UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

(Rule 14a-101)

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(A) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement

|

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

| ☒ |

Definitive Proxy Statement

|

| ☐ |

Definitive Additional Materials

|

| ☐ |

Soliciting Material Pursuant to or Rule 14a-12

|

Farmers & Merchants Bancorp

(Name of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check all boxes that apply):

| ☒ |

No fee required.

|

| ☐ |

Fee paid previously with preliminary materials.

|

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

March 31, 2023

Dear Fellow Shareholder:

I invite you to attend our Annual Meeting (the “Annual Meeting” or “Meeting”) of Shareholders of Farmers & Merchants Bancorp (the “Company”). The Meeting will be held at 4:00 P.M.,

Pacific Standard Time, on May 15, 2023 by means of remote communication (commonly referred to as a “virtual” meeting). You will find information in the enclosed proxy statement on how to

attend the Meeting. The Board of Directors has determined that the 2023 Annual Meeting will once again be held over the web in a virtual meeting format only. You will not be able to attend the Annual Meeting in person.

Your vote is important, regardless of the number of shares you hold. We will begin mailing proxy statements and the Company’s 2022 annual report on or about April 7, 2023.

Even if you do not plan to attend the Annual Meeting, please read the enclosed proxy statement and vote your shares as promptly as possible by mail, telephone or the internet. Voting promptly will

save the Company additional expense in soliciting proxies and will ensure that your shares are represented at the Meeting. Also, please retain a copy of your proxy card, since you will need information on the proxy card to access

the virtual meeting.

Our Board and management are committed to the success of the Company. We endeavor to support all stakeholders, including our shareholders, clients, associates, and the communities we serve. Thank you

for your continued confidence and support.

|

Sincerely,

|

|

| Kent A. Steinwert |

| Chairman, President, and Chief Executive Officer |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

March 31, 2023

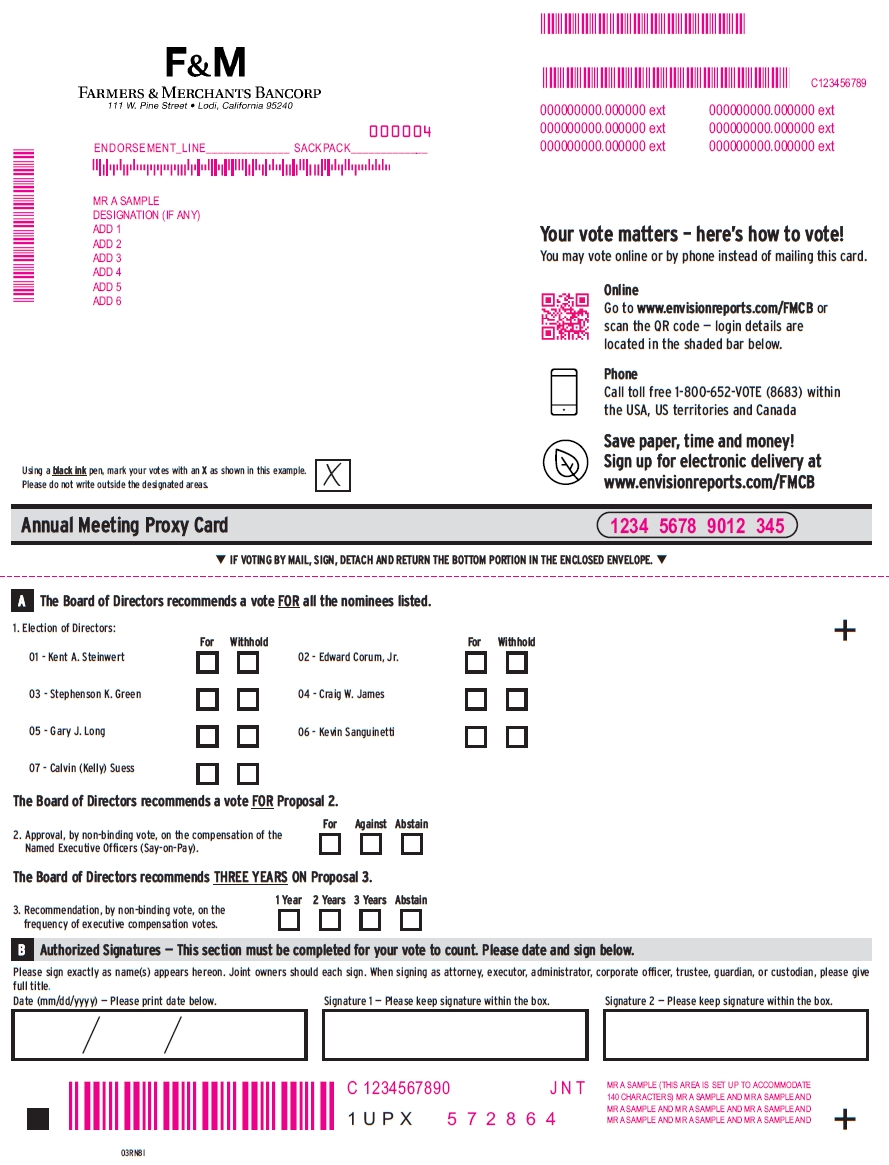

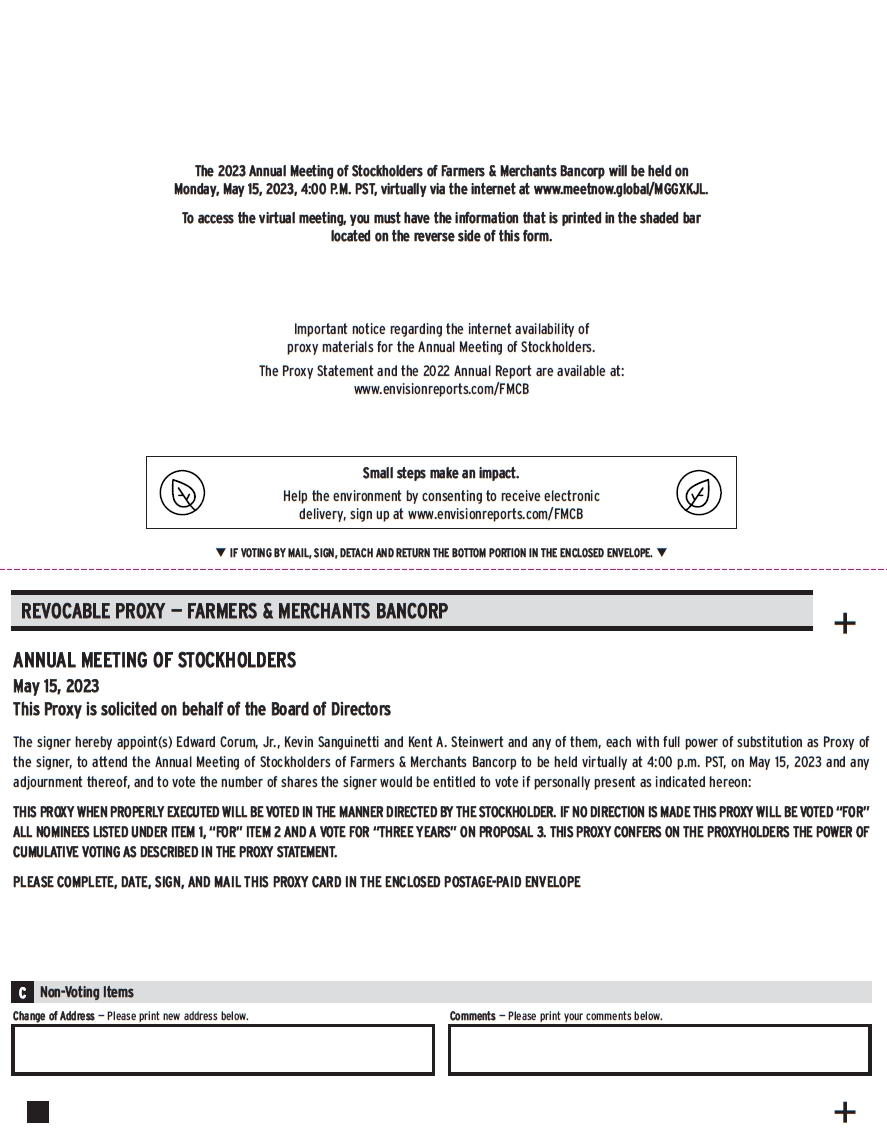

NOTICE is hereby given that the 2023 Annual Meeting of Shareholders of Farmers & Merchants Bancorp will be held:

|

DATE

|

May 15, 2023

|

|

TIME

|

4:00 p.m. Pacific Standard Time

|

|

LOCATION (VIRTUAL)

|

This year’s Annual Meeting will be conducted solely online via live webcast. There is no physical location for the Annual Meeting. You will be able to attend the Annual Meeting online,

vote your shares by mail, telephone, or the internet. You will be able to submit your questions during the meeting by logging into www.meetnow.global/MGGXKJL. Additionally, you will need to enter the 15 digit control number that is

printed in the shaded bar on the front of your proxy card.

