Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-09689

Wells Fargo Master Trust

(Exact name of registrant as specified in charter)

525 Market St., San Francisco, CA 94105

(Address of principal executive offices) (Zip code)

C. David Messman

Wells Fargo Funds Management, LLC

525 Market St., San Francisco, CA 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-222-8222

Date of fiscal year end: Registrant is making a filing for 13 of its series, Wells Fargo Advantage C&B Large Cap Value Portfolio, Wells Fargo Advantage Diversified Large Cap Growth Portfolio, Wells Fargo Advantage Emerging Growth Portfolio, Wells Fargo Advantage Index Portfolio, Wells Fargo Advantage International Growth Portfolio, Wells Fargo Advantage International Value Portfolio, Wells Fargo Advantage Large Company Value Portfolio, Wells Fargo Advantage Small Company Growth Portfolio, Wells Fargo Advantage Small Company Value Portfolio, Wells Fargo Advantage Core Bond Portfolio, Wells Fargo Advantage Inflation-Protected Bond Portfolio, Wells Fargo Advantage Managed Fixed Income Portfolio, and Wells Fargo Advantage Stable Income Portfolio. Each series had a May 31 fiscal year end.

Date of reporting period: November 30, 2013

Table of Contents

| ITEM 1. | REPORT TO STOCKHOLDERS |

Table of Contents

Wells Fargo Advantage Allocation Funds

Semi-Annual Report

November 30, 2013

| n | Wells Fargo Advantage Growth Balanced Fund |

| n | Wells Fargo Advantage Moderate Balanced Fund |

Table of Contents

Reduce clutter. Save trees.

Sign up for electronic delivery of prospectuses and shareholder reports at wellsfargo.com/advantagedelivery

The views expressed and any forward-looking statements are as of November 30, 2013, unless otherwise noted, and are those of the Fund managers and/or Wells Fargo Funds Management, LLC. Discussions of individual securities, or the markets generally, or any Wells Fargo Advantage Fund are not intended as individual recommendations. Future events or results may vary significantly from those expressed in any forward-looking statements; the views expressed are subject to change at any time in response to changing circumstances in the market. Wells Fargo Funds Management, LLC and the Funds disclaim any obligation to publicly update or revise any views expressed or forward-looking statements.

NOT FDIC INSURED ¡ NO BANK GUARANTEE ¡ MAY LOSE VALUE

Table of Contents

| 2 | Wells Fargo Advantage Allocation Funds | Letter to shareholders (unaudited) |

| 1. | The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-value-weighted index with each stock’s weight in the index proportionate to its market value. You cannot invest directly in an index. |

| 2. | The Morgan Stanley Capital International All Country World Index ex USA (Net) (MSCI ACWI ex USA (Net)) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. You cannot invest directly in an index. Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indexes or any securities or financial products. This report is not approved, reviewed or produced by MSCI. |

Table of Contents

| Letter to shareholders (unaudited) | Wells Fargo Advantage Allocation Funds | 3 |

Table of Contents

| 4 | Wells Fargo Advantage Allocation Funds | Performance highlights (unaudited) |

Wells Fargo Advantage Growth Balanced Fund1

Investment objective

The Fund seeks total return, consisting of capital appreciation and current income.

Adviser

Wells Fargo Funds Management, LLC

Subadviser

Wells Capital Management Incorporated

Subadvisers for master portfolios

Portfolio managers

Average annual total returns (%) as of November 30, 2013

| Including sales charge | Excluding sales charge | Expense ratios2 (%) | ||||||||||||||||||||||||||||||||

| Inception date | 1 year | 5 year | 10 year | 1 year | 5 year | 10 year | Gross | Net3 | ||||||||||||||||||||||||||

| Class A (WFGBX) | 10-14-1998 | 16.69 | 13.78 | 5.49 | 23.81 | 15.14 | 6.12 | 1.39 | 1.20 | |||||||||||||||||||||||||

| Class B (NVGRX)* | 10-1-1998 | 17.89 | 14.04 | 5.56 | 22.89 | 14.28 | 5.56 | 2.14 | 1.95 | |||||||||||||||||||||||||

| Class C (WFGWX) | 10-1-1998 | 21.93 | 14.29 | 5.32 | 22.93 | 14.29 | 5.32 | 2.14 | 1.95 | |||||||||||||||||||||||||

| Administrator Class (NVGBX) | 11-11-1994 | – | – | – | 24.17 | 15.43 | 6.39 | 1.23 | 0.95 | |||||||||||||||||||||||||

| Growth Balanced Composite Index4 | – | – | – | – | 18.59 | 13.62 | 7.16 | – | – | |||||||||||||||||||||||||

| Barclays U.S. Aggregate Bond Index5 | – | – | – | – | (1.61 | ) | 5.33 | 4.71 | – | – | ||||||||||||||||||||||||

| MSCI EAFE Index (Net) (USD)6 | – | – | – | – | 24.84 | 13.42 | 7.56 | – | – | |||||||||||||||||||||||||

| Russell 1000® Growth Index7 | – | – | – | – | 29.74 | 20.14 | 7.89 | – | – | |||||||||||||||||||||||||

| Russell 1000® Value Index8 | – | – | – | – | 31.92 | 16.40 | 7.96 | – | – | |||||||||||||||||||||||||

| Russell 2000® Index9 | – | – | – | – | 40.99 | 20.97 | 9.08 | – | – | |||||||||||||||||||||||||

| S&P 500 Index10 | – | – | – | – | 30.30 | 17.60 | 7.69 | – | – | |||||||||||||||||||||||||

| * | Class B shares are closed to investment, except in connection with the reinvestment of any distributions and permitted exchanges. |

Figures quoted represent past performance, which is no guarantee of future results, and do not reflect taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance shown without sales charges would be lower if sales charges were reflected. Current performance may be lower or higher than the performance data quoted, which assumes the reinvestment of dividends and capital gains. Current month-end performance is available on the Fund’s website, wellsfargoadvantagefunds.com.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses, or any taxes. It is not possible to invest directly in an index.

For Class A shares, the maximum front-end sales charge is 5.75%. For Class B shares, the maximum contingent deferred sales charge is 5.00%. For Class C shares, the maximum contingent deferred sales charge is 1.00%. Performance including sales charge assumes the sales charge for the corresponding time period. Administrator Class shares are sold without a front-end sales charge or contingent deferred sales charge.

Balanced funds may invest in stocks and bonds. Stock values fluctuate in response to the activities of individual companies and general market and economic conditions. Bond values fluctuate in response to the financial condition of individual issuers, general market and economic conditions, and changes in interest rates. In general, when interest rates rise, bond values fall and investors may lose principal value. The use of derivatives may reduce returns and/or increase volatility. Certain investment strategies tend to increase the total risk of an investment (relative to the broader market). The Fund is exposed to foreign investment risk, mortgage- and asset-backed securities risk, and smaller-company securities risk. Consult the Fund’s prospectus for additional information on these and other risks.

Please see footnotes on page 5.

Table of Contents

| Performance highlights (unaudited) | Wells Fargo Advantage Allocation Funds | 5 |

Wells Fargo Advantage Growth Balanced Fund (continued)

| 1. | The Fund is a gateway blended fund that invests all of its assets in two or more master portfolios of the Wells Fargo Master Trust in varying proportions. References to the investment activities of the Fund are intended to refer to the investment activities of the master portfolios in which it invests. |

| 2. | Reflects the expense ratios as stated in the most recent prospectuses. |

| 3. | The Adviser has committed through September 30, 2014, to waive fees and/or reimburse expenses to the extent necessary to cap the Fund’s Total Annual Fund Operating Expenses After Fee Waiver, excluding certain expenses, at the amounts shown. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses, and extraordinary expenses are excluded from the cap. Fees from the underlying master portfolios are included in the cap. Without this cap, the Fund’s returns would have been lower. |

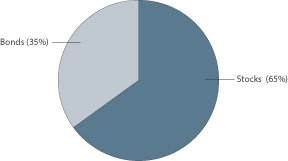

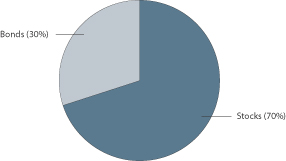

| 4. | Source: Wells Fargo Funds Management, LLC. The Growth Balanced Composite Index is weighted 35% in the Barclays U.S. Aggregate Bond Index, 16.25% in the Russell 1000® Value Index, 16.25% in the S&P 500 Index, 16.25% in the Russell 1000® Growth Index, 9.75% in the MSCI EAFE Index (Net) (USD), and 6.50% in the Russell 2000® Index. You cannot invest directly in an index. |

| 5. | The Barclays U.S. Aggregate Bond Index is composed of the Barclays U.S. Government/Credit Index and the Barclays U.S. Mortgage-Backed Securities Index and includes U.S. Treasury issues, agency issues, corporate bond issues, and mortgage-backed securities. You cannot invest directly in an index. |

| 6. | The Morgan Stanley Capital International Europe, Australasia, and Far East (MSCI EAFE) Index (Net) (USD) is an unmanaged group of securities widely regarded by investors to be representations of the stock markets of Europe, Australasia, and the Far East. Calculations for EAFE use net dividends, which reflect the deduction of withholding taxes. You cannot invest directly in an index. |

| 7. | The Russell 1000® Growth Index measures the performance of those Russell 1000 companies with higher price/book ratios and higher forecasted growth values. You cannot invest directly in an index. |

| 8. | The Russell 1000® Value Index measures the performance of those Russell 1000 companies with lower price/book ratios and lower forecasted growth values. You cannot invest directly in an index. |

| 9. | The Russell 2000® Index measures the performance of the 2,000 smallest companies in the Russell 3000® Index, which represents approximately 8% of the total market capitalization of the Russell 3000 Index. You cannot invest directly in an index. |

| 10. | The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market value weighted index with each stock’s weight in the index proportionate to its market value. You cannot invest directly in an index. |

| 11. | The ten largest long-term holdings are calculated based on the value of the securities of the master portfolios allocable to the Fund divided by the total net assets of the Fund. Holdings are subject to change and may have changed since the date specified. |

| 12. | Target allocations are subject to change. Cash and cash equivalents are not reflected in the calculations of target allocations. Neutral target allocation is the target allocation of the Fund as stated in the Fund’s prospectus. Current target allocation is the current allocation of the Fund based on the Tactical Asset Allocation (TAA) Model as of the date specified. |

Table of Contents

| 6 | Wells Fargo Advantage Allocation Funds | Performance highlights (unaudited) |

Wells Fargo Advantage Moderate Balanced Fund1

Investment objective

The Fund seeks total return, consisting of current income and capital appreciation.

