(State or other jurisdiction of incorporation or organization) | (Commission File Number) | (I.R.S. Employer Identification No.) | |||

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Exhibit Number | Description | |

99.1 | ||

99.2 | ||

104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) | |

J2 Global, Inc. (Registrant) | |||

Date: | February 10, 2020 | By: | /s/ Jeremy Rossen |

Jeremy Rossen Executive Vice President, General Counsel | |||

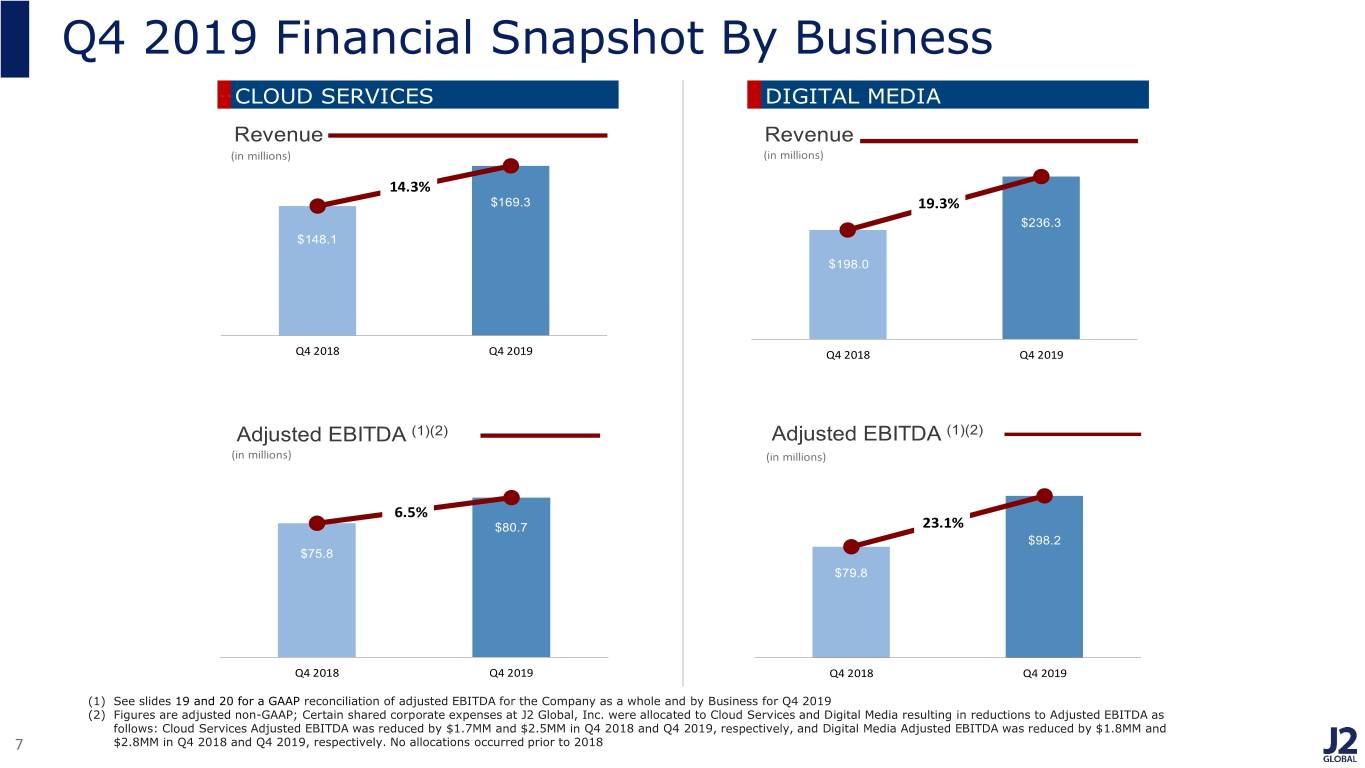

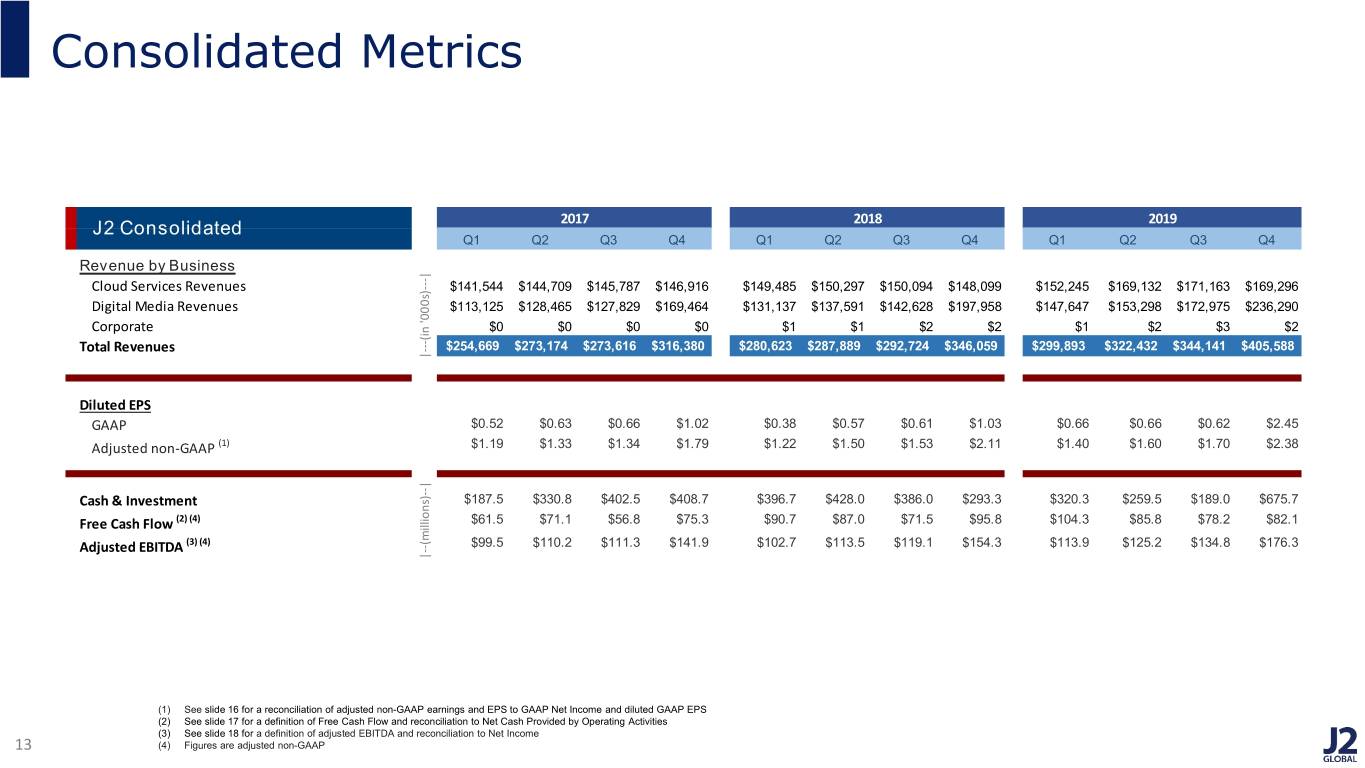

Q4 2019 | Q4 2018 | % Change | |

Revenues | |||

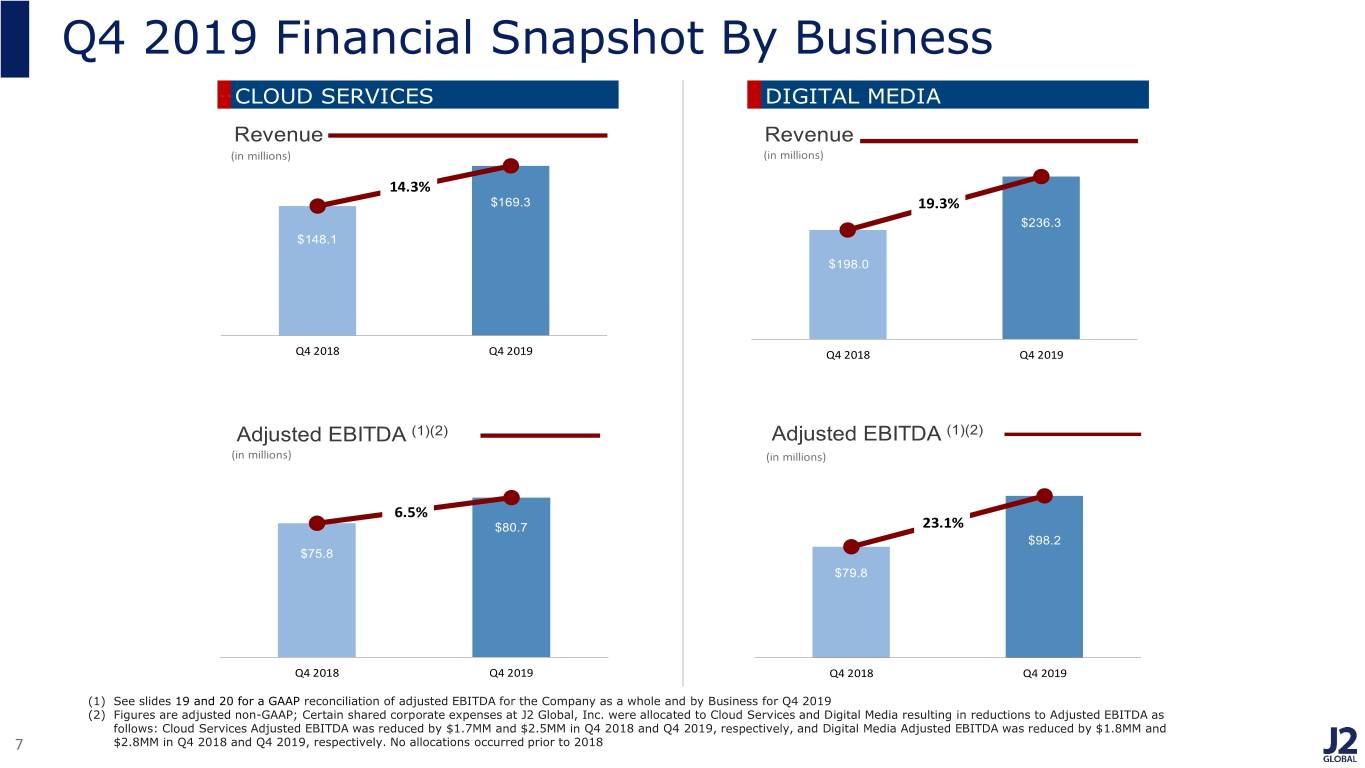

Cloud Services | $169.3 million | $148.1 million | 14.3% |

Digital Media | $236.3 million | $198.0 million | 19.3% |

Total Revenue: (1) | $405.6 million | $346.1 million | 17.2% |

Operating Income | $110.2 million | $86.7 million | 27.1% |

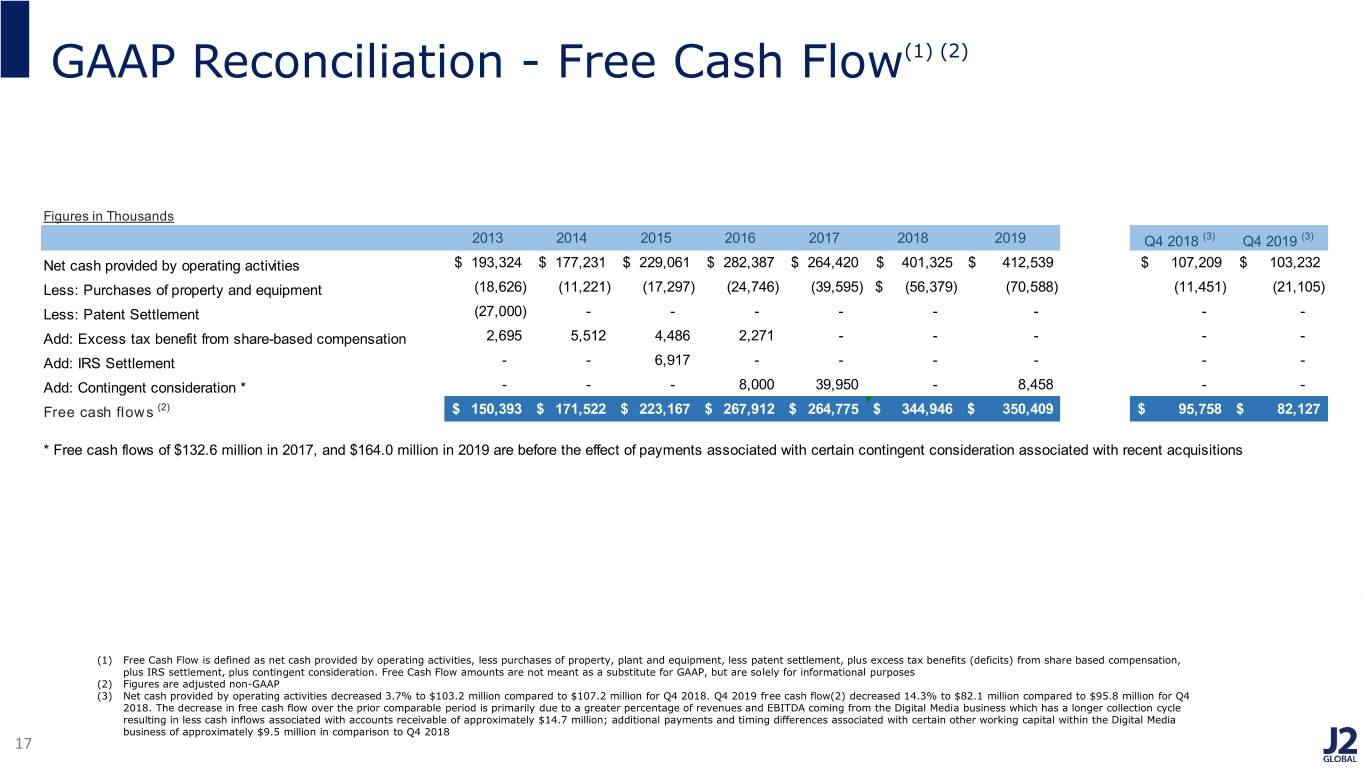

Net Cash Provided by Operating Activities | $103.2 million | $107.2 million | (3.7)% |

