UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

(Rule 14a-101)

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ |

Preliminary Proxy Statement |

☐ |

Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ |

Definitive Proxy Statement |

☐ |

Definitive Additional Materials |

☐ |

Soliciting Material under § 240.14a-12 |

(Name of Registrant as Specified in Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ |

No fee required |

☐ |

Fee paid previously with preliminary materials |

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Gaia, Inc.

833 West South Boulder Road

Louisville, Colorado 80027

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON THURSDAY, APRIL 20, 2023

To our shareholders:

We will hold the 2023 annual meeting of shareholders of Gaia, Inc. (“we”, “us”, “our”, or “Gaia”), a Colorado corporation, on Thursday, April 20, 2023, at 9:30 a.m. Mountain Time virtually at www.virtualshareholdermeeting.com/GAIA2023, for the following purposes:

Our board of directors has fixed the close of business on February 21, 2023, as the record date for the annual meeting. Only shareholders of record on the record date are entitled to notice of, and to vote at, our annual meeting and any adjournments or postponements thereof. A list of shareholders entitled to vote at our annual meeting will be available for inspection by any of our shareholders prior to our annual meeting, upon written request showing a proper purpose, during normal business hours at our Louisville, Colorado office. The shareholder list will also be available online during the annual meeting.

We are furnishing proxy materials to our shareholders primarily by the Internet. On March 7, 2023, we expect to mail our shareholders (other than those who previously requested electronic or paper delivery of our proxy materials) a Notice of Internet Availability of Proxy Materials containing instructions on how to access our 2023 proxy statement and 2022 annual report online at www.proxyvote.com and how to vote. The Notice of Internet Availability of Proxy Materials also instructs you on how to access your proxy card and provides instructions on how you can request a paper copy of these documents if you desire. This process is designed to expedite our shareholders’ receipt of proxy materials, lower the cost of our annual meeting, and help conserve natural resources. If you have previously elected to receive our proxy materials electronically, you will continue to receive these materials via e-mail unless you elect otherwise.

Our shareholders are cordially invited to attend our virtual annual meeting. To be admitted to the annual meeting at www.virtualshareholdermeeting.com/GAIA2023, you must enter the 16-digit control number included in your Notice of Internet Availability of Proxy Materials, voting instruction form, or proxy card. Although you may vote online during the virtual annual meeting, we encourage you to vote via the Internet, by telephone or by mail as outlined in the Notice of Internet Availability of Proxy Materials or on your proxy card to ensure that your shares are represented and voted.

By Order of the Board of Directors |

|

Paul Tarell, Secretary |

March 7, 2023 |

YOUR VOTE IS IMPORTANT

We urge you to vote your shares as promptly as possible by following the voting instructions in the Notice of Internet Availability of Proxy Materials or your proxy card.

If you hold our shares with a broker, you may also be eligible to vote via the Internet or by telephone if your broker or bank participates in the proxy voting program provided by Broadridge Investor Communication Services.

EXPLANATORY NOTE

We are a “smaller reporting company,” as defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and have elected to provide in this proxy statement certain scaled disclosures permitted under the Exchange Act for smaller reporting companies. We will remain a “smaller reporting company” until the fiscal year following the determination that our voting and non-voting common shares held by non-affiliates is at least $250 million measured on the last business day of our second fiscal quarter, or our annual revenues are at least $100 million during the most recently completed fiscal year and our voting and non-voting common shares held by non-affiliates is at least $700 million measured on the last business day of our second fiscal quarter.

1

Gaia, Inc.

833 West South Boulder Road

Louisville, Colorado 80027

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON THURSDAY, APRIL 20, 2023

We are furnishing this proxy statement and the accompanying proxy card to our shareholders in connection with the solicitation of proxies by and on behalf of our board of directors for use at our 2023 annual meeting of shareholders to be held on Thursday, April 20, 2023, starting at 9:30 a.m. Mountain Time virtually at www.virtualshareholdermeeting.com/GAIA2023, and at any adjournment(s) or postponement(s) thereof. On or about March 7, 2023, we expect to mail or give to our shareholders (other than those who previously requested electronic or paper delivery of our proxy materials) a Notice of Internet Availability of Proxy Materials containing instructions on how to access our 2023 proxy statement and 2022 annual report and how to request paper delivery of our proxy materials if desired. The address of our principal executive office is 833 West South Boulder Road, Louisville, Colorado 80027.

PURPOSE OF ANNUAL MEETING

At the annual meeting, our shareholders will be asked: (i) to elect six directors of our company to serve until the next annual meeting of shareholders or until their successors are duly elected and qualified; (ii) to approve, on an advisory basis, named executive officer compensation; (iii) to consider an advisory vote on the frequency of a shareholder vote on named executive officer compensation; and (iv) to transact such other business as may properly be brought before the annual meeting. Our board recommends a vote “FOR” the election of the nominees for directors of Gaia, Inc., a Colorado corporation (“we”, “us”, “our”, “company”, or “Gaia”), listed below; “FOR” approval, on an advisory basis, of named executive officer compensation; and to approve, on an advisory basis, the frequency of a shareholder vote on named executive officer compensation every three years.

ATTENDING THE ANNUAL MEETING

To attend, vote, and submit questions during the annual meeting visit www.virtualshareholdermeeting.com/GAIA2023 and enter the 16-digit control number included in your Notice of Internet Availability of Proxy Materials, voting instruction form, or proxy card. Online access to the webcast will open approximately 15 minutes prior to the start of the annual meeting. A technical support line will be available on the meeting website for any questions on how to participate in the annual meeting or if you encounter any difficulties accessing the virtual meeting.

2

INFORMATION CONCERNING SOLICITATION AND VOTING

Quorum and Voting Rights

Holders of a majority of the outstanding votes eligible to be cast by our Class A common stock and Class B common stock at the annual meeting must be present at the annual meeting or represented by proxy to constitute a quorum. Only shareholders of record at the close of business on the record date, February 21, 2023 will be entitled to notice of, and to vote at, the annual meeting. As of February 21, 2023, there were 15,425,974 shares of our Class A common stock, par value $0.0001 per share, and 5,400,000 shares of our Class B common stock, par value $0.0001 per share, outstanding and entitled to vote. Holders of our Class A common stock as of the record date are entitled to one vote for each share held and holders of our Class B common stock as of the record date are entitled to ten votes for each share held. The holders of our Class A common stock and Class B common stock will vote together as a single class. Cumulative voting is not permitted for any purpose. Once a quorum is present, the affirmative vote of a majority of the votes eligible to be cast on the subject matter shall be the act of the shareholders, other than with respect to the election of directors, as described below.

Mr. Jirka Rysavy, our Chairman, holds all 5,400,000 outstanding shares of our Class B common stock and 475,061 shares of our Class A common stock. These shares are sufficient to constitute a quorum and to elect all Gaia directors. Mr. Rysavy has indicated that he plans to be present at the meeting and vote in favor of the proposal identified in this proxy statement as recommended by the board.

All shares of our common stock represented by properly executed proxies will, unless the proxies have previously been revoked, be voted in accordance with properly executed instructions indicated in the proxies. Abstentions and broker non-votes will have no effect on the result of the vote, although abstentions will count towards the presence of a quorum. Any shareholder executing a proxy has the power to revoke the proxy at any time prior to its exercise.

IT IS THE INTENTION OF THE AGENT DESIGNATED IN THE ENCLOSED PROXY CARD TO VOTE “FOR” THE ELECTION OF ALL SIX NOMINEES FOR DIRECTOR IDENTIFIED BELOW (UNLESS AUTHORITY IS WITHHELD BY THE SHAREHOLDER GRANTING THE PROXY); “FOR” APPROVAL, ON AN ADVISORY BASIS, OF NAMED EXECUTIVE OFFICER COMPENSATION; AND TO APPROVE, ON AN ADVISORY BASIS, THE FREQUENCY OF A SHAREHOLDER VOTE ON EXECUTIVE COMPENSATION EVERY THREE YEARS. IF ANY NOMINEE FOR DIRECTOR BECOMES UNAVAILABLE TO SERVE FOR ANY REASON, THE PROXY WILL BE VOTED FOR A SUBSTITUTE NOMINEE OR NOMINEES TO BE SELECTED BY OUR BOARD OF DIRECTORS, UNLESS THE SHAREHOLDER WITHHOLDS AUTHORITY TO VOTE FOR THE ELECTION OF DIRECTORS. JIRKA RYSAVY, WHO HOLDS SHARES WITH A MAJORITY OF THE VOTES, HAS INFORMED GAIA THAT HE INTENDS TO VOTE HIS SHARES IN FAVOR OF THE ELECTION OF THE DIRECTORS NAMED IN THIS PROXY STATEMENT; “FOR” APPROVAL, ON AN ADVISORY BASIS, NAMED EXECUTIVE OFFICER COMPENSATION; AND TO APPROVE, ON AN ADVISORY BASIS, THE FREQUENCY OF A SHAREHOLDER VOTE ON NAMED EXECUTIVE OFFICER COMPENSATION EVERY THREE YEARS.

