Table of Contents

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended December 31, 2012 |

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number 001-32318

DEVON ENERGY CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware | 73-1567067 | |

| (State of other jurisdiction of incorporation or organization) | (I.R.S. Employer identification No.) | |

| 333 West Sheridan Avenue, Oklahoma City, Oklahoma | 73102-5015 | |

| (Address of principal executive offices) | (Zip code) | |

Registrant’s telephone number, including area code:

(405) 235-3611

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common stock, par value $0.10 per share |

The New York Stock Exchange | |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer x Accelerated filer ¨ Non-accelerated filer ¨ Smaller reporting company ¨

(Do not check if a smaller reporting company)

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the voting common stock held by non-affiliates of the registrant as of June 29, 2012, was approximately $23.3 billion, based upon the closing price of $57.99 per share as reported by the New York Stock Exchange on such date. On February 6, 2013, 406.0 million shares of common stock were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Proxy statement for the 2013 annual meeting of stockholders — Part III

Table of Contents

FORM 10-K

TABLE OF CONTENTS

| PART I | ||||

| 3 | ||||

| 15 | ||||

| 19 | ||||

| 19 | ||||

| 19 | ||||

| PART II | ||||

| 20 | ||||

| 22 | ||||

| Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations |

23 | |||

| Item 7A. Quantitative and Qualitative Disclosures about Market Risk |

44 | |||

| 46 | ||||

| Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

102 | |||

| 102 | ||||

| 102 | ||||

| PART III | ||||

| Item 10. Directors, Executive Officers and Corporate Governance |

103 | |||

| 103 | ||||

| 103 | ||||

| Item 13. Certain Relationships and Related Transactions, and Director Independence |

103 | |||

| 103 | ||||

| PART IV | ||||

| 104 | ||||

| 109 | ||||

INFORMATION REGARDING FORWARD-LOOKING STATEMENTS

This report includes forward-looking statements regarding our expectations and plans, as well as future events or conditions. Such forward-looking statements are based on our examination of historical operating trends, the information used to prepare our December 31, 2012 reserve reports and other data in our possession or available from third parties. Such statements are subject to a number of assumptions, risks and uncertainties, many of which are beyond our control. Consequently, actual future results could differ materially from our expectations due to a number of factors, such as changes in the supply of and demand for oil, natural gas and natural gas liquids (“NGLs”) and related products and services; exploration or drilling programs; political or regulatory events; general economic and financial market conditions; and other factors discussed in this report.

All subsequent written and oral forward-looking statements attributable to Devon, or persons acting on its behalf, are expressly qualified in their entirety by the cautionary statements above. We assume no duty to update or revise our forward-looking statements based on new information, future events or otherwise.

2

Table of Contents

PART I

Items 1 and 2. Business and Properties

General

Devon Energy Corporation (“Devon”) is a leading independent energy company engaged primarily in the exploration, development and production of oil, natural gas and NGLs. Our operations are concentrated in various North American onshore areas in the U.S. and Canada. We also own natural gas pipelines, plants and treatment facilities in many of our producing areas, making us one of North America’s larger processors of natural gas.

Devon pioneered the commercial development of natural gas from shale and coalbed formations, and we are a proven leader in using steam to produce bitumen from the Canadian oil sands. A Delaware corporation formed in 1971, we have been publicly held since 1988, and our common stock is listed on the New York Stock Exchange. Our principal and administrative offices are located at 333 West Sheridan, Oklahoma City, OK 73102-5015 (telephone 405/235-3611). As of December 31, 2012, we had approximately 5,700 employees.

Devon files or furnishes annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K as well as any amendments to these reports with the U.S. Securities and Exchange Commission (“SEC”). Through our website, http://www.devonenergy.com, we make available electronic copies of the documents we file or furnish to the SEC, the charters of the committees of our Board of Directors and other documents related to our corporate governance (including our Code of Ethics for the Chief Executive Officer, Chief Financial Officer and Chief Accounting Officer). Access to these electronic filings is available free of charge as soon as reasonably practicable after filing or furnishing them to the SEC. Printed copies of our committee charters or other governance documents and filings can be requested by writing to our corporate secretary at the address on the cover of this report.

In addition, the public may read and copy any materials Devon files with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Washington D.C. 20549. The public may also obtain information about the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. Reports filed with the SEC are also made available on its website at www.sec.gov.

Strategy

We strive to maximize long-term value for our shareholders by delivering strong full-cycle margins on our assets and top-quartile per share returns. In pursuit of this objective, we focus on growing cash flow per share, adjusted for debt, which has the greatest long-term correlation to share price appreciation in our industry. We also focus on growth in earnings, production and reserves, all on a per debt-adjusted share basis. We do this by:

| • | exercising capital allocation and investment discipline; |

| • | focusing on high-return projects; |

| • | maintaining a low cost structure; |

| • | preserving financial strength and flexibility; and |

| • | balancing our production and resource mix between oil, natural gas and NGLs. |

We hold 14 million net acres, of which roughly two-thirds are undeveloped, providing us with a platform for future growth. An important factor in determining the direction of our growth strategy, particularly our capital allocation, is the current and forecasted pricing applicable to our production. Our industry had been operating in an environment that had involved depressed North American gas prices contrasted with more robust prices for oil and NGLs. Consequently, with a production profile that is approximately 60% gas, we have focused our recent capital programs on higher-margin, liquids-based resource capture and development. With recent changes in market conditions that have led to challenged prices for NGLs and Canadian heavy oil, we are refining our capital allocations as needed and evaluating other investment opportunities to maximize and accelerate growth in cash flow per debt-adjusted share.

3

Table of Contents

Oil and Gas Properties

Property Profiles

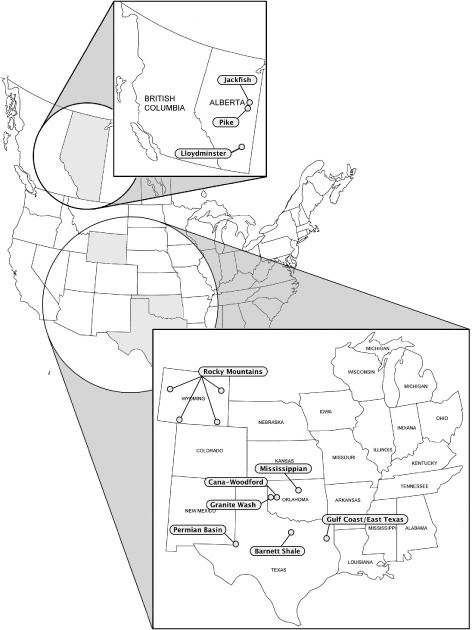

The locations of our key properties are presented on the following map. These properties include those that currently have significant proved reserves and production, as well as properties that do not currently have significant levels of proved reserves or production but are expected to be the source of significant future growth in proved reserves and production.

