Exhibit 10.25

***Denotes certain parts that have not been disclosed and have been filed separately with the Secretary, Securities and Exchange Commission, and is subject to a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934.

March 7, 2006

|

Tasman Exploration Ltd. |

Eden Energy Corp. |

| ||

|

675, 321 - 6th Avenue S.W. |

200 Burrard Street, Suite 1925 | |||

|

Calgary, Alberta |

Vancouver, B.C. |

| ||

|

T2P 3H3 |

V6C 3L6 |

| ||

|

Attention: Bob Mosoronchon |

Attention: Don Sharpe |

|

Ramshorn Canada Limited |

Solara Exploration Ltd. |

| |||

|

850, 505 - 3rd Street S.W. |

1800, 444 - 5th Avenue S.W. | ||||

|

Calgary, Alberta |

Calgary, Alberta |

| |||

|

T2P 3E6 |

T2P 2T8 |

| |||

|

Attention: Duane Mather |

Attention: Donald R. Holding |

Texola Energy Corp.

206, 427 Howe Street

Vancouver, B.C.

V6B 2B3

Attention: Richard Coglon

Dear Sir:

|

RE: |

Farmout and Option Agreement |

Dated March 7, 2006

***

|

|

Chinchaga Area, Alberta |

Suncor File: T06-40

Further to our recent discussions the following represents the terms and conditions under which Suncor Energy Inc. (“Suncor”) agrees to farmout a 100% Working Interest in the Farmout Lands to Tasman Exploration Ltd. (“Tasman”) as to 11.5%, Eden Energy Corp. (“Eden”) as to 50%, Ramshorn Canada Limited (“Ramshorn”) as to 15%, Texola Energy Corp. (“Texola”) as to 13.5% and Solara Exploration Ltd. (“Solara”) as to 10%; all under the terms and conditions as more particularly set forth in this letter. Suncor, Tasman, Eden, Ramshorn, Texola and Solara

Farmout & Area of Mutual Interest Agreement dated March 7, 2006

Tasman Exploration Ltd., Eden Energy Corp., Ramshorn Canada Limited., Texola Energy Corp. and Solara Exploration Ltd.

Page 2

hereby agree as follows:

|

1. |

Definitions |

In this Agreement, unless the context otherwise requires, terms which are defined in the Farmout and Royalty Procedure shall have the meaning ascribed to them in the Farmout and Royalty Procedure and in addition the following expressions shall have the respective meanings hereby assigned to them, namely:

|

|

a) |

“AMI Area” means all lands and Petroleum Substances, other than the lands and Petroleum Substances comprising the Farmout Lands, Option Lands - Block I and Option Lands - Block II within the AMI Area outlined in red on Schedule “E” hereof and subject to the provisions of clause 10 hereof; |

|

|

b) |

“Contract Depth” means a depth sufficient to penetrate 25 meters into the Muskeg formation or 2650m true vertical depth, whichever shall first occur; |

|

|

c) |

“Effective Date” means March 7, 2006; |

|

|

d) |

“Farmee” means individually or collectively as the context requires: Tasman, Eden, Ramshorn, Texola and Solara; |

|

|

e) |

“Farmor” means Suncor; |

|

|

f) |

“Farmout Lands” means the lands identified on Schedule “A” hereto as “Farmout Lands” |

|

|

g) |

“Farmout and Royalty Procedure” means the form of the 1997 CAPL Farmout and Royalty Procedure completed as to the schedule of elections, rates and modifications thereunder which is attached hereto as Schedule “B” |

|

|

h) |

“Farmor’s Overriding Royalty” means a 1/23.8365% (minimum 5%, maximum 12.5%) non-convertible gross overriding royalty on oil, and 12.5% non-convertible gross overriding royalty on all other Petroleum Substances paid to Farmor by Farmee on Farmor’s 100% Working Interest which is available to be earned by Farmee under terms as more particularly set forth herein to be paid in accordance with Article 5 of the Farmout and Royalty Procedure; |

|

|

i) |

“Operating Procedure” means the form of the 1990 CAPL Operating Procedure completed as to the schedule of elections, rates and modifications thereunder which is attached hereto as Schedule “C” |

|

|

j) |

“Option Lands - Block I” means the lands identified on Schedule “A” hereto as “Option Lands - Block I” |

Farmout & Area of Mutual Interest Agreement dated March 7, 2006

Tasman Exploration Ltd., Eden Energy Corp., Ramshorn Canada Limited., Texola Energy Corp. and Solara Exploration Ltd.

Page 3

|

|

k) |

“Option Lands - Block II” means the lands identified on Schedule “A” hereto as “Option Lands - Block II” and |

|

|

l) |

“Test Well” means Suncor et al Chinchaga 8-24-95-8-W6M (surface location: 12-19-95-7-W6M). |

|

2. |

Schedules |

The following Schedules are attached hereto and made a part of this Agreement:

|

|

a) |

Schedule “A” which describes the Title Documents, the Encumbrances, the Farmout Lands, the Option Lands - Block I, the Option Lands - Block II and the Farmor’s Working Interest prior to farmout to Farmee as contemplated hereunder; |

|

|

b) |

Schedule “B” which sets forth the rates, elections and modifications of the Farmout and Royalty Procedure; |

|

|

c) |

Schedule “C” which sets forth the rates, elections and modifications of the Operating Procedure; |

