UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form

(Mark One) | |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED | |

OR | |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

Commission | Exact Name of Registrant as Specified in its Charter, | State of | I.R.S. Employer | |||

| ||||||

|

Securities registered pursuant to Section 12(b) of the Exchange Act:

Registrant |

| Title of each class |

| Trading Symbol | Name of each exchange on which registered | |

Huntsman Corporation |

|

| ||||

Huntsman International LLC |

|

|

Securities registered pursuant to Section 12(g) of the Exchange Act:

Registrant | Title of each class | |

Huntsman Corporation | None | |

Huntsman International LLC | None |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Huntsman Corporation | No ◻ | |

Huntsman International LLC | Yes ◻ |

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act.

Huntsman Corporation | Yes ◻ | |

Huntsman International LLC | Yes ◻ |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days.

Huntsman Corporation | No ◻ | |

Huntsman International LLC | No ◻ |

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Huntsman Corporation | No ◻ | |

Huntsman International LLC | No ◻ |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. Huntsman Corporation

Huntsman Corporation | Accelerated filer ◻ | Non-accelerated filer ◻ | Smaller reporting company | Emerging Growth Companies | |

Huntsman International LLC | Large accelerated filer ◻ | Accelerated filer ◻ | Smaller reporting company | Emerging Growth Companies |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

Huntsman Corporation | Yes ◻ | No ◻ |

Huntsman International LLC | Yes ◻ | No ◻ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Huntsman Corporation | Yes | No ⌧ |

Huntsman International LLC | Yes | No ⌧ |

On June 28, 2019, the last business day of the registrants’ most recently completed second fiscal quarter, the aggregate market value of voting and non-voting common equity held by non-affiliates was as follows:

Registrant | Common Equity | Market Value Held by Nonaffiliates | ||

Huntsman Corporation | Common Stock | $ | ||

Huntsman International LLC | Units of Membership Interest | NA(2) |

(1) | Based on the closing price of $20.44 per share of common stock as quoted on the New York Stock Exchange. |

(2) | All units of membership interest are held by Huntsman Corporation, an affiliate. |

On January 31, 2020, the number of shares outstanding of each of the registrant’s classes of common equity were as follows:

Registrant | Common Equity | Outstanding | ||

Huntsman Corporation | Common Stock | | ||

Huntsman International LLC | Units of Membership Interest | 2,728 |

This Annual Report on Form 10-K presents information for two registrants: Huntsman Corporation and Huntsman International LLC. Huntsman International LLC is a wholly owned subsidiary of Huntsman Corporation and is the principal operating company of Huntsman Corporation. The information reflected in this Annual Report on Form 10-K is equally applicable to both Huntsman Corporation and Huntsman International LLC, except where otherwise indicated.

Huntsman International LLC meets the conditions set forth in General Instructions (I)(1)(a) and (b) of Form 10-K and, to the extent applicable, is therefore filing this form with a reduced disclosure format.

Documents Incorporated by Reference

Part III: Proxy Statement for the 2020 Annual Meeting of Stockholders to be filed within 120 days of

Huntsman Corporation’s fiscal year ended December 31, 2019.

HUNTSMAN CORPORATION AND SUBSIDIARIES

HUNTSMAN INTERNATIONAL LLC AND SUBSIDIARIES

2019 ANNUAL REPORT ON FORM 10-K

TABLE OF CONTENTS

i

HUNTSMAN CORPORATION AND SUBSIDIARIES

HUNTSMAN INTERNATIONAL LLC AND SUBSIDIARIES

2019 ANNUAL REPORT ON FORM 10-K

This report includes information with respect to market share, industry conditions and forecasts that we obtained from internal industry research, publicly available information (including industry publications and surveys), and surveys and market research provided by consultants. The publicly available information and the reports, forecasts and other research provided by consultants generally state that the information contained therein has been obtained from sources believed to be reliable. We have not independently verified any of the data from third-party sources, nor have we ascertained the underlying economic assumptions relied upon therein. Similarly, our internal research and forecasts are based upon our management’s understanding of industry conditions, and such information has not been verified by any independent sources.

For convenience in this report, the terms “Company,” “our,” “us,” or “we” may be used to refer to Huntsman Corporation and, unless the context otherwise requires, its subsidiaries and predecessors. Any references to our “Company,” “we,” “us” or “our” as of a date prior to October 19, 2004 (the date of our formation) are to Huntsman Holdings, LLC and its subsidiaries (including their respective predecessors). In this report, “Huntsman International” refers to Huntsman International LLC (our wholly-owned subsidiary) and, unless the context otherwise requires, its subsidiaries; “AAC” refers to Arabian Amines Company, our consolidated manufacturing joint venture with the Zamil Group; “HPS” refers to Huntsman Polyurethanes Shanghai Ltd. (our consolidated splitting joint venture with Shanghai Chlor-Alkali Chemical Company, Ltd); and “SLIC” refers to Shanghai Liengheng Isocyanate Investment BV (an unconsolidated manufacturing joint venture with BASF and three Chinese chemical companies).

In this report, we may use, without definition, the common names of competitors or other industry participants. We may also use the common names or abbreviations for certain chemicals or products. Many of these terms are defined in the Glossary of Chemical Terms found at the conclusion of “Part I. Item 1. Business” below.

Forward-Looking Statements

With respect to Huntsman Corporation, certain information set forth in this report contains “forward-looking statements” within the meaning the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements other than historical factual information are forward-looking statements, including without limitation statements regarding: projections of revenue, expenses, profit, profit margins, tax rates, tax provisions, cash flows, pension and benefit obligations and funding requirements, our liquidity position or other projected financial measures; management’s plans and strategies for future operations, including statements relating to anticipated operating performance, cost reductions, restructuring activities, new product and service developments, competitive strengths or market position, acquisitions, divestitures, spin-offs or other distributions, strategic opportunities, securities offerings, stock repurchases, dividends and executive compensation; growth, declines and other trends in markets we sell into; new or modified laws, regulations and accounting pronouncements; outstanding claims, legal proceedings, tax audits and assessments and other contingent liabilities; foreign currency exchange rates and fluctuations in those rates; general economic and capital markets conditions; the timing of any of the foregoing; assumptions underlying any of the foregoing; and any other statements that address events or developments that we intend or believe will or may occur in the future. In some cases, forward-looking statements can be identified by terminology such as “believes,” “expects,” “may,” “will,” “should,” “anticipates” or “intends” or the negative of such terms or other comparable terminology, or by discussions of strategy. We may also make additional forward-looking statements from time to time. All such subsequent forward-looking statements, whether written or oral, by us or on our behalf, are also expressly qualified by these cautionary statements.

All forward-looking statements, including without limitation management’s examination of historical operating trends, are based upon our current expectations and various assumptions. Our expectations, beliefs and projections are expressed in good faith and we believe there is a reasonable basis for them, but there can be no assurance that management’s expectations, beliefs and projections will result or be achieved. All forward-looking statements apply only as of the date made. We undertake no obligation to publicly update or revise forward-looking statements whether because of new information, future events or otherwise, except as required by securities and other applicable law.

There are a number of risks and uncertainties that could cause our actual results to differ materially from the forward-looking statements contained in or contemplated by this report. Any forward-looking statements should be considered in light of the risks set forth in “Part I. Item 1A. Risk Factors” and elsewhere in this report.

ii

PART I

ITEM 1. BUSINESS

General

We are a global manufacturer of differentiated organic chemical products. Our Company, a Delaware corporation, was formed in 2004 to hold the Huntsman businesses, which were founded by Jon M. Huntsman. Mr. Huntsman founded the predecessor to our Company in 1970 as a small polystyrene plastics packaging company. Since then, we have grown through a series of acquisitions and now own a global portfolio of businesses.

We operate all of our businesses through Huntsman International, our wholly-owned subsidiary. Huntsman International is a Delaware limited liability company and was formed in 1999.

Our principal executive offices are located at 10003 Woodloch Forest Drive, The Woodlands, Texas 77380, and our telephone number at that location is (281) 719-6000.

