Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2011

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-15395

MARTHA STEWART LIVING OMNIMEDIA, INC.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 52-2187059 | |

| (State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) | |

| 601 West 26th Street, New York, New York | 10001 | |

| (Address of Principal Executive Offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (212) 827-8000

Securities Registered Pursuant to Section 12(b) of the Act:

| Title of Each Class |

Name of Each Exchange on Which Registered | |

| Class A Common Stock, Par Value $0.01 Per Share | New York Stock Exchange |

Securities Registered Pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 of Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | þ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No þ

The aggregate market value of the voting stock held by non-affiliates of the registrant, computed by reference to the number of shares outstanding and using the price at which the stock was last sold on June 30, 2011, was $120,445,676.*

| * | Excludes 1,404,427 shares of our Class A Common Stock, and 25,984,625 shares of our Class B Common Stock, held by directors, officers and 10% stockholders, as of June 30, 2011. Exclusion of shares held by any person should not be construed to indicate that such person possesses the power, direct or indirect, to direct or cause the direction of the management or policies of the Company, or that such person controls, is controlled by or under common control with the Company. |

Number of Shares Outstanding As of March 2, 2012

40,842,451 shares of Class A Common Stock

25,984,625 shares of Class B Common Stock

Documents Incorporated by Reference.

Portions of Martha Stewart Living Omnimedia, Inc.’s Proxy Statement for

Its 2012 Annual Meeting of Stockholders are Incorporated

by Reference into Part III of This Report.

Table of Contents

| PART I |

||||

| 5 | ||||

| 5 | ||||

| 5 | ||||

| 6 | ||||

| 9 | ||||

| 10 | ||||

| 12 | ||||

| 13 | ||||

| 13 | ||||

| 19 | ||||

| 20 | ||||

| 20 | ||||

| 20 | ||||

| PART II |

||||

| 21 | ||||

| 23 | ||||

| Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations |

25 | |||

| Item 7A. Quantitative and Qualitative Disclosure About Market Risk |

42 | |||

| 43 | ||||

| Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

43 | |||

| 43 | ||||

| 45 | ||||

| PART III |

||||

| Item 10. Directors, Executive Officers and Corporate Governance |

46 | |||

| 46 | ||||

| 46 | ||||

| Item 13. Certain Relationships and Related Transactions, and Director Independence |

47 | |||

| 47 | ||||

| PART IV |

||||

| 48 | ||||

| 54 | ||||

2

Table of Contents

| F-1 | ||||

| F-2 | ||||

| Consolidated Statements of Operations for the years ended December 31, 2011, 2010 and 2009 |

F-3 | |||

| F-4 | ||||

| F-5 | ||||

| Consolidated Statements of Cash Flows for the years ended December 31, 2011, 2010 and 2009 |

F-6 | |||

| F-7 | ||||

| F-34 | ||||

| Exhibit Index |

||||

3

Table of Contents

In this Annual Report on Form 10-K, the terms “we,” “us,” “our,” “MSO” and the “Company” refer to Martha Stewart Living Omnimedia, Inc. and, unless the context requires otherwise, Martha Stewart Living Omnimedia LLC (“MSLO LLC”), the legal entity that, prior to October 22, 1999, operated many of the businesses we now operate, and their respective subsidiaries.

FORWARD-LOOKING STATEMENTS

All statements in this Annual Report on Form 10-K, except to the extent describing historical facts, are “forward-looking statements,” as that term is defined in the Private Securities Litigation Reform Act of 1995. These forward-looking statements represent our current beliefs regarding future events, many of which, by their nature, are inherently uncertain and outside of our control. These statements often can be identified by terminology such as “may,” “will,” “should,” “could,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “potential” or “continue” or the negative of these terms or other comparable terminology. Our actual results may differ materially from those projected in these statements, and factors that could cause such differences include those factors discussed in “Risk Factors” in Item 1A of this Annual Report on Form 10-K and those discussed in the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Item 7, as well as other factors. Forward-looking statements herein speak only as of the date of filing of this Annual Report on Form 10-K. We undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise. You are advised, however, to consult any further disclosures we make on related subjects in the reports we file with the Securities and Exchange Commission (the “SEC”).

4

Table of Contents

PART I

We are an integrated media and merchandising company providing consumers with inspiring lifestyle content and well-designed, high-quality products. We are organized into three business segments: Publishing and Broadcasting, our two media segments, and Merchandising. This combination enables us to cross-promote our content and products.

Our strategy to generate growth and profitability includes the following imperatives:

| • | Grow our merchandising business by leveraging our brand equity to expand the distribution of product in existing categories, diversify into new categories and distribution channels, and negotiate new partnerships that fully reward us for the value of our brands and our active role in product development and design; |

| • | Strengthen our media business by creating a brand-centric advertising sales force and by using our content across existing and new distribution channels; and |

| • | Expand our media presence and pursuing merchandising opportunities internationally. |

The media and merchandise we create generally encompasses the following core areas:

| • | Cooking and Entertaining |

| • | Holiday and Celebrations |

| • | Crafts |

| • | Home |

| • | Whole Living (healthy living and sustainable practices) |

| • | Weddings |

| • | Organizing |

| • | Gardening |

| • | Pets (grooming, apparel, feeding and health) |

As of March 1, 2012, we had approximately 582 employees. Our designed and branded products are available in thousands of retail outlets across the country including The Home Depot, Macy’s, Petsmart and, effective in the first quarter of 2012, in many Staples stores.

Our revenues from foreign sources were $9.8 million, $6.5 million and $10.8 million in 2011, 2010 and 2009, respectively, which was largely comprised of international sales of television content. In the future, we plan to grow international revenues from other areas of our business. Substantially all of our assets are located within the United States.

Martha Stewart published her first book, Entertaining, in 1982. Over the next eight years she became a well-known authority on the domestic arts, authoring eight more books on a variety of our core content areas. In 1990, Time Publishing Ventures, Inc. (“TPV”), a subsidiary of Time Inc., launched Martha Stewart Living magazine with Ms. Stewart serving as its editor-in-chief. In 1993, TPV began producing a weekly television program, Living, hosted by Ms. Stewart. In 1995, TPV launched a mail-order catalog, Martha by Mail, which made available products featured in, or developed in connection with, the magazine and television program. In late 1996 and early 1997, a series of transactions occurred resulting in MSLO LLC acquiring substantially all Martha Stewart-related businesses. Ms. Stewart was the majority owner of MSLO LLC; TPV retained a small equity interest in the business. On October 22, 1999, MSLO LLC merged into MSO, then a wholly owned subsidiary of MSLO LLC. Immediately following the merger, we consummated an initial public offering.

5

Table of Contents

BUSINESS SEGMENTS

Our three business segments are described below. Additional financial information relating to these segments may be found in Note 14, Industry Segments, in the Notes to Consolidated Financial Statements of this Annual Report on Form 10-K, which information is incorporated herein by reference.

In 2011, our Publishing segment accounted for 64% of our total revenues, consisting of operations related to magazine and book publishing and digital distribution, principally through our website, marthastewart.com. Revenues from magazine and digital advertising represented approximately 65% of the segment’s revenues in 2011, while circulation revenues represented approximately 33% of the segment’s revenues.

Magazines

Martha Stewart Living. Our flagship magazine, Martha Stewart Living, is the foundation of our publishing business. Launched in 1990 as a quarterly publication with a circulation of 250,000, we currently publish Martha Stewart Living on a monthly basis with a rate base of 2.05 million. The magazine appeals primarily to the college-educated woman between the ages of 25 and 54 who owns her principal residence. Martha Stewart Living offers lifestyle ideas and original how-to information in a highly visual, upscale editorial environment. The magazine has won numerous prestigious industry awards and is the leading publication for the Martha Stewart brand. Martha Stewart Living generates a majority of our magazine revenues, largely from advertising and circulation revenues.

