UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

x ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: December 31, 2014

¨ TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT

OF 1934

Commission file number: 000-32585

SUNRISE REAL ESTATE GROUP, INC.

(Name of Small Business Issuer in its Charter)

| Texas | 6500 | 75-2713701 |

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

No. 638, Hengfeng Road 25th Floor, Building A

Shanghai, PRC 200070

(Address of Principal Executive Offices) (Zip Code)

Issuer's telephone number: + 86-21-6167-2800

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: Common Stock, $0.01 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act of 1934. Yes ¨ No þ

Check whether the issuer(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes £ No R

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.45 of this Chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes £ No R

Indicate by check mark if there is no disclosure of delinquent filers in response to Item 405 of Regulation S-K (§229.405 of this Chapter) is not contained in this form, and no disclosure will be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. R

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer ¨ | ||

| Non-accelerated filer ¨ (Do not check if a smaller reporting company) | Smaller reporting company þ | ||

| Emerging Growth Company ¨ |

Emerging growth company If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by checkmark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act): Yes ¨ No þ

The aggregate market value of the common stock held by non-affiliates 16,357,122 shares was approximately $490,714, based on the average opening and closing price of $0.03 for the Common Stock on June 30, 2014.

The number of shares outstanding of the issuer's Common Stock, $0.01 par value, as of June 1, 2017 was 68,691,925 shares.

TABLE OF CONTENTS

| 1 |

Corporate History

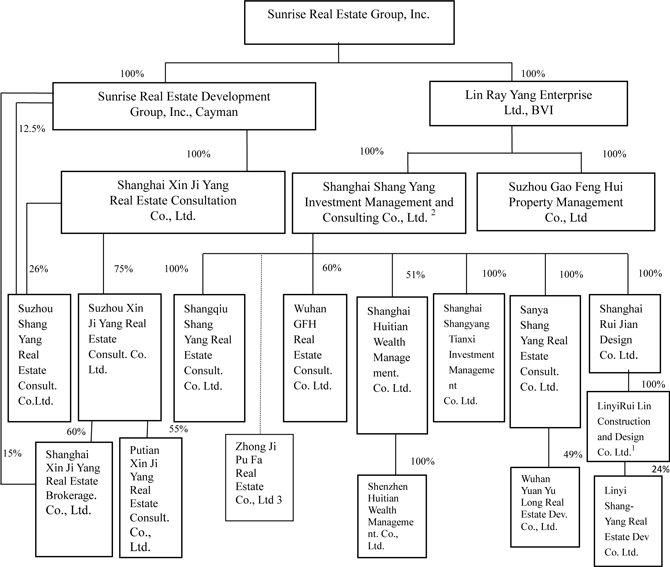

The principal activities of Sunrise Real Estate Group, Inc. (“SRRE”) and its subsidiaries (collectively referred to as the “Company”) are real estate development and property brokerage services, including real estate marketing services, property leasing services; and property management services in the People’s Republic of China (“PRC”). Our current ownership interests in our various subsidiaries and other entities is set forth in the below organizational chart.

Sunrise Real Estate Development Group, Inc. (“CY-SRRE”), a wholly-owned subsidiary of SRRE, was established in the Cayman Islands on April 30, 2004 as a limited liability company. CY-SRRE was wholly owned by Ace Develop Properties Limited (“Ace Develop”), a corporation, of which Lin Chi-Jung, an individual, is the principal and controlling shareholder. Shanghai Xin Ji Yang Real Estate Consultation Company Limited (“SHXJY”) was established in the PRC on August 20, 2001 as a limited liability company. SHXJY was originally owned by a Taiwanese company, of which the principal and controlling shareholder was Lin Chi-Jung. On June 8, 2004, all the fully paid up capital of SHXJY was transferred to CY-SRRE. On June 25, 2004, SHXJY and two individuals established a subsidiary, namely, Suzhou Xin Ji Yang Real Estate Consultation Company Limited (“SZXJY”) in the PRC, at which point in time, SHXJY held a 90% equity interest in SZXJY.

On August 9, 2005, SHXJY sold a 10% equity interest in SZXJY to a company owned by a director of SZXJY, and transferred a 5% equity interest in SZXJY to CY-SRRE. Following the disposal and the transfer, CY-SRRE effectively held an 80% equity interest in SZXJY. On November 24, 2006, CY-SRRE, SHXJY, a director of SZXJY and a third party established a subsidiary, namely, Suzhou Shang Yang Real Estate Consultation Company Limited (“SZSY”) in the PRC, with CY-SRRE holding a 12.5% equity interest, SHXJY holding a 26% equity interest and the director of SZXJY holding a 12.5% equity interest in SZSY. At the date of incorporation, SRRE and the director of SZXJY entered into a voting agreement that provided that SRRE is entitled to exercise the voting right in respect of his 12.5% equity interest in SZSY. As a result of the voting agreement, SRRE effectively holds has 51% of the voting power of SZSY. On September 24, 2007, CY-SRRE sold a 5% equity interest in SZXJY to a company owned by a director of SZXJY. Following the disposal, CY-SRRE effectively holds a 75% equity interest in SZXJY.

In October 2011, SHXJY purchased a 24% interest in Linyi Shang Yang Real Estate Consultation Company Limited (“LYSY”) and acquired approximately 103,385 square meters of land for the purpose of developing the land into villa-style residential housing. On March 6, 2012, SHXJY established a wholly-owned subsidiary, namely Linyi Rui Lin Construction and Design Company Limited (“LYRL”). SHXJY’s 24% equity interest in LYSY was then transferred to LYRL. In agreement with Zhang Shu Qin, who owns 51% of LYSY, we have the right to vote 51% interest and thus have 75% of the voting power of LYSY.

LIN RAY YANG Enterprise Ltd. (“LRY”), a wholly-owned subsidiary of SRRE, was established in the British Virgin Islands on November 13, 2003 as a limited liability company. LRY was owned by Ace Develop, Planet Technology Corporation (“Planet Tech”) and Systems & Technology Corporation (“Systems Tech”). On February 5, 2004, LRY established a wholly owned subsidiary, Shanghai Shang Yang Investment Management and Consulting Company Limited (“SHSY”) in the PRC as a limited liability company. On January 10, 2005, LRY and a PRC third party established a subsidiary, Suzhou Gao Feng Hui Property Management Company Limited (“SZGFH”), in the PRC, with LRY holding 80% of the equity interest in SZGFH. On May 8, 2006, LRY acquired 20% of the equity interest in SZGFH from the third party. Following the acquisition, LRY effectively holds 100% of the equity interest in SZGFH.

In 2011, we acquired a 49% ownership of Wuhan Yuan Yu Long Property Development Company Limited (“WHYYL”); the purpose of this project company was for a development project in Wuhan.

SRRE was initially incorporated in Texas on October 10, 1996, under the name of Parallax Entertainment, Inc. (“Parallax”). On December 12, 2003, Parallax changed its name to Sunrise Real Estate Development Group, Inc. On May 23, 2006, Sunrise Estate Development Group, Inc. changed its name to Sunrise Real Estate Group, Inc.

