Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended August 31, 2012

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 001-08399

WORTHINGTON INDUSTRIES, INC.

(Exact name of registrant as specified in its charter)

| Ohio |

31-1189815 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

| 200 Old Wilson Bridge Road, Columbus, Ohio |

43085 | |

| (Address of principal executive offices) |

(Zip Code) | |

| (614) 438-3210 |

(Registrant’s telephone number, including area code)

| Not applicable |

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

YES x NO ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

YES x NO ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

x |

Accelerated filer |

¨ | |||||

| Non-accelerated filer |

¨ (Do not check if a smaller reporting company) |

Smaller reporting company |

¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

YES ¨ NO x

APPLICABLE ONLY TO CORPORATE ISSUERS:

Indicate the number of shares outstanding of each of the Issuer’s classes of common stock, as of the latest practicable date. On October 1, 2012, the number of Common Shares issued and outstanding was 69,879,536.

Table of Contents

| ii | ||||||

| Item 1. |

||||||

| Consolidated Balance Sheets – |

1 | |||||

| Consolidated Statements of Earnings (Unaudited) – |

2 | |||||

| 3 | ||||||

| Consolidated Statements of Cash Flows (Unaudited) – |

4 | |||||

| 5 | ||||||

| Item 2. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

20 | ||||

| Item 3. |

30 | |||||

| Item 4. |

30 | |||||

| Item 1. |

30 | |||||

| Item 1A. |

30 | |||||

| Item 2. |

31 | |||||

| Item 3. |

31 | |||||

| Item 4. |

31 | |||||

| Item 5. |

31 | |||||

| Item 6. |

32 | |||||

| 33 | ||||||

| 34 | ||||||

i

Table of Contents

Selected statements contained in this Quarterly Report on Form 10-Q, including, without limitation, in “PART I – Item 2. – Management’s Discussion and Analysis of Financial Condition and Results of Operations,” constitute “forward-looking statements” as that term is used in the Private Securities Litigation Reform Act of 1995 (the “Act”). Forward-looking statements reflect our current expectations, estimates or projections concerning future results or events. These statements are often identified by the use of forward-looking words or phrases such as “believe,” “expect,” “anticipate,” “may,” “could,” “intend,” “estimate,” “plan,” “foresee,” “likely,” “will,” “should” or other similar words or phrases. These forward-looking statements include, without limitation, statements relating to:

| — | business plans or future or expected growth, performance, sales, volumes, cash flows, earnings, balance sheet strengths, debt, financial condition or other financial measures; |

| — | projected profitability potential, capacity, and working capital needs; |

| — | demand trends for us or our markets; |

| — | increases to product lines and opportunities to participate in new markets; |

| — | pricing trends for raw materials and finished goods and the impact of pricing changes; |

| — | anticipated capital expenditures and asset sales; |

| — | anticipated improvements and efficiencies in costs, operations, sales, inventory management, sourcing and the supply chain and the results thereof; |

| — | the ability to make acquisitions and the projected timing, results, benefits, costs, charges and expenditures related to acquisitions, newly-created joint ventures, headcount reductions and facility dispositions, shutdowns and consolidations; |

| — | the alignment of operations with demand; |

| — | the ability to operate profitably and generate cash in down markets; |

| — | the ability to maintain margins and capture and maintain market share and to develop or take advantage of future opportunities, new products and new markets; |

| — | expectations for Company and customer inventories, jobs and orders; |

| — | expectations for the economy and markets or improvements therein; |

| — | expected benefits from transformation plans, cost reduction efforts and other new initiatives; |

| — | expectations for increasing volatility or improving and sustaining earnings, earnings potential, margins or shareholder value; |

| — | effects of judicial rulings; and |

| — | other non-historical matters. |

Because they are based on beliefs, estimates and assumptions, forward-looking statements are inherently subject to risks and uncertainties that could cause actual results to differ materially from those projected. Any number of factors could affect actual results, including, without limitation, those that follow:

| — | the effect of national, regional and worldwide economic conditions generally and within major product markets, including a prolonged or substantial economic downturn; |

| — | the effect of conditions in national and worldwide financial markets; |

| — | product demand and pricing; |

| — | adverse impacts associated with the recent voluntary recall of our MAP-PRO®, propylene and MAAP® cylinders, including recall costs, legal and notification expenses, lost sales and potential negative customer perceptions of certain pressure cylinder products; |

| — | changes in product mix, product substitution and market acceptance of our products; |

| — | fluctuations in the pricing, quality or availability of raw materials (particularly steel), supplies, transportation, utilities and other items required by operations; |

| — | effects of facility closures and the consolidation of operations; |

| — | the effect of financial difficulties, consolidation and other changes within the steel, automotive, construction and other industries in which we participate; |

| — | failure to maintain appropriate levels of inventories; |

| — | financial difficulties (including bankruptcy filings) of original equipment manufacturers, end-users and customers, suppliers, joint venture partners and others with whom we do business; |

| — | the ability to realize targeted expense reductions from headcount reductions, facility closures and other cost reduction efforts; |

ii

Table of Contents

| — | the ability to realize other cost savings and operational, sales and sourcing improvements and efficiencies, and other expected benefits from transformation initiatives, on a timely basis; |

| — | the overall success of, and the ability to integrate, newly-acquired businesses and achieve synergies and other expected benefits and cost savings therefrom; |

| — | the ability to maintain relationships with customers of acquired businesses; |

| — | the overall success of newly-created joint ventures, including the demand for their products, and the ability to achieve the anticipated benefits therefrom; |

| — | capacity levels and efficiencies within facilities, within major product markets and within the industry as a whole; |

| — | the effect of disruption in the business of suppliers, customers, facilities and shipping operations due to adverse weather, casualty events, equipment breakdowns, acts of war or terrorist activities or other causes; |

| — | changes in customer demand, inventories, spending patterns, product choices, and supplier choices; |

| — | risks associated with doing business internationally, including economic, political and social instability, foreign currency exposure and the acceptance of our products in new markets; |

| — | the ability to improve and maintain processes and business practices to keep pace with the economic, competitive and technological environment; |

| — | the outcome of adverse claims experience with respect to worker’s compensation, product recalls or product liability, casualty events or other matters; |

| — | deviation of actual results from estimates and/or assumptions used by us in the application of our significant accounting policies; |

| — | level of imports and import prices in our markets; |

| — | the impact of the outcome of judicial and governmental agency rulings as well as the impact of governmental regulations, including those adopted by the United States Securities and Exchange Commission and other governmental agencies as contemplated by the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, both in the United States and abroad; and |

| — | other risks described from time to time in our filings with the United States Securities and Exchange Commission, including those described in “PART I – Item 1A. — Risk Factors” of our Annual Report on Form 10-K for the fiscal year ended May 31, 2012. |

We note these factors for investors as contemplated by the Act. It is impossible to predict or identify all potential risk factors. Consequently, you should not consider the foregoing list to be a complete set of all potential risks and uncertainties. Any forward-looking statements in this Quarterly Report on Form 10-Q are based on current information as of the date of this Quarterly Report on Form 10-Q, and we assume no obligation to correct or update any such statements in the future, except as required by applicable law.

iii

Table of Contents

Item 1. – Financial Statements

WORTHINGTON INDUSTRIES, INC.

