4Q 2016 Investor Presentation BAML Conference February 2017 Exhibit 99.1

Forward-Looking Statements This presentation may include forward-looking statements, both with respect to Argo Group and its industry, that reflect our current views with respect to future events and financial performance. These statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include all statements that do not relate solely to historical or current facts, and can be identified by the use of words such as "expect," "intend," "plan," "believe," “do not believe,” “aim,” "project," "anticipate," “seek,” "will," “likely,” “assume,” “estimate,” "may," “continue,” “guidance,” “objective,” “outlook,” “trends,” “future,” “could,” “would,” “should,” “target,” “on track” and similar expressions of a future or forward-looking nature. All forward-looking statements address matters that involve risks and uncertainties, many of which are beyond Argo Group's control. Accordingly, there are or will be important factors that could cause actual results to differ materially from those indicated in such statements and, therefore, you should not place undue reliance on any such statements. We believe that these factors include, but are not limited to, the following: 1) unpredictability and severity of catastrophic events; 2) rating agency actions; 3) adequacy of our risk management and loss limitation methods; 4) cyclicality of demand and pricing in the insurance and reinsurance markets; 5) statutory or regulatory developments including tax policy, reinsurance and other regulatory matters; 6) our ability to implement our business strategy; 7) adequacy of our loss reserves; 8) continued availability of capital and financing; 9) retention of key personnel; 10) competition; 11) potential loss of business from one or more major insurance or reinsurance brokers; 12) our ability to implement, successfully and on a timely basis, complex infrastructure, distribution capabilities, systems, procedures and internal controls, and to develop accurate actuarial data to support the business and regulatory and reporting requirements; 13) general economic and market conditions (including inflation, volatility in the credit and capital markets, interest rates and foreign currency exchange rates); 14) the integration of businesses we may acquire or new business ventures we may start; 15) the effect on our investment portfolios of changing financial market conditions including inflation, interest rates, liquidity and other factors; 16) acts of terrorism or outbreak of war; and 17) availability of reinsurance and retrocessional coverage, as well as management's response to any of the aforementioned factors.In addition, any estimates relating to loss events involve the exercise of considerable judgment and reflect a combination of ground-up evaluations, information available to date from brokers and cedants, market intelligence, initial tentative loss reports and other sources. The actuarial range of reserves and management’s best estimate is based on our then current state of knowledge including explicit and implicit assumptions relating to the pattern of claim development, the expected ultimate settlement amount, inflation and dependencies between lines of business. Our internal capital model is used to consider the distribution for reserving risk around this best estimate and predict the potential range of outcomes. However, due to the complexity of factors contributing to the losses and the preliminary nature of the information used to prepare these estimates, there can be no assurance that Argo Group’s ultimate losses will remain within the stated amount.The foregoing review of important factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included herein and elsewhere, including the risk factors included in our most recent reports on Form 10-K and Form 10-Q and other documents of Argo Group on file with or furnished to the U.S. Securities and Exchange Commission (“SEC”). Any forward-looking statements made in this presentation are qualified by these cautionary statements, and there can be no assurance that the actual results or developments anticipated by Argo Group will be realized or, even if substantially realized, that they will have the expected consequences to, or effects on, Argo Group or its business or operations. Except as required by law, Argo Group undertakes no obligation to update publicly or revise any forward-looking statement, whether as a result of new information, future developments or otherwise.