|

|

d) |

Schedule “D” which is Farmor’s Well Data Requirement Sheet; |

|

|

e) |

Schedule “E” which is a plat outlining the AMI Area; and |

|

|

f) |

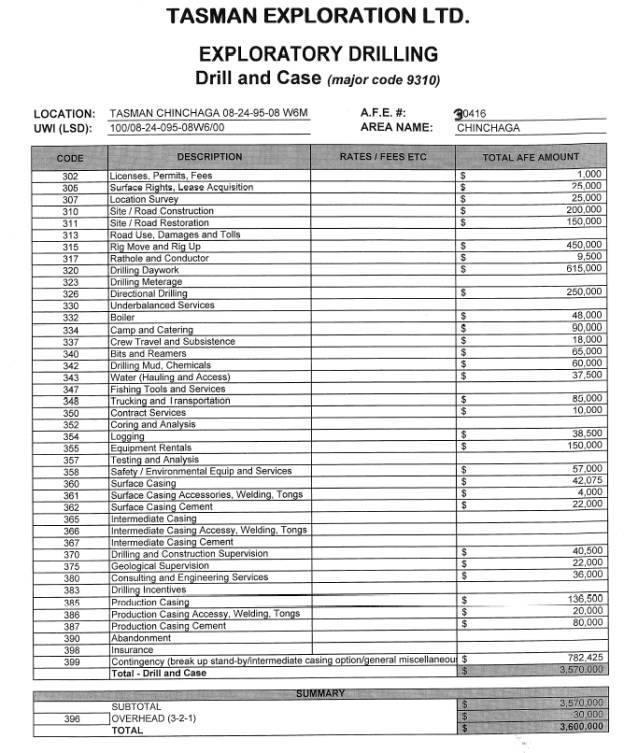

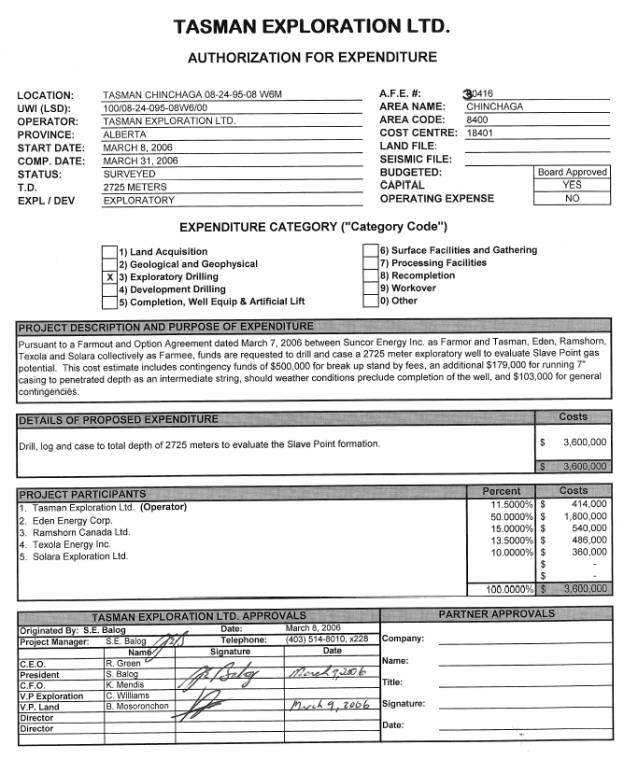

Schedule “F” which is Operator’s Authority for Expenditure (“AFE”) for the drilling of the Test Well. |

|

3. |

Test Well |

|

|

a) |

Farmee shall Spud the Test Well and Drill such well to Contract Depth prior to the end of the current 2006 winter drilling season subject to the Regulations and clause 14 of this Agreement. *** |

|

|

b) |

Farmee will provide Farmor with all information obtained from the Test Well on a daily basis in accordance with Farmor’s Well Data Requirement Sheet attached hereto as Schedule “D”. |

|

|

c) |

Except as otherwise provided in this Agreement, as between Farmee and Farmor the provisions of the Farmout and Royalty Procedure shall govern all operations conducted pursuant to this Agreement. Farmee’s rights and obligations will accrue singularly and proportionately to the Farmee Parties in the following percentages: |

|

|

Tasman |

11.50% |

|

|

Eden |

50.00% |

Farmout & Area of Mutual Interest Agreement dated March 7, 2006

Tasman Exploration Ltd., Eden Energy Corp., Ramshorn Canada Limited., Texola Energy Corp. and Solara Exploration Ltd.

Page 4

|

|

Ramshorn |

15.00% |

|

|

Texola |

13.50% |

|

|

Solara |

10.00% |

Tasman is hereby appointed the designated Farmee representative under the Farmout and Royalty Procedure and acknowledges and accepts such appointment.

|

|

d) |

As between the parties comprising Farmee the provisions of the Operating Procedure shall govern all operations conducted pursuant to this Agreement. Tasman is hereby appointed initial Operator under the Farmout and Royalty Procedure and Operating Procedure and shall conduct all operations with respect to the Test Well. Tasman, as Operator, hereby cash calls all Farmee parties for their respective participating interest share of the drill and case costs for the Test Well as set out in Schedule “F” hereto. Concurrent with the execution of this Agreement each Farmee party will return to Operator an executed copy of the Operator’s AFE and, in addition, remit to Operator their proportionate share of the costs outlined in the AFE either in the form of a cheque or electronic transfer of funds. As between the parties comprising Farmee and in consideration of the Test Well being a title preserving operation, if less than all parties elect to set production casing and attempt to complete the Test Well, the non-participants shall be subject to forfeiture provisions of the Operating Procedure and for clarity such non-participating party shall have earned no interest whatsoever in the Farmout Lands or retained any entitlement to earn an interest in the Option Lands - Block I or Option Lands - Block II. Where reference in the Operating Procedure is made to “Operator”, “Tasman” shall be substituted therefor, and “joint lands’ shall be substituted by “Farmout Lands” and/or Option Lands - Block I or Option Lands - Block II, as the case may be. Tasman hereby accepts appointment as Operator. |

