UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

(Mark One)

|

|

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

For the fiscal year ended December 31, 2015

|

|

OR

|

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

For the transition period from __________to____________

|

|

|

|

|

Commission file number 001-34245

|

|

THE YORK WATER COMPANY

|

|

(Exact name of registrant as specified in its charter)

|

|

|

|

PENNSYLVANIA

|

23-1242500

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

130 EAST MARKET STREET, YORK, PENNSYLVANIA

|

17401

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

|

|

|

Registrant's telephone number, including area code (717) 845-3601

|

|

|

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

None

|

|

|

(Title of Each Class)

|

(Name of Each Exchange on Which Registered)

|

Securities registered pursuant to Section 12(g) of the Act:

COMMON STOCK, NO PAR VALUE

(Title of Class)

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

|

|

YES

|

NO

|

|

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

|

|

YES

|

NO

|

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

|

|

YES

|

NO

|

|

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

|

|

YES

|

NO

|

|

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

|

|

|

|

|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act (check one):

|

|

|

Large accelerated filer

|

Accelerated filer

|

|

|

|

Non-accelerated filer

|

Small Reporting Company

|

|

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

|

|

YES

|

NO

|

The aggregate market value of the Common Stock, no par value, held by nonaffiliates of the registrant on June 30, 2015 was $268,720,487.

As of March 7, 2016 there were 12,826,147 shares of Common Stock, no par value, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement for the Company's 2016 Annual Meeting of Shareholders are incorporated by reference into Part I and Part III.

|

|

|

| |

|

|

|

PART I

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

PART II

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

PART III

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

PART IV

|

|

|

|

|

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

|

|

| |

|

|

| |

|

|

FORWARD-LOOKING STATEMENTS

Certain statements contained in this annual report and in documents incorporated by reference constitute "forward-looking statements" within the meaning of Section 21E of the Securities Exchange Act of 1934 and Section 27A of the Securities Act of 1933. Words such as "may," "should," "believe," "anticipate," "estimate," "expect," "intend," "plan" and similar expressions are intended to identify forward-looking statements. These forward-looking statements include certain information relating to the Company's business strategy; statements including, but not limited to:

|

·

|

the amount and timing of rate increases and other regulatory matters including the recovery of costs recorded as regulatory assets;

|

|

·

|

expected profitability and results of operations;

|

|

·

|

trends;

|

|

·

|

goals, priorities and plans for, and cost of, growth and expansion;

|

|

·

|

strategic initiatives;

|

|

·

|

availability of water supply;

|

|

·

|

water usage by customers; and

|

|

·

|

the ability to pay dividends on common stock and the rate of those dividends.

|

The forward-looking statements in this Annual Report reflect what the Company currently anticipates will happen. What actually happens could differ materially from what it currently anticipates will happen. The Company does not intend to make a public announcement when forward-looking statements in this Annual Report are no longer accurate, whether as a result of new information, what actually happens in the future or for any other reason. Important matters that may affect what will actually happen include, but are not limited to:

|

·

|

changes in weather, including drought conditions or extended periods of heavy rainfall;

|

|

·

|

levels of rate relief granted;

|

|

·

|

the level of commercial and industrial business activity within the Company's service territory;

|

|

·

|

construction of new housing within the Company's service territory and increases in population;

|

|

·

|

changes in government policies or regulations, including the tax code;

|

|

·

|

the ability to obtain permits for expansion projects;

|

|

·

|

material changes in demand from customers, including the impact of conservation efforts which may impact the demand of customers for water;

|

|

·

|

changes in economic and business conditions, including interest rates, which are less favorable than expected;

|

|

·

|

loss of customers;

|

|

·

|

changes in, or unanticipated, capital requirements;

|

|

·

|

the impact of acquisitions;

|

|

·

|

changes in accounting pronouncements;

|

|

·

|

changes in the Company's credit rating or the market price of its common stock;

|

|

·

|

the ability to obtain financing; and

|

|

·

|

other matters set forth in Item 1A, "Risk Factors" of this Annual Report.

|

THE YORK WATER COMPANY

PART I

The York Water Company (the "Company") is the oldest investor-owned water utility in the United States and is duly organized under the laws of the Commonwealth of Pennsylvania. The Company has operated continuously since 1816. The primary business of the Company is to impound, purify to meet or exceed safe drinking water standards and distribute water. The Company also owns and operates two wastewater collection and treatment systems. The Company operates within its franchised territory, which covers 39 municipalities within York County, Pennsylvania and nine municipalities within Adams County, Pennsylvania. The Company is regulated by the Pennsylvania Public Utility Commission, or PPUC, in the areas of billing, payment procedures, dispute processing, terminations, service territory, debt and equity financing and rate setting. The Company must obtain PPUC approval before changing any practices associated with the aforementioned areas.

Water service is supplied through the Company's own distribution system. The Company obtains the bulk of its water supply from both the South Branch and East Branch of the Codorus Creek, which together have an average daily flow of 73.0 million gallons. This combined watershed area is approximately 117 square miles. The Company has two reservoirs, Lake Williams and Lake Redman, which together hold up to approximately 2.2 billion gallons of water. The Company has a 15-mile pipeline from the Susquehanna River to Lake Redman which provides access to an additional supply of 12.0 million gallons of untreated water per day. The Company also owns seven wells which are capable of providing a safe yield of approximately 366,000 gallons per day to supply water to its customers in Carroll Valley Borough and Cumberland Township, Adams County. As of December 31, 2015, the Company's average daily availability was 35.4 million gallons, and average daily consumption was approximately 18.5 million gallons. The Company's service territory had an estimated population of 194,000 as of December 31, 2015. Industry within the Company's service territory is diversified, manufacturing such items as fixtures and furniture, electrical machinery, food products, paper, ordnance units, textile products, injectable drug delivery systems, air conditioning systems, laundry detergent, barbells and motorcycles.

The Company's water business is somewhat dependent on weather conditions, particularly the amount and timing of rainfall. Revenues are particularly vulnerable to weather conditions in the summer months. Prolonged periods of hot and dry weather generally cause increased water usage for watering lawns, washing cars, and keeping golf courses and sports fields irrigated. Conversely, prolonged periods of dry weather could lead to drought restrictions from governmental authorities. Despite the Company's adequate water supply, customers may be required to cut back water usage under such drought restrictions which would negatively impact revenues. The Company has addressed some of this vulnerability by instituting minimum customer charges which are intended to cover fixed costs of operations under all likely weather conditions.

The Company's business does not require large amounts of working capital and is not dependent on any single customer or a very few customers for a material portion of its business. Increases in revenues are generally dependent on the Company's ability to obtain rate increases from the PPUC in a timely manner and in adequate amounts and to increase volumes of water sold through increased consumption and increases in the number of customers served. The Company continuously looks for water and wastewater acquisition and expansion opportunities both within and outside its current service territory as well as additional opportunities to enter into bulk water contracts with municipalities and other entities to supply water.

