UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number:

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s name into English)

Kingdom of

(Jurisdiction of incorporation or organization)

(Address of principal executive offices)

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Title of each class |

| Trading Symbol |

| Name of each exchange on which registered |

Ordinary Share, no nominal value per share | The | |||

| The |

* |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None.

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None.

The number of outstanding shares of each of the issuer’s classes of capital or common stock as of December 31, 2023 was:

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐ Yes ☒

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. ☐ Yes ☒

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See the definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ | |

Non accelerated filer ☐ | Emerging growth company |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP ☐ |

| as issued by the International Accounting Standards Board ☒ |

| Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. ☐ Item 17 ☐ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. ☐ Yes ☐ No

TABLE OF CONTENTS

|

| Page | ||

3 | ||||

3 | ||||

3 | ||||

36 | ||||

54 | ||||

54 | ||||

76 | ||||

86 | ||||

88 | ||||

88 | ||||

89 | ||||

99 | ||||

101 | ||||

103 | ||||

Material Modifications to the Rights of Security Holders and Use of Proceeds | 103 | |||

103 | ||||

104 | ||||

104 | ||||

104 | ||||

105 | ||||

Purchases of Equity Securities by the Issuer and Affiliated Purchasers | 105 | |||

105 | ||||

105 | ||||

106 | ||||

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections | 106 | |||

106 | ||||

107 | ||||

109 | ||||

109 | ||||

109 |

INTRODUCTION

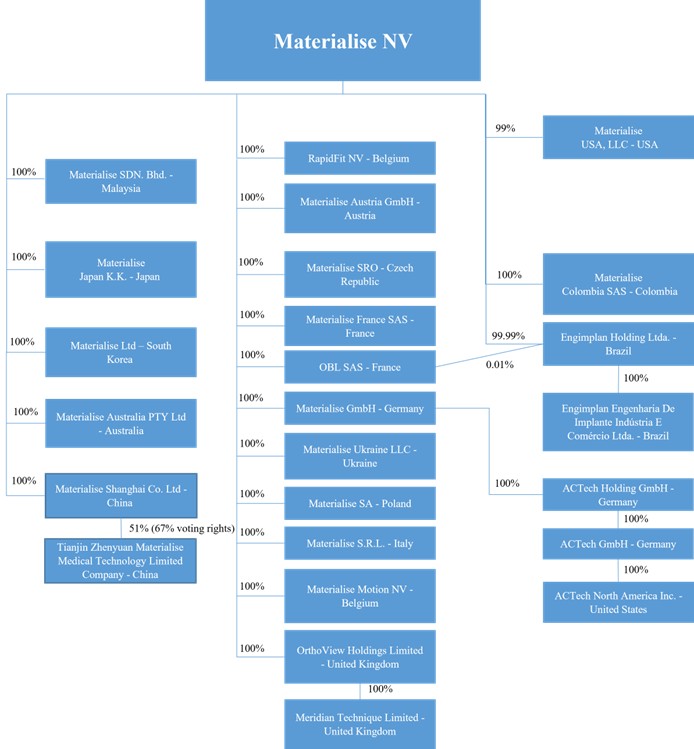

Except as otherwise required by the context, references to (i) “Materialise,” “Company,” “we,” “us” and “our” are to Materialise NV and its subsidiaries, (ii) “ACTech” are to ACTech Holding GmbH and its subsidiaries, which we acquired in 2017, (iii) “Engimplan” are to Engimplan Engenharia De Implante Indústria E Comércio Ltda., in which we acquired a controlling interest in 2019 and in which we acquired the remaining interest in 2020, making us Engimplan’s sole shareholder (through our Brazilian subsidiary), (iv) “Materialise Motion” are to Materialise Motion NV, a joint venture we established in 2014 under the name “RSPrint Powered by Materialise” NV and in which we acquired the remaining interest in 2020, together with substantially all of the assets of RSScan International NV, or RS Scan, making us Materialise Motion’s sole shareholder, (v) “Link3D” are to Link3D Inc., which we acquired an option to buy in 2021, which we exercised in 2022, and which we subsequently merged into our U.S. subsidiary, Materialise USA, LLC, and (vi) “Identify3D” are to Identify3D, Inc., which we acquired in 2022 and subsequently merged into Materialise USA, LLC.

Our trademark portfolio contained 185 registered trademarks and 3 pending trademark application as of December 31, 2023. All other trademarks or trade names referred to in this annual report are the property of their respective owners. Solely for convenience, the trademarks and trade names in this annual report are referred to without the ® and ™ symbols, but such references should not be construed as any indicator that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto.

All references in this annual report to “U.S. dollars” or “$” are to the legal currency of the United States and all references to “€” or “euro” are to the currency introduced at the start of the third stage of the European economic and monetary union pursuant to the treaty establishing the European Community, as amended.

SPECIAL NOTE REGARDING FORWARD-LOOKING INFORMATION

This annual report includes certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, concerning our business, operations and financial performance and condition as well as our plans, objectives and expectations for our business operations and financial performance and condition. Any statements that are not of historical facts may be deemed to be forward-looking statements. You can identify these forward-looking statements by words such as “believes,” “estimates,” “anticipates,” “expects,” “plans,” “intends,” “may,” “could,” “might,” “will,” “should,” “aims,” or other similar expressions that convey uncertainty of future events or outcomes. Forward-looking statements appear in a number of places throughout this annual report and include statements regarding our intentions, beliefs, assumptions, projections, outlook, analyses or current expectations concerning, among other things, our intellectual property position, research and development projects, acquisitions, results of operations, cash needs, spending of the remaining net proceeds from our initial public offering, capital expenditures, financial condition, liquidity, prospects, growth and strategies, regulatory approvals and clearances, the markets and industry in which we operate and the trends and competition that may affect the markets, industry or us. In particular, under “Item 5. Operating and Financial Review and Prospects—D. Trend Information” of this annual report and in the notes to our audited consolidated financial statements, we discuss, based on our current assessment of the ongoing armed conflict in Ukraine, and other geopolitical tensions how our business, results of operations, and financial condition could be impacted during the year 2024 and beyond.

By their nature, forward-looking statements involve risks and uncertainties because they relate to events, competitive dynamics and industry change, and depend on economic circumstances that may or may not occur in the future or may occur on longer or shorter timelines than anticipated. Although we believe that we have a reasonable basis for each forward-looking statement contained in this annual report, we caution you that forward-looking statements are not guarantees of future performance and involve known and unknown risks, uncertainties and other factors that are in some cases beyond our control. All of our forward-looking statements are subject to risks and uncertainties that may cause our actual results to differ materially from our expectations.

