Exhibit 99.1

Pareteum Announces Record First Quarter 2018 Results

| · | Revenues of $4.113 Million, up 47% Year-Over-Year |

| · | Achieved Positive Operating Cash Flows, Reached a Quarter Earlier than Expected |

| · | Connections, a Lead Indicator of Revenue, Increased 94% Versus the End of Q1 2017 and 30% from the Sequential Q4 2017 |

| · | Raised 2018 Outlook to At Least 60% Revenue Growth |

NEW YORK, NEW YORK – PRNewswire – May 7, 2018 – Pareteum Corporation (NYSE American: TEUM), (“Pareteum” or the “Company”), the rapidly growing Cloud Communications Platform company, announced today operating and financial results for the first quarter ended March 31, 2018.

| Sequential Quarterly Key Metrics | ||||||||||

| ($000’s) | Q1 2017 | Q2 2017 | Q3 2017 | Q4 2017 | Q1 2018 | |||||

| REVENUE | 2,795 | 3,239 | 3,499 | 4,015 | 4,113 | |||||

| YEAR-OVER-YEAR REVENUE GROWTH | (479) | (15%) | (28) | (1%) | 328 | 10% | 870 | 28% | 1,318 | 47% |

| GROSS MARGIN | 1,953 | 70% | 2,293 | 71% | 2,707 | 77% | 2,910 | 73% | 2,918 | 71% |

| ADJUSTED EBITDA | (198) | 463 | 603 | 708 | 283 | |||||

| EBITDA | (1,146) | (301) | (35) | (2,733) | (869) | |||||

| CASH BALANCE | 1,409 | 742 | 700 | 13,538 | 15,759 | |||||

| 36 MONTH CONTRACTUAL REVENUE BACKLOG | 44,000 | 60,000 | 94,000 | 147,000 | 200,000 | |||||

Key Financial Highlights for First Quarter 2018 Year over Year:

| · | Revenues increased by 47% to $4.113 million |

| · | Operating cash flows turned positive a quarter earlier than expected; from $1.24 million cash used to $29,000 cash provided |

| · | Gross margins increased 100 basis points to 71% |

| · | Adjusted EBITDA improved to a profit of $283 thousand, from a loss of $198 thousand |

| · | EBITDA loss improved by $277 thousand, or 24%, to $869 thousand |

| · | Operating loss improved by $156 thousand, or 8%, to $1.83 million |

| · | Increase in total assets from $13.1 million to $27.2 million |

| · | Cash balance of $15.8 million |

Key Business Highlights for First Quarter 2018:

| · | Awarded 14 contracts aggregating to $60 million in total contract value, which added $53 million to 36-month contractual revenue backlog |

| · | Increased 36-month contractual revenue backlog from $147 million at 12/31/17 to $200 million |

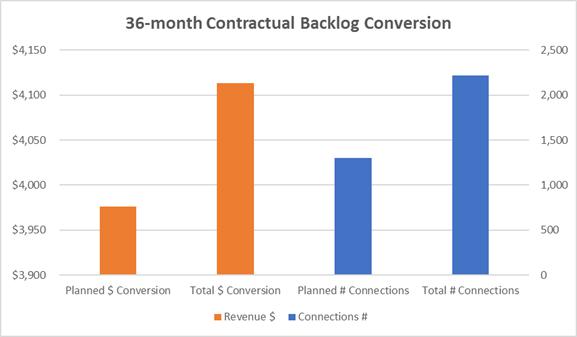

| · | Backlog revenue conversion at 103% |

| · | Ended Q1 2018 with 2,200,000 connections, a lead indicator of revenue, increased 94% versus the end of the first quarter 2017 and 30% from the sequential fourth quarter of 2017, with an additional conversion increase of 70% versus the expected in the 36-month contract backlog for connections |

| · | Published blockchain whitepaper defining opportunities in the mobile market |

| · | Granted patent for cloud security solution |

| · | Received 2018 Internet Telephony Product of the Year |

| · | Awarded IOT Evolution’s 2017 IoT Excellence Award |

| · | Published whitepaper defining the smart city movement and its role in this transformation |