Revocability of Proxies

A proxy may be revoked prior to exercise by: (a) filing with Gaia a written revocation of the proxy; (b) attending the virtual annual meeting and voting online; (c) voting by telephone or by using the Internet, either of which must be completed by 11:59 p.m. Eastern Time on April 19, 2023 (only your latest telephone or Internet proxy is counted); or (d) submitting to Gaia a duly executed proxy bearing a later date.

3

Electronic Availability of Proxy Statement and Annual Report

We are continuing to use the Securities and Exchange Commission’s “E-Proxy” rules and furnishing proxy materials to our shareholders primarily by the Internet. On March 7, 2023, we expect to mail or give to our shareholders (other than those who previously requested electronic or paper delivery of our proxy materials) a Notice of Internet Availability of Proxy Materials containing instructions on how to access our 2023 proxy statement and 2022 annual report. The Notice of Internet Availability of Proxy Materials also instructs you on how to access your proxy card to vote through the Internet or by telephone and provides instructions on how you can request a paper copy of these documents if you desire. If you received your annual meeting materials by mail, the proxy statement and proxy card from our board of directors and our annual report were enclosed. If you received your annual meeting materials via email, the email contained voting instructions and links to the proxy statement and annual report on the Internet, which are both available at www.proxyvote.com. This process is designed to expedite our shareholders’ receipt of proxy materials, lower the cost of our annual meeting, and help conserve natural resources. If you have previously elected to receive our proxy materials electronically, you will continue to receive these materials via e-mail unless you elect otherwise. Our annual report is not to be considered as a part of this proxy statement or as having been incorporated by reference into this proxy statement.

This proxy statement, the proxy card, voting instructions and our 2022 annual report are being made available to shareholders at www.proxyvote.com. You may also request a printed copy of this proxy statement and the proxy card or our annual report by any of the following methods: (a) telephone at (800) 579-1639; (b) Internet at www.proxyvote.com; or (c) e-mail at sendmaterial@proxyvote.com. To facilitate timely delivery, you should make this request prior to April 6, 2023.

Proxy Solicitation Costs

We will bear the cost of preparing, printing, assembling and mailing this proxy statement and other materials furnished to shareholders in connection with the solicitation of proxies. In addition, our officers, directors and other employees may solicit proxies by written communication or telephone. These persons will receive no special compensation for any solicitation activities.

4

PROPOSAL 1

ELECTION OF DIRECTORS

Nominees for Election as Directors

Our board of directors proposes that James Colquhoun, Kristin Frank, Keyur Patel, Jirka Rysavy, Paul Sutherland, and Anaal Udaybabu be elected as directors of our company, to hold office until the next annual meeting of shareholders or until their successors are duly elected and qualified. Unless contrary instructions are given, the proxies will be voted “FOR” these nominees. Each nominee has agreed to serve if elected, and management has no reason to believe that any of the nominees will be unavailable for service. If for any unforeseen reason any nominee should decline or be unable to serve, the proxies will be voted to fill any vacancy so arising in accordance with the discretionary authority of the persons named in the proxy, unless contrary instructions are given.

Our business encompasses the operation of a global digital video subscription streaming service and on-line community that provides curated conscious media to its subscribers in a context characterized by rapidly evolving technologies, exposure to business cycles, and significant competition. Our board of directors is responsible for reviewing and assessing the appropriate skills, experience, and background sought of directors in the context of our business and the current membership on the board of directors. This assessment of board skills, experience, and background includes numerous diverse factors, such as independence; understanding of and experience in video subscription services, technology, finance, and marketing; international experience; age; and gender and ethnic diversity. The priorities and emphasis of the board of directors regarding these factors change from time to time to consider changes in our business and other trends, as well as the portfolio of skills and experience of current and prospective board members. The board of directors reviews and assesses the relevance of and emphasis on these factors in connection with candidate searches.

We do not expect or intend that each director will have the same background, skills, and experience; we expect that board members will have a diverse portfolio of backgrounds, skills, and experiences. One goal of this diversity is to assist the board of directors in its oversight and advice concerning our business and operations. The biographies set forth below note each director’s or director nominee’s relevant experience, qualifications, and skills that led to the conclusion that such individual should serve as a director of our company.

5

The names of our director nominees, their ages, and the years in which they began serving as directors and their positions, are set forth below. All the director nominees currently serve as directors. Each director serves for a one-year term.

James Colquhoun – age 41 – Director since May 2020. He founded, and since 2008 has served as the Chief Executive Officer of, Food Matters, a digital media and production company. He also founded Food Matters TV Pty Ltd (FMTV), a health and wellness SVOD (subscription video on demand) company, and served as FMTV’s Chief Executive Officer until its acquisition by Gaia in June 2019. During his tenure, the Food Matters group has grown to reach over 120 countries. He is the producer of the feature documentary films Food Matters, Hungry For Change and the Transcendence TV docu-series.

Mr. Colquhoun brings to the board significant experience with management, operations, production and marketing of content.

Kristin Frank—age 57—Director since October 2013. She has served as CEO and President of AdPredictive, a software company delivering the industry’s first outcomes-driven customer marketing intelligence platform, since September 2018. Before joining AdPredictive, Ms. Frank spent 23 years at Viacom Inc. where she served from 2015 to 2017 as Chief Operating Officer of MTV. From 2013 to 2015, Ms. Frank served as Executive Vice President of Viacom Music and Entertainment’s Connected Content Division. From 2009 to 2012, Ms. Frank served as General Manager for MTV and VH1 Digital. From 2005 to 2009, she served as Chief Operating Officer at LOGO TV. Ms. Frank currently serves on the boards of Brightcove, Inc., The Beachbody Company, Inc. and the privately-held company board of AdPredictive.

Ms. Frank brings to the board significant experience with management, operations, branding, social media and digital content development, optimization and delivery.

Keyur Patel—age 57—Director since May 2017. He has served as the Chairman and Chief Executive Officer of Fuse+Media Pvt. Ltd. since 2008. Mr. Patel was a Co-Founder and a Chairman of Fabrik, LLC, led the turnarounds for Inktomi and Maxtor, and incubated, hatched, and ran a number of successful companies including Brience, Metrius, Webvibe, and Phoenix Software. He served as a General Partner of ComVentures. Mr. Patel has also served as the Managing Partner and Chief Strategy Officer of KPMG Consulting Worldwide, Chief Executive Officer of KPMG Internet business, and Managing Partner and Managing Director of the Price Waterhouse Technology Consulting Practice.

In addition to Mr. Patel’s entrepreneurial experience, he brings to the board significant experience with investment management and investor relations, as well as significant senior financial leadership and expertise in corporate strategy and execution.

Jirka Rysavy—age 68—Founder, Chairman and Chief Executive Officer. He has been Chairman since our inception and has served as our Chief Executive Officer, other than during the period from March 2009 to July 2019. Mr. Rysavy is the beneficial owner of approximately 30% of our outstanding shares. In 1986, Mr. Rysavy founded Corporate Express, Inc., which, under his leadership as Chairman and Chief Executive Officer, grew to become a Fortune 500 company supplying office and computer products and services. Mr. Rysavy also founded and served as Chairman and Chief Executive Officer of Crystal Market, a health foods concept, which was sold in 1987 to become the concept and first Wild Oats Market, now Whole Foods Market.

Mr. Rysavy brings to the board significant senior leadership, strategic focus, business development, sales and marketing and international experience from his past business experience as CEO and founder of several successful businesses. He also brings a significant amount of experience to the board in driving growth through acquisitions, having completed over 330 acquisitions in his career.

