Perficient, Inc.0001085869DEF 14Afalse00010858692023-01-012023-12-310001085869prft:ThomasJ.HoganMember2023-01-012023-12-31iso4217:USD0001085869prft:JeffreyS.DavisMember2023-01-012023-12-31xbrli:pure0001085869prft:JeffreyS.DavisMember2022-01-012022-12-3100010858692022-01-012022-12-310001085869prft:JeffreyS.DavisMember2021-01-012021-12-3100010858692021-01-012021-12-310001085869prft:JeffreyS.DavisMember2020-01-012020-12-3100010858692020-01-012020-12-3100010858692023-10-012023-12-3100010858692023-01-012023-09-300001085869prft:ThomasJ.HoganMemberprft:SummaryCompensationTableEquityMemberecd:PeoMember2023-01-012023-12-310001085869prft:ThomasJ.HoganMemberecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2023-01-012023-12-310001085869ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberprft:ThomasJ.HoganMemberecd:PeoMember2023-01-012023-12-310001085869prft:ThomasJ.HoganMemberecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2023-01-012023-12-310001085869prft:SummaryCompensationTableEquityMemberprft:JeffreyS.DavisMemberecd:PeoMember2023-01-012023-12-310001085869ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberprft:JeffreyS.DavisMemberecd:PeoMember2023-01-012023-12-310001085869ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberprft:JeffreyS.DavisMemberecd:PeoMember2023-01-012023-12-310001085869ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberprft:JeffreyS.DavisMemberecd:PeoMember2023-01-012023-12-310001085869prft:SummaryCompensationTableEquityMemberprft:JeffreyS.DavisMemberecd:PeoMember2022-01-012022-12-310001085869ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberprft:JeffreyS.DavisMemberecd:PeoMember2022-01-012022-12-310001085869ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberprft:JeffreyS.DavisMemberecd:PeoMember2022-01-012022-12-310001085869ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberprft:JeffreyS.DavisMemberecd:PeoMember2022-01-012022-12-310001085869prft:SummaryCompensationTableEquityMemberprft:JeffreyS.DavisMemberecd:PeoMember2021-01-012021-12-310001085869ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberprft:JeffreyS.DavisMemberecd:PeoMember2021-01-012021-12-310001085869ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberprft:JeffreyS.DavisMemberecd:PeoMember2021-01-012021-12-310001085869ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberprft:JeffreyS.DavisMemberecd:PeoMember2021-01-012021-12-310001085869prft:SummaryCompensationTableEquityMemberprft:JeffreyS.DavisMemberecd:PeoMember2020-01-012020-12-310001085869ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberprft:JeffreyS.DavisMemberecd:PeoMember2020-01-012020-12-310001085869ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberprft:JeffreyS.DavisMemberecd:PeoMember2020-01-012020-12-310001085869ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberprft:JeffreyS.DavisMemberecd:PeoMember2020-01-012020-12-310001085869ecd:NonPeoNeoMemberprft:SummaryCompensationTableEquityMember2023-01-012023-12-310001085869ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2023-01-012023-12-310001085869ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2023-01-012023-12-310001085869ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2023-01-012023-12-310001085869ecd:NonPeoNeoMemberprft:SummaryCompensationTableEquityMember2022-01-012022-12-310001085869ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2022-01-012022-12-310001085869ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2022-01-012022-12-310001085869ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2022-01-012022-12-310001085869ecd:NonPeoNeoMemberprft:SummaryCompensationTableEquityMember2021-01-012021-12-310001085869ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2021-01-012021-12-310001085869ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2021-01-012021-12-310001085869ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2021-01-012021-12-310001085869ecd:NonPeoNeoMemberprft:SummaryCompensationTableEquityMember2020-01-012020-12-310001085869ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2020-01-012020-12-310001085869ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2020-01-012020-12-310001085869ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2020-01-012020-12-31000108586922023-01-012023-12-31000108586912023-01-012023-12-31000108586932023-01-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No.)

Filed by the Registrant ☑

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☑ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Under §240.14a-12

PERFICIENT, INC.

(Name of Registrant as Specified in Its Charter)

______________________________________________________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☑ No fee required

☐ Fee paid previously with preliminary materials

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

PERFICIENT, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held May 29, 2024

NOTICE IS HEREBY GIVEN that the 2024 Annual Meeting of the Stockholders of Perficient, Inc. (“Perficient” or the “Company”) will be held at 555 Maryville University Dr., First Floor Conference Center, Saint Louis, Missouri, 63141, on May 29, 2024 at 10:00 a.m. local time, for the following purposes:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | 1 | | | | 2 | | | | 3 | | | | 4 | | |

| | | | | | | | | | | | | | | | |

| | To elect eight directors to hold office for a term of one year or until their successors have been duly elected and qualified | | | | To approve, on an advisory basis, a resolution relating to the 2023 compensation of the named executive officers as disclosed in the accompanying Proxy Statement | | | | To ratify KPMG LLP as the Company’s independent registered public accounting firm for the 2024 fiscal year | | | | To transact such other business as may properly come before the meeting or any adjournment thereof | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | Vote FOR ALL | | | | Vote FOR | | | | Vote FOR | | | | | | |

| | | | | | | | | | | | | | | | |

The Board of Directors of Perficient has fixed the close of business on April 5, 2024 as the record date for the determination of Company stockholders entitled to notice of, and to vote at, the 2024 Annual Meeting. Only holders of record of Perficient common stock at the close of business on that date will be entitled to notice of, and to vote at, the 2024 Annual Meeting or any adjournments or postponements thereof. A list of stockholders entitled to vote at the 2024 Annual Meeting will be available for inspection at 555 Maryville University Dr., Suite 600, Saint Louis, Missouri, 63141, during ordinary business hours for the ten-day period prior to the 2024 Annual Meeting.

Your attention is directed to the accompanying Proxy Statement for further information regarding each proposal to be made at the 2024 Annual Meeting.

Whether or not you plan to attend the 2024 Annual Meeting, you are asked to complete, sign, and date a proxy and return it promptly by mail or, alternatively, to vote your proxy by telephone or the Internet according to the instructions on your proxy card. You may revoke your proxy at any time prior to the 2024 Annual Meeting. If you decide to attend the 2024 Annual Meeting and wish to change your proxy vote, you may do so automatically by voting in person at the 2024 Annual Meeting.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be held on May 29, 2024.

| | | | | |

| The Proxy Statement and the Annual Report on Form 10-K are available at www.proxyvote.com and at www.perficient.com under the heading “Investor Relations” and then “SEC Filings.” |

By Order of the Board of Directors

/s/ Cameron D. Walbert

Cameron D. Walbert

Secretary

April 17, 2024

TABLE OF CONTENTS

PERFICIENT, INC.

Proxy Statement for Annual Meeting of Stockholders

| | | | | | | | | | | |

| Wednesday, May 29, 2024

10:00 am Local time | | 555 Maryville University Dr.,

First Floor Conference Center,

Saint Louis, Missouri 63141

|

This Proxy Statement is furnished by the Board of Directors (the “Board”) of Perficient, Inc., a Delaware corporation (“Perficient” or the “Company”), in connection with the solicitation of proxies to be used at the 2024 Annual Meeting of Stockholders (the “Meeting”) to be held on May 29, 2024 at 555 Maryville University Dr., First Floor Conference Center, Saint Louis, Missouri, 63141, at 10:00 a.m. local time, and at any adjournment or postponement thereof. The principal executive offices of Perficient are located at 555 Maryville University Dr., Suite 600, Saint Louis, Missouri, 63141.

This Proxy Statement and the accompanying Notice and Proxy, or the Notice Regarding Internet Availability of Proxy Materials (the “E-Proxy Notice”), as applicable, are being mailed to stockholders on or about April 17, 2024. The E-Proxy Notice contains instructions on how to access an electronic copy of our proxy materials, including this Proxy Statement and the Company’s 2023 Annual Report. The E-Proxy Notice also contains instructions on how to request a paper copy of the Company’s 2023 Annual Report, this Proxy Statement and a proxy card.

