UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the fiscal year ended

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission

File Number:

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization) | Identification Number) | |

| (Address of principal executive offices) | (Zip Code) |

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol(s) | Name of each exchange on which registered | ||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes

☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes

☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the issuer was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |

| ☒ | Smaller reporting company | |||

| (Do not check if a smaller reporting company) |

Emerging

growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes

☐

The

aggregate market value of voting and non-voting common stock held by non-affiliates of the registrant as of December 31, 2021 (the last

business day of the registrant’s most recently completed second fiscal quarter) was approximately $

As of September 12, 2022, there were shares of registrant’s common stock outstanding.

Documents

incorporated by reference:

FLUX POWER HOLDINGS, INC.

FORM 10-K ANNUAL REPORT

For the Fiscal Year Ended June 30, 2022

Table of Contents

| 2 |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements. The forward-looking statements are contained principally in the sections entitled “Description of Business,” “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” These statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements. These risks and uncertainties include, but are not limited to, the factors described in the section captioned “Risk Factors” below. In some cases, you can identify forward-looking statements by terms such as “anticipates,” “believes,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “would,” and similar expressions intended to identify forward-looking statements. Forward-looking statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. You should read these factors and the other cautionary statements made in this report and in the documents we incorporate by reference into this report as being applicable to all related forward-looking statements wherever they appear in this report or the documents we incorporate by reference into this report. If one or more of these factors materialize, or if any underlying assumptions prove incorrect, our actual results, performance or achievements may vary materially from any future results, performance or achievements expressed or implied by these forward-looking statements.

Given these uncertainties, you should not place undue reliance on these forward-looking statements. These forward-looking statements include, among other things, statements relating to:

| ● | our ability to secure sufficient funding to support our current and proposed operations, which could be more difficult in light of the negative impact of the COVID-19 pandemic on our operations, customer demand and supply chain as well as investor sentiment regarding our industry and our stock; | |

| ● | our ability to manage our working capital requirements efficiently; | |

| ● | our ability to obtain the necessary funds from our credit facilities; | |

| ● | our ability to obtain raw materials and other supplies for our products at existing or competitive prices and on a timely basis, particularly in light of the impact of COVID-19 pandemic on our suppliers and supply chain; | |

| ● | our anticipated growth strategies and our ability to manage the expansion of our business operations effectively; | |

| ● | our ability to maintain or increase our market share in the competitive markets in which we do business; | |

| ● | our ability to grow our revenue, increase our gross profit margin and become a profitable business; | |

| ● | our ability to fulfill our backlog of open sales orders due to delays in the receipt of key component parts and other potential manufacturing disruptions posed by the ongoing COVID-19 pandemic and supply chain disruption; | |

| ● | our ability to keep up with rapidly changing technologies and evolving industry standards, including our ability to achieve technological advances; | |

| ● | our dependence on the growth in demand for our products; | |

| ● | our ability to compete with larger companies with far greater resources than us; | |

| ● | our ability to shift to new suppliers and incorporate new components into our products in a manner that is not disruptive to our business; | |

| ● | our ability to obtain and maintain UL Listings and OEM approvals for our energy storage solutions; |

| 3 |

| ● | our ability to diversify our product offerings and capture new market opportunities; | |

| ● | our ability to source our needs for skilled labor, machinery, parts, and raw materials economically; | |

| ● | our ability to retain key members of our senior management; | |

| ● | our ability to continue to operate safely and effectively during the COVID-19 pandemic; and | |

| ● | our dependence on our major customers. |

Also, forward-looking statements represent our estimates and assumptions only as of the date of this report. You should read this report and the documents that we reference, and file as exhibits to this report completely and with the understanding that our actual future results may be materially different from what we expect. Except as required by law, we assume no obligation to update any forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in any forward-looking statements, even if new information becomes available in the future.

Use of Certain Defined Terms

Except where the context otherwise requires and for the purposes of this report only:

| ● | the “Company,” “Flux,” “we,” “us,” and “our” refer to the combined business of Flux Power Holdings, Inc., a Nevada corporation and its wholly owned subsidiary, Flux Power, Inc., a California corporation (“Flux Power”); | |

| ● | “Exchange Act” refers the Securities Exchange Act of 1934, as amended; | |

| ● | “SEC” refers to the Securities and Exchange Commission; and | |

| ● | “Securities Act” refers to the Securities Act of 1933, as amended. |

| 4 |

PART I

ITEM 1 – BUSINESS

Overview

We design, develop, manufacture, and sell a portfolio of advanced lithium-ion energy storage solutions for electrification of a range of industrial commercial sectors which include material handling, airport ground support equipment (“GSE”), and other commercial and industrial applications. We believe our mobile and stationary energy storage solutions provide our customers a reliable, high performing, cost effective, and more environmentally friendly alternative as compared to traditional lead acid and propane-based solutions. Our modular and scalable design allows different configurations of lithium-ion battery packs to be paired with our proprietary wireless battery management system to provide the level of energy storage required and “state of the art” real time monitoring of pack performance. We believe that the increasing demand for lithium-ion battery packs and more environmentally friendly energy storage solutions in the material handling sector should continue to drive our revenue growth.

Our Strategy

Our long-term strategy is to meet the rapidly growing demand for lithium-ion energy solutions and to be the supplier of choice, targeting large companies having demanding energy storage needs. We have established selling relationships equipment OEMs and customers with large fleets of forklifts and GSEs. We intend to reach this goal by investing in research and development to expand our product mix, by expanding our sales and marketing efforts, improving our customer support efforts and continuing our efforts to increase production capacity and efficiencies. Our research and development efforts will continue to focus on providing adaptable, reliable and cost-effective energy storage solutions for our customers.

Our largest sector of penetration thus far has been the material handling sector which we believe is a multi-billion dollar addressable market. We believe the sector will provide us with an opportunity to grow our business as we enhance our product mix and service levels and grow our sales to large fleets of forklifts and GSEs. Applications of our modular packs for other industrial and commercial uses, such as solar energy storage, are providing additional current growth and further opportunities. We intend to continue to expand our supply chain and customer partnerships and seek further partnerships and/or acquisitions that provide synergy to meeting our growth and “building scale” objectives.

Supply Chain Issues and Higher Procurement Costs

Due to COVID-19 pandemic, supply chain disruptions continue, notably with delivery delays at the ports of Los Angeles and Long Beach. In addition, the price of steel and certain other electrical components used in our products have seen dramatic increases, along with increased shipping costs. It is impossible to predict how long the current disruptions to the cost and availability of raw materials and component parts will last. We implemented price increases on certain new product orders in October 2021 and April 2022 to offset rising global costs of raw materials and component parts. In addition, we increased our inventory of raw materials and component parts to $16.3 million as of June 30, 2022 to mitigate supply chain disruptions and support timely deliveries. However, there can be no assurance that our price increases, inventory levels or any future steps we take will be sufficient to offset the rising procurement costs and manage sourcing of raw materials and component parts effectively.