Adviser

Wells Fargo Funds Management, LLC

Subadviser

Wells Capital Management Incorporated

Subadvisers for master portfolios

Portfolio managers

Average annual total returns2 (%) as of November 30, 2013

| Including sales charge | Excluding sales charge | Expense ratios3 (%) | ||||||||||||||||||||||||||||||||

| Inception date | 1 year | 5 year | 10 year | 1 year | 5 year | 10 year | Gross | Net4 | ||||||||||||||||||||||||||

| Class A (WFMAX) | 1-30-2004 | 7.74 | 10.27 | 4.66 | 14.32 | 11.58 | 5.28 | 1.36 | 1.15 | |||||||||||||||||||||||||

| Class B (WMOBX)* | 1-30-2004 | 8.49 | 10.48 | 4.72 | 13.49 | 10.74 | 4.72 | 2.11 | 1.90 | |||||||||||||||||||||||||

| Class C (WFBCX) | 1-30-2004 | 12.47 | 10.74 | 4.49 | 13.47 | 10.74 | 4.49 | 2.11 | 1.90 | |||||||||||||||||||||||||

| Administrator Class (NVMBX) | 11-11-1994 | – | – | – | 14.64 | 11.86 | 5.54 | 1.20 | 0.90 | |||||||||||||||||||||||||

| Moderate Balanced Composite Index5 | – | – | – | – | 10.76 | 9.76 | 5.95 | – | – | |||||||||||||||||||||||||

| Barclays Short Treasury: 9-12 Months Index6 | – | – | – | – | 0.27 | 0.58 | 2.09 | – | – | |||||||||||||||||||||||||

| Barclays U.S. Aggregate Bond Index7 | – | – | – | – | (1.61 | ) | 5.33 | 4.71 | – | – | ||||||||||||||||||||||||

| MSCI EAFE Index (Net) (USD)8 | – | – | – | – | 24.84 | 13.42 | 7.56 | – | – | |||||||||||||||||||||||||

| Russell 1000® Growth Index9 | – | – | – | – | 29.74 | 20.14 | 7.89 | – | – | |||||||||||||||||||||||||

| Russell 1000® Value Index10 | – | – | – | – | 31.92 | 16.40 | 7.96 | – | – | |||||||||||||||||||||||||

| Russell 2000® Index11 | – | – | – | – | 40.99 | 20.97 | 9.08 | – | – | |||||||||||||||||||||||||

| S&P 500 Index12 | – | – | – | – | 30.30 | 17.60 | 7.69 | – | – | |||||||||||||||||||||||||

| * | Class B shares are closed to investment, except in connection with the reinvestment of any distributions and permitted exchanges. |

Figures quoted represent past performance, which is no guarantee of future results, and do not reflect taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance shown without sales charges would be lower if sales charges were reflected. Current performance may be lower or higher than the performance data quoted, which assumes the reinvestment of dividends and capital gains. Current month-end performance is available on the Fund’s website, wellsfargoadvantagefunds.com.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses, or any taxes. It is not possible to invest directly in an index.

For Class A shares, the maximum front-end sales charge is 5.75%. For Class B shares, the maximum contingent deferred sales charge is 5.00%. For Class C shares, the maximum contingent deferred sales charge is 1.00%. Performance including sales charge assumes the sales charge for the corresponding time period. Administrator Class shares are sold without a front-end sales charge or contingent deferred sales charge.

Balanced funds may invest in stocks and bonds. Stock values fluctuate in response to the activities of individual companies and general market and economic conditions. Bond values fluctuate in response to the financial condition of individual issuers, general market and economic conditions, and changes in interest rates. In general, when interest rates rise, bond values fall and investors may lose principal value. The use of derivatives may reduce returns and/or increase volatility. Certain investment strategies tend to increase the total risk of an investment (relative to the broader market). The Fund is exposed to mortgage- and asset-backed securities risk. Consult the Fund’s prospectus for additional information on these and other risks.

Please see footnotes on page 7.

Table of Contents

| Performance highlights (unaudited) | Wells Fargo Advantage Allocation Funds | 7 |

Wells Fargo Advantage Moderate Balanced Fund (continued)

| 1. | The Fund is a gateway blended fund that invests all of its assets in two or more master portfolios of the Wells Fargo Master Trust in varying proportions. References to the investment activities of the Fund are intended to refer to the investment activities of the master portfolios in which it invests. |

| 2. | Historical performance shown for Class A, Class B, and Class C shares prior to their inception reflects the performance of Administrator Class shares, adjusted to reflect the higher expenses applicable to Class A, Class B, and Class C shares. |

| 3. | Reflects the expense ratios as stated in the most recent prospectuses. |

| 4. | The Adviser has committed through September 30, 2014, to waive fees and/or reimburse expenses to the extent necessary to cap the Fund’s Total Annual Fund Operating Expenses After Fee Waiver, excluding certain expenses, at the amounts shown. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses, and extraordinary expenses are excluded from the cap. Fees from the underlying master portfolios are included in the cap. Without this cap, the Fund’s returns would have been lower. |

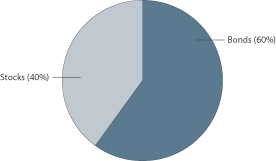

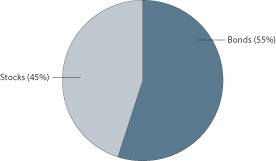

| 5. | Source: Wells Fargo Funds Management, LLC. The Moderate Balanced Composite Index is weighted 45% in the Barclays U.S. Aggregate Bond Index, 15% in the Barclays Short Treasury: 9-12 Months Index, 10% in the S&P 500 Index, 10% in the Russell 1000® Growth Index, 10% in the Russell 1000® Value Index, 6% in the MSCI EAFE Index (Net) (USD), and 4% in the Russell 2000® Index. You cannot invest directly in an index. |

| 6. | The Barclays Short Treasury: 9–12 Months Index is an unmanaged index that includes aged U.S. Treasury bills, notes, and bonds with a remaining maturity from 9 up to (but not including) 12 months. It excludes zero-coupon STRIPS. You cannot invest directly in an index. |

| 7. | The Barclays U.S. Aggregate Bond Index is composed of the Barclays U.S. Government/Credit Index and the Barclays U.S. Mortgage-Backed Securities Index and includes U.S. Treasury issues, agency issues, corporate bond issues, and mortgage-backed securities. You cannot invest directly in an index. |

| 8. | The Morgan Stanley Capital International Europe, Australasia, and Far East (MSCI EAFE) Index (Net) (USD) is an unmanaged group of securities widely regarded by investors to be representations of the stock markets of Europe, Australasia, and the Far East. Calculations for EAFE use net dividends, which reflect the deduction of withholding taxes. You cannot invest directly in an index. |

| 9. | The Russell 1000® Growth Index measures the performance of those Russell 1000 companies with higher price/book ratios and higher forecasted growth values. You cannot invest directly in an index. |

| 10. | The Russell 1000® Value Index measures the performance of those Russell 1000 companies with lower price/book ratios and lower forecasted growth values. You cannot invest directly in an index. |

| 11. | The Russell 2000® Index measures the performance of the 2,000 smallest companies in the Russell 3000® Index, which represents approximately 8% of the total market capitalization of the Russell 3000 Index. You cannot invest directly in an index. |

| 12. | The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market value weighted index with each stock’s weight in the index proportionate to its market value. You cannot invest directly in an index. |

| 13. | The ten largest long-term holdings are calculated based on the value of the securities of the master portfolios allocable to the Fund divided by the total net assets of the Fund. Holdings are subject to change and may have changed since the date specified. |

| 14. | Target allocations are subject to change. Cash and cash equivalents are not reflected in the calculations of target allocations. Neutral target allocation is the target allocation of the Fund as stated in the Fund’s prospectus. Current target allocation is the current allocation of the Fund based on the Tactical Asset Allocation (TAA) Model as of the date specified. |

Table of Contents

| 8 | Wells Fargo Advantage Allocation Funds | Fund expenses (unaudited) |

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and contingent deferred sales charges (if any) on redemptions and (2) ongoing costs, including management fees, distribution (12b-1) and/or shareholder service fees, and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the six-month period and held for the entire period from June 1, 2013 to November 30, 2013.