Actual results could differ materially from our forward-looking statements due to a number of factors, including, without limitation, risks related to:

| ● | the global political, economic, and macroeconomic climate, whether within our industry in general, or among specific types of customers or within particular geographies, including but not limited to, the impacts related to labor shortages, supply chain disruptions, actual or perceived instability in the global banking system, the results of local and national elections, a potential recession, inflation, and rising interest rates; |

| ● | our ability to enhance and adapt our software, products and services to meet changing technology and customer needs; |

1

| ● | fluctuations in our revenue and results of operations; |

| ● | impacts on our business, financial conditions and results of operations from the armed conflicts in Ukraine, Israel and the Middle East; |

| ● | impacts on our business, financial conditions and results of operations from increased geopolitical tensions, including the ongoing tensions between the United States and China; |

| ● | our ability to operate in a highly competitive and rapidly changing industry; |

| ● | our ability to adequately increase demand for our products and services; |

| ● | our collaborations, in-licensing arrangements, joint ventures, strategic alliances or partnerships with third parties; |

| ● | our ability to integrate acquired businesses or technologies effectively; |

| ● | our dependence upon sales to certain industries; |

| ● | our relationships with suppliers; |

| ● | our ability to attract and retain employees and contractors; |

| ● | any disruptions to our service center operations, including by accidents, warfare, natural disasters or otherwise; |

| ● | our ability to raise additional capital on attractive terms, or at all, if needed to meet our growth strategy; |

| ● | our ability to adequately protect our intellectual property and proprietary technology; |

| ● | our international operations; |

| ● | our ability to comply with applicable governmental laws and regulations to which our products, services and operations are subject; and |

| ● | other risk factors as set forth under “Item 3. Key Information – D. Risk Factors.” |

Any forward-looking statements that we make in this annual report speak only as of the date of such statement, and we undertake no obligation to update such statements to reflect events or circumstances after the date of this annual report or to reflect the occurrence of unanticipated events. Comparisons of results for current and any prior periods are not intended to express any future trends or indications of future performance, unless expressed as such, and should only be viewed as historical data. You should, however, review the factors and risks we describe in the reports we will file from time to time with the U.S. Securities and Exchange Commission, or the SEC, after the date of this annual report. See “Item 10. Additional Information – H. Documents on Display.”

You should also read carefully the factors described in “Item 3. Key Information – D. Risk Factors” and elsewhere in this annual report to better understand the risks and uncertainties inherent in our business and underlying any forward-looking statements. As a result of these factors, we cannot assure you that the forward-looking statements in this annual report will prove to be accurate. Furthermore, if our forward-looking statements prove to be inaccurate, the inaccuracy may be material. In light of the significant uncertainties in these forward-looking statements, you should not regard these statements as a representation or warranty by us or any other person that we will achieve our objectives and plans in any specified timeframe, or at all.

2

PART I

ITEM 1.IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE |

Not applicable.

ITEM 3.KEY INFORMATION

| A. | [Reserved] |

| B. | Capitalization and Indebtedness |

Not applicable.

| C. | Reasons for the Offer and Use of Proceeds |

Not applicable.

| D. | Risk Factors |

Summary of Risk Factors

Risks Relating to Our Business

| ● | We may not be able to maintain or increase the market share or reputation of our software and other products and services that they need to remain or become a market standard. |

| ● | We may not be successful in continuing to enhance and adapt our software, products and services in line with developments in market technologies and demands. |

| ● | The research and development programs that we are currently engaged in, or that we may establish in the future, may not be successful and our significant investments in these programs may be lost. |

| ● | Existing and increased competition may reduce our revenue and profits. |

| ● | We rely on collaborations with users of our additive manufacturing and related solutions to be present in certain large-scale markets and, indirectly, to expand into potentially high-growth specialty markets. Our inability to continue to develop or maintain these relationships in the future could harm our ability to remain competitive in existing markets and expand into other markets. |

| ● | Our revenue and results of operations may fluctuate. |

| ● | Inflation has had and may continue to have an adverse effect on our results. |

| ● | Demand for additive manufacturing generally and our additive manufacturing software solutions, products and services in particular may not increase adequately, or at all. |

| ● | We are dependent upon sales to certain industries. |

| ● | If our relationships with suppliers, including with limited source suppliers of consumables, were to terminate or our manufacturing arrangements were to be disrupted, our business could be adversely affected. |

3

| ● | The dominant software subscription model in the industrial sector is changing, and we may not be successful in developing and deploying a cloud-based platform to offer our software. |

| ● | We may not be able to successfully adapt our software offering to the changing needs of the additive manufacturing market. |

| ● | We depend on the knowledge and skills of key personnel throughout our entire organization, and if we are unable to retain and motivate them or recruit additional qualified personnel, our operations could suffer. |

| ● | We may need to raise additional capital from time to time in order to meet our growth strategy and may be unable to do so on attractive terms, or at all. |

| ● | As a result of the armed conflict in Ukraine, our supporting operations in Kyiv are expected to continue to be subject to continuous reorganization, uncertainty and instability. |

| ● | Our international operations pose currency risks, which may adversely affect our results of operations and net income. |

| ● | Our international operations subject us to various risks, and our failure to manage these risks could adversely affect our results of operations. |

| ● | We may engage in acquisitions or investments that could disrupt our business, cause dilution to our shareholders and harm our financial condition and results of operations. |

| ● | We may enter into collaborations, in-licensing arrangements, joint ventures, strategic alliances or partnerships with third parties that may not result in the development of commercially viable products or the generation of significant future revenue. |

| ● | Failure to comply with applicable anti-corruption and trade sanctions legislation could result in fines, criminal penalties and an adverse effect on our business. |

| ● | Errors or defects in our software or other products could cause us to incur additional costs, lose revenue and business opportunities, damage our reputation and expose us to potential liability. |

| ● | We rely on our information technology systems to manage numerous aspects of our business and customer and supplier relationships, and a disruption of these systems could adversely affect our results of operations. |

| ● | A breach of security in our products or computer systems may compromise the integrity of our products, harm our reputation, create additional liability and adversely impact our financial results. |

| ● | If our service center operations are disrupted, sales of our 3D printing services, including the medical devices that we print, may be affected, which could have an adverse effect on our results of operations. |

| ● | Our failure to adequately address current and emerging sustainability risks, including environmental, social and governance (ESG) matters, could have a material adverse effect on our business, financial condition and results of operations. |

Risks Related to Our Materialise Medical Segment and Regulatory Environment

| ● | Our medical business, financial condition, results of operations and cash flows could be significantly and negatively affected by substantial government regulations. |

| ● | Our Materialise Medical segment’s 3D printing operations are required to operate within a quality management system that is compliant with the regulations of various jurisdictions, including the requirements of ISO 13485, and the U.S. Quality System Regulation, which is costly and could subject us to enforcement action. |

4

Risks Related to Our Intellectual Property

| ● | If we are unable to obtain patent protection for our products or otherwise protect our intellectual property rights, our business could suffer. |

Risks Related to the American Depositary Shares (ADSs)

| ● | We do not expect to be a passive foreign investment company for U.S. federal income tax purposes; however, there is a risk that we may be classified as a passive foreign investment company, which could result in materially adverse U.S. federal income tax consequences to U.S. investors. |

Risks Relating to Our Business

We may not be able to maintain or increase the market share or reputation of our software and other products and services that they need to remain or become a market standard.

