UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| [X] | ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended December 31, 2012 | |

| [ ] | TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT |

For the transition period from _________ to ________

| |

| Commission file number: 000-25911 |

| Skinvisible, Inc. |

| (Exact name of registrant as specified in its charter) |

| Nevada | 88-0344219 |

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.) |

| 6320 South Sandhill Road, Suite 10, Las Vegas, NV | 89120 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number: 702.433.7154

|

Securities registered under Section 12(b) of the Exchange Act:

| |

| Title of each class | Name of each exchange on which registered |

| None | not applicable |

Securities registered under Section 12(g) of the Exchange Act:

| |

| Title of each class | |

| Common Stock, par value $0.001 | |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Indicate by checkmark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [ ] No [X]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. Yes [ ] No [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

| [ ] Large accelerated filer | [ ] Accelerated filer |

| [ ] Non-accelerated filer | [X] Smaller reporting company |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter. $3,332,481

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date. 109,707,409 common shares as of January 25, 2013

| 2 |

PART I

Company Overview

We, through our wholly owned subsidiary Skinvisible Pharmaceuticals Inc., are a pharmaceutical research and development (“R&D”) company that has developed and patented an innovative polymer delivery system, Invisicare® and formulated over forty topical skin products, which we out-license globally. We were incorporated in 1998, and target an estimated $80 billion global skincare and dermatology market and a $30 billion global over-the-counter market as well as other healthcare / medical and consumer goods markets.

With the research and development complete on forty products and numerous patents issued (technology and product patents), we are ready to monetize our investment. Our business model is to out-license our patented prescription, over-the-counter (“OTC”) and cosmeceutical products featuring Invisicare to established manufacturers and marketers of brands internationally and to maximize profits from the products we have already out-licensed. We have also recently developed a product for Netherton syndrome, for which we are seeking “orphan drug” status in both the United States and Europe. This designation has the potential to be highly lucrative, with more global companies seeing the value of an orphan drug.

The opportunity for us to license our products has recently increased due to improving market conditions and the need for pharmaceutical companies to access external R&D companies for new products due to their own down-sizing or elimination of internal R&D departments. The demand for our products is enhanced due to the granting of key US and international patents and the completed development of a number of unique products.

The Products

Pivotal to our success is our patented polymer delivery system technology Invisicare. The advantages of products formulated with Invisicare are (1) Invisicare’s ability to bind active ingredients (the drug) to the skin, forming a protective bond on the skin, for extended periods of time - some up to eight hours or more; (2) Invisicare can deliver targeted levels (high or low) of therapeutic or cosmetic ingredients to the skin in a controlled release; (3) Invisicare can help to reduce the irritation of some active ingredients due to how it controls the slower release of that active ingredient; and (4) Invisicare science proves that it provides a protective skin barrier which helps retain the natural moisture content of the skin, while still allowing it to breathe. These benefits present an excellent opportunity for clear scientific advantages and marketing messages which resonate with physicians and consumers.

The Market

The dermatology market is large, with over 80% of Americans affected by some kind of skin condition in their lifetime. The worldwide market for dermatology products including prescription, OTC and cosmeceuticals is estimated at $80 billion.

| 3 |

Company History

We formed Skinvisible Pharmaceuticals, Inc. (“Skinvisible”), in March 1998 and purchased the exclusive worldwide manufacturing and marketing rights for a polymer delivery system invention now called Invisicare® from the inventor for $2 million. We have continued to develop the Invisicare technology and subsequent product development resulting in over seven series of Invisicare and over forty unique, patented formulations offering distinctive benefits that differentiate them significantly from other leading products in the marketplace.

What We Do

We have positioned ourselves in the $80 billion worldwide prescription and over-the-counter dermatology and skincare market. We generate revenue by:

- LICENSING: We develop topical prescription and over-the-counter products enhanced with Invisicare to license to pharmaceutical and consumer goods companies around the world for an upfront fee and ongoing royalties;

- CO-DEVELOPMENT: We assist pharmaceutical clients in the early development of the most optimal formulation, which they then take forward into clinical testing;

- LIFE CYCLE MANAGEMENT: We provide cost-effective solutions to global pharmaceutical companies by reformulating their products coming off patent with a new Invisicare patent and new product benefits and line extensions. Pharmaceutical companies are under a lot of pressure to develop innovative strategies to counteract the revenue loss from their drugs coming off patent.

Corporate Ownership

We are a publicly traded company under the symbol SKVI, listed on the OTC Bulletin Board since February 1999 and currently trading on the OTCQB in the US.

We carry on business primarily through our wholly owned subsidiary Skinvisible Pharmaceuticals, Inc., also a Nevada corporation.

Patents

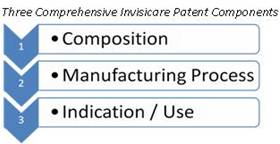

Patent protection provides our products with a key advantage in the marketplace, exclusivity and the advantage of no duplication from competitors. The patents are very comprehensive, covering three distinct categories: composition, the manufacturing process and the indication or use.

Patent approvals are sought (initially in the U.S. and later internationally) for all products developed. We have been granted numerous patents, including six in the United States as well as comprehensive international patents for Invisicare in Australia, China, India, South Korea, Hong Kong, Europe and Canada. There are a number of U.S. product and new Invisicare patents pending in addition to Patent Cooperation Treaties (or PCTs) which allow for one patent to be filed internationally. Some of these PCT patents cover up to five products. All Invisicare patents remain our property, with licensees obtaining the right to use the patented product formulations. |

|

| 4 |

This past year we received two product specific patents for sunscreens and retinoids and an additional US Invisicare technology patent. We have been granted a patent due to the ability of Invisicare® to “photo-stabilize” Avobenzone sunscreen for eight hours: a significant advantage over other sunscreens in the marketplace. In addition, recently the FDA implemented new regulations in respect to what claims can be made regarding a sunscreen. Our sunscreens not only surpass these new regulations for broad-spectrum sunscreens, they have been developed with a formula which does not conflict with other sunscreen patents on the market. We are currently in discussions for the licensing of these sunscreen formulations.

In November 2012, we were granted a US patent due to our ability to protect retinoic acid from breaking down during manufacturing. Retinoic acid breaks down when exposed to light and oxygen, however when formulated in our Invisicare®, this drug is protected by the stabilizing effect of Invisicare®. This patent protection extends until 2029.

We were also granted the third division of our Invisicare® patent. This patent protects the composition of Invisicare® so that no duplications can be made. This is in addition the two patents already granted covering manufacturing and the “precursor” (the pre-mix which is the first step of making Invisicare®.) This new patent extends Invisicare’s patent protection until 2029.

Trademarks

When developing new products using Invisicare, we file for both patent and trademark protection. We have been granted trademarks in the U.S. and Canada for the following names:

- Skinvisible® w Invisicare® w JUSTCARE® w Work Gluv®

Business Model

Our business model is to license out our patent protected products globally.

Our out-licensing business model is multi-pronged. Revenue is generated from several potential sources, including one-time and on-going fees. Products are licensed to established brand manufacturers in the dermatology and pharmaceutical markets globally.

Revenue generation: We receive a combination of four revenue streams including:

|

|

| 5 |

Strategic Growth Opportunities

Our growth strategy is to:

| 1. | Capitalize on the success of current licensees; |

| 2. | Increase the value of our current pipeline; and |

| 3. | Boost licensing revenues by securing additional licensees globally and develop a robust royalty revenue stream that will finance our future growth. |

| 1. | Capitalize On Current Licensees: |

This past year we made a consorted effort to help maximize the potential of our licensees but also to make some difficult decisions regarding some of our licensees. This past year, JD Nelson and Associates, RHEI Pharmaceuticals and Panalab S.A. agreements were cancelled. We continue to support our current licensees who remain focused on growing revenues.

