UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

for the fiscal year ended December 31, 2014

or

¨ TRANSACTION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

for the transition period from _____to _____

COMMISSION FILE NUMBER: 000-26399

INVENTERGY GLOBAL, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 62-1482176 | |

(State or other jurisdiction of organization) |

(IRS Employer Identification) |

900 E. Hamilton Avenue #180

Campbell, CA 95008

(408) 389-3510

(Address, including zip code, and telephone number,

including area code, of registrants principal executive offices)

Securities registered under Section 12(b) of the Exchange Act:

| Title of Each Class: | Name of Each Exchange on Which Registered: | |

| Common Stock, par value $0.001 per share | The Nasdaq Capital Market |

Securities registered under Section 12(g) of the Exchange Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Date File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Section 232.405 of the chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

(Check one):

| Large accelerated filer ¨ | Accelerated filer ¨ | Non-accelerated filer ¨ | Smaller reporting company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 126-2 of the act): Yes ¨ No x

The aggregate market value of the shares of common stock outstanding, other than shares held by persons who may be deemed affiliates of the Registrant, computed by reference to the closing sales price for the Registrant’s common stock on June 30, 2014, as reported on the Nasdaq Capital Market, was $34,669,970.

As of March 23, 2015, 30,996,750 shares of common stock, $0.001 par value per share, were outstanding.

TABLE OF CONTENTS

| 2 |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain information set forth in this Annual Report on Form 10-K, including in Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and elsewhere herein may address or relate to future events and expectations and as such constitutes “forward-looking statements” within the meaning of within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and Section 27A of the Securities Act of 1933, as amended (the “Securities Act”). Statements which are not historical reflect our current expectations and projections about our future results, performance, liquidity, financial condition, prospects and opportunities and are based upon information currently available to us and our management and their interpretation of what is believed to be significant factors affecting our business, including many assumptions regarding future events. Such forward-looking statements include statements regarding, among other things:

| · | anticipated growth and growth strategies; |

| · | the need for additional capital and the availability of financing; |

| · | the ability to secure additional patents; |

| · | the ability to monetize patents or recoup our investment; |

| · | the ability to protect intellectual property rights; |

| · | new legislation, regulations or court rulings related to enforcing patents and/or obligations regarding standards essential patents that could harm our business and operating results; |

| · | expansion plans and opportunities; |

| · | our ability to attract and retain key members of our management team; |

| · | our anticipated needs for working capital; |

| · | our ability to continue as a going concern; |

| · | the anticipated trends in our industry; |

| · | our ability to expand operational capabilities; and |

| · | competition existing today or that will likely arise in the future. |

Forward-looking statements, which involve assumptions and describe our future plans, strategies, and expectations, are generally identifiable by use of the words “may,” “should,” “would,” “could,” “scheduled,” “expect,” “anticipate,” “estimate,” “believe,” “intend,” “seek,” or “project” or the negative of these words or other variations on these words or comparable terminology. Actual results, performance, liquidity, financial condition and results of operations, prospects and opportunities could differ materially and perhaps substantially from those expressed in, or implied by, these forward-looking statements as a result of various risks, uncertainties and other factors.

In light of these risks and uncertainties there can be no assurance that the forward-looking statements contained herein will in fact occur. Readers should not place undue reliance on any forward-looking statements. Except as expressly required by the federal securities laws, we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, changed circumstances or any other reason. We advise you to carefully review the reports and documents we file from time to time with the Securities and Exchange Commission (the “SEC”).

| 3 |

Overview

Inventergy Global, Inc. (the “Company,” “we,” “us,” or “our”) is an intellectual property (“IP”) investment and licensing company that helps technology-leading corporations attain greater value from their IP assets in support of their business objectives and corporate brands. Inventergy, Inc., our wholly-owned subsidiary (“Inventergy”), was initially organized as a Delaware limited liability company under the name Silicon Turbine Systems, LLC in January 2012. It subsequently changed its name to Inventergy, LLC in March 2012 and it was converted from a limited liability company into a Delaware corporation in February 2013. On June 6, 2014, a subsidiary of the Company merged with and into Inventergy becoming a wholly-owned subsidiary of the Company (the “Merger”). In connection with the Merger, the Company changed its name to “Inventergy Global, Inc.” and effected a one-for-two reverse stock split of the Company’s common stock (the “Reverse Split”).

The Company works to develop long-term relationships with significant, technology-leading companies, which the Company refers to as clients, seeking to strategically realize appropriate returns for selected portfolios of their IP assets, in which they have invested significant research and development (IP value creation). The Company offers clients a professional corporate licensing model for IP value creation that provides both short term returns and attractive, long-term licensing revenue. The Company has focused initially on developing relationships with telecommunications companies, but its business purpose is not limited to this industry. The Company aspires to be a market-leader in IP value creation across various technology and market segments.

The core strategy of the Company is to acquire significant patent portfolios from Global Fortune 500 companies who are leaders or major players in their industries and then generate reasonable value from these portfolios through licensing or sales of these patents. The patents are typically purchased by the Company for an upfront fee as well as a percentage of net revenue (revenue generated from the relevant portfolio, usually after deduction of litigation or other related monetization costs, if any). This percentage is low enough so that, together with the outright acquisition of the IP assets, there is not actual or implied direct control of the actions of the Company in its IP value creation efforts. As a result, the Company remains independent of these clients. The Company typically gains full ownership of the portfolios including the rights to past damages and has the sole right to determine the best strategy to derive value from the portfolios.

The Company is headquartered in Campbell, California. In addition to its employees, the Company engages third party resources including technical experts, reverse engineering firms, valuation experts, market research firms and intellectual property legal firms. If and when the Company acquires additional large patent portfolios, we believe that usually two to three additional resources (business, technical or legal) may need to be hired for IP value creation for that new portfolio.

Business Strategy

Key elements of our strategy include:

| · | Targeting a select number of market- and technology-leading companies whose product and service revenue or internal IP monetization efforts may not be yielding appropriate value for their IP assets. |

| · | Developing long-term relationships with these companies (our clients) from which we may obtain one or more high quality IP asset portfolios. |

| · | Leveraging our management’s expertise to select, value and out-license patent assets to create additional IP value for these clients in relationship-based, fair and substantial licensing programs. |

| · | Expanding our approach across other technologies and businesses. |

| 4 |

Competitive Strengths

| · | Our directors and officers have significant experience creating value from IP assets and are recognized leaders in their fields (for more details please see “Item 10. Directors, Executive Officers and Corporate Governance” below). |

| · | We believe that the talent, experience and skill sets of our management team are key differentiators for the Company, and set it among the very best of its peers. |

| · | Our management team’s contacts across many IP-dependent industries provide key sourcing capability. |

| o | The Company’s officers and directors are well-known across IP and technical industries, with significant and important relationships with prospective target clients as well as potential out-licensing customers. The Company leverages its reputation and relationships to achieve fair and reasonable value and to complete transactions in a timely manner. |

| · | We expect that the development of long-term relationships with our clients will help ensure on-going revenue streams built on key asset portfolios from existing clients. |

| o | We expect that long-term relationships with clients will provide a continual potential source of new assets and support continuing revenue growth opportunities. |

| · | We believe that the Company’s professional corporate out-licensing model will enable timely value-creation from client portfolio assets as well as on-going revenue streams. |

| o | Management believes it can drive an efficient process for delivering value and concluding appropriate, fair and reasonable transactions in a timely manner below the industry average. |

Industry Overview

According to recent data from Ocean Tomo, an intellectual property merchant bank, 84% of the value of companies in the S&P 500 was based in intangible assets, as of January 2015. In many cases, product and service revenue based on patent assets can leave substantial amounts of untapped value in their IP, either because the IP is in areas that are no longer as strategically important or it is too time-consuming for the asset holders to pursue. As a result, companies may not realize appropriate value from the results of their research and development investments. Additionally, many companies cannot capture the full value of their IP assets themselves because they do not possess the necessary resources and personnel or because the pursuit of value involves a higher degree of risk than may be acceptable to such company.

