Document

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

|

| | |

For the year ended November 30, 2018 | | Commission File Number 1-15147 |

OMNOVA Solutions Inc.

(Exact name of registrant as specified in its charter)

|

| | |

Ohio | | 34-1897652 |

(State of Incorporation) | | (I.R.S. Employer Identification No.) |

| | |

25435 Harvard Road, Beachwood, Ohio | | 44122-6201 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code (216) 682-7000

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

Title of each class | | Name of each exchange on which registered |

Common Stock, par value 10¢ per share | | The New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant has submitted electronically every interactive data file required to be submitted pursuant to Rule 405 of Regulation S-T (232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files.) Yes þ No ¨

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act (check one):

|

| | | | | | | | |

Large accelerated filer ¨ | | Accelerated filer þ | | Non-accelerated filer ¨ | | Smaller reporting company ¨ | | Emerging growth company ¨ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. Yes ¨ No þ

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12-b of the Exchange Act) Yes ¨ No þ

The aggregate market value of the voting stock held by nonaffiliates of the registrant was $442,729,184 based on the closing price per share of $10.20 on May 31, 2018, the last business day of the registrant’s most recently completed second quarter.

As of January 22, 2019, there were 44,846,069 outstanding Common Shares of the Company’s $0.10 par value.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the 2019 Proxy Statement of OMNOVA Solutions Inc. are incorporated into Part III of this Report.

OMNOVA SOLUTIONS INC.

Annual Report on Form 10-K

For the Year Ended November 30, 2018

Table of Contents

|

| | | |

Item Number | | | |

| | | |

PART I | | | |

1 | | | |

1A | | | |

1B | | | |

2 | | | |

3 | | | |

4 | | | |

| | | |

PART II | | | |

5 | | | |

6 | | | |

7 | | | |

7A | | | |

| | | |

8 | | | |

9 | | | |

9A | | | |

9B | | | |

| | | |

PART III | | | |

10 | | | |

11 | | | |

12 | | | |

13 | | | |

14 | | | |

| | | |

PART IV | | | |

15 | | | |

| | | |

PART I

Introduction

OMNOVA Solutions Inc. (referred to in this report as "OMNOVA Solutions", "OMNOVA", the "Company", "we", "us", or "our") became an independent, publicly-traded company on October 1, 1999, when it was spun off by GenCorp Inc., its former parent company. OMNOVA Solutions is incorporated under the laws of the State of Ohio, and its headquarters is located at 25435 Harvard Road, Beachwood, Ohio 44122-6201.

OMNOVA Solutions is a global innovator of performance enhancing chemistries and surfaces for a variety of commercial, industrial and residential end uses. Our products provide a variety of important functional and aesthetic benefits to hundreds of products that people use daily. We hold leading positions in key market categories, which have been built through innovative products, customized product solutions, strong technical expertise, well-established distribution channels, recognized brands, and long-standing customer relationships. We have strategically located manufacturing, technical and other facilities globally to service our broad customer base.

During fiscal 2018, OMNOVA operated two business segments: Specialty Solutions and Performance Materials. We derived 63% of our 2018 net sales from the Specialty Solutions segment and 37% from the Performance Materials segment. Financial information relating to the Company’s business segments is included in Note O to the Consolidated Financial Statements of this report.

Specialty Solutions

Markets and Products

The Specialty Solutions segment consists of three business lines: Specialty Coatings & Ingredients, Oil & Gas, and Laminates & Films. The Specialty Solutions segment develops, designs, produces, and markets a broad line of specialty products for use in coatings, adhesives, sealants, elastomers, laminates, films, nonwovens, and oil & gas products. These products are used in numerous applications, including architectural and industrial coatings; nonwovens used in hygiene products, filtration and construction; drilling additives for oil and gas drilling, cementing and fracking; elastomeric modification of plastic casings and hoses used in household and industrial products and automobiles; tapes and adhesives; sports surfaces; textile finishes; commercial building refurbishment; new construction; residential cabinets; flooring; ceiling tile; furnishings; manufactured housing; health care patient and common area furniture; and a variety of industrial films applications. The segment's products improve the performance of customers’ products, including stain, rust and aging resistance; surface modification; gloss; softness or hardness; dimensional stability; high heat and pressure tolerance; and binding and barrier (e.g. moisture, oil) properties.

The following table shows major Specialty Solutions products, end-use applications, and brand names:

|

| | | | | | | | |

Product Line | | % of Specialty Solutions Fiscal 2018 Net Sales | | Primary Products | | End-use Applications | | Brand Names |

Specialty Coatings & Ingredients | | 51% | | SB, SBA, acrylic, vinyl acrylic, styrene acrylic and polyvinyl acetate emulsion polymers, glyoxal resins, elastomeric modifiers, silicone emulsions, polyethylene resins, fluorosurfactants and opacifiers

| | Nonwovens, Textiles, Graphic Arts, Automotive Thermoplastics, Specialty Coatings, Buildings & Construction, Home & Personal Care

| | OMNABOND, SUNSIZE, GENFLO, GENCRYL, OMNAPEL, SEQUABOND, SUNCRYL, ACRYGEN, SUNBOND, SEDGERES, SEDGELEV, SEQUACLEAN, SEQUASOFT, SEDGELCLEAN, SEDGEDYE, SEDGEFIX, SEDGEGARD, SEDGEKIL, SEDGELUB, SEDGEMUL, SEDGESCOUR, SEDGESOFT, SUNKOTE, MYKON, PERMAFRESH, SEQUAPEL, X-CAPE, MYKOSOFT, MYKOWICK, NOVACRYL, SECOAT, SECRYL, SEQUABOND, CDP, GENGLAZE, STYLECOAT, OMNAGLO, MORGLO, RWL, ML, MORFLO, MORSHINE, CONREZ, NM, NH, GENCEAL, HYDROPLIOLITE, PLIOLITE, PLIOWAY, PLIOTEC, GENCEAL, POLYFOX, SUNIGUM, CHEMIGUM, LYTRON |

Oil & Gas | | 15% | | Drilling fluid additives & systems, stimulation additives, and cement additives | | Fluid loss control and sealing, emulsifiers, lubricants, and rheological modifiers for drilling fluids | | PEXOSTART, PEXOSEAL, PEXOTROL, PEXOPLUG, PEXOMUL, PEXOVIS, PEXOTHIN, PEXOGUARD, PEXOLUBE |

Laminates & Films | | 34% | | Vinyl, paper, and specialty laminates; performance films | | Decorative and protective surfacing for retail display and food service fixtures, kitchen and bath cabinets, manufactured housing and recreational vehicle interiors, flooring, commercial and residential furniture, home furnishings and consumer appliances, wall panel systems, decorative wall surfacing; industrial films for banners, tents, ceiling tiles, decking, health care furniture, and bath and spa surrounds | | RADIANCE, SURF(X), DESIGN4, EFX, DURAMAX, HARMONY, VIEWNIQUE |

Specialty Coatings & Ingredients. OMNOVA Specialty Coatings & Ingredients is a leading global supplier of polymers, waterborne and solvent borne dispersions, elastomers, and other specialty chemicals for a variety of product categories. Applications for our specialty polymers and chemicals include: specialty coatings; nonwovens (such as disposable hygiene products, engine filters, roofing mat, scrub pads); construction; adhesives; tape; floor care; textiles; graphic arts; home & personal care; and various other specialty applications. Our focus is on developing unique products for custom applications that address specific customer needs, including enhanced functionality, improved durability, high temperature, chemical and UV resistance, corrosion resistance, improved environmental performance, and improved processibility. Sales of our Specialty Coatings & Ingredients products represented 33% of our consolidated net sales for 2018, 29% for 2017, and 29% for 2016.

