UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM

(Mark One)

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

OR |

|

|

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

|

OR |

|

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

OR |

|

|

|

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

Date of event requiring this shell company report

For the transition period from to

Commission file number:

(Exact name of Registrant as specified in its charter) |

|

N/A |

(Translation of Registrant’s name into English) |

|

Antigua, West Indies |

(Jurisdiction of incorporation or organization) |

|

(Address of principal executive offices) |

|

Chief Financial Officer Tel: Fax: E-mail: |

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person) |

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

|

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None |

(Title of Class) |

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None |

(Title of Class) |

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

☐ Yes ☒

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

☐ Yes ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

☒

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or such shorter period that the registrant was required to submit such files).

☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ |

Non-accelerated filer ☐ |

|

|

|

Emerging growth company |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

|

International Financial Reporting Standards as issued by the International Accounting Standards Board ☐ |

|

Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

☐ Item 17 ☐ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

☐ Yes ☒ No

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

☐ Yes

CONTENTS

1 |

|||

|

|

|

|

1 |

|||

|

|

||

2 |

|||

|

|

|

|

|

2 |

||

|

2 |

||

|

2 |

||

|

32 |

||

|

49 |

||

|

49 |

||

|

60 |

||

|

70 |

||

|

71 |

||

|

76 |

||

|

76 |

||

|

89 |

||

|

90 |

||

|

|

|

|

91 |

|||

|

|

|

|

|

91 |

||

|

Material Modifications to the Rights of Security Holders and Use of Proceeds |

91 |

|

|

92 |

||

|

93 |

||

|

93 |

||

|

93 |

||

|

93 |

||

|

Purchases of Equity Securities by the Issuer and Affiliated Purchasers |

93 |

|

|

93 |

||

|

93 |

||

|

94 |

||

|

Disclosure Regarding Foreign Jurisdictions That Prevent Inspections |

94 |

|

94 |

|||

|

|

||

95 |

|||

|

|

|

|

|

95 |

||

|

95 |

||

|

95 |

||

INTRODUCTION

In this annual report on Form 20-F, unless otherwise indicated or unless the context otherwise requires,

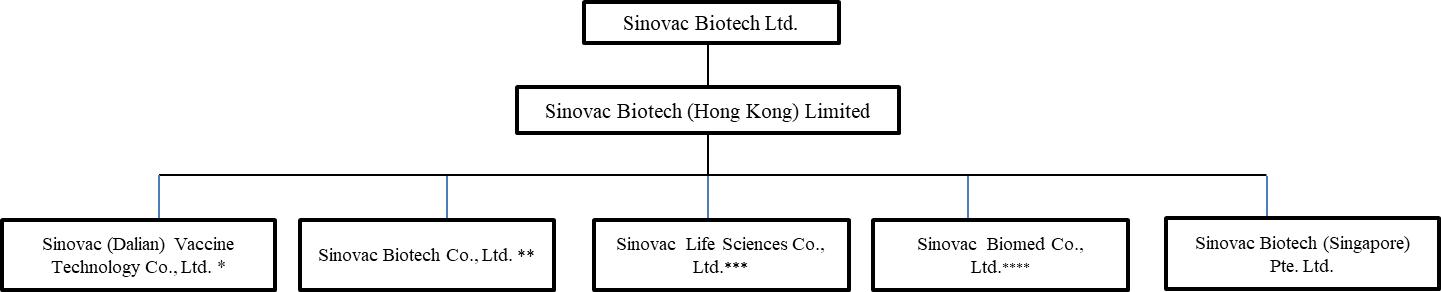

· “Sinovac,” “Sinovac Biotech,” “Company,” “we,” “us,” “our company,” and “our” refer to Sinovac Biotech Ltd., its predecessor entities and its consolidated subsidiaries

· “Sinovac Antigua” refers to Sinovac Biotech Ltd.;

· “China,” “Chinese” or the “PRC” refers to the People’s Republic of China, excluding, for the purposes of this annual report on Form 20-F only, Taiwan and the special administrative regions of Hong Kong and Macau;

· “RMB” or “renminbi” refers to the legal currency of China; and “$” or “U.S. dollars” refers to the legal currency of the United States;

· “shares” or “common shares” refers to our common shares, par value $0.001 per share; and

· “U.S. GAAP” refers to generally accepted accounting principles in the United States.

Discrepancies in any table between the amounts identified as total amounts and the sum of the amounts listed therein are due to rounding.

This annual report contains translations of certain renminbi amounts into U.S. dollars at specified rates solely for the convenience of readers. Unless otherwise stated, all translations from renminbi to U.S. dollars were made at a rate of RMB6.8972 to $1.00, the exchange rate in effect as set forth in the H.10 statistical release of The Board of Governors of the Federal Reserve System, or the Federal Reserve Exchange Rate, in effect on December 30, 2022. We make no representation that the renminbi or U.S. dollar amounts referred to in this annual report could have been or could be converted into U.S. dollars or renminbi, as the case may be, at any particular rate or at all. On April 21, 2023, the Federal Reserve Exchange Rate was RMB6.8920 to $1.00.

FORWARD-LOOKING INFORMATION

This annual report contains forward-looking statements that reflect our current expectations and views of future events. These forward-looking statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. Known and unknown risks, uncertainties and other factors, including those included in “Item 3. Key Information—D. Risk Factors,” may cause our actual results, performance, or achievements to be materially different from those expressed or implied by the forward-looking statements.

You can identify some of these forward-looking statements by words or phrases such as “may,” “might,” “will,” “would,” “expect,” “anticipate,” “aim,” “estimate,” “intend,” “plan,” “believe,” “is/are likely to,” “potential,” “continue,” or other similar expressions. We have based these forward-looking statements largely on our current expectations and projections about future events that we believe may affect our financial condition, results of operations, business strategy, and financial needs. These forward-looking statements include statements relating to:

These forward-looking statements involve various risks and uncertainties. Although we believe that our expectations expressed in these forward-looking statements are reasonable, our expectations may later be found to be incorrect. Our actual results could be materially different from our expectations. Important risks and factors that could cause our actual results to be materially different from our expectations are generally set forth in “Item 3. Key Information—D. Risk Factors,” “Item 4. Information on the Company—B. Business Overview,” “Item 5. Operating and Financial Review and Prospects,” and other sections in this annual report. You should read thoroughly this annual report and the documents that we refer to in this annual report with the understanding that our actual future results may be materially different from and worse than what we expect. We qualify all of our forward-looking statements by these cautionary statements.

We operate in an evolving environment. New risk factors and uncertainties emerge from time to time and it is not possible for our management to predict all risk factors and uncertainties, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

You should not rely upon forward-looking statements as predictions of future events. The forward-looking statements made in this annual report relate only to events or information as of the date on which the statements are made in this annual report. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

1

PART I

ITEM 1. Identity of Directors, Senior Management and Advisers

Not applicable.

ITEM 2. Offer Statistics and Expected Timetable

Not applicable.

ITEM 3. Key Information

Permissions Required from the PRC Authorities for Our Operations

We conduct our business primarily through our subsidiaries in China. Our operations in China are governed by PRC laws and regulations. We face various legal and operational risks and uncertainties associated with having a portion of our operations in China and the complex and evolving PRC laws and regulations. For example, we face risks associated with regulatory approvals on offerings conducted overseas and foreign investment in China-based issuers, anti-monopoly regulatory actions, and oversight on cybersecurity and data privacy, which may negatively impact our ability to conduct certain businesses or access foreign investments. These risks could result in a material adverse change in our operations and the value of our shares, significantly limit or completely hinder our ability to offer or continue to offer securities to investors, or cause the value of such securities to significantly decline or become worthless. For more detailed information, see “—D. Risk Factors—Risks Relating to Doing Business in China—Future changes in laws, regulations or enforcement policies in China and the PRC government’s oversight and discretion over our operations could adversely affect our business.”