The Company has agreements with several municipalities to provide sewer billing services. The Company also has a service line protection program on a targeted basis in order to further diversify its business. Under this optional program, customers pay a fixed monthly fee, and the Company will repair or replace damaged customer service lines, as needed, subject to an annual maximum dollar amount. Opportunities to expand both initiatives are being pursued.

Competition

As a regulated utility, the Company operates within an exclusive franchised territory that is substantially free from direct competition with other public utilities, municipalities and other entities. Although the Company has been granted an exclusive franchise for each of its existing community water and wastewater systems, the ability of the Company to expand or acquire new service territories may be affected by currently unknown competitors obtaining franchises to surrounding systems by application or acquisition. These competitors may include other investor-owned utilities, nearby municipally-owned utilities and sometimes from strategic or financial purchasers seeking to enter or expand in the water and wastewater industry. The addition of new service territory and the acquisition of other utilities are generally subject to review and approval by the PPUC.

Water and Wastewater Quality and Environmental Regulations

Provisions of water and wastewater service are subject to regulation under the federal Safe Drinking Water Act, the Clean Water Act and related state laws, and under federal and state regulations issued under these laws. In addition, the Company is subject to federal and state laws and other regulations relating to solid waste disposal, dam safety and other aspects of its operations.

The federal Safe Drinking Water Act establishes criteria and procedures for the U.S. Environmental Protection Agency, or EPA, to develop national quality standards. Regulations issued under the Act, and its amendments, set standards on the amount of certain contaminants allowable in drinking water. Current requirements are not expected to have a material impact on the Company's operations or financial condition as it already meets or exceeds standards. In the future, the Company may be required to change its method of treating drinking water, and may incur additional capital investments if new regulations become effective.

Under the requirements of the Pennsylvania Safe Drinking Water Act, or SDWA, the Pennsylvania Department of Environmental Protection, or DEP, monitors the quality of the finished water supplied to customers. The DEP requires the Company to submit weekly reports showing the results of daily bacteriological and other chemical and physical analyses. As part of this requirement, the Company conducts over 70,000 laboratory tests annually. Management believes that the Company complies with the standards established by the agency under the SDWA. The DEP assists the Company by regulating discharges into the Company's watershed area to prevent and eliminate pollution.

The federal Groundwater Rule became effective December 1, 2009 with implementation for community water supplies serving between 100 and 500 customers before April 1, 2012. This rule requires additional testing of water from well sources, and under certain circumstances requires demonstration and maintenance of effective disinfection. The Company holds public water supply permits issued by the DEP, which establishes the groundwater source operating conditions for its wells, including demonstrated 4-log treatment of viruses. All of the satellite systems operated by the Company are in compliance with the federal Groundwater Rule. The Company plans to make modifications at one of these systems to more reliably and consistently demonstrate 4-log treatment of viruses.

The Clean Water Act regulates discharges from water and wastewater treatment facilities into lakes, rivers, streams and groundwater. The Company complies with this Act by obtaining and maintaining all required permits and approvals for discharges from its water and wastewater facilities and by satisfying all conditions and regulatory requirements associated with the permits.

The DEP monitors the quality of wastewater discharge effluent under the provisions of the National Pollutant Discharge Elimination System, or NPDES. The Company submits monthly reports to the DEP showing the results of its daily effluent monitoring and removal of sludge and biosolids. The Company is not aware of any significant environmental remediation costs necessary from the handling and disposal of waste material from its wastewater operations.

The DEP and the Susquehanna River Basin Commission, or SRBC, regulate the amount of water withdrawn from streams in the watershed to assure that sufficient quantities are available to meet the needs of the Company and other regulated users. Through its Division of Dam Safety, the DEP regulates the operation and maintenance of the Company's impounding dams. The Company routinely inspects its dams and prepares annual reports of their condition as required by DEP regulations. The DEP reviews these reports and inspects the Company's dams approximately every year. The DEP most recently inspected the Company's dams in April 2014 and noted no significant violations.

Since 1980, the DEP has required any new dam to have a spillway that is capable of passing the design flood without overtopping the dam. The design flood is either the Probable Maximum Flood, or PMF, or some fraction of it, depending on the size and location of the dam. PMF is very conservative and is calculated using the most severe combination of meteorological and hydrologic conditions reasonably possible in the watershed area of a dam.

The Company engaged a professional engineer to analyze the spillway capacities at the Lake Williams and Lake Redman dams and validate the DEP's recommended flood design for the dams. Management presented the results of the study to the DEP in December 2004, and DEP then requested that the Company submit a proposed schedule for the actions to address the spillway capacities. Thereafter, the Company retained an engineering firm to prepare preliminary designs for increasing the spillway capacities to pass the PMF through armoring the dams with roller compacted concrete. Management has met with the DEP on a regular basis to review the preliminary design and discuss scheduling, permitting, and construction requirements. The Company is currently completing preliminary work on the dams as well as the final design and the permitting process. The Company expects to begin armoring one of the dams between 2017 and 2019. The second dam is expected to be armored in a year or two following the first dam armoring. The cost to armor each dam is expected to be approximately $5 million.

Capital expenditures and operating costs required as a result of water quality standards and environmental requirements have been traditionally recognized by state public utility commissions as appropriate for inclusion in establishing rates. The capital expenditures currently required as a result of water quality standards and environmental requirements have been budgeted in the Company's capital program and represent less than 10% of its expected total capital expenditures over the next five years. The Company is currently in compliance with wastewater environmental standards and does not anticipate any major capital expenditures for its current wastewater business.

Growth

During the five year period ended December 31, 2015, the Company continued to grow the number of customers and its distribution facilities.

The following table sets forth certain of the Company's summary statistical information.

|

(In thousands of dollars)

|

|

For the Years Ended December 31,

|

|

| |

|

2015

|

|

|

2014

|

|

|

2013

|

|

|

2012

|

|

|

2011

|

|

|

Revenues

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Residential

|

|

$

|

29,682

|

|

|

$

|

29,079

|

|

|

$

|

26,796

|

|

|

$

|

26,114

|

|

|

$

|

25,693

|

|

|

Commercial and industrial

|

|

|

13,822

|

|

|

|

13,267

|

|

|

|

12,299

|

|

|

|

12,114

|

|

|

|

11,820

|

|

|

Other

|

|

|

3,585

|

|

|

|

3,554

|

|

|

|

3,288

|

|

|

|

3,219

|

|

|

|

3,116

|

|

|

Total

|

|

$

|

47,089

|

|

|

$

|

45,900

|

|

|

$

|

42,383

|

|

|

$

|

41,447

|

|

|

$

|

40,629

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average daily water consumption (gallons per day)

|

|

|

18,507,000

|

|

|

|

18,327,000

|

|

|

|

19,094,000

|

|

|

|

18,553,000

|

|

|

|

18,465,000

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Miles of water mains at year-end

|

|

|

958

|

|

|

|

951

|

|

|

|

945

|

|

|

|

940

|

|

|

|

929

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Additional water distribution mains installed/acquired (ft.)

|

|

|

40,873

|

|

|

|

28,523

|

|

|

|

28,051

|

|

|

|

59,653

|

|

|

|

17,212

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Wastewater collection mains acquired (ft.)

|

|

|

-

|

|

|

|

28,250

|

|

|

|

-

|

|

|

|

14,820

|

|

|

|

-

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number of customers at year-end

|

|

|

66,087

|

|

|

|

65,102

|

|

|

|

64,118

|

|

|

|

63,779

|

|

|

|

62,738

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Population served at year-end

|

|

|

194,000

|

|

|

|

192,000

|

|

|

|

190,000

|

|

|

|

189,000

|

|

|

|

187,000

|

|

Executive Officers of the Registrant

The Company presently has 104 full time employees including the officers detailed in the information set forth under the caption "Executive Officers of the Company" of the 2016 Proxy Statement incorporated herein by reference.

