November 20th, 2015 4th Quarter Conference Call Private & Confidential

2 Agenda Quarterly Overview & Operating Highlights Omar Asali, President and CEO Financial Highlights Tom Williams, Chief Financial Officer (NYSE: HRG)

Safe Harbor Disclaimer 3 Limitations on the Use of Information. This company overview has been prepared by HRG Group Inc. (the “Company” or “HRG”) solely for informational purposes, and not for the purpose of updating any information or forecast with respect to the Company or any of its affiliates or any other purpose. This information is subject to change without notice and should not be relied upon for any purpose. Neither the Company nor any of its affiliates makes any representation or warranty, express or implied, as to the accuracy or completeness of the information contained herein and no such party shall have any liability for such information. In furnishing this information and making any oral statements, neither the Company nor any of its affiliates undertakes any obligation to provide the recipient with access to any additional information or to update or correct such information. The information herein or in any oral statements (if any) are prepared as of the date hereof or as of such earlier dates as presented herein; neither the delivery of this document nor any other oral statements regarding the affairs of Company or its affiliates shall create any implication that the information contained herein or the affairs of the Company or its affiliates have not changed since the date hereof or after the dates presented herein (as applicable); that such information is correct as of any time subsequent to its date; or that such information is an indication regarding the performance of the Company or any of its affiliates since the time of the Company’s or such affiliates latest public filings or disclosure. These materials and any related oral statements are not all- inclusive and shall not be construed as legal, tax, investment or any other advice. You should consult your own counsel, accountant or business advisors. Special Note Regarding Forward-Looking Statements. This document contains, and certain oral statements made by our representatives from time to time may contain, forward-looking statements, including those statements regarding the completion of the transaction between FGL and Anbang, the completion of the transaction at Compass, expected dividends from our subsidiaries, our or our subsidiaries' capital needs and potential acquisitions, dispositions or other transactions by us or our subsidiaries, and expectations with respect to foreign exchange rates and commodity prices. Generally, forward-looking statements include information concerning possible or assumed future distributions from subsidiaries, other actions, events, results, strategies and expectations and are identifiable by use of the words "believes," "expects," "intends," "anticipates," "plans," "seeks," "estimates," "projects," "may," "will," "could," "might," or "continues" or similar expressions. Such forward-looking statements are subject to risks and uncertainties that could cause actual results, events and developments to differ materially from those set forth in or implied by such statements. These statements are based on the beliefs and assumptions of HRG's management and the management of HRG's subsidiaries (including target businesses). Factors that could cause actual results, events and developments to differ include, without limitation: the ability of HRG subsidiaries to close previously announced transactions; the ability of HRG's subsidiaries (including, target businesses following their acquisition) to generate sufficient net income and cash flows to make upstream cash distributions; the decision of HRG subsidiaries' boards to make upstream cash distributions, which is subject to numerous factors such as restrictions contained in applicable financing agreements, state and regulatory restrictions and other relevant considerations as determined by the applicable board; HRG's liquidity, which may be impacted by a variety of factors, including the capital needs of HRG's current and future subsidiaries; capital market conditions; commodity market conditions; foreign exchange rates; HRG's and its subsidiaries' ability to identify, pursue or complete any suitable future acquisition or disposition opportunities, including realizing such transaction's expected benefits, efficiencies/cost avoidance or savings, income and margins, growth, economies of scale, streamlined/combined operations, economic performance and conditions to, and the timetable for, completing applicable financial reporting requirements; litigation; potential and contingent liabilities; management's plans; changes in regulations; taxes; and the risks that may affect the performance of the operating subsidiaries of HRG and those factors listed under the caption "Risk Factors" in HRG's most recent Annual Report on Form 10-K, filed with the Securities and Exchange Commission. All forward-looking statements described herein are qualified by these cautionary statements and there can be no assurance that the actual results, events or developments referenced herein will occur or be realized. Neither HRG nor any of its affiliates undertake any obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operation results, except as required by law. Non-U.S. GAAP Measures. Management believes that certain non-U.S. GAAP financial measures may be useful in certain instances to provide additional meaningful comparisons between current results and results in prior operating periods. Reconciliations of such measures to the most comparable U.S. GAAP measures are included herein. Adjusted EBITDA is a non-GAAP financial measure used in our Consumer Products (“Adjusted EBITDA - Consumer Products”) and Energy (“Adjusted EBITDA - Energy”) segments and one of the measures used for determining Spectrum Brands and Compass’ debt covenant compliance. “Insurance AOI” is a non-US GAAP financial measure frequently used throughout the insurance industry and is an economic measure the Insurance segment uses to evaluate financial performance each period. Earnings before interest, taxes, depreciation and amortization (“EBITDA”) represent net income adjusted to exclude interest expense, income taxes and depreciation, depletion and amortization. Adjusted EBITDA excludes certain items that are unusual in nature or not comparable from period to period and other non-recurring operating items, accretion of discount on asset retirement obligations, non-cash changes in the fair value of derivatives, non-cash write-downs of assets, and stock- based compensation. Adjusted EBITDA is a metric used by management and frequently used by the financial community and provides insight into an organization's operating trends and facilitates comparisons between peer companies, since interest, taxes, depreciation and amortization can differ greatly between organizations as a result of differing capital structures and tax strategies. Adjusted EBITDA can also be a useful measure of a company’s ability to service debt. Computations of EBITDA and Adjusted EBITDA may differ from computations of similarly titled measures of other companies due to differences in the inclusion or exclusion of items in our computations as compared to those of others. Insurance AOI is calculated by adjusting the Insurance segment’s net income to eliminate (i) the impact of net investment gains, including other-than-temporary impairment losses recognized in operations, but excluding gains and losses on derivatives; (ii) the effect of changes in the rates used to discount the FIA embedded derivative liability; (iii) the impact of certain litigation reserves; and (iv) impairments and bad debt expense from subsidiaries. All adjustments to Insurance AOI are net of the corresponding value of business acquired, deferred acquisition costs and income tax impact related to these adjustments as appropriate. While these adjustments are an integral part of the overall performance of the Insurance segment, market conditions impacting these items can overshadow the underlying performance of the business. Accordingly, we believe using a measure which excludes their impact is effective in analyzing the trends of our operations and together with net income, we believe Insurance AOI provides meaningful financial metric that helps investors understand our underlying results and profitability. We exclude the impact of foreign currency loses of $73.3 million and $229.8 million, respectively, in the quarter and full year and the net investment gains (losses) on the measure of revenue growth of the quarter and full year, which is based on a non-GAAP financial measure. While these adjustments are an integral part of the overall performance of the business, macroeconomic factors and volatility caused by portfolio repositioning and derivative movements can overshadow the underlying performance. We believe this measure assists in understanding the trends in our business. While management believes that non-U.S. GAAP measurements are useful supplemental information, such adjusted results are not intended to replace U.S. GAAP financial results and should be read in conjunction with those U.S. GAAP results. By accepting this document, each recipient agrees to and acknowledges the foregoing terms and conditions.

