,820,330 | |||||

|

Repurchased

|

(25,879 | ) | (282,240 | ) | ||||

|

Net increase

|

686,369 | $ | 7,538,090 | |||||

|

Century Shares Trust

|

Expenses Paid

|

|||||||||||

|

Beginning

|

Ending

|

During Period*

|

||||||||||

|

Account Value

|

Account Value

|

Six Months Ending

|

||||||||||

|

May 1, 2011

|

October 31, 2011

|

October 31, 2011

|

||||||||||

|

Based on Actual Fund Return

|

||||||||||||

|

Institutional Shares

|

$ | 1,000.00 | $ | 935.30 | $ | 5.46 | ||||||

|

Based on Hypothetical 5% Yearly Return before expenses

|

||||||||||||

|

Institutional Shares

|

$ | 1,000.00 | $ | 1,019.56 | $ | 5.70 | ||||||

|

*

|

The Fund's annualized expense ratio is 1.12%. The dollar amounts shown as “Expenses Paid” are equal to the annual expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal period (184) divided by 365.

|

|

Century Small Cap Select Fund

|

Expenses Paid

|

|||||||||||

|

Beginning

|

Ending

|

During Period*

|

||||||||||

|

Account Value

|

Account Value

|

Six Months Ending

|

||||||||||

|

May 1, 2011

|

October 31, 2011

|

October 31, 2011

|

||||||||||

|

Based on Actual Fund Return

|

||||||||||||

|

Institutional Shares

|

$ | 1,000.00 | $ | 874.20 | $ | 5.29 | ||||||

|

Investor Shares

|

$ | 1,000.00 | $ | 872.70 | $ | 7.32 | ||||||

|

Based on Hypothetical 5% Yearly Return before expenses

|

||||||||||||

|

Institutional Shares

|

$ | 1,000.00 | $ | 1,019.56 | $ | 5.70 | ||||||

|

Investor Shares

|

$ | 1,000.00 | $ | 1,017.39 | $ | 7.88 | ||||||

|

*

|

The Fund’s annualized expense ratios are 1.12% for Institutional Shares and 1.55% for Investor Shares. The dollar amounts shown as “Expenses Paid” are equal to the annual expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal period (184) divided by 365.

|

|

Century Growth Opportunities Fund

|

Expenses Paid

|

|||||||||||

|

Beginning

|

Ending

|

During Period*

|

||||||||||

|

Account Value

|

Account Value

|

Six Months Ending

|

||||||||||

|

May 1, 2011

|

October 31, 2011

|

October 31, 2011

|

||||||||||

|

Based on Actual Fund Return

|

||||||||||||

|

Institutional Shares

|

$ | 1,000.00 | $ | 913.50 | $ | 5.31 | ||||||

|

Based on Hypothetical 5% Yearly Return before expenses

|

||||||||||||

|

Institutional Shares

|

$ | 1,000.00 | $ | 1,019.66 | $ | 5.60 | ||||||

|

*

|

The Fund’s annualized expense ratio (net of reimbursements) is 1.10%. The dollar amounts shown as “Expenses Paid” are equal to the annual expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal period (184) divided by 365.

|

|

No. of

|

||

|

Portfolios

|

||

|

in

|

||

|

Name, Year of Birth,

|

Fund

|

|

|

Position(s) held with Trust

|

Principal Occupation During Past 5 Years

|

Complex

|

|

and Length of Service

|

And Other Directorships Held

|

Overseen

|

|

William Gray (1952)

|

Senior Advisor, The Blackstone Group (private equity firm); Special

|

3

|

|

Trustee, 2006 to present

|

Advisor, Chi & Partners (advertising firm). Formerly, Vice Chairman,

|

|

|

Ogilvy & Mather Group, NA (advertising firm) (retired 2010). Other

|

||

|

Directorships: American Red Cross of Greater New York, (Chairman

|

||

|

2002-2008, Member since 1996); The New York Public Library;

|

||

|

Wakeman Boys & Girls Club; First Tee of Connecticut.

|

||

|

Laura A. Johnson (1954)

|

President, Massachusetts Audubon Society. Other Directorships:

|

3

|

|

Trustee, 2007 to present

|

Corporation Member, Woods Hole Oceanographic Institute; Stewardship

|

|

|

Council, Massachusetts Department of Conservation and Recreation;

|

||

|

Land Trust Alliance.

|

||

|

Stephen W. Kidder (1952)

|

Managing Partner, Hemenway & Barnes (law firm). Other Directorships:

|

3

|

|

Trustee, 2005 to present

|

Trustee, Wellesley College; Trustee, Isabella Stewart Gardner Museum;

|

|

|

Trustee, Children’s Hospital Trust; Director, The Concord Bookshop, Inc.

|

||

|

Jerry S. Rosenbloom (1939)

|

Frederick H. Ecker Emeritus Professor of Insurance and Risk Management

|

3

|

|

Trustee, 1998 to present

|

and Academic Director, Certified Employee Benefit Specialist Program,

|

|

|

The Wharton School, University of Pennsylvania. Other Directorships:

|

||

|

Harleysville Group, Inc.; American Institute for Chartered Property Casualty

|

||

|

Underwriters; S.S. Huebner Foundation for Insurance Education. Former

|

||

|

Directorships: MBIA Claymore Managed Municipal Bond Fund

|

||

|

(through June 2006).

|

||

|

David D. Tripple (1944)

|