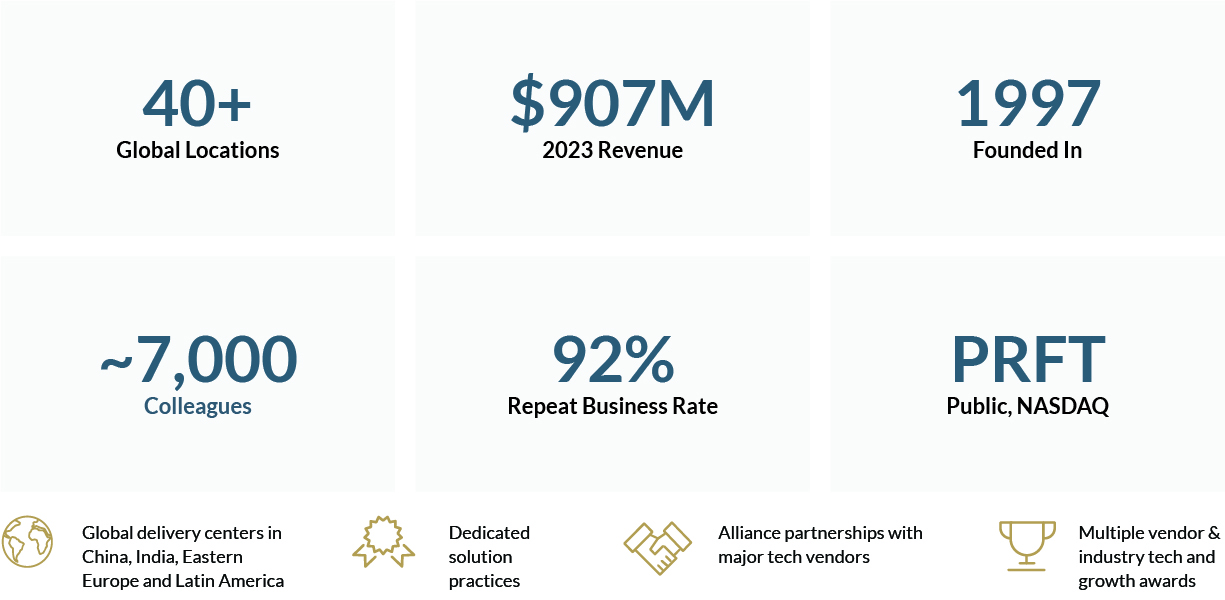

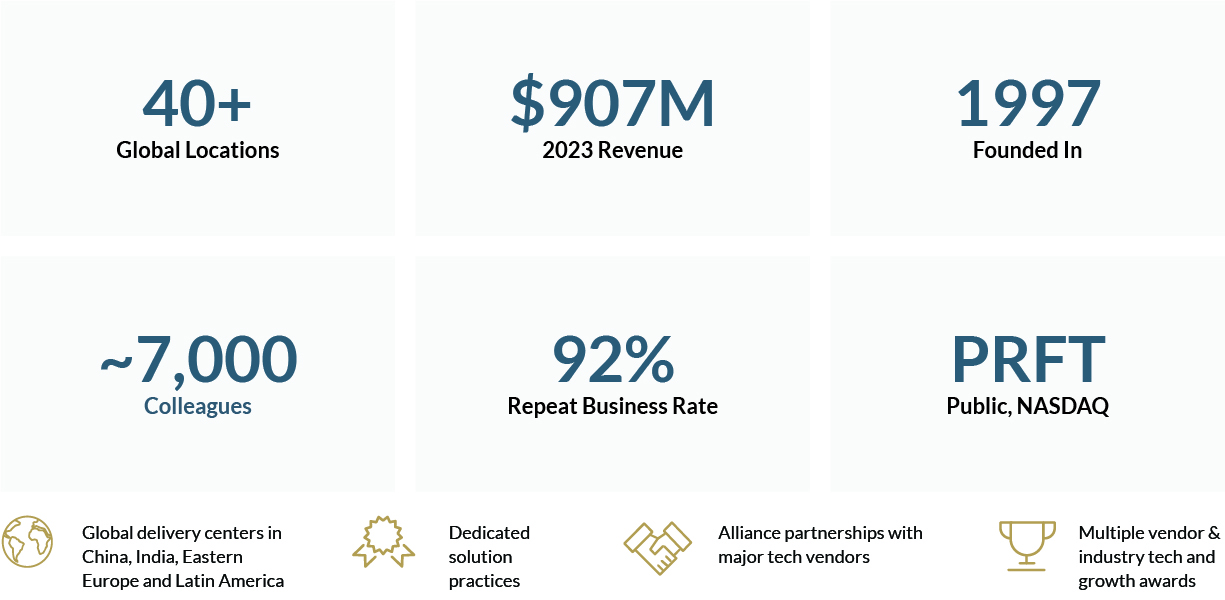

ABOUT PERFICIENT

Overview

Perficient is a global digital consultancy transforming how the world’s biggest brands connect with customers and grow their businesses. Our work enables clients to deliver experiences that surpass customer expectations; become more human-centered, authentic, and trusted; innovate through digital technologies; outpace competition; grow and strengthen relationships with customers, suppliers, and partners; and reduce costs.

| | | | | | | | | | | | | | | | | |

| DRIVEN BY |

OUR PURPOSE |

| To thrill our clients with innovation and impact – and deliver value with bright minds and deep expertise. |

| | | | | |

| To be the world’s leading consulting firm. |

|

| INSPIRED BY |

OUR VALUES |

| Integrity | Innovation | Clients |

| We’re forthright and ethical. | We’re pragmatic adventurers and curious explorers. We strive for the new and thrive on the proven. | We understand instinctively that we succeed only when our customers do. |

| | | | | |

| Collaboration | People | Pride |

| We work cooperatively and confidently. Our commitment to greatness is best achieved together. | We treasure talent, embrace effort and reward results. We cultivate a culture that challenges and champions great people. | We’re proud of Perficient. We pursue excellence on behalf of our clients, our colleagues and our stockholders – and when we achieve, it feels great. |

| | | | | | | | | | | |

| | | |

OUR PEOPLE PROMISE |

| Perficient promises to challenge, champion, and celebrate our people. |

| | | |

| Growth for Everyone | Diversity, Equity and Inclusion | Biggest Brands | Global Footprint and Genuine Connection |

| As a fast-growing, dynamic business, our success is because of our people. Our colleagues’ innovation and expertise propels our business forward. Our futures are written together and this prosperity creates new, exciting opportunities for career growth. | We believe in developing a workforce that is as diverse and inclusive as the clients we work with. Together, we’re constantly pursuing progress, and we’re committed to actively listening, learning, and acting, to further advance our organization, our communities and our future leaders, driving towards a diverse environment of inclusion and belonging, and we’re not done yet. | We’re proud to deliver amazing digital solutions that transform the world’s most recognizable brands. Our clients trust us because of the collaborative, experienced, and entrepreneurial spirit our people bring to each project, and our colleagues get to experience the excitement and opportunities that come with partnering with big brands they can be proud of. | With teams spanning technologies and time zones, our expanding global business and inclusive culture promise to create opportunities to collaborate with top talent, while maintaining personal and collaborative relationships with colleagues you know by name. We are uniquely positioned to deliver meaningful experiences and make a collective impact on our clients, communities and one another. |

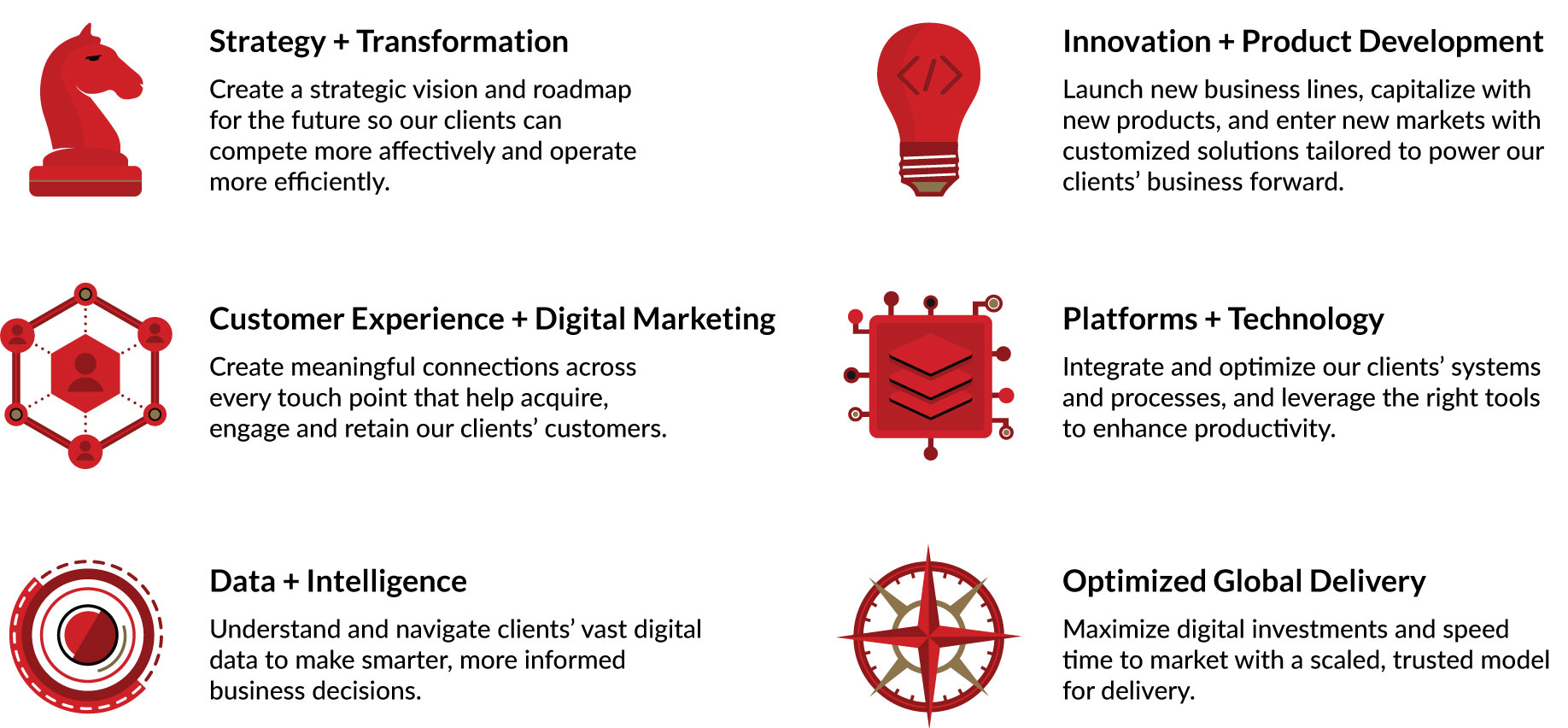

To articulate the full scope of our capabilities to clients and prospects, we go to market with six primary service categories:

Together, these service categories showcase our full end-to-end digital solutions. Individually, each demonstrates our specialized capabilities. Within each category, and collectively, we deliver a deep and broad portfolio of solutions that enable our clients to operate a real-time enterprise that dynamically adapts business processes and the systems that support them to meet the changing demands of a global, digital-driven, and competitive marketplace.

Our experience in developing and delivering solutions for our clients gives us domain expertise that differentiates our Company. We use project teams that deliver high-value, measurable results by working collaboratively with clients and their partners through a user-centered, technology-based, and business-driven solutions methodology. We believe this approach enhances return on investment for our clients by reducing the time and risk associated with designing and implementing technology solutions.

We serve our Global 2000 and other large enterprise clients from locations in multiple markets throughout North America and through domestic and global delivery centers and by leveraging an experienced sales team that is connected through a common service portfolio, sales process, and performance management system. Our sales process utilizes project pursuit teams that include those colleagues best suited to address a particular prospective client’s needs. Our primary target client base includes companies in North America with annual revenues in excess of $1 billion. We believe this market segment can generate the repeat business that is a fundamental part of our growth plan. We primarily pursue solution opportunities where our domain expertise and delivery track record give us a competitive advantage.

