Exhibit 4.1

CERTIFICATE OF DESIGNATION

OF SERIES A-2 PARTICIPATING CONVERTIBLE PREFERRED STOCK

OF

HARBINGER GROUP INC.

The undersigned, Francis T. McCarron, Executive Vice President of Harbinger Group Inc. (including any successor in interest, the "Company"), a corporation organized and existing under the General Corporation Law of the State of Delaware (the "DGCL"), does hereby certify, in accordance with Sections 103 and 151 of the DGCL, that the following resolutions were duly adopted by its Board of Directors (the "Board") on July 28, 2011:

WHEREAS, the Company's Certificate of Incorporation (the "Certificate of Incorporation"), authorizes 10,000,000 shares of preferred stock, par value $0.01 per share (the "Preferred Stock"), issuable from time to time in one or more series;

WHEREAS, the Certificate of Incorporation authorizes the Board to provide by resolution for the issuance of the shares of Preferred Stock in one or more series, the number of shares in each series, the voting powers, if any, and such designations, preferences and relative, participating, optional or other special rights, and the qualifications, limitations and restrictions thereof;

WHEREAS, the Board desires, pursuant to its authority as aforesaid, to designate a new series of Preferred Stock, set the number of shares constituting such series, and the voting powers, designations, preferences and relative, participating, optional or other special rights, and the qualifications, limitations and restrictions thereof;

WHEREAS, on May 13, 2011, the Company issued 280,000 shares of Series A Participating Convertible Preferred Stock of the Company, par value $0.01 per share (the “Existing Series A Preferred Stock”), to certain Persons (such Persons, the “Existing Holders”), which Existing Series A Preferred Stock was designated by the Board pursuant to the Certificate of Designation of Series A Participating Convertible Preferred Stock of Harbinger Group Inc., dated as of May 12, 2011 (the “Existing Series A Certificate of Designation”); and

WHEREAS, it is the Company's intention that the Existing Series A Preferred Stock and the Series A-2 Preferred Stock shall have equivalent powers, preferences, rights and privileges, other than with respect to (x) terms and provisions specifically applicable to, or for the benefit of, the Fortress Investor and/or its Affiliates, and (y) the Conversion Price and the conversion price of the Existing Series A Preferred Stock.

NOW, THEREFORE, BE IT RESOLVED, that the Board of Directors hereby designates a new series of Preferred Stock, consisting of the number of shares set forth herein, with the voting powers, designations, preferences and relative, participating, optional or other special rights, and the qualifications, limitations and restrictions relating to such series as follows:

SECTION 1. Number; Designation; Rank.

(a) This series of convertible participating preferred stock is designated as the "Series A-2 Participating Convertible Preferred Stock" (the "Series A-2 Preferred Stock"). The maximum number of shares constituting the Series A-2 Preferred Stock is 120,000 shares, par value $0.01 per share.

(b) The Series A-2 Preferred Stock ranks, with respect to the payment of dividends, redemption payments, rights (including as to the distribution of assets upon liquidation, dissolution or winding-up of the Company) or otherwise:

(i) senior in preference and priority to the Common Stock and each other class or series of Capital Stock of the Company, except for (x) any class or series of Capital Stock hereafter issued in compliance with the terms hereof and the terms of which expressly provide that it will rank senior to or on parity, without preference or priority, with the Series A-2 Preferred Stock with respect to the payment of dividends, redemption payments, rights (including as to the distribution of assets) upon liquidation, dissolution or winding-up of the Company, or otherwise (collectively with the Common Stock, the "Junior Securities") or (y) the Existing Series A Preferred Stock;

(ii) on parity, without preference and priority, with (x) the Existing Series A Preferred Stock, and (y) each other class or series of Capital Stock of the Company hereafter issued in compliance with the terms hereof and the terms of which expressly provide that it will rank on parity, without preference or priority, with the Series A-2 Preferred Stock with respect to the payment of dividends, redemption payments, rights (including as to the distribution of assets) upon liquidation, dissolution or winding-up of the Company, or otherwise (collectively, the "Parity Securities"); and

(iii) junior in preference and priority to each other class or series of Preferred Stock or any other Capital Stock of the Company hereafter issued in compliance with the terms hereof and the terms of which expressly provide that it will rank senior in preference or priority to the Series A-2 Preferred Stock with respect to the payment of dividends, redemption payments, rights (including as to the distribution of assets) upon liquidation, dissolution or winding-up of the Company or otherwise (collectively, "Senior Securities").

SECTION 2. Dividends.

(a) Cash Dividends. Holders shall be entitled to receive, out of funds legally available for the payment of dividends to the Company's stockholders under Delaware law, on each Preferred Share, cumulative cash dividends at a per annum rate of 8.00% on the amount of the Purchase Price ("Cash Dividends"). Such Cash Dividends shall begin to accrue and be cumulative from the Issue Date. Cash Dividends shall be payable quarterly with respect to each Dividend Period in arrears on the first Dividend Payment Date after such Dividend Period. If and to the extent that the Company does not for any reason (including because there are insufficient funds legally available for the payment of dividends) pay the entire Cash Dividend payable for a particular

2

Dividend Period in cash on the applicable Dividend Payment Date for such period (whether or not there are funds of the Company legally available for the payment of dividends to the Company’s stockholders under Delaware law or such dividends are declared by the Board), during the period in which such Cash Dividend remains unpaid, an additional accreting dividend (the "Cash Accretion Dividends") shall accrue and be payable at an annual rate equal to the Dividend Rate on the amount of the unpaid Cash Dividend through the daily addition of such Cash Accretion Dividends to the Purchase Price (whether or not such Cash Accretion Dividends are declared by the Board).

(b) Accreting Dividends. In addition to the Cash Dividend, for each Dividend Period beginning on or after the Issue Date, the Holders shall be entitled to receive on each Preferred Share additional dividends at the per annum rates set forth in this SECTION 2(b) (the "Basic Accreting Dividends" and, together with the Cash Accretion Dividends, the Participating Accretion Dividends and the In-Kind Participating Dividends, the "Accreting Dividends"; the Accreting Dividends, together with the Cash Dividend and the Participating Dividends, the "Dividends"). Basic Accreting Dividends shall accrue and be cumulative from the Issue Date. Basic Accreting Dividends shall be payable quarterly with respect to each Dividend Period in arrears on the first Dividend Payment Date after such Dividend Period by the addition of such amount to the Purchase Price, whether or not declared by the Board. Such Basic Accreting Dividend for any Dividend Period shall be at a per annum rate (the "Accreting Dividend Rate") determined as follows:

(i) If Net Asset Value as of the last day of any Dividend Period is less than 120% of the May 13 NAV, a per annum rate of 4.00% of the Purchase Price for the next succeeding Dividend Period;

(ii) If Net Asset Value as of the last day of any Dividend Period is equal to or greater than 120% and less than or equal to 140% of the May 13 NAV, a per annum rate of 2.00% of the Purchase Price for the next succeeding Dividend Period; and

(iii) If Net Asset Value as of the last day of any Dividend Period is greater than 140% of the May 13 NAV, no additional per annum rate for the next succeeding Dividend Period;

provided, however, that the Basic Accreting Dividend with respect to the period from the Original Issue Date to September 30, 2011 shall be payable at a per annum rate of 4.00% of the Purchase Price.

(c) Participating Cash Dividends. If the Company declares, makes or pays any cash dividend or distribution in respect of all or substantially all holders of Common Stock (a "Common Dividend"), each Holder shall receive a dividend (in addition to the Dividends provided for by SECTION 2(a) and SECTION 2(b)) in respect of each Preferred Share held thereby, in an amount equal to the product of (x) the amount of such Common Dividend paid per share of Common Stock, multiplied by (y) the number of shares of Common Stock issuable if such Preferred Share had been converted into shares of Common Stock immediately prior to the record date for such Common Dividend (such amount per share of Preferred Stock, the "Participating Cash Dividend"). Participating Cash Dividends shall be payable to Holders on the record date for such Common

3

Dividend at the same time and in the same manner as the Common Dividend triggering such Participating Cash Dividend is paid. If and to the extent that the Company does not for any reason pay the entire Participating Cash Dividend when the Common Dividend is paid to the holders of Common Stock, during the period in which such Participating Cash Dividend remains unpaid, an additional accreting dividend (the "Participating Accretion Dividends") shall accrue and be payable at an annual rate equal to the Dividend Rate on the amount of the unpaid Participating Cash Dividend through the daily addition of such Participating Accretion Dividends to the Purchase Price (whether or not such Participating Accretion Dividends are declared by the Board).