On August 31, 2004, SRRE, CY-SRRE and Lin Chi-Jung, an individual and agent for the beneficial shareholder of CY-SRRE, i.e., Ace Develop, entered into an exchange agreement under which SRRE issued 5,000,000 shares of common stock to the beneficial shareholder or its designees, in exchange for all outstanding capital stock of CY-SRRE. The transaction closed on October 5, 2004. Lin Chi-Jung is Chairman of the Board of Directors of SRRE, the President of CY-SRRE and the principal and controlling shareholder of Ace Develop.

| 2 |

Also on August 31, 2004, SRRE, LRY and Lin Chi-Jung, an individual and agent for beneficial shareholders of LRY, i.e., Ace Develop, Planet Tech and Systems Tech, entered into an exchange agreement under which SRRE issued 10 million shares of common stock to the beneficial shareholders, or their designees, in exchange for all outstanding capital stock of LRY. The transaction was closed on October 5, 2004. Lin Chi-Jung is Chairman of the Board of Directors of SRRE, the President of LRY and the principal and controlling shareholder of Ace Develop. Regarding the 10 million shares of common stock of SRRE issued in this transaction, SRRE issued 8.5 million shares to Ace Develop, 750,000 shares to Planet Tech and 750,000 shares to Systems Tech.

As a result of the acquisition, the former owners of CY-SRRE and LRY hold a majority interest in the combined entity. Generally accepted accounting principles require in certain circumstances that a company whose shareholders retain the majority voting interest in the combined business be treated as the acquirer for financial reporting purposes. Accordingly, the acquisition was accounted for as a “reverse acquisition” arrangement whereby CY-SRRE and LRY are deemed to have purchased SRRE. However, SRRE remained the legal entity and the Registrant for Securities and Exchange Commission reporting purposes.

General Business Description

SRRE has gone through a series of transactions leading to the completion of a reverse merger on October 5, 2004. Prior to the closing of the exchange agreements described in “Corporate History” above, SRRE was an inactive "shell" company. Following the closing, SRRE, through its two wholly owned subsidiaries, CY-SRRE and LRY, has engaged in the property brokerage services, real estate marketing services, property leasing services and property management services in the PRC.

The Company recognizes that in order to differentiate itself from the market, it should avoid direct competition with large-scale property developers who have their own marketing departments. Our objective is to develop a niche position with marketing alliances with medium size and smaller developers, and become their outsourcing marketing and sales agents. This strategic plan is designed to expand our activities beyond our existing revenue base, enabling us to assume higher investment risk and giving us flexibility in collaborating with partnering developers. The plan is aimed at improving our capital structure, diversifying our revenue base, creating higher values and equity returns.

SRRE operates through its wholly owned subsidiaries, CY-SRRE and LRY. Neither CY-SRRE nor LRY have operations but conduct operations in Mainland China through their respective subsidiaries that are based in the PRC. CY-SRRE operates through its wholly owned subsidiary, SHXJY. LRY operates through its two wholly owned subsidiaries, SHSY and SZGFH. SHXJY and SHSY are property agency business earning commission revenue from marketing and sales services to developers. The main business of SZGFH is to render property rental service, including buildings management and maintenance service for office buildings. Our company organization chart is as follows:

| 3 |

Figure 1: Company Organization Chart

| 1. | On March 6, 2012, LYRL was established by three Chinese individuals, who held the equity interest in LYRL for SHXJY. At the date of incorporation of LYRL. SHXJY transferred its 24% equity interest in LYSY to LYRL. |

| 2. | It was previously known as Shanghai Shang Yang Real Estate Consultation Co., Limited. The company changed its name to Shanghai Shang Yang Investment Management and Consulting Company Limited onMay 28, 2013. |

| 3. | SHGXL is consolidated into the Company’s financials because the Company has control of the development rights and are beneficiary of the revenue SHGXL generates. |

Our major business is agency sales, whereby our Chinese subsidiaries contract with property developers to market and sell their newly developed property units. For the fiscal year ended December 31, 2014, 100% of our net revenues of $8,210,356 were generated from our brokerage operations. For these services we earned a commission fee calculated as a percentage of the sales prices. We have focused our sales on the whole China market, especially in secondary cities. To expand our business agencies, we have established subsidiaries and branches in Shanghai, Suzhou, Yangzhou, Chongqing, Quanjiao, Hainan, Shangqiu, Chengdu, and Wuhan.

During 2005 and 2006, SZGFH entered into leasing agreements with certain buyers of the Sovereign Building underwriting project to lease the properties for them. These leasing agreements on these properties are for 62% of the floor space that was sold to third party buyers. In accordance with the leasing agreements, the owners of the properties can have a rental return of 8.5% and 8.8% per annum for a period of 5 years and 8 years, respectively. The leasing period started in the second quarter of 2006, and the Company had the right to sublease the leased properties to cover these lease commitments in the leasing period. In regards to the leasing agreements, we agreed with certain buyers to lower the annual rental return rate for the remaining leasing period from 8.5% for 5 years to 5.8%, and from 8.8% for 8 years to 6%, or to early terminate lease agreements. These leases related to the underwriting project expired in mid-2014.

| 4 |

Since we started our agency sales operations in 2001, we have established a reputation as a sales and marketing agency for new projects. With our accumulated expertise and experience, we intend to take a more aggressive role by participating in property investments. We plan to select property developers with outstanding qualifications as our strategic partners, and continue to build strength in design, planning, positioning and marketing services. Beginning in 2012, we commenced our first development project in Wuhan and Linyi and started the initial construction in the first quarter of 2012. In Wuhan, we commenced the construction of Phase 1 of the project in the third quarter of 2012.There are a total of eight buildings. The seven buildings that are open for sale currently have a 70% sales rate. The remaining building has not yet been open for sale. Since October 20, 2014, the Linyi project has constructed 121 units, which encompasses approximately 40% of the gross sales area. Proceeds from sales will be used to finance the constructions of the subsequent phases of the project. We are applying for bank loans and other forms of funding, however, there are no assurances we will be able to obtain future financings. On March 13, 2014, the Company has signed a joint development agreement with ZhongjiPufa Real Estate Co.. According to this agreement, the Company obtained a right to develop the Guangxinglu Project, which located in the, Putuo district, Shanghai, PRC. This project covers a site area of approximately 2,502 square meters for the development of one building of apartment.

Business Activities

Our main operating subsidiaries, SHXJY and SHSY, have engaged in sales and marketing agency work for newly built property units. We also have developed a network of landowners and developers, allowing us to explore opportunities in property investments.

In order to build a cushion against the cyclical nature of the real estate industry and have a more diversified revenue base, we established another operating subsidiary, SZGFH, in 2005 for property management and rental operations.

Additionally, we expanded into real estate development in 2011 by establishing LYSY and investing in WHYYL, an unconsolidated affiliate. LYSY has a real estate development project located in Linyi City Economic Development Zone, Shandong Province, PRC, which covers a site area of approximately 103,385 square meters for development of villa-style residential housing buildings. WHYYL is developing a real estate project in Wuhan, with a site area of approximately 27,950 square meters for development of eight high-rise residential buildings.

On June 6, 2013, SHSY and LYRL together with other 4 investors established a company, namely Shanghai Daerwei, in the PRC in the cosmetic and facial care business. SHSY holds 19% and LYRL holds 11% equity interest of Shanghai Daerwei. The cosmetic and facial care business is still in its early operational stage.

Commission Based Services

Commission based services refer to marketing and sales agency operations, which provide the following services:

a. Integrated Marketing Planning

b. Advertising Planning & Execution

c. Sales Planning and Execution

In this business, we sign a marketing and sales agency agreement with property developers to undertake the marketing and sales activities of a specific project. The scope of service varies according to clients' needs; it could be a full package of all the above services, a combination of any two of the above services or any single service.