Quarterly Overview & Operating Highlights Omar Asali Private & Confidential

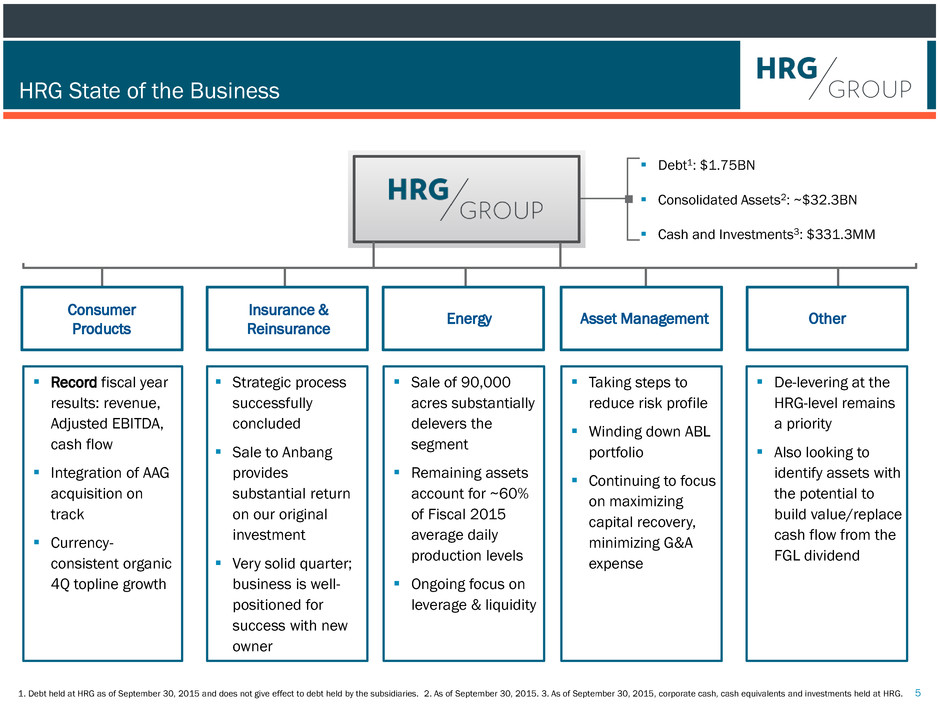

HRG State of the Business 5 Consumer Products Asset Management Energy Other Insurance & Reinsurance Record fiscal year results: revenue, Adjusted EBITDA, cash flow Integration of AAG acquisition on track Currency- consistent organic 4Q topline growth 1. Debt held at HRG as of September 30, 2015 and does not give effect to debt held by the subsidiaries. 2. As of September 30, 2015. 3. As of September 30, 2015, corporate cash, cash equivalents and investments held at HRG. Debt1: $1.75BN Consolidated Assets2: ~$32.3BN Cash and Investments3: $331.3MM Strategic process successfully concluded Sale to Anbang provides substantial return on our original investment Very solid quarter; business is well- positioned for success with new owner Sale of 90,000 acres substantially delevers the segment Remaining assets account for ~60% of Fiscal 2015 average daily production levels Ongoing focus on leverage & liquidity Taking steps to reduce risk profile Winding down ABL portfolio Continuing to focus on maximizing capital recovery, minimizing G&A expense De-levering at the HRG-level remains a priority Also looking to identify assets with the potential to build value/replace cash flow from the FGL dividend

