UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

x

|

ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2011

|

o

|

TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE TRANSITION PERIOD FROM ____ TO ____

|

Commission file number: 0-27355

CIGMA METALS CORPORATION

(Exact Name of registrant as specified in its charter)

|

Florida

|

98-0203244

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

|

Calle/ Zurbano 46, 2C, Madrid, Spain

|

28010

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

(+34) 91 4516157

Registrant’s telephone number, including area code

Securities registered under Section 12(b) of the Exchange Act:

None

Securities registered under Section 12 (g) of the Exchange Act:

|

Common stock, par value $0.0001 per share

|

Pink Sheets

|

|

|

Title of each class

|

Name of each exchange on which registered

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act of 1933 (the “Securities Act”).

o Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

o Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 (the “Exchange Act”) during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

o Yes x No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

o Yes x No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

o Yes x No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer: o | Accelerated Filer: o | |

| Non-accelerated filer: o (Do not check if a smaller reporting company) | Smaller reporting company: x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

o Yes x No

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter: $5,041,000 as of June 30, 2011 ($12,552,090 as of June 30, 2010).

Indicate the number of shares outstanding of each of the issuer’s classes of common equity, as of the latest practicable date: 59,500,000 shares of common stock were outstanding as of October 31, 2012.

Documents incorporated by reference: None

2

|

Part I

|

||

|

Item 1.

|

4

|

|

|

Item 1A

|

8

|

|

|

Item 1B

|

14

|

|

|

Item 2

|

14

|

|

|

Item 3

|

22

|

|

|

Item 4

|

22

|

|

|

PART II

|

||

|

Item 5

|

23

|

|

|

Item 6

|

24

|

|

|

Item 7

|

25

|

|

|

Item 7A

|

31

|

|

|

Item 8

|

31

|

|

|

Item 9

|

31

|

|

|

Item 9A

|

31

|

|

|

Item 9B

|

33

|

|

|

PART III

|

||

|

Item 10

|

34

|

|

|

Item 11

|

39

|

|

|

Item 12

|

42

|

|

|

Item 13

|

43

|

|

|

Item 14

|

43

|

|

|

PART IV

|

||

|

Item 15

|

44

|

|

|

46

|

PART I

BUSINESS

Forward-Looking Statements

Except for the historical information presented in this document, the matters discussed in this Form 10-K for the fiscal year ended December 31, 2011, contain forward-looking statements which involve assumptions and our future plans, strategies, and expectations. These statements are generally identified by the use of words such as “may,” “will,” “should,” “expect,” “anticipate,” “estimate,” “believe,” “intend,” or “project,” or the negative of these words or other variations on these words or comparable terminology. These statements are expressed in good faith and based upon a reasonable basis when made, but there can be no assurance that these expectations will be achieved or accomplished.

Such forward-looking statements include statements regarding, among other things, (a) the potential markets for our products, our potential profitability, and cash flows (b) our growth strategies (c) our future financing plans and (d) our anticipated needs for working capital. This information may involve known and unknown risks, uncertainties, and other factors that may cause our actual results, performance, or achievements to be materially different from the future results, performance, or achievements expressed or implied by any forward-looking statements. These statements may be found under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” as well as in this Form 10-K generally. Actual events or results may differ materially from those discussed in forward-looking statements as a result of various factors, including, without limitation, the matters described in this Form 10-K generally. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this filing will in fact occur. In addition to the information expressly required to be included in this filing, we will provide such further material information, if any, as may be necessary to make the required statements, in light of the circumstances under which they are made, not misleading.

Although forward-looking statements in this report reflect the good faith judgment of our management, forward-looking statements are inherently subject to known and unknown risks, business, economic and other risks and uncertainties that may cause actual results to be materially different from those discussed in these forward-looking statements. Readers are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this report. We assume no obligation to update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this report, other than as may be required by applicable law or regulation. Readers are urged to carefully review and consider the various disclosures made by us in our reports filed with the Securities and Exchange Commission (the “SEC”), including those set forth under “Risk Factors” in this Form 10-K, which attempt to advise interested parties of the risks and factors that may affect our business, financial condition, results of operation and cash flows. If one or more of these risks or uncertainties materialize, or if the underlying assumptions prove incorrect our actual results may vary materially from those expected or projected.