To address some of these negative consequences and to support the future growth of our business, we have implemented a number of new strategic initiatives:

Strategic Initiatives.

To support our high growth business and strategy, our first priority over the coming quarters is achieving “profitability,” specifically, cash flow breakeven. Accordingly, we have strategic initiatives underway in two areas:

| ○ | Gross margin improvements |

| ● | Utilize lower cost, more reliable, and secondary suppliers of key components including cells, steel, electronics, circuit boards and other key components. | |

| ● | Actively manage our suppliers to avoid supply chain disruptions and related risks. | |

| ● | Introduce new designs, including a simplified “platform” that reduces part count, lowers cost, improves manufacturability and serviceability. | |

| ● | Focus on ensuring profitability of all product lines including managing mix of products. | |

| ● | Seek more competitive carriers to reduce shipping costs. | |

| ● | Implement Lean Manufacturing process to enhance capacity utilization, efficiency, quality. | |

| ● | Introduce comprehensive “cost of quality” initiative to ensure effective and robust processes. | |

| ● | Implement “automated cell module assembly” to assemble purchased “individual” battery cells into a “module” for the battery pack. This will enable lower inventory from simplified SKU count and lower costs. |

| 5 |

| ○ | Business expansion to accelerate gross margin |

| ● | Leverage current high-profile “proven customer relationships” to respond to growing demand of large fleets for lithium-ion value proposition. | |

| ● | Pursue new market that can leverage our technology and manufacturing capabilities. | |

| ● | Expand features of our popular “SkyBMS” (telemetry) which provides customized fleet management, and real time reports. | |

| ● | Expand our manufacturing and service capacities to ensure customer satisfaction from increased deliveries, and service. | |

| ● | Capitalize on our leadership position with new offerings. | |

| ● | While we are “agnostic to the type of lithium chemistry,” ensure our research to support other chemistries as they may become available. Ensure we have leadership with our core technology, without dependence on purchasing critical technology. |

There can be no assurance that these initiatives and efforts will be successful.

DESCRIPTION OF OUR BUSINESS

Our Business

We have leveraged our experience in lithium-ion technology to design and develop a portfolio of industrial and commercial energy storage packs that we believe provide attractive solutions to customers seeking an alternative to lead acid and propane-based power products. We believe that the following attributes are significant contributors to our success:

Engineering and integration experience in lithium-ion for motive applications: Our engineers design, develop, test, and service our advanced lithium-ion energy storage solutions. We have been developing lithium-ion applications for the advanced energy storage market since 2010, starting with products for automotive electric vehicle manufacturers. We believe our engineering experience enables us to develop competitive solutions that meet our customers’ needs currently and in the foreseeable future.

UL Listing: We launched our Class 3 Walkie Pallet Pack product line in 2014 and obtained UL Listing for all three different power configurations. We have also obtained UL Listing for our Class 1 Packs, our Class 2 Packs, and our Class 3 End Rider. In addition, we have completed the process for obtaining UL Listings for our newest source of battery cells. We believe this UL Listing provides us a significant competitive advantage and provides assurance to customers that our technology has been rigorously tested by an independent third party and determined to be safe, durable and reliable.

Original equipment manufacturer (OEM) approvals: Many of our energy storage packs have been tested and approved for use by Toyota Material Handling USA, Inc., Crown Equipment Corporation, and The Raymond Corporation, among the top global lift truck manufacturers by revenue according to Material Handling & Logistics. We also provide a “private label” Class 3 Walkie Pallet Pack to a major forklift OEM.

Broad product offering and scalable design: We offer energy storage packs for use in a variety of industrial motive applications. We believe that our modular and scalable design enables us to optimize design, inventory, and part count to accommodate natural product extensions of our products to meet customer requirements. We have leveraged our Class 3 Walkie Pallet Pack design to develop larger energy storage packs for larger forklifts, GSE Packs, and other industrial equipment applications. Natural product extensions, based on our modular, scalable designs, include solar backup power for electric vehicle (“EV”) mobile charging stations and robotic warehouse equipment.

Significant advantages over lead acid and propane-based solutions: We believe that lithium-ion battery systems have significant advantages over existing technologies and will displace lead acid batteries and propane-based solutions, in most applications. Relative to lead acid batteries, such advantages include environmental benefits, no water maintenance, faster charge times, greater cycle life, longer run times, and less energy used that provide operational and financial benefits to customers. When compared to lead acid solutions, our energy storage solutions do not discharge carbon dioxide in the atmosphere due to lithium chemistry efficiencies. In addition, when compared to propane-based solutions, lithium-ion systems avoid the generation of exhaust emissions and associated odor and environmental contaminates, and maintenance of an internal combustion engine, which has substantially more parts subject to wear than an electric motor.

| 6 |

Proprietary Battery Management System: Critical to our success is our innovative and proprietary versatile BMS that optimizes the performance of our lithium-ion energy solutions and provides a platform for adding new battery pack features, including customized telemetry (pack data and reports available anytime, anywhere) for customers. The BMS serves as the brain of the battery pack, managing cell balancing, charging, discharging, monitoring and communication between the pack and the forklift. Our “next generation” versatile BMS is currently part of our full product lines and provides significant product features for improved customer productivity. Our BMS also enables ongoing feature development for reduced cost and higher performance. We have included our proprietary telemetry solution, branded “SkyBMS” which provides real time reports on pack performance, health, and remaining useful life.

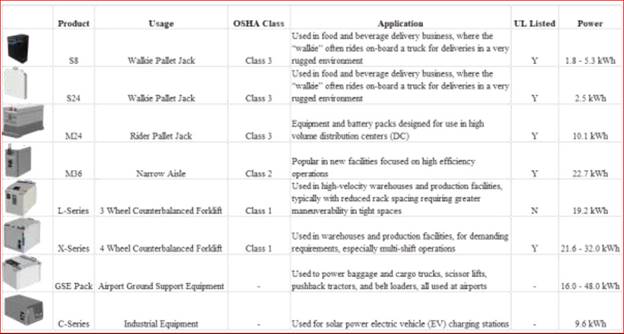

Our Products

We design, develop, test and sell our energy storage packs for use in a broad range of lift trucks, industrial equipment including airport GSE, energy storage for solar applications, and other commercial applications. Within each of these product segments, we offer a range of power and equipment solutions. Our current product offering is summarized in the chart below.

