Exhibit (c)(2)

PRIVATE & CONFIDENTIAL

DRAFT AS OF DECEMBER 18, 2013, FOR DISCUSSION PURPOSES ONLY

FOR REVIEW SOLELY AS TO FORM

SUBJECT TO FURTHER REVIEW AND INTERNAL MS APPROVALS

THIS DRAFT DOES NOT CONSTITUTE AN APPRAISAL, OPINION, OR REPORT

WITHIN THE MEANING OF THE UNITED STATES FEDERAL SECURITIES LAWS OR

FOR ANY OTHER PURPOSE

[MORGAN STANLEY LETTERHEAD]

December ·, 2013

The Independent Committee of the Board of Directors

Brookfield Office Properties Inc.

Brookfield Place

181 Bay Street, Suite 330

Toronto, Ontario M5J 2T3

Attention: Christie J.B. Clark and Paul J. Massey Jr.

Dear Sirs:

Morgan Stanley Canada Limited (“Morgan Stanley”, “we” or “our”) understands that Brookfield Property Partners L.P. (“BPY”), and its indirect subsidiaries, BOP Split Corp. (“BOP Split”) and BOP Exchange LP (“Exchange LP” and collectively with BPY and BOP Split, the “Offerors”) are proposing to make an offer, by way of a take-over bid, to purchase any or all of the common shares (the “BPO Common Shares”) of Brookfield Office Properties Inc. (“BPO”) not already owned by the Offerors (the “Offer”). BPY’s September 30, 2013 press release regarding the Offer states that BPY owns approximately 51% of BPO and that the Offer would constitute an “insider bid” for the purposes of Multilateral Instrument 61-101 — Protection of Minority Security Holders in Special Transactions (“MI 61-101”). BPY’s September 30, 2013 press release states that under the Offer each holder of a BPO Common Share will be permitted to elect to receive consideration per BPO Common Share (the “Consideration”) of either one non- voting limited partnership unit of BPY (a “BPY Unit”) or $19.34 in cash, subject in each case to pro-ration based on a maximum of 174,000,000 BPY Units and maximum cash consideration of $1,700,000,000. Morgan Stanley further understands that Canadian holders of BPO Common Shares can elect to receive, in lieu of BPY Units, exchangeable limited partnership units of Exchange LP (“Exchange LP Units”). Each Exchange LP Unit will be exchangeable at any time on a one-for-one basis, at the option of the holder, for BPY Units, subject to their terms and applicable laws, and will provide a holder thereof with economic terms which are substantially equivalent to those of a BPY Unit. The above description is summary in nature. The specific terms and conditions of the Offer are to be described in the offer to purchase and take-over bid circular of the Offerors (the “BPY Circular”) which are to be mailed to holders of the BPO Common Shares in connection with the Offer.

Morgan Stanley further understands that the board of directors of BPO (the “Board”) has appointed a committee (the “Independent Committee”) comprised of members of the Board who are independent for the purposes of MI 61-101, to consider the Offer and to make recommendations to the Board with respect to the Offer. The Independent Committee has retained Morgan Stanley to provide financial advice and assistance to the Independent

Committee in evaluating the Offer, including the preparation and delivery to the Independent Committee of a formal valuation of the BPO Common Shares (the “BPO Valuation”) and of the BPY Units (the “BPY Valuation”) (together, the “Valuations”) in accordance with the requirements of MI 61-101 and under the supervision of the Independent Committee.

All dollar amounts herein are expressed in United States dollars, unless stated otherwise.

ENGAGEMENT OF MORGAN STANLEY

On October 11, 2013, the Independent Committee requested Morgan Stanley to submit a proposal with respect to providing formal valuations of the BPO Common Shares and the BPY Units. Following Morgan Stanley’s submission of such a proposal on October 16, 2013, Morgan Stanley was invited to meet with the Independent Committee on October 23, 2013. The Independent Committee agreed to hire Morgan Stanley as announced in a press release on October 30, 2013, which was formalized in a letter agreement dated December 2, 2013 (the “Engagement Agreement”). On December 3, 2013, at the request of the Independent Committee, Morgan Stanley delivered the substance of the preliminary valuation analysis. On ·, 2013, at the request of the Independent Committee, Morgan Stanley orally delivered the substance of the Valuations. These Valuations provide the same opinions, in writing, as of ·, 2013.

The Engagement Agreement provides for a payment to Morgan Stanley of a fee upon our delivery of our preliminary valuation analysis ($2.0 million), which was delivered on December 3, 2013, a fee upon our delivery of the Valuations ($2.2 million) and a fee upon our delivery of each subsequent financial opinion ($500,000), if requested by the Independent Committee. None of the fees payable to us under the Engagement Agreement are contingent upon the conclusions reached by us in the Valuations or in any subsequent financial opinion, or the completion of the Offer. In addition, BPO has agreed to reimburse Morgan Stanley for our reasonable out-of-pocket expenses and to indemnify Morgan Stanley in respect of certain liabilities that might arise out of our engagement. The fees payable to Morgan Stanley pursuant to the Engagement Agreement are not financially material to Morgan Stanley.

Subject to the terms of the Engagement Agreement, Morgan Stanley consents to the inclusion of the Valuations in the BPY Circular and in the directors’ circular of BPO (the “Directors’ Circular”), with a summary thereof, in a form acceptable to Morgan Stanley, and to the filing thereof with the applicable Canadian and United States securities regulatory authorities.

CREDENTIALS OF MORGAN STANLEY

Morgan Stanley is a global financial services firm engaged in the securities, investment management and individual wealth management businesses. Our securities business is engaged in securities underwriting, trading and brokerage activities, foreign exchange, commodities and derivatives trading, prime brokerage, as well as providing investment banking, financing and financial advisory services.

The Valuations are the opinions of Morgan Stanley and their form and content have been approved by a committee of senior investment banking professionals of Morgan Stanley, each of whom is experienced in merger, acquisition, divestiture, valuation and fairness opinion matters. The Valuations have been prepared in accordance with the Disclosure Standards for Formal Valuations and the Fairness Opinions of the Investment Industry Organization (the “Organization”) but the Organization has not been involved in the preparation or review of the Valuations.

INDEPENDENCE OF MORGAN STANLEY

Morgan Stanley confirms that: (i) we and our affiliated entities are not an issuer insider, associated entity nor an affiliated entity of any interested party as each such term is used in MI 61-101; (ii) we and our affiliated entities are not acting as a financial advisor to any interested party in respect of the Offer; (iii) our compensation under the Engagement Agreement does not depend in whole or in part on the conclusion reached in the Valuations or the outcome of the Offer; (iv) we and our affiliated entities will not act as manager or co-manager of any soliciting dealer group formed by any interested party in connection with the Offer nor will we, as a member of any such group, perform services beyond customary soliciting dealer’s functions nor will we receive more than the per security or per securityholder fee payable to other members of the group; and (v) we and our affiliated entities do not have any material financial interest in the completion of the Offer.

Prior to entering into the Engagement Agreement, Morgan Stanley or its affiliated entities have provided various financial advisory services to BPO, Brookfield Asset Management Inc. (“BAM”), and certain of their respective affiliated entities in connection with transactions unrelated to the Offer. The fees paid to Morgan Stanley or its affiliated entities, as applicable, in connection with the foregoing activities, together with the fees payable to Morgan Stanley pursuant to the Engagement Agreement, are not, in the aggregate, financially material to Morgan Stanley and its affiliated entities. Morgan Stanley and its affiliates act as traders and dealers, both as principals and agents, in major financial markets and, as such, may have had, and may in the future have, positions in the securities of BPO or BPY or their affiliates and, from time to time, may have executed, or may execute, transactions on behalf of such entities. As investment dealers, Morgan Stanley and its affiliates conduct research on securities and may, in the ordinary course of business, provide research reports and investment advice to their clients on investment matters, including matters with respect to the Offer, BPO, BPY and their respective affiliates. There are no understandings or agreements between Morgan Stanley and its affiliated entities, BPO and its associated or affiliated entities or BPY and its associated or affiliated entities with respect to future financial advisory or investment banking business. Morgan Stanley and its affiliated entities may in the future, in the ordinary course of business, perform financial advisory or investment banking services for such entities.