Oil & Gas. OMNOVA's Oil & Gas is a leading supplier of specialty wellbore chemicals used in demanding applications all over the world. We offer a wide range of solutions including fluid loss control and sealing, emulsifiers, lubricants, and rheological modifiers for drilling fluids. The business also offers flow control and properties enhancement in cementing operations, gel additives for hydraulic fracturing fluids, and strengthening agents. We design unique polymers that meet conventional and unconventional drilling and completion requirements. Sales of our Oil & Gas products represented 9% of our consolidated net sales for 2018, 7% for 2017, and 6% for 2016.

Laminates & Films. OMNOVA's Laminates & Films business line is a leading supplier of vinyl, paper, and specialty laminates, and performance films. Our laminates are used as alternatives to wood, paint, stone, stainless steel, high pressure laminates, and thermally fused laminates in markets where durability, design, and cost are key requirements. We offer our customers a broad range of designs and textures, as well as proprietary coating technology that provides enhanced durability and scratch and stain resistance. Applications for our laminates include:

kitchen and bath cabinets; manufactured housing and recreational vehicle interiors; flooring; commercial and residential furniture; retail display fixtures; home furnishings; consumer appliances; bath and spa surrounds; food service tables; wall protection; and architectural accents. Films applications include: luxury vinyl tile (LVT); awnings; tents; flooring; promotional graphics; medical products; movie screens; decking; ceiling tile; and shower pan liners. Sales of our Laminates and Films products represented 21% of our consolidated net sales for 2018, 20% for 2017, and 18% for 2016.

A key strength of our laminates business is our coating technology, including ultraviolet, melamine, urethane, and thermally cured coatings, which provide greater durability for high-wear applications. In addition, our laminates business has differentiated itself in the market as a single-source supplier through its harmony programTM of integrated vinyl and paper laminate designs for the furniture and cabinet industries by building a unique library of matched vinyl and paper laminate designs, with a variety of patterns and textures, and developing rapid make-to-order production capabilities. We also offer SURF(X)® 3D Laminates for multi-dimensional applications for the office and health care furniture and retail display fixture and food service markets. These laminates offer a cost effective alternative to high pressure laminates, thermally fused melamine and real wood veneers. They provide furniture makers with design flexibility in rounded surfaces, eliminating the need for unsightly and expensive edge-banding, and providing enhanced cleanability/disinfection and durability with increased chip and crack resistance.

Markets and Customers

The Specialty Solutions segment includes many product categories that are performance driven, where product innovation, technical service, application support, and key account focus are key competitive differentiators. Each product line markets its products to different industries under numerous brand names.

Marketing and Distribution

Our Specialty Solutions segment primarily sells its products directly to manufacturers through dedicated internal marketing, sales, and technical service teams focused on providing highly responsive customized solutions. Distributors are used to help expand sales coverage geographically and with newer customers.

Competition

OMNOVA’s Specialty Coatings & Ingredients business line retains strong, industry recognized brands in antioxidants, specialty coatings, and elastomeric modifiers. OMNOVA's Laminates & Films business lines compete with numerous companies, including international companies. Many of these companies focus on only one product line and/or market and are smaller and privately-owned. Competitors include:

| |

• | Specialty Coatings & Ingredients: Pulcra Chemicals, Schill + Seilacher, Goulston, DowDupont, BASF, Engineered Polymer Solutions, Evonik, Arkema, Arlanxeo, Paratech, Nitriflex |

| |

• | Oil & Gas: American Gilsonite, BASF, Ashland, Drilling Specialties Company |

| |

• | Laminates & Films: Wilsonart, Toppan Printing, Renolit Corporation, LG Chemical America, PolyOne Corporation, and I2M |

Performance Materials

Markets and Products

The Performance Materials segment serves mature markets including plastics, paper, carpet and coated fabrics with a broad range of polymers based primarily on styrene butadiene (SB), styrene butadiene acrylonitrile (SBA), styrene butadiene vinyl pyridine, high styrene pigments, polyvinyl acetate, acrylic, styrene acrylic, calcium stearate, glyoxal, and bio-based chemistries. Performance Materials' custom-formulated products are tailored latexes, resins, binders, antioxidants, hollow plastic pigment, coated fabrics, and rubber reinforcing which are used in tire cord, polymer stabilization, industrial rubbers, carpet, paper, and various other applications. Its products provide a variety of functional properties to enhance the Company’s customers’ products, including greater strength, adhesion, dimensional stability, ultraviolet resistance, improved processibility, and enhanced appearance.

The following table shows our Performance Materials products, end-use applications and brand names: |

| | | | | | | | |

Product Line | | % of Performance Materials Fiscal

2018 Net Sales | | Primary Products | | End-use Applications | | Brand Names |

Paper and Carpet | | 40% | | SB SBA styrene acrylic and vinyl acetate latex binders crosslinkers, lubricants hollow plastic pigments, and bio-based polymers | | Paper, Paperboard, Packaging, Carpet | | SUNREZ, OMNAREZ, SUNKOTE, SEQUALFLOW, SUNKEM, GENCRYL, ECOKOTE, ACCUKOTE, LYTRON, REACTOPAQUE, GENFLO, GENCRYL PT, OMNAGLIDE, SEQUAREZ, OMNATUF, OMNABLOC, GENCAL, NOVAGREEN, UNIQPRINT |

Performance Additives | | 44% | | Styrene butadiene vinyl pyridine, antioxidants, reinforcing resins, phenolic antioxidants | | Tire Cord, Plastics, Synthetic Latex Gloves, and Rubber Products | | GENTAC, WINGSTAY, PLIOLITE. PLIOCORD, |

Coated Fabrics | | 16% | | Vinyl and urethane coated fabrics | | Upholstery and surfacing for transportation, marine, offices, hotels, hospitals and health care facilities, stores, schools, restaurants, public buildings, residences, and industrial applications | | BOLTAFLEX, BOLTASOFT, QUANTUM, NAUTOLEX, PREFIXX |

Paper and Carpet. OMNOVA Solutions is an innovative supplier of custom-formulated SB and SBA latex and hollow plastic pigments for carpet, paper and paperboard coatings. Applications for our products include paper and paperboard coatings used in specialty papers, food cartons, household and other consumer and industrial packaging, magazines, catalogs, direct mail advertising, and brochures. Our products for the carpet industry secure carpet fibers to the carpet backing and adhere the primary backing to the secondary backing, while meeting the stringent manufacturing, environmental, odor, flammability, and flexible installation requirements of our customers. Our strong historical position in residential carpeting has been enhanced by new products to serve that market, as well as innovations in commercial carpet backing binders that provide moisture barrier and other properties, enabling the replacement of higher cost polyurethane binders. Sales of our Paper and Carpet products represented 15% of our consolidated net sales for 2018, 24% for 2017, and 23% for 2016.

Performance Additives. OMNOVA is also a leading global supplier of vinyl pyridine latex which is used in bonding fabric to rubber for tire and belting applications. In addition, the Company is a leading global supplier of antioxidants used in polymer stabilization and synthetic latex gloves. Sales of our Performance Additives products represented 16% of our consolidated net sales for 2018, 13% for 2017, and 14% for 2016.

Coated Fabrics. OMNOVA Solutions is a leading North American and Asian supplier of vinyl and urethane coated fabrics for transportation, marine, commercial, residential, and health care applications. Our durable coated fabrics are well-suited for demanding, high-use environments and offer a cost effective alternative to other surfacing materials, such as leather and textile fabrics. Applications for our coated fabrics include: transportation seating (automotive OEM, bus and other mass transit, marine, and motorcycle); automotive aftermarket applications; contract and health care furniture; residential applications; stadium and arena seating; and healthcare equipment. A key differentiator for our coated fabrics products is our PreFixx® protective coating, long recognized for delivering the industry's best-in-class performance. Sales of our Coated Fabrics products represented 6% of our consolidated net sales for 2018, 7% for 2017, and 10% for 2016.

