Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2013

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-34574

TRANSATLANTIC PETROLEUM LTD.

(Exact name of registrant as specified in its charter)

| Bermuda | None | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 16803 Dallas Parkway Addison, Texas |

75001 | |

| (Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (214) 220-4323

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common shares, par value $0.10 | NYSE MKT |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | x | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of common shares, par value $0.10 per share, held by non-affiliates of the registrant, based on the last sale price of the common shares on June 28, 2013 (the last business day of the registrant’s most recently completed second fiscal quarter), was approximately $147.7 million. For purposes of this computation, all officers, directors and 10% beneficial owners of the registrant are deemed to be affiliates. Such determination should not be deemed an admission that such officers, directors or 10% beneficial owners are, in fact, affiliates of the registrant.

As of March 7, 2014, there were 37,402,698 common shares outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

The information required by Part III of this Annual Report on Form 10-K, to the extent not set forth herein, is incorporated by reference to the registrant’s definitive proxy statement relating to the 2014 Annual Meeting of Shareholders which will be filed with the Securities and Exchange Commission within 120 days after the end of the fiscal year to which this Annual Report on Form 10-K relates.

Table of Contents

TRANSATLANTIC PETROLEUM LTD.

FORM 10-K

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2013

| Page | ||||||

| PART I | 1 | |||||

| Item 1. | 1 | |||||

| Item 1A. | 12 | |||||

| Item 1B. | 25 | |||||

| Item 2. | 25 | |||||

| Item 3. | 40 | |||||

| Item 4. | 41 | |||||

| PART II | 41 | |||||

| Item 5. | 41 | |||||

| Item 6. | 44 | |||||

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

45 | ||||

| Item 7A. | 58 | |||||

| Item 8. | 60 | |||||

| Item 9. | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

60 | ||||

| Item 9A. | 60 | |||||

| Item 9B. | 62 | |||||

| PART III | 63 | |||||

| Item 10. | 63 | |||||

| Item 11. | 63 | |||||

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

63 | ||||

| Item 13. | Certain Relationships and Related Transactions, and Director Independence |

63 | ||||

| Item 14. | 63 | |||||

| PART IV | 64 | |||||

| Item 15. | 64 | |||||

Table of Contents

Forward-Looking Statements

Certain statements in this Annual Report on Form 10-K constitute “forward-looking statements” within the meaning of applicable U.S. and Canadian securities legislation. Additionally, forward-looking statements may be made orally or in press releases, conferences, reports, on our website or otherwise, in the future, by us or on our behalf. Such statements are generally identifiable by the terminology used such as “plans,” “expects,” “estimates,” “budgets,” “intends,” “anticipates,” “believes,” “projects,” “indicates,” “targets,” “objective,” “could,” “should,” “may” or other similar words.

By their very nature, forward-looking statements require us to make assumptions that may not materialize or that may not be accurate. Forward-looking statements are subject to known and unknown risks and uncertainties and other factors that may cause actual results, levels of activity and achievements to differ materially from those expressed or implied by such statements, including the factors discussed under Item 1A. Risk Factors in this Annual Report on Form 10-K. Such factors include, but are not limited to, the following: fluctuations in and volatility of the market prices for oil and natural gas products; the ability to produce and transport oil and natural gas; the results of exploration and development drilling and related activities; global economic conditions, particularly in the countries in which we carry on business, especially economic slowdowns; actions by governmental authorities including increases in taxes, legislative and regulatory initiatives related to fracture stimulation activities, changes in environmental and other regulations, and renegotiations of contracts; political uncertainty, including actions by insurgent groups or other conflicts; the negotiation and closing of material contracts; future capital requirements and the availability of financing; estimates and economic assumptions used in connection with our acquisitions; risks associated with drilling, operating and decommissioning wells; actions of third-party co-owners of interests in properties in which we also own an interest; our ability to effectively integrate companies and properties that we acquire; and the other factors discussed in other documents that we file with or furnish to the U.S. Securities and Exchange Commission (the “SEC”) and Canadian securities regulatory authorities. The impact of any one factor on a particular forward-looking statement is not determinable with certainty as such factors are interdependent upon other factors and our course of action would depend upon our assessment of the future, considering all information then available. In that regard, any statements as to: future oil or natural gas production levels; capital expenditures; the allocation of capital expenditures to exploration and development activities; sources of funding for our capital expenditure programs; drilling of new wells; demand for oil and natural gas products; expenditures and allowances relating to environmental matters; dates by which certain areas will be developed or will come on-stream; expected finding and development costs; future production rates; ultimate recoverability of reserves, including the ability to convert probable and possible reserves to proved reserves; dates by which transactions are expected to close; future cash flows, uses of cash flows, collectability of receivables and availability of trade credit; expected operating costs; changes in any of the foregoing and other statements using forward-looking terminology are forward-looking statements, and there can be no assurance that the expectations conveyed by such forward-looking statements will, in fact, be realized.

Although we believe that the expectations conveyed by the forward-looking statements are reasonable based on information available to us on the date such forward-looking statements were made, no assurances can be given as to future results, levels of activity, achievements or financial condition.

Readers should not place undue reliance on any forward-looking statement and should recognize that the statements are predictions of future results, which may not occur as anticipated. Actual results could differ materially from those anticipated in the forward-looking statements and from historical results, due to the risks and uncertainties described above, as well as others not now anticipated. The foregoing statements are not exclusive and further information concerning us, including factors that potentially could materially affect our financial results, may emerge from time to time. We do not intend to update forward-looking statements to reflect actual results or changes in factors or assumptions affecting such forward-looking statements.

i

Table of Contents

Glossary of Selected Oil and Natural Gas Terms

The following are abbreviations and definitions of terms commonly used in the oil and natural gas industry and this Annual Report on Form 10-K.

2D seismic. Geophysical data that depict the subsurface strata in two dimensions.

3D seismic. Geophysical data that depict the subsurface strata in three dimensions. 3D seismic typically provides a more detailed and accurate interpretation of the subsurface strata than 2D seismic.

Appraisal wells. Wells drilled to convert an area or sub-region from the resource to the reserves category.

Bbl. One stock tank barrel, or 42 U.S. gallons liquid volume, used in reference to oil or other liquid hydrocarbons.

Bbl/d. Barrels of oil per day.

Bcf. One billion cubic feet of natural gas.

Boe. Barrels of oil equivalent. Boe is not included in the DeGolyer and MacNaughton reserves report and is derived by the Company by converting natural gas to oil in the ratio of six Mcf of natural gas to one Bbl of oil. The conversion factor is the current convention used by many oil and natural gas companies. Boe may be misleading, particularly if used in isolation. A Boe conversion ratio of six Mcf to one Bbl is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead.

Boepd. Barrels of oil equivalent per day.

Commercial well; commercially productive well. An oil and natural gas well which produces oil and natural gas in sufficient quantities such that proceeds from the sale of such production exceed production expenses and taxes.

Completion. The installation of permanent equipment for the production of oil or natural gas or, in the case of a dry hole, the reporting of abandonment to the appropriate agency.

Developed acreage. The number of acres which are allocated or assignable to producing wells or wells capable of production.

Development well. A well drilled within the proved area of an oil or natural gas reservoir to the depth of a stratigraphic horizon known to be productive.

Directional drilling. The technique of drilling a well while varying the angle of direction of a well and changing the direction of a well to hit a specific target.

Dry hole; dry well. A well found to be incapable of producing either oil or natural gas in sufficient quantities to justify completion as an oil or natural gas well.

