Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

(Mark One)

| ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2013

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

OR

| ¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report to

Commission file number 001-14928

Santander UK plc

(Exact name of Registrant as specified in its charter)

England

(Jurisdiction of incorporation or organization)

2 Triton Square, Regent’s Place, London NW1 3AN, England

(Address of principal executive offices)

Julian Curtis

2 Triton Square, Regent’s Place, London NW1 3AN, England

Tel +44 (0) 870 607 6000

Fax +44 (0) 20 7756 5628

(Name, Telephone, Email and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| 3.050% Notes due 2018, issued by Abbey National Treasury Services plc * 4.000% Notes due 2016, issued by Abbey National Treasury Services plc * |

New York Stock Exchange New York Stock Exchange | |

| 2.875% Notes due 2014, issued by Abbey National Treasury Services plc * | New York Stock Exchange | |

| Floating Rate Notes due 2014, issued by Abbey National Treasury Services plc * | New York Stock Exchange |

| * | Guaranteed by Santander UK plc |

Table of Contents

Securities registered or to be registered pursuant to Section 12 (g) of the Act.

None

Securities registered or to be registered pursuant to Section 15 (d) of the Act.

7.95% Term Subordinated Securities due October 26, 2029

Subordinated Guarantee by Santander UK plc (as successor in interest to Abbey National plc) of the 8.963% Non-Cumulative Perpetual Preferred Limited Partnership Interests issued by Abbey National Capital LP I

Subordinated Guarantee by Santander UK plc (as successor in interest to Abbey National plc) of the 8.963% Non-Cumulative Trust Preferred Securities issued by Abbey National Capital Trust I

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

| Ordinary shares of nominal value of £0.10 each* | 31,051,768,866 | |

| 10 3/8% Non-cumulative Preference Shares of nominal value of £1 each | 200,000,000 | |

| 8 5/8% Non-cumulative Preference Shares of nominal value of £1 each | 125,000,000 | |

| Series A Fixed/Floating Rate Non-cumulative Preference Shares of nominal value of £1 each | 300,002 |

| * | All of the issued and outstanding ordinary shares of Santander UK plc are held by Santander UK Group Holdings Limited, which is a wholly-owned subsidiary of Banco Santander S.A. |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ¨ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ | Accelerated filer ¨ | Non-accelerated filer x |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| ¨ U.S. GAAP | x International Financial Reporting Standards as issued by the International Accounting Standards Board | ¨ Other |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ¨ Item 18 ¨

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

Table of Contents

Table of Contents

|

2013 Results highlights

|

||||||||||||

|

Net interest income |

Profit after tax |

Banking net interest margin |

||||||||||

| £2,963m | £921m | 1.55%(1) | ||||||||||

| Up 8% on 2012, largely due to an | Profit after tax from continuing operations up | Up 19 basis points from 1.36% in 2012, | ||||||||||

| improved mortgage stock interest | 5% on 2012 (up 13% excluding significant | reflecting improving mortgage stock | ||||||||||

| margin, lower cost of retail liabilities and | items), maintaining a record of consistent | margins and lower customer deposit | ||||||||||

| increased Commercial Banking lending. | profitability through the economic cycle. | and wholesale funding costs. | ||||||||||

| (1) Non-IFRS measure. See page 345. | ||||||||||||

|

Cost-to-income ratio |

CET 1 Capital ratio |

Loan-to-deposit ratio |

||||||||||

| 54% | 11.6%(1) | 126% | ||||||||||

| Costs remained tightly controlled, | Further strengthened our capital position | Improved three percentage points | ||||||||||

| with our focus on business as usual | with estimated CRD IV end point Common | from 129% in 2012 as we continued | ||||||||||

| expenses maintained. | Equity Tier 1 (‘CET 1’) capital ratio at | to manage the balance sheet. | ||||||||||

| 31 December 2013, up from 11.1% in 2012.

|

||||||||||||

| (1) Non-IFRS measure. See page 345. | ||||||||||||

|

Gross mortgage lending |

1I2I3 World customers |

Commercial Banking lending |

||||||||||

| £18.4bn | 2.4 million | £22.1bn | ||||||||||

| Up from £14.4bn in 2012, and | 1.1 million customers joined the 1I2I3 | Commercial Banking loan growth of 13% | ||||||||||

| including £3.4bn of loans extended | World in 2013, including 232,000 new | continues to be subject to prudent risk | ||||||||||

| to first-time buyers. | customers who moved their current accounts | management criteria, as demonstrated by the | ||||||||||

| to Santander UK from other providers. | good credit quality in newer loan vintages. | |||||||||||

Table of Contents

Annual Report

| In line with the UK’s new reporting regulation, we have improved the 2013 Annual Report in order to give readers a more complete picture of our business model and strategy, the performance and strength of our governance model, and the effectiveness of our risk management. In our Strategic report (pages 2 to 24), we bring together the most relevant information for all our stakeholders. | ||||||

| Strategic report | ||||||

|

|

| |||||

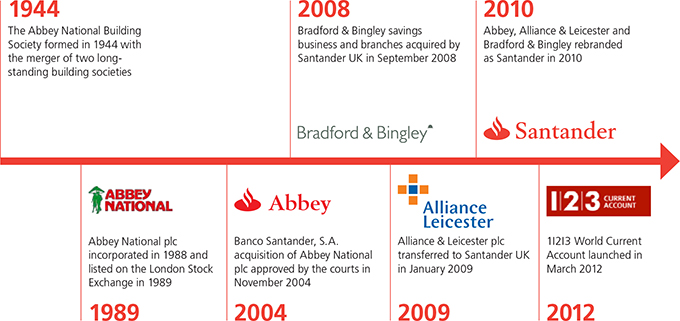

| 2 | Our heritage | |||||

|

|

| |||||

| 3 | Santander UK today | |||||

|

|

| |||||

| 4 | Our strategy and business model | |||||

|

|

| |||||

| 6 | Key performance indicators | |||||

|

|

| |||||

| 8 | Chief Executive Officer’s review | |||||

|

|

| |||||

| Ana Botín gives an overview of Santander UK’s three strategic priorities and the overall business performance in 2013, as we work to build a simple, personal and fair Santander UK for all our stakeholders. | ||||||

|

| ||||||

|

| ||||||

| 12 | Chief Financial Officer’s review | |||||

|

|

| |||||

| Stephen Jones reports on our financial progress, profitability and the further strengthening of our balance sheet in 2013. | ||||||

|

| ||||||

|

| ||||||

| 15 |

||||||

|

|

| |||||

| 19 |

||||||

|

|

| |||||

| Lord Burns sets out our commitment to the highest standards of corporate governance in line with UK best practice, our approach to remuneration, our people, our culture, our communities and the environment. | ||||||