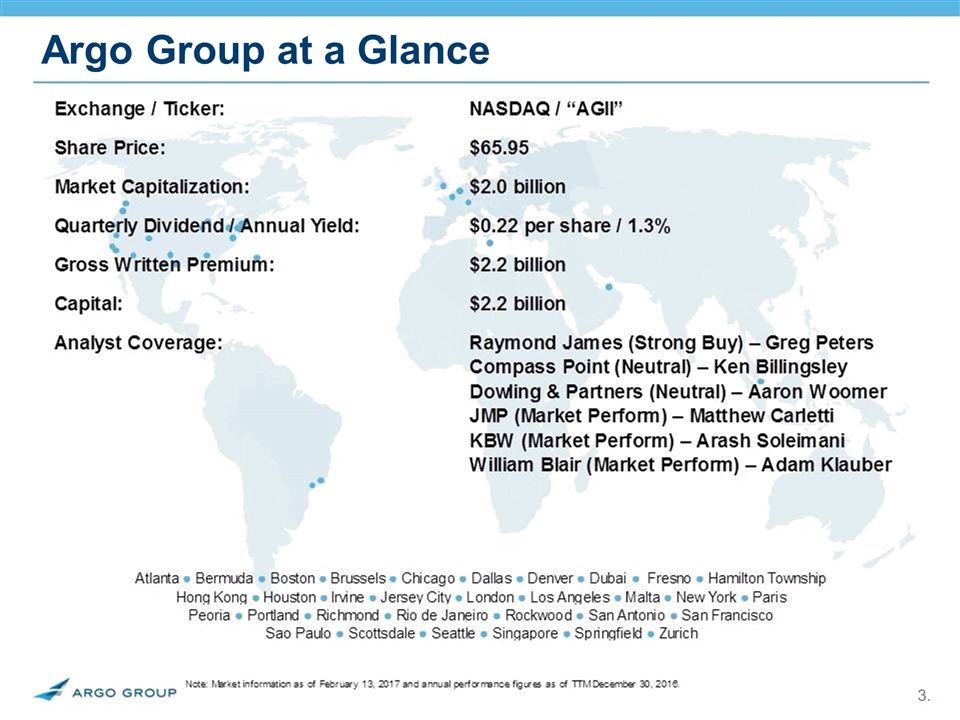

Argo Group at a Glance

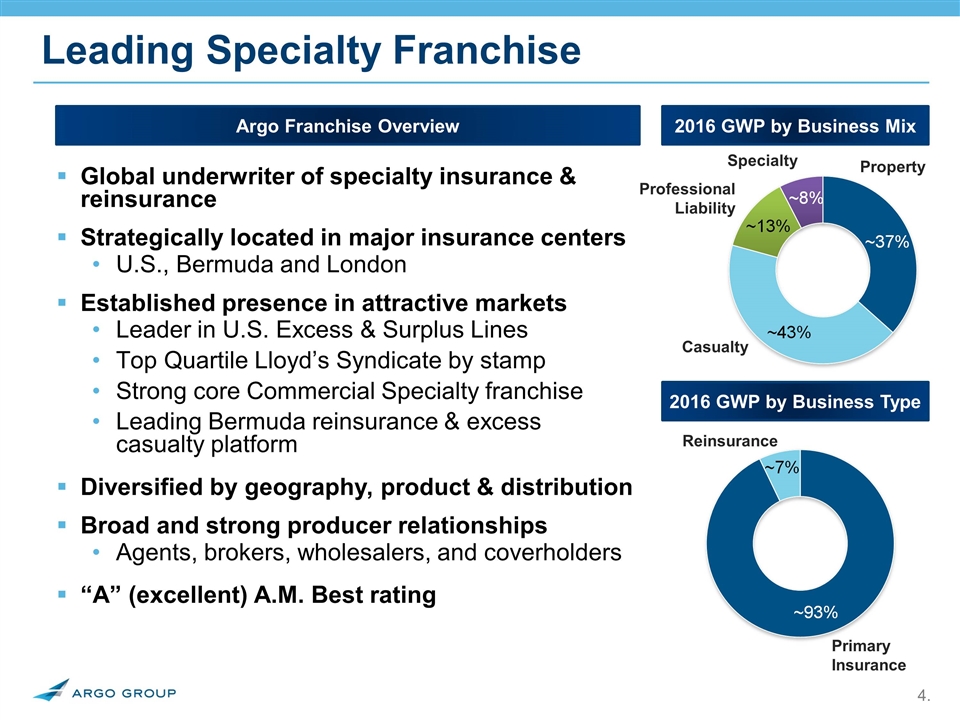

Leading Specialty Franchise Global underwriter of specialty insurance & reinsurance Strategically located in major insurance centers U.S., Bermuda and London Established presence in attractive markets Leader in U.S. Excess & Surplus Lines Top Quartile Lloyd’s Syndicate by stamp Strong core Commercial Specialty franchise Leading Bermuda reinsurance & excess casualty platform Diversified by geography, product & distribution Broad and strong producer relationships Agents, brokers, wholesalers, and coverholders “A” (excellent) A.M. Best rating Primary Insurance Reinsurance Property Casualty 2016 GWP by Business Type 2016 GWP by Business Mix Argo Franchise Overview Specialty Professional Liability

Maximize Shareholder Value through growth in Book Value per Share Sustainable competitive advantage Niche markets Underwriting expertise Superior customer service Product innovation Profitable organic & strategic growth Profitable through cycles Key underwriters/teams Deals that meet stringent criteria Deep, tenured management team Active capital management Strategy Aligned Toward Shareholder Value

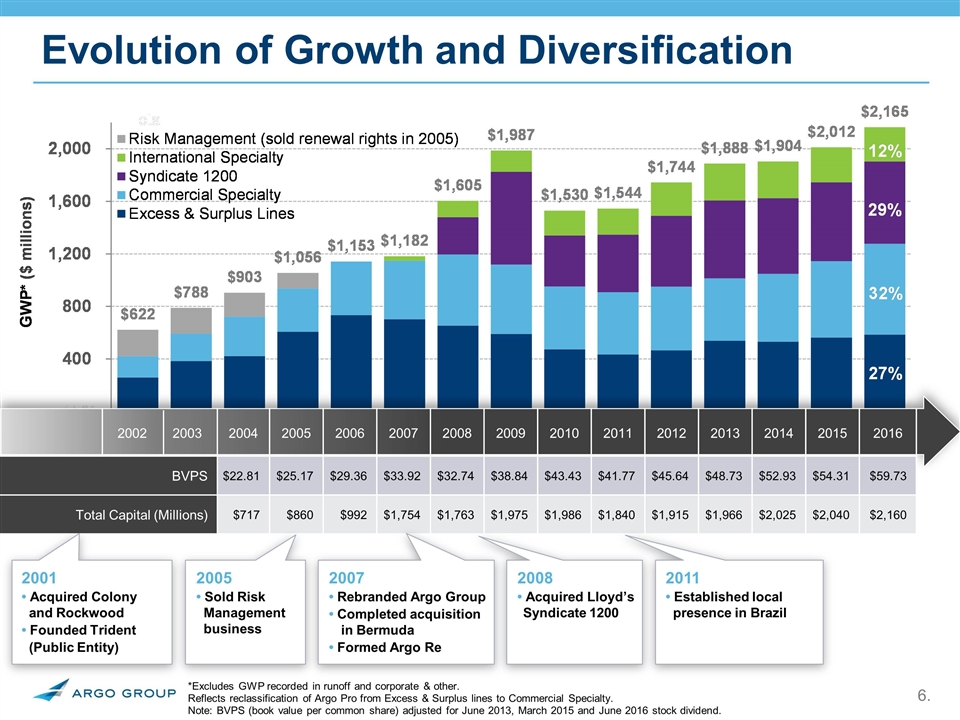

*Excludes GWP recorded in runoff and corporate & other. Reflects reclassification of Argo Pro from Excess & Surplus lines to Commercial Specialty. Note: BVPS (book value per common share) adjusted for June 2013, March 2015 and June 2016 stock dividend. Evolution of Growth and Diversification $23.03 $501.1M $30.36 $716.8M $992.0M $54.85 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 BVPS $22.81 $25.17 $29.36 $33.92 $32.74 $38.84 $43.43 $41.77 $45.64 $48.73 $52.93 $54.31 $59.73 Total Capital (Millions) $717 $860 $992 $1,754 $1,763 $1,975 $1,986 $1,840 $1,915 $1,966 $2,025 $2,040 $2,160 2001 • Acquired Colony and Rockwood • Founded Trident (Public Entity) 2005 • Sold Risk Management business 2007 • Rebranded Argo Group • Completed acquisition in Bermuda • Formed Argo Re 2008 • Acquired Lloyd’s Syndicate 1200 2011 • Established local presence in Brazil