Except where the context otherwise requires and for purposes of this 10-K only, “we,” “us,” “our,” “Company,” and “our Company,” refer to Cigma Metals Corporation, a Florida corporation, and its consolidated subsidiaries.

|

Item 1.

|

Business Development

We were incorporated under the laws of the State of Florida on January 13, 1989, as “Cigma Ventures Corporation.” On April 17, 1999, we changed our name to “Cigma Metals Corporation” and are in the business of locating, acquiring, exploring and, if warranted, developing mineral properties.

Through our Mexican subsidiary, Exploraciones Cigma SA de CV (“Exploraciones Cigma”) we are engaged in the exploration of gold and silver mining properties located in the Mexico, and have not yet determined whether our properties contain mineral reserves that may be economically recoverable.

Our general business strategy is to acquire mineral properties either directly or through the acquisition of operating entities. Our continued operations and the recoverability of mineral property costs is dependent upon the existence of economically recoverable mineral reserves, confirmation of our interest in the underlying properties, our ability to obtain necessary financing to complete the development and upon future profitable production.

Since 1999 we have acquired and disposed of a number of properties. We have not been successful in any of our exploration efforts to establish reserves on any of the properties that we owned or in which we have or have had an interest.

We currently have interest in six (6) properties, none of which contain any reserves. Please refer to “Description of Properties.” The accompanying consolidated financial statements have been prepared in accordance with generally accepted accounting principles applicable to a going concern which contemplates the realization of assets and the satisfaction of liabilities and commitments in the normal course of business. As discussed in Note 1 to the consolidated financial statements, we have not generated revenue and have experienced recurring losses from operations since inception, and have a working capital deficit. We will not generate revenues even if any of our exploration programs indicate that a mineral deposit may exist on our properties. Accordingly, we will be dependent on future financings in order to maintain our operations and continue our exploration activities. These conditions raise substantial doubt about our ability to continue as a going concern. Management’s plans regarding these matters are also described in Note 1 to the consolidated financial statements. The consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

We have not been involved in any bankruptcy, receivership or similar proceedings.

Our Principal Products and Their Markets

We are a junior mineral exploration company. Our strategy is to concentrate our investigations into: (i) existing operations where an infrastructure already exists; (ii) properties presently being developed and/or in advanced stages of exploration which have potential for additional discoveries; and (iii) grass-roots exploration opportunities.

We are currently concentrating our property exploration activity on our interest located in Mexico.

Our properties are in the exploration stage only and are without a known body of mineral reserves. Development of the properties will follow only if satisfactory exploration results are obtained. Mineral exploration and development involves a high degree of risk and few properties that are explored are ultimately developed into producing mines. There is no assurance that our mineral exploration and development activities will result in any discoveries of commercially viable bodies of mineralization. The long-term profitability of our operations will be, in part, directly related to the cost and success of our exploration programs, which may be affected by a number of factors. Please refer to “Item 1A. Risks Factors.”

Significant Developments in Fiscal 2011 and Subsequent Events

For the year ended December 31, 2011, we recorded exploration expenses of $4,000 compared to $100,000 in fiscal 2010. The following is a breakdown of the exploration expenses by property: Republic of Kazakhstan $0 (2010 - $100,000) and Mexico $4,000 (2010 - $0).

On March 9, 2010, we signed a property purchase agreement with Alphamin Resources Corp. (“Alphamin”) regarding the sale and transfer by Alphamin of a 100% interest in the Aurora II (title No. 235480) mining concession located in the State of Guerrero, Mexico, to us, in consideration for $150,000 and 1,000,000 shares of our common stock. The transactions were recorded at the exchange amount, being the trading price per published rates. Alphamin will retain a 1.5% Net Smelter Returns Royalty on production from the Property. On June 11, 2010, our wholly-owned Mexican subsidiary, Exploraciones Cigma, S.A. de C.V., filed an assignment agreement for the Aurora II mining concession between Alphamin’s wholly owned Mexican subsidiary, Exploraciones La Plata, S.A. de C.V. and Exploraciones Cigma, S.A. de C.V. with the Mexican Public Registry of Mining.