“This quarter represents a record quarterly revenue milestone since we executed our turnaround and transformed the business in 2016. I am also extremely pleased and proud to report that we generated positive operating cash flow in the first quarter, a full quarter earlier than expected. First quarter revenue would have been $4.22 million, but we instituted Accounting Standard for Revenue Recognition (606) for our SaaS business model and did not recognize $107,000 of deferred revenue in the first quarter. All of our profitability metrics improved dramatically; Adjusted EBITDA, EBITDA, operating loss and cash flow from operations. Key performance indicators of connections, backlog conversion, connection values, revenue per employee and churn continue to all move in the right direction and give us confidence in our overall strategy and business execution. We also invested in product development and sales and marketing during the quarter, as we prepare to scale our business for expected growth and profitability. Our TEUM remains laser focused on converting backlog to revenue, servicing our clients, selling into new geographical markets and creating shareholder value,” said Hal Turner, Pareteum’s Founder, Executive Chairman and Principal Executive Officer.

Raised 2018 Outlook to At Least 60% Revenue Growth2018 Outlook:

Based on our 36-month contractual revenue backlog of $200 million, as of March 31, 2018, and 2,200,000 connections, we are raising our 2018 outlook. The Company now expects 2018 revenue growth of at least 60% over 2017, up from the previous provided guidance of 50%. Also, with its current cost structures, Pareteum expects positive, EBITDA, and cash from continuing operations for the full year 2018. As we convert backlog to connections, our revenue will increase and for every incremental dollar of revenue, we expect contribution to our bottom line. Our target gross margins are 70-75%.

Highlight Key Performance Indicators and Trends (as of March 31, 2018):

36-month contractual revenue backlog of $200 million.

Connections of 2,200,000, up from 1,711,000 at the end of the fourth quarter 2017 and 1,140,000 at the end of 2016; increased 94% versus the end of the first quarter 2017 and 30% from the sequential fourth quarter of 2017; with an additional conversion increase of 70% versus the expected in the 36-month contract backlog for connections.

Backlog conversion of revenue 103%.

Lifetime connection value of $277, up from $224 at the end of the fourth quarter 2017 and $157 at the end of the first quarter 2017; increased 76% versus the end of the first quarter 2017 and 24% from the sequential fourth quarter of 2017.

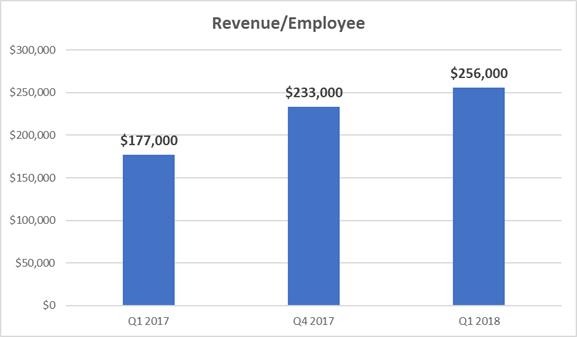

Average annualized revenue per employee of $256,000, up from $233,000 at the end of the fourth quarter 2017 and $177,000 at the end of the first quarter 2017; increased 45% versus the end of the first quarter 2017 and 10% from the sequential fourth quarter of 2017; increased 412% versus the end of the fourth quarter 2015.

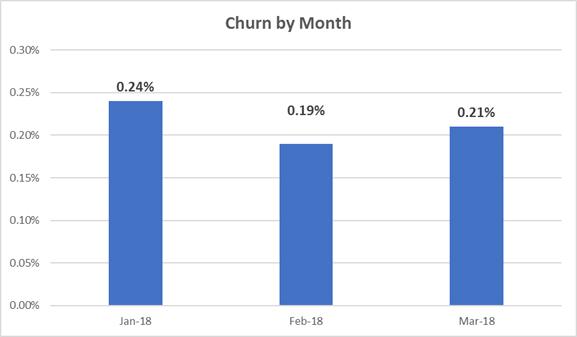

Connections Churn by month at an average of 0.21% for the first quarter 2018

Financial Results for the First Quarter Ended March 31, 2018:

Revenue for the first quarter ended March 31, 2018 was $4,112,570, an increase of $1,317,627 or 47%, compared to $2,794,943 for the first quarter ended March 31, 2017. This increase was attributable mainly due to the services deployment of signed sales contracts into billable revenues (backlog conversion) and growth in volumes of connections from our existing customer base; in addition to revenues from our Managed Services Platform (MSP), we benefited from Global Cloud Services (GCSP) and Application Exchange Platform (TEAX) revenues are coming into service. We fully implemented in Q1 2018 Accounting Standard for Revenue Recognition (606); this resulted the a onetime non-recognition of $107,000 for Q1; implementation of ASC 606 helps us in fully recognizing future revenues converted from our 36 Month Contractual Revenue Backlog.