RECENT DEVELOPMENTS

Sale of Chemical Intermediates Businesses

On January 3, 2020, we completed the sale of our chemical intermediates businesses, which includes PO/MTBE, and our surfactants businesses (collectively, our “Chemical Intermediates Businesses”) to Indorama Ventures Holdings L.P. (“Indorama”) in a transaction valued at approximately $2 billion, comprising a cash purchase price of approximately $1.93 billion, which includes estimated adjustments to the purchase price for working capital, plus the transfer of approximately $72 million in net underfunded pension and other post-employment benefit liabilities. The final purchase price is subject to customary post-closing adjustments. The net after tax cash proceeds are expected to be approximately $1.6 billion. Following the transaction, we still retain a 49% interest in our Chinese joint venture with Sinopec, which continues to produce and market PO/MTBE. For more information, see “Note 4. Discontinued Operations and Business Dispositions—Sale of Chemical Intermediates Businesses” to our consolidated financial statements.

Icynene-Lapolla Acquisition

On December 5, 2019, we entered into an agreement with an affiliate of FFL Partners, LLC to acquire Icynene-Lapolla, a leading North American manufacturer and distributor of spray polyurethane foam insulation systems for residential and commercial applications. Icynene-Lapolla operates two manufacturing facilities located in Houston, Texas and Mississauga, Ontario. Under terms of the agreement, we agreed to pay $350 million, subject to customary closing adjustments, in an all-cash transaction to be funded from available liquidity. The transaction is expected to close in the first quarter of 2020. The acquired business is expected to be integrated into our Polyurethanes segment.

Acquisition of Remaining Interest in Sasol-Huntsman Joint Venture

On September 30, 2019, we acquired from Sasol, our former joint venture partner, the 50% noncontrolling interest that we did not own in the Sasol-Huntsman GmbH and Co. KG (“Sasol-Huntsman”) maleic anhydride joint venture. The joint venture owned a manufacturing facility in Moers, Germany with capacity to produce 230 million pounds of maleic anhydride. We paid Sasol $101 million, which included acquired cash, net of any debt. The purchase price was funded from a new 364-day term loan facility (“the 2019 Term Loan”). See “Note 15. Debt—Direct and Subsidiary Debt—Term Loan Credit Facility” to our consolidated financial statements.

Overview

We are a global manufacturer of differentiated organic chemical products. Our products comprise a broad range of chemicals and formulations, which we market globally to a diversified group of consumer and industrial customers. Our products are used in a wide range of applications, including those in the adhesives, aerospace, automotive, construction products, personal care and hygiene, durable and non-durable consumer products, digital inks, electronics, insulation, medical, packaging, coatings and construction, power generation, refining, synthetic fiber, textile chemicals

1

and dyes industries. We are a leading global producer in many of our key product lines, including MDI, amines, maleic anhydride, epoxy-based polymer formulations, textile chemicals and dyes.

We operate in four segments: Polyurethanes, Performance Products, Advanced Materials and Textile Effects. In August 2017, we separated our Titanium Dioxide and Performance Additives business (the “P&A Business”) through an initial public offering (“IPO”) of ordinary shares of Venator Materials PLC (“Venator”), formerly a wholly-owned subsidiary. Beginning in the third quarter of 2017, we reported the results of operations of Venator as discontinued operations. On December 3, 2018, we sold an additional 4% of Venator ordinary shares which allowed us to immediately deconsolidate Venator and account for our remaining ownership interest in Venator as an equity method investment using the fair value option. For more information, see “Note 4. Discontinued Operations and Business Disposition—Separation and Deconsolidation of Venator” to our consolidated financial statements. On January 3, 2020, we completed the sale of our Chemical Intermediates Businesses, and, beginning in the third quarter of 2019, we reported the results of our Chemical Intermediates Businesses as discontinued operations. For more information, see “Note 4. Discontinued Operations and Business Dispositions—Sale of Chemical Intermediates Businesses” to our consolidated financial statements. In a series of transactions beginning in 2006, we sold or shut down substantially all of our Australian styrenics operations and our North American polymers and base chemicals operations. We also report the results of operations of these businesses as discontinued operations.

As of December 31, 2019, we employed approximately 10,000 associates worldwide, including approximately 1,000 employees associated with the Chemical Intermediates Businesses that was sold on January 3, 2020. Our revenues for the years ended December 31, 2019, 2018 and 2017 were $6,797 million, $7,604 million and $6,845 million, respectively.

Our Products

Our Polyurethanes, Performance Products, Advanced Materials and Textile Effects segments produce differentiated organic chemical products. Growth in our differentiated products has been driven by the substitution of our products for other materials and by the level of global economic activity. Accordingly, the profitability of our differentiated products has been somewhat less influenced by the cyclicality that typically impacts the petrochemical industry.

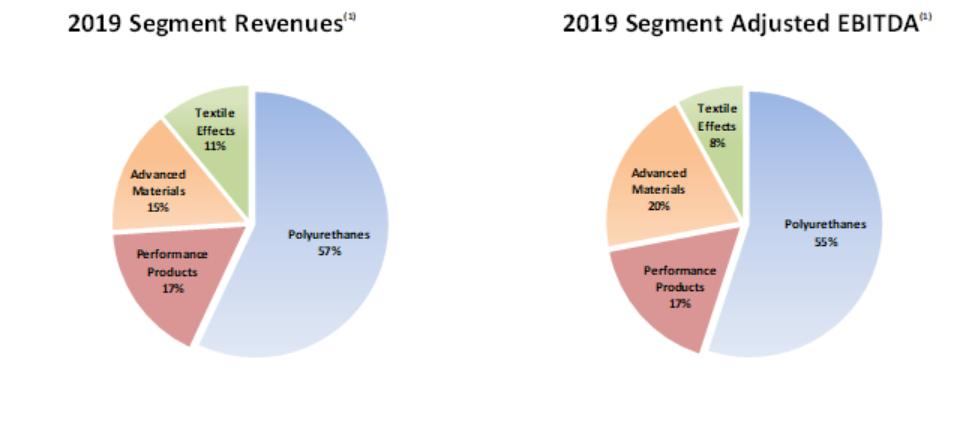

(1) | Percentage allocations in this chart do not give effect to Corporate and other unallocated items and eliminations. For a reconciliation of adjusted EBITDA to net income attributable to Huntsman Corporation and cash provided by operating activities, see “Part II. Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations—Results of Operations.” |

2

The following table identifies the key products, principal end markets and applications, representative customers, raw materials and representative competitors of each of our business segments:

Product Line | End Markets / Applications | Representative Customers | Raw Materials | Representative Competitors | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Polyurethanes | MDI | Polyurethane chemicals are used to produce rigid and flexible foams, as well as coatings, adhesives, sealants and elastomers. They are also used in refrigeration and appliance insulation, construction products, automotive, footwear, furniture, cushioning, specialized engineering applications. | BMW, Electrolux, Firestone, Haier, Henkel, Lear, Louisiana Pacific, Norbord and Recticel | Benzene =>Nitrobenzene and Aniline | ||||||||||||

Polyols | Polyols are combined with MDI and other isocyanates to create a broad spectrum of polyurethane products, such as rigid foam, flexible foam and other non-foam applications. | Mostly PO, some EO | Wanhua Chemical Group, BASF, Dow and Covestro | |||||||||||||

TPU | TPU is a high-quality, fully formulated thermal plastic that can be tailored with unique qualities. It can be used in injection molding and small components for automotive and footwear. It is also extruded into films, wires and cables for use in the coatings, adhesives, sealants and elastomers markets. | Isocyanate (such as MDI) and a polyol | ||||||||||||||

|

|

|

|

| ||||||||||||

Performance Products | Amines | Amines are a family of intermediate chemicals that are valued for their properties as a reactive agent, emulsifier, dispersant, detergent, solvent or corrosion inhibitor. Amines are used in polyurethane foam, fuel and lubricant additives, paints and coatings, composites, gas treatment, construction materials and personal care products | Afton, Chevron Oronite, Ecolab, Evonik, Georgia-Pacific, Hexion, Infineum, Ingevity, Lubrizol, Olin and PPG | EO, PO, glycols, ethylene dichloride, caustic soda, ammonia, hydrogen, methylamines and acrylonitrile | BASF, Delamine, Dow, Eastman, Evonik, Nouryon and Tosoh | |||||||||||