Industry Focus

The initial three patent portfolios the Company has acquired are portfolios in the telecommunications industry, specifically in the segments that cover (a) core network infrastructure (IP Multimedia Subsystems -IMS and Voice over IP -VOIP) and (b) mobile broadband communications (3G & 4G protocols -WCDMA/HSPA/LTE). Over time, the Company may acquire additional portfolios in this industry as well as other market segments. An overview of the telecommunications industry as well as the three initial Company portfolios follow below.

General Perspectives on the Telecommunication Industry

The telecommunication industry is global in nature and the technologies deployed are largely defined and developed by cooperative standard-setting “working groups,” between the various market participants. One such body is “3GPP” (3rd Generation Partnership Project, a collaboration among groups of telecom associations, covering radio, core network and service architecture technologies).

| 5 |

A number of other voluntary standard setting bodies exist, with the overall objective to ensure interoperability between networks and devices. According to the Global mobile Suppliers Association (“GSA”) organization (a 3GPP industry organization), in the fourth quarter of 2014 there were 6.44 billion subscriptions globally using 3GPP systems (covering 2G -GSM, 3G-WCDMA & HSPA, and 4G-LTE protocols). This included 1.83 billion 3G and 497 million 4G subscribers.

From an intellectual property commercialization perspective, the Company believes that the continued development and deployment of standards-compliant telecommunication equipment and systems, create large, global addressable markets where market participants must comply with both declared and de facto industry standards to remain competitive. In many cases, these providers may not have developed the standards themselves nor do they own or are licensed to key patents that relate to these standards. In addition, in this highly competitive industry, the Company believes market participants will also race to adopt key improvements above and in addition to standards-based technology.

The Company believes that the continued and accelerated deployment as well as upgrading of technologies that can handle richer content to mobile devices, faster and more reliable connections, quicker data speeds and more services delivered over networks, fixed and mobile, present significant opportunities for the Company. These trends accelerate the need for IMS and 3G & 4G technologies and protocols – areas in which the Company has significant patent portfolios. The Company’s focus is to acquire patent portfolios that contain a mixture of both standards declared patents as well as patents that cover important improvements to standards-based technologies.

The IMS and VOIP Segment – The primary focus of the Huawei and Nokia portfolios

IP Multimedia Subsystem (IMS) is an architectural framework for delivering IP multimedia services and voice applications from wireless and wireline devices. It was originally designed by 3GPP. IMS is intended to aid the access of multimedia and voice applications from wireless and wire line terminals, to help establish fixed-mobile convergence.

The technology is already deployed by more than 100 service providers around the world as well as through cable companies to offer services such as the popular “bundles” of voice, TV and Internet. A driving force behind the deployment of LTE (Long-Term Evolution) among service providers is the ability to offer Voice over LTE (VoLTE). The Company estimates based on data from Infonetics and internal analysis that the overall size of this market related to the service provider segment, which could benefit from the Company’s patented technologies, is $25-$30 billion cumulative over the next five years.

VOIP solutions are also extensively deployed in the corporate sector as companies are addressing the needs of an increasingly mobile workforce through so-called “unified communications” offerings that packet data networks help enable.

The Mobile Broadband Infrastructure Segment – The primary focus of the Panasonic portfolio

Mobile broadband is a term that encompasses 2G, 3G and 4G cellular technologies based on standards that are developed and managed by the 3GPP organization and covers the radio, core network and service architectures that enable broadband communication between base stations and devices (such as cell phones and tablets, wireless enabled computers).

In the document “Ericsson Mobility Report” from November 2014 , Ericsson estimates the 3G and 4G mobile broadband subscription market will grow 20% annually from 2014-2020 for 3G and 45% for 4G (LTE). By the end of 2020, Ericsson estimates there will be 9.5 billion mobile subscriptions, with 3.5 billion being LTE and 4.9 billion being 3G.

In North America 3G/LTE share of mobile subscriptions is already at 100% . In Western Europe the share is 75%, growing to 100% by 2020 according to Ericsson. In Asia Pacific the 3G/LTE share is at 35%, growing to 85% by 2020 according to the same report. Recent GSA data shows that 1,275 new LTE devices were released in 2014 bringing the number of LTE user devices to 2,646 from 275 different manufacturers. Of this, 52.7% are smartphones, with 98.3% of the smartphones handling both 3G and LTE.

| 6 |

Our Business Model

Obtaining Assets

Business Model with Client

The Company’s initial focus is on developing relationships in the information technology and telecommunications industries and expanding from there into other adjunct or distinct new industry segments. The Company seeks to enable clients to generate higher potential value from their patent asset portfolio. Clients can be sourced through management’s significant industry contacts. The Company seeks leading companies who have demonstrated early technology development, backed by strong R&D investments protected through substantial patent portfolios, but lacking expertise in IP monetization. Preferred clients include those that may be moving out of a market or have more assets in a segment than are needed to support their ongoing business.

Many key technology-leading companies have significant patent asset portfolios in areas that may no longer be of strategic value to the client but have clearly been adopted and built upon by other market participants. Preferred asset portfolios are in strong-margin, high-growth segments of particular industry sectors. The Company’s acquisition teams study patents of prospective clients and evaluate overall patent strength, the size of the appropriate addressable market(s), the reasonably probable revenue that might be generated from a successful licensing program, and how the remaining lifespan of a particular portfolio matches the expected trajectory of the target market(s).

Typically, the Company will seek to structure an acquisition with the original asset owner that includes a combination of an initial cash payment and a revenue share arrangement on future income, however the exact structure of an acquisition may vary depending on the particular patent portfolio or the negotiations with a patent owner. The combination of fixed payment and ongoing revenue return is intended to appropriately reflect the inherent riskiness of patent asset licensing, the expected significant costs of licensing campaigns, and appropriate returns for such investments. Such arrangements help each client balance cash flow and the risk and reward potential of ongoing research and development and patent operations.

The client may also receive a non-exclusive license to continue to make, have made, and sell products and services under the transferred patent assets to ensure continuity of their ongoing businesses. The original asset holder will have no continuing control over the Company’s licensing and enforcement programs, but in certain cases the assets acquired may be subject to existing licenses, existing business relationships and standards organization obligations (including in certain cases, Fair, Reasonable and Non-Discriminatory (FRAND) licensing obligations). The Company acquires patent asset portfolios cognizant of these potential existing encumbrances and factors these issues into the final arrangements.

The Company seeks to cultivate long-term relationships with its clients with the goal of acquiring additional asset portfolios from these same clients in the future.