On August 1, 2012, we signed a property purchase agreement with Alphamin regarding the sale and transfer by Alphamin of a 100% interest in the Aurora (title No. 238662), Aurora Fraccion 1 (title No. 238663), La Huerta (title No. 231940), La Pastoria (title No. 232204), and Lupita (title No. 232725) mining concessions located in the State of Guerrero, Mexico, to us, in consideration for MXN $20,000. Alphamin will retain a 1.5% Net Smelter Returns Royalty on production from the Aurora and Aurora Fraccion mining concessions.

On August 24, 2012, we entered into a subscription agreement for 4,000,000 shares of our common stock at a purchase price of $0.05 per share for gross aggregate proceeds of $200,000. The shares were issued to a company which resides outside the United States of America (in accordance with the exemption from registration requirements afforded by Regulation S).

In September 2012, we issued 1,000,000 shares of our common stock valued at $50,000 in settlement of amounts owing to creditors. The shares were issued to an individual who resides outside the United States of America (in accordance with the exemption from registration requirements afforded by Regulation S). The transactions were recorded at the exchange amount of the August 24, 2012 subscription agreement for 4,000,000 shares of common stock.

Distribution Methods of Our Products and Services

We are a mineral exploration company and are not in the business of distributing any products or services.

Status of Any Publicly Announced New Product or Service

We have no plans for new products or services that we do not already offer.

Competitive Business Conditions and Our Competitive Position in the Industry and Methods of Competition

Vast areas of Mexico have been explored and in some cases staked through mineral exploration programs. Vast areas also remain unexplored. The cost of staking and re-staking new mineral claims and the costs of most phase one exploration programs are relatively modest. Additionally, in many more prospective areas, extensive literature is readily available with respect to previous exploration activities. These facts make it possible for a junior mineral exploration company such as ours to be very competitive with other similar companies. We are also competitive with senior companies who are doing grass roots exploration. In the event our exploration activities uncover prospective mineral showings, we anticipate being able to attract the interest of better financed industry partners to assist on a joint venture basis in more extensive exploration. We are at a competitive disadvantage compared to established mineral exploration companies when it comes to being able to complete extensive exploration programs on claims which we hold or may hold in the future. If we are unable to raise capital to pay for extensive claim exploration, we will be required to enter into joint ventures with industry partners which will result in our interest in our claims being substantially diluted.

Our Management remains committed to building a portfolio of mineral exploration properties principally through their own efforts. We are one small company in a large competitive industry with many other junior exploration companies who are evaluating and re-evaluating prospective mineral properties in Mexico.

Competition and Mineral Prices

Given the continual increase in the value of gold, silver and other base metals, the business of acquiring, developing and/or exploring mineral properties is more competitive than ever before. Our competitors include companies with larger staffs, greater resources and equipment and, as such, those companies may be in a better position to compete for mineral properties. In order to compete with such companies, we need to raise additional capital. The competitive nature of the business and the risks we are therefore faced with are discussed further in the item entitled “Risk Factors,” below.

Sources and Availability of Raw Materials and the Names of Principal Suppliers

As a mineral exploration company, we do not require sources of raw materials and do not have principal suppliers in the way which applies to manufacturing companies. Our raw materials are, in effect, mineral exploration properties which we may stake or acquire from third parties. Our management team seeks to assemble a portfolio of quality mineral exploration properties in Mexico. Initially, we will operate in the field with our president, Technical director and various consultants on an as needed basis. This will enable us to assemble a portfolio of properties through grass roots exploration and staking. We will also acquire new properties through option agreements where new properties can be acquired on favorable terms.

Dependence on One or a Few Major Customers

We are in the business of mining exploration and do not currently have any proved reserves of any minerals; accordingly, we have no dependence on one or a few major customers.

Patents, Trademarks, Licenses, Franchises, Concessions, Royalty Agreements or Labor Contracts, Including Duration

We do not own any patents or trademarks. We are not party to any labor agreements or contracts. Licenses, franchises, concessions and royalty agreements are not part of our business.

Need for Government Approval of Principal Products or Services

As a mineral exploration company, we are not in a business which requires extensive government approvals for principal products or services.

