UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the fiscal year ended December 31 , 2021

OR

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the transition period from to

Commission File Number: 0-25965

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | ||||

(Address and telephone number of principal executive offices)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “small reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| ☒ | Accelerated filer | ☐ | Non-accelerated filer | o | Smaller reporting company | ||||||||||||||||||

| Emerging growth company | |||||||||||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

As of the last business day of the registrant’s most recently completed second fiscal quarter, the approximate aggregate market value of the common stock held by non-affiliates, based upon the closing price of the common stock as quoted by the Nasdaq Global Select Market was $3,961,400,936 . Shares of common stock held by executive officers, directors and holders of more than 5% of the outstanding common stock have been excluded. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of March 9, 2022, the registrant had 47,272,227 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE:

TABLE OF CONTENTS

| Page | |||||||||||

-2-

PART I

Item 1. Business

Overview

Ziff Davis, Inc., together with its subsidiaries (“Ziff Davis”, the “Company”, “our”, “us” or “we”), is a leading provider of internet information and services. Our Digital Media business specializes in the technology, shopping, entertainment, and health and wellness markets, offering content, tools and services to consumers and businesses. Our Cybersecurity and Martech business provides cloud-based subscription services to consumers and businesses including cybersecurity, privacy and marketing technology.

Our Digital Media business generates revenues from advertising and sponsorships, subscription and usage fees, performance marketing and licensing fees. Our Cybersecurity and Martech businesses generate revenues primarily from customer subscription and usage fees.

In addition to growing our business organically, on a regular basis we acquire businesses to grow our customer bases, expand and diversify our service offerings, enhance our technologies, acquire skilled personnel and enter into new markets.

Our consolidated revenues are currently generated primarily from two basic business models, each with different financial profiles and variability. Our Digital Media business is driven primarily by advertising revenues, has relatively higher sales and marketing expense and has seasonal strength in the fourth quarter. Our Cybersecurity and Martech business is driven primarily by subscription revenues, with relatively stable and predictable margins from quarter to quarter. We continue to pursue additional acquisitions, which may include companies operating under business models that differ from those we operate under today. Such acquisitions could impact our consolidated profit margins and the variability of our revenues.

In March 2022, Ziff Davis issued its first annual Environmental, Social & Governance (ESG) Report. Included in the report are the findings from our first GreenHouse Gas inventory, which calculates our Scope 1, 2, and 3 emissions. Our ESG efforts focus on five critical pillars: diversity, equity and inclusion; data security and data privacy; environmental sustainability; community engagement; and governance, transparency and accountability. The report highlights the policies, programs and practices Ziff Davis has in place to tackle critical challenges and the tangible results we have already achieved across our business, within our industry, and in our communities. Included in the report are details about several new programs including our Global Mentorship Program, ReStart Returnship Program, and Internal Mobility Program, among others.

Ziff Davis was incorporated in 2014 as a Delaware corporation through the creation of a holding company structure. Our Cybersecurity and Martech businesses are operated by our wholly owned subsidiary J2 Global Ventures, LLC. Prior to the spin-off of Consensus Cloud Solutions, Inc. (“Consensus”), our Cybersecurity and Martech businesses were operated by our former wholly owned subsidiary J2 Cloud Services, LLC (formerly J2 Cloud Services, Inc.), which was founded in 1995, and subsidiaries of J2 Cloud Services, LLC. On October 7, 2021 (the “Distribution Date”), the Company completed the previously announced separation (the “Separation”) of its cloud fax business into Consensus, an independent publicly traded company, and the Company transferred J2 Cloud Services, LLC to Consensus who in turn transferred non-fax assets and liabilities back to Ziff Davis such that Consensus was left with the cloud fax business. In connection with the Separation we changed our name to Ziff Davis, Inc. (“Ziff Davis”) from J2 Global, Inc. (for certain events prior to October 7, 2021, the Company may be referred to as J2 Global) and began trading under the stock symbol “ZD”. The Separation was achieved through the Company’s distribution of 80.1% of the shares of Consensus common stock to holders of Company common stock as of the close of business on October 1, 2021, the record date for the distribution. Before the Separation, we reported our results as Digital Media and Cloud Services. In connection with the Separation, we now refer to these segments as Digital Media and Cybersecurity and Martech, each of which is further described below.

Digital Media

Our Digital Media business operates a portfolio of web properties and apps which includes IGN, RetailMeNot, Mashable, PCMag, Humble Bundle, Speedtest, Offers, Black Friday, MedPageToday, Everyday Health, BabyCenter and What to Expect, among others. During 2021, our Digital Media web properties attracted approximately 8.5 billion web visits and 29.6 billion views.

-3-

Our properties provide trusted reviews of technology, shopping and entertainment products and services; news and commentary related to their vertical markets; professional networking tools, targeted emails and white papers for IT professionals; speed testing for internet and mobile network connections; online deals and discounts for consumers; news, interactive tools and mobile applications that enable consumers to manage a broad array of health and wellness needs on a daily basis, including medical conditions, pregnancy, diet and fitness; and news, tools and information for healthcare professionals to stay abreast of industry, legislative and regulatory developments across major medical specialties.

Our Digital Media business generates revenues from the sale of display and video advertising; customer clicks to online merchants as well as commissions on sales attributed to clicks to online merchants; business-to-business leads to IT vendors; the licensing of technology, data and other intellectual property to clients; and the sale of subscription services to consumers and businesses.

We believe competitive factors relating to attracting and retaining users include the ability to provide premium and exclusive content and the reach, effectiveness, and efficiency of our marketing services to attract consumers, advertisers, healthcare professionals and publishers. We continue to seek opportunities to acquire additional web properties, both within and outside of the technology, shopping, entertainment, and health and wellness verticals, with the goal of monetizing their audiences and content through application of our proprietary technologies and insight.

Web Properties

Our Digital Media properties and services include the following:

Technology

PCMag is an online resource for laboratory-based product reviews, technology news and buying guides. We operate one of the largest and oldest independent testing facilities for consumer technology products. Founded in 1984, our lab produces unbiased technology product and service reviews, and PCMag’s “Editor’s Choice” award is recognized globally as a trusted mark for buyers and sellers of technology products and services.

Mashable is a global media brand publishing premium content for individuals interested in technology and culture. Mashable is recognized as a trusted global brand and produces stories for more than a dozen platforms, including Snapchat, Twitter and Facebook.

Ookla provides customers fixed broadband and mobile network testing applications, data and analysis. Over ten million tests are actively initiated by consumers each day across all of Ookla’s Speedtest platforms, with more than 40 billion completed to date. As a result, Ookla maintains comprehensive analytics on worldwide internet performance and accessibility. Ookla solutions have been adopted by a significant number of internet service providers and mobile carriers worldwide and have been translated into dozens of languages for use by thousands of businesses, governments, universities and trade organizations. Ookla also offers its customers connectivity monitoring, testing and insights under the RootMetrics, Solutelia and SpatialBuzz brands.

Ekahau provides solutions for enterprise wireless network design and troubleshooting. Customers run their networks with Ekahau’s Wi-Fi planning and measurement solutions, which design and manage superior wireless networks by seeking to minimize network deployment time and establish sufficient wireless coverage across the network.