Maleic anhydride | Maleic anhydride is an intermediate chemical used primarily to produce unsaturated polyester resins (UPRs). UPRs are mainly used in the production of fiberglass reinforced resins for marine, automotive and construction products. Maleic anhydride is also used in the production of lubricants, food additives and food acidulants. | AOC, Ashland, Chevron Oronite, Cranston, Dixie, Ingevity, Lubrizol, MFG Chemical, Polynt-Reichhold and Tate & Lyle | Normal butane | Lanxess, INEOS, Bartek and Ashland | ||||||||||||

|

|

|

|

|

| |||||||||||

Advanced Materials | Technologically- advanced epoxy, acrylic and polyurethane-based polymer formulations | Aerospace and industrial adhesives; composites for aerospace, automotive, oil and gas and wind power generation; construction and civil engineering; industrial coatings; electrical power transmission; consumer electronics and DIY adhesives. | Bodo Moeller, Freeman, Hilti, Nordex, Schneider, Siemens, Speed Fair, Syngenta, Tianjin and Sherwin Williams | BLR, epichlorohydrin, amines, polyols, isocyanates, acrylic materials, hardeners and fillers | Henkel, Sika, 3M, Sumitomo, Hexion, Elantas and Olin | |||||||||||

High performance thermoset resins and curing agents | High performance chemical building blocks sold to formulators who develop formulations for aerospace, automotive, oil and gas, coatings, construction, electronics and electrical insulation applications. | Cytec, Hexcel and Toray | Epichlorohydrin (ECH), amines, phenols, aminophenols and fatty acids | Hexion, Olin, Sumitomo and Evonik | ||||||||||||

Base liquid resins (BLR), Base solid resins (BSR) | BLR is used internally and is the basic building block for many of our downstream products. Approximately 69% of what we produce is used internally and the rest is sold into the merchant market. | Akzo, Omya and Sherwin Williams | Epichlorohydrin, bisphenol A (BPA), BLR, MDA and phenol and aminophenols | Olin, Hexion, Kukdo and NanYa | ||||||||||||

|

|

|

|

|

| |||||||||||

Textile Effects | Chemicals, dyes & inks | Textile dyes add color to textiles from cotton, polyester and nylon, while textile chemicals improve the performance characteristics of the textile. These are used in apparel, home and technical textiles. Home and institutional textiles include textiles that are used within the home or institutions such as hotels. Functional and technical textiles include automotive textiles, carpet, military fabrics protective wear, nonwoven and other technical fabrics. | Esquel Group, Fruit of the Loom, Guilford Mills, Hanesbrands, Kahatex, Nice Dyeing, Sage Automotive, Tencate, Toray Group, Welspun Group, Y.R.C. Textiles and Zaber and Zubair | Thousands of raw materials, with no one representing more than 5% of raw material costs | Dyes: Archroma, DyStar, Longsheng, Runtu and Jihua Chemicals: Archroma, Nikka, Transfar/Tannatex, CHT and Rudolf Digital Inks: EFI/Reggiani, Dover/MS, JK Group, Sensient/Xennia, DuPont, DyStar and SPG | |||||||||||

3

Polyurethanes

General

We are a leading global manufacturer and marketer of a broad range of polyurethane chemicals, including MDI products, polyols, and TPU (each discussed in more detail below under “—Products and Markets”). Polyurethane chemicals are used to produce rigid and flexible foams, as well as coatings, adhesives, sealants and elastomers. We focus on the higher-margin, higher-growth markets for specialty MDI and MDI-based polyurethane systems. Volume growth in our Polyurethanes segment has been driven primarily by the continued substitution of MDI-based products for other materials across a broad range of applications. We operate five primary polyurethane manufacturing facilities in the U.S., Europe and China. We also operate 29 strategically located downstream facilities, 25 of them are polyurethane formulation facilities, commonly referred to in the chemical industry as “systems houses,” located in close proximity to our customers worldwide, which enables us to focus on customer support, technical service and a differentiated product offering. We also operate a specialty polyol manufacturing facility focused on the insulation market and three downstream TPU manufacturing facilities in the U.S., Europe and China.

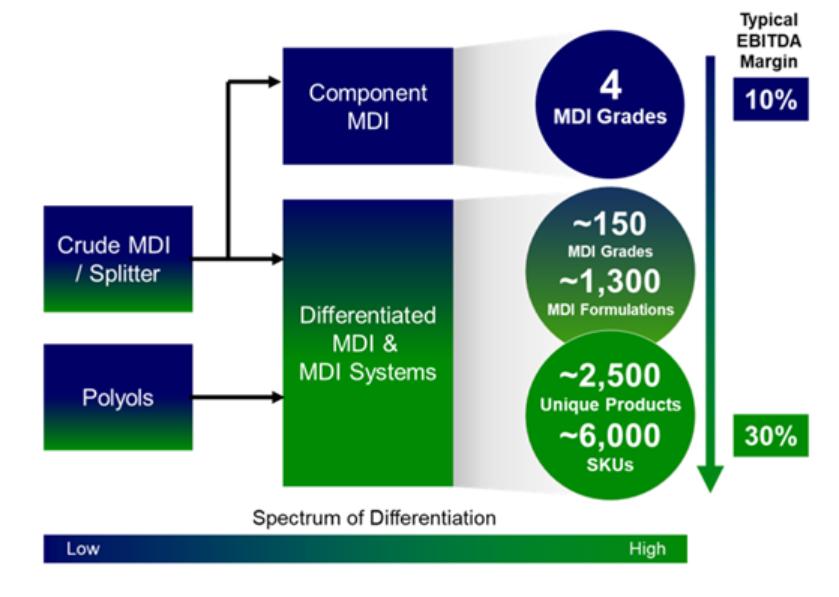

Our customers produce polyurethane products through the combination of an isocyanate, such as MDI, with polyols, which are derived largely from PO and EO. We are able to produce over 2,500 distinct MDI-based polyurethane products by modifying the MDI molecule through varying the proportion and type of polyol used and by introducing other chemical additives to our MDI formulations. As a result, polyurethane products, especially those derived from MDI, are continuing to replace traditional products in a wide range of end-use markets, including insulation in construction and appliances, cushioning for automotive and furniture, coatings, adhesives, wood binders for construction and furniture, footwear and other specialized engineering applications.

In 1992, we were the first global supplier of polyurethane chemicals to open a technical service center in China. We have since expanded this facility to include an integrated polyurethane formulations facility and a world-scale research and development campus. In January 2003, we entered into two related joint ventures to build MDI production and finishing facilities near Shanghai, China in Caojing. In June 2006, HPS, a consolidated joint venture, began production at our MDI finishing plant. In September 2006, SLIC, an unconsolidated joint venture, began production at the MNB, aniline and crude MDI plants. We completed capacity expansions of these facilities during the first quarter of 2018. These world-scale facilities strengthen our ability to service our customers in the critical Chinese market, the largest MDI market in the world, and will support the long-term demand growth that we believe this region will continue to experience. Additionally, in November 2012, we entered into an agreement with Sinopec to form a joint venture to build a world scale PO/MTBE plant in Nanjing, China utilizing proprietary PO/MTBE manufacturing technology. The facility was completed in early 2017 and beneficial commercial operations began in the second half of 2017. We own a 49% interest in the joint venture and account for our interest in the joint venture as an equity method investment.

4

Products and Markets

MDI is used primarily in rigid foam applications and in a wide variety of customized, higher-value flexible foam as well as coatings, adhesives, sealants and elastomers. Polyols, including polyether and polyester polyols, are used in conjunction with MDI in rigid foam, flexible foam and other non-foam applications. The following chart illustrates the range of product types and end uses for polyurethane chemicals. We produce MDI, polyols and TPU products and do not produce TDI products.

Polyurethane chemicals are sold to customers who combine the chemicals to produce polyurethane products. Depending on their needs, customers will use either component polyurethane chemicals produced for mass sales or polyurethane systems tailored for their specific requirements. By varying the blend, additives and specifications of the polyurethane chemicals, manufacturers are able to develop and produce a breadth and variety of polyurethane products.