Martha Stewart Weddings. We launched Martha Stewart Weddings in 1994, originally as an annual publication. In 1997, it went to semi-annual publication and became a quarterly in 1999. Martha Stewart Weddings targets the upscale bride and serves as an important vehicle for introducing young women to our brands. Martha Stewart Weddings is distributed primarily through newsstands.

Everyday Food. We launched Everyday Food in September 2003 after publishing four test issues. This digest-sized magazine, now published ten times per year, targets women ages 25 to 49 and is intended to broaden our consumer audience. Everyday Food features quick, easy recipes for the everyday cook, along with seasonal menus, cooking instructions, suggestions for healthy, “smart” eating and money saving shopping tips.

Whole Living. In August 2004, we acquired certain assets and liabilities of Body + Soul magazine and Dr. Andrew Weil’s Self Healing newsletter (“Body & Soul Group”), publications featuring “natural living” content. In 2010, we discontinued our relationship with Dr. Andrew Weil and no longer publish Dr. Andrew Weil’s Self Healing newsletter or any Dr. Weil special interest publications. Effective with the June 2010 issue, we changed the name of Body + Soul/Whole Living magazine to Whole Living in an attempt to more effectively integrate the magazine with our corresponding website, wholeliving.com, and to broaden the editorial coverage of the magazine, which we believe may provide opportunities to increase consumer and advertising demand.

Magazine Summary

Certain information related to our subscription magazines is as follows:

| Title |

2009 Rate Base * |

2010 Rate Base * |

2011 Rate Base * |

2012 Rate Base * |

Frequency | |||||||||||||||

| Martha Stewart Living |

2,025,000 | 2,025,000 | 2,050,000 | 2,050,000 | 12 | |||||||||||||||

| Martha Stewart Weddings |

N/A | *** | N/A | *** | N/A | *** | N/A | *** | 4 | ** | ||||||||||

| Everyday Food |

1,000,000 | 1,000,000 | 1,025,000 | 1,025,000 | 10 | |||||||||||||||

| Whole Living |

600,000 | 650,000 | 700,000 | 750,000 | 10 | |||||||||||||||

| * | Rate base increases are effective with the January issues which typically are on sale in December of the prior fiscal year. |

6

Table of Contents

| ** | In addition, we anticipate producing two special issues of Martha Stewart Weddings in 2012, as compared to the one special issue of Martha Stewart Weddings we produced in each of 2011, 2010 and 2009. |

| *** | Does not have a stated rate base. |

Special Interest Publications. In addition to our periodic magazines, we occasionally publish special interest magazine editions. Our special interest publications provide in-depth advice and ideas around a particular topic in one of our core content areas, allowing us to leverage our distribution network to generate additional revenues. Our special interest publications are sold at newsstands and may include advertising. In 2011, we published Martha Stewart Living Halloween Flights of Fancy Special, Martha Stewart Holiday Handbook, a full-sized Everyday Food special, and Martha Stewart Weddings—Destination Weddings and Dream Honeymoons.

Magazine Production, Distribution and Fulfillment. We print most of our domestic magazines under agreements with R. R. Donnelly and currently purchase paper through an agreement with Time Inc. In November 2011, we signed a new printing services agreement with R.R. Donnelly, extending the term through 2017 in exchange for rate concessions from the prior agreement. As paper prices decreased in 2009 and 2010 because of lower market demand, many paper mills consolidated operations in response to the declining paper demand. As a result of those actions, paper prices increased in 2011. Based on recent information from our paper supplier, we expect paper pricing to decline slightly in the first half of 2012 and increase in the second half of 2012. However, we expect our costs for magazine distribution to be lower in 2012 due to fewer pages in our magazines and lower print orders, as part of our circulation is increasingly distributed through digital editions, partially offset by one additional Martha Stewart Weddings special and increased postage unit costs. We use no other significant raw materials in our businesses. Newsstand distribution of the magazines is handled by Time Warner Retail Sales and Marketing, an affiliate of Time Inc., under an agreement that expires in June 2014. Subscription fulfillment services also for our magazines are provided by Time Customer Service, another affiliate of Time Inc., under an agreement that expires in June 2014.

Books

During 2007, we announced a multi-year agreement with Clarkson Potter/Publishers to publish ten Martha Stewart branded books. Subsequent amendments ultimately increased the number of books to be delivered to 17, all of which had been delivered and accepted as of December 31, 2011. Three books were published in 2011 under this agreement: Pies & Tarts, Entertaining and Handmade Holiday Crafts. In 2011, we negotiated a new multi-year, multi-book agreement with Clarkson Potter/Publishers to continue providing Martha Stewart branded books in the future.

In August 2008, we announced a multi-year agreement with Harper Studio to publish ten Emeril Lagasse branded books, of which four had been delivered and accepted through December 31, 2011. Sizzling Skillets was published under this agreement in 2011.

Through our efforts in the books business and the rights we acquired related to Emeril’s book backlist, we now have a library of approximately 92 published books.

Digital Properties

marthastewart.com

The marthastewart.com website is the flagship of our digital properties, offering a vast quantity of continually updated articles and recipes developed from several Martha Stewart brands, including our magazine properties. Since the website’s re-launch in 2007 as a content-focused, advertising-driven media website, marthastewart.com has received many industry awards. The website provides engaging experiences in several lifestyle categories: food, entertaining, holidays, home and garden, crafts and pets. The website also serves as a gateway to our other properties, including wholeliving.com and marthastewartweddings.com. In 2011, we

7

Table of Contents

invested in a re-platforming of our website that allows for additional functionality in 2012 and beyond. The enhancements to the website are expected to improve user engagement and expand our advertising inventory which, in combination, is expected to drive growth in our audience and revenues. In 2011, marthastewart.com averaged 3.6 million monthly unique visitors, a 25% increase over 2010, and 67 million monthly pageviews, a 5% increase over 2010.

marthastewartweddings.com

In 2008, we launched marthastewartweddings.com to guide brides-to-be through the process of planning and designing of their weddings, with a strong emphasis on identifying and developing each bride’s personalized wedding style. The site continues to grow in traffic and audience attention, averaging around 0.5 million monthly unique viewers in 2011, a 33% increase over 2010, and around 15 million monthly average pageviews, a 30% increase over 2010.

wholeliving.com

In 2008, we also launched wholeliving.com, a website designed to help women achieve their goals for living better lives, with a focus on wellness and beauty, healthy recipes, green living, fitness, and personal happiness. In 2010, unique visitors to wholeliving.com doubled due to improvements in branding, product and programming, as well as due to an increase in popularity of this lifestyle category overall. While unique viewers decreased 4% in 2011 compared to 2010, monthly average page views increased 17% to around 4 million and total visits increased to over 1 million average monthly visits, a 53% increase over 2010.

Digital Products

In 2011, we developed five digital apps that were available for download through Apple iTunes. We launched iPad apps of Martha Stewart Living and Everyday Food, which are enhanced digital versions of those titles for the iPad, and which are also available on other tablets. The three other iPad apps that launched were Egg Dyeing 101, Cocktails and Smoothies, along with add-ons and updates of our existing apps.

