UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form

(Mark One)

|

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

or

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number

DEVON ENERGY CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer identification No.) |

|

|

|

|

|

|

|

|

|

(Address of principal executive offices) |

|

(Zip code) |

Registrant’s telephone number, including area code: (

Securities registered pursuant to Section 12(b) of the Act:

|

|

Title of each class |

|

Trading Symbol |

|

Name of each exchange on which registered |

|

|

|

|

|

|

|

|

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

|

☑ |

Accelerated filer |

|

☐ |

Non-accelerated filer |

|

☐ |

|

Smaller reporting company |

|

|

Emerging growth company |

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes

The aggregate market value of the voting common stock held by non-affiliates of the registrant as of June 28, 2019 was approximately $

DOCUMENTS INCORPORATED BY REFERENCE

DEVON ENERGY CORPORATION

FORM 10-K

TABLE OF CONTENTS

2

DEFINITIONS

Unless the context otherwise indicates, references to “us,” “we,” “our,” “ours,” “Devon,” the “Company” and “Registrant” refer to Devon Energy Corporation and its consolidated subsidiaries. All monetary values, other than per unit and per share amounts, are stated in millions of U.S. dollars unless otherwise specified. In addition, the following are other abbreviations and definitions of certain terms used within this Annual Report on Form 10-K:

“2015 Plan” means the Devon Energy Corporation 2015 Long-Term Incentive Plan.

“2017 Plan” means the Devon Energy Corporation 2017 Long-Term Incentive Plan.

“ASC” means Accounting Standards Codification.

“ASR” means an accelerated share-repurchase transaction with a financial institution to repurchase Devon’s common stock.

“ASU” means Accounting Standards Update.

“Bbl” or “Bbls” means barrel or barrels.

“Bcf” means billion cubic feet.

“BKV” means Banpu Kalnin Ventures.

“BLM” means the United States Bureau of Land Management.

“Boe” means barrel of oil equivalent. Gas proved reserves and production are converted to Boe, at the pressure and temperature base standard of each respective state in which the gas is produced, at the rate of six Mcf of gas per Bbl of oil, based upon the approximate relative energy content of gas and oil. Bitumen and NGL proved reserves and production are converted to Boe on a one-to-one basis with oil.

“Btu” means British thermal units, a measure of heating value.

“Canada” means the division of Devon encompassing oil and gas properties located in Canada. All dollar amounts associated with Canada are in U.S. dollars, unless stated otherwise.

“CDM” means Cotton Draw Midstream, L.L.C.

“DD&A” means depreciation, depletion and amortization expenses.

“Devon Financing” means Devon Financing Company, L.L.C.

“Devon Plan” means Devon Energy Corporation Incentive Savings Plan.

“EnLink” means EnLink Midstream Partners, LP, a master limited partnership.

“EPA” means the United States Environmental Protection Agency.

“FASB” means Financial Accounting Standards Board.

“Federal Funds Rate” means the interest rate at which depository institutions lend balances at the Federal Reserve to other depository institutions overnight.

“G&A” means general and administrative expenses.

“GAAP” means U.S. generally accepted accounting principles.

“General Partner” means EnLink Midstream, LLC, the indirect general partner entity of EnLink, and, unless the context otherwise indicates, EnLink Midstream Manager, LLC, the managing member of EnLink Midstream, LLC.

“Inside FERC” refers to the publication Inside F.E.R.C.’s Gas Market Report.

“LIBOR” means London Interbank Offered Rate.

“LOE” means lease operating expenses.

“MBbls” means thousand barrels.

“MBoe” means thousand Boe.

“Mcf” means thousand cubic feet.

“MMBbls” means million barrels.

3

“MMBoe” means million Boe.

“MMBtu” means million Btu.

“MMcf” means million cubic feet.

“N/M” means not meaningful.

“NGL” or “NGLs” means natural gas liquids.

“NYMEX” means New York Mercantile Exchange.

“NYSE” means New York Stock Exchange.

“OPEC” means Organization of the Petroleum Exporting Countries.

“OPIS” means Oil Price Information Service.

“SEC” means United States Securities and Exchange Commission.

“Senior Credit Facility” means Devon’s syndicated unsecured revolving line of credit, effective as of October 5, 2018.

“Standardized measure” means the present value of after-tax future net revenues discounted at 10% per annum.

“S&P 500 Index” means Standard and Poor’s 500 index.

“Tax Reform Legislation” means Tax Cuts and Jobs Act.

“TSR” means total shareholder return.

“U.S.” means United States of America.

“VIE” means variable interest entity.

“WTI” means West Texas Intermediate.

“/Bbl” means per barrel.

“/d” means per day.

“/MMBtu” means per MMBtu.

4

INFORMATION REGARDING FORWARD-LOOKING STATEMENTS

This report includes “forward-looking statements” as defined by the SEC. Such statements include those concerning strategic plans, our expectations and objectives for future operations, as well as other future events or conditions, and are often identified by use of the words and phrases “expects,” “believes,” “will,” “would,” “could,” “continue,” “may,” “aims,” “likely to be,” “intends,” “forecasts,” “projections,” “estimates,” “plans,” “expectations,” “targets,” “opportunities,” “potential,” “anticipates,” “outlook” and other similar terminology. All statements, other than statements of historical facts, included in this report that address activities, events or developments that Devon expects, believes or anticipates will or may occur in the future are forward-looking statements. Such statements are subject to a number of assumptions, risks and uncertainties, many of which are beyond our control. Consequently, actual future results could differ materially from our expectations due to a number of factors, including, but not limited to:

|

|

• |

the volatility of oil, gas and NGL prices; |

|

|

• |

uncertainties inherent in estimating oil, gas and NGL reserves; |

|

|

• |

the extent to which we are successful in acquiring and discovering additional reserves; |

|

|

• |

the uncertainties, costs and risks involved in our operations, including as a result of employee misconduct; |

|

|

• |

regulatory restrictions, compliance costs and other risks relating to governmental regulation, including with respect to environmental matters; |

|

|

• |

risks related to regulatory, social and market efforts to address climate change; |

|

|

• |

risks related to our hedging activities; |

|

|

• |

counterparty credit risks; |

|

|

• |

risks relating to our indebtedness; |

|

|

• |

risks related to environmental regulations; |

|

|

• |

cyberattack risks; |

|

|

• |

our limited control over third parties who operate some of our oil and gas properties; |

|

|

• |

midstream capacity constraints and potential interruptions in production; |

|

|

• |

the extent to which insurance covers any losses we may experience; |

|

|

• |

competition for assets, materials, people and capital; |

|

|

• |

risks related to investors attempting to effect change; |

|

|

• |

our ability to successfully complete mergers, acquisitions and divestitures; and |

|

|

• |

any of the other risks and uncertainties discussed in this report. |

All subsequent written and oral forward-looking statements attributable to Devon, or persons acting on its behalf, are expressly qualified in their entirety by the cautionary statements above. We assume no duty to update or revise our forward-looking statements based on new information, future events or otherwise.