Actual expenses

The “Actual” line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the “Actual” line under the heading entitled “Expenses paid during period” for your applicable class of shares to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The “Hypothetical” line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) and contingent deferred sales charges. Therefore, the “Hypothetical” line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Wells Fargo Advantage Growth Balanced Fund | Beginning account value 6-1-2013 |

Ending account value 11-30-2013 |

Expenses paid during the period¹ |

Net annual expense ratio |

||||||||||||

| Class A |

||||||||||||||||

| Actual |

$ | 1,000.00 | $ | 1,101.35 | $ | 6.32 | 1.20 | % | ||||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,019.05 | $ | 6.07 | 1.20 | % | ||||||||

| Class B |

||||||||||||||||

| Actual |

$ | 1,000.00 | $ | 1,097.19 | $ | 10.25 | 1.95 | % | ||||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,015.29 | $ | 9.85 | 1.95 | % | ||||||||

| Class C |

||||||||||||||||

| Actual |

$ | 1,000.00 | $ | 1,097.01 | $ | 10.25 | 1.95 | % | ||||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,015.29 | $ | 9.85 | 1.95 | % | ||||||||

| Administrator Class |

||||||||||||||||

| Actual |

$ | 1,000.00 | $ | 1,102.71 | $ | 5.01 | 0.95 | % | ||||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,020.31 | $ | 4.81 | 0.95 | % | ||||||||

| Wells Fargo Advantage Moderate Balanced Fund | ||||||||||||||||

| Class A |

||||||||||||||||

| Actual |

$ | 1,000.00 | $ | 1,060.79 | $ | 5.94 | 1.15 | % | ||||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,019.30 | $ | 5.82 | 1.15 | % | ||||||||

| Class B |

||||||||||||||||

| Actual |

$ | 1,000.00 | $ | 1,057.41 | $ | 9.80 | 1.90 | % | ||||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,015.54 | $ | 9.60 | 1.90 | % | ||||||||

| Class C |

||||||||||||||||

| Actual |

$ | 1,000.00 | $ | 1,056.77 | $ | 9.80 | 1.90 | % | ||||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,015.54 | $ | 9.60 | 1.90 | % | ||||||||

| Administrator Class |

||||||||||||||||

| Actual |

$ | 1,000.00 | $ | 1,062.27 | $ | 4.65 | 0.90 | % | ||||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,020.56 | $ | 4.56 | 0.90 | % | ||||||||

| 1. | Expenses paid is equal to the annualized expense ratio of each class multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year divided by the number of days in the fiscal year (to reflect the one-half-year period). |

Table of Contents

| Portfolio of investments—November 30, 2013 (unaudited) | Wells Fargo Advantage Allocation Funds | 9 |

GROWTH BALANCED FUND

| Security name | Value | |||||||||||||||||

| Investment Companies: 99.67% |

||||||||||||||||||

| Affiliated Master Portfolios: 99.67% | ||||||||||||||||||

| Wells Fargo Advantage C&B Large Cap Value Portfolio |

$ | 13,900,692 | ||||||||||||||||

| Wells Fargo Advantage Core Bond Portfolio |

17,596,443 | |||||||||||||||||

| Wells Fargo Advantage Diversified Large Cap Growth Portfolio |

41,891,458 | |||||||||||||||||

| Wells Fargo Advantage Emerging Growth Portfolio |

4,158,662 | |||||||||||||||||

| Wells Fargo Advantage Index Portfolio |

41,769,959 | |||||||||||||||||

| Wells Fargo Advantage Inflation-Protected Bond Portfolio |

8,794,762 | |||||||||||||||||

| Wells Fargo Advantage International Growth Portfolio |

12,572,536 | |||||||||||||||||

| Wells Fargo Advantage International Value Portfolio |

12,368,803 | |||||||||||||||||

| Wells Fargo Advantage Large Company Value Portfolio |

27,789,118 | |||||||||||||||||

| Wells Fargo Advantage Managed Fixed Income Portfolio |

61,630,495 | |||||||||||||||||

| Wells Fargo Advantage Small Company Growth Portfolio |

4,174,189 | |||||||||||||||||

| Wells Fargo Advantage Small Company Value Portfolio |

8,410,403 | |||||||||||||||||

| Total Investment Companies (Cost $222,142,051) |

255,057,520 | |||||||||||||||||

|

|

|

|||||||||||||||||

| Yield | Maturity date | Principal | ||||||||||||||||

| Short-Term Investments: 0.38% |

||||||||||||||||||

| U.S. Treasury Securities: 0.38% | ||||||||||||||||||

| U.S. Treasury Bill (z)# |

0.01 | % | 12-26-2013 | $ | 963,000 | 962,964 | ||||||||||||

|

|

|

|||||||||||||||||

| Total Short-Term Investments (Cost $962,964) |

962,964 | |||||||||||||||||

|

|

|

|||||||||||||||||

| Total investments in securities (Cost $223,105,015) * |

|

100.05 |

% |

256,020,484 | ||||

| Other assets and liabilities, net |

(0.05 | ) | (122,189 | ) | ||||

|

|

|

|

|

|||||

| Total net assets | 100.00 | % | $ | 255,898,295 | ||||

|

|

|

|

|

| (z) | Zero coupon security. Rate represents yield to maturity at time of purchase. |

| # | All or a portion of this security is segregated as collateral for investments in derivative instruments. |

| * | Cost for federal income tax purposes is $224,608,421 and unrealized appreciation (depreciation) consists of: |

| Gross unrealized appreciation |

$ | 31,412,063 | ||

| Gross unrealized depreciation |

0 | |||

|

|

|

|||

| Net unrealized appreciation |

$ | 31,412,063 |

The accompanying notes are an integral part of these financial statements.

Table of Contents

| 10 | Wells Fargo Advantage Allocation Funds | Portfolio of investments—November 30, 2013 (unaudited) |

MODERATE BALANCED FUND

| Security name | Value | |||||||||||||||||

| Investment Companies: 99.65% |

||||||||||||||||||

| Affiliated Master Portfolios: 99.65% | ||||||||||||||||||

| Wells Fargo Advantage C&B Large Cap Value Portfolio |

$ | 5,804,095 | ||||||||||||||||

| Wells Fargo Advantage Core Bond Portfolio |

15,455,358 | |||||||||||||||||

| Wells Fargo Advantage Diversified Large Cap Growth Portfolio |

17,444,608 | |||||||||||||||||

| Wells Fargo Advantage Emerging Growth Portfolio |

1,742,727 | |||||||||||||||||

| Wells Fargo Advantage Index Portfolio |

17,427,694 | |||||||||||||||||

| Wells Fargo Advantage Inflation-Protected Bond Portfolio |

7,716,655 | |||||||||||||||||

| Wells Fargo Advantage International Growth Portfolio |

5,226,088 | |||||||||||||||||

| Wells Fargo Advantage International Value Portfolio |

5,140,251 | |||||||||||||||||

| Wells Fargo Advantage Large Company Value Portfolio |

11,603,099 | |||||||||||||||||

| Wells Fargo Advantage Managed Fixed Income Portfolio |

54,116,672 | |||||||||||||||||

| Wells Fargo Advantage Small Company Growth Portfolio |

1,748,318 | |||||||||||||||||

| Wells Fargo Advantage Small Company Value Portfolio |

3,494,367 | |||||||||||||||||

| Wells Fargo Advantage Stable Income Portfolio |

25,737,326 | |||||||||||||||||

| Total Investment Companies (Cost $159,474,218) |

172,657,258 | |||||||||||||||||

|

|

|

|||||||||||||||||

| Yield | Maturity date | Principal | ||||||||||||||||

| Short-Term Investments: 0.38% |

||||||||||||||||||

| U.S. Treasury Securities: 0.38% | ||||||||||||||||||

| U.S. Treasury Bill #(z) |

0.01 | % | 12-26-2013 | $ | 660,000 | 659,975 | ||||||||||||

|

|

|

|||||||||||||||||

| Total Short-Term Investments (Cost $659,975) |

659,975 | |||||||||||||||||

|

|

|

|||||||||||||||||

| Total investments in securities (Cost $160,134,193) * |

|

100.03 |

% |

|

173,317,233 |

| ||

| Other assets and liabilities, net |

(0.03 | ) | (48,987 | ) | ||||

|

|

|

|

|

|||||

| Total net assets | 100.00 | % | $ | 173,268,246 | ||||

|

|

|

|

|

| # | All or a portion of this security is segregated as collateral for investments in derivative instruments. |

| (z) | Zero coupon security. Rate represents yield to maturity at time of purchase. |

| * | Cost for federal income tax purposes is $159,535,615 and unrealized appreciation (depreciation) consists of: |

| Gross unrealized appreciation |

$ | 13,781,618 | ||

| Gross unrealized depreciation |

0 | |||

|

|

|

|||

| Net unrealized appreciation |

$ | 13,781,618 |

The accompanying notes are an integral part of these financial statements.