Digital Editions are available for all of our publications. In addition to the iPad versions of Martha Stewart Living and Everyday Food, we also have digital versions of these titles, along with Martha Stewart Weddings and Whole Living, available through the Color Nook, Kindle Fire and through the Zinio platform. Digital editions account for approximately 3% percent of all our circulation.

Competition

Publishing is a highly competitive business. Our magazines, books and digital apps compete not only with other magazines, books and digital apps, but also with other mass media, websites and many other types of leisure-time activities. Competition for advertising dollars in magazine operations is primarily based on advertising rates, as well as editorial and aesthetic quality, the desirability of the magazine’s demographic, reader response to advertisers’ products and services and the effectiveness of the advertising sales staff. Martha Stewart Living competes for readers and advertising dollars with women’s service, decorating, cooking and lifestyle magazines and websites. Everyday Food competes for readers and advertising dollars with women’s service and cooking magazines and websites. Martha Stewart Weddings competes for readers and advertising dollars primarily with wedding service magazines and websites. Whole Living competes for readers and advertising dollars primarily with women’s lifestyle, health, fitness, and natural living magazines and websites. Our special interest publications can compete with a variety of magazines depending on the focus of the particular issue. Capturing advertising sales for our digital properties is highly competitive as well. marthastewart.com competes with other how-to, food and lifestyle websites. Our challenge is to attract and retain users through an easy-to-use and content-relevant website. Competition for digital advertising rates is based on the number of unique users we attract each month, the demographic profile of that audience and the number of pages they view on our site.

8

Table of Contents

Seasonality

Our Publishing segment can experience fluctuations in quarterly performance due to variations in the publication schedule from year to year, timing of direct mail expenses, delivery and acceptance of books under our long-term book contracts and variability of audience and traffic on marthastewart.com, as well as other seasonal factors. Not all of our magazines are published on a regularly scheduled basis throughout the year. Additionally, the publication schedule for our special interest publications can vary and lead to quarterly fluctuations in the Publishing segment’s results. Advertising revenue in our magazines and on marthastewart.com is typically highest in the fourth quarter of the year due to higher consumer demand for our holiday content, and corresponding higher advertiser demand to reach our audience with their marketing messages.

Our Broadcasting business segment accounted for 14% of our total revenues in 2011. The segment consists of operations relating to the production of television programming, the domestic and international distribution of our library of programming in existing and repurposed formats, revenue derived from the provision of talent services, and the operations of our satellite radio channel. We generally own the copyrights in the programs we produce for television and radio distribution.

The Martha Stewart Show launched in September 2005 as a syndicated daily lifestyle series hosted by Martha Stewart. The Martha Stewart Show generates the majority of the Broadcasting segment’s revenue. Filmed in front of a studio audience, the Emmy™ Award-winning show consists of several segments within each episode, featuring inspiring ideas and new projects from one or several of our core content areas. NBC Universal Domestic Television Distribution distributed the program domestically through season 5, which ended in September 2010.

In 2010, we partnered with Hallmark Channel, a cable television network owned and operated by Crown Media Holdings, Inc., to exclusively televise original episodes of the The Martha Stewart Show. Season 6 of The Martha Stewart Show began airing on Hallmark Channel in September 2010. The Martha Stewart Show, in its current format with a live audience, is expected to conclude on Hallmark Channel with the completion of season 7 in September 2012. As part of our overall Hallmark Channel agreement, we also agreed to develop a range of new and original series and prime time specials, which included Mad Hungry with Lucinda Scala Quinn, Martha Bakes and Petkeeping with Marc Morrone. We own the television content we produce for Hallmark Channel and we have the right in the future to further monetize these assets. Revenues for The Martha Stewart Show on Hallmark Channel are mostly comprised of advertising, product integration and international licensing revenues. Revenues for the companion programs on Hallmark Channel generally consist of licensing revenue.

Emeril Lagasse also provides various television services for us. In 2011, Emeril Lagasse hosted The Originals on the Cooking Channel, as well as Emeril’s Table, which aired on Hallmark Channel.

The Martha Stewart Living Radio channel launched on Sirius Satellite Radio, now known as Sirius XM Radio, in November 2005 providing programming 24 hours a day, seven days a week, of which 65 hours each week was original programming created by our experts. In November 2011, we renewed our agreement with Sirius XM Radio for a one-year term ending December 31, 2012 at a reduced license fee, along with a reduction of original programming to approximately 40 hours each week.

Competition

Broadcasting is a highly competitive business. Overall competitive factors in this segment include programming content, quality and distribution as well as the demographic appeal of the programming. Competition for television and radio advertising dollars is based primarily on advertising rates, audience size and

9

Table of Contents

demographic composition, viewer response to advertisers’ products and services and the effectiveness of the advertising sales staffs. Our television programs compete directly for viewers, distribution and/or advertising dollars with other lifestyle and how-to television programs, as well as with general programming on other television stations and all other competing forms of media. Our radio programs compete for listeners with similarly themed programming on both satellite and terrestrial radio.

Seasonality

Our Broadcasting segment can experience fluctuations in quarterly performance due to, among other things, seasonal advertising patterns, seasonal influences on people’s viewing habits and audience increases for our programming during holiday seasons. Because television seasons run 12 months beginning and ending in the middle of September, the 2011 results include a large portion of season 6 of The Martha Stewart Show and the first 14 weeks of season 7 of The Martha Stewart Show on Hallmark Channel. While repeat episodes air over the summer, original episodes usually run September to May and typically generate higher ratings and revenues.

Our Merchandising segment contributed 22% of our total revenues in 2011. The segment consists of operations related to the design of merchandise and related packaging, promotional and advertising materials, and the licensing of various proprietary trademarks, in connection with retail programs conducted through a number of retailers and manufacturers. Pursuant to agreements with our retail and manufacturing partners, we are typically responsible for the design of all merchandise and/or related packaging, signage, advertising and promotional materials. Our retail partners source the products through a manufacturer base and are mostly responsible for the promotion of the product. Our manufacturing partners source and/or produce the branded products sometimes together with other lines they make or sell. Our licensing agreements do not require us to maintain any inventory nor incur any significant expenses other than employee compensation. We own all trademarks for each of our branded merchandising programs and generally retain all intellectual property rights related to the designs of the merchandise, packaging, signage and collateral materials developed for the various programs.

Select Licensed Retail Partnerships

Martha Stewart Living at The Home Depot

In 2010, we launched the Martha Stewart Living program at The Home Depot, which is currently available at all of The Home Depot’s 1,978 stores in the United States and all of the 180 The Home Depot stores in Canada, as well as on homedepot.com and Home Decorators Collection catalog business. The Martha Stewart Living program at The Home Depot encompasses a broad range of home décor, paint, storage and organization products, outdoor furniture, window treatments, kitchen and bathroom cabinetry, countertops, carpet and seasonal holiday decor. On February 29, 2012, we announced the extension of our agreement with The Home Depot through March 2016 and plan to offer an expanded array of Martha Stewart Living branded products.

Martha Stewart Collection at Macy’s

In September 2007, we introduced the Martha Stewart Collection at Macy’s. It is currently available at the nearly 650 Macy’s stores in the United States that offer home products, as well on macys.com. The Martha Stewart Collection line encompasses a broad range of home goods, including bed and bath textiles, housewares, food preparation and other kitchen items, tabletop, holiday decorating and trim-a-tree items.