The Holding Foreign Companies Accountable Act

The Holding Foreign Companies Accountable Act (“HFCAA”), as amended, was initially enacted on December 18, 2020. In accordance with the HFCAA, trading in our shares on a national securities exchange or in the over the counter trading market in the United States may be prohibited if the Public Company Accounting Oversight Board (United States) (“PCAOB”) determines that it cannot inspect or fully investigate our auditor for two consecutive years beginning in 2021, and, as a result, the United States Securities and Exchange Commission (“SEC”) may determine to delist our shares. On September 22, 2021, the PCAOB adopted a final rule implementing the HFCAA, which provides a framework for the PCAOB to use when determining, as contemplated under the HFCAA, whether the PCAOB is unable to inspect or investigate completely registered public accounting firms located in a foreign jurisdiction because of a position taken by one or more authorities in that jurisdiction. On December 16, 2021, the PCAOB issued a report on its determinations that the PCAOB was unable to inspect or investigate completely PCAOB-registered public accounting firms headquartered in mainland China and Hong Kong, because of positions taken by PRC authorities in these jurisdictions. The PCAOB included in its report a list of registered public accounting firms headquartered in mainland China and Hong Kong that the PCAOB was unable to inspect or investigate completely, including our auditor.

Our auditor, Grant Thornton Zhitong Certified Public Accountants LLP (“Grant Thornton”), is an independent registered public accounting firm that issues the audit reports included elsewhere in this annual report. Our auditor was subject to the determinations made by the PCAOB, on December 16, 2021, and as a result, the PCAOB was not able to fully inspect our auditor. On May 4, 2022, we were identified by the SEC under the HFCAA. On December 15, 2022, the PCAOB issued a report that vacated its December 16, 2021 determination and removed mainland China and Hong Kong from the list of jurisdictions where it was unable to inspect or investigate completely registered public accounting firms. For this reason, we do not expect to be identified as a Commission-Identified Issuer under the HFCAA after we file this annual report on Form 20-F. Each year, the PCAOB will determine whether it can inspect and investigate completely accounting firms in mainland China and Hong Kong, among other jurisdictions. If PCAOB determines in the future that it no longer has full access to inspect and investigate completely accounting firms in mainland China and Hong Kong and we continue to use an accounting firm headquartered in one of these jurisdictions to issue an audit report on our financial statements filed with the SEC, we would be identified as a Commission-Identified Issuer following the filing of the annual report on Form 20-F for the relevant fiscal year. There can be no assurance that we would not be identified as a Commission-Identified Issuer for any future fiscal year, and if we were so identified for two consecutive years, we would become subject to the prohibition on trading under the HFCAA. See “—D. Risk Factors—Risks Related to Doing Business in China—Our shares will be prohibited from trading in the United States under the HFCAA in 2023 if the PCAOB is unable to inspect or fully investigate auditors located in China. The delisting of our shares, or the threat of their being delisted, may materially and adversely affect the value of your investment.”

Cash and Asset Flows Through Our Organization

Sinovac Antigua is a holding company, and we rely in part on dividends paid by our subsidiaries for our cash needs, including our operating expenses and additional investment opportunities. The payment of dividends from subsidiaries in China is subject to limitations. Regulations in the PRC currently permit payment of dividends only out of accumulated profits as determined in accordance with accounting standards and

2

regulations in China. Our subsidiary is also required to set aside at least a portion of its after-tax profit based on PRC accounting standards each year to fund the statutory surplus reserves.

The reserves can be used to recoup previous years’ losses, if any, and, subject to the approval of the relevant PRC government authority, may be converted into share capital in proportion to their existing shareholdings, or by increasing the par value of the shares currently held by them. Such reserves, however, are not distributable as cash dividends. In addition, at discretion of their board of directors, our subsidiaries may allocate a portion of their after-tax profits based on PRC accounting standards to the employee welfare and bonus funds, which shall be utilized for collective staff benefits. In addition, if our PRC subsidiaries incur debt on its own behalf in the future, the instruments governing the debt may restrict the ability of one or more of our PRC subsidiaries, as the case may be, to pay dividends or make other distributions to us.

The ability of our subsidiary to convert renminbi into U.S. dollars and make payments to us is subject to PRC foreign exchange regulations. Under these regulations, the renminbi is convertible for current account items, including the distribution of dividends, interest payments, trade and service-related foreign exchange transactions. Conversion of renminbi for capital account items, such as direct investment, loan, security investment and repatriation of investment, however, is still subject to the approval of SAFE., see “—Risk Factors—Risks Relating to Doing Business in China—We rely on dividends paid by our PRC subsidiaries for our cash needs. If they are unable to pay us sufficient dividends due to statutory or contractual restrictions on their abilities to distribute dividends to us, our various cash needs may not be met.” and “Item 10. Additional Information — D. Exchange Controls.”

Under PRC laws, Sinovac Antigua may fund our PRC subsidiaries only through capital contributions or loans, subject to satisfaction of applicable government registration and approval requirements. In 2020, 2021 and 2022, no assets other than cash were transferred through our organization.

A. Reserved

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

Risk Factors Summary

The following summarizes some, but not all, of the risks provided below. Please carefully consider all of the information discussed in this Item D. “Risk Factors” in this annual report for a more thorough description of these and other risks.

Risks Related to Our Company

3

Risks Related to Government Regulation

Risks Related to Our Intellectual Property

Risks Related to Doing Business in China

Risks Related to Our Company

Our business performance relies on our ability to react to infectious disease threats and to continually introduce new vaccine products into the commercial market. Our failure to effectively develop and commercialize new products could materially and adversely affect our business, financial condition, results of operations and prospects.

The biopharmaceutical market in general and the vaccine product market in particular are developing rapidly as a result of ongoing infectious disease threats and new trends in the related research and technology developments. Consequently, our success depends on our ability to react to threats of disease and technology development trends and to identify, develop and commercialize in a timely and cost-effective manner effective vaccine products that meet evolving market needs.

Whether we are successful in developing and commercializing new products is determined by, among other things, our ability to:

4

Although we are profitable in 2020, 2021 and 2022, we incurred a loss in past years, and may incur losses again in the future.

Biopharmaceutical product development is a highly speculative undertaking and involves a substantial degree of risk. We recorded a profit in 2020, 2021 and 2022. However, we incurred a loss in the past years, caused primarily by research and development expenses. None of the research and development expenses incurred were capitalized in our financial statements. We intend to continue to invest in research and development to sustain our long-term growth. We expect our research and development expenses to fluctuate depending on the progress we make on each project, with relatively more spending on clinical studies than preclinical studies. We expect that our spending on research and development will have a negative impact on our future net earnings. As a result, we may incur losses in the future, which will have an adverse impact on our working capital, total assets, shareholders’ equity and cash flow.

As required by the PRC laws, we sell vaccines in China through CDCs) which are PRC government agencies. This exposes us to risks relating to doing business with the government.

As required by the PRC laws, we sell our vaccines to CDCs, which exposes us to various risks relating to doing business with the government. For example, demand and ability to pay for our products may be affected by government budgetary cycles, shifting availability of public funds and changes in policy. Funding reductions, delays in payment or unilateral demands for changes to the terms of our contracts by our government customers could adversely impact our results of operations and financial condition, exacerbate the existing seasonality of our revenues and make it difficult for us to allocate resources or anticipate demand for our products. More importantly, we have little or no control over government procurement decisions, and government agencies that contract to purchase our products may reduce or cancel orders, or demand price adjustments or other changes to their contracts with us without our consent. Changes in the personnel of the PRC government agencies that purchase our products may result in changes or delays to or cancellations of purchase commitments due to, among others, differing policy and budgetary agendas of the personnel involved. Similar changes could occur if CDC or other relevant government agencies were to be consolidated with another ministry. In addition, if our vaccines are to be sold in other countries or regions other than China, regulatory approvals from the relevant governmental authorities of the target markets are to be obtained. Any of the above mentioned actions taken by government agencies could have a material adverse effect on our results of operations and expected earnings, or result in our failure to meet, or having to adjust downwards, our sales and gross margin guidance or estimates, which could adversely affect our share price and result in substantial losses. In addition, many of the remedies that are available to us when dealing with private parties, such as making claims for breach of contract or taking other legal actions, may not be available or practicable in our dealings with government agencies.