In the event mining claims which we acquire in the future prove to host viable ore bodies, we would likely sell or lease the deposit to a company whose business is the extraction and treatment of ore. This company would undertake the sale of metals or concentrates and pay us a net smelter royalty as specified in a future lease agreement. All responsibility for government approvals pertaining to mining methods, environmental impacts and reclamation would be the responsibility of this contractor. All costs to obtain the necessary government approvals would be factored into technical and viability studies in advance of a decision being made to proceed with development of an ore body.

The mining industry in Mexico is highly regulated. Our technical director has extensive industry experience and is familiar with government regulations respecting the initial acquisition and early exploration of mining claims in Mexico. We are required under law to meet government standards relating to the protection of land and waterways, safe work practices and road construction. We are unaware of any proposed or probable government regulations which would have a negative impact on the mining industry in Mexico. We propose to adhere strictly to the regulatory framework which governs mining operations in the Mexico.

Effect of Existing or Probable Governmental Regulations on Our Business.

Mexico

Legislation Affecting Mining

The Mining Law, originally published in 1992 and amended in 1996, 2005 and 2006, is the primary legislation governing mining activities in Mexico. Other significant legislation applicable to mining operations in Mexico includes the regulations to the Mining Law, the Federal Law of Waters, the Federal Labor Law, the Federal Law of Fire Arms and Explosives, the General Law on Ecological Balance and Environmental Protection and regulations, and the Federal Law on Metrology and Standards.

The Concession System

Under Mexican law, mineral resources are property of the Mexican republic, and a mining concession, granted by the Executive branch of the federal government, is required for the exploration, exploitation and processing of mineral resources. Mining concessions may only be granted to Mexican individuals domiciled in Mexico or companies incorporated and validly existing under the laws of Mexico. Mexican companies that have foreign shareholders must register with the National Registry of Foreign Investments and renew their registration on an annual basis. Mining concessions grant rights to explore and exploit mineral resources but do not grant surface rights over the land where the concession is located. Mining concession holders are required to negotiate surface access with the land owner or holder (e.g. agrarian communities) or, should such negotiations prove unsuccessful, file an application with the courts to obtain an easement, temporary occupancy, or expropriation of the land, as the case may be. An application for a concession must be filed with the Mining Agency or Mining Delegation located closest to the area to which the application relates.

Mining concessions have a term of 50 years from the date on which title is recorded in the Public Registry of Mining. Holders of mining concessions are required to comply with various obligations, including the payment of certain mining duties based on the number of hectares of the concession and the number of years the concession has been in effect. Failure to pay the mining duties can lead to cancellation of the relevant concession. Holders of mining concessions are also obliged to carry out and prove assessment works in accordance with the terms and conditions set forth in the Mining Law and its regulations. The regulations to the Mining Law establish minimum amounts that must be spent or invested on exploration and exploitation activities. A report must be filed in May of each year regarding the assessment works carried out during the preceding year. The mining authorities may impose a fine on the mining concession holder if one or more proof of assessment works reports is not timely filed.

Environmental Legislation

Mining development projects in Mexico are subject to Mexican federal, state and municipal environmental laws and regulations for the protection of the environment. The principal legislation applicable to mining projects in Mexico is the federal General Law of Ecological Balance and Environmental Protection, which is enforced by the Federal Bureau of Environmental Protection, commonly known as "PROFEPA". PROFEPA monitors compliance with environmental legislation and enforces Mexican environmental laws, regulations and official standards. If warranted, PROFEPA may initiate administrative proceedings against companies that violate environmental laws, which proceedings may result in the temporary or permanent closure of non-complying facilities, the revocation of operating licenses and/or other sanctions or fines. According to the Federal Criminal Code, PROFEPA must inform the relevant governmental authorities of any environmental crimes that are committed by a mining company in Mexico.

Concession holders may submit themselves to comply with the Mexican Official Norm: NOM-120-SEMARNAT-1997, which provides, among other things, that mining exploration activities to be carried out within certain areas must be conducted in accordance with the environmental standards set forth inNOM-120-SEMARNAT-1997; otherwise, concession holders are required to file a preventive report or an environmental impact study prior to the commencement of the exploration, exploitation and processing of mineral resources. However, an environmental impact study may not be necessary if the concessionaire files an application with the environmental authorities confirming the concessionaire's commitment to observe and comply with NOM-120-SEMARNAT-1997.