|

| ||||||

| Detailed business review | ||||||

|

|

| |||||

| 25 | Group and divisional results | |||||

|

|

| |||||

| 39 | Balance sheet review | |||||

|

|

| |||||

| 61 | Risk management report | |||||

|

|

| |||||

|

| ||||||

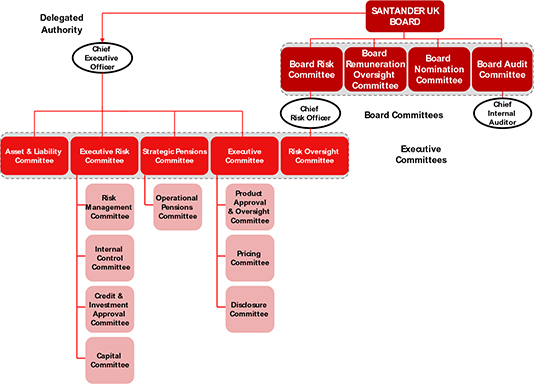

| Governance | ||||||

|

|

| |||||

| 165 | Directors | |||||

|

|

| |||||

| 169 | Corporate Governance report | |||||

|

|

| |||||

| 178 | Directors’ Remuneration report | |||||

|

|

| |||||

| 188 | Directors’ Report | |||||

|

|

| |||||

| 196 | Directors’ Responsibilities statement | |||||

|

|

| |||||

| 197 | Further remuneration disclosures | |||||

|

|

| |||||

|

| ||||||

| Financial statements | ||||||

|

|

| |||||

| 202 | Report of Independent Registered Public Accounting Firm | |||||

|

|

| |||||

| 205 | Primary Financial statements | |||||

|

|

| |||||

| 212 | Notes to the financial statements | |||||

|

|

| |||||

|

| ||||||

| Shareholder information | ||||||

|

|

| |||||

| 317 | Risk factors | |||||

|

|

| |||||

| 335 | Contact and other information | |||||

|

|

| |||||

|

|

| |||||

| 336 | Glossary of financial services industry terms | |||||

|

|

| |||||

| 342 | Forward-looking statements | |||||

|

|

| |||||

| 343 | Other information for US investors | |||||

|

|

| |||||

| This Annual Report contains forward-looking statements that involve inherent risks and uncertainties. Actual results may differ materially from those contained in such forward-looking statements. See ‘Forward-looking statements’ on page 342. | ||||||

| Santander UK plc Annual Report 2013 | 1 |

Table of Contents

| Strong foundations |

Our relationship with the Banco Santander group The Banco Santander group operates a subsidiary model. This model involves autonomous units, such as Santander UK, operating in core markets, with each unit being responsible for its own liquidity, funding and capital management on an ongoing basis. The model is designed to minimise the risk to individual Banco Santander group units from problems arising elsewhere in the Banco Santander group.

The subsidiary model also gives Santander UK considerable financial flexibility, yet enables it to continue to take advantage of the |

significant synergies that come from being part of a global group; in brand, products, systems, platforms, development and management capability. In the model the Banco Santander group facilitates the sharing of best practice and provides common technology, operations and support services to all of its subsidiaries via independent operating entities, themselves established by the Banco Santander group so as to be able to continue operating as viable standalone businesses.

| ||

|

| ||||

(1) With effect from 10 January 2014

| 2 | Santander UK plc Annual Report 2013 |

Table of Contents

Strategic report

|

Established UK market player

|

||||||||||||

| Employees |

Branches | Corporate Business Centres | Active customers | |||||||||

| 19,643 |

1,010 |

50 |

14m | |||||||||

|

Our businesses

|

||||||||||||

|

|

|

|

| |||||||||

| Retail Banking | Commercial Banking | Markets | Corporate Centre | |||||||||

| Offers a wide range of products and financial services to individuals and small businesses (with a turnover of less than £250,000 per annum) through a network of branches and ATMs, as well as through telephony, e-commerce and intermediary channels. | Provides a wide range of products and financial services to customers through a network of regional corporate business centres and through telephony and e-commerce channels across SME, mid-cap corporates and large-cap corporates. | Delivers risk management and other services to financial institutions, as well as to other Santander UK divisions. Its main product areas are fixed income and foreign exchange, equities, capital markets and institutional sales. | Principally comprises Financial Management & Investor Relations (‘FMIR’), responsible for managing capital and funding, balance sheet composition, structural market risk and strategic liquidity risk for the Santander UK group. Also includes the non-core corporate and legacy portfolios. | |||||||||

|

Income |

Income |

Income |

Short-term funding | |||||||||

| £3,673m | £705m | £108m | £21.2bn | |||||||||

|

Profit before tax |

Profit before tax |

Profit before tax |

Total wholesale funding | |||||||||

| £1,598m | £273m | £4m | £65.7bn | |||||||||

|

Residential mortgages |

Customer loans |

Total assets |

Total liquid assets | |||||||||

| £148.1bn | £22.1bn | £19.3bn | £73.0bn | |||||||||

|

Loyal customers |

Customers |

|

| |||||||||

| 2.7m | 71,000 | |||||||||||

(1) Data at 31 December 2013 and the year ended 31 December 2013

| Santander UK plc Annual Report 2013 | 3 |

Table of Contents

Strategic report

|

business model |

Our purpose is to help people and businesses prosper throughout the United Kingdom | |||

| 4 | Santander UK plc Annual Report 2013 |

Table of Contents

Strategic report

| Santander UK plc Annual Report 2013 | 5 |

Table of Contents

Strategic report

|

indicators |

Key performance indicators (‘KPI’s) help measure our progress against our strategic priorities, and represent the set of measures that management reviews and tracks on a regular basis. In 2013, business performance improved and we remain focused on delivering our key commitments for the end of 2015. | |||

|

Strategic Priority

|

Performance indicator

|

Why is it monitored?

|

||||

|

Loyal and satisfied retail customers |

Loyal customers | |||||

| Defined as primary current account customers who hold a debit card and at least one additional product. Primary current account customers have a minimum credit turnover of at least £500 per month and at least two direct debits set up on the account.

|

As part of the transformation to a more customer- focused organisation, we seek to develop and build deeper customer relationships through increased current account primacy and customer segmentation. | |||||

|

| ||||||

|

Number of 1I2I3 World customers |

||||||

| 1I2I3 World products provide cashback for customers who bank with us and increase utilisation of their accounts. Since their introduction in late 2011, we track the number of single and joint account holders of our range of 1I2I3 World products.

|

The 1I2I3 World products are a key to our strategy of building deeper customer relationships and delivering value to our customers. | |||||

|

| ||||||

| Customer satisfaction (‘Financial Research Survey’) | ||||||

| An independent monthly survey of approximately 5,000 consumers covering the personal finance sector, run by GfK. The ‘Overall Satisfaction’ score refers to the proportion of extremely satisfied and very satisfied customers for the three month rolling average. See footnote on page 11.

|

We continue to place significant focus on improving the customer experience and put it at the heart of our customer engagement model. | |||||

|

| ||||||

|

‘Bank of Choice’ for UK companies |

Commercial Banking percentage of customer loans | |||||

| Commercial Banking is defined as lending to corporate customers with a turnover in excess of £250,000 per annum, and includes SME, mid-cap corporates, large-cap corporates and multinationals. This ratio is defined as gross customer balances as a percentage of total gross customer loan balances.

|

A key element of our strategy is to diversify the business mix, in terms of income and customer base, and thus provide a better strategic balance to capitalise on key business opportunities and to manage the risk cycles. | |||||

|

| ||||||

|

Consistent profitability and a strong balance sheet |

Return on tangible equity (‘RoTE’)(2) | |||||

| Defined as profit attributable to ordinary shareholders divided by average shareholders’ equity, less preference shares and intangible assets (including goodwill). Formerly known as return on tangible book value.

|

We monitor RoTE as a measure of how much profit has been generated by the equity invested by ordinary shareholders, thus measuring overall profitability and the sustainability of the business. | |||||

|

| ||||||

|

Cost-to-income ratio |

||||||

| Defined as total operating expenses, excluding provisions and charges, divided by total operating income.

|

We review the cost-to-income ratio in order to measure our operating efficiency. | |||||

|

| ||||||

| Common Equity Tier 1 (‘CET 1’) capital ratio(2) | ||||||

| Defined on the basis of the Capital Requirements Directive IV (‘CRD IV’) rules (which implement Basel III in the EU from 1 January 2014) due to apply at the end of the transitional period.