Exploitation. The continuing development of a known producing formation in a previously discovered field, including efforts to maximize the ultimate recovery of oil or natural gas from the field by development wells, secondary recovery equipment or other suitable processes and technology.

ii

Table of Contents

Exploratory well. A well drilled to find a new field or to find a new reservoir in a field previously found to be productive of oil or natural gas in another reservoir. Generally, an exploratory well is any well that is not a development well.

Farm-in or farm-out. An assignment of an interest in a drilling location and related acreage conditional upon the drilling of a well on that location, the completion of other work commitments related to that acreage, or some combination thereof.

Formation. A succession of sedimentary beds that were deposited under the same general geologic conditions.

Frac; fracture stimulation. A stimulation treatment involving the fracturing of a reservoir and then injecting water, sand and chemicals into the fractures under pressure to stimulate hydrocarbon production in low-permeability reservoirs.

Gross acres or gross wells. The total acres or wells, as the case may be, in which a working interest is owned.

Horizontal drilling. A drilling technique used in certain formations where a well is drilled vertically to a certain depth and then drilled at a right angle with a specified interval.

Initial production rate. Generally, the maximum 24-hour production volume from a well.

Mbbl. One thousand stock tank barrels.

Mboe. One thousand barrels of oil equivalent.

Mboepd. One thousand barrels of oil equivalent per day.

Mcf. One thousand cubic feet of natural gas.

Mcf/d. One thousand cubic feet of natural gas per day.

Mmbbl. One million stock tank barrels.

Mmboe. One million barrels of oil equivalent.

Mmcf. One million cubic feet of natural gas.

Mmcf/d. One million cubic feet of natural gas per day.

Net acres or net wells. The sum of the fractional working interests owned in gross acres or gross wells.

Overriding royalty interest. An interest in an oil or natural gas property entitling the owner to a share of oil and natural gas production free of costs of production.

Play. A term applied to a portion of the exploration and production cycle following the identification by geologists and geophysicists of areas with potential oil and natural gas reserves.

Present value of estimated future net revenues or PV-10. The present value of estimated future net revenues is an estimate of future net revenues from a property at the date indicated, without giving effect to derivative financial instrument activities, after deducting production and ad valorem taxes, future capital costs, abandonment costs and operating expenses, but before deducting future federal income taxes. The future net

iii

Table of Contents

revenues have been discounted at an annual rate of 10% to determine their “present value.” The present value is shown to indicate the effect of time on the value of the net revenue stream and should not be construed as being the fair market value of the properties. Estimates have been made using constant oil and natural gas prices and operating and capital costs at the date indicated, at its acquisition date, or as otherwise indicated. We believe that the present value of estimated future net revenues before income taxes, while not a financial measure in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”), is an important financial measure used by investors and independent oil and natural gas producers for evaluating the relative significance of oil and natural gas properties and acquisitions because the tax characteristics of comparable companies can differ materially.

Productive well. A productive well is a well that is not a dry well.

Proved developed reserves. Developed oil and natural gas reserves are reserves of any category that can be expected to be recovered: (i) through existing wells with existing equipment and operating methods or in which the cost of the required equipment is relatively minor compared to the cost of a new well and (ii) through installed extraction equipment and infrastructure operational at the time of the reserves estimate.

Proved reserves. Those quantities of oil and natural gas, which, by analysis of geoscience and engineering data, can be estimated with reasonable certainty to be economically producible, from a given date forward, from known reservoirs, and under existing economic conditions, operating methods, and government regulations, prior to the time at which contracts providing the right to operate expire, unless evidence indicates that renewal is reasonably certain, regardless of whether deterministic or probabilistic methods are used for the estimation. The project to extract the hydrocarbons must have commenced or the operator must be reasonably certain that it will commence the project within a reasonable time.

The area of the reservoir considered as proved includes: (i) the area identified by drilling and limited by fluid contacts, if any, and (ii) adjacent undrilled portions of the reservoir that can, with reasonable certainty, be judged to be continuous with it and to contain economically producible oil or natural gas on the basis of available geoscience and engineering data.

In the absence of data on fluid contacts, proved quantities in a reservoir are limited by the lowest known hydrocarbons as seen in a well penetration unless geoscience, engineering, or performance data and reliable technology establishes a lower contact with reasonable certainty. Where direct observation from well penetrations has defined a highest known oil elevation and the potential exists for an associated gas cap, proved oil reserves may be assigned in the structurally higher portions of the reservoir only if geoscience, engineering, or performance data and reliable technology establish the higher contact with reasonable certainty.

Reserves which can be produced economically through application of improved recovery techniques (including, but not limited to, fluid injection) are included in the proved classification when: (i) successful testing by a pilot project in an area of the reservoir with properties no more favorable than in the reservoir as a whole, the operation of an installed program in the reservoir or an analogous reservoir, or other evidence using reliable technology establishes the reasonable certainty of the engineering analysis on which the project or program was based and (ii) the project has been approved for development by all necessary parties and entities, including governmental entities.

Existing economic conditions include prices and costs at which economic producibility from a reservoir is to be determined. The price shall be the average price during the twelve month period prior to the ending date of the period covered by the report, determined as an unweighted arithmetic average of the first-day-of-the-month price for each month within such period, unless prices are defined by contractual arrangements, excluding escalations based upon future conditions.

Proved undeveloped reserves. Reserves of any category that are expected to be recovered from new wells on undrilled acreage or from existing wells where a relatively major expenditure is required for recompletion.

iv

Table of Contents

Reserves on undrilled acreage shall be limited to those directly offsetting development spacing areas that are reasonably certain of production when drilled, unless evidence using reliable technology exists that establishes reasonable certainty of economic producibility at greater distances. Undrilled locations can be classified as having undeveloped reserves only if a development plan has been adopted indicating that they are scheduled to be drilled within five years, unless the specific circumstances justify a longer time.

Undrilled locations can be classified as having proved undeveloped reserves only if a development plan has been adopted indicating that they are scheduled to be drilled within five years, unless the specific circumstances justify a longer time.

Under no circumstances shall estimates for undeveloped reserves be attributable to any acreage for which an application of fluid injection or other improved recovery technique is contemplated, unless such techniques have been proved effective by actual projects in the same reservoir or an analogous reservoir or by other evidence using reliable technology establishing reasonable certainty.

Recompletion. An operation within an existing well bore to make the well produce oil or natural gas from a different, separately producible zone other than the zone from which the well had been producing.

Reasonable certainty. If deterministic methods are used, reasonable certainty means a high degree of confidence that the quantities will be recovered. If probabilistic methods are used, there should be at least a 90% probability that the quantities actually recovered will equal or exceed the estimate. A high degree of confidence exists if the quantity is much more likely to be achieved than not and, as changes due to increased availability of geoscience (geological, geophysical, and geochemical), engineering, and economic data are made to estimated ultimate recovery (“EUR”) with time, reasonably certain EUR is much more likely to increase or remain constant than to decrease.

Reservoir. A porous and permeable underground formation containing a natural accumulation of producible oil and/or natural gas that is confined by impermeable rock or water barriers and is individual and separate from other reservoirs.

Sales volumes. The amount of production of oil or natural gas sold after deducting royalties and working interests owned by third parties.

Shale. Fine-grained sedimentary rock composed mostly of consolidated clay or mud. Shale is the most frequently occurring sedimentary rock.