|

|

e) |

Within 30 days of rig release of the Test Well Farmor shall apply to Alberta Energy in accordance with the Regulations to group all eligible Title Documents by virtue of the drilling of the Test Well to Contract Depth with the first priority for grouping being given to the Farmout Lands and Option Lands - Block I. The parties will mutually agree on any other lands to be included in such grouping request. If, at the time when lands are required to be selected for subsequent validation there are more lands contained within a group than are ultimately eligible to be validated and retained pursuant to the Regulations, the Parties will consult to mutually agree on lands for validation prior to submission to Alberta Energy and in the case of disagreement Farmor’s decision will prevail. |

|

4. |

Surface Access |

|

|

a) |

In order to facilitate the drilling and if applicable, the completion, of the Test Well this 2006 winter drilling season Farmor has acquired the survey, surface documents and well license for the Test Well and made contact with third parties |

Farmout & Area of Mutual Interest Agreement dated March 7, 2006

Tasman Exploration Ltd., Eden Energy Corp., Ramshorn Canada Limited., Texola Energy Corp. and Solara Exploration Ltd.

Page 5

with whom road use agreements are required to utilize such third party access to the Test Well location. In accordance with the Regulations, Farmor has provided for activities associated with the Test Well during the current drilling season in the context of its Caribou Protection Plan (“CPP”) submitted to Alberta Sustainable and Resource Development (“ASRD”) designated as Approval # 32M-CPP-05/06-NW3-Suncor for the Boreal Caribou Area. Following the Spud of the Test Well and within 15 days of receipt of Farmor’s invoice to Farmee outlining such costs Farmee shall reimburse Farmor for 100% of Farmor’s total costs to survey, construct the lease and construct and acquire surface access to the Test Well. Farmee will likewise reimburse Farmor if there are any other survey or surface documents acquired by Farmor which Farmee wishes to utilize for any other location on any of the lands subject to this Agreement.

|

|

b) |

Farmee shall work cooperatively with all relevant stakeholders, to establish the manner in which Farmee can conduct such activities relative to the Test Well as the operator in the place and stead of Farmor. The parties shall execute all documents required to assign all relevant surface documentation directly to Farmee, and where surface documentation is not assignable, such as road use agreements and CPP, Farmee shall attend to the acquisition of such surface documentation in its own name directly with the relevant parties. |

|

|

c) |

For any surface documentation relative to the Test Well which cannot be assigned to Farmee or which Farmee is unable to acquire directly then Farmee shall be deemed to have acquired Farmor’s beneficial interest in such documentation held by Farmor and with respect to such beneficial interest, Farmee shall be liable to Farmor for all losses, costs, damages and expenses whatsoever and howsoever that the Farmor may suffer, sustain, pay or incur and shall indemnify and hold harmless the Farmor and its directors, officers, agents and employees against all actions, causes of action, proceedings, claims, demands, losses, costs, damages and expenses whatsoever that may be brought against or suffered by Farmor, its directors, officers, agents and employees or that they may sustain, pay or incur; insofar as they are a result, directly or indirectly, of any act or omission (whether negligent or otherwise) of the Farmee with respect to all operations or activities conducted by Farmee or on behalf of it hereunder. |

|

5. |

Interest Earned – Test Well |

Provided the Farmee is not in default of its obligations hereunder and has drilled the Test Well to Contract Depth in accordance with the provisions of this Agreement and subject to Article 3.00 of the Farmout and Royalty Procedure, the Farmee will earn an undivided 100% Working Interest in the Farmout Lands subject to the reservation unto Farmor of the Farmor’s Overriding Royalty to be paid by Farmee on Farmor’s pre-farmout 100% Working Interest in the Test Well and the Farmout Lands.

|

6. |

Option Lands - Block I |

Farmout & Area of Mutual Interest Agreement dated March 7, 2006

Tasman Exploration Ltd., Eden Energy Corp., Ramshorn Canada Limited., Texola Energy Corp. and Solara Exploration Ltd.

Page 6

|

|

a) |

Provided the Farmee is not in default of its obligations hereunder and has drilled the Test Well to Contract Depth in accordance with the terms of this Agreement and Article 3.01A of the Farmout and Royalty Procedure, Farmee shall have 30 days from the drilling rig release date of the Test Well to individually elect in writing to Farmor to acquire a percentage Working Interest from Farmor in the Option Lands - Block I, equal to Farmee’s participating Working Interest in the Test Well, subject to complying with clause 6(b) herein. Failure to elect by Farmee shall be deemed to be an election not to acquire such interest of Farmor and if Farmee has not elected to acquire such interest, or is deemed to have elected not to acquire such interest, then the Option Lands - Block I, as to such interest, shall be deemed to be included within the definition of Option Lands - Block II and subject to the provisions of clause 7 herein. |

|

|

b) |

If Farmee elects to acquire the Working Interest of Farmor as set out in clause 6(a) herein Farmee shall, at the time of its election, pay to Farmor a percentage, equivalent to the percentage Working Interest acquired, of the total cost paid by Farmor to acquire the Option Lands - Block I, which is the amount equal to the amount shown on Schedule “A” under the heading “Total Acquisition Cost” for the Option Lands – Block I, subject to the reservation of the Farmor’s Overriding Royalty payable to Farmor by Farmee. |

|

7. |

Option Lands - Block II |

|

|

a) |

Provided the Farmee is not in default of its obligations hereunder and has drilled the Test Well to Contract Depth and in accordance with the terms of this Agreement and Article 3.01A of the Farmout and Royalty Procedure, Farmee shall have 30 days from the Completion of the Test Well or August 1, 2006, whichever is the earlier date, to elect in writing to Farmor to commit to drill a well (in this clause, the “Option Well”) to Contract Depth at a location of its choice on the Option Lands - Block II with such well to reach Contract Depth prior to the end of the 2007 winter drilling season and to comply with the provisions of clause 7(c) herein to retain the right to earn Farmor’s Working Interest in the Option Lands Block II. Failure to elect by Farmee shall be deemed to be an election not to drill the Option Well. |