Paul Sutherland—age 68—Director since June 2012. He has worked in the investment and financial advisory business since 1975. Until it was acquired by Mercer Advisors in December 2018, he was President of Financial & Investment Management Group, Ltd., a registered investment adviser that he founded in 1984 and managed investment portfolios on a discretionary basis for individuals, trusts, foundations and retirement plans. Mr.

6

Sutherland is Chairman and a founding board member of the Utopia Foundation, Squaring the Education Pyramid Institute, and is author of various books including Zenvesting, Creating life success the Zenvesting way, Virtues of Wealth and the AMA guide to Financial Planning. Mr. Sutherland is the owner of Yen Yoga and Fitness LLC, the largest yoga, spinning and fitness studio in northern Michigan.

In addition to Mr. Sutherland’s significant senior leadership, global investment, business, entrepreneurial and financial experience, he brings to the board a broad understanding of the business aspects of the sustainable health, transformation, consciousness, spirituality, and wellbeing movement and market in which Gaia operates.

Anaal Udaybabu—age 52—Director since May 2021. She founded Culture Unplugged, a global platform of documentaries for cultural transformation, which has served millions of people globally since its launch in 2007. In 2019, she founded Fasting Culture, a provider of an online platform for fasting planning and at-home urine diagnostics to support Integral Fasting—the experience she has been exploring at the Center for Healing & Transformation, which she founded in India.

Ms. Udaybabu brings to the board significant experience with vision, brand strategy, user experience and user interface design, communications, digital content development and delivery, as well as deep experience with advancing the mission of the company.

Vote Required

Directors will be elected by a plurality of the votes cast. “Plurality” means that the nominees receiving the largest number of votes cast are elected as directors up to the maximum number of directors who are nominated to be elected at the meeting. If no instructions are indicated on a proxy card, the shares will be voted “FOR” the election of these nominees for director. Because director nominees must receive a plurality of the votes cast at the annual meeting, a vote withheld from a particular nominee or from all nominees or abstentions will not affect the election of that nominee.

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR”

THE NOMINEES OF THE BOARD

7

PROPOSAL 2

ADVISORY APPROVAL OF NAMED EXECUTIVE OFFICER COMPENSATION

As required by Section 14A of the Securities Exchange Act, we are seeking advisory shareholder approval of the compensation of our named executive officers as disclosed in the section of this proxy statement titled “Executive Compensation.” Shareholders are being asked to vote on the following advisory resolution:

Resolved, that the compensation of Gaia’s named executive officers, as disclosed pursuant to the compensation disclosure rules of the Securities and Exchange Commission (which disclosure pursuant to Item 402 of Regulation S-K, shall include the Compensation Discussion and Analysis, the compensation tables, narrative discussion and any related material in Gaia’s Proxy Statement for the 2023 Annual Meeting of Shareholders) is hereby APPROVED.

The compensation of our executive officers is based on a design that ties a substantial percentage of an executive’s compensation to the attainment of financial and other performance measures that, the board believes, promotes the creation of long-term shareholder value and positions Gaia for long-term success. As described more fully in the Compensation Discussion and Analysis, the mix of fixed and performance based compensation, the terms of the incentive bonus program and the terms of long-term incentive plans are all designed to enable Gaia to attract and retain top talent while, at the same time, creating a close relationship between performance and compensation. The compensation committee and the board believe that the design of the program, and hence the compensation awarded to named executive officers under the current program, fulfill this objective.

Shareholders are urged to read the “Executive Compensation” section of this proxy statement, which sets forth the compensation we paid our named executive officers in 2022 and discusses in detail how our compensation policies and procedures implement our compensation philosophy.

Although the vote is non-binding, the board and the compensation committee will review the voting results in connection with their ongoing evaluation of Gaia’s compensation program.

Vote Required

Approval of this Proposal 2 requires the affirmative vote of a majority of the votes cast “FOR” or “AGAINST” the proposal. For purposes of determining the number of votes cast on the matter, only those cast “FOR” or “AGAINST” are included, while abstentions and broker non-votes are not included.

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR”

ADVISORY APPROVAL OF THE RESOLUTION SET FORTH ABOVE

8

PROPOSAL 3

ADVISORY VOTE ON FREQUENCY OF VOTES ON NAMED EXECUTIVE OFFICER COMPENSATION

Section 14A of the Securities Exchange Act requires us to submit a non-binding, advisory resolution to shareholders at least once every six years to determine whether advisory votes on the compensation of our named executive officers should be held every one, two or three years. We intend to hold our next advisory vote on the frequency of votes on compensation of our named executive officers in 2029. In satisfaction of this requirement, shareholders are being asked to vote on the following advisory resolution:

Resolved, that the option of once every one year, two years, or three years that receives the highest number of votes cast for this resolution will be determined to be the shareholder’s preference, on an advisory basis, as to the frequency with which Gaia is to hold a shareholder advisory vote to approve Gaia’s executive compensation, as disclosed pursuant to the Securities and Exchange Commission’s compensation disclosure rules.

In voting on this resolution, you should mark your proxy for one, two or three years based on your preference as to the frequency with which an advisory vote on executive compensation should be held. If you have no preference you should abstain. Your vote on this proposal is advisory and the results are not binding upon the board, but the board values the opinions of our shareholders and will review and consider the outcome of the vote, along with other relevant factors, in evaluating the frequency of future advisory votes on executive compensation.

The optimal frequency of a shareholder vote necessarily turns on a judgment about the relative benefits and burdens of each of the options. There have been diverging views expressed on this question and the board believes there is a reasonable basis for each of the options.

Some have argued for less frequency. They point out that a less frequent vote would allow shareholders to focus on overall design issues rather than details of individual decisions, would align with the goal of compensation programs — such as that of Gaia — which are designed to reward performance that promotes long-term shareholder value, and would avoid the burden that annual votes would impose on shareholders required to evaluate the compensation programs of many companies each year. Based on these reasons, the board has determined that an advisory shareholder vote on executive compensation every three years is the best approach for Gaia and its shareholders.

Others believe that an annual vote is needed to give shareholders the opportunity to react promptly to emerging trends in compensation, provide feedback before those trends become pronounced over time, and give the board and the compensation committee the opportunity to evaluate individual compensation decisions each year in light of the ongoing feedback from shareholders.

The frequency (one year, two years, or three years) receiving the highest number of votes cast by our shareholders will be deemed the shareholders’ preference, on an advisory basis, that an advisory resolution with respect to executive compensation should be presented to the shareholders at that interval. For purposes of determining the number of votes cast on the matter, only those cast for “one year”, “two years”, or “three years” are included. Shareholders will not be voting to approve or disapprove the recommendation of the board. Abstentions and broker non-votes will have no effect on the results of this vote.

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE FOR

THE HOLDING OF A SHAREHOLDER ADVISORY VOTE ON EXECUTIVE COMPENSATION EVERY THREE YEARS

9

DIRECTOR INDEPENDENCE, COMMITTEES AND MEETINGS OF THE BOARD OF DIRECTORS

Board Size and Director Independence

The size of the board of directors is determined by the board pursuant to our Bylaws. Our board of directors currently consists of seven members and meets regularly during the year. The board of directors will consist of six members after the 2023 annual meeting of shareholders. Our board of directors has determined that of our current directors, Messrs. Colquhoun, Maisel, Patel, and Sutherland, and Ms. Frank and Ms. Udaybabu, are independent as defined by the listing standards of the NASDAQ Stock Market.

Insider Trading Policy; Employee, Officer and Director Hedging

Our directors, officers and employees are subject to our insider trading policy, which prohibits the purchase, sale or trade of our securities with the knowledge of material nonpublic information. In addition, our insider trading policy also prohibits short sales, transactions in derivatives, and hedging of Gaia’s securities by our directors, executive officers and employees and prohibits pledging of Gaia securities by our directors and executive officers.

Board Meetings and Board Committees

During 2022, our board held three telephonic and one in person meeting. The majority of our current directors attended at least 75% of the aggregate of the total number of meetings of our board of directors and the total number of meetings of the committees of our board of directors on which such director served during 2022 (with respect to meetings held while such director served as a director and on a committee). The majority of our current directors who served as director at the time of our 2022 annual meeting of shareholders attended our 2022 annual meeting of shareholders.