We have licensees around the globe. Three of these licensees are currently in the marketplace: Avon Products globally, Women’s Choice Pharmaceuticals in the United States and Alto Pharmaceuticals in Canada. Additionally, we have licensees that have products being prepared for launch. We work diligently with our licensees to ensure they have a smooth manufacturing process, ongoing R&D support and marketing feedback.

Avon Products, Inc:

Product: We have a long-term contract with Avon globally for over ten years to provide Invisicare polymer for their long-lasting lipsticks.

Sales: Invisicare polymers are purchased directly from Skinvisible. |

|

Alto Pharmaceuticals:

Product: DermSafe®, long lasting hand sanitizer lotion launched in Canada in Q4 of 2011 for commercial / industrial use

Sales and Royalties: Alto has received Health Canada marketing approval for DermSafe and is currently marketing the product directly and seeking distributors in the commercial / healthcare marketplace.. |

|

Women’s Choice Pharmaceuticals:

Product: ProCort®, long lasting prescription hemorrhoid cream launched in the United States August 2011

Sales and Royalties: ProCort continues to increase sales every quarter. Skinvisible receives a royalty based on net sales. This past year Women's Choice Pharmaceuticals LLC partnered with Advanced Medical Enterprises, LLC to market ProCort® in Puerto Rico. With over thirty pharmaceutical sales reps calling on OBGYNs in the US, Women’s Choice has been successfully growing their sales of ProCort® and we look forward to increased growth in 2013. Womens Choice is seeking to form other strategic alliances in 2013 in order to increase its sales efforts by targeting new territories and targeting medical specialists which previously were not called upon. |

|

| 6 |

Product Launches for 2013:

We have additional products which are anticipated to be in the market in 2013.

Triclosan Hand Sanitizer & First Aid Antiseptic Previously licensed as Safe4Hours® Antibacterial/Antimicrobial Hand Sanitizers (1% Triclosan) and Safe4Hours® First Aid Antiseptic & Skin Protectant for North America to Dermal Defense, Skinvisible has received the rights back for both products. Skinvisible anticipates setting up distributors for these products on an international basis. |

|

Embil Pharmaceuticals Co. Ltd. Licensed two prescription acne products: Clindamycin and Retinoic Acid for the countries of Turkey, Azerbaijan, Kazakhstan, Kyrgyzstan, Turkmenistan, and Uzbekistan, as well as the S.E Asian countries of Indonesia, Malaysia, and the Philippines, for an upfront license fee and royalty.

The launch has been delayed due to company reorganization. It is anticipated that regulatory approval will begin in the latter half of 2013. |

|

Mayquest Pharmaceuticals PTY

Licensed DermSafe chlorhexidine hand sanitizer for Singapore, Taiwan, Thailand, Indonesia and the Philippines for a license fee and royalty.

Received importation approval for DermSafe from Canada to Singapore. Launch pending.

Currently seeking distribution partner or sub- licensee to launch the product. |

|

| 7 |

| 2. | Increasing The Value Of Skinvisible’s Pipeline: Clinical Enhancement Of Pipeline |

We have a pipeline of over forty products which are available for licensing. Testing is conducted in-house generating proof of concept including release of the active ingredient as well as long term shelf life (stability). Additional studies conducted on specific products including skin sensitivity, toxicity and product efficacy are outsourced to FDA compliant laboratories. These studies are critical in attracting potential licensees. Our clinical strategy is to:

| (1) | Add new studies for our prescription products. Our clinical strategy is to increase the amount of outsourced studies, specifically for our prescription products. Additional studies including skin penetration and skin irritation studies will add to the integrity and value of our products available for licensing. |

| (2) | Add

new long-term efficacy studies

for our DermSafe® hand

sanitizer. Last year

we commissioned an independent

laboratory to further analyze

the long-term effectiveness

of DermSafe® when put

in contact with two bacteria;

the “super bug”

MRSA and E. coli, the “restaurant

bug” since it is often

transmitted by food and

food handlers. The long-term

effectiveness of two bacteria;

Methicillin-resistant Staphylococcus

aureus or MRSA (ATCC #33591)

and Escherichia coli or

E. coli (ATCC #43888")

were tested up to four hours

after application. The results

showed that the individual

arms of subjects which had

DermSafe® applied and

were even rinsed prior to

each bacteria challenge,

showed a 95.83% reduction

at the 4 hour time point

for MRSA and 99.38% for

E. coli. |

These new studies were undertaken to benefit our licensee in Canada, Alto Pharmaceuticals, and to assist in the re-licensing of DermSafe in Europe. In 2012 we cancelled the license agreement to RHEI Pharmaceuticals and we are in the process of transferring the regulatory approval in Europe to our company. The objective for 2013 is to make DermSafe available internationally to the general public and also for use in hospitals, schools, law enforcement and the military through independent distributors.

(3) Obtain orphan drug status for our Netherton syndrome product. Along with our research and development of products to treat common skin conditions, we have also developed a patent pending product to treat a rare skin condition called Netherton syndrome. This disease is caused by a genetic defect which causes the skin to continually exfoliate, never forming a skin bond. This leaves the patient highly susceptible to infection and dealing with a life-long condition that has no cure.

Our product has shown excellent results in lab studies blocking the enzyme that breaks down the skin and we are seeking “Orphan Drug” designation in both the US and Europe. Following our application to the US Orphan Drug Committee, we presented our findings to the European Medicine Agency this past year. We are currently undertaking a further proof-of-concept study in the disease itself. These findings will be submitted along with our original applications in the US and Europe. Due to previous feedback from these agencies, we feel confident that this additional data will provide the final evidence required for orphan drug status.

The advantages of obtaining Orphan Drug designation is that it provides various incentives including a reduction or elimination of registration and market authorization fees, protocol assistance, and seven years of market exclusivity for the product in the US and ten years in Europe. These incentives are highly attractive to pharmaceutical companies targeting this market. It is anticipated with an orphan drug approval, we will receive a multi-million dollar license fee plus an on-going royalty. We are currently in discussions with potential licensees and we are implementing a compassionate use study in 2013 to assist with the approval process. The study results will then be resubmitted to the both the EMA and FDA for Orphan Drug designation. Our lab studies have shown excellent results so we are positive on the human study.

(4) Seek clinical partnerships which will result in FDA approvals of our prescription products. There are three “Phases” involved in obtaining FDA approval. The completion of Phase 1 and/or Phase 2 will increase the value of the license and royalty fees of our products significantly. We are also seeking partnerships with Clinical Research Organizations (CROs) in order to define and begin the regulatory pathway for one or more of our prescription products.

| 8 |

| 3. | Secure Additional Licensees: |

We are in discussions with various global, US, Canadian and European based pharmaceutical companies for licenses. These negotiations are at various stages and some are expected to close in 2013.

To facilitate further expansion, we have entered discussions with potential partners that are dermatology service providers and knowledgeable and connected in the dermatology market.

