As filed with the Securities and Exchange Commission on November 24, 2021

Registration No. 333-260364

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Pre-Effective Amendment No. 3

to

FORM

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

(Exact name of registrant as specified in its charter)

| 7373 | ||||

| (State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification No.) |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including

area (

Dean L. Julia

Chief Executive Officer

Mobiquity Technologies, Inc.

35 Torrington Lane

Shoreham, NY 11786

(516) 246-9422

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

|

Gavin C. Grusd, Esq. David F. Durso, Esq. Ruskin Moscou Faltischek P.C. 1425 RXR Plaza East Tower, 15th Floor Uniondale, NY 11556 Tel: (516) 663-6514 |

Laura Anthony, Esq. Craig D. Linder, Esq. Anthony L.G., PLLC 625 N. Flagler Drive, Suite 600 West Palm Beach, Florida 33401 Tel: (561) 514-0936 |

Approximate date of commencement of proposed sale to the public:

From time to time after this registration statement is declared effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: þ

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer: ☐ | Accelerated filer: ☐ | Smaller reporting company: | |

| Emerging growth company: |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered | Proposed Maximum Aggregate Offering Price(1) | Amount of Registration Fee | ||||||

| Units(2) | $ | 12,650,004 | $ | 1,172.66 | ||||

| Common stock, par value $0.0001 per share, included in the units | – | (4) | – | (4) | ||||

| Warrants to purchase common stock, par value $0.0001 per share, included in the units | – | (4) | – | (4) | ||||

| Common stock, par value $0.0001 per share, underlying the warrants included in the units(3) | $ | 15,180,005 | $ | 1,407.19 | ||||

| Representative’s Warrant to purchase common stock | – | (5) | – | (5) | ||||

| Common stock issuable upon exercise of Representative’s Warrants to purchase common stock(6) | $ | 412,500 | $ | 38.24 | ||||

| TOTAL | $ | 28,242,509 | $ | 2,618.09 | (7) | |||

| (1) | Estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(o) of the Securities Act of 1933, as amended (the “Securities Act”). |

| (2) | Each unit consists of one share of common stock, par value $0.0001 per share, and one warrant to purchase one share of common stock, par value $0.0001 per share. Includes 275,000 shares of common stock and/or warrants to purchase 275,000 shares of common stock, which may be issued upon exercise of a 45-day option granted to the underwriters to cover over-allotments, if any. |

| (3) | The warrants are exercisable at a per share exercise price equal to 120% of the public offering price per share of common stock. The proposed maximum aggregate public offering price of the shares of common stock issuable upon exercise of the warrants was calculated to be $15,180,005 (which is 120% of $12,650,004 since each investor will receive a warrant to purchase one share of common stock for each share of common stock purchased in this offering). Pursuant to Rule 416, the registrant is also registering an indeterminate number of additional shares of common stock that are issuable by reason of the anti-dilution provisions of the warrants. |

| (4) | Included in the price of the units. No fee required pursuant to Rule 457(g) under the Securities Act. |

| (5) | No fee required pursuant to Rule 457(g) under the Securities Act. |

| (6) | The Representative’s Warrants are exercisable at a per share exercise price equal to 125% of the public offering price per share. As estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(g) under the Securities Act, the proposed maximum aggregate offering price of the representative’s warrants is $412,500 which is equal to 125% of $330,000 (3% of $11,000,004 of shares of common stock sold in this offering ). Pursuant to Rule 416, the registrant is also registering an indeterminate number of additional shares of common stock that are issuable by reason of the anti-dilution provisions of the Representative’s Warrants. |

| (7) | Previously paid $2,759.32. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

This Registration Statement contains two prospectuses, as set forth below.

| · | Public Offering Prospectus. A prospectus to be used for the public offering of 1,833,334 units of the Registrant (the “Public Offering Prospectus”) through the underwriter named on the cover page of the Public Offering Prospectus. | |

| · | Each unit consists of one share of common stock, par value $0.0001 per share, and one warrant to purchase one share of common stock, par value $0.0001 per share. | |

| · | Resale Prospectus. A prospectus to be used for the resale by the selling shareholders set forth therein of 281,250 shares of common stock of the Registrant (the “Resale Prospectus”). |

The Resale Prospectus is substantively identical to the Public Offering Prospectus, except for the following principal points:

| · | they contain different outside and inside front covers and back covers; | |

| · | they contain different Offering sections in the Prospectus Summary section beginning on page 5; | |

| · | they contain different Use of Proceeds sections on page 24; | |

| · | a Selling Shareholder section is included in the Resale Prospectus; | |

| · | the Dilution section from the Public Offering Prospectus on page 27 is deleted from the Resale Prospectus; | |

| · | the Capitalization section from the Public Offering Prospectus on page 29 is deleted from the Resale Prospectus; | |

| · | the Underwriting section from the Public Offering Prospectus on page 69 is deleted from the Resale Prospectus and a Selling Shareholders Plan of Distribution is inserted in its place; and | |

| · | the Legal Matters section in the Resale Prospectus on page 76 deletes the reference to counsel for the underwriter. |

The Registrant has included in this Registration Statement a set of alternate pages after the back cover page of the Public Offering Prospectus (the “Alternate Pages”) to reflect the foregoing differences in the Resale Prospectus as compared to the Public Offering Prospectus. The Public Offering Prospectus will exclude the Alternate Pages and will be used for the public offering by the Registrant. The Resale Prospectus will be substantively identical to the Public Offering Prospectus except for the addition or substitution of the Alternate Pages and will be used for the resale offering by the selling shareholders.

| i |

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS

SUBJECT TO COMPLETION DATED NOVEMBER 24, 2021

MOBIQUITY TECHNOLOGIES, INC.

1,833,334 UNITS

Mobiquity Technologies, Inc. is offering 1,833,334 units on a firm commitment basis, each unit consisting of one share of common stock, par value $0.0001 per share, and a warrant to purchase one share of common stock. It is currently estimated that the offering price will be between $5.00 and $6.00 per unit, with an estimated offering price of $6.00 per unit. The warrants included in the units are exercisable immediately, at an exercise price of $7.20 per share (equal to 120% of the public offering price per unit) and expire five years from the date of issuance. The units will have no stand-alone rights and will not be issued or certificated as stand-alone securities. Purchasers will receive only shares of common stock and warrants. The shares of common stock and warrants may be transferred separately, immediately upon issuance. The offering also includes the shares of common stock issuable from time to time upon exercise of the warrants.

Our common stock is currently quoted on the OTCQB market, operated by OTC Markets Group, under the symbol “MOBQ.” On November 19, 2021, the last quoted price of our common stock as reported on the OTCQB was $7.80 per share. There is a limited public trading market for our common stock. The final offering price per unit may be at a discount to the trading price of our common stock on the OTCQB. This price will fluctuate based on the demand for our common stock.