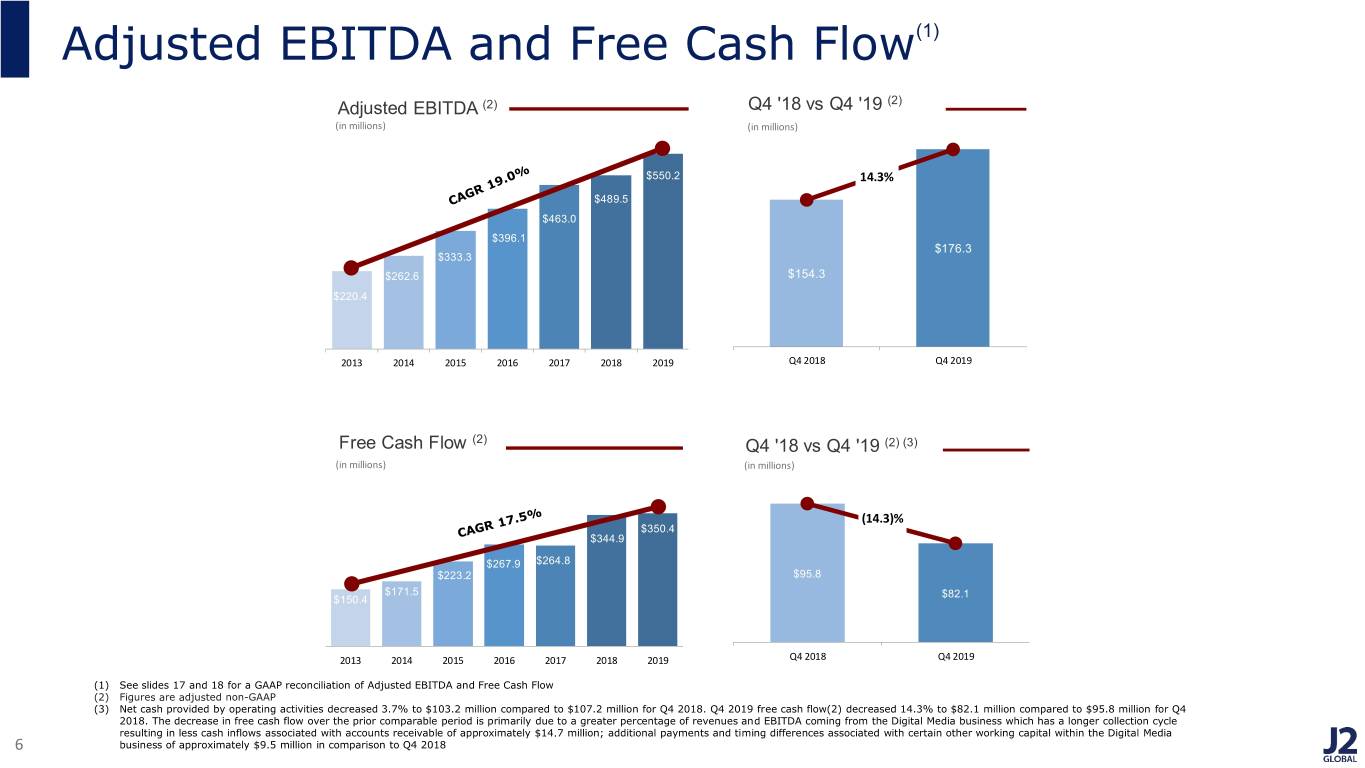

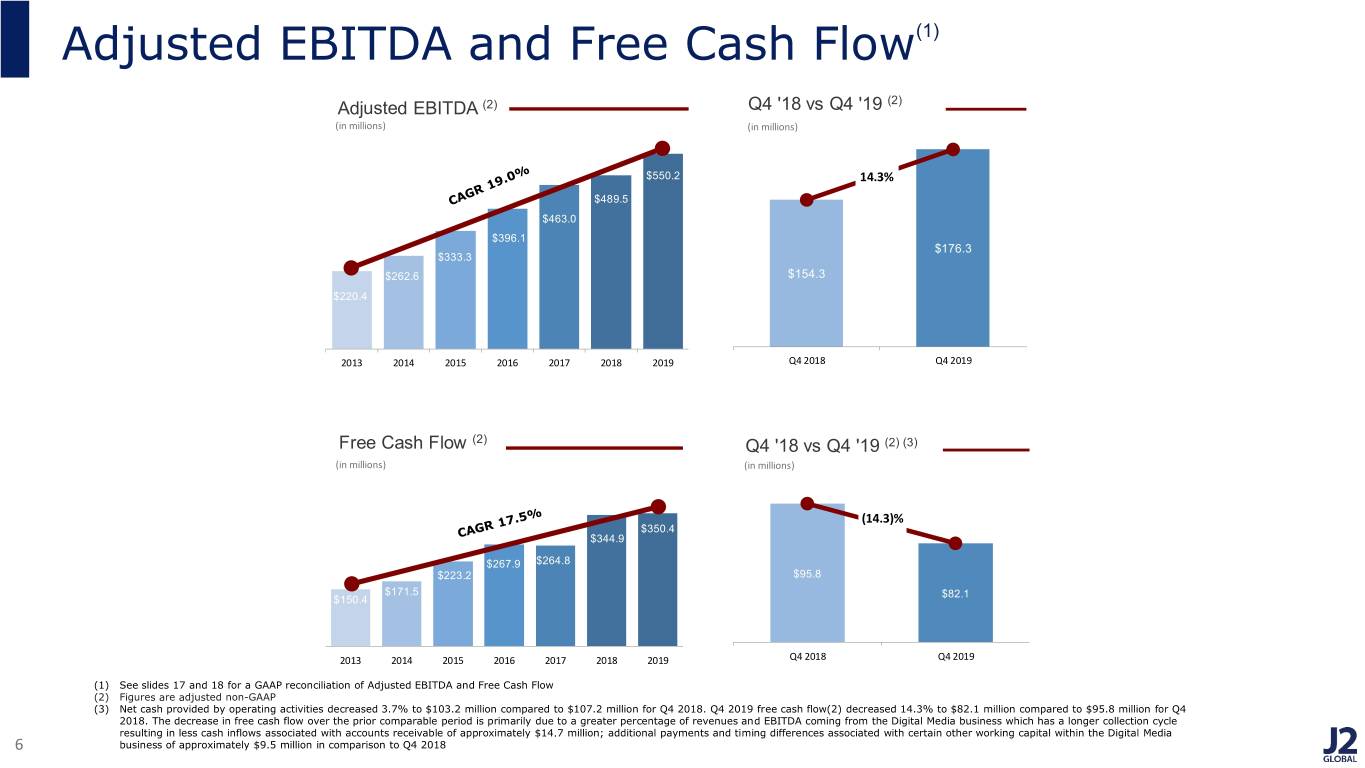

Free Cash Flow (2) | $82.1 million | $95.8 million | (14.3)% |

GAAP Earnings per Diluted Share (3) | $2.45 | $1.03 | 137.9% |

Adjusted Non-GAAP Earnings per Diluted Share (3) (4) | $2.38 | $2.11 | 12.8% |

GAAP Net Income | $123.0 million | $50.6 million | 143.1% |

Adjusted Non-GAAP Net Income | $115.5 million | $103.7 million | 11.4% |

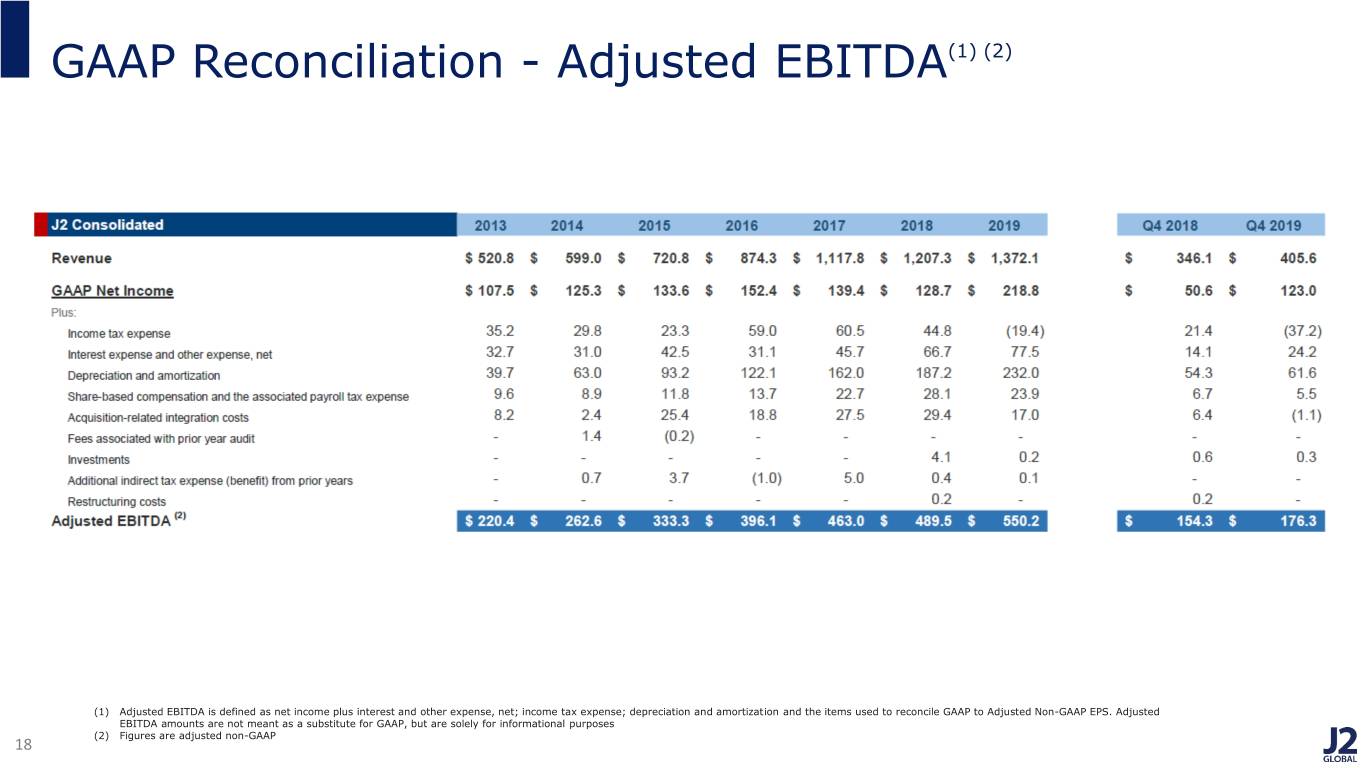

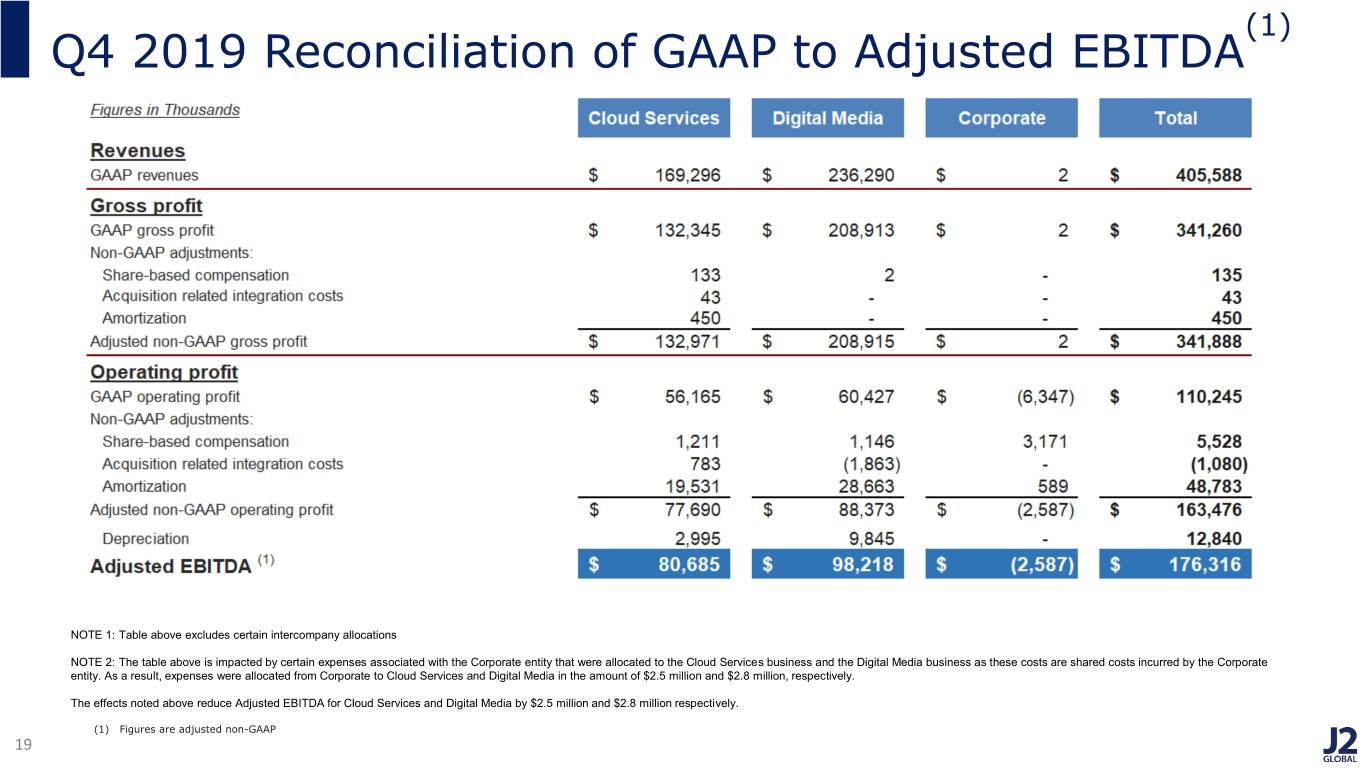

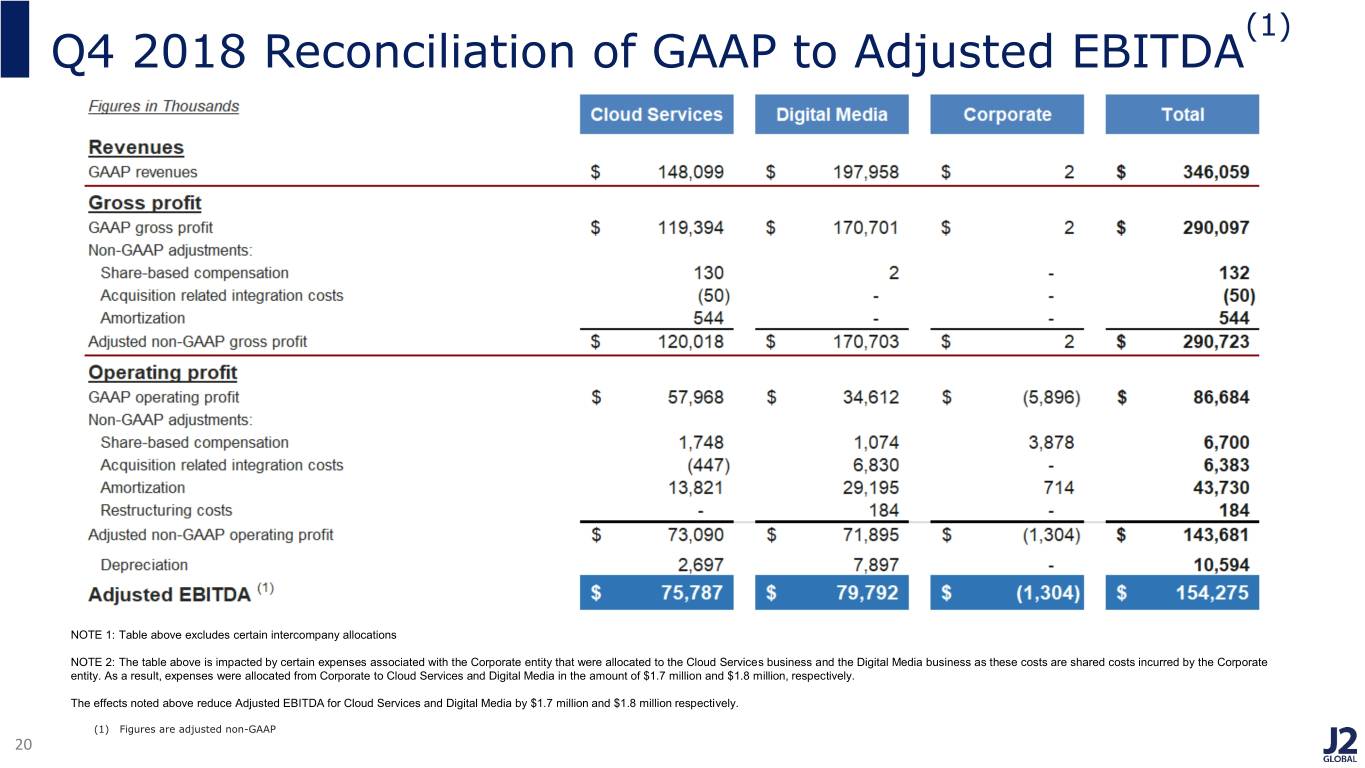