Standardized measure of discounted future net cash flows or the Standardized Measure. Under the Standardized Measure, future cash flows for the years ended December 31, 2013, 2012 and 2011 are estimated by applying the simple average spot prices for the trailing twelve month period using the first day of each month beginning on January 1 and ending on December 1 of each respective year, adjusted for fixed and determinable escalations, to the estimated future production of year-end proved reserves. Future cash inflows are reduced by estimated future production and development costs based on period-end and future plugging and abandonment costs to determine pre-tax cash inflows. Future income taxes are computed by applying the statutory tax rate to the excess of pre-tax cash inflows over our tax basis in the associated properties. Future net cash inflows after income taxes are discounted using a 10% annual discount rate to arrive at the Standardized Measure.

Tcf. One trillion cubic feet of natural gas.

Undeveloped acreage. License or lease acreage on which wells have not been drilled or completed to a point that would permit the production of commercial quantities of oil and natural gas regardless of whether such acreage contains proved reserves.

v

Table of Contents

Wellhead production. The volume of oil or natural gas produced after deducting royalties and working interests owned by third parties prior to any oil and natural gas lost or used from wellhead to market.

Working interest. The operating interest that gives the owner the right to drill, produce and conduct activities on the property and a share of production.

vi

Table of Contents

PART I

In this Annual Report on Form 10-K, references to “we,” “us,” “our,” or the “Company” refer to TransAtlantic Petroleum Ltd. and its subsidiaries on a consolidated basis. Unless stated otherwise, all sums of money stated in this Annual Report on Form 10-K are expressed in U.S. Dollars.

Our Business

We are an international oil and natural gas company engaged in acquisition, exploration, development and production. We have focused our operations in countries that have established, yet underexplored, petroleum systems, are net importers of petroleum, have an existing petroleum transportation infrastructure and provide favorable commodity pricing, royalty rates and tax rates to exploration and production companies. As of December 31, 2013, we held interests in approximately 1.9 million net acres of developed and undeveloped oil and natural gas properties in Turkey and Bulgaria. As of March 1, 2014, approximately 40% of our outstanding common shares were beneficially owned by N. Malone Mitchell 3rd, the chairman of our board of directors and our chief executive officer.

Based on the reserves report prepared by DeGolyer and MacNaughton, independent petroleum engineers, our estimated proved reserves at December 31, 2013 were approximately 12,221 net Mmboe, of which 79.5% was oil. Of these estimated proved reserves, 54.1% were proved developed reserves. As of December 31, 2013, the PV-10 and Standardized Measure of our proved reserves were $592.5 million and $495.8 million, respectively. See “Item 2. Properties—Value of Proved Reserves” for a reconciliation of PV-10 to the Standardized Measure.

Recent Developments

Relinquishment of Sud Craiova Exploration License. In 2012, the Romanian government temporarily suspended unconventional exploration of hydrocarbons, including fracture stimulation, pending a government review of unconventional drilling and completion techniques. As a result, in May 2013, we notified the Romanian government that we were relinquishing our Sud Craiova exploration license, covering approximately 500,000 net onshore acres in Romania.

Acquisition of Additional Exploration Acreage in Southeastern Turkey. On May 20, 2013, we completed the acquisition of three exploration licenses from ARAR Petrol ve Gaz Arama Uretim Pazarlama A.S (“ARAR”). The exploration licenses, which cover an aggregate of 150,000 acres, are located adjacent to our Molla exploration licenses in southeastern Turkey. We are the 100% owner and operator of the licenses. In December 2013, we applied to relinquish one of these exploration licenses.

TBNG Credit Facility. In June 2013, our wholly owned subsidiary, Thrace Basin Natural Gas (Turkiye) Corporation (“TBNG”), entered into a 78.8 million New Turkish Lira (approximately $36.9 million at December 31, 2013) unsecured line of credit with a Turkish bank, of which 60 million New Turkish Lira is available in cash for TBNG and 18.8 million New Turkish Lira is available in the form of non-cash bank guarantees and letters of credit for TBNG and several other of our wholly owned subsidiaries operating in Turkey. We have made two borrowings under this credit facility, each of which has a one-year term at a fixed interest rate of 4.6% per annum. At maturity, we expect to renew the borrowings for one additional year at then current market interest rates. As of December 31, 2013, we had borrowed $20.0 million under this credit facility.

Amendment of Purchase Agreement. In July 2013, our wholly owned subsidiary, TransAtlantic Worldwide, Ltd. (“TransAtlantic Worldwide”) entered into a second amendment (the “Amendment”) to our purchase agreement (the “Purchase Agreement”) with Direct Petroleum Exploration, LLC (formerly Direct Petroleum Exploration, Inc.) (“Direct”). Pursuant to the Amendment, we issued 351,074 common shares to Direct as partial

1

Table of Contents

payment of certain liquidated damages due under the Purchase Agreement. The parties also agreed that Direct is not eligible for any liquidated damages relating to the coring of the Etropole shale formation, which resulted in the 2013 reversal of a $5.0 million contingent liability recorded in 2011. The Amendment sets forth a new obligation to drill and test the Deventci-R2 well by May 1, 2014. We achieved target depth on the Deventci-R2 well in January 2014, and the well is currently awaiting completion. The Amendment provides that we will issue $7.5 million of common shares to Direct if the Deventci-R2 well is a commercial success (as defined in the Purchase Agreement) on or prior to May 1, 2016.

Additionally, the Amendment provides that if the Bulgarian government issues a production concession over our Stefenetz concession area, Direct will be entitled to $10.0 million of common shares, or a pro rata amount if the production concession is less than 200,000 acres.

Bulgaria Farm-Out. In August 2013, TransAtlantic Worldwide entered into a farm-out agreement with Koynare Development Ltd. (“KDL”), a private oil and natural gas investment company. Pursuant to the agreement, KDL will fund 75% of our initial $40 million work program in Bulgaria, and our wholly owned subsidiary, Direct Petroleum Bulgaria EOOD (“Direct Bulgaria”), will assign KDL a 50% interest in our Koynare concession area. Direct Bulgaria will also assign KDL 50% of its interest in our Stefenetz concession area, subject to LNG Energy Ltd.’s (“LNG”) farm-out interest, in the event that the pending concession application is approved by the Bulgarian government.

Idil Farm-Out. In February 2014, our wholly owned subsidiary, TransAtlantic Turkey, Ltd. (“TransAtlantic Turkey”), and Selsinsan Petrol Maden T.O. San ve Tic. Ltd. Sti. (“Selsinsan”) entered into a farm-out agreement with Onshore Petroleum Company AS (“Onshore”), a private oil and gas company. Pursuant to the agreement, Onshore will fund 100% of our initial exploration well, up to $3.5 million, on the Idil license in southeastern Turkey. Expenses over $3.5 million will be split equally between us and Onshore. In exchange, TransAtlantic Turkey and Selsinsan will assign Onshore a 50% interest in the Idil license.

Appointment of New Director. On February 10, 2014, we appointed Gregory K. Renwick to our board of directors. Mr. Renwick worked at Mobil for 25 years and, under his leadership, Mobil successfully acquired upstream assets in Kazakhstan, Turkmenistan and Azerbaijan. He served as president and chief executive officer of East West Petroleum Corp. from 2010 to 2013 and as the director of business development for Dana Gas PJSC in the United Arab Emirates from 2007 to 2010.

Reverse Stock Split. On March 4, 2014, the Company’s shareholders approved a 1-for-10 reverse stock split, which became effective March 6, 2014. Pursuant to the reverse stock split, all shareholders of record received one common share for each ten common shares owned (subject to minor adjustments as a result of fractional shares). The reverse stock split reduced the issued and outstanding common shares from 374,026,984 to 37,402,698. U.S. GAAP requires that the reverse stock split be applied retrospectively to all periods presented. As a result, all common share transactions described herein have been adjusted to reflect the 1-for-10 reverse stock split.