Markets and Customers

Our Performance Materials segment is a leader in its targeted product categories, which are highly competitive based on quality, customer service, product performance, supply chain, field technical support, and product innovations.

Marketing and Distribution

Our Performance Materials segment primarily sells their products directly to manufacturers through dedicated internal marketing, sales, and technical service teams focused on providing highly responsive customized solutions. Distributors are used to help expand sales coverage geographically and with newer customers.

Our Performance Materials segment distributes its products primarily through a direct sales force and agents to manufacturers of retail store fixtures, cabinets, furniture, seating, and health care components, and other products. Many of our Coated Fabrics products have strong, well-recognized brand names that are promoted through trade shows, industry periodicals, our website (www.omnova.com), and other media.

Competition

OMNOVA’s Performance Materials segment competes with numerous companies, including international companies. Many of these companies focus on only one product line and/or market and are smaller and privately-owned.

Competitors include:

| |

• | Paper and Carpet: BASF, Trinseo, Mallard Creek, Eco Synthetix |

| |

• | Performance Additives: Feiya, Addivant, Raschig, Synthomer, Jubilant, Croslene |

| |

• | Coated Fabrics: Morbern, Beneke, Uniroyal, Spradling International, CGT |

International Operations

Net sales from our foreign operations were $320.2 million in 2018, $301.4 million in 2017, and $305.9 million in 2016. These net sales represented 41.6% of our total net sales in 2018, 38.5% in 2017, and 40.3% in 2016. Long-lived assets primarily consist of net property, plant, and equipment. Long-lived assets of our foreign operations totaled $90.1 million at November 30, 2018, $84.2 million at November 30, 2017, and $77.4 million at November 30, 2016. Our consolidated long-lived assets totaled $205.8 million at November 30, 2018, $208.9 million at November 30, 2017, and $202.7 million at November 30, 2016.

Intellectual Property

We regard patents, trademarks, copyrights, and other intellectual property as important to our success, and we rely on them globally to protect our investments in products and technology. Our patents expire at various times, but we believe that the loss or expiration of any individual patent would not materially affect our business. We, like other companies in the industries in which we operate, may be subject to claims of alleged infringement of the patents, trademarks, and other intellectual property rights of third parties from time to time.

Seasonal Factors

We historically experience stronger sales and income in our second, third, and fourth quarters, comprised of the three-month periods ending May 31, August 31, and November 30. Our performance in the first quarter (December through February) has historically been affected by generally lower levels of customer manufacturing, construction, and refurbishment activities during the holidays and cold weather months.

Environmental Matters

Our business operations are subject to numerous federal, state, local, and foreign environmental laws and regulations. These laws and regulations not only affect our current operations, but also could impose liability on us for past operations that were conducted in compliance with then applicable laws and regulations. For further discussion of capital and noncapital expenditures for environmental compliance, please refer to “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Environmental Matters” of this report, which is incorporated herein by reference.

Employees

As of November 30, 2018, the Company employed approximately 1,900 employees globally. Approximately 11% of the Company’s U.S. employees are covered by collective bargaining agreements in the U.S. of which approximately 140 employees are covered by agreements that expire within the next 12 months. In addition, certain of our foreign employees are also covered by collective bargaining agreements.

Raw Materials

We utilize a variety of raw materials, primarily monomers, in the manufacture of our products. Most of these raw materials have been, and we expect will continue to be, generally available from multiple suppliers. Monomer costs, which are a major component of the polymers-based products, include butadiene, styrene, acrylates, acrylonitrile, vinyl acetate and vinyl pyridine, polyvinyl chloride (PVC) resins, textiles, plasticizers, paper, and titanium dioxide.

The cost of raw materials has a significant impact on our profitability. We generally attempt to respond to raw material cost increases through productivity programs and price increases to our customers. The success of attempted price increases depends on a variety of factors including the specific market application and competitive environment. Under certain circumstances, we are not able to pass along some or all of the increase. In addition, if accepted by customers, price increases generally lag the increase in raw material costs. Index pricing applies to approximately 25% of our total net sales.

Research and Development

OMNOVA Solutions' technology and design centers support research and development efforts across our businesses and complement the resources focused on innovation in both of our segments. Our efforts are focused on developing new applications with our base technologies and enhancing the functionality of our products in existing applications, as well as developing new product and technology platforms.

Research and development costs were $17.7 million in 2018, $18.9 million in 2017, and $20.8 million in 2016. Our research and development costs relating to new products were $6.1 million in 2018, $7.5 million in 2017, and $8.2 million in 2016. Research and development expenses include the costs of technical activities that are critical to developing new products, services, processes or techniques, as well as those expenses for technical activities that may improve existing products or processes. Information relating to research and development expense is set forth in Note A to the Consolidated Financial Statements of this report.

Available Information

Our website is located at www.omnova.com. We make available on our website all materials that we file electronically with the U.S. Securities and Exchange Commission ("SEC"), including our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to those reports, as soon as reasonably practicable after we electronically file or furnish such materials to the SEC. OMNOVA Solutions' Business Conduct Policies and Corporate Governance Guidelines and charters for the Committees of the OMNOVA

Solutions Board of Directors are also available on our website and in print to any shareholder who requests a copy. All requests must be made in writing and addressed to OMNOVA Solutions Inc., Attn: Corporate Secretary, 25435 Harvard Road, Beachwood, Ohio 44122-6201.

This Annual Report includes descriptions of our current business, operations, and financial condition, as well as “forward-looking statements” as defined by federal securities laws. All forward-looking statements by the Company, including verbal statements, are intended to qualify for the protections afforded forward-looking statements under the Private Securities Litigation Reform Act of 1995. Forward-looking statements reflect Management’s current expectation, judgment, belief, assumption, estimate or forecast about future events, circumstances or results and may address business conditions and prospects, strategy, capital structure, debt and cash levels, sales, profits, earnings, markets, products, technology, operations, customers, raw materials, claims and litigation, financial condition, and accounting policies among other matters. Words such as, but not limited to, “will,” “may,” “should,” “projects,” “forecasts,” “seeks,” “believes,” “expects,” “anticipates,” “estimates,” “intends,” “plans,” “targets,” “optimistic,” “likely,” “would,” “could,” "committed," and similar expressions or phrases identify forward-looking statements.

All descriptions of our current business, operations and financial condition, as well as all forward-looking statements, involve risks and uncertainties. Many risks and uncertainties are inherent in business generally. Other risks and uncertainties are more specific to the Company’s businesses and strategy, or to any new businesses which the Company may enter into or acquire. There also may be risks and uncertainties not currently known to us. The occurrence of any of such risks and uncertainties and the impact of such occurrences is often not predictable or within the Company’s control. Such impacts could adversely affect the Company’s business, operations, or financial condition, as well as the Company's actual and projected results and the value of an investment in the Company. In some cases, such effect could be material. Certain risks and uncertainties facing the Company are described below or elsewhere in this Annual Report.

All written and verbal descriptions of our business, operations and financial condition and all forward-looking statements attributable to the Company or any person acting on the Company’s behalf are expressly qualified in their entirety by the risks, uncertainties, and cautionary statements contained and referenced herein. All such descriptions and any forward-looking statement speak only as of the date on which such description or statement is made, and the Company undertakes no obligation, and specifically declines any obligation, other than that imposed by law, to publicly update or revise any such description or forward-looking statements whether as a result of new information, future events or otherwise.

Market and Economic Risks

Our business is sensitive to general economic, business, and industry conditions.