Costs and Effects of Compliance with Environmental Laws (federal, state and local)

At the present time, our costs of compliance with environmental laws are minimal. In the event that claims which we may acquire in the future host a viable ore body, the costs and effects of compliance with environmental laws will be incorporated in the exploration plan for these claims. These exploration plans will be prepared by qualified mining engineers.

Number of Total Employees and Number of Full Time Employees

We do not have employees; we engage contractors and consultants to provide us with needed services. As of October 31, 2012, we had three (3) part-time contractors and consultants.

|

Item 1A.

|

We are an exploration stage company and have incurred substantial losses since inception.

We have never earned any revenues. In addition, we have incurred net losses of $10,282,570 for the period from our inception (January 13, 1989) through December 31, 2011, and, based upon our current plan of operation, we expect that we will incur losses for the foreseeable future.

Potential investors should be aware of the difficulties normally encountered by mineral exploration companies and the high rate of failure of such companies. We are subject to all of the risks inherent to an exploration stage business enterprise, such as limited capital mineralized materials, lack of manpower, and possible cost overruns associated with our exploration programs. Potential investors must also weigh the likelihood of success in light of any problems, complications, and delays that may be encountered with the exploration of our properties.

Because we are small and do not have much capital, we must limit our exploration activity. As such we may not be able to complete an exploration program that is as thorough as we would like. In that event, an existing ore body may go undiscovered. Without an ore body, we cannot generate revenues and you will lose your investment.

Our independent registered public accounting firm has expressed substantial doubt about our ability to continue as a going concern, which may hinder our ability to obtain future financing.

Our independent registered public accounting firm has issued its report, which includes an explanatory paragraph for going concern uncertainty on our consolidated financial statements as of and for the year ended December 31, 2011. Because we have not yet generated revenues from our operations our ability to continue as a going concern is currently heavily dependent upon our ability to obtain additional financing to sustain our operations. Such financing may take the form of the issuance of common or preferred stock or debt securities, or may involve bank financing. Although we have completed several equity financings, the fact that our auditors have issued a “going concern” opinion may hinder our ability to obtain additional financing in the future. Currently, we have no commitments to obtain any additional financing, and there can be no assurance that financing will be available in amounts or on terms acceptable to us, if at all.

Our failure to timely file certain periodic reports with the SEC poses significant risks to our business, each of which could materially and adversely affect our financial condition and results of operations.

We have not timely filed our current reports on Form 8-K, our Quarterly Reports on Form 10-Q, and our Annual Reports on Form 10-K. Consequently, we were not compliant with the periodic reporting requirements under the Exchange Act. In addition, our failure to timely file those and possibly future periodic reports with the SEC could subject us to enforcement action by the SEC and shareholder lawsuits. Any of these events could materially and adversely affect our financial condition and results of operations and our ability to register with the SEC public offerings of our securities for our benefit or the benefit of our security holders.

Because we do not have any revenues, we expect to incur operating losses for the foreseeable future.

We have never generated revenues and we have never been profitable. Prior to completing exploration on our mineral properties, we anticipate that we will incur increased operating expenses without realizing any revenues. We therefore expect to incur significant losses into the foreseeable future. If we are unable to generate financing to continue the exploration of our properties, we will fail and you will lose your entire investment.

None of the properties in which we have an interest or the right to earn an interest have any known reserves.

We currently have an interest or the right to earn an interest in six (6) properties located in Mexico, none of which have any reserves. Based on our exploration activities through the date of this Form 10-K, we do not have sufficient information upon which to assess the ultimate success of our exploration efforts. If we do not establish reserves we may be required to curtail or suspend our operations, in which case the market value of our common stock may decline and you may lose all or a portion of your investment.

We have only completed the initial stages of exploration of our properties and thus have no way to evaluate whether we will be able to operate our business successfully. To date, we have been involved primarily in organizational activities, acquiring interests in properties and in conducting preliminary exploration of properties. We have not earned any revenues and have not achieved profitability as of the date of this Form 10-K.

We will require substantial additional funding to continue the advancement of our exploration activities.

Exploration of our properties will require funding in excess of our current cash on hand and will require us to access the public markets. Access to public financing has been negatively impacted by the volatility in the credit markets, which may impact our ability to obtain equity or debt financing in the future and, if obtained, to do so on favorable terms. We cannot assure you that we will be able to obtain the necessary financing for the advancement of our current exploration activities.