4

Table of Contents

The following table outlines a summary of key data in each of our operating areas for 2012. Notes 21 and 22 to the financial statements included in “Item 8. Financial Statements and Supplementary Data” of this report contain additional information on our segments and geographical areas. In the following table and throughout this report, we convert our proved reserves and production to Boe. Gas proved reserves and production are converted to Boe at the rate of six Mcf of gas per Bbl of oil, based upon the approximate relative energy content of gas and oil. Bitumen and NGL proved reserves and production are converted to Boe on a one-to-one basis with oil.

| Proved Reserves | Production | |||||||||||||||||||||||||||||||

| MMBoe | % of Total |

% Liquids | MBoe/d | % of Total |

% Liquids |

Total Net Acres |

Gross Wells Drilled |

|||||||||||||||||||||||||

| (In thousands) | ||||||||||||||||||||||||||||||||

| U.S. |

||||||||||||||||||||||||||||||||

| Barnett Shale |

1,058 | 35.7 | % | 23.7 | % | 227.5 | 33.3 | % | 21.3 | % | 620 | 322 | ||||||||||||||||||||

| Cana-Woodford Shale |

427 | 14.4 | % | 41.4 | % | 48.3 | 7.1 | % | 30.0 | % | 260 | 164 | ||||||||||||||||||||

| Permian Basin |

227 | 7.6 | % | 79.6 | % | 61.6 | 9.0 | % | 77.1 | % | 1,530 | 241 | ||||||||||||||||||||

| Gulf Coast/East Texas |

221 | 7.5 | % | 25.0 | % | 61.3 | 9.0 | % | 23.7 | % | 1,660 | 50 | ||||||||||||||||||||

| Rocky Mountains |

157 | 5.3 | % | 37.1 | % | 58.7 | 8.6 | % | 28.1 | % | 1,165 | 16 | ||||||||||||||||||||

| Granite Wash |

51 | 1.7 | % | 41.0 | % | 18.7 | 2.7 | % | 45.5 | % | 65 | 48 | ||||||||||||||||||||

| Mississippian |

6 | 0.2 | % | 61.5 | % | 1.0 | 0.2 | % | 76.8 | % | 545 | 35 | ||||||||||||||||||||

| Other |

89 | 3.1 | % | 32.6 | % | 22.5 | 3.3 | % | 29.2 | % | 1,155 | 71 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Total U.S. |

2,236 | 75.5 | % | 34.7 | % | 499.7 | 73.2 | % | 31.5 | % | 7,000 | 947 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Canada |

||||||||||||||||||||||||||||||||

| Canadian Oil Sands |

528 | 17.8 | % | 100.0 | % | 47.6 | 7.0 | % | 100.0 | % | 90 | 16 | ||||||||||||||||||||

| Lloydminster |

38 | 1.3 | % | 86.9 | % | 37.0 | 5.4 | % | 82.5 | % | 2,740 | 173 | ||||||||||||||||||||

| Other |

161 | 5.4 | % | 32.4 | % | 98.0 | 14.4 | % | 20.2 | % | 4,245 | 72 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Total Canada |

727 | 24.5 | % | 84.3 | % | 182.6 | 26.8 | % | 53.6 | % | 7,075 | 261 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Devon |

2,963 | 100.0 | % | 46.9 | % | 682.3 | 100.0 | % | 37.4 | % | 14,075 | 1,208 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

U.S.

Barnett Shale — This is our largest property both in terms of production and proved reserves. Our leases are located primarily in Denton, Johnson, Parker, Tarrant and Wise counties in north Texas. The Barnett Shale is a non-conventional reservoir, producing natural gas, NGLs and condensate.

We are the largest producer in the Barnett Shale. Since acquiring a substantial position in this field in 2002, we continue to introduce technology and new innovations to enhance production and have transformed this into one of the top producing gas fields in North America. We have drilled in excess of 5,000 wells in the Barnett Shale since 2002, yet we still have several thousand remaining drilling locations. In 2013, we plan to drill approximately 150 wells, focused in the areas with the highest liquids content.

In addition, we have a significant processing plant and gathering system in north Texas to service these properties. Our Bridgeport plant is one of the largest processing plants in the U.S., currently with 650 MMcf per day of total capacity, and an additional 140 MMcf expansion expected in 2013 to accommodate increasing demand from our liquids-rich drilling. These midstream assets also include an extensive pipeline system and a 15 MBbls per day NGL fractionator.

Cana-Woodford Shale — Our acreage is located primarily in Oklahoma’s Canadian, Blaine, Caddo and Dewey counties. The Cana-Woodford Shale is a non-conventional reservoir and produces natural gas, NGLs and condensate.

5

Table of Contents

The Cana-Woodford Shale is a leading growth area for us and has rapidly emerged as one of the most economic shale plays in North America. We are the largest leaseholder and the largest producer in the Cana-Woodford Shale. During 2012, we increased our production by 45 percent. We have several thousand remaining drilling locations. In 2013, we plan to drill approximately 150 wells.

In addition, we have a significant processing plant and gathering system to service these properties. Our Cana plant currently has 200 MMcf per day of total capacity, and an additional 150 MMcf expansion expected in 2013 to accommodate increasing demand from our liquids-rich drilling.

Permian Basin — Our acreage is located in various counties in west Texas and southeast New Mexico. These properties have been a legacy asset for us and continue to offer both exploration and low-risk development opportunities. We entered into a joint venture arrangement with Sumitomo in 2012, covering approximately 650,000 net acres in the Cline Shale and Midland-Wolfcamp Shale and further strengthening the capital efficiency of our exploration programs. In addition to the Cline and Wolfcamp Shale activity, our current drilling activity continues to target conventional and non-conventional oil and liquids-rich gas targets within the Conventional Delaware, Bone Spring, Midland-Wolfcamp, Wolfberry and Avalon Shale plays. In 2013, we plan to drill approximately 300 wells.

Gulf Coast/East Texas— Our acreage is located primarily in Harrison, Marion, Panola and Shelby counties in the Carthage/Groesbeck areas of east Texas. These wells produce natural gas and NGLs from conventional reservoirs. In 2013, we plan to drill approximately 10 wells, focused in the areas with the highest liquids content.

Rocky Mountains— These leases are primarily concentrated in the Washakie area in Wyoming’s Carbon and Sweetwater counties. The Washakie wells produce natural gas and NGLs from conventional reservoirs. Targeting the Almond and Lewis formations, we have been among the most active drillers in the Washakie area for many years. In 2013, we plan to drill approximately 25 wells, focused in the areas with the highest liquids content.

In recent years we also have acquired a significant acreage position in the DJ Basin. This acquired acreage, along with our legacy Powder River Basin acreage, primarily targets oil in the Niobrara formation. These acres are principally located in eastern Wyoming and are being explored using 3D seismic to identify appropriate drilling zones. Furthermore, in early 2012, we entered into a joint venture arrangement with Sinopec to explore and develop the Niobrara and other new venture properties.

Granite Wash — Our acreage is concentrated in the Texas Panhandle and western Oklahoma. These properties produce liquids and natural gas from conventional reservoirs. Our legacy land position in the Granite Wash is held by production and provides some of the best economics in our portfolio. High initial production rates and strong liquids yields contribute to the superior full-cycle rates of return. In 2013, we plan to drill approximately 50 wells.

Mississippian — These properties represent some of our newest assets, with most of our position acquired since 2011. Located in northern Oklahoma and southern Kansas, these acres target oil in the Mississippian Lime and Woodford Shale and are being explored and developed under our joint venture arrangement with Sinopec and independently by us on the acreage outside of our area of mutual interest with Sinopec. In 2013, we plan to drill approximately 400 wells.

Canada

Canadian Oil Sands — We are the first and only U.S.-based independent energy company to develop and operate a bitumen oil sands project in Canada. We currently have two main projects, Jackfish and Pike, located in Alberta, Canada.

Jackfish is our thermal heavy oil project in the non-conventional oil sands of east central Alberta. We are employing steam-assisted gravity drainage at Jackfish. The first phase of Jackfish is fully operational with a

6

Table of Contents

gross facility capacity of 35 MBbls per day. Jackfish production increased 37 percent in 2012 as the second phase of Jackfish, which came on-line in the second quarter of 2011, continued to increase production. Construction of a third phase began in 2012 with plant startup expected by year-end 2014. We expect each phase to maintain a flat production profile for greater than 20 years at an average net production rate of approximately 25-30 MBbls per day.

Our Pike oil sands acreage is situated directly to the south of our Jackfish acreage in east central Alberta and has similar reservoir characteristics to Jackfish. The Pike leasehold is currently undeveloped and has no proved reserves or production as of December 31, 2012. We filed a regulatory application in 2012 for the first phase of this project, with gross capacity of 105 MBbls per day, in which we hold a 50 percent interest.