(d) In-Kind Participating Dividends. If the Company distributes shares of its Capital Stock, evidences of its indebtedness or other assets, securities or property, to all or substantially all holders of Common Stock (an "In-Kind Common Dividend"), including without limitation any spin-off of one or more subsidiaries or businesses of the Company but excluding: (I) dividends or distributions referred to in SECTIONS 5(g)(i)(A) and 5(g)(i)(B); and (II) cash dividends with respect to which Holders are entitled to Participating Cash Dividends, then the Holders shall receive in such distribution or other transaction, at the same time and in the same manner as holders of Common Stock, the same type and amount of consideration (the "In-Kind Participating Dividend" and, collectively with the Participating Cash Dividend, the "Participating Dividends") as Holders would have received if, immediately prior to the record date of such In-Kind Common Dividend, they had held the number of shares of Common Stock issuable upon conversion of the Preferred Shares. To the extent that the Company establishes or adopts a stockholder rights plan or agreement (i.e., a "poison pill"), the Company shall ensure that the Holders will receive, as an In-Kind Participating Dividend, rights under the stockholder rights plan or agreement with respect to any shares of Common Stock that at the time of such distribution would be issuable upon conversion of the Preferred Shares. If and to the extent that the Company does not for any reason pay the entire In-Kind Participating Dividend when the Common Dividend is paid to the holders of Common Stock, during the period in which such In-Kind Participating Dividend remains unpaid, an additional accreting dividend (the "In-Kind Accretion Dividends") shall accrue and be payable at an annual rate equal to the Dividend Rate on the amount of the unpaid In-Kind Participating Dividend through the daily addition of such In-Kind Accretion Dividends to the Purchase Price (whether or not such In-Kind Accretion Dividends are declared by the Board).

(e) Dividends (other than Participating Dividends) payable on the Series A-2 Preferred Stock in respect of any Dividend Period shall be computed on the basis of a 360-day year consisting of twelve 30-day months. The amount of Dividends (other than Participating Dividends) payable on the Series A-2 Preferred Stock on any date prior to the end of a Dividend Period, and for the initial Dividend Period, shall be computed on the basis of a 360-day year consisting of twelve 30-day months, and actual days elapsed over a 30-day month.

(f) Cash Dividends and Accreting Dividends that are payable on Series A-2 Preferred Stock on any Dividend Payment Date will be payable to Holders of record on the applicable record date, which shall be the fifteenth (15th) calendar day before the applicable Dividend Payment Date, or, with respect to any Cash Dividends not paid on the scheduled Dividend Payment Date therefor, such record date fixed by the Board (or a duly authorized committee of the

4

Board) that is not more than sixty (60) nor less than ten (10) days prior to such date on which such accrued and unpaid Cash Dividends are to be paid (each such record date, a "Dividend Record Date"). Any such day that is a Dividend Record Date shall be a Dividend Record Date whether or not such day is a Business Day.

(g) The quarterly dividend periods with respect to Cash Dividends and Accreting Dividends shall commence on and include January 1, April 1, July 1 and October 1 (other than the initial Dividend Period, which shall commence on and include the Issue Date) and shall end on and include the last calendar day of the calendar quarter ending March 31, June 30, September 30 and December 31 preceding the next Dividend Payment Date (a "Dividend Period").

SECTION 3. Liquidation Preference.

(a) Upon any Liquidation Event, each Preferred Share entitles the Holder thereof to receive and to be paid out of the assets of the Company legally available for distribution to the Company's stockholders, before any distribution or payment may be made to a holder of any Junior Securities, an amount in cash per share equal to the greater of: (i) 150% of the sum of (A) the Purchase Price, plus (B) all accrued and unpaid Dividends (including, without limitation, accrued and unpaid Cash Dividends and accrued and unpaid Accreting Dividends for the then current Dividend Period), if any, on such share to the extent not included in the Purchase Price (such sum, after the 150% multiplier and as adjusted, the "Regular Liquidation Preference"), and (ii) an amount equal to the amount the Holder of such share would have received upon such Liquidation Event had such Holder converted such Preferred Share into Common Stock (or Reference Property, to the extent applicable) immediately prior thereto (the "Participating Liquidation Preference," and such greater amount, the "Liquidation Preference").

(b) If upon any such Liquidation Event, the assets of the Company legally available for distribution to the Company’s stockholders are insufficient to pay the Holders the full Liquidation Preference and the holders of all Parity Securities the full liquidation preferences to which they are entitled, the Holders and the holders of such Parity Securities will share ratably in any such distribution of the assets of the Company in proportion to the full respective amounts to which they are entitled.

(c) After payment to the Holders of the full Liquidation Preference to which they are entitled, the Holders as such will have no right or claim to any of the assets of the Company.

(d) The value of any property not consisting of cash that is distributed by the Company to the Holders will equal the Fair Market Value thereof on the date of distribution.

(e) No holder of Junior Securities shall receive any cash upon a Liquidation Event unless the entire Liquidation Preference in respect of the Preferred Shares has been paid in cash. To the extent that there is insufficient cash available to pay the entire Liquidation Preference in respect of the Preferred Shares and any liquidation preference in respect of Parity Securities in full in cash upon a Liquidation Event, the Holders and the holders of such Parity Securities will share ratably in

5

any cash available for distribution in proportion to the full respective amounts to which they are entitled upon such Liquidation Event.

SECTION 4. Voting Rights.

(a) The Holders are entitled to vote on all matters on which the holders of shares of Common Stock are entitled to vote and, except as otherwise provided herein or by law, the Holders shall vote together with the holders of shares of Common Stock as a single class. As of any record date or other determination date, each Holder shall be entitled to the number of votes such Holder would have had if all Preferred Shares held by such Holder on such date had been converted into shares of Common Stock immediately prior thereto, except that:

(i) at no time shall a Holder have voting rights pursuant to SECTION 4(a) or otherwise in respect of more than 9.9% of the Total Current Voting Power unless such Holder has received any approvals from the Insurance Regulatory Authorities required to be obtained by such Holder in order for such Holder to possess voting rights in respect of the Company in excess of 9.9% of the Total Current Voting Power; and

(ii) in the event that any Holder would be required to file any Notification and Report Form pursuant to the HSR Act as a result of the receipt of any Accreting Dividends by such Holder, the voting rights of such Holder pursuant to this Section 4(a) shall not be increased as a result of such Holder's receipt of such Accreting Dividends unless and until such Holder and the Company shall have made their respective filings under the HSR Act and the applicable waiting period shall have expired or been terminated in connection with such filings. The Company shall make all required filings and reasonably cooperate with and assist such Holder in connection with the making of such filing and obtaining the expiration or termination of such waiting period and shall be reimbursed by such Holder for any reasonable and documented out-of-pocket costs incurred by the Company in connection with such filings and cooperation.