Our battery pack system design is adaptable with three core design modules used in our entire family of small, medium, and large pack forklift products. A scalable modular design allows for core modules to be configured to address a variety of unique power and space requirements. We also have the capability to offer varying chemistries and configurations based on the specific application. Currently, our energy storage packs use lithium iron phosphate (LiFePO4) battery cells, which we source from a variety of overseas suppliers that meet our power, reliability, safety and other specifications. Our BMS works with a number of battery configurations providing the flexibility to use battery cells developed and manufactured by other suppliers. We believe we can readily adapt our energy storage packs to incorporate new chemistries as they become available in the future in order to meet changing customer preferences and to reduce the cost of our products.

| 7 |

We also offer 24-volt onboard chargers for our Class 3 Walkie Pallet Packs, and smart “wall mounted” chargers for larger applications. Our smart charging solutions are designed to interface with our BMS and integrate easily into most all major chargers in the market.

New Product Update

During the second half of the Fiscal 2022, we introduced new product designs to respond to customer requests and to allow for greater operational efficiencies for us. Some of the improvements included higher capacities for extra-long and demanding shifts, easier servicing, cost efficiencies, and other features to solve a variety of existing performance challenges of customer operations. We intend to continue to develop and to introduce new product designs for margin enhancement, part commonality and improved serviceability.

In March 2022, we introduced three (3) new products:

| Product | Description | ||||||

| ● | L36 lithium-ion battery pack, a 36-volt option for 3-wheel forklifts; | ● | The L36 addresses the 3-wheel forklift market. According to our OEM partners the 3-wheel forklift offerings are some of their best selling products. We are now strategically placed to fully address this market. | ||||

| ● | C48 lithium-ion battery pack for Automated Guided Vehicles (AGV) and Autonomous Mobile Robots (AMR); and | ● | The improved robustness and environmental protections mean it is no longer just a solar battery, but is now being sold into tugs and other types of industrial equipment, expanding our product offerings. | ||||

| ● | S24 lithium-ion battery pack providing twice the capacity (210Ah) for Walkie Pallet Jacks for heavy duty | ● | The S24-210Ah is a new high-capacity variant of our ‘slim’ walkie battery and addresses some of the toughest walkie applications in the market, giving exceptional runtime and fast recharge times when paired with an external high-powered charger. |

Industry Overview

Historically, lithium-ion battery solutions were unable to compete with lead acid and propane-based solutions in industrial applications on the basis of cost. However, the supply of lithium-ion batteries has rapidly expanded, leading to price declines of eighty-five percent (85%) since 2010 according to BloombergNEF. BloombergNEF also estimates that lithium-ion battery prices, which averaged $1,160 per kilowatt hour in 2010, were $156 per kWh in 2019 and could drop below $100 per kWh in 2024. Lithium metal itself represents well less than 5% cost of our packs.

The sharp decline in the price of lithium-ion batteries has made these energy solutions more cost competitive. Affordability has in turn enabled customers to shift away from lead acid and propane-based solutions for power lift equipment to lithium-ion based solutions with more favorable environmental and performance characteristics. We believe our position as a pioneer in the field and our extensive experience providing lithium-ion based energy storage solutions will enable us to take advantage of this shift in customer preferences.

Lift Equipment - Material Handling Equipment

We focus on energy storage solutions for industrial equipment and related industrial applications because we believe they represent large and growing markets that are just beginning to adopt lithium-ion based technology. We apply our scalable, modular designs to natural product extensions in the industrial equipment market. These markets include not only the sale of lithium-ion battery solutions for new equipment but also a replacement market for existing lead acid battery packs.

According to Modern Materials Handling, worldwide new lift truck orders reached approximately 1.4 million units in 2017. The Industrial Truck Association (“ITA”) has estimated that approximately 200,000 lift trucks had been sold yearly since 2013 in North America (Canada, the United States and Mexico), with sales relatively evenly distributed between electric rider (Class 1 and Class 2), motorized hand (Class 3), and internal combustion engine powered lift trucks (Class 4 and Class 5). The ITA estimates that electric products represented approximately sixty-nine percent (69%) of the North American shipments in 2020, reflecting the long-term trend of increasing mix of electric products versus internal combustion (propane) engines. Driven by growth in global manufacturing, e-commerce and construction, Research and Markets expects that the global lift truck market will grow at a compound annual growth rate of six and four-tenths percent (6.4%) through 2024.

| 8 |

Customers

Our customers include OEMs, lift equipment dealers, battery distributors and end users. Our customers vary from small companies to Fortune 500 companies.

During the year ended June 30, 2022, we had four (4) major customers that each represented more than 10% of our revenues on an individual basis, and together represented approximately $29,254,000 or 69% of our total revenues. During the year ended June 30, 2021, we had three (3) major customers that each represented more than 10% of our revenues on an individual basis, and together represented approximately $16,004,000 or 61% of our total revenues.

Shift Toward Lithium-ion Battery Technologies

The lithium-ion battery value proposition of higher performance, environmental benefit, and lower life cycle cost is driving an increase in demand for safe and efficient alternatives to lead acid and propane-based power products. The lithium-ion value proposition includes a number of factors impacting customer preferences:

Duration of Charge/Run Times: Lithium-based energy storage systems can perform for a longer duration compared to lead acid batteries. Lithium-ion batteries provide up to 50% longer run times than lead acid batteries of comparable capacity, or amps-per-hour rating, allowing equipment to be operated over a long period of time between charges.

High/Sustained Power: Lithium-ion batteries are better suited to deliver high power versus legacy lead acid. For example, a 100Ah lead acid battery will only deliver 80Ah if discharged over a four-hour period. In contrast, a 100Ah lithium-ion system will achieve over 92Ah even during a 30-minute discharge. Additionally, during discharge, the energy storage pack sustains its initial voltage, maximizing the performance of the forklift truck, whereas, lead acid voltages, and hence power, decline over the working shift.

Charging Time: Lead acid batteries are limited to one shift a day, as they discharge for eight hours, need eight hours for charging, and another eight hours for cooling. For multi-shift operations, this typically requires battery changeout for the equipment. Because lithium batteries can be recharged in as little as one hour and do not degrade when subjected to opportunity charging, hence, battery changeout is unnecessary.

Safe Operation: The toxic nature of lead acid batteries presents significant safety and environmental issues in the event of a cell breach. During charging, lead acid batteries emit combustible gases and increase in temperature. Lithium-ion (particularly LFP) batteries do not get as hot and avoid many of the safety and environmental issues associated with lead acid batteries.

Extended Life: The performance of lead acid batteries degrades after approximately 500 charging cycles in industrial equipment applications. In comparison, lithium-ion batteries last up to five times longer in the same application.

Size and Weight: Lithium is about one-third the weight of lead acid for comparable power ratings. Lower weight enables forklift OEMs the ability to optimize the design of the truck based on a smaller footprint for lithium-ion instead of lead acid.

Lower Cost: Lithium-ion batteries provide power dense solutions with extended cycle life, reduced maintenance and improved operational performance, resulting in lower total cost of ownership.