Our strategy is focused on growing our differentiated product offering (specialty MDI and polyols, formulated MDI systems and TPU), which requires a greater emphasis on formulating capability to help our downstream customers to meet the desired effect required in their applications. These differentiated products tend to require technical solutions, offer higher margins, lower volatility and are less dependent on industry utilization rates compared to sales of component MDI or component polyols.

MDI. MDI has grown substantially over the past three decades, increasing by a factor of 6% CAGR, well in excess of global GDP. MDI has a substantially larger market size and a higher growth rate than other polyurethane isocyanates. This is primarily because MDI can be used to make polyurethanes with a broader range of properties and can therefore be used in a wider range of applications. We believe that MDI and formulated MDI systems, which combine MDI and polyols, will continue to grow at approximately double the rate of global GDP driven by the mega trends of energy management, food preservation, demographics and urbanization/transportation. MDI offers key products benefits of energy efficiency, comfort and durability aligned with these megatrends. We believe that MDI and formulated MDI systems will continue to substitute for alternative materials such as fiberglass in insulation, phenol formaldehyde in wood binders and TDI in automotive and furniture. Specialty cushioning and insulation applications, thermoplastic polyurethanes and adhesives and coatings will further contribute to the continued growth of MDI. MDI experiences some seasonality in its sales reflecting its exposure to seasonal construction-related end markets such as insulation and composite wood products. Sales generally peak during the spring and summer months in the northern hemisphere, resulting in greater sales volumes during the second and third quarters of the year.

TPU. TPU is a high-quality, fully formulated thermal plastic derived from the reaction of MDI or an aliphatic isocyanate with polyols to produce unique qualities such as durability, flexibility, strength, abrasion-resistance, shock absorbency and chemical resistance. We can tailor the performance characteristics of TPU to help meet the specific

5

requirements of our customers. TPU is used in injection molding and small components for the automotive and footwear industries. It is also extruded into films for apparel, wires and cables for industrial use and in a wide variety of applications in the coatings, adhesives, sealants and elastomers markets.

Polyols. Polyols are combined with MDI and other isocyanates to create a broad spectrum of formulated polyurethane systems. Demand for specialty polyols has been growing at approximately the same rate at which MDI consumption has grown.

Aniline. Aniline is an intermediate chemical used primarily to manufacture MDI. The majority of our aniline is consumed internally with some sold to third parties. We believe that the lack of a significant spot market for aniline means that in order to remain competitive, MDI manufacturers must either be integrated with an aniline manufacturing facility or have a long-term, cost-competitive aniline supply contract.

Our strategic focus is on growing our differentiated (specialty MDI and polyols, formulated MDI-based systems and TPU) product offerings and the diagram below provides an overview of that focus with an approximation of the number of grades, formulations, products and stock keeping units which we produce and sell.

Sales and Marketing

We market our polyurethane chemicals to over 6,000 customers in more than 90 countries. Our sales, marketing and technical resources are organized to support major regional markets and key end-use markets, some of which require a coordinated global approach, such as key accounts across the automotive sector. These key end-use markets include the commercial and residential insulation, appliance, automotive, footwear, furniture and coatings, adhesives, sealants and elastomers industries. We sell both directly and indirectly to customers, the latter via a network of distributors and agents who in turn sell our products to customers who cannot be served as cost effectively by our internal sales groups.

We provide a wide variety of polyurethane solutions as components (i.e., the isocyanate or the polyol) or in the form of “systems” in which we provide the total isocyanate and polyol formulation to our customers. Our ability to deliver a range of polyurethane solutions and technical support, which can be tailored for the needs of our customers, is critical to our long-term success. We have strategically located our downstream polyurethane systems houses close to our customers, enabling us to focus on customer support and technical service. We believe this customer support and

6

technical service system contributes to customer retention and also provides opportunities for identifying further product and service needs of customers.

Our strategy is to grow the number and capability of our downstream facilities both organically and inorganically. As a result, we have made a number of “bolt-on” acquisitions in recent years to expand our downstream footprint and align with our strategic intent.

We believe that the extensive market knowledge and industry experience of our sales teams and technical experts, in combination with our strong emphasis on customer relationships, have facilitated our ability to establish and maintain long-term customer supply positions. Our sales strategy is to continue to increase sales to existing customers and to attract new customers by providing innovative solutions, quality products, reliable supply, competitive prices and superior customer service.

Manufacturing and Operations

Our world-scale MDI production facilities are located in Geismar, Louisiana; Rotterdam, The Netherlands; and through our joint ventures in Caojing, China. These facilities receive aniline, which is a primary material used in the production of MDI, from our facilities located in Geismar, Louisiana; Wilton, U.K.; and Caojing, China. We believe that this relative scale and product integration of our large facilities is necessary to provide cost competitiveness in MDI production. The following table sets forth the annual production capacity of polyurethane chemicals at select polyurethanes facilities:

| MDI |

| Polyols |

| TPU |

| Aniline |

| Nitrobenzene |

| |

(millions of pounds) | |||||||||||

Caojing, China |

| 825 | (1) |

|

|

|

|

|

|

| |

Geismar, Louisiana |

| 1,060 |

| 160 |

|

|

| 706 | (2) | 1,000 | (2) |

Houston, Texas |

|

|

| 168 |

|

|

|

|

|

|

|

Jinshan, China |

|

|

|

|

| 44 |

|

|

|

|

|

Osnabrück, Germany |

|

|

| 26 |

| 59 |

|

|

|

|

|

Ringwood, Illinois |

|

|

|

|

| 28 |

|

|

|

|

|

Rotterdam, The Netherlands |

| 1,036 |

| 190 |

|

|

|

|

|

|

|

Wilton, U.K. |

|

|

|

|

|

|

| 783 |

| 1,045 |

|

Total |

| 2,921 |

| 544 |

| 131 |

| 1,489 |

| 2,045 |

|

(1) Represents our share of capacity from SLIC.

(2) Represents our approximately 78% share of capacity under our consolidated Rubicon LLC manufacturing joint venture with Lanxess AG.

At our Geismar, Rotterdam and Caojing facilities we utilize sophisticated proprietary technology to produce MDI. This technology contributes to our position as a low-cost MDI producer.

Joint Ventures

Rubicon Joint Venture. Lanxess AG (“Lanxess”) is our joint venture partner in Rubicon LLC, which owns aniline, nitrobenzene and DPA manufacturing facilities in Geismar, Louisiana. We are entitled to approximately 78% of the nitrobenzene and aniline production capacity of Rubicon LLC, and Lanxess is entitled to 100% of the DPA production. In addition to operating the joint venture’s aniline, nitrobenzene and DPA facilities, Rubicon LLC operates our wholly-owned MDI, polyol and maleic anhydride facilities at Geismar and is responsible for providing other auxiliary services to the entire Geismar complex. As a result of this joint venture, we are able to achieve greater scale and lower costs for our products than we would otherwise have been able to obtain. Rubicon LLC is consolidated in our financial statements.

Chinese MDI Joint Ventures. We are involved in two related joint ventures which operate MDI production facilities in Caojing, China. SLIC, our manufacturing joint venture with BASF and three Chinese chemical companies, produces MNB, aniline and crude MDI. We effectively own 35% of SLIC and account for our investment under the equity method. HPS, our splitting joint venture with Shanghai Chlor-Alkali Chemical Company, Ltd, manufactures pure MDI, polymeric MDI, MDI variants and formulated MDI systems. We own 70% of HPS and it is consolidated in our financial statements. These projects have been funded by a combination of equity invested by the joint venture partners

7

and borrowed funds. We completed capacity expansions of these facilities in the first quarter of 2018. The total production capacity of the SLIC facilities is 1,280 million pounds per year of MDI, of which HPS is entitled to 825 million pounds.

Chinese PO/MTBE Joint Venture. In November 2012, we entered into an agreement to form a joint venture with Sinopec. The joint venture involved the construction and operation of a PO/MTBE facility in China. Under the joint venture agreement, we hold a 49% interest in the joint venture and Sinopec holds a 51% interest. Beneficial commercial operations began during the second half of 2017.