|

ITEMS OF BUSINESS

|

No.

|

Proposal

|

|

1.

|

Elect seven (7) director nominees named in this proxy statement each for a term of one year.

|

|

2.

|

Hold an advisory (non-binding) vote to approve the compensation paid to the Company’s named executive officers (commonly referred to as “Say-on-Pay”).

|

|

3.

|

Hold an advisory (non-binding) vote on the frequency of future advisory “Say-on-Pay” votes.

|

|

RECORD DATE

|

Holders of record of the Company’s voting common stock at the close of business on March 21, 2023 (the “Record Date”) will be entitled to vote at the Meeting or any adjournment or

postponement of the Meeting.

|

|

ANNUAL REPORT

|

The Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, as filed with the Securities and Exchange Commission (“SEC”) on March 15, 2023 (the “Annual Report”), accompanies this

proxy statement.

|

|

AVAILABLE MATERIALS

|

The Company’s proxy statement and the Annual Report are also available on the internet at www.fmbonline.com.

|

|

PROXY VOTING

|

It is important that your shares be represented and voted at the Meeting. You can vote your shares by completing the enclosed proxy card and returning it by mail. Registered shareholders, that is,

shareholders who hold stock in their own names, can also vote their shares by telephone or via the internet. If your shares are held through a bank, broker or other nominee, check your proxy card to see if you can also vote by telephone or

the internet. Regardless of the number of shares you own, your vote is very important. Please vote today.

|

| MEETING ADMISSION |

If you are a registered shareholder (i.e., you hold your shares through our transfer agent, Computershare), you do not need to register to attend the virtual Annual Meeting. Please follow the instructions on

the notice or on the proxy card that you received. If you hold your shares through an intermediary, such as a bank or broker, you must register in advance to attend the virtual Annual Meeting.

|

|

To register to attend the virtual Annual Meeting you must submit proof of your proxy power (legal proxy) reflecting your Farmers & Merchants Bancorp holdings along with your name and email address to

Computershare. Requests for registration must be labeled as “Legal Proxy” and be received no later than 5:00 p.m., Eastern Time, on May 10, 2023. You will receive a confirmation of your registration by email after we receive your

registration materials.

|

|

|

Requests for registration should be directed to the following:

|

|

|

Email:

|

|

|

Forward the email from your broker, or attach an image of your legal proxy to legalproxy@computershare.com.

|

|

|

Mail:

|

|

|

Computershare

|

|

|

Farmers & Merchants Bancorp Legal Proxy

|

|

|

P.O. Box 43001

|

|

|

Providence, RI 02940-3001

|

|

|

|

|

|

The virtual meeting platform is fully supported across browsers (Internet Explorer, Firefox, Chrome and Safari) and devices (desktops, laptops, tablets and cell phones) running the most up-to-date version of

applicable software and plug-ins. Participants should ensure that they have a strong Wi-Fi connection wherever they intend to participate in the meeting. We encourage you to access the meeting prior to the start time. A link on the meeting

page will provide further assistance should you need it.

|

| Please complete, sign and date, as promptly as possible, the enclosed proxy and immediately return it in the envelope provided for your use. This is important whether or not you plan to join the virtual annual meeting. The giving of such proxy will not affect your right to revoke such proxy or to vote online, should you join the virtual annual meeting. Please retain a copy of your proxy card since you will need information on the card to access the virtual meeting. |

March 31, 2023

|

BY ORDER OF THE BOARD OF DIRECTORS

|

|

|

/s/ Stephen W. Haley

|

|

|

Stephen W. Haley

|

|

|

Corporate Secretary

|

|

PROXY STATEMENT FOR THE 2023 ANNUAL MEETING OF STOCKHOLDERS TO BE

HELD ON MAY 15, 2023

General Information

The Board of Directors (the “Board of Directors” or “Board”) is providing you with these proxy materials in connection with its solicitation of proxies to be voted at our 2023 Annual Meeting of

Shareholders (the “Annual Meeting”) to be held virtually on May 15, 2023, at 4:00 p.m., Pacific Standard Time. In this Proxy Statement, Farmers & Merchants Bancorp may also be referred to as “we,” “our” or “the Company.” The Notice of Annual

Meeting, Proxy Statement, and a proxy or voting instruction card (the “Proxy Card”), together with our Annual Report on Form 10-K for the fiscal year ended December 31, 2022 (the “2022 Annual Report”), are being mailed starting on or about April 7,

2023.

Items of Business

The Board is asking you to vote on the following items at the Annual Meeting:

|

No.

|

Proposal

|

|

1.

|

Elect seven (7) director nominees named in this proxy statement each for a term of one year.

|

|

2.

|

Approve the compensation paid to the Company’s named executive officers (“Say-on-Pay”).

|

|

3.

|

Approve the frequency of future advisory “Say-on-Pay” votes.

|

Who Can Vote

Only shareholders of record at the close of business on March 21, 2023 (the “Record Date”), will be entitled to vote online at the virtual meeting or by proxy. On the Record Date, there were 763,140

shares of common stock outstanding and entitled to vote. Holders of common stock of the Company are entitled to one vote for each share held. However, with respect to the election of Directors, each shareholder may be eligible to exercise

cumulative voting rights.

Notice and Access (Electronic Proxy)

Farmers & Merchants Bancorp offers electronic access in lieu of mail delivery of our Annual Report and Proxy Statement. Should you want to discontinue receiving a paper copy of our Annual Report

and Proxy Statement, please sign up at www.envisionreports.com/FMCB. You may rescind electronic access at any time.

If you make this election, shortly before each annual meeting you will receive a proxy card, along with voting instructions and the web address where you can access that year’s annual report and proxy

statement.

If you have any questions regarding electronic access, please call Stephen W. Haley, Corporate Secretary, at (209) 367-2411.

- 1 -

Voting of Proxies

The shares represented by all properly executed proxies received in time for the virtual meeting will be voted in accordance with the shareholders’ choices specified therein.

Voting Requirements

In the election of Directors, the seven (7) director nominees receiving the most affirmative votes will be elected to the Board of Directors. Abstentions and broker non-votes will have no effect on

the election of Directors. For each matter other than the election of Directors, the affirmative vote of a majority of the shares represented at the Annual Meeting and entitled to vote on the matter shall be the act of the shareholders and,

therefore, abstentions as to a particular proposal will have the same effect as a vote against that proposal and broker non-votes will have no effect on the vote.

Number of Shares Required to be Present to Hold the Meeting

A majority of the shares entitled to vote represented either online during the virtual meeting or by properly executed proxies, will constitute a quorum at the virtual meeting. Abstentions and broker

“non-votes” are each included in the determination of the number of shares present and voting for purposes of determining the presence of a quorum. A broker “non-vote” occurs when a nominee holding shares for a beneficial owner does not have

discretionary voting power with respect to that item and has not received instructions from the beneficial owner.

If a quorum is not present at the scheduled time of the Meeting, the chair of the Meeting or the holders of a majority of the shares of voting common stock entitled to vote who are represented either

on-line during the virtual meeting or by proxy, may adjourn the Meeting to another date, place or time. The time and place of the adjourned Meeting will be announced at the time the adjournment is taken. An adjournment will have no effect on the

business that may be conducted at the Meeting.