|

We monitor the CET 1 capital ratio to support economic capital requirements and the capacity to grow while maintaining sufficient capital resources to meet the minimum regulatory requirements. | |||||

|

| ||||||

| Loan-to-deposit ratio | ||||||

| Defined as loans and advances to customers (excluding reverse repos) divided by deposits by customers (excluding repos).

|

We monitor the loan-to-deposit ratio to assess our ability to fund commercial operations with commercial borrowings, reducing reliance on wholesale markets.

|

|||||

|

| ||||||

| Non-performing loan (‘NPL’) ratio | ||||||

| Defined as the non-performing loans as a percentage of loans and advances to customers. | We review the NPL ratio as an important measure of risk in our business to ensure it remains consistent with our low-to-moderate risk appetite.

|

|||||

|

| ||||||

| (1) Income for 2012 included a gain from the capital management exercise. The cost-to- income ratio for the year ended 31 December 2012 of 53% excludes this gain. Including this gain, the 2012 cost-to-income ratio was 45%.The cost-to-income also in 2012 is a non-IFRS measure due to the exclusion of the gain on the capital management exercise. (2) Non-IFRS measure. See page 345. |

Dividend payout ratio | |||||

| Defined as the dividend paid and declared in the period on our ordinary shares as a percentage of retained earnings. | We monitor the dividend payout ratio to ensure we are able to grow the business while maintaining an appropriate return to our shareholder.

|

|||||

| 6 | Santander UK plc Annual Report 2013 |

Table of Contents

Strategic report

|

Target for 2015

|

Actual performance

|

Performance in 2013

|

||||||||

| 2013 | 2012 | 2011 | ||||||||

|

4 million |

2.7 million |

2.2 million |

1.6 million

|

Our loyal customer base continued to grow strongly helped by the success of the 1I2I3 World Current Account. |

||||||

|

4 million |

2.4 million |

1.3 million |

0.1 million

|

We maintained strong growth, with over one million new 1I2I3 World customers in 2013. This was accompanied by further growth in current account balances, which reached £27.9bn, a 75% increase in the year. |

||||||

|

Top 3 |

58% |

55% |

51%

|

We made a significant improvement in customer satisfaction since December 2011, reducing the gap between us and the top 3 peers. |

||||||

|

(Average of top 3 peers) |

(60%) |

(60%) |

(61%)

|

|||||||

|

20% |

12% |

10% |

9% |

We continued to make good progress, with customer loans increasing by £2.5bn to £22.1bn in 2013. We will not compromise our prudent risk management to meet the 20% target and if we are not satisfied with the credit quality of the opportunities available to us we would choose to slow the pace of corporate loan growth.

|

||||||

|

13%-15% |

8.9% |

9.1% |

9.0% |

RoTE of 8.9% increased from an annualised 8.3% for the first half, driven by a continued improvement in net interest income. RoTE is affected by the amount of capital we hold; at a 10.5% CET 1 capital ratio, RoTE would have been c. 9.5% for full year 2013.

|

||||||

|

<50% |

54% |

53%(1) |

47% |

Up from 53% in 2012, excluding the gain from the capital management exercise. Our focus on cost discipline remains, as we manage business-as-usual and secure further efficiencies in order to maintain the capacity to invest further.

|

||||||

|

>10.5% |

11.6% |

11.1% |

n/a |

We strengthened our estimated CET 1 capital ratio to 11.6% with a CRD IV end point leverage ratio of 3.3% and 3.0% on a post-PRA adjustment basis. Issuance of Additional Tier 1 capital, planned for 2014, as well as retained profits, are expected to result in a gradual improvement in leverage ratios in 2014.

|

||||||

|

<130% |

126% |

129% |

135% |

We continued to strengthen our balance sheet with selective deleveraging in mortgages and growing our current account and savings balances. We remain comfortable with the current position, given that it is underpinned by prime UK residential mortgages.

|

||||||

|

ratio maintained |

2.04% |

2.16% |

1.93% |

The improvement in 2013 largely reflected disciplined risk management, notwithstanding the increased share of Commercial Banking lending in the business mix.

|

||||||

|

50% |

47% |

48% |

47% |

Our dividend payout ratio was maintained in line with that for the Banco Santander group. All dividends are paid subject to the approval of the regulator and in 2013 we declared dividends totalling £425m.

|

||||||

| Santander UK plc Annual Report 2013 | 7 |

Table of Contents

Strategic report

|

Officer’s review |

Our purpose at Santander UK is to help individuals and businesses prosper. To do this, we have set ourselves an ambitious aim: to be the best bank for our people, our customers, our shareholders and our communities. We believe we need to serve all of these groups in a balanced way because this is how we will build a sustainable business. | |||

|

Ana Botín Chief Executive Officer

|

To become the best bank, we need to continue to innovate and challenge the status quo. We are doing this by building a bank that is simple, personal and fair in how it treats its people, cares for its customers, serves its shareholders and supports its communities.

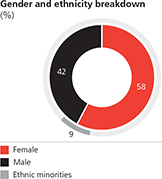

Our aim is to be the best bank to work at for our people. We are committed to creating an inclusive culture in which all our people feel valued and able to fulfil their potential. This means providing excellent opportunities for career progression and encouraging accountability and teamwork.

We are also focused on creating a safe and healthy environment for our employees and providing training, coaching and advice.

To become the best bank for our customers, we are listening to them and building a new proposition around the things they value.

In Retail Banking, we have developed simple and clear products that reward both new and existing customers with ongoing value. In Commercial Banking, we build partnerships with our customers by tailoring our products to meet their needs.

Only by delivering what customers want, and anticipating their needs, will we earn their trust and loyalty, which are the foundations upon which all long-lasting customer relationships are built. |

As a result, a new customer joined our 1I2I3 World every 30 seconds, our customer experience performance continued to improve, and we welcomed more current account switchers than any other bank, making a net gain of 11% of accounts transferred.

By delivering better results for our people and our customers, we have delivered better quality results for our shareholders. We increased our profits, excluding significant items, by 13%, while continuing to strengthen our balance sheet and capital position at the same time.

We achieved all this while continuing to support the communities in which we operate. Last year we lent £18.4bn of mortgages to UK households, including £3.4bn to first-time buyers.

Our unique Universities programme also continued to deliver a very significant impact, with more than 70 institutions already among our partners.

Our strategic priorities

1. Loyal and satisfied retail customers Our 1I2I3 World is driving our success with innovative, personal products that put the customer at the heart of everything we do.

Our Retail Banking business model is based on simple and clear products for new and existing customers, that offer ongoing value, reward existing behaviour, have a broad segment appeal and minimum small print. |

| 8 | Santander UK plc Annual Report 2013 |

Table of Contents

Strategic report

| Santander UK plc Annual Report 2013 | 9 |

Table of Contents

Strategic report

| 10 | Santander UK plc Annual Report 2013 |

Table of Contents

Strategic report

| Operating environment |

The UK economic environment has strengthened and has provided a more positive backdrop to 2013, while indications of increased confidence lead us to be cautiously optimistic regarding the outlook for 2014 and beyond. | |||

|

|

The macroeconomic environment Economic activity in the UK showed a clear improvement during 2013, with GDP growth of 1.9% in the year, a marked improvement on the 0.3% recorded in 2012 and the strongest performance since 2007. The overall level of output is, however, still 1.3% lower than in 2008 before recession took hold. As 2013 progressed, there were signs of improved consumer and business confidence as well as stronger activity in the housing market, and a steady growth in consumer spending provided the most significant support for the increase in activity. The improvements in confidence and housing market activity were, however, from relatively low levels, and the economy continued to face headwinds, especially from the squeeze on households’ real average earnings and a relatively high rate of unemployment. With households slowly increasing their level of debt (mortgage debt grew by 0.9% in 2013) there continued to be some rebalancing of finances as retail deposits grew more strongly than borrowing (by 5%).