Downdetector offers real-time overviews of status information and outages for services and digital products that consumers use every day. Downdetector aims to track any service that its users consider vital to their everyday lives, including (but not limited to) internet providers, mobile providers, airlines, banks, public transport and other online services.

Spiceworks Ziff Davis B2B provides digital content for buyers of information technology (IT) products and services, allowing IT vendors to identify, reach and influence corporate IT decision makers who are actively researching specific IT purchases.

-4-

Shopping

RetailMeNot is a savings destination that influences consumer purchase decisions through savings and discount opportunities by connecting retail partners representing more than 150,000 national and international brands with consumer shopping audiences. RetailMeNot promotional media solutions include mobile coupons and codes, cash back offers and browser extensions.

Offers.com is a coupons & deals website featuring offers from more than 20,000 of the internet’s more popular stores and brands. Offers.com’s objective is to help consumers find the best deals on the web. Additionally, Offers.com employs a process to verify that its coupon codes work, saving consumers time and money.

BlackFriday.com, TheBlackFriday.com, BestBlackFriday.com and DealsofAmerica.com are resources for shoppers to find the best deals and offers from retailers during the height of the holiday shopping season.

Entertainment

IGN Entertainment is an internet media brand focused on the video game and entertainment enthusiast markets. IGN reaches more than 280 million monthly users across 28 platforms and is followed by nearly 50 million social and YouTube followers with 500 million minutes watched monthly.

HumbleBundle.com is a digital subscription and storefront for video games, ebooks, and software. Customers purchase monthly subscriptions, product bundles, and individual products through our website. In addition, raising money for charity is a core mission for Humble Bundle. Each product sale transaction at Humble Bundle results in a charitable contribution.

Health and Wellness

Everyday Health Group (“EHG”) operates a portfolio of properties focused on driving better clinical and health outcomes through decision-making informed by highly relevant information, data and analytics. EHG is organized around three audiences: Health and Wellness Consumers, Pregnancy & Parenting, and Healthcare Professionals.

Health and Wellness Consumers

Consumer-focused properties include online content, news, interactive tools and applications designed to allow consumers to manage a broad array of health and wellness needs on a daily basis. Everyday Health, our flagship brand, is a broad-based health information portal that provides consumers with trusted and actionable health and wellness information intended to empower users to better manage their health and wellness.

Castle Connolly, a premier brand in healthcare provider research and rankings, publishes the renowned peer-reviewed Top Doctor series, including America’s Top Doctors. At present, there are approximately 6%, or over 61,000, of U.S. physicians across all specialties who have been nominated by their peers and have had their credentials validated by Castle Connolly’s research team.

EHG provides advertisers access to the Everyday Health Trusted Care Access Portfolio (“TCAP”) of digital health properties. In addition to Everyday Health and other EHG-owned and operated consumer websites, including Diabetes Daily and Migraine Again, TCAP features digital properties of two of the most world-renowned medical centers, to which Everyday Health holds exclusive advertising representation rights.

Pregnancy & Parenting

BabyCenter is the leading global digital pregnancy and parenting resource. BabyCenter operates nine international versions in seven different languages delivered via websites, mobile apps and online communities. We also operate the digital properties for the What to Expect brand, a leading pregnancy and parenting media resource. Based on the best-selling pregnancy book, What to Expect When You’re Expecting, by author Heidi Murkoff, the What to Expect website and mobile applications contain interactive content on conception planning and pregnancy, as well as information on raising newborns and toddlers.

-5-

Health and Wellness Professionals

For healthcare professionals, we provide digital content that enables healthcare professionals to stay abreast of clinical, industry, legislative and regulatory developments across all major medical specialties. Our flagship professional property, MedPage Today, delivers daily breaking medical news across all major medical specialties and major public policy developments from Washington D.C. MedPage Today coordinates with leading researchers, clinicians and academic medical centers to aid in gathering in-depth information for its coverage. MedPage Today’s excellence has been recognized with awards from the American Society of Healthcare Business Editors, the National Institute for Healthcare Management, the eHealthcare Leadership Awards, the Medical Marketing and Media Awards and the Web Health Awards. Additionally, MedPage Today was named as a finalist for the Jesse M. Neal Award and the Gerald M. Loeb Award.

PRIME Education provides accredited continuing medical education (“CME”) and continuing education (“CE”) programs to healthcare professionals. PRIME is nationally recognized for its healthcare outcomes research and its conduct of research-informed and other CME and CE programs in various therapeutic areas. For two of the last four years, PRIME has been honored by the Alliance for Continuing Education in the Health Professions as winner of the William Campbell Felch Award for Outstanding Research in Continuing Education (“CE”).

Health eCareers provides a digital portal to connect physicians, nurses, nurse practitioners, physician assistants and certified registered nurse anesthetists with jobs in every medical specialty. Health eCareers contracts with thousands of healthcare employers across the United States and an exclusive network of premier healthcare associations and community partners seeking connections to qualified healthcare professionals to fill open positions.

Subscriptions

We primarily offer subscription and licensing services to businesses for Speedtest Intelligence, which offers up-to-date insights into global fixed broadband and mobile performance data, as well as monthly subscription packages to consumers through Humble Bundle.

Display and Video Advertising

We sell online display and video advertising on our owned-and-operated web properties and on third party sites.

We have contractual arrangements with advertisers either directly or through agencies. The terms of these contracts specify the price of the advertising to be sold and the volume of advertisements that will be served over the course of a campaign.

In addition to the contracts with advertisers and agencies, we have contractual arrangements with certain third party websites not owned by us and third party advertising networks to deliver online display and video advertising to their websites or to third-party sites.

Performance Marketing

We generate business-to-business leads for IT vendors through the marketing of content, including white papers and webinars, and offer additional lead qualification and nurturing services. On the consumer side, we generate clicks to online merchants by promoting deals and discounts on our web properties.

Licensing

We license our proprietary technology, data and intellectual property to third parties for various purposes. For instance, we will license the right to use PCMag’s “Editors’ Choice” logo and other copyrighted editorial content to businesses whose products have earned such distinction.

Competition

Competition in the digital media space is fierce and continues to intensify.

-6-

Our digital media business competes with (i) diversified internet and digital media companies like IAC/InterActiveCorp, Future PLC, Red Ventures, Internet Brands, (ii) vertical-specific digital media companies like GoodRx, TechTarget, Vox, Centerfield, Doximity, CarGurus and Fandom and (iii) other large sellers of advertising including Google, Facebook, Snap, Twitch and others. We believe that the primary competitive factors determining our success in the market for our digital media include the reputation of brands as trusted sources of objective information and our ability to attract internet users and advertisers to our web properties and our expertise in multiple methods of monetization. Some of these companies may have greater financial and other resources than we do.

For more information regarding the competition that we face, please refer to the section entitled Risk Factors contained in Item 1A of this Annual Report on Form 10-K.