SCOPE OF REVIEW

In connection with the Valuations, Morgan Stanley reviewed and relied upon (subject to the exercise of professional judgment, and except as expressly described herein, without attempting to verify independently the completeness or accuracy of) or carried out, among other things, the following:

1) interim reports, including the comparative unaudited financial statements and management’s discussion and analysis, of BPO for the three and six months ended June 30, 2013 and September 30, 2013;

2) annual reports, comparative audited annual financial statements, management’s discussion and analysis, annual information forms and management information circulars of BPO for the fiscal years ended December 31, 2012, 2011 and 2010;

3) annual report on Form 20-F of BPY dated April 30, 2013 including the accompanying financial statements;

4) interim reports, including the comparative unaudited financial statements and management’s discussion and analysis, of BPY for the three and six months ended June 30, 2013 and September 30, 2013;

5) quarterly supplemental reports for the three months ended June 30, 2013 and September 30, 2013 for BPY and BPO, as well as a review of quarterly earnings call transcripts for the three months ended June 30, 2013 and September 30, 2013;

6) press releases, material change reports and other regulatory filings made by BPO and BPY during the past three years;

7) management-prepared operating and financial projections for BPO and BPY;

8) various BPY investor presentations including a September 2013 Investor Presentation regarding the Offer; a November 2013 Investor Presentation regarding BPY’s investment in General Growth Properties, Inc. (“GGP”); and monthly corporate profiles from September to December 2013;

9) publicly available information regarding GGP, Rouse Properties, Inc. (“RSE”), the Canary Wharf Group plc (“CWG”), affiliates of BPO and BPY such as BAM, Brookfield Canada Office Properties, Brookfield Prime Property Fund, Brookfield Renewable Energy Partners L.P, and Brookfield Infrastructure Partners L.P., and certain other funds in which BPY has investments;

10) review of due diligence files contained in a data room prepared by each of BPO and BPY, including such items as internal business plans, International Finance Reporting Standards (IFRS) valuations, asset, tenant, leasing, development and redevelopment project information, fund investor reports, asset appraisals, investment committee memos, tax disclosure, and debt, preferred stock, capital securities, and equity details, including shares, units, unit equivalents, and options outstanding;

11) discussions with management of each of BPO and BPY regarding the primary assets, operations, and businesses of each of BPO and BPY, and other issues deemed relevant by Morgan Stanley;

12) due diligence sessions and calls with senior management of each of BPO and BPY;

13) meetings and discussions with the Independent Committee;

14) discussions with legal counsel to the Independent Committee;

15) various research publications prepared by equity research analysts, industry sources, and credit rating agencies regarding BPO and BPY, the commercial real estate and office and mall property industries, and other public companies, as Morgan Stanley deemed relevant;

16) public information relating to the business, operations, financial performance and stock trading history of each of BPO and BPY, and other selected public companies, as Morgan Stanley considered relevant;

17) public information with respect to certain other transactions of a comparable nature, as Morgan Stanley considered relevant;

18) certificates addressed to Morgan Stanley, dated as of the date hereof, from two senior officers of each of BPO and BPG LLC (as defined below) as to the completeness and accuracy of the information provided to Morgan Stanley by BPO and BPY, respectively; and

19) such other corporate, industry, and financial market information, investigations and analyses as Morgan Stanley considered necessary or appropriate in the circumstances.

Morgan Stanley has not, to the best of its knowledge, been denied access by BPO or BPY to any information requested by Morgan Stanley. Morgan Stanley did, however, request certain non-public information regarding certain entities in which BPY has an investment for purposes of the BPY Valuation, including with respect to GGP, RSE, and certain private funds. BPY advised Morgan Stanley that it was legally precluded from providing such information to Morgan Stanley and, as such and with the permission of the Independent Committee, Morgan Stanley has relied upon publicly available information with respect to these entities and discussions with BPY with respect to its strategy for these investments for the purposes of the BPY Valuation.

PRIOR VALUATIONS

Each of BPO and BPY has represented to Morgan Stanley that there are no prior valuations (as defined in MI 61-101) of BPO or BPY or of their respective securities or material assets, which have been prepared as of a date within two years preceding the date hereof.

ASSUMPTIONS AND LIMITATIONS

The Valuations are subject to the assumptions and limitations set out below.

With the Independent Committee’s acknowledgement and agreement as provided for in the Engagement Agreement, Morgan Stanley has relied upon the accuracy, completeness and fair presentation of all data and other information obtained by it from public sources or provided to it by or on behalf of BPO and BPY, or otherwise obtained by Morgan Stanley, including the certificates identified below (collectively, the ‘‘Information’’). The Valuations are conditional upon such accuracy, completeness and fair presentation. Subject to the exercise of professional judgment, and except as expressly described herein, Morgan Stanley has not attempted to verify independently the accuracy, completeness of fair presentation of any of the Information. Without limiting the generality of the foregoing, our description of BPO, BPY and of their respective assets, businesses and operations are derived from information that we have obtained from BPO, BPY or their respective affiliates or advisors or from publicly available sources. We have not met separately with the independent auditors of BPO or BPY in connection with preparing the Valuations, and, with the Independent Committee’s permission, we have assumed the accuracy and fair presentation of, and relied upon, BPO’s and BPY’s audited financial statements and the reports of the auditors thereon and BPO’s and BPY’s interim unaudited financial statements.

With respect to the budgets, forecasts, projections and/or estimates provided to Morgan Stanley and used in its analyses, Morgan Stanley notes that projecting future results is inherently subject to uncertainty. Morgan Stanley has assumed, however, that such budgets, forecasts, projections and/or estimates were prepared using the assumptions identified therein which Morgan Stanley has been advised are (or were at the time of preparation and continue to be), in the opinion of BPO or BPY, as applicable, reasonable in the circumstances and were prepared on a basis reflecting the best currently available estimates and judgments of management of BPO and BPY, respectively. Senior officers of BPO and Brookfield Property Group LLC (“BPG LLC”), a manager of BPY (where we refer to BPY management herein, we are referring to management of BPG LLC as a manager of BPY), have represented to Morgan Stanley in certificates dated December ·, 2013, among other things, that to the best of their knowledge, information and belief after due inquiry (as it relates to BPO in the case of representations by senior officers of BPO, and BPY in the case of representations by senior officers of BPG LLC):

1) BPO and BPG LLC have no information or knowledge of any facts public or otherwise not specifically provided to Morgan Stanley relating to BPO or BPY, or any of their subsidiaries or their respective assets, liabilities, affairs, prospects or condition (financial or otherwise) which would reasonably be expected to affect the Valuations;

2) subject to (4) below regarding budgets, forecasts, projections and estimates, the Information provided orally by, or in the presence of, an officer of BPO or BPG LLC or in writing by BPO or BPG LLC or by any of BPO’s or BPY’s respective subsidiaries or their respective advisors or agents to Morgan Stanley for the purpose of preparing the Valuations is, or in the case of historical Information, was at the date of preparation, complete, true and accurate in all material respects, and does not and did not contain any untrue statement of a material

fact in respect of BPO, BPY, and their respective subsidiaries or the Offer and does not and did not omit to state a material fact in respect of BPO, BPY and their respective subsidiaries or the Offer necessary to make the Information or any statement therein not misleading in light of the circumstances under which the Information was provided or any such statement was made;

3) since the date on which the Information was provided to Morgan Stanley, except as disclosed in writing to Morgan Stanley, there has been no material change, financial or otherwise, in the financial condition, assets, liabilities (contingent or otherwise), business, operations or prospects of BPO, BPY or any of their respective subsidiaries and no material change has occurred in the Information or any part thereof which would have or which would reasonably be excepted to have a material effect on the Valuations and there is no plan or proposal by either BPO or BPY for any material change in the respective financial condition, assets, liabilities (contingent or otherwise), business, operations or prospects of BPO, BPY or any of their respective subsidiaries which has not been disclosed to Morgan Stanley;

4) with respect to any portion of the Information that constitute budgets, forecasts, projections and/or estimates, such budgets, forecasts, projections and/or estimates: (a) were prepared on a basis consistent in all material respects with relevant accounting policies applied in the most recent audited consolidated financial statements of BPO and BPY, respectively; (b) were prepared using the assumptions identified therein, which in the reasonable belief of management of BPO and BPG LLC are (or were at the time of preparation and continue to be) reasonable in the circumstances; (c) were prepared on a basis reflecting the best currently available estimates and judgments of management of BPO and BPG LLC as to matters covered thereby at the time thereof; (d) reasonably present the views of management of BPO and BPG LLC of the financial prospects and forecasted performance of BPO and BPY and their respective subsidiaries and are consistent with the historical operating experience of each of BPO and BPY and their respective subsidiaries; and (e) are not, in the reasonable belief of management of BPO and BPG LLC, misleading in any material respect in light of the assumptions used or in light of any developments since the time of their preparation;