Our board of directors has standing audit and compensation committees. We have adopted written charters for both committees. These charters can be found in the investors’ section of our website at http://ir/gaia.com/governance-docs. Our board of directors selects members for the audit and compensation committees on an annual basis.

Audit Committee. Our audit committee currently consists of Mr. Colquhoun, Ms. Frank, and Mr. Sutherland (chairperson), and each member of the audit committee is independent within the meaning of rules of the NASDAQ Stock Market. After the 2023 annual meeting, we expect that Mr. Sutherland will continue to serve as chairperson of the audit committee. Our board has determined that Mr. Sutherland is an “audit committee financial expert,” as defined in Item 407(d)(5)(ii) of Regulation S-K. Our audit committee is responsible for the appointment, compensation and oversight of our auditor and for approval of any non-audit services provided by the auditor. Our audit committee also oversees: (a) management’s maintenance of the reliability and integrity of our accounting policies and financial reporting and disclosure practices; (b) management’s establishment and maintenance of processes to assure that an adequate system of internal control over financial reporting is functioning; and (c) management’s establishment and maintenance of processes to assure our compliance with all laws, regulations and company policies relating to financial reporting. Our audit committee held 14 telephonic meetings during 2022.

Compensation Committee. Our compensation committee currently consists of Ms. Frank (chairperson), Mr. Maisel and Mr. Sutherland, and each member of the compensation committee is independent within the meaning of rules of the NASDAQ Stock Market. After the 2023 annual meeting, we expect that Ms. Frank will continue to serve as the chairperson of the compensation committee. None of the members of our compensation committee has at any time been an officer or employee of our company or has any interlocking relationships that are subject to disclosure under the rules of the Securities and Exchange Commission relating to compensation committees. Our compensation committee establishes compensation amounts and policies applicable to our executive officers, establishes salaries, bonuses and other compensation plans and matters for our executive officers, and administers our equity incentive plans. Our compensation committee held one telephonic meetings during 2022.

10

Director Nominations. We are exempt from the NASDAQ Stock Market rules with respect to independent director oversight over director nominations because we are a controlled company on the basis of Mr. Rysavy’s control of more than 50% of the voting power of our outstanding capital stock. In light of Mr. Rysavy’s voting control, our board of directors does not believe a nominating committee would serve a meaningful purpose. Our Bylaws set forth certain procedures that are required to be followed by shareholders in nominating persons for election to our board. Generally, written notice of a proposed nomination must be received by our corporate secretary not later than the 45th day nor earlier than the 70th day prior to the anniversary of the mailing of the preceding year’s proxy materials. As described above, our board considers a variety of factors when it selects candidates for election to the board, including business experience, skills and expertise that are complementary to those already represented on the board, familiarity and identification with our mission, values and market segments, and other relevant factors. Although the board does not have a formal policy with regard to consideration of diversity in identifying potential nominees, the board may consider whether a potential nominee’s professional experience, education, skills and other individual qualities and attributes, including gender, race or national origin, would provide beneficial diversity of skills, experience or perspective to the board’s membership and collective attributes. Such considerations will vary based on the board’s existing membership and other factors, such as the strength of a potential nominee’s overall qualifications relative to diversity considerations. Our board will consider qualified director candidates recommended by our shareholders. Nominations for directors are made by our full board of directors. Because we are a controlled company under the NASDAQ Stock Market rules, our board has not adopted a formal policy regarding the consideration of director candidates recommended by shareholders.

Executive Sessions of the Board and Leadership Structure

Our board of directors’ meet periodically in executive session.

Jirka Rysavy serves as a director and as our Chairman and Chief Executive Officer. As our Chairman and Chief Executive Officer, Mr. Rysavy is the most senior executive officer of Gaia and he presides at meetings of our shareholders and our board of directors. As Chairman, he is responsible for business initiative development and oversees our affairs and business in a supervisory role. As our Chief Executive Officer, he has primary, general and active control over our affairs and business and general supervision of our officers and employees. We do not have a lead independent director but, during the past year, with the exception of Mr. Rysavy the other members of our board of directors were considered independent. We also maintain an audit committee and a compensation committee, each consisting of three independent directors. Further, as described elsewhere in this proxy statement, Mr. Rysavy controls more than 50% of the voting power of our capital stock, thereby making Gaia a controlled company under the NASDAQ Stock Market rules and, therefore, exempt from several of the corporate governance rules concerning independent director oversight over our affairs.

The video subscription offerings and delivery channels, as well as the competitive and technology landscape, involved in our business are constantly evolving and our Chief Executive Officer brings extensive knowledge in these areas to the board of directors, allowing him to effectively direct board discussions and focus board decision-making on those items most important to our overall success. Our board of directors also believes that this leadership structure optimizes Mr. Rysavy’s contributions to the board’s efforts. Further, as our founder and largest shareholder, Mr. Rysavy brings an important perspective to board discussions.

The board works closely with Mr. Rysavy in his regular assessment of the risks that could confront our business, whether due to competitive issues, the economy or otherwise. It is management’s responsibility to manage risk and bring to our board of directors’ attention the most material risks to us. Our board of directors has oversight responsibility of the processes established to report and monitor systems for material risks applicable to us and reviews our enterprise risk management. Our board of directors reviews treasury risks (insurance, credit, and debt), financial and accounting risks, legal and compliance risks, information technology security and cybersecurity risks and risks related to internal control over financial reporting. Our compensation committee considers risks related to the attraction and retention of talent and risks relating to the design of compensation programs and incentive arrangements. We have determined that it is not reasonably likely that risks arising from compensation and benefit plans would have a material adverse effect on us. In addition, the full board of directors considers risks to our reputation, reviews risks related to the sustainability of our operations, considers risks related to succession planning, and oversees the appropriate allocation of responsibility for risk oversight among the committees of the board. The full board also has oversight of enterprise risk management and considers strategic risks and opportunities on a regular basis.

11

DIRECTOR COMPENSATION

Our directors who are not employees of, or consultants to, our company or its affiliates receive a restricted stock unit (“RSU”) grant valued at $41,250, which vests on the date of the annual shareholder meeting the following year assuming continuous service as a director. Since April 2022, we also pay these directors a fee of $5,500 for in person attendance and $2,200 for telephonic participation for each board and committee meeting. Prior to this we paid these directors a fee of $5,000 for in person attendance and $2,000 for telephonic participation for each board and committee meeting. In addition, the chairpersons of the audit committee and the compensation committee receive additional RSU grants valued at $22,000 and $11,000, respectively, that also vest on the date of the annual shareholder meeting the following year. Directors who serve on more than one committee and are not employees of our company or its affiliates receive an additional RSU grant valued at $11,000 that also vests on the date of the annual shareholder meeting the following year.

Director Compensation Table

The following table provides compensation information for the one-year period ended December 31, 2022 for each member of our board of directors other than Mr. Rysavy:

Name |

|

Fees Earned or |

|

|

Stock |

|

|

Option |

|

|

Total |

|

||||

James Colquhoun |

|

|

40,400 |

|

|

|

41,252 |

|

|

|

— |

|

|

|

81,652 |

|

Kristin Frank |

|

|

40,400 |

|

|

|

63,248 |

|

|

|

— |

|

|

|

103,648 |

|

David Maisel |

|

|

4,400 |

|

|

|

41,252 |

|

|

|

|

|

|

45,652 |

|

|

Paul Sutherland |

|

|

40,400 |

|

|

|

74,251 |

|

|

|

— |

|

|

|

114,651 |

|

Keyur Patel (4) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Anaal Udaybabu (4) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

—

Board Diversity

In August 2021, the SEC approved a Nasdaq Stock Market proposal to adopt new listing rules relating to board diversity and disclosure. As approved by the SEC, the new Nasdaq listing rules require all Nasdaq listed companies to disclose consistent, transparent diversity statistics regarding their boards of directors. The Board Diversity Matrix below presents the Board’s diversity statistics in the format prescribed by the Nasdaq rules.