We currently have limited revenue sources. A reduction in revenues from sales of COVID-19 vaccine will cause our revenues to decline significantly and could materially harm our business.

We generate all of our revenues from sales of our vaccine products. We derived a substantial percentage of our revenues from COVID-19 vaccine, CoronaVac, in 2021 and 2022. We face risks and uncertainties related to production and sales of CoronaVac, including (i) the demand of COVID-19 vaccines throughout the world may be reduced or no longer exist in the future as more and more people have been vaccinated; (ii) the possibility that COVID-19 epidemic may diminish in severity or prevalence, or disappear entirely; and (iii) other companies may produce superior or competitive products, any of which will adversely impact the sales of CoronaVac. As a result of the relative lack of product diversification, an investment in our company will be riskier than investments in companies that offer a wide variety of products or services.

We expect our key products, which will likely shift over time, to account for a significant portion of our net revenues for the foreseeable future. As a result, continued market acceptance and popularity of these products are critical to our success and a reduction in demand due to, among other factors, the introduction of competing products by our competitors, the entry of new competitors, or end-users’ dissatisfaction with the quality of our products, could materially and adversely affect our financial condition and results of operations.

We could be subject to costly and time-consuming product liability actions and, because our insurance coverage is limited, our exposure to such claims could cause significant financial burden.

Our business exposes us to potential product liability risks that are inherent in the testing, manufacturing and marketing of biopharmaceutical products. We manufacture vaccines that are injected into healthy people to protect against infectious illnesses. If our products do not function as anticipated, whether as a result of flaws in our design, unanticipated health consequences or side effects, misuse or mishandling by third parties, or faulty or contaminated supplies, they could harm the vaccines and, as a result, subject us to product liability lawsuits. Claims against us also

5

could be based on failure to immunize as anticipated. Any product liability claim brought against us, with or without merit, could have a material adverse effect on us. Meritless and unsuccessful product liability claims can be time-consuming and expensive to defend and could result in the diversion of management’s attention from managing our core business or result in associated negative publicity.

Successful assertion of product liability claims against us could require us to pay significant monetary damages. Although we currently carry worldwide product liability insurance for Healive, Bilive, Anflu, Panflu and Inlive, we cannot assure that such coverage will be sufficient to cover any liabilities resulting from successful product liability claims. In such a case, we may be required to make substantial payments to cover any losses, damages or liabilities arising from product liability claims. For any amounts covered by insurance, foreign exchange or other regulatory restrictions may prevent the use of insurance proceeds to meet the liabilities.

In addition, while we have procured liability insurance for the clinical trials which we are currently carrying out outside mainland China, we did not procure the liability insurance for each of our clinical trials which we have completed in mainland China and we do not have or plan to procure clinical trial liability insurance for our clinical trials in mainland China in the future to mitigate any unsuccessful clinical trial expenses or product liability claims arising therefrom for all our vaccine products. Any of these factors could have a material adverse effect on our business, financial condition and results of operations.

We face risks related to health epidemics and other widespread outbreaks of contagious disease, which could disrupt our operations and impact our operating results.

Significant outbreaks of contagious diseases, and other adverse public health developments, could have a material impact on our business operations and operating results. In December 2019, a strain of novel coronavirus, COVID-19, causing respiratory illness emerged in the city of Wuhan in the Hubei province of China and has subsequently spread throughout the world. The outbreak of COVID-19 was recognized as a pandemic by the World Health Organization (“WHO”) on March 11, 2020. In response to the outbreak, governmental authorities of countries all over the world imposed lockdowns and other restrictions to contain the virus, and various businesses suspended or reduced operations. The COVID-19 pandemic has resulted in significant disruptions in the global economy. The PRC government took certain emergency measures to combat the spread of the virus, including implementation of travel bans and closure of factories and businesses throughout the whole country, including Beijing where our research and development functions and main production lines are located. Since January 1, 2022, certain areas in China have suffered from outbreaks of COVID-19 variants including Delta and Omicron virus variants. In response, local governments in the affected areas imposed various restrictions on business and social activities, including city lockdowns, restrictions on travel and other emergency quarantines.

As COVID-19 pandemic continues to evolve and there is great uncertainty as to the future progress of the virus, we cannot anticipate with any certainty the length or severity of the effects of COVID-19 pandemic. We believe the ultimate impact of the COVID-19 pandemic on our business, financial condition and results of operations will be affected by the speed and extent of the continued spread of the coronavirus globally, the emergence of additional virus variants, the duration of the pandemic, new information regarding the severity and incidence of the COVID-19 virus, the safety, efficacy and availability of vaccines and treatments for COVID-19 and the rate at which the population becomes vaccinated against COVID-19. We continue to monitor the spread of COVID-19 in China and globally and have put in place and will continue to put in place measures as appropriate and necessary for our business. Any prolonged lockdowns or deviations from normal daily operations could negatively impact our business.

We could face risks and uncertainties related to our efforts to develop a vaccine to help prevent COVID-19 and potential treatments for COVID-19, as well as challenges related to their manufacturing, supply and distribution.

We face uncertainties related to our efforts to develop a vaccine to prevent the COVID-19, including uncertainties and risks that our existing and future vaccines may not be successful, commercially viable or receive final approval from regulatory authorities. The pre-clinical, clinical data or safety data and further analysis of the existing pre-clinical, clinical or safety of our existing COVID-19 vaccine or future vaccines or treatments may be unfavorable, or we may not be able to produce comparable clinical or other results, including but not limited to the rate of vaccine effectiveness and safety and tolerability profile observed to date or in larger, more diverse populations upon commercialization. Our COVID-19 vaccine, CoronaVac, may not be able to prevent COVID-19 caused by emerging virus variants. The widespread use of the vaccine may lead to new information about efficacy, safety or other developments, including the risk of additional adverse reactions or side effects and regulatory authorities may not be satisfied with the results from any future pre-clinical and clinical studies and may not approve our existing or future vaccines or treatments, or may withdraw or terminate such approvals granted previously to us. Disruptions in the relationships between us and our collaboration partners, research and development institutes, clinical trial sites, countries where the trials are conducted or third-party suppliers, availability of raw materials to manufacture any such products, our ability to scale up or maintain the manufacturing capacity on a timely basis or have access to logistics or supply channels commensurate within global demand for any potential approved vaccine or product candidate, could delay the commercialization of our existing COVID-19 vaccine or any future vaccines or products or otherwise have a significant impact on our business, financial condition and results of operations. We cannot guarantee you that we can produce superior or more competitive products than our competitors, or whether the demand for our COVID-19 vaccine may still exist. Any of these factors could have a material adverse effect on our business, financial condition and results of operations.