Invisicare – The Technology and Products

|

At the heart of our product line is our patented technology and trademarked Invisicare family of polymer delivery vehicles. Invisicare has a unique formula and process for combining hydrophilic and hydrophobic polymers into stable formulations with almost any type of active ingredient. The Invisicare technology delivers drugs on, in or through the skin with a controlled release and can be tailored to almost any type of molecule and the needs of our licensees. |

Key Benefits of the Invisicare Technology

Invisicare enhances topical products with the following advantages:

- Independent studies have proven that products utilizing Invisicare will bond active ingredients to the skin for up to four hours or more even after washing. - Invisicare is non-occlusive and allows for normal skin respiration and perspiration while holding the body’s natural moisture in the skin as well as protecting against exposure from a wide variety of environmental irritants. - Invisicare adheres to the skin's outer layers, forming a protective bond and delivering targeted levels of therapeutic or cosmetic skincare agents to the skin. The "invisible" polymer compositions wear off as part of the natural exfoliation process of the skin’s outer layer. - Invisicare allows enhanced delivery performance for a variety of skincare agents resulting in improved efficacy, longer duration of action, reduced irritation and often requires a lower dosage of the active. - Invisicare has a patented process for combining water-soluble and water-insoluble polymers to hold water insoluble and certain cationic active ingredients on the skin without the use of alcohol, waxes, or other organic solvents; a key advantage over similar product formulas. - When Invisicare is formulated into a new product, a patent can be applied for, giving the product a unique position in the marketplace that cannot be duplicated. It also provides a cost-effective solution to pharmaceutical companies looking for life cycle management for their existing products coming off patent or requiring market revitalization. |

|

Some product specific benefits illustrated in independent studies:

| - | DermSafe kills bacteria for up to four hours – studies conclude that DermSafe hand sanitizer kills the “Super Bug” methicillin-resistant staphylococcus (MRSA) up to 94% and Escherichia coli (E.coli), a major cause of food borne illnesses in humans, up to 99% after four hours, even when hands are rinsed and towel dried at hours 1, 2 and 4. (Bioscience Labs, Montana) |

| - | DermSafe kills viruses for up to four hours – studies conclude that DermSafe kills the influenza A virus’s including H1N1 (“bird flu”), H5N1 (“swine flu”) and H3N2. |

(RetroScreen Virology, Queen Mary School of Medicine, London England)

| 9 |

| - | Sunless Tanner lasts 73% longer than similar products – studies conducted by the largest supplier of DHA; the active that makes skin brown, showed significant advantages over leading branded products. (EMD Merck, Germany) |

| - | Sunscreens meet FDA critical wave length requirements – conducted by one of the largest suppliers of sunscreen filters, our sunscreens, SPF 15, 30 and 50 exceed the new FDA regulations for sunscreens in both critical wavelength and “broad spectrum” rating. (DSM Nutritional Products, New Jersey) |

Invisicare Formulations

Our forty products have been successfully tested in-house to show proof of concept and are ready to be licensed. We continue to develop other prescription, OTC and cosmeceutical products in response to the needs of the marketplace.

| Product patent applications are immediately filed on newly developed products. FDA regulatory approvals are required for prescription products while OTC products have limited requirements. Cosmetic-type products, products without therapeutic claims and OTC products that follow the FDA monograph, are immediately available for marketing. In Canada, OTC products follow the Health Canada monograph requiring only the submission of a DIN registration. |  |

We have over 40 products developed and available for licensing:

| CONDITION / USE | PRESCRIPTION (PRE-CLINICAL) | OTC / COSMECEUTICAL |

| Acne | 3 | 2 |

| Actinic Keratosis | 1 | |

| Analgesics | 1 | 6 |

| Anti-Fungal | 2 | 2 |

| Anti-Inflammatory | 4 | 1 |

| Antimicrobial | 1 | 4 |

| Pre-Operative Skin Prep | 1 | |

| Dermatitis / Dry Skin | 1 | 5 |

| Netherton Syndrome | 1 | |

| Anti- Aging | 4 | |

| Suncare | 6 | |

| Sunless Tanning | 3 | |

| TOTAL | 15 | 33 |

Skinvisible Introduces Complete Product Lines

Invisicare® adds many benefits to products including skin barrier properties to aid skin healing by retaining moisture, superior adherence, and improved delivery of actives. Through our research and development efforts over the past year, Skinvisible has formulated complete product lines that are available for immediate licensing and launch. The product lines include: Acne, Anti-Aging, Sunless Tanning, Sun Care and Leg & Foot Care.

| 10 |

| 11 |

Research and Development

Our facilities include a research and development laboratory, headed by James Roszell PhD, where we continue to enhance our current product offerings and to develop a variety of new product formulations with Invisicare for out-licensing.

Our R&D focus is centered on the following initiatives:

| - | We continue to expand our product development beyond the dermatology market into other areas including women’s health, orphan drugs, pain management and surgical; | |

| - | To increase the value of our prescription products, with additional testing on our most lucrative prescription products in order to provide independent validation and verification of our product claims. We utilize FDA compliant, independent laboratories with extensive qualifications for carrying out investigative product studies, utilizing protocols incorporating Good Lab Practice and Good Clinical Practice ("GLP/GCP") standards; | |

| - | We have successfully developed a unique product for Netherton syndrome and are seeking orphan drug status for this product. Additional studies are required in order to receive approval as an orphan drug in the United States and Europe. | |

| - | We have also completed preliminary development of a new Invisicare technology which will provide transdermal delivery of drugs. This new transdermal delivery system will allow us to enter the very lucrative markets of hormone replacement therapy, neurological treatment, nicotine cessation and others. |

Sales and Marketing Plan

Our Licensing Strategy

We pursue potential licensing agreements, business opportunities, strategic alliances and collaborative partners, directly through senior management as well as through our sales consultants and medical advisors.

Our management is focused on the success of our Invisicare formulated products, with continued efforts being made by senior staff and consultants to close current and future negotiations for out-licensing deals. Access is gained through direct contact by our personnel and with the assistance of our brokers, consultants and advisors. The advisors include medical experts with strong ties to pharmaceutical companies and/or key opinion leaders in dermatology, infectious disease and plastic surgery internationally. Recently, we added three agents who will assist with business development in the United States and Asia.

| 12 |

Licensing Target Market

We target key decision makers in pharmaceutical, medical, cosmetic and consumer goods companies, both on a national and international scale. Companies with products coming off patent, looking for line extensions and international companies that want to launch “US branded” products, continue to be key targets.

Additionally we seek strategic partnerships with companies with clinical development expertise in order to take our products further down the clinical development process and to achieve higher returns when licensing our products.

Competition

Market research indicates there is reasonably limited direct competition for Invisicare and patented products in terms of performance capabilities for topically administered skin products. Many companies are seeking unique delivery systems to enhance their portfolio and purchasing companies that have delivery technology.

Some of the companies involved in developing delivery technology are listed below. However, none of these competitors offer the same advantages of Invisicare principally the “long-term staying power” and the ability to control the release of active ingredients on the skin.

- Stiefel Laboratories Inc., the world's largest publically quoted pharmaceutical company specializing in dermatology, purchased Connetics Corporation for approximately $640 million in the fall of 2006. (Subsequently in 2009, Stiefel, with $900 million in sales, was purchased by GlaxoSmithKline for $3.9 billion – at 4 times revenue). Connetics has a patented foam delivery technology.

- Foamix Ltd is a drug development company with its head office in Israel. It has developed five platforms which use a foam delivery technology and is used in products like Rogaine®.

- A.P. Pharma sold its acne and actinic keratosis products made with its patented Microsponge® delivery system to two companies for a reported $30 million; Johnson & Johnson purchased the Retin-A Micro® product line, with revenues of $110 million in the US in 2006 and sanofi-aventis purchased Carac®, a product used to treat actinic keratosis, with $11 million in sales in 2001.

Government Regulation

We are not subject to any significant or material federal or state government regulation in connection with the research and development and licensing of our innovative topical polymer-based delivery systems and technologies.