Table of Contents

| Statements of assets and liabilities—November 30, 2013 (unaudited) | Wells Fargo Advantage Allocation Funds | 11 |

| Growth Balanced Fund |

Moderate Balanced Fund |

|||||||

| Assets |

||||||||

| Investments |

||||||||

| In affiliated Master Portfolios, at value (see cost below) |

$ | 255,057,520 | $ | 172,657,258 | ||||

| In unaffiliated securities, at value (see cost below) |

962,964 | 659,975 | ||||||

|

|

|

|

|

|||||

| Total investments, at value (see cost below) |

256,020,484 | 173,317,233 | ||||||

| Receivable for Fund shares sold |

108,935 | 214,445 | ||||||

| Receivable from adviser |

0 | 4,621 | ||||||

| Prepaid expenses and other assets |

37,284 | 23,645 | ||||||

|

|

|

|

|

|||||

| Total assets |

256,166,703 | 173,559,944 | ||||||

|

|

|

|

|

|||||

| Liabilities |

||||||||

| Payable for Fund shares redeemed |

141,478 | 208,440 | ||||||

| Payable for daily variation margin on open futures contracts |

1,450 | 1,000 | ||||||

| Advisory fee payable |

493 | 0 | ||||||

| Distribution fees payable |

7,623 | 2,631 | ||||||

| Due to other related parties |

42,053 | 24,699 | ||||||

| Shareholder servicing fees payable |

53,942 | 36,619 | ||||||

| Accrued expenses and other liabilities |

21,369 | 18,309 | ||||||

|

|

|

|

|

|||||

| Total liabilities |

268,408 | 291,698 | ||||||

|

|

|

|

|

|||||

| Total net assets |

$ | 255,898,295 | $ | 173,268,246 | ||||

|

|

|

|

|

|||||

| NET ASSETS CONSIST OF |

||||||||

| Paid-in capital |

$ | 387,028,001 | $ | 159,703,530 | ||||

| Undistributed net investment income |

2,422,121 | 2,205,940 | ||||||

| Accumulated net realized losses on investments |

(167,328,387 | ) | (2,418,480 | ) | ||||

| Net unrealized gains on investments |

33,776,560 | 13,777,256 | ||||||

|

|

|

|

|

|||||

| Total net assets |

$ | 255,898,295 | $ | 173,268,246 | ||||

|

|

|

|

|

|||||

| COMPUTATION OF NET ASSET VALUE AND OFFERING PRICE PER SHARE1 |

||||||||

| Net assets – Class A |

$ | 60,084,350 | $ | 16,283,344 | ||||

| Shares outstanding – Class A |

1,635,707 | 723,416 | ||||||

| Net asset value per share – Class A |

$36.73 | $22.51 | ||||||

| Maximum offering price per share – Class A2 |

$38.97 | $23.88 | ||||||

| Net assets – Class B |

$ | 852,932 | $ | 514,683 | ||||

| Shares outstanding – Class B |

26,052 | 22,910 | ||||||

| Net asset value per share – Class B |

$32.74 | $22.47 | ||||||

| Net assets – Class C |

$ | 11,318,783 | $ | 3,694,531 | ||||

| Shares outstanding – Class C |

351,172 | 166,763 | ||||||

| Net asset value per share – Class C |

$32.23 | $22.15 | ||||||

| Net assets – Administrator Class |

$ | 183,642,230 | $ | 152,775,688 | ||||

| Shares outstanding – Administrator Class |

5,572,223 | 6,734,204 | ||||||

| Net asset value per share – Administrator Class |

$32.96 | $22.69 | ||||||

| Investments in affiliated Master Portfolios, at cost |

$ | 222,142,051 | $ | 159,474,218 | ||||

|

|

|

|

|

|||||

| Investments in unaffiliated securities, at cost |

$ | 962,964 | $ | 659,975 | ||||

|

|

|

|

|

|||||

| Total investments, at cost |

$ | 223,105,015 | $ | 160,134,193 | ||||

|

|

|

|

|

|||||

| 1. | Each Fund has an unlimited number of authorized shares. |

| 2. | Maximum offering price is computed as 100/94.25 of net asset value. On investments of $50,000 or more, the offering price is reduced. |

The accompanying notes are an integral part of these financial statements.

Table of Contents

| 12 | Wells Fargo Advantage Allocation Funds | Statements of operations—six months ended November 30, 2013 (unaudited) |

| Growth Balanced Fund |

Moderate Balanced Fund |

|||||||

| Investment income |

||||||||

| Interest allocated from affiliated Master Portfolios** |

$ | 1,373,409 | $ | 1,427,243 | ||||

| Dividends allocated from affiliated Master Portfolios* |

1,257,018 | 534,801 | ||||||

| Securities lending income allocated from affiliated Master Portfolios |

22,018 | 10,000 | ||||||

| Interest |

332 | 165 | ||||||

| Expenses allocated from affiliated Master Portfolios |

(681,139 | ) | (453,835 | ) | ||||

| Waivers allocated from affiliated Master Portfolios |

52,298 | 67,916 | ||||||

|

|

|

|

|

|||||

| Total investment income |

2,023,936 | 1,586,290 | ||||||

|

|

|

|

|

|||||

| Expenses |

||||||||

| Advisory fee |

307,598 | 207,162 | ||||||

| Administration fees |

||||||||

| Fund level |

61,520 | 41,432 | ||||||

| Class A |

74,361 | 16,425 | ||||||

| Class B |

1,157 | 731 | ||||||

| Class C |

13,204 | 4,084 | ||||||

| Administrator Class |

88,915 | 74,696 | ||||||

| Shareholder servicing fees |

||||||||

| Class A |

71,501 | 15,793 | ||||||

| Class B |

1,113 | 703 | ||||||

| Class C |

12,696 | 3,927 | ||||||

| Administrator Class |

221,985 | 186,255 | ||||||

| Distribution fees |

||||||||

| Class B |

3,339 | 2,108 | ||||||

| Class C |

38,088 | 11,781 | ||||||

| Custody and accounting fees |

5,604 | 3,561 | ||||||

| Professional fees |

16,283 | 14,864 | ||||||

| Registration fees |

23,808 | 20,458 | ||||||

| Shareholder report expenses |

25,119 | 20,079 | ||||||

| Trustees’ fees and expenses |

5,036 | 5,094 | ||||||

| Other fees and expenses |

6,204 | 5,026 | ||||||

|

|

|

|

|

|||||

| Total expenses |

977,531 | 634,179 | ||||||

| Less: Fee waivers and/or expense reimbursements |

(310,764 | ) | (240,002 | ) | ||||

|

|

|

|

|

|||||

| Net expenses |

666,767 | 394,177 | ||||||

|

|

|

|

|

|||||

| Net investment income |

1,357,169 | 1,192,113 | ||||||

|

|

|

|

|

|||||

| REALIZED AND UNREALIZED GAINS (LOSSES) ON INVESTMENTS |

||||||||

| Net realized gains (losses) on: |

||||||||

| Securities transactions allocated from affiliated Master Portfolios |

4,297,867 | 1,328,081 | ||||||

| Futures transactions |

4,976,320 | 2,230,080 | ||||||

|

|

|

|

|

|||||

| Net realized gains on investments |

9,274,187 | 3,558,161 | ||||||

|

|

|

|

|

|||||

| Net change in unrealized gains (losses) on: |

||||||||

| Securities transactions allocated from affiliated Master Portfolios |

14,674,059 | 5,702,515 | ||||||

| Futures transactions |

(1,231,336 | ) | (322,556 | ) | ||||

|

|

|

|

|

|||||

| Net change in unrealized gains (losses) on investments |

13,442,723 | 5,379,959 | ||||||

|

|

|

|

|

|||||

| Net realized and unrealized gains (losses) on investments |

22,716,910 | 8,938,120 | ||||||

|

|

|

|

|

|||||

| Net increase in net assets resulting from operations |

$ | 24,074,079 | $ | 10,130,233 | ||||

|

|

|

|

|

|||||

| ** Net of foreign interest withholding taxes allocated from affiliated Master Portfolios in the amount of |

$138 | $120 | ||||||

| * Net of foreign dividend withholding taxes allocated from affiliated Master Portfolios in the amount of |

$20,350 | $10,648 | ||||||

The accompanying notes are an integral part of these financial statements.