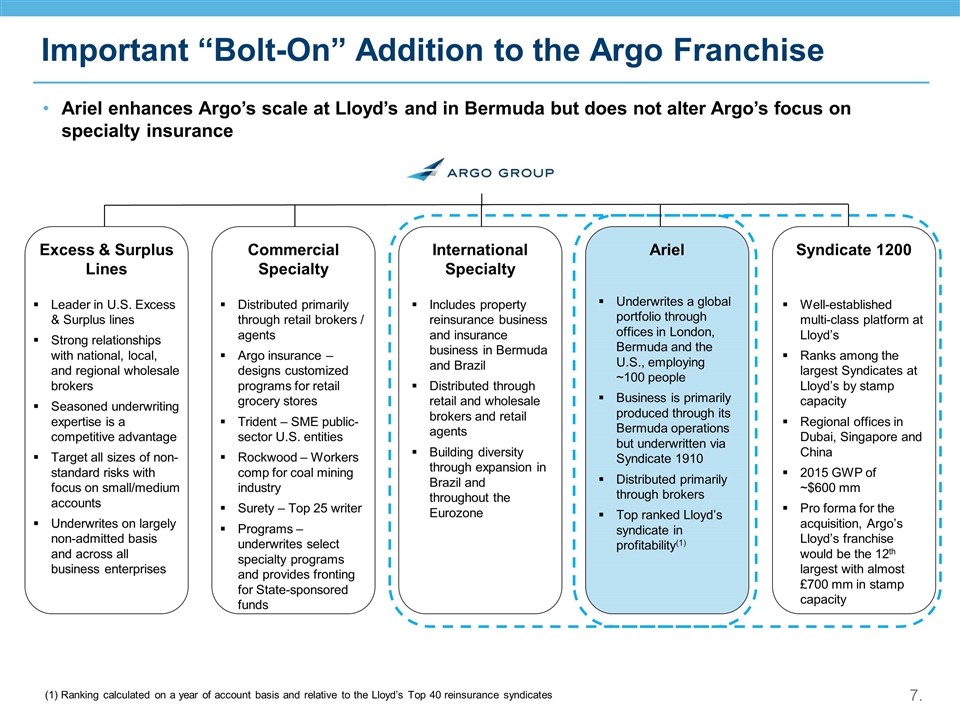

Excess & Surplus Lines Leader in U.S. Excess & Surplus lines Strong relationships with national, local, and regional wholesale brokers Seasoned underwriting expertise is a competitive advantage Target all sizes of non-standard risks with focus on small/medium accounts Underwrites on largely non-admitted basis and across all business enterprises Commercial Specialty Distributed primarily through retail brokers / agents Argo insurance – designs customized programs for retail grocery stores Trident – SME public-sector U.S. entities Rockwood – Workers comp for coal mining industry Surety – Top 25 writer Programs – underwrites select specialty programs and provides fronting for State-sponsored funds International Specialty Includes property reinsurance business and insurance business in Bermuda and Brazil Distributed through retail and wholesale brokers and retail agents Building diversity through expansion in Brazil and throughout the Eurozone Ariel Underwrites a global portfolio through offices in London, Bermuda and the U.S., employing ~100 people Business is primarily produced through its Bermuda operations but underwritten via Syndicate 1910 Distributed primarily through brokers Top ranked Lloyd’s syndicate in profitability(1) Syndicate 1200 Well-established multi-class platform at Lloyd’s Ranks among the largest Syndicates at Lloyd’s by stamp capacity Regional offices in Dubai, Singapore and China 2015 GWP of ~$600 mm Pro forma for the acquisition, Argo’s Lloyd’s franchise would be the 12th largest with almost £700 mm in stamp capacity Ariel enhances Argo’s scale at Lloyd’s and in Bermuda but does not alter Argo’s focus on specialty insurance (1) Ranking calculated on a year of account basis and relative to the Lloyd’s Top 40 reinsurance syndicates Important “Bolt-On” Addition to the Argo Franchise 7.

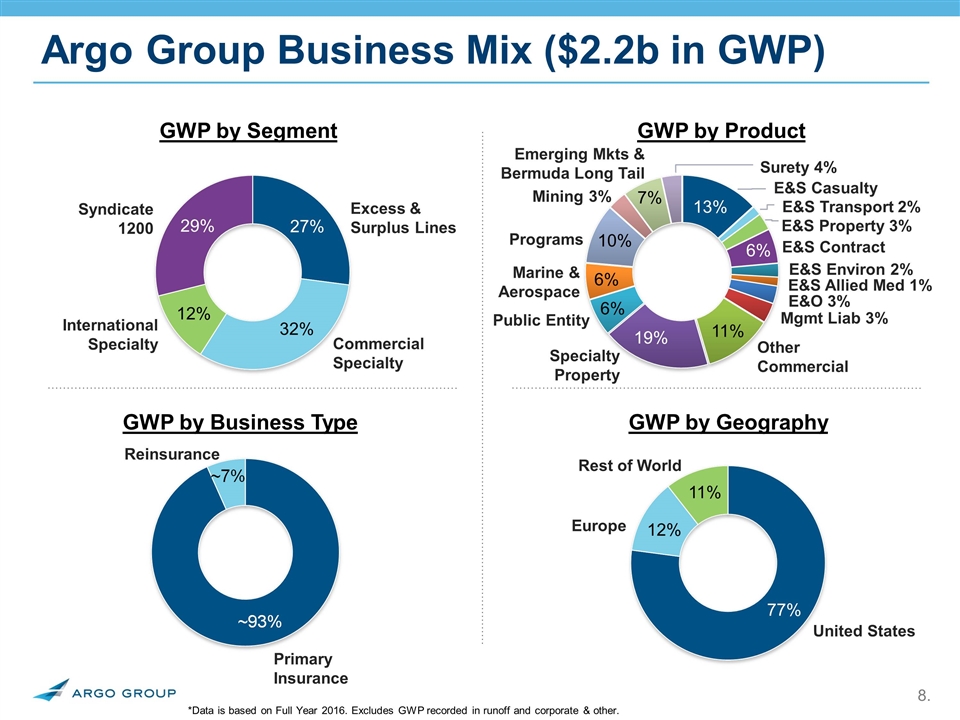

Argo Group Business Mix ($2.2b in GWP) *Data is based on Full Year 2016. Excludes GWP recorded in runoff and corporate & other. GWP by Segment GWP by Geography GWP by Business Type GWP by Product 11% Other Commercial Specialty Property Public Entity 19% 6% 6% Marine & Aerospace Surety 4% Programs Mining 3% Emerging Mkts & Bermuda Long Tail 10% 13% 6% 7% E&S Transport 2% E&S Property 3% E&S Contract E&S Environ 2% E&S Casualty E&S Allied Med 1% E&O 3% Mgmt Liab 3% United States 77% Rest of World 11% Europe 12% Primary Insurance Reinsurance Excess & Surplus Lines Commercial Specialty Syndicate 1200 International Specialty 29% 12% 27% 32%