Cybersecurity and Martech

Consumers and businesses of all sizes are increasingly subscribing to cloud-based services to meet their communication, messaging, security, privacy, customer marketing and other needs. Our Cybersecurity and Martech services represent a model for delivering and consuming, real time business technology services, resources and solutions over the internet. Their goal is to reduce or eliminate costs, increase sales and enhance productivity, mobility, business continuity and security. Our VIPRE security and Inspired eLearning cybersecurity solutions protect our customers from cyber threats with endpoint and email security, threat intelligence and security awareness training. IPVanish provides virtual private networks that encrypt our customers’ data and activity on the internet. Livedrive enables our customers to securely back up their data and dispose of tape or other physical systems. SEOMoz, Kickbox, Campaigner, iContact, and SMTP provide our customers with search engine optimization tools and enhanced email marketing and delivery solutions. eVoice and Line2 provide our customers a virtual phone system with various available enhancements. We believe these services represent more efficient and less expensive solutions than many existing alternatives, and provide increased security, privacy, flexibility and mobility.

We generate substantially all of our Cybersecurity and Martech revenues from “fixed” subscription revenues for basic customer subscriptions and, to a lesser extent, “variable” usage revenues generated from actual usage by our subscribers.

We market our Cybersecurity and Martech offerings to a broad spectrum of prospective business customers including sole proprietors, small to medium-sized businesses, enterprises and government organizations. We also market our Cybersecurity and Martech offerings to consumers. Our marketing efforts include enhancing brand awareness; utilizing online advertising, search engines and affiliate programs; selling through both a telesales and direct sales force; and working with resellers and other channel partners. We continuously seek to extend the number of distribution channels through which we acquire paying customers and improve the cost and volume of customers obtained through our current channels.

Our Cybersecurity and Martech businesses operate as the VIPRE Security Group and the Moz Group, respectively.

VIPRE Security Group

VIPRE software solutions protect people and businesses from costly and malicious cyber threats. VIPRE offerings include comprehensive endpoint and email security, along with threat intelligence for real-time malware analysis.

Inspired eLearning’s SaaS platform for cybersecurity awareness and compliance training helps enterprises protect their organizations by reducing human-related cybersecurity and workplace incidents.

IPVanish offers one of the fastest virtual private network services in the industry. The IPVanish network spans over 2,000 servers across more than 75 locations around the world, enabling users to browse the internet securely and anonymously, without restriction.

SugarSync provides online file backup, synchronization and sharing of all of a customer’s documents, photos, music and movies across all of the customer’s computers and mobile devices.

LiveDrive provides online backup and sync storage features for professionals and individuals. The customers can access their files from anywhere at any time so long as they have access to the internet.

-7-

Moz Group

Campaigner, iContact and Kickbox provide email marketing solutions to help small, medium and large businesses strengthen customer relationships and drive sales, and offer professional email campaign creation, advanced list management, segmentation and verification tools, marketing automation, attribution reports and campaign tracking, and targeted email autoresponders and workflows.

eVoice is a virtual phone system that provides small and medium-sized businesses on-demand voice communications services. Customers can assign departmental and individual extensions that can connect to multiple numbers, including land-line and mobile phones and IP networks, and can enhance reachability through “find me/follow me” capabilities. These services also include advanced integrated voicemail for each extension.

Line2 is a cloud phone service which allows users to add a 2nd line to a mobile device. Line2 enables users to separate work and personal calls on a single device and includes standard business phone service features such as SMS, MMS, auto attendant, call routing, call forwarding, voicemail, call queue, toll-free and vanity numbers.

Moz Pro, Moz Local and Stat Analytics offer search engine optimization services that are used to help understand and improve traffic, rankings and visibility in search results.

Competition

Our Cybersecurity and Martech business faces competition from, among others, email marketing solution providers, marketing automation services, cyber security software and service vendors, and virtual private networks. Our online cybersecurity solutions compete against publicly traded and privately-held providers of cybersecurity solutions and related software, such as NortonLifeLock, Kape Technologies, KnowBe4 and Malwarebytes. Our marketing technology solutions compete directly with various providers of search engine optimization technology and communication platforms that provide email and voice-related services to small- and medium-sized businesses, including companies like SEMRush, MailChimp, The Campaign Monitor group, Constant Contact and Dialpad. Our Cybersecurity and Martech business also competes against diversified and acquisitive vertical market software providers like Constellation Software. Some of these companies may have greater financial and other resources than we do.

We believe that the primary competitive factors determining our success in the market for our Cybersecurity and Martech include financial strength and stability; pricing; reputation for reliability and security of service; intellectual property ownership; effectiveness of customer support; sign-up, service and software ease-of-use; service scalability; customer messaging and branding; geographic coverage; scope of services; currency and payment method acceptance; and local language sales, messaging and support.

For more information regarding the competition that we face, please refer to the section entitled Risk Factors contained in Item 1A of this Annual Report on Form 10-K.

Patents and Proprietary Rights

We regard the protection of our intellectual property rights as important to our success. We aggressively protect these rights by relying on a combination of patents, trademarks, copyrights, trade dress and trade secrets. We also enter into confidentiality and intellectual property assignment agreements with employees and contractors, and nondisclosure agreements with parties with whom we conduct business in order to limit access to and disclosure of our proprietary information.

Through a combination of internal technology development and acquisitions, we have built a portfolio of numerous U.S. and foreign patents. We intend to continue to invest in patents, to aggressively protect our patent assets from unauthorized use and to generate patent licensing revenues from authorized users.

We have generated royalties from licensing certain of our patents and have enforced certain patents against companies using our patented technology without our permission.

We seek patents for inventions that may contribute to our business or technology sector. In addition, we have multiple pending U.S. and foreign patent applications, covering components of our technology and in some cases technologies beyond those that we currently offer. Unless and until patents are issued on the pending applications, no patent rights can be enforced.

-8-

We have obtained patent licenses for certain technologies where such licenses are necessary or advantageous.

We own and use a number of trademarks in connection with our services, including word and/or logo trademarks for IGN, Everyday Health, BabyCenter, Humble Bundle, PCMag, Mashable, Ookla, Speedtest, and RetailMeNot, among others. Many of these trademarks are registered worldwide, and numerous trademark applications are pending around the world. We hold numerous internet domain names, including “everydayhealth.com”, “retailmenot.com”, “pcmag.com”, “ign.com”, “speedtest.net”, “offers.com”, “humblebundle.com”, “mashable.com”, and “babycenter.com”, among others. We have filed to protect our rights to our brands in certain alternative top-level domains such as “.org”, “.net”, “.biz”, “.info” and “.us”, among others.

Like other technology-based businesses, we face the risk that we will be unable to protect our intellectual property and other proprietary rights, and the risk that we will be found to have infringed the proprietary rights of others. For more information regarding these risks, please refer to the section entitled Risk Factors contained in Item 1A of this Annual Report on Form 10-K.

Government Regulation

We are subject to a number of foreign and domestic laws and regulations that affect companies conducting business over the internet and, in some cases, using services of third-party telecommunications and internet service providers. These include, among others, laws and regulations addressing privacy, data storage, retention and security, freedom of expression, content, taxation, numbers, advertising and intellectual property. With respect to most of our business, we are not a regulated telecommunications provider in the U.S. For information about the risks we face with respect to governmental regulation, please see Item 1A of this Annual Report on Form 10-K entitled Risk Factors.