5

PART I

Items 1 and 2. Business and Properties

General

A Delaware corporation formed in 1971 and publicly held since 1988, Devon (NYSE: DVN) is an independent energy company engaged primarily in the exploration, development and production of oil, natural gas and NGLs. Our operations are concentrated in various onshore areas in the U.S. In June 2019, we completed the sale of substantially all of our oil and gas assets and operations in Canada. In December 2019, we announced the sale of our Barnett Shale assets.

Our principal and administrative offices are located at 333 West Sheridan, Oklahoma City, OK 73102-5015 (telephone 405-235-3611). As of December 31, 2019, Devon and its consolidated subsidiaries had approximately 1,800 employees.

Devon files or furnishes annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K, as well as any amendments to these reports, with the SEC. Through our website, www.devonenergy.com, we make available electronic copies of the documents we file or furnish to the SEC, the charters of the committees of our Board of Directors and other documents related to our corporate governance. The corporate governance documents available on our website include our Code of Ethics for Chief Executive Officer, Chief Financial Officer and Chief Accounting Officer, and any amendments to and waivers from any provision of that Code will also be posted on our website. Access to these electronic filings is available free of charge as soon as reasonably practicable after filing or furnishing them to the SEC. Printed copies of our committee charters or other governance documents and filings can be requested by writing to our corporate secretary at the address on the cover of this report. Reports filed with the SEC are also made available on its website at www.sec.gov.

Our Strategy

Our business strategy is focused on delivering a consistently competitive shareholder return among our peer group. Because the business of exploring for, developing and producing oil and natural gas is capital intensive, delivering sustainable, capital efficient cash flow growth is a key tenant to our success. While our cash flow is highly dependent on volatile and uncertain commodity prices, we pursue our strategy throughout all commodity price cycles with four fundamental principles.

Proven and responsible operator – We operate our business with the interests of our stakeholders and our environmental, social and governance progress in mind. With our vision to be a premier independent oil and natural gas exploration and production company, the work our employees do every day contributes to the local, national and global economies. We produce a valuable commodity that is fundamental to society, and we endeavor to do so in a safe, environmentally responsible and ethical way, while striving to deliver strong returns to our shareholders. We have an ongoing commitment to transparency in reporting our environmental, social and governance performance. See our Sustainability Report published on our company website for performance highlights and additional information. Information contained in our Sustainability Report is not incorporated by reference into, and does not constitute a part of, this Annual Report on Form 10-K.

A premier, sustainable portfolio of assets – As discussed in the next section of this Annual Report, we own a portfolio of assets located in the United States. We strive to own premier assets capable of generating cash flows in excess of our capital and operating requirements, as well as competitive rates of return. We also desire to own a portfolio of assets that can provide a production growth platform extending many years into the future. Due to the strength of oil prices relative to natural gas, we have been positioning our portfolio to be more heavily weighted to U.S. oil assets in recent years.

During 2019, we completed our transition to a U.S. oil company. We sold our Canadian business, generating $2.6 billion in proceeds, and announced the sale of our Barnett Shale assets for approximately $770 million, before purchase price adjustments. As a result of these divestitures, we expect our oil production growth, price realizations and field-level margins will all improve, as we sharpen our focus on four U.S. oil plays located in the Delaware Basin, STACK, Powder River Basin and Eagle Ford.

Superior execution – As we pursue cash flow growth, we continually work to optimize the efficiency of our capital programs and production operations, with an underlying objective of reducing absolute and per unit costs and enhancing our returns. We also strive to leverage our culture of health, safety and environmental stewardship in all aspects of our business.

Throughout 2019, we continued to achieve efficiency gains in various aspects of our business. Our initial production rates from new wells continued to improve in our four U.S. oil plays and have exceeded the average of the top 40 U.S. producers since 2015 by more than 40%. We continued to improve cycle times, incorporate production optimization strategies and other cost reduction initiatives, driving down breakeven costs across our portfolio of assets.

As we focus on a more streamlined portfolio of U.S. oil assets, we are aggressively pursuing an improved cost structure to further expand margins. We have realized annualized cost savings by reducing well costs, production expense, financing costs and G&A costs.

6

Financial strength and flexibility – Commodity prices are uncertain and volatile, so we strive to maintain a strong balance sheet, as well as adequate liquidity and financial flexibility, in order to operate competitively in all commodity price cycles. Our capital allocation decisions are made with attention to these financial stewardship principles, as well as the priorities of funding our core operations, protecting our investment-grade credit ratings, and paying and growing our shareholder dividend.

During 2019, we reduced our consolidated debt by $1.7 billion, primarily from proceeds from our divestitures. We also raised our quarterly dividend 12.5% and repurchased 69 million shares of common stock under our share repurchase program.

Oil and Gas Properties

Canadian Business and Barnett Shale Assets – Discontinued Operations

As a result of our divestment of substantially all of our oil and gas assets and operations in Canada, as well as the recently announced divestiture of our Barnett Shale assets, amounts associated with these assets are presented as discontinued operations. Therefore, financial and operational data, such as reserves, production, wells and acreage, provided in this document exclude amounts related to our Canadian and Barnett Shale assets unless otherwise noted. Included within the amounts presented as discontinued operations associated with the Barnett Shale are properties divested in previous reporting periods located primarily in Johnson and Wise counties, Texas. For additional information, please see Note 2 in “Item 8. Financial Statements and Supplementary Data” of this report.

Property Profiles

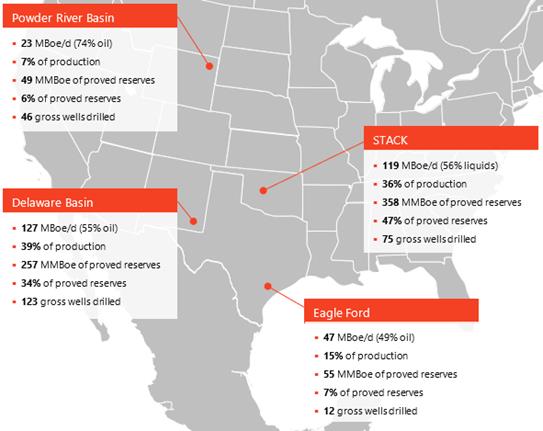

Key summary data from each of our areas of operation as of and for the year ended December 31, 2019 are detailed in the map below.

7

Delaware Basin – The Delaware Basin is Devon’s most active program in the portfolio. Through capital-efficient growth, it offers exploration and low-risk development opportunities from many geologic reservoirs and play types, including the oil-rich Bone Spring, Wolfcamp and Leonard formations. With a significant inventory of oil and liquids-rich drilling opportunities that have multi-zone development potential, Devon has a robust platform to deliver high-margin growth for many years to come. At December 31, 2019, we had eight operated rigs developing this asset. In 2020, we plan to invest approximately $1.0 billion of capital in the Delaware Basin, making it the top-funded asset in the portfolio.

STACK – The STACK development, located primarily in Oklahoma’s Canadian, Kingfisher and Blaine counties, provides long-term optionality through its significant inventory. Our STACK position is one of the largest in the industry, providing visible long-term production. In December 2019, we announced an agreement with Dow to jointly develop a portion of our STACK acreage. Dow will fund approximately 65% of the partnership capital requirements through a drilling carry of $100 million over the next four years. In 2020, we plan approximately $75 million of capital investment.