The final public offering price per unit will be determined through a negotiation between us and the underwriters in the offering and will take into account the recent market price of our common stock, the general condition of the securities market at the time of the offering, the history of, and the prospects for, the industry in which we compete, and our past and present operations and our prospects for future revenues. The assumed public offering price used throughout this prospectus may not be indicative of the actual final offering price.

We are also seeking to register the issuance of warrants to purchase 55,000 shares of Common Stock (the “Representative’s Warrants”) to the Underwriters, as a portion of the underwriting compensation payable in connection with this offering, as well as the 55,000 shares of Common Stock issuable upon exercise by the Underwriters of the Representative’s Warrants at an exercise price of $7.50 per share (125% of public offering price).

We have applied to list our common stock and warrants (forming part of the units offered hereby) on the NASDAQ Capital Market under the symbols “MOBQ” and “MOBQW,” respectively. There is no assurance that our listing application will be approved by the Nasdaq Capital Market. The approval of our listing on the Nasdaq Capital Market is a condition of closing this offering.

We will receive proceeds from the sale of the units being registered in this offering. See “Use of Proceeds” for more information about how we will use the proceeds from this offering.

An investment in our securities is speculative and involves a high degree of risk. Investors should carefully consider the risk factors and other uncertainties described in this prospectus before purchasing our securities. See “Risk Factors” beginning on page 7.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL, ACCURATE, OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

| Per Unit | Total | ||||||

| Public offering price (1) | $ | $ | |||||

| Underwriting discounts and commissions(2) | $ | $ | |||||

| Proceeds, before expenses, to us | $ | $ | |||||

_____________________

| (1) | The public offering price and underwriting discount and commissions in respect of each unit correspond to a public offering price per share of common stock of $ and a public offering price per accompanying warrant of $0.01. |

| (2) | This table depicts broker-dealer commissions of 8.00% of the gross offering proceeds. See “Underwriting” on page 66 for additional disclosure regarding underwriting discounts and commissions, overallotments, and reimbursement of expenses. |

We have granted the underwriters an option for a period of 45 days from the date of this prospectus to purchase up to an additional 275,000 shares of common stock and/or warrants to purchase 275,000 shares of common stock at the public offering price, less the underwriting discount, solely to cover over-allotments, if any.

We anticipate that delivery of the securities to purchasers in the offering will be made on or about [__], 2021.

| Spartan Capital Securities LLC | Revere Securities LLC |

The date of this prospectus is ____________, 2021.

TABLE OF CONTENTS

| i |

AVAILABLE INFORMATION

This prospectus constitutes a part of a registration statement on Form S-1 (together with all amendments and exhibits thereto, the “Registration Statement”) filed by us with the Securities and Exchange Commission (“SEC”) under the Securities Act of 1933, as amended (the “Securities Act”). As permitted by the rules and regulations of the SEC, this prospectus omits certain information contained in the Registration Statement, and reference is made to the Registration Statement and related exhibits for further information with respect to Mobiquity Technologies, Inc. and the securities offered hereby. With regard to any statements contained herein concerning the provisions of any document filed as an exhibit to the Registration Statement or otherwise filed with the SEC, in each instance reference is made to the copy of such document so filed. Each such statement is qualified in its entirety by such reference.

You should rely only on information contained in this prospectus or in any free writing prospectus we may authorize to be delivered or made available to you. We have not, and the underwriters have not, authorized anyone to provide you with additional information or information different from that contained in this prospectus or in any free writing prospectus. Neither the delivery of this prospectus nor the sale of our securities means that the information contained in this prospectus or any free writing prospectus is correct after the date of this prospectus or such free writing prospectus. This prospectus is not an offer to sell or the solicitation of an offer to buy our securities in any circumstances under which the offer or solicitation is unlawful or in any state or other jurisdiction where the offer is not permitted.

The information in this prospectus is accurate only as of the date on the front cover of this prospectus and the information in any free writing prospectus that we may provide you in connection with this offering is accurate only as of the date of that free writing prospectus. Our business, financial condition, results of operations and prospects may have changed since those dates.

No person is authorized in connection with this prospectus to give any information or to make any representations about us, the securities offered hereby or any matter discussed in this prospectus, other than the information and representations contained in this prospectus. If any other information or representation is given or made, such information or representation may not be relied upon as having been authorized by us.

Neither we nor any of the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than the United States. You are required to inform yourself about, and to observe any restrictions relating to, this offering and the distribution of this prospectus.

| 1 |

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus. Because this is only a summary, it does not contain all of the information that may be important to you. You should read this entire prospectus and should consider, among other things, the matters set forth under “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes thereto appearing elsewhere in this prospectus before making your investment decision. This prospectus contains forward-looking statements and information relating to Mobiquity Technologies, Inc. See “Cautionary Note Regarding Forward-Looking Statements” on page 23.

Our Company

We are a next-generation marketing and advertising technology and data intelligence company who operates through our proprietary software platforms in the programmatic advertising space, which has grown to over a $100 billion industry in approximately the last decade. Programmatic advertising is the automated buying and selling of digital advertising space using algorithms and software applications, in contrast to manual advertising which relies on human interaction and negotiation between publishers and marketers.

Our Mission

Our mission is to help advertisers target the delivery of their messages to the right person at the right time using our proprietary single-source end-to-end programmatic advertising and data intelligence technology platforms more efficiently and effectively than a stacked multi-vendor system.

The Programmatic Advertising and Data Markets

According to Statista, in 2020, global programmatic advertising spending reached an estimated $129 billion, with spending expected to surpass $150 billion by the end of 2021. In today’s competitive advertising landscape, marketers are increasingly using programmatic advertising and automation solutions to target audiences based on user data. Statista has forecasted that the marketing automation software market is on track to reach $17 billion by 2025, almost a threefold increase as compared to 2019.

According to MarketsandMarkets, the so-called big data market will grow to $229.4 billion by 2025. The proliferation of data from businesses in every industrial category, and all company sizes, has created a massive amount of data that is forcing many companies to adopt solution to manage data consumption, analysis and distribution. This modern era of data is essential for organizations to be efficient, stay competitive, and ultimately grow their businesses.

Our Opportunity

We perceived a problem in the advertising technology industry as it has rapidly grown over the last 10 years. We viewed the technology in the industry to be highly fragmented and thus inefficient. Many advertisers have had to mix multiple vendors’ different technologies, or bolt-on third-party technology to legacy technology, in an effort to create an integrated solution. This has led to the lack of a central source to address problems with an integrated system that arise.

We saw the opportunity to provide end-to-end global programmatic advertising solutions, integrating the required components from a single source that work together because they are built together, in an effective and cost-efficient way.