The additive manufacturing, or 3D printing, industry is rapidly growing on a global scale and is subject to constant innovation and technological change. A variety of technologies compete against one another in our market, which is driven, in part, by technological advances and end-user requirements and preferences, as well as by the emergence of new standards and practices. As the additive manufacturing market evolves, the industry standards that are adopted and adhered to are a function of the inherent qualities of the technology as well as the willingness of members of the industry to adopt them. To remain competitive, we depend in large part on our ability to increase and maintain market share and influence in the industry in order to be recognized as a market standard. Nonetheless, in the future, our influence in setting standards for the additive manufacturing industry may be limited and the standards adopted by the market may not be compatible with our present or future products and services.

We may not be successful in continuing to enhance and adapt our software, products and services in line with developments in market technologies and demands.

Our present or future software, products and services could be rendered obsolete or uneconomical by technological advances by one or more of our present or future competitors, by other technologies or by new customer needs. Our ability to remain competitive will depend, in large part, on our ability to enhance and adapt our current software, product and services to developments in technologies and to new and changing customer needs (including the manufacturing of end use parts and the offering of cloud-based software solutions). We believe that to remain competitive we must continuously enhance and expand the functionality and features of our products, services and technologies. However, there can be no assurance that we will be able to:

| ● | maintain and enhance the market share of our current products, services and technologies; |

| ● | enhance our existing products, services and technologies; |

| ● | develop new products, services and technologies that address the increasingly sophisticated and varied needs of prospective end-users (including in the emerging market of using additive manufacturing for end use parts instead of prototypes and the trend of offering more cloud-enabled software solutions); |

| ● | respond to technological advances and emerging industry standards and practices on a cost-effective and timely basis; |

| ● | adequately protect our intellectual property as we develop new products, services and technologies and anticipate intellectual property claims from third parties. |

5

The research and development programs that we are currently engaged in, or that we may establish in the future, may not be successful and our significant investments in these programs may be lost.

To remain competitive, we invest, and intend to continue to invest, significant amounts in various research and development programs. There can be no assurances, however, that these research and development programs will improve our existing additive manufacturing software solutions, products and services or create new software, products or services. Even if some of these programs are successful, it is possible that the new software, products or services developed from such programs will not be commercially viable, that new 3D printing technologies that we, or others, develop will eventually supplant our current 3D printing technologies, that changes in the manufacturing or use of 3D printers will adversely affect the need or demand for our software, products or services or that our competitors will create or successfully market 3D printing technologies that will replace our solutions, products and services in the market. As a result, any of our software solutions, products or services may be rendered obsolete or uneconomical and our significant investments in all or some of our research and development programs may be lost.

Existing and increased competition may reduce our revenue and profits.

The market segments in which we operate, Materialise Software, Materialise Medical and Materialise Manufacturing, are characterized by vigorous competition, by the entry of competitors with innovative technologies, by consolidation of companies with complementary products, services and technologies, and by entry of large corporations in any one or more of our market segments.

In particular, the barriers to enter the software, medical and industrial markets with 3D printing solutions are decreasing rapidly.

In the Materialise Software segment, the availability of computing devices with continually expanding performance at progressively lower prices contributes to the ease of market entry. Additionally, there are certain open-source software applications that are being offered free of charge or for a nominal fee that can place additional competitive pressure on us. 3D printer manufacturers, which closely work with their customers, may also successfully bundle their own software solutions with their equipment, which may make our independent software solutions obsolete. In addition, companies that have greater financial, technical, sales and marketing and other resources, including market leaders with significant in-house capacities in software development, or existing computer-aided design, or CAD, or computer-aided manufacturing, or CAM, or manufacturing execution system, or MES, software providers, are entering the additive manufacturing market and may very rapidly gain a significant share of the markets that we target (including through the acquisition of startup and scale-up companies that are active in the development and sale of additive manufacturing software tools).

In the Materialise Medical segment, medical device companies are investing in 3D printing solutions that may compete with our software solutions, products and services. Companies that initially rely on us to enter the additive manufacturing market for medical applications may, as they gain experience and as 3D printing technology gains strategic importance, decide to develop their own in-house solutions and enter the market themselves with their own software, products or services, thus becoming competitors and denying us continued access to their distribution channels. In addition, startup and scale-up companies, as well as companies that have greater financial, technical, sales and marketing and other resources, are entering the additive manufacturing market and may very rapidly gain a significant share of the markets that we target.

In the Materialise Manufacturing segment, as additive manufacturing gains importance as a strategic technology, our customers are likely to bring 3D manufacturing in-house and reduce or even discontinue using our 3D printing services. In addition, competitors with more efficient or profitable business models, superior techniques or more advanced technologies may take market share away from us. Also, in certain specific markets that our Materialise Manufacturing segment targets, including, among others, the shoe wear, eyewear and fixtures markets, established players may develop their own competitive solutions or may engage in collaborations with competitors of ours, preventing us from gaining a viable position in these markets.

Because of these and other factors, competitive conditions in the industry are likely to intensify in the future. Increased competition could result in price reductions, reduced revenue and operating margins and loss of market share, any of which would likely harm our results of operations.

6

We rely on collaborations with users of our additive manufacturing and related solutions to be present in certain large-scale markets and, indirectly, to expand into potentially high-growth specialty markets. Our inability to continue to develop or maintain these relationships in the future could harm our ability to remain competitive in existing markets and expand into other markets.

Our strategy includes entering into collaborations with our customers in certain large-scale markets and leveraging these collaborations to enter into other underserved specialty markets. In the medical market, we have entered into collaborations with DePuy Synthes Companies of Johnson & Johnson, or DePuy Synthes, and Zimmer Biomet Holdings, Inc., or Zimmer Biomet, as well as with Encore Medical, L.P. (d/b/a Enovis), or Enovis, Limacorporate Spa, or Lima, Mathys AG, or Mathys (which is now part of the same group as Enovis), Smith & Nephew Inc., or Smith & Nephew, Corin Ltd, or Corin, Medtronic Inc., or Medtronic, and Abbott Laboratories Inc., or Abbott. Increased adoption of our software, products and services, especially in potentially high-growth specialty markets, will depend in part on our current and future collaborators’ willingness to continue to adopt our additive manufacturing and other solutions in their markets and on our ability to continue to collaborate with these and other players. Certain of our customers that have initially relied on our 3D printing software and services have announced their intention to bring their 3D printing operations in-house and enter the market themselves, and other customers may also do so in the future as they gain experience and as 3D printing technology gains strategic importance, thus denying us continued access to their distribution channels. In addition, a change of control of any of our collaboration partners may negatively impact our relationship. If we are not able to maintain our existing collaborations and develop new collaborative relationships, our foothold in larger markets and expansion into potentially high-growth specialty markets could be harmed significantly.