To facilitate the delivery of our heavy oil production, we have a 50 percent interest in the Access Pipeline transportation system in Canada. This pipeline system allows us to blend our Jackfish, and eventually our Pike, heavy oil production with condensate or other blend-stock and transport the combined product to the Edmonton area for sale. The Access Pipeline system is currently undergoing a capacity expansion that we anticipate will be completed in late 2014. This expansion, in which we have a 50% interest, is expected to create adequate capacity to transport our anticipated Jackfish and Pike heavy oil production to the Edmonton market hub. Additionally, it will increase the transport capacity of condensate diluent available at our thermal oil facilities.

Lloydminster — Our Lloydminster properties are located to the south and east of Jackfish in eastern Alberta and western Saskatchewan. Lloydminster produces heavy oil by conventional means, without the need for steam injection.

The region is well-developed with significant infrastructure and is primarily accessible year-round for drilling. Lloydminster is a low-risk, high margin oil development play. We have drilled approximately 2,500 wells in the area since 2003. In 2013, we plan to drill approximately 155 wells.

Proved Reserves

For estimates of our proved developed and proved undeveloped reserves and the discussion of the contribution by each key property, see Note 22 to the financial statements included in “Item 8. Financial Statements and Supplementary Data” of this report.

No estimates of our proved reserves have been filed with or included in reports to any federal or foreign governmental authority or agency since the beginning of 2012 except in filings with the SEC and the Department of Energy (“DOE”). Reserve estimates filed with the SEC correspond with the estimates of our reserves contained herein. Reserve estimates filed with the DOE are based upon the same underlying technical and economic assumptions as the estimates of our reserves included herein. However, the DOE requires reports to include the interests of all owners in wells that we operate and to exclude all interests in wells that we do not operate.

Proved oil and gas reserves are those quantities of oil and gas, which, by analysis of geoscience and engineering data, can be estimated with reasonable certainty to be economically producible from known reservoirs under existing economic conditions, operating methods and government regulations. To be considered proved, oil and gas reserves must be economically producible before contracts providing the right to operate expire, unless evidence indicates that renewal is reasonably certain. Also, the project to extract the hydrocarbons must have commenced or the operator must be reasonably certain that it will commence the project within a reasonable time.

The process of estimating oil, gas and NGL reserves is complex and requires significant judgment as discussed in “Item 1A. Risk Factors” of this report. As a result, we have developed internal policies for estimating and recording reserves. Such policies require proved reserves to be in compliance with the SEC

7

Table of Contents

definitions and guidance. Our policies assign responsibilities for compliance in reserves bookings to our Reserve Evaluation Group (the “Group”). These same policies also require that reserve estimates be made by professionally qualified reserves estimators (“Qualified Estimators”), as defined by the Society of Petroleum Engineers’ standards.

The Group, which is led by Devon’s Director of Reserves and Economics, is responsible for the internal review and certification of reserves estimates. We ensure the Group’s Director and key members of the Group have appropriate technical qualifications to oversee the preparation of reserves estimates, including any or all of the following:

| • | an undergraduate degree in petroleum engineering from an accredited university, or equivalent; |

| • | a petroleum engineering license, or similar certification; |

| • | memberships in oil and gas industry or trade groups; and |

| • | relevant experience estimating reserves. |

The current Director of the Group has all of the qualifications listed above. The current Director has been involved with reserves estimation in accordance with SEC definitions and guidance since 1987. He has experience in reserves estimation for projects in the U.S. (both onshore and offshore), as well as in Canada, Asia, the Middle East and South America. He has been employed by Devon for the past twelve years, including the past five in his current position. During his career, he has been responsible for reserves estimation as the primary reservoir engineer for projects including, but not limited to:

| • | Hugoton Gas Field (Kansas), |

| • | Sho-Vel-Tum CO2 Flood (Oklahoma), |

| • | West Loco Hills Unit Waterflood and CO2 Flood (New Mexico), |

| • | Dagger Draw Oil Field (New Mexico), |

| • | Clarke Lake Gas Field (Alberta, Canada), |

| • | Panyu 4-2 and 5-1 Joint Development (Offshore South China Sea), and |

| • | ACG Unit (Caspian Sea). |

From 2003 to 2010, he served as the reservoir engineering representative on our internal peer review team. In this role, he reviewed reserves and resource estimates for projects including, but not limited to, the Mobile Bay Norphlet Discoveries (Gulf of Mexico Shelf), Cascade Lower Tertiary Development (Gulf of Mexico Deepwater) and Polvo Development (Campos Basin, Brazil).

The Group reports independently of any of our operating divisions. The Group’s Director reports to our Vice President of Budget and Reserves, who reports to our Chief Financial Officer. No portion of the Group’s compensation is directly dependent on the quantity of reserves booked.

Throughout the year, the Group performs internal audits of each operating division’s reserves. Selection criteria of reserves that are audited include major fields and major additions and revisions to reserves. In addition, the Group reviews reserve estimates with each of the third-party petroleum consultants discussed below. The Group also ensures our Qualified Estimators obtain continuing education related to the fundamentals of SEC proved reserves assignments.

The Group also oversees audits and reserves estimates performed by third-party consulting firms. During 2012, we engaged two such firms to audit 92 percent of our proved reserves. LaRoche Petroleum Consultants, Ltd. audited 91 percent of our 2012 U.S. reserves, and Deloitte audited 93 percent of our Canadian reserves.

8

Table of Contents

“Audited” reserves are those quantities of reserves that were estimated by our employees and audited by an independent petroleum consultant. The Society of Petroleum Engineers’ definition of an audit is an examination of a company’s proved oil and gas reserves and net cash flow by an independent petroleum consultant that is conducted for the purpose of expressing an opinion as to whether such estimates, in aggregate, are reasonable and have been estimated and presented in conformity with generally accepted petroleum engineering and evaluation methods and procedures.

In addition to conducting these internal and external reviews, we also have a Reserves Committee that consists of three independent members of our Board of Directors. This committee provides additional oversight of our reserves estimation and certification process. The Reserves Committee assists the Board of Directors with its duties and responsibilities in evaluating and reporting our proved reserves, much like our Audit Committee assists the Board of Directors in supervising our audit and financial reporting requirements. Besides being independent, the members of our Reserves Committee also have educational backgrounds in geology or petroleum engineering, as well as experience relevant to the reserves estimation process.

The Reserves Committee meets a minimum of twice a year to discuss reserves issues and policies, and meets separately with our senior reserves engineering personnel and our independent petroleum consultants at those meetings. The responsibilities of the Reserves Committee include the following:

| • | approve the scope of and oversee an annual review and evaluation of our oil, gas and NGL reserves; |

| • | oversee the integrity of our reserves evaluation and reporting system; |

| • | oversee and evaluate our compliance with legal and regulatory requirements related to our reserves; |

| • | review the qualifications and independence of our independent engineering consultants; and |

| • | monitor the performance of our independent engineering consultants. |

Production, Production Prices and Production Costs

The following table presents production, price and cost information for each significant field, country and continent.