12

Board Diversity Matrix (As of March 7, 2023) |

||||

Total Number of Directors |

7 |

|||

|

Female |

Male |

Non-Binary |

Did Not Disclose Gender |

Part I: Gender Identity |

||||

Directors |

2 |

5 |

|

|

Part II: Demographic Background |

||||

African American or Black |

|

|

|

|

Alaskan Native or Native American |

|

|

|

|

Asian |

1 |

1 |

|

|

Hispanic or Latin |

|

|

|

|

Native Hawaiian or Pacific Islander |

|

|

|

|

White |

1 |

3 |

|

|

Two or More Races or Ethnicities |

|

|

|

|

LGBTQ+ |

1 |

|||

Did Not Disclose Demographic Background |

1 |

|||

13

EXECUTIVE OFFICERS OF GAIA

The following table sets forth the names, ages and titles of our executive officers as of February 21, 2023:

Name |

|

Age |

|

Position |

Jirka Rysavy |

|

68 |

|

Chairman and Chief Executive Officer |

Paul Tarell |

|

41 |

|

Chief Financial Officer, Office of President |

Kiersten Medvedich |

|

50 |

|

Executive Vice President, Content, Office of President |

Our executive officers are elected annually by our board of directors. Mr. Rysavy has been employed by our company for more than five years. Biographical information about Mr. Rysavy is included in this proxy statement under the heading “Proposal 1—Election of Directors—Nominees for Election as Directors.”

Paul Tarell—age 41—Mr. Tarell became Gaia’s Chief Financial Officer on July 1, 2016 and joined the Office of President in November 2020. He previously served as the Chief Financial Officer of Gaia’s subscription segment since July 2014 and its Vice President of Finance from September 2013 to July 2014. Prior to that he served as Vice President – Finance at SET Media, Inc. (acquired by Conversant) from January 2012 until August 2013. He was Senior Director of Finance at Velti, Inc., a mobile advertising technology company, from October 2010 until December 2011. Prior to that, Mr. Tarell was a licensed certified public accountant in public practice with Armanino LLP.

Kiersten Medvedich —age 50—Ms. Medvedich became Gaia’s Executive Vice President, Content in June 2020 and joined the Office of President in November 2020. She previously served as Senior Vice President of Content, Vice President of Content Production and Senior Director of Content Production since joining Gaia in November 2016. Her experience has been firmly rooted in all facets of production and brings a level of national broadcast experience to Gaia by way of her long-standing tenure with Sony Pictures Television.

14

BENEFICIAL OWNERSHIP OF SHARES

The following table sets forth information with respect to the beneficial ownership of our common stock as of February 21, 2023 for (i) each person (or group of affiliated persons) who, insofar as we have been able to ascertain, beneficially owned more than 5% of the outstanding shares of our Class A common stock or Class B common stock, (ii) each director and director nominee, (iii) each executive officer named below in the Summary Compensation Table, and (iv) all current directors and executive officers as a group. We have based our calculation of the percentage of beneficial ownership on 15,425,974 shares of our Class A common stock and 5,400,000 shares of our Class B common stock outstanding on February 21, 2023.

Title of |

|

Name and Address of Beneficial Owner |

|

Amount and |

|

|

Percent of |

|

|

Percent of |

|

|||

Class A |

|

Ameriprise Financial, Inc. (4) |

|

|

1,315,000 |

|

|

|

8.52 |

% |

|

|

6.31 |

% |

|

|

AWM Investment Company, Inc. (5) |

|

|

879,375 |

|

|

|

5.70 |

% |

|

|

4.22 |

% |

|

|

Jirka Rysavy (6) |

|

|

5,875,061 |

|

|

|

28.21 |

% |

|

|

28.21 |

% |

|

|

Paul Tarell (7) |

|

|

154,802 |

|

|

|

1.00 |

% |

|

*% |

|

|

|

|

Kiersten Medvedich (8) |

|

|

32,403 |

|

|

*% |

|

|

*% |

|

||

|

|

James Colquhoun (9) |

|

|

883,782 |

|

|

|

5.73 |

% |

|

|

4.24 |

% |

|

|

Paul Sutherland (10) |

|

|

193,136 |

|

|

|

1.25 |

% |

|

*% |

|

|

|

|

David Maisel (11) |

|

|

171,245 |

|

|

|

1.11 |

% |

|

*% |

|

|

|

|

Kristin E. Frank (12) |

|

|

71,140 |

|

|

*% |

|

|

*% |

|

||

|

|

Anaal Udaybabu |

|

|

— |

|

|

—% |

|

|

—% |

|

||

|

|

Keyur Patel |

|

|

— |

|

|

—% |

|

|

—% |

|

||

|

|

All directors and officers as a group (9 persons) |

|

|

7,381,569 |

|

|

|

35.44 |

% |

|

|

35.44 |

% |

Class B |

|

Jirka Rysavy (6) |

|

|

1,400,000 |

|

|

|

25.93 |

% |

|

|

6.72 |

% |

|

|

Jirka Rysavy, LLC (6) |

|

|

4,000,000 |

|

|

|

74.07 |

% |

|

|

19.21 |

% |

|

|

All directors and officers as a group (9 persons) |

|

|

5,400,000 |

|

|

|

100.00 |

% |

|

N/A |

|

|

—

* Indicates less than one percent ownership.

— Indicates zero beneficial ownership and zero percent of class.

15

16

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

Overview of Our Compensation Program and Philosophy

Our compensation program is intended to meet three principal objectives: (1) attract, reward and retain qualified, energetic officers and other key employees; (2) motivate these individuals to achieve short-term and long-term corporate goals that enhance shareholder value; and (3) support our corporate values by promoting internal equity and external competitiveness.

Our executive compensation program is overseen and administered by the compensation committee of our board of directors, which is comprised entirely of independent directors as determined in accordance with various NASDAQ, Securities and Exchange Commission, and Internal Revenue Code rules. Our compensation committee operates under a written charter adopted by our board and is empowered to review and approve the annual compensation for our named executive officers. A copy of the charter is available on our website at http://ir.gaia.com/governance-docs. We have included the website address only as inactive textual reference, and the information contained on the website is not incorporated by reference into this proxy.

The principal objectives that guide our compensation committee in assessing our executive and other compensation programs include the proper allocation between long-term compensation, current cash compensation, and short-term bonus compensation. Other considerations include our business objectives, our fiduciary and corporate responsibilities (including internal considerations of fairness and affordability), competitive practices and trends, general economic conditions and regulatory requirements.

In determining the particular elements of compensation that will be used to implement our overall compensation objectives, our compensation committee takes into consideration a number of factors related to our performance, such as our earnings per share, profitability, revenue growth, and business-unit-specific operational and financial performance, as well as the competitive environment for our business. Stock price performance has not been a factor in determining annual compensation because the price of our common stock is subject to a variety of factors outside of our control. Our compensation committee may, when appropriate as determined on an annual basis, identify individual performance goals for executive and other officers, which goals may play a significant role in determining such officer’s incentive compensation for that year and which may be taken into consideration in setting base salary for the next year.

From time to time, our compensation committee meets with our Chairman and Chief Executive Officer, Jirka Rysavy, to obtain recommendations with respect to our compensation programs, practices and packages for executives, other employees and directors. Our Chairman and Chief Executive Officer makes recommendations to our compensation committee on the base salary, bonus targets and equity compensation for the executive team. Our compensation committee considers, but is not bound by and does not always accept, management’s recommendations with respect to executive compensation.

Our compensation committee has also in the past received input from an independent compensation consultant prior to finalizing determinations on material aspects of our compensation programs, practices and packages, and it expects to do so again from time to time. In 2022 our compensation committee did not engage an independent compensation consultant.

Mr. Rysavy attends some of our compensation committee’s meetings, but our compensation committee also holds executive sessions not attended by any members of management or non-independent directors. Our compensation committee discusses Mr. Rysavy’s compensation packages with him, but makes decisions with respect to his compensation without him present. Our compensation committee has the ultimate authority to make decisions with respect to the compensation of our named executive officers, but may, if it chooses, delegate any of its responsibilities to subcommittees. Our compensation committee has delegated to the administrative committee of our board of directors, comprised of Mr. Rysavy, the authority to grant long-term incentive awards to employees at or below the level of vice president under guidelines set by our compensation committee.