Our revenue and results of operations may fluctuate.

Our revenue and results of operations may fluctuate from quarter-to-quarter and year-to-year and are likely to continue to vary due to a number of factors, many of which are not within our control. You should not rely on our past results as an indication of our future performance.

Fluctuations in our results of operations and financial condition may occur due to a number of factors, including, but not limited to, those listed below and those identified throughout this annual report:

| ● | our ability to continue, renew or replace relationships with key customers; |

| ● | the degree of market acceptance of our software and our products; |

| ● | the mix of software, products and services that we sell during any period, as well as the mix of the various markets in which we make sales during said periods; |

| ● | a decline in new or renewed licenses or maintenance contracts for our software, including from customers refusing to transition from perpetual to annual licensing models for our software or disruptions related to our deployment of cloud-based software solutions; |

| ● | delays in the introduction of new features; |

| ● | the entry of new competitors into our market; |

| ● | the development and degree of market acceptance of new competitive systems or processes by others; |

| ● | changes in our pricing policies or those of our competitors, including our responses to price competition; |

| ● | changes in the amount we spend in our marketing and other efforts; |

| ● | delays between our expenditures to develop, acquire or license new technologies and processes, and the generation of sales related thereto; |

| ● | the amounts we spend on, and the success rate of, our research and development activities; |

7

| ● | changes in the regulatory environment, including changes in regulatory laws and regulations, and the interpretation thereof, applicable to our software programs, products or services; |

| ● | delays in obtaining regulatory approval for our products, services or software programs; |

| ● | interruptions to or other problems with our website and interactive user interface, information technology systems, manufacturing processes or other operations; |

| ● | general macroeconomic and industry conditions that affect end-user demand and end-user levels of product design and manufacturing, including the adverse effects of global macroeconomic uncertainties including those related to the armed conflicts in Ukraine, Israel and the Middle East and the ongoing geopolitical tensions between the United States and China; and |

| ● | changes in accounting rules and tax laws. |

Inflation has had and may continue to have an adverse effect on our results.

Inflationary pressures negatively impacted our operating margins and net income in fiscal 2022 and 2023, including increasing the costs of labor, energy, materials, and freight. We implemented price increases on many of our products and services in 2022 and 2023. In an effort to mitigate the effects of higher costs related to inflation. However, not all cost increases could be entirely offset, in part due to the delayed effect of price increases in multi-year agreements to which we are a party, where price increases can only be implemented at the renewal date. In addition, in Belgium, the salaries of our employees are indexed to inflation increases by law and, as a result, in can be difficult to keep our sales prices aligned with increases in our labor costs. If these inflationary pressures continue, our revenue, gross and operating margins and net income may be impacted in fiscal 2024 as well, which would harm our results of operations.

Demand for additive manufacturing generally and our additive manufacturing software solutions, products and services in particular may not increase adequately, or at all.

The industrial and medical industries are generally dominated by conventional production methods with limited use of additive manufacturing technology in certain specific instances. If additive manufacturing technology for the production of end use parts does not gain more mainstream market acceptance, the pace by which additive manufacturing technology gains market acceptance does not accelerate or if the marketplace adopts additive manufacturing based on a technology other than the technologies that we currently use or serve (including in the medical, eyewear, footwear and fixtures markets that we target), we may not be able to meet our growth objectives or increase or sustain the level of sales of our additive manufacturing software solutions, products and services, and our results of operations would be adversely affected as a result.

We are dependent upon sales to certain industries.

Our revenue from products is currently relatively concentrated in the industrial and medical industries, and particularly in the automotive/aerospace and orthopedic/cranio-maxillofacial segments within such industries, respectively, and we expect additional growth to come from certain other specific markets, such as the eyewear and footwear markets. To the extent any of these industries experience, or continue to experience, a downturn, our results of operations may be adversely affected. Additionally, if any of these industries or their respective suppliers or other providers of manufacturing services develop new technologies or alternatives to manufacture the products that are currently manufactured using our 3D printing software, products and services, it may adversely affect our results of operations.

If our relationships with suppliers, including with limited source suppliers of consumables, were to terminate or our manufacturing arrangements were to be disrupted, our business could be adversely affected.

We purchase consumables and other components that are used in our production from third party suppliers. We currently use only a limited number of suppliers for several of the raw materials that we use for our printing activities. Our reliance on a limited number of vendors involves a number of risks, including:

| ● | potential shortages of some key consumables or other components; |

8

| ● | printed material performance or quality shortfalls, if traceable to particular consumables or other components, since the supplier of the faulty consumable or component cannot readily be replaced; |

| ● | discontinuation of a consumable or other component on which we rely; |

| ● | potential insolvency of these vendors; and |

| ● | reduced control over delivery schedules, manufacturing capabilities, quality and costs. |

If certain suppliers were to decide to discontinue production, or the supply to us, of a consumable or other component that we use, the unanticipated change in the availability of supplies, or unanticipated supply limitations, could cause delays in, or loss of, sales, increased production or related costs and, consequently, reduced margins, and damage to our reputation. In addition, because we use a limited number of suppliers, and there is an increasing trend of consolidation among our existing suppliers, the increase in the prices charged by our suppliers may have an adverse effect on our results of operations, as we may be unable to find a supplier who can supply us at a lower price. As a result, the loss of a limited source supplier could adversely affect our relationships with our customers and our results of operations and financial condition.

The dominant software subscription model in the industrial sector is changing, and we may not be successful in developing and deploying a cloud-based platform to offer our software.

We offer most of our current software products through on-premises licensing (either on a perpetual or annual basis). We believe the industrial software market is evolving to Software as a Service, or SaaS, and other cloud-based models of software deployment where software providers typically license their applications to customers for use as a service on demand through web browser technologies. While we are deploying an increasing number of cloud-enabled platform components, through our CO-AM and Mimics Flow platforms to offer our software products either by means of a SaaS or a cloud-based subscription model, there is no guarantee that we will be able to complete this integration successfully or in a timely manner or that our platform will be adopted by customers over other platforms.

A SaaS or cloud-based software offering may differ significantly from the perpetual and annual licensing models that we have offered until recently. An increase in the prevalence of SaaS and cloud-based delivery models offered by us or our competitors could unfavorably impact the pricing of our on-premises software offerings and have a dampening impact on overall demand for our on-premises software product offerings, which could reduce our revenues and profitability. In addition, to the extent that demand for our SaaS or cloud-based offerings increases in the future, we may experience volatility in our reported revenues and operating results due to the differences in timing of revenue recognition between our perpetual and annual software licenses and our SaaS and cloud-based offering arrangements.