Referral Agreements

The Company also periodically enters into referral agreements with unaffiliated third parties for the provision of commercial and/or technical assistance to facilitate completion of designated acquisitions of assets. The agreements contain confidentiality provisions, may continue indefinitely and are terminable by either party upon notice. To date the Company has entered into three such agreements, one with a German consulting firm, one with a California firm and one with a Japanese firm, each with technology expertise related to the assets being evaluated for acquisition or with important local relationships with the clients owning the assets. The Company may enter into other such referral agreements in the future. Compensation under such agreements are subject to negotiations between the parties and may be based on a relatively low percentage of the purchase price of the assets payable in cash upon closing of the transaction or periodically over time, payable in equity or cash depending on the Company’s specific needs.

| 7 |

Generating Value from the Assets

The Patent Management Triad—The Company’s Internal Business System

The Company’s internal out-licensing campaign teams are typically managed by three leads, together with their respective internal and external teams—(1) Technical, (2) Legal, and (3) Business. Ultimately, the three teams collaborate to comprehend the addressable market space(s), the relevance of the patent assets, the mapping of patent assets to applicable standards and the products and services of other market participants, and technical and industrial value.

Technical Lead and Team

The Technical Lead and associated group works to understand the science and/or technology behind the patents of a particular portfolio, under the review of the Legal Lead and in support of the Business team – This group coordinates the work of third party technology consultants, including technical external resources such as technical experts, reverse engineering consultancies, and other providers, to deliver consolidated inputs to the Legal and Business teams.

Legal Lead and Team

This group manages the existing patent asset portfolio from a global perspective and also manages further prosecution of continuing patent cases to help maximize value in ongoing licensing efforts. Prior to a potential acquisition and continuing after the acquisition, the Legal Lead and associated group reviews the patent assets and, together with the Technical team, helps analyze the products and services of prospective licensees. In particular, this group analyzes patent claims and determines how these claims relate to products, services and industry standards, prepares claim charts and licensing packages and supervises the Technical Lead and the technology efforts from a legal perspective.

The Legal Lead also is responsible for the legal structure and legal documents of any license or negotiated settlement with prospective licensees. The Legal Lead and team also manage external legal providers, including patent prosecution, licensing and, if needed, litigation resources for effectively managing the life of each patent portfolio and providing consolidated services in support of business objectives. They also manage, if required, any assertions or litigation matters related to patent assets.

Business Lead and Team

This group has overall financial responsibility for each licensing campaign. For both the purpose of determining business terms of license agreements and acquiring new portfolios, the Business group gathers the Technical and Legal inputs and identifies companies that have products and/or services in areas that may be impacted by relevant patent assets.

The Business Lead, with Technical and Legal inputs, assesses the relevant addressable market for patent assets and establishes an achievable licensing campaign structure and process. The Business group leads the development of marketing and licensing materials and packages, and drives the engagements with prospective licensing targets. The Business group also determines, with Legal inputs, the structure and terms of proposed licenses, and helps set value for portfolios by setting a realistic, objective and achievable valuation of portfolios with respect to the particular market segments and products and services of target licensees.

The Company’s Professional Corporate Out-Licensing Model

Once the Company acquires an asset portfolio and analyzes the addressable market and existing and projected products and services using patented technology of the portfolio, the Company then develops an appropriate engagement campaign and process. Following a structured approach, the Company will contact key decision-makers of relevant market participants and seek further engagement. The Company anticipates structuring licenses in a flexible way to match the specific character and use of patented technology by its licensees.

| 8 |

Management believes that the Company’s approximately 755 currently active patents and patent applications are fundamental to the telecommunications industry. The technologies are utilized in, among other areas, the following markets:

| · | Telecommunications core network (including IMS) infrastructure; |

| · | Base stations; |

| · | Communications service providers; |

| · | End user communications devices (such as cell phones and tablets); |

| · | Enterprise voice over IP (VoIP) networks; and |

| · | Connected Automobiles. |

| · | Routers and cellular modems. |

The Company’s licensing strategy depends upon other parties being reasonable and willing to work out a fair licensing arrangement. A potential licensee’s willingness and ability to pay reasonable licensing fees or royalties may, in part, be affected by the number of patents infringed by a particular licensee product, the licensee’s cost of licensing those patents and the value or profitability of infringing products and/or services. The Company believes reasonable licensing fees or royalties for its patent assets are best secured through negotiated license agreements which will allow the Company and its potential licensees to avoid the uncertainties, costs and delays of litigation. Obtaining reasonable value for the use of its patents is generally dependent upon:

| · | Demonstrating infringement of claimed inventions; |

| · | Refuting arguments that its patents are supposedly invalid or unenforceable; and |

| · | Providing data supporting the licensing value it is seeking. |

Some of the companies that may be using the Company’s patent assets may not voluntarily enter into license agreements. As a result, the Company has developed abilities to plan, execute and sustain enforcement campaigns to protect its patent portfolios. Litigation may be required to enforce and protect such intellectual property rights.

Since the acquisition of the first three patent portfolios (described further below), the Company has begun reaching out to various prospective licensees and engaging a number of them in discussions regarding licensing one or more of these patent assets. On February 11, 2015, the Company licensed its IMS portfolio to a mid-tier telecommunications infrastructure provider. The license is for five years and will bring the Company approximately $2 million of revenue over the course of the license. During the fiscal year ended December 31, 2014, the Company initiated one litigation. The Company currently has 3 litigation matters pending, which are continuing in various stages of settlement negotiation.

Intellectual Property and Patent Rights

The Company’s intellectual property is primarily comprised of asset portfolios it has acquired from clients for the purpose of monetizing such patents under its corporate licensing approach, to generate reasonable value.

In connection with an acquisition of assets, the Company may seek financing to enable it to pay fixed up front fees or cash purchase prices. Acquisitions or investments may be consummated through the use of cash, equity, seller financing, third party debt, earn out obligations, revenue sharing, profit sharing, or some combination of two or more of these types of consideration.

| 9 |

Asset Portfolios

IMS and VOIP portfolios

The Company has acquired two complementary portfolios from telecommunication industry leaders Huawei and Nokia. Combined these two portfolios total approximately 282 patents including approximately 108 patents considered relevant to standards.

The portfolios cover the core network of the so-called “Next Generation Networks” enabling such functionality as Mobile Video delivery and Mobile High Definition Audio as well as enabling services like “triple play” (phone, television and data) offered by fixed line/cable operators and enterprise VOIP solutions.

The patents cover a broad range of functional aspects, including advanced call features, network security, interoperability, system performance and network reliability.

The Company believes the portfolios to be particularly relevant as mobile network operators, cable operators and equipment manufacturers roll out new features and content rich services for both mobile and fixed networks. The Company has identified over 125 companies within four primary licensee market segments, namely, IMS systems, enterprise networking equipment (VOIP), legacy mobile systems and telecommunications service providers that it intends to approach to monetize the IMS IP assets. Currently there are over 100 mobile network operators worldwide offering services based on the IMS standard and most cable companies that already offer “triple play bundles” do this on the IMS standard, so use of IMS is reasonably expected to increase substantially. The Company also estimates that there are already about 30 equipment manufacturers offering solutions relevant to this patent portfolio, and the company has already closed its first license with a mid tier equipment manufacturer.