With GCSP and TEAX playing an increasingly predominant role in our growth, Global Cloud Services revenue represents 11.7% of total revenue in 1Q18, showing the acceptance of our new product offerings.

It is also significant that “connections” (our term representing devices, subscribers and their variable usage), which are a lead indicator of revenue, rose to 2,220,000 as of March 31, 2018. This connections growth of 94% versus the end of the first quarter 2017 and 30% from the sequential fourth quarter of 2017

Operating cash flow for the three months ending March 31, 2018 was a positive $28,571, an increase of $1,266,629 or 102%, compared a negative $1,238,056 for the three months ending March 31, 2017. This change was primarily the result of our continued operational austerity measures, and a decrease of $1,019,670 in interest expense relating to debt discount and conversion feature which was $29,566 for the three months ending March 31, 2018, compared to $1,049,236 for the three months ending March 31, 2017. This is the direct result of the company paying off all of its senior secured debt in December of 2017.

Gross profit for the three months ending March 31, 2018 was $2,918,047, resulting in a gross margin of 70.9%, compared to $1,953,040 and 69.9% for the three months ending March 31, 2017.

Product development expenses for the three months ended March 31, 2018 and 2017 were $726,845 and $284,694, respectively, an increase of $442,151 or 155%. Product Development costs consist primarily of salaries and related expenses, including share-based expenses, of employees involved in the development of the Company’s services, which are expensed as incurred. Costs such as database architecture, and Pareteum B/OSS, Core Server and SuperAPI development and testing are included in this function.

Sales and Marketing expenses for the three months ended March 31, 2018 and 2017 were $688,998 and $319,487, respectively, an increase of $369,511 or 116%. This increase is a direct result of hiring new employees and allocating resources to growing our business.

General and Administrative expenses for the three months ended March 31, 2018 and 2017 were $2,296,852 and $2,365,388, respectively, a decrease of 3%.

EBITDA loss for the three months ended March 31, 2018, was $869 thousand, an improvement of $276 thousand or 24%, compared to the loss of $1.146 million for the same period in 2017.

Adjusted EBITDA profit for the three months ended March 31, 2018, was $283 thousand, an improvement of $481 thousand, compared to the loss of $198 thousand for the same period in 2017.

Operating loss for the three months ended March 31, 2018, was $1,833,537, an improvement of $156,004 or 8%, compared to the loss of $1,989,541 for the same period in 2017.

Restructuring charges for the three months ended March 31, 2018 and 2017 were $73,600 and $129,229, a decrease of $55,629 or 43%.

Of note, the following were non-cash expenses associated with the three months ended March 31, 2018 and 2017. We recognized share-based compensation expense of $1,077,625 and $818,286, respectively, an increase of $259,340 or 32%. Depreciation and amortization expenses for the three-month period ended March 31, 2018 was $965,290, an increase of $121,507 or 14%, compared to $843,783 for the same period in 2017. Changes in derivative liabilities for the three-month period ended March 31, 2018 was a loss of $313,733, a decrease of $2,234,614 or 116%, compared to a gain of $1,920,881 for the same period in 2017. This is due to the increase in our stock price, which increases the valuation of these derivative liabilities.

Net loss for the three-month period ended March 31, 2018, was $2,134,101, an increase of $840,961 or 65%, compared to the loss of $1,293,140 for the same period in 2017. The increase in Net Loss was primarily the changes in derivative liabilities, which was a negative $2,234,614, as a result of the their increased value as a result of the increase in our stock price. The resulting EPS for the three-month period ended March 31, 2018 was ($0.04), an improvement of 71% as compared to the ($0.14) for the same period in 2017.