Furthermore, the SaaS and cloud-based software products we offer reside upon and are hosted by third party providers. A security breach, whether of our products, of our customers’ network security and systems or of third party hosting services, could disrupt access to our customers’ stored information and could lead to the loss of, damage to or public disclosure of our customers’ stored information.

We may not be able to successfully adapt our software offering to the changing needs of the additive manufacturing market.

While the current proto-typing market that we serve with our software solutions (in particular the Magics 3D Print Suite) is not expected to disappear, the main growth in additive manufacturing is expected to come from the use of 3D printing for the production of end use parts. While we are investing significantly in the expansion of our current software product portfolio to also serve the needs of this new and growing market (in particular, with the development of our CO-AM platform), there can be no certainty that our new software offering will adequately serve the needs of this new market, will be operational in time to address these market needs, will be well received by the market or will effectively compete with other players in this market.

9

We depend on the knowledge and skills of key personnel throughout our entire organization, and if we are unable to retain and motivate them or recruit additional qualified personnel, our operations could suffer.

Our success depends upon the continued service and performance of key personnel at all levels within our organization, including machine operators, engineers, designers, software developers, salespeople, product managers and senior management, and our ability to identify, hire, develop, motivate and retain qualified personnel in the future. Competition for key employees in our industry is intense and we cannot guarantee that we will be able to retain our personnel or attract new, qualified personnel. We may need to invest significant amounts of cash and equity to attract and retain new employees and we may not realize returns on these investments. The loss of the services of key personnel could prevent or delay the implementation and completion of our strategic objectives, could divert management’s attention to seeking certain qualified replacements or could adversely affect our ability to manage our company effectively. Each member of our personnel may resign at any time. Only some of the members of our personnel are subject to non-competition agreements, which may also be difficult to enforce. Accordingly, the adverse effect resulting from the loss of certain member of our key personnel could be compounded by our inability to prevent them from competing with us. We do not carry key-man insurance on any member of our senior management team or other key personnel. If we lose the ability to hire and retain key executives and employees with a diversity and high level of skills in appropriate domains (such as research and development and sales), it could have a material adverse impact on our business activities and results of operations.

In addition, the success of our acquisitions may depend in part on our ability to retain senior management and other key personnel of the acquired company following the acquisition and to continue to attract such persons to our company. For example, the companies we acquire may depend on small teams of founders and senior managers with extensive market knowledge and relationships or that exercise substantial influence over the acquired business. As result, the loss of such persons could adversely affect us.

We may need to raise additional capital from time to time in order to meet our growth strategy and may be unable to do so on attractive terms, or at all.

We intend to continue to make investments to support the growth of our business and may require additional funds to respond to business challenges, including the need to implement our growth strategy, increase market share in our current markets or expand into other markets, or broaden our technology, intellectual property or service capabilities. Accordingly, we may require additional investments of capital from time to time, and our existing sources of cash and any funds generated from operations may not provide us with sufficient capital. For various reasons, including the current macroeconomic environment or any noncompliance with existing or future lending arrangements, additional financing, may not be available when needed, or may not be available on terms favorable to us. If we fail to obtain adequate capital on a timely basis or if capital cannot be obtained on terms satisfactory to us, we may not be able to achieve our planned rate of growth, which will adversely affect our results of operations.

Our international operations subject us to various risks, and our failure to manage these risks could adversely affect our results of operations.

We face significant operational risks as a result of doing business internationally, including, among others:

| ● | fluctuations in foreign currency exchange rates; |

| ● | potentially longer sales and payment cycles; |

| ● | potentially greater difficulties in collecting accounts receivable; |

| ● | potentially adverse tax consequences, including liabilities imposed from inconsistent enforcement; |

| ● | challenges in providing solutions across a significant distance, in different languages and among different cultures; |

| ● | the impact of global public health crises, pandemics and epidemics; |

| ● | transportation delays; |

| ● | becoming subject to the different, complex and changing laws, regulations and court systems of multiple jurisdictions and compliance with a wide variety of foreign laws, treaties and regulations; |

10

| ● | reduced protection of, or significant difficulties in enforcing, intellectual property rights in certain countries; |

| ● | difficulties in staffing and managing foreign operations, particularly in new geographic locations; |

| ● | restrictions imposed by local labor practices and laws on our business and operations, including unilateral cancellation or modification of contracts; |

| ● | expropriation or nationalization of property; |

| ● | rapid changes in global government, economic and political policies and conditions, political or civil unrest or instability, terrorism or pandemics, epidemics and other similar outbreaks or events, such as the armed conflicts in Ukraine, Israel and the Middle East and the ongoing geopolitical tensions between the United States and China; |

| ● | operating in countries with a higher incidence of corruption and fraudulent business practices; |

| ● | seasonal reductions in business activity in certain parts of the world, particularly during the summer months in Europe; |

| ● | costs and difficulties of customizing products for foreign countries; and |

| ● | tariffs, export controls, trade barriers and other regulatory or contractual limitations on our ability to sell or develop our products in certain foreign markets. |

As a result of the armed conflict in Ukraine, our supporting operations in Kyiv are expected to continue to be subject to continuous reorganization, uncertainty and instability.

We have an office in Kyiv, Ukraine where more than 400 of our collaborators are mainly engaged in engineering, software development and IT support, as well as other staff functions. The invasion of Ukraine by the Russian Federation on February 24, 2022, has impacted our operations in Kyiv significantly.

Although our operations in Kyiv nearly ceased in the first quarter of 2022, we have since been able to gradually reorganize the internal services provided from that region through a combination of measures, including Ukrainian collaborators who have fled to other regions in their country now working from home, support provided by existing (and often enlarged) Materialise teams in other regions, the relocation of a number of Ukrainian collaborators outside of Ukraine, and, circumstances permitting, services provided from our Kyiv office, which we have re-opened and accommodated to try to cope with the challenges resulting from the continuous military strikes on key infrastructure in the country.

While our people in Ukraine have shown, and continue to show, incredible resilience and professionalism, the situation in Ukraine remains unstable and uncertain and is expected to continue to have an impact on our operations, both financially and operationally. We expect that, as long as the armed conflict continues (and possibly for a period thereafter), this impact will continue and may even worsen, depending on the developments both geo-politically and in Ukraine. The ongoing additional mobilization for the Ukrainian army may also impact our operations. Although we are presently determined to continue to flexibly support our operations in Kyiv and at present do not see any reason to revise that strategy, we constantly monitor and evaluate the situation. Any change in strategy may have an additional negative impact on our results of operations and financial condition.