Less Energy Used: we believe our lithium-ion batteries use 20-50% less energy based on our internal studies comparing lithium-ion to lead acid.

| 9 |

Marketing and Sales

We sell our products through a number of different channels including OEMs, lift equipment dealers and battery distributors as well as directly to end users. In the industrial motive market, OEMs sell their lift products through dealer networks and directly to end customers. Because of environmental issues associated with lead acid batteries and to preserve customer choice, industrial lift products are typically sold without a battery pack. Equipment dealers source battery packs from battery distributors and battery pack suppliers based on demand or in response to customer specifications. End customers may specify a specific type and manufacturer of battery pack to the equipment dealer or may purchase battery packs from battery distributors or directly from battery suppliers.

Our direct sales staff is assigned to major geographies throughout North America to collaborate with our sales partners who have an established customer base. We plan to hire additional sales staff to support our expected sales growth. In addition, we have developed a nation-wide sales network of relationships with equipment OEMs, their dealers, and battery distributors. To support our products, we have a nation-wide network of service providers, typically forklift equipment dealers and battery distributors, who provide local customer service to large customers. We also maintain a customer support center and provide Tech Bulletins and training to our service and sales network out of our corporate headquarters. We have partnered with an experienced GSE distributor, to market our lithium-ion battery packs for airport GSE

Manufacturing and Assembly

Rather than manufacture our own battery cells and be limited to a single chemistry, our battery cells are sourced from a limited number of manufacturers located in China. We source the remainder of the components primarily from vendors in the United States. We developed our BMS to be agnostic to a battery’s lithium-ion chemistry and cell manufacturer. Despite such flexibility, we have experienced occasional supply interruptions in the past, and more recently, we have been forced to navigate supply chain and transportation issues stemming from the global pandemic. We are continuing to monitor and test potential new cell technologies on an ongoing basis to help mitigate our supply chain risks. Final assembly, testing and shipping of our products is done from our ISO 9001 certified facility in Vista, California, which includes three assembly lines.

We buy chargers from several sources, including a U.S. based supplier. Additionally, we are a qualified dealer for a well-known manufacturer of “high capacity, modular, smart chargers” which support our larger packs.

Research and Development

Our engineers design, develop, test, and service our advanced lithium-ion energy storage solutions at our company headquarters in Vista, California. We believe our strengths include our core competencies and capabilities in designing and developing proprietary technology for our BMS, lean manufacturing processes, systems engineering, engineering application, and software engineering for both battery packs and telemetry. We believe that our ability to develop new features and technology for our BMS is essential to our growth strategy.

As we continue to develop and expand our product offerings, we anticipate that research and development will continue to be a substantial part of our strategic priorities in the future. We seek to develop innovative new and improved products for cell and system management along with associated communication, display, current sensing and charging tools. Our research and development efforts are focused on improving performance, reliability and durability of our energy storage solutions for our customers and on lowering our costs of production.

Competition

Our competitors in the lift equipment market are primarily major lead acid battery manufacturers, including Stryten Energy, East Penn Manufacturing Company, EnerSys Corporation, and Crown Battery Corporation. Although these competitors have been introducing offerings of a lithium-ion battery, we do not believe that these suppliers offer lithium-based products for lift equipment in any significant volume to end users, equipment dealers, OEMs or battery distributors. Several OEMs offer lithium-ion battery packs on Class 3 forklifts for sale only with their own new forklifts. Some OEMs also offer forklift models designed with an integrated lithium-ion battery. As the demand for lithium-ion battery packs has increased, small lithium battery pack providers have entered the market, most of whom we believe are suppliers of other power products and have simply added a lithium product to their product lines.

| 10 |

The key competitive factors in this market are performance, reliability, durability, safety and price. We believe we compete effectively in all of these categories in light of our experience with lithium-ion technology, including our development capabilities and the performance of our proprietary BMS. We believe that the UL Listing covering many of our core products is a significant differentiating competitive advantage and we intend to extend that advantage by seeking to obtain UL Listings for our other energy storage pack products in the coming months. In addition, because our BMS is not reliant on any specific battery cell chemistry, we believe we can adapt rapidly to changes in advanced battery technology or customer preferences.

Intellectual Property

Our success depends, at least in part, on our ability to protect our core technology and intellectual property. To accomplish this, we rely on a combination of patents pending, patent applications, trade secrets, including know-how, employee and third-party nondisclosure agreements, copyright laws, trademarks, intellectual property licenses and other contractual rights to establish and protect our proprietary rights in our technology. In addition to such factors as innovation, technological expertise and experienced personnel, we believe that a strong patent position is important to remain competitive.

As of June 30, 2022, we have two issued patents and three trademark registrations protecting the Flux Power name and logo. We have filed three new patents on advanced technology related to lithium-ion battery packs. The technology behind these pending patents are designed to:

| ● | increase battery life by optimizing the charging cycle, | |

| ● | give users a better understanding of the health of their battery in use, and | |

| ● | apply artificial intelligence to predictively balance the cells for optimal performance. |

We do not know whether any of our efforts will result in the issuance of patents or whether the examination process will require us to narrow our claims. Even if granted, there can be no assurance that these pending patent applications will provide us with protection.

Suppliers

We obtain a limited number of components and supplies included in our products from a small group of suppliers. During the year ended June 30, 2022, we had one (1) supplier who accounted for more than 10% of our total purchases, which represented approximately $13,884,000 or 28% of our total purchases.

During the year ended June 30, 2021, we had two (2) suppliers who accounted for more than 10% of our total purchases, on an individual basis, and together represented approximately $9,260,000 or 27% of our total purchases.

Government Regulations

Product Safety Regulations. Our products are subject to product safety regulations by Federal, state, and local organizations. Accordingly, we may be required, or may voluntarily determine to obtain approval of our products from one or more of the organizations engaged in regulating product safety. These approvals could require significant time and resources from our technical staff and, if redesign were necessary, could result in a delay in the introduction of our products in various markets and applications.

Environmental Regulations. Federal, state, and local regulations impose significant environmental requirements on the manufacture, storage, transportation, and disposal of various components of advanced energy storage systems. Although we believe that our operations are in material compliance with current applicable environmental regulations, there can be no assurance that changes in such laws and regulations will not impose costly compliance requirements on us or otherwise subject us to future liabilities.

| 11 |

Moreover, Federal, state, and local governments may enact additional regulations relating to the manufacture, storage, transportation, and disposal of components of advanced energy storage systems. Compliance with such additional regulations could require us to devote significant time and resources and could adversely affect demand for our products. There can be no assurance that additional or modified regulations relating to the manufacture, storage, transportation, and disposal of components of advanced energy systems will not be imposed.

Occupational Safety and Health Regulations. The California Division of Occupational Safety and Health (Cal/OSHA) and other regulatory agencies have jurisdiction over the operations of our Vista, California facility. Because of the risks generally associated with the assembly of advanced energy storage systems we expect rigorous enforcement of applicable health and safety regulations. Frequent audits by, or changes, in the regulations issued by Cal/OSHA, or other regulatory agencies with jurisdiction over our operations, may cause unforeseen delays and require significant time and resources from our technical staff.