|

|

b) |

If fewer than all Farmee parties elect to drill the Option Well, the electing Farmee(s) may, within 3 days, further elect to assume any non-electing Farmee party(ies) share, on a proportionate basis, of the interest made available as a result of fewer than all Farmee parties electing to drill the Option Well. If electing Farmee parties are unable to confirm to Farmor that their collective election to drill the Option Well is on a 100% basis then Farmee shall be deemed to have elected not to drill the Option Well. |

|

|

c) |

If Farmee elects to drill the Option Well Farmee shall, within ten days of its |

Farmout & Area of Mutual Interest Agreement dated March 7, 2006

Tasman Exploration Ltd., Eden Energy Corp., Ramshorn Canada Limited., Texola Energy Corp. and Solara Exploration Ltd.

Page 7

election, pay to Farmor 100% of the total costs paid by Farmor to acquire the Option Lands - Block II which is the amount equal to the amount shown on Schedule “A” under the heading “Total Acquisition Cost” for the Option Lands – Block II, subject to the inclusion of the Option Lands - Block I as to Farmee’s proportionate share of Farmor’s Working Interest and payment to Farmor of Farmor’s costs if Farmee did not elect to acquire Farmor’s Working Interest in the Option Lands - Block I as provided for in clause 6(a) herein.

|

8. |

Interest Earned – Option Well |

|

|

a) |

Provided the Farmee is not in default of its obligations hereunder and has drilled the Option Well to Contract Depth in accordance with the provisions of this Agreement and subject to Article 3.00 of the Farmout and Royalty Procedure, the Farmee will earn 100% of Farmor’s Working Interest in the Option Lands - Block II which may include, subject to the provisions of clause 6(b), the Option Lands - Block I, subject to the reservation unto Farmor of the Farmor’s Overriding Royalty to be paid by Farmee on Farmor’s pre farmout 100% Working Interest in such lands. |

|

|

b) |

The grouping and validation provisions that apply to the Test Well in clause 3(e) herein also apply to the grouping and validation of the Option Lands – Block II and, if applicable, Option Lands – Block I by virtue of drilling the Option Well. |

|

9. |

Amendment to Farmout and Royalty Procedure |

Clause 9.03(b) – Well Information to Royalty Owners:

For all wells drilled on the Royalty Lands in which Suncor is a Royalty Owner, the Farmee will supply Suncor with the information prescribed in Schedule “C” attached to this Agreement. Clause 9.03(b) of the Farmout and Royalty Procedure will be amended by deleting the remainder of the said Clause 9.03(b) after the word “Article”.

|

10. |

AMI Area |

|

|

a) |

If Farmee acquires an interest in any lands and Petroleum Substances comprising the AMI Area during the term thereof, or during the term thereof secures the right to acquire an interest from a third party on third party held land, Farmee shall advise Farmor in writing of such acquisition by Farmee including, if applicable, if Farmee has secured the right to acquire an interest in third party held land and Farmee shall reserve to Farmor a 5.0% non-convertible overriding royalty on such land acquired (in this clause 10 referred to as “AMI Royalty”) provided further that if, during the term of the AMI Area, Farmee has secured the right to acquire an interest in third party held land but the actual acquisition of such interest occurs after the termination date of the AMI Area the AMI Royalty shall apply to Farmee’s acquired interest in such third party held land as if such acquisition had |

Farmout & Area of Mutual Interest Agreement dated March 7, 2006

Tasman Exploration Ltd., Eden Energy Corp., Ramshorn Canada Limited., Texola Energy Corp. and Solara Exploration Ltd.

Page 8

occurred during the term of the AMI Area.

|

|

b) |

Any lands acquired by Farmee pursuant to the provisions of this clause 10 shall be included in the definition of Royalty Lands in the Farmout and Royalty Procedure with the AMI Royalty calculated and paid on 100% of production attributable to Farmee’s interest, subject to all other provisions of this Agreement, including allowed deductions to the AMI Royalty as provided for in clause 5.04B and the provision for well information to Farmor as provided for in clause 9.03(b)(as amended herein) of the Farmout and Royalty Procedure. |

|

|

c) |

As between the parties comprising Farmee the provisions of Article 8 of the Farmout and Royalty Procedure shall apply as to the AMI Area during the term thereof in the following interests: |

|

|

Tasman |

11.5% |

|

|

Eden |

50.0% |

|

|

Ramshorn |

15.0% |

|

|

Texola |

13.5% |

|

|

Solara |

10.0% |

|

|

d) |

Notwithstanding the Effective Date and providing the Test Well is drilled by Farmee as provided for in clause 3(a) herein, the AMI Area shall be in effect for a period of time commencing on November 23, 2005 and terminating eighteen (18) months following the later of: the drilling rig release date of the last Earning Well drilled hereunder or the date on which the Farmee surrendered the option to drill the Option Well; provided, however, that nothing contained herein shall be construed as releasing a Party from the performance or fulfillment of an obligation arising and not fulfilled prior to the termination of the AMI Area. |

|

11. |

Limitations Act |

The two (2) year time period for seeking a remedial order under Section 3(1)(a) of the Limitations Act, R.S.A. 2000 c.L-12, as may be amended from time to time, for any claim (as defined in that Act) arising in connection with this agreement is extended to:

|

|

a) |

for claims disclosed by an audit, two years after the time this agreement permitted that audit to be performed; or |

|

|

b) |

for all other claims, six years. |

|

12. |

Restriction of Joint Operations |

Farmee with respect to any working interest it has earned in the Farmout Lands or Option Lands – Block I, or both, shall not give any party to this Agreement an Article X Independent Operations Notice under the Operating Procedure prior to making its

Farmout & Area of Mutual Interest Agreement dated March 7, 2006

Tasman Exploration Ltd., Eden Energy Corp., Ramshorn Canada Limited., Texola Energy Corp. and Solara Exploration Ltd.