5) the contents of each of BPO’s and BPY’s public disclosure documents, as of their respective dates, were true and correct in all material respects and did not contain any misrepresentation and such disclosure documents complied in all material respects with all requirements under applicable laws as of their respective dates;

6) there are no prior valuations (as defined in MI 61-101) of BPO or BPY, or of their respective securities or material assets, which have been prepared as of a date within two years preceding the date hereof;

7) there have been no written, or to the best of BPO and BPG LLC’s knowledge, verbal, offers for or proposed transactions involving all or a material part of the properties and assets owned by, or the securities of, BPO, BPY or any of their respective subsidiaries and no negotiations have occurred relating to any such offers or transactions within two years preceding the date on which the Offer was first publicly announced by BPY which have not been disclosed to Morgan Stanley;

8) other than as disclosed in the Information, neither BPO, BPY or any of their respective subsidiaries has any material contingent liabilities and there are no actions, suits, claims, proceedings, investigations, or inquiries pending or, to the best of BPO’s and BPG LLC’s knowledge, threatened against or affecting the Offer, BPO, BPY or any of their respective subsidiaries at law or in equity or before or by any federal, national, provincial, state, municipal or other governmental department, commission, bureau, board, agency or instrumentality which may, in any way, materially adversely affect BPO, BPY or their respective subsidiaries or the Offer;

9) there are no agreements, undertakings, commitments or understandings (whether written or oral, formal or informal) relating to the Offer, except as have been disclosed to Morgan Stanley;

10) BPO and BPG LLC have no knowledge of any material non-public information concerning the securities of BPO or BPY, or the assets, liabilities, affairs, prospects or condition (financial or otherwise) of BPO, BPY and their subsidiaries, considered on a consolidated basis, that has not been generally disclosed, except such information that has been disclosed to Morgan Stanley by BPO or BPG LLC; and

11) BPO and BPG LLC have either: (a) provided Morgan Stanley with all Information which Morgan Stanley has requested; or (b) informed Morgan Stanley that such information does not exist, is not in the possession of BPO or BPG LLC or that BPO or BPG LLC, respectively, is legally precluded from providing such information to Morgan Stanley.

In preparing the Valuations, Morgan Stanley has made several assumptions, including that conditions precedent to the completion of the Offer can be satisfied in due course, all consents, permissions, exemptions or orders of relevant third parties or regulatory authorities will be obtained, without adverse condition or qualification, the procedures being followed to implement the Offer are valid and effective, the BPY Circular and the Directors’ Circular will be distributed to the securityholders of BPO entitled to receive them in accordance with the applicable laws, the disclosure in the BPY Circular and the Directors’ Circular will be accurate in all material respects and will comply, in all material respects, with the requirements of all applicable laws and the BPY Units to be distributed to holders of BPO Common Shares as consideration under the Offer will be freely tradeable by such holders substantially concurrently with the acquisition of the BPO Common Shares by BPY pursuant to the Offer. In its analysis in connection with the preparation of the Valuations, Morgan Stanley made

numerous assumptions with respect to industry performance, general business and economic conditions, and other matters, many of which are beyond the control of Morgan Stanley, BPO or BPY.

In preparing the BPY Valuation, and with the permission of the Independent Committee, Morgan Stanley assumed that the Offer will result in the Offerors acquiring 100% of the BPO Common Shares not already owned by the Offerors.

The Valuations are conditional upon all of Morgan Stanley’s assumptions being correct and there being no ‘‘misrepresentation’’ (as defined in the Securities Act (Ontario)) in any Information.

Morgan Stanley is not a legal, tax or accounting expert, and Morgan Stanley expresses no opinion concerning any legal, tax or accounting matters concerning the Offer or the sufficiency of this letter for the purposes of the Independent Committee or the Board.

The Valuations have been provided for the use of the Independent Committee and are not intended to be, and do not constitute, a recommendation that any holders of BPO Common Shares tender their BPO Common Shares pursuant to the Offer. The Valuations may not be used by any other person or relied upon by any other person other than the Independent Committee and the Board without the express prior written consent of Morgan Stanley. The Valuations do not address the relative merits of the Offer as compared to other transactions or business strategies that might be available to BPO. Morgan Stanley expresses no opinion with respect to the future trading prices of securities of BPO or BPY. The Valuations are rendered as of December ·, 2013 on the basis of securities markets, economic and general business and financial conditions prevailing on that date and the condition and prospects, financial and otherwise, of BPO, BPY and their respective subsidiaries and affiliates as they were reflected in the Information provided to Morgan Stanley. Any changes therein may affect the Valuations and, although Morgan Stanley reserves the right to change or withdraw the Valuations in such event, it disclaims any undertaking or obligation to advise any person of any such change that may come to its attention, or update the Valuations after such date. In preparing the Valuations, Morgan Stanley was not authorized to solicit, and did not solicit, interest from any other party with respect to the acquisition of BPO Common Shares or other securities of BPO, or any business combination or other extraordinary transaction involving BPO, nor did Morgan Stanley negotiate with any party in connection with any such transaction involving BPO.

The preparation of a valuation is a complex process and is not necessarily amenable to partial analysis or summary description. Morgan Stanley believes that its analyses must be considered as a whole and that selecting portions of the analyses or the factors considered by it, without considering all factors and analyses together, could create an incomplete view of the process underlying the Valuations. Accordingly, the Valuations should be read in their entirety.

OVERVIEW OF BPO

BPO owns, develops and manages premier office properties in the United States, Canada, Australia and the United Kingdom. BPO’s portfolio is comprised of interests in 111

properties totaling 76 million square feet in the downtown cores of New York, Washington, D.C., Houston, Los Angeles, Denver, Seattle, Toronto, Calgary, Ottawa, London, Sydney, Melbourne and Perth. Landmark properties include: the Brookfield Places in New York, Toronto and Perth; Bank of America Plaza in Los Angeles; Bankers Hall in Calgary; and Darling Park in Sydney. The majority of BPO’s assets are not wholly-owned. These non-wholly owned assets are held within private funds structures, within publicly-traded entities (such as Brookfield Canada Office Properties in Canada and the Brookfield Prime Property Fund in Australia) or through property-level joint ventures.

BPO has a development pipeline and land bank in sites across the United States (“U.S.”), Canada, Australia and the United Kingdom (“U.K.”). Active developments include: the development site Manhattan West in New York City; Bay Adelaide Centre East in Toronto; Brookfield Place East and West in Calgary; and Brookfield Place Tower 2 in Perth. BPO is also the operating partner of and co-investor in Wynyard Properties Holding Limited, an Australian investment held within Brookfield Strategic Real Estate Partners (“BSREP”), the opportunity fund sponsored by BAM.

BPO derives fee income from the management of funds and assets in which it has a partial interest, including the U.S. Office Fund, the Canadian Office Fund, the Downtown LA Fund (the “DTLA Fund”) and various property-level partnerships.

BPO also has a minority ownership position in a global facilities management and services entity (the “Management Entity”) which includes Brookfield Johnson Controls Canada (“BJCC”), Brookfield Johnson Controls Australia (“BJCA”), Brookfield Residential Services Limited (“BRSL”) and the Middle East FM Business (the “Middle East Business”). BPO previously held partial interests in BJCC and BRSL, and contributed them into the Management Entity as of October 2013. BAM simultaneously contributed its interests in BJCC, BJCA and the Middle East Business to the Management Entity.

The BPO Common Shares are listed on the New York Stock Exchange (the “NYSE”) and the Toronto Stock Exchange (the “TSX”) under the symbol “BPO”.

OVERVIEW OF BPY

BPY was established on January 3, 2013 as a Bermuda exempted limited partnership registered under the Bermuda Limited Partnership Act of 1883, as amended, and the Bermuda Exempted Partnerships Act of 1992, as amended. BPY is a commercial real estate owner, operator and investor operating globally. BPY’s diversified portfolio includes interests in over 300 office and retail properties encompassing approximately 250 million square feet. In addition, BPY has interests in approximately 19,800 multi-family units, 29 million square feet of industrial space and an 18 million square foot office development pipeline.

In terms of investments, BPY owns direct real estate and development assets in Australia, New Zealand, the U.K., Germany and Brazil. The majority of BPY’s assets in New Zealand are owned through the Multiplex New Zealand Property Fund. BPY also has equity interests in private and public companies such as BPO, GGP, RSE and CWG. Finally, BPY has

limited partnership (“LP”) interests in ten real estate funds, including four opportunity funds, three real estate finance funds and three sector-specific funds.

BPY’s sole direct investment is its limited partnership interest in Brookfield Property L.P., which holds BPY’s real estate assets through primary holding subsidiaries which indirectly hold all of BPY’s interests in its real estate assets.