Available Information

The Company makes available free of charge, on or through its website (www.yorkwater.com), its annual report on Form 10-K, its quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after the Company electronically files such material with, or furnishes it to, the SEC.

Shareholders may request, without charge, copies of the Company's financial reports. Such requests, as well as other investor relations inquiries, should be addressed to:

|

Bonnie J. Rexroth

|

The York Water Company

|

(717) 845-3601

|

|

Investor Relations Administrator

|

130 East Market Street

|

(800) 750-5561

|

| |

York, PA 17401

|

bonnier@yorkwater.com

|

The rates we charge our customers are subject to regulation. If we are unable to obtain government approval of our requests for rate increases, or if approved rate increases are untimely or inadequate to cover our investments in utility plant and equipment and projected expenses, our results of operations may be adversely affected.

Our ability to maintain and meet our financial objectives is dependent upon the rates we charge our customers, which are subject to approval by the PPUC. We file rate increase requests with the PPUC, from time to time, to recover our investments in utility plant and equipment and projected expenses. Any rate increase or adjustment must first be justified through documented evidence and testimony. The PPUC determines whether the investments and expenses are recoverable, the length of time over which such costs are recoverable, or, because of changes in circumstances, whether a remaining balance of deferred investments and expenses is no longer recoverable in rates charged to customers. Once a rate increase application is filed with the PPUC, the ensuing administrative and hearing process may be lengthy and costly. The timing of our rate increase requests are therefore dependent upon the estimated cost of the administrative process in relation to the investments and expenses that we hope to recover through the rate increase. In addition, the amount or frequency of rate increases may be decreased or lengthened as a result of changes in income tax laws regarding tax-basis depreciation as it applies to our capital expenditures or qualifying repair tax deductible expenditures.

We can provide no assurances that future requests will be approved by the PPUC; and, if approved, we cannot guarantee that these rate increases will be granted in a timely or sufficient manner to cover the investments and expenses for which we sought the rate increase. If we are unable to obtain PPUC approval of our requests for rate increases, or if approved rate increases are untimely or inadequate to cover our investments in utility plant and equipment and projected expenses, our results of operations may be adversely affected.

We are subject to federal, state and local regulation that may impose costly limitations and restrictions on the way we do business.

Various federal, state and local authorities regulate many aspects of our business. Among the most important of these regulations are those relating to the quality of water we supply our customers, water allocation rights and the quality of the effluent we discharge from our wastewater treatment facility. Government authorities continually review these regulations, particularly the drinking water quality regulations, and may propose new or more restrictive requirements in the future. We are required to perform water and wastewater quality tests that are monitored by the PPUC, the EPA, and the DEP, for the detection of certain chemicals and compounds in our water and effluent. If new or more restrictive limitations on permissible levels of substances and contaminants in our water and wastewater are imposed, we may not be able to adequately predict the costs necessary to meet regulatory standards. If we are unable to recover the cost of implementing new water and wastewater treatment procedures in response to more restrictive quality regulations through our rates that we charge our customers, or if we fail to comply with such regulations, it could have a material adverse effect on our financial condition and results of operations.

We are also subject to water allocation regulations that control the amount of water that we can draw from water sources. The SRBC and the DEP regulate the amount of water withdrawn from streams in the watershed for water supply purposes to assure that sufficient quantities are available to meet our needs and the needs of other regulated users. In addition, government drought restrictions could cause the SRBC or the DEP to temporarily reduce the amount of our allocations. If new or more restrictive water allocation regulations are implemented or our allocations are reduced due to weather conditions, it may have an adverse effect on our ability to supply the demands of our customers, and in turn, on our revenues and results of operations.

Our business is subject to seasonal fluctuations, which could affect demand for our water service and our revenues.

Demand for our water during the warmer months is generally greater than during cooler months due primarily to additional requirements for water in connection with cooling systems, swimming pools, irrigation systems and other outside water use. Throughout the year, and particularly during typically warmer months, demand will vary with temperature and rainfall levels. If temperatures during the typically warmer months are cooler than expected, or there is more rainfall than expected, the demand for our water may decrease and adversely affect our revenues.

Weather conditions and overuse may interfere with our sources of water, demand for water services, and our ability to supply water to our customers.

We depend on an adequate water supply to meet the present and future demands of our customers and to continue our expansion efforts. Unexpected conditions may interfere with our water supply sources. Drought and overuse may limit the availability of surface and ground water. These factors might adversely affect our ability to supply water in sufficient quantities to our customers and our revenues and earnings may be adversely affected. Additionally, cool and wet weather, as well as drought restrictions and our customers' conservation efforts, may reduce consumption demands, also adversely affecting our revenue and earnings. Furthermore, freezing weather may also contribute to water transmission interruptions caused by pipe and main breakage. If we experience an interruption in our water supply, it could have a material adverse effect on our financial condition and results of operations.

Some scientific experts are predicting a worsening of weather volatility in the future, possibly created by the climate change greenhouse gases. Changing severe weather patterns could require additional expenditures to reduce the risk associated with any increasing storm, flood and drought occurrences.

The issue of climate change is receiving ever increasing attention worldwide. Many climate change predictions, if true, present several potential challenges to water and wastewater utilities, such as increased frequency and duration of droughts, increased precipitation and flooding, potential degradation of water quality, and changes in demand for services. The changes may result in lower revenue, the need for additional capital expenditures, or increased costs. Because of the uncertainty of weather volatility related to climate change, we cannot predict its potential impact on our business, financial condition, or results of operations. Although any potential expenditures and costs may be recovered in the form of higher rates, there can be no assurance that the PPUC would approve rate increases to enable us to recover such expenditures and costs. We cannot assure you that our costs of complying with any climate change related measures will not harm our business, financial condition, or results of operations.

General economic conditions may affect our financial condition and results of operations.