Mobile Broadband, (3G, 4G/LTE Portfolio)

Panasonic is among the most prolific patent filers and patent owners in the world. According to a recently released report from the World Intellectual Property Organization, Panasonic was the number 1 filer of PCT patent applications in the world in 2013. In 2013, Panasonic was issued the 6th most patents in the United States according to IFI Claims.

Panasonic has over the last few years moved out of several business areas and divested both businesses and patents.

One such technology area is 3G (WCDMA & HSPA) and 4G (LTE) mobile infrastructure, where Panasonic, through its relationship with NTT Docomo (a leading Japanese mobile operator), was an early innovator and pioneer. The Company has worked with Panasonic to select a comprehensive portfolio of patent assets totaling 473 in the 3G and 4G technology domain. Under the terms of the Panasonic Agreement, the Company has full ownership of the portfolio including the right to past damages and has the sole right to determine the best strategy to derive value from the portfolio.

The portfolio consists of approximately 331 3G patent assets and 142 4G patent assets. Approximately 205 of the patent assets are potentially standards relevant, which means that such patents may be infringed by companies, end-users or others that adhere to the optional or mandatory features of one or more operating standards adopted by industry, governmental or other organizations in the telecommunications industry. The main technical focus of the portfolio concerns base station equipment communication with mobile devices, specifically the radio aspects of such communications. The 3G/4G standards are widely adopted by telecom operators, infrastructure manufacturers and mobile device manufacturers around the world as the enabling standard for mobile broadband. According to data from GSA, there were 2.3 billion mobile broadband (3G/4G) subscriptions worldwide in Q4 2014.

The Company views the Panasonic portfolio as very complementary to the Huawei and Nokia IMS portfolios where, even though a few of the target licensee companies may be the same, the relevant revenue streams are different. The Company believes that such complementary coverage may offer operational and marketing efficiencies and it is exploring other opportunities that may add further synergy.

| 10 |

Patent Portfolios

The Company acquired an aggregate of approximately 755 currently active patents and patent applications from Huawei, Nokia, and Panasonic outright, including the general right to recover damages for past infringement. Of the 755 patents and patent applications acquired, the Company owns approximately 755 patents and patent applications 5 US and 12 non-US patents have expired and no patent applications have been denied. These patents have an average remaining life of 7.7 years. Approximately 313 of the patent assets are potentially standards relevant and there are very limited prior license encumbrances against the entire portfolio.

IMS & VOIP Portfolio

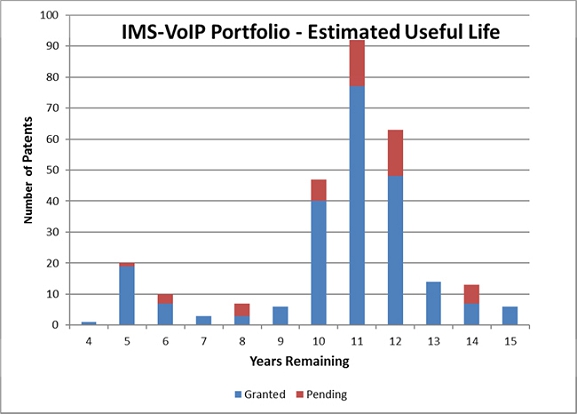

The chart below indicates, with respect to the Company’s 282 currently active patents and pending applications from Huawei and Nokia in the IMS & VOIP category, the estimated useful remaining lives of such patents as of the date of this Annual Report. Pending applications indicate applications for patent that could, if granted, become enforceable patents in relevant geographies. 99% of the patents have more than 5 years left with more than 80% having 10 years and more:

| 11 |

| Years Remaining | Granted | Pending | Grand Total | |||||||||

| 4 | 1 | 0 | 1 | |||||||||

| 5 | 19 | 1 | 20 | |||||||||

| 6 | 7 | 3 | 10 | |||||||||

| 7 | 3 | 0 | 3 | |||||||||

| 8 | 3 | 4 | 7 | |||||||||

| 9 | 6 | 0 | 6 | |||||||||

| 10 | 40 | 7 | 47 | |||||||||

| 11 | 77 | 15 | 92 | |||||||||

| 12 | 48 | 15 | 63 | |||||||||

| 13 | 14 | 0 | 14 | |||||||||

| 14 | 7 | 6 | 13 | |||||||||

| 15 | 6 | 0 | 6 | |||||||||

| Grand Total | 231 | 51 | 282 | |||||||||

Mobile Broadband Portfolio

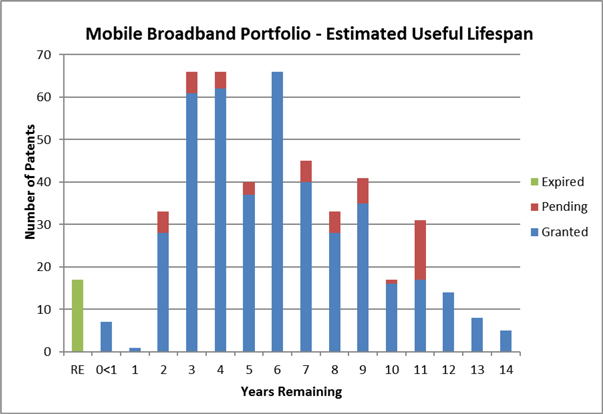

The chart below indicates, with respect to the Company’s 490 patents, pending applications or recently expired patents in the mobile broadband category acquired from Panasonic, the estimated useful remaining lives of such patents as of the date of this Annual Report. Though several patents recently expired (noted below as “RE”), key jurisdictions for these patents can still provide an ability to recover for past damages so the patents have been listed for completeness. Pending applications indicate applications for patents that could, if granted become enforceable patents in relevant geographies. Over 50% of the Company’s mobile broadband patents have between 6 and 14 years remaining and approximately 41% have between 2 and 5 years remaining as follows:

| 12 |

The below table reflects the data contained in the above chart.

| Years Remaining | Granted | Pending | Expired | Grand Total | ||||||||||||

| RE | 0 | 0 | 17 | 17 | ||||||||||||

| 0<1 | 7 | 0 | 0 | 7 | ||||||||||||

| 1 | 1 | 0 | 0 | 1 | ||||||||||||

| 2 | 28 | 5 | 0 | 33 | ||||||||||||

| 3 | 61 | 5 | 0 | 66 | ||||||||||||

| 4 | 62 | 4 | 0 | 66 | ||||||||||||

| 5 | 37 | 3 | 0 | 40 | ||||||||||||

| 6 | 66 | 0 | 0 | 66 | ||||||||||||

| 7 | 40 | 5 | 0 | 45 | ||||||||||||

| 8 | 28 | 5 | 0 | 33 | ||||||||||||

| 9 | 35 | 6 | 0 | 41 | ||||||||||||

| 10 | 16 | 1 | 0 | 17 | ||||||||||||

| 11 | 17 | 14 | 0 | 31 | ||||||||||||

| 12 | 14 | 0 | 0 | 14 | ||||||||||||

| 13 | 8 | 0 | 0 | 8 | ||||||||||||

| 14 | 5 | 0 | 0 | 5 | ||||||||||||

| Grand Total | 425 | 48 | 17 | 490 | ||||||||||||

RE: Recently Expired

eOn Communications Systems, Inc.

eOn Communications Systems, Inc. (“ECS”), our wholly-owned subsidiary, sells a line of Ethernet enabled biometric locks and also provides sales, marketing and technical support services to partners in the security products and services industry. The Company inherited ECS as part of the Merger.