One major change in 2013 was the Bank of England’s introduction of forward guidance for monetary policy. In setting a threshold for the unemployment rate at 7%, the Monetary Policy Committee (‘MPC’) also reaffirmed the commitment to the 2% inflation target. At the end of the year, the Bank of England Base Rate had been held at its all-time low of 0.5% since March 2009 and quantitative easing (‘QE’) had been held at £375bn, with the last decision to increase QE taken in July 2012.

The Bank of England’s forward guidance policy was subsequently updated in February 2014.

|

Outlook Information published by the UK Office for National Statistics showed increased GDP in the fourth quarter of 2013 while survey indicators of economic activity for the same period published by Markit also indicated that the economy entered 2014 with some momentum for growth. Monetary policy remains supportive, with a forward guidance approach in place. The recovery is expected to be sustained in 2014, with growth of about 2.5% expected in the year, which would be the strongest annual performance since 2007. Continued growth in output should support a further reduction in the unemployment rate, although the extent to which the rate could fall is highly uncertain and is related to the extent to which productivity growth picks up as the economic recovery continues. The housing market recovery, too, is anticipated to continue. After increasing by 7.5% in 2013 (on the Halifax house price index), we expect a further rise in house prices of around 6% in 2014, although any such predictions are subject to considerable uncertainty.

Regulation Significant uncertainty still remains and a number of key regulatory changes will have an impact on the market in which we operate. In 2014 we require further clarity on regulation, including in respect of minimum capital levels, leverage and the implementation of ICB ring-fencing, where there remain considerable uncertainties. | ||

|

The Financial Research Survey (‘FRS’) is a monthly personal finance survey of around 5,000 consumers prepared by the independent market research agency, GfK NOP. The ‘Overall Satisfaction’ score refers to a proportion of extremely and very satisfied customers across mortgages, savings, main current accounts, home insurance, UPLs and credit cards, based on a weighting of those products calculated to reflect the average product distribution across Santander UK and competitor brands. Data shown is for the three months ending 31 December 2013, three months ending 31 December 2012 and three months ending 31 December 2011. The competitor set included in this analysis is Barclays, Halifax, HSBC, Lloyds TSB and NatWest. | ||||

| Santander UK plc Annual Report 2013 | 11 |

Table of Contents

Strategic report

| 12 | Santander UK plc Annual Report 2013 |

Table of Contents

Strategic report

| Santander UK plc Annual Report 2013 | 13 |

Table of Contents

Strategic report

| 14 | Santander UK plc Annual Report 2013 |

Table of Contents

Strategic report

| Santander UK plc Annual Report 2013 | 15 |

Table of Contents

Strategic report

| Summary risk report continued Top risks |

All of our activities involve, to varying degrees, identification, assessment, management and reporting of risk or combinations of risks. During 2013, senior management focused on certain top and emerging risks and their causes. These are described in the following section, including how they link to our strategic business priorities which are described in more detail on page 4, as well as the change in importance for each of them in 2013. | |||

|

Risk description

|

Strategic priorities

|

Risk features and impact

|

||||

| Capital Capital risk is the risk that Santander UK does not have an adequate amount, or quality, of capital to meet its internal business objectives, market expectations and regulatory requirements. |

|

Capital risk has the potential to disrupt our business model and stop the normal functions of Santander UK. It could also cause Santander UK to fail to meet the supervisory requirements of regulators. Capital risk is significantly driven by credit risk, pension risk and the effects of regulatory change.

|

||||

| Conduct Conduct risk is the risk that the business and operational decisions we take and the behaviours displayed lead to poor outcomes for our customers. |

|

Conduct risk is a key risk to Santander UK in view of the evolving regulatory environment and the requirement to make significant conduct remediation provisions. Specific conduct risks to which we are exposed include: products and services not meeting customer needs; failing to deal with complaints effectively; and the risk that customers are sold unsuitable products or not provided adequate information to make informed decisions.

|

||||

| Credit Credit risk is the risk of financial loss arising from the default or credit quality deterioration of a customer or counterparty to which we have directly provided credit, or for which we have assumed a financial obligation. |

|

Deterioration in the credit quality of our loans to customers and counterparties could reduce the value of our assets, and increase our write-downs and allowances for impairment losses. Credit risk can be affected by a range of macroeconomic environment and other factors, including increased unemployment, house prices, increased corporate insolvency levels, reduced corporate profits, increased personal insolvency levels, increased interest rates and/or higher tenant defaults.

|

||||

| Liquidity Liquidity risk is the risk that Santander UK, although solvent, either does not have sufficient financial resources available to meet its obligations as they fall due, or can secure them only at excessive cost. |

|

Like all major banks, Santander UK can be impacted by confidence in the wholesale funding markets. Should Santander UK be unable to continue to source sustainable funding due to exceptional circumstances, our ability to fund our financial obligations could be adversely affected.

|

||||

| Pension Pension risk is the risk to Santander UK caused by its contractual or other liabilities to or with respect to its defined benefit pension schemes. |

|

The funding position of Santander UK’s pension schemes can be volatile due to the uncertainty of future investment returns and the projected value of scheme liabilities. Key risk factors include long-term interest rates, inflation expectations, salary growth, longevity of the scheme members, investment performance as well as changes in the regulatory environment. These factors may cause additional contributions to be required. They can also directly impact our capital position.

|

||||

| Operational Operational risk is the direct, or indirect, risk of loss to Santander UK resulting from inadequate or failed internal processes, people and systems, or from external events.

|

|

Operational risk is inherent in the processes Santander UK operates. Examples of operational risks include fraud, process failures, system downtime, and damage to assets due to fire or floods.

|

||||

| 16 | Santander UK plc Annual Report 2013 |

Table of Contents

Strategic report

| Developments in 2013 | Change in 2013 | |||

|

During 2013, regulatory developments had the potential to impact Santander UK’s capital plans materially and were mitigated through close monitoring, scenario analysis and capital issuance during the second half of the year. The finalisation of CRD IV and the PRA’s policy statement on implementation, has removed some of the uncertainties surrounding capital forecasting.

|

||||

| As part of a test of the UK banking system, the FPC introduced an effective leverage ratio minimum level ahead of international standards being finalised. Santander UK passed the test on both the risk-based and leverage measures. Both metrics continue to receive close scrutiny.

|

| |||

| The Core Tier 1 ratio improved to 12.9% (2012: 12.2%), reflecting retained profits. The reported CRD IV end point CET 1 leverage ratio was 3.3% (2012: 3.3%).

|

||||

|

Santander UK commenced a strategic review of conduct risk within the business in the year to identify and address key risk drivers. An enhanced Conduct Risk Framework has been developed to further improve the governance and management of conduct risk. Improvements have been made to specific business processes, such as product governance, as well as to the way the business identifies, manages and reports current, and potential future, conduct risks. |

| |||

|

During 2013, there was a decrease in both the volume of PPI activity and the number of complaints we received resulting in lower monthly redress costs, including related costs, throughout the year. Following a reassessment of the provision required to cover non-PPI related conduct remediation and enforcement actions in relation to interest rate hedging, Card Protection Plan and retail investments, there was a release during the year.