Seasonality

Revenues associated with our Digital Media operations are subject to seasonal fluctuations, becoming most active during the fourth quarter holiday period due to increased retail activity. Our Cybersecurity and Martech revenues are impacted by the number of effective business days in a given period. We traditionally experience lower than average Cybersecurity and Martech usage and customer sign-ups in the fourth quarter.

Research and Development

The markets for our services are evolving rapidly, requiring ongoing expenditures for research and development and timely introduction of new services and service enhancements. Our future success will depend, in part, on our ability to enhance our current services, to respond effectively to technological changes, attract and retain engineering talent, sell additional services to our existing customer base and introduce new services and technologies that address the increasingly sophisticated needs of our customers.

We devote significant resources to develop new services and service enhancements. Our research, development and engineering expenditures were $78.9 million, $57.1 million and $44.7 million for the fiscal years ended December 31, 2021, 2020 and 2019, respectively. For more information regarding the technological risks that we face, please refer to the section entitled Risk Factors contained in Item 1A of this Annual Report on Form 10-K.

Human Capital Resources

As of December 31, 2021, we had approximately 4,900 employees, nearly evenly split between U.S. and non-U.S based employees. Our ability to continue to attract, retain and motivate our highly qualified workforce is very important to our continued success. Approximately 70 of the editorial employees in our Digital Media business have elected to join a union. We chose to voluntarily recognize the union and have negotiated a collective bargaining agreement with the union. None of our other employees are represented by collective bargaining.

-9-

Acquisition Strategy Impact on Human Capital

Since 2012, we have deployed more than $2.8 billion on more than 80 acquisitions across the globe in a variety of verticals within the internet and software categories. Welcoming and integrating new groups of employees - each group with its own unique culture, organizational norms, and expectations - is a strength of ours. We have developed processes to reduce the human capital risk associated with our acquisition strategy, and we believe that our ability to effectively integrate new employees and businesses is a core competency for Ziff Davis.

Our Culture

Culture at Ziff Davis operates on two levels. While we have a strong enterprise-wide culture that focuses on our core values – leadership, collaboration, efficiency, innovation, and purpose – we also have a strong network of micro-cultures that operate within many of our businesses and drive their success. Integrating those micro-cultures and values is important; we work hard to foster an environment of collaboration and embrace the power of small groups working together.

An important dimension of the enterprise culture at Ziff Davis stems from our belief that profitability and corporate responsibility go hand in hand. We believe that “Doing is Greater than Talking,” which has been a rallying cry to employees, galvanizing them to take action to create social value and impact.

With their work and many contributions, our employees play a crucial role in supporting Ziff Davis’s “Five Pillars of Purpose,” which today include:

Diversity, Equity & Inclusion - Reinforce our diverse workforce, reflect our diverse audiences, and extend upon our inclusive culture.

Data - Protect our data and customer data, ensure our product security, and respect the data privacy rights of our users.

Environmental Sustainability - Reduce our environmental footprint and continue helping customers and users reduce their footprint.

Community - Support our employees worldwide and positively impact the communities around us.

Governance - Represent shareholders’ best interests with our rigorous and transparent corporate governance structure.

Diversity, Equity & Inclusion

Our digital media audiences and Cybersecurity and Martech services users are diverse – gender, race, ethnicity, age, orientation, geography, education, background, interests, and more. We believe that for our business to succeed over the long term, Ziff Davis must have an inclusive corporate culture that embraces diversity and promotes equity across our enterprise.

We are taking steps to promote that culture. To date, we have:

•created Ziff Davis Council, a diverse group of employees that develops recommendations for recruiting, mentorship, and advancement;

•supported five Employee Resource Groups to increase opportunities for networking, learning, and development, with more groups to come;

•promoted training and education through our Racism in America speaker series and through expanded mandatory training that includes Managing Bias and Diversity & Inclusion; and

•introduced DEI targets into our executive compensation program beginning in 2021.

We believe that transparency and accountability are important parts of managing human capital risk. To that end, in 2021 we published our second Annual Diversity Report, available on our website, which details our workforce race representation, gender representation, and details how those differ between our overall workforce and our senior employees, as well as introducing commitments to DEI initiatives within our current and future workforce. We are proud of our progress to date – and we recognize we have much more to do.

-10-

Hiring

We reinforce our culture and our values by seeking out diverse candidates, and looking for candidates that fit well with our organizational priorities. We have had success in this area; 37 percent of all recent new hires have been people of color, and 57 percent of recent new hires in the U.S. have been women. We are working to proactively attract more diverse talent; we have doubled our referral bonus paid to employees when we hire a person of color they recommend, and we are partnering with Jopwell and the Professional Diversity Network to advertise our open roles to employees aligning with a multitude of identity groups.

Employee Compensation & Benefits

Compensation is an important consideration for all of our employees and we strive to pay competitive compensation packages that reflect the success of the business and the individual contributions of each colleague. We are committed to fair pay practices; roles are periodically benchmarked to help inform where adjustments may be needed.

We care for our employees by providing benefits we believe are effective at attracting and retaining the talent critical for our success and, more importantly, assist in their day to day well-being. Those benefits include comprehensive health insurance coverage and covering 83% of health insurance premiums for covered U.S. employees, an employee stock purchase program, flexible time off, free access to telemedicine, up to 16 weeks of paid parental leave for birth parents, family planning support, 16 hours annually of fully paid Volunteer Time Off, partnering with Benevity to support volunteer event opportunities globally, and a program encouraging personal paths to wellness called “Wellness Your Way.”

Wellbeing

Creating a culture where all colleagues feel supported and valued is paramount to our corporate mission. The ongoing COVID-19 pandemic has led to unique challenges, and we are striving to ensure the health, safety and general well-being of our colleagues. In 2020, we introduced a mental health education program which continued with quarterly events throughout 2021. We continue to evolve our programs to meet our colleagues’ health and wellness needs, which we believe is essential to attract and retain employees of the highest caliber, and we offer a competitive benefits package focused on fostering work/life integration.

Available Information

We file Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, pursuant to Sections 13(a) and 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) with the Securities and Exchange Commission (the “SEC”). Such reports and other information and amendments thereto filed or furnished by the Company with the SEC are available free of charge on the Company’s website at www.ziffdavis.com as soon as reasonably practicable after we file such reports with, or furnish them to, the SEC’s website. The information on our website is not part of this report. The SEC maintains an internet site that contains reports, proxy and information statements and other information regarding our filings we file electronically with the SEC at www.sec.gov. Our Board has adopted a Code of Business Conduct and Ethics that applies to all of our directors and employees. The Code is posted on the corporate governance page of Ziff Davis’s website, and can be accessed at http://investor.ziffdavis.com. Any changes to or waiver of our Code of Business Conduct and Ethics for senior financial officers, executive officers or directors will be posted on that website.

-11-

Item 1A. Risk Factors

Before deciding to invest in Ziff Davis or to maintain or increase your investment, you should carefully consider the risks described below in addition to the other cautionary statements and risks described elsewhere in this Annual Report on Form 10-K and our other filings with the SEC, including our subsequent reports on Forms 10-Q and 8-K. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial also may affect our business. If any of these known or unknown risks or uncertainties actually occurs, our business, prospects, financial condition, operating results and cash flows could be materially adversely affected. In that event, the market price of our common stock will likely decline and you may lose part or all of your investment.