Powder River Basin – This asset is focused on emerging oil opportunities in the Powder River Basin. Recent drilling success in this basin has expanded our drilling inventory, and we expect further growth as we accelerate activity and continue to de-risk this emerging light-oil opportunity. As of December 31, 2019, we had three operated rigs targeting the Turner, Parkman, Teapot and Niobrara formations in northern Converse County, Wyoming of the Powder River Basin. In 2020, we plan approximately $350 million of capital investment.

Eagle Ford – We acquired our position in the Eagle Ford in 2014. Since acquiring these assets, we have delivered tremendous results driven by our development in DeWitt County, Texas located in the economic core of the play. Our Eagle Ford production is leveraged to oil and has low-cost access to premium Gulf Coast pricing, providing for solid operating margins. Our Eagle Ford assets generated substantial cash flow in 2019. In 2020, we plan approximately $300 million of capital investment.

Proved Reserves

Proved oil and gas reserves are those quantities of oil, gas and NGLs which can be estimated with reasonable certainty to be economically producible from known reservoirs under existing economic conditions, operating methods and government regulations. To be considered proved, oil and gas reserves must be economically producible before contracts providing the right to operate expire, unless evidence indicates that renewal is reasonably certain. Also, the project to extract the hydrocarbons must have commenced or the operator must be reasonably certain that it will commence the project within a reasonable time. For estimates of our proved developed and proved undeveloped reserves and the discussion of the contribution by each property, see Note 21 in “Item 8. Financial Statements and Supplementary Data” of this report.

The process of estimating oil, gas and NGL reserves is complex and requires significant judgment, as discussed in “Item 1A. Risk Factors” of this report. As a result, we have developed internal policies for estimating and recording reserves in compliance with applicable SEC definitions and guidance. Our policies assign responsibilities for compliance in reserves bookings to our Reserve Evaluation Group (the “Group”). The Group, which is led by Devon’s Director of Reserves and Economics, is responsible for the internal review and certification of reserves estimates. We ensure the Director and key members of the Group have appropriate technical qualifications to oversee the preparation of reserves estimates and are independent of the operating groups. The Director of the Group has over 30 years of industry experience, a degree in engineering and is a registered professional engineer. The Group also oversees audits and reserves estimates performed by qualified third-party petroleum consulting firms. During 2019, we engaged LaRoche Petroleum Consultants, Ltd. to audit approximately 85% of our proved reserves. Additionally, we have a Reserves Committee that provides additional oversight of our reserves process. The committee consists of five independent members of our Board of Directors with education or business backgrounds relevant to the reserves estimation process.

8

The following tables present production, price and cost information for each significant field.

|

|

|

Production |

|

|||||||||||||

|

Year Ended December 31, |

|

Oil (MMBbls) |

|

|

Gas (Bcf) |

|

|

NGLs (MMBbls) |

|

|

Total (MMBoe) |

|

||||

|

2019 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

STACK |

|

|

11 |

|

|

|

114 |

|

|

|

13 |

|

|

|

43 |

|

|

Delaware Basin |

|

|

26 |

|

|

|

65 |

|

|

|

10 |

|

|

|

46 |

|

|

U.S. |

|

|

55 |

|

|

|

219 |

|

|

|

28 |

|

|

|

119 |

|

|

2018 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

STACK |

|

|

12 |

|

|

|

121 |

|

|

|

14 |

|

|

|

45 |

|

|

Delaware Basin |

|

|

16 |

|

|

|

42 |

|

|

|

6 |

|

|

|

30 |

|

|

U.S. |

|

|

47 |

|

|

|

206 |

|

|

|

26 |

|

|

|

108 |

|

|

2017 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

STACK |

|

|

9 |

|

|

|

107 |

|

|

|

11 |

|

|

|

38 |

|

|

Delaware Basin |

|

|

12 |

|

|

|

37 |

|

|

|

4 |

|

|

|

23 |

|

|

U.S. |

|

|

42 |

|

|

|

189 |

|

|

|

21 |

|

|

|

95 |

|

|

|

|

Average Sales Price (1) |

|

|

|

|

|

|||||||||

|

Year Ended December 31, |

|

Oil (Per Bbl) |

|

|

Gas (Per Mcf) |

|

|

NGLs (Per Bbl) |

|

|

Production Cost (Per Boe) (1)(2) |

|

||||

|

2019 (1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

STACK |

|

$ |

55.13 |

|

|

$ |

1.97 |

|

|

$ |

15.90 |

|

|

$ |

7.36 |

|

|

Delaware Basin |

|

$ |

54.01 |

|

|

$ |

0.99 |

|

|

$ |

13.54 |

|

|

$ |

6.43 |

|

|

U.S. |

|

$ |

54.73 |

|

|

$ |

1.79 |

|

|

$ |

15.21 |

|

|

$ |

7.75 |

|

|

2018 (1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

STACK |

|

$ |

63.81 |

|

|

$ |

2.29 |

|

|

$ |

25.53 |

|

|

$ |

7.16 |

|

|

Delaware Basin |

|

$ |

57.24 |

|

|

$ |

1.80 |

|

|

$ |

24.05 |

|

|

$ |

8.15 |

|

|

U.S. |

|

$ |

61.96 |

|

|

$ |

2.34 |

|

|

$ |

25.47 |

|

|

$ |

8.22 |

|

|

2017 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

STACK |

|

$ |

48.43 |

|

|

$ |

2.40 |

|

|

$ |

17.78 |

|

|

$ |

4.72 |

|

|

Delaware Basin |

|

$ |

48.38 |

|

|

$ |

2.43 |

|

|

$ |

16.44 |

|

|

$ |

8.19 |

|

|

U.S. |

|

$ |

49.41 |

|

|

$ |

2.57 |

|

|

$ |

16.74 |

|

|

$ |

6.49 |

|

|

|

(1) |

As further discussed in Note 1 in “Item 8. Financial Statements and Supplementary Data” of this report, starting in 2018 the presentation of certain processing arrangements changed from a net to a gross presentation, which resulted in an increase to our upstream revenues and production expenses with no impact to net earnings. These changes primarily related to our STACK properties. |

|

|

(2) |

Represents production expense per Boe excluding production and property taxes. |

Drilling Statistics

The following table summarizes our development and exploratory drilling results in the U.S.

|

|

|

Development Wells (1) |

|

|

Exploratory Wells (1) |

|

|

Total Wells (1) |

|

|||||||||||||||||||

|

Year Ended December 31, |

|

Productive |

|

|

Dry |

|

|

Productive |

|

|

Dry |

|

|

Productive |

|

|

Dry |

|

|

Total |

|

|||||||

|

2019 |

|

|

161.7 |

|

|

|

— |

|

|

|

27.2 |

|

|

|

— |

|

|

|

188.9 |

|

|

|

— |

|

|

|

188.9 |

|

|

2018 |

|

|

154.9 |

|

|

|

3.1 |

|

|

|

69.4 |

|

|

|

— |

|

|

|

224.3 |

|

|

|

3.1 |

|

|

|

227.4 |

|

|

2017 |

|

|

145.8 |

|

|

|

— |

|

|

|

44.0 |

|

|

|

— |

|

|

|

189.8 |

|

|

|

— |

|

|

|

189.8 |

|

|

(1) |

Well counts represent net wells completed during each year. Net wells are gross wells multiplied by our fractional working interests. |

9

As of December 31, 2019, there were 132 gross and 95.3 net wells that have been spud and are in the process of drilling, completing or waiting on completion. Gross wells are the sum of all wells in which we own a working interest. Net wells are gross wells multiplied by our fractional working interests in each well.