J.C. Penney

In December 2011, we announced a strategic alliance with J.C. Penney Corporation, Inc. (“J. C. Penney”) and our plans to launch distinct Martha Stewart retail stores inside at least 600 of J.C. Penney’s department stores

10

Table of Contents

and to jointly develop an e-commerce site pursuant to a 10-year license agreement. For information regarding J.C. Penney’s investment in our company, see Note 8, Shareholders’ Equity, in the Notes to Consolidated Financial Statements of this Annual Report on Form 10-K. These Martha Stewart stores are intended to be destinations where consumers can experience an engaging and inspiring environment and buy a variety of affordable, high-quality home and lifestyle merchandise. We expect to launch both the Martha Stewart stores and the Martha Stewart-branded e-commerce site in early 2013.

Select Licensed Martha Stewart Manufacturing Partnerships

Martha Stewart Crafts

In May 2007, we launched Martha Stewart Crafts, a paper-based crafting program with our manufacturing partner, Wilton Properties Inc. (formerly UCG Paper Crafts Properties Inc. and EK Success), at Michaels stores in the United States. The program consists of tools, embellishments, paper/albums, and other seasonal products. Distribution for this program has expanded to include multiple specialty and independent craft chains in the United States and internationally.

In 2011, we further expanded our Martha Stewart Crafts portfolio by introducing a line of craft paints with Plaid Enterprises and a line of yarns and looms with Orchard Yarn and Thread, Inc. (d/b/a Lion Brand Yarn).

Martha Stewart Pets with Age Group

In July 2010, we launched the Martha Stewart Pets line, developed in partnership with Age Group Ltd and sold currently at Petsmart stores. The program consists of a wide range of pet accessories, including apparel, collars, leashes, bedding, grooming supplies and toys.

KB Home / Martha Stewart Homes

We have had a partnership with KB Home for the development of Martha Stewart Homes since 2005. The KB Home communities created with Martha Stewart feature homes with unique exterior and interior details that are inspired by Martha Stewart’s own homes. The Martha Stewart Homes are currently available at multiple communities in California, Colorado, North Carolina and Florida. We also offer a range of design options, featured exclusively at KB Home Studios nationwide.

Martha Stewart Home Office with Avery

In December 2011, shipment of products for Martha Stewart Home Office with Avery began, in preparation for the launch of the line in February 2012. The Martha Stewart Home Office line is sold currently at Staples and on Staples.com. The line encompasses a range of home office products, including surface organization, journals, portable filing and pantry organization.

Select Licensed Emeril Lagasse Manufacturing Partnerships

We acquired certain licensing agreements in connection with our April 2008 acquisition of specific Emeril Lagasse assets and have entered into new licensing agreements following the acquisition. These licensing agreements are primarily associated with partnerships with various food and kitchen preparation manufacturers that produce products under the Emeril Lagasse brand.

Emerilware by All-Clad

Introduced in August 2000, Emerilware by All-Clad consists of lines of high-quality, gourmet cookware and barbeque tools available at department stores and specialty retail outlets across the United States, as well as through the Home Shopping Network.

11

Table of Contents

Emerilware by T-Fal

Launched in November 2006, Emerilware by T-FAL is a line of small kitchen appliances available at department stores and specialty retail outlets across the United States, as well as through the Home Shopping Network.

Emeril’s Original with B&G Foods

In September 2000, Emeril Lagasse introduced with B&G Foods, Emeril’s Original, a signature line of seasonings, salad dressings, basting sauces and marinades, mustards, salsas, pasta sauces, pepper sauces, spice rubs, cooking sprays and stocks available at supermarkets and specialty markets across the United States, as well as through the Home Shopping Network.

Emeril’s Gourmet Coffee with Timothy’s World Coffee

Launched in September 2007, Emeril’s Gourmet Coffee with Timothy’s World Coffee is a single-cup coffee program comprised of flavored coffees inspired by Emeril Lagasse. The program is available in department and specialty stores nationwide, as well as in certain national hotel chains.

Other Emeril Manufacturing Partnerships

In 2010, we introduced a variety of new partnerships, including Emerilware Cutlery with SED International Inc. (formerly Lehrhoff ABL Inc.), which is a branded cutlery collection that includes knives and cutting boards. The line was launched on the Home Shopping Network in November. We also introduced Emeril’s Red Marble Steaks with Allen Brothers which is a line of hand-selected, aged steaks. The line, launched in the spring of 2010, is available through catalog, online and the Home Shopping Network.

Competition

The retail business is highly competitive and the principal competition for all of our merchandising lines consists of mass-market and department stores that compete with the mass-market, home improvement and department stores in which our Merchandising segment products are sold. Our merchandising lines also compete within the mass-market, home improvement and department stores that carry our product lines with other products offered by these stores in the respective product categories. Competitive factors include numbers and locations of stores, brand awareness and price. We also compete with the internet businesses of these stores and other websites that sell similar retail goods.

Seasonality

Revenues from the Merchandising segment can vary significantly from quarter to quarter due to new product launches and the seasonality of many product lines.

We use multiple trademarks to distinguish our various publications and brands, including Martha Stewart Living (the name of our flagship publication as well as the trademark for products sold at Home Depot), Martha Stewart Collection (for goods sold at Macy’s), Martha Stewart Crafts, Martha Stewart Weddings, Everyday Food, Whole Living, Mad Hungry and Emeril. These and numerous other trademarks are the subject of registrations and pending applications filed by us for use with a variety of products and other content, both domestically and internationally, and we continue to expand our worldwide usage and registration of related trademarks. We also register, both offensively and defensively, key domain names containing our trademarks, such as www.marthastewart.com, www.marthastewartweddings.com, www.wholeliving.com, www.emerils.com and www.everydayfood.com.

12

Table of Contents

We regularly file copyrights regarding our proprietary designs and editorial content. We have also applied for, and in some instances are now the owners of, domestic and international design and utility patents covering certain of our Martha Stewart Crafts paper punches.

We regard our rights in and to our trademarks, our proprietary designs and editorial content as valuable assets in the marketing of our products. Accordingly, we vigorously police and protect our trademarks against infringement and denigration by third parties. We also work with our licensees to assure that our trademarks are used properly. We own and license the perpetual rights to the “Martha Stewart” portion of our marks pursuant to an agreement between us and Ms. Stewart, the description of which is incorporated by reference into Item 13 of this Annual Report on Form 10-K.

Our flagship website can be found on the Internet at www.marthastewart.com. Our proxy statements, Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K and any amendments to these documents, as well as certain other forms we file with or furnish to the SEC, can be viewed and downloaded free of charge as soon as reasonably practicable after they have been filed with the SEC by accessing www.marthastewart.com and clicking on Investor Relations and SEC Filings. Please note that information on, or that can be accessed through, our website is not deemed “filed” with the SEC and is not incorporated by reference into any of our filings under the Securities Act of 1933, as amended (the “Securities Act”), or the Securities Exchange Act of 1934, as amended (the “Exchange Act”), irrespective of any general incorporation language contained in such filing.

A wide range of factors could materially affect our performance. Like other companies, we are susceptible to macroeconomic changes that may affect the general economic climate and our performance, the performance of those with whom we do business, and the appetite of consumers for products and publications. Similarly, the price of our stock is impacted by general equity market conditions, the relative attractiveness of our market sector, differences in results of operations from estimates and projections, and other factors beyond our control. In addition to the factors affecting specific business operations identified in connection with the description of those operations and the financial results of those operations elsewhere in this report, the factors listed below could adversely affect our operations. Although the risk factors listed below are the risk factors that Company management considers significant, material risk factors that are not presently known to Company management may also adversely affect our operations.