We are unable to predict how the armed conflict in Ukraine will evolve and what the further political and economic repercussions will be. As a result, we are unable to assess with certainty its future impact on our business and operations, results of operations, financial condition, cash flows and liquidity. In particular, although we have included under “Item 5. Operating and Financial Review and Prospects—D. Trend Information” of this annual report a discussion, based on our current assessment of the armed conflict in Ukraine, of how our business, results of operations, and financial condition could be impacted during fiscal 2024, this discussion should be considered as uncertain. While we expect to suffer adverse effects, the severity is currently impossible to assess.

11

Our international operations pose currency risks, which may adversely affect our results of operations and net income.

Our results of operations may be affected by volatility in currency exchange rates and our ability to effectively manage our currency transaction risks. In general, we conduct our business, earn revenue and incur costs in the local currency of the countries in which we operate. During the year ended December 31, 2023, 66% of our revenue was generated, and approximately 77% of our total costs were incurred in euros. As we continue to expand internationally, our exposure to currency risks may increase. Historically, although we seek to monitor the ratio of revenues to expenses in certain foreign currencies, we have not managed all our foreign currency exposure in a manner that would eliminate the effects of changes in foreign exchange rates. Changes in exchange rates between the foreign currencies in which we do business and the euro will affect our revenue, cost of sales, and operating margins, and could result in exchange losses in any given reporting period.

Changes in tax laws, treaties or regulations could adversely affect our financial results.

Our future effective tax rates could be adversely affected by changes in tax laws, treaties and regulations, both internationally and domestically, including possible changes to the innovation income deduction regime in Belgium or the way it proportionately impacts our effective tax rate. An increase of our future effective tax rates could have a material adverse effect on our business, financial position, results of operations and cash flows.

We may engage in acquisitions or investments that could disrupt our business, cause dilution to our shareholders and harm our financial condition and results of operations.

In the past, we have acquired or invested in companies that we believe have products, services, competencies or capabilities that are a strategic or commercial fit with any of our businesses or that otherwise offer opportunities for us, and we intend to continue evaluating opportunities to do so.

In connection with acquisitions or investments, we may:

| ● | issue American Depositary Shares, or ADSs, or other forms of equity that would dilute our existing shareholders’ percentage of ownership; |

| ● | incur debt and assume liabilities; and/or |

| ● | incur amortization expenses related to intangible assets or incur large and immediate write-offs. |

If we complete an acquisition or investment, we cannot assure that it will ultimately strengthen our competitive position or that it will be viewed positively by customers, suppliers, employees, financial markets or investors. Furthermore, future acquisitions or investments could pose numerous additional risks to our operations, including:

| ● | problems integrating the purchased business, products, services or technologies; |

| ● | challenges in achieving strategic objectives, cost savings and other anticipated benefits; |

| ● | increases to our expenses; |

| ● | the potential write down of assets or goodwill acquired in the context of an acquisition or investment; |

| ● | due diligence investigations failing to discover undisclosed liabilities or risks affecting the acquired businesses; |

| ● | the assumption of significant liabilities that exceed the limitations of any applicable indemnification provisions or the financial resources of any indemnifying party; |

| ● | inability to maintain relationships with key customers, vendors and other business partners of our current or acquired businesses; |

| ● | diversion of management’s attention from their day-to-day responsibilities; |

12

| ● | difficulty in maintaining controls, procedures and policies during the transition and integration; |

| ● | entrance into marketplaces where we have no or limited prior experience and where competitors have stronger marketplace positions; |

| ● | potential loss of key employees, particularly those of the acquired entity; and |

| ● | historical financial information may no longer be representative or indicative of our results as a combined company. |

Alternatively, while certain acquisitions or investments may be of strategic importance for the execution of our business plan, we may not ultimately be able to complete such acquisitions or investments on favorable terms, or at all, which may in turn materially affect our ability to grow or even cause us to lose market share, and could have a material adverse effect on our business, financial condition and results of operations.

We may enter into collaborations, in-licensing arrangements, joint ventures, strategic alliances or partnerships with third parties that may not result in the development of commercially viable products or the generation of significant future revenue.

In the ordinary course of our business, we enter into collaborations, in-licensing arrangements, joint ventures, strategic alliances or partnerships to develop proposed products or services and to pursue new markets. Proposing, negotiating and implementing collaborations, in-licensing arrangements, joint ventures, strategic alliances or partnerships may be a lengthy and complex process. Other companies, including those with substantially greater financial, marketing, sales, technology or other business resources, may compete with us for these opportunities or arrangements. We may not succeed in maintaining, renewing or extending existing collaborations or in identifying, securing, or completing any such new transactions or arrangements in a timely manner, on a cost-effective basis, on acceptable terms or at all. We may also not realize the anticipated benefits of any such transaction or arrangement. In particular, these collaborations may not result in the development of products or services that achieve commercial success or result in significant revenue and could be terminated prior to developing any products or services.

Additionally, we may not be in a position to exercise sole decision-making authority regarding the transaction or arrangement, which could create the potential risk of creating impasses on decisions, and our collaboration partners may have economic or business interests or goals that are, or that may become, inconsistent with our economic or business interests or goals. It is possible that conflicts may arise with our current or future collaboration partners, such as conflicts concerning the achievement of performance milestones, or the interpretation of terms under any agreement, such as those related to financial obligations, the ownership or license rights or control of intellectual property developed before or during the collaboration or indemnification. If any conflicts arise with our current or future collaboration partners, they may act in their self-interest, which may be adverse to our best interest, and they may breach their obligations to us. In addition, we have limited control over the amount and timing of resources that our current collaboration partners or any future collaboration partners devote to our collaboration partners’ or our future products or services. Disputes with our collaboration partners may result in litigation or arbitration that would increase our expenses and divert the attention of our management. Further, these transactions and arrangements are contractual in nature and may be terminated or dissolved under the terms of the applicable agreements and, in such event, we may not continue to have rights to the products or access to the markets relating to such transaction or arrangement or may need to purchase such rights at a premium.

Failure to comply with applicable anti-corruption and trade sanctions legislation could result in fines, criminal penalties and an adverse effect on our business.

We operate in a number of countries throughout the world and we are committed to doing business in accordance with applicable anti-corruption laws. We are subject, however, to the risk that our officers, directors, employees, agents and collaboration partners may take action determined to be in violation of such anti-corruption laws, as well as trade sanctions administered by the Office of Foreign Assets Control and the U.S. Department of Commerce. Any such violation could result in substantial fines, sanctions, civil and/or criminal penalties or curtailment of operations in certain jurisdictions and might adversely affect our results of operations. In addition, actual or alleged violations could damage our reputation and ability to do business.