(b) In addition to the voting rights provided for by SECTION 4(a) and any voting rights to which the Holders may be entitled to under law:

(i) for so long as any Preferred Shares, shares of Existing Series A Preferred Stock, or shares of Additional Permitted Preferred Stock are outstanding, the Company may not, directly or indirectly, take any of the following actions (including by means of merger, consolidation, reorganization, recapitalization or otherwise) without the prior written consent of the Majority Holders:

(A) amend the Certificate of Incorporation (excluding for this purpose this Certificate of Designation) or the By-Laws of the Company (including by means of merger, consolidation, reorganization, recapitalization or otherwise), in each case, in a manner adverse to the Holders;

6

(B) create or issue any (x) Senior Securities or (y) except as permitted under SECTION 8(b) and otherwise by this Certificate of Designation, Parity Securities or Additional Permitted Preferred Stock;

(C) incur, or permit any Subsidiary Guarantor to incur, any Debt (excluding any Debt incurred to refinance the Senior Notes) not otherwise permitted by the terms of the Indenture;

(D) make, or permit any Subsidiary Guarantor to make, any Asset Sales not otherwise permitted by the terms of the Indenture;

(E) make, or to the extent within the Company’s control, permit any of its Subsidiaries to make, any Restricted Payments not otherwise permitted by the terms of the Indenture;

(F) create a new Subsidiary of the Company not in existence on the Original Issue Date for the primary purpose of issuing Equity Securities of such Subsidiary or incurring Debt the proceeds of which will, directly or indirectly, be used to make dividends or other distributions or payments of cash to holders of the Company's Capital Stock other than the Holders; provided, that for the avoidance of doubt, the foregoing shall not prohibit dividends or other distributions to the Company; or

(G) agree to do, directly or indirectly, any of the foregoing actions set forth in clauses (A) through (F), unless such agreement expressly provides that the Company’s obligation to undertake any of the foregoing is subject to the prior approval of the Majority Holders; and

(ii) for so long as any Preferred Shares, shares of Existing Series A Preferred Stock, or shares of Additional Permitted Preferred Stock are outstanding, neither the Company nor, to the extent within the Company’s control, any of its Subsidiaries may, directly or indirectly, take any of the following actions (including by means of merger, consolidation, reorganization, recapitalization or otherwise) without the prior written consent of each of the Holders:

(A) make any repurchase, redemption or other acquisition for value of Preferred Shares, shares of Existing Series A Preferred Stock or shares of Additional Permitted Preferred Stock, unless such redemption is made on the same terms and on a pro rata basis among all Holders (other than Holders that are granted an equal opportunity to participate in such transaction but elect not to do so); or

(B) agree to do, directly or indirectly, any of the foregoing actions set forth in clause (A), unless such agreement expressly provides that the Company’s obligation to undertake any of the foregoing is subject to the prior approval of each of the Holders; and

7

(iii) for so long as any Preferred Shares are outstanding, the Company may not, directly or indirectly, take any of the following actions (including by means of merger, consolidation, reorganization, recapitalization or otherwise) without the prior written consent of the Series A-2 Majority Holders:

(A) amend, repeal, alter or add, delete or otherwise change the powers, preferences, rights or privileges of the Series A-2 Preferred Stock;

(B) effect any stock split or combination, reclassification or similar event with respect to the Series A-2 Preferred Stock; or

(C) agree to do, directly or indirectly, any of the foregoing actions set forth in clauses (A) and (B), unless such agreement expressly provides that the Company’s obligation to undertake any of the foregoing is subject to the prior approval of the Series A-2 Majority Holders; and

(iv) for so long as any Preferred Shares are outstanding, neither the Company nor, to the extent within the Company’s control, any of its Subsidiaries may, directly or indirectly, take any of the following actions (including by means of merger, consolidation, reorganization, recapitalization or otherwise) without the prior written consent of each of the holders of Preferred Shares:

(A) amend, repeal, alter or add, delete or otherwise change the powers, preferences, rights or privileges of the Series A-2 Preferred Stock set forth in the Specified Sections (including by means of merger, consolidation, reorganization, recapitalization or otherwise) in a manner adverse to the holders of Preferred Shares (whether by means of an amendment or other change to the Specified Sections or by means of an amendment or other change to any definitions used in the Specified Sections or any other terms of this Certificate of Designation affecting the Specified Sections); or

(B) agree to do, directly or indirectly, any of the foregoing actions set forth in clause (A), unless such agreement expressly provides that the Company’s obligation to undertake any of the foregoing is subject to the prior approval of each of the holders of Preferred Shares.

(c) The agreements of the Company in SECTION 4(b) insofar as they govern or purport to govern conduct concerning any Subsidiary of the Company are being made by the Company solely in its capacity as the controlling shareholder of such Subsidiary and not in any fiduciary capacity of it or any of the Subsidiary's officers or directors, and nothing herein shall require the Company to act in any way that would cause any shareholder, director or officer of any such Subsidiary to act in a manner that would violate legally imposed fiduciary duties applicable to any such shareholder, director or officer.

8

(d) Notwithstanding anything to the contrary contained in SECTION 4(b), the Holders shall have no voting or consent rights (but will continue to have voting rights to the extent set forth in SECTION 4(a)) in connection with any FS/OM Permitted Activities.

(e) Notwithstanding anything to the contrary contained in this SECTION 4, the Company may not, directly or indirectly, take any action otherwise approved pursuant to Section 4(b) if such action would have a materially adverse and disproportionate effect on the powers, preferences, rights, limitations, qualifications and restrictions or privileges of any Holder with respect to any shares of Series A-2 Preferred Stock held by any Holder, without the prior approval of such Holder.

(f) Written Consent. Any action as to which a class vote of the holders of Preferred Stock, or the holders of Preferred Stock and Common Stock voting together, is required pursuant to the terms of this Certificate of Designation may be taken without a meeting, without prior notice and without a vote, if a consent or consents in writing, setting forth the action so taken, shall be signed by the holders of outstanding stock having not less than the minimum number of votes that would be necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon were present and voted and shall be delivered to the Company.

SECTION 5. Conversion. Each Preferred Share is convertible into shares of Common Stock (or Reference Property, to the extent applicable) as provided in this SECTION 5, except that Preferred Shares may not be converted into Common Stock with respect to any Holder to the extent that, following such conversion, such Holder would Beneficially Own more than 9.9% of the Company’s outstanding Common Stock until the receipt by such Holder of any approvals from the Insurance Regulatory Authorities required to be obtained by such Holder in order for such Holder to Beneficially Own in excess of 9.9% of the Company’s outstanding Common Stock.

Notwithstanding anything to the contrary herein, if any of the approvals from the Insurance Regulatory Authorities required to be obtained by a Holder in order for such Holder to Beneficially Own in excess of 9.9% of the Company’s outstanding Common Stock have not been obtained at (x) a time when the Company desires to exercise its right to convert shares of Series A-2 Preferred Stock pursuant to SECTION 5(b) or (y) the Maturity Date in connection with the automatic conversion of the shares of Series A-2 Preferred Stock pursuant to SECTION 5(c), the Company will not be entitled to convert any Holder's Series A-2 Preferred Stock (and, in the case of SECTION 5(c), the Series A-2 Preferred Stock shall not automatically convert) to the extent conversion would cause such Holder to Beneficially Own more than 9.9% of the Company’s outstanding Common Stock (any such shares of Series A-2 Preferred Stock that are not converted as a result of the foregoing limitation, the "Regulated Shares"). From and after the date of the conversions contemplated by SECTIONS 5(b) or 5(c), as applicable, each Regulated Share shall have no rights, powers, preferences or privileges other than the right to (i) convert into Common Stock if and when the approvals from the Insurance Regulatory Authorities required to be obtained by such Holder in order for such Holder to Beneficially Own in excess of 9.9% of the Company’s outstanding Common Stock have been obtained and (ii) receive dividends and distributions pursuant to SECTIONS 2(c) and 2(d).