Page 9

election to Farmor as provided for in clause 7(a).

|

13. |

Assignment By Farmee Prior to Earning |

Farmee shall not assign all or any portion of its interest prior to earning pursuant to the terms of this Agreement unless the Farmor’s prior written consent is obtained which may reasonably be withheld.

|

14. |

Suspension of Test Well Operations |

If Farmee determines that operations on the Test Well should be suspended because of adverse surface access conditions prior to the Test Well having reached Contract Depth, then Farmee shall have the right to suspend the Test Well for the purpose of resuming Test Well drilling operations at a later date as soon as surface access conditions permit provided that notwithstanding anything to the contrary in this Agreement the following conditions (a) to (c) inclusive shall apply:

|

|

a) |

On behalf of the Parties, Suncor and Tasman will apply to Alberta Energy to request a continuation of the maximum number of sections of the Farmout Lands for a sufficient amount of time to allow the Farmee to resume the Drilling of the Test Well to Contract Depth during the 2006/2007 winter drilling season; and, |

|

|

b) |

Farmee shall, as soon as surface access conditions permit: |

|

|

(i) |

Prepare a drill ready surface location for the Option Well at a location of Farmee’s choice on the Option Lands – Block II at Farmee’s sole cost to facilitate the drilling of the Option Well during the 2006/2007 winter drilling season, which may or may not be drilled by Farmee depending on Farmee’s election in paragraph (ii) of this clause 14(b) with the timing for completion of such surface location to coincide with and be no later than the rig release date of the drilling rig used to finish drilling the Test Well to Contract Depth. The Parties will consult to determine the location of the Option Well and if mutual agreement cannot be reached by the Farmees on such location the Farmor’s decision on the location of the Option Well will prevail; and |

|

|

(ii) |

Finish Drilling the Test Well to Contract Depth and evaluate to the reasonable satisfaction of Farmor in accordance with the Farmout and Royalty Procedure and Farmee shall have the earlier of 4 days from receipt of wireline logs for the Test Well or January 31, 2007 by which it will make its election in writing to Farmor to either Drill the Option Well, with such well to reach Contract Depth during the 2006/2007 winter drilling season, or, not to Drill the Option Well. Failure to elect shall be deemed to be an election not to Drill the Option Well and if Farmee has elected or deemed to have elected not to Drill the Option Well, Farmor |

Farmout & Area of Mutual Interest Agreement dated March 7, 2006

Tasman Exploration Ltd., Eden Energy Corp., Ramshorn Canada Limited., Texola Energy Corp. and Solara Exploration Ltd.

Page 10

shall retain the option to take over the surface location for the Option Well from Farmee for the purpose of having a third party drill the Option Well during the 2006/2007 winter drilling season. If Farmor is successful in obtaining such a third party, Farmor will use reasonable efforts to have Farmee’s costs incurred to prepare the Option Well surface location reimbursed to Farmee by such third party and facilitate assumption of associated surface documentation by such third party, if required.

|

|

c) |

All of the remaining provisions of this Agreement continue to apply with the exception of clause 6. Farmee’s right to acquire Option Lands – Block I shall be combined with Farmee’s right to acquire Option Lands – Block II. Clause 7(c) in this Agreement is therefore modified to the extent that the payment by Farmee to Farmor referred to in 7(c) shall comprise the Total Acquisition Cost for the Option Lands – Block I and Option Lands - Block II. In clause 8(a) Option Lands – Block I shall be included in the lands to be earned by Farmee by virtue of Farmee paying Farmor’s costs for the Option Lands – Block I, Option Lands – Block II together with fulfillment of the Option Well obligations as outlined in clause 8(a). |

|

|

d) |

If any of the Farmout Lands revert to Alberta Energy and are acquired by Farmee during the term of the AMI, such acquisition by Farmee shall be subject to the reservation of the Farmor’s Overriding Royalty in place of the AMI Royalty. |

|

15. |

Miscellaneous |

|

|

a) |

The terms of this Agreement express and constitute the entire agreement between the Parties. No amendments shall be binding unless agreed to by all Parties in writing. No implied covenant or liability is created or shall arise by reason of this Agreement or anything herein contained. |

|

|

b) |

This Agreement supersedes and replaces all prior agreements, documents, writings and verbal understandings between the Parties relating to the Farmout Lands, Option Lands - Block I, Option Lands - Block II and AMI Area provided however that the Test Well is Spud pursuant to the terms of this Agreement. If there is a conflict between the terms of the Farmout and Royalty Procedure and this Agreement or the Operating Procedure and this Agreement, the terms of this Agreement shall prevail. |

|

|

c) |

This Agreement shall be binding upon and enure to the benefit of the Parties and their respective successors and assigns. |

|

|

d) |

This Agreement and the relationship between the Parties shall be construed and determined according to the laws of the Province of Alberta and the courts of the Province of Alberta shall have exclusive jurisdiction with respect to any matters or things arising directly or indirectly related to this Agreement. |

Farmout & Area of Mutual Interest Agreement dated March 7, 2006

Tasman Exploration Ltd., Eden Energy Corp., Ramshorn Canada Limited., Texola Energy Corp. and Solara Exploration Ltd.