|

||||

|

During 2013, the overall Santander UK NPL ratio improved to 2.04% (2012: 2.16%), with the performance across the business units as follows:

|

| |||

| The Retail Banking NPL ratio increased to 1.89% (2012: 1.76%), partly driven by a planned reduction in the portfolio size, and also due to regulatory-driven policy and reporting changes related to mortgage lending. Credit quality on other Retail Banking lending was also satisfactory, with a particular improvement evident in unsecured personal lending.

|

||||

| The Commercial Banking NPL ratio decreased to 3.02% (2012: 4.26%) as the credit quality in newer loan vintages remained satisfactory. We continued to adhere to our prudent lending criteria and will maintain this as we further deliver on our business plan and expand Commercial Banking lending.

|

||||

| The Corporate Centre NPL ratio decreased to 2.36% (2012: 4.49%) reflecting the ongoing sale and run-off of the non-core corporate and legacy assets.

|

||||

|

During 2013, Santander UK enjoyed continued stability in its external credit ratings with both Fitch and Standard & Poors affirming Santander UK’s ‘A’ credit rating. Eligible liquid assets decreased £7.4bn to £29.5bn (2012: £36.9bn). Balances have been managed down in response to regulatory guidance, initially received in the second half of 2012, as well as greater stability in the capital markets and as a consequence of the actions taken to strengthen the balance sheet liquidity over the last three years. |

| |||

|

Eligible liquid assets continued to significantly exceed wholesale funding of less than one year, with a coverage ratio of 139% (2012: 152%).

|

||||

| Further clarity on the implementation of the Basel Liquidity Coverage Ratio (‘LCR’) and Net Stable Funding Ratio (‘NSFR’) has helped to reduce the degree of uncertainty in this area.

|

||||

|

During 2013, the governance framework and responsibilities for managing pension risk were enhanced. This included a dedicated function to oversee the management of pension risk. The pension scheme investment and hedging strategy was also reviewed during the year. Additional controls, triggers and metrics have been introduced to reduce or control inherent risk, while allowing improved monitoring to anticipate any management actions required.

|

| |||

| The accounting deficit of the scheme deteriorated by £503m during 2013. However, the pension scheme was managed to within the risk triggers over the year, and so from a risk perspective while this deterioration was material it was consistent with the current risk appetite. The deterioration was equivalent to approximately a 1-in-10 year event.

|

||||

|

The full breadth of operational risks in Santander UK has always been closely managed. During 2013, our approach was further developed through more extensive use of industry tools, such as major risk scenario analysis, to help management identify and control risks as our risk profile evolves.

|

| |||

| During 2013, there was a significant increase in the attempts at external cyber crime targeted at UK banks. In response to this, and combined with the growth in the volume of automated and online services and transactions, we increased our protection of our systems and data.

|

| Santander UK plc Annual Report 2013 | 17 |

Table of Contents

Strategic report

|

Timeframe

|

Strategic priorities

|

Risk description and mitigation

| ||

| Less than 1 year |

|

UK economic and political environment The financial performance of Santander UK is intrinsically linked to the UK economy. Whilst some evidence of nascent recovery may be apparent, the possibility of economic downturn, along with its concomitant impact on profitability, remains a risk.

Equally, the balance of UK economic performance may swing to the up-side, bringing with it the possibility of a higher interest rate environment. In such a scenario, the reaction of our customers and other market participants might result in different patterns of behaviour. These could include increased customer attrition and more competitive product pricing and/or higher loan impairment.

In addition, any significant changes in UK Government policies or structure could have an impact on our business. We continue to monitor the potential consequences such changes may have with action to be taken as appropriate. The impacts of this risk may also be seen over more than a one-year period.

| ||

| 1-3 years |

|

Emerging regulation The aftermath of the financial crisis has seen the emergence of a significant volume of additional regulation. In some cases, the impacts this regulation has on Santander UK have become clearer and more precisely quantified. On the other hand, there remains a significant body of new regulation where the impact and timing, remains uncertain.

| ||

|

|

IT and business change Santander UK continues to invest in the roll-out of new IT platforms and systems to support its strategic growth plans. As with any significant programme of this nature, there is a need to ensure that the risks associated with the pace of change are properly monitored and controlled.

| |||

| More than 3 years |

|

New competitors and technology Innovations in technology applied to the delivery of financial services continued to develop at a rapid pace. We have also seen the advent of new financial services providers. These factors bring with them the potential for increased levels of competition in the medium term.

| ||

Key:

|

|

Loyal and satisfied retail customers | |

|

|

‘Bank of Choice’ for UK companies | |

|

|

Consistent profitability and a strong balance sheet | |

| 18 | Santander UK plc Annual Report 2013 |

Table of Contents

Strategic report

| Santander UK plc Annual Report 2013 | 19 |

Table of Contents

Strategic report

| 20 | Santander UK plc Annual Report 2013 |

Table of Contents

Strategic report

| Santander UK plc Annual Report 2013 | 21 |

Table of Contents

Strategic report

| 22 | Santander UK plc Annual Report 2013 |

Table of Contents

Strategic report

| Santander UK plc Annual Report 2013 | 23 |

Table of Contents

Strategic report

| 24 | Santander UK plc Annual Report 2013 |

Table of Contents

GROUP SUMMARY

SUMMARISED CONSOLIDATED INCOME STATEMENT

| Year ended 31 December 2013 £m |

Year ended 31 December 2012(1) £m |

Year ended 31 December 2011(1) £m |

||||||||||

| Net interest income |

2,963 | 2,734 | 3,633 | |||||||||

| Non-interest income |

1,066 | 1,949 | 1,303 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total operating income |

4,029 | 4,683 | 4,936 | |||||||||

|

|

|

|

|

|

|

|||||||

| Administrative expenses |

(1,947 | ) | (1,873 | ) | (1,876 | ) | ||||||

| Depreciation, amortisation and impairment |

(248 | ) | (241 | ) | (438 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Total operating expenses excluding impairment losses, provisions and charges |

(2,195 | ) | (2,114 | ) | (2,314 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Impairment losses on loans and advances |

(475 | ) | (988 | ) | (501 | ) | ||||||

| Provisions for other liabilities and charges |

(220 | ) | (434 | ) | (907 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Total operating impairment losses, provisions and charges |

(695 | ) | (1,422 | ) | (1,408 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Profit on continuing operations before tax |

1,139 | 1,147 | 1,214 | |||||||||

| Tax on profit on continuing operations |

(218 | ) | (270 | ) | (345 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Profit on continuing operations after tax |

921 | 877 | 869 | |||||||||

| (Loss)/profit from discontinued operations after tax |

(8 | ) | 62 | 34 | ||||||||

|

|

|

|

|

|

|

|||||||

| Profit after tax for the year |

913 | 939 | 903 | |||||||||

|

|

|

|

|

|

|

|||||||

| Attributable to: |

||||||||||||

| Equity holders of the parent |

913 | 939 | 903 | |||||||||

|

|

|

|

|

|

|

|||||||

| (1) | Adjusted to reflect the presentation of discontinued operations, as set out in Note 12 to the Consolidated Financial Statements. |

2013 compared to 2012

Profit on continuing operations before tax decreased by £8m to £1,139m (2012: £1,147m). Profit after tax from continuing operations increased 5% to £921m (2012: £877m). In 2012, a number of significant items resulted in a net gain of £84m, including a gain on a capital management exercise and provisions relating to the non-core corporate and legacy portfolios, conduct remediation and costs arising from the termination of the acquisition of businesses from RBS. Without the impact of these significant items, profit after tax from continuing operations increased 13%.