9

(a) Conversion at the Option of Holders of Series A-2 Preferred Stock. Subject to SECTION 5(b) hereof, each Holder is entitled to convert, at any time and from time to time, at the option and election of such Holder, any or all outstanding Preferred Shares held by such Holder and receive therefor the property described in SECTION 5(d) upon such conversion. In order to convert Preferred Shares into shares of Common Stock (or Reference Property, to the extent applicable), the Holder must surrender the certificates representing such Preferred Shares at the office of the Company's transfer agent for the Series A-2 Preferred Stock (or at the principal office of the Company, if the Company serves as its own transfer agent), together with (x) written notice that such Holder elects to convert all or part of the Preferred Shares represented by such certificates as specified therein, (y) a written instrument or instructions of transfer or other documents and endorsements reasonably acceptable to the transfer agent or the Company, as applicable (if reasonably required by the transfer agent or the Company, as applicable), and (z) funds for any stock transfer, documentary, stamp or similar taxes, if payable by the Holder pursuant to SECTION 5(f)(i). Except as provided in SECTION 5(b) and in SECTION 5(c), the date the transfer agent or the Company, as applicable, receives such certificates, together with such notice and any other documents and amounts required to be paid by the Holder pursuant to this SECTION 5, will be the date of conversion (the "Conversion Date").

(b) Conversion at the Option of the Company. Beginning on the third (3rd) anniversary of May 13, 2011, the Company shall have the right, at its option, to cause all shares of Series A-2 Preferred Stock to be automatically converted (without any further action by the Holder and whether or not the certificates representing the Preferred Shares are surrendered), in whole but not in part, into the property described in SECTION 5(d) within eight (8) Business Days of any day (the "Forced Conversion Trigger Date") on which all of the Company Conversion Conditions are satisfied from time to time. The Company may exercise its option under this SECTION 5(b) by providing the Holders with a notice, which notice shall specify that the Company is exercising the option contemplated by this SECTION 5(b), the Forced Conversion Trigger Date and the Conversion Date on which the conversion shall occur (which Conversion Date shall be not less than four (4) Business Days following the date such notice is provided to the Holders); provided that, once delivered, such notice shall be irrevocable, unless the Company obtains the written consent of the Series A-2 Majority Holders. For the avoidance of doubt, (x) the Holders shall continue to have the right to convert their Preferred Shares pursuant to SECTION 5(a) until and through the Conversion Date contemplated in this SECTION 5(b) and (y) if any Preferred Shares are converted pursuant to SECTION 5(a), such Preferred Shares shall no longer be converted pursuant to this SECTION 5(b) and the Company's notice delivered to the Holders pursuant to this SECTION 5(b) shall automatically terminate with respect to such Preferred Shares. Notwithstanding the foregoing, any notice delivered by the Company under this SECTION 5(b) in accordance with SECTION 10(g) shall be conclusively presumed to have been duly given at the time set forth therein, whether or not such Holder of Preferred Shares actually receives such notice, and neither the failure of a Holder to actually receive such notice given as aforesaid nor any immaterial defect in such notice shall affect the validity of the proceedings for the conversion of the Preferred Shares as set forth in this SECTION 5(b). The Company shall issue a press release for publication on the Dow Jones News Service or Bloomberg Business News (or if either such service is not available, another broadly disseminated news or press release service selected by the Company) prior to the opening of

10

business on the first Business Day following any date on which the Company provides notice to Holders pursuant to this SECTION 5(b) announcing the Company’s election to convert Preferred Shares pursuant to this SECTION 5(b).

(c) Automatic Conversion on Maturity Date. In the event that any Holder has not elected to have its Preferred Shares redeemed by the Company on the Maturity Date (as defined herein) pursuant to SECTION 6(a), then such Holder's Preferred Shares shall be automatically converted (without any further action by the Holder and whether or not the certificates representing the Preferred Shares are surrendered), in whole and not in part, into the property described in SECTION 5(d), effective as of the Maturity Date, which shall be deemed to be the "Conversion Date" for purposes of this SECTION 5(c). As promptly as practicable (but in no event more than five (5) Business Days) following the Maturity Date, the Company shall deliver a notice to any Holder whose Preferred Shares have been converted by the Company pursuant to this SECTION 5(c), informing such Holder of the number of shares of Common Stock into which such Preferred Shares have been converted, together with certificates evidencing such shares of Common Stock. Notwithstanding the foregoing, any notice delivered by the Company in compliance with this SECTION 5(c) shall be conclusively presumed to have been duly given, whether or not such Holder of Preferred Shares actually receives such notice, and neither the failure of a Holder to actually receive such notice given as aforesaid nor any immaterial defect in such notice shall affect the validity of the proceedings for the conversion of the Preferred Shares as set forth in this SECTION 5(c). The Company shall issue a press release for publication on the Dow Jones News Service or Bloomberg Business News (or if either such service is not available, another broadly disseminated news or press release service selected by the Company) prior to the opening of business on the first Business Day following the Maturity Date announcing the aggregate number of Preferred Shares being converted pursuant to this SECTION 5(c) and the number of shares of Common Stock issuable in connection therewith, as well as the aggregate number of Preferred Shares redeemed on the Maturity Date and the purchase price paid by the Company therefor.

(d) Amounts Received Upon Conversion. Upon a conversion of Preferred Shares pursuant to SECTION 5(a), (b) or (c), the Holder of such converted Preferred Shares shall, subject to the limitations and adjustments pursuant to the first paragraph of SECTION 5, receive in respect of each Preferred Share:

(i) a number of shares of Common Stock (or Reference Property, to the extent applicable) equal to the amount (the "Conversion Amount") determined by dividing (A) the Purchase Price for the Preferred Share to be converted by (B) the Conversion Price in effect at the time of conversion; provided that, notwithstanding the foregoing, if the Company has elected to convert all Preferred Shares pursuant to SECTION 5(b) and the Public Float Hurdle is not met on the Forced Conversion Trigger Date, then each Holder may elect, by delivery of a notice to the Company no later than the close of business on the Business Day immediately prior to the Conversion Date, to receive, in lieu of Common Stock (or Reference Property, to the extent applicable), cash equal to the Conversion Amount multiplied by the Thirty Day VWAP as of the close of business on the Business Day immediately preceding the Conversion Date, which cash amount shall be delivered to the electing Holders within forty-five (45) calendar days of the date that

11

the last Holder electing to receive cash pursuant to this SECTION 5(d)(i) has provided the Company with notice thereof;

(ii) cash in an amount equal to the amount of any accrued but unpaid Cash Dividends and Participating Cash Dividends (to the extent not included in the Purchase Price) on the Preferred Shares being converted; provided that, to the extent the Company is prohibited by law or by contract from paying such amount, then the Company shall provide written notice to the applicable Holder of such inability to pay, and at the written election of the Holder (which written election shall be delivered to the Company within five (5) Business Days of receipt of such written notice from the Company), the Company shall either pay such amount as soon as payment is no longer so prohibited or issue Common Stock (or Reference Property, to the extent applicable) in the manner specified in SECTION 5(d)(i) as if the amount of such accrued but unpaid Cash Dividends and Participating Cash Dividends were added to the Purchase Price;

(iii) a number of shares of Common Stock (or Reference Property, to the extent applicable) equal to the amount determined by dividing (A) the amount of any accrued but unpaid Accreting Dividends (to the extent not included in the Purchase Price) on the Preferred Shares being converted by (B) the Conversion Price in effect at the time of Conversion; and

(iv) any accrued and unpaid In-Kind Participating Dividends.

Notwithstanding the foregoing, in the event any Holder would be required to file any Notification and Report Form pursuant to the HSR Act as a result of the conversion of any Preferred Shares into the property described above in this Section 5(d), at the option of such Holder upon written notice to the Company, the effectiveness of such conversion shall be delayed (only to the extent necessary to avoid a violation of the HSR Act), until such Holder shall have made such filing under the HSR Act and the applicable waiting period shall have expired or been terminated; provided, however, that in such circumstances such Holder shall use commercially reasonable efforts to make such filing and obtain the expiration or termination of such waiting period as promptly as reasonably practical and the Company shall make all required filings and reasonably cooperate with and assist such Holder in connection with the making of such filing and obtaining the expiration or termination of such waiting period and shall be reimbursed by such Holder for any reasonable and documented out-of-pocket costs incurred by the Company in connection with such filings and cooperation. Notwithstanding the foregoing, if the conversion of any Preferred Share is delayed pursuant to the preceding sentence at (x) a time when the Company desires to exercise its right to convert shares of Series A-2 Preferred Stock pursuant to SECTION 5(b) or (y) the Maturity Date in connection with the automatic conversion of the shares of Series A-2 Preferred Stock pursuant to SECTION 5(c), from and after the date of the conversions contemplated by SECTIONS 5(b) or 5(c), as applicable, such Preferred Share not then converted shall have no rights, powers, preferences or privileges other than the rights provided by this paragraph and the right to (i) convert into Common Stock if and when such Holder shall have made such filing under the HSR Act and the waiting period in connection with such filing under the HSR Act shall have expired or been terminated and (ii) receive dividends and distributions pursuant to SECTIONS 2(c) and 2(d).