In 2023, we continued to implement a strategy focused on:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | 1 | | | | 2 | | | | 3 | | | | 4 | | |

| | | | | | | | | | | | | | | | |

| | Expanding our relationships with existing and new clients | | | | Strengthening our multi-shore delivery capabilities by entering into an agreement in October to acquire SMEDIX, Inc., an approximately $12 million revenue healthcare software engineering firm headquartered in San Diego, California, with offshore operations located in Cluj-Napoca, Romania with the acquisition closing in January 2024 | | | | Delivering solutions primarily via thousands of skilled strategists and technologists in the U.S., Latin America, and India | | | | Leveraging our existing (and pursuing new) strategic alliances by targeting leading business advisory companies and technology providers | | |

| | | | | | | | | | | | | | | | |

Our multi-shore, fully integrated global delivery approach continues to be a key driver of growth and a compelling differentiator in the market.

Approximately 96%, 97%, and 97% of our revenues were derived from clients in the United States during the years ended December 31, 2023, 2022, and 2021, respectively.

We provide services primarily to the healthcare (including pharma and life sciences), financial services (including banking and insurance), manufacturing, automotive, communications, media and technology, consumer markets, and energy and utilities markets.

Diversity and Social Initiatives

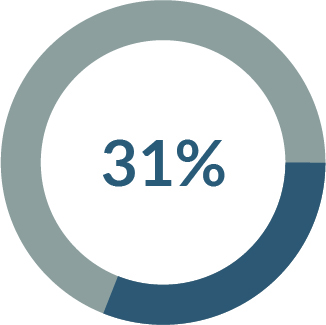

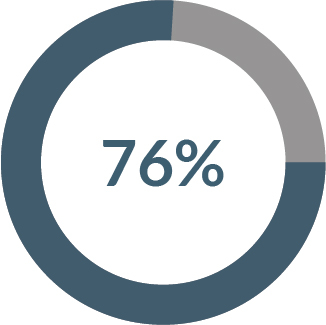

As of December 31, 2023;

| | | | | | | | | | | | | | | | | |

| |

| of our workforce is made up of women | | | of our workforce identifies as Asian, Hispanic or Latinx, Black or African American, American Indian or Alaskan Native, or two or more races. | |

We believe our diversity is reflective of our industry in our operating markets. We support our people in making a difference through active involvement in activities that strengthen the community. Our employees’ community support includes preparing women for careers in the tech industry through our global Employee Resource Group,

Women in Tech, which connects women across the Company, facilitates career growth, and builds a community dedicated to supporting fellow colleagues. In 2021, Perficient also introduced its ‘Giving’ Employee Resource Group, which inspires philanthropic action and generosity, while capturing and celebrating the time, talent and skills Perficient and its colleagues commit to helping those in need and making the world a better place. Perficient and its colleagues support a wide variety of initiatives and causes, but we place an emphasis on the priorities of advancing STEM (science, technology, engineering and math) education and improving health and well-being. Additionally, we support our community through Perficient Bright Paths, a program designed to create technology career opportunities for underrepresented constituencies and communities in the United States. Furthermore, in collaboration with the Mark Cuban Foundation, the Company hosted Artificial Intelligence (“AI”) Bootcamps for high school students about AI fundamentals to increase AI literacy and understanding. In 2023, we launched Perficient’s Cultural Connections Employee Resource Group, which allows our colleagues to explore, understand, and advance the cultural differences that help to shape our workforce and perspectives, and aims to cultivate a culture of inclusivity and allyship throughout Perficient around the globe.

Environmental Initiatives

We are also committed to protecting the environment and operating our business in a responsible and sustainable manner. To implement this commitment, we have adopted various policies and initiatives. We created a “Perficient Green Team” to identify and implement opportunities for Perficient employees to recycle more, waste less, and support environmentally-focused volunteer opportunities in our communities. Among our accomplishments, we have implemented a green purchasing policy for office supplies, reduced single-use drinkware, established recycling sites throughout our offices, and created informational programs to educate employees on effective ways to recycle. We encourage the reuse, recycling, and upcycling of our end-of-life electronics and computers responsibly in partnership with an external vendor. Additionally, in response to our environmental initiatives, our office in Colombia received the International Organization for Standardization (“ISO”) 14000 certification based on a series of environmental management standards, and our office in Somerville, Massachusetts was awarded a LEED Gold certificate by the U.S. Green Building Council (“USGBC”) for its environmentally efficient design, construction, and operating practices. In the fourth quarter of 2022, Perficient achieved certification of its Environmental Management System (“EMS”) under ISO 14001:2015, the international standard for an effective EMS to enhance environmental performance. This certification exemplifies our commitment to sustainability, compliance with applicable law, and continuous improvement by meeting environmental objectives.

Perficient is actively engaging partners and potential partners to evaluate its carbon footprint/emissions and identify opportunities to utilize renewable energy. This work will help us better understand the environmental impact of operations, inform a roadmap for future sustainability efforts, and provide our stakeholders with greater transparency.

Perficient is working to further understand the impact of its Scope 3 greenhouse gas (“GHG”) emissions. Scope 3 GHG emissions are the result of activities from assets not owned or controlled by the reporting organization, but that indirectly impact the organization in its value chain. For Perficient, these emissions have already decreased due to reduced business travel and employee commuting compared to pre COVID-19 levels. Perficient continues to leverage remote work in connection with providing client services and in its corporate functions.

THE MEETING

PURPOSE OF THE MEETING

The specific proposals to be considered and acted upon at the Meeting are summarized in the accompanying Notice of Annual Meeting of Stockholders and the E-Proxy Notice. Each proposal is described in more detail in this Proxy Statement.

VOTING RIGHTS AND SOLICITATION OF PROXIES

Only holders of record of Perficient common stock, $0.001 par value per share (“Common Stock”), at the close of business on the record date, April 5, 2024 (the “Record Date”), will be entitled to vote at the Meeting, and any adjournment thereof. On the Record Date, there were 35,102,756 shares of Common Stock outstanding and entitled

to vote. Each outstanding share of Common Stock is entitled to one vote on each matter to be voted upon. Votes cast, either in person or by proxy, will be tabulated by Broadridge, the Company’s proxy facilitator.

Quorum Required

The Company’s bylaws provide that the holders of a majority of the Company’s outstanding shares of stock entitled to vote at the Meeting, present in person or represented by proxy, shall constitute a quorum for the transaction of business at the Meeting. Abstentions and broker non-votes will be counted as present for the purpose of determining the presence of a quorum.

Effect of Broker Non-Votes and Abstentions

A broker “non-vote” occurs on an item when shares held by a bank, broker, or other nominee are present or represented at the Meeting but such nominee is not permitted to vote on that item because the nominee does not have discretionary voting power and has not received voting instructions from the beneficial owner of the shares. For this Annual Meeting, brokers will only have discretionary voting on Proposal 3. Broker non-votes and shares as to which proxy authority has been withheld with respect to any matter are not entitled to vote for purposes of determining whether stockholder approval of that matter has been obtained and will have no effect on the outcome of the vote on any such matter. Accordingly, we encourage you to direct your nominee to vote your shares by following the instructions provided on the voting instruction card that you receive from your broker.

In tabulating the voting results for the proposals being voted on at the Meeting, shares that constitute abstentions are not, pursuant to our bylaws, considered votes cast on the proposal. Accordingly, abstentions will not affect the outcome of such proposals.

Votes Required

Proposal 1: To elect eight directors to hold office for a term of one year or until their successors have been duly elected and qualified

Each outstanding share of Common Stock is entitled to one vote on each of the eight director positions to be filled at the Meeting. In an uncontested election, as is the case in this election, the affirmative vote of the holders of a majority of the shares of our Common Stock cast, excluding abstentions, at the Meeting is required for the election of each director. Stockholders do not have cumulative voting rights in the election of directors, meaning they cannot aggregate their votes on all seats to be filled and vote them on a lesser number of nominees or a single nominee.

Proposal 2: To approve, on an advisory basis, a resolution relating to the 2023 compensation of the named executive officers as disclosed in this Proxy Statement

Proposal 3: To ratify KPMG LLP as the Company’s independent registered public accounting firm for the 2024 fiscal year

The affirmative vote of the holders of a majority of the shares of our Common Stock cast in person or by proxy, excluding abstentions, will be required for approval of Proposals 2 and 3.

In tabulating the voting results for Proposals 1, 2 and 3, shares that constitute broker non-votes are not considered votes cast on that proposal.

E-Proxy Notice

The Company has elected to use the U.S. Securities and Exchange Commission (the “SEC”) rule that allows companies to furnish their proxy materials over the Internet. As a result, the Company is mailing to many of its stockholders an E-Proxy Notice about the Internet availability of the proxy materials instead of a paper copy of the proxy materials. All stockholders receiving the E-Proxy Notice will have the ability to access the proxy materials over the Internet at the website www.proxyvote.com and request to receive a paper copy of the proxy materials by mail. Instructions on how to access the proxy materials over the Internet or to request a paper copy may be found in the E-Proxy Notice. In addition, the E-Proxy Notice contains instructions on how you may request to access proxy materials in printed form by mail or electronically on an ongoing basis. Consistent with our environmental goals and efforts, employing this

distribution process will conserve natural resources and reduce the costs of printing and distributing our proxy materials.

A stockholder may request a paper copy of the proxy materials at no cost by selecting from one of the options below:

•By Internet: www.proxyvote.com

•By telephone: 1-800-579-1639

•By sending an e-mail to: sendmaterial@proxyvote.com

Stockholders will need the information included on page 1 of the E-Proxy Notice to vote.

Voting Procedures

Holders of record of the Common Stock may vote using one of the following methods:

In Person: Stockholders of record may attend the Meeting and vote in person.

By Mail: If you requested or received a hard copy of this Proxy Statement, stockholders of record may vote by completing, signing, dating, and returning the proxy card in the accompanying self-addressed envelope, which does not require postage if mailed in the United States.