With respect to our products under development, our licensing agreements require the licensee to seek all required approvals for marketing, distribution, and sale in the jurisdictions for which it is desired to make the product available should we succeed in developing a successful product.

We are not subject to any significant or material environmental regulation in the normal operation of our business.

Orphan Drug Designation

We are seeking “Orphan Drug” designation in both the US and Europe for a product to treat a rare skin condition called Netherton syndrome. The FDA may grant orphan drug designation to drugs intended to treat a rare disease or condition, which generally is a disease or condition that affects fewer than 200,000 individuals in the United States. Orphan drug designation must be requested before submitting a New Drug Application, or NDA. If the FDA grants orphan drug designation, which it may not, the identity of the therapeutic agent and its potential orphan use are publicly disclosed by the FDA. Orphan drug designation does not convey an advantage in, or shorten the duration of, the review and approval process. If a product which has an orphan drug designation subsequently receives the first FDA approval for the indication for which it has such designation, the product is entitled to seven years of orphan drug exclusivity, meaning that the FDA may not approve any other applications to market the same drug for the same indication for a period of seven years, except in limited circumstances, such as a showing of clinical superiority to the product with orphan exclusivity (superior efficacy, safety, or a major contribution to patient care). Orphan drug designation does not prevent competitors from developing or marketing different drugs for that indication. We have not received orphan drug status for any of our products.

| 13 |

Under European Union medicines laws, the criteria for designating a product as an “orphan medicine” are similar but

somewhat different from those in the United States. A drug is designated as an orphan drug if the sponsor can establish that the

drug is intended for a life-threatening or chronically debilitating condition affecting no more than five in 10,000 persons in

the European Union or that is unlikely to be profitable, and if there is no approved satisfactory treatment or if the drug would

be a significant benefit to those persons with the condition. Orphan medicines are entitled to ten years of marketing exclusivity,

except under certain limited circumstances comparable to United States law. During this period of marketing exclusivity, no “similar”

product, whether or not supported by full safety and efficacy data, will be approved unless a second applicant can establish that

its product is safer, more effective or otherwise clinically superior. This period may be reduced to six years if the conditions

that originally justified orphan designation change or the sponsor makes excessive profits.

Employees

We currently have four employees, including our sole officer Terry Howlett. Two of our employees are full-time.

Subsidiaries

We conduct our operations through our wholly-owned subsidiary, Skinvisible Pharmaceuticals, Inc.

Currently, we do not own any real estate. We are leasing our executive offices and research facility. We are located at 6320 South Sandhill Road, Suite 10, Las Vegas, Nevada 89120. We signed an addendum to our lease on February 21, 2013, which extends the term until February 28, 2015. Rent is $2,763 per month plus all applicable CAM charges. We currently owe our landlord $22,354 and late fees of $34,742, but our landlord has agreed to accept partial payment of $10,000 as payment in full provided that we fulfill the terms of the lease and addendum.

Skinvisible Pharmaceuticals, Inc., our wholly-owned subsidiary, owns the manufacturing and laboratory equipment at this location.

On September 30, 2011, we filed a complaint in the United States District Court for the District of Nevada (the “Court”), against Sunless Beauty, Ltd., Angie Trelstad, TMTA, LLC, and Norvell Skin Solutions, LLC (collectively, the “Defendants”), alleging patent infringement on the Company’s patents: U.S. Patent 6,756,059 B2, 7,674,471 B2, and 6,582,683 B2 (the “Patents”), trademark infringement, misappropriation of trade secrets, and breach of the License Agreement we entered into October 31, 2007 with Sunless Beauty, Ltd. We are seeking, among other things, the following relief from the Court against the Defendants:

§ For an order declaring that Defendants have infringed one or more claims of the Patents;

§ For an order declaring that Defendants have infringed on the Company’s trademarks;

§ For an order declaring that Defendants have willfully misappropriated the Company’s trade secrets;

§ A preliminary and permanent injunction against Defendants prohibiting each of them from further infringement of the Patents and the Company’s trademarks and trade secrets;

§ For an order declaring that Sunless Beauty Ltd. and Angie Trelstad have breached the License Agreement;

§ An award of damages the Company has suffered by reason of the allegations charged in the complaint;

§ An award to the Company of its costs and attorneys’ fees;

§ Such other relief as the Court may deem just and proper.

| 14 |

We have settled with Norvell Skin Solutions, LLC but the case is still open and we are pursuing the action against Sunless Beauty, Ltd., Angie Trelstad and TMTA, LLC.

We are not aware of any pending legal proceeding to which any of our officers, directors, or any beneficial holders of 5% or more of our voting securities are adverse to us or have a material interest adverse to us.

Item 4. Mine Safety Disclosures

Not Applicable

PART II

Item 5. Market for Registrant’s Common Equity and Related Stockholder Matters and Issuer Purchases of Equity Securities

Market Information

Our common stock is quoted under the symbol “SKVI” on the OTCBB operated by the Financial Industry Regulatory Authority, Inc. (“FINRA”) and the OTCQB operated by OTC Markets Group, Inc. Few market makers continue to participate in the OTCBB system because of high fees charged by FINRA. Consequently, market makers that once quoted our shares on the OTCBB system may no longer be posting a quotation for our shares. As of the date of this report, however, our shares are quoted by several market makers on the OTCQB. The criteria for listing on either the OTCBB or OTCQB are similar and include that we remain current in our SEC reporting. Our reporting is presently current and, since inception, we have filed our SEC reports on time.

Only a limited market exists for our securities. There is no assurance that a regular trading market will develop, or if developed, that it will be sustained. Therefore, a shareholder may be unable to resell his securities in our company.

The following table sets forth the range of high and low bid quotations for our common stock for each of the periods indicated as reported by the OTCQB. These quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not necessarily represent actual transactions.

| Fiscal Year Ending December 31, 2012 | ||||||||||

| Quarter Ended | High $ | Low $ | ||||||||

| December 31, 2012 | 0.06 | 0.021 | ||||||||

| September 30, 2012 | 0.045 | 0.019 | ||||||||

| June 30, 2012 | 0.06 | 0.038 | ||||||||

| March 31, 2012 | 0.061 | 0.025 | ||||||||

| Fiscal Year Ending December 31, 2011 | ||||||||||

| Quarter Ended | High $ | Low $ | ||||||||

| December 31, 2011 | 0.06 | 0.04 | ||||||||

| September 30, 2011 | 0.075 | 0.043 | ||||||||

| June 30, 2011 | 0.075 | 0.04 | ||||||||

| March 31, 2011 | 0.095 | 0.04 | ||||||||

On April 15, 2013, the last sales price per share of our common stock on the OTCQB was $0.03 per share.

| 15 |

Penny Stock

The SEC has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a market price of less than $5.00, other than securities registered on certain national securities exchanges or quoted on the NASDAQ system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock, to deliver a standardized risk disclosure document prepared by the SEC, that: (a) contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading; (b) contains a description of the broker’s or dealer’s duties to the customer and of the rights and remedies available to the customer with respect to a violation of such duties or other requirements of the securities laws; (c) contains a brief, clear, narrative description of a dealer market, including bid and ask prices for penny stocks and the significance of the spread between the bid and ask price; (d) contains a toll-free telephone number for inquiries on disciplinary actions; (e) defines significant terms in the disclosure document or in the conduct of trading in penny stocks; and (f) contains such other information and is in such form, including language, type size and format, as the SEC shall require by rule or regulation.

The broker-dealer also must provide, prior to effecting any transaction in a penny stock, the customer with (a) bid and offer quotations for the penny stock; (b) the compensation of the broker-dealer and its salesperson in the transaction; (c) the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock; and (d) a monthly account statement showing the market value of each penny stock held in the customer’s account.