All of our revenue in 2014 was from commission-based services. We secure these projects via bidding or direct appointments. As a result of our relationships with existing clients and our sales track record, we have secured a number of cases from prior clients on subsequent phases of projects.

Normally, before a developer retains us, we evaluate and determine the Average Sales Value of a project. This value will be proposed to the developer, and the parties agree on an Average Sales Value as the basis of our agency agreement. The actual sales price of the project is generally priced higher than the Average Sales Value depending on market conditions. On average, we have been to sell the property at a small premium over Average Sales Value.

Our normal commission structure is a combination of the following:

a) Base Commission of 1.0% - 1.5% based on the Average sales value.

b) Surplus Commission of 10% - 30% based on the difference between Average Sales Value and actual sales price.

Our wholly owned subsidiaries, SHXJY and SHSY, engage in this sales and marketing phase of our business.

Real Estate Development

In mid-2011, we established a project company in Wuhan in which we have a 49% stake. We commenced the construction of phase one of the project in the third quarter of 2012 and the pre-sale of the phase one in the first quarter of 2013. There are a total of eight buildings. Seven buildings are open for sale and have a 70% sales rate. The remaining building is expected to be open for sale in mid 2015.

| 5 |

In October 2011, we established LYSY with 24% stake in the company. During the first quarter of 2012, we acquired approximately 103,385 square meters for the purpose of developing villa-style residential housing. We began construction in mid-2012 and as of December31, 2015 have constructed 121 units, which encompasses all units in phase 1. The phase 2 will begin construction accordingly. Proceeds from sales will be used to finance the constructions of the subsequent phases of the project. The sales started in Novermber2013, we have made sales of 67 units as of January 2016.

In March 2014, we entered into a development project in Shanghai. The investment amount is RMB135 million. On December 26, 2014, we invested RMB135 million. The construction was started in January 2015.In February 1, 2016, the company has got the Per-sale permit and will start its sales soon.

We are applying for bank loans and other forms of funding; however, there are no assurances we will be able to obtain future financings.

Mainland China's Property Sector

The industry's macro environment is improving, and the property sector is gradually developing to be a more regulated market. Stable economic growth provides a solid and secure base for investment returns in the property sector.

GDP Growth of PRC for the period of 2009 through 2014:

| GDP GROWTH | ||||

| 2010 | 10.3 | % | ||

| 2011 | 9.2 | % | ||

| 2012 | 7.8 | % | ||

| 2013 | 7.7 | % | ||

| 2014 | 7.3 | % | ||

Source: National Bureau of Statistics of China

Government regulation

The State Taxation Administration issued the Regulation of Land Value-added Tax Clearing and Administrating in May 2009, effective on June 1, 2009. It requires developers to clear the land value-added tax, which have completed development projects and have finished sale, or have sold development projects under constructed, or have transferred the land use right to others.

In December 2009, the Ministry of Finance, Ministry of Land and Resources, Ministry of Supervision, the Central Government, and five other agencies announced in “Notice Regarding to Improve Upon Land Sale and Receivable Management,” to increase the initial payment of land purchases to 50% of the purchase price and the entire purchase price must be paid in full within the year. Prior to the announcement, initial payment was around 20% to 30%.

On January 1, 2010, the Ministry of Finance and the State Administration of Taxation re-imposed the business tax on total proceeds from the resale of certain residential properties held for less than five years. The China Banking Regulatory Authority withdrew its earlier policy and emphasized the minimum 40% down payment requirement for mortgages for second properties. On March 8, 2010, the Ministry of Land and Resources issued a circular to further strengthen the supervision on land supply, requiring a real estate developer to pay at least 50% of the land premium within one month and 100% within one year after the land use right contract is executed. On April 17, 2010, the State Council issued the Circular on Firmly Restraining Soaring Housing Prices in Certain Cities. According to this circular,

| • | A down payment must be no less than 30% of the purchase price for first self-use housing unit purchases by a family with a gross construction area of more than 90 square meters.; |

| • | The minimum down payment for the second housing unit purchased by a family increased from 40% to 50% and the loan interest rate must be no less than 110% of benchmark lending interest rate; |

| • | Down payment for the third or more housing unit purchased by any family and the loan interest rate must be further increased significantly based on the rate for the first and second housing units, as determined by commercial banks based on their assessment of the risks; |

| • | Commercial banks may suspend extending loans to families for their purchases of the third or more housing units in regions where commercial housing unit prices are too high or have risen too fast or supply of housing units is insufficient. The banks may also suspend extending loans to individuals for their purchase of housing units outside of their registered residence if they cannot furnish evidence of their tax or social insurance premium payment for at least one year locally in the region where the subject housing units are located; and |

| • | Local governments are allowed to limit the total number of housing units one can purchase in certain period in light of the local situation. |

| 6 |

On January 10, 2010, the government established 11 measures to strengthen management of the real estate market to address rising real estate prices. The measures called for an increasing supply of low-cost houses for low-income families and common residential houses, encouraging reasonably priced house buying while limiting purchases for speculation and investment, strengthening real estate project loan risk management and market supervision, speeding up construction of residential housing projects for low-income households, and specifying responsibilities of local governments.

In January 2011, the State Council released an additional eight new measures to put downward pressure on property prices by:

| 1) | Requiring local governments to set housing price targets in proportion with local income levels for 2011; |

| 2) | Requiring a business tax for housing sales within 5 years of purchase must be levied on total sales value; |

| 3) | Strengthening the management of land supply for housing; |

| 4) | Imposing purchase restrictions in all large- & medium-sized cities. Families already owning a residential property are restricted to buy only one more, while those already owning two or more properties are prohibited to purchase additional properties; |

| 5) | Accelerating the construction of social security residential housings; |

| 6) | Providing that the down payment ratio for second-home purchases must not be less than 60%, up from 50%, with an interest rate at least 1.1 times of the benchmark rate; |

| 7) | Improving guidance for the media's housing market coverage; |

| 8) | Providing for implementation & accountability for local governments over the housing price control targets. |

In May 2011, the National Development and Reform Commission (“NDRC”) began the “one house, one price” policy which requires developers to enhance its disclosure of the residential properties’ offering prices and available supply volume. This policy is designed to prevent developers from posting false supply volume and prices to fuel speculative price volatility.

In July 2011, the China’s State Council declared that it will continue to implement tightening policies and expand the housing purchase restrictions to second and third-tier cities.

In late February and March 2013, the PRC government issued the “New Five Policies” for administration of the housing market and detailed implementation rules, which revealed the PRC government’s strong determination on curbing the increase of housing prices by requiring more stringent implementation of the housing price control measures. For example, in the cities where there are existing restrictions on housing sale, if the housing prices are rising fast due to insufficient local housing supply, the local governments are required to take more stringent measures to restrict housing units from being sold to those households that own more than one housing unit. In these cities, the minimum down payment for the second housing unit purchased by a household may be further increased from 60% and the loan interest rate may be raised to be more than 110% of benchmark lending interest rate, as the local housing price control measures require. The New Five Policies also reiterated and emphasized the implementation of the 20% income tax on capital gain generated from housing unit sale. Following the request of the central government, Beijing, Shanghai and other major cities in China have announced detailed regulations to implement the New Five Policies in late March 2013, to further cool down the local real estate markets.