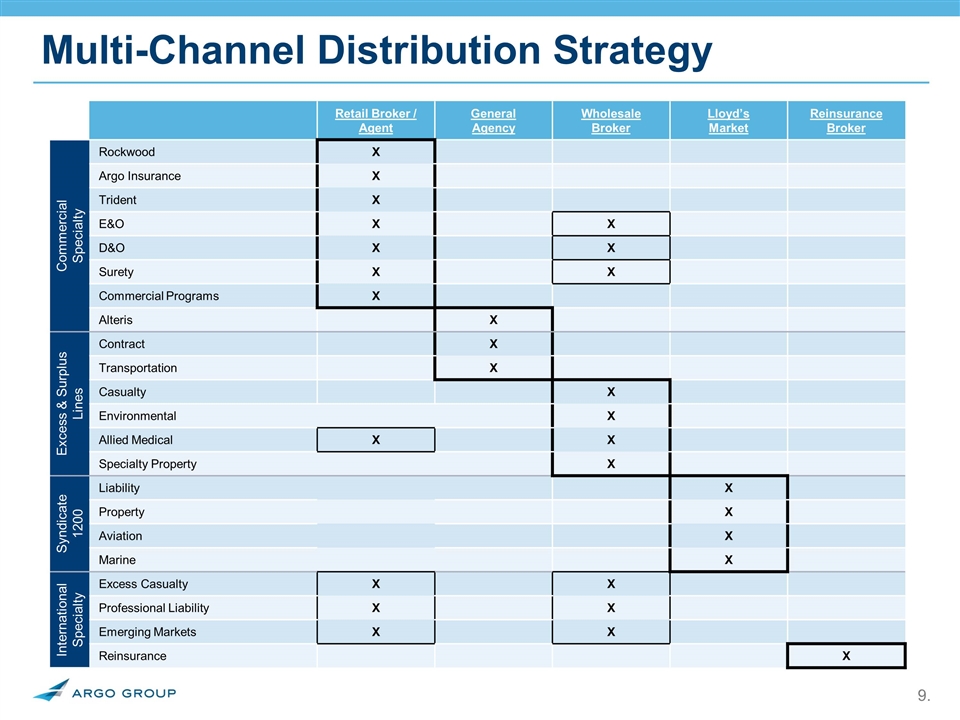

Multi-Channel Distribution Strategy Retail Broker / Agent General Agency Wholesale Broker Lloyd’s Market Reinsurance Broker Commercial Specialty Rockwood X Argo Insurance X Trident X E&O X X D&O X X Surety X X Commercial Programs X Alteris X Excess & Surplus Lines Contract X Transportation X Casualty X Environmental X Allied Medical X X Specialty Property X Syndicate 1200 Liability X Property X Aviation X Marine X International Specialty Excess Casualty X X Professional Liability X X Emerging Markets X X Reinsurance X

(1) Book value per common share: Adjusted for June 2013, March 2015 and June 2016 stock dividend 2008-2011 restated to reflect adoption of ASU 2010-26 (related to accounting for costs associated with acquiring or renewing insurance contracts); 2007 and prior not restated 2006 and prior years adjusted for PXRE merger 2003-2006 includes impact of Series A Mandatory Convertible Preferred on an as-if converted basis. Preferred stock fully converted into common shares as of Dec. 31, 2007 (2) Price / book represents the high for the YTD period Maximizing Shareholder Value – BVPS Growth 10% CAGR (Incl. Dividends) 2002 Reported Book Value1 Cumulative Dividends Price/Book2 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2015 2014 2016

Substantial Growth and Financial Strength (1) Book value per common share: Adjusted for June 2013, March 2015 and June 2016 stock dividend 2006 adjusted for PXRE merger and includes impact of Series A Mandatory Convertible Preferred on an as-if converted basis. Preferred stock fully converted into common shares as of Dec. 31, 2007