By Internet: Stockholders of record may vote by the Internet by following the instructions included on the E-Proxy Notice that you received in the mail or, if you requested or received a hard copy of this Proxy Statement, on the enclosed proxy card. Stockholders electing to vote by the Internet may incur Internet access charges.

By Telephone: Stockholders of record may vote by telephone by following the instructions included on the proxy card if you requested or received a hard copy of this Proxy Statement. Stockholders electing to vote by telephone may incur telephone access charges.

Proxies submitted by telephone or the Internet are treated in the same manner as if the stockholder had signed, dated, and returned the proxy card by mail. Therefore, stockholders of record electing to vote by telephone or the Internet should not return their proxy cards by mail.

If a proxy is properly signed by a stockholder and is not revoked, the shares represented thereby will be voted at the Meeting in the manner specified on the proxy, or if no manner is specified with respect to any matter therein, such shares will be voted by the person designated therein in accordance with the recommendations of the Board as indicated in this Proxy Statement. If any of the nominees for director are unable to serve or for good cause will not serve, an event that is not anticipated by Perficient, either (i) the shares represented by the accompanying proxy will be voted for a substitute nominee or substitute nominees designated by the Board; or (ii) the Board may determine to reduce the size of the Board. A proxy may be revoked by a stockholder at any time prior to the voting thereof by giving notice of revocation in writing to the Secretary of Perficient, duly executing and delivering to the Secretary of Perficient a proxy bearing a later date (by mail, telephone or Internet), or voting in person at the Meeting. Attendance alone at the Meeting will not revoke a proxy. If you plan to attend the Meeting in person, please bring proper identification and proof of ownership of your shares.

Please note that you MAY NOT USE your E-Proxy Notice to vote your shares; it is NOT a form for voting. If you send the E-Proxy Notice back, your vote will not count.

Householding

In some instances, only one copy of the proxy materials, including the E-Proxy Notice, is being delivered to multiple stockholders sharing an address, unless we have received instructions from one or more of the stockholders to continue to deliver multiple copies. We will deliver promptly upon oral or written request a separate copy of the proxy materials to any stockholder at your address. If you wish to receive a separate copy of proxy materials, requests should be directed to Mr. Cameron D. Walbert, Perficient, Inc., 555 Maryville University Dr., Suite 600, Saint Louis, Missouri, 63141, telephone number (314) 529-3600. If you have received only one copy of the proxy materials and wish to receive a separate copy for each stockholder in the future, you may call us at the telephone number listed above or write us at the address listed above. Alternatively, stockholders sharing an address who now receive multiple copies of

the proxy materials may request delivery of a single copy, also by calling us at the number listed above, or writing to us at the address listed above.

Solicitation of Proxies

Perficient will bear the entire cost of solicitation, including the preparation, assembly, printing, and mailing of the E-Proxy Notice, this Proxy Statement, the proxy card, and any additional soliciting material furnished to stockholders. Copies of solicitation material will be furnished to brokerage houses, fiduciaries, and custodians holding shares in their names that are beneficially owned by others so that they may forward this solicitation material to such beneficial owners. Perficient may reimburse such persons for their costs of forwarding the solicitation material to such beneficial owners. The directors, officers, employees, or agents of Perficient may solicit proxies by mail, telephone, email, or other means. No additional compensation will be paid to these individuals for any such service. The Company may in its discretion engage, at its cost, a proxy solicitor to solicit proxies for the Meeting.

PROPOSAL 1.

Election of Directors.

At the Meeting, eight directors will be elected to hold office for a term expiring at the next Annual Meeting of Stockholders or until their successor is duly elected and qualified or until their earlier death, resignation or removal. The nominees for election (the “Nominee Directors”) are:

Romil Bahl;

Jeffrey S. Davis;

Thomas J. Hogan;

Jill A. Jones;

David S. Lundeen;

Brian L. Matthews;

Nancy C. Pechloff; and

Gary M. Wimberly.

Each Nominee Director is currently serving as a director of Perficient. Each Nominee Director has consented to being named in this Proxy Statement and to serve as a director if elected until a successor is elected and qualified or until the director’s earlier resignation or removal.

If any of the Nominee Directors listed above becomes unable to serve or for good cause will not serve, an event that is not anticipated by the Company, either (i) the shares represented by the proxies will be voted for a substitute nominee or substitute nominees designated by the Board; or (ii) the Board may reduce the size of the Board. At this time, the Board knows of no reason why any of the persons listed above may not be able to serve as directors if elected.

DIRECTORS AND EXECUTIVE OFFICERS

The name and age of each of the Nominee Directors and executive officers of Perficient and their respective positions with Perficient are listed in the table below. The Board Diversity Matrix and additional biographical information concerning each of the Nominee Directors and executive officers, including the period during which each such individual has served Perficient, follows the table.

| | | | | | | | | | | | | | |

| Name | | Age | | Position |

| Thomas J. Hogan | | 47 | | President and Chief Executive Officer |

| Paul E. Martin | | 63 | | Chief Financial Officer, Treasurer and Assistant Secretary |

| Susan L. Adomite | | 47 | | Senior Vice President, Controller and Principal Accounting Officer |

| Kevin T. Sheen | | 60 | | Senior Vice President — Global Operations |

| Jeffrey S. Davis | | 59 | | Chairman of the Board |

| Romil Bahl | | 55 | | Director |

| Jill A. Jones | | 58 | | Director |

| David S. Lundeen | | 62 | | Lead Director |

| Brian L. Matthews | | 66 | | Director |

| Nancy C. Pechloff | | 71 | | Director |

| Gary M. Wimberly | | 63 | | Director |

| | | | | | | | | | | | | | |

| Board of Directors Diversity Matrix for Perficient, Inc. | As of April 5, 2024 |

| Total Number of Directors | 8 |

| Part I: Gender Identity | Female | Male | Non-Binary | Did Not Disclose Gender |

| Directors | 2 | 6 | — | — |

| Part II: Demographic Background | | | | |

| African American or Black | — | — | — | — |

| Alaskan Native or American Indian | — | — | — | — |

| Asian | — | 1 | — | — |

| Hispanic or Latinx | — | — | — | — |

| Native Hawaiian or Pacific Islander | — | — | — | — |

| White | 2 | 5 | — | — |

| Two or More Races or Ethnicities | — | — | — | — |

| LGBTQ+ | — | — | — | — |

| Did Not Disclose Demographic Background | — | — | — | — |

Since the 2020 Annual Meeting of Stockholders, Perficient added three new independent Directors, expanding both the skill sets and diversity of the Board.

| | | | | | | | | | | | | | |

| Key Skills: Senior Executive Leadership Global Expertise Innovation and Technology Investment/ M&A Expertise Sales and Marketing Operations Mgmt. People/Talent Mgmt. & Compensation Finance, Accounting and Risk Mgmt.

| | Thomas J. Hogan President and Chief Executive Officer, Director Since 2023 |

| | Thomas J. Hogan was appointed as the Company’s President and Chief Executive Officer effective October 1, 2023. Mr. Hogan previously began serving as the Company’s President in February 2021 and began serving as our Chief Operating Officer in 2018. Mr. Hogan joined the Company in January 2008 and has served the Company in several capacities, including Vice President of Field Operations, General Manager, Director of Business Development, and Engagement Director. Prior to joining the Company, Mr. Hogan served in business development and leadership positions with Creative Metrics Ltd., PreVisor, Inc., and TEKsystems, Inc. Mr. Hogan received his M.B.A. from the Kellogg School of Management at Northwestern University and a B.A. degree from Saint Mary’s University of Minnesota. |

| |

| |

| |

| |

| |

| |

| |

| | | |

| | | | | | | | | | | | | | |

| Key Skills: Senior Executive Leadership Global Expertise Investment/M&A Expertise People/Talent Mgmt. & Compensation Finance, Accounting and Risk Mgmt. Tax Expertise | | Paul E. Martin Chief Financial Officer, Treasurer and Assistant Secretary |

| | Paul E. Martin joined the Company in 2006 as Chief Financial Officer, Treasurer and Secretary. Mr. Martin served as the Company’s Principal Accounting Officer from 2006 until October 1, 2023. Mr. Martin served as Secretary until February 2022, when he was appointed as the Company’s Assistant Secretary. From 2004 until 2006, Mr. Martin was the Interim co-Chief Financial Officer and Interim Chief Financial Officer of Charter Communications, Inc. (NASDAQ: CHTR) (“Charter”), a publicly traded multi-billion dollar revenue domestic cable television multi-system operator. From 2002 through 2006, Mr. Martin was the Senior Vice President, Principal Accounting Officer and Corporate Controller of Charter, and was Charter’s Vice President and Corporate Controller from 2000 to 2002. From 1995 to 1999, Mr. Martin was Chief Financial Officer of Rawlings Sporting Goods Company, Inc., a formerly publicly traded multi-million dollar revenue sporting goods manufacturer and distributor. Mr. Martin serves on the board of directors of the Humane Society of Missouri. Mr. Martin received a B.S. degree in accounting from the University of Missouri — St. Louis. |

| |

| |

| |

| |

| |

| |

| |

| | | |

| | | | | | | | | | | | | | |

| Key Skills: Senior Executive Leadership Global Expertise Investment/M&A Expertise People/Talent Mgmt. & Compensation Finance, Accounting and Risk Mgmt.