Adjusted EBITDA (5) | $176.3 million | $154.3 million | 14.3% |

Adjusted EBITDA Margin (5) | 43.5% | 44.6% | (2.5)% |

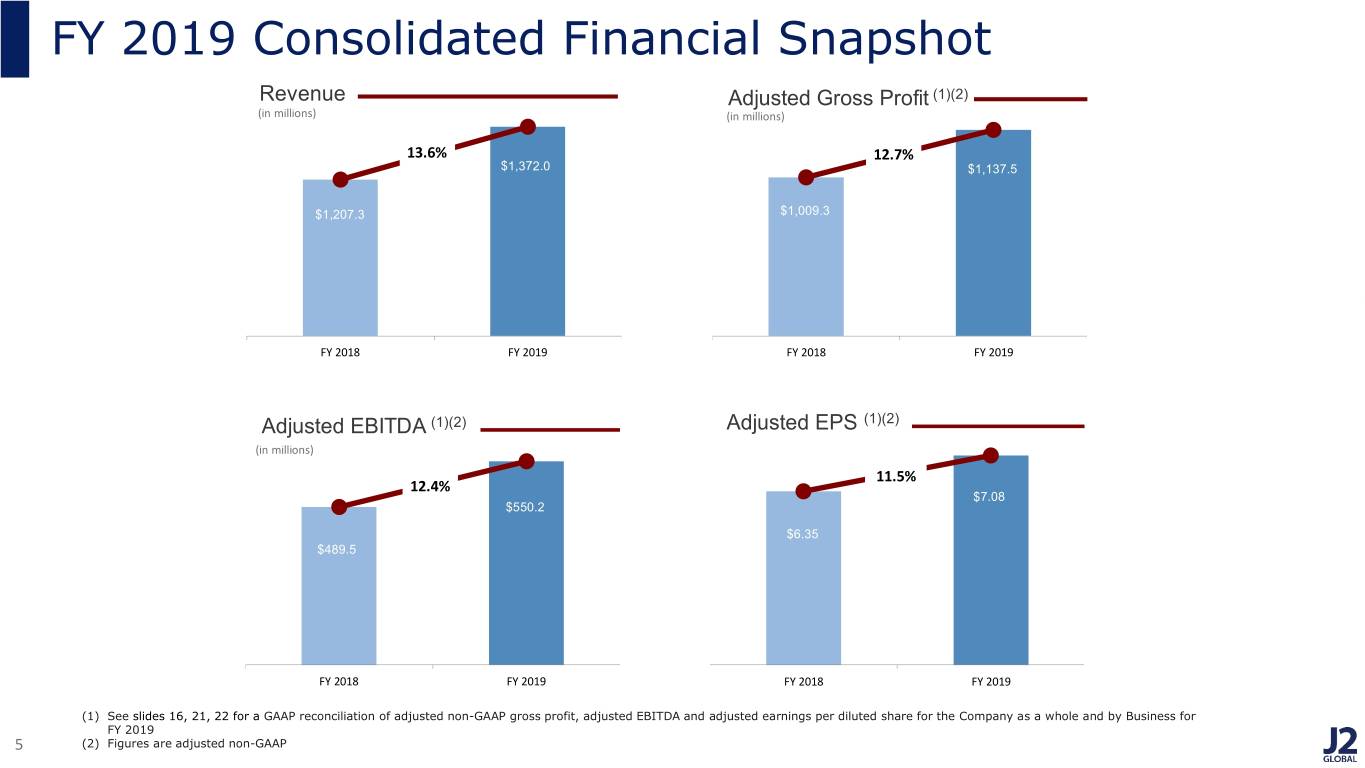

2019 | 2018 | % Change | |

Revenues | |||

Cloud Services | $661.8 million | $598.0 million | 10.7% |

Digital Media | $710.2 million | $609.3 million | 16.6% |

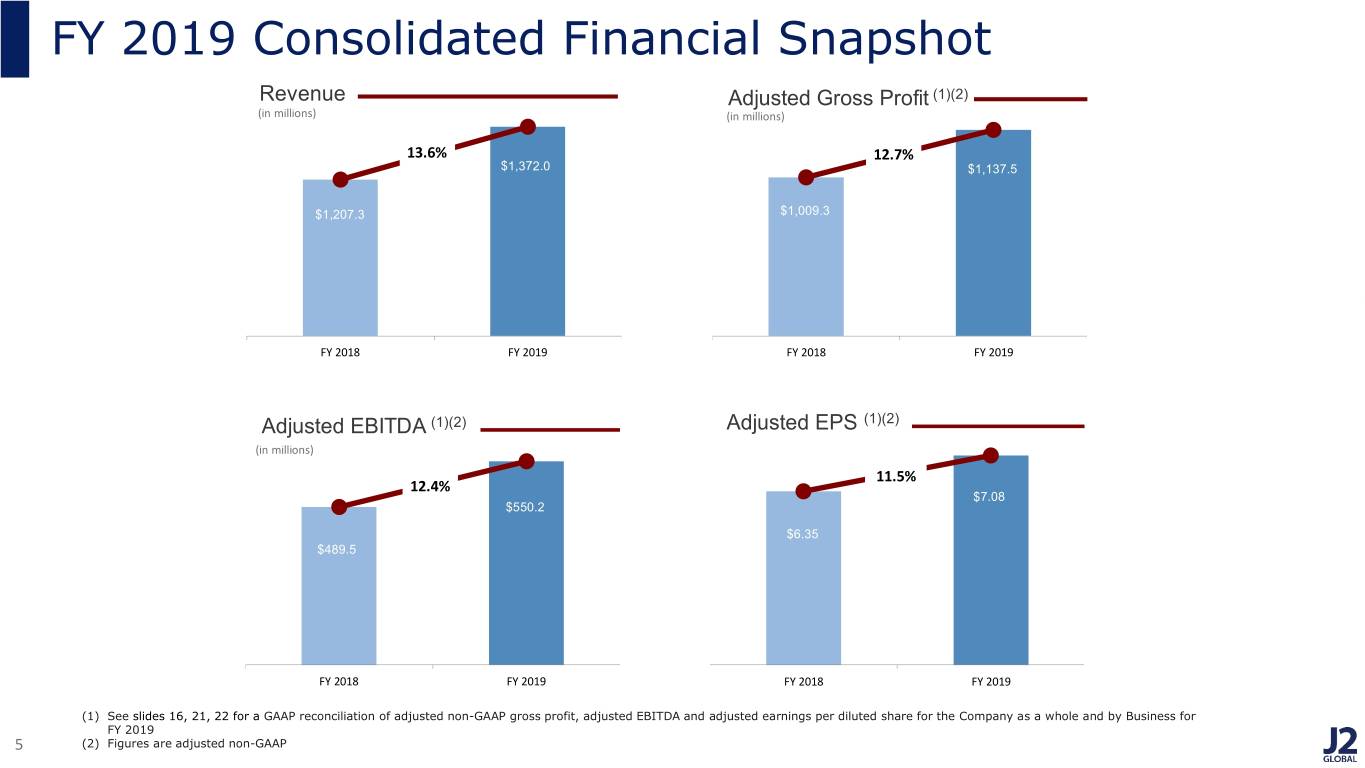

Total Revenue: (1) | $1,372.0 million | $1,207.3 million | 13.6% |

Operating Income | $277.1 million | $244.3 million | 13.4% |

Net Cash Provided by Operating Activities | $412.5 million | $401.3 million | 2.8% |