12

(e) Fractional Shares. No fractional shares of Common Stock (or fractional shares in respect of Reference Property, to the extent applicable) will be issued upon conversion of the Series A-2 Preferred Stock. In lieu of fractional shares, the Company shall pay cash in respect of each fractional share equal to such fractional amount multiplied by the Thirty Day VWAP as of the closing of business on the Business Day immediately preceding the Conversion Date. If more than one Preferred Share is being converted at one time by the same Holder, then the number of full shares issuable upon conversion will be calculated on the basis of the aggregate number of Preferred Shares converted by such Holder at such time.

(f) Mechanics of Conversion.

(i) As soon as reasonably practicable after the Conversion Date, or in the case of Regulated Shares, the date on which the Holder thereof provides evidence to the Company that such Holder has obtained the approvals from the Insurance Regulatory Authorities required to be obtained by such Holder to Beneficially Own in excess of 9.9% of the Company’s outstanding Common Stock, (and in any event within four (4) Trading Days after either such date), the Company shall issue and deliver to such Holder one or more certificates for the number of shares of Common Stock (or Reference Property, to the extent applicable) to which such Holder is entitled, together with, at the option of the Holder, a check or wire transfer of immediately available funds for payment of fractional shares and any payment required by SECTION 5(d)(ii) in exchange for the certificates representing the converted Preferred Shares (including any Regulated Shares). Such conversion will be deemed to have been made on the Conversion Date, or in the case of Regulated Shares, the date on which the Holder thereof provides evidence to the Company that such Holder has obtained the approvals from the Insurance Regulatory Authorities required to be obtained by such Holder to Beneficially Own in excess of 9.9% of the Company’s outstanding Common Stock, and the Person entitled to receive the shares of Common Stock (or Reference Property, to the extent applicable) issuable upon such conversion shall be treated for all purposes as the record holder of such shares of Common Stock (or Reference Property, to the extent applicable) on such date. The delivery of the Common Stock upon conversion of Preferred Shares (including any Regulated Shares) shall be made, at the option of the applicable Holder, in certificated form or by book-entry. Any such certificate or certificates shall be delivered by the Company to the appropriate Holder on a book-entry basis or by mailing certificates evidencing the shares to the Holders at their respective addresses as set forth in the conversion notice. In cases where fewer than all the Preferred Shares represented by any such certificate are to be converted, a new certificate shall be issued representing the unconverted Preferred Shares (or Regulated Shares). The Company shall pay any documentary, stamp or similar issue or transfer tax due on the issue of Common Stock (or Reference Property, to the extent applicable) upon conversion or due upon the issuance of a new certificate for any Preferred Shares (or Regulated Shares) not converted to the converting Holder; provided that the Company shall not be required to pay any such amounts, and any such amounts shall be paid by the converting Holder, in the event that such Common Stock or Preferred Shares are issued in a name other than the name of the converting Holder.

(ii) For the purpose of effecting the conversion of Preferred Shares (including any Regulated Shares), the Company shall: (A) at all times reserve and keep available,

13

free from any preemptive rights, out of its treasury or authorized but unissued shares of Common Stock (or Reference Property, to the extent applicable) the full number of shares of Common Stock (or Reference Property, to the extent applicable) deliverable upon the conversion of all outstanding Preferred Shares (including Regulated Shares) after taking into account any adjustments to the Conversion Price from time to time pursuant to the terms of this SECTION 5 and any increases to the Purchase Price from time to time and assuming for the purposes of this calculation that all outstanding Preferred Shares are held by one holder) and (B) without prejudice to any other remedy at law or in equity any Holder may have as a result of such default, take all actions reasonably required to amend its Certificate of Incorporation, as expeditiously as reasonably practicable, to increase the authorized and available amount of Common Stock (or Reference Property, to the extent applicable) if at any time such amendment is necessary in order for the Company to be able to satisfy its obligations under this SECTION 5. Before taking any action which would cause an adjustment reducing the Conversion Price below the then par value of the shares of Common Stock (or Reference Property, to the extent applicable) issuable upon conversion of the Series A-2 Preferred Stock, the Company will take any corporate action which may be necessary in order that the Company may validly and legally issue fully paid and nonassessable shares of Common Stock (or Reference Property, to the extent applicable) upon the conversion of all outstanding Preferred Shares at such adjusted Conversion Price.

(iii) From and after the Conversion Date, or in the case of Regulated Shares, the date on which the Holder thereof provides evidence to the Company that such Holder has obtained the approvals from the Insurance Regulatory Authorities required to be obtained by such Holder to Beneficially Own in excess of 9.9% of the Company’s outstanding Common Stock, the Preferred Shares (including any Regulated Shares) converted on such date, will no longer be deemed to be outstanding and all rights of the Holder thereof including the right to receive Dividends, but excluding the right to receive from the Company the Common Stock (or Reference Property, to the extent applicable) or any cash payment upon conversion, and except for any rights of Holders (including any voting rights) pursuant to this Certificate of Designation which by their express terms continue following conversion or, for the avoidance of doubt, rights which by their express terms continue following conversion pursuant to any of the other Transaction Agreements (as defined in the Securities Purchase Agreement) shall immediately and automatically cease and terminate with respect to such Preferred Shares (including any Regulated Shares); provided that, in the event that a Preferred Share or Regulated Share is not converted due to a default by the Company or because the Company is otherwise unable to issue the requisite shares of Common Stock (or Reference Property, to the extent applicable), such Preferred Share or Regulated Share will, without prejudice to any other remedy at law or in equity any Holder may have as a result of such default, remain outstanding and will continue be entitled to all of the rights attendant to such Preferred Share or Regulated Share (as the case may be) as provided herein.

(iv) If the conversion is in connection with any sale, transfer or other disposition of the shares of Common Stock (or Reference Property, to the extent applicable) issuable upon conversion of Preferred Shares made pursuant to the Tag-Along Agreement (as defined in the Securities Purchase Agreement), the conversion may, at the option of any Holder tendering Preferred Shares for conversion, be conditioned upon the closing of such sale, transfer or the disposition of the

14

shares of Common Stock (or Reference Property, to the extent applicable) issuable upon conversion of such Preferred Shares, in which event such conversion of such Preferred Shares shall not be deemed to have occurred until immediately prior to the closing of such sale, transfer or other disposition.

(v) The Company shall comply with all federal and state laws, rules and regulations and applicable rules and regulations of the Exchange on which shares of the Common Stock (or Reference Property, to the extent applicable) are then listed. If any shares of Common Stock (or Reference Property, to the extent applicable) to be reserved for the purpose of conversion of Preferred Shares require registration with or approval of any Person or group (as such term is defined in Section 13(d)(3) of the Exchange Act) under any federal or state law or the rules and regulations of the Exchange on which shares of the Common Stock (or Reference Property, to the extent applicable) are then listed before such shares may be validly issued or delivered upon conversion, then the Company will, as expeditiously as reasonably practicable, use commercially reasonable efforts to secure such registration or approval, as the case may be. So long as any Common Stock (or Reference Property, to the extent applicable) into which the Preferred Shares are then convertible is then listed on an Exchange, the Company will list and keep listed on any such Exchange, upon official notice of issuance, all shares of such Common Stock (or Reference Property, to the extent applicable) issuable upon conversion.