On March 17, 2015, the Company announced operational restructuring and process improvements for the product-based businesses of ECS, to strategically position the Company to increase earnings, reduce costs, improve cash flow and build shareholder value. ECS is managed by its President Stephen Swartz.

The ECS business now has three product/service lines:

a) A royalty bearing agreement with a third party for use of a private branch exchange (PBX) business which they had purchased from eOn Communications Corporation;

b) A valued-added reseller business of biometric security and access control products; and

c) A new business that provides outsourced sales, marketing and technical support services to business partners in the security products and services industry.

Additionally, as part of the reorganization, ECS announced it has terminated a legacy business that provided distribution services of facility security and access control products. In 2014, this legacy business had net operating losses of approximately $35,000 per month. Terminating this legacy business and selling off the remaining inventory and accounts receivables also netted approximately $200,000 in cash for the Company. The resources from this legacy business have been redeployed to ECS’s biometric security and access control product line. This business has recently completed its value-add product improvements and these products are now ready for shipment. Accordingly, the Company recorded an impairment charge of $686,350 on December 31, 2014 for the remaining balance of the acquired contract.

Competition

The Company encounters significant competition from others seeking to acquire and monetize intellectual property assets. This includes an increase in the number of competitors seeking to acquire the same or similar patents and technologies that we may seek to acquire. Other companies may develop competing technologies that offer better or less expensive alternatives to patented technologies that the Company may acquire and/or license. Many potential competitors may have significantly greater resources than the resources the Company possesses. Technological advances or entirely different approaches developed by one or more of its competitors could render certain of the technologies owned or controlled by the Company obsolete and/or uneconomical.

| 13 |

Entities such as Intellectual Ventures Management, LLC, Acacia Research Corporation, InterDigital, Inc., Rambus, Inc., Marathon Patent Group, Spherix, Inc., Tessera Technologies, Inc., Vringo, Inc., VirnetX Holding Corporation, Wi-LAN Inc. and others presently market themselves as being in the business of creating, acquiring, licensing or leveraging the value of intellectual property assets. Many of the Company’s competitors have longer operating histories and significantly greater financial resources.

Employees

As of December 31, 2014, the Company had fifteen full-time employees (two of whom are employees of the ECS subsidiary). None of the Company’s employees are subject to a collective bargaining agreement and the Company believes its employee relations to be good.

The Company uses the services of various consultants and contractors to manage its business, technical, accounting and legal operations. The Company believes selective use of such consultants allows it to achieve its business objectives in a flexible, cost-effective fashion.

Risks Related to the Company’s Business and Operations

Our independent registered public accounting firm has issued a “going concern” opinion.

Our ability to continue as a going concern is dependent upon our ability to generate profitable operations in the future and/or to obtain the necessary financing to meet our obligations and repay our liabilities arising from normal business operations when they come due. We plan to continue to provide for our capital requirements by issuing additional equity and or debt. No assurance can be given that additional capital will be available when required or on terms acceptable to us. We also cannot give assurance that we will achieve sufficient revenues in the future to achieve profitability and cash flow positive operations. The outcome of these matters cannot be predicted at this time and there are no assurances that, if achieved, we will have sufficient funds to execute our business plan or to generate positive operating results. Our independent registered public accounting firm has indicated that these matters, among others, raise substantial doubt about our ability to continue as a going concern.

We have identified a material weakness in our internal control over financial reporting, and if we fail to maintain proper and effective internal controls, our ability to produce accurate financial statements on a timely basis could be impaired.

Our management has determined that as of December 31, 2014, we had a material weakness in our internal control over financial reporting, because we did not have the appropriate internal personnel resources with the appropriate level of experience and technical expertise to provide oversight over the timely preparation and review of schedules necessary for the preparation of our financial statements and to make certain accounting judgments regarding accounting principles generally accepted in the United States, or U.S. GAAP.

We are taking steps to remediate the material weakness described above; however, we cannot assure you that we will be successful in such remediation, or that we or our independent registered public accounting firm will not identify additional material weaknesses or significant deficiencies in our internal control over financial reporting in the future. If we fail to remediate the material weakness described above, or fail to maintain effective internal controls in the future, it could result in a material misstatement of our financial statements that would not be prevented or detected on a timely basis, which could cause investors to lose confidence in our financial information or cause our stock price to decline. Our independent registered public accounting firm has not assessed the effectiveness of our internal control over financial reporting and will not be required to provide an attestation report on the effectiveness of our internal control over financial reporting so long as we are not an accelerated filer or larger accelerated filer as defined in Rule 12b-2 promulgated under the Exchange Act which may increase the risk that weaknesses or deficiencies in our internal control over financial reporting go undetected.

The Company’s limited operating history makes it difficult to evaluate its current business and future prospects and its inability to execute on its current business plan may adversely affect its results of operations and prospects.

The Company has generated minimal revenues to date. The Company not only has a very limited operating history, but also a limited track record in executing its business model which includes, among other things, acquiring, licensing, litigating or otherwise monetizing patent assets. The Company’s limited operating history makes it difficult to evaluate its current business model and future prospects.

In light of the costs, uncertainties, delays and difficulties frequently encountered by companies in the early stages of development with a limited operating history, there is a significant risk that the Company will not be able to:

| • | implement or execute its current business plan, or demonstrate that its business plan is sound; and/or |

| • | raise sufficient funds in the capital markets to fund acquisitions of additional patent portfolios or the costs of litigation or otherwise to effectuate its long-term business plan. |

The Company’s inability to execute any one of the foregoing or similar matters may adversely affect its results of operations and prospects.

The Company has incurred net losses and negative cash flows from operations since inception and has relied on external financing to support its operations. In the event the Company does not generate revenue from operations or obtain additional financing, its commercialization efforts will be delayed or curtailed.

Since inception, the Company has incurred net losses and negative cash flows from operations and has accumulated a deficit. The Company will need to generate revenue from operations or will require additional equity and/or debt financing to fund the Company’s ongoing activities. There are no assurances that additional financing will be available to the Company at a cost acceptable to the Company, or at all.

| 14 |

Our future capital needs are uncertain and we will need to raise additional funds, which may not be available on acceptable terms or at all. Moreover, additional financing may have an adverse effect on the value of the equity instruments held by the Company’s stockholders.

Assuming certain payables are deferred and expenses are managed efficiently, we believe our existing cash balances will be sufficient to meet our anticipated cash needs to conduct our planned operations for less than three months. We will need significant additional capital to monetize our current patent portfolios and we will need significant additional capital to purchase any new patent portfolios. We believe our working capital expenses will be approximately $7.8 million for the next twelve months, which amount consists of approximately $3.7 million in employee related costs, $1.3 million in patent maintenance and prosecution fees, $1.8 million in other operational costs and $1 million of payments relating to the acquisition of our patent portfolios and additionally our debt servicing fees payable to Fortress Investment Group, LLC and its affiliates ("Fortress") will be approximately $0.5 million. In addition, we will be required to pay unconditional guaranteed payments to the sellers of our existing patent portfolios of an aggregate of $20 million ($18 million of which to be paid out of net revenues from patent licensing receipts) through 2017 (with a net present value of $16.9 million,). See Note 10 in the Notes to the Company Financial Statements for further information on these guaranteed payments.