Our Solutions

Programmatic Advertising Platform

Our advertising technology operating system (or ATOS) platform is a single-vendor end-to-end solution that blends artificial intelligence (or AI) and machine learning (or ML)-based optimization technology that automatically serves advertising and manages digital advertising campaigns. Our ATOS platform engages with approximately 20 billion advertisement opportunities per day.

| 2 |

As an automated programmatic ecosystem, ATOS increases speed and performance, by providing dynamic technology that scales in real-time. It is this proprietary cloud-based architecture that keeps costs down and allows us to pass along savings to our customers. Also, by offering more of the features inherent in a digital advertising campaign, and removing the need for third-party integration of those features, we believe that our ATOS platform can generally be 30-40% more time efficient, and generally 20-30% more cost efficient than other Demand-Side Platforms (or DSPs). Our ATOS platform also decreases the effective cost basis for users by integrating all the necessary capabilities at no additional cost: DSP and bidding technologies, AdCop™ Fraud Protection, rich media and ad serving, attribution, reporting dashboard and DMP are all included.

Data Intelligence Platform

Our data intelligence platform provides precise data and insights on consumer’s real-world behavior and trends for use in marketing and research. Our management believes, based on its internal research in the industry, that we provide one of the most accurate and scaled solution for data collection and analysis, utilizing multiple internally developed proprietary technologies.

We provide our data intelligence platform to our customers on a managed services basis, and also offer a self-service alternative through our MobiExchange product, which is a software-as-a-service (or SaaS) fee model. MobiExchange is a data-focused technology solution that enables users to rapidly build actionable data and insights for its own use or for resale. MobiExchange’s easy-to-use, self-service tools allow anyone to reduce the complex technical and financial barriers typically associated with turning offline data, and other business data, into actionable digital products and services. MobiExchange provides out-of-the box private labeling, flexible branding, content management, user management, user communications, subscriptions, payment, invoices, reporting, gateways to third party platforms, and help desk, among other things.

Our Revenue Sources

We target brands, advertising agencies and other advertising technology companies as our audience for our ATOS platform products. Our sales and marketing strategy is focused on providing a de-fragmented operating system that facilitates a considerably more efficient and effective way for advertisers and publishers to transact with each other. Our goal is to become the programmatic display advertising industry standard for small and medium sized advertisers. We generate revenue from our ATOS platform through three verticals:

| · | managed services, where we handle all aspects of the programmatic display advertising campaign for an additional fee; |

| · | seats, which allows a brand or agency to log into our ATOS platform and run their own campaigns at predetermined margins; and |

| · | full white-label solutions, which allows our customers to license our ATOS technology as a SaaS for a fee to use on their own platform. |

Our data intelligence revenue is driven by managed services for advertising agencies, brands, market researchers, university research departments, healthcare, financial, sports, pet, civil planning, transportation and other data and technology companies and our MobiExchange self-service product. Often-times sales to users of our data intelligence platform will lead to those users using our ATOS platform as well.

Risk Factors

Investing in our securities involves risks. You should carefully consider the risks described in the “Risk Factors” section beginning on page 7 before making a decision to invest in our securities. If any of these risks actually occur, our business, financial condition and/or results of operations would likely be materially adversely affected. In each case, the trading price of our securities would likely decline, and you may lose all or part of your investment. The following is a summary of some of the principal risks we face:

| · | We have a history of operating losses and our management has concluded that factors raise substantial doubt about our ability to continue as a going concern and our auditor has included an explanatory paragraph relating to our ability to continue as a going concern in its audit report for the fiscal years ended December 31, 2020 and 2019. |

| 3 |

| · | We cannot predict our future capital needs and we may not be able to secure additional financing. |

| · | The Company’s financial condition and results of operations have been and may continue to be adversely affected by the COVID-19 pandemic. |

| · | The reliability of our product solutions is dependent on data from third-parties and the integrity and quality of that data. |

| · | Our business practices with respect to data and consumer protection could give rise to liabilities or reputational harm as a result of governmental regulation, legal requirements or industry standards relating to consumer privacy, data protection and consumer protection. |

| · | We face intense and growing competition, which could result in reduced sales and reduced operating margins, and limit our market share. |

| · | The market for programmatic advertising campaigns is relatively new and evolving. If this market develops slower or differently than we expect, our business, growth prospects and financial condition would be adversely affected. |

| · | If we fail to innovate and make the right investment decisions in our offerings and platform, we may not attract and retain advertisers and publishers and our revenue and results of operations may decline. |

| · | We need to protect our intellectual property or our operating results may suffer. |

| · | Our business practices with respect to data and consumer protection could give rise to liabilities or reputational harm as a result of governmental regulation, legal requirements or industry standards relating to consumer privacy, data protection and consumer protection. |

| · | Our failure to recruit or the loss of management and highly trained and qualified personnel could adversely affect our operations. |

| · | Our substantial amount of indebtedness may adversely affect our cash flow and our ability to operate our business, and make payments on our indebtedness. |

| · | We currently have identified significant deficiencies in our internal control over financial reporting that, if not corrected, could result in material misstatements of our financial statements. |

| · | There is a very limited public trading market for our common stock and; therefore, our investors may not be able to sell their shares and the price of our common stock may fluctuate substantially. Further, there is currently no trading market for our warrants and there can be no assurances that a trading market will develop. |

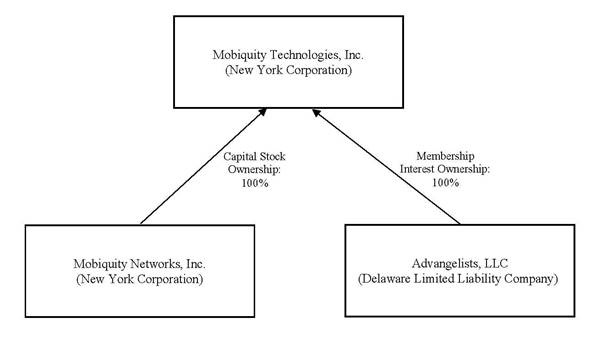

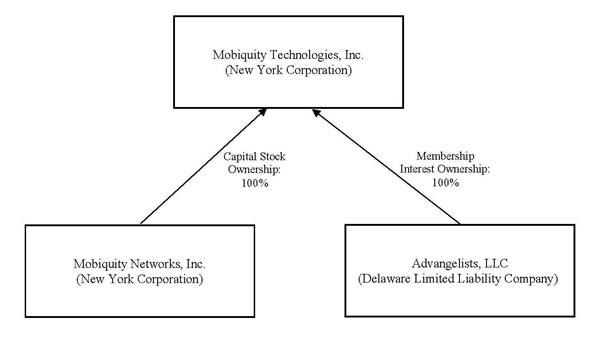

Corporate Information

We are based in New York and were incorporated in New York on March 16, 1998.

Our principal executive offices are located at 35 Torrington Lane, Shoreham, NY 11786. Our telephone number is (516) 246-9422, and our website is www.mobiquitytechnologies.com.