How to Vote Your Shares

| 1. |

You can vote your proxy by mail. If you properly complete, sign and return the proxy card, it will be voted in accordance with your instructions.

|

| 2. |

You can vote your proxy by telephone. If you are a registered shareholder, that is, if your shares are held in your own name, you can vote by telephone

by following the instructions included on the proxy card. If you vote by telephone, you do not have to mail in your proxy card. If your shares are held through a bank, broker or other nominee, check your proxy card to see if you can vote by

telephone.

|

| 3. |

You can vote your proxy via the internet. If you are a registered shareholder, you can vote via the internet by following the instructions included on

the proxy card. If your shares are held through a bank, broker or other nominee, check your proxy card to see if you can also vote via the internet.

|

- 2 -

| 4. |

You can vote online during the Meeting. If you are a registered shareholder, you can vote online during the Meeting. If your shares are held through a

bank, broker or other nominee and you wish to vote your shares online during the Meeting, you will need to obtain a legal proxy from the holder of your shares indicating that you were the beneficial owner of those shares on the Record Date

for the Meeting, and that you are authorized to vote such shares. You are encouraged to vote by proxy prior to the Meeting even if you plan to attend the Meeting.

|

Revoking Your Proxy

If you are a registered shareholder, you can revoke your proxy and change your vote at any time before the polls close at the Annual Meeting by:

| ● |

submitting another proxy with a later date;

|

| ● |

giving written notice of the revocation of your proxy to the Company’s Corporate Secretary prior to the Meeting; or

|

| ● |

voting during the Meeting. Your proxy will not be automatically revoked by your attendance at the Meeting; you must actually vote during the Meeting to revoke a prior proxy.

|

If your shares are held in street name, you should follow the instructions provided by your bank, broker or other holder of record to be able to participate in the Meeting.

Confidential Voting

We have a confidential voting policy to protect the privacy of our shareholders’ votes. Under this policy, ballots, proxy cards and voting instructions returned to banks, brokers and other nominees

are kept confidential. Only the proxy tabulator and the Inspector of Election have access to the ballots, proxy cards and voting instructions.

Inspector of Elections

The Board of Directors has appointed an officer of the Bank to act as Inspector of Election at the Annual Meeting and Computershare to tabulate the votes cast.

Director Nominees Unable to Stand for Election

If a Director nominee is unable to stand for election, the Board of Directors may either reduce the number of Directors to be elected or select a substitute Director nominee. If a substitute Director

nominee is selected, the persons named in the proxy will vote your shares for the substitute Director nominee unless you have withheld authority to vote for the Director nominee replaced.

Voting Results of the Meeting

We will announce preliminary voting results at the Annual Meeting and subsequently publish the results of the votes, including the name of each Director elected at the meeting, as well

as a brief description of each matter voted upon, in a Current Report on Form 8-K to be filed with the SEC within four business days after the date of the Annual Meeting (on or before May 19, 2023). You may view this Current Report on Form 8-K,

when available, on the Internet through the SEC’s website at www.sec.gov or through our website at www.fmbonline.com.

- 3 -

Multiple Proxy Cards

If you receive multiple Proxy Cards, your shares are probably registered differently or are in more than one account. Vote all Proxy Cards received to ensure that all your shares are voted. Unless you

need multiple accounts for specific purposes, we recommend that you consolidate as many of your accounts as possible under the same name and address. If the shares are registered in your name, contact our transfer agent, Computershare,

(800)736-3001; otherwise, contact your bank, broker or other nominee.

Board of Directors Voting Recommendations

The voting recommendations from the Board of Directors are as follows:

|

No.

|

Proposal

|

Board Recommendation

|

|

1.

|

Elect seven (7) director nominees named in this proxy statement each for a term of one year.

|

FOR

|

|

2.

|

Approve the compensation paid to the Company’s named executive officers.

|

FOR

|

|

3.

|

Approve the frequency of future advisory “Say-on-Pay” votes.

|

Three Years

|

ANNUAL MEETING BUSINESS MATTERS

PROPOSAL NO. 1—ELECTION OF DIRECTORS

The Board of Directors recommends a vote “FOR” each of the nominees listed below.

At this year’s virtual annual meeting, it will be proposed to elect seven (7) directors of the Company, each to hold office until the next annual meeting and until their successors shall be elected

and qualified. It is the intention of the proxy holders named in the enclosed proxy to vote such proxies (except those containing contrary instructions) for the seven (7) nominees named below.

The following table sets forth the names of each of the nominees for election as a Director, their age, their principal occupation for the past five years and the period during which they have served as a Director of the

Company (or the Bank).

|

Name

|

Age

|

Principal Occupation

|

Director

Since |

|

Kent A. Steinwert

|

70

|

Chairman, President & Chief Executive Officer

|

1998

|

|

Calvin (Kelly) Suess

|

87

|

Chairman of the Board of ShellPro

|

1990

|

|

Kevin Sanguinetti

|

65

|

Retired President, 1st American Title Company - Stockton

|

2001

|

|

Edward Corum, Jr.

|

71

|

Managing General Partner, Corum Real Estate

|

2003

|

|

Gary J. Long

|

70

|

Owner, Gary J. Long Jewelers

|

2014

|

|

Stephenson K. Green

|

77

|

Retired Banker and Business Consultant

|

2018

|

|

Craig W. James

|

63

|

Owner, Insurance Brokerage

|

2018

|

- 4 -

Kent A. Steinwert

Director since 1998

Chairman of the Board of Directors; Chief Executive Officer; Chairman of Nominating Committee; Member of Asset and Liability Committee and Loan Committee

Mr. Steinwert has served as a Director for 24 years, and has 48 years of business, agriculture, real estate and consumer banking experience.

Calvin (Kelly) Suess

Director since 1990

Chairman of the CRA Committee; Member of the Nominating Committee, Asset and Liability Committee, and Budget & Finance Committee

Mr. Suess has served as a Director for 32 years, lives and is actively involved in the Lodi market area, and provides agricultural production and processing expertise to the Board.

Kevin Sanguinetti

Director since 2001

Chairman of the Audit Committee; Member of the Budget & Finance Committee and Personnel Committee

Mr. Sanguinetti has served as a Director for 21 years, is actively involved in the Stockton market area, and provides real estate and financial expertise to the Board.

Edward Corum, Jr.

Director since 2003

Chairman of the Personnel Committee; Member of the Nominating Committee, Audit Committee, and Loan Committee

Mr. Corum has served as a Director for 19 years, lives and is actively involved in the Sacramento market area, and provides real estate and financial expertise to the Board.

Gary J. Long

Director since 2014

Member of the Nominating Committee, Asset and Liability Committee, Budget & Finance Committee, and CRA Committee

Mr. Long has served as a Director for 8 years, lives and is actively involved in the Stockton market area, and provides small business expertise to the Board.

Stephenson K. Green

Director since 2018

Member of the Audit Committee, CRA Committee, and Personnel Committee

Mr. Green has served as a Director for 5 years. Prior to his retirement in 2012, Mr. Green worked for 40 years in the commercial banking industry in California. He lives and is actively involved in

the Sacramento market area, and provides business banking and credit management expertise to the Board.

Craig W. James

Director since 2018

Member of the ALCO Committee and CRA Committee

Mr. James has served as a Director of the Bank or the Company for 5 years. Pursuant to the Company’s acquisition agreement with Bank of Rio Vista, the Bank added one former Bank of Rio Vista Director

to the Bank’s Board of Directors, who was not a Company Director. During 2022, upon the death of Former Director Terrance Young, Mr. James became a Director of the Company, as well as the Bank. He lives and is actively involved in the Lodi market

area, and provides agriculture and small business expertise to the Board.

- 5 -

All nominees are considered to be “independent” as such term is defined by Nasdaq’s current listing rules with the exception of Mr. Steinwert who is currently an employee of the Company. Mr.

Steinwert does not receive additional compensation for his participation as Chairman of the Board, Board Member, or Board Committee Member. Each of the nominees has been selected by the Nominating Committee.

None of the Directors were selected pursuant to arrangements or understandings other than with the Directors and shareholders of the Company acting within their capacity as such. There are no family

relationships among the Directors and executive officers, and none of the Directors serves as a Director of any company which has a class of securities registered under, or subject to periodic reporting requirements of, the Securities Exchange Act

of 1934, as amended, or any company registered as an investment company under the Investment Company Act of 1940.

The Nominating Committee of the Board of Directors follows the Bank’s policy regarding diversity in identifying new Director candidates. The Committee looks to establish diversity on the Board through

a number of demographics, experiences, skills and viewpoints, all with a view to identifying candidates that can assist the Board with its decision making. The Committee believes that the current Board of Directors reflects diversity on a number of

these factors.