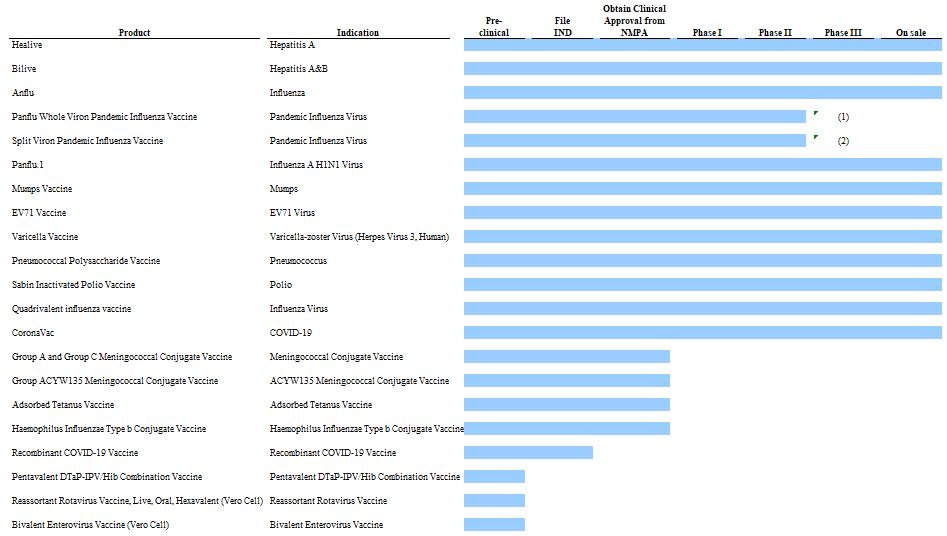

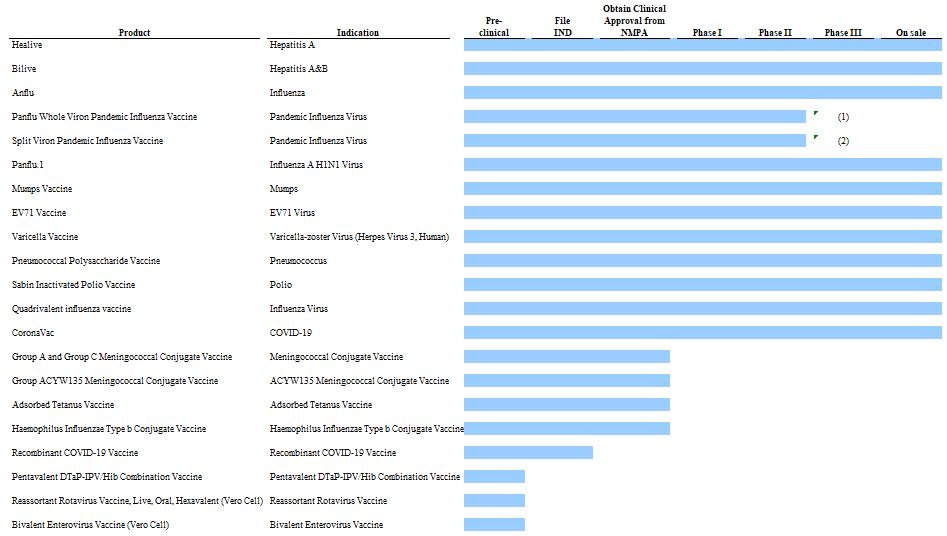

Our financial prospects depend on the success of our clinical-stage and pre-clinical stage product pipeline.

6

We have invested significant time and resources on the development of our existing vaccine candidates, and we expect to continue to incur substantial and increasing expenditures for the development and commercialization of our vaccine candidates. Our ability to achieve revenue and profitability is dependent on our ability to complete the clinical development of our vaccine candidates, obtain necessary regulatory approvals, and have our vaccines manufactured and successfully marketed. Clinical testing is expensive and can take many years to complete, and its outcome is inherently uncertain. Failure can occur at any time during the clinical trial process. The results of pre-clinical studies and early clinical trials of our vaccine candidates may not be predictive of the results of later-stage clinical trials, and initial or interim results of a trial may not be predictive of the final results. If our vaccine candidates fail to achieve their expected success in a timely manner or at all, we could experience significant delays in our ability to obtain approval for and/or to successfully commercialize our vaccine candidates. We would have expended a significant amount of capital to progress the relevant vaccine candidates to that stage, and would not realize any revenue on such vaccine candidate if it then ultimately failed to receive regulatory approval due to poor clinical trial results. It would materially harm our business and we may not be able to generate sufficient revenues and cash flows to continue our operations.

We have devoted significant resources to research and develop various vaccines to address the pandemic threat of infectious diseases, including COVID-19, SARS, avian flu and swine flu, and will continue to devote resources to the development of vaccines to address any new needs.

However, the threat of a pandemic outbreak may subside before we realize any return on our investment in our research and development. For example, although we believed we were the first company to complete a phase I clinical trial of an inactivated SARS vaccine in December 2004, we did not proceed with the phase II and phase III trials as the SARS epidemic subsequently subsided. Other organizations may obtain licenses for their own pandemic vaccines, or government health organizations may acquire adequate stockpiles of pandemic vaccine or adopt other technologies or strategies to prevent or limit outbreaks before our pandemic vaccines achieve significant sales. We may not achieve a return on our investment before the threat of a pandemic outbreak subsides or a competing product is adopted. We have completed phase III trials of COVID-19 vaccine in Brazil, Turkey, Indonesia and Chile and have received a conditional marketing authorization for CoronaVac from China’s National Medical Products Administration (“NMPA”). CoronaVac has been granted emergency use approval under the WHO’s Emergency Use Listing (EUL) procedure. We cannot assure comparable clinical or other results, including the rate of vaccine effectiveness and safety and tolerability profile or in larger, more diverse populations upon commercialization. Major international and Chinese vaccine companies, universities and other research institutions are also pursuing the development of the COVID 19- vaccines. They may succeed in developing COVID-19 vaccine and obtaining regulatory approvals before us or gain better acceptance for the same target markets as ours, which will undermine our competitive position.

Moreover, because we have limited financial and managerial resources, we focus our product pipeline on research programs and vaccine candidates that we identify for specific indications. As a result, we may forego or delay pursuit of opportunities with other vaccine candidates that later prove to have greater commercial potential.

Failure to achieve and maintain effective internal controls could have a material adverse effect on our business, results of operations and the trading price of our common shares.

We are subject to the reporting obligations under U.S. securities laws. Section 404 of the Sarbanes-Oxley Act of 2002 and related rules require public companies to include a report of management on their internal control over financial reporting in their annual reports. This report must contain an assessment by management of the effectiveness of a public company’s internal control over financial reporting. In addition, an independent registered public accounting firm for a public company must attest to and report on the effectiveness of our internal control over financial reporting.

Our management has concluded that our internal control over financial reporting was effective as of December 31, 2022. See “Item 15. Controls and Procedures.” Our independent registered public accounting firm has issued an attestation report on our internal control over financial reporting, which concludes that our internal control over financial reporting was effective in all material aspects as of December 31, 2022. However, we cannot assure that any material weakness or deficiency in our internal control over financial reporting will not be identified in the future. We may not always be able to maintain an effective internal control over financial reporting. If we fail to maintain effective internal control over financial reporting in the future, we and our independent registered public accounting firm may not be able to conclude that we have effective internal control over financial reporting at a reasonable assurance level. This could in turn result in the loss of investor confidence in the reliability of our financial statements and negatively impact the trading price of our common shares, inhibiting our ability to raise sufficient capital on favorable terms. Furthermore, we have incurred and anticipate that we will continue to incur considerable costs and use significant management time and other resources in an effort to comply with Section 404 and other requirements of the Sarbanes-Oxley Act.

If we are unable to successfully compete in the highly competitive biopharmaceutical industry, our business could be harmed.

We operate in a highly competitive environment and we expect the competition to increase in the future. Our competitors include large pharmaceutical and biotechnology companies, both domestic and international. Many of these competitors have greater resources than we do. New competitors may also enter into the markets in which we compete. Accordingly, even if we are successful in launching a product, we may not be able to outperform a competing product for any number of reasons, including the possibility that the competitor may:

7

The technologies applied by our competitors and us are rapidly evolving and new developments frequently result in price competition and product obsolescence. In addition, we may be impacted by competition from generic forms of our products, substitute products or imports of products from lower-priced markets. For a detailed description of our competitors, please see “Item 4. Information on the Company — B. Business Overview — Competition.”

We may not be able to maintain market share in China with our commercialized vaccines, which could adversely affect our ability to increase our revenues.

According to the NMPA, there are approximately 50 vaccine manufacturers in China. Many of our commercialized vaccine products are also marketed by other vaccine companies in China, of which we believe approximately 15 are our direct competitors for our non-covid vaccines. We are market leaders for certain products in China. We also compete internationally against multi-national corporations for market shares of certain vaccine products. Our revenue could be adversely impacted if we are not able to maintain our supplied quantity and market share.