Raw Materials

The primary raw materials for MDI-based polyurethane chemicals are benzene and PO. Benzene is a widely available commodity that is the primary feedstock for the production of MDI and aniline. Historically, benzene has been the largest component of our raw material costs. We purchase benzene from third parties to manufacture nitrobenzene and aniline, almost all of which we then use to produce MDI.

In connection with the sale of the Chemical Intermediates Businesses to Indorama, we entered into a strategic agreement for the supply of PO in North America. In China, the Chinese PO/MTBE joint venture supplies PO into our downstream China business. The strategic supply of PO gives us access to competitively priced PO and the opportunity to develop polyols that enhance our range of MDI products.

Competition

Our major competitors in the polyurethane chemicals market include BASF, Covestro, Dow, and Wanhua Chemical Group. While these competitors and others produce various types and quantities of polyurethane chemicals, we focus on MDI and MDI-based formulated polyurethane systems. Our downstream business is fragmented with different competitors in various markets and regions. Our competitors in downstream markets include Kingspan, Carlisle and Coim. Our polyurethane chemicals business competes in two basic ways: (1) where price is the dominant element of competition, our polyurethane chemicals business differentiates itself by its high level of customer support, including cooperation on technical and safety matters; and (2) elsewhere, we compete on the basis of product performance, our ability to react quickly to changing customer needs and providing customers with innovative solutions to their needs.

Performance Products

General

Our Performance Products segment has leading global positions in the manufacture and sale of amines and maleic anhydride and serves a wide variety of consumer and industrial end markets. Our Performance Products segment is organized by region and product family: amines and maleic anhydride (including catalyst and licensing).

We produce a wide range of amines, many of which are sold into specialty markets such as epoxy curing agents, oil exploration and production, agrochemicals, and fuel and lubricant additives. We believe we are the largest global producer of polyetheramines, one of the largest producers of 2-(2-amino ethoxy) ethanol, sold under our DGA™ brand, the largest global producer making the full range of ethyleneamines, the second largest producer of morpholine and a leading global producer of low emission polyurethane catalysts. We are the only producer and largest supplier of propylene carbonate and ethylene carbonate in North America. Many of the markets for these products have growth rates in excess of global GDP.

We believe we are the largest global producer of maleic anhydride, a highly versatile chemical intermediate that is used to produce UPRs, which are mainly used in the production of fiberglass reinforced resins for marine, automotive and construction products. Maleic anhydride is also used in the production of lubricants, food additives and artificial sweeteners. We are also the leading licensor of maleic anhydride manufacturing technology and are amongst the largest suppliers of fixed bed catalyst used in the manufacture of maleic anhydride from n-butane.

Beginning in 2013, our Performance Products segment initiated a restructuring program to refocus its surfactants business in Europe. In connection with this program, in 2014 we completed the sale of our European commodity surfactants business, including the ethoxylation facility in Lavera, France to Wilmar. Additionally, in 2014 we ceased production at our Patrica, Italy surfactants facility. In December 2015, we announced plans for a reorganization of our commercial and technical functions and a refocused divisional business strategy to better position our segment for growth in coming years and we launched a program to capture growth opportunities, improve manufacturing cost efficiency and reduce inventories. In December 2016, we completed the sale of our European differentiated surfactants business to Innospec Inc. for $199 million in cash plus our retention of trade receivables and

8

payables for an enterprise value of $225 million. In August 2019, we entered into an agreement with Indorama to sell our Chemical Intermediates Businesses, for a purchase price of $2.0 billion in cash plus the transfer of approximately $72 million in net underfunded pension and other post-employment benefit liabilities. We completed this sale on January 3, 2020. In September 2019, we acquired from Sasol, our joint venture partner, the 50% noncontrolling interest that we did not own in the Sasol-Huntsman maleic anhydride joint venture. We paid Sasol $101 million, which included acquired cash, net of any debt.

We produce a variety of products at 10 Performance Products manufacturing facilities in North America, Europe, the Middle East and Asia.

Products and Markets

Amines. Amines are a family of intermediate chemicals that are produced by reacting ammonia, or an alkylamine, with various ethylene and propylene derivatives. Generally, amines are valued for their properties as a reactive agent, emulsifier, dispersant, solvent or corrosion inhibitor. Growth in demand for amines is highly correlated with GDP growth. However, certain segments of the amines market, such as polyetheramines, have historically grown at rates in excess of GDP growth due to new product development, technical innovation and end-use substitution. As amines are generally sold based upon the performance characteristics that they provide to customer-specific end-use applications, pricing does not generally fluctuate directly with movements in underlying raw materials. Our amines business is organized around the following product groups:

Product Group |

| Applications |

Polyetheramines | Epoxy composites, polyurethane foams and insulation, construction and flooring, paints and coatings, lubricant and fuel additives, adhesives, agrochemicals, oilfield chemicals, printing inks and pigment dispersion | |

Ethyleneamines | Chemical building block used in lubricant and fuel additives, epoxy hardeners, wet strength resins, chelating agents and fungicides | |

Other specialty amines, including DGA™ Agent | Gas treating, agricultural chemicals, personal care, lubricant and fuel additives, polyurethane foams, fabric softeners, paints and coatings, refinery processing and water treating |

Polyetheramines are produced by reacting polyol with ammonia. They provide sophisticated performance characteristics as an additive in the manufacture of highly customized epoxy formulations, enabling customers to penetrate new markets and substitute for traditional curing materials.

Our ethyleneamines are manufactured by reacting EDC and caustic soda with ammonia to produce a range of various ethyleneamines homologues having different molecular weights. Most other producers utilize a reductive amination process, which yields a light slate of ethyleneamines. We believe our heavier slate of homologues allows access to a greater range of markets.

9

Our amines are used in a wide variety of mainly industrial applications, including composites, paints and coatings, polyurethane foam, fuel and lubricant additives, and solvents. Our key amines customers include Afton, Chevron-Oronite, Ecolab, Evonik, Georgia-Pacific, Hexion, Infineum, Ingevity, Lubrizol, Olin, and PPG.

Maleic Anhydride (including catalyst and licensing). Maleic anhydride is a highly versatile chemical intermediate that is used to produce UPRs, which are the main ingredient in fiberglass reinforced resins used for marine and automotive applications and commercial and residential construction products. Maleic anhydride is also used in the production of lubricants, food additives and artificial sweeteners.

Product Group |

| Applications |

Maleic anhydride | Boat hulls, automotive, construction, lubricant and fuel additives, countertops, agrochemicals, paper and food additives | |

Maleic anhydride catalyst and technology licensing | Maleic anhydride and 1-4 butanediol (BDO) and its derivatives, including polybutylene terephthalate (PBT) production |

Maleic anhydride is produced by oxidizing either benzene or normal butane through the use of a catalyst. Our maleic anhydride technology is a proprietary fixed bed butane-based process with a solvent recovery and refining system. We believe that our process is superior in the areas of feedstock and energy efficiency and solvent recovery. The maleic anhydride-based route to BDO manufacture is currently the preferred process technology and is favored over the other routes, which utilize PO, butadiene or acetylene as feedstocks. As a result, the growth in demand for BDO supports growing demand for our maleic anhydride technology and catalyst. Generally, changes in price have resulted from a combination of changes in industry capacity utilization and underlying raw material costs.

We license our maleic anhydride technology and supply our catalysts to licensees and to worldwide merchant customers. Revenue from licensing and catalyst comes from new plant commissioning, as well as current plant retrofits and routine catalyst changes. Our licensing group also licenses technology on behalf of other Performance Products businesses and other segments.

Our key maleic anhydride customers include AOC, Ashland, Chevron Oronite, Cranston, Dixie, Ingevity, Lubrizol, MFG Chemical, Polynt-Reichhold and Tate & Lyle.

Sales and Marketing

We sell over 800 products to over 1,000 customers globally through our Performance Products regional sales and marketing organizations, which have extensive market knowledge, considerable chemical industry experience and well-established customer relationships.

In more specialty markets (e.g., lubricants, coatings, construction, agrochemicals, oilfield, automotive, gas treating and insulation), our marketing efforts are focused on how our product offerings perform in certain customer applications. We believe that this approach enhances the value of our product offerings and creates opportunities for ongoing differentiation in our development activities with our customers.