| Production | ||||||||||||||||||||

| Year Ended December 31, |

Oil (MMBbls) | Bitumen (MMBbls) | Gas (Bcf) | NGLs (MMBbls) | Total (MMBoe) | |||||||||||||||

| 2012 |

||||||||||||||||||||

| Barnett Shale |

1 | — | 393 | 17 | 83 | |||||||||||||||

| Jackfish |

— | 17 | — | — | 17 | |||||||||||||||

| U.S. |

21 | — | 752 | 36 | 183 | |||||||||||||||

| Canada |

15 | 17 | 186 | 4 | 67 | |||||||||||||||

| Total North America |

36 | 17 | 938 | 40 | 250 | |||||||||||||||

| 2011 |

||||||||||||||||||||

| Barnett Shale |

1 | — | 367 | 16 | 78 | |||||||||||||||

| Jackfish |

— | 13 | — | — | 13 | |||||||||||||||

| U.S. |

17 | — | 740 | 33 | 173 | |||||||||||||||

| Canada |

15 | 13 | 213 | 4 | 67 | |||||||||||||||

| Total North America |

32 | 13 | 953 | 37 | 240 | |||||||||||||||

| 2010 |

||||||||||||||||||||

| Barnett Shale |

1 | — | 335 | 13 | 70 | |||||||||||||||

| Jackfish |

— | 9 | — | — | 9 | |||||||||||||||

| U.S. |

16 | — | 716 | 28 | 163 | |||||||||||||||

| Canada |

16 | 9 | 214 | 4 | 65 | |||||||||||||||

| Total North America |

32 | 9 | 930 | 32 | 228 | |||||||||||||||

9

Table of Contents

| Average Sales Price | Production Cost (Per Boe) |

|||||||||||||||||||

| Year Ended December 31, |

Oil (Per Bbl) | Bitumen (Per Bbl) | Gas (Per Mcf) | NGLs (Per Bbl) | ||||||||||||||||

| 2012 |

||||||||||||||||||||

| Barnett Shale |

$ | 91.45 | $ | — | $ | 2.23 | $ | 27.57 | $ | 3.91 | ||||||||||

| Jackfish |

$ | — | $ | 47.75 | $ | — | $ | — | $ | 19.48 | ||||||||||

| U.S. |

$ | 88.68 | $ | — | $ | 2.32 | $ | 28.49 | $ | 5.79 | ||||||||||

| Canada |

$ | 68.08 | $ | 47.75 | $ | 2.49 | $ | 48.63 | $ | 15.18 | ||||||||||

| Total North America |

$ | 80.35 | $ | 47.75 | $ | 2.36 | $ | 30.42 | $ | 8.30 | ||||||||||

| 2011 |

||||||||||||||||||||

| Barnett Shale |

$ | 94.23 | $ | — | $ | 3.30 | $ | 39.00 | $ | 3.97 | ||||||||||

| Jackfish |

$ | — | $ | 58.16 | $ | — | $ | — | $ | 17.28 | ||||||||||

| U.S. |

$ | 91.19 | $ | — | $ | 3.50 | $ | 39.47 | $ | 5.35 | ||||||||||

| Canada |

$ | 74.32 | $ | 58.16 | $ | 3.87 | $ | 55.99 | $ | 13.82 | ||||||||||

| Total North America |

$ | 83.16 | $ | 58.16 | $ | 3.58 | $ | 41.10 | $ | 7.71 | ||||||||||

| 2010 |

||||||||||||||||||||

| Barnett Shale |

$ | 77.40 | $ | — | $ | 3.55 | $ | 29.97 | $ | 3.87 | ||||||||||

| Jackfish |

$ | — | $ | 52.51 | $ | — | $ | — | $ | 16.81 | ||||||||||

| U.S. |

$ | 75.81 | $ | — | $ | 3.76 | $ | 30.86 | $ | 5.47 | ||||||||||

| Canada |

$ | 62.00 | $ | 52.51 | $ | 4.11 | $ | 46.60 | $ | 12.37 | ||||||||||

| Total North America |

$ | 68.75 | $ | 52.51 | $ | 3.84 | $ | 32.61 | $ | 7.42 | ||||||||||

Drilling Statistics

The following table summarizes our development and exploratory drilling results.

| Development Wells (1) | Exploratory Wells (1) | Total Wells (1) | ||||||||||||||||||||||||||

| Year Ended December 31, |

Productive | Dry | Productive | Dry | Productive | Dry | Total | |||||||||||||||||||||

| 2012 |

||||||||||||||||||||||||||||

| U.S. |

668.2 | 1.0 | 24.6 | 4.9 | 692.8 | 5.9 | 698.7 | |||||||||||||||||||||

| Canada |

209.3 | 4.0 | 27.3 | 1.0 | 236.6 | 5.0 | 241.6 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total North America |

877.5 | 5.0 | 51.9 | 5.9 | 929.4 | 10.9 | 940.3 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| 2011 |

||||||||||||||||||||||||||||

| U.S. |

721.2 | 5.5 | 18.8 | 4.0 | 740.0 | 9.5 | 749.5 | |||||||||||||||||||||

| Canada |

247.6 | 1.5 | 19.1 | 1.0 | 266.7 | 2.5 | 269.2 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total North America |

968.8 | 7.0 | 37.9 | 5.0 | 1,006.7 | 12.0 | 1,018.7 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| 2010 |

||||||||||||||||||||||||||||

| U.S. |

855.7 | 5.3 | 23.4 | 1.5 | 879.1 | 6.8 | 885.9 | |||||||||||||||||||||

| Canada |

267.8 | — | 41.9 | 1.0 | 309.7 | 1.0 | 310.7 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total North America |

1,123.5 | 5.3 | 65.3 | 2.5 | 1,188.8 | 7.8 | 1,196.6 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| (1) | These well counts represent net wells completed during each year. Net wells are gross wells multiplied by our fractional working interests on the well. |

10

Table of Contents

The following table presents the February 1, 2013, results of our wells that were in progress on December 31, 2012.

| Productive | Dry | Still in Progress | Total | |||||||||||||||||||||||||||||

| Gross (1) | Net (2) | Gross (1) | Net (2) | Gross (1) | Net (2) | Gross (1) | Net (2) | |||||||||||||||||||||||||

| U.S. |

65.0 | 53.6 | — | — | 126.0 | 65.6 | 191.0 | 119.2 | ||||||||||||||||||||||||

| Canada |

8.0 | 7.6 | — | — | 1.0 | 0.7 | 9.0 | 8.3 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total North America |

73.0 | 61.2 | — | — | 127.0 | 66.3 | 200.0 | 127.5 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| (1) | Gross wells are the sum of all wells in which we own an interest. |

| (2) | Net wells are gross wells multiplied by our fractional working interests on the well. |

Productive Wells

The following table sets forth our producing wells as of December 31, 2012.

| Oil Wells (1) | Natural Gas Wells | Total Wells | ||||||||||||||||||||||

| Gross (2) | Net (3) | Gross (2) | Net (3) | Gross (2) | Net (3) | |||||||||||||||||||

| U.S. |

8,655 | 3,202 | 20,858 | 13,672 | 29,513 | 16,874 | ||||||||||||||||||

| Canada |

5,316 | 4,119 | 5,578 | 3,320 | 10,894 | 7,439 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total North America |

13,971 | 7,321 | 26,436 | 16,992 | 40,407 | 24,313 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| (1) | Includes bitumen wells. |

| (2) | Gross wells are the sum of all wells in which we own an interest. |

| (3) | Net wells are gross wells multiplied by our fractional working interests on the well. |

The day-to-day operations of oil and gas properties are the responsibility of an operator designated under pooling or operating agreements. The operator supervises production, maintains production records, employs field personnel and performs other functions. We are the operator of approximately 25,000 of our wells. As operator, we receive reimbursement for direct expenses incurred to perform our duties, as well as monthly per-well producing and drilling overhead reimbursement at rates customarily charged in the area. In presenting our financial data, we record the monthly overhead reimbursements as a reduction of general and administrative expense, which is a common industry practice.

Acreage Statistics

The following table sets forth our developed and undeveloped lease and mineral acreage as of December 31, 2012. The acreage in the table includes 1.4 million, 0.8 million and 1.6 million net acres subject to leases that are scheduled to expire during 2013, 2014 and 2015, respectively.

| Developed | Undeveloped | Total | ||||||||||||||||||||||

| Gross (1) | Net (2) | Gross (1) | Net (2) | Gross (1) | Net (2) | |||||||||||||||||||

| (In thousands) | ||||||||||||||||||||||||

| U.S. |

3,195 | 2,210 | 7,830 | 4,790 | 11,025 | 7,000 | ||||||||||||||||||

| Canada |

3,665 | 2,270 | 6,635 | 4,805 | 10,300 | 7,075 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total North America |

6,860 | 4,480 | 14,465 | 9,595 | 21,325 | 14,075 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| (1) | Gross acres are the sum of all acres in which we own an interest. |

| (2) | Net acres are gross acres multiplied by our fractional working interests on the acreage. |

11

Table of Contents

Title to Properties

Title to properties is subject to contractual arrangements customary in the oil and gas industry, liens for taxes not yet due and, in some instances, other encumbrances. We believe that such burdens do not materially detract from the value of properties or from the respective interests therein or materially interfere with their use in the operation of the business.