Risk Factors Summary

The following is a summary of the principal risks that could adversely affect our business, operations and financial results.

Risks Related To Our Business

•Acquisitions and investments in our business play a significant role in our growth.

•Acquisitions may disrupt our operations and harm our operating results.

•The majority of our revenue within the Digital Media business is derived from short-term advertising arrangements, and our Digital Media business may lose or be unable to attract advertisers if it cannot develop, commission or acquire compelling content, if it cannot attract users to mobile offerings or if advertisers’ marketing budgets are cut or reduced.

•We face risks associated with system failures, security breaches and other technological issues.

•We face risks associated with changes in our tax rates, changes in tax treatment of companies engaged in e-commerce, the adoption of new U.S. or international tax legislation, assessments or audits by taxing authorities and potential exposure to additional tax liabilities (including with respect to sales and use, telecommunications or similar taxes).

•We face risks associated with political instability and volatility in the economy.

•The markets in which we operate are highly competitive, and we may not be successful in growing our brands or revenue.

•If the distribution of Consensus, together with certain related transactions, does not qualify as a transaction that is generally tax-free for U.S. federal income tax purposes, Ziff Davis, Consensus and Ziff Davis stockholders could be subject to significant tax liabilities.

•Our business is highly dependent on our billing systems functioning properly, and we face risks associated with credit and debit card declines and merchant standards imposed by credit and debit card companies.

•We face potential liability for various types of legal claims, and we may be engaged in legal proceedings that could cause us to incur unforeseen expenses and could divert significant operational resources and our management’s time and attention.

•Our businesses depend in part on attracting visitors to our websites from search engines.

•The COVID-19 pandemic and related governmental response, and related labor shortages, supply chain disruptions, and inflation, could negatively affect our business, operations and financial performance.

•We may be subject to risks from international operations, including risks associated with currency fluctuations and foreign exchange controls and other adverse changes in global financial markets, including unforeseen global crises such as war, strife, strikes, global health pandemics, as well as risks associated with international laws and regulations.

•We may be found to infringe the intellectual property rights of others, and we may be unable to adequately protect our own intellectual property rights.

•Our business is dependent on the supply of services and other business requirements from other companies.

•Our business is dependent on our retention of our executive officers, senior management and our ability to hire and retain key personnel.

•Our level of indebtedness could adversely affect our financial flexibility and our competitive position, and we require significant cash to service our debt and fund our capital requirements.

•We are exposed to risk if we cannot maintain or adhere to our internal controls and procedures.

-12-

•We identified a material weakness which could adversely affect our business, reputation, results of operations and stock price.

•We face risks associated with our 1.75% Convertible Notes and 4.625% Senior Notes, including the possibility of changes in interest deductions, triggering of the conditional conversion feature, lack of funds to settle conversions, redemptions or repurchase of the notes, use of particular accounting methods, and imposition of restrictions on future debt.

•Divestitures or other dispositions could negatively impact our business, and contingent liabilities from businesses that we have sold could adversely affect our financial statements.

•Potential indemnification liabilities to Consensus pursuant to the separation agreement could materially and adversely affect our businesses, financial condition, results of operations, and cash flows.

Risks Related To Our Industries

•We are subject to laws and regulations worldwide, changes to which could increase our costs and individually or in the aggregate adversely affect our business. These may in turn subject us to claims, judgments, monetary liabilities and other remedies, and to limitations on our business practices.

•We operate across many different markets and may be exposed to a variety of government and private actions or self-regulatory developments regarding data privacy and security.

•Data privacy and security regulations such as the GDPR and the CCPA impose significant compliance costs and expose us to substantial risks, particularly with respect to health data and other sensitive data.

•Developments in the healthcare industry and associated regulations could adversely affect our business, including our Everyday Health Group set of brands.

•Our business could suffer if providers of broadband internet access services block, impair or degrade our services.

•Our business faces risks associated with advertisement blocking technologies and advertising click fraud.

•The industries in which we operate are undergoing rapid technological changes, and we may not be able to keep up.

Risks Related To Our Stock

•Features of the 1.75% Convertible Notes and 4.625% Senior Notes may delay or prevent an otherwise beneficial attempt to take over our company.

•Conversions of the 1.75% Convertible Notes would dilute the ownership interest of our existing stockholders, including holders who had previously converted their 1.75% Convertible Notes.

•We are a holding company and our operations are conducted through, and substantially all of our assets are held by, subsidiaries, which may be subject to restrictions on their ability to pay dividends to us to fund our dividends, if any, and interest payments and other holding company expenses.

•Future sales of our common stock may negatively affect our stock price.

•Anti-takeover provisions could negatively impact our stockholders.

•Our stock price may be volatile or may decline, due to various reasons, including variations between actual results and investor expectations, industry and regulatory changes, introduction of new services by our competitors, developments with respect to IP rights, geopolitical events such as war, threat of war or terrorist actions, and global health pandemics, among others.

-13-

Risks Related To Our Business

Acquisitions and investments in our business have historically played a significant role in our growth and we anticipate that they will continue to do so.

We must acquire additional or invest in new or current businesses, products, services and technologies that complement or augment our service offerings and customer base in order to sustain our rate of growth. We may not successfully identify suitable acquisition candidates or investment strategies, manage disparate technologies, lines of business, personnel and corporate cultures, realize our business strategy or the expected return on our investment or manage a geographically dispersed company. If we are unable to identify and execute on acquisitions or execute on our investment strategies, our revenues, business, prospects, financial condition, operating results and cash flows could suffer.

We have made and expect to continue to make acquisitions that could disrupt our operations and harm our operating results.

We intend to continue to develop new services, enhance existing services and expand our geographic presence through acquisitions of other companies, service lines, technologies and personnel.

Acquisitions involve numerous risks, including the following:

•Difficulties in integrating the operations, systems, technologies, products and personnel of the acquired businesses;

•Difficulties in entering markets in which we have no or limited direct prior experience and where competitors in such markets may have stronger market positions;

•Diversion of management’s attention from normal daily operations of the business and the challenges of managing larger and more widespread operations resulting from acquisitions; and

•The potential loss of key employees, customers, distributors, vendors and other business partners of the businesses we acquire.

Acquisitions may also cause us to:

•Use a substantial portion of our cash resources or incur debt;

•Significantly increase our interest expense, leverage and debt service requirements if we incur additional debt to pay for an acquisition;

•Assume liabilities;

•Issue common stock that would dilute our current stockholders’ percentage ownership;

•Record goodwill and intangible assets that are subject to impairment testing on a regular basis and potential periodic impairment charges;

•Incur amortization expenses related to certain intangible assets; and

•Become subject to intellectual property or other litigation.

Mergers and acquisitions are inherently risky and subject to many factors outside of our control. We cannot give assurances that our previous or future acquisitions will be successful and will not materially adversely affect our business, operating results or financial condition. Failure to manage and successfully integrate acquisitions could materially harm our business and operating results. In addition, our effective tax rate for future periods is uncertain and could be impacted by mergers and acquisitions.

-14-

The majority of our revenue within the Digital Media business is derived from short-term advertising arrangements and a reduction in spending by or loss of current or potential advertisers would cause our revenue and operating results to decline.