(in thousands)

| August 31, 2012 |

May 31, 2012 |

|||||||

| (Unaudited) | ||||||||

| Assets |

||||||||

| Current assets: |

||||||||

| Cash and cash equivalents |

$ | 30,481 | $ | 41,028 | ||||

| Receivables, less allowances of $3,593 and $3,329 at August 31, 2012 and May 31, 2012 |

359,660 | 400,869 | ||||||

| Inventories: |

||||||||

| Raw materials |

206,656 | 211,543 | ||||||

| Work in process |

93,681 | 115,510 | ||||||

| Finished products |

83,245 | 74,887 | ||||||

|

|

|

|

|

|||||

| Total inventories |

383,582 | 401,940 | ||||||

| Income taxes receivable |

1,394 | 892 | ||||||

| Assets held for sale |

11,768 | 7,202 | ||||||

| Deferred income taxes |

20,397 | 20,906 | ||||||

| Prepaid expenses and other current assets |

38,903 | 41,402 | ||||||

|

|

|

|

|

|||||

| Total current assets |

846,185 | 914,239 | ||||||

| Investments in unconsolidated affiliates |

244,087 | 240,882 | ||||||

| Goodwill |

156,754 | 156,681 | ||||||

| Other intangible assets, net of accumulated amortization of $18,040 and $16,103 at August 31, 2012 and May 31, 2012 |

98,695 | 100,333 | ||||||

| Other assets |

18,900 | 22,585 | ||||||

| Property, plant and equipment, net |

440,885 | 443,077 | ||||||

|

|

|

|

|

|||||

| Total assets |

$ | 1,805,506 | $ | 1,877,797 | ||||

|

|

|

|

|

|||||

| Liabilities and equity |

||||||||

| Current liabilities: |

||||||||

| Accounts payable |

$ | 237,885 | $ | 252,334 | ||||

| Short-term borrowings |

51,234 | 274,923 | ||||||

| Accrued compensation, contributions to employee benefit plans and related taxes |

47,624 | 71,271 | ||||||

| Dividends payable |

9,371 | 8,478 | ||||||

| Other accrued items |

38,633 | 38,231 | ||||||

| Income taxes payable |

6,721 | 11,697 | ||||||

| Current maturities of long-term debt |

1,256 | 1,329 | ||||||

|

|

|

|

|

|||||

| Total current liabilities |

392,724 | 658,263 | ||||||

| Other liabilities |

69,371 | 72,371 | ||||||

| Distributions in excess of investment in unconsolidated affiliate |

64,801 | 69,165 | ||||||

| Long-term debt |

407,097 | 257,462 | ||||||

| Deferred income taxes |

79,131 | 73,099 | ||||||

|

|

|

|

|

|||||

| Total liabilities |

1,013,124 | 1,130,360 | ||||||

| Shareholders’ equity — controlling interest |

741,105 | 697,174 | ||||||

| Noncontrolling interest |

51,277 | 50,263 | ||||||

|

|

|

|

|

|||||

| Total equity |

792,382 | 747,437 | ||||||

|

|

|

|

|

|||||

| Total liabilities and equity |

$ | 1,805,506 | $ | 1,877,797 | ||||

|

|

|

|

|

|||||

See notes to consolidated financial statements.

1

Table of Contents

WORTHINGTON INDUSTRIES, INC.

CONSOLIDATED STATEMENTS OF EARNINGS

(In thousands, except per share)

(Unaudited)

| Three Months Ended August 31, |

||||||||

| 2012 | 2011 | |||||||

| Net sales |

$ | 666,035 | $ | 602,387 | ||||

| Cost of goods sold |

572,384 | 530,925 | ||||||

|

|

|

|

|

|||||

| Gross margin |

93,651 | 71,462 | ||||||

| Selling, general and administrative expense |

59,422 | 45,361 | ||||||

| Impairment of long-lived assets |

1,570 | - | ||||||

| Restructuring and other expense |

403 | 1,703 | ||||||

| Joint venture transactions |

(1,162 | ) | 3,215 | |||||

|

|

|

|

|

|||||

| Operating income |

33,418 | 21,183 | ||||||

| Other income (expense): |

||||||||

| Miscellaneous income |

165 | 401 | ||||||

| Interest expense |

(5,259 | ) | (4,688 | ) | ||||

| Equity in net income of unconsolidated affiliates |

22,643 | 24,697 | ||||||

|

|

|

|

|

|||||

| Earnings before income taxes |

50,967 | 41,593 | ||||||

| Income tax expense |

16,102 | 13,252 | ||||||

|

|

|

|

|

|||||

| Net earnings |

34,865 | 28,341 | ||||||

| Net earnings attributable to noncontrolling interest |

903 | 2,688 | ||||||

|

|

|

|

|

|||||

| Net earnings attributable to controlling interest |

$ | 33,962 | $ | 25,653 | ||||

|

|

|

|

|

|||||

| Basic |

||||||||

| Average common shares outstanding |

68,278 | 71,518 | ||||||

|

|

|

|

|

|||||

| Earnings per share attributable to controlling interest |

$ | 0.50 | $ | 0.36 | ||||

|

|

|

|

|

|||||

| Diluted |

||||||||

| Average common shares outstanding |

69,571 | 72,418 | ||||||

|

|

|

|

|

|||||

| Earnings per share attributable to controlling interest |

$ | 0.49 | $ | 0.35 | ||||

|

|

|

|

|

|||||

| Common shares outstanding at end of period |

68,679 | 70,042 | ||||||

| Cash dividends declared per share |

$ | 0.13 | $ | 0.12 | ||||

See notes to consolidated financial statements.

2

Table of Contents

WORTHINGTON INDUSTRIES, INC.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(In thousands)

(Unaudited)

| Three Months Ended August 31, |

||||||||

| 2012 | 2011 | |||||||

| Net earnings |

$ | 34,865 | $ | 28,341 | ||||

| Other comprehensive income (loss), net of tax: |

||||||||

| Foreign currency translation |

3,908 | (300 | ) | |||||

| Pension liability adjustment |

(172 | ) | - | |||||

| Cash flow hedges |

984 | (2,035 | ) | |||||

|

|

|

|

|

|||||

| Other comprehensive income (loss) |

4,720 | (2,335 | ) | |||||

|

|

|

|

|

|||||

| Comprehensive income |

39,585 | 26,006 | ||||||

| Comprehensive income attributable to noncontrolling interest |

1,014 | 1,867 | ||||||

|

|

|

|

|

|||||

| Comprehensive income attributable to controlling interest |

$ | 38,571 | $ | 24,139 | ||||

|

|

|

|

|

|||||

See notes to consolidated financial statements.

3

Table of Contents

WORTHINGTON INDUSTRIES, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited, in thousands)

| Three Months Ended August 31, |

||||||||

| 2012 | 2011 | |||||||

| Operating activities |

||||||||

| Net earnings |

$ | 34,865 | $ | 28,341 | ||||

| Adjustments to reconcile net earnings to net cash provided (used) by operating activities: |

||||||||

| Depreciation and amortization |

14,987 | 12,854 | ||||||

| Impairment of long-lived assets |

1,570 | - | ||||||

| Provision for deferred income taxes |

4,679 | 7,678 | ||||||

| Bad debt expense |

7 | 29 | ||||||

| Equity in net income of unconsolidated affiliates, net of distributions |

(7,358 | ) | (5,069 | ) | ||||

| Net loss (gain) on sale of assets |

2,310 | (415 | ) | |||||

| Stock-based compensation |

3,193 | 3,201 | ||||||

| Changes in assets and liabilities: |

||||||||

| Receivables |

38,116 | 27,374 | ||||||

| Inventories |

17,019 | 5,915 | ||||||

| Prepaid expenses and other current assets |

(145 | ) | 611 | |||||

| Other assets |

2,847 | 1,273 | ||||||

| Accounts payable and accrued expenses |

(39,573 | ) | (96,848 | ) | ||||

| Other liabilities |

(1,519 | ) | 216 | |||||

|

|

|

|

|

|||||

| Net cash provided (used) by operating activities |

70,998 | (14,840 | ) | |||||

|

|

|

|

|

|||||

| Investing activities |

||||||||

| Investment in property, plant and equipment, net |

(16,705 | ) | (6,472 | ) | ||||

| Acquisitions, net of cash acquired |

- | (41,000 | ) | |||||

| Investments in unconsolidated affiliates |

- | (785 | ) | |||||

| Proceeds from sale of assets |

6,585 | 5,041 | ||||||

|

|

|

|

|

|||||

| Net cash used by investing activities |

(10,120 | ) | (43,216 | ) | ||||

|

|

|

|

|

|||||

| Financing activities |

||||||||

| Net proceeds from (repayments of) short-term borrowings |

(223,688 | ) | 76,250 | |||||

| Proceeds from long-term debt, net |

150,000 | - | ||||||

| Principal payments on long-term debt |

(442 | ) | - | |||||

| Proceeds from issuance of common shares |

10,855 | 8,208 | ||||||

| Payments to noncontrolling interest |

- | (3,120 | ) | |||||

| Repurchase of common shares |

- | (35,405 | ) | |||||

| Dividends paid |

(8,150 | ) | (7,169 | ) | ||||

|

|

|

|

|

|||||

| Net cash provided (used) by financing activities |

(71,425 | ) | 38,764 | |||||

|

|

|

|

|

|||||

| Decrease in cash and cash equivalents |

(10,547 | ) | (19,292 | ) | ||||

| Cash and cash equivalents at beginning of period |

41,028 | 56,167 | ||||||

|

|

|

|

|

|||||

| Cash and cash equivalents at end of period |

$ | 30,481 | $ | 36,875 | ||||

|

|

|

|

|

|||||

See notes to consolidated financial statements.