In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from those rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written acknowledgment of the receipt of a risk disclosure statement, a written agreement as to transactions involving penny stocks, and a signed and dated copy of a written suitability statement.

These disclosure requirements may have the effect of reducing the trading activity for our common stock. Therefore, stockholders may have difficulty selling our securities.

Holders of Our Common Stock

As of December 31, 2012, we had 109,507,409 shares of our common stock issued and outstanding, held by 187 shareholders of record, other than those held in street name.

Dividends

There are no restrictions in our articles of incorporation or bylaws that prevent us from declaring dividends. The Nevada Revised Statutes, however, do prohibit us from declaring dividends where after giving effect to the distribution of the dividend:

| 1. | we would not be able to pay our debts as they become due in the usual course of business, or; |

| 2. | our total assets would be less than the sum of our total liabilities plus the amount that would be needed to satisfy the rights of shareholders who have preferential rights superior to those receiving the distribution. |

We have not declared any dividends and we do not plan to declare any dividends in the foreseeable future.

Recent Sales of Unregistered Securities

The information set forth below relates to our issuances of securities without registration under the Securities Act of 1933 during the reporting period which were not previously included in a Quarterly Report on Form 10-Q or Current Report on Form 8-K.

On October 24, 2012, we issued 90,000 shares of our common stock as a result of entering into loan conversion agreements with lenders to convert a total principal balance and interest of $3,600 into equity.

On October 1, 2012, we issued 680,500 shares of our common stock as a result of entering into loan conversion agreements with lenders to convert a total principal balance and interest of $17,013 into equity. We also issued a two year warrant to the lenders to purchase an aggregate amount of 340,250 shares of common shares at a strike price of $0.04 per share.

On November 20, 2012, we issued a warrant for 425,000 shares of common stock to Retire Happy, LLC with an exercise price of $0.03.

| 16 |

On December 10, 2012, we issued a warrant for 150,000 shares of common stock to Retire Happy, LLC with an exercise price of $0.04.

On December 20, 2012, we issued a warrant for 425,000 shares of common stock to Retire Happy, LLC with an exercise price of $0.04.

On January 3, 2013, we issued 100,000 shares of our common stock as a result of entering into loan conversion agreements with lenders to convert a total principal balance and interest of $3,600 into equity.

On January 10, 2013, we issued 100,000 shares of our common stock as a result of entering into loan conversion agreements with lenders to convert a total principal balance and interest of $3,600 into equity.

On January 30, 2013, we issued and convertible promissory note to James Roszell to convert his accrued compensation of $23,404 as of December 31, 2012, into our common stock at $0.03 per share at any time until December 31, 2007. If exercised, we also agreed to issue a three year warrant to Mr. Roszell to purchase an aggregate amount of 390,070 shares of common shares at a strike price of $0.04 per share.

On January 30, 2013, we issued and convertible promissory note to Terry Howlett to convert his accrued compensation of $46,056 as of December 31, 2012 into our common stock at $0.03 per share at any time until December 31, 2007. If exercised, we also agreed to issue a three year warrant to Mr. Howlett to purchase an aggregate amount of 767,600 shares of common shares at a strike price of $0.04 per share.

On January 30, 2013, we issued and convertible promissory note to Terry Howlett to convert debt of $46,352 as of December 31, 2012 into our common stock at $0.03 per share at any time until December 31, 2007. If exercised, we also agreed to issue a three year warrant to Mr. Howlett to purchase an aggregate amount of 772,533 shares of common shares at a strike price of $0.04 per share.

On January 30, 2013, we issued and convertible promissory note to Doreen McMorran to convert her accrued compensation of $66,281 as of December 31, 2012 into our common stock at $0.03 per share at any time until December 31, 2007. If exercised, we also agreed to issue a three year warrant to Ms. McMorran to purchase an aggregate amount of 1,104,685 shares of common shares at a strike price of $0.04 per share.

On February 11, 2013, we issued 542,560 shares of our common stock as a result of entering into loan conversion agreements with lenders to convert a total principal balance and interest of $16,277 into equity. We also issued a two year warrant to the lenders to purchase an aggregate amount of 271,280 shares of common shares at a strike price of $0.05 per share.

These securities were issued pursuant to Section 4(2) of the Securities Act and/or Rule 506 promulgated thereunder. The holders represented their intention to acquire the securities for investment only and not with a view towards distribution. The investors were given adequate information about us to make an informed investment decision. We did not engage in any general solicitation or advertising. We directed our transfer agent to issue the stock certificates with the appropriate restrictive legend affixed to the restricted stock.

Securities Authorized for Issuance under Equity Compensation Plans

The following table provides information about our compensation plans under which shares of common stock may be issued upon the exercise of options as of December 31, 2012.

In July 2006, we adopted the 2006 Skinvisible, Inc. Stock Option Plan, which provides for the grant of incentive stock options, non-qualified stock options, stock appreciation rights, restricted stock, performance shares and performance units, and stock awards our officers, directors or employees of, as well as advisers and consultants. This plan was confirmed by our stockholders on August 7, 2006 at the annual shareholders meeting.

Under the 2006 Skinvisible, Inc. Stock Option Plan, we reserved 10,000,000 shares of common stock for the granting of options and rights.

| 17 |

Equity Compensation Plans as of December 31, 2012

| A | B | C | |

| Plan Category | Number of securities to be issued upon exercise of outstanding options, warrants and rights | Weighted-average

exercise price of outstanding options, warrants and right |

Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (A)) |

Equity compensation plans approved by security holders |

7,250,000 | $0.05 | 2,750,000 |

Equity compensation plans not approved by security holders |

8,915,200 | $0.06 | |

| Total | 16,165,200 | $0.06 | 2,750,000 |

Item 6. Selected Financial Data

A smaller reporting company is not required to provide the information required by this Item.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Forward-Looking Statements

Certain statements, other than purely historical information, including estimates, projections, statements relating to our business plans, objectives, and expected operating results, and the assumptions upon which those statements are based, are “forward-looking statements.” These forward-looking statements generally are identified by the words “believes,” “project,” “expects,” “anticipates,” “estimates,” “intends,” “strategy,” “plan,” “may,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties which may cause actual results to differ materially from the forward-looking statements. Our ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Factors which could have a material adverse affect on our operations and future prospects on a consolidated basis include, but are not limited to: changes in economic conditions, legislative/regulatory changes, availability of capital, interest rates, competition, and generally accepted accounting principles. These risks and uncertainties should also be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements.

| 18 |

Results of Operations for the Years Ended December 31, 2012 and 2011

Revenues

Our total revenue reported for the year ended December 31, 2012 was $270,298, an increase from $180,185 for the year ended December 31, 2011. The increase in revenues for the year ended December 31, 2012 from the prior year is primarily attributable the cancellation of the RHEI Pharmaceuticals HK Ltd. agreement, which was cancelled on October 12, 2012. Due to the cancellation of the agreement there is no longer any remaining life to amortize the agreement over and the remaining deferred revenue is immediately considered earned and recognized. The rights received by us were rights that we initially provided to RHEI per the agreement; we now have received the rights back.

Cost of Revenues

Our cost of revenues for the year ended December 31, 2012 increased to $4,627 from the prior year when cost of revenues was $1,680. The increase in our cost of revenues for the year ended December 31, 2012 from the prior year is attributable to the purchase of a larger volume of raw ingredients.

Gross Profit

Gross profit for the year ended December 31, 2012 was $265,671, or approximately 98% of sales. Gross profit for the year ended December 31, 2011 was 178,505, or approximately 99% of sales.