At March 31, 2018, Pareteum had $15.8 million of cash, $0 senior secured debt and 51.0 million shares issued and outstanding. In the first quarter of 2018, over $2.5 million has been received from cash exercises of warrants.

Conference Call Information:

| Date: | Monday, May 7, 2018 |

| Time: | 4:30 p.m. ET |

| Conference ID: | 7487990 |

| Domestic Dial-in Number: | 1-866-548-4713 |

| International Dial-in Number: | 1-323-794-2093 |

| U.K. Toll Free: | 0800 358 6377 |

| Live webcast: | http://public.viavid.com/index.php?id=129506 |

All interested participants should dial in approximately 5 to 10 minutes prior to the 4:30 p.m. ET conference call and an operator will register your name and organization.

A replay of the call will be available approximately one hour after the end of the call through May 7, 2019, and can be accessed at: http://public.viavid.com/index.php?id=129506

About Pareteum:

The mission of Pareteum Corporation (NYSE American: TEUM) is to connect “every person and everything.” Organizations use Pareteum to energize their growth and profitability through cloud communication services and complete turnkey solutions featuring relevant content, applications, and connectivity worldwide. Our platform services partners (technologies integrated into our cloud) include: HPE, IBM, Ribbon Communications (Sonus+GenBand), NetNumber, Oracle, Microsoft, and other world class technology providers). All of the relevant customer acquired value is derived from Pareteum’s award winning software, developed and enhanced for many years. By harnessing the value of communications, Pareteum serves retail, enterprise and IoT customers. Pareteum currently has offices in New York, Sao Paulo, Madrid, Barcelona, Bahrain and the Netherlands. For more information please visit: www.pareteum.com

Forward Looking Statements:

Certain statements contained herein constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements may include, without limitation, statements with respect to Pareteum’s plans and objectives, projections, expectations and intentions. These forward-looking statements are based on current expectations, estimates and projections about Pareteum’s industry, management’s beliefs and certain assumptions made by management. Readers are cautioned that any such forward-looking statements are not guarantees of future performance and are subject to certain risks, uncertainties and assumptions that are difficult to predict. Because such statements involve risks and uncertainties, the actual results and performance of Pareteum may differ materially from the results expressed or implied by such forward-looking statements. Given these uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements. Unless otherwise required by law, Pareteum also disclaims any obligation to update its view of any such risks or uncertainties or to announce publicly the result of any revisions to the forward-looking statements made here. Additional information concerning certain risks and uncertainties that could cause actual results to differ materially from those projected or suggested in Pareteum’s filings with the Securities and Exchange Commission, copies of which are available from the SEC or may be obtained upon request from Pareteum Corporation.

Contractual Revenue Backlog Definition:

Contractual revenue backlog, a Non-GAAP measure is measured on a forward looking 36 month snapshot view monthly, and, is generated by each of the Company’s Managed Services, Global Mobility Cloud, and Application Exchange & Developer’s Platform customers. The Pareteum multi-year Software-as-a-Service agreements include service establishment and implementation fees, guaranteed minimum monthly recurring fees, as well as contractually scheduled subscribers, in some cases including subscriber usage, during the term of the agreement, and, their resulting monthly contractual revenue. There can be no assurances that we reach the total contract revenue backlog. Timing of revenue recognition may vary from actual results.

Discussion of Non-GAAP Financial Measures:

Pareteum’s management believes that the non-GAAP measures of (1) “EBITDA” (2) “Adjusted EBITDA” and (3) Contract Revenue Backlog enhance an investor’s understanding of Pareteum’s financial and operating performance by presenting (i) a focus on core operating performance and (ii) comparable financial results over various periods. Pareteum ’s management uses these financial measures for strategic decision making, forecasting future financial results and operating performance. The presentation of non-GAAP (“Generally Accepted Accounting Principles”) financial information is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP.

EBITDA and Adjusted EBITDA Definition:

“EBITDA” is a non-GAAP measure defined as earnings before interest, taxes, depreciation and amortization. “Adjusted EBITDA” is a non-GAAP measure defined by Pareteum as “EBITDA” excluding stock based compensation, restructuring charges, nonrecurring expenditures and certain software and non-cash adjustments made during the 2016 restructuring that are not applicable in 2017 and 2018.