Free Cash Flow (2) | $350.4 million | $344.9 million | 1.6% |

GAAP Earnings per Diluted Share (6) | $4.39 | $2.59 | 69.5% |

Adjusted Non-GAAP Earnings per Diluted Share (6) (7) | $7.08 | $6.35 | 11.5% |

GAAP Net Income | $218.8 million | $128.7 million | 70.0% |

Adjusted Non-GAAP Net Income | $344.4 million | $312.3 million | 10.3% |

Adjusted EBITDA (5) | $550.2 million | $489.5 million | 12.4% |

Adjusted EBITDA Margin (5) | 40.1% | 40.5% | (1.0)% |

(1) | The revenues associated with each of the businesses may not foot precisely since each is presented independently. | |

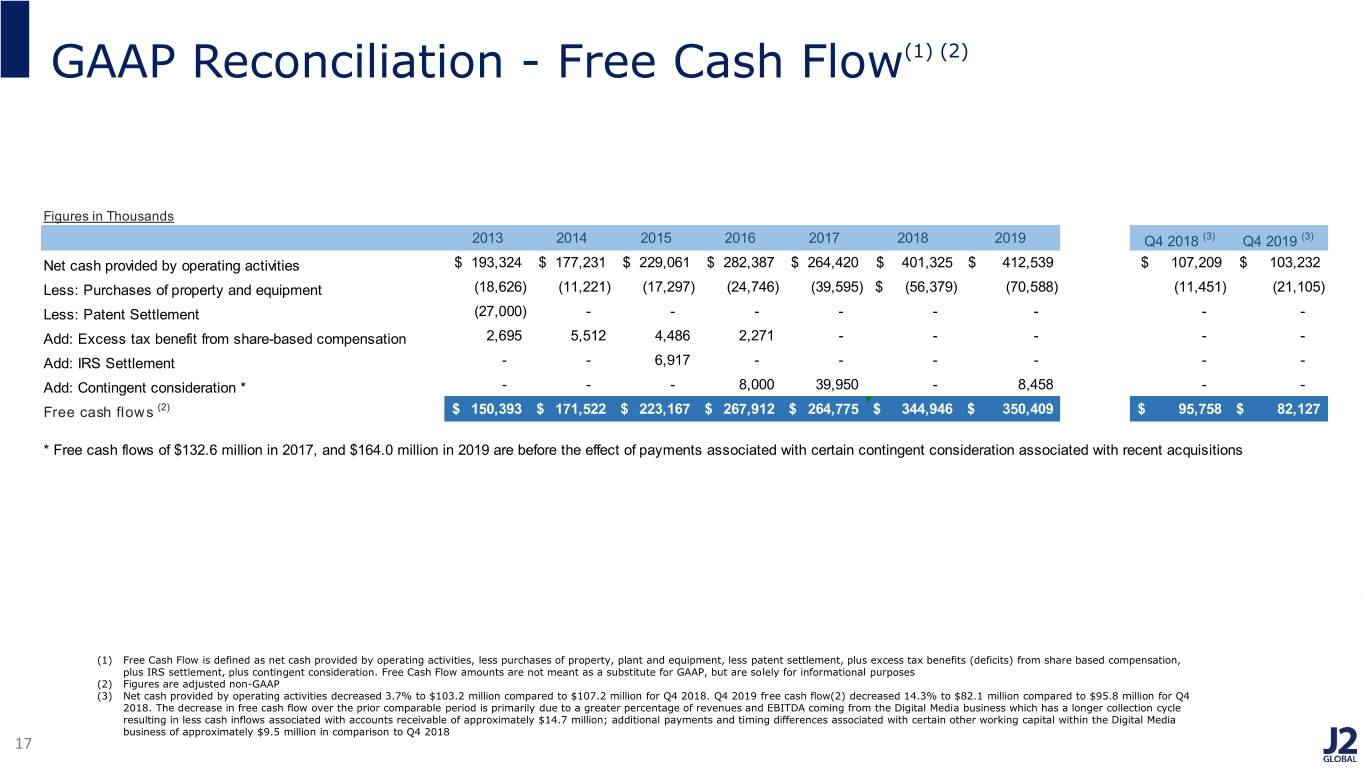

(2) | Free cash flow is defined as net cash provided by operating activities, less purchases of property, plant and equipment, plus contingent consideration. Free cash flow amounts are not meant as a substitute for GAAP, but are solely for informational purposes. | |

(3) | The estimated GAAP effective tax rates were approximately -43.2% for Q4 2019 and 29.5% for Q4 2018. The estimated Adjusted non-GAAP effective tax rates were approximately 21.3% for Q4 2019 and 21.3% for Q4 2018. | |

(4) | Adjusted non-GAAP earnings per diluted share excludes certain non-GAAP items, as defined in the Reconciliation of GAAP to Adjusted non-GAAP Financial Measures, for the three months ended December 31, 2019 and 2018 totaled ($0.07) and $1.08 per diluted share, respectively. | |

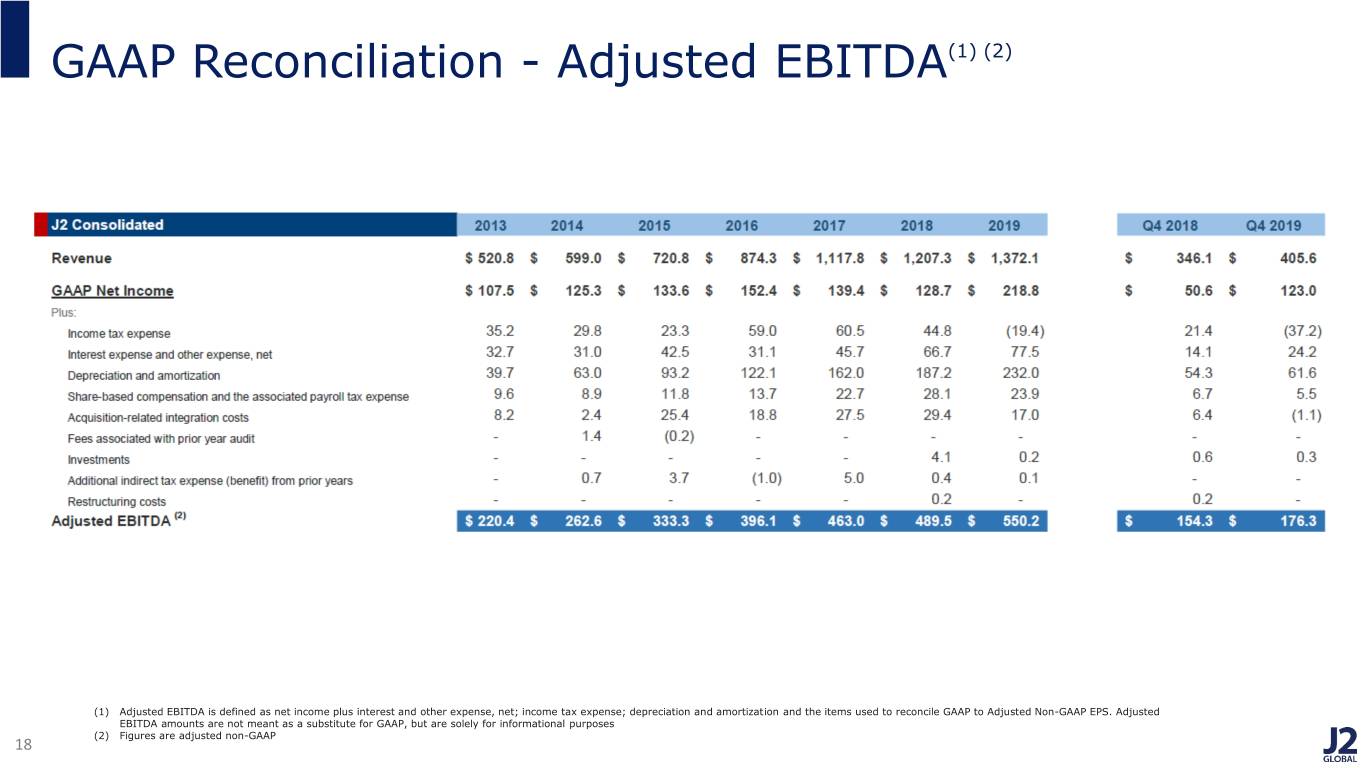

(5) | Adjusted EBITDA is defined as earnings before interest and other expense, net; income tax expense; depreciation and amortization; and the items used to reconcile EPS to Adjusted non-GAAP EPS, as defined in the Reconciliation of GAAP to Adjusted non-GAAP Financial Measures. Adjusted EBITDA amounts are not meant as a substitute for GAAP, but are solely for informational purposes. | |

(6) | The estimated GAAP effective tax rates were approximately -9.7% for 2019 and 25.2% for 2018. The estimated Adjusted non-GAAP effective tax rates were approximately 21.3% for 2019 and 21.0% for 2018. | |

(7) | Adjusted non-GAAP earnings per diluted share excludes certain non-GAAP items, as defined in the Reconciliation of GAAP to Adjusted non-GAAP Financial Measures, for the twelve months ended December 31, 2019 and 2018 totaled $2.69 and $3.76 per diluted share, respectively. | |

December 31, 2019 | December 31, 2018 | ||||||

ASSETS | |||||||

Cash and cash equivalents | $ | 575,615 | $ | 209,474 | |||

Accounts receivable, net of allowances of $12,701 and $10,422, respectively | 261,928 | 221,615 | |||||

Prepaid expenses and other current assets | 49,347 | 29,242 | |||||

Total current assets | 886,890 | 460,331 | |||||

Long-term investments | 100,079 | 83,828 | |||||

Property and equipment, net | 127,817 | 98,813 | |||||

Operating lease right-of-use assets | 125,822 | — | |||||

Goodwill | 1,633,033 | 1,380,376 | |||||

Other purchased intangibles, net | 556,553 | 526,468 | |||||

Deferred income taxes, noncurrent | 59,976 | — | |||||

Other assets | 15,676 | 11,014 | |||||

TOTAL ASSETS | $ | 3,505,846 | $ | 2,560,830 | |||

LIABILITIES AND STOCKHOLDERS’ EQUITY | |||||||

Accounts payable and accrued expenses | $ | 238,059 | $ | 166,521 | |||

Income taxes payable, current | 17,758 | 12,915 | |||||

Deferred revenue, current | 162,855 | 127,568 | |||||

Operating lease liabilities, current | 26,927 | — | |||||

Other current liabilities | 1,973 | 318 | |||||

Total current liabilities | 447,572 | 307,322 | |||||

Long-term debt | 1,448,461 | 1,013,129 | |||||

Deferred revenue, noncurrent | 12,744 | 13,200 | |||||

Operating lease liabilities, noncurrent | 104,070 | — | |||||

Income taxes payable, noncurrent | 11,675 | 11,675 | |||||

Liability for uncertain tax positions | 52,451 | 59,644 | |||||

Deferred income taxes, noncurrent | 107,453 | 69,048 | |||||

Other long-term liabilities | 10,228 | 51,068 | |||||

TOTAL LIABILITIES | 2,194,654 | 1,525,086 | |||||

Commitments and contingencies | — | — | |||||

Preferred stock | — | — | |||||

Common stock | 476 | 481 | |||||

Additional paid-in capital | 465,652 | 354,210 | |||||

Treasury stock | — | (42,543 | ) | ||||

Retained earnings | 891,526 | 769,575 | |||||

Accumulated other comprehensive loss | (46,462 | ) | (45,979 | ) | |||

TOTAL STOCKHOLDERS’ EQUITY | 1,311,192 | 1,035,744 | |||||

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | $ | 3,505,846 | $ | 2,560,830 | |||

Three Months Ended December 31, | Twelve Months Ended December 31, | ||||||||||||||

2019 | 2018 | 2019 | 2018 | ||||||||||||

Total revenues | $ | 405,588 | $ | 346,059 | $ | 1,372,054 | $ | 1,207,295 | |||||||