Our website and the information contained therein, or connected thereto, are not intended to be incorporated into this Registration Statement on Form S-1.

| 4 |

THE OFFERING

| Units Being Offered by the Company | 1,833,334 units (or 2,108,334 units if the Underwriters’ exercise the over-allotment option to purchase additional units in full), each unit consisting of one share of common stock and a warrant to purchase one share of common stock. The Units will not be certificated and the shares of our common stock and the warrants are immediately separable at closing and will be issued and tradeable separately, but will be purchased together as a unit in this offering. |

| Description of warrants included in units offered by us | The warrants included in the units are exercisable immediately, at an exercise price of $7.20 per share (equal to 120% of the public offering price per unit) and expire five years from the date of issuance. This prospectus also relates to the shares of common stock issuable upon exercise of the warrants. |

| Over-allotment option | We have granted the Representative an option to purchase up to an additional 275,000 shares of common stock and/or warrants to purchase up to 275,000 shares of common stock (equal to 15% of the number of shares of common stock and warrants underlying the Units sold in the offering), from us in any combination thereof, at the public offering price less the underwriting discount and commissions solely to cover over-allotments, if any. The Representative may exercise this option in full or in part at any time and from time to time until 45 days after the date of this prospectus. |

| Securities Being Offered by the Selling Shareholders | 281,250 shares of our common stock are being offered by the Selling Shareholders in a Resale Prospectus. |

| Shares of Common Stock Outstanding Prior to the Offering | 3,685,689 shares of our common stock. |

| Shares of Common Stock Outstanding Immediately Following this Offering | 5,519,023 shares of our common stock (or 5,794,023 shares if the underwriters exercise of their over-allotment option to purchase additional units in full), assuming no exercise of the warrants being offered in this offering. |

| Offering Price Per Unit Being Offered by the Company | $6.00 per unit (based on an assumed public offering price per unit of $6.00). The actual offering price per unit will be as determined among the underwriters and us based on market conditions at the time of pricing and may be issued at a discount to the current market price of our common stock. Therefore, the recent market price used throughout this prospectus may not be indicative of the final offering price. |

| Representative’s Warrant | The registration statement of which this prospectus is a part also registers for sale warrants (the “Representative’s Warrants”) to purchase 55,000 shares of common stock (3% of the shares of common stock sold in this offering) to the underwriters, as a portion of the underwriting compensation payable in connection with this offering. The Representative’s Warrants will be exercisable at any time, and from time to time, in whole or in part, during the five year period commencing 180 days following the effective date of the registration statement of which this prospectus is a part at an exercise price of $7.50 (125% of the public offering price of the units). Please see “Underwriting—Representative’s Warrants” for a description of these warrants. |

| OTCQB Trading Symbol and Proposed NASDAQ Trading Symbol | Our shares of common stock trade on the OTCQB market under the symbol “MOBQ”. We have applied to list our common stock and warrants comprising of the units on the Nasdaq Capital Market under the symbols “MOBQ” and “MOBQW,” respectively. No assurance can be given that our application for a Nasdaq Capital Market listing will be approved. The approval of our listing on the Nasdaq Capital Market is a condition of closing this offering. |

| We will not be issuing physical units in this offering. At closing, we will issue to investors only the shares of common stock and warrants underlying the units offered hereby. | |

| Risk Factors | An investment in our securities is highly speculative and involves a high degree of risk. See “Risk Factors” beginning on page 7. |

| Voting Rights | Shares of our common stock are entitled to one vote per share. There are no other classes of stock entitled to vote and, therefore, all holders of our common stock, including our officers and directors, are entitled to the same voting rights. |

| Lock-Ups | We, our officers and directors, and certain holders of our capital stock will enter into lock-ups restricting the transfer of shares of, or relating to, our capital stock for 180 days after the date of this prospectus. |

| 5 |

Unless we indicate otherwise, all information in this prospectus:

| · | is based on 3,685,689 shares of common stock issued and outstanding as of November 19, 2021; |

| · | assumes no exercise by the underwriters of their option to purchase up to an additional 275,000 shares of common stock and/or warrants to purchase up to 275,000 shares of common stock to cover over-allotments, if any; |

| · | excludes 304,930 shares of our common stock issuable upon exercise of outstanding stock options by the members of our board of directors and third parties at a weighted average exercise price of $46.16 per share as of November 19, 2021; |

| · | excludes 904,136 shares of our common stock issuable upon exercise of outstanding warrants held by investors at a weighted average price of $47.68 per share as of November 19, 2021; |

| · | excludes 2,108,334 shares of common stock issuable upon the full exercise of the warrants (included as part of the units and over-allotment option) offered hereby; |

| · | excludes 55,000 shares of our common stock issuable upon the exercise of warrants we expect to grant to the underwriters in this offering at an exercise price of $7.50 per share as of November 19, 2021; |

| · | excludes 923,833 shares of our common stock issuable upon conversion of outstanding convertible debt at a weighted average price of $4.97 as of November 19, 2021; |

| · | excludes 1,100,000 shares of our common stock reserved for future grants pursuant to the exercise of options or other equity awards under our stock incentive plans, including 825,000 options which are being granted on the date of this Prospectus at an exercise price equal to 110% of the public offering price of this offering, and |

| · | excludes 168,324 shares issuable upon conversion of outstanding Preferred Stock as of November 19, 2021. |

| 6 |

RISK FACTORS

An investment in our securities is highly speculative, involves a high degree of risk and should be made only by investors who can afford a complete loss. You should carefully consider the following risk factors, together with the other information in this prospectus, including our financial statements and the related notes, before you decide to buy our securities. If any of the following risks actually occurs, then our business, financial condition or results of operations could be materially adversely affected, the trading of our common stock and warrants could decline, and you may lose all or part of your investment therein. In addition to the risks outlined below, risks and uncertainties not presently known to us or that we currently consider immaterial may also impair our business operations. Potential risks and uncertainties that could affect our operating results and financial condition include, without limitation, the following:

Risks Relating to our Business Operations

We have a history of operating losses and our management has concluded that factors raise substantial doubt about our ability to continue as a going concern and our auditor has included an explanatory paragraph relating to our ability to continue as a going concern in its audit report for the fiscal years ended December 31, 2020 and 2019.

To date, we have not been profitable and have incurred significant losses and cash flow deficits. For the fiscal years ended December 31, 2020 and 2019, we reported net losses of $15,029,395 and $43,747,375, respectively, and negative cash flow from operating activities of $4,750,443 and $8,342,506, respectively. For the nine months ended September 30, 2021, we reported a net loss of $9,000,988 and had negative cash flow from operating activities of $5,060,535. As of September 30, 2021, we had an aggregate accumulated deficit of $194,904,072. Our operating losses for the past several years are primarily attributable to the transformation of our company into an advertising technology corporation. We can provide no assurances that our operations will generate consistent or predictable revenue or be profitable in the foreseeable future. Our management has concluded that our historical recurring losses from operations and negative cash flows from operations as well as our dependence on private equity and other financings raise substantial doubt about our ability to continue as a going concern, and our auditor has included an explanatory paragraph relating to our ability to continue as a going concern in its audit report for the fiscal year ended December 31, 2020 and 2019.