Spectrum continues to deliver strong growth through product and geography expansion, and smart M&A 6 Consumer Products 6th consecutive year of record financial performance at Spectrum — Double-digit Adjusted EBITDA growth, to $800.6 million Execution in the business continues at a very high level: — 11.0% reported revenue growth this quarter, despite ongoing F/X headwinds — 22.8% increase in Adjusted EBITDA from 4Q14, to $229.4 million — 17.5% Adjusted EBITDA margin this quarter, up 160 basis points from 4Q14 Integrations of recent deals remain on-track or ahead of schedule — Focus is shifting to sales growth and margin expansion initiatives for recently-acquired assets Prudent management of the product portfolio continues — Achieved targeted cost improvement savings in 2015 — Exited unprofitable geographic categories in Hardware, Home Improvement Execution of the organic growth strategy continues (“More, More, More” strategy) Expecting 7th consecutive year for record financial performance in 2016

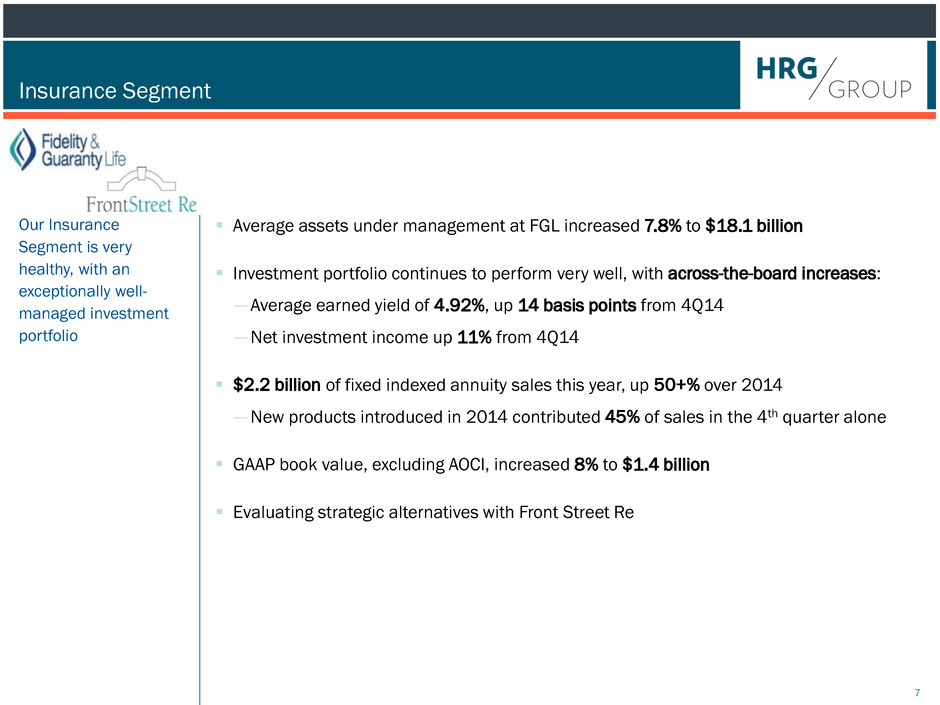

Our Insurance Segment is very healthy, with an exceptionally well- managed investment portfolio 7 Insurance Segment Average assets under management at FGL increased 7.8% to $18.1 billion Investment portfolio continues to perform very well, with across-the-board increases: —Average earned yield of 4.92%, up 14 basis points from 4Q14 —Net investment income up 11% from 4Q14 $2.2 billion of fixed indexed annuity sales this year, up 50+% over 2014 —New products introduced in 2014 contributed 45% of sales in the 4th quarter alone GAAP book value, excluding AOCI, increased 8% to $1.4 billion Evaluating strategic alternatives with Front Street Re