Productive Wells

The following table sets forth our producing wells as of December 31, 2019.

|

|

|

Oil Wells |

|

|

Natural Gas Wells |

|

|

Total Wells |

|

|||||||||||||||

|

|

|

Gross (1)(3) |

|

|

Net (2) |

|

|

Gross (1)(3) |

|

|

Net (2) |

|

|

Gross (1)(3) |

|

|

Net (2) |

|

||||||

|

U.S. |

|

|

7,739 |

|

|

|

2,376 |

|

|

|

3,138 |

|

|

|

1,281 |

|

|

|

10,877 |

|

|

|

3,657 |

|

|

(1) |

Gross wells are the sum of all wells in which we own a working interest. |

|

(2) |

Net wells are gross wells multiplied by our fractional working interests in each well. |

|

(3) |

Includes 63 and 85 gross oil and gas wells, respectively, which had multiple completions. |

The day-to-day operations of oil and gas properties are the responsibility of an operator designated under pooling or operating agreements. The operator supervises production, maintains production records, employs field personnel and performs other functions. We are the operator of approximately 3,955 gross wells. As operator, we receive reimbursement for direct expenses incurred to perform our duties, as well as monthly per-well producing, drilling, and construction overhead reimbursement at rates customarily charged in the respective areas. In presenting our financial data, we record the monthly overhead reimbursements as a reduction of G&A, which is a common industry practice.

Acreage Statistics

The following table sets forth our developed and undeveloped lease and mineral acreage as of December 31, 2019. Of our 1.8 million net acres, approximately 1.1 million acres are held by production and approximately 20% are located on federal lands. The acreage in the table includes approximately 0.1 million net acres subject to leases that are scheduled to expire during 2020, 2021 and 2022. As of December 31, 2019, there were no proved undeveloped reserves associated with our expiring acreage. Of the 0.1 million net acres set to expire by December 31, 2022, we anticipate performing operational and administrative actions to continue the lease terms for portions of the acreage that we intend to further assess. However, we do expect to allow a portion of the acreage to expire in the normal course of business. In 2019, we allowed approximately 0.1 million acres to expire.

|

|

|

Developed |

|

|

Undeveloped |

|

|

Total |

|

|||||||||||||||

|

|

|

Gross (1) |

|

|

Net (2) |

|

|

Gross (1) |

|

|

Net (2) |

|

|

Gross (1) |

|

|

Net (2) |

|

||||||

|

|

|

(Thousands) |

|

|||||||||||||||||||||

|

U.S. |

|

|

1,055 |

|

|

|

576 |

|

|

|

2,956 |

|

|

|

1,272 |

|

|

|

4,011 |

|

|

|

1,848 |

|

|

(1) |

Gross acres are the sum of all acres in which we own a working interest. |

|

(2) |

Net acres are gross acres multiplied by our fractional working interests in the acreage. |

Title to Properties

Title to properties is subject to contractual arrangements customary in the oil and gas industry, liens for taxes not yet due and, in some instances, other encumbrances. We believe that such burdens do not materially detract from the value of properties or from the respective interests therein or materially interfere with their use in the operation of the business.

As is customary in the industry, a preliminary title investigation, typically consisting of a review of local title records, is made at the time of acquisitions of undeveloped properties. More thorough title investigations, which generally include a review of title records and the preparation of title opinions by outside legal counsel, are made prior to the consummation of an acquisition of producing properties and before commencement of drilling operations on undeveloped properties.

10

Marketing Activities

Oil, Gas and NGL Marketing

The spot markets for oil, gas and NGLs are subject to volatility as supply and demand factors fluctuate. As detailed below, we sell our production under both long-term (one year or more) and short-term (less than one year) agreements at prices negotiated with third parties. Regardless of the term of the contract, the vast majority of our production is sold at variable, or market-sensitive, prices.

Additionally, we may enter into financial hedging arrangements or fixed-price contracts associated with a portion of our oil, gas and NGL production. These activities are intended to support targeted price levels and to manage our exposure to price fluctuations. See Note 3 in “Item 8. Financial Statements and Supplementary Data” of this report for further information.

As of January 2020, our production was sold under the following contract terms.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Short-Term |

|

|

Long-Term |

|

||||||||||

|

|

|

Variable |

|

|

Fixed |

|

|

Variable |

|

|

Fixed |

|

||||

|

Oil |

|

|

64 |

% |

|

|

— |

|

|

|

36 |

% |

|

|

— |

|

|

Natural gas |

|

|

64 |

% |

|

|

3 |

% |

|

|

33 |

% |

|

|

— |

|

|

NGLs |

|

|

38 |

% |

|

|

28 |

% |

|

|

34 |

% |

|

|

— |

|

Delivery Commitments

A portion of our production is sold under certain contractual arrangements that specify the delivery of a fixed and determinable quantity. As of December 31, 2019, we were committed to deliver the following fixed quantities of production.

|

|

|

Total |

|

|

Less Than 1 Year |

|

|

1-3 Years |

|

|

3-5 Years |

|

|

More Than 5 Years |

|

|||||

|

Natural gas (Bcf) |

|

|

273 |

|

|

|

128 |

|

|

|

94 |

|

|

|

37 |

|

|

|

14 |

|

|

NGLs (MMBbls) |

|

|

8 |

|

|

|

8 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Total (MMBoe) |

|

|

53 |

|

|

|

29 |

|

|

|

16 |

|

|

|

6 |

|

|

|

2 |

|

We expect to fulfill our delivery commitments primarily with production from our proved developed reserves. Moreover, our proved reserves have generally been sufficient to satisfy our delivery commitments during the three most recent years, and we expect such reserves will continue to be the primary means of fulfilling our future commitments. However, where our proved reserves are not sufficient to satisfy our delivery commitments, we can and may use spot market purchases to satisfy the commitments.

Customers

During 2019 and 2017, no purchaser accounted for over 10% of our consolidated sales revenue.

During 2018, we had one purchaser that accounted for approximately 11% of our consolidated sales revenue.

Competition

See “Item 1A. Risk Factors.”

11

Public Policy and Government Regulation

Our industry is subject to a wide range of regulations. Laws, rules, regulations, taxes, fees and other policy implementation actions affecting our industry have been pervasive and are under constant review for amendment or expansion. Numerous government agencies have issued extensive regulations which are binding on our industry and its individual members, some of which carry substantial penalties for failure to comply. These laws and regulations increase the cost of doing business and consequently affect profitability. Because public policy changes are commonplace, and existing laws and regulations are frequently amended, we are unable to predict the future cost or impact of compliance. However, we do not expect that any of these laws and regulations will affect our operations materially differently than they would affect other companies with similar operations, size and financial strength. The following are significant areas of government control and regulation affecting our operations.