Our consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty. These adjustments would likely include substantial impairment of the carrying amount of our assets and potential contingent liabilities that may arise if we are unable to fulfill various operational commitments. In addition, the value of our securities, including common stock issued in this offering, would be greatly impaired. Our ability to continue as a going concern is dependent upon generating sufficient cash flow from operations and obtaining additional capital and financing, including funds to be raised in this offering. If our ability to generate cash flow from operations is delayed or reduced and we are unable to raise additional funding from other sources, we may be unable to continue in business even if this offering is successful. For further discussion about our ability to continue as a going concern and our plan for future liquidity, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Ability to Continue as a Going Concern.”

We cannot predict our future capital needs and we may not be able to secure additional financing.

From January 2013 through September 2021, we raised a total of over $40 million in private equity and debt financing to support our transformation from an integrated marketing company to a technology company. Since we might be unable to generate recurring or predictable revenue or cash flow to fund our operations, we will likely need to seek additional (perhaps substantial) equity or debt financing even following this offering to provide the capital required to maintain or expand our operations. We expect that we will also need additional funding for developing products and services, increasing our sales and marketing capabilities, and acquiring complementary companies, technologies and assets (there being no such acquisitions which we have identified or are pursuing as of the date of this prospectus), as well as for working capital requirements and other operating and general corporate purposes. We cannot predict our future capital needs with precision, and we may not be able to secure additional financing on terms satisfactory to us, if at all, which could lead to termination of our business.

| 7 |

If we elect to raise additional funds or additional funds are required, we may seek to raise funds from time to time through public or private equity offerings, debt financings or other financing alternatives. Additional equity or debt financing may not be available on acceptable terms, if at all. If we are unable to raise additional capital in sufficient amounts or on terms acceptable to us, we will be prevented from pursuing operational development and commercialization efforts and our ability to generate revenues and achieve or sustain profitability will be substantially harmed.

If we raise additional funds by issuing equity securities, our shareholders will experience dilution. Debt financing, if available, would result in increased fixed payment obligations and may involve agreements that include covenants limiting or restricting our ability to take specific actions, such as incurring additional debt, making capital expenditures or declaring dividends. Any debt financing or additional equity that we raise may contain terms, such as liquidation and other preferences, which are not favorable to us or our stockholders. If we raise additional funds through collaboration and licensing arrangements with third parties, it may be necessary to relinquish valuable rights to our technologies, future revenue streams or product candidates or to grant licenses on terms that may not be favorable to us. Should the financing we require to sustain our working capital needs be unavailable or prohibitively expensive when we require it, our business, operating results, financial condition and prospects could be materially and adversely affected, and we may be unable to continue our operations. Failure to secure additional financing on favorable terms could have severe adverse consequences to us.

The Company’s financial condition and results of operations have been and may continue to be adversely affected by the COVID-19 pandemic.

Since March 2020, COVID -19 has caused a material and substantial adverse impact on our general economy and our business operations. It has caused there to be a substantial decrease in our sales, cancellations of purchase orders and has resulted in accounts receivables not being timely paid as anticipated. Further, it has caused us to have concerns about our ability to meet our obligations as they become due and payable. In this respect, our business is directly dependent upon and correlates closely to the marketing levels and ongoing business activities of our existing clients. If material adverse developments in domestic and global economic and market conditions adversely affect our clients’ businesses, such as COVID-19, our business and results of operations could (and in the case of COVID-19) equally suffer. Our results of operations are affected directly by the level of business activity of our clients, which in turn is affected by the level of economic activity in the industries and markets that they serve. COVID-19 future widespread economic slowdowns in any of these markets, particularly in the United States, may negatively affect the businesses, purchasing decisions and spending of our clients and prospective clients, and payment of accounts receivable due us, which could result in reductions in our existing business as well as our new business development and difficulties in meeting our cash obligations as they become due. In the event of continued widespread economic downturn caused by COVID-19, we will likely continue to experience a reduction in projects, longer sales and collection cycles, deferral or delay of purchase commitments for our data products, processing functionality, software systems and services, and increased price competition, all of which could substantially adversely affect revenue and our ability to remain a going concern.

In the event we remain a going concern, the impacts of the global emergence of Coronavirus disease (COVID-19) on our business, sources of revenues and then general economy, are currently not fully known. We are conducting business as usual with some modifications to employee work locations, and cancellation of certain marketing events, among other modifications. We lost a purchase order in excess of one million dollars with major US sports organization. We have observed other companies taking precautionary and preemptive actions to address COVID-19 and companies may take further actions that alter their normal business operations. We will continue to actively monitor the situation and may take further actions that alter our business operations as may be required by federal, state or local authorities or that we determine are in the best interests of our employees, customers, partners, suppliers and stockholders. It is not clear what the potential effects any such alterations or modifications may have on our business, including the effects on our customers and prospects, although we do anticipate it to continue to negatively impact our financial results during fiscal years 2021 and 2022.

Forecasts of our revenue is difficult.

When purchasing our products and services, our clients and prospects are often faced with a significant commitment of capital, the need to integrate new software and/or hardware platforms and other changes in company-wide operational procedures, all of which result in cautious deliberation and evaluation by prospective clients, longer sales cycles and delays in completing transactions. Additional delays result from the significant up-front expenses and substantial time, effort and other resources necessary for our clients to implement our solutions. For example, depending on the size of a prospective client’s business and its needs, a sales cycle can range from two weeks to 12 months. Because of these longer sales cycles, revenues and operating results may vary significantly from period to period. As a result, it is often difficult to accurately forecast our revenues for any fiscal period as it is not always possible for us to predict the fiscal period in which sales will actually be completed. This difficulty in predicting revenue, combined with the revenue fluctuations we may experience from period to period, can adversely affect and cause substantial fluctuations in our stock price.

| 8 |

The reliability of our product solutions is dependent on data from third-parties and the integrity and quality of that data.

Much of the data that we use is licensed from third-party data suppliers, and we are dependent upon our ability to obtain necessary data licenses on commercially reasonable terms. We could suffer material adverse consequences if our data suppliers were to withhold their data from us. For example, data suppliers could withhold their data from us if there is a competitive reason to do so; if we breach our contract with a supplier; if they are acquired by one of our competitors; if legislation is passed restricting the use or dissemination of the data they provide; or if judicial interpretations are issued restricting use of such data. Additionally, we could terminate relationships with our data suppliers if they fail to adhere to our data quality standards. If a substantial number of data suppliers were to withdraw or withhold their data from us, or if we sever ties with our data suppliers based on their inability to meet our data standards, our ability to provide products and services to our clients could be materially adversely impacted, which could result in decreased revenues.