The Board does not anticipate that any of the nominees will be unable to serve as a Director of the Company, but if that should occur before the meeting, the Board of Directors reserve the right to

substitute as nominee another person of their choice in the place and stead of any nominee unable so to serve. Proxy holders would vote to approve the election of such substitute nominee. The proxy holders reserve the right to cumulate votes for

the election of Directors and cast all of such votes for any one or more of the nominees, to the exclusion of the others, and in such order of preference as the proxy holders may determine in their discretion, based upon the recommendation of the

Board of Directors.

PROPOSAL NO. 2—STOCKHOLDER VOTE ON EXECUTIVE COMPENSATION

The Board of Directors recommends a vote “FOR” Proposal #2.

In accordance with the requirements of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, the Company is asking stockholders to provide advisory approval of executive compensation

as described in the “Executive Compensation Discussion and Analysis” and “Executive Compensation” sections of this proxy statement. While this vote is advisory, and not binding on the Company, it will provide information to the Board of Directors

regarding stockholder views about the Company’s executive compensation practices, which the Personnel Committee will then consider in future years.

When this vote was last taken in the 2020 proxy statement, the results were that 86.6% of the shares voted approved the Company’s current executive compensation.

The Company believes that the information provided within the Executive Compensation Discussion and Analysis section of this proxy statement demonstrates the reasons why the Company’s compensation

programs are appropriate for achieving the objective of the Company’s compensation strategy: “To establish a competitive compensation package that rewards each officer based on their contribution and performance, thereby serving to attract and

retain talented individuals who can implement the Company’s strategic plan and maximize long-term stockholder value.” Since the current senior management team began arriving at the Company in 1997, the Company has:

| 1. |

Provided shareholders with a total annualized return (stock price appreciation plus dividends) of 13.44% per year. This compares very favorably to the return on both the S&P (8.52%) and Dow (8.95%)

stock indices over the same period. Additionally, over the past three years EPS has increased from $74.03 to $96.55, or 30.4%.

|

| 2. |

Received the prestigious distinction of being named a “Dividend King” as one of only 43 publicly traded companies in the United States to have paid dividends for 87 consecutive years or more, and to have

increased them for 58 consecutive years or more.

|

| 3. |

Maintained a “5-Star, Superior Bank” rating from Bauer Financial for 31 consecutive years, longer than any other commercial bank in California.

|

- 6 -

This record of having consistently been one of the highest performing bank holding companies in California over the past 26 years, reflects what the Board considers well balanced compensation

practices that caused Senior Management to carefully consider the risks it assumes in the context of long-term financial performance. The Board believes that its approach to “pay-for-performance” has achieved, and will continue to achieve, the

desired results. Accordingly, the Board of Directors unanimously recommends that stockholders approve the following advisory resolution:

RESOLVED, that the stockholders of Farmers & Merchants Bancorp approve, on an advisory basis, the compensation of the individuals identified in the Summary Compensation Table, as disclosed in this

proxy statement pursuant to the compensation disclosure rules of the SEC (which disclosure includes the Executive Compensation Discussion and Analysis and Executive Compensation sections, the compensation tables and the accompanying footnotes and

narratives within the Executive Compensation Discussion and Analysis section of this proxy statement).

PROPOSAL NO. 3—STOCKHOLDER VOTE ON FREQUENCY OF STOCKHOLDER VOTES ON EXECUTIVE COMPENSATION

The Board of Directors recommends a vote “FOR” Three Years on Proposal #3.

The Company is also seeking stockholder input with regard to the frequency of future stockholder advisory votes on our executive compensation programs. Consistent with the requirements of the

Dodd-Frank Act, stockholders are provided the option of selecting a frequency of one, two or three years, or they may abstain from the vote.

When this vote was last taken in the 2017 proxy statement, the results were that 71.4% of the stockholders voting approved three years as the frequency of future stockholder advisory votes. For the

reasons described below, the Board of Directors recommends that our stockholders vote for a frequency of three years.

The Company’s executive compensation program is designed to attract and retain talented individuals who can implement the Company’s strategic plan and maximize long-term stockholder value. As

described in the Executive Compensation Discussion and Analysis section of this proxy statement, one of the core principles of the executive compensation program is that many parts are structured such that the benefits cannot be withdrawn by the

participant until they retire from the Company. This results in a significant portion of each executive’s compensation remaining at risk during their employment, so as to encourage adopting a long-term perspective and conservative risk management

practices. This ensures management’s interests are aligned with the stockholders’ interests to maximize long-term stockholder value.

- 7 -

Accordingly, the Company recommends a stockholder vote every three years which would allow executive compensation programs to be evaluated in relation to longer-term performance.

Additionally, a vote every three years will provide:

| • |

Board members sufficient time to thoughtfully consider the results of the advisory vote and to implement any desired changes to the Company’s executive compensation program; and

|

| • |

Stockholders sufficient time to evaluate the effectiveness of our short- and long-term compensation strategies and the related business outcomes of the Company.

|

The Board of Directors unanimously recommends that stockholders select “Three Years” when voting on the frequency of advisory votes on executive compensation.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

To the knowledge of the Company, as of the record date, no person or entity was the beneficial owner of more than five percent (5%) of the outstanding shares of the Company’s common stock, except as

set forth in the following tables.

For the purpose of this disclosure and the disclosure of ownership shares by management, shares are considered to be “beneficially” owned if the person has or shares the power to vote or direct the

voting of the shares, the power to dispose of or direct the disposition of the shares, or the right to acquire beneficial ownership (as so defined) within 60 days of the record date.

|

Title of Class

|

Name and Address of Beneficial Owner

|

Amount and

Nature of

Beneficial

Ownership

|

Percent of

Class

|

|

Common stock

|

DAC/JAC Trust and Cortopassi Partners

11292 N. Alpine Road Stockton, CA 95212 |

51,755

|

6.78%

|

|

Common stock

|

Sheila M. Wishek (1)

111 West Pine Street Lodi, CA, 95240 |

40,350

|

5.29%

|

| (1) |

Mail should be sent to this individual at the Company’s address marked “c/o Shareholders Relations.”

|

- 8 -

The following table shows, as of the record date, the number of common shares and the percentage of the total shares of common stock of the Company beneficially owned by each of

the current Directors, by each of the nominees for election to the office of Director, by the Named Executive Officers and by all Directors and Named Executive Officers of the Company and of the Bank as a group. Unless otherwise indicated, all shares of common stock held by each individual named in the table below are held by the trustee (the “Trustee”) of the Farmers & Merchants Bank of Central California and Farmers & Merchants

Bancorp Executive Retirement Plan Trust and the Senior Management Retention Plan Trust, which held as of the record date a total of 64,092 shares (8.40% of the outstanding shares) attributable to the directors and officers, some of which are

attributable below:

|

Name and Address of Beneficial Owner (1)

|

Amount and

Nature of

Beneficial

Ownership (2)

|

Percent of

Class

|

|

Jay J. Colombini (3)

|

5,373

|

*

|

|

Edward Corum, Jr. (4)

|

2,236

|

*

|

|

Stephenson K. Green (5)

|

743

|

*

|

|

Stephen W. Haley (6)

|

480

|

*

|

|

Craig W. James (7)

|

422

|

*

|

|

Kyle Koelbel (8)

|

42

|

*

|

|

Gary J. Long (9)

|

1,899

|

*

|

|

Ryan J. Misasi (10)

|

2,459

|

*

|

|

Kevin Sanguinetti (11)

|

7,814

|

*

|

|

Deborah E. Skinner (12)

|

4,749

|

*

|

|

Kent A. Steinwert (13)

|

31,549

|

4.13%

|

|

Calvin (Kelly) Suess (14)

|

3,694

|

*

|

|

David M. Zitterow (15)

|

973

|

*

|

|

All Directors, Nominees and Named Executive Officers as a group (13 persons)

|

62,433

|

8.18%

|

* Indicates less than 1.00%.

| (1) |

Mail should be sent to this individual at the Company’s address marked “c/o Shareholder Relations”.

|

| (2) |

Shares held by the Trustee are voted as directed by the Bank. All shares are beneficially owned, directly and indirectly, together with spouses. Unless otherwise indicated, holders of shares which are not held by the Trustee, share

voting power with their spouses. None of the shares are pledged.

|

| (3) |

3,285 shares held by Trustee.

|

| (4) |

1,631 shares held by Trustee.

|

| (5) |

558 shares held by Trustee.

|

| (6) |

480 shares held by Trustee.

|

| (7) |

389 shares held by Trustee.

|

| (8) |

42 shares held by Trustee.

|

| (9) |

1,036 shares held by Trustee.

|

| (10) |

2,349 shares held by Trustee.

|

| (11) |

1,397 shares held by Trustee.

|

| (12) |

4,637 shares held by Trustee.

|

| (13) |

26,329 shares held by Trustee.

|

| (14) |

1,594 shares held by Trustee.

|

| (15) |

973 shares held by Trustee.

|

- 9 -

CORPORATE GOVERNANCE

Code of Ethics

The Company has adopted a Code of Conduct. A copy of the Code of Conduct is posted on the Company’s website at http://www.fmbonline.com

. The Company intends to disclose promptly on its website any amendment to, or waiver from any provision of, the Code of Conduct applicable to Executive Officers and Directors.