We are exposed to general economic, business and industry conditions, both in the United States and internationally. Adverse global economic and financial conditions are difficult to predict and mitigate against, and therefore the potential impact is difficult to estimate. The end markets that we serve can be sensitive to changes in general economic conditions and can be volatile, with significant, rapid, and unpredictable reductions in demand and/or increases in raw material and other costs. Adverse general economic conditions may cause, among other things, significant reductions in available capital and liquidity from banks and other credit providers, substantial volatility in equity and currency values worldwide, and/or a prolonged recessionary or slow growth period. In addition, downturns in our customers’ particular industries, and markets, even when overall economic conditions are favorable, may also adversely affect our sales, profitability, operating results, and cash flows.

Our suppliers may be similarly affected by general economic conditions which may affect their access to capital and liquidity, and which may in turn cause them to raise prices or reduce or eliminate production.

Raw material prices and availability have a significant impact on results.

The cost of raw materials has a significant impact on results. The principal raw materials that we use in our business are derived from petrochemicals and chemical feedstocks. The prices of many of these raw materials are cyclical and volatile and are affected by supply and demand factors beyond our control. While we generally attempt to pass along higher raw material costs to our customers in the form of price increases, there historically has been a delay between an increase in our raw material costs and our ability to increase the prices of our products. Additionally, we may not be able to increase the prices of our products due to competitive pricing pressure and other factors.

We generally have multiple global raw material suppliers. However, in some cases there are a limited number of suppliers which are capable of delivering certain raw materials that meet our standards. Certain raw materials are only available from a single source. While we use a limited number of raw materials which are available only from a single source and we order those materials in limited quantities, the loss of any of these raw materials could significantly impact our ability to deliver differentiated products in some of our most specialized businesses. Accordingly, sole source and limited source suppliers generally have greater pricing and supply leverage.

In some cases, we may choose to sole source certain raw materials to obtain certain commercial advantages, including superior pricing and terms. Any disruption in raw material availability from one of these suppliers may require us to secure raw material supplies from alternative suppliers on less favorable terms.

Various factors, including feedstock shortages, production disruptions, natural disasters, the financial stability of our suppliers, supplier commitments to others, and internal raw material use by suppliers have reduced and eliminated, and in the future may reduce or eliminate, the availability of certain raw materials. Additionally, disruptions in transportation could delay receipt of raw materials. As a result of any of the foregoing events, higher prices and shortages could occur in the future, which may result in customers switching to substitutes for our products.

The occurrence or threat of extraordinary events, including natural disasters, political disruptions, terrorist attacks, public health issues, and acts of war, could significantly disrupt production, and decrease market demand for our products.

Extraordinary events, including natural disasters, political disruptions, terrorist attacks, public health issues, and acts of war could adversely affect the economy generally, and disrupt our business and operations resulting in a loss of sales and customers. In addition, in many cases we do not have redundant manufacturing or transportation capability and thus, any disruption of production or transportation may result in loss of sales and customers. Such events may also disrupt our supply chain and access to necessary raw materials.

We are subject to the risks of doing business in foreign countries and markets.

We conduct a significant portion of our business in countries outside of the United States. Accordingly, our business is subject to risks related to the differing legal, political, social, regulatory, and economic requirements and conditions. Risks associated with international operations, include, but are not limited to:

•fluctuations in currency exchange rates;

•region to region fluctuations in key raw material costs;

•transportation delays and interruptions;

| |

• | political and economic instability and disruptions, including instability and disruptions caused by actual or threatened trade and tariff disputes with the United States, Brexit, or other Brexit-like events; |

•failure to have or obtain, delays in obtaining, or the revocation of governmental licenses and permits;

•the imposition of duties and tariffs;

•import and export controls;

•government control of capital transactions, including the borrowing of funds for operations or the expatriation of cash;

•difficulties in staffing and managing operations;

•limitations on our ability to enforce legal rights and remedies;

•more stringent environmental, health and safety laws and regulations;

•potentially adverse tax consequences; and

•government expropriation of a business or assets.

We participate in highly competitive markets.

Many of the markets in which we operate are highly competitive. The bases of competition may include product performance and quality, price, product availability, and security of supply and customer service. Some of our competitors are larger and have more financial resources than us. We may also experience increased competition from companies that offer alternative products based on technologies and processes that have superior performance or better pricing, which could cause a decline in the market acceptance of our products. The increasing pressure from our competitors to keep pace and develop new technologies and products requires us to incur substantial expense.

Ongoing consolidation in various industries continues to create individual customers with greater purchasing power and competitors with greater financial and other resources. Customers in established markets like the United States and Europe face their own competitive pressures, particularly from businesses in regions with lower overhead costs. These competitive pressures may require us to reduce prices and attempt to offset such price reductions with improved operating efficiencies and reduced expenditures, which options may be limited or unavailable. Additionally, larger competitors may be better positioned to weather prolonged periods of reduced prices, which may incentivize them to reduce prices even when not dictated by market and competitive conditions.

Legal, Regulatory, and Compliance Risks

We are subject to extensive and increasing governmental regulation.

Our business is subject to numerous foreign, federal, state and local regulations which govern and restrict numerous aspects of our business and involve significant compliance cost. These regulations may change rapidly, and new regulations or interpretations of regulations may be applied to us, due to circumstances beyond our control. We expect regulations, and the costs associated with compliance, to continue to increase.

Among these regulations are increasingly stringent environmental and health and safety regulations. The cost of compliance with these regulations is significant and increasing, and violating these regulations can result in substantial costs, including fines, damages, criminal or civil sanctions, remediation costs, and interruptions in our operations. These regulations may also restrict or prohibit our ability to use certain raw materials key to our products or prohibit the sale of our products altogether.

Certain environmental requirements provide for strict, and under certain circumstances joint and several, liability for investigation and remediation of releases of regulated materials or from properties owned or operated by us or our predecessors and from properties where substances were sent for off-site treatment or disposal.

We may be unable to effectively protect our intellectual property or may be subject to intellectual property claims.

For certain products we rely on trademark, trade secret, patent, and copyright laws to protect our intellectual property. We cannot be sure that these intellectual property rights will be successfully asserted in the future or that they will not be invalidated or circumvented. In addition, the laws of some foreign countries in which our products are or may be sold do not protect our intellectual property rights to the same extent as the laws of the United States. The failure or inability of us to protect our proprietary information could make us less competitive.

From time to time, we may be subject to claims or allegations that we infringe upon or have misappropriated the intellectual property of third parties. Defending against such claims is costly and intellectual property litigation often involves complex questions of fact and law, with unpredictable results. We may be forced to acquire rights to such third-party intellectual property on unfavorable terms (if rights are made available at all), pay damages, modify accused products to be non-infringing, or stop selling the applicable product altogether.

We are subject to claims and litigation.

From time to time, we are subject to various claims, proceedings, and lawsuits related to products, services, contracts, employment, environmental, safety, intellectual property, and other matters arising out of our business operations or the business operations of our predecessors. Whether founded or unfounded, if any such claims, proceedings, or lawsuits are not resolved in our favor, they may result in significant financial liability, negatively impact our business operations, and harm the reputation of the Company. The costs of investigating and defending against claims can be substantial. We may not have applicable insurance coverage, and any such insurance coverage that we do have may be inadequate to cover the full cost of a particular claim.

Resolutions of claims, proceedings, and lawsuits can be unpredictable and can often take years. As a result, any estimates of liability that we may have made could be materially over or understated.

Changes in accounting policies, standards, and interpretations could materially affect how we report our financial condition, results of operations, and cash flows.

The Financial Accounting Standard Board ("FASB"), regulatory agencies, and other bodies that establish accounting standards periodically change the financial accounting and reporting standards governing the preparation of the Company’s consolidated financial statements. Additionally, those bodies that establish and interpret the accounting standards (such as the FASB and the SEC) may change prior interpretations or positions on how these standards should be applied. These changes can be difficult to predict and can materially affect how the Company records and reports its financial condition, results of operations, and cash flows. In unusual circumstances, the Company could be required to retroactively apply a new or revised standard, resulting in changes to previously reported financial results.