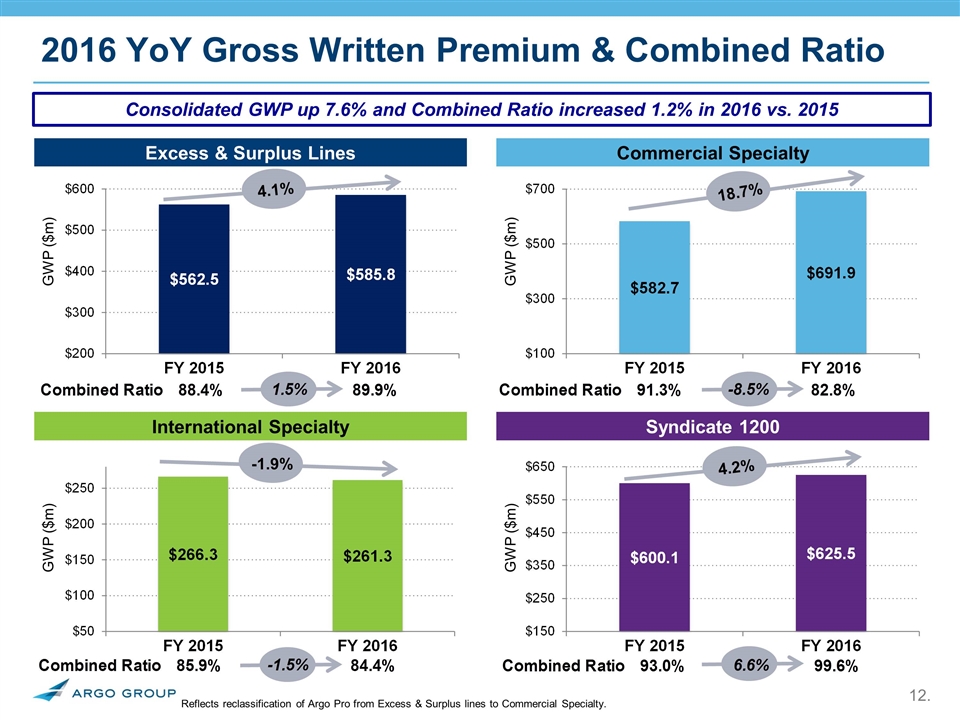

2016 YoY Gross Written Premium & Combined Ratio GWP ($m) GWP ($m) GWP ($m) GWP ($m) 4.1% 4.2% Consolidated GWP up 7.6% and Combined Ratio increased 1.2% in 2016 vs. 2015 Excess & Surplus Lines Commercial Specialty International Specialty Syndicate 1200 -1.9% 18.7% Reflects reclassification of Argo Pro from Excess & Surplus lines to Commercial Specialty.

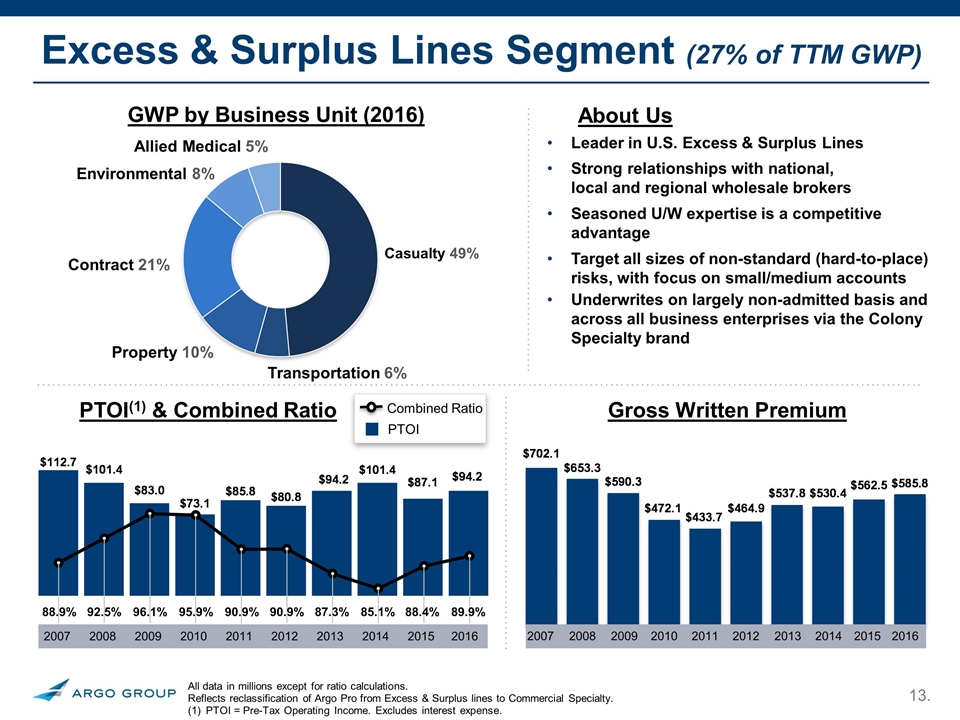

Excess & Surplus Lines Segment (27% of TTM GWP) 88.9% 96.1% 95.9% 90.9% 90.9% 92.5% 85.1% 87.3% About Us Leader in U.S. Excess & Surplus Lines Strong relationships with national, local and regional wholesale brokers Seasoned U/W expertise is a competitive advantage Target all sizes of non-standard (hard-to-place) risks, with focus on small/medium accounts Underwrites on largely non-admitted basis and across all business enterprises via the Colony Specialty brand GWP by Business Unit (2016) Casualty 49% Transportation 6% Environmental 8% Allied Medical 5% Property 10% Contract 21% Combined Ratio PTOI Gross Written Premium PTOI(1) & Combined Ratio 2011 2010 2009 2008 2012 2007 2013 88.4% 2013 2011 2010 2009 2008 2012 2007 2014 89.9% 2014 2015 2016 2015 2016 All data in millions except for ratio calculations. Reflects reclassification of Argo Pro from Excess & Surplus lines to Commercial Specialty. PTOI = Pre-Tax Operating Income. Excludes interest expense.