Human Capital Resources

As of June 30, 2022, we had 121 employees. We engage outside consultants for business development, operations and other functions from time to time. None of our employees is currently represented by a trade union.

Corporate Office

Our corporate headquarters and production facility totals approximately 63,200 square feet and is located in Vista, California. Our production facility is ISO 9001 certified. The telephone number at our principal executive office is (760)-741-FLUX or (760)-741-3589.

Other Information

Our Internet address is www.fluxpower.com. We make available on our website our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after we electronically file such material with, or furnish it to, the Securities and Exchange Commission (“SEC”). Other than the information expressly set forth in this annual report, the information contained, or referred to, on our website is not part of this annual report.

The SEC also maintains a website at www.sec.gov that contains reports, proxy and information statements, and other information regarding issuers, such as us, that file electronically with the SEC.

| 12 |

ITEM 1A - RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully consider the summary of risk factors described below, together with all of the other information included in this report, before making an investment decision. If any of the following risks actually occur, our business, financial condition or results of operations could suffer. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment. You also should read the section entitled “Special Note Regarding Forward Looking Statements” above for a discussion of what types of statements are forward-looking statements, as well as the significance of such statements in the context of this report. The risk factors below do not address all the risks relating to securities, business and operations, and financial condition.

Risk Factors Relating to Our Business

We have a history of losses and negative working capital.

For the fiscal years ended June 30, 2022 and 2021, we had net losses of $15,609,000 and $12,793,000, respectively. We have historically experienced net losses and until we generate sufficient revenue, we anticipate to continue to experience losses in the near future.

As of June 30, 2022 and 2021, we had a cash balance of $485,000 and $4,713,000, respectively. We expect that our existing cash balances, credit facilities, and cash resources from operations will be sufficient to fund our existing and planned operations for the next twelve months. Until such time as we generate sufficient cash to fund our operations, we will need additional capital to continue our operations thereafter.

We have relied on equity financings, borrowings under short-term loans with related parties, our credit facilities and/or cash resources from operating activities to fund our operations. However, there is no guarantee that we will be able to obtain additional funds in the future or that funds will be available on terms acceptable to us, if at all. Any future financing may result in dilution of the ownership interests of our stockholders. If such funds are not available on acceptable terms, we may be required to curtail our operations or take other actions to preserve our cash, which may have a material adverse effect on our future cash flows and results of operations.

We will need to raise additional capital or financing to continue to execute and expand our business.

While we expect that our existing cash and additional funding available under our SVB Line of Credit, combined with funds available to us under our subordinated line of credit and the potential net proceeds from our At-The-Market offering will be sufficient to meet our anticipated capital resources and to fund our planned operations for the next twelve months, such sources of funding are subject to certain restrictions and covenants and our ability to sell stock will be impacted by market conditions. If we are unable to meet the conditions provided in the loan documents, the funds will not be available to us. In addition, should there be any delays in the receipts of key component parts, due in part to supply change disruptions, our ability to fulfil the backlog of sales orders will be negatively impacted resulting in lower availability of cash resources from operations. In that event, we may be required to raise additional capital to support our expanded operations and execute on our business plan by issuing equity or convertible debt securities. In the event we are required to obtain additional funds, there is no guarantee that additional funds will be available on a timely basis or on acceptable terms. To the extent that we raise additional funds by issuing equity or convertible debt securities, our stockholders may experience additional dilution and such financing may involve restrictive covenants. Newly issued securities may include preferences, superior voting rights, and the issuance of warrants or other convertible securities that will have additional dilutive effects. We cannot assure that additional funds will be available when needed from any source or, if available, will be available on terms that are acceptable to us. Further, we may incur substantial costs in pursuing future capital and/or financing. We may also be required to recognize non-cash expenses in connection with certain securities we may issue, such as convertible notes and warrants, which will adversely impact our financial condition and results of operations. Our ability to obtain needed financing may be impaired by such factors as the weakness of capital markets, and the fact that we have not been profitable, which could impact the availability and cost of future financings. If such funds are not available when required, management will be required to curtail investments in additional sales and marketing and product development, which may have a material adverse effect on future cash flows and results of operations.

| 13 |

Backlog may not be indicative of future operating results.

Future revenue for the Company can be influenced by order backlog. Backlog represents the dollar amount of revenues we expect to recognize in the future from contracts awarded and in progress. Backlog substantially represents new orders. Backlog is not a measure defined by generally accepted accounting principles and is not a measure of contract profitability. Our methodology for determining backlog may not be comparable to methodologies used by other companies in determining their backlog amounts. The backlog values we disclose include anticipated revenues associated with: (1) the original contract amounts; (2) change orders for which we have received written confirmations from the applicable customers; (3) change orders for which we expect to receive confirmations in the ordinary course of business; and (4) claims that we have made against customers. In addition, the timing of order placement, size, and customer delivery dates can create unusual fluctuations in backlog.

We include unapproved change orders for which we expect to receive confirmations in the ordinary course of business in backlog, generally to the extent of the lesser of the amounts management expects to recover or the associated costs incurred. Any revenue that would represent profit associated with unapproved change orders is generally excluded from backlog until written confirmation is obtained from the applicable customer. However, consideration is given to our history with the customer as well as the contractual basis under which we may be operating. Accordingly, in certain cases based on our historical experience in resolving unapproved change orders with a customer, the associated profit may be included in backlog. However, if an unapproved change order is under dispute or has been previously rejected by the customer, the associated amount of revenue is treated as a claim.

For amounts included in backlog that are attributable to claims, we include unapproved claims in backlog when we have a legal basis to do so, consider collection to be probable and believe we can reliably estimate the ultimate value. Claims revenue is included in backlog to the extent of the lesser of the amounts management expects to recover or associated costs incurred.

Backlog may not be indicative of future operating results, and projects in our backlog may be cancelled, modified or otherwise altered by customers. Our ability to realize revenue from the current backlog is dependent on among other things, the delivery of key parts from our vendors in a timely manner. We can provide no assurance as to the profitability of our contracts reflected in backlog.

Economic conditions may adversely affect consumer spending and the overall general health of our customers, which, in turn, may adversely affect our financial condition, results of operations and cash resources.

Uncertainty about the current and future global economic conditions may cause our customers to defer purchases or cancel purchase orders for our products in response to tighter credit, decreased cash availability and weakened consumer confidence. Our financial success is sensitive to changes in general economic conditions, both globally and nationally. Recessionary economic cycles, higher interest borrowing rates, higher fuel and other energy costs, inflation, increases in commodity prices, higher levels of unemployment, higher consumer debt levels, higher tax rates and other changes in tax laws or other economic factors that may affect consumer spending or buying habits could continue to adversely affect the demand for our products. If credit pressures or other financial difficulties result in insolvency for our customers, it could adversely impact our financial results. There can be no assurances that government and consumer responses to the disruptions in the financial markets will restore consumer confidence.