We will seek to raise additional capital through, among other things, public and private equity offerings and debt financings (to the extent such financings are permissible pursuant to the Fortress Agreement), including through takedowns from our shelf registration statement on Form S-3 and the issuance of additional promissory notes to Fortress pursuant to the terms of the Fortress Agreement. We may also seek additional funds through arrangements with collaborators or other third parties. Our future capital requirements will depend on many factors, including our levels of net sales and licensing and the timing and extent of expenditures to support our patent infringement litigation, if any. Additional funds may not be available on terms acceptable to us, or at all. Furthermore, if we issue equity or convertible debt securities to raise additional funds, our existing stockholders may experience dilution, and the new equity or debt securities may have rights, preferences, and privileges senior to those of our existing stockholders. If we incur additional debt, it may increase our leverage relative to our earnings or to our equity capitalization which could impact our business operations.

If adequate working capital is not available when needed, we may be required to significantly modify our business model and operations to reduce spending to a sustainable level. It could cause us to be unable to execute our business plan, take advantage of future opportunities, or respond to competitive pressures. It may also cause us to reduce or cease operations altogether.

We may not be able to incur any additional indebtedness as a result of the Fortress Agreement. Our inability to incur additional indebtedness may prevent us from raising additional funds on acceptable terms or at all.

The Fortress Agreement limits our ability to raise additional indebtedness. Pursuant to the Fortress Agreement, we may only incur indebtedness (i) in respect to our obligations to Fortress, (ii) on unsecured trade payables that are not evidenced by a promissory note and are incurred in the ordinary course of business, (iii) if such indebtedness is unsecured and subordinated to the rights of the Fortress debt, and only then if Fortress provides its consent and (iv) if such indebtedness is secured by patent assets acquired after the Fortress transaction was consummated, and only then if such indebtedness is subordinated to the Fortress debt, Fortress provides its consent and Fortress is afforded a right of first refusal to issue the new debt. These limitations could substantially impact our ability to raise additional funds on acceptable terms or at all. If we cannot raise additional funds, it could cause us to be unable to execute our business plan, take advantage of future opportunities, or respond to competitive pressures. It may also cause us to delay, scale back or eliminate some or all of our research and development programs, reduce our operations, enable Fortress to foreclose on our patent assets or cause us to cease operations altogether.

We have incurred a material amount of indebtedness to fund our operations, the terms of which require that we pledge all of our assets as security and that we agree to share certain patent monetization revenues that may accrue in the future. Our level of indebtedness and the terms of such indebtedness, could adversely affect our operations and liquidity.

We have incurred debt secured by all of our assets under the terms of the Fortress Agreement and related transaction documents. Our obligations under the Fortress Agreement are secured by a first priority security interest in all of the Company’s currently owned patent assets and all proceeds thereof, as well as a general security interest in all of the assets of the Company and its subsidiaries (though not in any future patent purchases by the Company). Additionally, the Fortress Agreement contains customary representations, warranties and indemnification provisions, as well as affirmative and negative covenants that, among other things, restrict our ability to incur additional indebtedness or guarantees, incur liens, sell our patent assets or permit a change in control of our Company.

| 15 |

The Fortress Agreement and the notes issued pursuant thereto (the “Fortress Notes”) also include customary event of default provisions and if we were to default under the Fortress Agreement and were unable to obtain a waiver for such a default, interest on the obligations would accrue at an increased rate. In the case of a default, Fortress could accelerate our obligations under the Fortress Agreement and exercise their right to foreclose on their security interests, which could force us to cease operations.

Incurrence and maintenance of this debt has material consequences on the Company, such as:

| · | requiring us to dedicate a material portion of our cash flow from operations and other capital resources to debt service, thereby reducing our ability to fund working capital, capital expenditures, and other cash requirements; |

| · | limiting our flexibility in planning for, or reacting to, changes and opportunities in, our business and industry, which may place us at a competitive disadvantage; |

| · | limiting our ability to incur additional debt on acceptable terms, if at all; and | |

| · | limiting our ability to dispose of patent assets to generate revenue. |

The Fortress Agreement further provides, among other things, that an affiliate of Fortress is entitled to share in certain monetization revenues that we may derive in the future related to our current patent portfolios even after our indebtedness to Fortress is paid in full. There can be no assurance that we will be successful in securing revenues, and we may expend resources in pursuit of monetization revenues that may not result in any benefit to us. Moreover, the revenue sharing obligation will reduce the benefit we receive from any monetization transactions, which will adversely affect our operating results.

The Company may not be able to successfully monetize the patents it has acquired from Huawei, Nokia or Panasonic or which it may hereafter acquire and thus the Company may fail to realize the anticipated benefits of any such acquisition which would have a material adverse effect on its business and results of operations.

There is no assurance that the Company will be able to successfully monetize the patent portfolios that it acquires. The patents the Company acquires could fail to produce anticipated benefits, or could have other adverse effects that the Company currently does not foresee. Failure to successfully monetize these patent assets would have a material adverse effect on the Company’s business, financial condition and results of operations.

In addition, the acquisition of patent portfolios is subject to a number of risks, including, but not limited to the following:

| · | There is a significant time lag between acquiring a patent portfolio and recognizing revenue from those patent assets, if at all. During that time lag, material costs (such as patent prosecution, maintenance, legal, financial and technical reviews, and potential reverse engineering) are likely to be incurred that would have a negative effect on the Company’s results of operations, cash flows and financial position, lagging any potential revenues generated by such activity. |

| · | The out-licensing of a patent portfolio is a time consuming and expensive process. If the Company’s efforts are not successful, the Company’s results of operations could be harmed. In addition, the Company may not achieve anticipated licensing results or other benefits from such acquisitions. |

| · | If the Company initiates a patent infringement suit against potential infringers or potential licensees initiate a declaratory judgment action or administrative review action against the Company, such potential infringers and/or licensees may successfully invalidate the Company’s patents or a fact finder may find that the potential infringer’s products do not infringe the Company’s patents. Thus, the Company may not successfully monetize the patents. These activities are inherently risky, time consuming and costly. |

| 16 |

The Company has, to date, entered into only one licensing arrangement. Accordingly, there is no assurance that the Company will be able to monetize its patent portfolios and recoup its full investment.

New legislation, regulations or court rulings related to enforcing patents could harm the Company’s business and operating results.

If Congress, the United States Patent and Trademark Office (the “USPTO”) or courts implement new legislation, regulations or rulings that impact the patent enforcement process or the rights of patent holders, these changes could negatively affect the Company’s business model. For example, limitations on the ability to bring patent enforcement claims, limitations on potential liability for patent infringement, lower evidentiary standards for invalidating patents, increases in the cost to resolve patent disputes and other similar developments could negatively affect the Company’s ability to license or assert the Company’s patent or other intellectual property rights.