We provide extensive pre- and post-sales technical service support to our customers where our technical service professionals work closely with our research and development functions to tailor our product offerings to meet our customers unique and changing requirements. These technical service professionals interact closely with our marketing managers and business leadership teams to help guide future offerings and market approach strategies. In addition to our focused direct sales efforts, we maintain an extensive global network of distributors and agents that also sell our products. These distributors and agents typically promote our products to smaller end-use customers who cannot be served cost effectively by our direct sales forces.

10

Manufacturing and Operations

Our Performance Products segment has the capacity to produce a variety of products at 10 manufacturing locations in North America, EAME, and Asia. These production capacities are as follows:

Current capacity | ||||||||

| North |

|

|

| ||||

Product Area | America | EAME | APAC | Total | ||||

(millions of pounds) | ||||||||

Amines |

| 760 |

| 257 | (1) | 107 |

| 1,124 |

Maleic anhydride |

| 340 |

| 231 |

| — |

| 571 |

(1) Includes up to 30 million pounds of ethyleneamines that are made available from Dow’s Terneuzen, The Netherlands facility by way of a long-term supply arrangement and 70 million pounds from AAC, our consolidated 50%-owned joint venture, located in Jubail, Saudi Arabia. |

Our amines facilities are located globally. These facilities have a competitive cost base and use modern manufacturing units that allow for flexibility in production capabilities and technical innovation.

A number of our facilities are located within large integrated petrochemical manufacturing complexes. We believe this results in greater scale and lower costs for our products than we would be able to obtain if these facilities were stand-alone operations. These include our maleic anhydride facilities in Pensacola, Florida, Geismar, Louisiana and Moers, Germany and our ethyleneamines facility in Freeport, Texas.

Joint Ventures

Ethyleneamines Joint Venture. Since July 1, 2010, we have consolidated the results of AAC, our 50%-owned joint venture with the Zamil Group. AAC operates an ethyleneamines manufacturing plant in Jubail, Saudi Arabia. The plant has an approximate annual capacity of 70 million pounds. We purchase and sell all of the production from this joint venture.

Raw Materials

The main raw materials used in the production of our amines are EO, PO, glycols, EDC, caustic soda, ammonia, hydrogen, methylamines and acrylonitrile. The majority of these raw materials are available from multiple sources in the merchant market at competitive prices.

Maleic anhydride is produced by the reaction of normal butane with oxygen using our proprietary catalyst. The principal raw material is normal butane, which is purchased pursuant to long-term contracts and delivered to our Pensacola, Florida site by barge, to our facility in Geismar, Louisiana via pipeline and to our Moers, Germany site by railcar. Our maleic anhydride catalyst is toll manufactured by a third party according to our proprietary methods. These raw materials are available from multiple sources at competitive prices.

Competition

There are a small number of competitors for many of our amines due to the considerable customization of product formulations, the proprietary nature of many of our product applications and manufacturing processes and the relatively high research and development and technical costs involved. Our global competitors include BASF, Delamine, Dow, Evonik, Nouryon and Tosoh. We compete primarily on the basis of product performance, new product innovation and, to a lesser extent, on the basis of price.

In our maleic anhydride market, we compete primarily on the basis of price, customer service, technical support and logistics management. Our competitors include Lanxess, INEOS, Bartek and Ashland. We are a leading global supplier of fixed bed catalyst for the manufacture of maleic anhydride from n-butane. The main competitors in the fixed bed n-butane based maleic anhydride catalyst market include Clariant and Polynt-Reichhold. In our maleic anhydride technology licensing market, our primary competitor is Conser. We compete primarily on the basis of technological performance and service.

11

Advanced Materials

General

Our Advanced Materials segment is a leading global manufacturer and marketer of technologically-advanced epoxy, acrylic and polyurethane-based polymer products. We focus on formulations and systems that are used to address customer-specific needs in a wide variety of industrial and consumer applications. Our products are used either as replacements for traditional materials or in applications where traditional materials do not meet demanding engineering specifications. For example, structural adhesives are used to replace metal rivets and advanced composites are used to replace traditional aluminum panels and other steel materials to lighten structures in aerospace, automotive and other transportation. Our Advanced Materials segment is characterized by the breadth of our product offering, our expertise in complex chemistry, our long-standing relationships with our customers, our ability to develop and adapt our technology and our applications expertise for new markets and new applications.

We operate synthesis, formulating and production facilities in North America, Europe, Asia and South America. We sell to nearly 1,700 customers in the following end markets: aerospace, automotive, liquid natural gas transport, coatings and construction, printed circuit boards, consumer, industrial and automotive electronics, consumer and industrial appliances, wind power generation, consumer/do it yourself (“DIY”), electrical power transmission and distribution, recreational sports equipment, medical appliances and food and beverage packaging.

Products and Markets

Aerospace. Our Advanced Materials segment is a leading global supplier of advanced, high-performance materials for the fabrication and repair of aircraft components. We supply leading aerospace companies with innovations in composites, adhesives, laminating and repair systems.

We offer a wide range of materials to the aerospace market under the ARALDITE®, EPIBOND®, EPOCAST® and URALANE® brands. Many of these products are qualified under the specification of major aerospace original equipment manufacturers (“OEM”), complying with appropriate regulations governing large civil aircraft.

Transportation and Industrial. We offer to the automotive, recreational sports equipment and industrial composite markets, including leading automotive OEM’s and Tier 1 suppliers, high end composite formulations. Lightweight, strength, flexibility, shorter cycle time and fatigue resistance are key requirements of our industrial partners. Our Advanced Materials segment had numerous awards from the JEC Composite Association for innovation in the composite industry.

ARALDITE® is an important brand in high-performance adhesive technologies. We offer formulation expertise in various chemistries, including epoxies, polyurethanes, methacrylates and phenolics. Our materials address requirements such as long open times for large area applications, fast-curing adhesives for early removal and rapid through-put, resistance to high temperature, water and chemicals, thixotropy for gap-filling or vertical applications, and toughness, impact-resistance and elasticity to cope with different thermal expansions when bonding larger structures. Our adhesives are used in a large variety of industrial applications and in the consumer/DIY market.

Electrical Engineering and Electronics. We are a leading global supplier of insulating materials for motors, generators, switchgears, distribution and instrument transformers, and insulators and bushings for utility and industrial applications. The products formulated by our Advanced Materials segment are designed to provide an extended service life and meet specific industry requirements for electrical insulation in indoor and outdoor environments.

In the field of electronics, our Advanced Materials segment has a long history delivering a wide range of solutions meeting stringent requirements for electronics applications, such as high temperature and chemical resistance, flame-retardancy and excellent mechanical and dielectric properties. The strong global push for e-vehicles opens up new opportunities in e-motor encapsulation.

Coatings and Construction. We offer expertise in curing technologies and a portfolio of specialized resins and additives to the manufacturers of paints and construction materials. Our specialty resins and additives, including epoxy hardeners and high solid or water based components, enable customers to address challenging industry requirements such as resistance to aggressive chemicals and high temperature, adhesion to difficult substrates, excellent mechanical properties, high drying speed and easy re-coatability, low temperature and sub-zero cure. Our product technologies enhance performance and productivity at low VOC and environmental impact in several coatings and construction applications, like heavy duty protection, marine, transportation, food packaging, flooring and chemical anchoring.

12

Wind and Base Resins. Our products are used by leading wind blade manufacturers on a large range of applications from plugs to complete composite turbine blade production, as well as its assembly and repair. Our portfolio includes standard products as well as custom-made solutions formulated to meet specific customer requirements.

We also offer basic liquid and solid epoxy resins to the general formulators market.

Sales and Marketing

We maintain multiple routes to market to service our diverse and fragmented customer base throughout the world. These routes to market range from using our own direct sales force, technically-oriented distribution to mass distribution. Our direct sales force focuses on engineering solutions for our major customers who purchase significant amount of product. We use technically-oriented specialist distributors to augment our sales effort in niche markets and applications where we do not believe it is appropriate to develop direct sales resources. We use mass general distribution channels to sell our products into a wide range of general applications where technical expertise is less important, which reduces our overall selling expenses. We believe our use of multiple routes to market enables us to reach a broader customer base at an efficient cost.