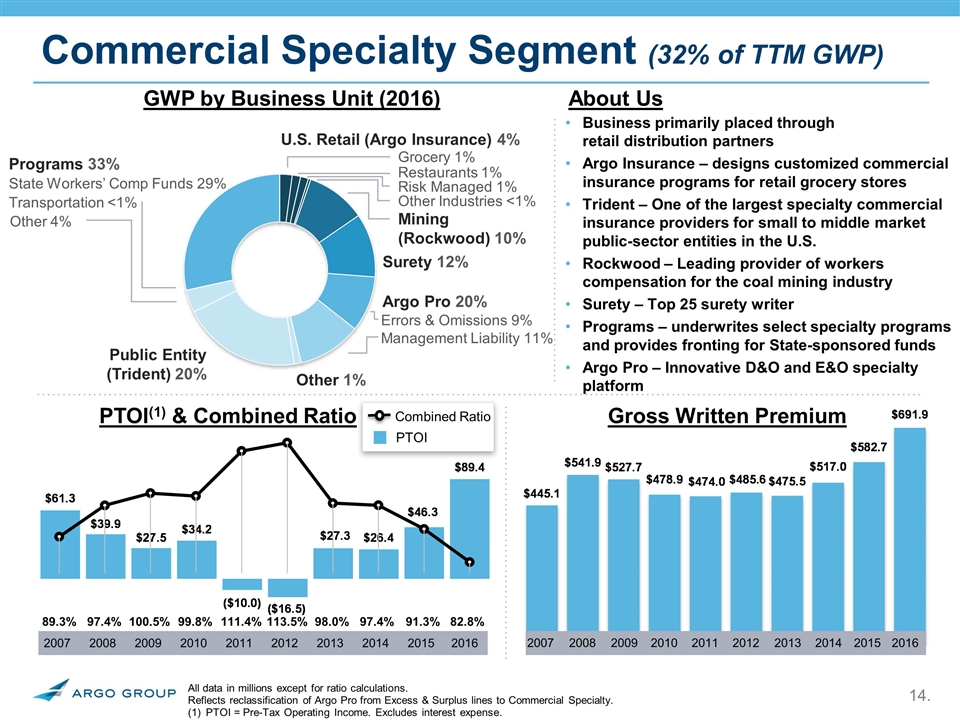

Commercial Specialty Segment (32% of TTM GWP) About Us Business primarily placed through retail distribution partners Argo Insurance – designs customized commercial insurance programs for retail grocery stores Trident – One of the largest specialty commercial insurance providers for small to middle market public-sector entities in the U.S. Rockwood – Leading provider of workers compensation for the coal mining industry Surety – Top 25 surety writer Programs – underwrites select specialty programs and provides fronting for State-sponsored funds Argo Pro – Innovative D&O and E&O specialty platform GWP by Business Unit (2016) U.S. Retail (Argo Insurance) 4% Restaurants 1% Grocery 1% Other Industries <1% Public Entity (Trident) 20% Surety 12% Mining (Rockwood) 10% Programs 33% Transportation <1% State Workers’ Comp Funds 29% Combined Ratio PTOI Gross Written Premium PTOI(1) & Combined Ratio 89.3% 97.4% 99.8% 111.4% 113.5% 98.0% 100.5% 91.3% 97.4% 82.8% Other 4% Risk Managed 1% Other 1% 2011 2010 2009 2008 2012 2007 2013 2013 2011 2010 2009 2008 2012 2007 2014 2014 2015 2016 2015 2016 All data in millions except for ratio calculations. Reflects reclassification of Argo Pro from Excess & Surplus lines to Commercial Specialty. PTOI = Pre-Tax Operating Income. Excludes interest expense. Argo Pro 20% Errors & Omissions 9% Management Liability 11%

131.9% 115.2% Syndicate 1200 Segment (29% of TTM GWP) General Liability 7% Prof. Indemnity 11% Int’l Casualty Treaty 4% Directors & Officers 3% Medical Malpractice 2% Other 4% About Us Well-established multi-class platform at Lloyd’s of London Ranks among the largest Syndicates at Lloyd’s by Stamp Capacity Lloyd’s market ratings: ‘A’ (Excellent) by A.M. Best ‘A+’ (Strong) by S&P Regional offices in Dubai, Singapore and China GWP by Business Unit (2016) Property 32% Liability 31% Marine & Energy 18% Asia 3% Property Fac 16% N. Am. & Int’l Binders 9% Other 6% 95.8% 112.3% 96.5% 92.6% Offshore Energy 5% Onshore Energy 3% Cargo 4% Yachts & Hulls 4% Marine Liability 2% 91.4% Combined Ratio PTOI Gross Written Premium PTOI & Combined Ratio 93.0% Aerospace 2% Specialty 12% PRI & Contingency 3% Personal Accident 9% MENA 2% 2013 2011 2010 2009 2008 2012 2014 2015 2016 99.6% 2013 2011 2010 2009 2008 2012 2014 2015 2016 All data in millions except for ratio calculations. PTOI = Pre-Tax Operating Income. Excludes interest expense.

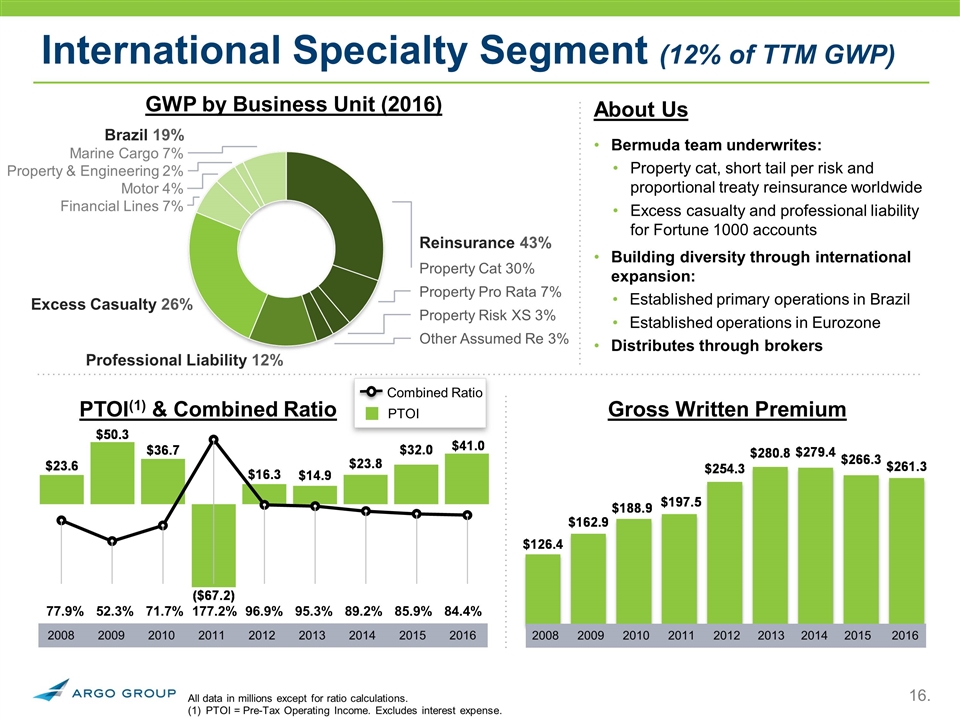

International Specialty Segment (12% of TTM GWP) About Us Bermuda team underwrites: Property cat, short tail per risk and proportional treaty reinsurance worldwide Excess casualty and professional liability for Fortune 1000 accounts Building diversity through international expansion: Established primary operations in Brazil Established operations in Eurozone Distributes through brokers GWP by Business Unit (2016) Excess Casualty 26% Professional Liability 12% Brazil 19% Marine Cargo 7% Property & Engineering 2% Motor 4% Financial Lines 7% Reinsurance 43% Other Assumed Re 3% Property Risk XS 3% Property Pro Rata 7% Property Cat 30% Combined Ratio PTOI Gross Written Premium PTOI(1) & Combined Ratio 177.2% 71.7% 52.3% 77.9% 96.9% 95.3% 89.2% 85.9% 2013 2011 2010 2009 2008 2012 2014 2015 2016 84.4% 2013 2011 2010 2009 2008 2012 2014 2015 2016 All data in millions except for ratio calculations. PTOI = Pre-Tax Operating Income. Excludes interest expense.