We are dependent on a few customers for the majority of our net revenues, and our success depends on demand from OEMs and other users of our battery products.

Historically a majority of our product sales have been generated from a small number of OEMs and customers, including four (4) customers who, on an aggregate basis, made up 69% of our sales for the year ended June 30, 2022, and three (3) customers who, on an aggregate basis, made up 61% of our sales for the year ended June 30, 2021. As a result, our success depends on continued demand from this small group of customers and their willingness to incorporate our battery products in their equipment. The loss of a significant customer would have an adverse effect on our revenues. There is no assurance that we will be successful in our efforts to convince end users to accept our products. Our failure to gain acceptance of our products could have a material adverse effect on our financial condition and results of operations.

| 14 |

Additionally, OEMs, their dealers and battery distributors may be subject to changes in demand for their equipment which could significantly affect our business, financial condition and results of operations.

Our business is vulnerable to a near-term severe impact from the COVID-19 outbreak, and the continuation of the pandemic could have a material adverse impact on our operations and financial condition.

COVID-19 and another public health epidemic/pandemic could pose the risk that we or our employees, contractors, customers, suppliers, third party shipping carriers, government and other partners may be prevented from or limited in their ability to conduct business activities for an indefinite period of time, including due to the spread of the disease within these groups or due to shutdowns that may be requested or mandated by governmental authorities. While it is not possible at this time to estimate the impact that COVID-19 could have on our business, the continued spread of COVID-19 and the measures taken by the governments of states and countries affected could disrupt, among other things, the supply chain and the manufacture or shipment of our products. Our manufacturing operations may be subject to closure or shut down for a variety of reasons. While manufacturing operations were not materially impacted, future operations could be affected by the continued spread of COVID-19. Any substantial disruption in our manufacturing operations from COVID-19, or its related impacts, would have a material adverse effect on our business and would impede our ability to manufacture and ship products to our customers in a timely manner, or at all.

The effect of the COVID-19 pandemic and its associated restrictions may adversely impact many aspects of our business, including customer demand, the length of our sales cycles, disruptions in our supply chain, lower the operating efficiencies at our facility, worker shortages and declining staff morale, and other unforeseen disruptions. The demand for our products may significantly decline if the COVID-19 pandemic continues, restrictions are implemented or re-implemented, or the virus resurges and spreads and our customers suffer losses in their businesses. The supply of our raw materials and our supply chain may be disrupted and adversely impacted by the pandemic. The occurrence of any of the foregoing events and their adverse effect on capital markets and investor sentiment may adversely impact our ability to raise capital when needed or on terms favorable to us and our stockholders to fund our operations, which could have a material adverse effect on our business, financial condition and results of operations. The extent to which the COVID-19 outbreak impacts our results, its effect on near or long-term value of our share price are highly uncertain and cannot be predicted, including new information that may emerge concerning the severity of the virus and the actions to contain its impact.

We do not have long term contracts with our customers.

We do not have long-term contracts with our customers. Future agreements with respect to pricing, returns, promotions, among other things, are subject to periodic negotiation with each customer. No assurance can be given that our customers will continue to do business with us. The loss of any of our significant customers will have a material adverse effect on our business, results of operations, financial condition and liquidity. In addition, the uncertainty of product orders can make it difficult to forecast our sales and allocate our resources in a manner consistent with actual sales, and our expense levels are based in part on our expectations of future sales. If our expectations regarding future sales are inaccurate, we may be unable to reduce costs in a timely manner to adjust for sales shortfalls.

Real or perceived hazards associated with Lithium-ion battery technology may affect demand for our products.

Press reports have highlighted situations in which lithium-ion batteries in automobiles and consumer products have caught fire or exploded. In response, the use and transportation of lithium-ion batteries has been prohibited or restricted in certain circumstances. This publicity has resulted in a public perception that lithium-ion batteries are dangerous and unpredictable. Although we believe our battery packs are safe, these perceived hazards may result in customer reluctance to adopt our lithium-ion based technology.

| 15 |

Our products may experience quality problems from time to time that could result in negative publicity, litigation, product recalls and warranty claims, which could result in decreased revenues and harm to our brands.

A catastrophic failure of our battery modules could cause personal or property damages for which we would be potentially liable. Damage to or the failure of our battery packs to perform to customer specifications could result in unexpected warranty expenses or result in a product recall, which would be time consuming and expensive. Such circumstances could result in negative publicity or lawsuits filed against us related to the perceived quality of our products which could harm our brand and decrease demand for our products.

We may be subject to product liability claims.

If one of our products were to cause injury to someone or cause property damage, including as a result of product malfunctions, defects, or improper installation, then we could be exposed to product liability claims. We could incur significant costs and liabilities if we are sued and if damages are awarded against us. Further, any product liability claim we face could be expensive to defend and could divert management’s attention. The successful assertion of a product liability claim against us could result in potentially significant monetary damages, penalties or fines, subject us to adverse publicity, damage our reputation and competitive position, and adversely affect sales of our products. In addition, product liability claims, injuries, defects, or other problems experienced by other companies in the solar industry could lead to unfavorable market conditions for the industry as a whole, and may have an adverse effect on our ability to attract new customers, thus harming our growth and financial performance. Although we carry product liability insurance, it may be insufficient in amount to cover our claims.

Tariffs could be imposed on lithium-ion batteries or on any other component parts by the United States government or a resulting trade war could have a material adverse effect on our results of operations.

In 2018, the United States government announced tariffs on certain steel and aluminum products imported into the United States, which led to reciprocal tariffs being imposed by the European Union and other governments on products imported from the United States. The United States government has implemented tariffs on goods imported from China.

The lithium-ion battery industry has been subjected to tariffs implemented by the United States government on goods imported from China. There is an ongoing risk of new or additional tariffs being put in place on lithium-ion batteries or related part. Since all of our lithium-ion batteries are manufactured in China, current and potential tariffs on lithium-ion batteries imported by us from China could increase our costs, require us to increase prices to our customers or, if we are unable to do so, result in lower gross margins on the products sold by us. China has already imposed tariffs on a wide range of American products in retaliation for the American tariffs on steel and aluminum. Additional tariffs could be imposed by China in response to actual or threatened tariffs on products imported from China. The imposition of additional tariffs by the United States could trigger the adoption of tariffs by other countries as well. Any resulting escalation of trade tensions, including a “trade war,” could have a significant adverse effect on world trade and the world economy, as well as on our results of operations. At this time, we cannot predict how such enacted tariffs will impact our business. Tariffs on components imported by us from China could have a material adverse effect on our business and results of operations.