As is customary in the industry, other than a preliminary review of local records, little investigation of record title is made at the time of acquisitions of undeveloped properties. Investigations, which generally include a title opinion of outside counsel, are made prior to the consummation of an acquisition of producing properties and before commencement of drilling operations on undeveloped properties.

Marketing and Midstream Activities

Our marketing and midstream operations provide gathering, compression, treating, processing, fractionation and marketing services to us and other third-parties. We generate revenues from these operations by collecting service fees and selling processed gas and NGLs. The expenses associated with these operations primarily consist of the costs to operate our gathering systems, plants and related facilities, as well as purchases of gas and NGLs.

Oil, Gas and NGL Marketing

The spot markets for oil, gas and NGLs are subject to volatility as supply and demand factors fluctuate. As detailed below, we sell our production under both long-term (one year or more) and short-term (less than one year) agreements at prices negotiated with third parties. Regardless of the term of the contract, the vast majority of our production is sold at variable, or market-sensitive, prices.

Additionally, we may periodically enter into financial hedging arrangements or fixed-price contracts associated with a portion of our oil, gas and NGL production. These activities are intended to support targeted price levels and to manage our exposure to price fluctuations. See Note 2 to the financial statements included in “Item 8. Financial Statements and Supplementary Data” of this report for further information.

As of January 2013, our production was sold under the following contracts.

| Short-Term | Long-Term | |||||||||||||||

| Variable | Fixed | Variable | Fixed | |||||||||||||

| Oil and bitumen |

76 | % | — | 24 | % | — | ||||||||||

| Natural gas |

73 | % | — | 27 | % | — | ||||||||||

| NGLs |

78 | % | 14 | % | 1 | % | 7 | % | ||||||||

Delivery Commitments

A portion of our production is sold under certain contractual arrangements that specify the delivery of a fixed and determinable quantity. As of December 31, 2012, we were committed to deliver the following fixed quantities of production.

| Total | Less Than 1 Year | 1-3 Years | 3-5 Years | More Than 5 Years |

||||||||||||||||

| Oil and bitumen (MMBbls) |

124 | 14 | 30 | 31 | 49 | |||||||||||||||

| Natural gas (Bcf) |

1,175 | 623 | 374 | 133 | 45 | |||||||||||||||

| NGLs (MMBbls) |

10 | 5 | 3 | 2 | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total (MMBoe) |

330 | 123 | 95 | 55 | 57 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

12

Table of Contents

We expect to fulfill our delivery commitments over the next three years with production from our proved developed reserves. We expect to fulfill our longer-term delivery commitments beyond three years primarily with our proved developed reserves. In certain regions, we expect to fulfill these longer-term delivery commitments with our proved undeveloped reserves.

Our proved reserves have been sufficient to satisfy our delivery commitments during the three most recent years, and we expect such reserves will continue to satisfy our future commitments. However, should our proved reserves not be sufficient to satisfy our delivery commitments, we can and may use spot market purchases to fulfill the commitments.

Customers

During 2012, 2011 and 2010, no purchaser accounted for over 10 percent of our revenues.

Competition

See “Item 1A. Risk Factors.”

Public Policy and Government Regulation

The oil and natural gas industry is subject to regulation throughout the world. Laws, rules, regulations and other policy implementation actions affecting the oil and natural gas industry have been pervasive and are under constant review for amendment or expansion. Numerous government agencies have issued extensive laws and regulations which are binding on the oil and natural gas industry and its individual members, some of which carry substantial penalties for failure to comply. These laws and regulations increase the cost of doing business and consequently affect profitability. Because public policy changes are commonplace, and existing laws and regulations are frequently amended, we are unable to predict the future cost or impact of compliance. However, we do not expect that any of these laws and regulations will affect our operations differently than they would affect other oil and natural gas companies of similar size and financial strength. The following are significant areas of government control and regulation affecting our operations.

Exploration and Production Regulation

Our oil and gas operations are subject to federal, state, provincial, tribal and local laws and regulations. These laws and regulations relate to matters that include:

| • | acquisition of seismic data; |

| • | location, drilling and casing of wells; |

| • | hydraulic fracturing; |

| • | well production; |

| • | spill prevention plans; |

| • | emissions and discharge permitting; |

| • | use, transportation, storage and disposal of fluids and materials incidental to oil and gas operations; |

| • | surface usage and the restoration of properties upon which wells have been drilled; |

| • | calculation and disbursement of royalty payments and production taxes; |

| • | plugging and abandoning of wells; and |

| • | transportation of production. |

Our operations also are subject to conservation regulations, including the regulation of the size of drilling and spacing units or proration units; the number of wells that may be drilled in a unit; the rate of production allowable

13

Table of Contents

from oil and gas wells; and the unitization or pooling of oil and gas properties. In the U.S., some states allow the forced pooling or integration of tracts to facilitate exploration, while other states rely on voluntary pooling of lands and leases, which may make it more difficult to develop oil and gas properties. In addition, state conservation laws generally limit the venting or flaring of natural gas and impose certain requirements regarding the ratable purchase of production. These regulations limit the amounts of oil and gas we can produce from our wells and the number of wells or the locations at which we can drill.

Certain of our U.S. natural gas and oil leases are granted by the federal government and administered by the Bureau of Land Management of the Department of the Interior. Such leases require compliance with detailed federal regulations and orders that regulate, among other matters, drilling and operations on lands covered by these leases, and calculation and disbursement of royalty payments to the federal government. The federal government has been particularly active in recent years in evaluating and, in some cases, promulgating new rules and regulations regarding competitive lease bidding and royalty payment obligations for production from federal lands.

Royalties and Incentives in Canada

The royalty system in Canada is a significant factor in the profitability of oil and gas production. Royalties payable on production from lands other than Crown lands are determined by negotiations between the parties. Crown royalties are determined by government regulation and are generally calculated as a percentage of the value of the gross production, with the royalty rate dependent in part upon prescribed reference prices, well productivity, geographical location and the type and quality of the petroleum product produced. Occasionally the federal and provincial governments of Canada also have established incentive programs, such as royalty rate reductions, royalty holidays, and tax credits, for the purpose of encouraging oil and gas exploration or enhanced recovery projects. These incentives generally increase our revenues, earnings and cash flow.

Marketing in Canada

Any oil or gas export that exceeds a certain duration or a certain quantity requires an exporter to obtain export authorizations from Canada’s National Energy Board (“NEB”). The governments of Alberta, British Columbia and Saskatchewan also regulate the volume of natural gas that may be removed from those provinces for consumption elsewhere.

Environmental and Occupational Regulations

We are subject to many federal, state, provincial, tribal and local laws and regulations concerning occupational safety and health as well as the discharge of materials into, and the protection of, the environment. Environmental laws and regulations relate to:

| • | assessing the environmental impact of seismic acquisition, drilling or construction activities; |

| • | the generation, storage, transportation and disposal of waste materials; |

| • | the emission of certain gases into the atmosphere; |

| • | the monitoring, abandonment, reclamation and remediation of well and other sites, including sites of former operations; and |

| • | the development of emergency response and spill contingency plans. |

We consider the costs of environmental protection and safety and health compliance necessary yet manageable parts of our business. We have been able to plan for and comply with environmental, safety and health initiatives without materially altering our operating strategy or incurring significant unreimbursed expenditures. However, based on regulatory trends and increasingly stringent laws, our capital expenditures and operating expenses related to the protection of the environment and safety and health compliance have increased over the years and will likely continue to increase. We cannot predict with any reasonable degree of certainty our future exposure concerning such matters.