| | Susan L. Adomite Senior Vice President, Controller and Principal Accounting Officer |

| | Susan L. Adomite joined the Company in 2018 as the Company’s Vice President and Controller and was appointed as the Senior Vice President and Principal Accounting Officer effective October 1, 2023, responsible for the accounting and reporting functions at the Company. Prior to joining the Company, Ms. Adomite served as Vice President of Accounting and Controller at Isle of Capri Casinos, Inc., and in senior finance positions at Smurfit-Stone Container Corporation, Argosy Gaming Company, and Arthur Andersen LLP. Ms. Adomite holds B.A. and M.A. degrees in accounting from the University of Missouri. |

| |

| |

| |

| |

| |

| |

| |

| | | |

| | | | | | | | | | | | | | |

| Key Skills: Senior Executive Leadership Global Expertise Innovation and Technology Investment/M&A Expertise Sales and Marketing People/Talent Mgmt. & Compensation

| | Kevin T. Sheen Senior Vice President — Global Operations |

| | Kevin T. Sheen joined the Company in 2007 through an acquisition and was appointed as the Senior Vice President — Global Operations effective October 1, 2023. With a career in the IT consulting industry that spans nearly 30 years, over half of that at the Company, Mr. Sheen has played nearly every role in the software development lifecycle from software developer/tester, technical architect, and program manager across a wide range of IT/business consulting companies including Accenture plc, Capgemini SE, Syntel, Inc., and Hewlett Packard Consulting. Mr. Sheen provides leadership to the Company’s Latin America, Asia and Romania operations, including overseeing global delivery strategy, product development, Agile methodology, and customer engagement quality. Mr. Sheen holds a Bachelor of Electrical Engineering from Lawrence Technical University in Southfield, Michigan, and has multiple professional-level certifications. |

| |

| |

| |

| |

| |

| |

| |

| | | |

| | | | | | | | | | | | | | |

| Key Skills: Senior Executive Leadership Global Expertise Innovation and Technology Investment/ M&A Expertise Sales and Marketing Operations Mgmt. People/Talent Mgmt. & Compensation Finance, Accounting and Risk Mgmt.

| | Jeffrey S. Davis Director Since 2009 |

| | Jeffrey S. Davis was appointed as Executive Chairman effective October 1, 2023 but resigned his employment position as Executive Chairman effective as of March 1, 2024. Mr. Davis previously served as the Chief Executive Officer. He has served as a member of the Board since 2009 and was elected Chairman of the Board in 2017. Mr. Davis will continue to serve as the non-executive Chairman of the Board. He previously served as the Chief Operating Officer of the Company following its acquisition of Vertecon in April 2002 and was named the Company’s President in 2004, in which capacity he served until February 2021. He served as Chief Operating Officer at Vertecon from October 1999 until its acquisition by the Company. Before Vertecon, Mr. Davis was a Senior Manager and member of the leadership team in Arthur Andersen’s Business Consulting Practice, where he was responsible for defining and managing internal processes, while managing business development and delivery of all products, services and solutions to a number of large accounts. Mr. Davis also served in a leadership position at Ernst & Young LLP in the Management Consulting practice and in industry at Boeing, Inc. (NYSE: BA) and Mallinckrodt, Inc. (NYSE: MNKKQ). Mr. Davis is a member of the University of Missouri Trulaske College of Business advisory board. Mr. Davis has an M.B.A. from Washington University and a B.S. degree in Electrical Engineering from the University of Missouri. |

| |

| |

| |

| |

| |

| |

| |

| | | Chairman of the Board |

| | | | | | | | | | | | | | |

| Key Skills: Senior Executive Leadership Global Expertise Innovation and Technology Investment/ M&A Expertise Sales and Marketing Operations Mgmt. People/Talent Mgmt. & Compensation Finance, Accounting and Risk Mgmt. Public Company Board Experience

| | Romil Bahl Director Since 2022 |

| | Romil Bahl became a member of the Board in February 2022. Mr. Bahl is a three-time CEO with 30 years of experience with public companies and private equity. Mr. Bahl is an executive with extensive experience with information, product and professional services companies across a range of industries including IoT, healthcare and connected car/auto/fleet management. Mr. Bahl’s board of directors experience includes several companies including the IoT M2M Council (IMC), the Institute of Financial Operations and the Advisory Council of the M.S./M.B.A. program at the University of Texas at Austin. Mr. Bahl is currently CEO of KORE Group Holdings, Inc. (NYSE: KORE) and has served in this role since October 2017. Prior roles include CEO at Lochbridge and PRGX Global. Mr. Bahl holds an M.B.A. from the University of Texas at Austin and a Bachelor of Engineering from DMET, India. |

| |

| |

| |

| |

| |

| |

| |

| | | Nominating, Governance and Sustainability Committee |

| | | | | | | | | | | | | | |

| Key Skills: Senior Executive Leadership Global Expertise Investment/ M&A Expertise Sales and Marketing Operations Mgmt. People/Talent Mgmt. & Compensation Finance, Accounting and Risk Mgmt.

| | Jill A. Jones Director Since 2023 |

| | Jill A. Jones became a member of the Board in June 2023. Until her departure in 2018, Ms. Jones served as Executive Vice President for Brown-Forman Corp. (NYSE: BFA and BFB), a manufacturer, distiller, bottler, importer, exporter, marketer, and seller of a wide variety of beverage alcohol products under recognized brands (“Brown-Forman”), President of North America, CCSA (Caribbean and Central and South America), IMEA (India, Middle East and Africa) and GTR (Global Travel Retail). Ms. Jones joined Brown-Forman in 2000 and progressed rapidly through a series of increasingly responsible roles, including several key financial and strategic business planning positions. Prior to serving as Executive Vice President, she served as Senior Vice President, Chief Production Officer. Ms. Jones is a member of the board of managers for Breakthru Beverage Group, a leading beverage alcohol distributor within the United States and is a prior board of director for First Beverage Group, a private equity company. Ms. Jones began her career in public accounting at Coopers & Lybrand from 1987 to 1990. Ms. Jones earned her Bachelor of Science in accounting from the University of Kentucky. She earned her M.B.A. from Washington University. |

| |

| |

| |

| |

| |

| |

| |

| | | Audit Committee |

| | | | | | | | | | | | | | |

| Key Skills: Senior Executive Leadership Global Expertise Innovation and Technology Investment/ M&A Expertise Sales and Marketing Operations Mgmt. People/Talent Mgmt. & Compensation Finance, Accounting and Risk Mgmt. Public Company Board Experience

| | David S. Lundeen Director Since 1998 |

| | David S. Lundeen was a founding angel investor of the Company and became a member of the Board in 1998 and was appointed Lead Director in 2020. Mr. Lundeen was also a founding angel investor, board member and venture investor of Parago, Inc., a leading corporate incentives and rebate company, from 1999 until its sale to Blackhawk Network Holdings, Inc. in November 2014. Beginning in 1999, Mr. Lundeen was an angel investor, venture investor and board member of Tipping Point, Inc., a network security company, until its sale to 3Com Corporation in January 2005. From 1999 through 2002, he was a co-founder and a partner of Watershed Capital, a venture capital firm, based in Mountain View, California. From early 1995 through 1997, Mr. Lundeen was Chief Financial Officer and Chief Operating Officer of BSG Corporation, a software services company based in Austin, Texas, in which he orchestrated a growth turnaround, until its sale to Per Se Technology in 1996. Mr. Lundeen was president of the technology division and head of mergers and acquisitions at Blockbuster Entertainment from 1990 through 1994, was an investment banker at Drexel Burnham Lambert from 1988 through 1990, and worked at Accenture plc and Booz, Allen & Hamilton Inc. from 1984 through 1987. Mr. Lundeen received a B.S. in Engineering from the University of Michigan and an M.B.A. from the University of Chicago. Mr. Lundeen serves on the Advisory Committees of American YouthWorks, Ben & Jerry’s LifeWorks, and Deep Creek Middle School. |

| |

| |

| |

| |

| |

| |

| |

| | | Lead Director |

| | | Audit Committee (Chair) |

| | | Compensation Committee |

| | | | | | | | | | | | | | |

| Key Skills: Innovation and Technology Investment/ M&A Expertise Sales and Marketing People/Talent Mgmt. & Compensation

| | Brian L. Matthews Director Since 2017 |

| | Brian L. Matthews became a member of the Board in April 2017. Mr. Matthews has more than 25 years of experience in investing in, and managing, software technology companies. Currently Mr. Matthews is a Co-Founder and General Partner of Cultivation Capital, a venture capital company. In addition, he is a co-founder of River City Internet Group, an Internet holding company that focuses on software, Internet access, and hosting products. Prior to starting Cultivation Capital, Mr. Matthews, a serial technology entrepreneur, co-founded and assisted in the sale of the following technology companies: Primary Network to Mpower Communications (MPWR) in 2000, Primary Webworks to Perficient in 2001, CDM Fantasy Sports to Fun Technologies, a Liberty Media Company in 2006, and IntraISP to Clearwire Communications in 2007. Mr. Matthews began his career at McDonnell Douglas from 1981 through 1993. Mr. Matthews also has roles as a member of the University of Missouri — St. Louis Chancellors Council, a board member of TechSTL, and a board member of T-REX, a technology coworking space. Mr. Matthews holds a B.S. degree in Mechanical Engineering from the Missouri University of Science & Technology. |

| |

| |

| |

| |

| |

| |

| |

| | | Compensation Committee (Chair) |

| | | Nominating, Governance and Sustainability Committee |

| | | | | | | | | | | | | | |

| Key Skills: Senior Executive Leadership Global Expertise Sales and Marketing Operations Mgmt. People/Talent Mgmt. & Compensation Finance, Accounting and Risk Mgmt. Public Company Board Experience

| | Nancy C. Pechloff Director Since 2020 |

| | Nancy C. Pechloff became a member of the Board in July 2020. Ms. Pechloff has more than 45 years of professional services experience in accounting, financial reporting and internal controls. Ms. Pechloff previously served as Managing Director of Protiviti Inc. from 2005 through 2019. From 2002 to 2004, Ms. Pechloff was an Adjunct Professor of Accounting at Washington University. Ms. Pechloff began her career at Arthur Andersen LLP in 1973, where she was a partner from 1984 until her departure in 2002. Ms. Pechloff is a board member of Quad Plus Inc., a global, privately-held systems integrator of manufacturing controls equipment, and has previously served on the board and audit committees of Allegiant Bancorp and Phoenix Textile Company. In addition, Ms. Pechloff has served on a number of non-profit and state agency boards, including the Missouri State Board of Accountancy, St. Louis Psychoanalytic Institute, Center for Emerging Technology, National MS Society — Gateway Area Chapter, Mentor St. Louis, Shakespeare Festival — St. Louis, Girls Inc. of St. Louis, Visiting Nurse Association of Greater St. Louis, and the St. Louis Chapter of the International Women’s Forum. She holds a Bachelor of Business degree in Accounting from Western Illinois University. |