Director Independence

The Company follows Rule 5605(a)(2) of Nasdaq’s current listing rules to determine whether a Director is independent. With the exception of Mr. Steinwert who is currently an employee of the Company,

all nominees are considered to be “independent.”

Board of Directors Meetings

The Company’s principal asset is its wholly-owned subsidiary, Farmers & Merchants Bank of Central California (the “Bank”). The Directors of the Company are also Directors of the Bank.

During the calendar year ended December 31, 2022, the Board of Directors of the Company and the Board of Directors of the Bank met twelve (12) times. In addition, as required, the Board holds

telephonic meetings to address issues between monthly meetings. Each incumbent Director attended more than 75% of the meetings of the Board of Directors and the committees to which they were named. The Company expects Directors to attend the

annual meeting of shareholders. All Directors attended the virtual annual meeting of shareholders in 2022.

Roles and Responsibilities of the Board of Directors

Leadership Structure

The Board of Directors has determined that the Chairmanship should reside with the Director who is most familiar with the banking industry, and who is the most capable of setting strategic direction

and integrating that direction with the Company’s day-to-day business development and risk management activities. Accordingly, since 2010 Mr. Steinwert has been unanimously elected to the position of Chairman in addition to his role since 1997 as

President and Chief Executive Officer of the Company.

The Board believes that the combination of these positions does not compromise the important “check-and-balance” role that independent Directors play in the oversight of the Company since Mr.

Steinwert is not a member of the Audit Committee or the Personnel Committee of the Board, and therefore key Board decisions and oversight regarding: (1) accounting, financial reporting, and overall risk management; and (2) executive compensation;

are made only by “independent” Directors. Furthermore, Mr. Steinwert receives no additional compensation for his role as Chairman, Board Member or Board Committee member, thus representing a cost savings to the Company.

- 10 -

As of this date, the Board of Directors has not formally designated a lead independent Director.

Role in Enterprise Risk Management

The Board of Directors is responsible for monitoring all aspects of the Company’s enterprise risk. Their involvement in enterprise risk management centers on the following key roles and

responsibilities:

| 1. |

The Board develops and approves the strategic plan and financial budget, and receives monthly reporting of financial and non-financial performance relative to plan.

|

| 2. |

The Asset and Liability Committee is a joint committee of management and the Board. As a result, “independent” Directors are actively involved in interest rate, liquidity and investment risk management

processes.

|

| 3. |

The Loan Committee is a joint committee of management and the Board. The Committee meets weekly to review all new and renewed loans over $2 million and evaluate overall portfolio performance and risk. As a

result, “independent” Directors are actively involved in the credit risk management process.

|

| 4. |

The Audit Committee is responsible for providing oversight of all internal controls, reviewing the reports of audits and examinations of the Bank and the Company made by independent auditors, internal

auditors, credit examiners, and regulatory agencies, and approving all SEC and other regulatory agency reports before they are filed.

|

| 5. |

The Personnel Committee is responsible for all performance evaluation and compensation decisions for the executive management team.

|

| 6. |

The Budget and Finance Committee reviews and examines financial results on a quarterly basis.

|

Committees of the Board

Nominating Committee

The Nominating Committee of the Company and the Bank identifies candidates to serve as Directors of the Bank and the Company in the event of future Board openings. The Committee’s

charter is available for review on the Company’s website at http://www.fmbonline.com. The Committee is comprised of the following voting members: Messrs. Steinwert (Chairman), Long, Corum

and Suess. The Committee met two (2) times in 2022. Messrs. Corum, Long and Suess have been determined by the Board of Directors to be “independent” as such term is defined by Rule 5605(a)(2) of Nasdaq’s current listing rules.

- 11 -

Audit Committee

The Audit Committee of the Company and the Bank is responsible for the ongoing adequacy of the internal control environment, and oversees the activities of the internal and independent

registered public accounting firm of the Company and the Bank with the aim of ensuring compliance with applicable laws. The Committee selects the independent registered public accounting firm. The Committee’s charter is available for review on

the Company’s website at http://www.fmbonline.com. The Audit Committee reports to the Boards of Directors of the Bank and the Company, as appropriate. The Audit Committee reviews the

reports of audits and examinations of the Bank and the Company made by the independent registered public accounting firm, internal auditors, credit examiners, and regulatory agencies and reports the results to the Boards of Directors of the Bank

and the Company. The Committee met twelve (12) times in 2022 and is comprised of the following voting members: Messrs. Sanguinetti (Chairman), Corum and Green. Each of the Directors serving on the Audit Committee has been determined by the Board

of Directors to be “independent” as such term is defined by Rule 5605(a)(2) of Nasdaq’s current listing rules and in the SEC rules relating to audit committees. Mr. Sanguinetti has been determined by the Board of Directors to be a “financial

expert” for purposes of applicable regulations.

Personnel Committee

The Personnel Committee of the Company and the Bank: (1) reviews the Company’s overall compensation strategies and practices; (2) reviews the employment contracts of all executive

officers; (3) annually establishes executive compensation levels and performance evaluation measures for the Chief Executive Officer and Directors; and (4) reviews the executive compensation levels and performance evaluation measures for the

other executive officers of the Company. The Committee’s charter is available for review on the Company’s website at http://www.fmbonline.com.

The Company’s management: (1) provides information, analysis and recommendations for the Personnel Committee; and (2) manages the ongoing operations of the compensation program.

In fulfilling their duties, the Personnel Committee periodically evaluates information obtained from independent sources regarding financial institutions that we compete against for talent.

The Personnel Committee is comprised of the following voting members: Messrs. Corum (Chairman), Green and Sanguinetti. The Committee met eight (8) times in 2022. Each of the Directors serving on the

Personnel Committee has been determined by the Board of Directors to be “independent” as such term is defined by Rule 5605(a)(2) of Nasdaq’s current listing rules.

Asset and Liability Committee

The Asset and Liability Committee of the Bank is responsible for the formulation, revision and administration of the Bank’s policies relating to interest rate, liquidity and investment risk

management. The Asset and Liability Committee is a joint committee of management and Directors. The following Directors are voting members: Messrs. Suess, James, Long and Steinwert. The Committee met four (4) times in 2022.

Loan Committee

The Loan Committee of the Bank is responsible for the formulation, revision and administration of the Bank’s policy relating to credit and loan risk management. The Loan Committee meets weekly and is

responsible for approving all new and renewed loans between $2 million and $15 million (over $15 million requires full Board approval) and reviewing all loans over $500,000. The Loan Committee is a joint committee of management and Directors. The

full Board reviews all loans greater than $5 million. The following Directors are voting members: Messrs. Corum and Steinwert. The Committee met fifty-two (52) times in 2022.

- 12 -

Budget and Finance Committee

The Budget and Finance Committee of the Company and the Bank reviews and examines Bank and Company expenses on a quarterly basis comparing the results with: (1) the established annual budget, the

previous quarter and prior year; and (2) selected peer banks and the community banking industry as a whole; and proposes recommendations to management regarding improving financial performance. The Budget and Finance Committee is a joint committee

of management and Directors. The Committee met four (4) times in 2022 and is comprised of the following voting members: Messrs. Long, Suess, and Sanguinetti.