Table of Contents

| Statements of changes in net assets | Wells Fargo Advantage Allocation Funds | 13 |

| Growth Balanced Fund | ||||||||||||||||

| Six months ended November 30, 2013 (unaudited) |

Year ended May 31, 2013 |

|||||||||||||||

| Operations |

||||||||||||||||

| Net investment income |

$ | 1,357,169 | $ | 3,291,127 | ||||||||||||

| Net realized gains on investments |

9,274,187 | 22,185,874 | ||||||||||||||

| Net change in unrealized gains (losses) on investments |

13,442,723 | 21,087,053 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net increase in net assets resulting from operations |

24,074,079 | 46,564,054 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Distributions to shareholders from |

||||||||||||||||

| Net investment income |

||||||||||||||||

| Class A |

0 | (790,330 | ) | |||||||||||||

| Class B |

0 | (6,107 | ) | |||||||||||||

| Class C |

0 | (78,360 | ) | |||||||||||||

| Administrator Class |

0 | (3,056,559 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total distributions to shareholders |

0 | (3,931,356 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Capital share transactions |

Shares | Shares | ||||||||||||||

| Proceeds from shares sold |

||||||||||||||||

| Class A |

89,843 | 3,123,792 | 252,844 | 7,707,814 | ||||||||||||

| Class B |

1,371 | 42,627 | 1,720 | 47,281 | ||||||||||||

| Class C |

45,651 | 1,392,594 | 55,670 | 1,517,079 | ||||||||||||

| Administrator Class |

303,986 | 9,484,928 | 682,034 | 18,741,686 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| 14,043,941 | 28,013,860 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Reinvestment of distributions |

||||||||||||||||

| Class A |

0 | 0 | 26,105 | 783,165 | ||||||||||||

| Class B |

0 | 0 | 227 | 6,107 | ||||||||||||

| Class C |

0 | 0 | 2,921 | 77,436 | ||||||||||||

| Administrator Class |

0 | 0 | 112,461 | 3,019,584 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| 0 | 3,886,292 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Payment for shares redeemed |

||||||||||||||||

| Class A |

(126,400 | ) | (4,404,342 | ) | (385,427 | ) | (11,789,241 | ) | ||||||||

| Class B |

(7,819 | ) | (240,492 | ) | (38,181 | ) | (1,038,792 | ) | ||||||||

| Class C |

(11,944 | ) | (362,269 | ) | (53,297 | ) | (1,442,155 | ) | ||||||||

| Administrator Class |

(591,564 | ) | (18,426,906 | ) | (3,759,086 | ) | (97,832,397 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (23,434,009 | ) | (112,102,585 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net decrease in net assets resulting from capital share transactions |

(9,390,068 | ) | (80,202,433 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total increase (decrease) in net assets |

14,684,011 | (37,569,735 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net assets |

||||||||||||||||

| Beginning of period |

241,214,284 | 278,784,019 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| End of period |

$ | 255,898,295 | $ | 241,214,284 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Undistributed net investment income |

$ | 2,422,121 | $ | 1,064,952 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

The accompanying notes are an integral part of these financial statements.

Table of Contents

| 14 | Wells Fargo Advantage Allocation Funds | Statements of changes in net assets |

| Moderate Balanced Fund | ||||||||||||||||

| Six months ended November 30, 2013 (unaudited) |

Year ended May 31, 2013 |

|||||||||||||||

| Operations |

||||||||||||||||

| Net investment income |

$ | 1,192,113 | $ | 2,729,351 | ||||||||||||

| Net realized gains on investments |

3,558,161 | 12,235,693 | ||||||||||||||

| Net change in unrealized gains (losses) on investments |

5,379,959 | 7,981,882 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net increase in net assets resulting from operations |

10,130,233 | 22,946,926 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Distributions to shareholders from |

||||||||||||||||

| Net investment income |

||||||||||||||||

| Class A |

0 | (174,454 | ) | |||||||||||||

| Class B |

0 | (6,037 | ) | |||||||||||||

| Class C |

0 | (26,366 | ) | |||||||||||||

| Administrator Class |

0 | (2,930,711 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total distributions to shareholders |

0 | (3,137,568 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Capital share transactions |

Shares | Shares | ||||||||||||||

| Proceeds from shares sold |

||||||||||||||||

| Class A |

315,387 | 6,863,509 | 106,892 | 2,150,751 | ||||||||||||

| Class B |

3,260 | 69,860 | 6,379 | 129,702 | ||||||||||||

| Class C |

47,925 | 1,022,921 | 32,118 | 642,068 | ||||||||||||

| Administrator Class |

387,599 | 8,451,544 | 644,259 | 13,114,398 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| 16,407,834 | 16,036,919 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Reinvestment of distributions |

||||||||||||||||

| Class A |

0 | 0 | 8,688 | 172,200 | ||||||||||||

| Class B |

0 | 0 | 271 | 5,404 | ||||||||||||

| Class C |

0 | 0 | 1,191 | 23,401 | ||||||||||||

| Administrator Class |

0 | 0 | 144,213 | 2,874,170 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| 0 | 3,075,175 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Payment for shares redeemed |

||||||||||||||||

| Class A |

(79,560 | ) | (1,721,774 | ) | (155,234 | ) | (3,093,238 | ) | ||||||||

| Class B |

(9,182 | ) | (198,191 | ) | (20,626 | ) | (416,879 | ) | ||||||||

| Class C |

(4,064 | ) | (87,458 | ) | (34,884 | ) | (701,338 | ) | ||||||||

| Administrator Class |

(524,174 | ) | (11,523,622 | ) | (3,018,081 | ) | (60,096,397 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (13,531,045 | ) | (64,307,852 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net increase (decrease) in net assets resulting from capital share transactions |

2,876,789 | (45,195,758 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total increase (decrease) in net assets |

13,007,022 | (25,386,400 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net assets |

||||||||||||||||

| Beginning of period |

160,261,224 | 185,647,624 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| End of period |

$ | 173,268,246 | $ | 160,261,224 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Undistributed net investment income |

$ | 2,205,940 | $ | 1,013,827 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

The accompanying notes are an integral part of these financial statements.

Table of Contents

This page is intentionally left blank.