In July 2012, the Ministry of Land and Resources and the Ministry of Housing and Urban-Rural Development jointly issued a notice to further tighten the land use administration and seek stricter enforcement of the existing real estate market regulations, which include, in particular, enhanced control over the floor area and plot ratio of land for housing purpose, closer scrutiny on the qualification of land bidders, and strengthened investigation and punishment on land bidding winners who leave land idle for more than one year.

Such measures and policies by the government have negatively affected the real estate market and caused a reduction in transactions in the real estate market. While these measures and policies remain in effect, they may continue to depress the real estate market, dissuade would-be buyers from making purchases, reduce transaction volume, cause a decline in average selling prices, and prevent developers from raising the capital they need and increase developers’ costs to start new projects.

Environmental matters

There is a growing concern in regards to the global warming issues affecting the world. The changing weather patterns and abnormal conditions may affect the construction and logistics of developers and this may indirectly cause inverse effect to our operation. Extreme weather conditions may delay in construction of properties; this then may delay the sale of these properties and therefore delaying our future revenue stream.

| 7 |

Employees

As of December 31, 2014, we had the following number and categories of employees:

| Employees | |

| SRRE | |

| Executive Dept. | 2 |

| Accounting Dept. | 2 |

| Investor Relations Dept. | 1 |

| SHXJY | |

| Administration Dept. | 11 |

| Accounting Dept. | 2 |

| Research & Development Dept. | 4 |

| Marketing Dept. | 18 |

| Chongqing Branch of SHXJY | |

| Accounting Dept. | 1 |

| SZXJY | |

| Administration Dept. | 17 |

| Research & Development Dept. | 11 |

| Advertising & Communication Planning Dept. | 8 |

| Marketing Dept. | 60 |

| SZSY | |

| Administration Dept. | 1 |

| Accounting Dept. | 2 |

| SHSY | |

| Administration Dept. | 9 |

| Accounting Dept. | 3 |

| Development Dept. | 5 |

| SYSY | |

| Marketing Dept. | 20 |

| SZGFH | |

| Administration Dept. | 1 |

| Accounting Dept. | 1 |

| Marketing Dept. | 3 |

| SQSY | |

| Marketing Dept. | 5 |

| WHGFH | |

| Marketing Dept. | 12 |

| LYSY | |

| Accounting Dept | 3 |

| Administration Dept. | 5 |

| Construction Dept. | 10 |

| PR Dept. | 1 |

| Executive Dept. | 1 |

| LYRL | |

| Administration Dept | 3 |

| PTXJY | |

| Marketing Dept | 17 |

| SHRJ | |

| Administration Dept. | 5 |

| Design Dept. | 5 |

| Total | 249 |

None of our employees are represented by a labor union or bound by a collective bargaining unit. We believe that our relationship with its employees is satisfactory.

| 8 |

RISK FACTORS

SRRE has identified a number of risk factors faced by the Company. These factors, among others, may cause actual results, events or performance to differ materially from those expressed in this 10-K or in press releases or other public disclosures. You should be aware of the existence of these factors.

RISKS RELATING TO THE GROUP

SRRE is a holding company and depends on its subsidiaries’ cash flows to meet its obligations.

SRRE is a holding company, and it conducts all of its operations through its subsidiaries. As a result, its ability to meet any obligations depends upon its subsidiaries’ cash flows and payment of funds as dividends, loans, advances or other payments. In addition, the payment of dividends or the making of loans, advances or other payments to SRRE may be subject to regulatory or contractual restrictions.

Continued losses threaten our operations.

In 2014, we had a net loss of $3,374,928 compared to a net loss of $1,355,263 in 2013.Management believes that the Company will generate sufficient cash flows to fund its operations and to meet its obligations on timely basis for the next twelve months by successful implementation of its business plans, obtaining continued support from its lenders to rollover debts when they became due, and securing additional debt or equity financing as needed. We have been able to secure new bank lines of credit and secure additional loans from affiliates to fund our operations to date. However, if events or circumstances occur that the Company is unable to successfully implement its business plans, fails to obtain continued supports from its lenders or to secure additional financing, the Company may be required to suspend operations or cease business entirely.

Our invoicing for commissions may be delayed.

Generally, we recognize our commission revenues after the contracts signed with developers are completed and confirmations are received from the developers. However, sometimes we do not recognize income even when we have rendered our services for any of the following reasons:

| a. | The developers have not received payments from potential purchasers who have promised to pay the outstanding sum by cash; |

| b. | The purchasers, who need to obtain mortgage financing to pay the outstanding balance due, are unable to obtain the necessary financing from their banks; |

| c. | Banks are sometimes unwilling to grant the necessary bridge loan to the developers in time due to the developers’ relatively low credit rating; |

| d. | The developers tend to be in arrears with sales commissions; therefore, do not grant confirmation to us to be able to invoice them accordingly. |

Development of new business may stretch our cash flow and strain our operation efficiency.

Business expansion and the need to integrate operations arising from the expansion may place a significant strain on our managerial, operational and financial resources, and will further contribute to a need to increase in our financial needs.

Our acquisition of new property may involve risks.

These acquisitions involve several risks including, but not limited to, the following:

a. The acquired properties may not perform as well as we expected or ever become profitable.

b. Improvements to the properties may ultimately cost significantly more than we had originally estimated.

Additional acquisitions might harm our business.

As part of our business strategy, we may seek to acquire or invest in additional businesses, products, services or technologies that we think could complement or expand our business. If we identify an appropriate acquisition opportunity, we might be unable to negotiate the terms of that acquisition successfully, finance it, or integrate it into our existing business and operations. We may also be unable to select, manage or absorb any future acquisitions successfully. Furthermore, the negotiation of potential acquisitions, as well as the integration of an acquired business, would divert management time and other resources. We may have to use a substantial portion of our available cash to consummate an acquisition. If we complete acquisitions through exchange of our securities, our shareholders could suffer significant dilution. In addition, we cannot assure you that any particular acquisition, even if successfully completed, will ultimately benefit our business.

| 9 |

Our real estate investments are subject to numerous risks.

We are subject to risks that generally relate to investments in real estate. The investment returns available from equity investments in real estate depend in large part on the amount of income earned and capital appreciation generated by the related properties, as well as the expenses incurred. In addition, a variety of other factors affect income from properties and real estate values, including governmental regulations, insurance, zoning, tax and eminent domain laws, interest rate levels and the availability of financing. For example, new or existing real estate zoning or tax laws can make it more expensive and/or time-consuming to develop real property or expand, modify or renovate properties. When interest rates increase, the cost of acquiring, developing, expanding or renovating real property increases and real property values may decrease as the number of potential buyers decrease. Similarly, as financing becomes less available, it becomes more difficult both to acquire and to sell real property. Finally, governments can, under eminent domain laws, take real property. Sometimes this taking is for less compensation than the owner believes the property is worth. Any of these factors could have a material adverse impact on results of our operations or financial condition. In addition, equity real estate investments, such as the investments we hold and any additional properties that we may acquire, are relatively difficult to sell quickly. If our properties do not generate sufficient revenue to meet operating expenses, including debt servicing and capital expenditures, our income will be reduced.

Competition, economic conditions and similar factors affecting us, and the real estate industry in general, could affect our performance.