We may not be able to maintain market share in the government-funded hepatitis A vaccine market, or other government-funded vaccine markets, which could adversely affect our revenues, and if we do maintain or expand market share in these markets, we may need to sell our vaccines at a lower price, which could adversely affect our gross margin.

Hepatitis A vaccines have been included in the Expanded Program of Immunization (“EPI”) in China since 2007. The PRC government purchases hepatitis A vaccines for each 18-month-old child. Although the hepatitis A vaccines have been included in the EPI, most provincial and municipal governments are not able to afford the two shots of inactivated hepatitis A vaccines due to insufficient financial support, which constrains the purchase of inactivated hepatitis A vaccines in government-funded markets. Most provincial and municipal governments prefer to purchase lower-priced live attenuated hepatitis A vaccines; however, a few affluent provincial and municipal governments, such as Beijing, Tianjin, Shanghai and Jiangsu province, have started to purchase inactivated hepatitis A vaccines. We are supplying vaccines in these government-funded markets at a lower price than we do in the private market, which could adversely affect our gross margin. Our revenue could also be adversely impacted if we are not able to maintain our market share of the government-funded markets in these cities and provinces. As we are making efforts to breakthrough into additional provincial and municipal public markets, we may be forced to lower our prices to win tenders, which will adversely affect our gross margin.

Since 2007, we have been selected as one of the seasonal flu vaccine suppliers by Beijing CDC and by Zhejiang CDC, respectively. In 2022, we supplied flu vaccine to Tibet Autonomous Region CDC. However, we cannot assure that we will continue to obtain orders in the future and maintain these market share. If the supply volume decreases, it would negatively impact our sales revenue in the future.

Since 2008, we have received three stockpiling orders for our H5N1 vaccine from China’s central government every two years in an amount of three million doses per order, and four stockpiling orders from Beijing government in an amount of 20,000 doses per order. The latest batch of stockpiled H5N1 vaccines for the central government expired in the first half of 2016 and we recognized the revenue upon the government inspection. The most recent batch ordered by Beijing government expired in 2020. We cannot assure that we will receive additional stockpiling orders from governments in the future.

If CDCs, hospitals, CDC doctors and end users do not accept our products, we may be unable to generate significant revenue.

Even if we have obtained regulatory approvals for commercialization of our vaccines in China or in other countries or regions, they still may not gain market acceptance among CDCs, regulatory agencies, CDC doctors, end users, patients and the medical community, which would limit our ability to generate revenue and adversely affect our results of operations. CDCs, regulatory agencies and CDC doctors may not recommend products developed by us or our collaborators until clinical data or other factors demonstrate superior or comparable safety and efficacy of our products as compared to other available products. Even if the clinical safety and efficacy of our products are established, CDCs, regulatory agencies and CDC doctors may elect not to recommend these products for a variety of reasons. There are other vaccines and prevention options for the conditions that many of our products and product candidates target, such as EV71, hepatitis A, influenza, varicella, etc.. In order to

8

successfully launch a product, we must educate CDC doctors and end users about the relative benefits of our products. If our products are not perceived as easy and convenient to use, perceived to present a greater risk of side effects or are not perceived to be as effective as other available vaccines, CDCs, CDC doctors , parents and end users might not adopt our products. A failure of our products to gain commercial acceptance would have a material adverse effect on our business, financial condition and results of operations.

Our business could be negatively affected as a result of actions of shareholders or others.

On March 5, 2018, we announced the re-election of the members of our board of directors—Mr. Weidong Yin, Mr. Yuk Lam Lo, Mr. Simon Anderson, Mr. Kenneth Lee, and Mr. Meng Mei—at our annual general meeting of shareholders held on February 6, 2018 (the “2017 AGM”). We also announced that we had determined, after consultation with our Antigua legal counsel, that an alternative, pre-printed ballot not made available to all our shareholders and purportedly submitted at the 2017 AGM by certain of our shareholders, including 1Globe Capital LLC (“1Globe”), The Chiang Li Family, OrbiMed Advisors LLC and OrbiMed Capital LLC (together “OrbiMed”), and certain additional shareholders (collectively, the “Shareholder Group”) was invalid. We refer to this ballot as the “Non-Public Submission.” On March 13, 2018, 1Globe filed a complaint against Sinovac Antigua in the Eastern Caribbean Supreme Court in the High Court of Justice, Antigua and Barbuda (the “Antigua Court”). The complaint sought a declaration that the five persons purportedly proposed by the Shareholder Group on the Non-Public Submission at the 2017 AGM were elected as directors of Sinovac Antigua at that meeting, an order that those directors be installed as Sinovac Antigua’s board of directors, and a declaration that any actions taken on behalf of Sinovac Antigua at the direction of the board of directors since the 2017 AGM are null and void. Following a trial in early December 2018, the Antigua Court issued a judgment on December 19, 2018 (the “Antigua Judgment”) that dismissed 1Globe’s claim and declared that Sinovac Antigua’s shareholder rights agreement (the “Rights Agreement”) was validly adopted as a matter of Antigua law. 1Globe filed notice to appeal the Antigua Court’s judgment on January 29, 2019. 1Globe’s appeal of the Antigua Court’s Judgment was heard on September 18, 2019. On December 9, 2021, the Eastern Caribbean Supreme Court, Court of Appeal (the “Court of Appeal”), handed down its judgment, dismissing all grounds of appeal and upholding the Antigua Judgment, including confirming that Sinovac Antigua’s Rights Agreement was consistent with its Articles of Incorporation and By-laws, and Antiguan business law. 1Globe applied for leave to appeal to the Judicial Committee of the Privy Council (the “Privy Council”), and the hearing of the application was held on February 24, 2022, in which the Court of Appeal granted 1Globe leave to appeal to the Privy Council on certain grounds, although not including the challenge to the validity of the Rights Agreement. On April 19, 2022, 1Globe renewed its application directly to the Privy Council for leave to appeal on its ground of appeal concerning the validity of the Rights Agreement. On July 13, 2022, 1Globe filed its Notice of Appeal on those grounds on which the Court of Appeal had granted 1Globe leave to appeal. On September 16, 2022, 1Globe filed an application to the Privy Council seeking permission to amend its existing application for permission to appeal and its existing Notice of Appeal, and to seek permission to appeal on another ground rejected by the Court of Appeal concerning the exercise of the Antigua Court’s discretion. Sinovac responded on October 21, 2022. On February 15, 2023, the Privy Council made a procedural decision to allow amendment of its existing application for permission to appeal, and decided to deal with procedural and substantive issues together at the Final Hearing. 1Globe has not yet taken steps to list a substantive hearing before the Privy Council. The appeal outcome is therefore pending.

On October 8, 2018, we became aware that unauthorized documents in respect of Sinovac Biotech (Hong Kong) Limited. (“Sinovac Hong Kong”) had been filed with the Hong Kong Companies Registry to change the directors of Sinovac Hong Kong from Mr. Weidong Yin and Ms. Nan Wang to Mr. Jianzeng Cao and Mr. Pengfei Li. Mr. Yin and Ms. Wang commenced legal proceedings before the High Court of the Hong Kong Special Administrative Region (“Hong Kong High Court”) (“HCMP 1731/2018”). In a hearing before the Hong Kong High Court on October 19, 2018, the judge granted an interlocutory injunction restraining Mr. Li and Mr. Cao from purporting to act or holding themselves out as directors of Sinovac Hong Kong or its subsidiaries, purporting to take any actions as directors of Sinovac Antigua or its subsidiaries, and relying on or using the forged documents in any way whatsoever. On November 28, 2018 at a further hearing in the Hong Kong High Court, the Hong Kong High Court made orders (“November 28 Order”) and held that it is beyond dispute that the documents in respect of Sinovac Hong Kong had been forged and unlawfully filed with the Hong Kong Companies Registry, based on the evidence filed by Mr. Yin and Ms. Wang as Plaintiff, and Mr. Cao and Mr. Li as the Defendants. The Hong Kong High Court therefore declared that Mr. Yin and Ms. Wang were and still are the lawful directors of Sinovac Hong Kong (“Lawful Directors”), and Mr. Li and Mr. Cao were not and are not the lawful directors of Sinovac Hong Kong. The Hong Kong High Court also granted a permanent injunction restraining Mr. Li and Mr. Cao from purporting to act or holding themselves out as directors of Sinovac Hong Kong or its subsidiaries (including but not limited to Sinovac Biotech Co., Ltd. (“Sinovac Beijing”), purporting to take any actions as directors of Sinovac Hong Kong or its subsidiaries, and relying on or using the forged documents in any way whatsoever. Furthermore, the Hong Kong High Court also ordered the Companies Registry to remove the forged documents in respect of Sinovac Hong Kong that had been unlawfully filed. The November 28 Order is effective and enforceable. The Companies Registry has removed the forged documents following the November 28 Order. On November 28, 2018, Mr. Cao and Mr. Li filed a Notice of Appeal with the Hong Kong Court of Appeal, indicating their intention to appeal the orders made by the Hong Kong High Court. The appeal does not operate as a stay on the November 28 Order except to the extent that the Court below, or the Court of Appeal otherwise directs: O.59, r. 13 (1)(a) of the Rules of the High Court. As of the date of this annual report, neither the Court of First Instance nor the Court of Appeal directed that the execution of the November 28 Order should be stayed. So far, Mr. Cao and Mr. Li have taken no further steps in respect of the appeal after the Notice of Appeal was filed on November 28, 2018. No hearing date has yet been fixed to hear the appeal.