We are subject to all the risks inherent to mineral exploration, which may have an adverse effect on our business operations.

Potential investors should be aware of the difficulties normally encountered by mineral exploration companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the mineral properties that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to exploration and additional costs and expenses that may exceed current estimates. If we are unsuccessful in addressing these risks, our business will likely fail and you will lose your entire investment.

We are subject to the numerous risks and hazards inherent to the mining industry and resource exploration including, without limitation, the following:

|

|

·

|

interruptions caused by adverse weather conditions;

|

|

|

·

|

unforeseen limited sources of supplies resulting in shortages of materials, equipment and availability of experienced manpower.

|

The prices and availability of such equipment, facilities, supplies and manpower may change and have an adverse effect on our operations, causing us to suspend operations or cease our activities completely.

It is possible that our title for the property in which we have an interest will be challenged by third parties.

We do not seek to confirm the validity of our rights to, title to, or contract rights with respect to, each mineral property in which we have a material interest and we cannot guarantee that title to our properties will not be challenged. Title insurance generally is not available for mineral properties, and our ability to ensure that we have obtained secure rights to individual mineral properties or mining concessions may be severely constrained. We have not conducted surveys of all of the exploration properties in which we hold direct or indirect interests and, therefore, the precise area and location of these exploration properties may be in doubt. Accordingly, our mineral properties may be subject to prior unregistered agreements, transfers or claims, and title may be affected by, among other things, undetected defects. In addition, we may be unable to operate our properties as permitted or to enforce our rights with respect to our properties, and the title to our mineral properties may also be impacted by state action.

In some of the countries in which we operate, failure to comply with applicable laws and regulations relating to mineral right applications and tenure could result in loss, reduction or expropriation of entitlements, or the imposition of additional local or foreign parties as joint venture partners. Any such loss, reduction or imposition of partners could have a material adverse effect on our financial condition, results of operations and prospects.

Under the laws of Mexico, mineral resources belong to the state, and government concessions are required to explore for or exploit mineral reserves. Mineral rights derive from concessions granted, on a discretionary basis, by the Ministry of Economy, pursuant to the Mexican mining law and regulations thereunder. There may be valid challenges to the title of any of our claims that, if successful, could impair development and operations with respect to such properties in the future. A defect could result in our losing all or a portion of our right, title, and interest in and to the properties to which the title defect relates.

Mining concessions in Mexico may be terminated if the obligations of the concessionaire are not satisfied, including obligations to explore or exploit the relevant concession, to pay any relevant fees, to comply with all environmental and safety standards, to provide information to the Ministry of Economy and to allow inspections by the Ministry of Economy. In addition to termination, failure to make timely concession maintenance payments and otherwise comply strictly with applicable laws, regulations and local practices relating to mineral right applications and tenure could result in reduction or expropriation of entitlements.

Our mining operations located in Mexico and are subject to various levels of political, economic, legal and other risks with which we have limited or no previous experience.

Our mining operations conducted in Mexico are exposed to various levels of political, economic, legal and other risks and uncertainties, including military repression; extreme fluctuations in currency exchange rates; high rates of inflation; labor unrest; the risks of war or civil unrest; local acts of violence, including violence from drug cartels; expropriation and nationalization; renegotiation or nullification of existing concessions, licenses, permits and contracts; illegal mining; acts of political corruption; changes in taxation policies; restrictions on foreign exchange and repatriation; and changing political conditions, currency controls and governmental regulations that favor or require the awarding of contracts to local contractors or require foreign contractors to employ citizens of, or purchase supplies from, a particular jurisdiction.

In the past, Mexico has been subject to political instability, changes and uncertainties, which have resulted in changes to existing governmental regulations affecting mineral exploration and mining activities. Mexico’s status as a developing country may make it more difficult for us to obtain any required funding for the expansion of our exploration of our current projects in Mexico, or other projects in in the future.