The BPY Units are listed on the NYSE and the TSX under the symbols “BPY” and “BPY.UN”, respectively.

DEFINITION AND APPROACH TO FAIR MARKET VALUE

The Valuations are based upon techniques and assumptions that Morgan Stanley considers appropriate in the circumstances for the purposes of arriving at an opinion as to the range of fair market values of the BPO Common Shares and the range of fair market values of the BPY Units. Morgan Stanley approached the Valuations in accordance with MI 61-101, which, in the case of an insider bid such as the Offer, requires the valuator to make a determination as to the “fair market value” of not only the affected securities (i.e. the BPO Common Shares), but also the non-cash consideration (except in certain circumstances outlined in MI 61-101), to be received pursuant to the Offer. Morgan Stanley has therefore been requested by the Independent Committee to determine, and it has determined, the fair market value of the BPY Units as part of the Valuations.

MI 61-101 defines “fair market value” as the monetary consideration that, in an open and unrestricted market, a prudent and informed buyer would pay a prudent and informed seller, each acting at arm’s length with the other and under no compulsion to act. In accordance with MI 61-101, Morgan Stanley has made no downward adjustment to the fair market value of the BPO Common Shares to reflect the liquidity of the BPO Common Shares, the effect of the Offer on the BPO Common Shares, or the fact that the BPO Common Shares held by minority shareholders do not form part of a controlling interest. Consequently, the BPO Valuation provides a conclusion on a per BPO Common Share basis with respect to BPO’s “en bloc” value, being the price at which all of the BPO Common Shares could be sold to one or more buyers at the same time.

As Exchange LP was established for the sole purpose of the Offer, the Exchange LP Units will be exchangeable at any time on a one-for-one basis, at the option of the holder, for BPY Units, subject to their terms and applicable laws, and, as Morgan Stanley understands it, will provide a holder thereof with economic terms which are substantially equivalent to those of a BPY Unit, Morgan Stanley believes that the fair market value of a BPY Unit is an appropriate indicator of the expected fair market value of the Exchange LP Units.

BPO VALUATION APPROACH AND METHODOLOGIES

In determining the fair market value of the BPO Common Shares, Morgan Stanley relied primarily on the net asset value (“NAV”) approach. As secondary methodologies, Morgan Stanley considered the comparable trading approach, the precedent transactions approach and the dividend discount model (“DDM”) approach. Finally, Morgan Stanley reviewed and

considered valuation reference points such as the 52-week trading range of the BPO Common Shares, equity research analysts’ price targets and NAV estimates of the BPO Common Shares, and BPO’s IFRS valuations as provided by BPO management.

APPLICATION OF VALUATION METHODOLOGIES TO THE BPO COMMON SHARES

Net Asset Value Analysis

The NAV methodology ascribes a separate value for each category of asset and liability, utilizing the methodology appropriate in each case based on the unique characteristics of each asset. The sum of total assets less total liabilities yields the NAV. As Morgan Stanley does not consider a NAV analysis a liquidation analysis, it has not included frictional costs that may be incurred in the liquidation of the assets such as transaction costs or tax leakage in the subsequent analysis. In preparing BPO’s NAV analysis, Morgan Stanley relied on financial projections as prepared by BPO management.

The key components of BPO’s NAV are as follows:

· Operating real estate

· Redevelopment and development projects

· Real estate funds / asset management business

· Services business

· Cash and net other assets

· Debt, mark-to-market on debt, capital securities, and preferred stock

Operating Real Estate

Operating real estate includes office assets located in the U.S., Canada, Australia, and the U.K. Based on each asset’s profile, Morgan Stanley applied either a range of select nominal capitalization rates to 2014 net operating income as estimated by BPO management, or employed a discounted cash flow (“DCF”) approach. In this approach, unlevered cash flows over a specific forecast period are discounted at a specific rate to determine the present value of the unlevered cash flows. The present value of a terminal value, representing the value of cash flows beyond the end of the forecast period, is added to arrive at a total aggregate value. For assets with respect to which Morgan Stanley employed a DCF approach, Morgan Stanley determined the terminal value by applying a reversionary cap rate to the year following the end of the forecast period’s net operating income.

For those assets with respect to which Morgan Stanley employed a DCF approach, Morgan Stanley relied upon the unlevered cash flow projections prepared by BPO management. In determining the length of each asset’s forecast period, Morgan Stanley took into account such factors as the asset’s expected occupancy, anticipated tenant turnover and re- leasing expectations as provided by BPO management, and the timing of certain redevelopment projects, resulting in a weighted average hold period of 6.4 years. For each market, Morgan Stanley selected a range of discount rates and reversionary cap rates based on third-party data providers and Morgan Stanley’s review of discount rates and reversionary cap rates used by BPO management in its quarterly International Finance Reporting Standards (“IFRS”)

valuations. In certain cases, Morgan Stanley made adjustments to the resulting range of market discount rates and reversionary capitalization rates to reflect each asset’s unique characteristics, the length of the DCF period, and Morgan Stanley’s knowledge of current real estate pricing parameters. As a result, the range of market discount rates ranged from a weighted average 7.4% to a weighted average of 7.9% and the range of market reversionary cap rates ranged from a weighted average of 5.9% to a weighted average 6.3%. Morgan Stanley then made adjustments to each asset’s resulting gross asset value to reflect BPO’s proportionate ownership in each asset, net of non-controlling interests.

For those assets with respect to which Morgan Stanley applied a range of nominal capitalization rates to 2014 estimated net operating income, Morgan Stanley selected a range of nominal capitalization rates for each market based on third-party data providers and select precedent transactions. In certain cases, Morgan Stanley made adjustments to the resulting range of market capitalization rates to reflect each asset’s unique characteristics and Morgan Stanley’s knowledge of current real estate pricing parameters. As a result, the range of market nominal capitalization rates Morgan Stanley applied to 2014 estimated net operating income ranged from a weighted average of 5.5% to a weighted average of 5.9%. Morgan Stanley then made adjustments to each asset’s resulting gross asset value to reflect BPO’s proportionate ownership in each asset, net of non-controlling interests.

As a result of these approaches, Morgan Stanley determined the fair market value of the operating real estate to be in the range of $22,845 million to $24,602 million.

Development and Redevelopment Projects

BPO’s development and redevelopment assets include the 450 West 33rd Street property undergoing redevelopment, the Manhattan West parcel adjacent to 450 West 33rd Street, Bay Adelaide East in Toronto, Brookfield Place East in Calgary, Brookfield Place South in Perth, and other development assets and land held for development in the U.S., Canada, Australia and the U.K. In determining the fair market value of the development and redevelopment assets, Morgan Stanley considered the residual land value approach, the DCF approach, the cost basis approach, and also comparable land valuation metrics, as appropriate. Morgan Stanley also reviewed BPO’s third-quarter 2013 IFRS values for these projects. As a result of these approaches, Morgan Stanley determined the fair market value of these projects to be in the range of $1,659 million to $2,024 million.

Real Estate Funds / Asset Management Business

BPO has three funds with institutional investors that invest in office assets across specific geographies. The Canadian Fund, formed in 2005, owns Canadian office buildings that were acquired as part of BPO’s acquisitions of O&Y Properties Corporation and of the assets and liabilities of O&Y Real Estate Investment Trust. The U.S. Office Fund, formed in October 2006, owns U.S. office buildings that were acquired as part of BPO’s acquisitions of Trizec Properties, Inc. and Trizec Canada Inc. The DTLA Fund, formed in October 2013, consists of assets acquired as part of BPO’s acquisition of MPG Office Trust, Inc. (“MPG”), as well as other downtown Los Angeles assets previously owned by BPO that were contributed to the DTLA Fund at the time of the MPG acquisition. These funds are all managed by BPO, which receives

asset management fees, transaction-related fees for development, redevelopment, and leasing activities, and incentive fees. BPO also owns assets in property level joint-ventures, and receives similar fees on those assets. Morgan Stanley has valued these asset management- related fees by applying a 50% margin to 2014 fees as estimated by BPO management. Morgan Stanley then applied a range of EBITDA multiples (7.0x — 9.0x) selected based on its review of third-party research. As a result, Morgan Stanley determined the fair market value of the fees BPO receives from its real estate asset management function to be in the range of $158 million to $203 million.