17

Elements of Our Compensation Program

Our compensation committee believes that compensation paid to executive officers and other members of our senior management should be closely aligned with our performance on both a short-term and a long-term basis, and that such compensation should assist us in attracting and retaining talented persons who are committed to our mission and critical to our long-term success. To that end, our compensation committee believes that the compensation packages for executive officers should consist of three principal components:

We have selected these elements because each is considered useful and/or necessary to meet one or more of the principal objectives of our compensation policy. For instance, base salary and bonus target percentages are set with the goal of attracting employees and adequately compensating and rewarding them on a day-to-day basis for the services they perform and for achieving short-term business objectives, while our equity programs are geared toward providing an incentive and reward for the achievement of long-term business objectives and retaining key talent. We believe that these elements of compensation, when combined, are effective, and will continue to be effective, in achieving the objectives of our compensation program.

Our compensation committee believes in the importance of equity ownership for all executive officers and a broader-based segment of our work force, for purposes of economic incentive, key employee retention and alignment of employees’ interests with those of shareholders. Our compensation committee believes that the Gaia, Inc. 2019 Long-Term Incentive Plan provides valuable flexibility to achieve a balance between providing equity-based compensation for employees and creating and maintaining long-term shareholder value.

Restricted stock unit awards are typically made when a new executive officer is hired, and in determining the size of restricted stock unit awards, our compensation committee bases its determinations on such subjective considerations as the individual’s position within management, experience, the market value of the executive’s skill set, and historical grant amounts to similarly positioned executives of our company. Since 2017, we have not granted stock options as we shifted to restricted stock unit awards. Our historical policy was that the exercise price of a stock option grant shall be equal to or greater than the closing price of the Class A common stock on the date of grant and, accordingly, will have value only if the market price of the Class A common stock increases after that date. The stock options granted pursuant to the Gaia, Inc. 2019 Long-Term Incentive Plan generally vest at 2% per month during the 11th through 60th month after the date of grant with respect to the first option grant awarded to an individual, and generally vest at 2% per month beginning in the first full month after the date of grant with respect to subsequent option grants. The restricted stock units granted pursuant to the Gaia, Inc. 2019 Long-Term Incentive Plan, as well as those previously granted pursuant to the Gaia, Inc. 2009 Long-Term Incentive Plan, generally vest on a specific date approximately five years from the date of grant.

Our compensation committee reviews our compensation program on an annual basis. In setting compensation levels for a particular executive, our compensation committee takes into consideration the proposed compensation package

18

as a whole and each element individually, but does not apply any specific formula in doing so. While the importance of one compensation element to another may vary among executive officers, our compensation committee attempts to correlate the overall compensation package to each executive officer’s past and expected future contributions to our business. We currently do not have any employment agreements with our executive officers or other agreements to make payments to our executive officers upon their termination or a change-in-control.

Consideration of Say-on-Pay Vote Results

At the 2020 annual meeting of shareholders, our shareholders approved, on an advisory basis, the compensation of our named executive officers, as disclosed pursuant to the compensation disclosure rules of the Securities and Exchange Commission. Our compensation committee reviewed and considered the final vote results for that resolution, and we have not made any changes to our executive compensation policies or decisions as a result of the vote. Further, at the 2017 annual meeting of shareholders, our shareholders voted, on an advisory basis, for holding an advisory vote to approve named executive officer compensation every three years. Accordingly, our board of directors determined that Gaia will hold the next advisory vote to approve named executive officer compensation at this 2023 annual meeting of shareholders as described in Proposal 3. Our board will consider the results of the shareholder vote on Proposal 3, indicating our shareholders’ preference whether the advisory resolution should be presented every one, two or three years, and will decide when the next advisory vote to approve named executive officer compensation will be submitted to the shareholders.

Risk Assessments

With respect to risk related to compensation matters, our compensation committee considers, in establishing and reviewing our executive compensation program, whether the program encourages unnecessary or excessive risk taking and has concluded that it does not. Our executive officers’ base salaries are fixed in amount and thus do not encourage risk-taking. Bonuses generally are capped and are tied to overall business unit and corporate performance. A portion of compensation provided to the executive officers has in the past been in the form of stock options that are important to help further align executives’ interests with those of our shareholders. Our compensation committee believes that these awards do not encourage unnecessary or excessive risk-taking, as the value of the stock options fluctuate with our stock price and do not represent significant downward/upward risk and reward.

Summary Compensation Table for 2022

The following table includes information concerning compensation for each of the last two years for our named executive officers.

Name and Principal Position |

|

Year |

|

Salary (2) |

|

|

Bonus (2) |

|

|

Stock |

|

|

All Other |

|

|

Total ($) |

|

|||||

Jirka Rysavy (1) |

|

2022 |

|

$ |

524,064 |

|

|

$ |

349,550 |

|

|

$ |

— |

|

|

$ |

4,800 |

|

|

$ |

878,414 |

|

Chairman, Chief Executive Officer and Director |

|

2021 |

|

$ |

524,064 |

|

|

$ |

524,064 |

|

|

$ |

— |

|

|

$ |

4,800 |

|

|

$ |

1,052,928 |

|

Paul Tarell |

|

2022 |

|

$ |

358,166 |

|

|

$ |

223,445 |

|

|

$ |

— |

|

|

$ |

4,800 |

|

|

$ |

586,411 |

|

Chief Financial Officer |

|

2021 |

|

$ |

335,812 |

|

|

$ |

251,859 |

|

|

$ |

499,995 |

|

|

$ |

4,800 |

|

|

$ |

1,092,466 |

|

Kiersten Medvedich |

|

2022 |

|

$ |

322,885 |

|

|

$ |

200,100 |

|

|

$ |

— |

|

|

$ |

4,770 |

|

|

$ |

527,755 |

|

Executive Vice President Content |

|

2021 |

|

$ |

294,808 |

|

|

$ |

213,750 |

|

|

$ |

— |

|

|

$ |

4,080 |

|

|

$ |

512,638 |

|

—

19

Outstanding Equity Awards at Fiscal 2022 Year-End Table

The following table includes certain information as of December 31, 2022 with respect to unexercised options and restricted stock units previously awarded to our executive officers named above in the Summary Compensation Table.

|

|

Option and Restricted Stock Unit Awards |

|

|||||||||||||||||||||

|

|

Number of |

|

|

Number of |

|

|

Option |

|

|

Option |

|

|

Number of |

|

|

Market Value |

|

||||||

Name |

|

Exercisable (1) |

|

|

Unexercisable (1) |

|

|

(1) |

|

|

(1) |

|

|

(1) |

|

|

(1) (2) |

|

||||||

Jirka Rysavy (3) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

53,784 |

|

|

|

128,006 |

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

76,543 |

|

|

|

182,172 |

|

Paul Tarell (4) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

28,173 |

|

|

|

67,052 |

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

40,873 |

|

|

|

97,278 |

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

47,664 |

|

|

|

113,440 |

|

Kiersten Medvedich (5) |

|

|

10,000 |

|

|

|

— |

|

|

$ |

7.40 |

|

|

11/1/2026 |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

12,403 |

|

|

|

29,519 |

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

34,688 |

|

|

|

82,557 |

|

—

Generally Available Benefit Programs

We maintain a tax-qualified 401(k) Plan, which provides for broad-based employee participation. Our executive officers are eligible to participate in the 401(k) Plan on the same basis as other employees. For 2022, under the 401(k) Plan, all of our employees were eligible to receive a matching contribution from us, and the matching contribution equaled $0.50 for each dollar contributed by an employee up to a maximum annual matching benefit of $3,000 per person. The matching contribution is calculated and paid on a payroll-by-payroll basis subject to applicable Federal limits. We do not provide defined benefit pension plans or defined contribution retirement plans to our executives or other employees other than our 401(k) Plan described herein.

In 2022, our executive officers were eligible to receive the same health care coverage that is generally available to our other employees. We also offered a number of other benefits to our named executive officers pursuant to benefit programs that provide for broad-based employee participation. These benefits programs included medical, dental and vision insurance, long-term and short-term disability insurance, life and accidental death and dismemberment insurance, health and dependent care flexible spending accounts, business travel insurance, wellness programs

20

(including chiropractic, massage therapy, acupuncture, and fitness classes), relocation/expatriate programs and services, educational assistance, and certain other benefits.

Our compensation committee believes that our 401(k) Plan and the other generally available benefit programs allow us to remain competitive for employee talent, and that the availability of the benefit programs generally enhances employee productivity and loyalty to us. The main objectives of our benefits programs are to give our employees access to quality healthcare, financial protection from unforeseen events, assistance in achieving retirement financial goals, and enhanced health and productivity, in full compliance with applicable legal requirements. Typically, these generally available benefits do not specifically factor into decisions regarding an individual executive officer’s total compensation or equity-based award package.