| |

| |

| |

| |

| |

| |

| |

| | | Audit Committee |

| | | | | | | | | | | | | | |

| Key Skills: Senior Executive Leadership Global Expertise Innovation and Technology Investment/ M&A Expertise People/Talent Mgmt. & Compensation

| | Gary M. Wimberly Director Since 2018 |

| | Gary M. Wimberly became a member of the Board in May 2018. Mr. Wimberly has over 35 years’ experience in various industries, while leading large integrations, significant transformational projects and cybersecurity initiatives. From 2004 to 2016, Mr. Wimberly served as Senior Vice President and Chief Information Officer (“CIO”) for Express Scripts Inc. (“Express Scripts”). Prior to joining Express Scripts, from June 1999 to October 2004, Mr. Wimberly held key leadership positions in logistic and manufacturing systems for Mallinckrodt Worldwide. From August 1995 to June 1999, Mr. Wimberly served as a senior manager with Ernst & Young LLP. Mr. Wimberly is or has been(*) a board member of several charitable, advisory and industry boards, including the Cystic Fibrosis Foundation of St. Louis, the Innovation Technology and Entrepreneur Network Advisory Board at Lindenwood University, the St. Louis CIO Board, Washington University Technology Advisory Board*, and several Express Scripts Inc. middle-market subsidiary companies boards including: Fertility Products*, Specialty Distribution*, and HealthBridge Services*. Mr. Wimberly received his bachelor’s degree in Computer Science from the University of Missouri. |

| |

| |

| |

| |

| |

| |

| |

| | | Nominating, Governance and Sustainability Committee (Chair) |

| | | Compensation Committee |

There are no family relationships between any of the Company’s directors and executive officers.

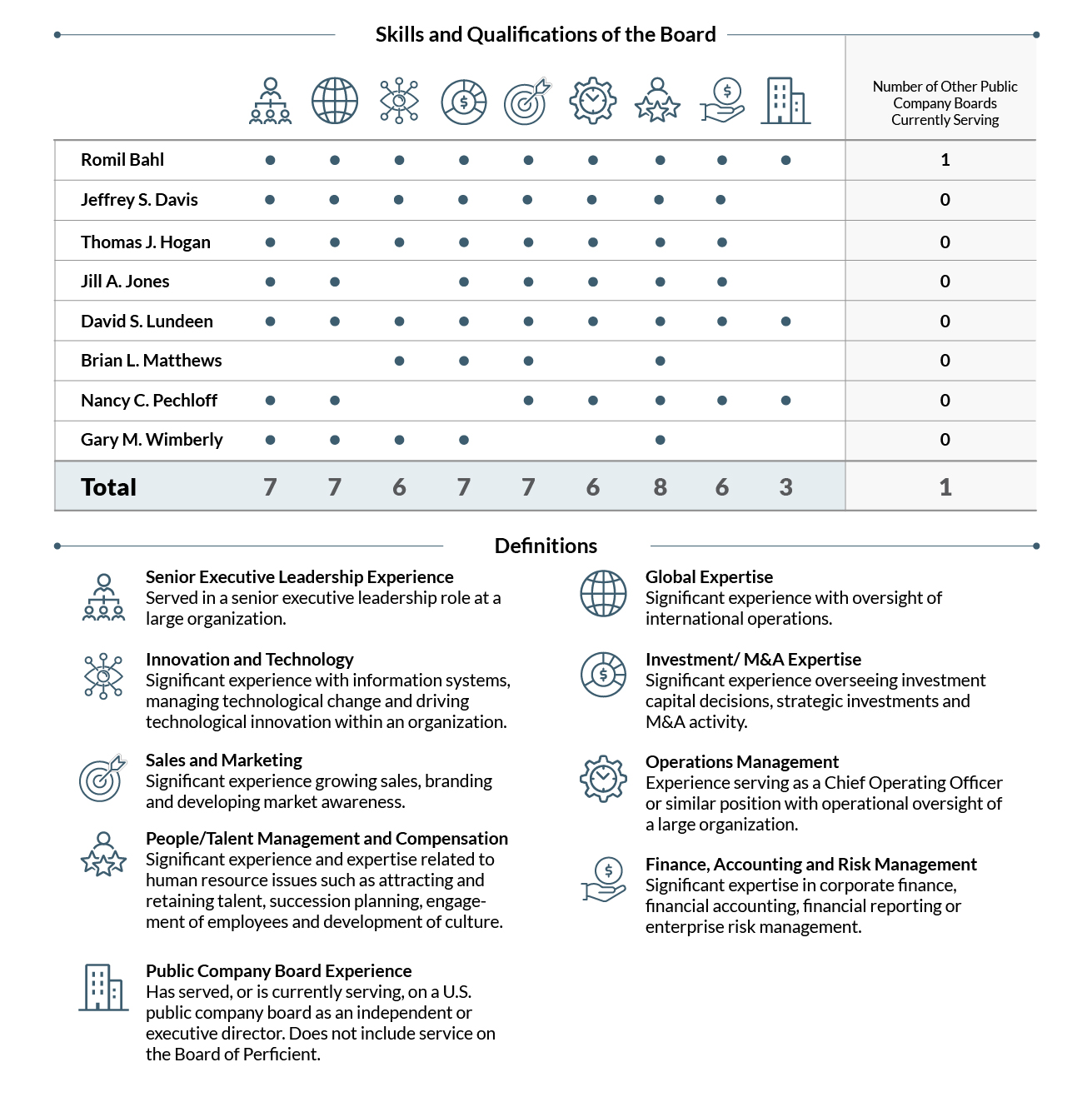

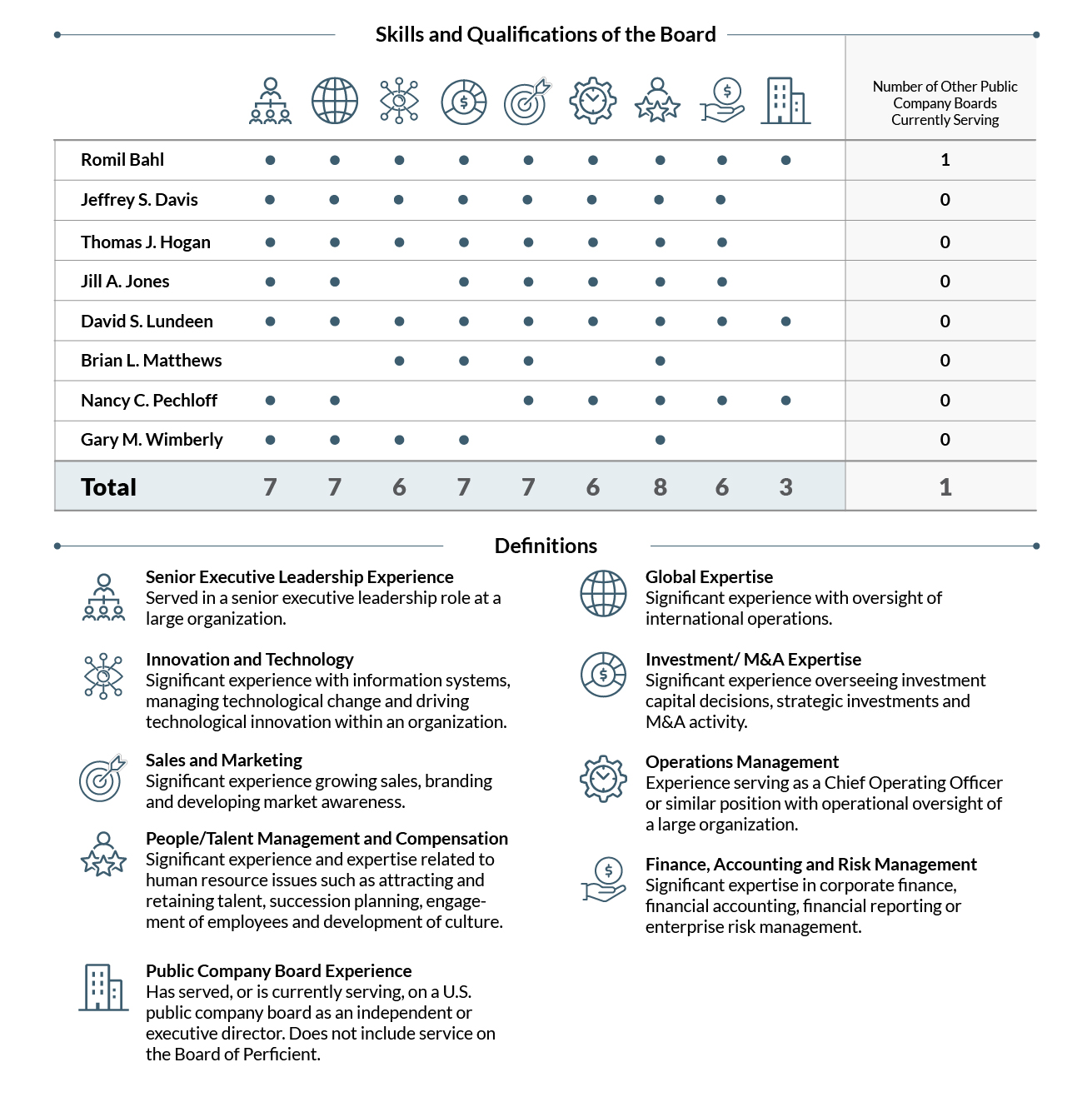

Director Qualifications

When considering whether directors and nominees have the experience, qualifications, attributes, diversity, and skills, taken as a whole, to enable the Board to satisfy its oversight responsibilities effectively in light of the Company’s business and structure, the Nominating, Governance, and Sustainability Committee and the Board focused primarily on the information discussed in each of the directors’ individual biographies set forth above. In particular:

•With regard to Mr. Bahl, the Board considered his extensive experience building top performing information, product and professional services companies across a range of industries.