A general economic downturn may lead to a number of impacts on our business that may affect our financial condition and results of operations. Such impacts may include: a reduction in discretionary and recreational water use by our residential water customers, particularly during the summer months when such discretionary usage is normally at its highest; a decline in usage by industrial and commercial customers as a result of decreased business activity; an increased incidence of customers' inability to pay or delays in paying their utility bills, or an increase in customer bankruptcies, which may lead to higher bad debt expense and reduced cash flow; a lower customer growth rate due to a decline in new housing starts; and a decline in the number of active customers due to housing vacancies or abandonments. A deterioration in general economic conditions may also lead to an investment market downturn, which may result in our pension plans' asset market values suffering a decline and significant volatility. A decline in our pension plans' asset market values could increase our required cash contributions to these plans and pension expense in subsequent years.

The current concentration of our business in central and southern Pennsylvania makes us particularly susceptible to adverse developments in local economic and demographic conditions.

Our service territory presently includes 39 municipalities within York County, Pennsylvania and nine municipalities within Adams County, Pennsylvania. Our revenues and operating results are therefore especially subject to local economic and demographic conditions in the area. A change in any of these conditions could make it more costly or difficult for us to conduct our business. In addition, any such change would have a disproportionate effect on us, compared to water and wastewater utility companies that do not have such a geographic concentration.

Contamination of our water supply may cause disruption in our services and adversely affect our revenues.

Our water supply is subject to contamination from the migration of naturally-occurring substances in groundwater and surface systems and pollution resulting from man-made sources. In the event that our water supply is contaminated, we may have to interrupt the use of that water supply until we are able to substitute the flow of water from an uncontaminated water source through our interconnected transmission and distribution facilities. In addition, we may incur significant costs in order to treat the contaminated source through expansion of our current treatment facilities or development of new treatment methods. Our inability to substitute water supply from an uncontaminated water source, or to adequately treat the contaminated water source in a cost-effective manner, may have an adverse effect on our revenues.

The necessity for increased security has and may continue to result in increased operating costs.

We have taken steps to increase security measures at our facilities and heighten employee awareness of threats to our water supply. We have also tightened our security measures regarding the delivery and handling of certain chemicals used in our business. We have and will continue to bear increased costs for security precautions to protect our facilities, operations and supplies. We are not aware of any specific threats to our facilities, operations or supplies. However, it is possible that we would not be in a position to control the outcome of such events should they occur.

The growing dependence on digital technology has increased the risks related to cybersecurity.

Computers and the Internet have led to increased productivity and improved customer service. Unfortunately, progress in this area has brought with it cybersecurity risks. Recently, the frequency and severity of cyber attacks on companies has increased resulting in a disruption to business operations and the corruption or misappropriation of proprietary data. We have and will continue to bear increased costs for security precautions to protect our information technology. However, if such an attack was to occur and could not be prevented, customer information could be misappropriated, our networks may be down for an extended period of time disrupting our business, and it could require costly replacement of hardware and software. We carry cyber liability insurance, however, our limits may not be sufficient to cover all losses or liabilities.

We depend on the availability of capital for expansion, construction and maintenance.

Our ability to continue our expansion efforts and fund our construction and maintenance program depends on the availability of adequate capital. There is no guarantee that we will be able to obtain sufficient capital in the future or that the cost of capital will not be too high for future expansion and construction. In addition, approval from the PPUC must be obtained prior to our sale and issuance of securities. If we are unable to obtain approval from the PPUC on these matters, or to obtain approval in a timely manner, it may affect our ability to effect transactions that are beneficial to us or our shareholders. A single transaction may itself not be profitable but might still be necessary to continue providing service or to grow the business.

The failure to maintain our existing credit rating could affect our cost of funds and related liquidity.

Standard & Poor's Ratings Services rates our outstanding debt and has given a credit rating to us. Their evaluations are based on a number of factors, which include financial strength as well as transparency with rating agencies and timeliness of financial reporting. Failure to maintain our current credit rating could adversely affect our cost of funds and related liquidity.

We may face competition from other water suppliers that may hinder our growth and reduce our profitability.

We face competition from other water suppliers for acquisitions, which may limit our growth opportunities. Furthermore, even after we have been the successful bidder in an acquisition, competing water suppliers may challenge our application for extending our franchise territory to cover the target company's market. Finally, third parties either supplying water on a contract basis to municipalities or entering into agreements to operate municipal water systems might adversely affect our business by winning contracts that may be beneficial to us. If we are unable to compete successfully with other water suppliers for these acquisitions, franchise territories and contracts, it may impede our expansion goals and adversely affect our profitability.

An important element of our growth strategy is the acquisition of water and wastewater systems. Any pending or future acquisitions we decide to undertake will involve risks.

The acquisition and integration of water and wastewater systems is an important element in our growth strategy. This strategy depends on identifying suitable acquisition opportunities and reaching mutually agreeable terms with acquisition candidates. The negotiation of potential acquisitions as well as the integration of acquired businesses could require us to incur significant costs. Further, acquisitions may result in dilution for the owners of our common stock, our incurrence of debt and contingent liabilities and fluctuations in quarterly results. In addition, the businesses and other assets we acquire may not achieve the financial results that we expect, which could adversely affect our profitability.

We have restrictions on our dividends. There can also be no assurance that we will continue to pay dividends in the future or, if dividends are paid, that they will be in amounts similar to past dividends.

The terms of our debt instruments impose conditions on our ability to pay dividends. We have paid dividends on our common stock each year since our inception in 1816 and have increased the amount of dividends paid each year since 1997. Our earnings, financial condition, capital requirements, applicable regulations and other factors, including the timeliness and adequacy of rate increases, will determine both our ability to pay dividends on our common stock and the amount of those dividends. There can be no assurance that we will continue to pay dividends in the future or, if dividends are paid, that they will be in amounts similar to past dividends.

If we are unable to pay the principal and interest on our indebtedness as it comes due or we default under certain other provisions of our loan documents, our indebtedness could be accelerated and our results of operations and financial condition could be adversely affected.

Our ability to pay the principal and interest on our indebtedness as it comes due will depend upon our current and future performance. Our performance is affected by many factors, some of which are beyond our control. We believe that our cash generated from operations, and, if necessary, borrowings under our existing credit facilities will be sufficient to enable us to make our debt payments as they become due. If, however, we do not generate sufficient cash, we may be required to refinance our obligations or sell additional equity, which may be on terms that are not as favorable to us. No assurance can be given that any refinancing or sale of equity will be possible when needed or that we will be able to negotiate acceptable terms. In addition, our failure to comply with certain provisions contained in our trust indentures and loan agreements relating to our outstanding indebtedness could lead to a default under these documents, which could result in an acceleration of our indebtedness.

We depend significantly on the services of the members of our senior management team, and the departure of any of those persons could cause our operating results to suffer.

Our success depends significantly on the continued individual and collective contributions of our senior management team. If we lose the services of any member of our senior management or are unable to hire and retain experienced management personnel, our operating results could suffer.

Work stoppages and other labor relations matters could adversely affect our operating results.