Stock Option and Restricted Stock Unit Grant Timing Practices

During 2022, our compensation committee and our board consistently applied the following guidelines for stock option and restricted stock unit grant and timing practices.

Our directors, officers, and managers are required to sign a confidentiality agreement and, upon receiving a stock option grant or a restricted stock unit award, a two-year non-compete agreement commencing with the date they leave our company.

Compensation of Mr. Rysavy

The board-approved annual base salary for Mr. Rysavy for 2022 and 2021 was $524,064. Mr. Rysavy serves as our Chairman and Chief Executive Officer and is our largest shareholder.

Our compensation committee and our board of directors strongly believe that Mr. Rysavy’s salary and overall compensation level are modest given the importance of Mr. Rysavy to our future, his previous experience and business accomplishments and the market value of his skill set as an executive.

Pay versus Performance

As required by Section 953(a) of the Dodd-Frank Wall Street Reform and Consumer Protection Act, and Item 402(v) of Regulation S-K, we are providing the following information about the relationship between executive compensation actually paid and certain financial performance of Gaia. For further information concerning our variable pay-for-performance philosophy and how we align executive compensation with our performance, refer to “Executive Compensation – Compensation Discussion and Analysis.”

Year |

|

|

Summary Compensation Table Total for PEO (1) |

|

|

Compensation Actually Paid to PEO (2) |

|

|

Average Summary Compensation Table Total for Non-PEO NEO's (3) |

|

|

Average Compensation Actually Paid to Non-PEO NEO's (4) |

|

|

Value of Initial Fixed $100 Investment Based on Total Shareholder Return (5) |

|

|

Net Income |

|

|||||||

(a) |

|

|

(b) |

|

|

(c) |

|

|

(d) |

|

|

(e) |

|

|

(f) |

|

|

(g) |

|

|||||||

|

2022 |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

( |

) |

||||

|

2021 |

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||||

—

21

Year |

|

|

Reported Summary Compensation Table Total for PEO |

|

|

Reported Value of Equity Awards (A) |

|

|

Equity Award |

|

|

Compensation Actually Paid to PEO |

|

|||||

|

2022 |

|

|

$ |

|

|

$ |

— |

|

|

$ |

( |

) |

|

$ |

( |

) |

|

|

2021 |

|

|

$ |

|

|

$ |

— |

|

|

$ |

( |

) |

|

$ |

|

||

—

(A) The grant date fair value of equity awards represents the total of the amounts reported in the “Stock Awards” column in the Summary Compensation Table for the applicable year.

(B) The equity award adjustments for each applicable year include the addition (or subtraction, as applicable) of the following: (i) the year-end fair value of any equity awards granted in the applicable year that are outstanding and unvested as of the end of the year; (ii) the amount of change as of the end of the applicable year (from the end of the prior fiscal year) in fair value of any awards granted in prior years that are outstanding and unvested as of the end of the applicable year; (iii) for awards that are granted and vest in same applicable year, the fair value as of the vesting date; (iv) for awards granted in prior years that vest in the applicable year, the amount equal to the change as of the vesting date (from the end of the prior fiscal year) in fair value; (v) for awards granted in prior years that are determined to fail to meet the applicable vesting conditions during the applicable year, a deduction for the amount equal to the fair value at the end of the prior fiscal year; and (vi) the dollar value of any dividends or other earnings paid on stock or option awards in the applicable year prior to the vesting date that are not otherwise reflected in the fair value of such award or included in any other component of total compensation for the applicable year. The valuation assumptions used to calculate fair values did not materially differ from those disclosed at the time of grant. The amounts deducted or added in calculating the equity award adjustments are as follows:

Year |

|

|

Year End Fair Value of Equity Awards |

|

|

Year over Year Change in Fair Value of Outstanding and Unvested Equity Awards |

|

|

Fair Value as of Vesting Date of Equity Awards Granted and Vested in the Year |

|

|

Year over Year Change in Fair Value of Equity Awards Granted in Prior Years that Vested in the Year |

|

|

Fair Value at the End of the Prior Year of Equity Awards that Failed to Meet Vesting Conditions in the Year |

|

|

Value of Dividends or other Earnings Paid on Stock or Option Awards not Otherwise Reflected in Fair Value or Total Compensation |

|

|

Total Equity Award |

|

||||||||

|

2022 |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

— |

|

|

$ |

( |

) |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

( |

) |

|

|

2021 |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

( |

) |

|

—

22

Year |

|

|

Average Reported Summary Compensation Table Total for Non-PEO NEOs |

|

|

Average Reported Value of Equity Awards |

|

|

Average Equity Award |

|

|

Average Compensation Actually Paid to Non-PEO NEOs |

|

|||||

|

2022 |

|

|

$ |

|

|

$ |

— |

|

|

$ |

( |

) |

|

$ |

|

||

|

2021 |

|

|

$ |

|

|

$ |

— |

|

|

$ |

( |

) |

|

$ |

|

||

—

Year |

|

|

Average Year End Fair Value of Equity Awards |

|

|

Year over Year Average Change in Fair Value of Outstanding and Unvested Equity Awards |

|

|

Average Fair Value as of Vesting Date of Equity Awards Granted and Vested in the Year |

|

|

Year over Year Average Change in Fair Value of Equity Awards Granted in Prior Years that Vested in the Year |

|

|

Average Fair Value at the End of the Prior Year of Equity Awards that Failed to Meet Vesting Conditions in the Year |

|

|

Average Value of Dividends or other Earnings Paid on Stock or Option Awards not Otherwise Reflected in Fair Value or Total Compensation |

|

|

Total Average Equity Award Adjustments |

|

||||||||

|

2022 |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

— |

|

|

$ |

( |

) |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

( |

) |

|

|

2021 |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

( |

) |

|

—

(A) The grant date fair value of equity awards represents the total of the amounts reported in the “Stock Awards” column in the Summary Compensation Table for the applicable year

Analysis of the Information Presented in the Pay versus Performance Table

As described in more detail in the section “Executive Compensation – Compensation Discussion and Analysis,” our executive compensation program reflects a variable pay-for-performance philosophy. In accordance with Item 402(v) of Regulation S-K, we are providing the following graphs that describe the relationships between information presented in the Pay Versus Performance table.