Table of Contents

| 16 | Wells Fargo Advantage Allocation Funds | Financial highlights |

| Beginning |

Net investment income1 |

Net realized and unrealized gains (losses) on investments |

Distributions from net investment income |

|||||||||||||

| Growth Balanced Fund |

||||||||||||||||

| Class A |

||||||||||||||||

| June 1, 2013 to November 30, 2013 (unaudited) |

$ | 33.35 | 0.15 | 3.23 | 0.00 | |||||||||||

| June 1, 2012 to May 31, 2013 |

$ | 27.77 | 0.32 | 5.70 | (0.44 | ) | ||||||||||

| June 1, 2011 to May 31, 2012 |

$ | 29.34 | 0.39 | 4 | (1.73 | ) | (0.23 | ) | ||||||||

| October 1, 2010 to May 31, 20115 |

$ | 25.89 | 0.23 | 4.11 | (0.89 | ) | ||||||||||

| October 1, 2009 to September 30, 2010 |

$ | 24.12 | 0.40 | 4 | 1.75 | (0.38 | ) | |||||||||

| October 1, 2008 to September 30, 2009 |

$ | 25.63 | 0.41 | 4 | (1.32 | ) | (0.52 | ) | ||||||||

| October 1, 2007 to September 30, 2008 |

$ | 36.21 | 0.63 | (7.32 | ) | (0.63 | ) | |||||||||

| Class B |

||||||||||||||||

| June 1, 2013 to November 30, 2013 (unaudited) |

$ | 29.84 | 0.03 | 4 | 2.87 | 0.00 | ||||||||||

| June 1, 2012 to May 31, 2013 |

$ | 24.80 | 0.12 | 4 | 5.05 | (0.13 | ) | |||||||||

| June 1, 2011 to May 31, 2012 |

$ | 26.17 | 0.15 | 4 | (1.52 | ) | 0.00 | |||||||||

| October 1, 2010 to May 31, 20115 |

$ | 23.07 | 0.12 | 4 | 3.62 | (0.64 | ) | |||||||||

| October 1, 2009 to September 30, 2010 |

$ | 21.46 | 0.22 | 4 | 1.53 | (0.14 | ) | |||||||||

| October 1, 2008 to September 30, 2009 |

$ | 22.70 | 0.22 | 4 | (1.13 | ) | (0.25 | ) | ||||||||

| October 1, 2007 to September 30, 2008 |

$ | 32.51 | 0.36 | (6.52 | ) | (0.39 | ) | |||||||||

| Class C |

||||||||||||||||

| June 1, 2013 to November 30, 2013 (unaudited) |

$ | 29.38 | 0.03 | 4 | 2.82 | 0.00 | ||||||||||

| June 1, 2012 to May 31, 2013 |

$ | 24.52 | 0.13 | 4 | 4.98 | (0.25 | ) | |||||||||

| June 1, 2011 to May 31, 2012 |

$ | 25.94 | 0.16 | 4 | (1.53 | ) | (0.05 | ) | ||||||||

| October 1, 2010 to May 31, 20115 |

$ | 22.93 | 0.12 | 4 | 3.60 | (0.71 | ) | |||||||||

| October 1, 2009 to September 30, 2010 |

$ | 21.42 | 0.19 | 4 | 1.56 | (0.24 | ) | |||||||||

| October 1, 2008 to September 30, 2009 |

$ | 22.77 | 0.23 | 4 | (1.17 | ) | (0.33 | ) | ||||||||

| October 1, 2007 to September 30, 2008 |

$ | 32.60 | 0.36 | 4 | (6.54 | ) | (0.39 | ) | ||||||||

| Administrator Class |

||||||||||||||||

| June 1, 2013 to November 30, 2013 (unaudited) |

$ | 29.89 | 0.22 | 4 | 2.85 | 0.00 | ||||||||||

| June 1, 2012 to May 31, 2013 |

$ | 24.93 | 0.65 | 4 | 4.82 | (0.51 | ) | |||||||||

| June 1, 2011 to May 31, 2012 |

$ | 26.39 | 0.41 | 4 | (1.57 | ) | (0.30 | ) | ||||||||

| October 1, 2010 to May 31, 20115 |

$ | 23.39 | 0.31 | 4 | 3.64 | (0.95 | ) | |||||||||

| October 1, 2009 to September 30, 2010 |

$ | 21.81 | 0.46 | 4 | 1.55 | (0.43 | ) | |||||||||

| October 1, 2008 to September 30, 2009 |

$ | 23.29 | 0.41 | 4 | (1.21 | ) | (0.60 | ) | ||||||||

| October 1, 2007 to September 30, 2008 |

$ | 33.29 | 0.64 | 4 | (6.67 | ) | (0.71 | ) | ||||||||

| Moderate Balanced Fund |

||||||||||||||||

| Class A |

||||||||||||||||

| June 1, 2013 to November 30, 2013 (unaudited) |

$ | 21.21 | 0.13 | 4 | 1.17 | 0.00 | ||||||||||

| June 1, 2012 to May 31, 2013 |

$ | 18.84 | 0.21 | 2.50 | (0.34 | ) | ||||||||||

| June 1, 2011 to May 31, 2012 |

$ | 19.64 | 0.32 | (0.54 | ) | (0.58 | ) | |||||||||

| October 1, 2010 to May 31, 20115 |

$ | 17.97 | 0.28 | 1.80 | (0.41 | ) | ||||||||||

| October 1, 2009 to September 30, 2010 |

$ | 17.12 | 0.38 | 4 | 1.03 | (0.56 | ) | |||||||||

| October 1, 2008 to September 30, 2009 |

$ | 17.85 | 0.38 | (0.36 | ) | (0.57 | ) | |||||||||

| October 1, 2007 to September 30, 2008 |

$ | 22.76 | 0.55 | (3.34 | ) | (0.61 | ) | |||||||||

| Class B |

||||||||||||||||

| June 1, 2013 to November 30, 2013 (unaudited) |

$ | 21.25 | 0.05 | 4 | 1.17 | 0.00 | ||||||||||

| June 1, 2012 to May 31, 2013 |

$ | 18.86 | 0.13 | 4 | 2.43 | (0.17 | ) | |||||||||

| June 1, 2011 to May 31, 2012 |

$ | 19.58 | 0.18 | 4 | (0.53 | ) | (0.37 | ) | ||||||||

| October 1, 2010 to May 31, 20115 |

$ | 17.85 | 0.14 | 4 | 1.84 | (0.25 | ) | |||||||||

| October 1, 2009 to September 30, 2010 |

$ | 16.99 | 0.30 | 0.97 | (0.41 | ) | ||||||||||

| October 1, 2008 to September 30, 2009 |

$ | 17.67 | 0.26 | 4 | (0.34 | ) | (0.42 | ) | ||||||||

| October 1, 2007 to September 30, 2008 |

$ | 22.53 | 0.42 | (3.34 | ) | (0.43 | ) | |||||||||

Please see footnotes on page 18.

The accompanying notes are an integral part of these financial statements.

Table of Contents

| Financial highlights | Wells Fargo Advantage Allocation Funds | 17 |

| Distributions from net realized gains |

Ending value per |

Ratio to average net assets (annualized) | Total |

Portfolio |

Net assets at |

|||||||||||||||||||||||||

| |

Net investment income1 |

|

|

Gross expenses1 |

|

|

Net expenses1 |

|

||||||||||||||||||||||

| 0.00 | $ | 36.73 | 0.96 | % | 1.39 | % | 1.20 | % | 10.13 | % | 39 | % | $ | 60,084 | ||||||||||||||||

| 0.00 | $ | 33.35 | 1.23 | % | 1.39 | % | 1.20 | % | 21.85 | % | 80 | % | $ | 55,777 | ||||||||||||||||

| 0.00 | $ | 27.77 | 1.40 | % | 1.36 | % | 1.20 | % | (4.53 | )% | 107 | % | $ | 49,403 | ||||||||||||||||

| 0.00 | $ | 29.34 | 1.43 | % | 1.35 | % | 1.20 | % | 17.02 | % | 70 | % | $ | 60,055 | ||||||||||||||||

| 0.00 | $ | 25.89 | 1.61 | % | 1.38 | % | 1.20 | % | 9.00 | % | 94 | % | $ | 55,284 | ||||||||||||||||

| (0.08 | ) | $ | 24.12 | 1.95 | % | 1.32 | % | 1.20 | % | (2.95 | )% | 105 | % | $ | 55,318 | |||||||||||||||

| (3.26 | ) | $ | 25.63 | 2.09 | % | 1.34 | % | 1.20 | % | (20.42 | )% | 80 | % | $ | 55,626 | |||||||||||||||

| 0.00 | $ | 32.74 | 0.20 | % | 2.13 | % | 1.95 | % | 9.72 | % | 39 | % | $ | 853 | ||||||||||||||||

| 0.00 | $ | 29.84 | 0.45 | % | 2.12 | % | 1.95 | % | 20.91 | % | 80 | % | $ | 970 | ||||||||||||||||

| 0.00 | $ | 24.80 | 0.61 | % | 2.10 | % | 1.95 | % | (5.23 | )% | 107 | % | $ | 1,704 | ||||||||||||||||

| 0.00 | $ | 26.17 | 0.62 | % | 2.09 | % | 1.95 | % | 16.43 | % | 70 | % | $ | 4,163 | ||||||||||||||||

| 0.00 | $ | 23.07 | 0.96 | % | 2.12 | % | 1.95 | % | 8.19 | % | 94 | % | $ | 6,924 | ||||||||||||||||

| (0.08 | ) | $ | 21.46 | 1.21 | % | 2.08 | % | 1.95 | % | (3.66 | )% | 105 | % | $ | 13,869 | |||||||||||||||

| (3.26 | ) | $ | 22.70 | 1.31 | % | 2.09 | % | 1.95 | % | (21.02 | )% | 80 | % | $ | 31,892 | |||||||||||||||

| 0.00 | $ | 32.23 | 0.21 | % | 2.14 | % | 1.95 | % | 9.70 | % | 39 | % | $ | 11,319 | ||||||||||||||||

| 0.00 | $ | 29.38 | 0.48 | % | 2.14 | % | 1.95 | % | 20.97 | % | 80 | % | $ | 9,326 | ||||||||||||||||

| 0.00 | $ | 24.52 | 0.65 | % | 2.11 | % | 1.95 | % | (5.26 | )% | 107 | % | $ | 7,656 | ||||||||||||||||

| 0.00 | $ | 25.94 | 0.68 | % | 2.10 | % | 1.95 | % | 16.45 | % | 70 | % | $ | 8,388 | ||||||||||||||||

| 0.00 | $ | 22.93 | 0.84 | % | 2.12 | % | 1.95 | % | 8.20 | % | 94 | % | $ | 7,665 | ||||||||||||||||

| (0.08 | ) | $ | 21.42 | 1.21 | % | 2.06 | % | 1.95 | % | (3.69 | )% | 105 | % | $ | 7,738 | |||||||||||||||

| (3.26 | ) | $ | 22.77 | 1.33 | % | 2.08 | % | 1.95 | % | (21.02 | )% | 80 | % | $ | 9,588 | |||||||||||||||

| 0.00 | $ | 32.96 | 1.21 | % | 1.23 | % | 0.95 | % | 10.27 | % | 39 | % | $ | 183,642 | ||||||||||||||||

| 0.00 | $ | 29.89 | 1.47 | % | 1.22 | % | 0.95 | % | 22.18 | % | 80 | % | $ | 175,142 | ||||||||||||||||

| 0.00 | $ | 24.93 | 1.64 | % | 1.20 | % | 0.95 | % | (4.30 | )% | 107 | % | $ | 220,021 | ||||||||||||||||

| 0.00 | $ | 26.39 | 1.66 | % | 1.19 | % | 0.95 | % | 17.19 | % | 70 | % | $ | 273,174 | ||||||||||||||||

| 0.00 | $ | 23.39 | 2.04 | % | 1.19 | % | 0.95 | % | 9.32 | % | 94 | % | $ | 287,073 | ||||||||||||||||

| (0.08 | ) | $ | 21.81 | 2.18 | % | 1.14 | % | 0.95 | % | (2.68 | )% | 105 | % | $ | 861,399 | |||||||||||||||

| (3.26 | ) | $ | 23.29 | 2.32 | % | 1.16 | % | 0.95 | % | (20.25 | )% | 80 | % | $ | 1,161,210 | |||||||||||||||

| 0.00 | $ | 22.51 | 1.23 | % | 1.36 | % | 1.15 | % | 6.08 | % | 45 | % | $ | 16,283 | ||||||||||||||||

| 0.00 | $ | 21.21 | 1.41 | % | 1.36 | % | 1.15 | % | 14.57 | % | 86 | % | $ | 10,344 | ||||||||||||||||

| 0.00 | $ | 18.84 | 1.68 | % | 1.33 | % | 1.15 | % | (0.93 | )% | 115 | % | $ | 9,935 | ||||||||||||||||

| 0.00 | $ | 19.64 | 1.89 | % | 1.34 | % | 1.15 | % | 11.72 | % | 70 | % | $ | 10,702 | ||||||||||||||||

| 0.00 | $ | 17.97 | 2.42 | % | 1.37 | % | 1.15 | % | 8.41 | % | 103 | % | $ | 7,992 | ||||||||||||||||