(vi) All shares of Common Stock (or Reference Property, to the extent applicable) issued upon conversion of the Preferred Shares (including any Regulated Shares) will, upon issuance by the Company, be duly and validly issued, fully paid and nonassessable, not issued in violation of any preemptive or similar rights arising under law or contract and free from all taxes, liens and charges with respect to the issuance thereof, and the Company shall take no action which will cause a contrary result.

(g) Adjustments to Conversion Price.

(i) The Conversion Price shall be subject to the following adjustments:

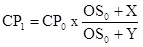

(A) Common Stock Dividends or Distributions. If the Company issues shares of Common Stock as a dividend or distribution on shares of Common Stock, or if the Company effects a share split or share combination with respect to shares of Common Stock, the Conversion Price will be adjusted based on the following formula:

where,

CP0 = the Conversion Price in effect immediately prior to the open of business on the Ex-Date for such dividend or distribution, or the open of business on the effective date of such share split or share combination, as the case may be;

15

CP1 = the Conversion Price in effect immediately after the open of business on the Ex-Date for such dividend or distribution, or the open of business on the effective date of such share split or share combination, as the case may be;

OS0 = the number of shares of Common Stock outstanding immediately prior to the open of business on the Ex-Date for such dividend or distribution, or the open of business on the effective date of such share split or share combination, as the case may be; and

OS1 = the number of shares of Common Stock outstanding immediately after such dividend or distribution, or such share split or share combination, as the case may be.

Any adjustment made under this SECTION 5(g)(i)(A) shall become effective immediately after the open of business on the Ex-Date for such dividend or distribution, or immediately after the open of business on the effective date for such share split or share combination. If any dividend or distribution of the type described in this SECTION 5(g)(i)(A) is declared but not so paid or made, or any share split or combination of the type described in this SECTION 5(g)(i)(A) is announced but the outstanding shares of Common Stock are not split or combined, as the case may be, the Conversion Price shall be immediately readjusted, effective as of the date the Board determines not to pay such dividend or distribution, or not to split or combine the outstanding shares of Common Stock, as the case may be, to the Conversion Price that would then be in effect if such dividend, distribution, share split or share combination had not been declared or announced.

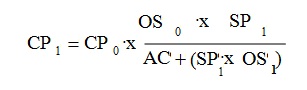

(B) Rights, Options or Warrants on Common Stock. If the Company distributes to all or substantially all holders of its Common Stock any rights, options or warrants entitling them, for a period expiring not more than sixty (60) days immediately following the record date of such distribution, to purchase or subscribe for shares of Common Stock at a price per share less than the average of the Daily VWAP of the Common Stock over the ten (10) consecutive Trading Day period ending on the Trading Day immediately preceding the Ex-Date for such distribution, the Conversion Price will be adjusted based on the following formula:

where,

CP0 = the Conversion Price in effect immediately prior to the open of business on the Ex-Date for such distribution;

CP1 = the Conversion Price in effect immediately after the open of business on the Ex-Date for such distribution;

OS0 = the number of shares of Common Stock outstanding immediately prior to the open of business on the Ex-Date for such distribution;

16

X = the number of shares of Common Stock equal to the aggregate price payable to exercise all such rights, options or warrants divided by the average of the Daily VWAP of the Common Stock over the ten (10) consecutive Trading Day period ending on the Trading Day immediately preceding the Ex-Date for such distribution; and

Y = the total number of shares of Common Stock issuable pursuant to all such rights, options or warrants.

Any adjustment made under this SECTION 5(g)(i)(B) will be made successively whenever any such rights, options or warrants are distributed and shall become effective immediately after the open of business on the Ex-Date for such distribution. To the extent that shares of Common Stock are not delivered prior to the expiration of such rights, options or warrants, the Conversion Price shall be readjusted following the expiration of such rights to the Conversion Price that would then be in effect had the decrease in the Conversion Price with respect to the distribution of such rights, options or warrants been made on the basis of delivery of only the number of shares of Common Stock actually delivered. If such rights, options or warrants are not so distributed, the Conversion Price shall be immediately readjusted, effective as of the date the Board determines not to make such distribution, to the Conversion Price that would then be in effect if such distribution had not occured.

In determining whether any rights, options or warrants entitle the holders to subscribe for or purchase shares of Common Stock at less than such average of the Daily VWAP for the ten (10) consecutive Trading Day period ending on the Trading Day immediately preceding the Ex-Date for such distribution, and in determining the aggregate offering price of such shares of the Common Stock, there shall be taken into account any consideration received by the Company for such rights, options or warrants and any amount payable on exercise or conversion thereof, the fair market value of such consideration, if other than cash, to be reasonably determined by the Board in good faith.

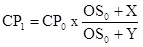

(C) Tender Offer or Exchange Offer Payments. If the Company or any of its Subsidiaries makes a payment in respect of a tender offer or exchange offer for Common Stock, if the aggregate value of all cash and any other consideration included in the payment per share of Common Stock (as reasonably determined in good faith by the Board) exceeds the average of the Daily VWAP of the Common Stock over the ten (10) consecutive Trading Day period commencing on, and including, the Trading Day next succeeding the date on which such tender offer or exchange offer expires, the Conversion Price will be decreased based on the following formula:

where,

CP1 = the Conversion Price in effect immediately after the close of business on the last Trading Day of the ten (10) consecutive Trading Day period commencing on, and including, the Trading Day next succeeding the date such tender or exchange offer expires;

17

CP0 = the Conversion Price in effect immediately prior to the close of business on the last Trading Day of the ten (10) consecutive Trading Day period commencing on, and including, the Trading Day next succeeding the date such tender or exchange offer expires;

OS0 = the number of shares of Common Stock outstanding immediately prior to the date such tender or exchange offer expires;

SP1 = the average of the Daily VWAP of the Common Stock over the ten (10) consecutive Trading Day period commencing on, and including, the Trading Day next succeeding the date such tender or exchange offer expires;

AC = the aggregate value of all cash and any other consideration (as reasonably determined in good faith by the Board) paid or payable for shares purchased in such tender or exchange offer; and

OS1 = the number of shares of Common Stock outstanding immediately after the date such tender or exchange offer expires (after giving effect to such tender offer or exchange offer and excluding fractional shares).

The adjustment to the Conversion Price under this SECTION 5(g)(i)(C) will occur at the close of business on the tenth (10th) Trading Day immediately following, but excluding, the date such tender or exchange offer expires; provided that, for purposes of determining the Conversion Price, in respect of any conversion during the ten (10) Trading Days immediately following, but excluding, the date that any such tender or exchange offer expires, references within this SECTION 5(g)(i)(C) to ten (10) consecutive Trading Days shall be deemed replaced with such lesser number of consecutive Trading Days as have elapsed between the date such tender or exchange offer expires and the relevant conversion date.

(D) Common Stock Issued at Less than Conversion Price. If, after the Original Issue Date, with respect to the next $45 million of Additional Permitted Preferred Stock issued or sold by the Company, the Company issues or sells any such Additional Permitted Preferred Stock for consideration per share of Common Stock (determined pursuant to SECTION 5(g)(i)(D)(4)) less than the Conversion Price in effect as of the date of such issuance or sale but equal to or greater than $6.50 per share (as adjusted for any splits, combinations, reclassifications or similar adjustments to the Common Stock during such period), the Conversion Price in effect immediately prior to each such issuance or sale will (except as provided below) be adjusted at the time of such issuance or sale to be equal to such per share consideration. If, after the Original Issue Date, with respect to the next $45 million of Additional Permitted Preferred Stock issued or sold by the Company, the Company issues or sells any Additional Permitted Preferred Stock for no consideration or for consideration per share of Common Stock (determined pursuant to SECTION 5(g)(i)(D)(4)) less than $6.50 per share (as adjusted for any splits,