On October 8, 2018, we also became aware that unauthorized documents in respect of Sinovac Beijing had been filed with the Industry and Commerce Bureau of Haidian District of Beijing (“Haidian AIC”) to change the directors of Sinovac Beijing from Mr. Yin, Ms. Wang and Mr. Dawei Mao to Mr. Cao, Mr. Li and Ms. Xiaomin Yang. Mr. Yin and Ms. Wang filed objection to such unlawful change to the Haidian AIC. On March 19, 2020, Haidian AIC issued an official decision (“AIC Decision”) declaring that (i) the unauthorized documents filed are forged and fake documents; (ii) the filing of change of directors with the forged documents is null and void; (iii) the unlawful filing to change the directors

9

will be removed and the registration of Mr. Yin, Ms. Wang and Mr. Mao as directors of Sinovac Beijing will be restored. The parties of material interest concerned in the AIC Decision may raise objection or file a lawsuit within 60 days. No one has filed the objection or lawsuit against the AIC Decision within 60 days thereof.

On May 31, 2019, Heng Ren Investments LP (“Heng Ren”) filed suit against Sinovac and Mr. Yin for alleged breach of fiduciary duties and wrongful equity dilution, in Massachusetts state court. Sinovac moved the matter from state court to the United States District Court for the District of Massachusetts. Subsequently, on April 29, 2021, Heng Ren filed an amended complaint which alleged that Mr. Yin breached fiduciary duties owed to minority shareholders, that Sinovac aided and abetted breaches of fiduciary duties, and that both Sinovac and Mr. Yin engaged in wrongful equity dilution. Heng Ren requested damages, attorneys’ fees, and prejudgment interest. On September 14, 2020, Sinovac filed a motion to dismiss Heng Ren’s claims. In July 2021, Sinovac moved to dismiss Heng Ren’s amended complaint in the federal court in Massachusetts. On March 4, 2022, the court granted the motion as to the breach of fiduciary duty claims and denied the motion as to the wrongful equity dilution claim, and denied reconsideration of its decision on the motion. Sinovac has answered the complaint. On February 15, 2023, the court stayed discovery in the Heng Ren matter pending the resolution of an outstanding motion to dismiss filed in a purported shareholder's matter by us.

On December 5, 2022, a purported shareholder filed a putative class action complaint in United States District Court for the District of Massachusetts, asserting a claim under Section 204 of the Antigua and Barbuda International Business Corporations Act related to the PIPE transaction, alleging that all shareholders were harmed in an identical manner to one another by the PIPE transaction because the shares that were issued in the PIPE transaction allegedly undervalued Sinovac and all shareholders were purportedly wrongfully diluted as a result. The purported shareholder is represented by the same attorney who represents Heng Ren, and requests damages, attorneys’ fees, and prejudgment interest. On January 18, 2023, we filed a motion to dismiss. The motion was fully briefed as of March 9, 2023, and is currently pending before the court.

We cannot predict the outcome of our ongoing litigation, including whether we will prevail. We also cannot predict how the litigation may affect our share price, which could be volatile during the pendency of each suit and following its conclusion. Preparing for the litigation, or any related litigation or related matters, has caused us to incur significant costs and we expect these costs to continue until the litigation concludes. In addition, preparing for litigation is time-consuming and may disrupt our operations and divert the attention of management and our employees from executing our strategic plan. In addition, the uncertainties as to the composition of the board of directors of Sinovac Antigua may materially and adversely affect business in unpredictable ways, which, in turn, could cause our revenue, earnings and operating cash flows to be materially and adversely affected.

The ongoing litigation regarding the Rights Agreement could have a material adverse effect on the results of our operations and our financial condition.

On March 5, 2018, we filed a lawsuit in the Court of Chancery of the State of Delaware seeking a determination whether the Shareholder Group had triggered the Rights Agreement, by forming a group holding approximately 45% of outstanding shares, in excess of the Right Agreement’s threshold of 15%, and acting in concert prior to the 2017 AGM. The Rights Agreement is intended to promote the fair and equal treatment of all Sinovac shareholders and ensure that no person or group can gain control of Sinovac through undisclosed voting arrangements, open market accumulation or other tactics potentially disadvantaging the interest of all our shareholders.

On April 12, 2018, 1Globe filed an amended answer to our complaint, counterclaims, and a third-party complaint against Mr. Weidong Yin alleging, among other allegations, that the Rights Agreement is not valid, that Mr. Yin and the Buyer Consortium (comprising Mr. Yin, SAIF partners IV L.P., or SAIF, C-Bridge Healthcare Fund II, L.P., Advantech Capital L.P., Vivo Capital Fund VIII, L.P. and Vivo Capital Surplus Fund VIII, L.P.) had previously triggered the Rights Agreement, and that 1Globe did not trigger the Rights Agreement. The Chiang Li Family and OrbiMed filed similar responses. We, and our board of directors, believe that the actions taken by our board of directors were appropriate under the circumstances and in the interests of our company and all our shareholders. We also believe that the allegations in the counterclaim and third-party complaint are without merit. 1Globe asks for various measures of equitable relief and also includes a claim for its costs, including attorneys’ fees. On March 6, 2019, the Delaware Court entered a status quo order preventing us from distributing Exchange Shares (defined below) to any shareholders or otherwise take any action pursuant to the Rights Agreement until the conclusion of the Delaware litigation or Court order. The case is stayed pending resolution of parallel litigation in Antigua, which we anticipate will resume following the conclusion of the Antigua litigation.