Approximately one-third of our workforce is unionized under a contract with a labor union. In light of rising costs for healthcare and retirement benefits, contract negotiations in the future may be difficult. We are subject to a risk of work stoppages and other labor actions as we negotiate with the union to address these issues, which could affect our business, financial condition, and results of operations. Although we believe we have a good relationship with our union workforce and have a strike contingency plan, we cannot be assured that issues with our labor force will be resolved favorably to us in the future or that we will not experience work stoppages.

There is a limited trading market for our common stock; you may not be able to resell your shares at or above the price you pay for them.

Although our common stock is listed for trading on the NASDAQ Global Select Market, the trading in our common stock has substantially less liquidity than many other companies quoted on the NASDAQ Global Select Market. A public trading market having the desired characteristics of depth, liquidity and orderliness depends on the presence in the market of willing buyers and sellers of our common stock at any given time. This presence depends on the individual decisions of investors and general economic and market conditions over which we have no control. Because of the limited volume of trading in our common stock, a sale of a significant number of shares of our common stock in the open market could cause our stock price to decline.

The failure of, or the requirement to repair, upgrade or dismantle, either of our dams may adversely affect our financial condition and results of operations.

Our water system includes two impounding dams. While we maintain robust dam maintenance and inspection programs, a failure of the dams could result in injuries and damage to residential and/or commercial property downstream for which we may be responsible, in whole or in part. The failure of a dam could also adversely affect our ability to supply water in sufficient quantities to our customers and could adversely affect our financial condition and results of operations. We carry liability insurance on our dams, however, our limits may not be sufficient to cover all losses or liabilities incurred due to the failure of one of our dams. The estimated costs to maintain and upgrade our dams are included in our capital budget. Although such costs have previously been recoverable in rates, there is no guarantee that these costs will continue to be recoverable and in what magnitude they will be recoverable.

Wastewater operations entail significant risks and may impose significant costs.

Wastewater collection and treatment and septage pumping and sludge hauling involve various unique risks. If collection or treatment systems fail or do not operate properly, or if there is a spill, untreated or partially treated wastewater could discharge onto property or into nearby streams and rivers, causing various damages and injuries, including environmental damage. These risks are most acute during periods of substantial rainfall or flooding, which are the main causes of sewer overflow and system failure. Liabilities resulting from such damages and injuries could materially and adversely affect our business, financial condition, and results of operations.

The final determination of our income tax liability may be materially different from our income tax provision.

Significant judgment is required in determining our provision for income taxes. The calculation of the provision for income taxes is subject to our interpretation of applicable business tax laws in the federal and state jurisdictions in which we file. In addition, our income tax returns are subject to periodic examination by the Internal Revenue Service, or IRS, and other taxing authorities. In December 2014, we changed our tax method of accounting to permit the expensing of qualifying asset improvement costs that were previously being capitalized and depreciated for tax purposes. Our determination of what qualifies as a capital cost versus a repair expense tax deduction is subject to subsequent adjustment and may impact the income tax benefits that have been recognized. Although we believe our income tax estimates are appropriate, there is no assurance that the final determination of our income tax liability will not be materially different, either higher or lower, from what is reflected in our income tax provision. In the event we are assessed additional income taxes, our business, financial condition, and results of operations could be adversely affected.

We are subject to market and interest rate risk on our $12,000,000 variable interest rate debt issue.

We are subject to interest rate risk in conjunction with our $12,000,000 variable interest rate debt issue. This exposure, however, has been hedged with an interest rate swap. This hedge will protect the Company from the risk of changes in the benchmark interest rates, but does not protect the Company's exposure to the changes in the difference between its own variable funding rate and the benchmark rate. A breakdown of the historical relationships between the cost of funds of the Company and the benchmark rate underlying the interest rate swap could result in higher interest rates adversely affecting our financial results.

The holders of the $12,000,000 variable rate Pennsylvania Economic Development Financing Authority (PEDFA) Series A Bonds may tender their bonds at any time. When the bonds are tendered, they are subject to an annual remarketing agreement, pursuant to which a remarketing agent attempts to remarket the tendered bonds pursuant to the terms of the Indenture. In order to keep variable interest rates down and to enhance the marketability of the Series A Bonds, the Company entered into a Reimbursement, Credit and Security Agreement with PNC Bank, National Association ("the Bank") dated as of May 1, 2008. This agreement provides for a direct pay letter of credit issued by the Bank to the trustee for the Series A Bonds. The letter of credit expires June 30, 2017 and is reviewed annually for a potential extension of the expiration date. The Bank is responsible for providing the trustee with funds for the timely payment of the principal and interest on the Series A Bonds and for the purchase price of the Series A Bonds that have been tendered or deemed tendered for purchase and have not been remarketed. If the Bank is unable to meet its obligations, the Company would be required to buy any bonds which had been tendered.

|

|

Unresolved Staff Comments.

|

None.

Source of Water Supply

The Company owns two impounding dams located in York and Springfield Townships adjoining the Borough of Jacobus to the south. The lower dam, the Lake Williams Impounding Dam, creates a reservoir covering approximately 165 acres containing about 870 million gallons of water. The upper dam, the Lake Redman Impounding Dam, creates a reservoir covering approximately 290 acres containing about 1.3 billion gallons of water.

In addition to the two impounding dams, the Company owns a 15-mile pipeline from the Susquehanna River to Lake Redman that provides access to a supply of an additional 12.0 million gallons of water per day.

The Company also owns three satellite water systems in Adams County, Pennsylvania. The Carroll Valley Water System consists of two groundwater wells capable of providing a safe yield of approximately 100,000 gallons per day with a current average daily consumption of 12,000 gallons per day. The Western Cumberland Water System (formerly Lincoln Estates) consists of three groundwater wells capable of providing a safe yield of 144,000 gallons per day with a current average daily consumption of 18,000 gallons per day. The Eastern Cumberland Water System (formerly The Meadows) consists of two groundwater wells capable of providing a safe yield of 122,000 gallons per day with a current average daily consumption of 17,000 gallons per day.

As of December 31, 2015, the Company's present average daily availability was 35.4 million gallons, and daily consumption was approximately 18.5 million gallons.

Pumping Stations

The Company's main pumping station is located in Spring Garden Township on the south branch of the Codorus Creek about four miles downstream from the Company's lower impounding dam. The pumping station presently houses pumping equipment consisting of three electrically driven centrifugal pumps and two diesel-engine driven centrifugal pumps with a combined pumping capacity of 68.0 million gallons per day. The pumping capacity is more than double peak requirements and is designed to provide an ample safety margin in the event of pump or power failure. A large diesel backup generator is installed to provide power to the pumps in the event of an emergency. The untreated water is pumped approximately two miles to the filtration plant through pipes owned by the Company.

The Susquehanna River Pumping Station is located on the western shore of the Susquehanna River several miles south of Wrightsville, PA. The pumping station is equipped with three Floway Vertical Turbine pumps rated at 6 million gallons per day each. The pumping station pumps water from the Susquehanna River approximately 15 miles through a combination of 30" and 36" ductile iron main to the Company's upper impounding dam, located at Lake Redman.