18

combinations, reclassifications or similar adjustments to the Common Stock during such period), the Conversion Price in effect immediately prior to each such issuance or sale will (except as provided below) be adjusted at the time of such issuance or sale based on the formula set forth in the following sentence, except that for purposes of such calculation, CP0 shall be equal to $6.50 per share (as adjusted for any splits, combinations, reclassifications or similar adjustments to the Common Stock during such period). If, after the Original Issue Date, the Company issues or sells any Common Stock (or Option Securities or Convertible Securities, to the extent set forth in this SECTION 5(g)(i)(D)), other than (x) Excluded Stock or (y) the next $45 million of Additional Permitted Preferred Stock issued or sold by the Company, for no consideration or for consideration per share less than the Conversion Price in effect as of the date of such issuance or sale, the Conversion Price in effect immediately prior to each such issuance or sale will (except as provided below) be adjusted at the time of such issuance or sale based on the following formula:

where,

CP1 = the Conversion Price in effect immediately following such issuance or sale;

CP0 = the Conversion Price in effect immediately prior to such issuance or sale;

OS0 = the number of shares of Common Stock outstanding immediately prior to such issuance or sale (treating for this purpose as outstanding all shares of Common Stock issuable upon the conversion or exchange of (x) all Preferred Shares issued on the Original Issue Date, (y) all shares of Existing Series A Preferred Stock and Additional Permitted Preferred Stock and (z) all convertible, exchangeable or exercisable Equity Securities of the Company not listed in (x) or (y) if the conversion price, exercise price or exchange price applicable to such Equity Securities of the Company is below Market Value on the determination date) outstanding immediately prior to such issuance or sale;

X = the number of shares of Common Stock that the aggregate consideration received by the Company for the number of shares of Common Stock so issued or sold would purchase at a price per share equal to CP0; and

Y = the number of additional shares of Common Stock so issued.

For the purposes of any adjustment of the Conversion Price pursuant to this SECTION 5(g)(i)(D), the following provisions shall be applicable:

(1) In the case of the issuance of Common Stock for cash, the amount of the consideration received by the Company shall be deemed to be the amount of the cash proceeds received by the Company for such Common Stock after deducting therefrom any discounts or commissions allowed, paid or incurred by the Company for any underwriting or otherwise in connection with the issuance and sale thereof.

(2) In the case of the issuance of Common Stock (otherwise than upon the conversion of shares of Capital Stock or other securities of the Company) for a consideration in whole or in part other than cash, including securities acquired in exchange

19

therefor (other than securities by their terms so exchangeable), the consideration other than cash shall be deemed to be the fair market value thereof as reasonably determined by the Board in good faith.

(3) For the avoidance of doubt, the provisions of this SECTION 5(g)(i)(D) shall apply to any issuance of Additional Permitted Preferred Stock that are Convertible Securities and meet the criteria for requiring an adjustment under this SECTION 5(g)(i)(D).

(4) In the case of (A) the issuance of Option Securities (whether or not at the time exercisable) or (B) the issuance of Convertible Securities (whether or not at the time so convertible or exchangeable):

i) the issuance of Option Securities shall be deemed the issuance of all shares of Common Stock deliverable upon the exercise of such Option Securities;

ii) such Option Securities shall be deemed to be issued for a consideration equal to the value of the consideration (determined in the manner provided in SECTION 5(g)(i)(D)(1) and (2)), if any, received by the Company for such Option Securities, plus the exercise price, strike price or purchase price provided in such Option Securities for the Common Stock covered thereby;

iii) the issuance of Convertible Securities shall be deemed the issuance of all shares of Common Stock deliverable upon conversion of, or in exchange for, such Convertible Securities;

iv) such Convertible Securities shall be deemed to be issued for a consideration equal to the value of the consideration (determined in the manner provided in SECTION 5(g)(i)(D)(1) and (2) and excluding any cash received on account of accrued interest or accrued dividends), if any, received by the Company for such Convertible Securities, plus the value of the additional consideration (determined in the manner provided in SECTION 5(g)(i)(D)(1) and (2)) to be received by the Company upon the conversion or exchange of such Convertible Securities, if any;

v) upon any change in the number of shares of Common Stock deliverable upon exercise of any Option Securities or Convertible Securities or upon any change in the consideration to be received by the Company upon the exercise, conversion or exchange of such securities, the Conversion Price then in effect shall be readjusted to such Conversion Price as would have been in effect had such change been in effect, with respect to any Option Securities or Convertible Securities outstanding at the time of the change, at the time such Option Securities or Convertible Securities originally were issued;

vi) upon the expiration or cancellation of Option Securities (without exercise), or the termination of the conversion or exchange rights of Convertible

20

Securities (without conversion or exchange), if the Conversion Price shall have been adjusted upon the issuance of such expiring, canceled or terminated securities, the Conversion Price shall be readjusted to such Conversion Price as would have been obtained if, at the time of the original issuance of such Option Securities or Convertible Securities, the expired, canceled or terminated Option Securities or Convertible Securities, as applicable, had not been issued;

vii) if the Conversion Price shall have been fully adjusted upon the issuance of any such options, warrants, rights or convertible or exchangeable securities, no further adjustment of the Conversion Price shall be made for the actual issuance of Common Stock upon the exercise, conversion or exchange thereof; and

viii) if any issuance of Common Stock, Option Securities or Convertible Securities would also require an adjustment pursuant to any other adjustment provision of this SECTION 5(g)(i), then only the adjustment most favorable to the Holders shall be made.

(ii) If the Company issues rights, options or warrants that are only exercisable upon the occurrence of certain triggering events (each, a "Trigger Event"), then the Conversion Price will not be adjusted pursuant to SECTION 5(g)(i)(B) until the earliest Trigger Event occurs, and the Conversion Price shall be readjusted to the extent any of these rights, options or warrants are not exercised before they expire (provided, however, that, for the avoidance of doubt, if such Trigger Event would require an adjustment pursuant to SECTION 5(g)(i)(D), such adjustment pursuant to SECTION 5(g)(i)(D) shall be made at the time of issuance of such rights, options or warrants in accordance with such Section).

(iii) Notwithstanding anything in this SECTION 5(g) to the contrary, if a Conversion Price adjustment becomes effective pursuant to any of clauses (A), (B) or (C) of this SECTION 5(g)(i) on any Ex-Date as described above, and a Holder that converts its Preferred Shares on or after such Ex-Date and on or prior to the related record date would be treated as the record holder of shares of Common Stock as of the related Conversion Date based on an adjusted Conversion Price for such Ex-Date and participate on an adjusted basis in the related dividend, distribution or other event giving rise to such adjustment, then, notwithstanding the foregoing Conversion Price adjustment provisions, the Conversion Price adjustment relating to such Ex-Date will not be made for such converting Holder. Instead, such Holder will be treated as if such Holder were the record owner of the shares of Common Stock on an un-adjusted basis and participate in the related dividend, distribution or other event giving rise to such adjustment.

Notwithstanding anything in this SECTION 5(g) to the contrary, no adjustment under SECTION 5(g)(i) need be made to the Conversion Price unless such adjustment would require a decrease of at least 1% of the Conversion Price then in effect. Any lesser adjustment shall be carried forward and shall be made at the time of and together with the next subsequent adjustment, if any, which, together with any adjustment or adjustments so carried forward, shall amount to a decrease of at least 1% of such Conversion Price; provided that, on the date of any conversion of the Preferred Shares pursuant to SECTION 5, adjustments to the Conversion Price will be made with respect to any such adjustment carried forward that has not been taken into account before such date. In

21

addition, at the end of each year, beginning with the year ending December 31, 2011, the Conversion Price shall be adjusted to give effect to any adjustment or adjustments so carried forward, and such adjustments will no longer be carried forward and taken into account in any subsequent adjustment.

(iv) Adjustments Below Par Value. The Company shall not take any action that would require an adjustment to the Conversion Price such that the Conversion Price, as adjusted to give effect to such action, would be less than the then-applicable par value per share of the Common Stock, except that the Company may undertake a share split or similar event if such share split results in a corresponding reduction in the par value per share of the Common Stock such that the as-adjusted new Conversion Price per share would not be below the new as-adjusted par value per share of the Common Stock following such share split or similar transaction and the Conversion Price is adjusted as provided under SECTION 5(g)(i)(A) and any other applicable provision of SECTION 5(g).