•With regard to Mr. Davis, the Board considered his extensive knowledge and understanding of the Company and its operations, as well as his more than 30 years of experience in technology management and consulting.

•With regard to Mr. Hogan, the Board considered his extensive knowledge and understanding of the Company and its operations.

•With regard to Ms. Jones, the Board considered her extensive leadership, sales and marketing experience, including regional leadership roles of domestic and international regions, global production and supply chain leadership, and finance leadership roles.

•With regard to Mr. Lundeen, the Board considered his financial acumen, his strong background in business, finance and investment banking, and his vast and diverse board experience.

•With regard to Mr. Matthews, the Board considered his strong business and entrepreneurial background, especially his extensive experience with investing in, and managing, technology firms.

•With regard to Ms. Pechloff, the Board considered her financial acumen, her strong background in business, and her extensive and diverse board experience.

•With regard to Mr. Wimberly, the Board considered his extensive experience in integrating and growing businesses, building strong, collaborative relationships with customers and driving innovation and leading change across complex organizations.

COMPOSITION AND MEETINGS OF THE

BOARD OF DIRECTORS AND COMMITTEES

As of the date hereof, the size of the Board is currently set at eight directors. Effective as of October 1, 2023, the Board approved an increase in the size of the Board from eight directors to nine directors and appointed Mr. Hogan to fill the newly-created vacancy. On December 7, 2023, Ralph C. Derrickson, a member of the Board, tendered his resignation to the Board as required by the Mandatory Director Resignation provision included within the Company’s Corporate Code of Business Conduct and Ethics as a result of a “Status Change” impacting Mr. Derrickson due to the acquisition of Bsquare Corporation by a subsidiary of Kontron AG. On December 15, 2023, the Board accepted Mr. Derrickson’s resignation effective December 31, 2023. Acting by unanimous written consent, on April 12, 2024, the Board reset the Board to eight directors. The Board has affirmatively determined that a majority of the directors qualify as independent directors as defined by SEC regulations and The Nasdaq Global Select Market (“Nasdaq”) listing standards. The current independent directors are Romil Bahl, Jill A. Jones, David S. Lundeen, Brian L. Matthews, Nancy C. Pechloff and Gary M. Wimberly. Mr. Hogan is not considered independent under such regulations and standards because he serves as our President and CEO. Mr. Davis is also not considered independent because of his recent service as our CEO.

During 2023, the Board held six meetings and acted by unanimous written consent two times. Each of the directors that served on the Board during 2023 attended each of the meetings of the Board and the meetings of the committees on which such director served, except for Ralph C. Derrickson, who attended five of six of the meetings of the Board and 11 of 12 meetings of the committees on which he served. Mr. Derrickson attended all Board and committee meetings prior to tendering his resignation on December 7, 2023, effective December 31, 2023. Each director is invited to attend the Annual Meeting. All seven of the then currently serving directors attended the 2023 Annual Meeting remotely.

Committees of the Board of Directors

The Board has created a Compensation Committee, an Audit Committee, and a Nominating, Governance, and Sustainability Committee. Each member of these committees is independent as defined by SEC regulations and Nasdaq listing standards.

Compensation Committee

The Compensation Committee establishes salaries, incentives, and other forms of compensation for Perficient’s directors, executive officers, and key employees, and administers its equity incentive plans and other incentive and benefit plans. During 2023, this committee held four meetings and acted by unanimous written consent two times. Ralph C. Derrickson, David S. Lundeen, and Gary M. Wimberly served on the Compensation Committee in 2023. Mr. Derrickson previously served as Chairman of the Compensation Committee prior to his departure on December 31, 2023. Brian L. Matthews joined the Compensation Committee and began serving as Chairman of the Compensation Committee on January 1, 2024. For 2023, the Board affirmatively determined that each of Messrs. Derrickson, Lundeen and Wimberly qualified as an independent director as defined by Nasdaq listing standards and as required by SEC regulations. For 2024, the Board affirmatively determined that each of Messrs. Matthews, Lundeen, and Wimberly qualifies as an independent director as defined by Nasdaq listing standards and as required by SEC regulations. Additional information regarding the Compensation Committee is included in the section titled “Compensation Discussion and Analysis.” A copy of the current Compensation Committee Charter is available on the Company’s website, www.perficient.com.

Audit Committee

The Audit Committee has the sole authority to appoint, retain, and terminate the Company’s independent accountants and is directly responsible for the compensation, oversight, and evaluation of the work of the independent accountants. The independent accountants report directly to the Audit Committee. The Audit Committee also has the sole authority to approve all audit engagement fees and terms and all non-audit engagements with the Company’s independent accountants. The Audit Committee must pre-approve all audit and permitted non-audit services to be performed for the Company by the independent accountants, subject to certain exceptions provided by the Securities Exchange Act of 1934, as amended (the “Exchange Act”). A copy of the current Audit Committee Charter is available on the Company’s website, www.perficient.com.

This committee held four meetings during 2023. David S. Lundeen, Ralph C. Derrickson, and Nancy C. Pechloff served on the Audit Committee in 2023. Mr. Derrickson previously served on the Audit Committee prior to his departure on December 31, 2023. Following Mr. Derrickson’s departure, Jill A. Jones joined the Audit Committee on January 1, 2024. Mr. Lundeen serves as Chairman of the Audit Committee. For 2023, the Board affirmatively determined that each of Messrs. Derrickson and Lundeen and Ms. Pechloff qualified as an independent director as defined by Nasdaq listing standards and Rule 10A-3 of the Exchange Act, and further affirmatively determined that each member has sufficient knowledge and experience in financial matters to perform their duties on the committee. For 2023, the Board affirmatively determined that each of Mr. Lundeen and Ms. Pechloff qualified as an “audit committee financial expert” within the meaning of SEC regulations and that each has accounting and related financial management expertise within the meaning of Nasdaq listing standards. For 2024, the Board affirmatively determined that each of Mr. Lundeen and Mses. Jones and Pechloff qualifies as an independent director as defined by Nasdaq listing standards and Rule 10A-3 of the Exchange Act, and further affirmatively determined that each member has sufficient knowledge and experience in financial matters to perform their duties on the committee. For 2024, the Board affirmatively determined that each of Mr. Lundeen and Mses. Jones and Pechloff qualifies as an “audit committee financial expert” within the meaning of SEC regulations and that each has accounting and related financial management expertise within the meaning of Nasdaq listing standards.

Nominating, Governance and Sustainability Committee

The Nominating, Governance and Sustainability Committee is responsible for establishing the criteria for selecting directors, recommending to the Board individuals for election or re-election, overseeing orientation and continuing education programs, advising the Board on corporate governance practices, recommending chairpersons of each of the Board committees, reporting annually on the performance of the Board, overseeing sustainability matters and making recommendations to the Board and Company management for sustainability initiatives, activities and strategies. A copy of the current Nominating, Governance and Sustainability Committee Charter is available on the Company’s website, www.perficient.com.

Based on the recommendation of the Nominating, Governance and Sustainability Committee, the Board has adopted a set of Corporate Governance Guidelines. These Corporate Governance Guidelines, which are subject to annual review by the Nominating, Governance and Sustainability Committee, provide a framework within which the Board and executive officers fulfill their respective responsibilities and reflect the Board’s commitment to monitor the effectiveness of decision-making both at the Board and senior executive management level. A copy of the current Corporate Governance Guidelines is available on the Company’s website, www.perficient.com.

This committee held four meetings during 2023 and acted by unanimous written consent one time. Brian L. Matthews, Romil Bahl and Ralph C. Derrickson served on the Nominating, Governance and Sustainability Committee in 2023. Mr. Matthews served as Chairman of the Nominating, Governance and Sustainability Committee in 2023. Following Mr. Derrickson’s departure, Gary M. Wimberly joined the Nominating, Governance and Sustainability Committee and began serving as Chairman of the Nominating, Governance and Sustainability Committee on January 1, 2024. For 2023, the Board affirmatively determined that each of Messrs. Matthews, Bahl and Derrickson qualified as an independent director as defined by Nasdaq listing standards. For 2024, the Board affirmatively determined that each of Messrs. Wimberly, Bahl and Matthews qualifies as an independent director as defined by Nasdaq listing standards.

Identification of Director Candidates

The Nominating, Governance and Sustainability Committee is responsible for evaluating potential or suggested director nominees and identifying individuals qualified to become members of the Board. This committee evaluates persons suggested by stockholders and conducts appropriate inquiries into the backgrounds and qualifications of all possible nominees. The Nominating, Governance and Sustainability Committee has established criteria for selecting new director nominees, which includes knowledge of business, industry and economic environment, educational background, professional experience, and availability to serve as a director of the Company. Under the Corporate Governance Guidelines, a person may not stand for election after age 79. The Nominating, Governance and Sustainability Committee will identify and select candidates based on, among other things, their independence, character, ability to exercise sound judgment, diversity, age, demonstrated leadership, skills, including financial literacy, and experience in the context of the needs of the Board. To ensure the necessary range of experiences and skills required for the Board, the Nominating, Governance and Sustainability Committee will challenge the negative influence of unconscious bias and work towards an objective assessment of each candidate’s abilities and contributions to the Board. To the extent that the Nominating, Governance and Sustainability Committee is seeking new candidates, it will actively seek out candidates from underrepresented groups, including women and members of racial and ethnic minority groups. In accordance with the initial “Rooney Rule,” for each vacant Board position, the

Nominating, Governance and Sustainability Committee will interview at least one candidate who is a member of one or more underrepresented groups. The Nominating, Governance and Sustainability Committee will assess the effectiveness of this policy annually in connection with the nomination of directors for election at the Annual Meeting of Stockholders. Each nominee should be a person of integrity and be committed to devoting the time and attention necessary to fulfill their duties to the Company. Please see the section titled “Stockholder Proposals for Next Annual Meeting” for additional information regarding certain notice and other requirements applicable to director nominations made by stockholders.