Our mineral exploration and mining activities in Mexico may be adversely affected in varying degrees by changing government regulations relating to the mining industry or shifts in political conditions that increase the costs related to our Mexican operations or the maintenance of our properties. Changes, if any, in mining or investment policies or shifts in political attitude may adversely affect our operations and financial condition. Operations may be affected in varying degrees by government regulations with respect to restrictions on production, price controls, export controls, currency remittance, income and other taxes, expropriation of property, foreign investment, maintenance of claims, environmental legislation, land use, land claims of local people, water use and mine safety. Expansion of our facilities will also be subject to the need to assure the availability of adequate supplies of water and power, which could be affected by government policy and competing operations in the area. The occurrence of these various factors and uncertainties cannot be accurately predicted and could have an adverse effect on our operations and financial condition.

Our failure to compete with our competitors in mineral exploration for financing, acquiring mining claims, and for qualified managerial and technical employees will cause our business operations to slow down or be suspended.

Our competition includes large established mineral exploration companies with substantial capabilities and with greater financial and technical mineralized materials than we have. As a result of this competition, we may be unable to acquire additional attractive mining claims or financing on terms we consider acceptable. We may also compete with other mineral exploration companies in the recruitment and retention of qualified managerial and technical employees. If we are unable to successfully compete for financing or for qualified employees, our exploration programs may be slowed down or suspended.

Compliance with environmental regulations applicable to our operations may adversely affect our capital liquidity.

All phases of our operations in Mexico, where one of our properties is located, will be subject to environmental regulations. Environmental legislation in Mexico is evolving in a manner which will require stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects and a heightened degree of responsibility for companies and their officers, directors and employees. It is possible that future changes in environmental regulation will adversely affect our operations as compliance will be more burdensome and costly.

Because we have not allocated any money for reclamation of any of our mining claims, we may be subject to fines if the mining claims are not restored to its original condition upon termination of our activities.

Our long-term profitability will be affected by changes in the prices of the metals we find on our properties, if any.

Our ability to establish reserves and develop our exploration properties, and our profitability and long-term viability, depend, in large part, on the market prices of silver, gold, zinc, lead, copper and other metals. The market prices for these metals are volatile and are affected by numerous factors beyond our control, including:

|

|

·

|

global or regional consumption patterns;

|

|

|

·

|

supply of, and demand for, silver, gold, zinc, lead, copper and other metals;

|

|

|

·

|

speculative activities and producer hedging activities;

|

|

|

·

|

expectations for inflation;

|

|

|

·

|

political and economic conditions; and

|

|

|

·

|

supply of, and demand for, consumables required for production of metals.

|

Future weakness in the global economy could increase volatility in metals prices or depress metals prices, which could in turn reduce the cash flow generated by our operations in Mexico.

The exploration of mineral properties is highly speculative in nature, involves substantial expenditures and is frequently non-productive.

Our future growth and profitability will likely depend, in large part, on the costs and results of our exploration programs, certain of our exploration portfolio properties, and other properties that we do not currently hold. Mineral exploration is highly speculative in nature and is frequently nonproductive. Substantial expenditures are required to:

|

|

·

|

establish mineral reserves through drilling and metallurgical and other testing techniques;

|

|

|

·

|

determine metal content and metallurgical recovery processes to extract metal from the ore;

|

|

|

·

|

determine the feasibility of mine development and production; and

|

|

|

·

|

construct, renovate or expand mining and processing facilities.

|

If we discover ore at a property, it usually takes several years from the initial phases of exploration until production is possible. During this time, the economic feasibility of a project may change because of increased costs, lower metal prices or other factors. As a result of these uncertainties, we may not successfully acquire additional mineral rights, or our exploration programs may not result in proven and probable reserves at all or in sufficient quantities to justify developing any of our exploration properties.

The decisions about future development of projects may be based on feasibility studies, which derive estimates of reserves, operating costs and project economic returns. Estimates of economic returns are based, in part, on assumptions about future metal prices and estimates of average cash operating costs based upon, among other things:

|

|

·

|

anticipated tonnage, grades and metallurgical characteristics of ore to be mined and processed;

|

|

|

·

|

anticipated recovery rates of silver and other metals from the ore;

|

|

|

·

|

cash operating costs of comparable facilities and equipment; and

|

|

|

·

|

anticipated climatic conditions.

|

Actual cash operating costs, production and economic returns may differ significantly from those anticipated by our studies and estimates.

Lack of infrastructure could forestall or prevent further exploration and development.