Cost of revenues (1) | 64,328 | 55,962 | 237,323 | 201,074 | |||||||||||

Gross profit | 341,260 | 290,097 | 1,134,731 | 1,006,221 | |||||||||||

Operating expenses: | |||||||||||||||

Sales and marketing (1) | 105,371 | 88,113 | 379,183 | 338,304 | |||||||||||

Research, development and engineering (1) | 15,704 | 12,958 | 54,396 | 48,370 | |||||||||||

General and administrative (1) | 109,940 | 102,342 | 424,072 | 375,267 | |||||||||||

Total operating expenses | 231,015 | 203,413 | 857,651 | 761,941 | |||||||||||

Income from operations | 110,245 | 86,684 | 277,080 | 244,280 | |||||||||||

Interest expense, net | 18,921 | 15,559 | 69,546 | 61,987 | |||||||||||

Other expense (income), net | 5,234 | (1,443 | ) | 7,936 | 4,706 | ||||||||||

Income before income taxes and net loss in earnings of equity method investment | 86,090 | 72,568 | 199,598 | 177,587 | |||||||||||

Income tax (benefit) expense | (37,227 | ) | 21,395 | (19,376 | ) | 44,760 | |||||||||

Net loss in earnings of equity method investment | 294 | 559 | 168 | 4,140 | |||||||||||

Net income | $ | 123,023 | $ | 50,614 | $ | 218,806 | $ | 128,687 | |||||||

Basic net income per common share: | |||||||||||||||

Net income attributable to J2 Global, Inc. common shareholders | $ | 2.54 | $ | 1.04 | $ | 4.52 | $ | 2.64 | |||||||

Diluted net income per common share: | |||||||||||||||

Net income attributable to J2 Global, Inc. common shareholders | $ | 2.45 | $ | 1.03 | $ | 4.39 | $ | 2.59 | |||||||

Basic weighted average shares outstanding | 47,626,833 | 47,967,014 | 47,647,397 | 47,950,746 | |||||||||||

Diluted weighted average shares outstanding | 49,425,395 | 48,505,023 | 49,025,684 | 48,927,791 | |||||||||||

(1) Includes share-based compensation expense as follows: | |||||||||||||||

Cost of revenues | $ | 135 | $ | 132 | $ | 525 | $ | 510 | |||||||

Sales and marketing | 335 | 418 | 1,547 | 1,798 | |||||||||||

Research, development and engineering | 385 | 366 | 1,477 | 1,553 | |||||||||||

General and administrative | 4,673 | 5,784 | 20,373 | 24,232 | |||||||||||

Total | $ | 5,528 | $ | 6,700 | $ | 23,922 | $ | 28,093 | |||||||

Twelve Months Ended December 31, | |||||||

2019 | 2018 | ||||||

Cash flows from operating activities: | |||||||

Net income | $ | 218,806 | $ | 128,687 | |||

Adjustments to reconcile net earnings to net cash provided by operating activities: | |||||||

Depreciation and amortization | 232,032 | 187,174 | |||||

Amortization of financing costs and discounts | 14,038 | 11,385 | |||||

Amortization of operating lease assets | 21,419 | — | |||||

Share-based compensation | 23,922 | 28,093 | |||||

Provision for doubtful accounts | 13,134 | 17,338 | |||||

Deferred income taxes, net | (63,444 | ) | 25,050 | ||||

Changes in fair value of contingent consideration | 6,318 | 18,944 | |||||

Loss on equity method investments | 139 | 10,506 | |||||

Impairment loss on equity securities | 4,164 | — | |||||

Decrease (increase) in: | |||||||

Accounts receivable | (30,680 | ) | 4,034 | ||||

Prepaid expenses and other current assets | (8,685 | ) | 2,211 | ||||

Other assets | (4,083 | ) | 2,391 | ||||

Increase (decrease) in: | |||||||

Accounts payable and accrued expenses | (770 | ) | (35,220 | ) | |||

Income taxes payable | (1,738 | ) | (29,042 | ) | |||

Deferred revenue | 6,844 | 11,991 | |||||

Operating lease liabilities | (20,240 | ) | — | ||||

Liability for uncertain tax positions | (453 | ) | 7,694 | ||||

Other long-term liabilities | 1,816 | 10,089 | |||||

Net cash provided by operating activities | 412,539 | 401,325 | |||||

Cash flows from investing activities: | |||||||

Distribution from equity method investment | 10,288 | — | |||||

Purchases of equity method investment | (29,584 | ) | (36,635 | ) | |||

Purchases of available-for-sale investments | — | (500 | ) | ||||

Purchases of property and equipment | (70,588 | ) | (56,379 | ) | |||

Acquisition of businesses, net of cash received | (415,343 | ) | (312,430 | ) | |||

Purchases of intangible assets | (46 | ) | (669 | ) | |||

Net cash used in investing activities | (505,273 | ) | (406,613 | ) | |||

Cash flows from financing activities: | |||||||

Issuance of long-term debt | 550,000 | — | |||||

Debt issuance cost | (12,862 | ) | — | ||||

Payment of debt | (5,100 | ) | (2,204 | ) | |||

Proceeds from line of credit | 185,000 | — | |||||

Repayment of line of credit | (185,000 | ) | — | ||||

Repurchase of common stock | (20,803 | ) | (47,102 | ) | |||

Issuance of common stock under employee stock purchase plan | 4,512 | 2,084 | |||||

Exercise of stock options | 5,274 | 1,540 | |||||

Dividends paid | (43,533 | ) | (81,679 | ) | |||

Deferred payments for acquisitions | (18,876 | ) | (3,558 | ) | |||

Other | (1,917 | ) | (443 | ) | |||

Net cash provided by (used in) financing activities | 456,695 | (131,362 | ) | ||||

Effect of exchange rate changes on cash and cash equivalents | 2,180 | (4,821 | ) | ||||

Net change in cash and cash equivalents | 366,141 | (141,471 | ) | ||||

Cash and cash equivalents at beginning of year | 209,474 | 350,945 | |||||

Cash and cash equivalents at end of year | $ | 575,615 | $ | 209,474 | |||

Three Months Ended December 31, | |||||||||||||

2019 | Per Diluted Share * | 2018 | Per Diluted Share * | ||||||||||

Net income | $ | 123,023 | $ | 2.45 | $ | 50,614 | $ | 1.03 | |||||

Plus: | |||||||||||||

Share based compensation (1) | 7,843 | 0.16 | 5,806 | 0.12 | |||||||||

Acquisition related integration costs (2) | (824 | ) | (0.02 | ) | 6,396 | 0.13 | |||||||

Interest costs (3) | 5,198 | 0.11 | 1,915 | 0.04 | |||||||||

Amortization (4) | 30,399 | 0.64 | 38,113 | 0.79 | |||||||||

Investments (5) | 3,567 | 0.08 | 671 | 0.01 | |||||||||

Tax benefit from prior years (6) | (10 | ) | — | (2 | ) | — | |||||||

Restructuring costs (7) | — | — | 161 | — | |||||||||

Intra-entity transfers (8) | (53,690 | ) | (1.13 | ) | — | — | |||||||

Convertible debt dilution (9) | — | 0.07 | — | 0.02 | |||||||||

Adjusted non-GAAP net income | $ | 115,506 | $ | 2.38 | $ | 103,674 | $ | 2.11 | |||||

Twelve Months Ended December 31, | |||||||||||||

2019 | Per Diluted Share * | 2018 | Per Diluted Share * | ||||||||||

Net income | $ | 218,806 | $ | 4.39 | $ | 128,687 | $ | 2.59 | |||||

Plus: | |||||||||||||

Share based compensation (1) | 21,701 | 0.46 | 21,062 | 0.44 | |||||||||

Acquisition related integration costs (2) | 13,152 | 0.28 | 25,535 | 0.53 | |||||||||

Interest costs (3) | 10,367 | 0.22 | 6,079 | 0.13 | |||||||||

Amortization (4) | 130,547 | 2.74 | 123,789 | 2.57 | |||||||||

Investments (5) | 3,441 | 0.07 | 6,636 | 0.14 | |||||||||

Tax expense from prior years (6) | 62 | — | 335 | 0.01 | |||||||||

Restructuring costs (7) | — | — | 161 | — | |||||||||

Intra-entity transfers (8) | (53,690 | ) | (1.13 | ) | — | — | |||||||

Convertible debt dilution (9) | — | 0.12 | — | 0.05 | |||||||||

Adjusted non-GAAP net income | $ | 344,386 | $ | 7.08 | $ | 312,284 | $ | 6.35 | |||||

Three Months Ended December 31, | |||||||

2019 | 2018 | ||||||

Cost of revenues | $ | 64,328 | $ | 55,962 | |||

Plus: | |||||||

Share based compensation (1) | (135 | ) | (132 | ) | |||

Acquisition related integration costs (2) | (43 | ) | 50 | ||||

Amortization (4) | (450 | ) | (544 | ) | |||

Adjusted non-GAAP cost of revenues | $ | 63,700 | $ | 55,336 | |||

Sales and marketing | $ | 105,371 | $ | 88,113 | |||

Plus: | |||||||

Share based compensation (1) | (335 | ) | (418 | ) | |||

Acquisition related integration costs (2) | 274 | 53 | |||||

Restructuring costs (7) | — | (184 | ) | ||||

Adjusted non-GAAP sales and marketing | $ | 105,310 | $ | 87,564 | |||

Research, development and engineering | $ | 15,704 | $ | 12,958 | |||

Plus: | |||||||

Share based compensation (1) | (385 | ) | (366 | ) | |||

Acquisition related integration costs (2) | 48 | (38 | ) | ||||

Adjusted non-GAAP research, development and engineering | $ | 15,367 | $ | 12,554 | |||

General and administrative | $ | 109,940 | $ | 102,342 | |||

Plus: | |||||||

Share based compensation (1) | (4,673 | ) | (5,784 | ) | |||

Acquisition related integration costs (2) | 801 | (6,448 | ) | ||||

Amortization (4) | (48,333 | ) | (43,186 | ) | |||

Adjusted non-GAAP general and administrative | $ | 57,735 | $ | 46,924 | |||

Interest expense, net | $ | 18,921 | $ | 15,559 | |||

Plus: | |||||||

Acquisition related integration costs (2) | — | (15 | ) | ||||

Interest costs (3) | (3,293 | ) | (2,211 | ) | |||

Adjusted non-GAAP interest expense, net | $ | 15,628 | $ | 13,333 | |||

Other expense (income), net | $ | 5,234 | $ | (1,443 | ) | ||

Plus: | |||||||

Investments (5) | (4,164 | ) | — | ||||

Adjusted non-GAAP other expense (income), net | $ | 1,070 | $ | (1,443 | ) | ||

Continued from previous page | |||||||

Income Tax Provision | $ | (37,227 | ) | $ | 21,395 | ||

Plus: | |||||||

Share based compensation (1) | (2,315 | ) | 894 | ||||

Acquisition related integration costs (2) | (256 | ) | 2 | ||||

Interest costs (3) | (1,905 | ) | 296 | ||||

Amortization (4) | 18,384 | 5,617 | |||||

Investments (5) | 891 | (112 | ) | ||||

Tax expense from prior years (6) | 10 | 2 | |||||

Restructuring costs (7) | — | 23 | |||||

Intra-entity transfers (8) | 53,690 | — | |||||

Adjusted non-GAAP income tax provision | $ | 31,272 | $ | 28,117 | |||

Net loss in earnings of equity method investment | $ | 294 | $ | 559 | |||

Plus: | |||||||

Investments (5) | (294 | ) | (559 | ) | |||

Adjusted non-GAAP net loss in earnings of equity method investment | $ | — | $ | — | |||

Total adjustments | $ | 7,517 | $ | (53,060 | ) | ||

GAAP earnings per diluted share | $ | 2.45 | $ | 1.03 | |||

Adjustments * | $ | (0.07 | ) | $ | 1.08 | ||

Adjusted non-GAAP earnings per diluted share | $ | 2.38 | $ | 2.11 | |||

Twelve Months Ended December 31, | |||||||

2019 | 2018 | ||||||

Cost of revenues | $ | 237,323 | $ | 201,074 | |||

Plus: | |||||||

Share based compensation (1) | (525 | ) | (510 | ) | |||

Acquisition related integration costs (2) | (368 | ) | (296 | ) | |||

Amortization (4) | (1,893 | ) | (2,230 | ) | |||

Adjusted non-GAAP cost of revenues | $ | 234,537 | $ | 198,038 | |||

Sales and marketing | $ | 379,183 | $ | 338,304 | |||

Plus: | |||||||

Share based compensation (1) | (1,547 | ) | (1,798 | ) | |||

Acquisition related integration costs (2) | (2,870 | ) | (1,872 | ) | |||

Restructuring costs (7) | — | (184 | ) | ||||

Adjusted non-GAAP sales and marketing | $ | 374,766 | $ | 334,450 | |||

Research, development and engineering | $ | 54,396 | $ | 48,370 | |||

Plus: | |||||||

Share based compensation (1) | (1,477 | ) | (1,553 | ) | |||

Acquisition related integration costs (2) | (2,039 | ) | (324 | ) | |||

Adjusted non-GAAP research, development and engineering | $ | 50,880 | $ | 46,493 | |||