Our Strengths

We believe that the following strengths provide us with meaningful competitive advantages:

Significant Exploration Acreage in Known Hydrocarbon Basins. As of March 1, 2014, we held approximately 1.9 million net acres in Turkey and Bulgaria. The majority of this acreage is exploratory, but lies within areas of known hydrocarbon production. We will seek to actively develop our acreage to monetize production, and we will consider joint ventures or farm-out agreements where appropriate.

Strong and Experienced Management Team. Our management team, led by our chairman and chief executive officer, Mr. Mitchell, includes executives and managers with significant industry, operational and technical experience. Mr. Mitchell previously built Riata Energy, Inc. (re-named SandRidge Energy, Inc.) into

2

Table of Contents

one of the largest privately-held energy companies in the United States before selling his controlling stake in 2006. Upon his departure, Riata Energy, Inc. had 1 Tcf in proved reserves, 300 miles of natural gas-gathering pipeline, more than 34,000 horsepower of natural gas compression, and owned or operated 43 drilling rigs. In 2013, we added four senior technical employees who have substantial experience in geology, horizontal drilling, unconventional reservoirs and completions, and secondary recovery. On average, our operations management team possesses more than 25 years of industry experience. The team manages our operations from our corporate offices near Dallas, Texas.

Growing Production and Cash Flow. We increased our proved reserves by 5.4% in 2013. In the second half of 2013, based on our 2013 exit rate, we increased our average daily wellhead production rate by 24%. We expect to continue to grow production and cash flow through the development of our Selmo, Molla, and Thrace Basin exploration licenses and production leases, the development of other exploration properties in Turkey and Bulgaria, and the reduction of our general and administrative expenses and operational inefficiencies.

Operations in Attractive Regions. We have focused our operations in countries that have established, yet underexplored petroleum systems, are net importers of petroleum, have an existing petroleum transportation infrastructure and provide favorable commodity pricing, royalty rates and tax rates to exploration and production companies. Our production in Turkey is subject to a 12.5% royalty rate, and the corporate income tax rate is 20%. We sell our oil based on Brent crude pricing, and natural gas prices are generally higher in Turkey than in North America. During 2013, we realized average prices of $101.05 per Bbl for our oil sales volumes and $9.43 per Mcf for our natural gas sales volumes in Turkey. We expect that our properties in Bulgaria will also operate under favorable economic terms. We expect that future production in Bulgaria will be subject to royalty rates ranging from 2.5% to 30%, and corporate income tax rates of 10% after a one-year tax holiday.

Our Strategy

The following are key elements of our strategy:

Increase Reserves and Production. We increased our proved reserves by 5.4% in 2013. In the second half of 2013, based on our 2013 exit rate, we increased our average daily wellhead production rate by 24%. We plan to continue to increase our oil and natural gas reserves and production in Turkey through exploration and development on our Selmo, Molla and Thrace Basin exploration licenses and production leases, including the application of 3D seismic, horizontal drilling and fracture stimulation techniques. In 2014, we plan to drill or participate in the drilling of between 19 and 27 new gross wells in southeastern Turkey and between 14 and 22 new gross wells in northwestern Turkey, and recomplete between 15 and 25 existing gross wells in northwestern Turkey.

Utilize New 3D Seismic Data to Improve Well Targeting. During 2013, we spent $12.8 million shooting 3D seismic over areas of Turkey where 3D seismic data did not previously exist. We expect this new data will improve our ability to target well locations, drill wells and ultimately delineate hydrocarbon reservoirs.

Expand the Use of Horizontal Drilling. During 2013, we expanded our use of horizontal drilling, employing it on 13 of 35 wells drilled, with successful results in the Selmo, Molla and Thrace Basin areas. During 2014, we anticipate extensive use of horizontal drilling techniques on our wells in southeastern and northwestern Turkey to more effectively extract hydrocarbons and increase our returns on invested capital.

Further Expand Fracture Stimulation Program. In 2013, we expanded our use of hydraulic fracturing technology to complete otherwise low productive formations in Turkey. The evolution of fracturing fluids and stimulation designs has yielded positive results in both northwestern and southeastern Turkey. For 2014, we plan to continue optimizing our hydraulic fracturing techniques to improve well performance and economics.

3

Table of Contents

Our Properties and Operations

Summary of Geographic Areas of Operations

The following table shows net reserves information as of December 31, 2013:

| Proved Developed Reserves (Mboe) |

Proved Undeveloped Reserves (Mboe) |

Total Proved Reserves (Mboe) |

Probable

Reserves (Mboe) |

Possible

Reserves (Mboe) |

||||||||||||||||

| Turkey |

6,617 | 5,604 | 12,221 | 11,958 | 29,911 | |||||||||||||||

Turkey

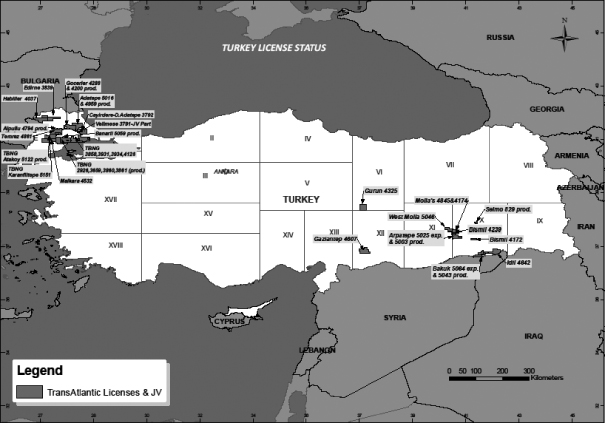

As of March 1, 2014, we held interests in 23 onshore and offshore exploration licenses and 12 onshore production leases covering a total of 2.1 million gross acres (1.3 million net acres) in Turkey. As of December 31, 2013, we had total net proved reserves of 9,714 Mbbl of oil and 15,039 Mmcf of natural gas, net probable reserves of 8,120 Mbbl of oil and 23,030 Mmcf of natural gas and net possible reserves of 16,877 Mbbl of oil and 78,205 Mmcf of natural gas in Turkey. During 2013, our average wellhead production was approximately 4,375 net Boepd of oil and natural gas in Turkey. The following summarizes our core producing properties in Turkey:

Southeastern Turkey. Substantially all of our oil production is concentrated in southeastern Turkey, primarily in the Selmo, Goksu, Bahar and Arpatepe oil fields. These properties are in close proximity to the Zagros fold belt, which encompasses the oil fields of Iran and Iraq. In 2013, we drilled 10 horizontal wells and five vertical wells in southeastern Turkey.

We hold a 100% working interest in the Selmo production lease. The Selmo oil field is the second largest oil field in Turkey in terms of historical cumulative production and is responsible for the largest portion of our current crude oil production. In 2013, we drilled six horizontal developmental wells in the field, five of which were commercially successful. We also remodeled the Selmo field based on 3D seismic and well control. The static model we developed led us to form a new horizontal drilling plan in the field. For 2013, our wellhead production of crude oil from the Selmo field was 670,711 Bbls at an average rate of approximately 1,838 Bbl/d. Turkiye Petrolleri Anonim Ortakligi (“TPAO”), a Turkish government-owned oil and natural gas company, and Türkiye Petrol Rafinerileri A.Ş. (“TUPRAS”), a privately-owned oil refinery in Turkey, purchase all of our crude oil production from the Selmo field, which is transported by truck to their neighboring facilities. At March 1, 2014, we had 50 producing wells in the Selmo field, and we plan to drill 10 horizontal development wells in Selmo during 2014.