We may be subject to the actions of activist shareholders.

We have been the subject of activity by activist shareholders, and shareholder activism generally is increasing. Responding to shareholder activism can be costly and time-consuming, disrupt our operations, and divert the attention of Management and our employees from our strategic initiatives. Activist campaigns can create perceived uncertainties as to our future direction, strategy, or leadership and may result in the loss of potential business opportunities, harm our ability to attract new employees, investors, customers, and joint venture partners, and cause our stock price to experience periods of volatility or stagnation.

Business and Strategic Risks

Our manufacturing facilities are subject to operating risks.

We are dependent on the continued operation of our manufacturing facilities. These facilities are subject to hazards associated with the manufacturing, handling, storage, and transportation of chemical materials and products, including tank and pipeline leaks and ruptures, explosions, fires, inclement weather, natural disasters, mechanical failure, unscheduled downtime, labor difficulties, transportation interruptions, and environmental risks. These hazards can cause personal injury and loss of life, severe damage to, or destruction of, property and equipment, and environmental contamination. The occurrence of material operating problems at our facilities may diminish or eliminate our ability to manufacture product. Further, from time to time, we may experience capacity limitations in our manufacturing operations. If we are unable to effectively forecast our customers’ demand, it could affect our ability to successfully manage such operating capacity limitations.

We may be unable to achieve, or may be delayed in achieving, the objectives and benefits of our cost reduction initiatives.

We continuously utilize operational excellence program improvements such as our One OMNOVA initiative, LEAN SixSigma, manufacturing footprint optimization, global supply chain management, Enterprise Resource Planning (ERP) and other initiatives in an effort to improve efficiencies and lower our cost structure. There may be unanticipated difficulties in implementing one or more of these initiatives, and we may not ultimately realize the full benefits of, or be able to sustain the benefits anticipated by, these initiatives. Additionally, even if we achieve these goals, the cost of implementing these initiatives could ultimately exceed their benefits. In addition, certain of these initiatives have resulted in us streamlining and consolidating our manufacturing capacity, increasing the risk of business interruption if a consolidated manufacturing site experiences operational or other difficulties.

Our sales and profitability depend on our ability to develop and commercialize innovative new products that can be value priced.

Our specialization strategy requires that we develop, introduce, sell, and support innovative new products and technologies on a timely basis and that we make significant investments in research and development to do so. We may be unsuccessful in developing or introducing new products, modifying our existing products, achieving market acceptance of new products, or securing pricing that reflects the investment into and value of our new products.

We may not be able to identify or complete transactions with attractive acquisition candidates.

As part of our business strategy, we have pursued, and may continue to pursue, targeted acquisition opportunities. Implementing this business strategy requires Management to identify and evaluate acquisition candidates (including potential synergies, business opportunities, and growth prospects), and to successfully negotiate the acquisition with the target company and its stakeholders. There are a limited number of attractive acquisition candidates. Even if we identify attractive acquisition candidates we may not be able to reach agreement on an acceptable acquisition price. If we complete an acquisition, we may not achieve the anticipated benefits, such as reduced costs or increased sales.

We may not be able to successfully integrate acquisitions into our operations.

The integration of acquisitions into our operations involves a number of risks, including:

| |

• | difficulty integrating operations and personnel at different locations; |

| |

• | diversion of Management attention; |

| |

• | potential disruption or loss of business due to negative reactions to the acquisition by customers, suppliers, and other key constituencies; |

| |

• | difficulties in assimilating the technologies and products of the acquisition; |

| |

• | inability to retain key personnel; |

| |

• | difficulties integrating operational and financial information technology systems; |

| |

• | difficulty in expanding product manufacturing to new sites; and |

| |

• | inability to maintain uniform standards, controls, procedures, and policies. |

These risks may be magnified in acquisitions of significant size and scale. If we are unable to effectively integrate operations and personnel in a timely and efficient manner after an acquisition is completed, we may not realize the projected benefits of the acquisition.

Our information systems may experience an interruption or a breach in security.

We rely heavily on electronic communications, information technology systems (both internal systems and external systems provided by third parties) and the internet to operate our factories, sell our products, fulfill orders, manage inventory, and bill, collect, and make payments. Our systems are vulnerable to damage or interruption from natural disasters, power loss, telecommunication failures, computer viruses, computer denial-of-service attacks, unauthorized intrusion, and other events, any of which could interrupt our business operations. Our business may also be subject to break-ins, sabotage, and intentional acts of vandalism.

Cybersecurity attacks can originate from a wide variety of sources, including persons who are linked to terrorist organizations or hostile foreign governments. Those same parties may also attempt to fraudulently induce employees, customers, or other users of our systems to disclose sensitive information in order to gain access to our systems, our data or the data of our customers.

Our security systems may not be able to protect our systems from attacks or other disruptions due to the rapid evolution and sophistication of cyberattack methods. Any significant disruption or slowdown of our current or future information systems as a result of a system security failure could disrupt the flow of operational information, cause orders to be lost or delayed, cause disruption and damage to our manufacturing facilities, damage our reputation with our customers, or cause our customers to cancel orders. Additionally, the theft of sensitive data and our inability to protect our trade secrets or information concerns our employees, customers, or suppliers could have an adverse effect on our business, customers, suppliers, and employees. These risks may increase in the future as we increase our usage of mobile platforms and expand our internal usage of third-party, web-based products and applications.

We generally do not have long-term contracts with our customers.

With some exceptions, most of our business is conducted on a purchase order basis rather than through long-term contracts. Accordingly, customers may elect to discontinue business with us with limited or no notice and with limited recourse by OMNOVA.

Certain product lines contribute disproportionately to the Company’s profitability.

Certain of the Company’s product lines and certain of its customers contribute disproportionately to the Company’s operating profit. A downturn in the markets those product lines serve, or the loss of these customers, could have an adverse affect on our financial results.

We are exposed to credit risk from our customers.

We extend credit on most of our sales, which exposes us to the risk of customer nonpayment. In deciding whether to extend credit or enter into other transactions, we may rely on information furnished by or on behalf of customers, including financial statements, credit reports, and other information. We may also rely on representations of these customers or third-parties as to the accuracy and completeness of credit risk related information. The inaccuracy of that information or those representations would affect our ability to accurately evaluate the credit risk of a customer. Even with accurate information, negative changes in economic, business, or industry conditions may increase the credit risk of customers who are initially determined to have acceptable credit risk.

Employee healthcare costs continue to increase.

We maintain a self-insured healthcare plan under which we generally share the cost of health care with certain of our employees and retirees. Employee healthcare is a significant operating cost for us, and these costs have continued to escalate well in excess of other inflationary trends over the past several years. If healthcare costs continue to increase, we may not be able or willing to pass these costs along to our employees and retirees.

We may be unable to attract or retain key employees.

Many parts of our business are highly technical and specialized. Global competition for skilled employees meeting our specialized needs is intense and our business success is dependent on our ability to attract highly-qualified new employees or retain our key employees. Our inability to attract necessary talent or the unanticipated departure of any key member of Management or any key employee, could adversely affect our ability to implement strategic initiatives and effectively operate our business.

We are subject to collective bargaining agreements with certain employees.

Approximately 11% of our employees located in the United States are covered by collective bargaining agreements. In addition, certain employees of our foreign operations are also covered by collective bargaining agreements. We may not be able to renew our collective bargaining agreements on terms similar to current terms, or renegotiate collective bargaining agreements on terms acceptable to us. The prolonged failure to renew or renegotiate a collective bargaining agreement could result in work stoppages. Additionally, in foreign jurisdictions where we operate, national unions and foreign governments may be unable to reach agreements, which could result in work stoppages that are out of the Company’s control. In addition, if a collective bargaining agreement is negotiated at higher-than-anticipated cost, absorbing those costs or passing them through to customers in the form of higher prices may make us less competitive.