4

Table of Contents

WORTHINGTON INDUSTRIES, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Three-Month Periods Ended August 31, 2012 and August 31, 2011

(Unaudited)

NOTE A – Basis of Presentation

The accompanying unaudited consolidated financial statements include the accounts of Worthington Industries, Inc. and consolidated subsidiaries (collectively, “we”, “our”, “Worthington” or the “Company”). Investments in unconsolidated affiliates are accounted for using the equity method. Significant intercompany accounts and transactions are eliminated.

Spartan Steel Coating, LLC (“Spartan”), in which we own a 52% controlling interest, Worthington Nitin Cylinders Limited (“WNCL”), in which we own a 60% controlling interest, and Worthington Energy Innovations, LLC (“WEI”, formally PSI Energy Solutions, LLC), in which we own a 75% controlling interest, are fully consolidated with the equity owned by the other joint venture members shown as noncontrolling interest in our consolidated balance sheets, and the other joint venture members’ portion of net earnings shown as net earnings attributable to noncontrolling interest in our consolidated statements of earnings.

These unaudited consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) for interim financial information and with the instructions to Form 10-Q and Article 10 of Regulation S-X of the Securities and Exchange Commission (“SEC”). Accordingly, they do not include all of the information and notes required by accounting principles generally accepted in the United States of America (the “United States”) for complete financial statements. In the opinion of management, all adjustments, which are of a normal and recurring nature, except those which have been disclosed elsewhere in this Quarterly Report on Form 10-Q, necessary for a fair statement of the results of operations of these interim periods, have been included. Operating results for the three months ended August 31, 2012 are not necessarily indicative of the results that may be expected for the fiscal year ending May 31, 2013 (“fiscal 2013”). For further information, refer to the consolidated financial statements and notes thereto included in the Annual Report on Form 10-K for the fiscal year ended May 31, 2012 (“fiscal 2012”) of Worthington Industries, Inc. (the “2012 Form 10-K”).

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. Actual results could differ from those estimates.

Joint Venture Transactions

On March 1, 2011, we joined with ClarkWestern Building Systems Inc. to form Clarkwestern Dietrich Building Systems LLC (“ClarkDietrich”), a joint venture that manufactures a full line of drywall studs and accessories, structural studs and joists, metal lath and accessories, and shaft wall studs and track used primarily in residential and commercial construction. We contributed our metal framing business and related working capital in exchange for a 25% ownership interest in ClarkDietrich. As we do not have a controlling financial interest in ClarkDietrich, our investment in this joint venture is accounted for under the equity method, and the contributed net assets were deconsolidated effective March 1, 2011.

We retained and continued to operate the remaining metal framing facilities (the “retained facilities”), on a short-term basis, to support the transition of the business into ClarkDietrich. The buildings and equipment associated with the majority of these facilities were sold during fiscal 2012. The remaining facilities are expected to be sold during fiscal 2013 and actions to locate buyers are ongoing. As the other relevant criteria for classification as assets held for sale have been satisfied, the $4,834,000 carrying value of these asset groups, which consist primarily of property, plant and equipment, is presented separately in our consolidated balance sheet as of August 31, 2012.

The remaining balance classified as assets held for sale at August 31, 2012, relates to certain assets within our Pressure Cylinders reportable business segment as further described in “NOTE M – Fair Value.”

5

Table of Contents

Recently Issued Accounting Standards

In December 2011, new accounting guidance was issued that establishes certain additional disclosure requirements about financial instruments and derivatives instruments that are subject to netting arrangements. The new disclosures are required for annual reporting periods beginning on or after January 1, 2013, and interim periods within those periods. We do not expect the adoption of this amended accounting guidance to have a material impact on our financial position or results of operations.

In June 2011, new accounting guidance was issued regarding the presentation of comprehensive income in financial statements prepared in accordance with U.S. GAAP. This new guidance requires entities to present reclassification adjustments included in other comprehensive income on the face of the financial statements and allows entities to present total comprehensive income, the components of net income and the components of other comprehensive income either in a single continuous statement of comprehensive income or in two separate but consecutive statements. It also eliminates the option for entities to present the components of other comprehensive income as part of the statement of equity. For public companies, this accounting guidance is effective for fiscal years (and interim periods within those fiscal years) beginning after December 15, 2011, with early adoption permitted. Retrospective application to prior periods is required. In December 2011, certain provisions of this new guidance related to the presentation of reclassification adjustments out of accumulated other comprehensive income were temporarily deferred to a later date that has yet to be determined. We adopted the effective provisions of this new accounting guidance on June 1, 2012 and have provided the required statements of comprehensive income for the three months ended August 31, 2012 and 2011.

In September 2011, amended accounting guidance was issued that simplifies how an entity tests goodwill for impairment. The amended guidance allows an entity to first assess qualitative factors to determine whether it is necessary to perform the two-step quantitative goodwill impairment test. The two-step quantitative impairment test is required only if, based on its qualitative assessment, an entity determines that it is more likely than not that the fair value of a reporting unit is less than its carrying amount. The amended guidance is effective for interim and annual goodwill impairment tests performed for fiscal years beginning after December 15, 2011. Our adoption of this amended accounting guidance does not impact our financial position or results of operations.

In July 2012, amended accounting guidance was issued that simplifies how an entity tests indefinite-lived intangible assets for impairment. The amended guidance allows an entity to first assess qualitative factors to determine whether it is necessary to perform a quantitative impairment test. An entity will no longer be required to calculate the fair value of an indefinite-lived intangible asset and perform the quantitative test unless the entity determines, based on a qualitative assessment, that it is more likely than not that its fair value is less than its carrying amount. The amended guidance is effective for interim and annual indefinite-lived intangible asset impairment tests performed for fiscal years beginning after September 15, 2012, with early adoption permitted. We do not expect the adoption of this amended accounting guidance to have a material impact on our financial position or results of operations.

NOTE B – Investments in Unconsolidated Affiliates

Our investments in affiliated companies that we do not control, either through majority ownership or otherwise, are accounted for using the equity method. At August 31, 2012, these equity investments and the percentage interests owned consisted of: ArtiFlex (50%), ClarkDietrich (25%), Gestamp Worthington Wind Steel, LLC (the “Gestamp JV”) (50%), Samuel Steel Pickling Company (31%), Serviacero Planos, S. de R. L. de C.V. (50%), TWB Company, L.L.C. (“TWB”) (45%), Worthington Armstrong Venture (“WAVE”) (50%), Worthington Modern Steel Framing Manufacturing Co., Ltd. (“WMSFMCo.”) (40%), and Worthington Specialty Processing (“WSP”) (51%). WSP is considered to be jointly controlled and not consolidated due to substantive participating rights of the minority partner.