13

Errors or defects in our software or other products could cause us to incur additional costs, lose revenue and business opportunities, damage our reputation and expose us to potential liability.

Sophisticated software and complex 3D printed products may contain errors, defects or other performance problems at any point in the life of the product. If errors or defects are discovered in our current or future software or other products, we may not be able to correct them in a timely manner, or provide an adequate response to our customers. We may therefore need to expend significant financial, technical and management resources, or divert some of our development resources, in order to resolve or work around those defects. We may also experience an increase in our service and warranty costs. Particularly in the medical sector, errors or defects in our software or products could lead to claims by patients against us and our customers and expose us to lawsuits that may damage our and our customers’ reputations. Claims may be made by individuals or by classes of users. Our product liability and related insurance policies may not apply or sufficiently cover any product liability lawsuit that arises from defective software or products. Customers such as our collaboration partners may also seek indemnification for third party claims allegedly arising from breaches of warranties under our collaboration agreements.

Errors, defects or other performance problems in our software or other products may also result in the loss of, or delay in, the market acceptance of our software, our products and related 3D printing or engineering services or postponement of customer deployment. Such difficulties could also cause us to lose customers and, particularly in the case of our largest customers, the potentially substantial associated revenue which would have been generated by our sales to companies participating in our customer’s supply chain. Technical problems, or the loss of a customer with a particularly important global reputation, could also damage our own business reputation and cause us to lose new business opportunities.

We rely on our information technology systems to manage numerous aspects of our business and customer and supplier relationships, and a disruption of these systems could adversely affect our results of operations.

We rely on our information technology systems and databases to manage numerous aspects of our business and to provide analytical information to management. Our information technology systems allow us to, among other things, optimize our software development and research and development efforts, organize our in-house 3D printing services logistics, efficiently purchase products from our suppliers, provide other procurement and logistic services, ship and invoice products to our customers on a timely basis, maintain cost-effective operations and generally provide service to our customers. Our information technology systems are an essential component of our business and growth strategies, and a disruption to or perceived failure in our information technology systems could significantly limit our ability to manage and operate our business efficiently. Although we take steps to secure our information technology systems, including our computer systems, intranet and internet sites, email and other telecommunications and data networks, the security measures we have implemented may not be effective and our systems may be vulnerable to, among other things, damage and interruption from power loss, including as a result of natural disasters, computer system and network failures, loss of telecommunication services, operator negligence, loss of data, security breaches, computer viruses and other disruptive events. Any such disruption could adversely affect our reputation, brand and financial condition.

In addition, during the next few years, we expect to gradually replace a number of our information technology systems with new, cloud-based systems. This transformation is intended to further increase our security and data integrity. Disruptions during the configuration, implementation or operation of, or during the migration to, these new systems may have an impact on our operations and could adversely affect us.

14

A breach of security in our products or computer systems may compromise the integrity of our products, harm our reputation, create additional liability and adversely impact our financial results.

We make significant efforts to maintain the security and integrity of our product source code and computer systems. The risk of a security breach or disruption, particularly through cyber-attack or cyber intrusion, including by computer hackers, foreign governments and cyber terrorists, has increased as the number, intensity and sophistication of attempted attacks and intrusions from around the world have increased. These threats include identity theft, unauthorized access, DNS attacks, wireless network attacks, viruses and worms, advanced persistent threat, application centric attacks, peer-to-peer attacks, phishing, backdoor trojans and distributed denial of service attacks. Any of the foregoing could attack our products and computer systems. Despite significant efforts to create and continuously reinforce the security barriers to such programs, it is virtually impossible for us to entirely eliminate this risk. Like all software products and computer systems, our software products and computer systems are vulnerable to such cyber-attacks, and our computer systems have been subject to certain cyber security incidents in the past. The impact of cyber-attacks could disrupt the proper functioning of our software products and computer systems, cause errors in the output of our or our customers’ work, allow unauthorized access to sensitive, proprietary or confidential information of our company, our customers or the patients that we and our customers serve through our medical solutions. Moreover, as we continue to invest in new lines of products and services we are exposed to increased security risks and the potential for unauthorized access to, or improper use of, the information of our product and service users. If any of the foregoing occur, our reputation may suffer, customers may stop buying our products or services, we could face lawsuits and potential liability, and our results of operations could be adversely affected.

As noted above, any security compromise that causes an apparent privacy violation could also result in legal claims or proceedings; liability under various laws and regulations that regulate the privacy, security, or breach of personal information; and related regulatory penalties. See “—We face potential liability related to the privacy and security of personal information we collect.” below for more information. Moreover, the landscape of laws, regulations, and industry standards related to patient health and other private information, data privacy and cybersecurity is evolving globally. We may be subject to increased compliance burdens by regulators and our customers and the patients that we and our customers serve, as well as additional costs to oversee and monitor security risks. Many jurisdictions have enacted laws mandating companies to inform individuals, shareholders, regulatory authorities, and others of security breaches. For example, the SEC recently adopted cybersecurity risk management and disclosure rules, which require the disclosure of information pertaining to cybersecurity incidents and cybersecurity risk management, strategy, and governance. In addition, certain of our customer agreements may require us to promptly report security breaches involving their data on our systems or those of subcontractors processing such data on our behalf. This mandatory disclosure can be costly, harm our reputation, erode customer trust, and require significant resources to mitigate issues stemming from actual or perceived security breaches.

We rely on third-party technology, platform, carriers, server and hardware providers and as well as local servers, and a failure of service by these providers or by our local servers could adversely affect our business and reputation.

We use third party cloud providers to host a major part of our servers as well as to host our SaaS and cloud-based software applications. If these providers are unable to handle current or higher volumes of use, experience any interruption in operations or cease operations for any reason or if we are unable to agree on satisfactory terms for a continued hosting relationship, we would be forced to enter into a relationship with other service providers or assume these hosting responsibilities ourselves. Moreover, breaches of our customers’ data caused by errors, omissions or hostile acts of third parties within the third party hosted environment are beyond our control, yet we would remain responsible for such data security incidents from a regulatory standpoint, in some instances. We may also be limited in our remedies against our third party hosting providers in the event of a failure of service. A failure or limitation of service or available capacity by our third party hosting providers could adversely affect our business and reputation.

In addition to using third party cloud providers, we have also established local servers and infrastructure in multiple offices, including in Leuven. A failure of these local servers could adversely affect our business and reputation.

15

We develop and offer online software services through our SaaS and cloud-based software applications where we manage data we receive from our customers, and a cybersecurity breach of these online services could harm our customers and our reputation, expose us to liability, and adversely impact our business, financial condition and results of operations.