We hold a 100% working interest in each of our three Molla exploration licenses, which contain the Goksu and Bahar oil fields. In the Goksu field, we are primarily targeting the Mardin formation, and in the Bahar field, we are primarily targeting the Bedinan and Hazro formations. In 2013, we completed five horizontal wells and began shooting approximately 800 sq. km. of 3D seismic over the Molla area. During the first half of 2014, we anticipate drilling two vertical wells in the Bahar field, including a vertical sidetrack of the Bahar-2 well, to better understand the geology in preparation for horizontal drilling in the Molla area.

During 2013, we also drilled the Catak-1 well in the Molla area, and we plan to complete the well in early 2014 using hydraulic fracture stimulation to target the Hazro and Bedinan formations.

We hold a 50% working interest in our Arpatepe production lease and exploration license. For 2013, our wellhead production of crude oil from the Arpatepe field was 56,561 Bbls at an average rate of approximately 155 Bbl/d. At March 1, 2014, we had five producing wells on the Arpatepe production lease, and we plan to drill one or two development wells on the Arpatepe field in 2014.

Northwestern Turkey. Substantially all of our natural gas production is concentrated in the Thrace Basin, which is one of Turkey’s most productive onshore natural gas regions. It is located in northwestern Turkey near Istanbul. We have accumulated significant onshore acreage in the Thrace Basin.

4

Table of Contents

Our goal is to monetize proven formations in the Thrace Basin. For 2013, our wellhead production of natural gas in the Thrace Basin was approximately 3,793 Mmcf, or approximately 10.4 Mmcf/d. In 2013, we drilled three horizontal wells in southern Thrace Basin, six shallow vertical wells in northern Thrace Basin, and 11 conventional vertical wells in the Thrace Basin area. We also completed a 234 sq. km. 3D seismic program in the Osmanli area of the southern Thrace Basin. As of March 1, 2014, we had 123 producing wells on our Thrace Basin properties, and we plan to drill or participate in the drilling of between 14 and 22 new gross wells and recomplete between 15 and 25 existing gross wells in 2014. We plan to target the Mezardere siltstone and the Teslimkoy formation with horizontal drilling. We also expect to drill conventional vertical wells in the area.

Bulgaria

As of March 1, 2014, we held interests in one onshore exploration concession and one onshore production concession covering a total of 567,000 acres in Bulgaria. During 2013, our wellhead production was approximately 15.8 Mmcf of natural gas on a limited test basis in Bulgaria.

On November 14, 2012, Bulgaria’s Council of Ministers awarded our subsidiary, Direct Bulgaria, a 35-year production concession covering the approximately 163,000 acre Koynare concession area (the “Koynare Concession Area”). The Koynare Concession Area contains the Deventci-R1 well, where we discovered a reservoir in the Jurassic-aged Ozirovo formation at a depth of approximately 13,800 feet, which the Bulgarian government has certified as a geologic and commercial discovery. During 2013, our wellhead production was approximately 15.8 Mmcf of natural gas on a limited test basis, which was sold to a compressed natural gas facility adjacent to the Deventci-R1 well.

In August 2013, we entered into a farm-out agreement with KDL, pursuant to which KDL would fund 75% of our initial $40 million work program in Bulgaria in exchange for a 50% interest in our Koynare Concession Area. We will also assign KDL 50% of our interest in our Stefenetz concession area, subject to LNG’s farm-out interest, in the event that the pending concession application is approved by the Bulgarian government.

In January 2012, the Bulgarian Parliament enacted legislation that banned fracture stimulation in the Republic of Bulgaria. The legislation had the effect of preventing conventional drilling and completion activities. As a result, we temporarily suspended drilling and completion operations in Bulgaria in January 2012. In June 2012, the Bulgarian Parliament amended the legislation to clarify that conventional operations were not intended to be affected by the law. Accordingly, our conventional natural gas exploration, development and production activity in Bulgaria resumed in 2013. The current legislation significantly constrains our unconventional natural gas exploration, development and production activities in Bulgaria.

During the second half of 2013, we resumed drilling the Deventci-R2 directional well on our Koynare Concession Area. In January 2014, we reached target depth of 14,100 feet, and the well is currently awaiting completion.

In November 2011, we initiated the application process for a production concession covering approximately 395,000 acres over the southern portion of our former A-Lovech exploration permit (the “Stefenetz Concession Area”). The Stefenetz Concession Area is estimated to contain over 300,000 prospective acres of Etropole shale at a depth of approximately 12,500 feet, which the Bulgarian government has certified as a geologic discovery. During 2012, we initiated an environmental impact assessment which the Bulgarian government must approve prior to granting the production concession. Pursuant to our agreement with LNG, if we obtain a production concession over the Stefenetz Concession Area, LNG would fund an additional $12.5 million in exchange for a 50% working interest in the production concession. The remaining 50% working interest in the production concession would be split equally between us and KDL.

5

Table of Contents

Current Operations

As of March 1, 2014, our wellhead production was an aggregate of approximately 2,800 Bbl/d, primarily from the Selmo production lease, Arpatepe production lease and Molla exploration licenses, and approximately 11.1 Mmcf/d of natural gas, primarily from our various Thrace Basin production leases and exploration licenses. As of March 1, 2014, we were engaged in the following drilling and exploration activities:

Turkey. During the first quarter of 2014, we were drilling the Selmo-92H well, our fifth Selmo MSD horizontal well, and completing the Selmo-86H well, and we initiated our first waterflood pilot test in the Selmo field to assess the field’s potential for secondary recovery. We also completed the final four stages of the Selmo-36H1 well in the Selmo field and completed the Ambaracik-2 well in the Arpatepe field. We continue to interpret data from our 800 sq. km. 3D seismic program over the Molla exploration licenses. Due to weather conditions, we believe the remaining 3D seismic to be shot over the Goksu field will resume in late April 2014.

Bulgaria. We reached target depth of 14,100 feet on the Deventci-R2 well on the Koynare Concession Area in the first quarter of 2014, and the well is currently awaiting completion.

Planned Operations

We continue to actively explore and develop our existing oil and natural gas properties in Turkey and evaluate opportunities for further activity in Bulgaria. Our success will depend in part on discovering additional hydrocarbons in commercial quantities and then bringing those discoveries to production.

We expect our net field capital expenditures for 2014, which includes seismic, to range between $75.0 and $100.0 million. We expect net field capital expenditures during 2014 to consist of approximately $76.0 million of drilling and completion expense for between 33 and 49 gross wells, $4.0 million of seismic expense and $8.5 million of infrastructure improvements and other capital investments. Of these expenditures, we expect to spend approximately 15% in northwestern Turkey, devoted to developing conventional and unconventional natural gas production and building infrastructure. Most of the remaining 85% of these anticipated expenditures is expected to be invested in southeastern Turkey, devoted to drilling developmental and exploratory oil wells at Selmo, Arpatepe and Molla and acquiring seismic data. We expect cash on hand, borrowings from our credit facilities, including our planned debt refinancing, and cash flow from operations will be sufficient to fund our 2014 net field capital expenditures. If not, we will either curtail our discretionary capital expenditures or seek other funding sources. Our projected 2014 capital expenditure budget is subject to change.

Exploration, Development and Production. We currently plan to execute the following drilling and exploration activities during 2014:

Turkey. We plan to drill between 33 and 49 gross wells, of which 26 are expected to be drilled horizontally and approximately 60% of which will be fracture stimulated. We also plan to execute at least four waterflood pilot tests and construct the infrastructure necessary to produce and sell oil and natural gas from the productive wells we drill.