Page 11

|

|

e) |

This Agreement may be executed in counterpart. |

|

|

f) |

The parties shall do such further acts and execute and/or deliver and/or record such other and further documents as may be necessary to give effect to the terms of this Agreement. |

Should the foregoing accurately reflect our agreement, please so indicate by signing the Agreement and returning the signed counterpart execution page to the attention of the undersigned either by fax to: (403) 269-6258 or by hand delivery to: 19th Floor, 144 - 4th Avenue S.W., Calgary, Alberta. Your immediate attention is required since the Test Well Spud on Friday, March 10, 2006.

Please also confirm that you have returned the signed Operator’s AFE and paid the cash call funds for Operator’s AFE directly to: Tasman Exploration Ltd., 675, 321 - 6th Avenue S.W., Calgary, Alberta Attn: Bob Mosoronchon. If you have not already done so, your well information requirements, including contact information, should be provided directly to Tasman Exploration Ltd. by email to: djackman@tasmanexploration.com.

Yours very truly,

SUNCOR ENERGY INC.

/s/ Leslie Simpson

Leslie Simpson

Senior Landman

Prospect Generation Services

Accepted and agreed to this 13th day of March, 2006

|

COMPANY: |

EDEN ENERGY CORP. |

PER: /s/ Donald A. Sharpe

NAME: Donald A. Sharpe

TITLE: President

This is the execution page to that certain Farmout & Option Agreement dated March 7, 2006 between Suncor Energy Inc., Tasman Exploration Ltd., Eden Energy Corp., Ramshorn Canada Limited, Texola Energy Corp. and Solara Exploration Ltd.

Schedule “A”

Attached to and made a part of a Farmout & Option Agreement

dated March 7, 2006 between Suncor Energy Inc., Tasman Exploration Ltd., Eden Energy Corp., Ramshorn Canada Limited, Texola Energy Corp. and Solara Exploration Ltd.

***

Farmor’s Working Interest in Farmout Lands, Option Lands - Block I, and Option Lands - Block II prior to farmout to Farmee: 100%

Schedule “B”

Attached to and made a part of a Farmout & Option Agreement

dated March 7, 2006 between Suncor Energy Inc., Tasman Exploration Ltd., Eden Energy Corp., Ramshorn Canada Limited, Texola Energy Corp. and Solara Exploration Ltd.

|

1. |

Effective Date (Subclause 1.01(f)): March 7, 2006 |

| ||||||||||||||||

|

2. |

Payout (Subclause 1.01(t), if Article 6.00 applies) |

-Alternate A- |

N/A |

| ||||||||||||||

|

|

-Alternate B- |

N/A |

| |||||||||||||||

|

|

Alternate B options, if applicable - |

m3 of equivalent production - years. |

| |||||||||||||||

|

3. |

Incorporation of Clauses from 1990 CAPL Operating Procedure (Clause 1.02) |

| ||||||||||||||||

|

|

(i) |

Insurance (311): |

Alternate A Alternate B X | |||||||||||||||

|

|

(ii) |

Address for Notices (Clause 2202): The Parties addresses for service are: |

| |||||||||||||||

|

|

Suncor Energy Inc. |

Tasman Exploration Ltd. |

| |||||||||||||||

|

|

P.O. Box 38 |

675, 321 - 6th Ave. SW |

| |||||||||||||||

|

|

112 – 4th Avenue S.W. |

Calgary, Alberta |

| |||||||||||||||

|

|

Calgary, Alberta |

T2P 2V2 |

Attn: V. P., Land |

| ||||||||||||||

|

|

Attn: Manager, Contracts & Land Admin. |

| ||||||||||||||||

|

|

Eden Energy Corp. |

Ramshorn Canada Limited | ||||||

|

|

200 Burrard Street, Suite 1925 |

850, 505 - 3rd Street S.W. |

| |||||

|

|

Vancouver, B.C. |

Calgary, Alberta |

| |||||

|

|

V6C 3L8 |

T2P 3E6 |

| |||||

|

|

Attn: President |

Attn: President |

| |||||

|

|

With a copy to: |

| ||||||

|

|

Ramshorn Investments, Inc. |

| ||||||

|

|

515 W. Greens Rd., Suite 1000 | |||||||

|

|

Houston, Texas 77067 |

| ||||||

|

|

Fax: 281-775-8416 |

| ||||||

|

|

Attn: President |

| ||||||

|

|

Texola Energy Corp. |

Solara Exploration Ltd. |

| ||||

|

|

206, 475 Howe Street |

1800, 444 - 5th Avenue S.W. | |||||

|

|

Vancouver, B.C. |

Calgary, Alberta |

| ||||

|

|

V6B 2B3 |

T2P 2T8 |

| ||||

|

|

Attn: President |

Attn: President |

| ||||

|

4. |

Article 4.00 (Option Wells): |

will X /will not |

apply |

| |||||||

|

5. |

Article 5.00 (Overriding Royalty): will X /will not |

apply | |||||||||

|

6. |

Quantification of Overriding Royalty (Subclause 5.01A, if applicable): |

| |||||||||

|

|

(i) |

Crude Oil |

(a) |

-Alternate 2 |

| ||||||

|

|

-If Alternate I applies, n/a |

| |||||||||

|

|

-If Alternate 2 applies, 1/23.8365, Min. 5.0% Max 12.5% |

| |||||||||

|

|

(ii) |

Other |

(b) |

-Alternate 1 |

| ||

|

|

-If Alternate I applies, 12.5% |

| |||||

|

|

-If Alternate 2 applies, N/A in (i) and N/A in (ii) | ||||||

|

7. |

Permitted Deductions (Subclause 5.04B, if applicable): Alternate 1 & 2, 50% |

|

8. |

Article 6.00 (Conversion of Overriding Royalty): will |

/will not X |

|

9. |

Article 8.00 (Area of Mutual Interest): will /will not X apply Superceded and replaced by clause 10 of Head Agreement |

|

10. |

Reimbursement of Land Maintenance Costs (Clause 11.02) will /will not X apply |

Schedule “C” - Page 1 of 2

Attached to and made a part of a Farmout & Option Agreement

Dated March 7, 2006 between Suncor Energy Inc., Tasman Exploration Ltd., Eden Energy Corp., Ramshorn Canada Limited, Texola Energy Corp. and Solara Exploration Ltd.