Exploration and Production Regulation

Our operations are subject to federal, state and local laws and regulations. These laws and regulations relate to matters that include:

|

|

• |

acquisition of seismic data; |

|

|

• |

location, drilling and casing of wells; |

|

|

• |

well design; |

|

|

• |

hydraulic fracturing; |

|

|

• |

well production; |

|

|

• |

spill prevention plans; |

|

|

• |

emissions and discharge permitting; |

|

|

• |

use, transportation, storage and disposal of fluids and materials incidental to oil and gas operations; |

|

|

• |

surface usage and the restoration of properties upon which wells have been drilled; |

|

|

• |

calculation and disbursement of royalty payments and production taxes; |

|

|

• |

plugging and abandoning of wells; |

|

|

• |

transportation of production; and |

|

|

• |

endangered species and habitat. |

Our operations also are subject to conservation regulations, including the regulation of the size of drilling and spacing units or proration units; the number of wells that may be drilled in a unit; the rate of production allowable from oil and gas wells; and the unitization or pooling of oil and gas properties. In the U.S., some states allow the forced pooling or unitization of tracts to facilitate exploration, while other states rely on voluntary pooling of lands and leases, which may make it more difficult to develop oil and gas properties. In addition, federal and state conservation laws generally limit the venting or flaring of natural gas, and state conservation laws impose certain requirements regarding the ratable purchase of production. These regulations limit the amounts of oil and gas we can produce from our wells and the number of wells or the locations at which we can drill.

Certain of our U.S. natural gas and oil leases are granted or approved by the federal government and administered by the BLM or Bureau of Indian Affairs of the Department of the Interior. Such leases require compliance with detailed federal regulations and orders that regulate, among other matters, drilling and operations on lands covered by these leases and calculation and disbursement of royalty payments to the federal government, tribes or tribal members. The federal government has, from time to time, evaluated and, in some cases, promulgated new rules and regulations regarding competitive lease bidding, venting and flaring, oil and gas measurement and royalty payment obligations for production from federal lands. In addition, permitting activities on federal lands can sometimes be subject to delays.

12

Environmental, Pipeline Safety and Occupational Regulations

We strive to conduct our operations in a socially and environmentally responsible manner, which includes compliance with applicable law. We are subject to many federal, state, and local laws and regulations concerning occupational safety and health as well as the discharge of materials into, and the protection of, the environment and natural resources. Environmental laws and regulations relate to:

|

|

• |

the discharge of pollutants into federal and state waters; |

|

|

• |

assessing the environmental impact of seismic acquisition, drilling or construction activities; |

|

|

• |

the generation, storage, transportation and disposal of waste materials, including hazardous substances; |

|

|

• |

the emission of certain gases into the atmosphere; |

|

|

• |

the monitoring, abandonment, reclamation and remediation of well and other sites, including sites of former operations; |

|

|

• |

the development of emergency response and spill contingency plans; |

|

|

• |

the monitoring, repair and design of pipelines used for the transportation of oil and natural gas; |

|

|

• |

the protection of threatened and endangered species; and |

|

|

• |

worker protection. |

Failure to comply with these laws and regulations can lead to the imposition of remedial liabilities, administrative, civil or criminal fines or penalties or injunctions limiting our operations in affected areas. Moreover, multiple environmental laws provide for citizen suits, which can allow environmental organizations to sue operators for alleged violations of environmental law. Environmental organizations also can assert legal and administrative challenges to certain actions of oil and gas regulators, such as the BLM, for allegedly failing to comply with environmental laws, which can result in delays in obtaining permits or other necessary authorizations. Environmental protection and health and safety compliance are necessary, manageable parts of our business. We have been able to plan for and comply with environmental, safety and health initiatives without materially altering our operating strategy or incurring significant unreimbursed expenditures. However, based on regulatory trends and increasingly stringent laws, our capital expenditures and operating expenses related to the protection of the environment and safety and health compliance have increased over the years and may continue to increase.

Item 1A. Risk Factors

Our business and operations, and our industry in general, are subject to a variety of risks. The risks described below may not be the only risks we face, as our business and operations may also be subject to risks that we do not yet know of, or that we currently believe are immaterial. If any of the following risks should occur, our business, financial condition, results of operations and liquidity could be materially and adversely impacted. As a result, holders of our securities could lose part or all of their investment in Devon.

Volatile Oil, Gas and NGL Prices Significantly Impact Our Business

Our financial condition, results of operations and the value of our properties are highly dependent on the general supply and demand for oil, gas and NGLs, which impact the prices we ultimately realize on our sales of these commodities. Historically, market prices and our realized prices have been volatile. For example, over the last five years, NYMEX WTI oil and NYMEX Henry Hub prices ranged from highs of over $75 per Bbl and $4.80 per MMBtu, respectively, to lows of under $27 per Bbl and $1.70 per MMBtu, respectively. Such volatility is likely to continue in the future due to numerous factors beyond our control, including, but not limited to:

|

|

• |

the domestic and worldwide supply of and demand for oil, gas and NGLs; |

|

|

• |

volatility and trading patterns in the commodity-futures markets; |

|

|

• |

conservation and environmental protection efforts; |

|

|

• |

production levels of members of OPEC, Russia, the U.S. or other producing countries; |

|

|

• |

geopolitical risks, including political and civil unrest in the Middle East, Africa and South America; |

13

|

|

• |

adverse weather conditions, natural disasters, public health crises and other catastrophic events, such as tornadoes, earthquakes, hurricanes and epidemics of infectious diseases; |

|

|

• |

regional pricing differentials, including in the Delaware Basin and other areas of our operations; |

|

|

• |

differing quality of production, including NGL content of gas produced; |

|

|

• |

the level of imports and exports of oil, gas and NGLs and the level of global oil, gas and NGL inventories; |

|

|

• |

the price and availability of alternative energy sources; |

|

|

• |

technological advances affecting energy consumption and production, including with respect to electric vehicles; |

|

|

• |

stockholder activism or activities by non-governmental organizations to restrict the exploration and production of oil and natural gas in order to reduce greenhouse gas emissions; |

|

|

• |

the overall economic environment; |

|

|

• |

changes in trade relations and policies, including the imposition of tariffs by the U.S. or China; and |

|

|

• |

other governmental regulations and taxes. |

Estimates of Oil, Gas and NGL Reserves Are Uncertain and May Be Subject to Revision

The process of estimating oil, gas and NGL reserves is complex and requires significant judgment in the evaluation of available geological, engineering and economic data for each reservoir, particularly for new discoveries. Because of the high degree of judgment involved, different reserve engineers may develop different estimates of reserve quantities and related revenue based on the same data. In addition, the reserve estimates for a given reservoir may change substantially over time as a result of several factors, including additional development and appraisal activity, the viability of production under varying economic conditions, including commodity price declines, and variations in production levels and associated costs. Consequently, material revisions to existing reserves estimates may occur as a result of changes in any of these factors. Such revisions to proved reserves could have an adverse effect on our financial condition and the value of our properties, as well as the estimates of our future net revenue and profitability. Our policies and internal controls related to estimating and recording reserves are included in “Items 1 and 2. Business and Properties” of this report.