Our properties and business are subject to all operating risks common to the real estate industry. These risks include:

| a. | Adverse effects of general and local economic conditions; |

| b. | Increases in operating costs attributable to inflation and other factors; and |

| c. | Overbuilding in certain property sectors. |

These factors could adversely affect our revenues, profitability and results of operations.

Our business is susceptible to fluctuations in the real estate market of China, especially in certain areas of eastern China where a significant portion of our operations are concentrated, which may adversely affect our revenues and results of operations.

We conduct our real estate services business in China. Our business depends substantially on the conditions of the PRC real estate market. Demand for private residential real estate in China has grown rapidly in the recent decade but such growth is often coupled with volatility in market conditions and fluctuation in real estate prices. Fluctuations of supply and demand in China’s real estate market are caused by economic, social, political and other factors. To the extent fluctuations in the real estate market adversely affect real estate transaction volumes or prices, our financial condition and results of operations may be materially and adversely affected.

As a significant portion of our operations is concentrated in Shanghai and Jiangsu Province, any decrease in demand or real estate prices or any other adverse developments in these regions may materially and adversely affect our total real estate transaction volumes and average selling prices, which may in turn adversely affect our revenues and results of operations. These economic uncertainties involve, among other things, conditions of supply and demand in local markets and changes in consumer confidence and income, employment levels, increase in mortgage interest rates and government regulations. These risks and uncertainties could periodically have an adverse effect on consumer demand for and the pricing of our homes, which could cause our operating revenues to decline. In addition, builders are subject to various risks, many of them outside the control of the homebuilder including competitive overbuilding, availability and cost of building lots, materials and labor, adverse weather conditions, cost overruns, changes in government regulations, and increases in real estate taxes and other local government fees. A reduction in our revenues could in turn negatively affect the market price of our securities.

Our business may be materially and adversely affected by government measures aimed at China’s real estate industry.

The real estate industry in China is subject to government regulations. Until 2009, the real estate markets in a number of major cities in China had experienced rapid and significant growth. Before the global economic crisis hit all the major economies worldwide in 2009, the PRC government had adopted a series of measures to restrain what it perceived as unsustainable growth in the real estate market. From 2003 to 2013, the PRC government introduced a series of specific administrative and credit-control measures including, but not limited to, setting minimum down payment requirements for residential and commercial real estate transactions, limiting availability of mortgage loans, and tightening governmental approval process for certain real estate transactions.

In cities such as Beijing and Shanghai, we have seen the effects of such policies and regulatory measures. The sales volumes for real properties in Beijing and Shanghai decreased significantly after the policy change. The sale prices for certain properties in such cities are also weakened. The PRC government’s policy and regulatory measures on the PRC real estate sector could adversely affect the property purchasers’ ability to obtain mortgage financing or significantly increase the cost of mortgage financing and reduce market demand for properties. These factors may materially and adversely affect our business, financial condition, results of operations and prospects.

| 10 |

Despite the recent government measures aimed at maintaining the long-term stability of the real estate market, there is no assurance that the PRC government will not continue to adopt new measures in the future that may result in short-term downward adjustments and uncertainty in the real estate market.

Our business may be materially and adversely affected as a result of decreased transaction volumes or real estate prices that may follow these adjustments or market uncertainty.

We operate in a highly competitive environment.

Our competitors may be able to adapt more quickly to changes in customer needs or to devote greater resources than we can to developing and expanding our services. Such competitors could also attempt to increase their presence in our markets by forming strategic alliances with other competitors, by offering new or improved services or by increasing their efforts to gain and retain market share through competitive pricing. As the market for our services matures, price competition and penetration into the market will intensify. Such competition may adversely affect our gross profits, margins and results of operations. There can be no assurance that we will be able to compete successfully with existing or new competitors.

We may be unable to effectively manage our growth.

We will need to manage our growth effectively, which may entail devising and effectively implementing business and integration plans, training and managing our growing workforce, managing our costs, and implementing adequate control and reporting systems in a timely manner. We may not be able to successfully manage our growth or to integrate and assimilate any acquired business operations. Our failure to do so could affect our success in executing our business plan and adversely affect our revenues, profitability and results of operations.

If we fail to successfully manage our planned expansion of operations, our growth prospects will be diminished and our operating expenses could exceed budgeted amounts.

Our ability to offer our services in an evolving market requires an effective planning and management process. We have expanded our operations rapidly since inception, and we intend to continue to expand them in the foreseeable future. This rapid growth places significant demand on our managerial and operational resources and our internal training capabilities. In addition, we have hired a significant number of employees and plan to further increase our total work force. This growth will continue to substantially burden our management team. To manage growth effectively, we must:

| a. | Implement and improve our operational, financial and other systems, procedures and controls on a timely basis. |

| b. | Expand, train and manage our workforce, particularly our sales and marketing and support organizations. |

We cannot be certain that our systems, procedures and controls will be adequate to support our current or future operations or that our management will be able to handle such expansion and still achieve the execution necessary to meet our growth expectations. Failure to manage our growth effectively could diminish our growth prospects and could result in lost opportunities as well as operating expenses exceeding the amount budgeted.

We may be unable to maintain internal funds or obtain financing or renew credit facilities in the future.

Adequate financing is one of the major factors, which can affect our ability to execute our business plan in this regard. We finance our business mainly through internal funds, bank loans or raising equity funds. There is no guarantee that we will always have internal funds available for future developments or we will not experience difficulties in obtaining financing and renewing credit facilities granted by financial institutions in the future. In addition, there may be a delay in equity fundraising activities. Although in August and November 2014,we issued 40,000,000 shares of stock of the Company in the aggregate for cash of approximately $3,400,000 to Ace Develop, with Lin Chi-Jung, our CEO, President and Chairman, the sole shareholder of Ace Develop, our access to obtain debt or equity financing depends on the bank’s willingness to lend and on conditions in the capital markets, and we may not be able to secure additional sources of financing on commercially acceptable terms, if at all. If we cannot raise additional capital on acceptable terms, we may not be able to develop or enhance our services, take advantage of future opportunities or respond to competitive pressures or unanticipated requirements. To fully realize our business objectives and potential, we may require additional financing. If we are unable to obtain any necessary additional financing, we will be required to substantially curtail our approach to implementing our business objectives. Additional financing may be debt, equity or a combination of debt and equity. If equity is used, it could result in significant dilution to our shareholders.

We require substantial capital resources to fund our land use rights acquisition and property developments, which may not be available.

Property development is capital intensive. Our ability to secure sufficient financing for land use rights acquisition and property development depends on a number of factors that are beyond our control, including market conditions in the capital markets, the PRC economy and the PRC government regulations that affect the availability and cost of financing for real estate companies.

| 11 |

In order to strengthen liquidity management and regulate money and credit supply, the People’s Bank of China raised the RMB reserve requirement ratio for depository financial institutions. Prior to December 2011, the People’s Bank of China raised the reserve requirement ratio by an additional 1.5%. Effective on December 5, 2011, the People’s Bank of China reduced the RMB reserve requirement ratio by 0.5%. Effective on February 24, 2012 and May 18, 2012, People’s Bank of China decided to further cut the RMB reserve requirement ratio by 0.5% twice. The reserve requirement ratio refers to the amount of funds that banks must hold in reserve against deposits made by their customers. These increases in the reserve requirement ratio have reduced the amount of commercial bank credit available to businesses in China, including us.