General and administrative | $ | 424,072 | $ | 375,267 | |||

Plus: | |||||||

Share based compensation (1) | (20,373 | ) | (24,232 | ) | |||

Acquisition related integration costs (2) | (11,745 | ) | (26,909 | ) | |||

Amortization (4) | (180,603 | ) | (145,849 | ) | |||

Tax expense from prior years (6) | (104 | ) | (378 | ) | |||

Adjusted non-GAAP general and administrative | $ | 211,247 | $ | 177,899 | |||

Interest expense, net | $ | 69,546 | $ | 61,987 | |||

Plus: | |||||||

Acquisition related integration costs (2) | 27 | (83 | ) | ||||

Interest costs (3) | (10,121 | ) | (8,655 | ) | |||

Tax expense from prior years (6) | — | (57 | ) | ||||

Adjusted non-GAAP interest expense, net | $ | 59,452 | $ | 53,192 | |||

Other expense, net | $ | 7,936 | $ | 4,706 | |||

Plus: | |||||||

Investments (5) | (4,164 | ) | (2,900 | ) | |||

Adjusted non-GAAP other expense, net | $ | 3,772 | $ | 1,806 | |||

Continued from previous page | |||||||

Income tax provision | $ | (19,376 | ) | $ | 44,760 | ||

Plus: | |||||||

Share based compensation (1) | 2,221 | 7,031 | |||||

Acquisition related integration costs (2) | 3,843 | 3,949 | |||||

Interest costs (3) | (246 | ) | 2,576 | ||||

Amortization (4) | 51,949 | 24,290 | |||||

Investments (5) | 891 | 404 | |||||

Tax expense from prior years (6) | 42 | 100 | |||||

Restructuring costs (7) | — | 23 | |||||

Intra-entity transfers (8) | 53,690 | — | |||||

Adjusted non-GAAP income tax provision | $ | 93,014 | $ | 83,133 | |||

Net loss in earnings of equity method investment | $ | 168 | $ | 4,140 | |||

Plus: | |||||||

Investments (5) | (168 | ) | (4,140 | ) | |||

Adjusted non-GAAP net loss in earnings of equity method investment | $ | — | $ | — | |||

Total adjustments | $ | (125,580 | ) | $ | (183,597 | ) | |

GAAP earnings per diluted share | $ | 4.39 | $ | 2.59 | |||

Adjustments * | $ | 2.69 | $ | 3.76 | |||

Adjusted non-GAAP earnings per diluted share | $ | 7.08 | $ | 6.35 | |||

Three Months Ended December 31, | Twelve Months Ended December 31, | ||||||||||||||

2019 | 2018 | 2019 | 2018 | ||||||||||||

Net income | $ | 123,023 | $ | 50,614 | $ | 218,806 | $ | 128,687 | |||||||

Plus: | |||||||||||||||

Interest expense, net | 18,921 | 15,559 | 69,546 | 61,987 | |||||||||||

Other expense (income), net | 5,234 | (1,443 | ) | 7,936 | 4,706 | ||||||||||

Income tax expense | (37,227 | ) | 21,395 | (19,376 | ) | 44,760 | |||||||||

Depreciation and amortization | 61,623 | 54,324 | 232,032 | 187,174 | |||||||||||

Reconciliation of GAAP to Adjusted non-GAAP financial measures: | |||||||||||||||

Share-based compensation | 5,528 | 6,700 | 23,922 | 28,093 | |||||||||||

Acquisition-related integration costs | (1,080 | ) | 6,383 | 17,022 | 29,401 | ||||||||||

Investments | 294 | 559 | 168 | 4,140 | |||||||||||

Additional indirect tax expense from prior years | — | — | 104 | 378 | |||||||||||

Restructuring costs | — | 184 | — | 184 | |||||||||||

Adjusted EBITDA | $ | 176,316 | $ | 154,275 | $ | 550,160 | $ | 489,510 | |||||||

Q1 | Q2 | Q3 | Q4 | YTD | |||||||||||||||

2019 | |||||||||||||||||||

Net cash provided by operating activities | $ | 116,854 | $ | 95,357 | $ | 97,096 | $ | 103,232 | $ | 412,539 | |||||||||

Less: Purchases of property and equipment | (12,531 | ) | (18,260 | ) | (18,692 | ) | (21,105 | ) | (70,588 | ) | |||||||||

Add: Contingent consideration* | — | 8,698 | (240 | ) | — | 8,458 | |||||||||||||

Free cash flows | $ | 104,323 | $ | 85,795 | $ | 78,164 | $ | 82,127 | $ | 350,409 | |||||||||

* Free Cash Flows of $85.8 million for Q2 2019 and $78.2 million for Q3 2019 is before the effect of payments associated with certain contingent consideration associated with recent acquisitions. | |||||||||||||||||||

Q1 | Q2 | Q3 | Q4 | YTD | |||||||||||||||

2018 | |||||||||||||||||||

Net cash provided by operating activities | $ | 103,910 | $ | 102,383 | $ | 87,823 | $ | 107,209 | $ | 401,325 | |||||||||

Less: Purchases of property and equipment | (13,165 | ) | (15,393 | ) | (16,370 | ) | (11,451 | ) | (56,379 | ) | |||||||||

Free cash flows | $ | 90,745 | $ | 86,990 | $ | 71,453 | $ | 95,758 | $ | 344,946 | |||||||||

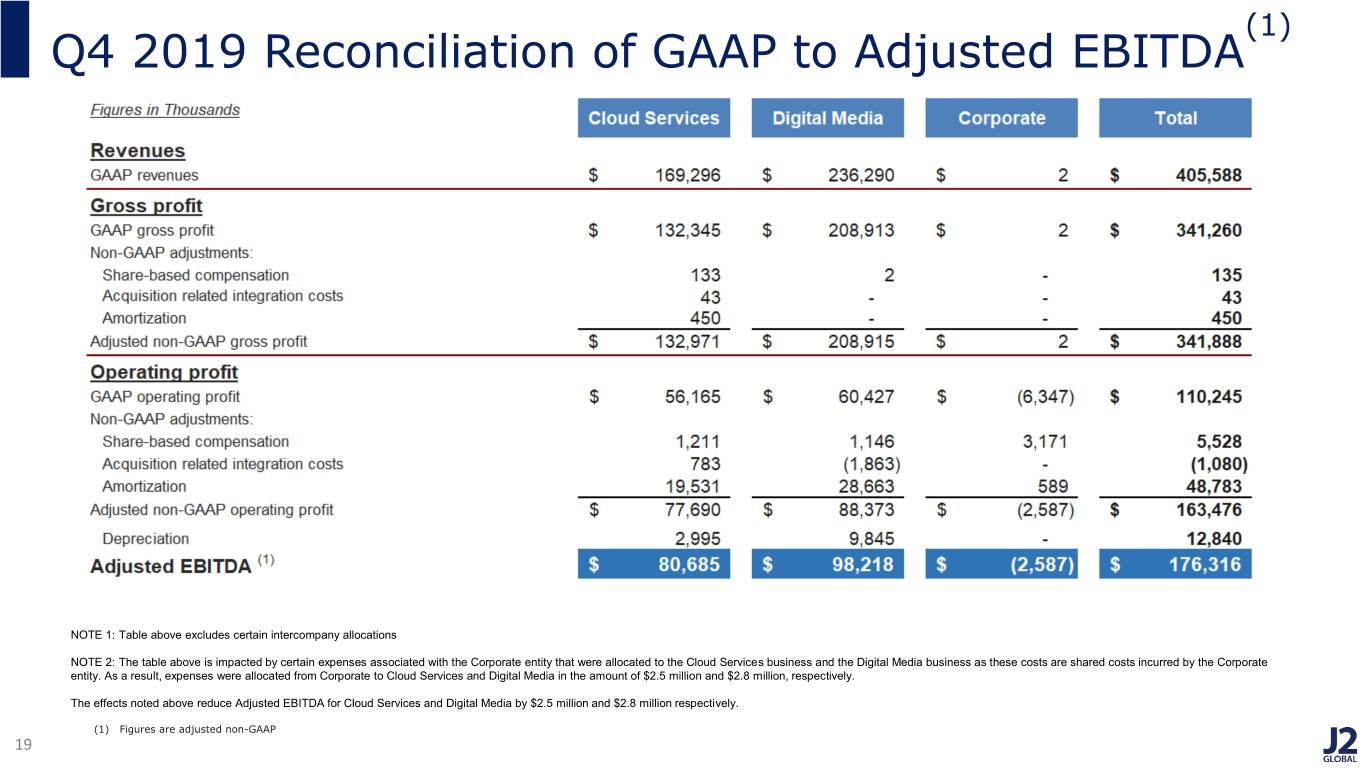

Cloud | Digital | ||||||||||||||

Services | Media | Corporate | Total | ||||||||||||

Revenues | |||||||||||||||

GAAP revenues | $ | 169,296 | $ | 236,290 | $ | 2 | $ | 405,588 | |||||||

Gross profit | |||||||||||||||

GAAP gross profit | $ | 132,345 | $ | 208,913 | $ | 2 | $ | 341,260 | |||||||

Non-GAAP adjustments: | |||||||||||||||

Share-based compensation | 133 | 2 | — | 135 | |||||||||||

Acquisition related integration costs | 43 | — | — | 43 | |||||||||||

Amortization | 450 | — | — | 450 | |||||||||||

Adjusted non-GAAP gross profit | $ | 132,971 | $ | 208,915 | $ | 2 | $ | 341,888 | |||||||

Operating profit | |||||||||||||||

GAAP operating profit | $ | 56,165 | $ | 60,427 | $ | (6,347 | ) | $ | 110,245 | ||||||

Non-GAAP adjustments: | |||||||||||||||

Share-based compensation | 1,211 | 1,146 | 3,171 | 5,528 | |||||||||||

Acquisition related integration costs | 783 | (1,863 | ) | — | (1,080 | ) | |||||||||

Amortization | 19,531 | 28,663 | 589 | 48,783 | |||||||||||

Adjusted non-GAAP operating profit | $ | 77,690 | $ | 88,373 | $ | (2,587 | ) | $ | 163,476 | ||||||

Depreciation | 2,995 | 9,845 | — | 12,840 | |||||||||||

Adjusted EBITDA | $ | 80,685 | $ | 98,218 | $ | (2,587 | ) | $ | 176,316 | ||||||

NOTE 1: Table above excludes certain intercompany allocations | |||||||||||||||

NOTE 2: The table above is impacted by certain expenses associated with the Corporate entity that were allocated to the Cloud Services business and the Digital Media business as these costs are shared costs incurred by the Corporate entity. As a result, expenses were allocated from Corporate to Cloud Services and Digital Media in the amount of $2.5 million and $2.8 million, respectively. The effects noted above reduce Adjusted EBITDA for Cloud Services and Digital Media by $2.5 million and $2.8 million respectively. | |||||||||||||||