Operating Expenses

Operating expenses increased to $1,589,650 for the year ended December 31, 2012 from $1,406,733 for the year ended December 31, 2011. Our operating expenses for the year ended December 31, 2012 consisted mainly of discount amortization of $571,844, accrued salaries and wages of $323,745, commissions of $106,218, salaries and wages of $80,281, consulting expenses of $72,219, rent of $53,708, amortization expenses of $50,585, legal fees of $50,490, and accounting and audit expenses of $47,850. In comparison, our operating expenses for the year ended December 31, 2011 consisted mainly of salaries and wages of $31,305, accrued salaries and wages of $365,404, rent of $56,177, accounting and audit expenses of $46,120, depreciation and amortization expenses of $56,313, and consulting expenses of $58,448.

Other Expenses

We had other expenses of $128,442 for the year ended December 31, 2012, compared with other expenses of $132,257 for the year ended December 31, 2011. We paid $173,780 in interest expenses for the year ended December 31, 2012 from $127,152 in the prior year ended 2011. In 2012, however, we realized other income of $25,000 and $6,000 gain on the sale of equipment and a $14,338 gain on the extinguishment of debt, which was not realized in 2011.

Net Loss

Net loss for the year ended December 31, 2012 was $1,452,421 compared to net loss of $1,360,485 for the year ended December 31, 2011.

Liquidity and Capital Resources

As of December 31, 2012, we had total current assets of $498,235 and total assets in the amount of $754,247. Our total current liabilities as of December 31, 2012 were $2,372,633. We had a working capital deficit of $1,874,398 as of December 31, 2012.

Operating activities used $538,904 in cash for year ended December 31, 2012. Our net loss of $1,452,421 and decrease in unearned revenue of $210,000 were the main components of our negative operating cash flow, offset mainly by amortization of debt discount of $571,844 accrued expenses converted to notes of $399,528 and an increase in accounts payable and accrued liabilities of $84,577.

Cash flows used by investing activities during the year ended December 31, 2012 was $31,971 as a result of the purchase of fixed and intangible assets offset by the sale of fixed assets.

| 19 |

Cash flows provided by financing activities during year ended December 31, 2012 amounted to $1,020,164 and consisted of $1,238,900 from the issuance of convertible promissory notes, offset by $195,000 in payments on convertible promissory notes, $20,000 in payments on loans, and $3,736 payments to related party loans.

From September, 2012 to December 31, 2012, we executed Convertible Promissory Notes (the “Notes”) in the aggregate principal amount of $1,000,000 to several investors. The proceeds of the Notes are to be used for our general working capital purposes. The Notes bear interest at the rate of 9% per annum and mature at various times from September 14, 2014 to December 13, 2014.

The Notes are convertible into shares of our common stock at a conversion price of 90% of the average trading prices of our common stock during the five trading days on the OTCBB proceeding the conversion date. The number of shares issuable upon conversion shall be proportionally adjusted to reflect any stock dividend, split or similar event. The option of conversion is only available following the 1 year anniversary of the note.

The Notes are secured by the accounts receivable of a license agreement the Company has with Womens Choice Pharmaceuticals, LLC on its proprietary prescription product, ProCort®.

Unless waived in writing by the Holder, we are prohibited from effecting the conversion of the Note to the extent that as a result of such conversion the Holder thereof would beneficially own more than 4.99% in the aggregate of our issued and outstanding common stock immediately after giving effect to the issuance of common stock upon conversion.

For so long as we have any obligation under the Note, we agreed to certain restrictions on our ability to declare dividends, repurchase our capital stock, sell our assets, or advance loans to others.

Based upon our current financial condition, we do not have sufficient cash to operate our business at the current level for the next twelve months. We intend to fund operations through increased sales and debt and/or equity financing arrangements, which may be insufficient to fund expenditures or other cash requirements. We plan to seek additional financing in a private equity offering to secure funding for operations. There can be no assurance that we will be successful in raising additional funding. If we are not able to secure additional funding, the implementation of our business plan will be impaired. There can be no assurance that such additional financing will be available to us on acceptable terms or at all.

Off Balance Sheet Arrangements

As of December 31, 2012, there were no off balance sheet arrangements.

Critical Accounting Policies

In December 2001, the SEC requested that all registrants list their most “critical accounting polices” in the Management Discussion and Analysis. The SEC indicated that a “critical accounting policy” is one which is both important to the portrayal of a company’s financial condition and results, and requires management’s most difficult, subjective or complex judgments, often as a result of the need to make estimates about the effect of matters that are inherently uncertain.

Going concern – The accompanying financial statements have been prepared on a going concern basis, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. The Company has incurred cumulative net losses of $22,571,364 since its inception and requires capital for its contemplated operational and marketing activities to take place. The Company’s ability to raise additional capital through the future issuances of common stock is unknown. The obtainment of additional financing, the successful development of the Company’s contemplated plan of operations, and its transition, ultimately, to the attainment of profitable operations are necessary for the Company to continue operations. The ability to successfully resolve these factors raise substantial doubt about the Company’s ability to continue as a going concern. The consolidated financial statements of the Company do not include any adjustments that may result from the outcome of these aforementioned uncertainties.

| 20 |

Product sales – Revenues from the sale of products (Invisicare® polymers) are recognized when title to the products are transferred to the customer and only when no further contingencies or material performance obligations are warranted, and thereby have earned the right to receive reasonably assured payments for products sold and delivered.

Royalty sales – The Company also recognizes royalty revenue from licensing its patented product formulations only when earned, with no further contingencies or material performance obligations are warranted, and thereby have earned the right to receive and retain reasonably assured payments.

Distribution and license rights sales – The Company also recognizes revenue from distribution and license rights only when earned (and are amortized over a five year period), with no further contingencies or material performance obligations are warranted, and thereby have earned the right to receive and retain reasonably assured payments.

Costs of Revenue – Cost of revenue includes raw materials, component parts, and shipping supplies. Shipping and handling costs is not a significant portion of the cost of revenue.

Accounts Receivable – Accounts receivable is comprised of uncollateralized customer obligations due under normal trade terms requiring payment within 30 days from the invoice date. The carrying amount of accounts receivable is reviewed periodically for collectability. If management determines that collection is unlikely, an allowance that reflects management’s best estimate of the amounts that will not be collected is recorded. Management reviews each accounts receivable balance that exceeds 30 days from the invoice date and, based on an assessment of creditworthiness, estimates the portion, if any, of the balance that will not be collected. As of December 31, 2012, the Company had not recorded a reserve for doubtful accounts.

Recently Issued Accounting Pronouncements

We do not expect the adoption of recently issued accounting pronouncements to have a significant impact on our results of operations, financial position or cash flow.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

A smaller reporting company is not required to provide the information required by this Item.

| 21 |

Item 8. Financial Statements and Supplementary Data

Index to Financial Statements Required by Article 8 of Regulation S-X:

Audited Financial Statements:

| 22 |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors

Skinvisible, Inc.

Las Vegas, Nevada

We have audited the accompanying consolidated balance sheets of Skinvisible, Inc. as of December 31, 2012 and 2011, and the related consolidated statements of operations, stockholders’ deficit, and cash flows for the years then ended. Skinvisible, Inc.’s management is responsible for these financial statements. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of Skinvisible, Inc., as of December 31, 2012 and December 31, 2011, and the consolidated results of its operations and cash flows for the years then ended, in conformity with accounting principles generally accepted in The United States of America.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 1 to the financial statements, the Company has suffered recurring losses from operations, which raise substantial doubt about its ability to continue as a going concern. Management's plans regarding those matters also are described in Note 1. Absent the successful completion of one of these alternatives, the Company’s operating results will increasingly become uncertain. The financial statements do not contain any adjustments that might result from the outcome of this uncertainty.