Treatment Facilities

The Company's water filtration plant is located in Spring Garden Township about one-half mile south of the City of York. Water at this plant is filtered through twelve dual media filters having a stated capacity of 31.0 million gallons per day with a maximum supply of 42.0 million gallons per day for short periods if necessary. Based on an average daily consumption in 2015 of approximately 18.5 million gallons, the Company believes the pumping and filtering facilities are adequate to meet present and anticipated demands. In 2005, the Company performed a capacity study of the filtration plant, and in 2007, began upgrading the facility to increase capacity to meet peak demands, for operational redundancy, and for future growth. The current phase of the upgrade, replacement of the filter media, began in 2013 and is expected to be completed in 2016.

The Company's sediment recycling facility is located adjacent to its water filtration plant. This state of the art facility employs cutting edge technology to remove fine, suspended solids from untreated water. The Company estimates that through this energy efficient, environmentally friendly process, approximately 600 tons of sediment will be removed annually, thereby improving the quality of the Codorus Creek watershed.

The Company's two wastewater treatment facilities are located in East Manchester and Lower Windsor Townships. The two wastewater treatment plants are each small, packaged, extended aeration activated sludge facilities with a combined average daily flow capacity of 167,000 gallons. With a projected maximum daily demand of 77,000 gallons, the plants' flow paths offer both capacity and operational redundancy for maintenance, high flow events, and potential growth.

Distribution and Collection

The distribution system of the Company has approximately 958 miles of water main lines which range in diameter from 2 inches to 36 inches. The distribution system includes 31 booster stations and 33 standpipes and reservoirs capable of storing approximately 58.0 million gallons of potable water. All booster stations are equipped with at least two pumps for protection in case of mechanical failure. Following a deliberate study of customer demand and pumping capacity, the Company installed standby generators at all critical booster stations to provide an alternate energy source or emergency power in the event of an electric utility interruption.

The two wastewater collection systems of the Company have a combined approximate 38,270 feet of 6 inch and 8 inch gravity collection mains and 4,800 feet of 6" pressure force main along with 3 sewage pumping stations each rated at 80 gallons per minute.

Other Properties

The Company's distribution center and material and supplies warehouse are located in Springettsbury Township, and are composed of three one-story concrete block buildings aggregating 30,680 square feet.

The administrative and executive offices of the Company are located in one three-story and one two-story brick and masonry buildings, containing a total of approximately 21,861 square feet, in the City of York, Pennsylvania.

All of the Company's properties described above are held in fee by the Company. There are no material encumbrances on such properties.

In 1976, the Company entered into a Joint Use and Park Management Agreement with York County under which the Company licensed use of certain of its lands and waters for public park purposes for a period of 50 years. Under the agreement, York County has agreed not to erect a dam upstream on the East Branch of the Codorus Creek or otherwise obstruct the flow of the creek.

There are no material legal proceedings involving the Company.

Not applicable.

PART II

|

|

Market for the Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

|

Market for Common Stock and Dividends

The common stock of The York Water Company is traded on the NASDAQ Global Select Market (Symbol "YORW"). Quarterly price ranges and cash dividends per share for the last two years follow:

| |

|

2015

|

|

|

2014

|

|

| |

|

High

|

|

|

Low

|

|

|

Dividend*

|

|

|

High

|

|

|

Low

|

|

|

Dividend*

|

|

|

1st Quarter

|

|

$

|

24.97

|

|

|

$

|

21.08

|

|

|

$

|

0.1495

|

|

|

$

|

21.50

|

|

|

$

|

19.45

|

|

|

$

|

0.1431

|

|

|

2nd Quarter

|

|

|

25.99

|

|

|

|

20.69

|

|

|

|

0.1495

|

|

|

|

20.98

|

|

|

|

19.00

|

|

|

|

0.1431

|

|

|

3rd Quarter

|

|

|

22.72

|

|

|

|

19.69

|

|

|

|

0.1495

|

|

|

|

21.20

|

|

|

|

18.85

|

|

|

|

0.1431

|

|

|

4th Quarter

|

|

|

26.67

|

|

|

|

20.93

|

|

|

|

0.1555

|

|

|

|

24.25

|

|

|

|

19.75

|

|

|

|

0.1495

|

|

*Cash dividends per share reflect dividends declared at each dividend date.

Prices listed in the above table are sales prices as listed on the NASDAQ Global Select Market. Shareholders of record (excluding individual participants in securities positions listings) as of December 31, 2015 numbered approximately 2,007.

Dividend Policy

Dividends on the Company's common stock are declared by the Board of Directors and are normally paid in January, April, July and October. Dividends are paid based on shares outstanding as of the stated record date, which is ordinarily the last day of the calendar month immediately preceding the dividend payment.

The dividend paid on the Company's common stock on January 15, 2016 was the 580th consecutive dividend paid by the Company. The Company has paid consecutive dividends for its entire history, since 1816. The policy of the Company's Board of Directors is currently to pay cash dividends on a quarterly basis. The dividend rate has been increased annually for nineteen consecutive years. The Company's Board of Directors declared dividend number 581 in the amount of $0.1555 per share at its February 2016 meeting. The dividend is payable on April 15, 2016 to shareholders of record as of February 29, 2016. Future cash dividends will be dependent upon the Company's earnings, financial condition, capital demands and other factors and will be determined by the Company's Board of Directors. See Note 4 to the Company's financial statements included herein for restrictions on dividend payments.

Purchases of Equity Securities by the Company

On March 11, 2013, the Board of Directors authorized a share repurchase program granting the Company authority to repurchase up to 1,200,000 shares of the Company's common stock from time to time. Under the stock repurchase program, the Company may repurchase shares in the open market or through privately negotiated transactions. The Company may suspend or discontinue the repurchase program at any time. The Company did not repurchase any shares that were not part of the publicly announced plan during the quarter ended December 31, 2015.

The following table summarizes the Company's purchases of its common stock for the quarter ended December 31, 2015.

|

Period

|

|

Total Number

of Shares

Purchased

|

|

|

Average Price

Paid per Share

|

|

|

Total Number

of Shares Purchased

as a Part of Publicly

Announced Plans or

Programs

|

|

|

Maximum Number

of Shares that May

Yet Be Purchased

Under the Plans or

Programs

|

|

|

Oct. 1 – Oct. 31, 2015

|

|

|

2,200

|

|

|

$

|

22.93

|

|

|

|

2,200

|

|

|

|

702,004

|

|

|

Nov. 1 – Nov. 30, 2015

|

|

|

-

|

|

|

$

|

-

|

|

|

|

-

|

|

|

|

702,004

|

|

|

Dec. 1 – Dec. 31, 2015

|

|

|

-

|

|

|

$

|

-

|

|

|

|

-

|

|

|

|

702,004

|

|

|

Total

|

|

|

2,200

|

|

|

$

|

22.93

|

|

|

|

2,200

|

|

|

|

702,004

|

|

The Company's loan agreements contain various covenants and restrictions regarding dividends and share repurchases. As of December 31, 2015, management believes it was in compliance with all of these restrictions. See Note 4 for additional information regarding these restrictions.