Our Energy Segment is comprised of long- lived, lower-decline rate and lower geologic risk conventional oil and gas assets 8 Energy Segment This year’s 44% decrease in the average sales price for oil and 50+% decrease in gas liquids pricing demanded a strong strategic response Deleveraging the segment is one of our priorities —Compass term loan reduced by $20 million after the quarter using proceeds from the earlier disposition of non-core assets —Following the quarter, agreement reached to sell ~40% of daily production assets for $160 million, providing resource for further deleveraging The business remains profitable on an Adjusted EBITDA basis because of operational oversight and strong cost controls —Quarterly production levels maintained within cost constraints We remain focused on protecting & building HRG value and managing leverage and liquidity

Our focus in Asset Management is mitigating risk, maximizing opportunity to build book value 9 Asset Management Salus’ loan portfolio continues to unwind —Amounts outstanding continue to decline through a combination of capital recovery and the intentional halt of new loan originations —G&A has been dramatically reduced to align the infrastructure Ongoing review of Salus’ portfolio being conducted to identify and mitigate risk —Performance of underlying collateral, cash flow are key —$16 million increase to allowance this quarter —We will continue to target the full recovery of amounts owed to us —No additional allowance or exposure in connection with RadioShack this quarter

Quarterly Overview & Operating Highlights Omar Asali Private & Confidential

Financial Highlights Tom Williams Private & Confidential

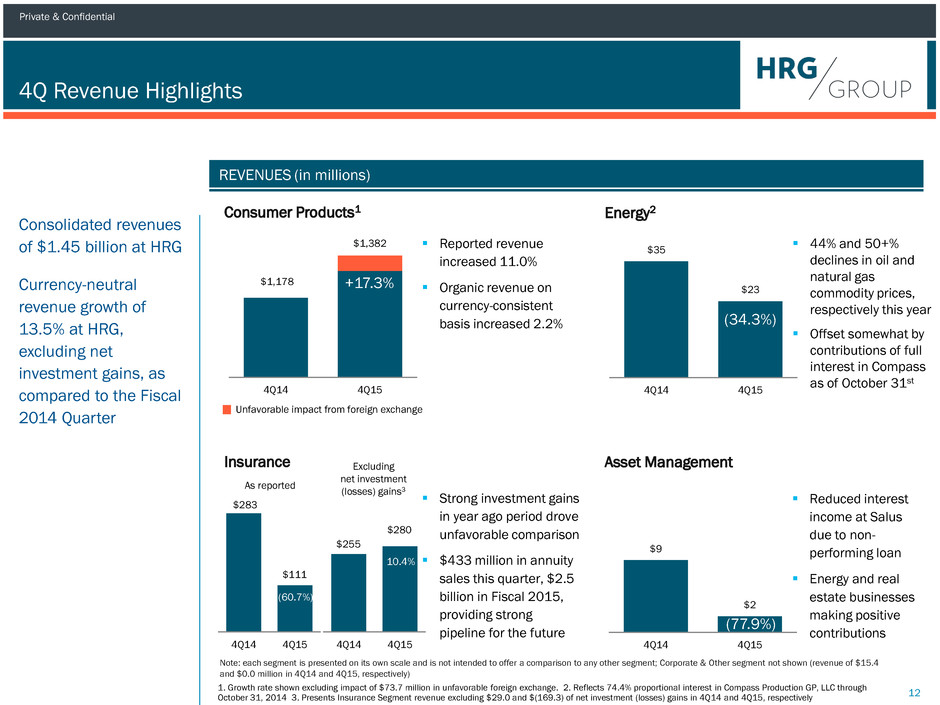

Private & Confidential Consolidated revenues of $1.45 billion at HRG Currency-neutral revenue growth of 13.5% at HRG, excluding net investment gains, as compared to the Fiscal 2014 Quarter 12 4Q Revenue Highlights REVENUES (in millions) $1,178 $1,382 4Q14 4Q15 +17.3% 4Q14 4Q15 Note: each segment is presented on its own scale and is not intended to offer a comparison to any other segment; Corporate & Other segment not shown (revenue of $15.4 and $0.0 million in 4Q14 and 4Q15, respectively) Consumer Products1 Insurance (60.7%) $35 $23 4Q14 4Q15 (34.3%) $9 $2 4Q14 4Q15 Energy2 Asset Management (77.9%) Reported revenue increased 11.0% Organic revenue on currency-consistent basis increased 2.2% Strong investment gains in year ago period drove unfavorable comparison $433 million in annuity sales this quarter, $2.5 billion in Fiscal 2015, providing strong pipeline for the future 44% and 50+% declines in oil and natural gas commodity prices, respectively this year Offset somewhat by contributions of full interest in Compass as of October 31st Reduced interest income at Salus due to non- performing loan Energy and real estate businesses making positive contributions 1. Growth rate shown excluding impact of $73.7 million in unfavorable foreign exchange. 2. Reflects 74.4% proportional interest in Compass Production GP, LLC through October 31, 2014 3. Presents Insurance Segment revenue excluding $29.0 and $(169.3) of net investment (losses) gains in 4Q14 and 4Q15, respectively 4Q14 4Q15 As reported Excluding net investment (losses) gains3 $255 $280 10.4% $283 $111 Unfavorable impact from foreign exchange