Bulgaria. We spud the Deventci-R2 well on our Koynare Concession Area in October 2013 and reached target depth in January 2014. We may drill an additional well in Bulgaria, depending on the results of the Deventci-R2 well.

Principal Markets

In accordance with the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 280, Segment Reporting (“ASC 280”), we currently have two reportable geographic segments: Bulgaria and Turkey. For financial information about our operating segments and geographic areas, refer to “Note 12—Segment information” to our consolidated financial statements.

6

Table of Contents

Customers

Oil. During 2013, 71.3% of our oil production was concentrated in the Selmo field in Turkey. TUPRAS purchases the majority of our oil production from the Selmo field. During 2013, we sold $87.2 million of oil to TUPRAS, representing approximately 66.7% of our total revenues. We sell our oil to TUPRAS pursuant to a domestic crude oil purchase and sale agreement. Under the purchase and sale agreement, TUPRAS purchases oil produced by us and delivered to our Boru Hatlari ile Petrol Tasima A.S. (“BOTAŞ”) Batman tanks and to the BOTAŞ Dörtyol plant. The price of the oil delivered pursuant to the purchase and sale agreement is determined under the Petroleum Market Law No. 5015 under the laws of the Republic of Turkey. The purchase and sale agreement automatically renews for successive one-year terms unless earlier terminated in writing by either party. No other purchasers of our oil accounted for more than 10% of our total revenues.

Natural Gas. During 2013, no purchasers of our natural gas accounted for 10% or more of our total revenues.

Competition

We operate in the highly competitive areas of oil and natural gas exploration, development, production and acquisition with a substantial number of other companies, including U.S.-based and international companies doing business in each of the countries in which we operate. We face intense competition from independent, technology-driven companies as well as from both major and other independent oil and natural gas companies in each of the following areas:

| • | seeking oil and natural gas exploration licenses and production licenses and leases; |

| • | acquiring desirable producing properties or new leases for future exploration; |

| • | marketing oil and natural gas production; |

| • | integrating new technologies; and |

| • | contracting for drilling services and equipment and securing the expertise necessary to develop and operate properties. |

Many of our competitors have substantially greater financial, managerial, technological and other resources than we do. To the extent competitors are able to pay more for properties than we are paying, we will be at a competitive disadvantage. Further, many of our competitors enjoy technological advantages over us and may be able to implement new technologies more rapidly than we can. Our ability to explore for and produce oil and natural gas prospects and to acquire additional properties in the future will depend upon our ability to successfully conduct operations, implement advanced technologies, evaluate and select suitable properties and consummate transactions in this highly competitive environment.

Fracture Stimulation Program

Oil and natural gas may be recovered from our properties through the use of fracture stimulation combined with modern drilling and completion techniques. Fracture stimulation involves the injection of water, sand and chemicals under pressure into formations to fracture the surrounding rock and stimulate production. We have successfully utilized fracture stimulation in our Thrace Basin, Molla and Selmo licenses and production leases.

For unconventional reservoirs, including the Mezardere formation in the Thrace Basin, a typical fracture stimulation consists of injecting between 20,000 and 100,000 gallons of fluid that contain between 10,000 and 150,000 pounds of sand. Fluids vary depending on formation and treatment objective but, in general, are either slickwater (fresh water with salt and friction reducer) or a gelled fluid containing organic polymers with a 4% potassium chloride solution and required breakers. Fracture stimulations in Selmo and Molla are conducted in a low permeability carbonate reservoir. These stimulations generally consist of injecting between 20,000 and

7

Table of Contents

100,000 gallons of fluid that contain between 10,000 and 100,000 pounds of sand. Fluids are generally a mixture of slickwater and 15% hydrochloric acid, which is typical in carbonate stimulation. The size of fracture stimulation treatments is dependent on net pay thickness and the proximity of the hydrocarbon zones of interest to water bearing zones.

Although the cost of each well will vary, on average approximately 30% of the total cost of drilling and completing a well in the unconventional Mezardere formation in the Thrace Basin and approximately 15% of the total cost of re-entering and completing a well at Selmo is associated with fracture stimulation activities. We account for these costs as typical drilling and completion costs and include them in our capital expenditure budget.

We believe that the stacked nature of the sandstone intervals within the Mezardere unconventional formation, which is up to approximately 5,300 feet thick, and the limited number of deep penetrations to date on these structures provides significant opportunities for additional drilling and multi-stage fracs as the program matures.

We diligently review best practices and industry standards in connection with fracture stimulation activities and strive to comply with all regulatory requirements in the protection of potable water sources. Protective practices include, but are not limited to, setting multiple strings of protection pipe across potable water sources, cementing surface casing from setting depth to surface and second string from setting depth up into the surface casing and, in some cases, to surface, continuously monitoring the fracture stimulation process in real time and disposing of all non-commercially produced fluids in certified disposal wells at depths below the potable water sources or at a certified water treatment plant. There have not been any incidents, citations or suits involving environmental concerns related to our fracture stimulation operations on our properties.

In the Thrace Basin, Selmo and Molla, we have access to water resources which we believe will be adequate to execute our fracture stimulation program in 2014. We also employ procedures for environmentally friendly disposal of fluids recovered from fracture stimulation, including recycling approximately 50% of these fluids.

For more information on the risks of fracture stimulation, please read “Item 1A. Risk Factors—Risks Related to the Oil and Natural Gas Industry—Our oil and natural gas operations are subject to extensive and complex laws and government regulation in the jurisdictions in which we operate and compliance with existing and future laws may increase our costs or impair our operations” and “Item 1A. Risk Factors—Risks Related to the Oil and Natural Gas Industry—Legislative and regulatory initiatives and increased public scrutiny relating to fracture stimulation activities could result in increased costs and additional operating restrictions or delays.”

Governmental Regulations

Government Regulation. Our current or future operations, including exploration and development activities on our properties, require permits from various governmental authorities, and such operations are and will be governed by laws and regulations concerning exploration, development, production, exports, taxes, labor laws and standards, occupational health, waste disposal, toxic substances, land use, environmental protection and other matters. Compliance with these requirements may prove to be difficult and expensive. Due to our international operations, we are subject to the following issues and uncertainties that can affect our operations adversely:

| • | the risk of expropriation, nationalization, war, revolution, political instability, border disputes, renegotiation or modification of existing contracts, and import, export and transportation regulations and tariffs; |

| • | laws of foreign governments affecting our ability to fracture stimulate oil or natural gas wells, such as the legislation enacted in Bulgaria in January 2012 and the temporary suspension of unconventional exploration and drilling activities imposed in Romania in 2012; |

8

Table of Contents

| • | the risk of not being able to procure residency and work permits for our expatriate personnel; |

| • | taxation policies, including royalty and tax increases and retroactive tax claims; |

| • | exchange controls, currency fluctuations and other uncertainties arising out of foreign government sovereignty over international operations; |

| • | laws and policies of the United States affecting foreign trade, taxation and investment, including anti-bribery and anti-corruption laws; |

| • | the possibility of being subjected to the exclusive jurisdiction of foreign courts in connection with legal disputes and the possible inability to subject foreign persons to the jurisdiction of courts in the United States; and |

| • | the possibility of restrictions on repatriation of earnings or capital from foreign countries. |

Permits and Licenses. In order to carry out exploration and development of oil and natural gas interests or to place these into commercial production, we may require certain licenses and permits from various governmental authorities. There can be no guarantee that we will be able to obtain all necessary licenses and permits that may be required. In addition, such licenses and permits are subject to change and there can be no assurances that any application to renew any existing licenses or permits will be approved.