Discoveries or Acquisitions of Reserves Are Needed to Avoid a Material Decline in Reserves and Production

The production rates from oil and gas properties generally decline as reserves are depleted, while related per unit production costs generally increase due to decreasing reservoir pressures and other factors. Moreover, our current development activity is focused on unconventional oil and gas assets, which generally have significantly higher decline rates as compared to conventional assets. Therefore, our estimated proved reserves and future oil, gas and NGL production will decline materially as reserves are produced unless we conduct successful exploration and development activities, such as identifying additional producing zones in existing wells, utilizing secondary or tertiary recovery techniques or acquiring additional properties containing proved reserves. Consequently, our future oil, gas and NGL production and related per unit production costs are highly dependent upon our level of success in finding or acquiring additional reserves.

14

Our Operations Are Uncertain and Involve Substantial Costs and Risks

Our operating activities are subject to numerous costs and risks, including the risk that we will not encounter commercially productive oil or gas reservoirs. Drilling for oil, gas and NGLs can be unprofitable, not only from dry holes, but from productive wells that do not return a profit because of insufficient revenue from production or high costs. Substantial costs are required to locate, acquire and develop oil and gas properties, and we are often uncertain as to the amount and timing of those costs. Our cost of drilling, completing, equipping and operating wells is often uncertain before drilling commences. Declines in commodity prices and overruns in budgeted expenditures are common risks that can make a particular project uneconomic or less economic than forecasted. While both exploratory and developmental drilling activities involve these risks, exploratory drilling involves greater risks of dry holes or failure to find commercial quantities of hydrocarbons. In addition, our oil and gas properties can become damaged, our operations may be curtailed, delayed or canceled and the costs of such operations may increase as a result of a variety of factors, including, but not limited to:

|

|

• |

unexpected drilling conditions, pressure conditions or irregularities in reservoir formations; |

|

|

• |

equipment failures or accidents; |

|

|

• |

fires, explosions, blowouts, cratering or loss of well control, as well as the mishandling or underground migration of fluids and chemicals; |

|

|

• |

adverse weather conditions and natural disasters, such as tornadoes, earthquakes, hurricanes and extreme temperatures; |

|

|

• |

issues with title or in receiving governmental permits or approvals; |

|

|

• |

restricted takeaway capacity for our production, including due to inadequate midstream infrastructure or constrained downstream markets; |

|

|

• |

environmental hazards or liabilities; |

|

|

• |

restrictions in access to, or disposal of, water used or produced in drilling and completion operations; and |

|

|

• |

shortages or delays in the availability of services or delivery of equipment. |

The occurrence of one or more of these factors could result in a partial or total loss of our investment in a particular property, as well as significant liabilities. Moreover, certain of these events could result in environmental pollution and impact to third parties, including persons living in proximity to our operations, our employees and employees of our contractors, leading to possible injuries, death or significant damage to property and natural resources. For example, we have from time to time experienced well-control events that have resulted in various remediation and clean-up costs and certain of the other impacts described above.

In addition, we rely on our employees, consultants and sub-contractors to conduct our operations in compliance with applicable laws and standards. Any violation of such laws or standards by these individuals, whether through negligence, harassment, discrimination or other misconduct, could result in significant liability for us and adversely affect our business. For example, negligent operations by employees could result in serious injury, death or property damage, and sexual harassment or racial and gender discrimination could result in legal claims and reputational harm.

We Are Subject to Extensive Governmental Regulation, Which Can Change and Could Adversely Impact Our Business

Our operations are subject to extensive federal, state, local and other laws, rules and regulations, including with respect to environmental matters, worker health and safety, wildlife conservation, the gathering and transportation of oil, gas and NGLs, conservation policies, reporting obligations, royalty payments, unclaimed property and the imposition of taxes. Such regulations include requirements for permits to drill and to conduct other operations and for provision of financial assurances (such as bonds) covering drilling, completion and well operations and decommissioning obligations. If permits are not issued, or if unfavorable restrictions or conditions are imposed on our drilling or completion activities, we may not be able to conduct our operations as planned. In addition, we may be required to make large expenditures to comply with applicable governmental laws, rules, regulations, permits or orders. For example, certain regulations require the plugging and abandonment of wells and removal of production facilities by current and former operators, including corporate successors of former operators. These requirements may result in significant costs associated with the removal of tangible equipment and other restorative actions.

In addition, changes in public policy have affected, and in the future could further affect, our operations. Regulatory and public policy developments could, among other things, restrict production levels, impose price controls, change environmental protection requirements and increase taxes, royalties and other amounts payable to governments or governmental agencies. Our operating and

15

other compliance costs could increase further if existing laws and regulations are revised or reinterpreted, or if new laws and regulations become applicable to our operations. In addition, changes in public policy may indirectly impact our operations by, among other things, increasing the cost of supplies and equipment and fostering general economic uncertainty. For example, changes in U.S. trade relations, particularly the imposition of tariffs by the U.S. and China, may increase the cost of materials we or our vendors use, thereby increasing our operating expense. Although we are unable to predict changes to existing laws and regulations, such changes could significantly impact our profitability, financial condition and liquidity, particularly changes related to hydraulic fracturing, environmental matters more generally, seismic activity and income taxes, as discussed below.

Hydraulic Fracturing – In recent years, various federal agencies have asserted regulatory authority over certain aspects of the hydraulic fracturing process. For example, the EPA has issued regulations under the federal Clean Air Act establishing performance standards for oil and gas activities, including standards for the capture of air emissions released during hydraulic fracturing, and it finalized in 2016 regulations that prohibit the discharge of wastewater from hydraulic fracturing operations to publicly owned wastewater treatment plants. The EPA also released a report in 2016 finding that certain aspects of hydraulic fracturing, such as water withdrawals and wastewater management practices, could result in impacts to water resources. The BLM previously finalized regulations to regulate hydraulic fracturing on federal lands but subsequently issued a repeal of those regulations in 2017. Moreover, several states in which we operate have adopted, or stated intentions to adopt, laws or regulations that mandate further restrictions on hydraulic fracturing, such as requiring disclosure of chemicals used in hydraulic fracturing, imposing more stringent permitting, disclosure and well-construction requirements on hydraulic fracturing operations and establishing standards for the capture of air emissions released during hydraulic fracturing. In addition to state laws, local land use restrictions, such as city ordinances, may restrict drilling in general or hydraulic fracturing in particular.

Beyond these regulatory efforts, various policy makers, regulatory agencies and political candidates at the federal, state and local levels have proposed implementing even further restrictions on hydraulic fracturing, including prohibiting the technology outright. For example, certain candidates running to be elected President of the United States in 2020 have pledged to impose a ban on hydraulic fracturing. It is possible that any such restrictions may particularly target industry activity on federal lands, which could adversely impact our operations in the Delaware and Powder River Basins, as well as other areas where we operate under federal leases. As of December 31, 2019, approximately 20% of our total leasehold resides on federal lands, and approximately 40% and 60% of our leasehold in the Delaware and Powder River Basins, respectively, resides on federal lands. Although it is not possible at this time to predict the outcome of these or other proposals, any new restrictions on hydraulic fracturing that may be imposed in areas in which we conduct business could potentially result in increased compliance costs, delays or cessation in development or other restrictions on our operations.