Private & Confidential Ongoing commodity pricing resulted in non- cash impairments to our oil & gas properties 13 Significant Items Impacting Results Non-cash Energy charge — Commodity pricing environment continues to generate industry-wide impairments — The required ceiling test limitation performed under the full cost method of accounting uses historical prices, which are not necessarily indicative of market value of an asset — Triggered a $45.7 million non- cash impairment to our oil & gas properties this quarter —We believe the market value for our Energy assets exceeds the book value indicated by these impairments FGL transaction — Agreement to sell our stake was reached after the close of the quarter — Accordingly, there are no changes required to the presentation of our results in Fiscal 2015

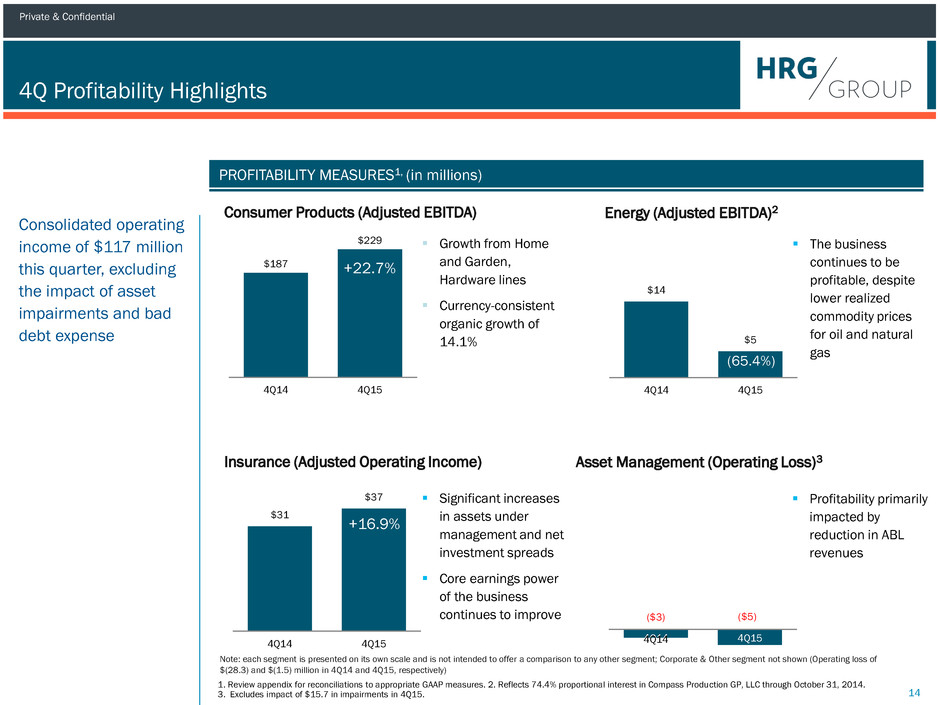

Private & Confidential Consolidated operating income of $117 million this quarter, excluding the impact of asset impairments and bad debt expense 14 4Q Profitability Highlights PROFITABILITY MEASURES1, (in millions) $187 $229 4Q14 4Q15 $31 $37 4Q14 4Q15 Consumer Products (Adjusted EBITDA) Insurance (Adjusted Operating Income) $14 $5 4Q14 4Q15 Energy (Adjusted EBITDA)2 Asset Management (Operating Loss)3 Growth from Home and Garden, Hardware lines Currency-consistent organic growth of 14.1% Significant increases in assets under management and net investment spreads Core earnings power of the business continues to improve The business continues to be profitable, despite lower realized commodity prices for oil and natural gas Note: each segment is presented on its own scale and is not intended to offer a comparison to any other segment; Corporate & Other segment not shown (Operating loss of $(28.3) and $(1.5) million in 4Q14 and 4Q15, respectively) 1. Review appendix for reconciliations to appropriate GAAP measures. 2. Reflects 74.4% proportional interest in Compass Production GP, LLC through October 31, 2014. 3. Excludes impact of $15.7 in impairments in 4Q15. +22.7% (65.4%) +16.9% Profitability primarily impacted by reduction in ABL revenues ($3) ($5) 4Q14 4Q15