CRA (Community Reinvestment Act) Committee

The CRA Committee of the Company and the Bank monitors the Bank’s efforts and responsibilities to comply with the Community Reinvestment Act. The CRA Committee makes recommendations to the Board of

Directors to assure the Bank is meeting the credit, investment and service needs of the communities it serves. The Committee met twelve (12) times in 2022 and is comprised of the following voting members: Messrs. Suess (Chairman), Green, James, and

Long.

Certain Relationships and Related Person Transactions

Certain Directors and Named Executive Officers of the Company, and the Bank, and corporations and other organizations, associated with them and members of their immediate families were customers of

and engaged in banking transactions, including loans, with the Bank in the ordinary course of business in 2022. Such loans were made on substantially the same terms, including interest rates and collateral, as those prevailing at the time for

comparable loans with borrowers not related to the Company or Bank. These loans did not involve more than the normal risk of collectability or have other unfavorable features. All Director and Named Executive Officer loans must be approved by the

Board of Directors.

No family relationships exist among any of our Directors or executive officers. There is a family relationship between one of our executive officers and three of our employees. These employees

participate in compensation and incentive plans or arrangements on the same basis as other employees with similar positions.

The following individuals are related to our chief executive officer as indicated and have been employed by the Bank for a period of years in non-executive officer positions:

Mr. Jared Steinwert, Senior Vice President, Regional Wholesale Banking (son); Ms. Jehna Silva, Vice President, Commercial Relationship Manager (daughter); and Ms. Elizabeth Beigh, First Vice

President, Commercial Relationship Manager (sister). None of these individuals reports to the Chief Executive Officer, nor do they share a household with him. Their individual performance ratings and compensation are evaluated and approved by the

independent Directors comprising the Personnel Committee of the Board of Directors of the Bank, and are based on the recommendations of their respective managers in accordance with the Bank’s compensation practices applicable to employees holding

similar positions with comparable qualifications and responsibilities. There are three (3) regional wholesale banking managers and 28 commercial relationship managers Bank-wide. In 2022, the total annual compensation for the regional wholesale

banking managers ranged from approximately $607,000 to $1,151,000. Total annual compensation for the commercial relationship managers ranged from $107,000 to $442,000. Mr. Steinwert is the lowest paid of the three regional wholesale banking

managers, and Ms. Silva and Ms. Beigh ranked tenth and first respectively, amongst the commercial relationship managers. Compensation for these individuals is determined in a manner consistent with the Company’s practices that apply to all

employees. Some of the compensation is commissions-based, and the methodology by which the compensation is calculated is consistent with that used for other individuals having similar roles. Compensation and other terms of employment are

determined on a basis consistent with the Company’s human resources policies.

- 13 -

DIRECTOR COMPENSATION

Directors of the Company, who are not employees of the Company or the Bank (“Outside Directors”), receive compensation for services. Mr. Steinwert, who is an employee of the Company and the Bank,

receives no additional compensation for his role as a Director, Chairman of the Board, or Committee Member.

An Outside Director of both the Company and Bank receives a $3,200 fee for each Board meeting attended, and an $800 fee for each Committee meeting attended (Committee Chairmen receive $1,000 with the

exception of the Audit Committee Chairman who receives $1,200). In addition, each Outside Director is eligible to receive an annual bonus and participate in the Equity Component of the Executive Retirement Plan (see “Executive

Compensation—Compensation Discussion and Analysis – Qualified and Non-Qualified Retirement Programs”). Fees are paid to the Outside Directors only for meetings physically attended, any telephone or internet based meetings do not receive financial

compensation.

Outside Directors of the Company, thus Mr. Steinwert is excluded, are compensated up to $550 per month to cover a portion of the cost of outside medical insurance. Outside Directors of the Company do

not participate in any retirement or medical plans of the Company or the Bank. The summary compensation earned by each Director of the Company (other than Mr. Steinwert who is a Named Executive Officer) during 2022 is set forth in the following

“Director Compensation Table”.

2022 Directors Compensation Table

|

Name

|

Fees Earned or Paid in Cash

|

Change in Pension Value & Non-qualified Deferred Compensation Earnings (1)

|

All Other

Compensation (2)

|

Total

|

||||||||||||

|

Kent A. Steinwert (3)

|

$

|

0

|

$

|

0

|

$

|

0

|

$

|

0

|

||||||||

|

Calvin (Kelly) Suess

|

$

|

54,200

|

$

|

134,000

|

$

|

85,676

|

$

|

273,876

|

||||||||

|

Kevin Sanguinetti

|

$

|

62,800

|

$

|

134,000

|

$

|

86,600

|

$

|

283,400

|

||||||||

|

Edward Corum, Jr. (4)

|

$

|

104,600

|

$

|

134,000

|

$

|

86,600

|

$

|

325,200

|

||||||||

|

Gary J. Long

|

$

|

58,000

|

$

|

134,000

|

$

|

86,600

|

$

|

278,600

|

||||||||

|

Stephenson K. Green

|

$

|

60,400

|

$

|

134,000

|

$

|

86,600

|

$

|

281,000

|

||||||||

|

Craig W. James (5)

|

$

|

37,000

|

$

|

120,000

|

$

|

84,675

|

$

|

241,675

|

||||||||

|

Terrence A. Young (6)

|

$

|

19,400

|

$

|

50,000

|

$

|

1,925

|

$

|

71,325

|

||||||||

| (1) |

The amounts in this column represent contributions to the Executive Retirement Plan - Equity Component. See Plan description in “Executive Compensation—Compensation Discussion and Analysis - Qualified and

Non-Qualified Retirement Programs” for further details.

|

| (2) |

All Outside Directors received an $80,000 bonus in 2022 with the exception of Mr. Young who did not receive a bonus during 2022. Outside Directors are compensated up to $550 per month towards the cost of

outside medical insurance.

|

- 14 -

| (3) |

Mr. Kent Steinwert was an employee of the Company in 2022 and received no additional compensation for his services as a Director or Chairman of the Board. Mr. Steinwert is a Named Executive Officer and his

compensation is listed in the “Summary Compensation Table”.

|

| (4) |

Mr. Corum is a member of the Loan Committee which meets weekly, resulting in his fees exceeding those of the other Outside Directors whose Committee responsibilities are monthly in frequency.

|

| (5) |

Mr. James was an Outside Director of the Bank only until August 2022 when he became a director of both the Company and the Bank, so his monthly fees were less than the other Outside Directors during the year.

|

| (6) |

Mr. Young was an Outside Director of the Company only (not the Bank) until he passed away in August of 2022, so his monthly fees are less than other Outside Directors.

|

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

Named Executive Officers Who Are Not Directors

The following table sets forth information with respect to the Named Executive Officers, who are not directors or nominees for director of the Company for 2022. All executive officers serve at the discretion of the

Board.

|

Name

|

Age

|

Position

|

Employed

Since

|

|

Stephen W. Haley (1)

|

69

|

EVP, Chief Financial Officer

|

2003

|

|

Deborah E. Skinner

|

60

|

EVP, Chief Admin Officer

|

2000

|

|

Jay J. Colombini

|

60

|

EVP, Chief Credit Officer

|

1993

|

|

Ryan J. Misasi

|

46

|

EVP, Retail Banking Division Manager

|

2014

|

|

David M. Zitterow

|

50

|

EVP, Director of Banking

|

2017

|

|

Kyle Koelbel

|

44

|

EVP, Enterprise Risk Officer

|

2022

|

|

Mark K. Olson (1)

|

59

|

Former EVP, Chief Financial Officer

|

2021

|

| (1) |

Mr. Olson resigned effective April 29, 2022, and Mr. Haley who had previously retired on December 31, 2021 resumed his role as the Chief Financial Officer.

|

Roles and Responsibilities

The Board of Directors, operating both on its own and through its Personnel Committee: (1) reviews the Company’s overall compensation strategies and practices; (2) reviews the employment contracts of

all Named Executive Officers; and (3) annually establishes compensation levels and performance evaluation measures for the CEO (the CEO does not participate in these discussions) and the other Named Executive Officers. As used in this Proxy

Statement, the term “Named Executive Officer” means each officer listed in the 2022 Summary Compensation Table in this Proxy Statement, which includes the Company’s chief executive officer, chief financial officer, the three most highly compensated

executive officers other than the chief executive officer and the chief financial officer, and all other executive vice presidents, who were serving as executive officers of the Company at the end of the last completed fiscal year. Included in such

definition, in certain cases, are executive officers of the Bank.