(v) Reference Property. In the case of any Going Private Event or recapitalization, reclassification or change of the Common Stock (other than changes resulting from a subdivision, combination or reclassification described in SECTION 5(g)(i)(A)), a consolidation, merger or combination involving the Company, a sale, lease or other transfer to a third party of all or substantially all of the assets of the Company (or the Company and its Subsidiaries on a consolidated basis), or any statutory share exchange, in each case as a result of which the Common Stock would be converted into, or exchanged for, stock, other securities, other property or assets (including cash or any combination thereof) (any of the foregoing, a "Transaction"), then, at the effective time of the Transaction, the right to convert each Preferred Share will be changed into a right to convert such Preferred Share into the kind and amount of shares of stock, other securities or other property or assets (including cash or any combination thereof) (the "Reference Property") that a Holder would have received in respect of the Common Stock issuable upon conversion of such Preferred Shares immediately prior to such Transaction. In the event that holders of Common Stock have the opportunity to elect the form of consideration to be received in the Transaction, the Company shall make adequate provision whereby the Holders shall have a reasonable opportunity to determine the form of consideration into which all of the Preferred Shares, shares of Existing Series A Preferred Stock and shares of Additional Permitted Preferred Stock, treated as a single class, shall be convertible from and after the effective date of the Transaction. For so long as the Fortress Investor Group owns a number of shares of Existing Series A Preferred Stock equal to or greater than 50% of the Initial Preferred Share Amount, such determination shall be made by the Fortress Investor; thereafter, any such election shall be made by the Majority Holders. Any such determination by the Holders shall be subject to any limitations to which all holders of Common Stock are subject, such as pro rata reductions applicable to any portion of the consideration payable in the Transaction, and shall be conducted in such a manner as to be completed at approximately the same time as the time elections are made by holders of Common Stock. The provisions of this SECTION 5(g)(v) and any equivalent thereof in any such securities similarly shall apply to successive Transactions. The Company shall not become a party to any Transaction unless its terms are in compliance with the foregoing.

22

(vi) Rules of Calculation; Treasury Stock. All calculations will be made to the nearest one-hundredth of a cent or to the nearest one-ten thousandth of a share. Except as explicitly provided herein, the number of shares of Common Stock (or Reference Property, to the extent applicable) outstanding will be calculated on the basis of the number of issued and outstanding shares of Common Stock (or Reference Property, to the extent applicable), not including shares held in the treasury of the Company. The Company shall not pay any dividend on or make any distribution to shares of Common Stock (or Reference Property, to the extent applicable) held in treasury.

(vii) No Duplication. If any action would require adjustment of the Conversion Price pursuant to more than one of the provisions described in this SECTION 5 in a manner such that such adjustments are duplicative, only one adjustment (which shall be the adjustment most favorable to the Holders) shall be made.

(viii) Notice of Record Date. In the event of:

(A) any event described in SECTION 5(g)(i)(A), (B), (C) or (D);

(B) any Transaction to which SECTION 5(g)(v) applies;

(C) the dissolution, liquidation or winding-up of the Company; or

(D) any other event constituting a Change of Control or a Going Private Event;

then the Company shall mail to the Holders at their last addresses as shown on the records of the Company, at least twenty (20) days prior to the record date specified in (A) below or twenty (20) days prior to the date specified in (B) below, as applicable, a notice stating:

(A) the record date for the dividend, other distribution, stock split or combination or, if a record is not to be taken, the date as of which the holders of Common Stock of record to be entitled to such dividend, other distribution, stock split or combination; or

(B) the date on which such reclassification, change, dissolution, liquidation, winding-up or other event constituting a Transaction, Change of Control or Going Private Event, or any transaction which would result in an adjustment pursuant to SECTION 5(g)(i)(D), is estimated to become effective or otherwise occur, and the date as of which it is expected that holders of Common Stock of record will be entitled to exchange their shares of Common Stock for Reference Property, other securities or other property deliverable upon such reclassification, change, liquidation, dissolution, winding-up, Transaction, Change of Control or Going Private Event or that such issuance of Common Stock, Option Securities or Convertible Securities is anticipated to occur.

(ix) Certificate of Adjustments. Upon the occurrence of each adjustment or readjustment of the Conversion Price pursuant to this SECTION 5, the Company at its expense

23

shall as promptly as reasonably practicable compute such adjustment or readjustment in accordance with the terms hereof and furnish to each Holder a certificate, signed by an officer of the Company (in his or her capacity as such and not in an individual capacity), setting forth (A) the calculation of such adjustments and readjustments in reasonable detail, (B) the facts upon which such adjustment or readjustment is based, (C) the Conversion Price then in effect, and (D) the number of shares of Common Stock (or Reference Property, to the extent applicable) and the amount, if any, of Capital Stock, other securities or other property (including but not limited to cash and evidences of indebtedness) which then would be received upon the conversion of a Preferred Share.

(x) No Upward Revisions to Conversion Price. For the avoidance of doubt, except in the case of a reverse share split or share combination resulting in an adjustment under SECTION 5(g)(i)(A) effected with the approvals, if any, required pursuant to SECTION 4(b), in no event shall any adjustment be made pursuant to this SECTION 5 that results in an increase in the Conversion Price.

SECTION 6. Redemption.

(a) Redemption at Option of Holder on Maturity Date. Each Holder shall have the right to require the Company to redeem such Holder's Preferred Shares, in whole or in part, on the seventh (7th) anniversary of May 13, 2011 (the "Maturity Date") at a price per share payable, subject to SECTION 6(e), in cash and equal to the Redemption Price. At any time during the period beginning on the thirtieth (30th) calendar day prior to the Maturity Date (the "Holder Redemption Notice Period"), each Holder may deliver written notice to the Company notifying the Company of such Holder's election to require the Company to redeem all or a portion of such Holder's Preferred Shares on the Maturity Date (the "Election Notice"). No later than thirty (30) calendar days prior to the commencement of the Holder Redemption Notice Period, the Company shall deliver a notice to each Holder including the following information: (A) informing the Holder of the Maturity Date and such Holder's right to elect to have all or a portion of its Preferred Shares redeemed by Company on the Maturity Date, (B) the Redemption Price payable with respect to each share of Series A-2 Preferred Stock on the Maturity Date in connection with any such redemption (to the extent the Redemption Price is known or can be calculated, and to the extent not capable of being calculated, the manner in which such price will be determined); (C) that any certificates representing Preferred Shares which a Holder elects to have redeemed must be surrendered for payment of the Redemption Price at the office of the Company or any redemption agent located in New York City selected by the Company therefor together with any written instrument or instructions of transfer or other documents and endorsements reasonably acceptable to the redemption agent or the Company, as applicable (if reasonably required by the redemption agent or the Company, as applicable); (D) that, upon a Holder's compliance with clause (C), payment of the Redemption Price with respect to any Preferred Shares to be made on the Maturity Date will be made to the Holder within five (5) Business Days of the Maturity Date to the account specified in such Holder's redemption election notice; (E) that any Holder may withdraw its Election Notice with respect to all or a portion of its Preferred Shares at any time prior to 5:00 p.m. (New York City time) on the Business Day immediately preceding the Maturity Date; and (F) the number of shares of Common Stock (or, if applicable, the amount of Reference Property) and the amount of cash, if any, that a Holder would

24

receive upon conversion of a Preferred Share if a Holder does not elect to have its Preferred Shares redeemed. The Company shall issue a press release for publication on the Dow Jones News Service or Bloomberg Business News (or if either such service is not available, another broadly disseminated news or press release service selected by the Company) prior to the opening of business on the first Business Day following any date on which the Company provides notice to Holders pursuant to this SECTION 6(a) disclosing the right of Holders to have the Company redeem Preferred Shares pursuant to this SECTION 6(a).