Our success depends in part on the popularity of our brands and the reputation and popularity of Martha Stewart, our Founder, and Emeril Lagasse. Any adverse reactions to publicity relating to Ms. Stewart or Mr. Lagasse, or the loss of either of their services, could adversely affect our revenues, results of operations and our ability to maintain or generate a consumer base.

While we believe there has been significant consumer acceptance for our products as stand-alone brands, the image, reputation, popularity and talent of Martha Stewart and Emeril Lagasse remain important factors.

Ms. Stewart’s efforts, personality and leadership, including her services as an officer and director of MSLO, have been, and continue to be, critical to our success. While we have managed our business without her daily participation at times in the past, the repeated diminution or loss of her services due to disability, death or some other cause, or any repeated or sustained shifts in public or industry perceptions of her, could have a material adverse effect on our business. Ms. Stewart’s current employment agreement ends March 31, 2012. We expect to enter into an extension of Ms. Stewart’s employment agreement prior to its expiration.

13

Table of Contents

In addition, in 2008 we acquired the assets relating to Emeril Lagasse’s businesses other than his restaurants and foundation. The value of these assets is largely related to the ongoing popularity and participation of Mr. Lagasse in the activities related to exploiting these assets. Therefore, the continued value of these assets could be materially adversely affected if Mr. Lagasse were to lose popularity with the public or be unable to participate in our business, forcing us potentially to write-down a significant amount of the value we paid for these assets.

A loss of the services of other key personnel could have a material adverse effect on our business.

Our continued success depends to a large degree upon our ability to attract and retain key management executives, as well as upon a number of members of creative, technology, and sales and marketing staffs. The loss of some of our key executives or key members of our operating staff, or an inability to attract or retain other key individuals, could materially adversely affect us.

Failure of the economy to sustain a recovery or difficulties in the financial markets could significantly impact our business, financial condition, results of operations and cash flows, and could adversely affect the value of our assets or hamper our ability to raise additional funds.

The economy experienced extreme disruption during each of the three years in the period ended December 31, 2011, including extreme volatility in securities prices, severely diminished liquidity and a drastic reduction in credit availability. These events led to increased unemployment, a downturn in the housing market, declines in consumer confidence and declines in personal income and consumer spending, particularly discretionary spending. These adverse consumer trends led to reduced spending on general merchandise, homes and home improvement projects—categories in which we license our brands—resulting in weaker revenues from our licensed products in our Merchandising business.

This economic downturn also resulted in extraordinary and unprecedented uncertainty and instability for many companies, across all industries, and severely impacted many of the companies with which we do business. We depend on advertising revenue in our Publishing and Broadcasting businesses. We cannot control how much or where companies choose to advertise. Since 2009, we have seen a significant downturn in advertising dollars generally in the marketplace, and more competition for the reduced dollars. During the course of the advertising recession, we experienced a decline in advertising revenues, and a permanent reversal of that trend is not assured. If advertisers continue to spend less money, or if they advertise elsewhere in lieu of our magazines, websites or television programming, our business and revenues will be materially adversely affected. Furthermore, if our licensees experience financial hardship, they may be unwilling or unable to pay us royalties or continue selling our products, regardless of their contractual obligations. We cannot predict the future health and viability of the companies with which we do business and upon which we depend for royalty revenues, advertising dollars and credit.

Although economic conditions have stabilized and shown some indications of improvement, it is difficult to judge the scope and sustainability of any general economic recovery. This makes it difficult for us to forecast consumer and product demand trends and companies’ willingness to spend money to advertise in our media properties. While consumer spending and confidence have improved, consumer spending remains constrained. Unemployment remains and is expected to remain at high levels and the housing market remains weak and may in fact further deteriorate. If consumer confidence, consumer spending and the housing market do not rebound and/or if the companies with which we do business experience ongoing problems, our revenues may not grow as planned. An extended period of reduced cash flows could increase our need for credit at a time when such credit may not be available. Because of residual uncertainties regarding the economy, our operating results will be difficult to predict, and prior results will not necessarily be indicative of results to be expected in future periods.

In addition, we have significant goodwill, intangible and other assets recorded on our balance sheet. We evaluate the recoverability of the carrying amount of our goodwill, intangible and other assets on an ongoing

14

Table of Contents

basis, and we may in the future incur substantial impairment charges, which would adversely affect our financial results. Impairment assessment inherently involves the exercise of judgment in determining assumptions about expected future cash flows and the impact of market conditions on those assumptions. Although we believe the assumptions we have used in testing for impairment are reasonable, significant changes in any one of our assumptions could produce a significantly different result. Future events and changing market conditions may prove our assumptions to be wrong with respect to prices, costs, holding periods or other factors. Differing results may amplify impairment charges in the future.

Acquiring or developing additional brands or businesses poses inherent financial and other risks and challenges and may result in losses.

If we were to acquire or create a new brand, or expand an existing brand, we may be required to increase expenditures to accelerate the development process with the goal of achieving longer-term cost savings and improved profitability. Brand developments may increase expenses if we hire additional personnel to manage our growth. These investments also would require significant time commitments from our senior management and place a strain on their ability to manage our existing businesses.

We continue to evaluate the acquisition of other businesses. These transactions involve challenges and risks in negotiation, execution, valuation, and integration. Moreover, competition for certain types of acquisitions is significant, particularly in the field of interactive media. Even if successfully negotiated, closed, and integrated, an acquisition may not advance our business strategy and may result in losses.

We are expanding our merchandising and licensing programs into new areas and products, the failure of any of which could diminish the perceived value of our brand, impair our ability to grow and adversely affect our prospects.

Our growth depends to a significant degree upon our ability to develop new or expand existing retail merchandising programs. We have entered into several new merchandising and licensing agreements in the past few years. Some of these agreements are exclusive and have a duration of many years. While we require that our licensees maintain the quality of our respective brands through specific contractual provisions, we cannot be certain that our licensees, or their manufacturers and distributors, will honor their contractual obligations or that they will not take other actions that will diminish the value of our brands.

There is also a risk that our extension into new business areas will meet with disapproval from consumers. We cannot guarantee that these programs will be fully implemented, or if implemented, that they will be successful. If the licensing or merchandising programs do not succeed, we may be prohibited from seeking different channels for our products due to the exclusive nature and multi-year terms of these agreements. Disputes with new or existing licensees may arise that could hinder our ability to grow or expand our product lines. Disputes also could prevent or delay our ability to collect the licensing revenue that we expect in connection with these products. If such developments occur or our merchandising programs are otherwise not successful, the value and recognition of our brands, as well as our business, financial condition and prospects, could be materially adversely affected.

For example, a dispute with a current licensee is a lawsuit filed on January 23, 2012, against us in the Supreme Court of the State of New York, County of New York titled Macy’s, Inc. and Macy’s Merchandising Group, Inc. v. Martha Stewart Living Omnimedia, Inc. In this lawsuit, Macy’s Inc. and Macy’s Merchandising Group, Inc. (together, the “Macy’s plaintiffs”) claim that our planned activities under the agreement governing our strategic alliance with J.C. Penney Corporation, Inc. materially breach the agreement between us and Macy’s Merchandising Group, Inc. dated April 3, 2006 (the “Macy’s Agreement”). The Macy’s plaintiffs seek a declaratory judgment, preliminary and permanent injunctive relief, and incidental and other damages. The Macy’s plaintiffs initially filed a motion for a preliminary injunction and subsequently withdrew the motion without prejudice. On February 10, 2012, the Company filed an answer to the Macy’s plaintiffs’ original

15

Table of Contents

complaint and asserted three counterclaims against the Macy’s plaintiffs, alleging that Macy’s, Inc. and Macy’s Merchandising Group, Inc. had breached the Macy’s Agreement by, among other things, failing to maximize net sales. The Macy’s plaintiffs have denied the allegations of the counterclaims. If the Macy’s plaintiffs are successful and we are enjoined, some of the future benefits we anticipate receiving from our relationship with J. C. Penney could be reduced.