14

Table of Contents

Our business activities, and the oil and gas industry in general, are subject to a variety of risks. If any of the following risk factors should occur, our profitability, financial condition or liquidity could be materially impacted. As a result, holders of our securities could lose part or all of their investment in Devon.

Oil, Gas and NGL Prices are Volatile

Our financial results are highly dependent on the general supply and demand for oil, gas and NGLs, which impact the prices we ultimately realize on our sales of these commodities. A significant downward movement of the prices for these commodities could have a material adverse effect on our revenues, operating cash flows and profitability. Such a downward price movement could also have a material adverse effect on our estimated proved reserves, the carrying value of our oil and gas properties, the level of planned drilling activities and future growth. Historically, market prices and our realized prices have been volatile and are likely to continue to be volatile in the future due to numerous factors beyond our control. These factors include, but are not limited to:

| • | supply of and consumer demand for oil, gas and NGLs; |

| • | conservation efforts; |

| • | OPEC production levels; |

| • | weather; |

| • | regional pricing differentials; |

| • | differing quality of oil produced (i.e., sweet crude versus heavy or sour crude); |

| • | differing quality and NGL content of gas produced; |

| • | the level of imports and exports of oil, gas and NGLs; |

| • | the price and availability of alternative fuels; |

| • | the overall economic environment; and |

| • | governmental regulations and taxes. |

Estimates of Oil, Gas and NGL Reserves are Uncertain

The process of estimating oil, gas and NGL reserves is complex and requires significant judgment in the evaluation of available geological, engineering and economic data for each reservoir, particularly for new discoveries. Because of the high degree of judgment involved, different reserve engineers may develop different estimates of reserve quantities and related revenue based on the same data. In addition, the reserve estimates for a given reservoir may change substantially over time as a result of several factors including additional development activity, the viability of production under varying economic conditions and variations in production levels and associated costs. Consequently, material revisions to existing reserve estimates may occur as a result of changes in any of these factors. Such revisions to proved reserves could have a material adverse effect on our estimates of future net revenue, as well as our financial condition and profitability. Our policies and internal controls related to estimating and recording reserves are included in “Items 1 and 2. Business and Properties” of this report.

Discoveries or Acquisitions of Reserves are Needed to Avoid a Material Decline in Reserves and Production

The production rates from oil and gas properties generally decline as reserves are depleted, while related per unit production costs generally increase, due to decreasing reservoir pressures and other factors. Therefore, our estimated proved reserves and future oil, gas and NGL production will decline materially as reserves are

15

Table of Contents

produced unless we conduct successful exploration and development activities or, through engineering studies, identify additional producing zones in existing wells, secondary or tertiary recovery techniques, or acquire additional properties containing proved reserves. Consequently, our future oil, gas and NGL production and related per unit production costs are highly dependent upon our level of success in finding or acquiring additional reserves.

Future Exploration and Drilling Results are Uncertain and Involve Substantial Costs

Substantial costs are often required to locate and acquire properties and drill exploratory wells. Such activities are subject to numerous risks, including the risk that we will not encounter commercially productive oil or gas reservoirs. The costs of drilling and completing wells are often uncertain. In addition, oil and gas properties can become damaged or drilling operations may be curtailed, delayed or canceled as a result of a variety of factors including, but not limited to:

| • | unexpected drilling conditions; |

| • | pressure or irregularities in reservoir formations; |

| • | equipment failures or accidents; |

| • | fires, explosions, blowouts and surface cratering; |

| • | adverse weather conditions; |

| • | lack of access to pipelines or other transportation methods; |

| • | environmental hazards or liabilities; and |

| • | shortages or delays in the availability of services or delivery of equipment. |

A significant occurrence of one of these factors could result in a partial or total loss of our investment in a particular property. In addition, drilling activities may not be successful in establishing proved reserves. Such a failure could have an adverse effect on our future results of operations and financial condition. While both exploratory and developmental drilling activities involve these risks, exploratory drilling involves greater risks of dry holes or failure to find commercial quantities of hydrocarbons.

Competition for Leases, Materials, People and Capital Can Be Significant

Strong competition exists in all sectors of the oil and gas industry. We compete with major integrated and independent oil and gas companies for the acquisition of oil and gas leases and properties. We also compete for the equipment and personnel required to explore, develop and operate properties. Competition is also prevalent in the marketing of oil, gas and NGLs. Typically, during times of high or rising commodity prices, drilling and operating costs will also increase. Higher prices will also generally increase the cost to acquire properties. Certain of our competitors have financial and other resources substantially larger than ours. They also may have established strategic long-term positions and relationships in areas in which we may seek new entry. As a consequence, we may be at a competitive disadvantage in bidding for drilling rights. In addition, many of our larger competitors may have a competitive advantage when responding to factors that affect demand for oil and gas production, such as changing worldwide price and production levels, the cost and availability of alternative fuels, and the application of government regulations.

Midstream Capacity Constraints and Interruptions Impact Commodity Sales

We rely on midstream facilities and systems to process our natural gas production and to transport our production to downstream markets. Such midstream systems include the systems we operate, as well as systems operated by third parties. When possible, we gain access to midstream systems that provide the most advantageous downstream market prices available to us. Regardless of who operates the midstream systems we

16

Table of Contents

rely upon, a portion of our production in any region may be interrupted or shut in from time to time due to loss of access to plants, pipelines or gathering systems. Such access could be lost due to a number of factors, including, but not limited to, weather conditions, accidents, field labor issues or strikes. Additionally, we and third-parties may be subject to constraints that limit our ability to construct, maintain or repair midstream facilities needed to process and transport our production. Such interruptions or constraints could negatively impact our production and associated profitability.

Hedging Limits Participation in Commodity Price Increases and Increases Counterparty Credit Risk Exposure

We periodically enter into hedging activities with respect to a portion of our production to manage our exposure to oil, gas and NGL price volatility. To the extent that we engage in price risk management activities to protect ourselves from commodity price declines, we may be prevented from fully realizing the benefits of commodity price increases above the prices established by our hedging contracts. In addition, our hedging arrangements may expose us to the risk of financial loss in certain circumstances, including instances in which the contract counterparties fail to perform under the contracts.

Public Policy, Which Includes Laws, Rules and Regulations, Can Change

Our operations are generally subject to federal laws, rules and regulations in the U.S. and Canada. In addition, we are also subject to the laws and regulations of various states, provinces, tribal and local governments. Pursuant to public policy changes, numerous government departments and agencies have issued extensive rules and regulations binding on the oil and gas industry and its individual members, some of which require substantial compliance costs and carry substantial penalties for failure to comply. Changes in such public policy have affected, and at times in the future could affect, our operations. Political developments can restrict production levels, enact price controls, change environmental protection requirements, and increase taxes, royalties and other amounts payable to governments or governmental agencies. Existing laws and regulations can also require us to incur substantial costs to maintain regulatory compliance. Our operating and other compliance costs could increase further if existing laws and regulations are revised or reinterpreted or if new laws and regulations become applicable to our operations. Although we are unable to predict changes to existing laws and regulations, such changes could significantly impact our profitability, financial condition and liquidity, particularly changes related to hydraulic fracturing, income taxes and climate change as discussed below.

Hydraulic Fracturing – The U.S. Department of the Interior is considering the possibility of additional regulation of hydraulic fracturing on federal and Indian lands. Currently, regulation of hydraulic fracturing is conducted primarily at the state level through permitting and other compliance requirements. We lease federal and Indian lands and would be affected by the Interior Department proposal if it were to become law.