The Company will fund repurchases under the share repurchase program with internally generated funds and borrowings under its credit facilities, if necessary.

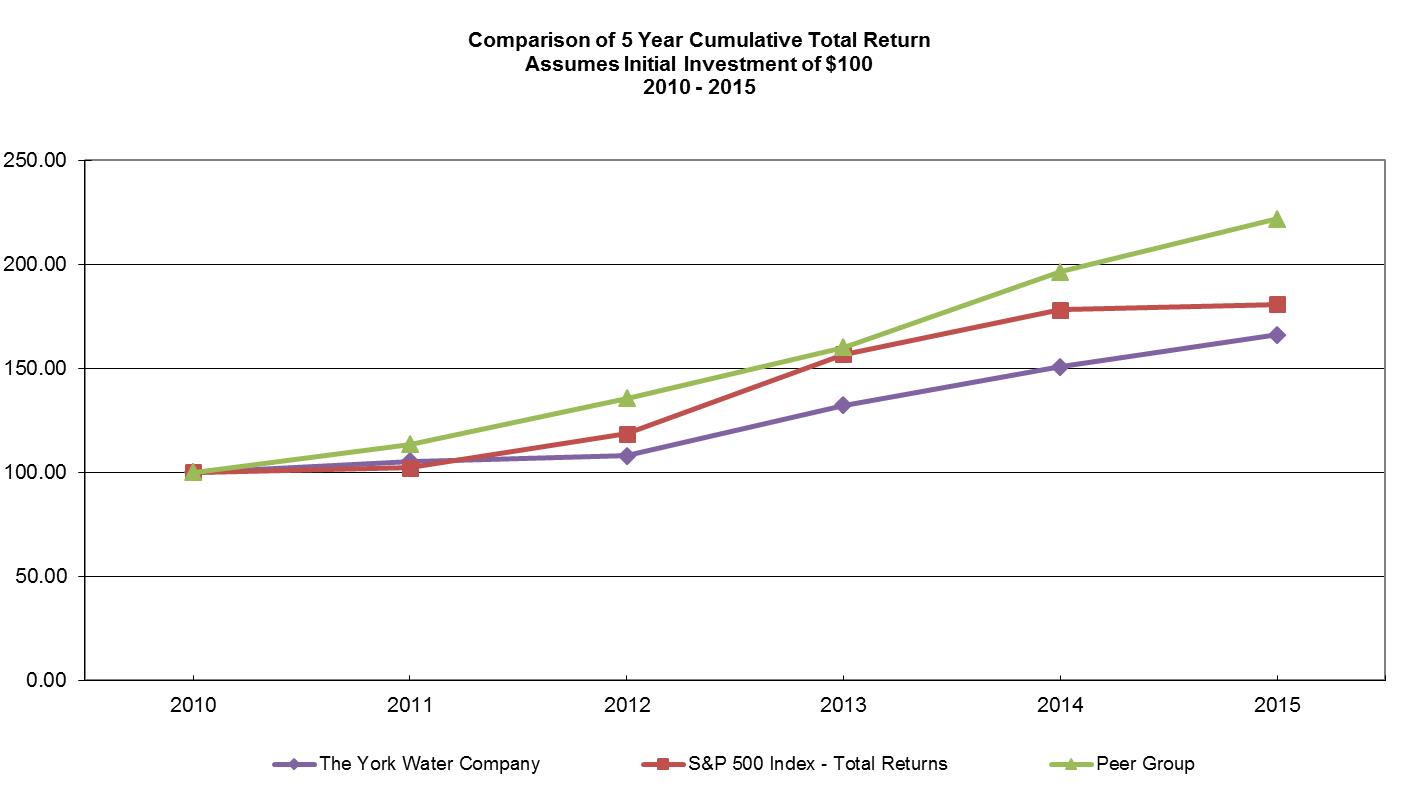

Performance Graph

The following line graph presents the annual and cumulative total shareholder return for The York Water Company Common Stock over a five-year period from 2010 through 2015, based on the market price of the Common Stock and assuming reinvestment of dividends, compared with the cumulative total shareholder return of companies in the S&P 500 Index and a peer group made up of publicly traded water utilities, also assuming reinvestment of dividends. The peer group companies include: American States, American Water, Aqua America, Artesian Resources, California Water Service, Connecticut Water, Middlesex Water and San Jose Water.

(All dollar amounts are stated in thousands of dollars.)

| |

|

Summary of Operations

|

|

|

For the Year

|

|

2015

|

|

|

2014

|

|

|

2013

|

|

|

2012

|

|

|

2011

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating revenues

|

|

$

|

47,089

|

|

|

$

|

45,900

|

|

|

$

|

42,383

|

|

|

$

|

41,447

|

|

|

$

|

40,629

|

|

|

Operating expenses

|

|

|

24,428

|

|

|

|

23,823

|

|

|

|

21,622

|

|

|

|

20,874

|

|

|

|

20,754

|

|

|

Operating income

|

|

|

22,661

|

|

|

|

22,077

|

|

|

|

20,761

|

|

|

|

20,573

|

|

|

|

19,875

|

|

|

Interest expense

|

|

|

4,847

|

|

|

|

4,877

|

|

|

|

5,162

|

|

|

|

5,144

|

|

|

|

5,155

|

|

|

Gain on sale of land

|

|

|

-

|

|

|

|

316

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

Other income (expenses), net

|

|

|

(585

|

)

|

|

|

(1,155

|

)

|

|

|

(133

|

)

|

|

|

(520

|

)

|

|

|

(677

|

)

|

|

Income before income taxes

|

|

|

17,229

|

|

|

|

16,361

|

|

|

|

15,466

|

|

|

|

14,909

|

|

|

|

14,043

|

|

|

Income taxes

|

|

|

4,740

|

|

|

|

4,877

|

|

|

|

5,812

|

|

|

|

5,606

|

|

|

|

4,959

|

|

|

Net income

|

|

$

|

12,489

|

|

|

$

|

11,484

|

|

|

$

|

9,654

|

|

|

$

|

9,303

|

|

|

$

|

9,084

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Per Share of Common Stock

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Book value

|

|

$

|

8.51

|

|

|

$

|

8.15

|

|

|

$

|

7.98

|

|

|

$

|

7.73

|

|

|

$

|

7.45

|

|

|

Basic earnings per share

|

|

|

0.97

|

|

|

|

0.89

|

|

|

|

0.75

|

|

|

|

0.72

|

|

|

|

0.71

|

|

|

Cash dividends declared per share

|

|

|

0.6040

|

|

|

|

0.5788

|

|

|

|

0.5580

|

|

|

|

0.5391

|

|

|

|

0.5266

|

|

|

Weighted average number of shares outstanding during the year

|

|

|

12,831,687

|

|

|

|

12,879,912

|

|

|

|

12,928,040

|

|

|

|

12,847,160

|

|

|

|

12,734,420

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Utility Plant

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Original cost, net of acquisition adjustments

|

|

$

|

325,691

|

|

|

$

|

313,003

|

|

|

$

|

298,670

|

|

|

$

|

289,579

|

|

|

$

|

278,344

|

|

|

Construction expenditures

|

|

|

13,844

|

|

|

|

14,139

|

|

|

|

9,852

|

|

|

|

11,543

|

|

|

|

9,472

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets

|

|

$

|

313,491

|

|

|

$

|

304,339

|

|

|

$

|

282,529

|

|

|

$

|

282,490

|

|

|

$

|

274,219

|

|

|

Long-term debt including current portion

|

|

|

87,305

|

|

|

|

84,885

|

|

|

|

84,928

|

|

|

|

84,975

|

|

|

|

85,017

|

|

For Management's Discussion and Analysis of Financial Condition and Results of Operations, please refer to Item 7 of this Annual Report.