|

1990 CAPL OPERATING PROCEDURE | ||||

|

ARTICLE |

CLAUSE |

ELECTION | ||

|

III VI IX

X

XXII

XXIV |

311 - Insurance 604 - Marketing Fee 903 - Party Participation

1007 - Penalty for Independent Well

1010 - Title Preserving Well

2202 - Addresses for Notices

2401 - Right to Assign, Sell, Dispose 2404 - Recognition Upon Assignment |

“B” “A” “B”

400% - Development 600% - Exploratory

365 days

Suncor Energy Inc. P.O. Box 38 112 - 4 Ave. S.W. Calgary, AB T2P 2V5

Attention: Manager, Contracts & Land Administration

Ramshorn Canada Limited 850, 505 - 3rd Street S.W. Calgary, Alberta T2P 3E6 Attn: President

“A” N/A |

Tasman Exploration Ltd. 675, 321 - 6th Ave. SW Calgary, Alberta T2P 3H3

Attn: V. P., Land

Solara Exploration Ltd. 1800, 444 - 5th Ave. SW Calgary, Alberta T2P 2T8 Attn: President & CEO

|

Eden Energy Corp. 1925, 200 Burrard St. Vancouver, B.C. V6C 3L8

Attn: President

Texola Energy Corp. 206, 427 Howe St. Vancouver, B.C. V6B 2B3

Attn: President

|

|

1996 PASC ACCOUNTING PROCEDURE | ||||

|

ARTICLE |

CLAUSE |

ELECTION | ||

|

I

II

III

IV |

105 - Operating Advances 110 - Approvals

112 - Expenditure Limitations

202 - Employee Benefits 213 - Camp and Housing 216 - Warehouse Handling 221 - Allocation Options 302 - Overhead Rates a) Exploration Project

b) Drilling Well

c) Initial Construction

d) Subsequent Construction

e) Operations & Maintenance

406 - Dispositions |

a) 10% of approved forecast Approvals from two (2) or more parties having interests in the Joint Property totalling 75 percent a) excess of $25,000.00 c) excess of $25,000.00 b) Non-Compulsory - 25% b) shall __ shall not _X_ 5% N/A

1) 5% of first $50,000 plus 2) 3% of next $100,000 3) 1% of cost exceeding 1 & 2 1) 3% of first $50,000 plus 2) 2% of next $100,000 3) 1% of cost exceeding 1 & 2 1) 5% of first $50,000 plus 2) 3% of next $100,000 3) 1% of cost exceeding 1 & 2 1) 5% of first $50,000 plus 2) 3% of next $100,000 3) 1% of cost exceeding 1 & 2 1) 0% of Cost; and/or 2) $275 per Producing Well per month; or 3) A flat rate of $0 per month Subclause 302(e)(2) and 302(e)(3) hereof shall ___ shall not X

$25,000.00 | ||

|

Schedule “C” - Page 2of 2 Attached to and made a part of a Farmout & Option Agreement Dated March 7, 2006 between Suncor Energy Inc., Tasman Exploration Ltd., Eden Energy Corp., Ramshorn Canada Limited, Texola Energy Corp. and Solara Exploration Ltd.

102. Modifications to the PASC Accounting Procedure

The Accounting Procedure is modified as follows:

The clauses contained in the Accounting Procedure are deleted and replaced as follows:

Clause 201(a)(6) - Salaries and wages of the Operator's employees engaged in Production Engineering who are either temporarily or permanently assigned to and directly employed off-site in direct support of Joint Operations.

Clause 207(d) - Maintaining and operating an On-Site Warehouse that is part of the Joint Property. When additional operations or activities are served by the On-Site Warehouse, the cost of maintaining and operating the On-Site Warehouse shall be allocated among all operations and activities served, on an equitable basis or as otherwise agreed to by the Owners pursuant to Clause 216 of this Accounting Procedure.

Clause 406 - The Operator shall make timely disposition of idle and/or surplus Material, either through sale to the Non-Operators or sale to other parties. The Operator may purchase, but shall be under no obligation to purchase, the interest of the Non-Operator's surplus Material. All sales of Material, regardless of Condition, the proceeds from disposition of which is greater than twenty five thousand ___________________ dollars ($_25,000.00____________) shall be subject to approval by the Owners. All other disposals of Material shall be at the discretion of the Operator excepting sale to the Operator or its Affiliates. Exceptions shall be priced pursuant to Clause 402 of this Accounting Procedure unless prior approval by the Owners is obtained.

Clause 501(b) The Operator shall conduct an inventory of stock maintained in a Warehouse which is part of Joint Operations on an annual basis or as otherwise approved by the Owners.