By income statement line, the movements were:

| • | Net interest income increased by £229m to £2,963m in 2013 (2012: £2,734m) primarily due to improved mortgage stock interest margins and continued growth in Commercial Banking customer loans. The pressure from increased customer deposit funding costs, evident earlier in 2013, eased noticeably in the second half of the year. |

In Retail Banking, net interest income increased by £348m. The key drivers of the increase were improved mortgage margins, as a greater proportion of customers remained on the Standard Variable Rate (‘SVR’), combined with reduced retail funding costs and better stock margins. The increase was also driven by the benefit from the lower cost of deposit acquisition in 2013. The success of the 1|2|3 World enabled us to attract less price sensitive deposits from our growing primary banking customer base and reduce the pricing of our less relationship-focused savings products. These increases were partly offset by the impact of the managed reduction in selected higher risk elements of the residential mortgage portfolio.

In Commercial Banking, net interest income increased by £88m, principally as a result of continued growth in customer loans. Much of this growth was generated through the network of regional CBCs which serve our SME clients. Growth in customer loans was also generated through our trade finance business (invoice discounting programmes) and credit business with Large Corporates. Net interest income also benefitted from the impact of improving new business margins.

In Markets, net interest income increased by £8m, primarily due to a decrease in funding costs.

In Corporate Centre, net interest expense increased by £215m as a consequence of the continued low interest rate environment. This reflected the increased drag from the run-off of the structural hedge put in place in previous years.

| • | Non-interest income decreased by £883m to £1,066m in 2013 (2012: £1,949m), largely due to a gain of £705m on a capital management exercise in the third quarter of 2012, and not repeated in 2013, in Corporate Centre. |

In Commercial Banking, non-interest income decreased due to lower income from Large Corporates, notably as a result of lower demand for interest rate and foreign exchange risk management products. Furthermore, fixed income sales and money market transactions decreased reflecting reduced market activity. In addition, non-interest income decreased reflecting a reduced volume of interest rate hedging services, driven by the continued low interest rate environment; and the planned reduction in transactions from certain legacy cash transmission businesses.

In Retail Banking, non-interest income decreased by £32m, reflecting lower investment and protection fees as we operated under new regulatory rules, which limited new business volumes. This was partially offset by a change to the pricing structure for current accounts.

In Markets, non-interest income decreased by £78m compared to a particularly strong 2012. This reflected a return to more normalised levels of market making activity with reduced customer activity in a relatively stable, low interest rate environment. Market making businesses (particularly in Equity markets) also suffered lower levels of activity.

In Corporate Centre, these decreases were partially offset by the £38m credit arising from the debit valuation adjustment on derivatives written by Santander UK. This debit valuation adjustment was introduced in accordance with the requirements of IFRS 13.

| • | Administrative expenses increased by £74m to £1,947m in 2013 (2012: £1,873m) principally due to continued investment in the growth of the SME business and investment in growth opportunities for Large Corporates. We further developed our capacity to support our SME customers, with more customer-facing staff in our growing regional CBC network, as we expand into new financial centres across the UK. We also completed the rollout of and customer migration to the new transactional platform in 2013. |

| Santander UK plc Annual Report 2013 | 25 |

Table of Contents

Detailed Business Review

Group and Divisional Results continued

The increase was also driven by ongoing investment in business growth in Retail Banking focused on improving customer experience, and developing interest rate and foreign exchange product capabilities in Markets, as well as increased regulatory compliance and control costs. These increases were in part offset by tight cost control, the consolidation of multi-branch locations, and the effects of deleveraging of the non-core corporate and legacy portfolios.

| • | Depreciation, amortisation and impairment costs increased by £7m to £248m in 2013 (2012: £241m). Investment programmes continued to support the business transformation and underpin future efficiency improvements. Investment focused on systems in the branch network, digital channels, and new transactional capabilities for our commercial customers. This increase was partially offset by the effects of deleveraging of the non-core corporate and legacy portfolios. |

| • | Impairment losses on loans and advances decreased by £513m to £475m in 2013 (2012: £988m). The decrease was mainly due to the £335m provision made in 2012, not repeated in 2013, following the review and full re-assessment of the assets held in the non-core corporate and legacy portfolios in run-off. The provision related to assets acquired from Alliance & Leicester plc (especially the shipping and property portfolios) as well as certain assets taken on as part of the old Abbey Commercial Mortgages book. The provision raised reflected the increased losses experienced in these portfolios. No further significant provisions were required in 2013 as disposals of assets across the portfolios were consistent with provisioned levels. |

Credit quality in the Retail Banking and Commercial Banking loan portfolios continued to be satisfactory. Impairment losses on loans and advances in Retail Banking decreased by £60m largely due to the reduction in impairment loss charges on secured portfolios with lower impacts from regulatory-driven policy and reporting changes, combined with improving underlying performance, and on unsecured portfolios due to better credit quality business.

| • | Provisions for other liabilities and charges decreased by £214m to £220m in 2013 (2012: £434m). In 2012, provisions for other liabilities and charges included a net provision for conduct remediation of £232m, relating to retail products and to interest rate derivatives sold to corporate customers. In addition, in 2012 there was a £55m write off of costs arising from the termination of the acquisition of the RBS businesses. |

No additional provisions were made for PPI in the year. The volume of PPI activity decreased and the number of complaints we received fell 29% in 2013, although the high proportion of invalid complaints continued. Monthly PPI redress costs decreased through the year to an average in the fourth quarter of the year of £11m per month, compared to a monthly average of £18m for the full year 2013 and £26m in 2012. Following a reassessment of the provision required to cover non-PPI related conduct remediation and enforcement actions in relation to interest rate hedging, Card Protection Plan and retail investments, there was a release during the year. Together with modest utilisation, the combined total was £54m.

The UK Bank Levy and Financial Services Compensation Scheme (‘FSCS’) fees increased by £20m to £118m in 2013 (2012: £98m).

| • | The effective tax rate for 2013, based on profit on continuing operations before tax was 19.1% (2012: 23.5%). The reduction in the year was largely attributable to the continued reduction in the main corporation tax rate affecting current and deferred tax. |

(Loss)/profit from discontinued operations after tax of £(8)m in 2013 (2012: £62m) comprised the profit before tax of the discontinued operations of £nil (2012: £84m), a loss on sale before tax of £10m, and a tax credit of £2m (2012: tax charge of £22m). The decrease in profit before tax of the discontinued operations principally reflected the reduction in the size of the co-brand credit cards business prior to the completion of its sale in 2013.

2012 compared to 2011

Profit on continuing operations before tax decreased by £67m to £1,147m in 2012 (2011: £1,214m), whilst profit on continuing operations after tax increased 1% to £877m (2011: £869m). Profit on continuing operations before tax continued to be adversely impacted by structural market conditions, primarily low interest rates and increased term funding costs. 2012 benefitted from the non-recurrence of the significant customer remediation provision, principally in relation to payment protection insurance ('PPI'), of £751m before tax made in 2011. There were a number of significant items in 2012 resulting in a net gain of £84m profit before tax, including a gain on a capital management exercise and provisions relating to the non-core corporate and legacy portfolios, conduct remediation and costs arising from the termination of the acquisition of businesses from RBS.

By income statement line, the movements were:

| • | Net interest income decreased by £899m to £2,734m in 2012 (2011: £3,633m). The key drivers of the decrease were sustained lower interest rates which reduced income earned on the structural hedges put in place in previous years and now maturing in a much lower, static interest rate environment, and the higher cost of funding (both retail deposits and wholesale term funding). In addition, lower mortgage business volumes, as we selectively reduced parts of our mortgage book, negatively impacted net interest income. |

These decreases were partly offset by the favourable impact of improved lending margins as more customers reverted to standard variable rate mortgages in the current low interest rate environment, and improved margins on new business in both the mortgage and corporate loan portfolios, even though the launch of the Funding for Lending Scheme in the last quarter of 2012 reduced funding costs and had a negative impact on asset pricing.