|

|

Management's Discussion and Analysis of Financial Condition and Results of Operations.

|

(All dollar amounts are stated in thousands of dollars.)

Overview

The York Water Company (the "Company") is the oldest investor-owned water utility in the United States, operated continuously since 1816. The Company also operates two wastewater collection and treatment systems. The Company is a purely regulated water and wastewater utility. Profitability is largely dependent on water revenues. Due to the size of the Company and the limited geographic diversity of its service territory, weather conditions, particularly rainfall, economic, and market conditions can have an adverse effect on revenues. Market conditions and the economy in general remain sluggish. While there was little organic growth in the customer base in 2015, total water usage per customer declined by only 0.1% compared to 2014.

The Company increased revenues in 2015 compared to 2014 due to an 11.7% rate increase effective February 28, 2014, an interconnection with a neighboring municipality to provide water due to an emergency event, and growth in the customer base as a result of acquisitions.

The Company's business does not require large amounts of working capital and is not dependent on any single customer or a very few customers for a material portion of its business. In 2015, operating revenue was derived from the following sources and in the following percentages: residential, 63%; commercial and industrial, 29%; and other, 8% which is primarily from the provision for fire service and other water and wastewater service-related income. The customer mix helps to reduce volatility in consumption.

The Company seeks to grow revenues by increasing the volume of water sold through increases in the number of customers served, making timely and prudent investments in infrastructure replacements, expansion and improvements, and timely filing for rate increases. The Company continuously looks for acquisition and expansion opportunities both within and outside its current service territory as well as through contractual services and bulk water supply. The Company's wastewater business provides additional opportunities to expand.

The Company has entered into agreements with several municipalities to provide sewer billing services. The Company also has a service line protection program on a targeted basis. Opportunities to expand both initiatives are being pursued to further diversify the business.

In addition to increasing revenue, the Company consistently focuses on minimizing costs without sacrificing water quality or customer service. Paperless billing, negotiation of favorable electric and banking costs, as well as taking advantage of the IRS tangible property regulations are examples of some of the Company's efforts to minimize costs.

Performance Measures

Company management uses financial measures including operating revenues, net income, earnings per share and return on equity to evaluate its financial performance. Additional statistical measures including number of customers, customer complaint rate, annual customer rates and the efficiency ratio are used to evaluate performance quality. These measures are calculated on a regular basis and compared with historical information, budget and the other publicly-traded water and wastewater companies.

The Company's performance in 2015 was strong under the above measures. Residual increases from a prior year rate filing, higher consumption from an interconnection with a neighboring municipality, and increases in the number of customers mostly as a result of acquisitions resulted in higher revenue and offset the higher operating expenses recorded in 2015. The Company also benefited from a decrease in other net expenses and lower income taxes despite higher income due to the effects of the IRS tangible property regulations, or TPR. The overall effect was an increase in net income in 2015 over 2014 of 8.8% and a return on year end common equity of 11.5%, its highest level in more than five years.

The efficiency ratio, which is calculated as net income divided by revenues, is used by management to evaluate its ability to control expenses. Over the five previous years, the Company's ratio averaged 23.1%. In 2015, the ratio was higher than the average at 26.5% due to the higher net income resulting from higher revenue and lower income taxes. Management is confident that its ratio will compare favorably to that of its peers. Management continues to look for ways to decrease expenses and increase efficiency as well as to file for rate increases promptly when needed.

Results of Operations

2015 Compared with 2014

Net income for 2015 was $12,489, an increase of $1,005, or 8.8%, from net income of $11,484 for 2014. The primary contributing factors to the increase in net income were higher operating revenues, lower retirement expenses and reduced charitable contributions. The increased income was partially offset by higher operating expenses and a non-recurring prior year gain on the sale of land.

Operating revenues for the year increased $1,189, or 2.6%, from $45,900 for 2014 to $47,089 for 2015. The primary reason for the increase was a rate increase effective February 28, 2014. Additionally, revenues increased from an interconnection with a neighboring municipality to provide water due to an emergency event and from an increase in customers. The average number of customers served in 2015 increased as compared to 2014 by 894 customers, from 64,773 to 65,667 customers, due primarily to recent acquisitions. Total per capita consumption for 2015 was 0.1% lower than last year. The Company expects revenues for 2016 to show a modest increase over 2015 due to an increase in the number of water and wastewater customers due to recently announced acquisitions. Other regulatory actions and weather patterns could impact results.

Operating expenses for the year increased $605, or 2.5%, from $23,823 for 2014 to $24,428 for 2015. The increase was primarily due to higher depreciation expense of approximately $219, increased water treatment chemical usage of approximately $131 due to weather conditions, and higher pension expense of approximately $118. Also adding to the increase were higher expenses of approximately $71 for sediment hauling and a survey of piping at the water treatment plant, $45 for insurance, $33 for information technology strategic planning and $31 for credit card fees due to increased on-line payments. The increased expenses were partially offset by a reduction of $32 for power. Other expenses decreased by a net of $11. In 2016, the Company expects depreciation expense to continue to rise due to additional investment in utility plant, and other expenses to increase at a moderate rate as costs to maintain and extend the distribution system continue to rise and as additional water and wastewater systems are acquired.

Interest expense on debt for 2015 decreased $34, or 0.7%, from $5,087 for 2014 to $5,053 for 2015. The decrease was due to the 2014 bond refinancing at a lower interest rate. The decrease was partially offset by an increase in interest due to additional long-term debt outstanding. Interest expense for 2016 is expected to increase due to the increase in long-term debt outstanding (see Note 4 to the financial statements) and possible line of credit borrowings.

Allowance for funds used during construction decreased $4, from $210 in 2014 to $206 in 2015, due to a lower volume of eligible construction. Allowance for funds used during construction in 2016 is expected to show a modest increase based on a projected increase in the amount of eligible construction.

A non-recurring gain on the sale of land of $316 was recorded in 2014 as a result of a PennDOT realignment project which included a portion of the Company's distribution facility property. No additional land sales are anticipated at this time.