Our operations and growth prospects may be significantly impeded if we are unable to retain our key personnel or attract additional key personnel, particularly since experienced personnel and new skilled personnel are in short supply.

Competition for key personnel is intense. As a small company, our success depends on the service of our executive officers, and other skilled managerial and technical personnel, and our ability to attract, hire, train and retain personnel. There is always the possibility that certain of our key personnel may terminate their employment with us to work for one of our competitors at any time for any reason. There can be no assurance that we will be successful in attracting and retaining key personnel. The loss of services of one or more key personnel could have a material adverse effect on us and would materially impede the operation and growth of our business.

If our partnering developers experience financial or other difficulties, our business and revenues could be adversely affected.

As a service-based company, we greatly depend on the working relationships and agency contracts with its partnering developers. We are exposed to the risks that our partnering developers may experience financial or other difficulties, which may affect their ability or will to carry out any existing development projects or resell contracts, thus delaying or canceling the fulfillment of their agency contracts with us. Any of these factors could adversely affect our revenues, profitability and results of operations.

Our partnering developers are subject to extensive government regulation which could make it difficult for them to obtain adequate funding or additional funding. Various PRC regulations restrict developers’ ability to raise capital through external financings and other methods, including, but not limited to, the following:

| · | developers cannot pre-sell uncompleted residential units in a project prior to achieving certain development milestones specified in related regulations; | |

| · | PRC banks are prohibited from extending loans to real estate companies to fund the purchase of land use rights; | |

| · | developers cannot borrow from a PRC bank for a particular project unless we fund at least 35% of the total investment amount of that project using our own capital; | |

| · | developers cannot borrow from a PRC bank for a particular project if we do not obtain the land use right certificate for that project; | |

| · | property developers are strictly prohibited from using the proceeds from a loan obtained from a local bank to fund property developments outside of the region where the bank is located; and | |

| · | PRC banks are prohibited from accepting properties that have been vacant for more than three years as collateral for a loan. |

We may fail to obtain, or may experience material delays in obtaining necessary government approvals for any major property development, which will adversely affect our business.

The real estate industry is strictly regulated by the PRC government. Property developers in China must abide by various laws and regulations, including implementation rules promulgated by local governments to enforce these laws and regulations. Before commencing, and during the course of, development of a property project, we need to apply for various licenses, permits, certificates and approvals, including land use rights certificates, construction site planning permits, construction work planning permits, construction permits, pre-sale permits and completion acceptance certificates. We need to satisfy various requirements to obtain these certificates and permits. To date, we have not encountered serious delays or difficulties in the process of applying for these certificates and permits, but we cannot guarantee that we will not encounter serious delays or difficulties in the future. In the event that we fail to obtain the necessary governmental approvals for any of our major property projects, or a serious delay occurs in the government’s examination and approval progress, we may not be able to maintain our development schedule and our business and cash flows may be adversely affected.

We may be unable to complete our property developments on time or at all.

The progress and costs for a development project can be adversely affected by many factors, including, without limitation:

| · | delays in obtaining necessary licenses, permits or approvals from government agencies or authorities; |

| · | shortages of materials, equipment, contractors and skilled labor; |

| 12 |

| · | disputes with our third-party contractors; |

| · | failure by our third-party contractors to comply with our designs, specifications or standards; |

| · | difficult geological situations or other geotechnical issues; |

| · | on-site labor disputes or work accidents; and natural catastrophes or adverse weather conditions. |

Any construction delays, or failure to complete a project according to our planned specifications or budget, may delay our property sales, which could harm our revenues, cash flows and our reputation.

If we fail to establish and maintain strategic relationships, the market acceptance of our services, and our profitability, may suffer.

To offer services to a larger customer base, our direct sales force depends on strategic partnerships, marketing alliances, and partnering developers to obtain customer leads and referrals. If we are unable to maintain our existing strategic relationships or fail to enter into additional strategic relationships, we will have to devote substantially more resources to the marketing of our services. We would also lose anticipated customer introductions and co-marketing benefits. Our success depends in part on the success of our strategic partners and their ability to market our services successfully. In addition, our strategic partners may not regard us as significant for their own businesses. Therefore, they could reduce their commitment to us or terminate their respective relationships with us, pursue other partnerships or relationships, or attempt to develop or acquire services that compete with our services. Even if we succeed in establishing these relationships, they may not result in additional customers or revenues.

We are subject to the risks associated with projects operated through joint ventures.

Some of our projects are operated through joint ventures in which we have controlling interests. We may enter into similar joint ventures in the future. Any joint venture investment involves risks such as the possibility that the joint venture partner may seek relief under Chinese insolvency laws, or have economic or business interests or goals that are inconsistent with our business interests or goals. While the bankruptcy or insolvency of our joint venture partner generally should not disrupt the operations of the joint venture, we could be forced to purchase the partner’s interest in the joint venture, or the interest could be sold to a third party. Additionally, we may enter into joint ventures in the future in which we have non-controlling interests. If we do not have control over a joint venture, the value of our investment may be affected adversely by a third party that may have different goals and capabilities than ours. It may also be difficult for us to exit a joint venture that we do not control after an impasse. In addition, a joint venture partner may be unable to meet its economic or other obligations, and we may be required to fulfill those obligations.

We are subject to the risks associated with projects operated through joint ventures.

Some of our projects are operated through joint ventures in which we have controlling interests. We may enter into similar joint ventures in the future. Any joint venture investment involves risks such as the possibility that the joint venture partner may seek relief under federal or state insolvency laws, or have economic or business interests or goals that are inconsistent with our business interests or goals. While the bankruptcy or insolvency of our joint venture partner generally should not disrupt the operations of the joint venture, we could be forced to purchase the partner’s interest in the joint venture, or the interest could be sold to a third party. Additionally, we may enter into joint ventures in the future in which we have non-controlling interests. If we do not have control over a joint venture, the value of our investment may be affected adversely by a third party that may have different goals and capabilities than ours. It may also be difficult for us to exit a joint venture that we do not control after an impasse. In addition, a joint venture partner may be unable to meet its economic or other obligations, and we may be required to fulfill those obligations.

We are subject to risks relating to acts of God, terrorist activity and war.

Our operating income may be reduced by acts of God, such as natural disasters or acts of terror, in locations where we own and/or operate significant properties and areas from which we draw customers and partnering developers. Some types of losses, such as from earthquake, hurricane, terrorism and environmental hazards, may be either uninsurable or too expensive to justify insuring against. Should an uninsured loss or a loss in excess of insured limits occur, we could lose all or a portion of the capital we have invested in any particular property, as well as any anticipated future revenue from such property. In that event, we might nevertheless remain obligated for any mortgage debt or other financial obligations related to the property. Similarly, wars (including the potential for war), terrorist activity (including threats of terrorist activity), political unrest and other forms of civil strife as well as geopolitical uncertainty have caused in the past, and may cause in the future, our results to differ materially from anticipated results.

We have limited business insurance coverage in China.

The insurance industry in China is still at an early stage of development. Insurance companies in China offer limited business insurance products. As a result, we do not have any business liability or disruption insurance coverage for our operations in China. Any business disruption, litigation or natural disaster might result in substantial costs and diversion of resources.

We may be affected by global climate change or by legal, regulatory, or market responses to such change.