| (0.18 | ) | $ | 17.12 | 2.47 | % | 1.31 | % | 1.15 | % | 0.94 | % | 116 | % | $ | 8,669 | |||||||||||||||

| (1.51 | ) | $ | 17.85 | 2.88 | % | 1.31 | % | 1.15 | % | (13.39 | )% | 89 | % | $ | 8,524 | |||||||||||||||

| 0.00 | $ | 22.47 | 0.47 | % | 2.10 | % | 1.90 | % | 5.74 | % | 45 | % | $ | 515 | ||||||||||||||||

| 0.00 | $ | 21.25 | 0.65 | % | 2.11 | % | 1.90 | % | 13.65 | % | 86 | % | $ | 613 | ||||||||||||||||

| 0.00 | $ | 18.86 | 0.94 | % | 2.08 | % | 1.90 | % | (1.66 | )% | 115 | % | $ | 807 | ||||||||||||||||

| 0.00 | $ | 19.58 | 1.11 | % | 2.09 | % | 1.90 | % | 11.16 | % | 70 | % | $ | 1,097 | ||||||||||||||||

| 0.00 | $ | 17.85 | 1.65 | % | 2.12 | % | 1.90 | % | 7.58 | % | 103 | % | $ | 1,257 | ||||||||||||||||

| (0.18 | ) | $ | 16.99 | 1.72 | % | 2.06 | % | 1.90 | % | 0.19 | % | 116 | % | $ | 1,720 | |||||||||||||||

| (1.51 | ) | $ | 17.67 | 2.13 | % | 2.06 | % | 1.90 | % | (14.06 | )% | 89 | % | $ | 2,177 | |||||||||||||||

Please see footnotes on page 18.

The accompanying notes are an integral part of these financial statements.

Table of Contents

| 18 | Wells Fargo Advantage Allocation Funds | Financial highlights |

| Beginning |

Net investment income1 |

Net realized and unrealized gains (losses) on investments |

Distributions from net investment income |

|||||||||||||

| Moderate Balanced Fund (continued) |

||||||||||||||||

| Class C |

||||||||||||||||

| June 1, 2013 to November 30, 2013 (unaudited) |

$ | 20.96 | 0.05 | 4 | 1.14 | 0.00 | ||||||||||

| June 1, 2012 to May 31, 2013 |

$ | 18.63 | 0.11 | 2.42 | (0.20 | ) | ||||||||||

| June 1, 2011 to May 31, 2012 |

$ | 19.45 | 0.18 | 4 | (0.53 | ) | (0.47 | ) | ||||||||

| October 1, 2010 to May 31, 20115 |

$ | 17.77 | 0.14 | 4 | 1.83 | (0.29 | ) | |||||||||

| October 1, 2009 to September 30, 2010 |

$ | 16.96 | 0.28 | 4 | 0.99 | (0.46 | ) | |||||||||

| October 1, 2008 to September 30, 2009 |

$ | 17.64 | 0.26 | 4 | (0.34 | ) | (0.42 | ) | ||||||||

| October 1, 2007 to September 30, 2008 |

$ | 22.52 | 0.41 | (3.33 | ) | (0.45 | ) | |||||||||

| Administrator Class |

||||||||||||||||

| June 1, 2013 to November 30, 2013 (unaudited) |

$ | 21.36 | 0.17 | 1.16 | 0.00 | |||||||||||

| June 1, 2012 to May 31, 2013 |

$ | 18.96 | 0.41 | 2.38 | (0.39 | ) | ||||||||||

| June 1, 2011 to May 31, 2012 |

$ | 19.77 | 0.40 | (0.58 | ) | (0.63 | ) | |||||||||

| October 1, 2010 to May 31, 20115 |

$ | 18.11 | 0.29 | 1.83 | (0.46 | ) | ||||||||||

| October 1, 2009 to September 30, 2010 |

$ | 17.23 | 0.52 | 4 | 0.95 | (0.59 | ) | |||||||||

| October 1, 2008 to September 30, 2009 |

$ | 17.98 | 0.42 | 4 | (0.37 | ) | (0.62 | ) | ||||||||

| October 1, 2007 to September 30, 2008 |

$ | 22.90 | 0.60 | (3.36 | ) | (0.65 | ) | |||||||||

| 1. | Includes net expenses allocated from the affiliated Master Portfolios in which the Fund invests. |

| 2. | Total return calculations do not include any sales charges. Returns for periods of less than one year are not annualized. |

| 3. | Portfolio turnover rate is calculated by aggregating the results of multiplying the Fund’s investment percentage in the respective affiliated Master Portfolio by the corresponding affiliated Master Portfolio’s portfolio turnover rate. |

| 4. | Calculated based upon average shares outstanding |

| 5. | For the eight months ended May 31, 2011. The Fund changed its fiscal year end from September 30 to May 31, effective May 31, 2011. |

The accompanying notes are an integral part of these financial statements.

Table of Contents

| Financial highlights | Wells Fargo Advantage Allocation Funds | 19 |

| Distributions from net realized gains |

Ending value per |

Ratio to average net assets (annualized) | Total |

Portfolio |

Net assets at |

|||||||||||||||||||||||||

| |

Net investment income1 |

|

|

Gross expenses1 |

|

|

Net expenses1 |

|

||||||||||||||||||||||

| 0.00 | $ | 22.15 | 0.49 | % | 2.11 | % | 1.90 | % | 5.68 | % | 45 | % | $ | 3,695 | ||||||||||||||||

| 0.00 | $ | 20.96 | 0.66 | % | 2.11 | % | 1.90 | % | 13.65 | % | 86 | % | $ | 2,576 | ||||||||||||||||

| 0.00 | $ | 18.63 | 0.92 | % | 2.08 | % | 1.90 | % | (1.67 | )% | 115 | % | $ | 2,319 | ||||||||||||||||

| 0.00 | $ | 19.45 | 1.16 | % | 2.09 | % | 1.90 | % | 11.17 | % | 70 | % | $ | 2,364 | ||||||||||||||||

| 0.00 | $ | 17.77 | 1.59 | % | 2.12 | % | 1.90 | % | 7.58 | % | 103 | % | $ | 1,726 | ||||||||||||||||

| (0.18 | ) | $ | 16.96 | 1.72 | % | 2.05 | % | 1.90 | % | 0.21 | % | 116 | % | $ | 1,445 | |||||||||||||||

| (1.51 | ) | $ | 17.64 | 2.13 | % | 2.05 | % | 1.90 | % | (14.05 | )% | 89 | % | $ | 1,677 | |||||||||||||||

| 0.00 | $ | 22.69 | 1.48 | % | 1.20 | % | 0.90 | % | 6.23 | % | 45 | % | $ | 152,776 | ||||||||||||||||

| 0.00 | $ | 21.36 | 1.66 | % | 1.20 | % | 0.90 | % | 14.81 | % | 86 | % | $ | 146,729 | ||||||||||||||||

| 0.00 | $ | 18.96 | 1.92 | % | 1.17 | % | 0.90 | % | (0.66 | )% | 115 | % | $ | 172,587 | ||||||||||||||||

| 0.00 | $ | 19.77 | 2.14 | % | 1.18 | % | 0.90 | % | 11.93 | % | 70 | % | $ | 192,305 | ||||||||||||||||

| 0.00 | $ | 18.11 | 3.06 | % | 1.18 | % | 0.90 | % | 8.65 | % | 103 | % | $ | 176,179 | ||||||||||||||||

| (0.18 | ) | $ | 17.23 | 2.72 | % | 1.13 | % | 0.90 | % | 1.14 | % | 116 | % | $ | 330,340 | |||||||||||||||

| (1.51 | ) | $ | 17.98 | 3.13 | % | 1.13 | % | 0.90 | % | (13.17 | )% | 89 | % | $ | 407,829 | |||||||||||||||

The accompanying notes are an integral part of these financial statements.

Table of Contents

| 20 | Wells Fargo Advantage Allocation Funds | Notes to financial statements (unaudited) |

1. ORGANIZATION

Wells Fargo Funds (the “Trust”), a Delaware statutory trust organized on March 10, 1999, is an open-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). These financial statements report on the following funds: the Wells Fargo Advantage Growth Balanced Fund (“Growth Balanced Fund”) and the Wells Fargo Advantage Moderate Balanced Fund (“Moderate Balanced Fund” ) (each, a “Fund”, collectively, the “Funds”). Each Fund is a diversified series of the Trust.