Following a trial on the validity of the Sinovac Antigua’s Rights Agreement, on December 19, 2018, the Antigua Court held that Sinovac Antigua’s Rights Agreement is valid under Antigua law, and found that “there was a secret plan to take control of the Company” at the 2017 AGM by the Shareholder Group. On February 18, 2019, after reviewing the Court’s judgment and considering all additional facts known to the Board, the Board determined that the Shareholder Group, together with their affiliates and associates (collectively, the “Collaborating Shareholders”) became Acquiring Persons on or prior to the 2017 AGM and that their conduct resulted in a “Trigger Event” under Sinovac Antigua’s Rights Agreement. Pursuant to the Rights Agreement, our board of directors elected to exchange (the “Exchange”) each valid and outstanding preferred share purchase right held by Sinovac Antigua’s shareholders (not including the Collaborating Shareholders) for a combination of 0.655 of Sinovac Antigua’s common shares and 0.345 of Sinovac Antigua’s newly created Series B Convertible preferred shares (the “Series B Preferred Shares” and, together, each an “Exchange Share”). On February 22, 2019, the Exchange Shares were issued into the Shareholder 2019 Rights Exchange Trust in the name of Wilmington Trust, National Association, which holds the Exchange Shares for the benefit of Sinovac Antigua’s shareholders (not including the Collaborating Shareholders). 1Globe filed notice to appeal the Antigua Court’s judgment on January 29, 2019. On April 4, 2019, the Eastern Caribbean Supreme Court, Court of Appeal issued an order that restrains Sinovac Antigua from taking further action under its Rights Agreement, including the distribution of the previously issued Exchange Shares, until the

10

conclusion of such appeal. 1Globe’s appeal of the Antigua Court’s Judgment was heard on September 18, 2019. On December 9, 2021, the Court of Appeal handed down its judgment, dismissing all grounds of appeal and upholding the Antigua Judgment. The Court of Appeal also confirmed that Sinovac Antigua’s Rights Agreement was consistent with its Articles of Incorporation and By-laws, and Antiguan business law. 1Globe applied for leave to appeal to the Privy Council, and the hearing of the application was held on February 24, 2022, in which the Court of Appeal refused 1Globe’s application to take the issue of the Rights Agreement to the Privy Council. In January 2022, the Court of Appeal extended the order initially made on April 4, 2019, that restrains Sinovac Antigua from taking further action under its Rights Agreement, including the distribution of the previously issued Exchange Shares, until the conclusion of any appeal to the Privy Council. 1Globe applied for leave to appeal to the Judicial Committee of the Privy Council, and the hearing of the application was held on February 24, 2022, in which the Court of Appeal granted 1Globe leave to appeal to the Privy Council on certain grounds, although not including the challenge to the validity of the Rights Agreement. On April 19, 2022, 1Globe renewed its application directly to the Privy Council for leave to appeal on its ground of appeal concerning the validity of the Rights Agreement. On July 13, 2022, 1Globe filed its Notice of Appeal on those grounds on which the Court of Appeal had granted 1Globe leave to appeal. On September 16, 2022, 1Globe filed an application to the Privy Council seeking permission to amend its existing application for permission to appeal, and its existing Notice of Appeal, and to seek permission to appeal on another ground rejected by the Court of Appeal concerning the exercise of the Antigua Court’s discretion. Sinovac responded on October 21, 2022. On February 15, 2023, the Privy Council made a procedural decision to allow amendment of its existing application for permission to appeal, and decided to deal with procedural and substantive issues together at the Final Hearing. 1Globe has not yet taken steps to list a substantive hearing before the Privy Council. The appeal outcome is therefore pending.

We cannot predict the outcome of the litigation. Preparing for this litigation, or any related litigation or related matters, has caused us to incur significant costs and we expect these costs to continue until the litigation concludes. In addition, preparing for this litigation is time-consuming and may disrupt our operations and divert the attention of management and our employees from executing our strategic plan.

Our ongoing litigation against 1Globe and The Chiang Li Family claiming violations of U.S. federal securities laws could have a material adverse effect on the results of our operations and our financial condition.

On March 5, 2018, Sinovac Antigua filed a lawsuit in the United States District Court for Massachusetts alleging violations of Section 13(d) and Section 13(g) of the Securities Exchange Act of 1934 (the “Exchange Act”) by 1Globe and The Chiang Li Family. The lawsuit alleges, among other things, that the defendant shareholders failed to make required disclosures on Schedule 13D regarding their intentions to attempt to replace Sinovac Antigua’s board of directors. 1Globe counterclaimed to allege violations of securities laws; specifically, abuse of process, negligent misrepresentation, and fraudulent misrepresentation by Sinovac Antigua.

The litigation is currently stayed pending resolution of the parallel litigation in Antigua, and we cannot predict when or how the litigation will be resolved. There can be no assurance that we will prevail in this litigation. Preparing for this litigation, or any related litigation or related matters may result in significant costs to our company or otherwise adversely affect our business.

Disruptive actions taken by the minority shareholder of Sinovac Beijing caused suspension of production, destruction of products and disruption of our website, which may materially and adversely affect our business, financial condition and results of operations.

Sinovac Beijing, our principal operating subsidiary, is a Sino-foreign equity joint venture in which we own a 73.09% interest and Sinobioway Bio-medicine Co., Ltd., formerly named Xiamen Bioway Group Co., Ltd (“Sinobioway Medicine”), owns a 26.91% interest. Certain events suggest that Sinobioway Medicine’s interests are not aligned with our interests. We cannot assure that Sinobioway Medicine will be cooperative with us in handling matters related to the operations of Sinovac Beijing.

As the minority shareholder of Sinovac Beijing, according to Sinovac Beijing’s articles of association, Sinobioway Medicine has the right to assign a director to the five-director board of Sinovac Beijing, and the director assigned by Sinobioway Medicine is the legal representative of Sinovac Beijing. Accordingly, the representative of Sinobioway Medicine has the ability to take actions that bind Sinovac Beijing or to block any action that requires unanimous board approval. In addition, if we wish to transfer our equity interest in Sinovac Beijing, in whole or in part, to a third party, Sinobioway Medicine has a right of first refusal to purchase our interest in accordance with relevant PRC regulations.

Sinobioway Medicine, the minority shareholder of Sinovac Beijing, has additional rights under the joint venture contract and articles of association of Sinovac Beijing. The joint venture contract and articles of association require the consent of each of Sinovac Beijing’s shareholders and/or unanimous board approval on matters such as a major change in the business line of the company, expansion or amendment of the business scope of the company, transfer of the registered capital by a shareholder, creation of a mortgage or pledge upon the company’s assets, a change in the organizational form of the company and designation or removal of the general manager.

In February 2018, Mr. Aihua Pan, the representative of Sinobioway Medicine, sent letters without the approval of the full board of Sinovac Beijing, to Mr. Yin, Ms. Wang, and other senior managers of Sinovac Beijing purporting to terminate their employment. The board of directors of Sinovac Beijing subsequently determined, with the advice of PRC legal counsel, that this action did not conform with the joint venture contract and articles of association and was unlawful. On March 5, 2018, Sinovac Biotech announced actions taken to enhance the corporate governance and management of Sinovac Beijing, including the appointment of Mr. Dawei Mao, Chairman of Zhongke Biopharmaceutical Co., Ltd., as a director of Sinovac Beijing. He replaced Ms. Xiaomin Yang, then President of Sinobioway Group Co., Ltd. In addition, in March 2018, Mr. Yin, Ms. Wang, and other senior managers of Sinovac Beijing signed new employment agreements with Sinovac Biotech Ltd. and Sinovac Beijing.

11

On April 17, 2018, Mr. Aihua Pan and dozens of unidentified individuals forcibly entered Sinovac Beijing’s corporate offices and limited the physical movements of employees in Sinovac Beijing’s general manager’s office and finance department in an attempt to wrongfully take control of Sinovac Beijing’s official seal, legal documents, accounting seal, financial documents and financial information systems. In addition, these individuals disrupted Sinovac Beijing’s hepatitis A vaccine production and seasonal flu vaccine production by cutting power, seriously impacting Sinovac Beijing’s production and manufacturing processes and possibly damaging product quality. Due to these disruptive actions, Sinovac Beijing was forced to destroy the affected products. To maintain product safety, Sinovac Beijing temporarily suspended production at the impacted facility, though production has resumed at this facility months later. Sinovac Beijing was also forced to destroy the bacterial seeds intended for use in the production of its 23-valent pneumococcal polysaccharide vaccine (“PPV”) and to suspend all preparations for and ultimately postpone the inspection by NMPA, formerly known as the PRC State Food and Drug Administration, of the manufacturing site necessary for 23-valent PPV production approval.