Board Leadership and Risk Oversight

The Board regularly considers the appropriate leadership structure for the Company and whether the same individual should serve as the Company’s CEO and Chairman of the Board or whether different individuals should serve in these positions. The Board believes that it is important to retain the flexibility to make this determination from time to time to reflect the structure that the Board believes will provide the best leadership to the Company and to best serve the interests of the Company’s stockholders. With Mr. Davis resigning as Executive Chairman of the Company, effective March 1, 2024, the Company now has a Board chair that is not a part of executive management. Since Mr. Davis is not considered to be independent, Mr. Lundeen currently serves as the Lead Director, elected by the independent directors. As the Lead Director, Mr. Lundeen has the power to provide formal input into board meeting agendas, call meetings of the independent directors and preside at meetings of independent directors. Mr. Hogan currently serves as the Company’s CEO and as a member of the Board. The Board may determine at a future date that a different Board leadership structure is preferable.

The Board has responsibility for the oversight of risk management. The Board, either as a whole or through its committees, regularly discusses with management the Company’s major risk exposures, their potential impact on the Company, and the steps necessary to manage them. While the Board is ultimately responsible for risk oversight at the Company, the committees assist the Board in fulfilling its oversight responsibilities in certain areas of risk. In particular, the Audit Committee meets periodically with management in order to review the Company’s significant financial risk exposures and cybersecurity risk exposures and the steps management has taken to monitor and control such exposures. The Nominating, Governance and Sustainability Committee focuses on the management of risks associated with board organization, membership and structure, succession planning for the directors and executive officers, corporate governance, sustainability and other environmental, social and governance issues. Finally, the Compensation Committee assists the Board in fulfilling its oversight responsibilities with respect to the management of risks arising from compensation policies and programs.

Cybersecurity

Risk Management & Strategy

Perficient proactively manages its cybersecurity and data privacy risks with organizational and technical controls including a comprehensive set of policies, procedures, required annual and role-based training, cybersecurity insurance, security assessments for vendors with access to Perficient and/or Perficient client networks, and use of technology such as Multi-Factor Authentication (the “Program”). Perficient regularly tests and validates the Program using internal resources, external auditors, and rigorous industry certifications. After maintaining a Systems and Organization Controls 2 (SOC2) certification, Perficient achieved its global ISO27001:2022 certification, an international standard for information security management systems, in October 2023.

The Program is supported by a cross-functional team which identifies, assesses, monitors, tracks and pro-actively mitigates general and company specific risks, including those related to business continuity and third parties.

Perficient’s Information Technology, Data Security, Data Privacy, Finance and Communications teams conduct annual tabletop exercises in which various levels of management participate in simulated data security/privacy scenarios that Perficient, its clients and/or its personnel may face in the future. Perficient engages external resources to refresh the subject matter of these exercises and to continually challenge Perficient’s management in these exercises. Annual formal training using an online platform is required for all Perficient employees and subcontractors. Topics include how to identify suspicious activities and occurrences related to social engineering, phishing, viruses, and insider threats. Certain employees complete additional role-based training. Perficient’s formal training is supplemented throughout the year by regular “Securing Perficient” emails which reinforce relevant cybersecurity policies and procedures and cover topics such as emerging cybersecurity risks.

Perficient’s senior management are members of the Security and Compliance Executive Committee (“SCEC”) which meets at least semi-annually to review Perficient’s current cybersecurity risks, the effectiveness of current controls, policies and training. Any security-related policy violations or incidents involving Perficient or client data would be included in the SCEC briefing. Perficient senior management also regularly considers the impact of cybersecurity risks when developing its business strategy, financial planning, and capital allocation. Perficient is not aware of any current or past cyber related risks which have or are reasonably likely to materially affect its strategy, operations, or financial condition.

Governance

Perficient’s Vice President of Information Technology and General Counsel are active members of the cross-functional team managing the Program. Perficient’s Vice President of Information Technology is responsible for Perficient’s internally facing technology solutions, infrastructure, and data security team. He has served in similar leadership roles prior to joining Perficient. Perficient’s General Counsel is responsible for Perficient’s legal and privacy teams. He has over 10 years of experience in the technology sector which includes substantial experience in cybersecurity-related matters. These members of Perficient’s senior management team oversee day to day risk management activities performed by the Company’s IT Infrastructure, Data Security, and Data Privacy colleagues and participate in annual simulated data security/privacy exercises. The VP of Information Technology and General Counsel also regularly brief other members of the Company’s senior management team and the Board, either as a whole or through its Audit Committee, which is charged with oversight of the Program. These briefings occur at least quarterly and address the Program’s operations, management of cybersecurity risks, and any potential impact on Perficient’s operations and financial stability.

Communications with the Board

Communications by stockholders or by other parties may be sent to the Board by U.S. mail or overnight delivery and should be addressed to the Board of Directors c/o Secretary, Perficient, Inc., 555 Maryville University Dr., Suite 600, Saint Louis, Missouri, 63141. Communications directed to the Board, or one or more directors, will be reviewed by the Secretary and forwarded to the Board, as appropriate. Communications may be made anonymously.

COMPENSATION OF DIRECTORS

The Company uses a combination of cash and equity-based incentive compensation to attract and retain qualified candidates to serve on the Board. When recommending changes to director compensation, the Company considers the significant amount of time the directors expend in fulfilling their duties to the Company, as well as the skill level required of members of the Board. A director who is also an employee of the Company, such as Mr. Hogan, the Company’s CEO, is not entitled to any additional compensation for service on the Board.

For 2023, the Board compensation plan provided the following for non-employee directors:

•Each new non-employee director, in connection with their election or appointment to the Board, will be granted restricted stock with a value of $100,000, based on the closing market price of the Common Stock on the date of election or appointment to the Board vesting ratably on the last day of each calendar quarter over the immediately succeeding two years;

•Subject to continuing Compensation Committee approval, on the first business day in November of each year, each then-serving non-employee director will be granted an annual award of restricted stock with a value of $75,000, based on the closing stock price of the Common Stock on the date of grant, vesting ratably on the last day of each calendar quarter over the immediately succeeding one year;

•Subject to continuing Compensation Committee approval, on the first business day in November of each year, a non-employee Chairman of the Board will be granted an annual award of restricted stock with a value of $115,000, which is comprised of the annual award for non-employee directors of $75,000 and an additional annual award for a non-employee Chairman of the Board of $40,000, based on the closing stock price of the Common Stock on the date of grant, vesting ratably on the last day of each calendar quarter over the immediately succeeding one year;

•For each open-market purchase of Common Stock by non-employee directors, the Company will match the purchase with the grant of an equal number of shares, not to exceed $50,000 in value per calendar year, vesting ratably over a two-year period, contingent on continued service as a director;

•All director restricted stock awards are subject to accelerated vesting upon a change in control;

•Each non-employee director will be entitled to receive an annual cash fee of $55,000 paid in quarterly installments;

•The non-employee director serving as Chairman of the Board will receive an additional fee payable at the rate of $5,000 per quarter;

•The non-employee director serving as Chairman of the Audit Committee will receive an additional fee payable at the rate of $5,000 per quarter;

•The non-employee director serving as Chairman of the Compensation Committee will receive an additional fee payable at the rate of $4,500 per quarter;

•The non-employee director serving as Lead Director of the Board will receive an additional fee payable at the rate of $7,500 per quarter; and

•Effective October 24, 2023, the non-employee director serving as Chairman of the Nominating, Governance and Sustainability Committee will receive an additional fee payable at the rate of $2,500 per quarter.

Mr. Davis, as Chairman of the Board, did not receive any additional compensation for his service on the Board in 2023. Mr. Hogan, who became our Chief Executive Officer on October 1, 2023, was also appointed as a director of the Company on such date. Mr. Hogan did not receive any additional compensation for his service on the Board in 2023. The compensation of Messrs. Davis and Hogan as employees of the Company during 2023 is shown in the “Summary Compensation Table.” The following table provides information relating to total compensation amounts paid to non-employee members of the Board in 2023:

| | | | | | | | | | | | | | | | | | | | |

| 2023 DIRECTOR COMPENSATION |

| Name | | Fees Earned or Paid in Cash | | Stock Awards (1)(2)(3) | | Total |

| Romil Bahl (4) | | $ | 55,000 | | | $ | 124,920 | | | $ | 179,920 | |

| Ralph C. Derrickson (5) | | 73,000 | | | 124,899 | | | 197,899 | |

| Jill A. Jones (6) | | 31,126 | | | 224,841 | | | 255,967 | |

| David S. Lundeen (7) | | 105,000 | | | 74,953 | | | 179,953 | |

| Brian L. Matthews (8) | | 56,875 | | | 94,718 | | | 151,593 | |

| Nancy C. Pechloff (9) | | 55,000 | | | 124,909 | | | 179,909 | |

| Gary M. Wimberly (10) | | 55,000 | | | 123,538 | | | 178,538 | |

(1)Amounts listed represent the aggregate grant date fair value, with respect to restricted stock awards, computed in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718, Compensation-Stock Compensation (“ASC Topic 718”). In accordance with SEC rules, the amounts shown exclude the impact of estimated forfeitures related to service-based vesting conditions. Assumptions used in the calculation of the 2023 amounts were disclosed in Notes 2 and 5 to the Company’s consolidated financial statements for 2023, included in the Company’s Annual Report on Form 10-K filed with the SEC on February 27, 2024.

(2)To calculate the number of shares issued in the October 2023 restricted stock awards, the Company used the closing stock price on the date of grant. Accordingly, Messrs. Bahl, Derrickson, Lundeen, Matthews and Wimberly and Mses. Jones and Pechloff received a restricted stock award of 1,371 shares on October 24, 2023. The grant date fair value is based on the per share closing market price of the Common Stock on October 24, 2023 of $54.67.