In addition, on September 16, 2011, the Leahy-Smith America Invents Act (the “AIA”) was signed into law. The AIA includes a number of significant changes to the United States patent law. These changes include provisions that affect the way patent applications are prosecuted and may also affect patent litigation. As the regulations and procedures to govern administration of the AIA, especially the contested cases provisions (Inter-Partes Review (“IPR”) and Post-Grant Review (“PGR”) were only recently fully effective, it is too early to tell what, if any, impact the AIA will have on the operation of the Company’s business. However, the AIA and its implementation could increase the uncertainties and costs surrounding the prosecution of patent applications and the enforcement or defense of patents acquired by the Company, all of which could have a material adverse effect on the Company’s business and financial condition.

The United States government has placed restrictions on NASA, the National Science Foundation and the Commerce and Justice departments from buying information technology (in particular from Huawei) that has been “produced, manufactured or assembled” by companies with ties to the Chinese government unless the FBI or a similar agency first determines the purchase would be in the national interest. We believe these restrictions impose no limitations on the Company’s ability to license or enforce the patent assets that the Company has currently purchased or may purchase in the future from Huawei. Because we understand these restrictions apply solely to purchases of actual hardware and equipment, we believe the patent assets and rights which the Company has purchased from Huawei, with respect to those restrictions, include valid rights within the geographical United States which remain enforceable against all potential infringers. However, the United States government may try to apply other restrictions to prohibit its departments from licensing Huawei-related intellectual property rights, in which case we may be unable to consensually license patent assets purchased from Huawei to the U.S. government. Such interpretation of the prohibition, and other changes in United States law, regulation or practice as it relates to the license or enforcement of patent assets acquired from Huawei, could result in a material adverse impact on the Company’s business and financial condition.

New legislation has been introduced into the House of Representatives and the Senate, seeking to curb so-called “Litigation Abuses”. These bills include potential provisions for, among other things, expanded pleading requirements for patent litigations, patent-specific discovery and case management rules, disclosure obligations for parties having a financial interest in a patent case, certain provisions regarding so-called “customer suits” in favor of manufacturers. These bills have not yet been voted upon or amended and it is uncertain what, if any, new legislation will issue from the United States Congress, and what if any impact such legislation would have on the Company’s business and operations.

Furthermore, in various pending litigation and appeals in the United States Federal courts, various arguments and legal theories are being advanced to potentially limit the scope of damages that a patent licensing company such as us might be entitled to. Any one of these pending cases could result in new legal doctrines.

In September 2013, the Federal Trade Commission announced that it is planning to gather information from approximately 25 companies that are in the business of buying and asserting patents in order to develop a better understanding of how those companies do business and impact innovation and competition. Both the Federal Trade Commission and European Commission are actively considering what the appropriate restrictions are on the ability of owners of patents declared to technical standards to receive both injunctions and royalties.

In addition, the U.S. Department of Justice (“DOJ”) has conducted reviews of the patent system to evaluate the impact of patent assertion entities on industries in which those patents relate. It is possible that the findings and recommendations of the DOJ could impact the ability to effectively license and enforce standards-essential patents and could increase the uncertainties and costs surrounding the enforcement of any such patented technologies.

Further, the leadership changes in the European Commission (“EC”) make it challenging to predict whether and how the EC will shift its focus from its prior stances regarding the enforcement of intellectual property rights and the relationship between such rights and European competition law.

Additionally, there are numerous initiatives being pursued in multiple countries including India and Brazil, regarding when and how intellectual property rights should be enforced as well as the relationship between enforcement and other laws, including relevant anti-trust or competition law. It is too early to state with any degree of certainty the impact that such initiatives may have on our business.

Additionally, the political and legal climate in China appears to have changed and may cause significant challenges for foreign companies that attempt to enforce their intellectual property rights against Chinese business whether such rights are enforced in China or elsewhere in the world. At this time, it is unclear what if any impact this change in climate will have on our business.

| 17 |

Further, and in general, it is impossible to determine the extent of the impact of any new laws, regulations or initiatives that may be proposed, or whether any of the proposals will become enacted as laws. Compliance with any new or existing laws or regulations could be difficult and expensive, affect the manner in which the Company conducts its business and negatively impact the Company’s business, prospects, financial condition and results of operations.

Current litigation and contemplated regulatory developments may render the Company's business model less profitable and may have a material adverse effect on its results of operations.

The Company negotiates with leading technology companies to invest in, aggregate and acquire or in-license portfolios of patents and other intellectual property. Recent regulatory developments, as well as other pending litigation that is continuing to establish new laws and rules for the licensing and/or assertion of patents, may make this business model more difficult to execute, more risky and/or less profitable. As noted, new draft legislation proposed in Congress, if passed, might place more significant hurdles to the enforcement of the Company’s patent rights, allow defendants increased opportunities to challenge the Company’s patents in court and in the USPTO, introduce potentially expanded fee shifting for prevailing parties in litigation, and increase the risks and costs of patent litigation for all parties, including the Company. These changes and risks could decrease the value of the Company’s intellectual property portfolio, as well as increase the risk of unlicensed infringement of such portfolio.

In addition, in various pending litigation and appeals in the United States Federal courts, various arguments and legal theories are being advanced to potentially limit the scope of damages a patent licensing company such as the Company might be entitled to. While the Company rejects many of these arguments as improperly limiting the rights granted to legitimate patent holders under the Constitution and US patent laws, any one of these pending cases could result in new legal doctrines that could make the Company’s patent portfolios less valuable or more costly to enforce.

In addition, competition authorities in various countries and regions, as well as judicial actions in the United States and abroad are examining the rights and obligations of holders of standards essential patents (SEPs), and in some cases imposing restrictions and further obligations on the licensing and enforcement of SEPs. These changes in law and/or regulation may make the Company’s licensing programs more difficult, may render some or all SEP patents held by Company unenforceable, or impose other restrictions, costs, impediments or harm to the Company’s patent portfolios.

We commenced legal proceedings against security and communications companies, and we expect such proceedings to be time-consuming and costly, which may adversely affect our financial condition and our ability to operate our business.

To license or otherwise monetize the patent assets that we own, we commenced legal proceedings against two companies, pursuant to which we allege that such companies infringe on one or more of our patents. As with all litigation, there is a risk that we may be unable to achieve the results we desire from such litigation, failure from which would harm our business to a great degree. In addition, the defendants in these litigations may have more resources than we do, which could make our litigation efforts more difficult.

We anticipate that legal proceedings may continue for several years and may require significant expenditures for legal fees and other expenses. Disputes regarding the assertion of patents and other intellectual property rights are highly complex and technical. Once initiated, we may be forced to litigate against other parties in addition to the originally named defendants. Our adversaries may allege defenses and/or file counterclaims for, among other things, revocation of our patents or file collateral litigations or initiate investigations in the United States or elsewhere in an effort to avoid or limit liability and damages for patent infringement. If such actions are successful, they may preclude our ability to derive licensing revenue from the patents currently being asserted.

Additionally, we anticipate that our legal fees and other expenses will be material and will negatively impact our financial condition and results of operations and may result in our inability to continue our business unless we are able to raise significant new capital or are successful in licensing our patent portfolios. We estimate that our legal fees over the next twelve months will be significant for these enforcement actions. Expenses thereafter are dependent on the outcome of the status of the litigation. Our failure to monetize our patent assets would significantly harm our business.

It is difficult to predict the outcome of patent enforcement litigation at the trial level. It is often difficult for juries and trial judges to understand complex, patented technologies and, as a result, there is a higher rate of successful appeals in patent enforcement litigation than more standard business litigation. Such appeals are expensive and time consuming, resulting in increased costs and delayed revenue. Although we diligently pursue enforcement litigation, we cannot predict with significant reliability the decisions that may be made by juries and trial courts.