We are in an ongoing transition from distributing desktop software applications to developing and distributing online software services through our SaaS and cloud-based software applications. This transition comes with a shift in cybersecurity responsibilities from the customer to us, since we manage data we receive from our customers and may be responsible to our customers for breaches of their data. This shift in responsibilities requires us to implement appropriate internal changes and to invest in additional cybersecurity capabilities (including training, tooling, and processes). However, cybersecurity incidents and malicious internet-based activity continue to increase generally, and providers of cloud-based services have frequently been targeted by such attacks. We may be unable to anticipate or prevent techniques used to obtain unauthorized access or to sabotage systems because they change frequently and often are not detected until after an incident has occurred. If sensitive customer information is lost, improperly disclosed or threatened to be disclosed, our reputation could be harmed, we could incur significant costs associated with remediation and the implementation of additional security measures, we may incur significant liability and financial loss, and we may be subject to regulatory scrutiny, investigations, proceedings, and penalties. In addition, certain of our customers are large and highly regulated, and if any of them were to conclude that our systems and procedures are insufficiently rigorous, they could terminate their relationships with us, and our financial condition, results of operations and business could be adversely affected.

In addition, the SaaS and cloud-based software applications business is a highly dynamic market with rapidly evolving regulatory requirements, and we need to continually improve our cybersecurity controls to ensure continued compliance. We are investing in information security and privacy certifications to meet these evolving requirements. However, given the rapidly evolving nature of the regulatory landscape (e.g., the Cybersecurity Maturity Model Certification program of the U.S. Department of Defense, the EU-wide NIS2 directive, the upcoming EU-wide Cyber Resilience Act), we may be unable to ensure timely compliance with these requirements, which may adversely impact our business, financial condition and results of operations.

We may not be successful in our artificial intelligence and machine learnng initiatives, which could adversely affect our business, reputation or financial results.

We have recently begun incorporating generative artificial intelligence (or AI) and machine learning (or ML) into our programs and platforms, particularly in the Materialise Medical segment. As with many innovations, AI and ML present risks, challenges and unintended consequences that could impact our successful ability to incorporate the use of AI and ML in our business. For example, our algorithms may be flawed and not achieve sufficient levels of accuracy or contain biased information. In addition, our competitors or other third parties may incorporate AI and ML solutions into their platforms more successfully than us, and their AI and ML solutions may achieve higher market acceptance than ours, which may result in us failing to recoup our investments in developing ML and AI-powered offerings. We have made and expect to continue to make significant investments in our AI and ML technology. Our ability to employ AI and ML, or any ability of our competitors to do so more successfully, may negatively impact our business, impair our ability to compete effectively, result in reputational harm and have an adverse impact on our operating results.

Moreover, our use of AI and ML may give rise to litigation risk, including potential intellectual property or privacy liability. Because AI is an emerging technology, there is not a mature body of case law construing the appropriateness of certain of its uses of data – whether through the employment of large language models or other models leveraging data found on the internet – and the evolution of this law may limit our ability to exploit artificial intelligence tools, or expose us to litigation. Further, AI and ML presents emerging ethical issues and if our use of AI and ML algorithms draws controversy due to their perceived or actual impact on society, we may experience brand or reputational harm, competitive harm or legal liability.

In addition, given the complex nature of AI and ML technology, we face an evolving regulatory landscape and significant competition from other companies, some of which have longer operating histories and significantly greater financial, technical, marketing, distribution, professional services, or other resources than us. For example, the European Union’s Artifical Intelligence Act (or the AI Act) – the world’s first comprehensive AI law – is anticipated to enter into force in the spring of 2024 and, with some exceptions, become effective 24 months thereafter. This legislation imposes significant obligations on providers and deployers of high risk AI systems, and encourages providers and deployers of AI systems to account for E.U. ethical principles in their development and use of these systems. If we develop or use AI or ML systems that are governed by the AI Act, it may necessitate ensuring higher standards of data quality, transparency, and human oversight, as well as adhering to specific and potentially burdensome and costly ethical, accountability, and administrative requirements. Any of the foregoing could adversely affect our business, reputation, or financial results.

16

If businesses do not continue to adopt our platform for any of the reasons discussed above or for other reasons not contemplated, our sales would not grow as quickly as anticipated, or at all, and our business, operating results, and financial condition would be adversely affected.

Workplace accidents or environmental damage could result in substantial remedial obligations and damage to our reputation.

Accidents or other incidents that occur at our service centers and other facilities or involve our personnel or operations could result in claims for damages against us. In addition, in the event we are found to be financially responsible, as a result of environmental or other laws or by court order, for environmental damages alleged to have been caused by us or occurring on our premises, we could be required to pay substantial monetary damages or undertake expensive remedial obligations. The amount of any costs, including fines or damages payments that we might incur under such circumstances could substantially exceed any insurance we have to cover such losses. Any of these events, alone or in combination, could have a material adverse effect on our business, financial condition and results of operations and could adversely affect our reputation.

Our operations are subject to environmental laws and other government regulations that could result in liabilities in the future.

We are subject to local environmental laws and regulations governing our operations, including, but not limited to, emissions into the air and water and the use, handling, disposal and remediation of hazardous substances. A certain risk of environmental liability is inherent in our production activities. Under certain environmental laws, we could be held solely or jointly and severally responsible, regardless of fault, for the remediation of any hazardous substance contamination at our service centers and other facilities and the respective consequences arising out of human exposure to such substances or other environmental damage. We may not have been and may not be at all times in complete compliance with environmental laws, regulations and permits, and the nature of our operations exposes us to the risk of liabilities or claims with respect to environmental and worker health and safety matters. If we violate or fail to comply with environmental laws, regulations and permits, we could be subject to penalties, fines, restrictions on operations or other sanctions, and our operations could be interrupted. The cost of complying with current and future environmental, health and safety laws applicable to our operations, or the liabilities arising from past releases of, or exposure to, hazardous substances, may result in future expenditures. Any of these developments, alone or in combination, could have a material adverse effect on our business, financial condition and results of operations.

If our service center operations are disrupted, sales of our 3D printing services, including the medical devices that we print, may be affected, which could have an adverse effect on our results of operations.

We have seven 3D printing service centers in Europe, the United States, Brazil and Japan, including our principal 3D printing service center located in Leuven, Belgium. If the operations of these facilities are materially disrupted, whether by fires or other industrial accidents, extreme weather, natural disasters, labor stoppages, acts of terror, or otherwise, we would be unable to fulfill customer orders for the period of the disruption, we would not be able to recognize revenue on orders, we could suffer damage to our reputation, and we might need to modify our standard sales terms to secure the commitment of new customers during the period of the disruption and perhaps longer. In addition, extreme weather and other natural disasters may become more intense or more frequent as a result of climate change. Depending on the cause of the disruption, we could incur significant costs to remedy the disruption and resume providing 3D printing services. Such a disruption could have an adverse effect on our results of operations.

We could experience unforeseen difficulties in building and operating key portions of our 3D printing infrastructure.