Services Business

BPO has an approximate 22% interest in the Management Entity, which collectively owns BJCC, BJCA, BRSL and the Middle East Business, all of which are facilities management businesses. Morgan Stanley has valued these businesses by applying a range of EBITDA multiples (7.0x — 9.0x) selected based on its review of third-party research to 2014 EBITDA as estimated by BPO management. Morgan Stanley used a foreign exchange rate of 1.0575 CAD$ to 1 USD in its valuation of BPO’s Service Business. As a result, Morgan Stanley determined the fair market value of these businesses to be in the range of $64 million to $83 million.

Cash and Net Other Assets

Morgan Stanley included BPO’s proportionate share of cash, net of non-controlling interests, as stated in BPO’s third-quarter 2013 financial statements. This figure was then adjusted for the funding of BPO’s acquisitions of One North End Avenue (New York), 685 Market Street (San Francisco) and the remaining 50% interest in 125 Old Broad Street (London), all which occurred following the end of the third quarter of 2013. Morgan Stanley also included BPO’s proportionate share of accounts receivable and other assets, restricted cash, deposits, accounts payable, and accrued liabilities, net of non-controlling interests, as stated in BPO’s third-quarter 2013 financial statements. This figure was then adjusted for BPO’s proportionate share of additional net working capital from the MPG acquisition, which closed following the end of the third-quarter of 2013. As a result, Morgan Stanley determined cash and net other assets to be $80 million.

Debt, Capital Securities, Preferred Equity, and Mark-to-Market

BPO’s proportionate share of total debt outstanding is $12,857 million, which includes $11,997 million outstanding as of September 30, 2013 as well as adjustments for BPO’s acquisitions of MPG, One North End Avenue, 685 Market Street and the remaining 50% interest in 125 Old Broad Street. Based upon materials prepared by BPO and reviewed by Morgan Stanley, the mark-to-market on BPO’s debt is estimated to be $342 million and the mark-to- market on BPO’s hedges is estimated to be $109 million.

BPO has four series of capital securities outstanding totaling $644 million. BPO has preferred securities outstanding totaling of $1,701 million, of which $1,542 million represents BPO’s outstanding securities as of September 30, 2013 and $159 million represents BPO’s proportionate share of MPG’s preferred securities and accrued preferred dividends resulting from the MPG acquisition. As a result, Morgan Stanley determined the fair market value of the

debt, capital securities, preferred equity and mark-to-market of select securities to be $15,653 million.

Total Shares Outstanding

As of September 30, 2013, 510,567,181 BPO Common Shares were issued and outstanding on a fully diluted basis, including options determined to be in-the-money as of December 16, 2013.

Net Asset Value — Conclusion

Based on the foregoing, by subtracting the sum of BPO’s total liabilities from the sum of its total assets, Morgan Stanley has determined a range of $17.93 per BPO Common Share to $22.21 per BPO Common Share under the NAV analysis.

Comparable Companies Analysis

Using publicly available information including equity research analyst estimates, Morgan Stanley reviewed and analyzed certain trading multiples of the following select real estate companies:

U.S.

· Boston Properties, Inc.

· Douglas Emmett, Inc.

· Empire State Realty Trust, Inc.

· Forest City Enterprises, Inc.

· Kilroy Realty Corp.

· SL Green Realty Corp.

· Vornado Realty Trust

Canada

· Dundee Real Estate Investment Trust

Australia

· Commonwealth Property Office Fund

· DEXUS Property Group

· Investa Office Fund

While Morgan Stanley did not consider any of the companies reviewed to be identical to BPO, Morgan Stanley believed that they shared similar business characteristics to those of BPO and relied upon its professional judgment in selecting the most appropriate trading multiples. Morgan Stanley considered funds from operations (“FFO”) multiples for 2014E and premium / discount to Green Street Advisors’ net asset value for select U.S. real estate companies to be the most appropriate trading metrics for BPO. As summarized below, Morgan Stanley selected the

following multiple ranges for BPO. These ranges reflect the ranges of select U.S. real estate companies adjusted for observed historical discounts BPO has traded at relative to these companies.

Implied BPO Valuation — Comparable Companies

|

|

|

2014E P / FFO |

|

|

|

Premium / Discount |

|

|

| ||

|

|

|

|

|

|

|

|

|

|

| ||

|

Selected Range of Multiples |

|

|

|

|

|

|

|

|

| ||

|

Low |

|

13.3x |

|

|

|

(23.4 |

)% |

|

| ||

|

High |

|

17.2x |

|

|

|

(15.9 |

)% |

|

| ||

|

Imputed Share Price |

|

Low |

|

$ |

13.56 |

|

High |

|

$ |

17.54 |

|

Given that publicly traded company values generally reflect minority discount values rather than “en bloc” values, Morgan Stanley considered the comparable companies analysis to be a secondary approach for determining the fair market value of the BPO Common Shares.

Precedent Transactions Analysis

Morgan Stanley reviewed the purchase prices paid in select precedent transactions involving office companies over the last ten years. Based on publicly available information, Morgan Stanley identified and reviewed 17 publicly announced transactions involving companies in the office real estate sector with a value of greater than $150 million. Morgan Stanley also reviewed the purchase prices paid in select precedent transactions involving minority buyouts of Canadian companies over the last ten years. Based on publicly available information, Morgan Stanley identified and reviewed four publicly announced transactions involving minority buyouts of Canadian companies.

For both sets of transactions, Morgan Stanley reviewed the premiums paid to the target companies’ unaffected stock prices (defined as the average ten day stock price five days prior to the earliest date of the deal announcement, announcement of a competing bid or market rumors in certain transactions, as appropriate) for the selected precedent transactions. The overall observed bottom quartile and top quartile unaffected stock price premiums paid in such selected transactions were 10.0% and 20.8%, respectively.

Precedent Transactions Analysis

|

|

|

# of |

|

Selected Range |

|

BPO Unaffected |

|

Implied Share Price |

| |||||||

|

|

|

Transactions |

|

25% Quartile |

|

75% Quartile |

|

Share Price |

|

Low |

|

High |

| |||

|

Premium / (Discount) to Unaffected Price |

|

21 |

|

10.0 |

% |

20.8 |

% |

$ |

16.74 |

|

$ |

18.42 |

|

$ |

20.23 |

|

Based on Morgan Stanley’s professional judgment, no company or transaction utilized in the precedent transaction analysis may be considered directly comparable to BPO or the Offer. As a result, Morgan Stanley considered the precedent transactions approach to be a secondary approach for determining the fair market value of the BPO Common Shares.

Dividend Discount Model Analysis

Morgan Stanley performed a DDM analysis using four-year dividend projections as provided by BPO management. In this approach, dividend projections are discounted at a specific rate to determine the present value of the dividend stream. The present value of a terminal value, representing the value of dividends beyond the end of the forecast period, is added to arrive at a total equity value. Morgan Stanley also analyzed dividend payout ratios based on four-year FFO and adjusted FFO projections as provided by BPO management.

Morgan Stanley calculated a range of terminal values by applying a range of FFO multiples to the fifth year’s estimated FFO as provided by BPO management. An FFO multiple range of 13.3x to 17.2x was selected based on Morgan Stanley’s professional judgment, which included an analysis of the FFO multiples of other comparable companies. Morgan Stanley then discounted the resulting terminal value, along with the dividends over the four-year forecast period, to present value using equity discount rates ranging from 9.6% to 10.6%. These equity discount rates were the result of a capital asset pricing model (“CAPM”) approach, which generates a cost of equity by adding a risk-free rate of return to a premium that represents the financial and non-diversifiable business risk of a stock.

The above analysis yielded an implied equity value of $14.68 per BPO Common Share to $19.02 per BPO Common Share. Given the sensitivity of the analysis to terminal value and cost of equity assumptions, and the fact that the resulting valuation reflects a minority discount value rather than an “en bloc” value, Morgan Stanley considered the DDM to be a secondary approach for determining the fair market value of the BPO Common Shares.

Valuation Reference Points

Morgan Stanley also reviewed and took into consideration other valuation reference points in determining the fair market value of the BPO Common Shares.