Private & Confidential Consolidated operating income of $448 million in Fiscal 2015, excluding the impact of asset impairments and bad debt expense HRG received $65.7 million in dividends* from its subsidiaries in Fiscal 2015 Corporate cash and investments of $331.3 million as of September 30, 2015 15 2015 Highlights CONSOLIDATED REVENUES $2,000 $3,500 $5,000 $6,500 2012 2013 2014 2015 $Ms Consumer Products Adjusted EBITDA Energy Adjusted EBITDA $724 $801 2014 2015 +10.5% $63 $29 2014 2015 (54.3%) $155 $111 2014 2015 (28.0%) $1 ($15) 2014 2015 $Ms Insurance Adj. Operating Income Asset Management Operating Profit1 PROFITABILITY METRICS Unfavorable impact from foreign exchange 9.1% CAGR (2012 – 2015) * Excludes $9.0 million of interest payments made by HRG on behalf of HGI Energy with respect to certain intercompany notes issued by HGI Energy to other HRG subsidiaries 1. Excludes impact of $87.9 in impairments in Fiscal 2015.

Private & Confidential 4Q 2015 Sum of the Parts Valuation (Dilutive) without AOCI 16 As of the close of the fourth quarter, the estimated net value of our assets and liabilities was $14.07 per share of diluted common stock. SUM OF THE PARTS VALUATION – ESTIMATED VALUE VS. COMMON STOCK PRICE ($) $13.11 $6.28 -$0.78 $3.11 -$0.21 $1.48 -$8.92 $14.07 $11.73 Difference of $2.34 or a 16.6% Discount Spectrum Brands1 Insurance Segment2 Total Estimated Value8 September 30th Common Stock Price9 HGI Funding LLC4 HGI Asset Mgmt Holdings LLC5 Cash6 Debt & Other Liabilities7 HGI Energy Holdings LLC3 1. The valuation of HRG’s interest in Spectrum Brands (NYSE: SPB) is based on the volume weighted average closing price (“VWAP”) of SPB shares for the 20 day trading period of $95.15 through September 30, 2015 multiplied by the 27,756,905 SPB shares owned by HRG. 2. The valuation of HRG’s interest in the insurance segment reflects the sum of the per-share-value of its interests in (i) Fidelity & Guaranty Life (NYSE: FGL) based on the VWAP of FGL shares for the 20-day trading period of $24.95 through September 30, 2015 multiplied by the 47,000,000 shares owned by HRG (or $5.82 per share); and (ii) of the $6.73 per share book value of the Insurance segment, Front Street Re (Holdings) Ltd. represents a net book value of $92.4 million, or $0.46 per share. 3. The valuation of HGI Energy Holdings LLC reflects its net book of value as of September 30, 2015. 4. The valuation of HGI Funding LLC reflects its net book value as of September 30, 2015 (which includes 6,483,984 SPB shares and the market value of other securities owned by HGI Funding). 5. The valuation of HGI Asset Management Holdings LLC, reflects its net book of value as of September 30, 2015. 6. Total cash consists of cash at HRG as of September 30, 2015. 7. Debt and other liabilities includes the face value of all liabilities at HRG as of September 30, 2015. 8. Per share amount for each of the above mentioned assets and liabilities is calculated by dividing the total valuation of such asset or liability by the 201,389,915 shares of HRG common stock (NYSE: HRG) outstanding as of September 30, 2015, which amount does gives effect to dilution for the vesting of all outstanding restricted shares (4,283,697). 9. The closing price for HRG’s shares of common stock September 30, 2015. Note: Book value as reflected above is not necessarily indicative of market value