Repatriation of Earnings. Currently, there are no restrictions on the repatriation of earnings or capital to foreign entities from Turkey or Bulgaria. However, there can be no assurance that any such restrictions on repatriation of earnings or capital from the aforementioned countries or any other country where we may invest will not be imposed in the future. We may be liable for the payment of taxes upon repatriation of certain earnings from the aforementioned countries.

Environmental. The oil and natural gas industry is subject to extensive and varying environmental regulations in each of the jurisdictions in which we operate. Environmental regulations establish standards respecting health, safety and environmental matters and place restrictions and prohibitions on emissions of various substances produced concurrently with oil and natural gas. In most instances, the regulatory requirements relate to the handling and disposal of drilling and production waste products and waste created by water and air pollution control procedures. These regulations can have an impact on the selection of drilling locations and facilities, and potentially result in increased capital expenditures. In addition, environmental legislation may require those wells and production facilities to be abandoned and sites reclaimed to the satisfaction of local authorities. Such regulation has increased the cost of planning, designing, drilling, operating and, in some instances, abandoning wells. We are committed to complying with environmental and operational legislation wherever we operate.

There has been a recent surge in interest among the media, government regulators and private citizens concerning the possible negative environmental and geological effects of fracture stimulation. Some have alleged that fracture stimulation results in the contamination of aquifers and may even contribute to seismic activity. In January 2012, the government of Bulgaria enacted legislation that banned the fracture stimulation of oil and natural gas wells in the Republic of Bulgaria and imposed large monetary penalties on companies that violate that ban. In 2012, the Romanian government temporarily suspended unconventional drilling and exploration of hydrocarbons, including fracture stimulation, pending a government review of unconventional drilling and completion techniques. As a result of the suspension, we relinquished our Sud Craiova license in Romania. There is a risk that Turkey could at some point impose similar legislation or regulations. Such legislation or regulations could severely impact our ability to drill and complete wells, and could increase the cost of planning, designing, drilling, completing and operating wells. We are committed to complying with legislation and regulations involving fracture stimulation wherever we operate.

Such laws and regulations not only expose us to liability for our own negligence, but may also expose us to liability for the conduct of others or for our actions that were in compliance with all applicable laws at the time

9

Table of Contents

those actions were taken. We may incur significant costs as a result of environmental accidents, such as oil spills, natural gas leaks, ruptures, or discharges of hazardous materials into the environment, including clean-up costs and fines or penalties. Additionally, we may incur significant costs in order to comply with environmental laws and regulations and may be forced to pay fines or penalties if we do not comply.

Insurance

We currently carry general liability insurance and excess liability insurance with a combined annual limit of $21.0 million per occurrence and $32.0 million in the aggregate. These insurance policies contain maximum policy limits and are subject to customary exclusions and limitations. Our pollution insurance, which is part of our general liability policy, has a per occurrence limit of $1.0 million and aggregate annual limit of $2.0 million. Our general liability insurance covers us and our subsidiaries for third-party claims and liabilities arising out of lease operations and related activities. The excess liability insurance is in addition to, and is triggered if, the general liability insurance per occurrence limit is reached.

We also maintain control of well insurance. Our control of well insurance has a per occurrence and combined single limit of $15.0 million and is subject to deductibles ranging from $150,000 to $500,000 per occurrence.

We require our third-party service providers to sign master service agreements with us pursuant to which they agree to indemnify us for the personal injury and death of the service provider’s employees as well as subcontractors that are hired by the service provider. Similarly, we generally agree to indemnify our third-party service providers against similar claims regarding our employees and our other contractors.

We also require our third-party service providers that perform fracture stimulation operations for us to sign master service agreements containing the indemnification provisions noted above. We do not currently have any insurance policies in effect that are intended to provide coverage for losses solely related to fracture stimulation operations. We believe that our general liability, excess liability and pollution insurance policies would cover third-party claims related to fracture stimulation operations and associated legal expenses, in accordance with, and subject to, the terms of such policies. However, these policies may not cover fines, penalties or costs and expenses related to government-mandated environmental clean-up responsibilities.

Bermuda Tax Exemption

As a Bermuda exempted company and under current Bermuda law, we are not subject to tax on profits, income or dividends, nor is there any capital gains tax applicable to us in Bermuda. Profits can be accumulated, and it is not obligatory for us to pay dividends.

Furthermore, we have received an assurance from the Minister of Finance of Bermuda under the Exempted Undertakings Tax Protection Act 1966, as amended, that in the event that Bermuda enacts any legislation imposing tax computed on profits, income, any capital asset, gain or appreciation, we and any of our operations or our shares, debentures or other obligations shall be exempt from the imposition of such tax until March 31, 2035, provided that such exemption shall not prevent the application of any tax payable in accordance with the provisions of the Land Tax Act, 1967 or otherwise payable in relation to land in Bermuda leased to us.

We are required to pay an annual government fee (the “AGF”), which is determined on a sliding scale by reference to our authorized share capital and share premium account, with a minimum fee of $1,995 Bermuda Dollars and a maximum fee of $31,120 Bermuda Dollars. The Bermuda Dollar is treated at par with the U.S. Dollar. The AGF is payable each year on or before the end of January and is based on the authorized share capital and share premium account on August 31 of the preceding year.

In Bermuda, stamp duty is not chargeable in respect of the incorporation, registration, licensing of an exempted company or, subject to certain minor exceptions, on their transactions.

10

Table of Contents

Employees

As of March 1, 2014, we employed 287 people. Approximately 41 of our employees at one of our subsidiaries operating in Turkey were represented by collective bargaining agreements with the Petroleum, Chemical and Rubber Workers Union of Turkey (“PETROL-IS”). We are currently negotiating a collective bargaining agreement with PETROL-IS covering approximately 36 employees at another of our subsidiaries operating in Turkey. We consider our employee relations to be satisfactory.

Formation

We were incorporated under the laws of British Columbia, Canada on October 1, 1985 under the name Profco Resources Ltd. and continued to the jurisdiction of Alberta, Canada under the Business Corporations Act (Alberta) on June 10, 1997. Effective December 2, 1998, we changed our name to TransAtlantic Petroleum Corp. Effective October 1, 2009, we continued to the jurisdiction of Bermuda under the Bermuda Companies Act 1981 under the name TransAtlantic Petroleum Ltd.

Available Information

Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), are made available free of charge on our website at www.transatlanticpetroleum.com as soon as reasonably practicable after those reports and other information are electronically filed with or furnished to the SEC.

Executive Officers of the Registrant

The following table and text sets forth certain information with respect to the Company’s executive officers as of March 1, 2014:

| Name |

Age | Positions | ||||

| N. Malone Mitchell 3rd |

52 | Chairman and Chief Executive Officer | ||||

| Ian J. Delahunty |

34 | President | ||||

| Wil F. Saqueton |

44 | Vice President and Chief Financial Officer | ||||

| Jeffrey S. Mecom |

48 | Vice President, Legal and Corporate Secretary | ||||

N. Malone Mitchell 3rd has served as our chief executive officer since May 2011, as a director since April 2008 and as our chairman since May 2008. Since 2005, Mr. Mitchell has served as the president of Riata Corporate Group, LLC, a Dallas-based private oil and natural gas exploration and production company. From June to December 2006, Mr. Mitchell served as president and chief operating officer of SandRidge Energy, Inc. (formerly Riata Energy, Inc.), an independent oil and natural gas company concentrating in exploration, development and production activities. Until he sold his controlling interest in Riata Energy, Inc. in June 2006, Mr. Mitchell also served as president, chief executive officer and chairman of Riata Energy, Inc., which Mr. Mitchell founded in 1985 and built into one of the largest privately held energy companies in the United States.