We are dependent on a limited number of suppliers for our battery cells, and the inability of these suppliers to continue to deliver, or their refusal to deliver, our battery cells at prices and volumes acceptable to us would have a material adverse effect on our business, prospects and operating results.

We do not manufacture the battery cells used in our energy storage packs. Our battery cells, which are an integral part of our battery products and systems, are sourced from a limited number of manufacturers located in China. While we obtain components for our products and systems from multiple sources whenever possible, we have spent a great deal of time in developing and testing our battery cells that we receive from our suppliers. We refer to the battery cell suppliers as our “limited source suppliers.” Additionally, our operations are materially dependent upon the continued market acceptance and quality of these manufacturers’ products and their ability to continue to manufacture products that are competitive and that comply with laws relating to environmental and efficiency standards. Our inability to obtain products from one or more of these suppliers or a decline in market acceptance of these suppliers’ products could have a material adverse effect on our business, results of operations and financial condition. From time to time we have experienced shortages, allocations and discontinuances of certain components and products, resulting in delays in filling orders. Qualifying new suppliers to compensate for such shortages may be time-consuming and costly. In addition, we may have to recertify our UL Listings for the battery cells from new suppliers, which in turn has led to delays in product acceptance. Similar delays may occur in the future. Furthermore, the performance of the components from our suppliers as incorporated in our products may not meet the quality requirements of our customers.

| 16 |

To date, we have no qualified alternative sources for our battery cells although we research and assess cells from other suppliers on an ongoing basis. We generally do not maintain long-term agreements with our limited source suppliers. While we believe that we will be able to establish additional supplier relationships for our battery cells, we may be unable to do so in the short term or at all at prices, quality or costs that are favorable to us.

Changes in business conditions, wars, regulatory requirements, economic conditions and cycles, governmental changes, pandemic, and other factors beyond our control could also affect our suppliers’ ability to deliver components to us on a timely basis or cause us to terminate our relationship with them and require us to find replacements, which we may have difficulty doing. Furthermore, if we experience significant increased demand, or need to replace our existing suppliers, there can be no assurance that additional supplies of component parts will be available when required on terms that are favorable to us, at all, or that any supplier would allocate sufficient supplies to us in order to meet our requirements or fill our orders in a timely manner. In the past, we have replaced certain suppliers because of their failure to provide components that met our quality control standards. The loss of any limited source supplier or the disruption in the supply of components from these suppliers could lead to delays in the deliveries of our battery products and systems to our customers, which could hurt our relationships with our customers and also materially adversely affect our business, prospects and operating results.

Increases in costs, disruption of supply or shortage of raw materials, in particular lithium-ion phosphate cells, could harm our business.

We may experience increases in the costs, or a sustained interruption in the supply or shortage, of raw materials. Any such cost increase or supply interruption could materially negatively impact our business, prospects, financial condition and operating results. For instance, we are exposed to multiple risks relating to price fluctuations for lithium-iron phosphate cells.

These risks include:

| ● | the inability or unwillingness of battery manufacturers to supply the number of lithium-iron phosphate cells required to support our sales as demand for such rechargeable battery cells increases; | |

| ● | disruption in the supply of cells due to quality issues or recalls by the battery cell manufacturers; and | |

| ● | an increase in the cost of raw materials, such as iron and phosphate, used in lithium-iron phosphate cells. |

Our success depends on our ability to develop new products and capabilities that respond to customer demand, industry trends or actions by our competitors and failure to do so may cause us to lose our competitiveness in the battery industry and may cause our profits to decline.

Our success will depend on our ability to develop new products and capabilities that respond to customer demand, industry trends or actions by our competitors. There is no assurance that we will be able to successfully develop new products and capabilities that adequately respond to these forces. In addition, changes in legislative, regulatory or industry requirements or in competitive technologies may render certain of our products obsolete or less attractive. If we are unable to offer products and capabilities that satisfy customer demand, respond adequately to changes in industry trends or legislative changes and maintain our competitive position in our markets, our financial condition and results of operations would be materially and adversely affected.

| 17 |

The research and development of new products and technologies is costly and time consuming, and there are no assurances that our research and development efforts will be either successful or completed within anticipated timeframes, if at all. Our failure to technologically evolve and/or develop new or enhanced products may cause us to lose competitiveness in the battery market. In addition, in order to compete effectively in the renewable battery industry, we must be able to launch new products to meet our customers’ demands in a timely manner. However, we cannot provide assurance that we will be able to install and certify any equipment needed to produce new products in a timely manner, or that the transitioning of our manufacturing facility and resources to full production under any new product programs will not impact production rates or other operational efficiency measures at our manufacturing facility. In addition, new product introductions and applications are risky, and may suffer from a lack of market acceptance, delays in related product development and failure of new products to operate properly. Any failure by us to successfully launch new products, or a failure by us to meet our customers criteria in order to accept such products, could adversely affect our results.

Our business will be adversely affected if we are unable to protect our intellectual property rights from unauthorized use or infringement by third parties.

Any failure to protect our intellectual proprietary rights could result in our competitors offering similar products, potentially resulting in the loss of some of our competitive advantage and a decrease in our revenue, which would adversely affect our business, prospects, financial condition and operating results. Our success depends, at least in part, on our ability to protect our core technology and intellectual property. To accomplish this, we rely on a combination of patents, patent applications, trade secrets, including know-how, employee and third-party nondisclosure agreements, copyright laws, trademarks, intellectual property licenses and other contractual rights to establish and protect our proprietary rights in our technology.

The protections provided by patent laws will be important to our future opportunities. However, such patents and agreements and various other measures we take to protect our intellectual property from use by others may not be effective for various reasons, including the following:

| ● | the patents we have been granted may be challenged, invalidated or circumvented because of the pre-existence of similar patented or unpatented intellectual property rights or for other reasons; | |

| ● | the costs associated with enforcing patents, confidentiality and invention agreements or other intellectual property rights may make aggressive enforcement impracticable; and | |

| ● | existing and future competitors may independently develop similar technology and/or duplicate our systems in a way that circumvents our patents. |

Our patent applications may not result in issued patents, which may have a material adverse effect on our ability to prevent others from commercially exploiting products similar to ours.

We cannot be certain that we are the first creator of inventions covered by pending patent applications or the first to file patent applications on these inventions, nor can we be certain that our pending patent applications will result in issued patents or that any of our issued patents will afford protection against a competitor. In addition, patent applications that we intend to file in foreign countries are subject to laws, rules and procedures that differ from those of the United States, and thus we cannot be certain that foreign patent applications related to issue United States patents will be issued. Furthermore, if these patent applications issue, some foreign countries provide significantly less effective patent enforcement than in the United States.