Income Taxes – We are subject to federal, state, provincial and local income taxes and our operating cash flow is sensitive to the amount of income taxes we must pay. In the jurisdictions in which we operate, income taxes are assessed on our earnings after consideration of all allowable deductions and credits. Changes in the types of earnings that are subject to income tax, the types of costs that are considered allowable deductions or the rates assessed on our taxable earnings would all impact our income taxes and resulting operating cash flow. Recently, the U.S. President and other policy makers have proposed provisions that would, if enacted, make significant changes to U.S. tax laws applicable to us. The most significant change to our business would eliminate the immediate deduction for intangible drilling and development costs. Such a change could have a material adverse effect on our profitability, financial condition and liquidity.

Climate Change – Policymakers in the U.S. and Canada are increasingly focusing on whether the emissions of greenhouse gases, such as carbon dioxide and methane, are contributing to harmful climatic changes. Policymakers at both the U.S. federal and state levels have introduced legislation and proposed new regulations that are designed to quantify and limit the emission of greenhouse gases through inventories, limitations and/or

17

Table of Contents

taxes on greenhouse gas emissions. Legislative initiatives and discussions to date have focused on the development of cap-and-trade and/or carbon tax programs. A cap-and-trade program generally would cap overall greenhouse gas emissions on an economy-wide basis and require major sources of greenhouse gas emissions or major fuel producers to acquire and surrender emission allowances. Cap-and-trade programs could be relevant to us and our operations in several ways. First, the equipment we use to explore for, develop, produce and process oil and natural gas emits greenhouse gases. We could therefore be subject to caps, and penalties if emissions exceeded the caps. Second, the combustion of carbon-based fuels, such as the oil, gas and NGLs we sell, emits carbon dioxide and other greenhouse gases. Therefore, demand for our products could be reduced by imposition of caps and penalties on our customers. Carbon taxes could likewise affect us by being based on emissions from our equipment and/or emissions resulting from use of our products by our customers. Of overriding significance would be the point of regulation or taxation. Application of caps or taxes on companies such as Devon, based on carbon content of produced oil and gas volumes rather than on consumer emissions, could lead to penalties, fees or tax assessments for which there are no mechanisms to pass them through the distribution and consumption chain where fuel use or conservation choices are made. Moreover, because oil and natural gas are used as chemical feedstocks and not solely as fossil fuel, applying a carbon tax to oil and gas at the production stage would be excessive with respect to actual carbon emissions from petroleum fuels.

Environmental Matters and Costs Can Be Significant

As an owner, lessee or operator of oil and gas properties, we are subject to various federal, state, provincial, tribal and local laws and regulations relating to discharge of materials into, and protection of, the environment. These laws and regulations may, among other things, impose liability on us for the cost of pollution clean-up resulting from our operations in affected areas. Any future environmental costs of fulfilling our commitments to the environment are uncertain and will be governed by several factors, including future changes to regulatory requirements. There is no assurance that changes in or additions to public policy regarding the protection of the environment will not have a significant impact on our operations and profitability.

Insurance Does Not Cover All Risks

Our business is hazardous and is subject to all of the operating risks normally associated with the exploration, development, production, processing and transportation of oil, natural gas and NGLs. Such risks include potential blowouts, cratering, fires, loss of well control, mishandling of fluids and chemicals and possible underground migration of hydrocarbons and chemicals. The occurrence of any of these risks could result in environmental pollution, damage to or destruction of our property, equipment and natural resources, injury to people or loss of life. Additionally, for our non-operated properties, we generally depend on the operator for operational safety and regulatory compliance.

To mitigate financial losses resulting from these operational hazards, we maintain comprehensive general liability insurance, as well as insurance coverage against certain losses resulting from physical damages, loss of well control, business interruption and pollution events that are considered sudden and accidental. We also maintain worker’s compensation and employer’s liability insurance. However, our insurance coverage does not provide 100 percent reimbursement of potential losses resulting from these operational hazards. Additionally, insurance coverage is generally not available to us for pollution events that are considered gradual, and we have limited or no insurance coverage for certain risks such as political risk, war and terrorism. Our insurance does not cover penalties or fines assessed by governmental authorities. The occurrence of a significant event against which we are not fully insured could have a material adverse effect on our profitability, financial condition and liquidity.

Limited Control on Properties Operated by Others

Certain of the properties in which we have an interest are operated by other companies and involve third-party working interest owners. We have limited influence and control over the operation or future development

18

Table of Contents

of such properties, including compliance with environmental, health and safety regulations or the amount of required future capital expenditures. These limitations and our dependence on the operator and other working interest owners for these properties could result in unexpected future costs and adversely affect our financial condition and results of operations.

Item 1B. Unresolved Staff Comments

Not applicable.

We are involved in various routine legal proceedings incidental to our business. However, to our knowledge as of the date of this report, there were no material pending legal proceedings to which we are a party or to which any of our property is subject.

Item 4. Mine Safety Disclosures

Not applicable.

19

Table of Contents

PART II

Item 5. Market for Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Our common stock is traded on the New York Stock Exchange (the “NYSE”). On February 6, 2013, there were 11,695 holders of record of our common stock. The following table sets forth the quarterly high and low sales prices for our common stock as reported by the NYSE during 2012 and 2011, as well as the quarterly dividends per share paid during 2012 and 2011. We began paying regular quarterly cash dividends on our common stock in the second quarter of 1993. We anticipate continuing to pay regular quarterly dividends in the foreseeable future.

| Price Range of Common Stock | Dividends | |||||||||||

| High | Low | Per Share | ||||||||||

| 2012: |

||||||||||||

| Quarter Ended December 31, 2012 |

$ | 63.00 | $ | 50.89 | $ | 0.20 | ||||||

| Quarter Ended September 30, 2012 |

$ | 63.95 | $ | 54.56 | $ | 0.20 | ||||||

| Quarter Ended June 30, 2012 |

$ | 73.14 | $ | 54.01 | $ | 0.20 | ||||||

| Quarter Ended March 31, 2012 |

$ | 76.34 | $ | 62.13 | $ | 0.20 | ||||||

| 2011: |

||||||||||||

| Quarter Ended December 31, 2011 |

$ | 69.55 | $ | 50.74 | $ | 0.17 | ||||||

| Quarter Ended September 30, 2011 |

$ | 84.52 | $ | 55.14 | $ | 0.17 | ||||||

| Quarter Ended June 30, 2011 |

$ | 92.69 | $ | 75.50 | $ | 0.17 | ||||||

| Quarter Ended March 31, 2011 |

$ | 93.55 | $ | 76.96 | $ | 0.16 | ||||||

20

Table of Contents

Performance Graph

The following performance graph compares the yearly percentage change in the cumulative total shareholder return on Devon’s common stock with the cumulative total returns of the Standard & Poor’s 500 index (“the S&P 500 Index”) and the group of companies included in the Crude Petroleum and Natural Gas Standard Industrial Classification code (“the SIC Code”). The graph was prepared assuming $100 was invested on December 31, 2007 in Devon’s common stock, the S&P 500 Index and the SIC Code and dividends have been reinvested subsequent to the initial investment.

The graph and related information shall not be deemed “soliciting material” or to be “filed” with the SEC, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except to the extent that we specifically incorporate such information by reference into such a filing. The graph and information is included for historical comparative purposes only and should not be considered indicative of future stock performance.

21

Table of Contents

Issuer Purchases of Equity Securities

The following table provides information regarding purchases of our common stock that were made by us during the fourth quarter of 2012. Such purchases represent shares received by us from employees and directors for the payment of personal income tax withholding on restricted stock vesting and stock option exercises.

| Period |

Total Number of Shares Purchased |

Average Price Paid per Share |

||||||

| October 1 - October 31 |

6,000 | $ | 60.15 | |||||

| November 1 - November 30 |

406,725 | $ | 52.72 | |||||

| December 1 - December 31 |

459,320 | $ | 52.24 | |||||

|

|

|

|||||||

| Total |

872,045 | $ | 52.52 | |||||

|

|

|

|||||||

Under the Devon Energy Corporation Incentive Savings Plan (the “Plan”), eligible employees may purchase shares of our common stock through an investment in the Devon Stock Fund (the “Stock Fund”), which is administered by an independent trustee. Eligible employees purchased approximately 57,000 shares of our common stock in 2012, at then-prevailing stock prices, that they held through their ownership in the Stock Fund. We acquired the shares of our common stock sold under the Plan through open-market purchases.