Further, should we be deemed the losing party in certain of our litigations, we may be liable for some or all of our opponents’ legal fees.

Federal courts are becoming more crowded and, as a result, patent enforcement litigation is taking longer.

Our patent enforcement actions are almost exclusively prosecuted in federal court. Federal trial courts that hear our patent enforcement actions also hear criminal cases. Criminal cases always take priority over our actions. As a result, it is difficult to predict the length of time it will take to complete an enforcement action. Moreover, we believe there is a trend in increasing numbers of civil lawsuits and criminal proceedings before federal judges and, as a result, we believe that the risk of delays in our patent enforcement actions will have a greater effect on our business in the future unless this trend changes.

Acquisitions of additional patent assets may be time consuming, complex and costly, which could adversely affect the Company’s operating results.

Acquisitions of patent or other intellectual property assets are often time consuming, complex and costly to consummate. The Company may utilize many different transaction structures in its acquisitions and the terms of such acquisition agreements tend to be heavily negotiated. As a result, if the Company seeks out new acquisition opportunities, the Company expects to incur significant operating expenses and will likely be required to raise additional financing during the negotiations even if any particular acquisition is ultimately not consummated. Even if the Company is able to acquire particular patent assets, there is no guarantee that the Company will generate sufficient revenue related to those patent assets to offset the acquisition costs. While the Company will seek to conduct reasonable due diligence on the patent assets it is considering for acquisition, the Company may acquire patent assets from a seller who does not have proper title to those assets or the assets may prove invalid, or unenforceable in subsequent litigation. In those cases, the Company may be required to spend significant resources to defend the interests in its patent assets and, if the Company is not successful, the Company’s acquisition may be rendered effectively in part, or wholly, unusable, in which case the Company could lose part or all of its investment in the assets. Moreover, the Company may pay more to acquire a patent portfolio than it generates in future revenues. In addition, the Company could make an error in its due diligence or fail to uncover an important fact before acquiring a patent portfolio, thereby acquiring patents that are invalid or unenforceable.

The Company may also identify patent or other intellectual property assets that cost more than it is prepared to spend with its own capital resources. The Company may incur significant costs to organize and negotiate a structured acquisition that does not ultimately result in an acquisition of any patent assets or, if consummated, proves to be unprofitable for us. These higher costs could adversely affect the Company’s operating results, and if the Company incurs losses, the value of the Company’s securities may decline.

In addition, the Company may acquire patents and technologies that are in the early stages of adoption in the telecommunications and information technology markets. Demand for some of these technologies may likely be untested and may be subject to fluctuation based upon the rate at which the Company’s licensees will adopt the Company’s patents and technologies in their products and services. As a result, there can be no assurance as to whether technologies the Company acquires or develops will have value that the Company can monetize.

| 18 |

In certain acquisitions of patent assets, the Company may seek to defer payment or finance a portion of the acquisition price. This approach may put us at a competitive disadvantage to other parties pursuing the same assets and could result in harm to the Company’s business.

The Company has limited capital and may seek to negotiate acquisitions of patent or other intellectual property assets where the Company can defer payments or finance a portion of the acquisition price from the seller. These types of debt financing or deferred payment arrangements may not be as attractive to sellers of patent assets as receiving the full purchase price for those assets in cash at the closing of the acquisition. As a result, the Company might not compete effectively against other companies in the market for acquiring patent assets, some of whom have greater cash resources than the Company has.

If our market capitalization falls below the aggregate dollar amount that we owe to Panasonic at any time prior to our full payment of Panasonic pursuant to that certain patent purchase agreement, Panasonic will have a right to repurchase the assets we acquired at the purchase price we paid.

Pursuant to the patent purchase agreement with Panasonic, Panasonic is owed additional payments for the patents we purchased. If our market capitalization falls below the aggregate dollar amount that we owe at that relevant point in time to Panasonic, at any time prior to full payment, they may exercise their limited right to repurchase the assets we acquired from them at a purchase price at least equal to the amount we paid to purchase the entire portfolio. If they repurchase their assets, our ability to enforce our patent rights will be adversely affected.

Any failure to maintain or protect the Company’s patent assets or other intellectual property rights could significantly impair the Company’s return on investment from such assets and harm the Company’s brand, business and operating results.

The Company’s ability to operate its business and compete in the intellectual property market largely depends on the superiority and value of its patent assets and other intellectual property. To protect the Company’s proprietary rights, the Company relies and will rely on a combination of patent, trademark, copyright, and confidentiality agreements with the Company’s employees and third parties and other protective contractual provisions. No assurances can be given that any of the measures the Company undertakes to protect and maintain the Company’s assets will have any measure of success.

Despite the Company’s efforts to protect its intellectual property rights, any of the following or similar occurrences may reduce the value of the Company’s intellectual property:

| • | applications for patents, trademarks and copyrights may not be granted and, if granted, may be challenged or invalidated; |

| • | issued trademarks, copyrights, or patents may not provide the Company with any commercially viable claims against potentially infringing parties; |

| • | the Company’s efforts to protect its intellectual property rights may not be effective in preventing misappropriation of the Company’s IP assets; or |

| • | the Company’s efforts may not prevent the development and design by others of products or technologies similar to or competitive with, or superior to those covered by the Company’s IP. |

Moreover, the Company may not be able to effectively protect its intellectual property rights in certain foreign countries from which potential licensees or infringers may operate. If the Company fails to maintain, defend or prosecute its patent assets properly, the value of those assets would be reduced or eliminated, and the Company’s business would be harmed.

Following its acquisition of IP, the Company needs to spend significant time and resources maintaining and defending such assets which could cause it to incur significant costs and divert management attention from its core business which could adversely affect its prospects.

Following the acquisition of patent assets, the Company needs to spend significant time and resources to maintain the effectiveness of those assets by paying maintenance fees and making filings with the USPTO and non-US equivalent government bodies. The Company acquired patent assets, including patent applications, which require us to spend resources to prosecute the applications with the USPTO and non-US equivalent government bodies. Further, there is a material risk that patent related claims (such as, for example, infringement claims (and/or claims for indemnification resulting therefrom), unenforceability claims, or invalidity claims) will be asserted or prosecuted against us, and such assertions or prosecutions could materially and adversely affect the Company’s business. Regardless of whether any such claims are valid or can be successfully asserted, defending such claims could cause the Company to incur significant costs and could divert resources away from its core business activities which could adversely affect its prospects.

| 19 |

The Company seeks to process pending patent applications for acquired and related intellectual property which takes time and is costly. Moreover, the failure to obtain or maintain intellectual property rights for such inventions would lead to the loss of the Company’s investments in such activities.

Members of the Company’s management team have experience as inventors. As such, part of the Company’s business may include the internal development of pending patent applications or other acquired intellectual property that the Company will seek to monetize. However, this aspect of the Company’s business would likely require significant capital and would take time to achieve. Such activities could also distract the Company’s management team from its present business initiatives, which could have a material and adverse effect on the Company’s business. There is also the risk that the Company’s initiatives in this regard would not yield any viable new intellectual property, which would lead to a loss of the Company’s investments in time and resources in such activities.