In addition, net interest income increased as a result of growth in corporate customer loans, with much of this growth generated through the network of 35 regional CBCs which serve our SME clients. SME lending balances increased by 18% compared to 31 December 2011.

| • | Non-interest income increased by £646m to £1,949m in 2012 (2011: £1,303m), principally due to the significant gain earned on the repurchase of certain debt capital instruments completed on 16 July 2012. The net impact of the purchase and crystallisation of mark-to-market positions on associated derivatives resulted in a gain of £705m. |

The remaining decrease of £59m was principally due to increased repo costs relating to the management of the liquid asset portfolio being reported in net trading and other income, lower non-interest income reflecting reduced assets in the non-core corporate and legacy portfolios in run-off.

| 26 | Santander UK plc Annual Report 2013 |

Table of Contents

Detailed Business Review

Group and Divisional Results continued

In addition, the replacement of overdraft net interest income with daily fees as a result of the new pricing structure for current accounts resulted in higher fees, but these were more than offset by a decrease in monthly overdraft fees charged to customers and a higher volume of fees waived as we promoted our 1|2|3 credit card. Fees from unsecured lending and mortgages were also lower driven by reduced customer volumes.

Volume growth in the SME business resulted in increases in income from treasury services, banking and cash transmission services, invoice discounting and asset finance. This was partially offset by lower income in retail structured products and money markets.

Markets delivered a solid performance, with a much improved performance in the fixed income and equity businesses, partly offset by lower market volumes principally affecting the financial institutions business.

| • | Administrative expenses decreased by £3m to £1,873m in 2012 (2011: £1,876m). Reduced costs were driven by further efficiencies, reduced variable staff remuneration in Markets and lower technology costs relating to regulatory projects in Corporate Centre. These were in part offset by investment in new Retail Banking products, including the 1|2|3 World product range and the continued investment in the growth of the SME, Large Corporates and Markets (relating to new products, markets and customer segments) businesses. During 2012, we increased our regional CBCs by seven (net) and significantly increased our capacity to serve SMEs by recruiting 113 customer-facing staff into our business. |

| • | Depreciation, amortisation and impairment costs decreased by £197m to £241m in 2012 (2011: £438m). The decrease reflected the write-off of certain intangible assets in December 2011 and lower software depreciation costs following the impairment of these intangible assets in December 2011. In addition, lower operating lease depreciation resulted from lower balances in the legacy portfolios in run-off following the continued deleveraging process. This was partially offset by the continued investment in the IT systems to support growth in Commercial Banking. |

| • | Impairment losses on loans and advances increased by £487m to £988m in 2012 (2011: £501m). The increase was mainly due to the £335m provision made following the review and full re-assessment of the assets held in the non-core corporate and legacy portfolios in run-off. The provision related to assets acquired from Alliance & Leicester plc (particularly the shipping portfolio) as well as certain assets within the old Abbey Commercial Mortgages book. The provision raised reflects the increasing losses experienced in these portfolios. |

The remaining increase largely reflects the increase in the level of non-performing mortgage loans affected by the regulatory collection process changes. The underlying performance on mortgages remains broadly stable due to the continued low interest rate environment and the high quality of the book. In addition, provisions increased as a result of provisions raised in the first half of 2012 relating to the non-core portfolio. The increase was partly offset by lower losses experienced in the commercial real estate portfolio as transactions that originated at the peak of the market have begun to work their way out of the book.

| • | Provisions for other liabilities and charges reduced by £473m to £434m in 2012 (2011: £907m). 2012 included a net provision for conduct remediation of £232m, relating to retail products and to interest rate derivatives sold to corporate customers. In addition, there was a £55m write off of costs arising from the termination of the acquisition of the RBS businesses. In 2011, Santander UK made a customer remediation provision relating principally to PPI of £751m. No additional provision relating to PPI was required in 2012. |

The UK Bank Levy and FSCS fees decreased by £58m to £98m in 2012 (2011: £156m), largely reflecting the impact of ongoing deleveraging on the balance sheet. This was partially offset by restructuring costs of £45m incurred in 2012 in relation to the closure of certain properties and redundancies

| • | The effective tax rate for 2012, based on profit on continuing operations before tax was 23.5% (2011: 28.4%) which was broadly in line with the UK standard corporation tax rate of 24.5% (2011: 26.5%). |

Profit from discontinued operations after tax of £62m in 2012 (2011: £34m) comprised the profit before tax of the discontinued operations of £84m (2011: £47m), and a tax charge of £22m (2011: £13m). The increase in profit before tax of the discontinued operations principally reflected a decrease in the impairment loss allowance charge of £43m.

Critical factors affecting results

The preparation of our Consolidated Financial Statements requires management to make estimates and judgements that affect the reported amount of assets and liabilities at the balance sheet date and the reported amount of income and expenses during the reporting period. Management evaluates its estimates and judgements on an ongoing basis. Management bases its estimates and judgements on historical experience and other factors believed to be reasonable under the circumstances. Actual results may differ from these estimates under different assumptions or conditions. Estimates and judgements that are considered important to the portrayal of our financial condition including, where applicable, quantification of the effects of reasonably possible ranges of such estimates are set out in “Critical Accounting Policies” in Note 1 to the Consolidated Financial Statements.

The rest of this section contains a summary of the results, and commentary thereon, by Income Statement line item for each segment.

Basis of results presentation

The segmental information in this Annual Report reflects the reporting structure in place at the reporting date in accordance with which the segmental information in Note 2 to the Consolidated Financial Statements has been presented. The Company’s board of directors (the ‘Board’) is the chief operating decision maker for Santander UK. The segmental information below is presented on the basis used by the Board to evaluate performance and allocate resources. The Board reviews discrete financial information for each segment of the business which follows Santander UK’s normal accounting policies and principles, including measures of operating results, assets and liabilities.

As described in Note 2 to the Consolidated Financial Statements, in early 2013, once it was determined to sell the co-brand credit cards business, the business was managed and reported for segmental reporting purposes as part of Corporate Centre, rather than Retail Banking as in 2012. In addition, the co-brand credit cards business qualified as a discontinued operation, as set out in Note 12 to the Consolidated Financial Statements. The segmental analyses for prior years have been adjusted to reflect these changes.

| Santander UK plc Annual Report 2013 | 27 |

Table of Contents

Detailed Business Review

Group and Divisional Results continued

PROFIT BEFORE TAX BY SEGMENT

| 31 December 2013 |

Retail Banking £m |

Commercial Banking £m |

Markets £m |

Corporate Centre £m |

Total £m |

|||||||||||||||

| Net interest income/(expense) |

3,022 | 415 | 2 | (476 | ) | 2,963 | ||||||||||||||

| Non-interest income |

651 | 290 | 106 | 19 | 1,066 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total operating income |

3,673 | 705 | 108 | (457 | ) | 4,029 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Administration expenses |

(1,520 | ) | (301 | ) | (98 | ) | (28 | ) | (1,947 | ) | ||||||||||

| Depreciation, amortisation and impairment |

(196 | ) | (17 | ) | (2 | ) | (33 | ) | (248 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total operating expenses excluding impairment losses, provisions and charges |

(1,716 | ) | (318 | ) | (100 | ) | (61 | ) | (2,195 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Impairment losses on loans and advances |