In most cases, our agreements with advertisers have a term of one year or less and may be terminated at any time by the advertiser or by us without penalty. Advertising agreements often provide that we receive payment based on “served” impressions but the online ad industry has started to shift so that payment will be made based on “viewable” impressions, and that change in basis could have a negative effect on available impressions thereby reducing our revenue potential. Accordingly, it is difficult to accurately forecast display revenue. In addition, our expense levels are based in part on expectations of future revenue. Moreover, we believe that advertising on the internet, as in traditional media, fluctuates significantly as a result of a variety of factors, many of which are outside of our control. Some of these factors include (a) budget constraints of our advertisers, (b) cancellations or delays of projects by our advertisers due to numerous factors, including but not limited to, supply chain issues, (c) the cyclical and discretionary nature of advertising spending, (d) general economic, internet-related and media industry conditions, (e) tax and other legislation and regulation, as well as (f) extraordinary events, such as war, acts of terrorism or aggression, extreme weather events including as exacerbated by climate change, and pandemics or other public health crises. Further, impairment of our ability to produce and/or participate in “live events” for an indefinite period of time as occurred during the COVID-19 pandemic, due to any such extraordinary or other circumstances may result in a reduction of spending or loss of current or potential advertisers. The state of the global economy and availability of capital has impacted and could further impact the advertising spending patterns of existing and potential advertisers. Any reduction in spending by, or loss of, existing or potential advertisers would negatively impact our revenue and operating results. Further, we may be unable to adjust our expenses and capital expenditures quickly enough to compensate for any unexpected revenue shortfall.

If we are unable to develop, commission or acquire compelling content in our Digital Media business at acceptable prices, our expenses may increase, the number of visitors to our online properties may not grow, or may decline, and/or visitors’ level of engagement with our websites may decline, any of which could harm our operating results.

Our future success depends in part on the ability of our Digital Media business to aggregate compelling content and deliver that content through our online properties. We believe that users will increasingly demand high-quality content and services including more video and mobile-specific content. Such content and services may require us to make substantial payments to third parties if we are unable to develop content of our own. Our ability to maintain and build relationships with such third-party providers is critical to our success. In addition, as new methods for accessing the internet become available, including through alternative devices, we may need to enter into amended agreements with existing third-party providers to cover the new devices. We may be unable to enter into new, or preserve existing, relationships with the third-parties whose content or services we seek to obtain. In addition, as competition for compelling content increases both domestically and internationally, our third-party providers may increase the prices at which they offer their content and services to us and potential providers may not offer their content or services to us at all, or may offer them on terms that are not agreeable to us. An increase in the prices charged to us by third-party providers could harm our operating results and financial condition. Further, many of our content and services licenses with third parties are non-exclusive. Accordingly, other media providers may be able to offer similar or identical content. This increases the importance of our ability to deliver compelling content and personalization of this content for users in order to differentiate our properties from other businesses. Although we generally develop compelling content of our own, when we are unable to do so, we engage freelance services or obtain licensed content which may not be at reasonable prices and which could harm our operating results.

In our Digital Media business, if we are unable to prove that our advertising and sponsorship solutions provide an attractive return on investment for our customers, our financial results could be harmed.

Our ability to grow revenue from our Digital Media business is dependent on our ability to demonstrate to marketers that their marketing campaigns with us provide a meaningful return on investment (“ROI”) relative to offline and other online opportunities. Certain of the marketing campaigns with respect to our Digital Media business are designed such that the revenues received are based entirely upon the ROI delivered for customers. Our Digital Media business has invested significant resources in developing its research, analytics, and campaign effectiveness capabilities and expects to continue to do so in the future. Our ability, however, to demonstrate the value of advertising and sponsorship on Digital Media business properties will depend, in part, on the sophistication of the analytics and measurement capabilities, the actions taken by our competitors to enhance their offerings, whether we meet the ROI expectations of our customers, and a number of other factors. If we are unable to maintain sophisticated marketing and communications solutions that provide value to our customers or demonstrate our ability to provide value to our customers, our financial results will be harmed.

-15-

A system failure, security breach or other technological risk could delay or interrupt service to our customers, harm our reputation, lead to a loss of customers, or subject us to significant liability.

Our operations are dependent on our network being free from material interruption by damage from fire, earthquake, or other natural disaster, power loss, telecommunications failure, unauthorized entry, computer viruses, cyber-attacks, or any other events beyond our control. Similarly, the operations of our partners and other third parties with which we work are also susceptible to the same risks. There can be no assurance that our existing and planned precautions of backup systems, regular data backups, security protocols, and other procedures will be adequate to prevent significant damage, system failure or data loss, and the same is true for our partners, vendors, and other third parties on which we rely. We have experienced automated log in attempts to gain unauthorized access to customer accounts. To date, these events have not resulted in the material impairment of any business operations.

Also, many of our services are web-based, and the amount of data we store for our users on our servers has been increasing. Despite the implementation of security measures, our infrastructure, and that of our partners, vendors, and other third parties may be vulnerable to computer viruses, hackers, or similar disruptive problems caused by our vendors, partners, other third parties, subscribers, employees, or other internet users who attempt to invade public and private data networks. As seen in the industries in which we operate and others, these activities have been, and will continue to be, subject to continually evolving cybersecurity and technological risks. Further, in some cases we do not have in place disaster recovery facilities for certain ancillary services. Moreover, a significant portion of our operations relies heavily on the secure processing, storage, and transmission of confidential and other sensitive data. For example, a significant number of our Cybersecurity and Martech customers authorize us to bill their credit or debit card accounts directly for all transaction fees charged by us. We rely on encryption and authentication technology to effect secure transmission of confidential information, including customer credit and debit card numbers. Advances in computer capabilities, new discoveries in the field of cryptography, or other developments may result in a material compromise or breach of the technology used by us, our partners, our vendors, or other third parties to protect transaction and other confidential data. Any system failure or security breach that causes interruptions or data loss in and to our operations and systems or those of our partners, vendors, customers, or other third parties, or which leads to the misappropriation of our or our customers’ confidential information, could result in a significant liability to us (including in the form of judicial decisions and/or settlements, regulatory findings and/or forfeitures, and other means), cause considerable harm to us and our reputation (including requiring notification to customers, regulators, and/or the media), cause a loss of confidence in our products and services, and deter current and potential customers from using our services. We use vendors to assist with cybersecurity risks, but these vendors may not be able to assist us adequately in preparing for or responding to a cybersecurity incident. We maintain insurance related to cybersecurity risks, but this insurance may not be sufficient to cover all of our losses from any breaches or other adverse consequences related to a cybersecurity-event. Any of these events could have a material adverse effect on our business, prospects, financial condition, operating results, and cash flows, or our reputation could cause us to suffer other negative consequences. For example, we may incur remediation costs (such as liability for stolen assets or information, repairs of system damage, and incentives to customers or business partners in an effort to maintain relationships after an attack); increased cybersecurity protection costs (which may include the costs of making organizational changes, deploying additional personnel and protection technologies, training employees, and engaging third party experts and consultants); lost revenues resulting from the unauthorized use of proprietary information or the failure to retain or attract customers following an attack; litigation and legal risks (including regulatory actions by state and federal governmental authorities and non-U.S. authorities); increased insurance premiums; reputational damage that adversely affects customer or investor confidence; and damage to the company’s competitiveness, stock price, and diminished long-term shareholder value. To date, such events have not resulted in the material impairment of any business operations.