Our U.S. pension plan is underfunded, requiring the Company to make significant cash contributions to the plan.

The Company’s U.S. pension plan is underfunded, and we are required to make significant cash contributions to it to comply with minimum funding requirements imposed by benefit and tax laws. Contribution amounts are based on plan performance, interest rates, and pension funding legislation, among other factors. We currently expect to make a contribution of $6.4 million to our U.S. pension plan during 2019, in part to satisfy our requirements under the Pension Protection Act of 2006. We cannot predict whether changing conditions including interest rates, pension assets performance, discount rates, government regulation, or other factors will require us to make future contributions in excess of current expectations, or whether we will have the funds necessary to make minimum pension contributions at the times that they may be required.

We maintain cash balances in foreign financial institutions.

We maintain cash balances in foreign financial institutions. While we monitor the financial institutions that we maintain accounts with, we may not be able to recover our funds in the event that the financial institution would fail. In addition, we may be limited by foreign governments in the amount and timing of funds to be repatriated from foreign financial institutions.

We carry a significant amount of goodwill on our balance sheet.

As of November 30, 2018, we had goodwill of $70.9 million. The future occurrence of a potential indicator of impairment, such as a significant adverse change in business climate, an adverse action or assessment by a regulator, unanticipated competition, a material negative change in relationships with significant customers, strategic decisions made in response to economic or competitive conditions, loss of key personnel, or a more-likely-than-not expectation that a reporting unit or a significant portion of a reporting unit will be sold or disposed of, could result in goodwill impairment charges. We have recorded goodwill impairment charges in the past, and such charges materially affected our historical results of operations. For additional information, see Note A, Goodwill and Intangible Assets, to the accompanying consolidated financial statements.

The market price for our common shares is particularly volatile.

The market for our common shares is characterized by significant price volatility, and we expect that our share price will continue to be volatile. The trading of relatively small quantities of our common shares may cause disproportionate movements upwards and downwards in our share price due to our small market capitalization and low trading volume, and the cyclical nature of our business may create prolonged periods of higher or lower share prices not correlated to Company performance or to general economic or market conditions.

Debt Risks

Our substantial debt could adversely affect our financial health and prevent us from fulfilling our obligations.

We have substantial debt and, as a result, significant debt service obligations. Our substantial debt could:

| |

• | make it more difficult for us to satisfy our obligations with respect to our term loan and our revolving credit facility; |

| |

• | increase our vulnerability to general adverse economic and industry conditions, including interest rate fluctuations, because a portion of our borrowings, including those under our term loan and our revolving credit facility, are at variable rates of interest; |

| |

• | require us to dedicate a substantial portion of our cash flow from operations to payments on our debt, thereby reducing the availability of our cash flow to fund working capital, capital expenditures, acquisitions, joint ventures, pension contributions and investments, and other general corporate purposes; |

| |

• | limit our flexibility in planning for, or reacting to, changes in our business and the markets we serve; |

| |

• | limit our ability to obtain additional debt or equity financing due to applicable financial and restrictive covenants in our debt agreements, and; |

| |

• | place us at a competitive disadvantage compared to our competitors that have less debt. |

Our ability to make scheduled payments on or to refinance our debt obligations and to fund planned capital expenditures and expansion efforts and any acquisitions we may make in the future depends on our ability to generate cash in the future and our financial condition and operating performance, which are subject to prevailing economic and competitive conditions and to certain financial, business and other factors beyond our control. We could be required to obtain the consent of the lenders under our term loan and our revolving credit facility to refinance material portions of our debt. We may not be able to maintain a level of cash flows from operating activities sufficient to permit us to pay the principal, premium, if any, and interest on our debt.

If our cash flows and capital resources are insufficient to fund our debt service obligations, we may be forced to reduce or delay investments and capital expenditures, sell assets, seek additional capital, or restructure or refinance our debt. These alternative measures may not be successful and may not permit us to meet our scheduled debt service obligations. If our operating results and available cash are insufficient to meet our debt service obligations, we could face substantial liquidity problems and might be required to dispose of material assets or operations to meet our debt service and other obligations. We may not be able to consummate those dispositions or to obtain the proceeds that we could

realize from them, and these proceeds may not be adequate to meet any debt service obligations then due. Additionally, the agreements governing our term loan and our revolving credit facility will limit the use of the proceeds from any disposition; as a result, we may not be allowed, under these documents, to use proceeds from such dispositions to satisfy all current debt service obligations. Further, we may need to refinance all or a portion of our debt on or before maturity, and we cannot assure that we will be able to refinance any of our debt on commercially reasonable terms or at all.

Despite ongoing actions to reduce our debt, we may still be required to incur significant additional debt.

We may be able to incur substantial additional debt, including additional secured debt, in the future, and such additional debt may be necessary to accomplish some of our strategic objectives. The terms of the agreements governing our term loan and revolving credit facility restrict but do not completely prohibit us from incurring substantial additional debt. If new debt or other liabilities are added to our current debt levels, the related risks that we and our subsidiaries now face could intensify.

The agreements governing our term loan and our revolving credit facility impose significant operating and financial restrictions on us, which may prevent us from capitalizing on business opportunities.

The agreements governing our term loan and our revolving credit facility impose significant operating and financial restrictions on us. These restrictions limit our ability, among other things, to:

| |

• | incur additional debt or issue certain disqualified stock and preferred stock; |

| |

• | pay dividends or certain other distributions on our capital stock or repurchase our capital stock; |

| |

• | make certain investments or other restricted payments; |

| |

• | place restrictions on the ability of our restricted subsidiaries to pay dividends or make other payments to us; |

| |

• | engage in transactions with affiliates; |

| |

• | sell certain assets or merge with or into other companies; |

| |

• | enter into sale and leaseback transactions; |

| |

• | enter into unrelated businesses. |

Our term loan and revolving credit facility require us to meet certain financial covenants, including covenants relating to senior net debt leverage, minimum excess availability and a springing minimum fixed charge coverage ratio if average excess availability falls below a certain level.

As a result of these covenants and restrictions, we may be limited in how we conduct our business and may be unable to raise additional debt or equity financing to compete effectively or to take advantage of new business opportunities. The terms of any future debt we may incur could include more restrictive covenants. We may not be able maintain compliance with these covenants in the future and, if we fail to do so, we may be unable to obtain waivers from the lenders and/or amend the covenants.

Moreover, our revolving credit facility provides the lenders considerable discretion to impose reserves, which could materially impair the amount of borrowings that would otherwise be available to us. There can be no assurance that the lenders under our revolving credit facility will not impose such actions during the term of our revolving credit facility and further, were they to do so, the resulting impact of this action could materially and adversely impair our ability to make interest payments on our debt.

If we default under our term loan or our revolving credit facility, we may not be able to service our debt obligations.

In the event of a default under our term loan or our revolving credit facility, the lenders under each of these facilities could elect to declare all amounts borrowed, together with accrued and unpaid interest and other fees, to be due and payable. If such acceleration occurs, we may not be able to repay the amounts due under our term loan, or our revolving credit facility. This could have serious consequences to our financial condition, results of operations, cash flows and could cause us to become bankrupt or insolvent.

Our subsidiaries may incur obligations that will constrain their ability to provide us with cash, which may affect our ability to make payments on our debt.

Our cash flows and our ability to service our debt, including our ability to make interest and principal payments when due, are dependent upon cash dividends and other distributions or other transfers from our subsidiaries. Dividends, loans, and advances to us from our subsidiaries may be restricted by covenants in certain debt agreements. If our subsidiaries incur obligations with these restrictive covenants, it will constrain our subsidiaries' ability to provide us with cash, which may affect our ability to make payments on our debt.

The LIBOR calculation method may change and LIBOR is expected to be phased out after 2021.