- 15 -

The role of the Company’s management is to: (1) provide information, analysis and recommendations for the Personnel Committee’s consideration; and (2) manage the ongoing operations of the compensation

program.

In fulfilling its duties, the Personnel Committee: (1) has the authority to retain and fund compensation consultants, independent legal counsel and other compensation advisors; (2) considers those

factors that impact the independence of such advisors prior to their selection; and (3) periodically evaluates information obtained from independent sources regarding financial institutions that we compete against for talent. No outside

compensation consultants or similar advisors were used in 2022.

Executive Compensation Strategy and Programs

The objective of the Company’s compensation strategy is to attract and retain talented individuals who can implement the Company’s strategic plan and maximize long-term shareholder value.

In order to achieve these objectives, the Board has structured a compensation program that includes three major components: (1) annual base salary; (2) annual performance-based bonus; and (3)

qualified and non-qualified retirement plans.

Say On Pay Vote

In accordance with the requirements of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010:

| 1. |

In the 2017 proxy statement the Company asked shareholders to provide advisory (non-binding) input with regard to the frequency of future shareholder advisory votes on the Company’s executive compensation

programs. The results of this election were that 71.4% of the shares voting approved three years as the frequency of future shareholder advisory votes. The Dodd-Frank Act requires that this vote be taken at least once every six years.

|

| 2. |

In the 2020 proxy statement the Company asked shareholders to provide advisory (non-binding) approval of executive compensation as described in the “Director and Executive Officer—Executive Compensation

Discussion and Analysis” section of the 2020 proxy statement. The results of the election were that 86.6% of the shares voting approved the Company’s current executive compensation. Based on this 2020 shareholder advisory vote the Board of

Directors determined that no material changes were required to current compensation strategies and programs.

|

Performance Evaluation Measures

In evaluating the performance of each Named Executive Officer, the Personnel Committee considers a combination of objective and subjective factors, including the following:

| 1. |

The Company’s annual financial performance (relative to both the current year’s budget and the overall performance of a select group of peer community banks as well as the community bank industry as a whole)

as measured by Return on Assets; Return on Equity; Efficiency Ratios; and Net Income performance;

|

| 2. |

Progress towards achieving the Company’s strategic plan;

|

| 3. |

Results of the Company’s and Bank’s regulatory examinations; and

|

| 4. |

Current economic and industry conditions.

|

- 16 -

These performance measurement factors are evaluated at least annually. Both the annual budget and strategic plan are approved in advance by the Board of Directors and reevaluated during the year. The

Personnel Committee periodically evaluates information obtained from independent sources regarding financial institutions that we compete against for talent (which increasingly include regional and national banks and other financial services

companies), and makes recommendations regarding changes to compensation programs.

Impact of Compensation Practices on the Company’s Risk Profile

The Bank is a “traditional” community bank that generates the majority of its income from the net interest margin generated between taking customer deposits and making customer loans. Furthermore,

credit risk is centrally controlled as reflected by the following: (1) no branch employee has the authority to approve, board or advance funds on a loan; all loan actions must be approved by Credit Administration personnel, and the compensation of

Credit Administration personnel is tied to loan quality, not loan volume or production; and (2) the Loan Committee, which includes one Outside Director, must approve all new and renewed loans between $2 million and $15 million (over $15 million

requires full Board approval) and reviews all loans over $500,000. The full Board reviews all loans greater than $5 million.

We do not have non-traditional fee-based or proprietary trading financial business units that could materially increase this risk profile. Nor do we have any business units where employees with loan

approval authority generate any substantial amount of their total compensation based upon generating large volumes of activity or taking significant risks.

In order to ensure that the Company’s compensation strategies and programs do not result in inappropriate risk-taking on the part of executive management, the Board has determined that:

| 1. |

Annual Performance-Based Bonuses must include consideration of the results of the Company’s and Bank’s regulatory examinations by the Federal Reserve Board, the Federal Deposit Insurance Corporation and the

California Department of Financial Protection and Innovation, all of which involve a review of the Company’s and the Bank’s risk management practices and resulting risk profile.

|

| 2. |

All parts of the Company’s non-qualified Executive Retirement Plan are structured such that the benefits cannot be withdrawn by the participant, or paid out by the Company, until the participant retires, is

terminated without cause or, in limited circumstances, reaches early retirement age. For designated contributions made on or after December 1, 2021, upon attainment of age 59½ the participant can elect “In-Service Distributions”. This

results in a significant portion of each executive’s compensation remaining at risk during their employment, so as to encourage adopting a long-term perspective and conservative risk management practices. All balances are held in a trust

but remain subject to the claims of the Company’s creditors in the event of the Company’s insolvency.

|

As a result, the Board has determined that the Company’s compensation practices are not likely to have a material adverse impact on the Company’s risk profile.

- 17 -

Annual Compensation Program

Base Salary and Annual Performance-Based Bonus

Each Named Executive Officer receives a monthly base salary and is eligible for an annual performance-based bonus. Given that at the present time the Company does not offer stock options or restricted

stock compensation, in order to be competitive, total levels of annual compensation for each Named Executive Officer are targeted (assuming performance objectives are met) at the top range of financial institutions that we compete against for

talent.

Salaries are determined largely based upon comparative industry data for: (1) positions of similar responsibility in California institutions that we compete against for talent; and (2) individuals

with similar experience and expertise. Merit salary adjustments are evaluated periodically based on Company and individual performance. Goals and objectives are established annually for each officer with performance evaluated at least annually.

Annual bonus compensation is paid according to the Company’s Executive Management Incentive Compensation Plan. Bonus compensation is awarded based primarily on actual results against budgeted goals

for the particular year including performance ratios and net income. Broad award guidelines are established annually for the CEO, currently 0-200% of base salary, and the other Named Executive Officers, currently 0-125% of base salary. The Board

reserves some discretion with regard to these guidelines when: (1) the Company’s profit performance exceeds budget; (2) the Company’s profit performance exceeds other peer banking institutions in California; and/or (3) an individual’s performance

in a given year was beyond expectation.

It is important to understand that the Company’s annual compensation program is not formula driven and relies substantially on subjective analysis. The Named Executive Officers are assigned specific

performance goals and objectives on a yearly basis but these individual goals and objectives are not tied to specific targeted compensation levels. Performance evaluation measures are not prioritized or otherwise assigned a specific weighting.

Indeed, some of the measures, such as results of regulatory examinations and local economic conditions, do not lend themselves to a weighted or formula approach.

Although the Board has established broad bonus payout guidelines, the Board has purposely avoided establishing either: (1) hard targets for any performance factors; or (2) a weighting or formula as to

how much each performance factor will contribute to the ultimate annual bonus for each Named Executive Officer. This philosophy has evolved based upon the Board’s belief that all banks operate in volatile financial markets amidst external

conditions over which the Officer has little or no control.

Accordingly, before making annual bonus or other compensation decisions, it is important for the Board to evaluate and weigh all key performance factors in the context of the current financial

services environment and how the Named Executive Officer’s current year’s performance against those factors has influenced the Company’s progress toward achieving both short- and long-term financial goals.

Since the Company has consistently been one of the highest performing bank holding companies in California over the past 10 years, a reflection of what the Board considers well-balanced compensation

practices that caused the Named Executive Officers to carefully consider the risks they assumed in the context of long-term financial performance, the Board believes that its approach to “pay-for-performance” has achieved, and will continue to

achieve, the desired results.

- 18 -

Each Named Executive Officer’s salary and annual bonus amounts for the last three years are disclosed in the “Summary Compensation Table.” All base salaries and annual bonuses are paid in cash and

fully expensed in the current year.

Qualified and Non-Qualified Retirement Programs

In developing the various parts of a long-term compensation program, the Board developed what it believes is an effective and competitive retirement program.

The objectives of the Company’s retirement program are to: (1) successfully attract and retain talented individuals; and (2) align long-term compensation directly with shareholder interests by

rewarding prudent risk-taking and creation of long-term shareholder value through generation of high quality and sustainable financial performance.