There is a growing concern in regards to the global warming issues affecting the world. The changing weather patterns and abnormal conditions may affect the construction and logistics of developers and this may indirectly cause inverse effect to our operation. Extreme weather conditions may delay in construction of properties; this then may delay the sale of these properties and therefore delaying our future revenue stream. There may be regulations in manufacturing materials for property construction and new building codes in response to global warming that may delay construction and/or create further expenses to the developers. These possible changes may indirectly affect our business.

| 13 |

Our real estate development operating results may not achieve our goals.

As there are many variables to developing a real estate project, we face the risk of running out of funds mid construction and may have to delay or be unable to continue developing the project. We may also run into market downturn and not be able to sell any of the housings we’ve developed. If any of the above happens, we may face an extreme cash shortage and will directly affect our business.

The staff of our accounting department lack training and experience in the accounting principles generally accepted in the United States (“U.S. GAAP”), which may result in accounting errors in the financial statements that we file with the Securities and Exchange Commission (the “SEC”).

Our executive offices are located in the PRC. Our entire bookkeeping and accounting staff is located there. Our books and records are maintained in Chinese, using Chinese accounting principles. Chinese accounting principles vary in many important respects from U.S. GAAP. To file our Company’s financial statements with the SEC, our accounting staff must convert the financial statements from Chinese accounting principles to U.S. accounting principles. However, none of the members of our accounting staff has extensive experience or training in the preparation of financial statements under U.S. accounting principles. Neither do we have any employee who has previous experience in accounting for a U.S. public company. This situation creates a risk that the financial statements we file with the SEC will fail to present our financial condition and/or results of operations as required by SEC rules and U.S. GAAP.

We have identified material weaknesses in our internal control over financial reporting. If we fail to develop or maintain an effective system of internal controls, we may not be able to accurately report our financial results and prevent fraud. As a result, current and potential stockholders could lose confidence in our financial statements, which would harm the trading price of our common stock.

Companies that file reports with the SEC, including us, are subject to the requirements of Section 404 of the Sarbanes-Oxley Act of 2002, or SOX 404. SOX 404 requires management to establish and maintain a system of internal control over financial reporting and annual reports on Form 10-K filed under the Exchange Act to contain a report from management assessing the effectiveness of a company’s internal control over financial reporting. A report of our management is included under Item 9A.“Controls and Procedures” of this report. We are a smaller reporting company and, consequently, are not required to include an attestation report of our auditor in this annual report. However, if and when we become subject to the auditor attestation requirements under SOX 404, we can provide no assurance that we will receive an unqualified report from our independent auditors.

During its evaluation of the effectiveness of internal control over financial reporting as of December 31, 2014, management identified a material weakness relating to our lack of sufficient accounting personnel with an appropriate understanding of U.S. GAAP and SEC reporting requirements. Although we are undertaking steps to address these material weaknesses, the existence of a material weakness is an indication that there is more than a remote likelihood that a material misstatement of our financial statements will not be prevented or detected in the current or any future period.

We are undertaking remedial measures, which measures will take time to implement and test, to address the material weakness. There can be no assurance that such measures will be sufficient to remedy the material weakness identified or that additional material weaknesses or other control or significant deficiencies will not be identified in the future. If we continue to experience material weaknesses in our internal controls or fail to maintain or implement required new or improved controls, such circumstances could cause us to fail to meet our periodic reporting obligations or result in material misstatements in our financial statements, or adversely affect the results of periodic management evaluations and, if required, annual auditor attestation reports. Each of the foregoing results could cause investors to lose confidence in our reported financial information and lead to a decline in our stock price. If we cannot produce reliable financial reports, investors could lose confidence in our reported financial information, the market price of our common stock could decline significantly, we may be unable to obtain additional financing to operate and expand our business, and our business and financial condition could be harmed. See Item 9A.“Controls and Procedures” for more information.

RISKS RELATING TO OUR SECURITIES

Our controlling shareholders could take actions that are not in the public shareholders’ best interests.

As of March 31, 2016, Ace Develop directly controls 64.80% of our outstanding common stock and Lin Chi-Jung, our Chairman, is the sole shareholder of Ace Develop. As of March 31, 2016, Robert Lin Investments directly controls 6.57% of our outstanding common stock and Lin Chao Chun, one of our directors, is the principal and controlling shareholder of Robert Lin Investments. Accordingly, pursuant to our Articles of Incorporation and bylaws, Ace Develop and Lin Chi-Jung, and Robert Lin Investments and Lin Chao Chun, by virtue of their controlling ownership of share interests, will be able to exercise substantial influence over our business by directly or indirectly voting at either shareholders meetings or the board of directors meetings in matters of significance to us and our public shareholders, including matters relating to:

a. Election of directors and officers;

b. The amount and timing of dividends and other distributions;

c. Acquisition of or merger with another company; and

d. Any proposed amendments to our Articles of Incorporation.

| 14 |

Future sales of our common stock could adversely affect our stock price.

If our shareholders sell substantial amounts of our common stock in the public market, the market price of our common stock could be adversely affected. In addition, the sale of these shares could impair our ability to raise capital through the sale of additional equity securities.

We are traded on the OTCQB, which can be a volatile market.

Our common stock is quoted on the OTCQB, a quotation system for equity securities. It is a more limited trading market than the Nasdaq Capital Market, and timely and accurate quotations of the price of our common stock may not always be available. Investors may expect trading volume to be low in such a market. Consequently, the activity of only a few shares may affect the market and may result in wide swings in price and in volume.

We may be subject to exchange rate fluctuations.

A majority of our revenues are received, and a majority of our operating costs are incurred, in Renminbi. Because our financial statements are presented in U.S. Dollars, any significant fluctuation in the currency exchange rates between the Renminbi and the U.S. Dollar will affect our reported results of operations. We do not currently engage in currency-hedging transactions.

Trading of our common stock is limited, which may make it difficult for investors to sell their shares at times and prices that investors feel are appropriate.

Trading of our common stock has been extremely limited. This adversely effects the liquidity of our common stock, not only in terms of the number of shares that can be bought and sold at a given price, but also through delays in the timing of transactions and reduction in security analysts’ and the media’s coverage of us. This may result in lower prices for our common stock than might otherwise be obtained and could also result in a larger spread between the bid and asked prices for our common stock.

There is a limited market for our common stock and an active trading market for our common stock may never develop.

Trading in our common stock has been limited and has been characterized by wide fluctuations in trading prices, due to many factors that may have little to do with a company’s operations or business prospects.

Because it may be a “penny stock,” it will be more difficult for shareholders to sell shares of our common stock.

In addition, our common stock may be considered a “penny stock” under SEC rules because it has been trading on the OTC Bulletin Board at prices lower than $1.00. Broker-dealers who sell penny stocks must provide purchasers of these stocks with a standardized risk-disclosure document prepared by the SEC. This document provides information about penny stocks and the nature and level of risks involved in investing in the penny-stock market. A broker must also give a purchaser, orally or in writing, bid and offer quotations and information regarding broker and salesperson compensation, make a written determination that the penny stock is a suitable investment for the purchaser, and obtain the purchaser’s written agreement for the purchaser. Broker-dealers also must provide customers that hold penny stocks in their accounts with such broker-dealers a monthly statement containing price and market information relating to the penny stock. If a penny stock is sold to investors in violation of the penny stock rules, investors may be able to cancel the purchase and get the money back. The penny stock rules may make it difficult for investors to sell their shares of our stock, and because of these rules, there is less trading in penny stocks. Moreover, many brokers simply choose not to participate in penny-stock transactions. Accordingly, investors may not always be able to resell shares of our common stock publicly at times and at prices that investors feel are appropriate.