The Company’s Term Loan B Credit Facility and its Senior Secured Credit Facility permit interest on the outstanding principal balance to be calculated based on LIBOR. On July 27, 2017, the U.K. Financial Conduct Authority (the "FCA") announced that it will no longer require banks to submit rates for the calculation of LIBOR after 2021. In the meantime, actions by the FCA, other regulators, or law enforcement agencies may result in changes to the method by which LIBOR is calculated. At this time, it is not possible to predict the effect of any such changes or any other reforms to LIBOR that may be enacted in the U.K. or elsewhere.

|

| | |

Item 1B. | | Unresolved Staff Comments |

None.

The Company’s significant operating, manufacturing, distribution, research, design and/or sales, and marketing facilities are set forth below:

|

| |

Corporate Headquarters OMNOVA Solutions Inc. 25435 Harvard Road Beachwood, OH | Global Technology Center OMNOVA Solutions Global Technology Center 2990 Gilchrist Road Akron, OH |

Manufacturing/Technical/Distribution Facilities: Akron, OH Auburn, PA Calhoun, GA Caojing, China Chester, SC Columbus, MS* Fitchburg, MA Green Bay, WI Jeannette, PA Le Havre, France Mem Martins, Portugal Mogadore, OH Monroe, NC Ningbo, China Rayong, Thailand* Stafford, TX Villejust, France* | Sales/Marketing: Akron, OH Bangkok, Thailand* Beachwood, OH* Madrid, Spain Mem Martins, Portugal Mumbai, India* Rayong, Thailand* Shanghai, China* Singapore* Villejust, France* Valongo, Portugal*

|

For further discussion of our leased properties, please refer to Note M to the Consolidated Financial Statements of this report.

|

| | |

Item 3. | | Legal Proceedings |

From time to time, the Company is subject to various claims, proceedings and lawsuits related to products, services, contracts, employment, environmental, safety, intellectual property, and other matters. The ultimate resolution of such claims, proceedings, and lawsuits is inherently unpredictable and, as a result, the Company’s estimates of liability, if any, are subject to change. Actual results may materially differ from the Company’s estimates and an unfavorable resolution of any matter could have a material adverse effect on the business, operations, or financial condition of the Company. However, subject to the above and taking into account such amounts, if any, as are accrued from time to time on the Company’s consolidated balance sheet, the Company does not believe, based on the information currently available to it, that the ultimate resolution of these matters will have a material effect on the business, operations, or financial condition of the Company.

|

| | |

Item 4. | | Mine Safety Disclosures |

None.

PART II

|

| | |

Item 5. | | Market for Registrant’s Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities |

The Company’s common shares are listed on the New York Stock Exchange and trade under the symbol OMN. At November 30, 2018, there were 5,440 holders of record of the Company’s common shares. Information regarding the high and low quarterly sales prices of the Company’s common share is contained in the Selected Quarterly Financial Data (Unaudited) and is incorporated herein by reference. The Company has not declared a dividend on its common shares since 2001.

On September 25, 2018, the Company's Board of Directors authorized the repurchase of up to $20.0 million of the Company's common shares, which authorization expires upon the completion of $20.0 million in repurchases. The Company may use various methods to make the repurchases, including open market repurchases, negotiated block transactions, or open market solicitations for shares, all or some of which may be effected through Rule 10b5-1 plans. The timing of repurchases will depend upon several factors including market or business conditions, and repurchases may be discontinued at any time.

The Company did not repurchase any of its common shares during the three months ended November 30, 2018.

Information concerning long-term debt appears in Note K to the Consolidated Financial Statements and is incorporated herein by reference. Information concerning securities authorized for issuance under the Company’s equity compensation plans is set forth in Equity Compensation Plan Information of Item 12 in this Annual Report is incorporated herein by reference.

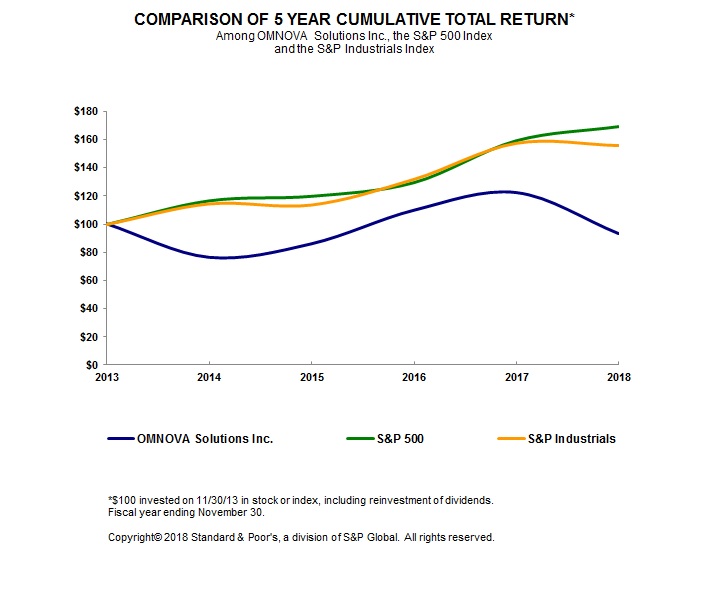

The graph below matches OMNOVA Solutions Inc.'s cumulative 5-Year total shareholder return on common stock with the cumulative total returns of the S&P 500 index and the S&P Industrials index. The graph tracks the performance of a $100 investment in our common share and in each index (with the reinvestment of all dividends) from November 30, 2013 to November 30, 2018.

|

| | | | | | | | | | | | | | | | | | | | | | | |

| 2013 | | 2014 | | 2015 | | 2016 | | 2017 | | 2018 |

| | | | | | | | | | | |

OMNOVA Solutions Inc. | $ | 100.00 |

| | $ | 76.26 |

| | $ | 85.84 |

| | $ | 109.59 |

| | $ | 122.15 |

| | $ | 93.04 |

|

S&P 500 | 100.00 |

| | 116.86 |

| | 120.07 |

| | 129.75 |

| | 159.43 |

| | 169.43 |

|

S&P Industrials | 100.00 |

| | 114.65 |

| | 113.88 |

| | 131.97 |

| | 157.55 |

| | 155.88 |

|

|

| | |

Item 6. | | Selected Financial Data |

The following table sets forth the Company’s selected financial data for all periods presented. The selected financial data as of November 30, 2018, 2017, 2016, 2015, and 2014, and for each of the five years in the period ended November 30, 2018 are derived from the Company’s audited consolidated financial statements.