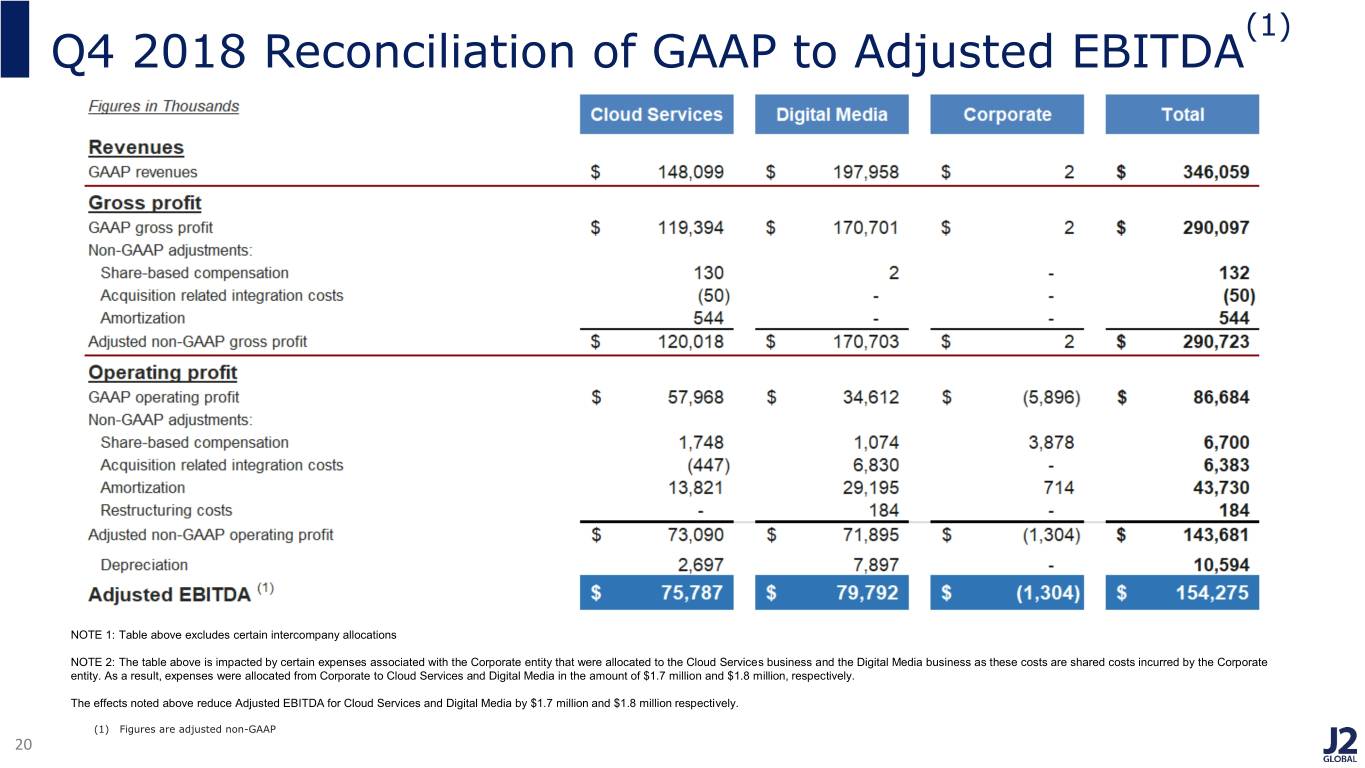

Cloud | Digital | ||||||||||||||

Services | Media | Corporate | Total | ||||||||||||

Revenues | |||||||||||||||

GAAP revenues | $ | 148,099 | $ | 197,958 | $ | 2 | $ | 346,059 | |||||||

Gross profit | |||||||||||||||

GAAP gross profit | $ | 119,394 | $ | 170,701 | $ | 2 | $ | 290,097 | |||||||

Non-GAAP adjustments: | |||||||||||||||

Share-based compensation | 130 | 2 | — | 132 | |||||||||||

Acquisition Related Integration Costs | (50 | ) | — | — | (50 | ) | |||||||||

Amortization | 544 | — | — | 544 | |||||||||||

Adjusted non-GAAP gross profit | $ | 120,018 | $ | 170,703 | $ | 2 | $ | 290,723 | |||||||

Operating profit | |||||||||||||||

GAAP operating profit | $ | 57,968 | $ | 34,612 | $ | (5,896 | ) | $ | 86,684 | ||||||

Non-GAAP adjustments: | |||||||||||||||

Share-based compensation | 1,748 | 1,074 | 3,878 | 6,700 | |||||||||||

Acquisition related integration costs | (447 | ) | 6,830 | — | 6,383 | ||||||||||

Amortization | 13,821 | 29,195 | 714 | 43,730 | |||||||||||

Restructuring costs | — | 184 | — | 184 | |||||||||||

Adjusted Non-GAAP operating profit | $ | 73,090 | $ | 71,895 | $ | (1,304 | ) | $ | 143,681 | ||||||

Depreciation | 2,697 | 7,897 | — | 10,594 | |||||||||||

Adjusted EBITDA | $ | 75,787 | $ | 79,792 | $ | (1,304 | ) | $ | 154,275 | ||||||

NOTE 1: Table above excludes certain intercompany allocations | |||||||||||||||

NOTE 2: The table above is impacted by certain expenses associated with the Corporate entity that were allocated to the Cloud Services business and the Digital Media business as these costs are shared costs incurred by the Corporate entity. As a result, expenses were allocated from Corporate to Cloud Services and Digital Media in the amount of $1.7 million and $1.8 million, respectively. The effects noted above reduce Adjusted EBITDA for Cloud Services and Digital Media by $1.7 million and $1.8 million respectively. | |||||||||||||||

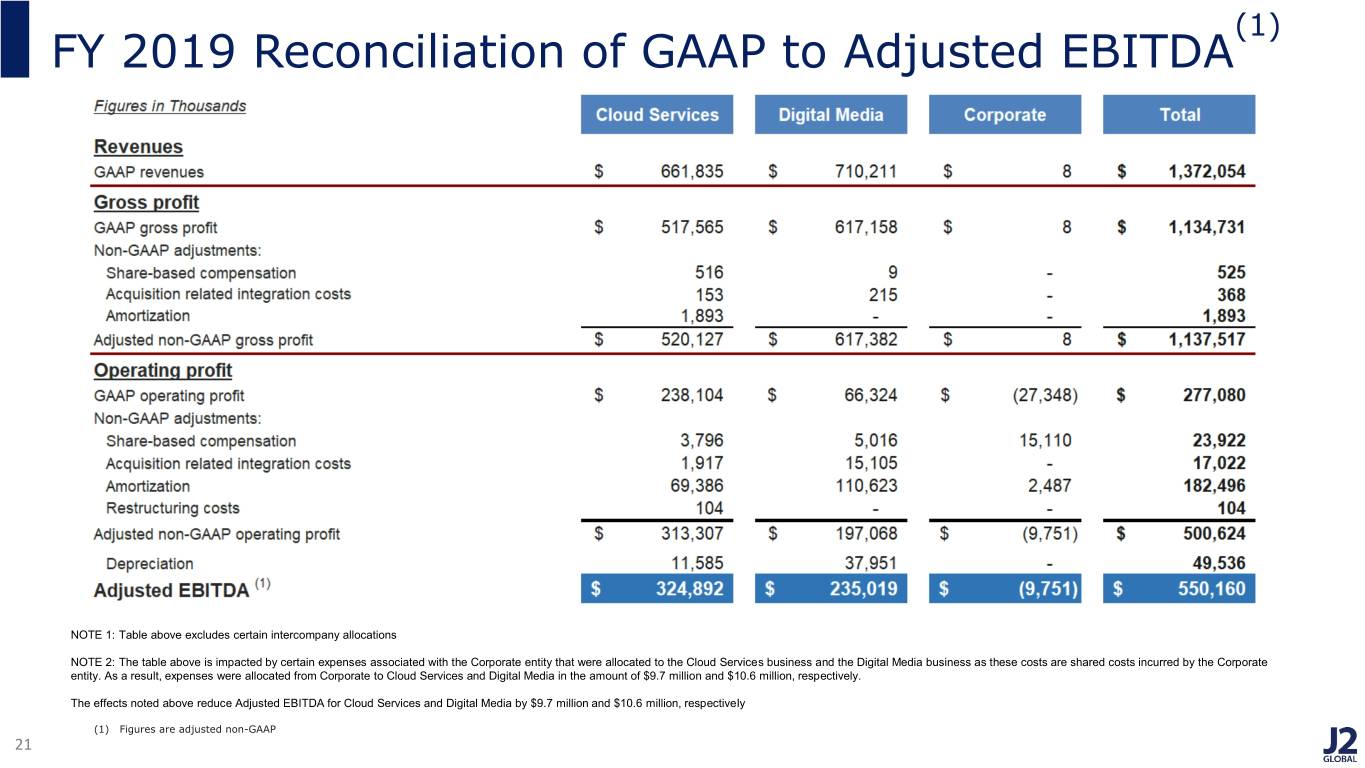

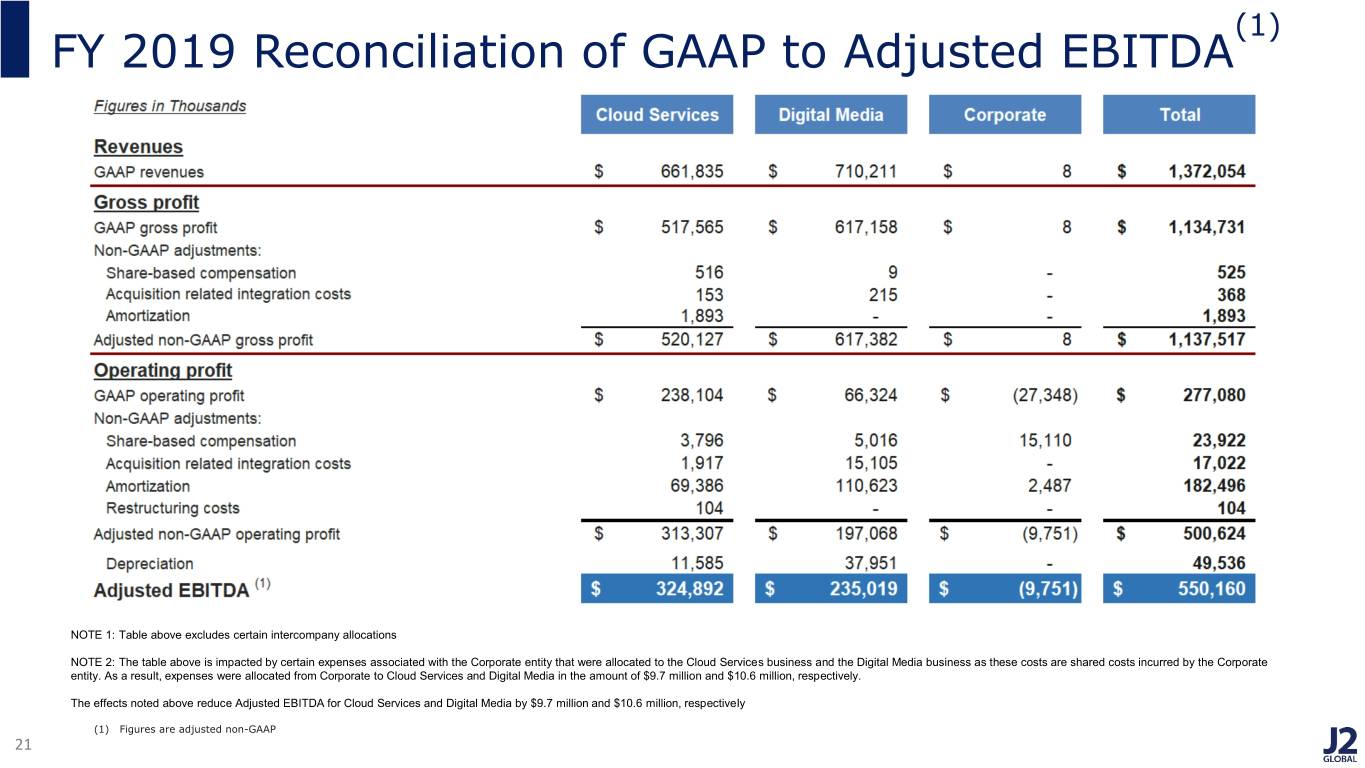

Cloud | Digital | ||||||||||||||

Services | Media | Corporate | Total | ||||||||||||

Revenues | |||||||||||||||

GAAP revenues | $ | 661,835 | $ | 710,211 | $ | 8 | $ | 1,372,054 | |||||||

Gross profit | |||||||||||||||

GAAP gross profit | $ | 517,565 | $ | 617,158 | $ | 8 | $ | 1,134,731 | |||||||

Non-GAAP adjustments: | |||||||||||||||

Share-based compensation | 516 | 9 | — | 525 | |||||||||||

Acquisition related integration costs | 153 | 215 | — | 368 | |||||||||||

Amortization | 1,893 | — | — | 1,893 | |||||||||||

Adjusted non-GAAP gross profit | $ | 520,127 | $ | 617,382 | $ | 8 | $ | 1,137,517 | |||||||

Operating profit | |||||||||||||||

GAAP operating profit | $ | 238,104 | $ | 66,324 | $ | (27,348 | ) | $ | 277,080 | ||||||

Non-GAAP adjustments: | |||||||||||||||

Share-based compensation | 3,796 | 5,016 | 15,110 | 23,922 | |||||||||||

Acquisition related integration costs | 1,917 | 15,105 | — | 17,022 | |||||||||||

Amortization | 69,386 | 110,623 | 2,487 | 182,496 | |||||||||||

Additional tax expense from prior years | 104 | — | — | 104 | |||||||||||

Adjusted non-GAAP operating profit | $ | 313,307 | $ | 197,068 | $ | (9,751 | ) | $ | 500,624 | ||||||

Depreciation | 11,585 | 37,951 | — | 49,536 | |||||||||||

Adjusted EBITDA | $ | 324,892 | $ | 235,019 | $ | (9,751 | ) | $ | 550,160 | ||||||