Changes in our tax rates, changes in tax treatment of companies engaged in e-commerce, the adoption of new U.S. or international tax legislation, or exposure to additional tax liabilities may adversely impact our financial results.

We are a U.S.-based multinational company subject to taxes in the U.S. and numerous foreign jurisdictions, including Ireland, where a number of our subsidiaries are organized. Our provision for income taxes is based on a jurisdictional mix of earnings, statutory tax rates, and enacted tax rules, including transfer pricing. Due to economic and political conditions, tax rates in various jurisdictions may be subject to significant change. As a result, our future effective tax rates could be affected by changes in the mix of earnings in countries with differing statutory tax rates, changes in the valuation of deferred tax assets and liabilities, or changes in tax laws or their interpretation. These changes may adversely impact our effective tax rate and harm our financial position and results of operations.

-16-

We are subject to examination by the U.S. Internal Revenue Service (“IRS”) and other domestic and foreign tax authorities and government bodies. We regularly assess the likelihood of adverse outcomes resulting from these examinations to determine the adequacy of our income tax and other tax reserves. If our reserves are not sufficient to cover these contingencies, such inadequacy could materially adversely affect our business, prospects, financial condition, operating results, and cash flows.

In addition, due to the global nature of the internet, it is possible that various states or foreign countries might attempt to impose additional or new regulation on our business or levy additional or new sales, income, or other taxes relating to our activities. Tax authorities at the international, federal, state, and local levels are currently reviewing the appropriate treatment of companies engaged in e-commerce and online advertising. New or revised international, federal, state, or local tax regulations or court decisions may subject us or our customers to additional sales, income, and other taxes. For example, the European Union, certain member states, and other countries, as well as states within the United States, have proposed or enacted taxes on online advertising and marketplace service revenues. The application of existing, new or revised taxes on our business, in particular, sales taxes, VAT, and similar taxes would likely increase the cost of doing business online and decrease the attractiveness of selling products and advertising over the internet. The application of these taxes on our business could also create significant increases in internal costs necessary to capture data and collect and remit taxes. Any of these events could have a material adverse effect on our business, financial condition, and operating results.

Moreover, we are currently under or subject to examination for indirect taxes in various states, municipalities and foreign jurisdictions. We currently have a $24.0 million reserve established for these matters. If a material indirect tax liability associated with prior periods were to be recorded, for which there is not a reserve, it could materially affect our financial results for the period in which it is recorded.

Furthermore, much of our Digital Media e-commerce revenue comes from arrangements in which we are paid by retailers to promote their digital product and service offers on our sites. Certain states have implemented regulations that require retailers to collect and remit sales taxes on sales made to residents of such states if a publisher, such as us, that facilitated that sale is a resident of such state. Paid retailers in our marketplace that do not currently have sales tax nexus in any state that subsequently passes similar regulations and in which we have operations, employees, or contractors now or in the future, may significantly alter the manner in which they pay us, cease paying us for sales we facilitate for that retailer in such state, or cease using our marketplace, each of which could adversely impact our business, financial condition, and operating results.

Taxing authorities may successfully assert that we should have collected, or in the future should collect sales and use, telecommunications, or similar taxes, and we could be subject to liability with respect to past or future tax, which could adversely affect our operating results.

We believe we remit state and local sales and use, excise, utility user, and ad valorem taxes, as well as fees and surcharges or other similar obligations, in all relevant jurisdictions in which we generate sales, based on our understanding of the applicable laws in those jurisdictions. Such tax, fee, and surcharge laws and rates vary greatly by jurisdiction, and the application of each of them to e-commerce businesses, such as ours, is a complex and evolving area. The jurisdictions where we have sales may apply more rigorous enforcement efforts or take more aggressive positions in the future that could result in greater tax liability. In addition, in the future we may also decide to engage in activities that would require us to pay sales and use, telecommunications, or similar taxes in new jurisdictions. Such tax assessments, penalties and interest or future requirements may materially adversely affect our business, financial condition, and operating results.

Political instability and volatility in the economy may adversely affect segments of our customers, which may result in decreased usage and advertising levels, customer acquisition and customer retention rates and, in turn, could lead to a decrease in our revenues or rate of revenue growth.

Certain segments of our customers may be adversely affected by political instability and volatility in the general economy or any downturns. To the extent these customers’ businesses are adversely affected by political instability or volatility, their usage of our services and/or our customer retention rates could decline. This may result in decreased cloud services subscription and/or usage revenues and decreased advertising, e-commerce or other revenues, which may adversely impact our revenues and profitability. For example, in connection with the conflict between Russia and Ukraine, the U.S. governments have imposed severe economic sanctions and export controls and have threatened additional sanctions and controls. The full impact of these measures, or of any potential responses to them by Russia or other countries, on the businesses and results of operations or our customers or us is unknown.

-17-

The markets in which we operate are highly competitive and some of our competitors may have greater resources to commit to growth, superior technologies, cheaper pricing, or more effective marketing strategies. Also, we face significant competition for users, advertisers, publishers, developers, and distributors.

For information regarding our competition, and the risks arising out of the competitive environment in which we operate, see the subsection entitled “Competition” with respect to each of our Digital Media and Cybersecurity and Martech businesses contained in Item 1 of this Annual Report on Form 10-K. In addition, some of our competitors include major companies with much greater resources and significantly larger customer bases than we have. Some of these competitors offer their services at lower prices than we do. These companies may be able to develop and expand their network infrastructures and capabilities more quickly, adapt more swiftly to new or emerging technologies and changes in customer requirements, take advantage of acquisition and other opportunities more readily, and devote greater resources to the marketing and sale of their products and services than we can. There can be no assurance that additional competitors will not enter markets that we are currently serving and plan to serve or that we will be able to compete effectively. Competitive pressures may reduce our revenue, operating profits, or both.

Our Digital Media business faces significant competition from online media companies as well as from social networking sites, mobile applications, traditional print and broadcast media, general purpose and search engines, and various e-commerce sites. Our Cybersecurity and Martech business faces competition from cloud software services and applications across several categories including secured communications, cybersecurity, and marketing technology.

Several of our competitors offer an integrated variety of software and internet products, advertising services, technologies, online services, and content. We compete against these and other companies to attract and retain subscribers, users, advertisers, partners, and developers. We also compete with social media and networking sites which are attracting a substantial and increasing share of users and users’ online time, and may continue to attract an increasing share of online advertising dollars.

In addition, several competitors offer products and services that directly compete for users with our Digital Media business offerings. Similarly, the advertising networks operated by our competitors or by other participants in the display marketplace offer services that directly compete with our offerings for advertisers, including advertising exchanges, ad networks, demand side platforms, ad serving technologies, and sponsored search offerings. We also compete with traditional print and broadcast media companies to attract advertising spending. Some of our existing competitors and possible entrants may have greater brand recognition for certain products and services, more expertise in a particular segment of the market, and greater operational, strategic, technological, financial, personnel, or other resources than we do. Many of our competitors have access to considerable financial and technical resources with which to compete aggressively, including by funding future growth and expansion and investing in acquisitions, technologies, and research and development. Further, emerging start-ups may be able to innovate and provide new products and services faster than we can. In addition, competitors may consolidate with each other or collaborate, and new competitors may enter the market. Some of the competitors of our Cybersecurity and Martech business in international markets have a substantial competitive advantage over us because they have dominant market share in their territories, are owned by local telecommunications providers, have greater brand recognition, are focused on a single market, are more familiar with local tastes and preferences, or have greater regulatory and operational flexibility due to the fact that we may be subject to both U.S. and foreign regulatory requirements.