On September 17, 2020, the Fourth Intermediate People’s Court of Beijing (“Beijing Fourth Court”) issued a judgment holding Sinobioway Medicine and Mr. Aihua Pan liable for torts and breaches of shareholders fiduciary duty under the PRC Company Law and liable for Sinovac Beijing’s losses of RMB15.4 million caused by their disruptive actions. Sinovac Beijing, Sinobioway Medicine and Mr. Aihua Pan filed notice to appeal to the Higher People’s Court of Beijing Municipality. The Higher People’s Court of Beijing Municipality held a hearing in September 2021. On October 31, 2022, the Higher People’s Court of Beijing Municipality issued a judgment in favor of Sinovac Hong Kong, upholding the judgment issued by the Beijing Fourth Court and ruling that Shandong Sinobioway Biomedicine, as the sole shareholder of Sinobioway Medicine, is jointly and severally liable for all the relevant obligations of Sinobioway Medicine to Sinovac Hong Kong.

On November 15, 2021, Sinobioway Medicine filed a complaint against Sinovac Beijing and Sinovac Hong Kong in Beijing Fourth Court. The complaint sought to dissolve and liquidate Sinovac Beijing with the argument that the board of directors of Sinovac Beijing has been unable to function for the benefit of the company and the two shareholders of Sinovac Beijing have gotten into a deadlock. In December 2022, Sinobioway Medicine filed a request to the Beijing Fourth Court to voluntarily withdraw the case. The Beijing Fourth Court supported such voluntary withdrawal and made an official ruling to dismiss the case on January 20, 2023.

In November 2021, Sinobioway Medicine filed a complaint against Sinovac Life Sciences Co., Ltd. (“Sinovac LS”, formerly known as Sinovac Research and Development Co., Ltd.), Sinovac Hong Kong, Mr. Weidong Yin and Keding Investment (Hong Kong) Limited with Beijing Fourth Court, claiming that Sinovac LS has infringed the legitimate rights of Sinovac Beijing when doing the research and development of CoronaVac. Sinobioway Medicine listed Sinovac Beijing as a third party in the case. On March 13, 2023, Beijing Fourth Court notified us by telephone that Sinobioway Medicine had just filed a request to the Beijing Fourth Court to voluntarily withdraw the case. The Beijing Fourth Court supported such voluntary withdrawal and is in the process of making an official ruling to dismiss the case.

On February 13, 2023, Shandong Sinobioway Biomedicine filed a complaint against Sinobioway Medicine and Sinovac Beijing with the People’s Court of Zhangdian District, Zibo Municipality (“Zhangdian District Court”), requesting the court to rule and confirm that Shandong Sinobioway Biomedicine, instead of Sinobioway Medicine, should be the shareholder of Sinovac Beijing despite that Sinobioway Medicine has been and is currently registered as the shareholder of Sinovac Beijing with the company registrar. Shandong Sinobioway Biomedicine also requested Zhangdian District Court to rule and order Sinovac Beijing to correct the registration of Shandong Sinobioway Biomedicine as the shareholder of Sinovac Beijing, Mr. Jialin Yue as the director, Chairman and Legal Representative of Sinovac Beijing and Mr. Weining Luan as the supervisor of Sinovac Beijing with the company registrar. In response to this newly filed case, on February 24, 2023, Sinovac Beijing filed an objection to the jurisdiction of Zhangdian District Court to hear this case. On March 12, 2023, Zhangdian District Court ruled that it has the jurisdiction to hear this case. On March 24, 2023, Sinovac Beijing filed an appeal to the Intermediate People’s Court of Zibo Municipality (“Zibo Intermediate Court”), in objection to the ruling made by Zhangdian District Court regarding its jurisdiction to hear the case. As of the date of this annual report, the case is pending with the final ruling to be made by Zibo Intermediate Court on the jurisdiction of Zhangdian District Court.

These and other actions taken by Sinobioway Medicine and its representatives may materially and adversely affect our business, financial condition and results of operations. We also cannot assure you that Sinobioway Medicine and its representatives will cease from interfering with our business.

We do not currently intend to hold an annual general meeting of shareholders until after the final determination of the litigation concerning the Rights Agreement, which will delay the ability of our shareholders to vote in an election of our directors.

With the ongoing litigations concerning the Exchange and the Rights Agreement, we have not been able to hold an annual meeting of shareholders since February 2018, and will not be able to hold an annual meeting of shareholders before the final determination of such litigations. Therefore, our shareholders will not have the opportunity to vote in an election of our directors for an indeterminate amount of time. If our shareholders want us to hold an annual meeting prior to the final determination of these ongoing litigations, they may attempt to force us to hold one under Antigua law.

The interests of the minority shareholder of Sinovac Beijing, Sinovac LS and Sinovac Dalian may diverge from our own, which may adversely affect our ability to manage these subsidiaries.

We are the majority shareholder of and have equity interests in Sinovac Beijing, Sinovac LS and Sinovac (Dalian) Vaccine Technology Co., Ltd. (“Sinovac Dalian”). If our interests diverge from those of our minority shareholders, they may exercise their rights under the relevant articles of association, shareholder’s agreement or joint venture contracts of each of such subsidiaries and the relevant PRC laws to protect their own

12

interests, which may substantially differ from ours. As a result, our ability to manage these subsidiaries as well as their own subsidiaries and affiliates may be adversely affected, which in turn may materially and adversely affect our business, financial condition and results of operations.

Recent disruptive actions taken by Sinobioway Medicine, a minority shareholder of Sinovac Beijing, has shown that its interests are not aligned with ours. We cannot assure that Sinobioway Medicine will be cooperative in handling matters related to the operations of Sinovac Beijing in the future.

As of the date of this annual report, Dalian Jin Gang Group, a minority shareholder of Sinovac Dalian, has been cooperating with us with respect to the business of Sinovac Dalian, and the minority shareholders of Sinovac LS have been aligned with us with respect to the business of Sinovac LS. We cannot assure, however, that these minority shareholders will continue to act in a cooperative manner in the future.

Our growth may be adversely affected if market demand for our vaccine products and product candidates does not meet our expectations. We may encounter problems of inadequate supply or oversupply, which would materially and adversely affect our financial condition and results of operations and would also damage our reputation and brand.

The production of vaccine products is a lengthy and complex process. As a result, our inability to match our production to market demand may result in a failure to meet market demand, which could materially and adversely affect our financial condition and results of operations and could also damage our reputation and corporate brand. For example, many patients receive their seasonal flu vaccinations in the three-month period from September to November in anticipation of an upcoming flu season and we expect this period to be one of the most significant sales periods for this product each year. In anticipation of the flu season, we intend to build up inventory of our influenza vaccine product in line with what we believe will be the anticipated demand for the product. If actual demand does not meet our expectations, we may be required to write off significant inventory and may otherwise experience adverse consequences in our financial condition. If we overestimate demand, we may purchase more raw materials than required. If we underestimate demand, our third-party suppliers may have inadequate raw material inventories, which could interrupt our manufacturing, delay shipments and result in lost sales.

If we are unable to enroll sufficient subjects and identify clinical investigators for our clinical trials, our development programs could be delayed or terminated.

The rate of completion of our clinical trials significantly depends on the rate of enrollment of volunteers. Patients’ enrollment is a function of many factors, including:

We may have difficulty in obtaining sufficient volunteer subjects’ enrollment or finding qualified investigators to conduct the clinical trials as planned and we may need to expend substantial funds to obtain access to resources or delay or modify our plans significantly. These considerations may lead us to consider the termination of development of a product for a particular indication.

A setback in any of our clinical trials could adversely affect our share price.

Clinical trials are an important part of vaccine research before any vaccine is approved for commercial use in humans. Setbacks in any phase of the clinical trials of our product candidates could have a material adverse effect on our business and prospects and financial results and would likely cause a decline in the price of our common shares. We may not achieve our projected development goals in the time frames we announce and expect. If we fail to achieve one or more milestones as contemplated, the market price of our common shares could decline.

We set goals for, and make public statements regarding, our anticipated timing of the accomplishment of objectives material to our success, such as the commencement and completion of clinical trials and other milestones. The actual timing of these events can vary significantly due to factors such as delays or failures in our clinical trials, the uncertainties inherent in the regulatory approval process and delays in achieving manufacturing or marketing arrangements sufficient to commercialize our products. We may not complete our clinical trials or make regulatory

13