We received distributions from unconsolidated affiliates totaling $15,286,000 during the three months ended August 31, 2012. We have received cumulative distributions from WAVE in excess of our investment balance totaling $64,801,000 and $69,165,000 at August 31 and May 31, 2012, respectively. In accordance with the applicable accounting guidance, these excess distributions are reclassified to the liabilities section of our consolidated balance sheet. We will continue to record our equity in the net income of WAVE as a debit to the investment account, and if it becomes positive, it will again be shown as an asset on our consolidated balance sheet. If it becomes obvious that any excess distribution may not be returned (upon joint venture liquidation or otherwise), we will recognize any balance classified as a liability as income immediately.

6

Table of Contents

We use the “cumulative earnings” approach for determining cash flow presentation of distributions from our unconsolidated joint ventures. Distributions received are included in our consolidated statements of cash flows as operating activities, unless the cumulative distributions exceed our portion of the cumulative equity in the net earnings of the joint venture, in which case the excess distributions are deemed to be returns of the investment and are classified as investing activities in our consolidated statements of cash flows.

Combined financial information for our unconsolidated affiliates is summarized as follows:

| (in thousands) | August 31, 2012 |

May 31, 2012 |

||||||

| Current assets |

$ | 632,088 | $ | 626,975 | ||||

| Noncurrent assets |

352,672 | 345,500 | ||||||

|

|

|

|

|

|||||

| Total assets |

$ | 984,760 | $ | 972,475 | ||||

|

|

|

|

|

|||||

| Current liabilities |

$ | 186,131 | $ | 174,016 | ||||

| Current maturities of long-term debt |

5,323 | 5,305 | ||||||

| Long-term debt |

275,970 | 289,308 | ||||||

| Other noncurrent liabilities |

20,832 | 21,934 | ||||||

| Equity |

496,504 | 481,912 | ||||||

|

|

|

|

|

|||||

| Total liabilities and equity |

$ | 984,760 | $ | 972,475 | ||||

|

|

|

|

|

|||||

| Three Months Ended August 31, |

||||||||

| (in thousands) | 2012 | 2011 | ||||||

| Net sales |

$ | 446,853 | $ | 427,794 | ||||

| Gross margin |

77,918 | 83,825 | ||||||

| Operating income |

51,711 | 57,147 | ||||||

| Depreciation and amortization |

8,990 | 4,834 | ||||||

| Interest expense |

2,261 | 876 | ||||||

| Income tax expense |

3,469 | 4,358 | ||||||

| Net earnings |

46,284 | 51,865 | ||||||

NOTE C – Restructuring and Other Expense

In fiscal 2008, we initiated a Transformation Plan (the “Transformation Plan”) with the overall goal to improve our sustainable earnings potential, asset utilization and operational performance. The Transformation Plan focuses on cost reduction, margin expansion and organizational capability improvements and, in the process, seeks to drive excellence in three core competencies: sales; operations; and supply chain management. The Transformation Plan is comprehensive in scope and includes aggressive diagnostic and implementation phases.

To date, we have completed the transformation phases in each of the core facilities within our Steel Processing operating segment, including the facilities of our Mexican joint venture. We also substantially completed the transformation phases at our metal framing facilities prior to their contribution to ClarkDietrich. Transformation efforts within our Pressure Cylinders operating segment, which began during the first quarter of fiscal 2012, are ongoing. In addition, during the three months ended August 31, 2012, we initiated the diagnostics phase of the Transformation Plan in our Engineered Cabs operating segment.

During the quarter ended August 31, 2012, the following actions were taken in connection with the Transformation Plan:

| • | In connection with the wind-down of our former Metal Framing operating segment: |

| - | Approximately $231,000 of facility exit and other costs were incurred in connection with the closure of the retained facilities. |

7

Table of Contents

| - | The severance accrual was adjusted downward, resulting in a $235,000 credit to earnings. |

| - | Certain assets of the retained facilities classified as held for sale were disposed of for cash proceeds of $3,526,000 resulting in a net gain of $1,158,000. |

These items were recognized within the joint venture transactions line item in our consolidated statements of earnings to correspond with amounts previously recognized in connection with the formation of ClarkDietrich and the subsequent wind-down of our former Metal Framing operating segment.

| • | In connection with the closure of our commercial stairs business, we incurred net charges of approximately $312,000, consisting primarily of facility exit and other costs. |

| • | In connection with certain organizational changes impacting our Global Group operating segment, we accrued approximately $85,000 of employee severance. For further information regarding these organizational changes, refer to “NOTE K – Segment Operations.” |

A progression of the liabilities created as part of the Transformation Plan, combined with a reconciliation to the restructuring and other expense line item in our consolidated statement of earnings for the three months ended August 31, 2012 is summarized as follows:

| (in thousands) | Beginning Balance |

Expense | Payments | Adjustments | Ending Balance |

|||||||||||||||

| Early retirement and severance |

$ | 4,892 | $ | (165 | ) | $ | (510 | ) | $ | (3 | ) | $ | 4,214 | |||||||

| Facility exit and other costs |

691 | 564 | (500 | ) | (333 | ) | 422 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| $ | 5,583 | 399 | $ | (1,010 | ) | $ | (336 | ) | $ | 4,636 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net gain on asset disposals |

(1,158 | ) | ||||||||||||||||||

| Less: joint venture transactions |

1,162 | |||||||||||||||||||

|

|

|

|||||||||||||||||||

| Restructuring and other expense |

$ | 403 | ||||||||||||||||||

|

|

|

|||||||||||||||||||

NOTE D – Contingent Liabilities

We are defendants in certain legal actions. In the opinion of management, the outcome of these actions, which is not clearly determinable at the present time, would not significantly affect our consolidated financial position or future results of operations. We believe that environmental issues will not have a material effect on our capital expenditures, consolidated financial position or future results of operations.

Pressure Cylinders Voluntary Product Recall

On January 10, 2012, we announced a voluntary recall of our MAP-PRO®, propylene and MAAP® cylinders and related hand torch kits. The recall was precautionary in nature and involves a valve supplied by a third party that may leak when a torch or hose is disconnected from the cylinder.

During the quarter ended August 31, 2012, we incurred additional expenses of $1,534,000 related to the recall, bringing the total pre-tax charges incurred to $11,485,000, which represents our best estimate of the total liability. Recoveries, if any, will not be recorded until an agreement is reached with the supplier.

NOTE E – Guarantees

We do not have guarantees that we believe are reasonably likely to have a material current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources. However, as of August 31, 2012, we were party to an operating lease for an aircraft in which we have guaranteed a residual value at the termination of the lease. The maximum obligation under the terms of this guarantee was approximately $14,702,000 at August 31, 2012. We have also guaranteed the repayment of a $5,000,000 term loan entered into by one of our unconsolidated affiliates, ArtiFlex. Based on current facts and circumstances, we have estimated the likelihood of payment pursuant to these guarantees, and determined that the fair value of our obligation under each guarantee based on those likely outcomes is not material.

We also had in place $10,982,000 of outstanding stand-by letters of credit for third-party beneficiaries as of August 31, 2012. These letters of credit were issued to third-party service providers and had no amounts drawn against them at August 31, 2012. The fair value of these guarantee instruments, based on premiums paid, was not material, and therefore no amounts have been recognized in our consolidated financial statements.

8

Table of Contents

NOTE F – Debt and Receivables Securitization

On August 10, 2012, we issued $150,000,000 aggregate principal amount of unsecured senior notes due August 10, 2024 (the “2024 Notes”). The 2024 Notes bear interest at a rate of 4.60%. The net proceeds from this issuance were used to repay a portion of the outstanding borrowings under our multi-year revolving credit facility and amounts outstanding under our revolving trade accounts receivable securitization facility, both of which are described in more detail below.

We have a $425,000,000 multi-year revolving credit facility (the “Credit Facility”) with a group of lenders that matures in May 2017. Borrowings outstanding under the Credit Facility were $30,435,000 at August 31, 2012. Additionally, as discussed in “NOTE E – Guarantees”, we provided $10,982,000 in stand-by letters of credit for third-party beneficiaries as of August 31, 2012. While not drawn against, these letters of credit are issued against availability under the Credit Facility, leaving $383,583,000 available at August 31, 2012.