The Company’s retirement program has been structured to provide benefits as follows:

| 1. |

Profit Sharing Plan, which provides qualified retirement benefits.

|

| 2. |

Executive Retirement Plan, which provides supplemental non-qualified retirement benefits and has the following components:

|

| a. |

Salary Component, which provides benefits based upon each participant’s salary level;

|

| b. |

Performance Component, which provides benefits based upon the Company’s long-term growth in net income and increase in market capitalization; and

|

| c. |

Equity Component, which provides discretionary benefits amounts based upon Board approval, and contributions are invested primarily in the stock of the Company.

|

| 3. |

Split-Dollar Bank Owned Life Insurance Program, which provides for a division of life insurance death proceeds between the Company and each participant’s designated beneficiary.

|

All of the Company’s qualified and non-qualified retirement plans are structured as defined contribution plans to avoid the uncertain future financial liabilities that can exist under defined benefit

plans. The entire cost of these plans is expensed annually.

Qualified Profit Sharing Plan

Substantially all full-time employees of the Company, including each Named Executive Officer, participate in the Company’s qualified Profit Sharing Plan. Two levels of contributions are made to the

Profit Sharing Plan: (1) contributions equal to 5% of eligible salaries (subject to Internal Revenue Service limits) calculated according to criteria set forth in the plan; and (2) additional discretionary contributions authorized by the Board of

Directors. None of these contributions are dependent upon the employee contributing to the plan (i.e., the plan does not require “matching”). Benefits pursuant to the Profit Sharing Plan vest 0% during the first year of participation, 25% per full

year thereafter and after five years such benefits are fully vested. Benefits under the Profit Sharing Plan are disclosed in the participant’s Company Contributions to Qualified Retirement and 401(k) Plans in the “2022 All Other Compensation

Table”.

Upon a Change in Control of the Company, each participant receives only those balances in their account, including any net earnings or losses thereon.

- 19 -

Non-Qualified Executive Retirement Plan

The Executive Retirement Plan is a non-qualified plan developed to supplement the Profit Sharing Plan, which as a qualified retirement plan, has a ceiling on benefits as set by the Internal Revenue

Service. All contributions are subject to the claims of the Company’s creditors in the event of the Company’s insolvency. This results in a significant portion of each executive’s compensation remaining at risk during their employment, so as to

encourage adopting a long-term perspective and conservative risk management practices. The Executive Retirement Plan is intended to be compliant with the provisions of Section 409A of the Internal Revenue Code. All balances are held in a trust.

The Equity Component of this Plan is invested primarily in the stock of the Company. Some level of the balances in other Plan components is also invested in the stock of the Company (see Note 11 to

Item 8. - Financial Statements and Supplementary Data - in the Company’s Annual Report on Form 10-K filed with the SEC for the year ended December 31, 2022). The Board believes that this increased ownership further encourages key executives to

operate consistent with long-term shareholder objectives.

The Company has established a grantor trust relating to its non-qualified plan to assist the Company in ensuring that it has cash on hand to meet its contractual obligations under the plan. The

Company makes contributions to the trust and directs the trustee to invest the contributions consistent with the plan benefit formulas. The investments are generally in the common stock of the Company, cash equivalents and other liquid investments.

While plan participants are deemed to have their account balances invested in the common stock of the Company and other investments held by the trustee, participants have no legal interest in the

trust assets, and such assets are subject to the claims of the Company’s creditors in the event of the Company’s insolvency. The plan participant’s only right is their contractual right to receive the benefit provided in the plan in accordance with

its terms. The Company has no obligation under the Plan to maintain the trust.

Salary Component

The Salary Component was developed to provide levels of total retirement compensation that are competitive in the banking industry. An account is established for each participant that is credited

annually with a defined contribution determined based upon the individual’s compensation at the time he or she became a participant and the number of years of service remaining to age 65. Balances are held in trust, and earnings and losses

equivalent to the investment earnings of the designated amounts in the trust are credited and debited to each participant’s account.

The balance in each participant’s account is 0% vested during the first five years of employment and becomes fully vested after five years of employment. Benefits are disclosed in the participant’s

Company Contributions to Non-Qualified Retirement Plans in the “2022 All Other Compensation Table” as well as Registrant Contributions in Last Fiscal Year in the “2022 Non-Qualified Deferred Compensation Table”.

- 20 -

Benefits under the Salary Component become payable to participants after either: (1) the participant has become vested and his or her employment at the Company terminates (including retirement); or

(2) there has been a “Change in Control” as defined in this plan component. Benefits under the Salary Component become payable to participants: (1) upon termination of the participant’s employment with the Company without cause (including

retirement); (2) upon a “Change in Control” as defined in this plan component; (3) as necessary to satisfy payroll taxes.

Distribution of the balances which are deemed invested in shares of the Company are made through the distribution of cash, except in the event of a Change in Control in which the Bank will determine

whether the distribution will be made in cash or shares to the participant, to the extent permitted under applicable law and subject to such restrictive legends as may be required under securities laws (subject to payroll tax withholding, which may

be satisfied with cash proceeds from the sale of shares in the trust).

Performance Component

The Performance Component was developed to compensate for the lack of a stock option program and to reward participants based upon the Company’s long-term growth in net income and market

capitalization. Each Named Executive Officer is eligible to participate in this plan component. Participants receive contributions based on the Company’s long-term cumulative profitability and the resulting impact on the increase in market

capitalization in excess of the increase in book value. Participants do not receive compensation for increases in market capitalization above a P/E ratio of 20 times earnings per share or EPS.

Contributions are calculated using a bonus factor or “carry” determined by the Personnel Committee for each participant (currently 2.90% for the CEO and up to 0.60% for each Named Executive Officer).

The total “carry” for all current program participants is 4.45%.

Balances are held in a trust, and earnings and losses are credited and debited to each participant’s account at a rate equivalent to the earnings rate of the designated amounts in the trust.

Benefits under the Performance Component vest 50% during the first year of participation, and 50% during the second year of participation. Each award of a bonus factor is treated as a separate

participation and subject to a separate vesting schedule. Benefits are disclosed in the participant’s Company Contributions to Non-Qualified Retirement Plans in the “All Other Compensation Table” as well as Registrant Contributions in Last Fiscal

Year in the “Non-Qualified Deferred Compensation Table”.

Benefits under the Performance Component become payable to participants (1) upon termination of the participant’s employment without cause (including retirement); (2) upon a “Change in Control” as

defined in this plan component; (3) for designated contributions made on or after December 1, 2021, upon attainment of age 59½, if so elected; or (4) as necessary to satisfy payroll taxes.

- 21 -

Equity Component

The Equity Component was developed to encourage key executives to adopt a long-term perspective and conservative risk management practices consistent with shareholder objectives.

Each Named Executive Officer is eligible to participate in this plan component, along with members of the Board of Directors. The amount of the cash contributions to this plan component is determined

and approved by the Personnel Committee. Balances are held in a trust, and corresponding earnings and losses are credited and debited to each participant’s account.

Benefits under the Equity Component immediately vest when awarded. Benefits are disclosed in the participant’s Company Contributions to Non-Qualified Retirement Plans in the “All Other Compensation

Table” as well as Registrant Contributions in Last Fiscal Year in the “Non-Qualified Deferred Compensation Table”.

Benefits under the Equity Component become payable to participants (1) upon termination of the participant’s employment without cause (including retirement); (2) upon a “Change in Control” as defined

in this plan component; (3) for designated contributions made on or after December 1, 2021, upon attainment of age 59½, if so elected; or (4) as necessary to satisfy payroll taxes.

Distribution of the balances that are deemed invested in shares of the Company are made through the distribution of shares to the participant, to the extent permitted under applicable law, except in

the event of a Change of Control or an acceleration to satisfy payroll taxes, in which cases distributions are made in cash.

This plan component is not a “stock option or other stock-based compensation program”, rather it is a deferred compensation program (whereby cash contributions made by the Company are invested by the

independent trustee of the trust primarily in Company stock). Participants have no voting rights in the shares until a distribution of the shares is made.

Bank-Owned Life Insurance Program

The Company has a Bank-Owned Life Insurance (“BOLI”) program under which it has purchased single premium life insurance policies on the lives of the Named Executive Officers as well as certain other

senior officers of the Company. The Company is both the owner of, and beneficiary under, the policies. These policies provide: (1) financial protection to the Company in the event of the death of an officer; and (2) significant income to the

Company to offset the expense associated with the Company’s employee benefits with a favorable tax treatment.