NOTE 1: Table above excludes certain intercompany allocations | |||||||||||||||

NOTE 2: The table above is impacted by certain expenses associated with the Corporate entity that were allocated to the Cloud Services business and the Digital Media business as these costs are shared costs incurred by the Corporate entity. As a result, expenses were allocated from Corporate to Cloud Services and Digital Media in the amount of $9.7 million and $10.6 million, respectively. The effects noted above reduce Adjusted EBITDA for Cloud Services and Digital Media by $9.7 million and $10.6 million, respectively. | |||||||||||||||

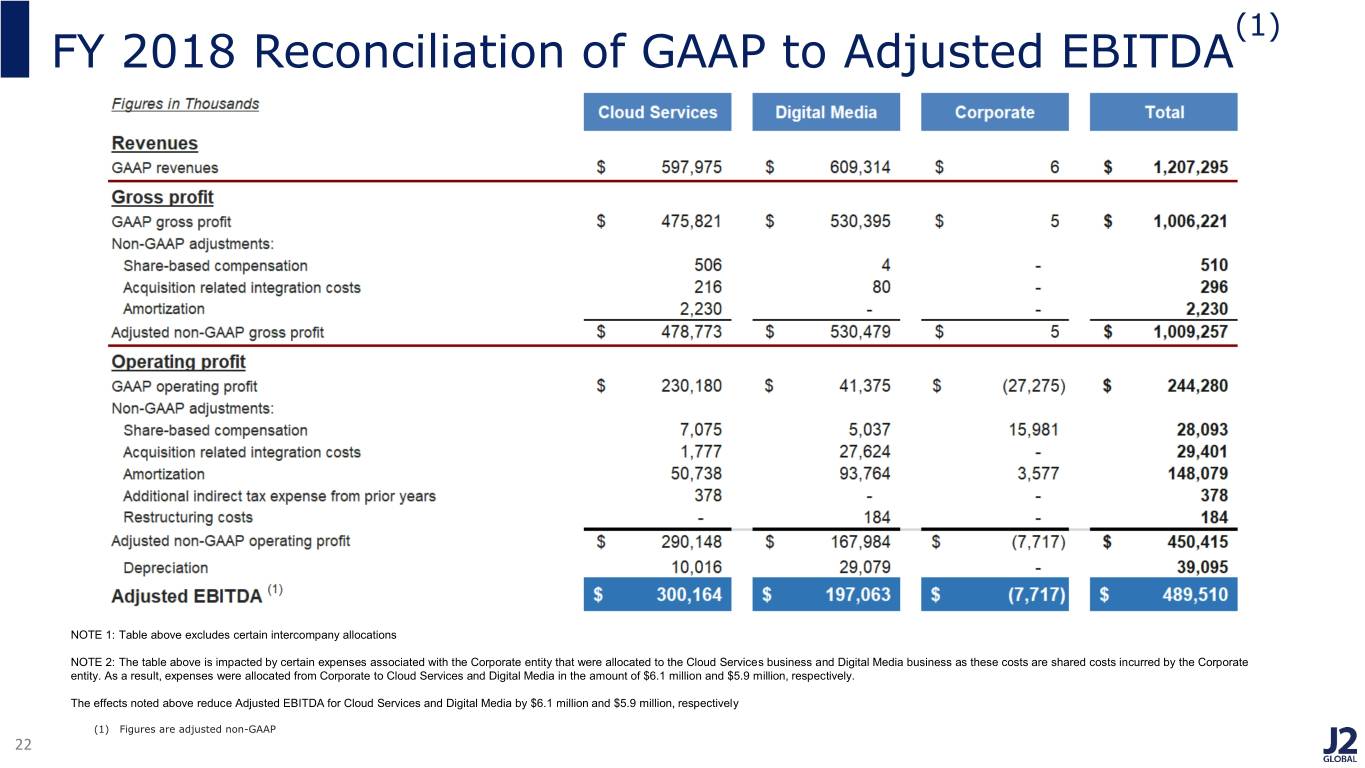

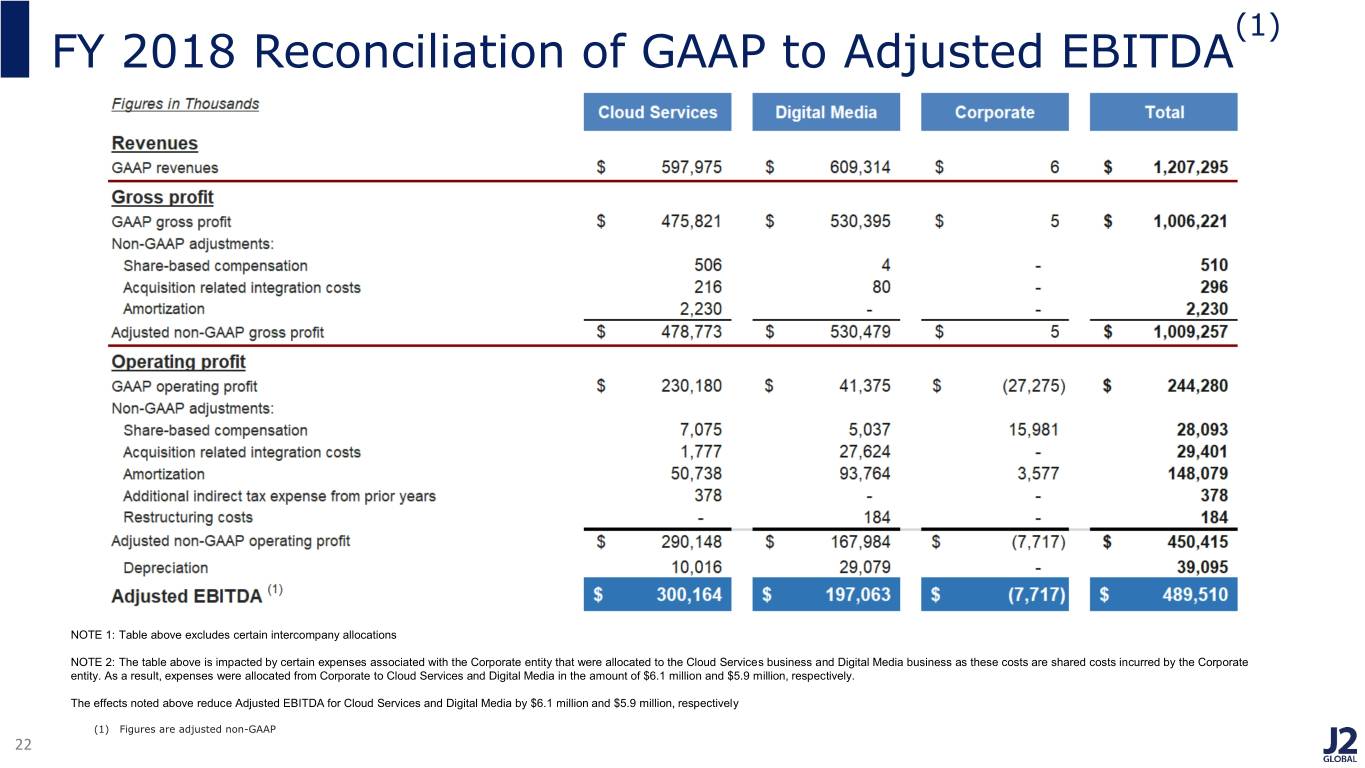

Cloud | Digital | ||||||||||||||

Services | Media | Corporate | Total | ||||||||||||

Revenues | |||||||||||||||

GAAP revenues | $ | 597,975 | $ | 609,314 | $ | 6 | $ | 1,207,295 | |||||||

Gross profit | |||||||||||||||

GAAP gross profit | $ | 475,821 | $ | 530,395 | $ | 5 | $ | 1,006,221 | |||||||

Non-GAAP adjustments: | |||||||||||||||

Share-based compensation | 506 | 4 | — | 510 | |||||||||||

Acquisition related integration costs | 216 | 80 | — | 296 | |||||||||||

Amortization | 2,230 | — | — | 2,230 | |||||||||||

Adjusted non-GAAP gross profit | $ | 478,773 | $ | 530,479 | $ | 5 | $ | 1,009,257 | |||||||

Operating profit | |||||||||||||||

GAAP operating profit | $ | 230,180 | $ | 41,375 | $ | (27,275 | ) | $ | 244,280 | ||||||

Non-GAAP adjustments: | |||||||||||||||

Share-based compensation | 7,075 | 5,037 | 15,981 | 28,093 | |||||||||||

Acquisition related integration costs | 1,777 | 27,624 | — | 29,401 | |||||||||||

Amortization | 50,738 | 93,764 | 3,577 | 148,079 | |||||||||||

Additional tax expense from prior years | 378 | — | — | 378 | |||||||||||

Restructuring costs | — | 184 | — | 184 | |||||||||||

Adjusted non-GAAP operating profit | $ | 290,148 | $ | 167,984 | $ | (7,717 | ) | $ | 450,415 | ||||||

Depreciation | 10,016 | 29,079 | — | 39,095 | |||||||||||

Adjusted EBITDA | $ | 300,164 | $ | 197,063 | $ | (7,717 | ) | $ | 489,510 | ||||||

NOTE 1: Table above excludes certain intercompany allocations | |||||||||||||||

NOTE 2: The table above is impacted by certain expenses associated with the Corporate entity that were allocated to the Cloud Services business and Digital Media business as these costs are shared costs incurred by the Corporate entity. As a result, expenses were allocated from Corporate to Cloud Services and Digital Media in the amount of $6.1 million and $5.9 million, respectively. The effects noted above reduce Adjusted EBITDA for Cloud Services and Digital Media by $6.1 million and $5.9 million, respectively. | |||||||||||||||

1[BK MOP]@F@\$:>)HVB:4RS!&&"%DE=UX^C"MZ>TMKK9]IMXIMAROF(&VGU&>E34 M%%%% !1110 4444 %%%% !1110 4444 %%%% !1110 4444 %%%% !1110 4 M444 %%%% !1110 4444 %%%% !1110 4444 %%%% !1110 4444 %%%% !11 M10 4444 %%%% !1110 4444 %%%% !1110 4444 %%%% !1110 4444 %%%% M !1110 4444 %%%% !1110 4444 %%%% !1110 4444 %%%% !1110 4444 M%%%% !1110 4444 %%%% !1110 4444 %%%% !1110 4444 %%%% !1110 4 M444 %%%% !1110 4444 %%%% !1110 4444 %%%% !1110 4444 %%%% !11 M10 4444 %%%% !1110 4444 %%%% !1110 4444 %%%% !1110 4444 %%%% M !1110 4444 %%%% !1110 4444 %%%% !1110 4444 %%%% !1110 4444 M%%%% !1110 4444 %%%% !1110 4444 %%%% !1110 4444 %%%% !1110 4 M444 %%%% !1110 4444 %%%% !1110 4444 %%%% !1110 4444 %%%% !11 M10 4444 %%%% !1110 4444 %%%% !1110 4444 %%%% !1110 4444 %%%% M !1110 4444 %%%% !1110 4444 %%%% !1110 4444 %%%% !1110 4444 M%%%% !1110 4444 %%%% !1110 4444 %%%% !1110 4444 %%%% !1110 4 M444 %%%% !1110 4444 %%%% !1110 4444 %%%% !1110 4444 %%%% !11 M10 4444 %%%% !1110 4444 %%%% !1110 4444 %%%% !1110 4444 %%%% < !1110 4444 %%%% !1110 4444 %%%% '__V0$! end

6GX?_ !"T$;]*U4RJO(2VNV7/

M_ 6P*U?!'Q&U:37E\.^)H_\ 2'8QI,R;'5_[K@<<]CC\\UZ;<7,%I"TUS-'#

M$HRSR,%4?B:\8>6+QA\9[>ZT@%[>">*1I@,!EBP2WT)&!^%;QE[5/G7S,VN5

MJQZ]K&L6.A:=)J&HSB&"/J>I8]@!W->?M\6M0U*9X_#OA:ZO%4XWMN8_BJ X

M_.HOCB9_[/T@+G[/YLF_TW87;^FZN\\*G3?^$9L/[),?V40+M\O'7'.?]K/7

MOFLU&,8*35[E-MRLCR'Q]KGBO5]'MUUW04T^U2X!CD\ME8OM;Y>3Z9/3M7KG

M@\EO!NC$G)^PP_\ H K@_C+KNEW.D6VDV]Y'->1W0EDCC.[8H5AR1P#EAQUK

MN_!W_(F:+_UXP_\ H JJCO2CI84?B9YYX?\ ^2[:C_O3?^@UZO=3_9K2:X(S

MY4;/CUP,UY1X?_Y+MJ/^]-_Z#7K4T2SPO$_*R*5/T-37^)>B'#9G@O@3Q7+H

M>H:CJ3Z+ *XZQL[V'X63SSZG)<02:.WEVYA11%\G9@,GTYHC&XV['>0RI/"DT3

M;DD4,I]0>13ZX,+6VM[FZEMQ;N7!C .