Sarna & Company,

Certified Public Accountants

Thousand Oaks, California

April 14, 2013

| F-1 |

CONSOLIDATED BALANCE SHEETS

(Audited)

| Years ended | |||||||

| December 31, 2012 | December 31, 2011 | ||||||

| ASSETS | (Restated) | ||||||

| Current assets | |||||||

| Cash | $ | 450,507 | $ | 1,218 | |||

| Accounts receivable | 27,299 | 1,105 | |||||

| Inventory | 18,769 | 14,953 | |||||

| Due from related party | 1,145 | 1,145 | |||||

| Prepaid expense and other current assets | 515 | 8,613 | |||||

| Total current assets | 498,235 | 27,034 | |||||

| Fixed assets, net of accumulated depreciation of $318,519 and $330,002, respectively | 4,459 | 5,717 | |||||

| Intangible and other assets: | |||||||

| Patents

and trademarks, net of accumulated amortization of $213,205 and $162,621, respectively |

251,553 | 264,166 | |||||

| Total assets | $ | 754,247 | $ | 296,917 | |||

| LIABILITIES AND STOCKHOLDERS' DEFICIT | |||||||

| Current liabilities | |||||||

| Accounts payable and accrued liabilities | $ | 636,313 | $ | 623,972 | |||

| Accrued interest payable | 25,263 | — | |||||

| Loans from related party | 7,661 | 12,400 | |||||

| Loans payable | 1,991 | 27,661 | |||||

| Convertible

notes payable, net of unamortized debt discount of $102,200 and $-0-, respectively |

1,088,386 | 62,475 | |||||

| Convertible

notes payable related party, net of unamortized discount of $1,036,956 and $1,145,867, respectively |

593,227 | 84,789 | |||||

| Unearned revenue | 19,792 | 229,792 | |||||

| Total current liabilities | 2,372,633 | 1,041,089 | |||||

| Total liabilities | 2,372,633 | 1,041,089 | |||||

| Stockholders' deficit | |||||||

Common stock; $0.001 par value; 200,000,000 shares authorized 109,507,409 and 106,592,159 shares issued and outstanding at September 30, 2012 and December 31, 2011, respectively |

109,507 | 106,594 | |||||

| Additional paid-in capital | 20,841,671 | 20,268,177 | |||||

| Stock payable | 1,800 | — | |||||

| Accumulated deficit | (22,571,364 | ) | (21,118,943 | ) | |||

| Total stockholders' deficit | (1,618,386 | ) | (744,172 | ) | |||

| Total liabilities and stockholders' deficit | $ | 754,247 | $ | 296,917 | |||

See Accompanying Notes to Consolidated Financial Statements.

| F-2 |

CONSOLIDATED STATEMENTS OF OPERATIONS

(Audited)

| Years ended | |||||||

| December 31, 2012 | December 31, 2011 | ||||||

| Revenues | $ | 270,298 | $ | 180,185 | |||

| Cost of revenues | 4,627 | 1,680 | |||||

| Gross profit | 265,671 | 178,505 | |||||

| Operating expenses | |||||||

| Depreciation and amortization | 51,842 | 56,313 | |||||

| Selling general and administrative | 1,537,808 | 1,350,420 | |||||

| Total operating expenses | 1,589,650 | 1,406,733 | |||||

| Loss from operations | (1,323,979 | ) | (1,228,228 | ) | |||

| Other income and (expense) | |||||||

| Other income | 25,000 | — | |||||

| Gain on Sale of Equipment | 6,000 | — | |||||

| Interest expense | (173,780 | ) | (127,152 | ) | |||

| Gain on extinguishment of Debt | 14,338 | (5,105 | ) | ||||

| Total other expense | (128,442 | ) | (132,257 | ) | |||

| Net loss | $ | (1,452,421 | ) | $ | (1,360,485 | ) | |

| Basic loss per common share | $ | (0.01 | ) | $ | (0.01 | ) | |

| Basic weighted average common shares outstanding | 108,703,907 | 101,370,461 | |||||

See Accompanying Notes to Consolidated Financial Statements.

| F-3 |

CONSOLIDATED STATEMENT OF STOCKHOLDERS' DEFICIT

| Common Stock | Additional Paid-in | Stock | Accumulated | Total Stockholders' | |||||||||||||||||||

| Shares | Amount | Capital | Payable | Deficit | Deficit | ||||||||||||||||||

| Balance, December 31, 2010 (audited) | 97,518,259 | $ | 97,520 | $ | 18,628,922 | $ | — | $ | (19,758,458 | ) | $ | (1,032,016 | ) | ||||||||||

| Issuance of stock for cash | 4,187,500 | 4,188 | 203,813 | — | — | 208,001 | |||||||||||||||||

| Issuance of stock for conversion of debts | 1,912,400 | 1,912 | 79,663 | — | — | 81,575 | |||||||||||||||||

| Issuance of stock for services | 2,724,000 | 2,724 | 152,376 | — | — | 155,100 | |||||||||||||||||

| Issuance of stock upon exercise of warrants in lieu of debt | 250,000 | 250 | 14,750 | — | — | 15,000 | |||||||||||||||||

| Financing costs related to convertible notes payable | — | — | 1,188,653 | — | — | 1,188,653 | |||||||||||||||||

| Net loss | — | — | — | — | (1,360,485 | ) | (1,360,485 | ) | |||||||||||||||

| Balance, December 31, 2011 (audited) | 106,592,159 | $ | 106,594 | $ | 20,268,177 | $ | — | $ | (21,118,943 | ) | $ | (744,172 | ) | ||||||||||

| Issuance of stock for conversion of debts | 2,915,250 | 2,913 | 113,846 | 1,800 | — | 118,559 | |||||||||||||||||

| Issuance of warrants for services | — | — | 39,006 | — | — | 39,006 | |||||||||||||||||

| Financing costs related to convertible notes payable | — | — | 420,642 | — | — | 420,642 | |||||||||||||||||

| Net loss | — | — | — | — | (1,452,421 | ) | (1,452,421 | ) | |||||||||||||||

| Balance, December 31, 2012 (audited) | 109,507,409 | 109,507 | 20,841,671 | 1,800 | (22,571,364 | ) | $ | (1,618,386 | ) | ||||||||||||||

See Accompanying Notes to Consolidated Financial Statements.