Current borrowings under this revolving Credit Facility have maturities of less than one year, and given that we intend to repay them within the next year, they have been classified as short-term borrowings in our consolidated balance sheet. However, we can extend the term of amounts borrowed by renewing these borrowings for the term of the Credit Facility. We have the option to borrow at rates equal to an applicable margin over the LIBOR, Prime or Fed Funds rates. The applicable margin is determined by our credit rating. At August 31, 2012, the applicable variable rate, based on LIBOR, was 1.28%.

We also maintain a $150,000,000 revolving trade accounts receivable securitization facility (the “AR Facility”), which expires in January 2013. The AR Facility has been available throughout fiscal 2013 to date, and was available throughout fiscal 2012. During the third quarter of fiscal 2012, we increased our borrowing capacity under the AR Facility from $100,000,000 to $150,000,000. Pursuant to the terms of the AR Facility, certain of our subsidiaries sell their accounts receivable without recourse, on a revolving basis, to Worthington Receivables Corporation (“WRC”), a wholly-owned, consolidated, bankruptcy-remote subsidiary. In turn, WRC may sell without recourse, on a revolving basis, up to $150,000,000 of undivided ownership interests in this pool of accounts receivable to a multi-seller, asset-backed commercial paper conduit (the “Conduit”). Purchases by the Conduit are financed with the sale of A1/P1 commercial paper. We retain an undivided interest in this pool and are subject to risk of loss based on the collectability of the receivables from this retained interest. Because the amount eligible to be sold excludes receivables more than 90 days past due, receivables offset by an allowance for doubtful accounts due to bankruptcy or other cause, concentrations over certain limits with specific customers and certain reserve amounts, we believe additional risk of loss is minimal. The book value of the retained portion of the pool of accounts receivable approximates fair value. As of August 31, 2012, the pool of eligible accounts receivable exceeded the $150,000,000 limit, and $15,000,000 of undivided ownership interests in this pool of accounts receivable had been sold.

The remaining balance of short-term borrowings at August 31, 2012 consisted of $5,799,000 outstanding under a $9,500,000 credit facility maintained by our consolidated affiliate, WNCL. This credit facility bears interest at a variable rate, which was 3.25% at August 31, 2012. We plan to renew this credit facility prior to its expiration in November 2012.

NOTE G – Comprehensive Income

The following table summarizes the tax effects of each component of other comprehensive income for the three months ended August 31, 2012:

| (in thousands) | Before-Tax Amount |

Tax Expense | Net-of-Tax Amount |

|||||||||

| Foreign currency translation |

$ | 3,908 | $ | - | $ | 3,908 | ||||||

| Pension liability adjustment |

(255 | ) | 83 | (172 | ) | |||||||

| Cash flow hedges |

1,224 | (240 | ) | 984 | ||||||||

|

|

|

|

|

|

|

|||||||

| Other comprehensive income |

$ | 4,877 | $ | (157 | ) | $ | 4,720 | |||||

|

|

|

|

|

|

|

|||||||

9

Table of Contents

NOTE H – Changes in Equity

The following table provides a summary of the changes in total equity, shareholders’ equity attributable to controlling interest, and equity attributable to noncontrolling interest for the three months ended August 31, 2012:

| Controlling Interest | ||||||||||||||||||||||||

| (in thousands) | Additional Paid-in Capital |

Cumulative Other Comprehensive Income (Loss), Net of Tax |

Retained Earnings |

Total | Non- controlling Interest |

Total | ||||||||||||||||||

| Balance at May 31, 2012 |

$ | 192,338 | $ | (20,387 | ) | $ | 525,223 | $ | 697,174 | $ | 50,263 | $ | 747,437 | |||||||||||

| Comprehensive income |

- | 4,609 | 33,962 | 38,571 | 1,014 | 39,585 | ||||||||||||||||||

| Common shares issued |

10,855 | - | - | 10,855 | - | 10,855 | ||||||||||||||||||

| Stock-based compensation |

3,548 | - | - | 3,548 | - | 3,548 | ||||||||||||||||||

| Cash dividends declared |

- | - | (9,043 | ) | (9,043 | ) | - | (9,043 | ) | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Balance at August 31, 2012 |

$ | 206,741 | $ | (15,778 | ) | $ | 550,142 | $ | 741,105 | $ | 51,277 | $ | 792,382 | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

NOTE I – Stock-Based Compensation

Non-Qualified Stock Options

During the three months ended August 31, 2012, we granted non-qualified stock options covering a total of 918,250 common shares under our stock-based compensation plans. The option price of $20.47 per share was equal to the market price of the underlying common shares at the grant date. The fair value of these stock options, based on the Black-Scholes option-pricing model, calculated at the grant date, was $7.73 per share. The calculated pre-tax stock-based compensation expense for these stock options, after an estimate for forfeitures, is $6,317,000, which will be recognized on a straight-line basis over the three-year vesting period. The following assumptions were used to value these stock options:

| Dividend yield |

2.96 | % | ||

| Expected volatility |

52.91 | % | ||

| Risk-free interest rate |

0.92 | % | ||

| Expected term (years) |

6.0 |

Expected volatility is based on the historical volatility of our common shares and the risk-free interest rate is based on the United States Treasury strip rate for the expected term of the stock options. The expected term was developed using historical exercise experience.

Restricted Common Shares

During the three months ended August 31, 2012, we granted 98,600 restricted common shares under our stock-based compensation plans that vest after three years of service. The fair values of these restricted common shares were equal to the closing market prices of the underlying common shares on the date of grant, or $20.47 per share. The calculated pre-tax stock-based compensation expense for these restricted common shares of $1,796,000 will be recognized on a straight-line basis over the three-year vesting period.

NOTE J – Income Taxes

Income tax expense for the three months ended August 31, 2012 and 2011 reflected estimated annual effective income tax rates of 32.6% and 32.4% respectively. These rates are applicable only to net earnings attributable to controlling interest, as reflected in our consolidated statements of earnings. Net earnings attributable to noncontrolling interest is primarily a result of our Spartan consolidated joint venture. The earnings attributable to the noncontrolling interest in Spartan do not generate tax expense to Worthington since the investors in Spartan are taxed directly based on the earnings attributable to them. Management is required to estimate the annual effective income tax rate based upon its forecast of annual pre-tax income for domestic and foreign operations. Our actual effective income tax rate for fiscal 2013 could be materially different from the forecasted rate used for the first quarter of fiscal 2013.

10

Table of Contents

NOTE K – Segment Operations

During the first quarter of fiscal 2013, we made certain organizational changes impacting the internal reporting and management structure of our former Global Group operating segment. As a result of these organizational changes, management responsibilities and internal reporting were re-aligned resulting in three new operating segments: Commercial Stairs, Construction Services and Worthington Energy Innovations. These operating segments are reported in the “Other” category for segment reporting purposes, as they do not meet the applicable aggregation criteria or quantitative thresholds for separate disclosure. Accordingly, these organizational changes did not impact the composition of our reportable business segments.

Additionally, we no longer manage our residual metal framing assets in a manner that constitutes an operating segment. Accordingly, the activity related to the wind-down of our former Metal Framing operating segment has been reported in the “Other” category. Segment information reported in previous periods has been restated to conform to this new presentation.