If our competitors are more successful than we are in developing and deploying compelling products or in attracting and retaining users, advertisers, publishers, developers, or distributors, our revenue and growth rates could decline.

Our growth will depend on our ability to develop, strengthen, and protect our brands, and these efforts may be costly and have varying degrees of success.

Our brand recognition has significantly contributed to the success of our business. Strengthening our current brands and launching competitive new brands will be critical to achieving widespread commercial acceptance of our products and services. This will require our continued focus on active marketing, the costs of which have been increasing and may continue to increase. In addition, substantial initial investments may be required to launch new brands and expand existing brands to cover new geographic territories and technology fields. Accordingly, we may need to spend increasing amounts of money on, and devote greater resources to, advertising, marketing and other efforts to cultivate brand recognition and customer loyalty. In addition, we are supporting an increasing number of brands, each of which requires its own investment of resources. Brand promotion activities may not yield increased revenues and, even if they do, increased revenues may not offset the expenses incurred. A failure to launch, promote, and maintain our brands, or the incurrence of substantial expenses in doing so, could have a material adverse effect on our business.

-18-

Our brand recognition depends, in part, on our ability to protect our trademark portfolio and establish trademark rights covering new brands and territories. Some regulators and competitors have taken the view that certain of our brands, such as eVoice, are descriptive or generic when applied to the products and services offered by our Cybersecurity and Martech business. Nevertheless, we have obtained U.S. and foreign trademark registrations for our brand names, logos, and other brand identifiers, including eVoice. If we are unable to obtain, maintain or protect trademark rights covering our brands across the territories in which they are or may be offered, the value of these brands may be diminished, competitors may be able to dilute, harm, or take advantage of our brand recognition and reputation, and our ability to attract subscribers may be adversely affected.

We hold domain names relating to our brands, in the U.S. and internationally. The acquisition and maintenance of domain names are generally regulated by governmental agencies and their designees. The regulation of domain names may change. Governing bodies may establish additional top-level domains, appoint additional domain name registrars, or modify the requirements for holding domain names. As a result, we may be unable to acquire or maintain all relevant domain names that relate to our brands. Furthermore, international rules governing the acquisition and maintenance of domain names in foreign jurisdictions are sometimes different from U.S. rules, and we may not be able to obtain all of our domains internationally. As a result of these factors, we may be unable to prevent third parties from acquiring domain names that are similar to, infringe upon or otherwise decrease the value of our brands, trademarks or other proprietary rights. In addition, failure to secure or maintain domain names relevant to our brands could adversely affect our reputation and make it more difficult for users to find our websites and services.

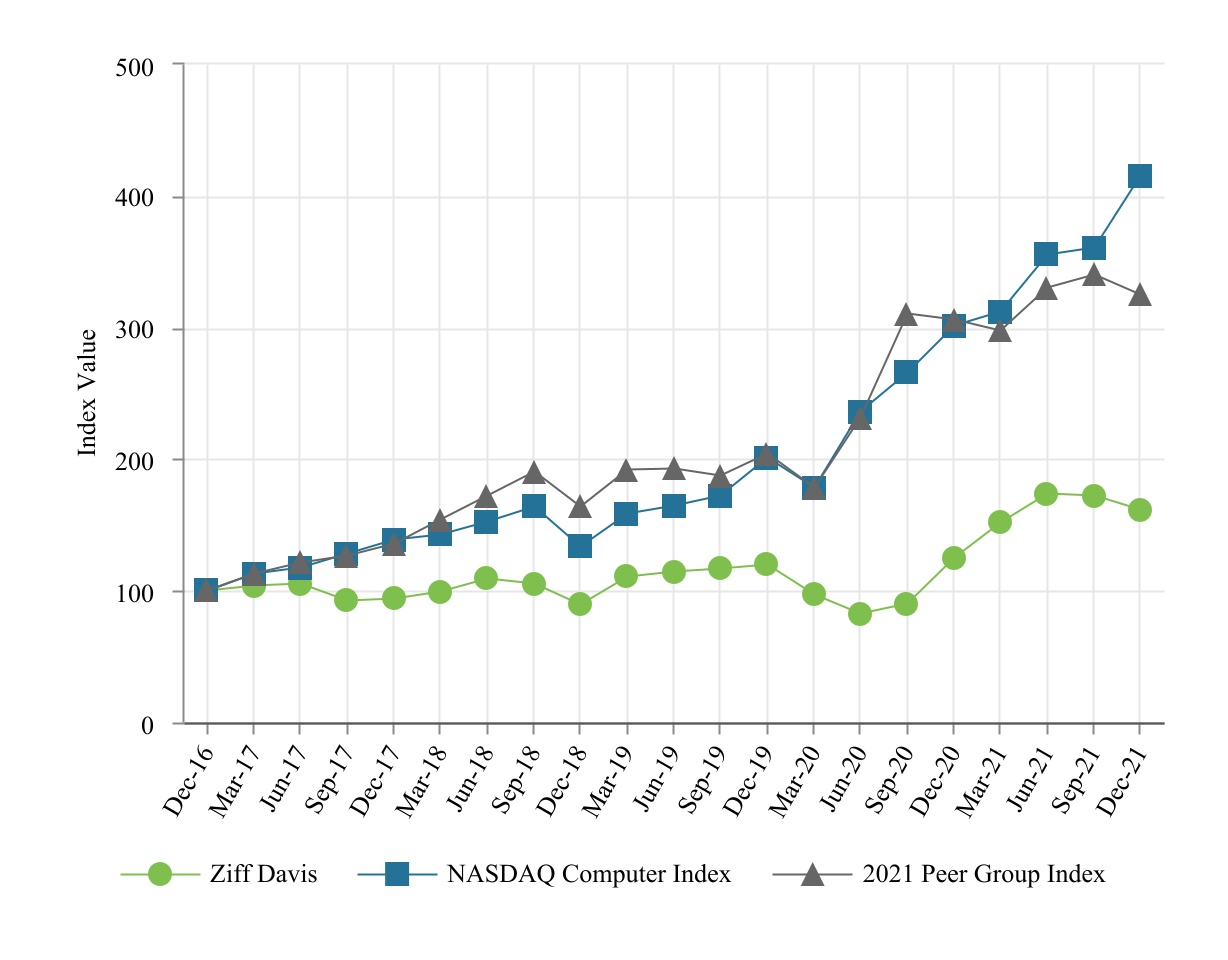

If the distribution of Consensus equity, together with certain related transactions, does not qualify as a transaction that is generally tax-free for U.S. federal income tax purposes, Ziff Davis, Consensus and Ziff Davis stockholders could be subject to significant tax liabilities.