Ian J. Delahunty has served as our president since January 2013. Mr. Delahunty served as our vice president, business development from February 2012 until his promotion to president. He joined us in October 2008 and has worked with our operations in Turkey, Romania and Morocco, serving as our vice president, engineering overseeing completions and workovers from November 2009 to January 2012. Prior to joining us, he worked as a senior engineer with Schlumberger N.V. in Vietnam and the United States and as a completions engineer with Occidental Petroleum Corp. in the United States.

11

Table of Contents

Wil F. Saqueton has served as the Company’s vice president and chief financial officer since August 2011. Mr. Saqueton previously served as the Company’s corporate controller from May 2011 until August 2011 and as a consultant to the Company from February 2011 until May 2011. Prior to joining the Company, Mr. Saqueton served as the vice president and chief financial officer of BCSW, LLC, the owner of Just Brakes in Dallas, Texas, from July 2006 to December 2010. From July 1995 until July 2006, he held a variety of positions at Intel Corporation, including strategic controller at the Chipset Group, operations controller at the Americas Sales and Marketing Organization Division, finance manager at the Intel Online Services, Inc. Division and senior financial analyst at the Chipset Group. Prior to 1995, Mr. Saqueton was a senior associate at Price Waterhouse, LP.

Jeffrey S. Mecom has served as the Company’s corporate secretary since May 2006 and as a vice president since May 2007. Before joining the Company in April 2006, Mr. Mecom was an attorney in private practice in Dallas. Mr. Mecom served as vice president, legal and corporate secretary with Aleris International, Inc., a former NYSE-listed international metals recycling and processing company, from 1995 until April 2005.

Risks Related to Our Business

We have a history of losses and may not achieve consistent profitability in the future.

We have incurred substantial losses in prior years. During 2013, we generated a net loss from continuing operations of $13.3 million. We will need to generate and sustain increased revenue levels in future periods in order to become consistently profitable, and even if we do, we may not be able to maintain or increase our level of profitability. We may incur losses in the future for a number of reasons, including risks described herein, unforeseen expenses, difficulties, complications and delays, and other unknown risks.

Our exploration, development and production activities may not be profitable or achieve our expected returns.

The future performance of our business will depend upon our ability to identify, acquire and develop additional oil and natural gas reserves that are economically recoverable. Success will depend upon our ability to acquire working and revenue interests in properties upon which oil and natural gas reserves are ultimately discovered in commercial quantities, and the ability to develop prospects that contain additional proven oil and natural gas reserves to the point of production. Without successful acquisition and exploration activities, we will not be able to develop additional oil and natural gas reserves or generate additional revenues. There are no assurances that additional oil and natural gas reserves will be identified or acquired on acceptable terms, or that oil and natural gas reserves will be discovered in sufficient quantities to enable us to recover our exploration and development costs or sustain our business.

The successful acquisition and development of oil and natural gas properties requires an assessment of recoverable reserves, future oil and natural gas prices and operating costs, potential environmental and other liabilities, and other factors. Such assessments are inherently uncertain. In addition, no assurance can be given that our exploration and development activities will result in the discovery of additional reserves. Operations may be curtailed, delayed or canceled as a result of lack of adequate capital and other factors, such as lack of availability of rigs and other equipment, title problems, weather, compliance with governmental regulations or price controls, mechanical difficulties, or unusual or unexpected formations, pressures and/or work interruptions. In addition, the costs of exploration and development may materially exceed our internal estimates.

Drilling for and producing oil and natural gas are high-risk activities with many uncertainties that could adversely affect our business, financial condition or results of operations.

Our future success depends on the success of our exploration, development and production activities in each of our prospects. These activities are subject to numerous risks beyond our control, including the risk that we will be unable to economically produce our reserves or be able to find commercially productive oil or natural gas

12

Table of Contents

reservoirs. Our decisions to purchase, explore, develop or otherwise exploit prospects or properties will depend in part on the evaluation of data obtained through geophysical and geological analyses, production data and engineering studies, the results of which are often inconclusive or subject to varying interpretations. The cost of drilling, completing and operating wells is often uncertain before drilling commences. Overruns in budgeted expenditures are common risks that can make a particular project unprofitable. Further, many factors may curtail, delay or prevent drilling operations, including:

| • | unexpected drilling conditions; |

| • | pressure or irregularities in geological formations; |

| • | equipment failures or accidents; |

| • | pipeline and processing interruptions or unavailability; |

| • | title problems; |

| • | adverse weather conditions; |

| • | lack of market demand for oil and natural gas; |

| • | delays imposed by, or resulting from, compliance with environmental laws and other regulatory requirements; |

| • | declines in oil and natural gas prices; and |

| • | shortages or delays in the availability of drilling rigs, equipment and qualified personnel. |

Our future drilling activities might not be successful, and drilling success rates overall or within a particular area could decline. We could incur losses by drilling unproductive wells. Shut-in wells, curtailed production and other production interruptions may materially adversely affect our business, financial condition and results of operations.

Shortages of drilling rigs, equipment, oilfield services and qualified personnel could delay our exploration and development activities and increase the prices we pay to obtain such drilling rigs, equipment, oilfield services and personnel.

Our industry is cyclical and, from time to time, there may be a shortage of drilling rigs, equipment, oilfield services and qualified personnel in the countries in which we operate. Shortages of drilling and workover rigs, pipe and other equipment may occur as demand for drilling rigs and equipment increases, along with increases in the number of wells being drilled. These factors can also cause significant increases in costs for equipment, oilfield services and qualified personnel. Higher oil and natural gas prices generally stimulate demand and result in increased prices for drilling and workover rigs, crews and associated supplies, equipment and services. It is beyond our control and ability to predict whether these conditions will exist in the future and, if so, what their timing and duration will be. These types of shortages or price increases could significantly increase our net loss, decrease our cash provided by operating activities, or restrict our ability to conduct the exploration and development activities we currently have planned and budgeted or which we may plan in the future. In addition, the availability of drilling rigs can vary significantly from region to region at any particular time. An undersupply of rigs in any of the regions where we operate may result in drilling delays and higher drilling costs for the rigs that are available in that region.

We depend on the services of our chairman and chief executive officer.

We depend on the performance of Mr. Mitchell, our chairman and chief executive officer. The loss of Mr. Mitchell could negatively impact our ability to execute our strategy. We do not maintain a key person life insurance policy on Mr. Mitchell.

13

Table of Contents

We have concentrated current production of oil in the Selmo oil field, the majority of which is sold to one customer.

During 2013, we derived 71.3% of our oil production from the Selmo oil field in southeastern Turkey. As a result of this concentration, we may be disproportionately exposed to the impact of regional supply and demand factors, delays or interruptions of production from wells in this area caused by governmental regulation, processing or transportation capacity constraints, market limitations, water shortages, litigation or interruption of the processing or transportation of oil, natural gas or natural gas liquids. In addition, we are currently in litigation with a group of villagers who live around the Selmo oil field and who claim ownership of a portion of the surface rights at Selmo.

In addition, TPAO, the national oil company of Turkey, and TUPRAS, a privately owned oil refinery in Turkey, purchase all of our oil production from the Selmo field. TUPRAS purchases the majority of our oil production from Selmo, representing 66.7% of our total revenues in 2013. If either of these companies fails to purchase our oil production, our results of operations could be materially and adversely affected.

We could lose permits or licenses on certain of our properties unless the permits or licenses are extended or we commence production and convert the permits or licenses to production leases or concessions.