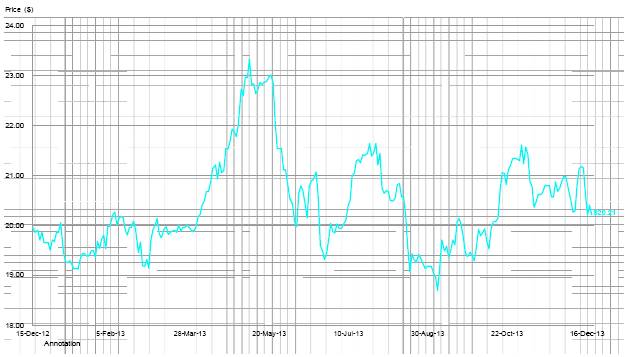

Historical Trading Analysis

Morgan Stanley reviewed historical trading prices and volumes for the BPO Common Shares on both the NYSE and the TSX for the last twelve months ended September 27, 2013, or the last trading day immediately prior to BPY’s announcement of the Offer. Morgan Stanley aggregated the trading volumes on both the NYSE and the TSX. Cumulative trading volume over the last twelve months on both the NYSE and the TSX was 591 million shares, representing 231% of the public float. Morgan Stanley also examined the volume weighted average price (“VWAP”) over this time period, aggregated over both exchanges. Over the last twelve months ended September 27, 2013, the VWAP was $16.79, and over the last 30-trading days ended September 27, 2013, the VWAP was $16.44. As of December 16, 2013, the trading price of the BPO Common Shares was $19.36 on the NYSE.

BPO Historical Stock Price Chart — Last Twelve Months

Research Analyst Price Targets and NAV Estimates

Morgan Stanley reviewed public market trading price targets for the BPO Common Shares prepared and published by 14 available equity research analysts. Morgan Stanley also reviewed the consensus price target for the BPO Common Shares as determined by Bloomberg. Equity research analyst price targets reflect each analyst’s estimate of the future public market trading price of the BPO Common Shares at the time the price target is published.

Additionally, Morgan Stanley reviewed NAV estimates for BPO prepared and published by six available equity research analysts. Morgan Stanley also reviewed the consensus NAV estimate as determined by SNL Financial LC.

Morgan Stanley specifically reviewed these price targets and NAV estimates immediately prior to and following BPY’s announcement of the Offer on September 30, 2013. For the date immediately prior to BPY’s announcement of the Offer, Morgan Stanley used September 27, 2013, and for the date following BPY’s announcement of the Offer, Morgan Stanley used December 16, 2013.

BPO Research Views

$

|

|

|

Before Offer |

|

After Offer |

| ||

|

|

|

27-Sep |

|

16-Dec |

| ||

|

|

|

|

|

|

| ||

|

Price Targets |

|

|

|

|

| ||

|

Min |

|

$ |

15.00 |

|

$ |

18.00 |

|

|

Max |

|

$ |

20.00 |

|

$ |

21.50 |

|

|

Consensus |

|

$ |

17.85 |

|

$ |

19.79 |

|

|

NAV Estimates |

|

|

|

|

| ||

|

Min |

|

$ |

18.30 |

|

$ |

19.10 |

|

|

Max |

|

$ |

22.00 |

|

$ |

22.00 |

|

|

Consensus |

|

$ |

20.04 |

|

$ |

20.36 |

|

IFRS Valuation

Morgan Stanley reviewed and considered BPO’s third-quarter 2013 IFRS NAV of $21.03 per BPO Common Share.

Fair Market Value of the BPO Common Shares

Based upon and subject to the foregoing, in addition to other factors that it considered relevant, Morgan Stanley is of the opinion that, as of December 16, 2013, the fair market value of the BPO Common Shares is in the range of $18.50 per BPO Common Share to $21.00 per BPO Common Share.

Distinctive Material Benefits to BPY and its Affiliates

Morgan Stanley reviewed and considered whether any distinctive material benefit would accrue to BPY or its affiliates through the acquisition of all of the BPO Common Shares not already owned by the Offerors. Morgan Stanley determined that by completing the Offer, BPY would benefit from greater direct ownership of real estate as well as a more simplified ownership structure, both of which would give BPY greater control of its assets and increases its strategic flexibility. Morgan Stanley also concluded that by completing the Offer, BPY will benefit from an enhanced public float and trading liquidity. Additionally, based on interviews with BPY management, BPY estimated that by completing the Offer, they may be able to reduce BPO general and administrative expenses by up to approximately $15 million. However, as the financial projections provided by BPY management did not include general and administrative expense savings, these general and administrative expense savings were not included in the Valuations.

BPY VALUATION APRROACH AND METHODOLOGIES

As noted above, in preparing the BPY Valuation, and with the permission of the Independent Committee, Morgan Stanley assumed that the Offer will result in the Offerors acquiring 100% of the BPO Common Shares not already owned by the Offerors.

In determining the fair market value of the BPY Units, Morgan Stanley relied primarily on the NAV approach and its review of valuation reference points such as the trading range of

the BPY Units and IFRS NAV valuations for BPY and its various holdings, including direct real estate assets and development projects, equity stakes in public and private companies, and LP interests in real estate funds. As a secondary methodology, Morgan Stanley considered the DDM approach.

APPLICATION OF VALUATION METHODOLOGIES TO THE BPY UNITS

Net Asset Value Analysis

As Morgan Stanley does not consider a NAV analysis a liquidation analysis, it has not included frictional costs that may be incurred in the liquidation of the assets such as transaction costs or tax leakage in the subsequent analysis. In preparing BPY’s NAV analysis (which assumes the acquisition of 100% of the BPO Common Shares not already owned by the Offerors), Morgan Stanley relied on financial projections as prepared by both BPY and BPO management.

The key components of BPY’s NAV are as follows:

· GGP common shares (the “GGP Shares”)

· GGP common share warrants (the “GGP Warrants”)

· RSE common shares (the “RSE Shares”)

· Equity interest in CWG

· Operating real estate assets, including BPO’s operating real estate assets

· Development and redevelopment projects, including BPO’s development and redevelopment projects

· Limited partnership interests in real estate funds

· BPO real estate asset management and services business

· Cash and net other assets

· Debt, mark-to-market on debt, capital securities, and preferred stock

GGP Shares

BPY owns 255,356,036 GGP Shares. GGP is a publicly-traded real estate investment trust (“REIT”) that owns 123 regional malls in the U.S. comprising approximately 128 million square feet of gross leasable area. Morgan Stanley reviewed a number of factors in determining the fair market value of the GGP Shares, including but not limited to:

· Trading multiples of GGP relative to those of select publicly traded U.S. mall REITs;

· Valuation reference points such as:

· The trading price and volume of the GGP Shares;

· Liquidity of the GGP Shares;

· Recent transactions on the part of institutional investors involving the GGP Shares;

· BPY’s IFRS valuation of the GGP Shares of $23.45 per share, which reflects BPY’s IFRS NAV value as of September 30, 2013, adjusted for its November 1, 2013 $1,431 million investment in GGP and RSE, and includes approximately $552 million of goodwill as estimated by BPY management related to BPY’s purchase of the GGP Shares;

· An adjusted IFRS valuation of the GGP Shares of $21.28 per share, which excludes approximately $552 million of goodwill as estimated by BPY management related to BPY’s purchase of the GGP Shares;

· A review of GGP equity research, including seven individual NAV estimates and seventeen price targets, as prepared and published by available equity research; and

· Morgan Stanley also considered:

· BPY’s representation on GGP’s board of directors, with three representatives of BPY serving as directors (including the Chairman of GGP’s board of directors, J. Bruce Flatt) out of a total of nine directors on GGP’s board of directors; and

· The relative size of BPY’s equity interest in GGP, which at 32% on a fully diluted basis makes BPY the largest shareholder of GGP.

Using publicly available information including equity research analyst estimates, Morgan Stanley reviewed and analyzed certain trading multiples of the following real estate companies:

· The Macerich Company

· Simon Property Group, Inc.

· Taubman Centers, Inc.

While Morgan Stanley did not consider any of the companies reviewed to be identical to GGP, Morgan Stanley believed that they shared similar business characteristics to those of GGP and relied upon its professional judgment in selecting the most appropriate trading multiples. Morgan Stanley considered FFO multiple for 2014E, implied capitalization rate as determined by Green Street Advisors and premium / discount to Green Street Advisors’ net asset value to be the most appropriate trading metrics for GGP. As summarized below, Morgan Stanley selected the following multiple ranges for GGP.