The reliability of our solutions depends upon the integrity and quality of the data in our database. A failure in the integrity or a reduction in the quality of our data could cause a loss of customer confidence in our solutions, resulting in harm to our brand, loss of revenue and exposure to legal claims. We may experience an increase in risks to the integrity of our database and quality of our data as we move toward real-time, non-identifiable, consumer-powered data through our products. We must continue to invest in our database to improve and maintain the quality, timeliness and coverage of the data if we are to maintain our competitive position. Failure to do so could result in a material adverse effect on our business, growth and revenue prospects.

Our business practices with respect to data and consumer protection could give rise to liabilities or reputational harm as a result of governmental regulation, legal requirements or industry standards relating to consumer privacy, data protection and consumer protection.

Federal, state and international laws and regulations govern the collection, use, retention, sharing and security of data that we collect. We strive to comply with all applicable laws, regulations, self-regulatory requirements and legal obligations relating to privacy, data protection and consumer protection, including those relating to the use of data for marketing purposes. It is possible, however, that these requirements may be interpreted and applied in a manner that is inconsistent from one jurisdiction to another and may conflict with other rules or our practices. We cannot assure you that our practices have complied, comply, or will comply fully with all such laws, regulations, requirements and obligations. Any failure, or perceived failure, by us to comply with federal, state or international laws or regulations, including laws and regulations regulating privacy, data security, marketing communications or consumer protection, or other policies, self-regulatory requirements or legal obligations could result in harm to our reputation, a loss in business, and proceedings or actions against us by governmental entities, consumers, retailers or others. We may also be contractually liable to indemnify and hold harmless performance marketing networks or other third parties from the costs or consequences of noncompliance with any laws, regulations, self-regulatory requirements or other legal obligations relating to privacy, data protection and consumer protection or any inadvertent or unauthorized use or disclosure of data that we store or handle as part of operating our business. Any such proceeding or action, and any related indemnification obligation, could hurt our reputation, force us to incur significant expenses in defense of these proceedings, distract our management, increase our costs of doing business and cause consumers and retailers to decrease their use of our marketplace, and may result in the imposition of monetary liability. Furthermore, the costs of compliance with, and other burdens imposed by, the data and privacy laws, regulations, standards and policies that are applicable to the businesses of our clients may limit the use and adoption of, and reduce the overall demand for, our products.

A significant breach of the confidentiality of the information we hold or of the security of our or our customers’, suppliers’, or other partners’ computer systems could be detrimental to our business, reputation and results of operations. Our business requires the storage, transmission and utilization of data. Although we have security and associated procedures, our databases may be subject to unauthorized access by third parties. Such third parties could attempt to gain entry to our systems for the purpose of stealing data or disrupting the systems. We believe we have taken appropriate measures to protect our systems from intrusion, but we cannot be certain that advances in criminal capabilities, discovery of new vulnerabilities in our systems and attempts to exploit those vulnerabilities, physical system or facility break-ins and data thefts or other developments will not compromise or breach the technology protecting our systems and the information we possess. Furthermore, we face increasing cyber security risks as we receive and collect data from new sources, and as we and our customers continue to develop and operate in cloud-based information technology environments. In the event that our protection efforts are unsuccessful, and we experience an unauthorized disclosure of confidential information or the security of such information or our systems are compromised, we could suffer substantial harm. Any breach could result in one or more third parties obtaining unauthorized access to our customers’ data or our data, including personally identifiable information, intellectual property and other confidential business information. Such a security breach could result in operational disruptions that impair our ability to meet our clients’ requirements, which could result in decreased revenues. Also, whether there is an actual or a perceived breach of our security, our reputation could suffer irreparable harm, causing our current and prospective clients to reject our products and services in the future and deterring data suppliers from supplying us data. Further, we could be forced to expend significant resources in response to a security breach, including repairing system damage, increasing cyber security protection costs by deploying additional personnel and protection technologies, and litigating and resolving legal claims, all of which could divert the attention of our management and key personnel away from our business operations. In any event, a significant security breach could materially harm our business, financial condition and operating results.

| 9 |

Significant system disruptions, loss of data center capacity or interruption of telecommunication links could adversely affect our business and results of operations.

Our product platforms are hosted and managed on Amazon Web Service (AWS) and takes full advantage of open standards for processing, storage, security and big data technology. Significant system disruptions, loss of data center capacity or interruption of telecommunication links could adversely affect our business, results of operations and financial condition. Our business is heavily dependent upon highly complex data processing capability. The ability or our platform hosts and managers to protect these data centers against damage or interruption from fire, flood, tornadoes, power loss, telecommunications or equipment failure or other disasters is beyond our control and is critical to our ability to succeed.

We rely on information technology to operate our business and maintain competitiveness, and any failure to adapt to technological developments or industry trends could harm our business.

We depend on the use of information technologies and systems. As our operations grow in size and scope, we will be required to continuously improve and upgrade our systems and infrastructure while maintaining or improving the reliability and integrity of our infrastructure. Our future success also depends on our ability to adapt our systems and infrastructure to meet rapidly evolving consumer trends and demands while continuing to improve the performance, features and reliability of our solutions in response to competitive services and product offerings. The emergence of alternative platforms will require new investment in technology. New developments in other areas, such as cloud computing, could also make it easier for competition to enter our markets due to lower up-front technology costs. In addition, we may not be able to maintain our existing systems or replace or introduce new technologies and systems as quickly as we would like or in a cost-effective manner.

Our technology and associated business processes may contain undetected errors, which could limit our ability to provide our services and diminish the attractiveness of our offerings.

Our technology may contain undetected errors, defects or bugs. As a result, our customers or end users may discover errors or defects in our technology or the systems incorporating our technology may not operate as expected. We may discover significant errors or defects in the future that we may not be able to fix. Our inability to fix any of those errors could limit our ability to provide our solution, impair the reputation of our brand and diminish the attractiveness of our product offerings to our customers. In addition, we may utilize third party technology or components in our products, and we rely on those third parties to provide support services to us. Failure of those third parties to provide necessary support services could materially adversely impact our business.

We need to protect our intellectual property or our operating results may suffer.

Third parties may infringe our intellectual property and we may suffer competitive injury or expend significant resources enforcing our rights. As our business is focused on data-driven results and analytics, we rely heavily on proprietary information technology. Our proprietary portfolio consists of various intellectual property including source code, trade secrets, and know-how. The extent to which such rights can be protected is substantially based on federal, state and common law rights as well as contractual restrictions. The steps we have taken to protect our intellectual property may not prevent the misappropriation of our proprietary information or deter independent development of similar technologies by others. If we do not enforce our intellectual property rights vigorously and successfully, our competitive position may suffer which could harm our operating results.

We could incur substantial costs and disruption to our business as a result of any claim of infringement of another party’s intellectual property rights, which could harm our business and operating results.

From time to time, third parties may claim that one or more of our products or services infringe their intellectual property rights. We analyze and take action in response to such claims on a case-by-case basis. Any dispute or litigation regarding patents or other intellectual property could be costly and time-consuming due to the complexity of our technology and the uncertainty of intellectual property litigation, which could divert the attention of our management and key personnel away from our business operations. A claim of intellectual property infringement could force us to enter into a costly or restrictive license agreement, which might not be available under acceptable terms or at all, or could subject us to significant damages or to an injunction against development and sale of certain of our products or services.

| 10 |

We face intense and growing competition, which could result in reduced sales and reduced operating margins, and limit our market share.