The Funds each seek to achieve their investment objective by investing primarily all investable assets in two or more separate diversified portfolios (each, an “affiliated Master Portfolio”, collectively, the “affiliated Master Portfolios”) of Wells Fargo Master Trust, a registered open-end management investment company. Each affiliated Master Portfolio directly acquires portfolio securities, and a Fund investing in an affiliated Master Portfolio acquires an indirect interest in those securities. Each Fund accounts for its investment in the affiliated Master Portfolios as partnership investments and records on a daily basis its share of the affiliated Master Portfolio’s income, expenses and realized and unrealized gains and losses. The financial statements of the affiliated Master Portfolios for the six months ended November 30, 2013 are included in this report and should be read in conjunction with each Fund’s financial statements. As of November 30, 2013, the Funds own the following percentages of the affiliated Master Portfolios:

| Growth Balanced Fund |

Moderate Balanced Fund |

|||||||

| Wells Fargo Advantage C&B Large Cap Value Portfolio |

4 | % | 2 | % | ||||

| Wells Fargo Advantage Core Bond Portfolio |

1 | 1 | ||||||

| Wells Fargo Advantage Diversified Large Cap Growth Portfolio |

27 | 11 | ||||||

| Wells Fargo Advantage Emerging Growth Portfolio |

0 | * | 0 | * | ||||

| Wells Fargo Advantage Index Portfolio |

1 | 1 | ||||||

| Wells Fargo Advantage Inflation-Protected Bond Portfolio |

16 | 14 | ||||||

| Wells Fargo Advantage International Growth Portfolio |

8 | 3 | ||||||

| Wells Fargo Advantage International Value Portfolio |

3 | 1 | ||||||

| Wells Fargo Advantage Large Company Value Portfolio |

27 | 11 | ||||||

| Wells Fargo Advantage Managed Fixed Income Portfolio |

53 | 47 | ||||||

| Wells Fargo Advantage Small Company Growth Portfolio |

2 | 1 | ||||||

| Wells Fargo Advantage Small Company Value Portfolio |

4 | 2 | ||||||

| Wells Fargo Advantage Stable Income Portfolio |

N/A | 100 | ||||||

| * | The amount invested is less than 1%. |

2. SIGNIFICANT ACCOUNTING POLICIES

The following significant accounting policies, which are consistently followed in the preparation of the financial statements of each Fund, are in conformity with U.S. generally accepted accounting principles which require management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Securities valuation

All investments are valued each business day as of the close of regular trading on the New York Stock Exchange (generally 4 p.m. Eastern Time).

Investments in the affiliated Master Portfolios are valued daily based on each Fund’s proportionate share of each affiliated Master Portfolio’s net assets, which are also valued daily. Securities held in the affiliated Master Portfolios are valued as discussed in the Notes to Financial Statements of the affiliated Master Portfolios, which are included elsewhere in this report.

Futures that are listed on a foreign or domestic exchange or market are valued at the official closing price.

Short-term securities, with maturities of 60 days or less at time of purchase, generally are valued at amortized cost which approximates fair value. The amortized cost method involves valuing a security at its cost, plus accretion of discount or minus amortization of premium over the period until maturity.

Table of Contents

| Notes to financial statements (unaudited) | Wells Fargo Advantage Allocation Funds | 21 |

Investments which are not valued using any of the methods discussed above are valued at their fair value, as determined in good faith by the Board of Trustees of the Funds. The Board of Trustees has established a Valuation Committee comprised of the Trustees and has delegated to it the authority to take any actions regarding the valuation of portfolio securities that the Valuation Committee deems necessary or appropriate, including determining the fair value of portfolio securities, unless the determination has been delegated to the Management Valuation Team of Wells Fargo Funds Management, LLC (“Funds Management”). The Board of Trustees retains the authority to make or ratify any valuation decisions or approve any changes to the Valuation Procedures as it deems appropriate. On a quarterly basis, the Board of Trustees receives reports on any valuation actions taken by the Valuation Committee or the Management Valuation Team which may include items for ratification.

Valuations of fair valued securities are compared to the next actual sales price when available, or other appropriate market values, to assess the continued appropriateness of the fair valuation methodologies used. These securities are fair valued on a day-to-day basis, taking into consideration changes to appropriate market information and any significant changes to the inputs considered in the valuation process until there is a readily available price provided on an exchange or by an independent pricing service. Valuations received from an independent pricing service or independent broker-dealer quotes are periodically validated by comparisons to most recent trades and valuations provided by other independent pricing services in addition to the review of prices by the adviser and/or subadviser. Unobservable inputs used in determining fair valuations are identified based on the type of security, taking into consideration factors utilized by market participants in valuing the investment, knowledge about the issuer and the current market environment.

Futures contracts

Each Fund may be subject to interest rate risk and equity price risk in the normal course of pursuing its investment objectives. Each Fund may buy and sell futures contracts in order to gain exposure to, or protect against, changes in security values and interest rates. The primary risks associated with the use of futures contracts are the imperfect correlation between changes in market values of securities held by each Fund and the prices of futures contracts, and the possibility of an illiquid market.

Futures contracts are valued based upon their quoted daily settlement prices when available. The aggregate principal amounts of the contracts are not recorded in the financial statements. Fluctuations in the value of the contracts are recorded in the Statements of Assets and Liabilities as an asset or liability and in the Statements of Operations as unrealized gains or losses until the contracts are closed, at which point they are recorded as net realized gains or losses on futures contracts. With futures contracts, there is minimal counterparty risk to each Fund since futures are exchange traded and the exchange’s clearinghouse, as counterparty to all exchange traded futures, guarantees the futures against default.

Security transactions and income recognition

Securities transactions are recorded on a trade date basis in by each Fund and each affiliated Master Portfolio. Realized gains or losses are recorded on the basis of identified cost by each Fund and each affiliated Master Portfolio.

Interest income is accrued daily and bond discounts are accreted and premiums are amortized daily based on the effective interest method by each Fund and each affiliated Master Portfolio. To the extent debt obligations are placed on non-accrual status, any related interest income may be reduced by writing off interest receivables when the collection of all or a portion of interest has become doubtful based on consistently applied procedures. If the issuer subsequently resumes interest payments or when the collectability of interest is reasonably assured, the debt obligation is removed from non-accrual status.

Dividend income in each affiliated Master Portfolio is recognized on the ex-dividend date, except for certain dividends from foreign securities, which are recorded as soon as the affiliated Master Portfolio is informed of the ex-dividend date.

Income from foreign securities in each affiliated Master Portfolio is recorded net of foreign taxes withheld where recovery of such taxes is not assured.

Each Fund records daily its proportionate share of each affiliated Master Portfolio’s interest and dividend income and realized and unrealized gains or losses.

Distributions to shareholders

Distributions to shareholders from net investment income and net realized gains, if any, are recorded on the ex-dividend date. Such distributions are determined in conformity with federal income tax regulations, which may differ in amount or character from net investment income and realized gains recognized for purposes of U.S. generally accepted accounting principles.

Table of Contents

| 22 | Wells Fargo Advantage Allocation Funds | Notes to financial statements (unaudited) |

Federal and other taxes

Each Fund is treated as a separate entity for federal income tax purposes. Each Fund intends to continue to qualify as a regulated investment company by distributing substantially all of its investment company taxable income and any net realized capital gains (after reduction for capital loss carryforwards) sufficient to relieve it from all, or substantially all, federal income taxes. Accordingly, no provision for federal income taxes was required.

Each Fund’s income and federal excise tax returns and all financial records supporting those returns for the prior three fiscal years are subject to examination by the federal and Delaware revenue authorities. Management has analyzed each Fund’s tax positions taken on federal, state, and foreign tax returns for all open tax years and does not believe that there are any uncertain tax positions that require recognition of a tax liability.

At May 31, 2013, capital loss carryforwards available to offset future net realized capital gains were as follows through the indicated expiration dates:

| 2016 | 2017 | 2018 | ||||||||||

| Growth Balanced Fund |

$ | 11,249,610 | $ | 79,417,787 | $ | 82,578,227 | ||||||

| Moderate Balanced Fund |

0 | 0 | 5,730,209 | |||||||||

Class allocations

The separate classes of shares offered by each Fund differ principally in applicable sales charges, distribution, shareholder servicing, and administration fees. Shareholders of each class bear certain expenses that pertain to that particular class. All shareholders bear the common expenses of a Fund, earn income from the portfolio, and are allocated unrealized gains and losses pro rata based on the average daily net assets of each class, without distinction between share classes. Dividends are determined separately for each class based on income and expenses allocable to each class. Realized gains and losses are allocated to each class pro rata based upon the net assets of each class on the date realized. Differences in per share dividend rates generally result from the relative weightings of pro rata income and realized gain allocations and from differences in separate class expenses, including distribution, shareholder servicing, and administration fees.

3. FAIR VALUATION MEASUREMENTS

Fair value measurements of investments are determined within a framework that has established a fair value hierarchy based upon the various data inputs utilized in determining the value of each Fund’s investments. The three-level hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1) and the lowest priority to significant unobservable inputs (Level 3). Each Fund’s investments are classified within the fair value hierarchy based on the lowest level of input that is significant to the fair value measurement. The inputs are summarized into three broad levels as follows:

| n | Level 1 – quoted prices in active markets for identical securities |

| n | Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, use of amortized cost, etc.) |

| n | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

The inputs or methodologies used for valuing investments in securities are not necessarily an indication of the risk associated with investing in those securities.

As of November 30, 2013, the inputs used in valuing investments in securities were as follows:

| Investments in securities | Quoted prices (Level 1) |

Other significant (Level 2) |

Significant unobservable inputs (Level 3) |

Total | ||||||||||||

| Growth Balanced Fund |

||||||||||||||||

| Equity securities |

||||||||||||||||

| Investment companies |

$ | 0 | $ | 255,057,520 | $ | 0 | $ | 255,057,520 | ||||||||

| Short-term investments |

||||||||||||||||

| U.S. Treasury securities |

0 | 962,964 | 0 | 962,964 | ||||||||||||

| $ | 0 | $ | 256,020,484 | $ | 0 | $ | 256,020,484 | |||||||||