11

Table of Contents

Summarized financial information for our reportable segments is shown in the following table:

| Three Months Ended August 31, |

||||||||

| (in thousands) | 2012 | 2011 | ||||||

| Net sales |

||||||||

| Steel Processing |

$ | 379,972 | $ | 408,174 | ||||

| Pressure Cylinders |

194,236 | 168,829 | ||||||

| Engineered Cabs |

64,495 | - | ||||||

| Other |

27,332 | 25,384 | ||||||

|

|

|

|

|

|||||

| Consolidated net sales |

$ | 666,035 | $ | 602,387 | ||||

|

|

|

|

|

|||||

| Operating income (loss) |

||||||||

| Steel Processing |

$ | 16,019 | $ | 16,276 | ||||

| Pressure Cylinders |

15,026 | 11,915 | ||||||

| Engineered Cabs |

4,694 | - | ||||||

| Other |

(2,321 | ) | (7,008 | ) | ||||

|

|

|

|

|

|||||

| Consolidated operating income |

$ | 33,418 | $ | 21,183 | ||||

|

|

|

|

|

|||||

| Restructuring and other expense |

||||||||

| Steel Processing |

$ | - | $ | - | ||||

| Pressure Cylinders |

6 | - | ||||||

| Engineered Cabs |

- | - | ||||||

| Other |

397 | 1,703 | ||||||

|

|

|

|

|

|||||

| Consolidated restructuring and other expense |

$ | 403 | $ | 1,703 | ||||

|

|

|

|

|

|||||

| Impairment of long-lived assets |

||||||||

| Steel Processing |

$ | - | $ | - | ||||

| Pressure Cylinders |

1,570 | - | ||||||

| Engineered Cabs |

- | - | ||||||

| Other |

- | - | ||||||

|

|

|

|

|

|||||

| Consolidated impairment of long-lived assets |

$ | 1,570 | $ | - | ||||

|

|

|

|

|

|||||

| Joint venture transactions |

||||||||

| Steel Processing |

$ | - | $ | - | ||||

| Pressure Cylinders |

- | - | ||||||

| Engineered Cabs |

- | - | ||||||

| Other |

(1,162 | ) | 3,215 | |||||

|

|

|

|

|

|||||

| Consolidated joint venture transactions |

$ | (1,162 | ) | $ | 3,215 | |||

|

|

|

|

|

|||||

| (in thousands) | August 31, 2012 |

May 31, 2012 |

||||||

| Total assets |

||||||||

| Steel Processing |

$ | 661,141 | $ | 703,336 | ||||

| Pressure Cylinders |

552,524 | 575,250 | ||||||

| Engineered Cabs |

200,466 | 199,594 | ||||||

| Other |

391,375 | 399,617 | ||||||

|

|

|

|

|

|||||

| Consolidated total assets |

$ | 1,805,506 | $ | 1,877,797 | ||||

|

|

|

|

|

|||||

12

Table of Contents

NOTE L – Derivative Instruments and Hedging Activities

We utilize derivative financial instruments to manage exposure to certain risks related to our ongoing operations. The primary risks managed through the use of derivative instruments include interest rate risk, currency exchange risk and commodity price risk. While certain of our derivative instruments are designated as hedging instruments, we also enter into derivative instruments that are designed to hedge a risk, but are not designated as hedging instruments and therefore do not qualify for hedge accounting. These derivative instruments are adjusted to current fair value through earnings at the end of each period.

Interest Rate Risk Management – We are exposed to the impact of interest rate changes. Our objective is to manage the impact of interest rate changes on cash flows and the market value of our borrowings. We utilize a mix of debt maturities along with both fixed-rate and variable-rate debt to manage changes in interest rates. In addition, we enter into interest rate swaps to further manage our exposure to interest rate variations related to our borrowings and to lower our overall borrowing costs.

Currency Exchange Risk Management – We conduct business in several major international currencies and are therefore subject to risks associated with changing foreign exchange rates. We enter into various contracts that change in value as foreign exchange rates change to manage this exposure. Such contracts limit exposure to both favorable and unfavorable currency fluctuations. The translation of foreign currencies into United States dollars also subjects us to exposure related to fluctuating exchange rates; however, derivative instruments are not used to manage this risk.

Commodity Price Risk Management – We are exposed to changes in the price of certain commodities, including steel, natural gas, zinc and other raw materials, and our utility requirements. Our objective is to reduce earnings and cash flow volatility associated with forecasted purchases and sales of these commodities to allow management to focus its attention on business operations. Accordingly, we enter into derivative contracts to manage the associated price risk.

We are exposed to counterparty credit risk on all of our derivative instruments. Accordingly, we have established and maintain strict counterparty credit guidelines and enter into derivative instruments only with major financial institutions. We do not have significant exposure to any one counterparty and management believes the risk of loss is remote and, in any event, would not be material.

Refer to “Note M – Fair Value” for additional information regarding the accounting treatment for our derivative instruments, as well as how fair value is determined.

13

Table of Contents

The following table summarizes the fair value of our derivative instruments and the respective line item in which they were recorded in our consolidated balance sheet at August 31, 2012:

| Asset Derivatives | Liability Derivatives | |||||||||||

| (in thousands) | Balance Sheet Location |

Fair Value |

Balance Sheet Location |

Fair Value |

||||||||

| Derivatives designated as hedging instruments: |

||||||||||||

| Interest rate contracts |

Receivables | $ | - | Accounts payable | $ | 1,882 | ||||||

| Other assets | - | Other liabilities | 7,540 | |||||||||

|

|

|

|

|

|||||||||

| - | 9,422 | |||||||||||

|

|

|

|

|

|||||||||

| Commodity contracts |

Receivables | 672 | Accounts payable | 233 | ||||||||

| Other assets | - | Other liabilities | - | |||||||||

|

|

|

|

|

|||||||||

| 672 | 233 | |||||||||||

|

|

|

|

|

|||||||||

| Totals |

$ | 672 | $ | 9,655 | ||||||||

|

|

|

|

|

|||||||||

| Derivatives not designated as hedging instruments: |

||||||||||||

| Commodity contracts |

Receivables | $ | 67 | Accounts payable | $ | 2,633 | ||||||

|

|

|

|

|

|||||||||

| 67 | 2,663 | |||||||||||

|

|

|

|

|

|||||||||

| Foreign exchange contracts |

Receivables | Accounts payable | 82 | |||||||||

|

|

|

|

|

|||||||||

| - | 82 | |||||||||||

|

|

|

|

|

|||||||||

| Totals |

$ | 67 | $ | 2,715 | ||||||||

|

|

|

|

|

|||||||||

| Total Derivative Instruments |

$ | 739 | $ | 12,370 | ||||||||

|

|

|

|

|

|||||||||

14

Table of Contents

The following table summarizes the fair value of our derivative instruments and the respective line in which they were recorded in the consolidated balance sheet at May 31, 2012:

| Asset Derivatives | Liability Derivatives | |||||||||||

| (in thousands) | Balance Sheet Location |

Fair Value |

Balance Sheet Location |

Fair Value |

||||||||

| Derivatives designated as hedging instruments: |

||||||||||||

| Interest rate contracts |

Receivables | $ | - | Accounts payable | $ | 1,859 | ||||||

| Other assets | - | Other liabilities | 8,825 | |||||||||

|

|

|

|

|

|||||||||

| - | 10,684 | |||||||||||

|

|

|

|

|

|||||||||

| Commodity contracts |

Receivables | - | Accounts payable | 249 | ||||||||

|

|

|

|

|

|||||||||

| - | 249 | |||||||||||

|

|

|

|

|

|||||||||

| Totals |

$ | - | $ | 10,933 | ||||||||

|

|

|

|

|

|||||||||

| Derivatives not designated as hedging instruments: |

||||||||||||

| Commodity contracts |

Receivables | $ | 245 | Accounts payable | $ | 4,060 | ||||||

|

|

|

|

|

|||||||||

| 245 | 4,060 | |||||||||||

|

|

|

|

|

|||||||||

| Foreign exchange contracts |

Receivables | 912 | Accounts payable | - | ||||||||

|

|

|

|

|

|||||||||

| 912 | - | |||||||||||

|

|

|

|

|

|||||||||

| Totals |

$ | 1,157 | $ | 4,060 | ||||||||

|

|

|

|

|

|||||||||

| Total Derivative Instruments |

$ | 1,157 | $ | 14,993 | ||||||||

|

|

|

|

|

|||||||||

Cash Flow Hedges

We enter into derivative instruments to hedge our exposure to changes in cash flows attributable to interest rate and commodity price fluctuations associated with certain forecasted transactions. These derivative instruments are designated and qualify as cash flow hedges. Accordingly, the effective portion of the gain or loss on the derivative instrument is reported as a component of other comprehensive income (“OCI”) and reclassified into earnings in the same line item associated with the forecasted transaction and in the same period during which the hedged transaction affects earnings. The ineffective portion of the gain or loss on the derivative instrument is recognized in earnings immediately.