We conduct sales activities through dedicated regional sales teams in EMEAI, Asia and the Americas. Our global customers are covered by key account managers who are familiar with the specific requirements of these customers. The management of long-standing customer relationships is critical to the sales and marketing process.

For our consumer/DIY range, with the exception of the Indian market, we have entered into branding and distribution arrangements. Under these arrangements, our distribution partners fund advertising and sales promotions, negotiate and sell to major retail chains, own inventories and provide store deliveries (and sometimes shelf merchandising) for ARALDITE® branded, ready-to-sell packaged products.

Manufacturing and Operations

We are a global business serving customers in three principal geographic regions: EAMEI, Asia and the Americas. To service our customers efficiently, we maintain manufacturing plants around the world with a strategy of global, regional and local manufacturing employed to optimize the level of service and minimize the cost to our customers. The following table summarizes the plants that we operate:

Description of Facility | |||||

Location | Synthesis | Formulations | |||

Bad Säckingen, Germany | ✓ | ||||

Bergkamen, Germany | ✓ | ||||

Duxford, U.K. | ✓ | ✓ | |||

East Lansing, Michigan | ✓ | ||||

Ho Chi Minh City, Vietnam | ✓ | ||||

Los Angeles, California | ✓ | ||||

McIntosh, Alabama | ✓ | ✓ | |||

Monthey, Switzerland | ✓ | ✓ | |||

Pamplona, Spain | ✓ | ||||

Panyu, China(1) | ✓ | ✓ | |||

Taboão da Serra, Brazil | ✓ | ||||

(1) 95%-owned and consolidated manufacturing joint venture with Guangzhou Sheng’an Package Company Limited.

Raw Materials

The principal raw materials we purchase for the manufacture of basic and advanced epoxy resins are epichlorohydrin, bisphenol A, MDA, phenol and aminophenols. We also purchase amines, polyols, isocyanates, acrylic materials, hardeners and fillers for the production of our formulated polymer systems and complex chemicals and additives. Raw material costs constitute a sizeable percentage of the costs for certain applications. We have supply contracts with a number of suppliers. The terms of our supply contracts vary, but, in general, these contracts contain provisions that set forth the quantities of product to be supplied and purchased. Formula pricing is sometimes used if advantageous for the business.

Additionally, we produce large volumes of some of our most important raw materials, such as BLR and its basic derivatives, which are the basic building blocks of many of our products. Approximately 70% of the BLR we produce is

13

consumed internally in our downstream products. The balance of our BLR is sold in the merchant market, allowing us to increase the utilization of our production plants and lower our overall BLR production cost.

We consume certain amines produced by our Performance Products segment and isocyanates produced by our Polyurethanes segment, which we use to formulate Advanced Materials products.

Competition

The markets in which our Advanced Materials segment competes are diverse and require an appropriate human capital and asset footprint to compete effectively. The competitive intensity, capital investment and development of proprietary technology and maintenance of product research and development are all market specific. We operate dedicated technology centers in Basel, Switzerland; The Woodlands, Texas; and Shanghai, China in support of our product and technology development. Among our competitors are some of the world’s largest chemical companies with integrated raw material value chains to formulation companies that leverage intellectual and highly proprietary technology for problem solving.

Aerospace. Our leading market position is driven by our specialty resins and formulations offerings backed by customer-specific certifications, quality and consistency. These products are value-added, and differentiated, backed by many years of reliable global supply and service. Our major competitors include Hexion, Sumitomo, Wakayama Seika, 3M and Henkel.

Transportation and Industrial. Our composite and adhesive markets are being driven by light weighting, cost effective production and assembling, and are serviced by our leading positions in systems formulations backed by application and process manufacturing knowledge. Our product offering allows for reliable and competitive solutions, with a strong ARALDITE® brand reputation, a robust supply chain and a specialized distribution channel to fulfill customers’ expectant demand for service & quality. Our major competitors include Dow, Hexion, Henkel, Sika and 3M.

Electrical Engineering and Electronics. Our competitive position in these diverse markets is primarily based on formulations expertise, product reliability and performance, process expertise and technical support. Our competitive strengths result from our focus on defined market segment needs, our long-standing customer relationships, product reliability and technical performance, and reputation and recognition as a quality supplier. Our major competitors in these markets are Hexion, Hitachi, Nagase, Xiongrun, Peters, Taiyo, Elantas, 3M and Lord.

Coatings and Construction. Our long-standing position in these markets is served by our specialty resins and additives. Our additives and specialty resins offerings, including epoxy hardeners and high solid or water based components, are value-added products that allow our customers to differentiate their own products. Our major competitors include AirProducts / Evonik, Allnex, Hexion, BASF, EMS, Nissan and Kukdo.

Wind and Base Resins. The wind market for thermoset resins is being driven by light weighting and energy efficiency and our product offering with standard products and custom-made formulations allows for competitively priced solutions backed by an effective supply chain. The market for basic liquid and solid epoxy resins is driven by global supply-and-demand and industry consolidation and rationalization continues as a trend as macro-economic factors affect profitability and supply balance. Our major competitors in these markets include OLIN, Hexion, NanYa, Kukdo, Chang Chun and Adytia Birla.

Textile Effects

Our Textile Effects segment is a major global solutions provider in the wet processing of textiles across pretreatment, coloration, printing and finishing and provides a diverse portfolio of textile chemicals, dyes and digital inks. Our textile solutions provide color and enhance the aesthetic, durability and performance of finished textiles, including functionality such as wrinkle resistance and water and stain repellence. Our Textile Effects segment is characterized by the breadth of our product offering and long-standing relationships with our customers and downstream brands and retailers and OEMs (e.g., in the automotive sector).

We market products to customers in multiple end-markets, including consumer fashion apparel, sportswear, career and uniform apparel, military, automotive, home and institutional textiles and furnishings, carpet and other functional textiles. Competition within these markets is generally fragmented with few competitors who can offer complete solutions for each market. We develop and adapt our technology and our applications expertise for new markets and new applications to improve our competitive offering. Increased environmental regulations, particularly in many parts of Asia, and consumer awareness about the environmental impact of the apparel industry has resulted in increased demand for sustainably produced textiles. We are at the forefront of developing sustainable textiles with advanced technology such as non-fluorinated durable water repellence, and eco-friendly digital printing. Our

14

award-winning AVITERA® reactive dyeing technology meets global industry environmental standards and helps textile mills increase yield, improve productivity and reduce processing costs by significantly reducing water and energy consumption. We operate 11 synthesis and formulation production sites in Asia, Europe and the Americas.

Since 2011, our Textile Effects segment has implemented a plan (the “Textile Effects Restructuring Plan”) to significantly restructure its business including geographically and commercially repositioning operations, optimizing supply chains and improving operational efficiency. The segment closed large, inefficient operations, transferred most of its production to facilities located closer to its customers, formed strategic partnerships and expanded in Mexico, Thailand and India, which has resulted in improved cash flows in the segment.

Products and Markets

Textile Chemicals. Our product offering in textile chemicals covers process and effect chemicals for the entire wet processing of textiles, such as pretreatment, optical brightener, dyeing and printing processes and finishing effects such as UV-protection, flame-retardancy, wrinkle resistance, water and oil repellency, moisture management and enhanced textile comfort.

We own a portfolio of textile chemical brands such as PHOBOTEX®, which is used in the sportswear sector and for outdoor textiles for products that provide non-fluorinated durable water repellency, UVITEX®, which is used for products that provide lasting white in the apparel sector to T-shirts and formal shirts as well as in in the home textile sector for towels and bed sheeting, and PYROVATEX®, which is used for products that provide non-halogenated flame-retardancy to functional textiles like protective workwear and textile insulation material used in the automotive sector.