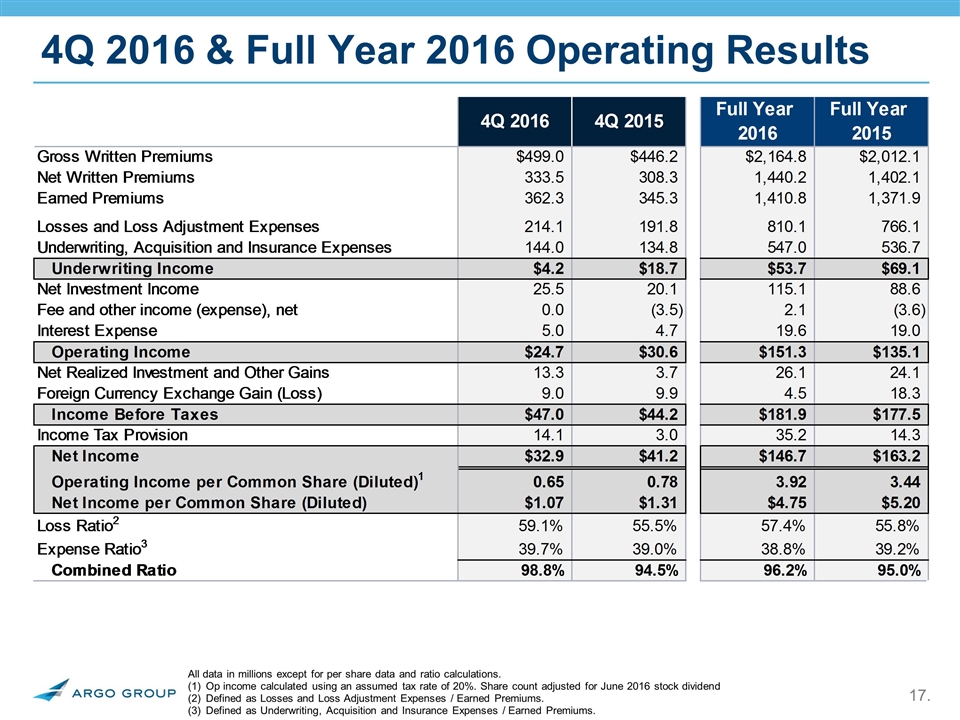

All data in millions except for per share data and ratio calculations. Op income calculated using an assumed tax rate of 20%. Share count adjusted for June 2016 stock dividend Defined as Losses and Loss Adjustment Expenses / Earned Premiums. Defined as Underwriting, Acquisition and Insurance Expenses / Earned Premiums. 4Q 2016 & Full Year 2016 Operating Results

As of December 30, 2016 Conservative Investment Strategy 17% Duration of 2.2 years Average rating of ‘A1/A+’ Book yield of 2.4%* Very liquid Conservatively managed Portfolio Characteristics *Book yield is pre-tax & includes all fixed maturities . Asset Allocation *Duration includes cash & equivalents Fixed Maturities by Type 15% Short Term & Cash Corporate 39%. 15% Gov. 21% Structured State/Muni 11%. Total: $3.4b* *$2.9 billion in fixed maturities, $0.5 billion in short term & cash Equity Investments by Sector 10% Health Care 15% Energy Financials 19% Industrials 7% Technology 14% 2% Real Estate Materials 3% Consumer Discretionary 8% 19% Consumer Staples Total: $0.4b 3% Utilities & Telecom 12% Other Fixed Maturities 66% 9% Short Term 10% Equities Total: $4.4b 2% Cash

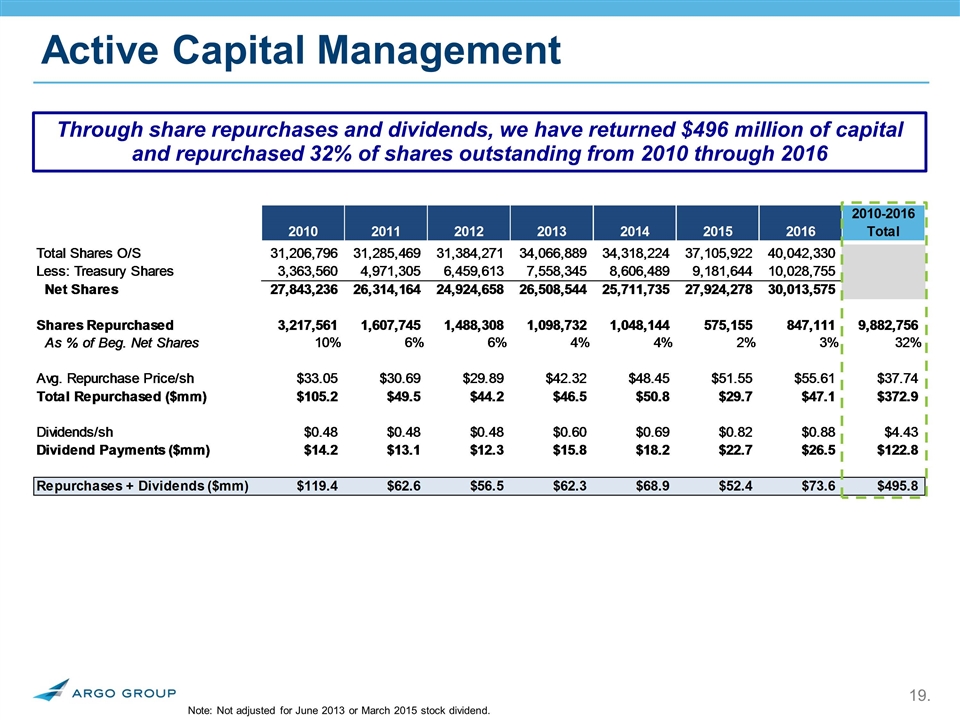

Note: Not adjusted for June 2013 or March 2015 stock dividend. Active Capital Management Through share repurchases and dividends, we have returned $496 million of capital and repurchased 32% of shares outstanding from 2010 through 2016