If adverse trends develop in the television production business generally, or if we were unable to sustain a television presence, our business could be adversely affected.

Television revenues may be affected by a number of other factors, most of which are not within our control. These factors include a general decline in daytime television viewers, pricing pressure in the television advertising marketplace, the strength of the channel on which our programming is carried, general economic conditions, increases in production costs, availability of other forms of entertainment and leisure time activities and other factors. Any or all of these factors may quickly change, and these changes cannot be predicted with certainty. There has been a reduction in advertising dollars generally available and more competition for the reduced dollars across more media platforms.

The Martha Stewart Show has experienced a decline in ratings in 2011 compared to 2010 that reflect the general decline in daytime cable television viewers. If ratings for the show were to further decline, it would adversely affect our Broadcasting advertising revenues.

In addition, if we are unsuccessful in creating replacement programming for The Martha Stewart Show, which is expected to only air through September 2012, or if visibility of Ms. Stewart on different television programming formats is diminished, Broadcasting segment revenues will be severely reduced. Publishing segment advertising revenues could be negatively impacted, as well as opportunities for multi-platform advertising sales.

We have also produced television shows featuring Emeril Lagasse. Emeril’s failure to maintain or build popularity could negatively impact his marketing platform and his products, as well as the loss of anticipated revenue and profits from his television shows.

We have placed emphasis on building an advertising-revenue-based website, dependent on a large consumer audience and resulting page views. Failure to maintain growth could adversely affect our brand and business prospects.

Our growth depends to a significant degree upon the continued development and growth of our digital properties. We have had failures with direct commerce in the past, and only limited experience in building an advertising-revenue-based website. When initial results from the re-launch of the marthastewart.com site in the second quarter of 2007 were below expectations, we made changes to the site and continue to enhance and upgrade the site including the 2010/2011 initiative to re-platform marthastewart.com. We cannot be certain that those changes will enable us to sustain growth for our website in the long term. In addition, the competition for advertising dollars has intensified. In order for our digital properties to succeed, we must, among other things maintain and continue to:

| • | significantly increase our online audience and advertising revenue; |

| • | attract and retain a base of frequent visitors to our website; |

| • | expand the content, products and interactive experiences we offer on our website; |

| • | respond to competitive developments while maintaining a distinct brand identity; |

| • | develop and upgrade our technologies so that they can support more efficient and effective migration of content from the print platform and provide a more robust user experience; and |

| • | bring innovative product features to market in a timely manner. |

16

Table of Contents

We cannot be certain that we will be successful in achieving these and other necessary objectives. If we are not successful in achieving these objectives, our business, financial condition and prospects could be materially adversely affected.

If we are unable to predict, respond to and influence trends in what the public finds appealing, our business will be adversely affected.

Our continued success depends on our ability to provide creative, useful and attractive ideas, information, concepts, programming, content and products that strongly appeal to a large number of consumers, as well as distributing the content through the latest technology and traditional channels. In order to accomplish this, we must be able to respond quickly and effectively to changes in consumer tastes for ideas, information, concepts, programming, technology, content and products. The strength of our brands and our business units depends in part on our ability to influence tastes through broadcasting, print publication, digital distribution and merchandising. We cannot be sure that our new ideas and content will have the appeal and garner the acceptance that they have in the past, or that we will be able to respond quickly to changes in the tastes of homemakers and other consumers and their appetite for new technology.

Absence of new product launches may reduce our earnings or generate losses.

Our future success will depend in part on our ability to continue offering new products and services that successfully gain market acceptance by addressing the needs of our current and future customers. Our efforts to introduce new products or integrate acquired products may not be successful or profitable. The process of internally researching and developing, launching, gaining acceptance and establishing profitability for a new product, or assimilating and marketing an acquired product, is both risky and costly. New products generally incur initial operating losses. Costs related to the development of new products and services are generally expensed as incurred and, accordingly, our profitability from year to year may be adversely affected by the number and timing of new product launches. For example, we had a cumulative loss of $15.7 million in connection with Blueprint, which we ceased publishing in 2007. Other businesses and brands that we may develop also may prove not to be successful.

Our principal print business vendors are consolidating and this may adversely affect our business and operations.

We rely on certain principal vendors in the print portion of our Publishing segment and their ability or willingness to sell goods and services to us at favorable prices and other terms. Many factors outside our control may harm these relationships and the ability and willingness of these vendors to sell these goods and services to us on favorable terms. Our principal vendors include paper suppliers, printers, subscription fulfillment houses, subscription agents and national newsstand wholesalers, distributors and retailers. Each of these industries in recent years has experienced consolidation among its principal participants. Further consolidation may result in decreased competition, which may lead to greater dependence on certain vendors and increased prices; as well as interruptions and delays in services provided by such vendors, all of which could adversely affect our results of operations. As a result of many paper mills consolidating their operations, we experienced paper price increases in 2011.

We may be adversely affected by fluctuations in paper, postage and distribution costs.

In our Publishing segment, our principal raw material is paper for the print portion of that business. Paper prices have fluctuated over the past several years. We generally purchase paper from major paper suppliers who adjust the price periodically. We have not entered, and do not currently plan to enter, into long-term forward price or option contracts for paper. Accordingly, significant increases in paper prices would adversely affect our future results of operations.

17

Table of Contents

Postage for magazine distribution is also one of our significant expenses. We primarily use the U.S. Postal Service to distribute magazine subscriptions. In recent years, postage rates have increased, and a significant further increase in postage prices could adversely affect our future results of operations. We may not be able to recover, in whole or in part, paper or postage cost increases.

Distribution of magazines to newsstands and bookstores is conducted primarily through companies known as wholesalers. Wholesalers have in the past advised us that they intended to increase the price of their services. We have not experienced any material increase to date; however, some wholesalers have experienced credit and going concern risks. It is possible that other wholesalers likewise may seek to increase the price of their services or discontinue operations. An increase in the price of our wholesalers’ services could have a material adverse effect on our results of operations. The need to change wholesalers could cause a disruption or delay in deliveries, which could adversely impact our results of operations.

We may be adversely affected by a continued weakening of newsstand sales.

The magazine industry has seen a weakening of newsstand sales during the past few years. A continuation of this decline would adversely affect our financial condition and results of operations by further reducing our circulation revenue and causing us to either incur higher circulation expenses to maintain our rate bases, or to reduce our rate bases, which would in turn negatively impact our revenue.

Our websites and internal networks may be vulnerable to unauthorized persons accessing our systems, which could disrupt our operations and result in the theft of our proprietary information.

Our website activities involve the storage and transmission of proprietary information, which we endeavor to protect from third party access. However, it is possible that unauthorized persons may be able to circumvent our protections and misappropriate proprietary information or cause interruptions or malfunctions in our digital operations. We may be required to spend significant capital and other resources to protect against or remedy any such security breaches. Accordingly, security breaches could expose us to a risk of loss due to business interruption, or litigation. Our security measures and contractual provisions attempting to limit our liability in these areas may not be successful or enforceable.

Martha Stewart controls our Company through her stock ownership, enabling her to elect most of our board of directors, and potentially to block matters requiring stockholder approval, including any potential changes of control.