Dyes. We provide dyes for all major fibers, including cotton, polyester, wool, nylon, silk and acrylic, each of which requires different dye chemistry for optimum results. We develop and offer processes for technological applications of dyes that enable our customers to improve their production yield and reduce their water and energy consumption. We focus on high-quality specialty dyes, which sets us apart from our Asian competitors who are primarily focused on commodity dyes. Because we provide dyes for all major fibers, we are able to differentiate ourselves from industry competitors by providing solutions for a broad range of fiber blended fabrics.

We own a portfolio of dye brands such as AVITERA®, for dyes used in T-shirts, formal shirts and towels for achieving sustainability, NOVACRON®, for dyes used widely across casual wear and home textiles, LANASOL®, for dyes used in wool formal suits, TERASIL®, for dyes used in sportswear, outerwear, home textiles and furnishings, ERIOFAST®, for dyes used in high-end intimate apparel and lingerie, TERATOP®, for dyes used across the automotive industry and NOVASOL®, for dyes used across military, protective wear and other technical textiles.

Digital Inks. We are at the forefront of the emerging trend in digital textile printing, including the time-to-market pressures of rapidly changing fashion trends and environmental concerns. Our range of digital inks solutions cover cotton, polyester, nylon, silk and other types of fiber blends, and are available for all mainstream digital printing technologies from plotters to industrial printers. Our innovative and sustainable digital inks technology is designed to help mills improve process efficiency, print reliability and improve overall environmental performance.

We own a portfolio of digital inks brands, such as LANASET® and TERASIL®, used for inks primarily for apparel and sportswear, and LYOSPERSE®, TERASIL® and NOVACRON®, used for inks for apparel and home textiles. We also have digital ink solutions designed for the fast-growing segments of soft-signage and technical textiles.

Markets. Textiles generally involve a complex matrix of fibers, colors, effects and functionality, and the resulting products range from fashion apparel to bulletproof vests, home and institutional textiles to carpet, and upholstery to automotive interiors. Our broad range of dyes, chemicals and digital inks enhance both the aesthetic appearance of these products and the functionality needed to ensure that they perform in their end-use markets. To meet the emerging digital market landscape and increasing demands for sustainable textiles, our Textile Effects segment has a comprehensive range of digital inks to meet this trend and new market opportunity. Since the requirements for these markets vary dramatically, our business strategy focuses on three major end markets—apparel, home and institutional furnishings, and functional and technical textiles. We work to provide the right balance of products and service to meet the technical and environmental challenges in each of these markets.

The apparel market focuses on products that provide an aesthetic effect through colors, as well as comfort and performance effects. Our solutions also extend to improving the processing efficiency within the textile mill. We offer a complete range of colors for cotton, polyester, wool and nylon that cover the range of shades needed for casualwear, sportswear, intimate apparel, and formal wear. Our dyes have been developed to ensure that they offer the highest levels of color durability currently available in the market. The Textile Effects segment’s AVITERA® dyes meet global

15

industry environmental standards and helps textile mills increase yield, improve productivity and reduce processing costs by reducing water and energy consumption. Pretreatment and dyeing auxiliaries ensure that these fabrics are processed efficiently and effectively—cleaning the fabrics with fewer chemicals, less energy and less water and thereby minimizing the environmental footprint and reducing the processing costs. Silicone softeners may be used to enhance the feel of products. Textile Effects has developed advanced non-fluorinated durable water repellent technology that enhances the performance levels of sportswear and outdoor wear offering comfort and durability.

Home and institutional textiles include bed linen, towels, curtains, carpets, upholstery, mattress ticking and other textiles that are used within the home or institutions, such as hotels. Dyes, chemicals and digital ink technology for these applications enhance color and shape durability, comfort, prevent color fading and enable limitless design possibilities for consumers. Optical brighteners and other pretreatment products provide “bright white” effects for towels and sheeting.

Functional and technical textiles include automotive textiles, carpet, military fabrics protective wear, nonwoven and other technical fabrics. Though the product groups may differ in their end uses, the articles must provide a high-level of functionality, durability and performance in their respective markets. High-lightfast dyes and UV absorbers are used in automotive interiors and outdoor furnishings to provide colors that do not fade when exposed to sunlight and heat. Powerful stain repellent and release technology imparts durable protection for upholstery, military and medical fabrics, without affecting the color, breathability or feel of the fabric. Specialized dyes and prints create unique camouflage patterns for military uniforms, backpacks and tarps that will not fade through wash and wear or during exposure to the elements.

Our Textile Effects segment is at the forefront of the emerging trend in digital textile printing, including the time-to-market pressures of rapidly changing fashion trends and environmental concerns. The segment’s range of digital ink solutions covers cotton, polyester, silk and other types of fiber blends. The innovative and sustainable digital ink technology is designed to help mills improve process efficiency, print reliability and improve overall environmental performance.

Sales and Marketing

During 2019, approximately 64% of our sales were generated with approximately 1,600 direct customers through our global sales and technical services network and the remaining 36% is generated through our distribution partners. Our sales and technical services representatives work directly with our existing customers forming strong relationships and uncovering new opportunities. Demand for our products is subject to fabric trends and seasonal changes in connection with summer and winter fashion trends. As such, sales generally peak in the second quarter of the year as textile mills prepare for the winter fashion trends which tend to use darker shades and heavier fabric, thereby using more of our products.

In determining the markets on which we focus, we look at growth opportunity and value proposition. Consumption markets are primarily in developed economies, such as Europe and North America, while production markets are primarily in Asia, particularly China, India, Taiwan, Vietnam, Indonesia and Bangladesh. Our downstream marketing team engages with leading brands and retailers in developed economies while our sales force and manufacturing footprint are primarily in Asia, closer to the manufacturing and sourcing base for textiles. We believe that this set-up also enables us to take advantage of continuous demand growth due to demographic and lifestyle changes in emerging markets.

For our textile effects products, we focus on providing effect competence and process competence to our customers. Effect competence, which we define as delivering value-added effects to our customers’ products, enables us to capitalize on new and innovative technologies and to assist our customers in their efforts to differentiate themselves from competitors. Process competence, which we define as applying know-how and expertise to improve customers’ processes, allows us to utilize our technical service to reduce cost, enhance efficiency and offer recommendations to improve the ecological and environmental footprint in the wet processing of textiles.

We maintain strong customer relationships through the delivery of high levels of technical service and product innovation. There are 12 technical services laboratories in North America, South America, Europe and Asia that are close to our customers in these markets, which enables us to serve our customers with greater speed and flexibility.

Manufacturing and Operations

We are a global business serving customers in three principal geographic regions: EAME, the Americas and Asia. To service our customers efficiently, we maintain manufacturing plants around the world with a strategy of global,

16

regional and local manufacturing employed to optimize the level of service and minimize the cost to our customers. The following table summarizes the capabilities of each of the plants that we operate:

Description of Facility | ||||||||||

Textile Chemicals | Textile Dyes | Inks | ||||||||

Location |

| Synthesis |

| Formulation |

| Synthesis |

| Formulation |

| Formulation |

Atotonilquillo, Mexico | ✓ | ✓ | ✓ | ✓ | ||||||

Baroda, India | ✓ | ✓ | ✓ | |||||||

Bogota, Colombia | ✓ | |||||||||

Charlotte, North Carolina | ✓ | |||||||||

Fraijanes, Guatemala | ✓ | |||||||||

Gandaria, Jakarta, Indonesia | ✓ | ✓ | ||||||||

Hangzhou, China | ✓ | |||||||||

Langweid am Leich, Germany | ✓ | ✓ | ✓ | |||||||

Panyu, China(1) | ✓ | ✓ | ||||||||

Samutsakorn (Mahachai), Thailand | ✓ | ✓ | ✓ | |||||||

Taboão da Serra, Brazil | ✓ | ✓ | ||||||||

| (1) | 95%-owned and consolidated manufacturing joint venture with Guangzhou Sheng’an Package Company Limited. |

Joint Venture

In September 2015, our Textile Effects segment established Huntsman Pürsan Chemicals Kimya Sanayi ve Ticaret Limited Şirketi (“HPC”), a 60%-owned joint venture company in Turkey, for the formulation, sale and marketing of textile chemicals and dyes. HPC ceased operating in the third quarter of 2018. The shareholders of HPC are in the process of appointing a liquidator to liquidate the company.

Raw Materials