We compete in the data, marketing and research business and in all other facets of our business against small, medium and large companies throughout the United States. Some examples include companies such as LiveRamp, Beeswax and TradeDesk. If we are unable to successfully compete for new business our revenue growth and operating margins may decline. The market for our advertising and marketing technology operating system platform is competitive. We believe that our competitors’ product offerings in that our competitor’s products do not provide the end-to-end solutions our product solutions do, and their minimum fees are substantially higher than ours for a comparative suite of solutions. However, barriers to entry in our markets are relatively low. With the introduction of new technologies and market entrants, we expect competition to intensify in the future. Some of these competitors may be in a better position to develop new products and strategies that more quickly and effectively respond to changes in customer requirements in our markets. The introduction of competent, competitive products, pricing strategies or other technologies by our competitors that are superior to or that achieve greater market acceptance than our products and services could adversely affect our business. Our failure to meet a client’s expectations in any type of contract may result in an unprofitable engagement, which could adversely affect our operating results and result in future rejection of our products and services by current and prospective clients. Some of our principal competitors offer their products at a lower price, which may result in pricing pressures. These pricing pressures and increased competition generally could result in reduced sales, reduced margins or the failure of our product and service offerings to achieve or maintain more widespread market acceptance.

Many of our competitors are substantially larger than we are and have significantly greater financial, technical and marketing resources, and established direct and indirect channels of distribution. As a result, they are able to devote greater resources to the development, promotion and sale of their products than we can.

We can provide no assurance that our business will be able to maintain a competitive technology advantage in the future.

Our ability to generate revenues is substantially based upon our proprietary intellectual property that we own and protect through trade secrets and agreements with our employees to maintain ownership of any improvements to our intellectual property. Our ability to generate revenues now and in the future is based upon maintaining a competitive technology advantage over our competition. We can provide no assurances that we will be able to maintain a competitive technology advantage in the future over our competitors, many of whom have significantly more experience, more extensive infrastructure and are better capitalized than us.

No assurances can be given that we will be able to keep up with a rapidly changing business information market.

Consumer needs and the business information industry as a whole are in a constant state of change. Our ability to continually improve our current processes and products in response to these changes and to develop new products and services to meet those needs are essential in maintaining our competitive position and meeting the increasingly sophisticated requirements of our customers. If we fail to enhance our current products and services or fail to develop new products in light of emerging industry standards and information requirements, we could lose customers to current or future competitors, which could result in impairment of our growth prospects and revenues.

The market for programmatic advertising campaigns is relatively new and evolving. If this market develops slower or differently than we expect, our business, growth prospects and financial condition would be adversely affected.

A substantial portion of our revenue has been derived from customers that programmatically purchase and sell advertising inventory through our platform. We expect that spending on programmatic ad buying and selling will continue to a significant source of revenue for the foreseeable future, and that our revenue growth will largely depend on increasing spend through our platform. The market for programmatic ad buying is an emerging market, and our current and potential customers may not shift quickly enough to programmatic ad buying from other buying methods, reducing our growth potential. Because our industry is relatively new, we will encounter risks and difficulties frequently encountered by early-stage companies in similarly rapidly evolving industries, including the need to:

| · | Maintain our reputation and build trust with advertisers and digital media property owners; |

| 11 |

| · | Offer competitive pricing to publishers, advertisers, and digital media agencies; |

| · | Maintain quality and expand quantity of our advertising inventory; |

| · | Continue to develop, launch and upgrade the technologies that enable us to provide our solutions; |

| · | Respond to evolving government regulations relating to the internet, telecommunications, mobile, privacy, marketing and advertising aspects of our business; |

| · | Identify, attract, retain and motivate qualified personnel; and |

| · | Cost-effectively manage our operations, including our international operations. |

If the market for programmatic ad buying deteriorates or develops more slowly than we expect, it could reduce demand for our platform, and our business, growth prospects and financial condition would be adversely affected.

In addition, revenue may not necessarily grow at the same rate as spend on our platform. Growth in spend may outpace growth in our revenue as the market for programmatic advertising matures due to a number of factors including quantity discounts and product, media, customer and channel mix shifts. A significant change in revenue as a percentage of spend could reflect an adverse change in our business and growth prospectus. In addition, any such fluctuations, even if they reflect our strategic decisions, could cause our performance to fall below the expectations of securities analysts and investors, and adversely affect the price of our common stock.

Our failure to maintain and grow the customer base on our platform may negatively impact our revenue and business.

To sustain or increase our revenue, we must regularly add both new advertiser customers and publishers, while simultaneously keeping existing customers to maintain or increase the amount of advertising inventory purchased through our platform and adopt new features and functionalities that we add to our platform. If our competitors introduce lower cost or differentiated offerings that compete with or are perceived to compete with ours, our ability to sell access to our platform to new or existing customers could be impaired. Our agreements with our customers allow them to change the amount of spending on our platform or terminate our services with limited notice. Our customers typically have relationships with different providers and there is limited cost to moving budgets to our competitors. As a result, we may have limited visibility as to our future advertising revenue streams. We cannot assure you that our customers will continue to use our platform or that we will be able to replace, in a timely or effective manner, departing customers with new customers that generate comparable revenue. If a major customer representing a significant portion of our business decides to materially reduce its use of our platform or to cease using our platform altogether, it is possible that our revenue could be significantly reduced.

We rely substantially on a limited number customers for a significant percentage of our sales.

During the nine-month period ending on September 30, 2021, sales of our products to four customers generated 35.93% of our revenues. Our contracts with our customers generally do not obligate them to a specified term and they can generally terminate their relationship with us at any time with a minimal amount of notice. If we lose any of our customers, or any of them decide to scale back on purchases of our products, it will have a material adverse effect on our financial condition and prospects. Therefore, we must engage in continual sales efforts to maintain revenue, sustain our customer relationships and expand our client base or our operating results will suffer. If a significant client fails to renew a contract or renews the contract on terms less favorable to us than before, our business could be negatively impacted if additional business is not obtained to replace or supplement that which was lost. We require financial resources to expand our internal and external sales capabilities, and plan to use a portion of the net proceeds from the offering of our shares under this prospectus for such purpose. We cannot assure that we will be able to sustain our customer relationships and expand our client base. The loss of any of our current customers or our inability to expand our customer base will have a material adverse effect on our business plans and prospects.

| 12 |

If we fail to innovate and make the right investment decisions in our offerings and platform, we may not attract and retain advertisers and publishers and our revenue and results of operations may decline.