| F-4 |

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Audited)

| Years ended | |||||||

| December 31, 2012 | December 31, 2011 | ||||||

| (Restated) | |||||||

| Cash flows from operating activities: | |||||||

| Net loss | $ | (1,452,421 | ) | $ | (1,360,485 | ) | |

| Adjustments to reconcile net loss to net | |||||||

| cash used in operating activities: | |||||||

| Depreciation and amortization | 51,842 | 56,313 | |||||

| Stock based compensation | — | 155,100 | |||||

| Amortization of debt discount | 571,844 | 584,559 | |||||

| Loss on conversion of debt | — | 5,105 | |||||

| Accrued expenses converted to notes | 399,528 | 442,978 | |||||

| Warrants issued for services | 39,006 | — | |||||

| Gain on extinguishment of debt | (14,338 | ) | — | ||||

| Gain on sale of assets | (6,000 | ) | — | ||||

| Changes in operating assets and liabilities: | |||||||

| Decrease in inventory | (3,816 | ) | 1,642 | ||||

| Increase in accounts receivable | (26,194 | ) | (1,105 | ) | |||

| Decrease in prepaid expenses and other current assets | 8,098 | 5,390 | |||||

| Increase in accounts payable and accrued liabilities | 84,577 | (14,749 | ) | ||||

| Increase in accrued interest | 18,970 | 5,815 | |||||

| Increase (decrease) in unearned revenue | (210,000 | ) | (73,023 | ) | |||

| Net cash used in operating activities | (538,904 | ) | (192,460 | ) | |||

| Cash flows from investing activities: | |||||||

| Sale of fixed assets | 6,000 | ||||||

| Purchase of fixed assets and intangible assets | (37,971 | ) | (87,404 | ) | |||

| Net cash used in investing activities | (31,971 | ) | (87,404 | ) | |||

| Cash flows from financing activities: | |||||||

| Proceeds from issuance of stock | — | 223,001 | |||||

| Proceeds from, net of payments to, related parties for loans | (3,736 | ) | 12,400 | ||||

| Proceeds from convertible notes payable | 1,238,900 | 18,000 | |||||

| Payments on convertible notes payable | (195,000 | ) | — | ||||

| Proceeds from loans | — | 25,200 | |||||

| Payments on loans | (20,000 | ) | — | ||||

| Net cash provided by financing activities | 1,020,164 | 278,601 | |||||

| Net change in cash | 449,289 | (1,263 | ) | ||||

| Cash, beginning of period | 1,218 | 2,481 | |||||

| Cash, end of period | $ | 450,507 | $ | 1,218 | |||

| Supplemental disclosure of cash flow information: | |||||||

| Cash paid for interest | $ | 11,389 | $ | 4,051 | |||

| SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION: | |||||||

| Non-cash investing and financing activities: | |||||||

| Common stock payable for debt | $ | 1,800 | $ | — | |||

| Common stock issued on conversion of interest | $ | 613 | $ | — | |||

| Loan payable converted to convertible loan | $ | (9,719 | ) | $ | — | ||

| Common stock issued on conversion of debts | $ | 116,145 | $ | 81,575 | |||

| Beneficial conversion feature | $ | 420,642 | $ | 118,653 | |||

See Accompanying Notes to Consolidated Financial Statements.

| F-5 |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(AUDITED)

1. DESCRIPTION OF BUSINESS, HISTORY AND SUMMARY OF SIGNIFICANT POLICIES

Description of business – Skinvisible, Inc., (referred to as the “Company”) is focused on the development and manufacture of innovative topical, transdermal and mucosal polymer-based delivery system technologies and formulations incorporating its patent-pending formula/process for combining hydrophilic and hydrophobic polymer emulsions. The technologies and formulations have broad industry applications within the pharmaceutical, over-the-counter, personal skincare and cosmetic arenas. Additionally, the Company’s non-dermatological formulations, offer solutions for a broad spectrum of markets women’s health, pain management, and others. The Company maintains executive and sales offices in Las Vegas, Nevada.

History – Skinvisible, Inc. (referred to as the “Company”) was incorporated in Nevada on March 6, 1998 under the name of Microbial Solutions, Inc. The Company underwent a name change on February 26, 1999, when it changed its name to Skinvisible, Inc. The Company’s subsidiary’s name of Manloe Labs, Inc. was also changed to Skinvisible Pharmaceuticals, Inc.

Skinvisible, Inc. together with its subsidiary shall herein be collectively referred to as the “Company”.

Going concern – The accompanying financial statements have been prepared on a going concern basis, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. The Company has incurred cumulative net losses of $22,571,364 since its inception and requires capital for its contemplated operational and marketing activities to take place. The Company’s ability to raise additional capital through the future issuances of common stock is unknown. The obtainment of additional financing, the successful development of the Company’s contemplated plan of operations, and its transition, ultimately, to the attainment of profitable operations are necessary for the Company to continue operations. The ability to successfully resolve these factors raise substantial doubt about the Company’s ability to continue as a going concern. The consolidated financial statements of the Company do not include any adjustments that may result from the outcome of these aforementioned uncertainties.

Principles of consolidation – The consolidated financial statements include the accounts of the Company and its subsidiary. All significant intercompany balances and transactions have been eliminated.

Use of estimates – The preparation of consolidated financial statements in conformity with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates.

Cash and cash equivalents

For purposes of the statement of cash flows, the Company considers all highly liquid investments and short-term debt instruments with original maturities of three months or less to be cash equivalents.

Fair Value of Financial Instruments

The carrying amounts reflected in the balance sheets for cash, accounts payable and accrued expenses approximate the respective fair values due to the short maturities of these items.

As required by the Fair Value Measurements and Disclosures Topic of the FASB ASC, fair value is measured based on a three-tier fair value hierarchy, which prioritizes the inputs used in measuring fair value as follows: (Level 1) observable inputs such as quoted prices in active markets; (Level 2) inputs, other than the quoted prices in active markets, that are observable either directly or indirectly; and (Level 3) unobservable inputs in which there is little or no market data, which require the reporting entity to develop its own assumptions.

The three levels of the fair value hierarchy are described below:

Level 1: Unadjusted quoted prices in active markets that are accessible at the measurement date for identical, unrestricted assets or liabilities;

Level 2: Quoted prices in markets that are not active, or inputs that are observable, either directly or indirectly, for substantially the full term of the asset or liability;

Level 3: Prices or valuation techniques that require inputs that are both significant to the fair value measurement and unobservable (supported by little or no market activity).

| F-6 |

SKINVISIBLE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(AUDITED)

Revenue recognition

Product sales – Revenues from the sale of products (Invisicare® polymers) are recognized when title to the products are transferred to the customer and only when no further contingencies or material performance obligations are warranted, and thereby have earned the right to receive reasonably assured payments for products sold and delivered.

Royalty sales – The Company also recognizes royalty revenue from licensing its patented product formulations only when earned, when no further contingencies or material performance obligations are warranted, and thereby have earned the right to receive and retain reasonably assured payments.

Distribution and license rights sales – The Company also recognizes revenue from distribution and license rights only when earned (and are amortized over a five year period), when no further contingencies or material performance obligations are warranted, and thereby have earned the right to receive and retain reasonably assured payments.

Costs of Revenue – Cost of revenue includes raw materials, component parts, and shipping supplies. Shipping and handling costs is not a significant portion of the cost of revenue.

Accounts Receivable – Accounts receivable is comprised of uncollateralized customer obligations due under normal trade terms requiring payment within 30 days from the invoice date. The carrying amount of accounts receivable is reviewed periodically for collectability. If management determines that collection is unlikely, an allowance that reflects management’s best estimate of the amounts that will not be collected is recorded. Management reviews each accounts receivable balance that exceeds 30 days from the invoice date and, based on an assessment of creditworthiness, estimates the portion, if any, of the balance that will not be collected. As of December 31, 2012, the Company had not recorded a reserve for doubtful accounts.

Inventory – Substantially all inventory consists of finished goods and are valued based upon first-in first-out ("FIFO") cost, not in excess of market. The determination of whether the carrying amount of inventory requires a write-down is based on an evaluation of inventory.

Goodwill and intangible assets – The Company follows Financial Accounting Standard Board’s (FASB) Codification Topic 350-10 (“ASC 350-10”), “Intangibles – Goodwill and Other”. According to this statement, goodwill and intangible assets with indefinite lives are no longer subject to amortization, but rather an annual assessment of impairment by applying a fair-value based test. Fair value for goodwill is based on discounted cash flows, market multiples and/or appraised values as appropriate. Under ASC 350-10, the carrying value of assets are calculated at the lowest level for which there are identifiable cash flows.