Implied GGP Valuation – Comparable Companies

|

|

|

2014 P / FFO |

|

Implied Cap Rate |

|

Premium / |

|

|

Selected Range of Multiples |

|

|

|

|

|

|

|

|

Low |

|

16.0x |

|

5.8 |

% |

(9.0 |

)% |

|

High |

|

17.0x |

|

5.6 |

% |

(5.3 |

)% |

|

Imputed Share Price |

|

|

|

|

|

|

|

Implied GGP Valuation – Comparable Companies

|

|

|

|

|

2014 P / |

|

Implied Cap |

|

Premium / |

| |||

|

Low |

|

|

|

$ |

20.37 |

|

$ |

20.25 |

|

$ |

20.94 |

|

|

High |

|

|

|

$ |

21.62 |

|

$ |

21.36 |

|

$ |

21.79 |

|

|

Selected Share Price |

|

Low |

|

$ |

20.25 |

|

High |

|

$ |

21.79 |

| |

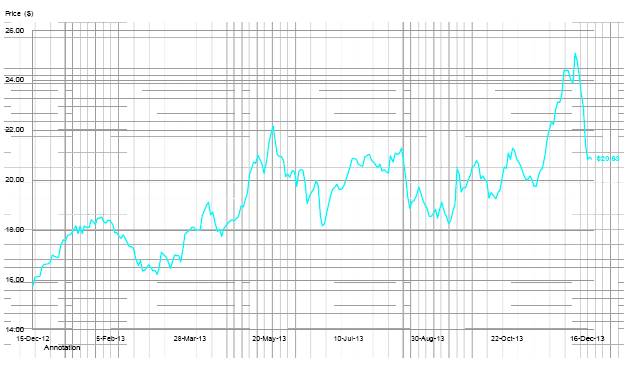

Morgan Stanley also reviewed historical trading prices and volumes for the GGP Shares on the NYSE for the last twelve months ended December 16, 2013. Over the last twelve months, the trading range for the GGP Shares was $18.63 per GGP Share to $23.33 per GGP Share and over the last 30 days, the trading range was $19.91 per GGP Share to $21.76 per GGP Share. Cumulative trading volume over the last twelve months was 1,143 million shares, representing 192% of the public float. Morgan Stanley also examined VWAP over this time period. Over the last twelve months, the VWAP was $20.46 and over the last 30-trading days, the VWAP was $20.93. As of December 16, 2013, the trading price of the GGP Shares was $20.21.

GGP Historical Stock Price Chart – Last Twelve Months

Morgan Stanley reviewed seven individual NAV estimates and seventeen price targets, as prepared and published by available equity research analysts. Morgan Stanley also reviewed the consensus price target as determined by Bloomberg and the consensus NAV estimate as determined by SNL Financial LC:

GGP Research Views

$

|

|

|

Price Target |

|

NAV |

| ||

|

Min |

|

$ |

21.00 |

|

$ |

21.09 |

|

|

Max |

|

$ |

25.00 |

|

$ |

27.23 |

|

|

Consensus |

|

$ |

22.97 |

|

$ |

23.78 |

|

Given that GGP Shares are highly liquid, Morgan Stanley relied primarily on the market trading value for the GGP Shares. Morgan Stanley also considered applying a control premium to the GGP Shares to reflect BPY’s influence given its representation on GGP’s board and position as GGP’s largest shareholder. Based on GGP’s market trading value as of December 16, 2013 and by applying a representative control premium of 10% to this market trading value, Morgan Stanley determined the fair market value of the GGP Shares to be in the range of $20.21 per GGP Share to $22.23 per GGP Share, or adjusted for the 255,356,036 GGP Shares that BPY owns, $5,161 million to $5,677 million in total value.

GGP Warrants

BPY is the owner of 59.4 million GGP Warrants which convert into GGP Shares at a 1 to 1.1509 ratio, 43.0 million of which have a common-share strike price of $9.3419 and 16.4 million of which have a common-share strike price of $9.1247. BPY acquired these warrants as a result of a series of transactions ranging from its original recapitalization of GGP in November 2010 to its purchase of GGP Warrants from its consortium partners in November 2013.

In valuing the GGP Warrants, Morgan Stanley relied primarily on the Black-Scholes option pricing model and valuation reference points such as recent GGP Warrant transactions on the part of institutional investors. The Black-Scholes model is an approach for valuing derivative instruments based on various inputs such as stock price, strike price, risk-free rate, and assumptions regarding the expected future volatility of the GGP Shares and the term of the derivative instrument.

In valuing the GGP Warrants using the Black-Scholes option pricing model, Morgan Stanley relied on the following inputs and assumptions:

· $20.21 stock price (as of December 16, 2013)

· $9.3419 and $9.1247 strike prices (for the two tranches of GGP Warrants)

· 1.1366% risk-free rate

· 15% - 50% volatility levels for the expected future volatility of the GGP Shares

· 3.897 year term

· 1.1509 GGP Shares per GGP Warrant (December 16, 2013 conversion rate)

· Zero dividends due to a dividend protection provision

· Zero borrow costs and no transfer restrictions

Morgan Stanley also considered the implied pricing of recent GGP Warrant transactions on the part of institutional investors. As a result, Morgan Stanley determined the theoretical value of the GGP Warrants held by BPY to be in the range of $775 million to $870 million.

RSE Shares

BPY owns 19,387,623 RSE Shares. RSE is a publicly-traded REIT that owns 34 malls encompassing 23.4 million square feet. Morgan Stanley reviewed a number of factors in determining the fair market value of the RSE Shares, including but not limited to:

· Trading multiples of RSE relative to those of select publicly traded U.S. mall REITs;

· Valuation reference points such as:

· The trading price and volume of the RSE Shares;

· Liquidity of the RSE Shares;

· Recent transactions on the part of institutional investors involving the RSE Shares;

· BPY’s IFRS valuation of the RSE Shares of $20.48 per share, which reflects BPY’s IFRS NAV value as of September 30, 2013, adjusted for its November 1, 2013 $1,431 million investment in GGP and RSE;

· A review of RSE equity research, including a NAV estimate as prepared and published by one available equity research analyst; and

· Morgan Stanley also considered:

· BPY’s representation on RSE’s board of directors, with three representatives of BPY serving as directors (including the Chairman of RSE’s board of directors, Richard Clark) out of a total of eight directors on RSE’s board of directors; and

· The relative size of BPY’s equity interest in RSE, which at 40% on a fully diluted basis makes BPY the largest shareholder of RSE.

Using publicly available information including equity research analyst estimates, Morgan Stanley reviewed and analyzed certain trading multiples of the following select real estate companies:

· CBL & Associates Properties, Inc.

· Glimcher Realty Trust

· Pennsylvania Real Estate Investment Trust

While Morgan Stanley did not consider any of the companies reviewed to be identical to RSE, Morgan Stanley believed that they shared similar business characteristics to those of RSE and relied upon its professional judgment in selecting the most appropriate trading multiples. Morgan Stanley considered FFO multiple for 2014E, implied capitalization rate as determined by Green Street Advisors and premium / discount to Green Street Advisors’ net asset value to

be the most appropriate trading metrics for RSE. As summarized below, Morgan Stanley selected the following multiple ranges for RSE:

Implied RSE Valuation – Comparable Companies

|

|

|

|

|

2014 P / FFO |

|

Implied Cap Rate |

|

Premium / |

| |||

|

Selected Range of Multiples |

|

|

|

|

|

|

|

|

| |||

|

Low |

|

|

|

7.9x |

|

8.3 |

% |

(35.8 |

)% | |||

|

High |

|

|

|

9.5x |

|

7.0 |

% |

(33.0 |

)% | |||

|

Imputed Share Price |

|

|

|

|

|

|

|

|

| |||

|

Low |

|

|

|

$ |

13.19 |

|

$ |

17.17 |

|

$ |

11.08 |

|

|

High |

|

|

|

$ |

15.89 |

|

$ |

25.35 |

|

$ |

11.57 |

|

|

Selected Share Price |

|

Low |

|

$ |

11.08 |

|

High |

|

$ |

25.35 |

| |

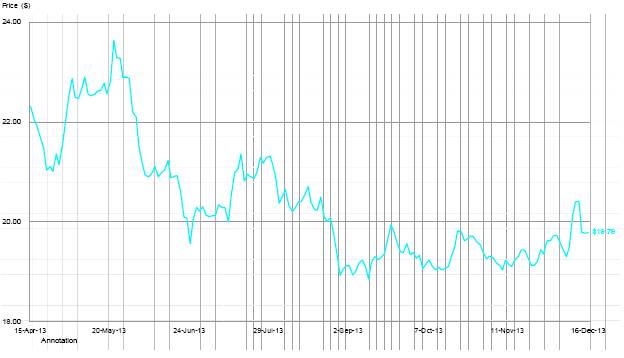

Morgan Stanley also reviewed historical trading prices and volumes for the RSE Shares on the NYSE for the last twelve months ended December 16, 2013. Over the last twelve months, the trading range for the RSE Shares was $15.75 per RSE Share to $25.26 per RSE Shares and over the last 30 days, the trading range was $19.22 per RSE Share to $25.26 per RSE Share. Cumulative trading volume over the last twelve months was 45 million shares, representing 149% of the public float. Morgan Stanley also examined VWAP over this time period. Over the last twelve months, the VWAP was $19.22 and over the last 30-trading days, the VWAP was $21.81. As of December 16, 2013, the trading price of the RSE Shares was $20.83.