Ms. Stewart controls all of our outstanding shares of Class B Common Stock, representing over 89% of our voting power. The Class B Common Stock has ten votes per share, while Class A Common Stock, which is the stock available to the public, has one vote per share. Because of this dual-class structure, Ms. Stewart has a disproportionately influential vote. As a result, Ms. Stewart has the ability to control unilaterally the outcome of all matters requiring stockholder approval, including the election and removal of all directors other than the two directors whose election is controlled by J.C. Penney and generally any merger, consolidation or sale of all or substantially all of our assets, and indirectly the ability to control our management and affairs. Ms. Stewart’s concentrated control could, among other things, discourage others from initiating any potential merger, takeover or other change of control transaction that may otherwise be beneficial to our businesses and stockholders.

Our intellectual property may be infringed upon or others may accuse us of infringing on their intellectual property, either of which could adversely affect our business and result in costly litigation.

Our business is highly dependent upon our creativity and resulting intellectual property. We are susceptible to others imitating our products and infringing our intellectual property rights. We may not be able to successfully protect our intellectual property rights, upon which we depend. In addition, the laws of many foreign

18

Table of Contents

countries do not protect intellectual property rights to the same extent as do the laws of the United States. Imitation of our products or infringement of our intellectual property rights could diminish the value of our brands or otherwise adversely affect our revenues. If we are alleged to have infringed the intellectual property rights of another party, any resulting litigation could be costly, affecting our finances and our reputation. Litigation also diverts the time and resources of management, regardless of the merits of the claim. There can be no assurance that we would prevail in any litigation relating to our intellectual property. If we were to lose such a case, and be required to cease the sale of certain products or the use of certain technology or if we were forced to pay monetary damages, the results could adversely affect our financial condition and our results of operations.

We operate in three highly competitive businesses: Publishing, Broadcasting and Merchandising, each of which subjects us to competitive pressures and other uncertainties.

We face intense competitive pressures and uncertainties in each of our three businesses.

Our magazines, books and related publishing products compete not only with other magazines, books and publishing products, but also with other mass media, websites, and many other types of leisure-time activities. We face significant competition from a number of print and website publishers, some of which have greater financial and other resources than we have, which may enhance their ability to compete in the markets we serve. As advertising budgets have diminished, the competition for advertising dollars has intensified. Competition for advertising revenue in publications is primarily based on advertising rates, the nature and scope of readership, reader response to the promotions for advertisers’ products and services, the desirability of the magazine’s demographic and the effectiveness of advertising sales teams. Other competitive factors in publishing include product positioning, editorial quality, circulation, price, customer service, circulation revenues and, ultimately, advertising revenues. Our websites compete with other how-to, food and lifestyle websites. Our challenge is to attract and retain users through an easy-to-use and content-relevant website. Competition for digital adverting is based on the number of unique users we attract each month, the demographic profile of that audience and the number of pages they view on our site. Because some forms of media have relatively low barriers to entry, we anticipate that additional competitors, some of which have greater resources than we do, may enter these markets and intensify competition.

Our television programs compete directly for viewers, distribution and/or advertising dollars with other lifestyle and how-to television programs, as well as with general programming and all other competing forms of media. Overall competitive factors in Broadcasting include programming content, quality and distribution, as well as the demographic appeal of the programming. Competition for television and radio advertising dollars is based primarily on advertising rates, audience size and demographic composition, viewer response to advertisers’ products and services and the effectiveness of the advertising sales staff. Our radio programs compete for listeners with similarly themed programming on both satellite and terrestrial radio.

Our Merchandising segment competitors consist of mass-market and department stores that compete with the mass-market, home improvement and department stores in which our Merchandising segment products are sold. Our merchandising lines also compete within the mass-market, home improvement and department stores that carry our product lines with other products offered by these stores in the respective product categories. We also compete with the internet businesses of these stores and other websites that sell similar retail goods.

Our failure to meet the competitive pressures in any of these segments could negatively impact our results of operations and financial condition.

Item 1B. Unresolved Staff Comments.

None.

19

Table of Contents

Information concerning the location, use and approximate square footage of our principal facilities as of December 31, 2011, all of which are leased, is set forth below:

| Location |

Use |

Approximate Area in Square Feet |

||||

| 601 West 26th Street New York, NY |

Product design facilities, photography studio, test kitchens and property storage

Principal executive and administrative offices; Publishing segment offices; Corporate offices; and advertising sales offices |

218,249 | ||||

| 226 West 26th Street New York, NY |

Executive and administrative office for television production | 24,586 | ||||

| 221 West 26th Street New York, NY |

Television production facilities | 23,723 | ||||

| Satellite Sales Offices in Michigan, Illinois and California |

Advertising sales offices | 7,271 | ||||

We expect to vacate our television production facilities at 221 West 26th Street and our executive and administrative office for television production at 226 West 26th Street at the end of the second quarter of 2012. The other leases for our offices and facilities expire between 2012 and 2018, and some of these leases are subject to our renewal.

We also have an intangible asset agreement covering our use of various properties owned by Martha Stewart for our editorial, creative and product development processes. These living laboratories allow us to experiment with new designs and new products, such as garden layouts, help generate ideas for new content available to all of our media outlets and serve as locations for photo spreads and television segments. The description of this intangible asset agreement is incorporated by reference into Item 13 and disclosed in the related party transaction disclosure in Note 11, Related Party Transactions, in the Notes to Consolidated Financial Statements of this Annual Report on Form 10-K.

We believe that our existing facilities are well maintained and in good operating condition.

On January 23, 2012, Macy’s Inc. and Macy’s Merchandising Group, Inc. filed a lawsuit against us in the Supreme Court of the State of New York, County of New York titled Macy’s, Inc. and Macy’s Merchandising Group, Inc. v. Martha Stewart Living Omnimedia, Inc. In such lawsuit, the Macy’s plaintiffs claim that our planned activities under our commercial agreement with J.C. Penney Corporation, Inc. (“JCP”) materially breach the agreement between us and Macy’s Merchandising Group, Inc. dated April 3, 2006. The Macy’s plaintiffs seek a declaratory judgment, preliminary and permanent injunctive relief, and incidental and other damages. The Macy’s plaintiffs initially filed a motion for a preliminary injunction and subsequently withdrew the motion without prejudice. On February 10, 2012, we filed an answer to the Macy’s plaintiffs’ original complaint and asserted three counterclaims against the Macy’s plaintiffs, alleging that Macy’s Inc. and Macy’s Merchandising Group, Inc. had breached the Macy’s Agreement by, among other things, failing to maximize net sales. The Macy’s plaintiffs have denied the allegations of the counterclaims. We believe that we have meritorious defenses to the claims made by the Macy’s plaintiffs, and we intend to vigorously defend such claims. Litigation costs in this matter may be significant.

We are party to legal proceedings in the ordinary course of business, including product liability claims for which we are indemnified by our licensees[, other than Macy’s]. None of these proceedings is deemed material.

Item 4. Mine Safety Disclosures.

Not applicable.