Our industry is subject to rapid and frequent changes in technology, evolving customer needs and the frequent introduction by our competitors of new and enhanced offerings. We must constantly make investment decisions regarding our offerings and technology to meet customer demand and evolving industry standards. We may make wrong decisions regarding these investments. If new or existing competitors have more attractive offerings or functionalities, we may lose customers or customers may decrease their use of our platform. New customer demands, superior competitive offerings or new industry standards could require us to make unanticipated and costly changes to our platform or business model. If we fail to adapt to our rapidly changing industry or to evolving customer needs, demand for our platform could decrease and our business, financial condition and operating results may be adversely affected.

We may not be able to integrate, maintain and enhance our advertising solutions to keep pace with technological and market developments.

The market for digital video advertising solutions is characterized by rapid technological change, evolving industry standards and frequent introductions of new products and services. To keep pace with technological developments, satisfy increasing publisher and advertiser requirements, maintain the attractiveness and competitiveness of our advertising solutions and ensure compatibility with evolving industry standards and protocols, we will need to anticipate and respond to varying product lifecycles, regularly enhance our current advertising solutions and develop and introduce new solutions and functionality on a timely basis. This requires significant investment of financial and other resources. For example, we will need to invest significant resources into expanding and developing our platforms in order to maintain a comprehensive solution. Ad exchanges and other technological developments may displace us or introduce an additional intermediate layer between us and our customers and digital media properties that could impair our relationships with those customers.

If we fail to detect advertising fraud, we could harm our reputation and hurt our ability to execute our business plan.

As we are in the business of providing services to publishers, advertisers and agencies, we must deliver effective digital advertising campaigns. Despite our efforts to implement fraud protection techniques in our platforms, some of advertising and agency campaigns may experience fraudulent and other invalid impressions, clicks or conversions that advertisers may perceive as undesirable, such as non-human traffic generated by computers designed to simulate human users and artificially inflate user traffic on websites. These activities could overstate the performance of any given digital advertising campaign and could harm our reputation. It may be difficult for us to detect fraudulent or malicious activity because we do not own content and rely in part on our digital media properties to control such activity. Industry self-regulatory bodies, the U.S. Federal Trade Commission and certain influential members of Congress have increased their scrutiny and awareness of, and have taken recent actions to address, advertising fraud and other malicious activity. If we fail to detect or prevent fraudulent or other malicious activity, the affected advertisers may experience or perceive a reduced return on their investment and our reputation may be harmed. High levels of fraudulent or malicious activity could lead to dissatisfaction with our solutions, refusals to pay, refund or future credit demands or withdrawal of future business.

The loss of advertisers and publishers as customers could significantly harm our business, operating results and financial condition.

Our customer base consists primarily of advertisers and publishers. We do not have exclusive relationships with advertising agencies, companies that are advertisers, or publishers, such that we largely depend on agencies to work with us as they embark on advertising campaigns for advertisers. The loss of agencies as customers and referral sources could significantly harm our business, operating results and financial condition. If we fail to maintain satisfactory relationships with an advertising agency, we risk losing business from the advertisers represented by that agency.

Furthermore, advertisers and publishers may change advertising agencies. If an advertiser switches from an agency that utilizes our platform to one that does not, we will lose revenue from that advertiser. In addition, some advertising agencies have their own relationships with publishers that are different that our relationships, such that they might directly connect advertisers with such publishers. Our business may suffer to the extent that advertising agencies and inventory suppliers purchase and sell advertising inventory directly from one another or through intermediaries other than us.

| 13 |

Our sales efforts with advertisers and publishers require significant time and expense.

Attracting new advertisers and publishers requires substantial time and expense, and we may not be successful in establishing new relationships or in maintaining or advancing our current relationships.

Our solutions, including our programmatic solutions, and our business model often requires us to spend substantial time and effort educating our own sales force and potential advertisers, advertising agencies, supply side platforms and digital media properties about our offerings, including providing demonstrations and comparisons against other available solutions. This process is costly and time-consuming. If we are not successful in targeting, supporting and streamlining our sales processes, our ability to grow our business may be adversely affected.

Changes in consumer sentiment or laws, rules or regulations regarding tracking technologies and other privacy matters could have a material adverse effect on our ability to generate net revenues and could adversely affect our ability to collect data on consumer shopping behavior.

The collection and use of electronic information about user is an important element of our data intelligence technology and solutions. However, consumers may become increasingly resistant to the collection, use and sharing of information, including information used to deliver advertising and to attribute credit to publishers in performance marketing programs, and take steps to prevent such collection, use and sharing of information. For example, consumer complaints and/or lawsuits regarding advertising or other tracking technologies in general and our practices specifically could adversely impact our business. In addition to this change in consumer preferences, if retailers or brands perceive significant negative consumer reaction to targeted advertising or the tracking of consumers’ activities, they may determine that such advertising or tracking has the potential to negatively impact their brand. In that case, advertisers may limit or stop the use of our solutions, and our operating results and financial condition would be adversely affected.

Government regulation of the Internet, e-commerce and m-commerce is evolving, and unfavorable changes or failure by us to comply with these laws and regulations could substantially harm our business and results of operations.

We are subject to general business regulations and laws as well as regulations and laws specifically governing the Internet, e-commerce and m-commerce in a number of jurisdictions around the world. Existing and future regulations and laws could impede the growth of the Internet, e-commerce, m-commerce or other online services. These regulations and laws may involve taxation, tariffs, privacy and data security, anti-spam, data protection, content, copyrights, distribution, electronic contracts, electronic communications and consumer protection. It is not clear how existing laws and regulations governing issues such as property ownership, sales and other taxes, libel and personal privacy apply to the Internet as the vast majority of these laws and regulations were adopted prior to the advent of the Internet and do not contemplate or address the unique issues raised by the Internet, e-commerce or m-commerce. It is possible that general business regulations and laws, or those specifically governing the Internet, e-commerce or m-commerce may be interpreted and applied in a manner that is inconsistent from one jurisdiction to another and may conflict with other rules or our practices. We cannot assure you that our practices have complied, comply or will comply fully with all such laws and regulations. Any failure, or perceived failure, by us to comply with any of these laws or regulations could result in damage to our reputation, a loss in business, and proceedings or actions against us by governmental entities or others. Any such proceeding or action could hurt our reputation, force us to spend significant resources in defense of these proceedings, distract our management, increase our costs of doing business, and cause consumers and retailers to decrease their use of our marketplace, and may result in the imposition of monetary liability. We may also be contractually liable to indemnify and hold harmless third parties from the costs or consequences of noncompliance with any such laws or regulations. In addition, it is possible that governments of one or more countries may seek to censor content available on our websites and mobile applications or may even attempt to completely block access to our marketplace. Adverse legal or regulatory developments could substantially harm our business. In particular, in the event that we are restricted, in whole or in part, from operating in one or more countries, our ability to retain or increase our customer base may be adversely affected and we may not be able to maintain or grow our net revenues as anticipated.

| 14 |

We may be required to invest significant monies upfront in capital intensive project(s) which we may be unable to recover.