Similarly, under the Devon Canada Corporation Savings Plan (the “Canadian Plan”), eligible Canadian employees may purchase shares of our common stock through an investment in the Canadian Plan, which is administered by an independent trustee. Eligible Canadian employees purchased approximately 22,900 shares of our common stock in 2012, at then-prevailing stock prices, that they held through their ownership in the Canadian Plan. We acquired the shares sold under the Canadian Plan through open-market purchases. These shares and any interest in the Canadian Plan were offered and sold in reliance on the exemptions for offers and sales of securities made outside of the U.S., including under Regulation S for offers and sales of securities to employees pursuant to an employee benefit plan established and administered in accordance with the law of a country other than the U.S.

Item 6. Selected Financial Data

The financial information below should be read in conjunction with “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Item 8. Financial Statements and Supplementary Data” of this report.

| Year Ended December 31, | ||||||||||||||||||||

| 2012 | 2011 | 2010 | 2009 | 2008 | ||||||||||||||||

| (In millions, except per share amounts) | ||||||||||||||||||||

| Revenues |

$ | 9,502 | $ | 11,454 | $ | 9,940 | $ | 8,015 | $ | 13,858 | ||||||||||

| Earnings (loss) from continuing operations (1) |

$ | (185 | ) | $ | 2,134 | $ | 2,333 | $ | (2,753 | ) | $ | (3,039 | ) | |||||||

| Earnings (loss) per share from continuing operations - Basic |

$ | (0.47 | ) | $ | 5.12 | $ | 5.31 | $ | (6.20 | ) | $ | (6.86 | ) | |||||||

| Earnings (loss) per share from continuing operations - Diluted |

$ | (0.47 | ) | $ | 5.10 | $ | 5.29 | $ | (6.20 | ) | $ | (6.86 | ) | |||||||

| Cash dividends per common share |

$ | 0.80 | $ | 0.67 | $ | 0.64 | $ | 0.64 | $ | 0.64 | ||||||||||

| Weighted average common shares outstanding - Basic |

405 | 417 | 440 | 444 | 444 | |||||||||||||||

| Weighted average common shares outstanding - Diluted |

405 | 418 | 441 | 444 | 444 | |||||||||||||||

| Total assets (1) |

$ | 43,326 | $ | 41,117 | $ | 32,927 | $ | 29,686 | $ | 31,908 | ||||||||||

| Long-term debt |

$ | 8,455 | $ | 5,969 | $ | 3,819 | $ | 5,847 | $ | 5,661 | ||||||||||

| Stockholders’ equity |

$ | 21,278 | $ | 21,430 | $ | 19,253 | $ | 15,570 | $ | 17,060 | ||||||||||

| (1) | During 2012, 2009 and 2008, we recorded noncash asset impairments totaling $2.0 billion ($1.3 billion after income taxes), $6.4 billion ($4.1 billion after income taxes) and $9.9 billion ($6.7 billion after income taxes), respectively. |

22

Table of Contents

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Introduction

The following discussion and analysis presents management’s perspective of our business, financial condition and overall performance. This information is intended to provide investors with an understanding of our past performance, current financial condition and outlook for the future and should be read in conjunction with “Item 8. Financial Statements and Supplementary Data” of this report.

Overview of 2012 Results

As an enterprise, we strive to optimize value for our shareholders by growing cash flow, earnings, production and reserves, all on a per debt-adjusted share basis. We accomplish this by executing our strategy, which is outlined in “Items 1 and 2. Business and Properties” of this report.

2012 was a year of mixed results for Devon. We grew our production 4% and closed two significant joint venture transactions with a combined value of approximately $4.0 billion. Furthermore, with a focus on development of higher-margin oil and bitumen properties in our portfolio, we increased our oil and bitumen production 20% in 2012 and are positioned to deliver similar oil and bitumen growth in 2013. However, this growth was overshadowed by the effects of declining commodity prices, which negatively impacted a number of our 2012 financial performance measures, as well as our year-end proved reserves. Key measures of our 2012 performance are summarized below, which exclude amounts from our discontinued operations.

| Year Ended December 31, | ||||||||||||||||||||

| 2012 | Change | 2011 | Change | 2010 | ||||||||||||||||

| ($ in millions, except per share amounts) | ||||||||||||||||||||

| Net earnings (loss) |

$ | (185 | ) | -109 | % | $ | 2,134 | -9 | % | $ | 2,333 | |||||||||

| Adjusted earnings (1) |

$ | 1,322 | -48 | % | $ | 2,536 | +0 | % | $ | 2,536 | ||||||||||

| Earnings (loss) per share |

$ | (0.47 | ) | -109 | % | $ | 5.10 | -4 | % | $ | 5.29 | |||||||||

| Adjusted earnings per share (1) |

$ | 3.26 | -46 | % | $ | 6.07 | +6 | % | $ | 5.75 | ||||||||||

| Production (MBoe/d) |

682.3 | +4 | % | 657.7 | +5 | % | 623.6 | |||||||||||||

| Realized price per Boe |

$ | 28.65 | -17 | % | $ | 34.64 | +9 | % | $ | 31.91 | ||||||||||

| Operating margin per Boe (2) |

$ | 19.41 | -23 | % | $ | 25.15 | +1 | % | $ | 24.89 | ||||||||||

| Operating cash flow |

$ | 4,930 | -21 | % | $ | 6,246 | +24 | % | $ | 5,022 | ||||||||||

| Adjusted operating cash flow (1) |

$ | 4,892 | -21 | % | $ | 6,225 | +7 | % | $ | 5,840 | ||||||||||

| Capitalized costs |

$ | 8,474 | +9 | % | $ | 7,795 | +13 | % | $ | 6,920 | ||||||||||

| Shareholder distributions (3) |

$ | 324 | -88 | % | $ | 2,610 | +80 | % | $ | 1,449 | ||||||||||

| Reserves (MMBoe) |

2,963 | -1 | % | 3,005 | +5 | % | 2,873 | |||||||||||||

| (1) | Adjusted earnings, adjusted earnings per share and adjusted operating cash flow are not financial measures prepared in accordance with accounting principles generally accepted in the U.S. (GAAP). For a description of adjusted earnings, adjusted earnings per share and adjusted operating cash flow as well as reconciliations to the comparable GAAP measures, see “Non-GAAP Measures” in this Item 7. |

| (2) | Computed as revenues from commodity sales, commodity derivatives settlements, and marketing and midstream operations, less expenses for lease operations, marketing and midstream operations, general and administration, taxes other than income taxes and interest, with the result divided by total production. |

| (3) | Includes common stock dividends and share repurchases. |

Our 2012 net loss resulted from noncash asset impairments, which reduced our earnings by $2.0 billion ($1.3 billion after tax). Excluding the asset impairments and other items typically excluded by securities analysts, our adjusted earnings were $1.3 billion, or $3.26 per diluted share. This compares to adjusted earnings of $2.5 billion, or $6.07 per diluted share in 2011.

23

Table of Contents

In spite of growing our production, our 2012 adjusted earnings, adjusted cash flow, operating margin and proved reserves declined largely due to the effects of lower commodity prices. In virtually all our operating areas, we realized lower prices in 2012 due to either declines in benchmarks or widening price differentials. The most significant price declines were associated with our gas and NGL production, for which we experienced realized price decreases of 34% and 26%, respectively. With increasing focus on oil and bitumen production growth, which generally require a higher cost to produce per unit than our gas projects, we were also impacted by upward pressure on operating costs.

We replaced 152% of our 2012 production from proved reserve extensions, discoveries and revisions other than price. Yet, our proved reserves decreased 1% overall due to significant downward revisions resulting from lower gas and NGL prices.

Business and Industry Outlook