103. Warranty as to Modifications Except as otherwise provided for in Clause 101 and 102 hereof, the Accounting Procedure published by the Petroleum Accountants Society of Canada, 1996 (copyright) is hereby incorporated in its entirety in the Agreement and the Parties so warrant that said Accounting Procedure has been amended only to the extent set forth herein.

|

Schedule “D”

Attached to and made a part of a Farmout & Option Agreement dated March 7, 2006 between Suncor Energy Inc. Tasman Exploration Ltd., Eden Energy Corp., Ramshorn Canada Limited, Texola Energy Corp. and Solara Exploration Ltd.

|

|

Well Requirement Sheet

| ||||||||||||||

|

Date Sent |

| ||||||||||||||

|

Operation Type |

| ||||||||||||||

|

Sent By |

| ||||||||||||||

|

Well Name |

| ||||||||||||||

|

Location |

| ||||||||||||||

|

TO: |

|

BC LOCATION |

| ||||||||||||

|

ATTN: |

|

UWI |

| ||||||||||||

|

Fax |

|

PROVINCE |

| ||||||||||||

|

Phone |

|

LICENCE # |

| ||||||||||||

|

|

Interest |

| |||||||||||||

|

Before Spudding: |

# of Copies |

|

After Drillling: |

# of copies | |||||||||||

|

Well Cost Estimate/AFE |

NA |

|

|

| |||||||||||

|

Drilling Licence |

2 |

|

|

Final Wireline Logs |

|

2 |

| ||||||||

|

Drilling Program |

2 |

|

|

Final Wireline Logs, including LIS, LAS and Print files (PDS PBM or META) on CD |

1 |

| |||||||||

|

Geological Prognosis |

2 |

|

|

|

|

|

| ||||||||

|

Survey Plat |

2 |

|

|

Final Oil, Gas and Water Reports |

|

|

2 |

| |||||||

|

|

Final Core Reports |

|

2 |

| |||||||||||

|

During Drilling: |

Final Core Reports (Floppy/Ascii File) |

|

|

1 |

| ||||||||||

|

Daily Drilling Reports (typed version) |

1 |

|

|

Final DST Reports and Charts |

|

|

2 |

| |||||||

|

Daily Geological Reports |

1 |

|

|

Final DST Reports (Floppy/Ascii File) |

|

|

1 |

| |||||||

|

Prints of Field/Transmitted Logs |

2 |

|

|

Final Deviation Survey Report |

|

|

2 |

| |||||||

|

Reports of all Prelim. Core and Fluid Analysis |

2 |

|

|

Final Deviation Survey Report (Floppy/Ascii) |

|

1 |

| ||||||||

|

|

Final Lithological Report |

|

|

|

2 |

| |||||||||

|

Completion: |

Final Lithological Report (Floppy/digital copy) |

|

1 |

| |||||||||||

|

AFE for Completion |

NA |

|

|

Final Geological Report |

|

|

|

2 |

| ||||||

|

Completion Program |

2 |

|

|

Final Geological Report (Floppy/digital copy) |

|

1 |

| ||||||||

|

Completion Wireline Logs |

2 |

|

|

Abandonment Report |

|

|

|

1 |

| ||||||

|

Cased Hole Form. Evaluation Logs |

2 |

|

|

Subsurface Pressure Temp. Report (Floppy/Ascii File) |

|

1 |

| ||||||||

|

Daily Completion Reports (typed version) |

1 |

|

|

All Production Test Data and subsequent workover service information |

1 |

| |||||||||

|

Cased Hole and Prod. Eval Logs (Floppy) |

1 |

|

|

|

|

|

|

|

| ||||||

|

PLEASE SEND ALL REQUIRED DOCUMENTS DIRECTLY TO SUNCOR OPERATIONS: Kirsten Ytsma: Fax 205 6995 /269 6216, klytsma@suncor.com | |||||||||||||||

|

Name Position Bus.# Fax # Cellular Res Fax # Res. # Home Address | |||||||||||||||

|

|

Operations |

|

|

|

|

|

| ||||||||

|

|

Log Analyst |

|

|

|

|

|

| ||||||||

|

|

Geologist |

|

|

|

|

|

| ||||||||

|

SPECIAL REQUIREMENTS: | |||||||||||||||

|

1. Daily drilling and completions reports telefaxed to Kirsten Ytsma at 269 6216 (pages), 205 6899 (computer fax) | |||||||||||||||

|

Complete and Final Digital Reports can be in Word, Excel or other formats. | |||||||||||||||

|

2. 48-hour advance notice of spudding, logging, coring, drill stem testing, completion or abandonment and advice of oil or gas shows to Suncor operations. | |||||||||||||||

|

3. Letter of authority giving: a) Access to rig floor at all times b) Access to view core and c) Access to Operator's sample. | |||||||||||||||

|

4. Copy of all forms and correspondence with government agencies re: incentives, royalty or tax exemptions, etc. | |||||||||||||||

|

Please acknowledge receipt of the above items and /or the sheet, by signing and returning the 2nd copy to: SUNCOR ENERGY INC., PO BOX 38, 22nd Floor, 112 - 4 AVE SW, CALGARY, AB T2P 2V5, ATTN: Kirsten Ytsma | |||||||||||||||

|

Received by:_________________________________ |

| ||||||||||||||

Schedule “E”

Attached to and made a part of a Farmout & Option Agreement dated March 7, 2006 between Suncor Energy Inc. Tasman Exploration Ltd., Eden Energy Corp., Ramshorn Canada Limited, Texola Energy Corp. and Solara Exploration Ltd.

***

Schedule “F” - Page 1 of 2

Attached to and made a part of a Farmout & Option Agreement

Dated March 7, 2006 between Suncor Energy Inc., Tasman Exploration Ltd., Eden Energy Corp., Ramshorn Canada Limited, Texola Energy Corp. and Solara Exploration Ltd.

Schedule “F” - Page 2 of 2

Attached to and made a part of a Farmout & Option Agreement

Dated March 7, 2006 between Suncor Energy Inc., Tasman Exploration Ltd., Eden Energy Corp., Ramshorn Canada Limited, Texola Energy Corp. and Solara Exploration Ltd.