Questions and Answers Private & Confidential

November 20th, 2015 4th Quarter Conference Call Private & Confidential

Appendix Private & Confidential

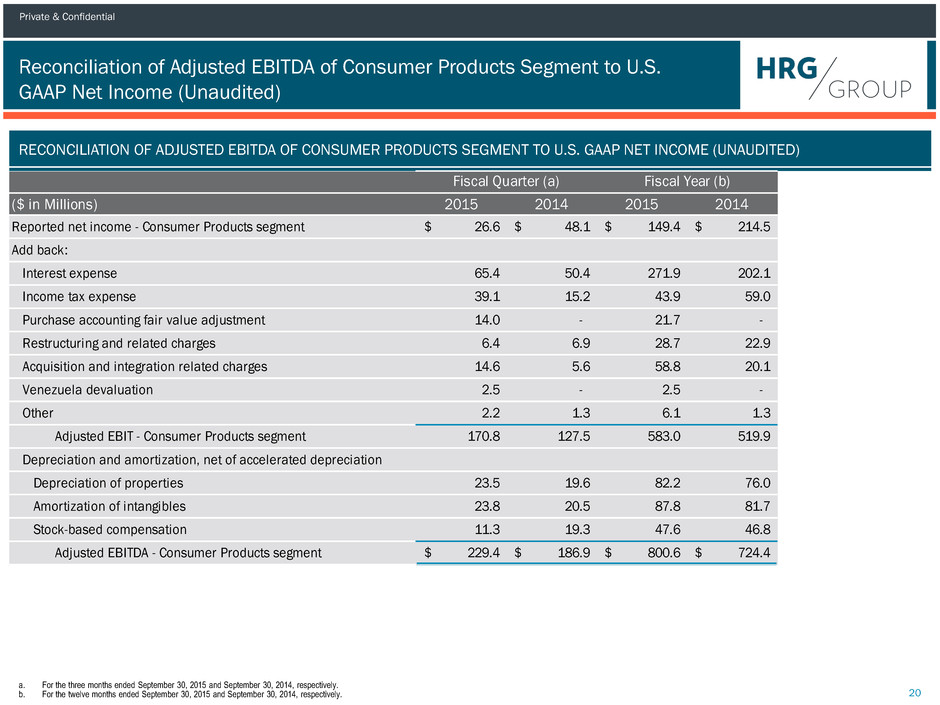

Private & Confidential Reconciliation of Adjusted EBITDA of Consumer Products Segment to U.S. GAAP Net Income (Unaudited) 20 RECONCILIATION OF ADJUSTED EBITDA OF CONSUMER PRODUCTS SEGMENT TO U.S. GAAP NET INCOME (UNAUDITED) ($ in Millions) 2015 2014 2015 2014 Reported net income - Consumer Products segment 26.6$ 48.1$ 149.4$ 214.5$ Add back: Interest expense 65.4 50.4 271.9 202.1 Income tax expense 39.1 15.2 43.9 59.0 Purchase accounting fair value adjustment 14.0 - 21.7 - Restructuring and related charges 6.4 6.9 28.7 22.9 Acquisition and integration related charges 14.6 5.6 58.8 20.1 Venezuela devaluation 2.5 - 2.5 - Other 2.2 1.3 6.1 1.3 Adjusted EBIT - Consumer Products segment 170.8 127.5 583.0 519.9 Depreciation and amortization, net of accelerated depreciation Depreciation of properties 23.5 19.6 82.2 76.0 Amortization of intangibles 23.8 20.5 87.8 81.7 Stock-based compensation 11.3 19.3 47.6 46.8 Adjusted EBITDA - Consumer Products segment 229.4$ 186.9$ 800.6$ 724.4$ Fiscal Quarter (a) Fiscal Year (b) a. For the three months ended September 30, 2015 and September 30, 2014, respectively. b. For the twelve months ended September 30, 2015 and September 30, 2014, respectively.