The following table summarizes our cash flow hedges outstanding at August 31, 2012:

| (in thousands) | Notional Amount |

Maturity Date | ||||

| Commodity contracts |

$ | 3,983 | September 2012 -December 2013 | |||

| Interest rate contracts |

100,000 | December 2014 | ||||

15

Table of Contents

The following table summarizes the gain (loss) recognized in OCI and the gain (loss) reclassified from accumulated OCI into earnings for derivative instruments designated as cash flow hedges during the three months ended August 31, 2012 and 2011:

| (in thousands) | Gain (Loss) Recognized in OCI (Effective Portion) |

Location of Gain (Loss) Reclassified from Accumulated OCI (Effective Portion) |

Gain (Loss) Reclassified from Accumulated OCI (Effective Portion) |

Location of Gain (Loss) (Ineffective Portion) and Excluded from Effectiveness Testing |

Gain

(Loss) (Ineffective Portion) and Excluded from Effectiveness Testing |

|||||||||||

| For the three months ended |

||||||||||||||||

| Interest rate contracts |

$ | (606 | ) | Interest expense | $ | (983 | ) | Interest expense | $ | - | ||||||

| Commodity contracts |

428 | Cost of goods sold | (419 | ) | Cost of goods sold | - | ||||||||||

|

|

|

|

|

|

|

|||||||||||

| Totals |

$ | (178 | ) | $ | (1,402 | ) | $ | - | ||||||||

|

|

|

|

|

|

|

|||||||||||

| For the three months ended |

||||||||||||||||

| Interest rate contracts |

$ | (2,130 | ) | Interest expense | $ | (1,070 | ) | Interest expense | $ | - | ||||||

| Commodity contracts |

284 | Cost of goods sold | 2,021 | Cost of goods sold | - | |||||||||||

|

|

|

|

|

|

|

|||||||||||

| Totals |

$ | (1,846 | ) | $ | 951 | $ | - | |||||||||

|

|

|

|

|

|

|

|||||||||||

The estimated net amount of the losses recognized in accumulated OCI at August 31, 2012 expected to be reclassified into net earnings within the succeeding twelve months is $854,000 (net of tax of $588,000). This amount was computed using the fair value of the cash flow hedges at August 31, 2012, and will change before actual reclassification from OCI to net earnings during the fiscal years ended May 31, 2013 and 2014.

Economic (Non-designated) Hedges

We enter into foreign currency contracts to manage our foreign exchange exposure related to inter-company and financing transactions that do not meet the requirements for hedge accounting treatment. We also enter into certain commodity contracts that do not qualify for hedge accounting treatment. Accordingly, these derivative instruments are adjusted to current market value at the end of each period through earnings.

The following table summarizes our economic (non-designated) derivative instruments outstanding at August 31, 2012:

| (in thousands) | Notional Amount |

Maturity Date(s) | ||||

| Commodity contracts |

$ | 49,888 | September 2012 - December 2013 | |||

| Foreign currency contracts |

63,740 | November 2012 | ||||

16

Table of Contents

The following table summarizes the gain (loss) recognized in earnings for economic (non-designated) derivative financial instruments during the three months ended August 31, 2012 and 2011:

| Location of Gain

(Loss) Recognized in Earnings |

Gain (Loss) Recognized in Earnings for the Three Months Ended August 31, |

|||||||||

| (in thousands) | 2012 | 2011 | ||||||||

| Commodity contracts |

Cost of goods sold | $ | 1,813 | $ | (877 | ) | ||||

| Foreign exchange contracts |

Miscellaneous income (expense) | (863 | ) | 26 | ||||||

|

|

|

|

|

|||||||

| Total |

$ | 950 | $ | (851 | ) | |||||

|

|

|

|

|

|||||||

The gain (loss) on the foreign currency derivatives significantly offsets the gain (loss) on the hedged item.

NOTE M – Fair Value

Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. Fair value is an exit price concept that assumes an orderly transaction between willing market participants and is required to be based on assumptions that market participants would use in pricing an asset or a liability. Current accounting guidance establishes a three-tier fair value hierarchy as a basis for considering such assumptions and for classifying the inputs used in the valuation methodologies. This hierarchy requires entities to maximize the use of observable inputs and minimize the use of unobservable inputs. The three levels of inputs used to measure fair values are as follows:

| Level 1 |

– | Observable prices in active markets for identical assets and liabilities. | ||

| Level 2 |

– | Observable inputs other than quoted prices in active markets for identical assets and liabilities. | ||

| Level 3 |

– | Unobservable inputs that are supported by little or no market activity and that are significant to the fair value of the assets and liabilities. | ||

Recurring Fair Value Measurements

At August 31, 2012, our financial assets and liabilities measured at fair value on a recurring basis were as follows:

| (in thousands) | Quoted Prices in Active Markets (Level 1) |

Significant Other Observable Inputs (Level 2) |

Significant Unobservable Inputs (Level 3) |

Totals | ||||||||||||

| Assets |

||||||||||||||||

| Derivative contracts |

$ | - | $ | 739 | $ | - | $ | 739 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total assets |

$ | - | $ | 739 | $ | - | $ | 739 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Liabilities |

||||||||||||||||

| Derivative contracts |

$ | - | $ | 12,370 | $ | - | $ | 12,370 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total liabilities |

$ | - | $ | 12,370 | $ | - | $ | 12,370 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

17

Table of Contents

At May 31, 2012, our financial assets and liabilities measured at fair value on a recurring basis were as follows:

| (in thousands) | Quoted Prices in Active Markets (Level 1) |

Significant Other Observable Inputs (Level 2) |

Significant Unobservable Inputs (Level 3) |

Totals | ||||||||||||

| Assets |

||||||||||||||||

| Derivative contracts |

$ | - | $ | 1,157 | $ | - | $ | 1,157 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total assets |

$ | - | $ | 1,157 | $ | - | $ | 1,157 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Liabilities |

||||||||||||||||

| Derivative contracts |

$ | - | $ | 14,993 | $ | - | $ | 14,993 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total liabilities |

$ | - | $ | 14,993 | $ | - | $ | 14,993 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

Non-Recurring Fair Value Measurements

At August 31, 2012, our financial assets and liabilities measured at fair value on a non-recurring basis were as follows:

| (in thousands) | Quoted Prices in Active Markets (Level 1) |

Significant Other Observable Inputs (Level 2) |

Significant Unobservable Inputs (Level 3) |

Totals | ||||||||||||

| Assets |

||||||||||||||||

| Long-lived assets held for sale (1) |

$ | - | $ | 6,934 | $ | - | $ | 6,934 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total assets |

$ | - | $ | 6,934 | $ | - | $ | 6,934 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (1) | During the first quarter of fiscal 2013, certain assets within our Pressure Cylinders operating segment met the applicable criteria for classification as assets held for sale. Accordingly, this asset group is presented separately in our consolidated balance sheet as assets held for sale. The net book value of the asset group was determined to be in excess of fair value, and, as a result, the asset group was written down to its fair value less cost to sell, or $6,934,000, resulting in an impairment charge of $1,570,000. This impairment charge was recorded within impairment of long-lived assets in our consolidated statement of earnings. Fair value was determined based on market prices for similar assets. |

The fair value of our foreign currency contracts, commodity contracts and interest rate contracts is based on the present value of the expected future cash flows considering the risks involved, including non-performance risk, and using discount rates appropriate for the respective maturities. Market observable, Level 2 inputs are used to determine the present value of the expected future cash flows. Refer to “NOTE L – Derivative Instruments and Hedging Activities” for additional information regarding our use of derivative instruments.