Environmental Laws Generally – In addition to regulatory efforts focused on hydraulic fracturing, we are subject to various other federal, state and local laws and regulations relating to discharge of materials into, and protection of, the environment. These laws and regulations may, among other things, impose liability on us for the cost of remediating pollution that results from our operations. Environmental laws may impose strict, joint and several liability, and failure to comply with environmental laws and regulations can result in the imposition of administrative, civil or criminal fines and penalties, as well as injunctions limiting operations in affected areas. Any future environmental costs of fulfilling our commitments to the environment are uncertain and will be governed by several factors, including future changes to regulatory requirements. Any such changes could have a significant impact on our operations and profitability.

Seismic Activity – Earthquakes in northern and central Oklahoma and elsewhere have prompted concerns about seismic activity and possible relationships with the oil and gas industry. Legislative and regulatory initiatives intended to address these concerns may result in additional levels of regulation or other requirements that could lead to operational delays, increase our operating and compliance costs or otherwise adversely affect our operations. In addition, we are currently defending against certain third-party lawsuits and could be subject to additional claims, seeking alleged property damages or other remedies as a result of alleged induced seismic activity in our areas of operation.

Changes to Tax Laws – We are subject to U.S. federal income tax as well as income or capital taxes in various state and foreign jurisdictions, and our operating cash flow is sensitive to the amount of income taxes we must pay. In the jurisdictions in which we operate, income taxes are assessed on our earnings after consideration of all allowable deductions and credits. Changes in the types of earnings that are subject to income tax, the types of costs that are considered allowable deductions or the rates assessed on our taxable earnings would all impact our income taxes and resulting operating cash flow.

16

Concerns About Climate Change and Related Regulatory, Social and Market Actions May Adversely Affect Our Business

Continuing and increasing political and social attention to the issue of climate change has resulted in legislative, regulatory and other initiatives, including international agreements, to reduce greenhouse gas emissions, such as carbon dioxide and methane. Policy makers at both the U.S. federal and state levels have introduced legislation and proposed new regulations designed to quantify and limit the emission of greenhouse gases. For example, both the EPA and the BLM have issued regulations for the control of methane emissions, which also include leak detection and repair requirements, for the oil and gas industry. Following the change in presidential administrations, however, the agencies have attempted to revise or rescind their previously issued methane standards. Litigation concerning these methane regulations and subsequent attempts to revise or rescind them is ongoing. Nevertheless, several states where we operate, including Wyoming and New Mexico, have already imposed, or stated intentions to impose, laws or regulations designed to reduce methane emissions from oil and gas exploration and production activities. With respect to more comprehensive regulation, policy makers and political candidates have made, or expressed support for, a variety of proposals, such as the development of cap-and-trade or carbon tax programs, as well as the more sweeping “green new deal” resolutions introduced in Congress in early 2019. As generally proposed, a cap-and-trade program would cap overall greenhouse gas emissions on an economy-wide basis and require major sources of greenhouse gas emissions or major fuel producers to acquire and surrender emission allowances, while a carbon tax could impose taxes based on emissions from our operations and downstream uses of our products. The “green new deal” resolutions call for a 10-year national mobilization effort to, among other things, transition 100% of power demand in the U.S. to zero-emission sources and overhaul transportation systems in the U.S. to remove greenhouse gas emissions as much as is technologically feasible.

In addition to regulatory risk, other market and social initiatives resulting from the changing perception of climate change present risks for our business. For example, in an effort to promote a lower-carbon economy, there are various public and private initiatives subsidizing the development and adoption of alternative energy sources and technologies, including by mandating the use of specific fuels or technologies. These initiatives may reduce the competitiveness of carbon-based fuels, such as oil and gas. Moreover, certain financial institutions, funds and other sources of capital have begun restricting or eliminating their investment in oil and natural gas activities due to their concern regarding climate change. Such restrictions in capital could decrease the value of our business and make it more difficult to fund our operations. Finally, governmental entities and other plaintiffs have brought, and may continue to bring, claims against us and other oil and gas companies for purported damages caused by the alleged effects of climate change. These and the other regulatory, social and market risks relating to climate change described above could result in unexpected costs, increase our operating expense and reduce the demand for our products, which in turn could lower the value of our reserves and have an adverse effect on our profitability, financial condition and liquidity.

Our Hedging Activities Limit Participation in Commodity Price Increases and Involve Other Risks

We enter into financial derivative instruments with respect to a portion of our production to manage our exposure to oil, gas and NGL price volatility. To the extent that we engage in price risk management activities to protect ourselves from commodity price declines, we will be prevented from fully realizing the benefits of commodity price increases above the prices established by our hedging contracts. In addition, our hedging arrangements may expose us to the risk of financial loss in certain circumstances, including instances in which the contract counterparties fail to perform under the contracts. Moreover, as a result of the Dodd-Frank Wall Street Reform and Consumer Protection Act and other legislation and regulation, hedging transactions and many of our contract counterparties have become subject to increased governmental oversight and regulations in recent years. Although we cannot predict the ultimate impact of these laws and the related rulemaking, some of which is ongoing, existing or future regulations may adversely affect the cost and availability of our hedging arrangements.

The Credit Risk of Our Counterparties Could Adversely Affect Us

We enter into a variety of transactions that expose us to counterparty credit risk. For example, we have exposure to financial institutions and insurance companies through our hedging arrangements, our syndicated revolving credit facility and our insurance policies. Disruptions in the financial markets or otherwise may impact these counterparties and affect their ability to fulfill their existing obligations and their willingness to enter into future transactions with us.

In addition, we are exposed to the risk of financial loss from trade, joint interest billing and other receivables. We sell our oil, gas and NGLs to a variety of purchasers, and, as an operator, we pay expenses and bill our non-operating partners for their respective share of costs. We also frequently look to buyers of oil and gas properties from us or our predecessors to perform certain obligations associated with the disposed assets, including the removal of production facilities and plugging and abandonment of wells. Certain of these counterparties or their successors may experience insolvency, liquidity problems or other issues and may not be able to meet their obligations and liabilities (including contingent liabilities) owed to, and assumed from, us, particularly during a depressed or volatile commodity price environment. Any such default may result in us being forced to cover the costs of those obligations and liabilities, which could adversely impact our financial results and condition.

17

Our Debt May Limit Our Liquidity and Financial Flexibility, and Any Downgrade of Our Credit Rating Could Adversely Impact Us

As of December 31, 2019, we had total indebtedness of $4.3 billion. Our indebtedness and other financial commitments have important consequences to our business, including, but not limited to:

|

|

• |

requiring us to dedicate a portion of our cash flows from operations to debt service payments, thereby limiting our ability to fund working capital, capital expenditures, investments or acquisitions and other general corporate purposes; |

|

|

• |

increasing our vulnerability to general adverse economic and industry conditions, including low commodity price environments; and |

|

|

• |

limiting our ability to obtain additional financing due to higher costs and more restrictive covenants. |

In addition, we receive credit ratings from rating agencies in the U.S. with respect to our debt. Factors that may impact our credit ratings include, among others, debt levels, planned asset sales and purchases, liquidity, forecasted production growth and commodity prices. We are currently required to provide letters of credit or other assurances under certain of our contractual arrangements. Any credit downgrades could adversely impact our ability to access financing and trade credit, require us to provide additional letters of credit or other assurances under contractual arrangements and increase our interest rate under any credit facility borrowing as well as the cost of any other future debt.