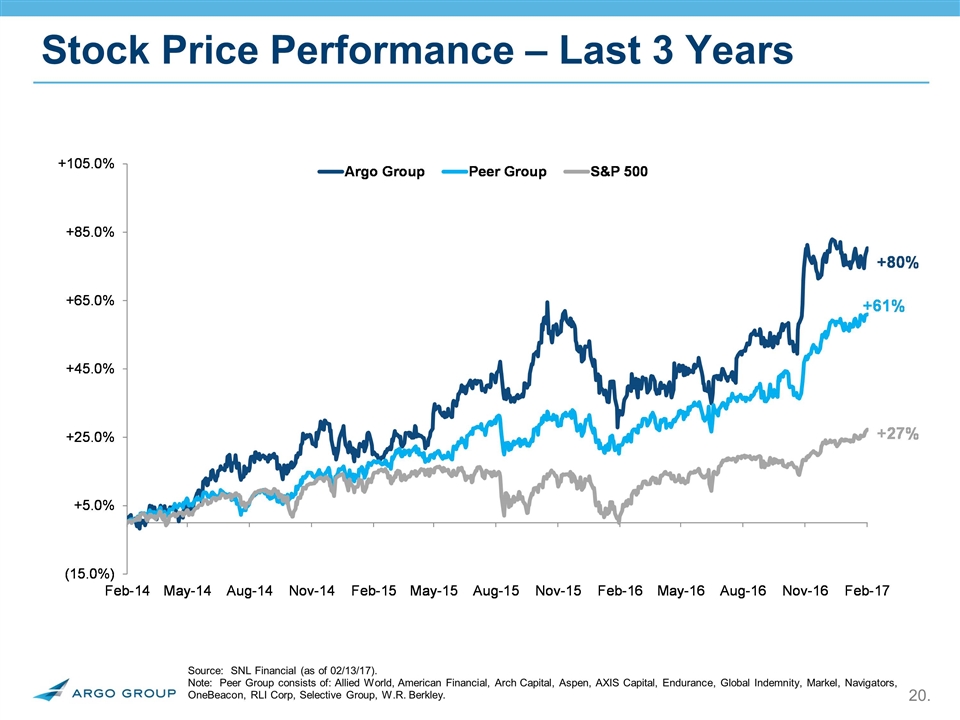

Stock Price Performance – Last 3 Years Source: SNL Financial (as of 02/13/17). Note: Peer Group consists of: Allied World, American Financial, Arch Capital, Aspen, AXIS Capital, Endurance, Global Indemnity, Markel, Navigators, OneBeacon, RLI Corp, Selective Group, W.R. Berkley.

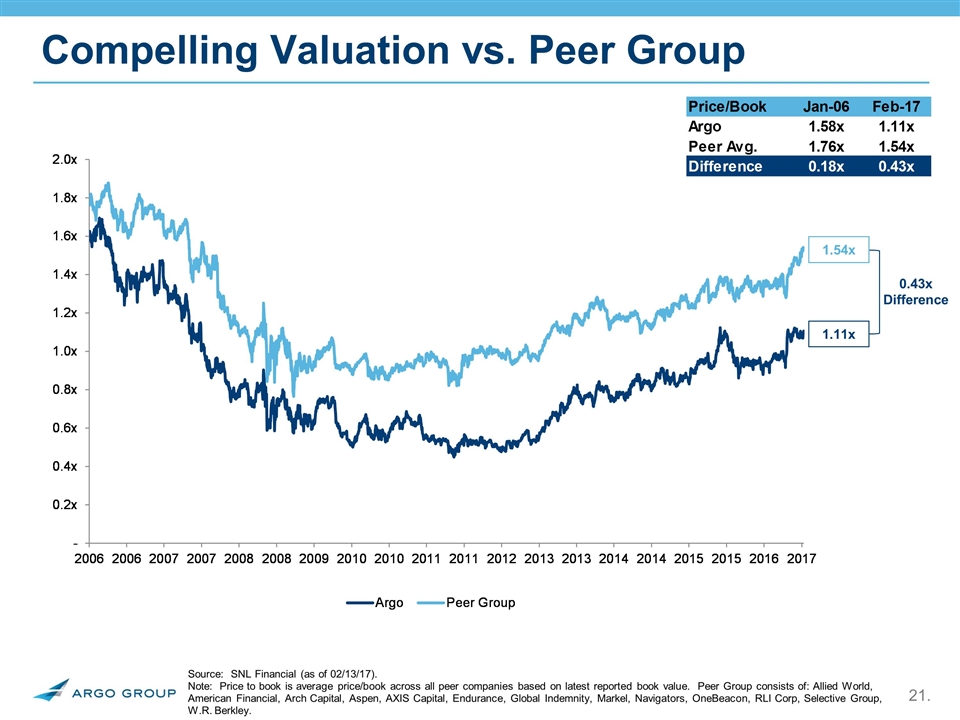

Compelling Valuation vs. Peer Group Source: SNL Financial (as of 02/13/17). Note: Price to book is average price/book across all peer companies based on latest reported book value. Peer Group consists of: Allied World, American Financial, Arch Capital, Aspen, AXIS Capital, Endurance, Global Indemnity, Markel, Navigators, OneBeacon, RLI Corp, Selective Group, W.R. Berkley. 1.11x 1.54x 0.43x Difference

We believe that Argo Group has potential to generate substantial value for new and existing investors Operations Well Positioned for Value Creation in 2017 and Beyond Moderate financial leverage Strong balance sheet with adequate reserves and excellent asset quality Capital Significant changes to premium composition completed Results of underwriting initiatives evident in financials Continue to employ and attract some of the best talent in the industry Incremental yield improvements can have a favorable impact on ROE Valuation Compelling investment case Stock trading at a discount to peers Upside potential as past and ongoing efforts continue