Our stock price is, and we expect it to remain, volatile, which could limit investors’ ability to sell stock at a profit.

Since the completion of the SRRE /CY-SRRE/LRY share exchange transactions the market price of our common stock has ranged from a high of $0.05 per share to a low of $0.01 per share in 2014. The volatile price of our stock makes it difficult for investors to predict the value of our investment, to sell shares at a profit at any given time, or to plan purchases and sales in advance. A variety of factors may affect the market price of our common stock. These include, but are not limited to:

a. Announcements of new technological innovations or new commercial services by our competitors or us;

b. Developments concerning proprietary rights;

c. Regulatory developments in Mainland China and foreign countries;

d. Period-to-period fluctuations in our revenues and other results of operations;

e. Economic or other crises and other external factors;

f. Changes in financial estimates by securities analysts; and

g. Sales of our common stock.

| 15 |

We will not be able to control many of these factors, and we believe that period-to-period comparisons of our financial results will not necessarily be indicative of our future performance.

The stock market in general has experienced extreme price and volume fluctuations that may have been unrelated and disproportionate to the operating performance of individual companies. These broad market and industry factors may seriously harm the market price of our common stock, regardless of our operating performance.

Because we have not paid and do not plan to pay cash dividends, investors will not realize any income from an investment in our common stock unless and until investors sell their shares at profit.

We did not pay cash dividends on our common stock in 2014, and we do not anticipate paying any cash dividends in the near future. Investors should not rely on an investment in our stock if they require dividend income. Further, investors will only realize income on an investment in our stock in the event they sell or otherwise dispose of their shares at a price higher than the price they paid for their shares. Such a gain would result only from an increase in the market price of our common stock, which is uncertain and unpredictable.

We intend to retain all of our earnings for use in our business and do not anticipate paying any cash dividends in the near future.

The payment of any future dividends will be at the discretion of the Board of Directors and will depend upon a number of factors, including future earnings, the success of our business activities, general financial condition, future prospects, general business conditions and such other factors as our Board of Directors may deem relevant.

RISKS RELATING TO THE REAL ESTATE INDUSTRY IN YANGTZE DELTA AND OTHER AREAS OF THE PRC

The real estate market in Yangtze Delta and other areas of the PRC is at an early stage of development.

We are subject to real estate market conditions in the PRC generally and Yangtze Delta in particular. Private ownership of property in the PRC is still at an early stage of development. Although there is a perception that economic growth in the PRC and the higher standard of living resulting from such growth will lead to a greater demand for private properties in the PRC, it is not possible to predict with certainty that such a correlation exists as many social, political, economic, legal and other factors may affect the development of the property market. The level of uncertainty is increased by the limited availability of accurate financial and market information as well as the overall low level of transparency in the PRC.

The PRC property market, including the Yangtze Delta property market, is volatile and may experience oversupply and property price fluctuations. The central and local governments frequently adjust monetary and other economic policies to prevent and curtail the overheating of the PRC and local economies, and such economic adjustments may affect the real estate market in Yangtze Delta and other parts of China. Furthermore, the central and local governments from time to time make policy adjustments and adopt new regulatory measures in a direct effort to control the over development of the real estate market in China, including Yangtze Delta. Such policies may lead to changes in market conditions, including price instability and an imbalance of supply and demand of residential properties, which may materially adversely affect our business and financial conditions. Also, there is no assurance that there will not be over development in the property sector in Yangtze Delta and other parts of China in the future. Any future over development in the property sector in Yangtze Delta and other parts of China may result in an oversupply of properties and a fall of property prices in Yangtze Delta or any of our other markets, which could adversely affect our business and financial condition. The lack of a liquid secondary market for residential property may discourage investors from acquiring new properties. The limited amount of property mortgage financing available to PRC individuals may further inhibit demand for residential developments.

Local government may issue further restrictive measures in the future.

In January, 2011, the Shanghai municipal government put forward a local restrictive policy. The policy prohibits residential housing purchases for 1) non-local residents, who are not able to provide a local tax payment or social security payment certificate over one year within the most recent two years, 2) local resident, who is already in possession of two residential units. The policy also limits residential housing purchases for 1) non-local residents, who are able to provide local tax payment certificate over one year, to only one unit, 2) local residents, who are already in possession of only one residential unit, to one additional residential unit.

We cannot assure you that the local government in Shanghai or Jiangsu Province will not issue further restrictive measures in the future. The local government’s restrictive regulations and measures could increase our operating costs in adapting to these regulations and measures, limit our access to capital resources or even restrict our business operations, which could further adversely affect our business and prospects.

We face increasing competition, which may adversely affect our revenues, profitability and results of operations.

In recent years, a large number of property companies have begun undertaking property sales and investment projects in Yangtze Delta and elsewhere in the PRC. Some of these property companies may have better track records and greater financial and other resources than we do. The intensity of the competition may adversely affect our business and financial position. In addition, the real estate market in Yangtze Delta and elsewhere in the PRC is rapidly changing. If we cannot respond to the changes in the market conditions more swiftly or effectively than our competitors do, our business and financial position will be adversely affected.

| 16 |

If the availability or attractiveness of mortgage financing were significantly limited, many of our prospective customers would not be able to purchase the properties, thus adversely affecting our business and financial position.

Mortgages are becoming increasingly popular as a means of financing property purchases in the PRC. An increase in interest rates may significantly increase the cost of mortgage financing, thus reducing the affordability of mortgages as a source of financing for residential property purchases. The PRC government has increased the down payment requirements and imposed certain other conditions that make mortgage financing unavailable or unattractive for some potential property purchasers. There is no assurance that the down payment requirements and other conditions will not be further revised. If the availability or attractiveness of mortgage financing is further significantly limited, many of our prospective customers would not be able to purchase the properties and, as a result, our business and future prospects would be adversely affected.

Our future prospects are heavily dependent on the performance of property sectors in specific geographical areas.

The properties we resell and intend to invest in are mainly based in Yangtze Delta. Our future prospects are, therefore, heavily dependent on the continued growth of the property sector around Yangtze Delta, and our business may be affected by any adverse developments in the supply and demand or housing prices in the property sector around Yangtze Delta.

The current level of property development and investment activity in Yangtze Delta and other markets is substantial. However, there is no assurance that such property resale and investment activity in Yangtze Delta or any of our other markets will continue at this level in the future or that we will be able to benefit from the future growth of these property markets.

Our revenues and operating income could be reduced by adverse conditions specific to our property locations.

The properties we resell and intend to invest in are concentrated geographically and are located predominately in Yangtze Delta. As a result, our business and our financial operating results may be materially affected by adverse economic, weather or business conditions in this area. Adverse conditions that affect these areas such as economic recession, changes in extreme weather conditions and natural disasters, may have an adverse impact on our operations.

RISKS RELATING TO THE PEOPLES REPUBLIC OF CHINA

All of our current prospects and deals are generated in Mainland China; thus all of our revenues are derived from our operations in the PRC. Accordingly, our business, financial condition, results of operations and prospects are subject, to a significant extent, to economic, political and legal developments in the PRC.

PRC economic, political policies and social conditions could adversely affect our business.