Cyber Attacks May Adversely Impact Our Operations

Our business has become increasingly dependent on digital technologies, and we anticipate expanding the use of technology in our operations, including through artificial intelligence, process automation and data analytics. Concurrent with this growing dependence on technology is greater sensitivity to cyber attack related activities, which have frequently targeted our industry. Cyber attackers often attempt to gain unauthorized access to digital systems for purposes of misappropriating sensitive information, intellectual property or financial assets, corrupting data or causing operational disruptions as well as to prevent users from accessing systems or information and demand payment in order to regain access. These attacks may be perpetrated by third parties or insiders. Techniques used in these attacks often range from highly sophisticated efforts to electronically circumvent network security to more traditional intelligence gathering and social engineering aimed at obtaining information necessary to gain access. Cyber attacks may also be performed in a manner that does not require gaining unauthorized access, such as by causing denial-of-service attacks. In addition, our vendors, midstream providers and other business partners may separately suffer disruptions or breaches from cyber attacks, which, in turn, could adversely impact our operations and compromise our information. Although we have not suffered material losses related to cyber attacks to date, if we were successfully attacked, we could incur substantial remediation and other costs or suffer other negative consequences, including litigation risks. Moreover, as the sophistication of cyber attacks continues to evolve, we may be required to expend significant additional resources to further enhance our digital security or to remediate vulnerabilities.

We Have Limited Control Over Properties Operated by Others

Certain of the properties in which we have an interest are operated by other companies and involve third-party working interest owners. We have limited influence and control over the operation or future development of such properties, including compliance with environmental, health and safety regulations or the amount and timing of required future capital expenditures. These limitations and our dependence on the operator and other working interest owners for these properties could result in unexpected future costs and delays, curtailments or cancellations of operations or future development, which could adversely affect our financial condition and results of operations.

18

Midstream Capacity Constraints and Interruptions Impact Commodity Sales

We rely on midstream facilities and systems owned and operated by others to process our gas production and to transport our oil, gas and NGL production to downstream markets. All or a portion of our production in one or more regions may be interrupted or shut in from time to time due to losing access to plants, pipelines or gathering systems. Such access could be lost due to a number of factors, including, but not limited to, weather conditions and natural disasters, accidents, field labor issues or strikes. Additionally, the midstream operators may be subject to constraints that limit their ability to construct, maintain or repair midstream facilities needed to process and transport our production. Such interruptions or constraints could negatively impact our production and associated profitability.

Insurance Does Not Cover All Risks

As discussed above, our business is hazardous and is subject to all of the operating risks normally associated with the exploration, development and production of oil, gas and NGLs. To mitigate financial losses resulting from these operational hazards, we maintain comprehensive general liability insurance, as well as insurance coverage against certain losses resulting from physical damages, loss of well control, business interruption and pollution events that are considered sudden and accidental. We also maintain workers’ compensation and employer’s liability insurance. However, our insurance coverage does not provide 100% reimbursement of potential losses resulting from these operational hazards. Additionally, we have limited or no insurance coverage for a variety of other risks, including pollution events that are considered gradual, war and political risks and fines or penalties assessed by governmental authorities. The occurrence of a significant event against which we are not fully insured could have an adverse effect on our profitability, financial condition and liquidity.

Competition for Assets, Materials, People and Capital Can Be Significant

Strong competition exists in all sectors of the oil and gas industry. We compete with major integrated and independent oil and gas companies for the acquisition of oil and gas leases and properties. We also compete for the equipment and personnel required to explore, develop and operate properties. Typically, during times of rising commodity prices, drilling and operating costs will also increase. During these periods, there is often a shortage of drilling rigs and other oilfield services, which could adversely affect our ability to execute our development plans on a timely basis and within budget. Competition is also prevalent in the marketing of oil, gas and NGLs. Certain of our competitors have financial and other resources substantially greater than ours and may have established superior strategic long-term positions and relationships, including with respect to midstream take-away capacity. As a consequence, we may be at a competitive disadvantage in bidding for assets or services and accessing capital and downstream markets. In addition, many of our larger competitors may have a competitive advantage when responding to factors that affect demand for oil and gas production, such as changing worldwide price and production levels, the cost and availability of alternative energy sources and the application of government regulations.

Our Business Could Be Adversely Impacted by Investors Attempting to Effect Change

Stockholder activism has been increasing in our industry, and investors may from time to time attempt to effect changes to our business or governance, whether by stockholder proposals, public campaigns, proxy solicitations or otherwise. Such actions could adversely impact our business by distracting our board of directors and employees from core business operations, requiring us to incur increased advisory fees and related costs, interfering with our ability to successfully execute on strategic transactions and plans and provoking perceived uncertainty about the future direction of our business. Such perceived uncertainty may, in turn, make it more difficult to retain employees and could result in significant fluctuation in the market price of our common stock.

Our Acquisition and Divestiture Activities Involve Substantial Risks

Our business depends, in part, on making acquisitions that complement or expand our current business and successfully integrating any acquired assets or businesses. If we are unable to make attractive acquisitions, our future growth could be limited. Furthermore, even if we do make acquisitions, they may not result in an increase in our cash flow from operations or otherwise result in the benefits anticipated due to various risks, including, but not limited to:

|

|

• |

mistaken estimates or assumptions about reserves, potential drilling locations, revenues and costs, including synergies and the overall costs of equity or debt; |

|

|

• |

difficulties in integrating the operations, technologies, products and personnel of the acquired assets or business; and |

19

|

|

• |

unknown and unforeseen liabilities or other issues related to any acquisition for which contractual protections prove inadequate, including environmental liabilities and title defects. |

In addition, from time to time, we may sell or otherwise dispose of certain of our properties or businesses as a result of an evaluation of our asset portfolio and to help enhance our liquidity. These transactions also have inherent risks, including possible delays in closing, the risk of lower-than-expected sales proceeds for the disposed assets or business and potential post-closing claims for indemnification. Moreover, volatility in commodity prices may result in fewer potential bidders, unsuccessful sales efforts and a higher risk that buyers may seek to terminate a transaction prior to closing.

Item 1B. Unresolved Staff Comments

Not applicable.

Item 3. Legal Proceedings

We are involved in various legal proceedings incidental to our business. However, to our knowledge as of the date of this report, there were no material pending legal proceedings to which we are a party or to which any of our property is subject.

On April 4, 2019, Devon Energy Production Company, L.P., a wholly-owned subsidiary of the Company (“DEPCO”), agreed to settle its previously disclosed negotiations with the EPA relating to certain alleged Clean Air Act violations at its Beaver Creek Gas Plant located near Riverton, Wyoming by executing an agreed order with the EPA. The order included a penalty of $150,000 and was approved by the regional EPA judicial officer on June 12, 2019. Moreover, in connection with the resolution of this matter with the EPA, DEPCO entered into a consent decree on May 9, 2019 with respect to the same matter with the Wyoming Department of Environmental Quality, which also included a separate penalty of $150,000.