20

Table of Contents

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Market for the Common Stock

Our Class A Common Stock is listed and traded on The New York Stock Exchange (the “NYSE”). Our Class B Common Stock is not listed or traded on any exchange, but is convertible into Class A Common Stock at the option of its owner on a share-for-share basis. The following table sets forth the high and low sales price of our Class A Common Stock as reported by the NYSE for each of the periods listed.

| Q1 2010 |

Q2 2010 |

Q3 2010 |

Q4 2010 |

Q1 2011 |

Q2 2011 |

Q3 2011 |

Q4 2011 |

|||||||||||||||||||||||||

| High Sales Price |

$ | 6.15 | $ | 7.45 | $ | 5.75 | $ | 4.96 | $ | 4.54 | $ | 5.49 | $ | 4.75 | $ | 5.19 | ||||||||||||||||

| Low Sales Price |

$ | 4.36 | $ | 4.89 | $ | 4.28 | $ | 4.25 | $ | 3.40 | $ | 3.45 | $ | 2.97 | $ | 2.77 | ||||||||||||||||

As of March 1, 2012, there were 7,572 record holders of our Class A Common Stock and one record holder of our Class B Common Stock. This does not include the number of persons whose stock is in nominee or “street name” accounts through brokers.

Dividends

We do not pay regular quarterly dividends. However, in December 2011, our Board of Directors declared and paid a special one-time dividend of $0.25 per share of common stock for a total dividend payment of $16.7 million.

Recent Sales of Unregistered Securities and Use of Proceeds

As previously reported, on December 6, 2011, JCP purchased 11 million newly issued shares of our $0.01 par value Class A Common Stock and one share of our Series A Preferred Stock in exchange for cash of $38.5 million.

Issuer Purchases of Equity Securities

The following table provides information about our purchases of our Class A Common Stock during each month of the quarter ended December 31, 2011:

| Period |

Total Number of Shares (or Units) Purchased (1) |

Average Price Paid per Share (or Unit) |

Total Number of Shares (or Units) Purchased as Part of Publicly Announced Plans or Programs |

Maximum Number (or Approximate Dollar Value) of Shares (or Units) that May Yet Be Purchased under the Plans or Programs |

||||||||||||

| October 2011 |

1,539 | $ | 3.12 | Not applicable | Not applicable | |||||||||||

| November 2011 |

— | — | Not applicable | Not applicable | ||||||||||||

| December 2011 |

— | — | Not applicable | Not applicable | ||||||||||||

|

|

|

|

|

|||||||||||||

| Total |

1,539 | $ | 3.12 | |||||||||||||

| (1) | Represents shares withheld by, or delivered to us pursuant to provisions in agreements with recipients of restricted stock granted under our stock incentive plans allowing us to withhold, or the recipient to deliver to us, the number of shares having the fair value equal to tax withholding due. |

21

Table of Contents

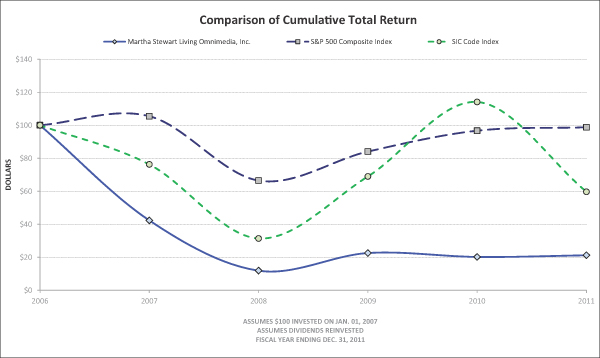

Notwithstanding anything to the contrary set forth in any of our filings under the Securities Act or the Exchange Act, the following performance graph shall not be deemed to be incorporated by reference into any such filings.

PERFORMANCE GRAPH

The following graph compares the performance of our Class A Common Stock with that of the Standard & Poor’s 500 Stock Index (“S&P 500 Composite Index”) and the stocks included in the Media General Financial Services database under the Standard Industry Code 2721 (Publishing-Periodicals) (the “SIC Code Index”*) during the period commencing on January 1, 2007 and ending on December 31, 2011. The graph assumes that $100 was invested in each of our Class A Common Stock, the S&P 500 Composite Index and the SIC Code Index at the beginning of the relevant period, is calculated as of the end of each calendar month and assumes reinvestment of dividends. The performance shown in the graph represents past performance and should not be considered an indication of future performance.

| * | The SIC Code Index consists of companies that are primarily publishers of periodicals, although many also conduct other businesses, including owning and operating television stations and cable networks, and is weighted according to market capitalization of the companies in the index. The hypothetical investment assumes investment in a portfolio of equity securities that mirror the composition of the SIC Code Index. |

22

Table of Contents

Item 6. Selected Financial Data.

The information set forth below for the five years ended December 31, 2011 is not necessarily indicative of results of future operations, and should be read in conjunction with Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and related notes thereto incorporated by reference into Item 8 of this Annual Report on Form 10-K. The Notes to Selected Financial Data below include certain factors that may affect the comparability of the information presented below (in thousands, including per share amounts).

| 2011 | 2010 | 2009 | 2008 | 2007 | ||||||||||||||||

| INCOME STATEMENT DATA REVENUES |

||||||||||||||||||||

| Publishing |

$ | 140,857 | $ | 145,573 | $ | 146,100 | $ | 179,116 | $ | 202,916 | ||||||||||

| Broadcasting |

31,962 | 42,434 | 46,111 | 47,328 | 40,263 | |||||||||||||||

| Merchandising |

48,614 | 42,806 | 52,566 | 57,866 | 84,711 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total revenues |

221,433 | 230,813 | 244,777 | 284,310 | 327,890 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Operating (loss) income |

(18,594 | ) | (8,663 | ) | (11,968 | ) | (10,857 | ) | 7,714 | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net (loss) income |

$ | (15,519 | ) | $ | (9,596 | ) | $ | (14,578 | ) | $ | (15,665 | ) | $ | 10,289 | ||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| PER SHARE DATA |

||||||||||||||||||||

| Earnings/(loss) per share: |

||||||||||||||||||||

| Basic and diluted—Net (loss) income |

$ | (0.28 | ) | $ | (0.18 | ) | $ | (0.27 | ) | $ | (0.29 | ) | $ | 0.20 | ||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Weighted average common shares outstanding: |

||||||||||||||||||||

| Basic |

55,881 | 54,440 | 53,880 | 53,360 | 52,449 | |||||||||||||||

| Diluted |

55,881 | 54,440 | 53,880 | 53,360 | 52,696 | |||||||||||||||

| Dividends per common share |

$ | 0.25 | $ | — | $ | — | $ | — | $ | — | ||||||||||

| FINANCIAL POSITION |

||||||||||||||||||||

| Cash and cash equivalents |

$ | 38,453 | $ | 23,204 | $ | 25,384 | $ | 50,204 | $ | 30,536 | ||||||||||

| Short-term investments |

11,051 | 10,091 | 13,085 | 9,915 | 26,745 | |||||||||||||||

| Total assets |

216,120 | 222,314 | 229,791 | 261,285 | 255,267 | |||||||||||||||

| Long-term obligations |

— | 7,500 | 13,500 | 19,500 | — | |||||||||||||||

| Shareholders’ equity |

147,947 | 139,033 | 143,820 | 150,995 | 155,529 | |||||||||||||||

| OTHER FINANCIAL DATA |

||||||||||||||||||||

| Cash flow (used in) provided by operating activities |

$ | (2,220 | ) | $ | 1,872 | $ | (9,273 | ) | $ | 39,699 | $ | 8,306 | ||||||||

| Cash flow (used in) provided by investing activities |

6,886 | 153 | (9,617 | ) | (38,856 | ) | (6,606 | ) | ||||||||||||

| Cash flow (used in) provided by financing activities |

10,583 | (4,205 | ) | (5,930 | ) | 18,825 | 308 | |||||||||||||

NOTES TO SELECTED FINANCIAL DATA

(Loss) / income from continuing operations

2011 results include restructuring charges of approximately $5.1 million.