The fair value of non-derivative financial instruments included in the carrying amounts of cash and cash equivalents, receivables, income taxes receivable, other assets, deferred income taxes, accounts payable, short-term borrowings, accrued compensation, contributions to employee benefit plans and related taxes, other accrued expenses, income taxes payable and other liabilities approximate carrying value due to their short-term nature. The fair value of long-term debt, including current maturities, based upon models utilizing market observable inputs and credit risk, was $429,870,000 and $274,754,000 at August 31, 2012 and May 31, 2012, respectively. The carrying amount of long-term debt, including current maturities, was $408,353,000 and $258,791,000 at August 31, 2012 and May 31, 2012, respectively.

18

Table of Contents

NOTE N – Subsequent Events

On September 17, 2012, we acquired 100% of the outstanding common shares of Westerman, Inc. (“Westerman”) for $70,000,000, of which approximately $6,000,000 went to pay down Westerman debt. Westerman is a leading manufacturer of tanks and pressure vessels for the oil and gas and nuclear markets as well as hoists for marine applications. We anticipate completing the preliminary purchase price allocation for this acquisition in the second quarter of fiscal 2013. The acquired net assets became part of our Pressure Cylinders operating segment upon closing.

In September 2012, ThyssenKrupp AG, the other member of our tailored steel blanks joint venture, TWB, announced that it had reached an agreement to sell its interest in the joint venture to Wuhan Iron and Steel Corporation. The sale is subject to approval by the supervisory bodies and responsible regulatory authorities.

19

Table of Contents

Item 2. — Management’s Discussion and Analysis of Financial Condition and Results of Operations

Selected statements contained in this “Item 2. – Management’s Discussion and Analysis of Financial Condition and Results of Operations” constitute “forward-looking statements” as that term is used in the Private Securities Litigation Reform Act of 1995. Such forward-looking statements are based, in whole or in part, on management’s beliefs, estimates, assumptions and currently available information. For a more detailed discussion of what constitutes a forward-looking statement and of some of the factors that could cause actual results to differ materially from such forward-looking statements, please refer to the “Safe Harbor Statement” in the beginning of this Quarterly Report on Form 10-Q and “Part I—Item 1A.—Risk Factors” of our Annual Report on Form 10-K for the fiscal year ended May 31, 2012.

Introduction

The following discussion and analysis of market and industry trends, business developments, and the results of operations and financial position of Worthington Industries, Inc., together with its subsidiaries (collectively, “we,” “our,” “Worthington,” or our “Company”), should be read in conjunction with our consolidated financial statements included in “Item 1. – Financial Statements” of this Quarterly Report on Form 10-Q. Our Annual Report on Form 10-K for the fiscal year ended May 31, 2012 (“fiscal 2012”) includes additional information about us, our operations and our financial position and should be read in conjunction with this Quarterly Report on Form 10-Q.

We are primarily a diversified metal processing company, focused on value-added steel processing, pressure cylinders and custom-engineered cabs and operator stations for heavy mobile equipment. As of August 31, 2012, excluding our joint ventures, we operated 35 manufacturing facilities worldwide, principally in three reportable business segments: Steel Processing, Pressure Cylinders and the recently-formed Engineered Cabs. Our remaining operating segments, which do not meet the applicable aggregation criteria or quantitative thresholds for separate disclosure, are combined and reported in the “Other” category. These include the Steel Packaging, Commercial Stairs, Construction Services and Worthington Energy Innovations operating segments.

During the first quarter of fiscal 2013, we made certain organizational changes impacting the internal reporting and management structure of our former Global Group operating segment. As a result of these organizational changes, management responsibilities and internal reporting were re-aligned resulting in three new operating segments: Commercial Stairs, Construction Services and Worthington Energy Innovations. These organizational changes did not impact the composition of our reportable business segments.

Additionally, we no longer manage our residual metal framing assets in a manner that constitutes an operating segment. Accordingly, the activity related to the wind-down of our former Metal Framing operating segment, consisting primarily of the sale of assets, has been reported in the “Other” category. Segment information reported in previous periods has been restated to conform to this new presentation.

We also held equity positions in 12 joint ventures, which operated 45 manufacturing facilities worldwide, as of August 31, 2012.

Overview

The Company’s performance during the first quarter of fiscal 2013 was strong, aided by significant volume increases in our Pressure Cylinders operating segment, steady performance in our Steel Processing operating segment and solid earnings from our recently-formed Engineered Cabs operating segment.

Volume growth was mixed in the first quarter. Cylinder volumes were very strong, up 47%, driven by acquisitions and improvement in both our domestic and European cylinder businesses. Steel Processing volumes were down 1%, but after excluding volumes from the MISA Metals acquisition, most of which was wound down or sold during the past year, volumes were up 4%.

Equity income from our joint ventures during the quarter was down 8% over last year driven by lower income at Serviacero and ClarkDietrich. However, all of our major joint ventures operated at a profit during the quarter and we received $15.3 million in dividends from them.

The Company continues its strategy of optimizing existing operations and pursuing growth opportunities that add to our current businesses. We initiated the diagnostics phase of the Transformation Plan in our Pressure Cylinders operating segment in the first quarter of fiscal 2012, and these efforts are progressing through each facility. Additionally, during the first quarter of fiscal 2013, we initiated the diagnostics phase of the Transformation Plan in our Engineered Cabs operating segment. This operating segment contributed $64.5 million in net sales during the first quarter of fiscal 2013.

20

Table of Contents

Recent Business Developments

| — | On August 10, 2012, we issued $150.0 million aggregate principal amount of 12-year unsecured Senior Notes due 2024 through a private placement with seven entities within the Prudential Capital Group. The Senior Notes bear interest at a fixed rate of 4.60%. |

| — | On September 17, 2012, we acquired 100% of the outstanding common shares of Westerman, Inc. (“Westerman”) for $70.0 million, of which approximately $6.0 million went to pay down Westerman debt. Westerman is a leading manufacturer of tanks and pressure vessels for the oil and gas and nuclear markets as well as hoists for marine applications. The acquired net assets became part of our Pressure Cylinders operating segment from the closing date. |

Market & Industry Overview

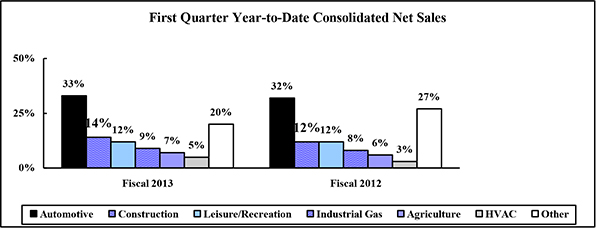

We sell our products and services to a diverse customer base and a broad range of end markets. The breakdown of our net sales by end market for the first three months of fiscal 2013 and fiscal 2012 is illustrated in the following chart:

The automotive industry is one of the largest consumers of flat-rolled steel, and thus the largest end market for our Steel Processing operating segment. Approximately 56% of the net sales of our Steel Processing operating segment are to the automotive market. Nearly 40% of the net sales of our Steel Packaging operating segment are to the automotive market. North American vehicle production, primarily by Chrysler, Ford and General Motors (the “Detroit Three automakers”), has a considerable impact on the activity within this operating segment. The majority of the net sales of five of our unconsolidated affiliates are also to the automotive end market.

Approximately 10% of the net sales of our Steel Processing operating segment and substantially all of the net sales of our Commercial Stairs and Construction Services operating segments are to the construction market. While the market price of steel significantly impacts these businesses, there are other key indicators that are meaningful in analyzing construction market demand, including U.S. gross domestic product (“GDP”), the Dodge Index of construction contracts, and trends in the relative price of framing lumber and steel. The construction market is also the predominant end market of three of our unconsolidated joint ventures, WAVE, ClarkDietrich and WMSFMCo.