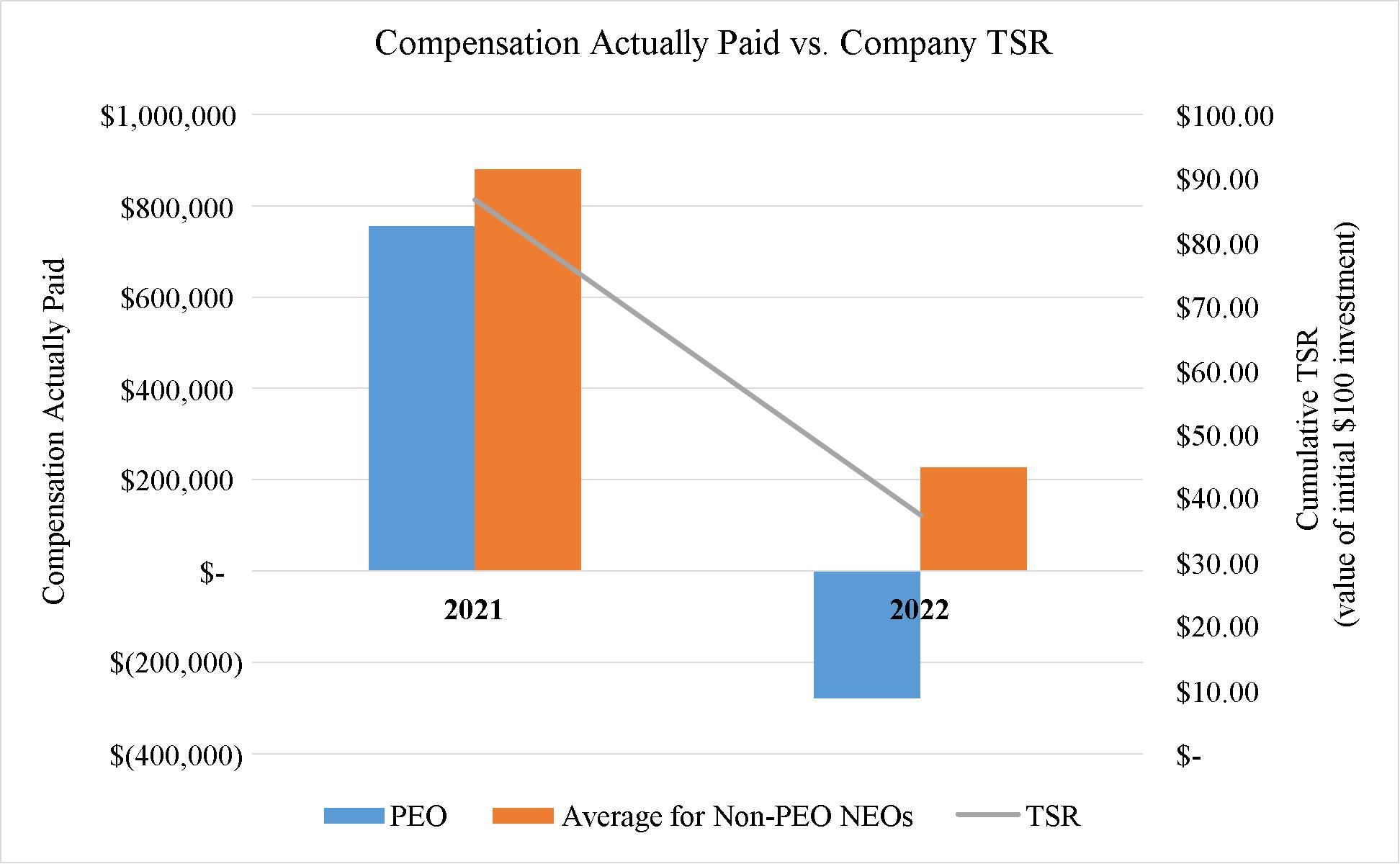

Compensation Actually Paid and Cumulative TSR

As demonstrated by the following graph, the amount of compensation actually paid to Mr. Rysavy and the average amount of compensation actually paid to our NEOs as a group (excluding Mr. Rysavy) is aligned with our cumulative TSR over the two years presented in the table.

23

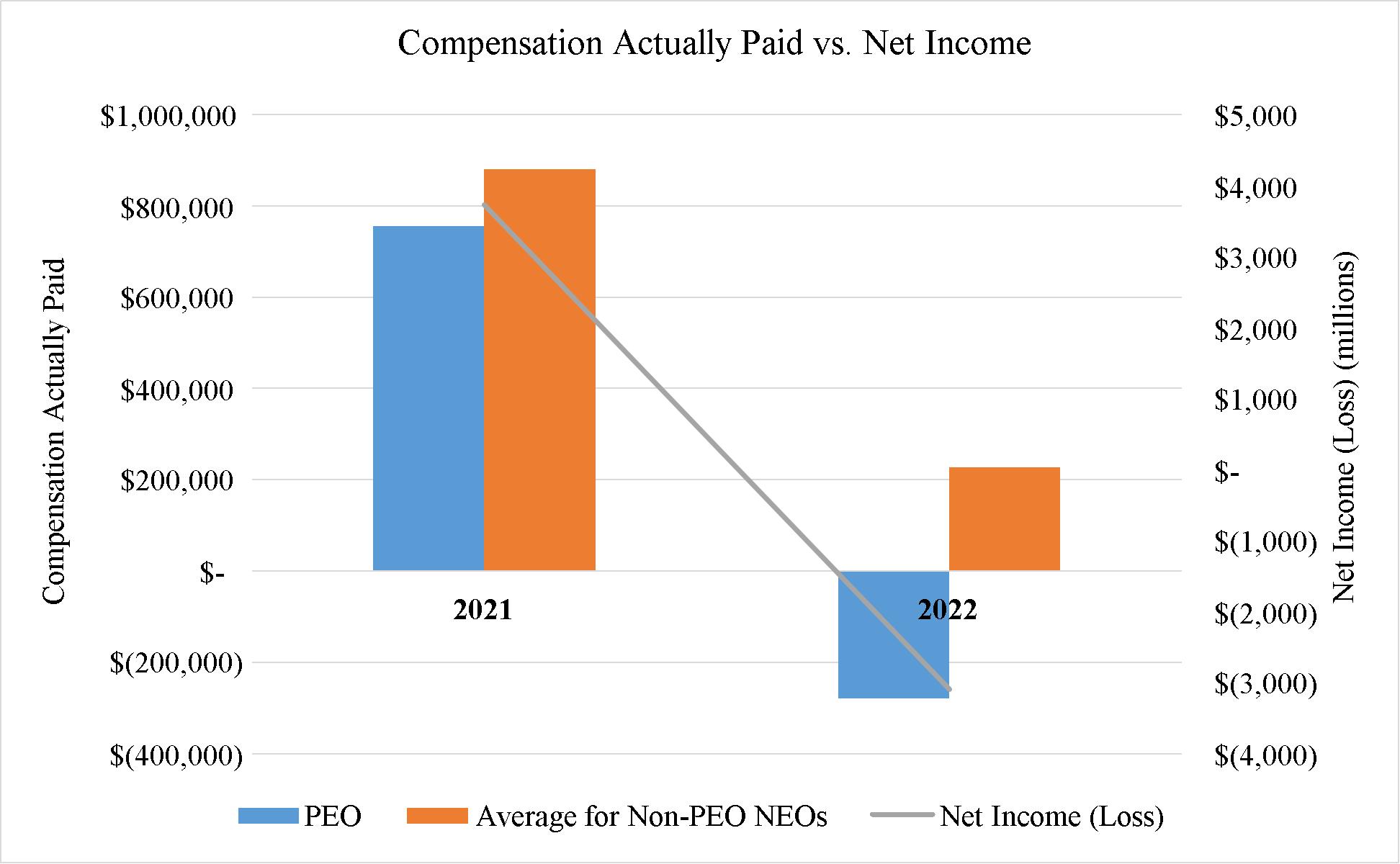

Compensation Actually Paid vs. Net Income

Compensation Actually Paid and Net Income

As demonstrated by the following table, the amount of compensation actually paid to Mr. Rysavy and the average amount of compensation actually paid to our NEOs as a group (excluding Mr. Rysavy) is generally aligned with the Company’s net income over the two years presented in the table.

Compensation Actually Paid vs. Company TSR

24

AUDIT COMMITTEE REPORT

Our management is responsible for establishing and maintaining adequate internal control over financial reporting, for the preparation of our consolidated financial statements, and for the public reporting process. Our audit committee, on behalf of our board of directors, oversees management’s conduct of internal control processes and procedures for financial reporting designed to ensure the integrity and accuracy of our consolidated financial statements and to ensure that we are able to timely record, process and report information required for public disclosure. In connection with the 2022 audit, our audit committee has:

Audit Committee |

Paul Sutherland, Chairperson |

James Colquhoun |

Kristin Frank |

This Audit Committee Report shall not be deemed to be “soliciting material” or to be “filed” with the Securities and Exchange Commission or subject to Regulation 14A or 14C, or to the liabilities of Section 18 of the Exchange Act, except to the extent that we specifically request that this information be treated as “soliciting material” or specifically incorporate this information by reference into a document filed under the Securities Act of 1933 or the Exchange Act.

INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS

On April 29, 2021, the audit committee approved the dismissal of Plante Moran PLLC (“Plante Moran”) as the company’s independent registered public accounting firm. The reports of Plante Moran on the company's consolidated financial statements for the fiscal years ended December 31, 2019 and 2020 did not contain an adverse opinion or a disclaimer of opinion, and were not qualified or modified as to uncertainty, audit scope or accounting principles. During the fiscal years ended December 31, 2019 and 2020, and through April 29, 2021, there were no “disagreements” (as defined in Item 304(a)(1)(iv) of Regulation S-K and related instructions) with Plante Moran on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure, which disagreements if not resolved to the satisfaction of Plante Moran would have caused Plante Moran to make reference thereto in its reports on the consolidated financial statements for such years. During the fiscal years ended

25

December 31, 2019 and 2020, and through April 29, 2021, there were no “reportable events” (as defined in Item 304(a)(1)(v) of Regulation S-K).