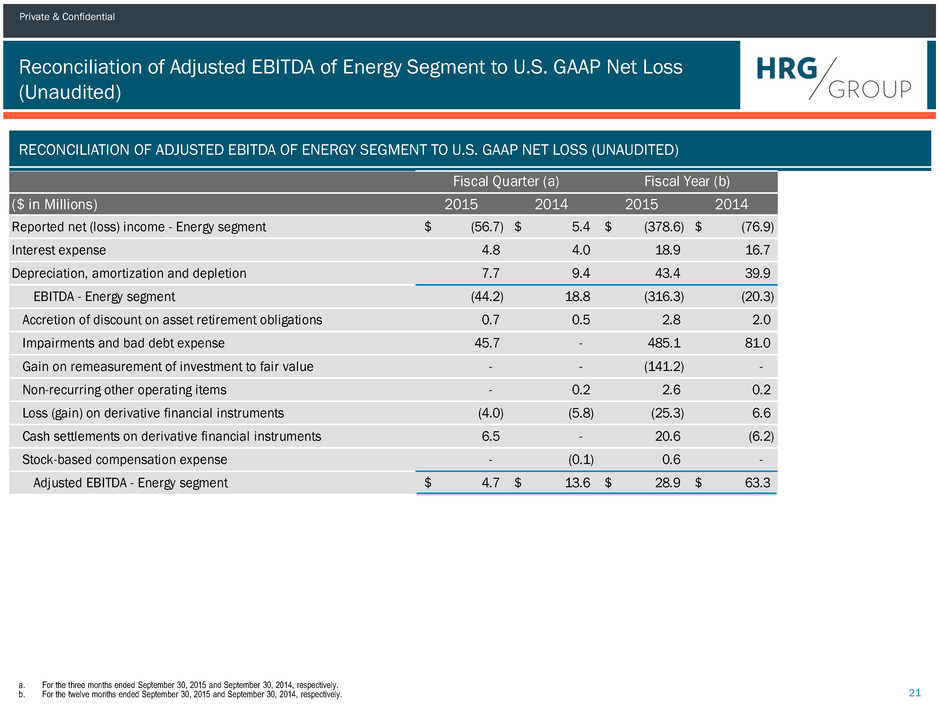

Private & Confidential Reconciliation of Adjusted EBITDA of Energy Segment to U.S. GAAP Net Loss (Unaudited) 21 RECONCILIATION OF ADJUSTED EBITDA OF ENERGY SEGMENT TO U.S. GAAP NET LOSS (UNAUDITED) ($ in Millions) 2015 2014 2015 2014 Reported net (loss) income - Energy segment (56.7)$ 5.4$ (378.6)$ (76.9)$ Interest expense 4.8 4.0 18.9 16.7 Depreciation, amortization and depletion 7.7 9.4 43.4 39.9 EBITDA - Energy segment (44.2) 18.8 (316.3) (20.3) Accretion of discount on asset retirement obligations 0.7 0.5 2.8 2.0 Impairments and bad debt expense 45.7 - 485.1 81.0 Gain on remeasurement of investment to fair value - - (141.2) - Non-recurring other operating items - 0.2 2.6 0.2 Loss (gain) on derivative financial instruments (4.0) (5.8) (25.3) 6.6 Cash settlements on derivative financial instruments 6.5 - 20.6 (6.2) Stock-based compensation expense - (0.1) 0.6 - Adjusted EBITDA - Energy segment 4.7$ 13.6$ 28.9$ 63.3$ Fiscal Quarter (a) Fiscal Year (b) a. For the three months ended September 30, 2015 and September 30, 2014, respectively. b. For the twelve months ended September 30, 2015 and September 30, 2014, respectively.

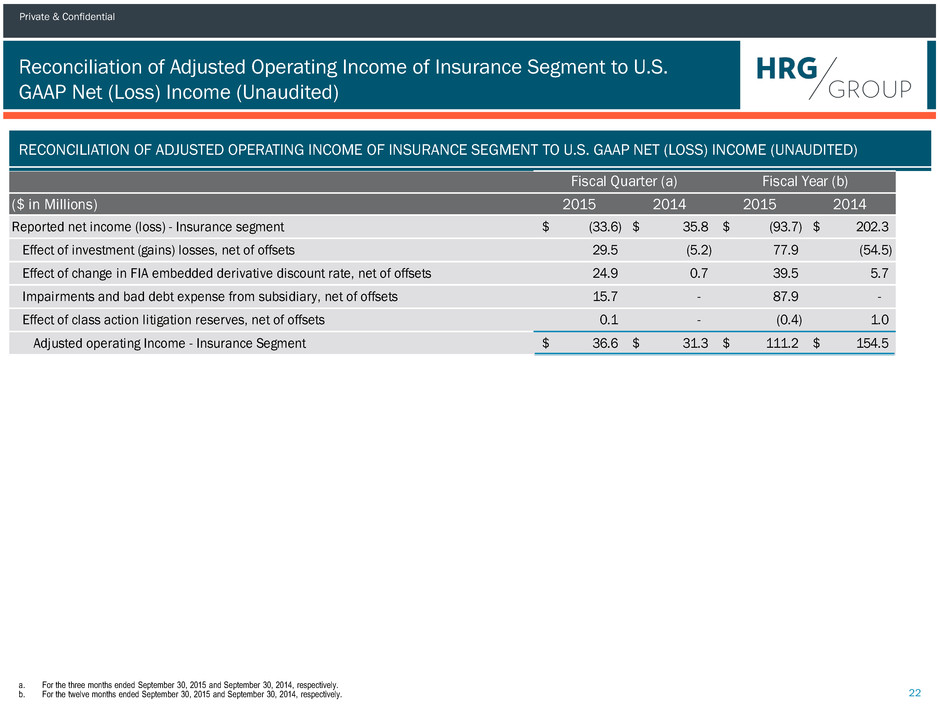

Private & Confidential Reconciliation of Adjusted Operating Income of Insurance Segment to U.S. GAAP Net (Loss) Income (Unaudited) 22 RECONCILIATION OF ADJUSTED OPERATING INCOME OF INSURANCE SEGMENT TO U.S. GAAP NET (LOSS) INCOME (UNAUDITED) ($ in Millions) 2015 2014 2015 2014 Reported net income (loss) - Insurance segment (33.6)$ 35.8$ (93.7)$ 202.3$ Effect of investment (gains) losses, net of offsets 29.5 (5.2) 77.9 (54.5) Effect of change in FIA embedded derivative discount rate, net of offsets 24.9 0.7 39.5 5.7 Impairments and bad debt expense from subsidiary, net of offsets 15.7 - 87.9 - Effect of class action litigation reserves, net of offsets 0.1 - (0.4) 1.0 Adjusted operating Income - Insurance Segment 36.6$ 31.3$ 111.2$ 154.5$ Fiscal Quarter (a) Fiscal Year (b) a. For the three months ended September 30, 2015 and September 30, 2014, respectively. b. For the twelve months ended September 30, 2015 and September 30, 2014, respectively.