|

| | | | | | | | | | | | | | | | | | | |

| 2018 | | 2017 | | 2016 | | 2015 | | 2014 |

| (Dollars in millions, except per share data) |

Statement of operations data: | | | | | | | | | |

Net Sales | $ | 769.8 |

| | $ | 783.1 |

| | $ | 759.9 |

| | $ | 838.0 |

| | $ | 987.4 |

|

Cost of goods sold (exclusive of depreciation) | 579.1 |

| | 582.3 |

| | 556.0 |

| | 644.1 |

| | 788.0 |

|

Gross profit | 190.7 |

| | 200.8 |

| | 203.9 |

| | 193.9 |

| | 199.4 |

|

Selling, general, and administrative | 104.2 |

| | 117.1 |

| | 118.5 |

| | 119.3 |

| | 120.2 |

|

Depreciation and amortization | 30.2 |

| | 27.9 |

| | 30.6 |

| | 34.0 |

| | 34.8 |

|

Asset impairments | 13.5 |

| | 32.9 |

| | 5.7 |

| | 19.4 |

| | — |

|

Loss (gain) on asset sales | (0.9 | ) | | 0.4 |

| | 0.3 |

| | 0.2 |

| | 0.5 |

|

Restructuring and severance | 3.5 |

| | 5.7 |

| | 11.1 |

| | 5.9 |

| | 0.9 |

|

Interest expense | 19.3 |

| | 21.5 |

| | 24.7 |

| | 28.3 |

| | 32.9 |

|

Debt issuance costs write-off | 0.8 |

| | — |

| | 2.9 |

| | 0.6 |

| | 0.8 |

|

Acquisition and integration related expense | 4.1 |

| | 0.3 |

| | 0.9 |

| | 0.4 |

| | — |

|

Other (income) expense, net | 1.5 |

| | (0.9 | ) | | (0.7 | ) | | 6.9 |

| | (2.4 | ) |

| 176.2 |

| | 204.9 |

| | 194.0 |

| | 215.0 |

| | 187.7 |

|

Income (loss) from continuing operations before income taxes | 14.5 |

| | (4.1 | ) | | 9.9 |

| | (21.1 | ) | | 11.7 |

|

Income tax (expense) benefit | 6.2 |

| | (83.7 | ) | | (10.3 | ) | | 2.4 |

| | 0.4 |

|

Income (loss) from continuing operations | 20.7 |

| | (87.8 | ) | | (0.4 | ) | | (18.7 | ) | | 12.1 |

|

Income (loss) from discontinued operations, net of tax | — |

| | — |

| | — |

| | 0.9 |

| | (0.6 | ) |

Net income (loss) | $ | 20.7 |

| | $ | (87.8 | ) | | $ | (0.4 | ) | | $ | (17.8 | ) | | $ | 11.5 |

|

| | | | | | | | | |

Basic Income (Loss) Per Share: | | | | | | | | | |

Income (loss) per share from continuing operations | $ | 0.46 |

| | $ | (1.98 | ) | | $ | (0.01 | ) | | $ | (0.41 | ) | | $ | 0.26 |

|

Income (loss) per share from discontinued operations | — |

| | — |

| | — |

| | 0.02 |

| | (0.01 | ) |

Basic net income (loss) per share | $ | 0.46 |

| | $ | (1.98 | ) | | $ | (0.01 | ) | | $ | (0.39 | ) | | $ | 0.25 |

|

| | | | | | | | | |

Diluted Income (Loss) Per Share: | | | | | | | | | |

Income (loss) per share from continuing operations | $ | 0.46 |

| | $ | (1.98 | ) | | $ | (0.01 | ) | | $ | (0.41 | ) | | $ | 0.26 |

|

Income (loss) per share from discontinued operations | — |

| | — |

| | — |

| | 0.02 |

| | (0.01 | ) |

Diluted net income (loss) per share | $ | 0.46 |

| | $ | (1.98 | ) | | $ | (0.01 | ) | | $ | (0.39 | ) | | $ | 0.25 |

|

| | | | | | | | | |

General: | | | | | | | | | |

Capital expenditures | $ | 23.8 |

| | $ | 25.1 |

| | $ | 25.6 |

| | $ | 24.0 |

| | $ | 29.8 |

|

Total assets | 589.2 |

| | 612.8 |

| | 687.3 |

| | 687.2 |

| | 829.2 |

|

Long-term debt | 329.7 |

| | 361.8 |

| | 366.0 |

| | 357.2 |

| | 409.6 |

|

Cash | 54.1 |

| | 88.0 |

| | 72.0 |

| | 44.9 |

| | 99.5 |

|

See Management's Discussion and Analysis of Financial Condition and Results of Operations and Notes to Consolidated Financial Statements.

|

| | |

Item 7. | | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

Overview

OMNOVA Solutions is a global innovator of performance enhancing chemistries and surfaces for a variety of commercial, industrial, and residential end uses. Our products provide a variety of important functional and aesthetic benefits to hundreds of products that people use daily. We hold leading positions in key market categories, which have been built through innovative products, customized product solutions, strong technical expertise, well-established distribution channels, recognized brands, and long-standing customer relationships. We have strategically located manufacturing, technical and other facilities globally to service our broad customer base. Please refer to Item 1. Business, of this Annual Report on Form 10-K for further description of and background on the Company and its operating segments.

The Company’s Chief Operating Decision Maker ("CODM"), its Chief Executive Officer ("CEO"), makes decisions, assesses performance, and allocates resources prospectively by reporting segment. Segment information has been prepared in accordance with guidance promulgated by the FASB.

The Company has two reporting segments: "Specialty Solutions", a segment focused on the Company's higher growth specialty business lines, and "Performance Materials," a segment comprised of the Company's mature business lines. These reporting segments were determined based on products and services provided. Accounting policies of the segments are the same as those described in Note A—Description of Business and Significant Accounting Policies of the Company’s Consolidated Financial Statements. For a reconciliation of the Company’s segment operating performance information, refer to Note O of the Company’s Consolidated Financial Statements.

A majority of the Company’s raw materials are derived from petrochemicals and chemical feedstocks, where prices can be cyclical and volatile. Styrene, a key raw material for the Company, is generally available worldwide, and OMNOVA has supply contracts with several producers. OMNOVA believes there is adequate global capacity to serve demand. OMNOVA’s styrene purchases for 2016 through 2018 and the range of market prices were as follows:

|

| | | |

| Pounds Purchased (in millions) | | Market Price Range Per Pound |

2018 | 102 | | $0.53 - $0.73 |

2017 | 129 | | $0.48 - $0.72 |

2016 | 144 | | $0.39 - $0.54 |

Butadiene, a key raw material for the Company, is generally available worldwide, but its price is volatile. OMNOVA has supply contracts with several producers. At times, when the demand for butadiene exceeds supply, it is sold on an allocated basis. OMNOVA’s butadiene purchases for 2016 through 2018 and the range of market prices were as follows:

|

| | | |

| Pounds Purchased (in millions) | | Market Price Range Per Pound |

2018 | 77 | | $0.36 - $0.79 |

2017 | 103 | | $0.39 - $1.42 |

2016 | 111 | | $0.24 - $0.71 |

Other key raw materials utilized by the Company include acrylites, polyvinyl chloride (PVC) resins, textiles, and plasticizers. These raw materials are generally available worldwide from several suppliers.

OMNOVA had indexed sales price contracts covering approximately 25% of its sales in 2018. These contract indexes are generally comprised of several components: a negotiated fixed amount per pound, and the market price of key raw materials (i.e., styrene and butadiene). The indexed contracts provide that OMNOVA will pass through the increases or decreases of key raw materials, generally within a 30 to 60 day period. Indexed contracts vary in length, generally from 12 to 36 months.

The majority of OMNOVA’s customers do not maintain indexed contracts. Instead, the Company negotiates pricing with each customer based on the cost of the raw materials components of the products being purchased and the value-added performance attributes of those products. The Company’s pricing objective, which may or may not be met, is to recover raw material price increases for these non-indexed contracts within three months.

Key Indicators

Key economic measures relevant to the Company include global economic growth rates, discretionary spending for durable goods, oil and gas consumption and drilling levels, U.S. commercial real estate occupancy rates, U.S. office furniture sales, manufactured housing shipments, housing starts and sales of existing homes, and forecasts of raw material pricing for certain petrochemical feed stocks. Key Original Equipment Manufacturer ("OEM") industries, which provide a general indication of demand drivers to the Company, include commercial and residential construction and refurbishment, automotive and tire production, furniture, flooring, and ABS manufacturing. These measures provide general information on trends relevant to the demand for the Company’s products, but the trend information does not necessarily directly correlate with demand levels in the markets which ultimately use the Company’s products in part because the Company's market share is relatively small in a number of specialty markets.

Key operating measures utilized by the business segments include: orders; sales and pricing; working capital days; inventory; productivity; plant utilization; new product vitality; cost of quality; order fill-rates, which provide key indicators of business trends; and safety and other internal metrics. These measures are reported on various cycles including daily, weekly and monthly, depending on the needs established by operating management.