Pareteum Investor Relations Contacts:

Ted O’Donnell

Chief Financial Officer

(212) 984-1096

InvestorRelations@pareteum.com

Stephen Hart

Hayden IR

917-658-7878

Carrie Howes

Rayleigh Capital

Dubai- London

T UAE: +971 (0) 55 997 0427 | T UK: +44 (0) 870 490 5443 | T CAN: +1 416 900 3634

PARETEUM CORPORATION AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS

(In thousands except for per share amounts)

| Three Month Period Ended | ||||||||

| March 31, 2018 | March 31, 2017 | |||||||

| REVENUES | $ | 4,113 | $ | 2,795 | ||||

| COST AND OPERATING EXPENSES | ||||||||

| Cost of revenues | 1,195 | 842 | ||||||

| Product development | 727 | 285 | ||||||

| Sales and marketing | 689 | 319 | ||||||

| General and administrative | 2,297 | 2,365 | ||||||

| Restructuring charges | 74 | 129 | ||||||

| Depreciation and amortization of intangibles assets | 965 | 844 | ||||||

| Total cost and operating expenses | $ | 5,947 | $ | 4,784 | ||||

| LOSS FROM OPERATIONS | $ | (1,834 | ) | $ | (1,989 | ) | ||

| Total other income (expense) | (301 | ) | 698 | |||||

| LOSS BEFORE PROVISION FOR INCOME TAXES | (2,135 | ) | (1,291 | ) | ||||

| Provision for income taxes | $ | - | $ | 1 | ||||

| NET LOSS | $ | (2,135 | ) | $ | (1,292 | ) | ||

| OTHER COMPREHENSIVE LOSS | ||||||||

| Foreign currency translation (loss) gain | $ | 104 | $ | (27 | ) | |||

| COMPREHENSIVE LOSS | $ | (2,031 | ) | $ | (1,319 | ) | ||

| Net loss per common share | $ | (0.04 | ) | $ | (0.14 | ) | ||

| Weighted average shares – basic | 50,062,434 | 9,322,228 | ||||||

| Non-GAAP Reconciliation | Three Month Period Ended | |||||||

| March 31, 2018 | March 31, 2017 | |||||||

| NET LOSS | $ | (2,135 | ) | $ | (1,292 | ) | ||

| Total interest and other income (expense) | 301.00 | (698.00 | ) | |||||

| Depreciation and amortization | 965.00 | 844.00 | ||||||

| Provision for income taxes | - | 1.00 | ||||||

| EBITDA | $ | (869 | ) | $ | (1,145 | ) | ||

| Nonrecurring and restructuring costs | 74.00 | 129.00 | ||||||

| Stock based compensation | 1,078.00 | 818.00 | ||||||

| Adjusted EBITDA | $ | 283 | $ | (198 | ) | |||

PARETEUM CORPORATION AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEET INFORMATION

(In thousands)

| March 31, 2018 | December 31, 2017 | |||||||

| Cash and cash equivalents | $ | 15,759 | $ | 13,538 | ||||

| Restricted cash | 230 | 200 | ||||||

| Accounts receivable | 1,954 | 2,058 | ||||||

| Prepaid expenses and other current assets | 1,154 | 900 | ||||||

| Total current assets | 19,097 | 16,696 | ||||||

| Total assets | 27,199 | 25,326 | ||||||

| Total current liabilities | 7,562 | 7,538 | ||||||

| Total liabilities | 10,212 | 9,904 | ||||||

| Total stockholders’ equity | 16,987 | 15,422 | ||||||

PARETEUM CORPORATION AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS INFORMATION

(In thousands)

| For the Three Months Ended | ||||||||

| March

31, 2018 | March

31, 2017 | |||||||

| CASH FLOWS FROM OPERATING ACTIVITIES: | $ | 29 | $ | (1,238 | ) | |||

| CASH FLOWS FROM INVESTING ACTIVITIES: | (434 | ) | (31 | ) | ||||

| CASH FLOWS FROM FINANCING ACTIVITIES: | 2,525 | 1,631 | ||||||

| EFFECT OF EXCHANGE RATES | 101 | 221 | ||||||

| NET INCREASE (DECREASE) IN CASH & CASH EQUIVALENTS | 2,221 | 583 | ||||||