RSE Historical Stock Price Chart – Last Twelve Months

Given the liquidity of the RSE Shares, Morgan Stanley relied primarily on the market trading value for the RSE Shares. Morgan Stanley also considered applying a control premium

to the RSE Shares to reflect BPY’s influence given its representation on RSE’s board and position as RSE’s largest shareholder. Based on RSE’s market trading value as of December 16, 2013 and by applying a representative control premium of 10% to this market trading value, Morgan Stanley determined the fair market value of the RSE Shares to be in the range of $20.83 per RSE Share to $22.91 per RSE Share, or adjusted for the 19,387,623 RSE Shares that BPY owns, $404 million to $444 million in total value.

Equity Interest in CWG

BPY owns an approximate 22% equity interest in CWG, a private real estate company in the U.K. which owns 18 completed properties and a development pipeline and land bank within the Canary Wharf Estate and within Central London. CWG also derives income from managing the entire Canary Wharf Estate. CWG is 69% owned by Songbird Estates plc (“Songbird”), a publicly-traded entity whose sole asset is its equity interest in CWG. Morgan Stanley used a foreign exchange rate of 0.6132 GBP to 1 USD in its valuation of BPY’s equity interest in CWG.

In determining the fair market value of BPY’s equity interest in CWG, Morgan Stanley relied primarily on two methodologies: the comparable trading approach and an adjusted NNAV approach. Morgan Stanley also considered CWG’s reported European Public Real Estate Association (“EPRA”) NNNAV and valuation reference points, such as Songbird’s trading price, its public market trading price targets and NAV estimates prepared and published by three available equity research analysts, and BPY’s IFRS NAV value of its CWG stake of $1,019 million as of September 30, 2013.

In terms of NAVs relevant to Morgan Stanley’s analysis of CWG, EPRA NAV may be considered a “going-concern” NAV that takes into account properties and other investment interests at fair market value and excludes liabilities that are not expected to crystallize in normal circumstances, assuming CWG intends to hold its properties over the long term. Excluded liabilities in EPRA NAV generally include, but are not limited to, deferred tax liabilities and the mark-to-market on debt and hedging financial instruments. Based on Morgan Stanley’s experience, public market investors in the U.K. and Continental Europe tend to consider EPRA NAV the most important measure of value. EPRA NNNAV takes into account deferred tax liabilities and the mark-to-market on fixed rate debt and hedging financial instruments, as opposed to EPRA NAV.

In the case of CWG, Morgan Stanley determined that premium / discount to reported EPRA NAV was the most relevant trading metric because of CWG’s large development pipeline and land bank, making traditional income-based trading metrics less applicable. Morgan Stanley analyzed this metric in the context of two U.K. publicly-traded companies, British Land Company plc (“BLND”) and Land Securities Group plc (“LAND”), which Morgan Stanley believes are representative of highly liquid U.K. listed real estate stocks. As of December 16, 2013, BLND and LAND traded at (4.0%) and (0.6%) as compared to their June 2013 EPRA NAVs, respectively. Applying these discounts and premiums to CWG’s reported June 2013 EPRA NAV yielded a range of $6.98 to $7.23 per share, or $982 million to $1,017 million.

Morgan Stanley also performed an adjusted NNAV analysis, which is similar to an EPRA NAV analysis although it takes into account the full mark-to-market on the fixed rate notes, floating rate notes and the swaps of CWG’s securitization. Morgan Stanley estimated CWG’s adjusted NNAV to be approximately $6.11 to $7.64 per share, or adjusted for BPY’s 22% equity interest in CWG, approximately $860 million to $1,075 million in total value. This analysis reflects adjustments to CWG’s June 2013 NAV for rental growth, cap rate compression, the development pipeline, a mark-to-market of debt, among other items, and a potential illiquidity discount related to BPY’s position as a minority shareholder in a controlled private entity.

As a result of these approaches, Morgan Stanley determined a fair market value range of BPY’s interest in CWG of $860 million to $1,017 million.

Operating Real Estate Assets (Including BPO’s Operating Real Estate Assets)

BPY is the direct owner of: six office assets and one retail asset in Australia; six office assets in New Zealand through the Multiplex New Zealand Property Fund; and one office asset in the U.K. BPY is also in the process of finalizing the recapitalization of Deutsche Interhotel AG (“Interhotel”), a European hotel portfolio of ten hotels and one retail asset in which BPY currently holds a mezzanine position.

Morgan Stanley primarily relied on a DCF approach in valuing BPY’s operating real estate. Morgan Stanley used unlevered cash flow projections prepared by BPY management and in most instances, assumed a ten-year hold period. For each asset, Morgan Stanley selected a range of discount rates and reversionary cap rates based on third-party data providers and Morgan Stanley’s review of discount rates and reversionary cap rates used by BPY management in its quarterly IFRS valuations. As a result, the range of discount rates ranged from a weighted average of 7.6% to a weighted average of 8.2% and the range of reversionary cap rates ranged from a weighted average of 6.6% to a weighted average of 6.9%. Morgan Stanley valued the Interhotel portfolio at BPY’s acquisition price.

As a result of these approaches, and inclusive of the fair market value of BPO’s operating real estate described previously in this document, Morgan Stanley determined the fair market value of BPY’s operating real estate to be in the range of $24,661 million to $26,541 million.

Development and Redevelopment Projects (Including BPO’s Development and Redevelopment Projects)

BPY owns Giroflex, an office and retail development in Brazil. Morgan Stanley reviewed the cash projections and underlying assumptions involved in BPY management’s quarterly IFRS valuation of Giroflex and concluded that these were reasonable. Based upon this, and other factors that Morgan Stanley considered relevant, Morgan Stanley determined the fair market value of BPY’s Giroflex development project to be in a range of $153 million to $169 million. Morgan Stanley used a foreign exchange rate of 2.3214 R$ to 1 USD in its valuation of BPY’s Giroflex development project.

As a result of this approach, and inclusive of the value of BPO’s development and redevelopment projects described previously, Morgan Stanley determined the fair market value of BPY’s development and redevelopment projects to be in the range of $1,812 million to $2,194 million.

Limited Partnership Interests in Real Estate Funds

BPY is a limited partner in ten real estate funds, which consist of four opportunity funds, three real estate finance funds and three sector-specific real estate funds. Brookfield Property Partners Limited, the general partner of BPY, is also the general partner of these funds. BPY’s share of the limited partnership interests ranges from 12% to 55% for each fund.

In determining the fair market value of BPY’s limited partnership interests, Morgan Stanley considered BPY management’s quarterly IFRS values and estimates of capital invested to-date as provided by BPY management. Morgan Stanley also reviewed quarterly investor fund reports and, where available, investment committee memos and asset appraisals for select investments within the funds. Finally, Morgan Stanley also took into account recent fund investments that were announced and / or closed following the close of third-quarter 2013. These investments include BSREP’s recent acquisition of Industrial Developments International Inc. (“IDI”) and its announced preferred equity investment in China Xintiandi (“CXTD”). IDI owns and operates industrial distribution facilities comprising 27 million square feet of distribution facilities in the U.S., including markets such as Chicago, Memphis and Cincinnati. CXTD owns Shui On Land’s portfolio of office and retail assets in Shanghai. As a result of these approaches and other factors that Morgan Stanley considered relevant, Morgan Stanley determined the fair market value of BPY’s limited partnership interests to be in the range of $1,107 million to $1,388 million.

BPO Real Estate Asset Management and Services Business

As described previously, Morgan Stanley determined the fair market value of the fees BPO receives from its real estate asset management function to be in the range of $158 million to $203 million. Morgan Stanley also determined the fair market value of BPO’s Services Business to be in the range of $64 million to $83 million.

Cash and Net Other Assets

BPY management provided Morgan Stanley with a breakdown of balance sheet items by business segment shown at BPY’s proportionate ownership of each asset and liability. Cash at the BPY Corporate, U.K. Office, and BPY’s Australian segments were included in the NAV analysis, as the remaining segments reflected assets that were already accounted for in other parts of Morgan Stanley’s NAV analysis. Similarly, only other assets and other liabilities in the previously mentioned segments were included, and only insofar as they were not reflected elsewhere in Morgan Stanley’s NAV analysis.

Net other assets also included and reflected:

· Australian development projects such as Bathurst Street, Bouquet Street, The Hub, and Dee Why that have been characterized by BPY management as “held for sale”;

· The remaining mezzanine position in the Interhotel portfolio post-recapitalization; and