The status of patents involves complex legal and factual questions and the breadth of claims allowed is uncertain. As a result, we cannot be certain that the patent applications that we file will result in patents being issued, or that our patents and any patents that may be issued to us in the near future will afford protection against competitors with similar technology. In addition, patents issued to us may be infringed upon or designed around by others and others may obtain patents that we need to license or design around, either of which would increase costs and may adversely affect our business, prospects, financial condition and operating results.

| 18 |

We rely on trade secret protections through confidentiality agreements with our employees, customers and other parties; the breach of such agreements could adversely affect our business and results of operations.

We rely on trade secrets, which we seek to protect, in part, through confidentiality and non-disclosure agreements with our employees, customers and other parties. There can be no assurance that these agreements will not be breached, that we would have adequate remedies for any such breach or that our trade secrets will not otherwise become known to or independently developed by competitors. To the extent that consultants, key employees or other third parties apply technological information independently developed by them or by others to our proposed projects, disputes may arise as to the proprietary rights to such information that may not be resolved in our favor. We may be involved from time to time in litigation to determine the enforceability, scope and validity of our proprietary rights. Any such litigation could result in substantial cost and diversion of effort by our management and technical personnel.

Our business depends substantially on the continuing efforts of the members of our senior management team, and our business may be severely disrupted if we lose their services.

We believe that our success is largely dependent upon the continued service of the members of our senior management team, who are critical to establishing our corporate strategies and focus, overseeing the execution of our business strategy and ensuring our continued growth. Our continued success will depend on our ability to attract and retain a qualified and competent management team in order to manage our existing operations and support our expansion plans. Although we are not aware of any change, if any of the members of our senior management team are unable or unwilling to continue in their present positions, we may not be able to replace them readily. Therefore, our business may be severely disrupted, and we may incur additional expenses to recruit and retain their replacement. In addition, if any of the members of our senior management team joins a competitor or forms a competing company, we may lose some of our customers.

If we are forced to implement workforce reductions, our staff resources will be stretched making our ability to comply with legal and regulatory requirements as a Public Company difficult.

There can be no assurance that our management team will be able to implement and affect programs and policies in an effective and timely manner especially if subject to workforce reductions, that adequately respond to increased legal, regulatory compliance and reporting requirements imposed by such laws and regulations. Our failure to comply with such laws and regulations could lead to the imposition of fines and penalties and further result in the deterioration of our business.

Compliance with changing regulations concerning corporate governance and public disclosure may result in additional expenses.

There have been changing laws, regulations and standards relating to corporate governance and public disclosure, including the (Sarbanes-Oxley) Act of 2002, new regulations promulgated by the SEC and rules promulgated by the national securities exchanges. These new or changed laws, regulations and standards are subject to varying interpretations in many cases due to their lack of specificity, and, as a result, their application in practice may evolve over time as new guidance is provided by regulatory and governing bodies, which could result in continuing uncertainty regarding compliance matters and higher costs necessitated by ongoing revisions to disclosure and governance practices. As a result, our efforts to comply with evolving laws, regulations and standards are likely to continue to result in increased general and administrative expenses and a diversion of management time and attention from revenue-generating activities to compliance activities. Members of our Board of Directors and our chief executive officer and chief financial officer could face an increased risk of personal liability in connection with the performance of their duties. As a result, we may have difficulty attracting and retaining qualified directors and executive officers, which could harm our business. If the actions we take in our efforts to comply with new or changed laws, regulations and standards differ from the actions intended by regulatory or governing bodies, we could be subject to liability under applicable laws or our reputation may be harmed.

In addition, Sarbanes-Oxley specifically requires, among other things, that we maintain effective internal controls for financial reporting and disclosure of controls and procedures. In particular, we must perform system and process evaluation and testing of our internal controls over financial reporting to allow management to report on the effectiveness of our internal controls over financial reporting, as required by Section 404 of Sarbanes-Oxley. Our testing, or the subsequent testing by our independent registered public accounting firm, when required, may reveal deficiencies in our internal controls over financial reporting that are deemed to be material weaknesses. Our compliance with Section 404 will require that we incur substantial accounting expense and expend significant management efforts. We currently do not have an internal audit group, and we may need to hire additional accounting and financial staff with appropriate public company experience and technical accounting knowledge. Moreover, if we are not able to comply with the requirements of Section 404 in a timely manner, or if we or our independent registered public accounting firm identifies deficiencies in our internal controls over financial reporting that are deemed to be material weaknesses, the market price of our stock could decline, and we could be subject to sanctions or investigations by the SEC or other regulatory authorities, which would require additional financial and management resources.

| 19 |

We have identified material weaknesses in our internal control over financial reporting. If we are unable to remediate these material weaknesses, or if we identify additional material weaknesses in the future or otherwise fail to maintain an effective system of internal controls, we may not be able to accurately or timely report our financial condition or results of operations, which may adversely affect our business and stock price.

Based on management’s evaluation of our disclosure controls and procedures as of June 30, 2022, we identified material weaknesses in our internal controls over financial reporting. The material weaknesses were based on our ineffective oversight of our internal control over financial reporting and lack of sufficient review and approval of the underlying data used in the calculation of warranty reserve. We are taking remedial measures designed to improve our internal control over financial reporting to remediate material weaknesses, We are implementing additional control procedures to strengthen the oversight of the Company’s internal control over financial reporting through review and sign off by the senior management of all significant assumptions and estimates being used and the underlying the data used in producing financial schedules/estimates and financial reporting. We are also adding a second level of review and approval for all manual journal entries for significant estimates and assumptions made by management.

We are committed to remediating our material weakness. However, there can be no assurance as to when this material weakness will be remediated or that additional material weaknesses will not arise in the future. If we are unable to maintain effective internal control over financial reporting, our ability to record, process and report financial information timely and accurately could be adversely affected and could result in a material misstatement in our financial statements, which could subject us to litigation or investigations, require management resources, increase our expenses, negatively affect investor confidence in our financial statements and adversely impact the trading price of our common stock.

We may face significant costs relating to environmental regulations for the storage and shipment of our lithium-ion battery packs.

Federal, state, and local regulations impose significant environmental requirements on the manufacture, storage, transportation, and disposal of various components of advanced energy storage systems. Although we believe that our operations are in material compliance with applicable environmental regulations, there can be no assurance that changes in such laws and regulations will not impose costly compliance requirements on us or otherwise subject us to future liabilities. Moreover, Federal, state, and local governments may enact additional regulations relating to the manufacture, storage, transportation, and disposal of components of advanced energy storage systems. Compliance with such additional regulations could require us to devote significant time and resources and could adversely affect demand for our products. There can be no assurance that additional or modified regulations relating to the manufacture, storage, transportation, and disposal of components of advanced energy systems will not be imposed.

Natural disasters, public health crises, political crises and other catastrophic events or other events outside of our control may damage our sole facility or the facilities of third parties on which we depend, and could impact consumer spending.