(359 | ) | (108 | ) | — | (8 | ) | (475 | ) | |||||||||||

| Provisions for other liabilities and charges |

— | (6 | ) | (4 | ) | (210 | ) | (220 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total operating impairment losses, provisions and charges |

(359 | ) | (114 | ) | (4 | ) | (218 | ) | (695 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Profit/(loss) on continuing operations before tax |

1,598 | 273 | 4 | (736 | ) | 1,139 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Loss from discontinued operations after tax |

— | — | — | (8 | ) | (8 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| 31 December 2012 |

Retail Banking(1) £m |

Commercial Banking £m |

Markets £m |

Corporate Centre(1) £m |

Total £m |

|||||||||||||||

| Net interest income/(expense) |

2,674 | 327 | (6 | ) | (261 | ) | 2,734 | |||||||||||||

| Non-interest income |

683 | 381 | 184 | 701 | 1,949 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total operating income |

3,357 | 708 | 178 | 440 | 4,683 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Administration expenses |

(1,501 | ) | (255 | ) | (98 | ) | (19 | ) | (1,873 | ) | ||||||||||

| Depreciation, amortisation and impairment |

(181 | ) | (15 | ) | (2 | ) | (43 | ) | (241 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total operating expenses excluding impairment losses, provisions and charges |

(1,682 | ) | (270 | ) | (100 | ) | (62 | ) | (2,114 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Impairment losses on loans and advances |

(419 | ) | (109 | ) | — | (460 | ) | (988 | ) | |||||||||||

| Provisions for other liabilities and charges |

— | (2 | ) | (2 | ) | (430 | ) | (434 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total operating impairment losses, provisions and charges |

(419 | ) | (111 | ) | (2 | ) | (890 | ) | (1,422 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Profit/(loss) on continuing operations before tax |

1,256 | 327 | 76 | (512 | ) | 1,147 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Profit from discontinued operations after tax |

— | — | — | 62 | 62 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (1) | Adjusted to reflect the presentation of discontinued operations, as set out in Note 12 to the Consolidated Financial Statements. |

| 31 December 2011 |

Retail Banking(1) £m |

Commercial Banking £m |

Markets £m |

Corporate Centre(1) £m |

Total £m |

|||||||||||||||

| Net interest income/(expense) |

2,995 | 296 | (3 | ) | 345 | 3,633 | ||||||||||||||

| Non-interest income |

724 | 358 | 162 | 59 | 1,303 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total operating income |

3,719 | 654 | 159 | 404 | 4,936 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Administration expenses |

(1,496 | ) | (212 | ) | (109 | ) | (59 | ) | (1,876 | ) | ||||||||||

| Depreciation, amortisation and impairment |

(199 | ) | (11 | ) | (2 | ) | (226 | ) | (438 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total operating expenses excluding impairment losses, provisions and charges |

(1,695 | ) | (223 | ) | (111 | ) | (285 | ) | (2,314 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Impairment losses on loans and advances |

(281 | ) | (120 | ) | — | (100 | ) | (501 | ) | |||||||||||

| Provisions for other liabilities and charges |

— | (3 | ) | (3 | ) | (901 | ) | (907 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total operating impairment losses, provisions and charges |

(281 | ) | (123 | ) | (3 | ) | (1,001 | ) | (1,408 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Profit/(loss) on continuing operations before tax |

1,743 | 308 | 45 | (882 | ) | 1,214 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Profit from discontinued operations after tax |

— | — | — | 34 | 34 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (1) | Adjusted to reflect the presentation of discontinued operations, as set out in Note 12 to the Consolidated Financial Statements. |

| 28 | Santander UK plc Annual Report 2013 |

Table of Contents

Detailed Business Review

Group and Divisional Results continued

RETAIL BANKING

Retail Banking offers a wide range of products and financial services to customers through a network of branches and ATMs, as well as through telephony, e-commerce and intermediary channels. It principally serves personal banking customers, but also services small businesses with a turnover of less than £250,000 per annum. Retail Banking products include residential mortgage loans, savings and current accounts, credit cards and personal loans as well as a range of insurance policies.

Summarised income statement

| Year ended 31 December 2013 £m |

Year ended 31 December 2012(1) £m |

Year ended 31 December 2011(1) £m |

||||||||||

| Net interest income |

3,022 | 2,674 | 2,995 | |||||||||

| Non-interest income |

651 | 683 | 724 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total operating income |

3,673 | 3,357 | 3,719 | |||||||||

|

|

|

|

|

|

|

|||||||

| Administration expenses |

(1,520 | ) | (1,501 | ) | (1,496 | ) | ||||||

| Depreciation, amortisation and impairment |

(196 | ) | (181 | ) | (199 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Total operating expenses excluding impairment losses, provisions and charges |

(1,716 | ) | (1,682 | ) | (1,695 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Impairment losses on loans and advances |

(359 | ) | (419 | ) | (281 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Total operating impairment losses, provisions and charges |

(359 | ) | (419 | ) | (281 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Profit on continuing operations before tax |

1,598 | 1,256 | 1,743 | |||||||||

|

|

|

|

|

|

|

|||||||

| (1) | Adjusted to reflect the presentation of discontinued operations, as set out in Note 12 to the Consolidated Financial Statements. |

2013 compared to 2012

Profit on continuing operations before tax increased by £342m to £1,598m in 2013 (2012: £1,256m). By income statement line, the movements were:

| • | Net interest income increased by £348m to £3,022m in 2013 (2012: £2,674m). The key drivers of the increase were improved mortgage stock interest margins, as a greater proportion of customers remained on the Standard Variable Rate (‘SVR’), combined with reduced retail funding costs and better stock margins. The increase was also driven by the benefit from the lower cost of deposit acquisition in 2013. The success of the 1|2|3 World enabled us to attract less price sensitive deposits from our growing primary banking customer base and reduce the pricing of our less relationship-focused savings products. |

These increases were partly offset by the impact of the managed reduction in selected higher risk elements of the residential mortgage portfolio.

| • | Non-interest income decreased by £32m to £651m in 2013 (2012: £683m). The decrease reflected lower investment and protection fees as we operated under new regulatory rules, which limited new business volumes. This was partially offset by a change to the pricing structure for current accounts made in 2012. |

| • | Administration expenses increased by £19m to £1,520m in 2013 (2012: £1,501m). The increase was driven by ongoing investment in business growth focused on improving customer experience, partially offset by the consolidation of multi-branch locations. |

| • | Depreciation and amortisation increased by £15m to £196m in 2013 (2012: £181m). The increase reflected continued investment in systems in the branch network and digital channels. An ongoing programme to transform the branch network continued with optimisation of the geographic footprint of the network, spend on refurbishment and further investment in our channel capability and self-service terminals to increase productivity and improve efficiency. |

| • | Impairment losses on loans and advances decreased by £60m to £359m in 2013 (2012: £419m). This was largely due to the high quality of the book and the supportive economic environment for UK households, with low interest rates and decreasing unemployment. There was a reduction in impairment loss charges on secured portfolios with lower impacts from regulatory-driven policy and reporting changes, combined with improving underlying performance, and on unsecured portfolios due to better credit quality business. |

2012 compared to 2011

Profit on continuing operations before tax decreased by £487m to £1,256m in 2012 (2011: £1,743m). By income statement line, the movements were:

| • | Net interest income decreased by £321m to £2,674m in 2012 (2011: £2,995m). The key driver of the decrease in net interest income was the higher cost of funding (both retail deposits and wholesale term funding). In addition, lower mortgage new business volumes, as we selectively reduced parts of our mortgage book, negatively impacted net interest income, as did interest on overdraft accounts being lower with interest charges being replaced by daily fees, which are included within non-interest income. |