Exploration activities, as well as any development activities, depend on adequate infrastructure. Reliable roads, bridges, power sources and water supply are important factors that affect capital and operating costs and the feasibility and economic viability of a project. Unanticipated or higher than expected costs and unusual or infrequent weather phenomena, or government or other interference in the maintenance or provision of such infrastructure, could adversely affect our operations, financial condition and results of operations.

Our exploration activities are in countries with developing economies and are subject to the risks of political and economic instability associated with these countries.

We currently conduct exploration activities almost in Latin American and Central Asian countries with developing economies. These countries and other emerging markets in which we may conduct operations have from time to time experienced economic or political instability. We may be materially adversely affected by risks associated with conducting exploration activities in countries with developing economies, including:

|

|

·

|

political instability and violence;

|

|

|

·

|

war and civil disturbance;

|

|

|

·

|

acts of terrorism or other criminal activity;

|

|

|

·

|

expropriation or nationalization;

|

|

|

·

|

changing fiscal, royalty and tax regimes;

|

|

|

·

|

fluctuations in currency exchange rates;

|

|

|

·

|

high rates of inflation;

|

|

|

·

|

uncertain or changing legal requirements respecting the ownership and maintenance of mineral properties, mines and mining operations, and

|

|

|

·

|

inconsistent or arbitrary application of such legal requirements;

|

|

|

·

|

underdeveloped industrial and economic infrastructure;

|

|

|

·

|

corruption; and

|

|

|

·

|

unenforceability of contractual rights.

|

Changes in mining or investment policies or shifts in the prevailing political climate in any of the countries in which we conduct exploration activities could adversely affect our business.

Our directors may face conflicts of interest in connection with our participation in certain ventures because they are directors of other mineral mineralized material companies.

Mr. Antonio Jaramillo and Ms. Michelle Robinson, who serve as directors, may also be directors of other companies (including mineralized material exploration companies) and, if those other companies participate in ventures in which we may participate, our directors may have a conflict of interest in negotiating and concluding terms respecting the extent of such participation. It is possible that due to our directors’ conflicting interests, we may be precluded from participating in certain projects that we might otherwise have participated in, or we may obtain less favourable terms on certain projects than we might have obtained if our directors were not also directors of other participating mineral mineralized materials companies. In an effort to balance their conflicting interests, our directors may approve terms equally favourable to all of their companies as opposed to negotiating terms more favourable to us but adverse to their other companies. Additionally, it is possible that we may not be afforded certain opportunities to participate in particular projects because those projects are assigned to our directors’ other companies for which the directors may deem the projects to have a greater benefit.

Our future performance is dependent on our ability to retain key personnel, loss of which would adversely affect our success and growth.

Our performance is substantially dependent on performance of our senior management. In particular, our success depends on the continued efforts of Mr. Antonio Jaramillo and Ms. Michelle Robinson. The loss of their services could have a material adverse effect on our business, results of operations and financial condition as our potential future revenues would most likely dramatically decline and our costs of operations would rise. We do not have employment agreements in place with any of our officers or our key employees, nor do we have key person insurance covering our employees.

Our stockholders may suffer additional dilution to their equity and voting interests as a result of future financing transactions.

We will need external financing to support the exploration and, if warranted, development of our properties. Because we do not currently generate any revenues, and because debt financing is difficult to obtain for early stage mining operations, it is likely that we will seek such financing in the equity markets. If we were to engage in a private equity financing, or engage in a public equity offering, the current ownership interest of our stockholders would be diluted.

The value and transferability of our shares may be adversely impacted by the limited trading market for our shares.

There is only a limited trading market for our common stock on the Pink Sheets. This may make it more difficult for you to sell your stock if you so desire.

Our common stock is a penny stock and because “penny stock” rules will apply, you may find it difficult to sell the shares of our common stock.

Our common stock is a “penny stock” as that term is defined under Rule 3a51-1 of the Exchange Act. Generally, a “penny stock” is a common stock that is not listed on a national securities exchange and trades for less than $5.00 a share. Prices often are not available to buyers and sellers and the market may be very limited. Penny stocks in start-up companies are among the most risky equity investments. Broker-dealers who sell penny stocks must provide purchasers of these stocks with a standardized risk-disclosure document prepared by the SEC. The document provides information about penny stocks and the nature and level of risks involved in investing in the penny stock market. A broker must also give a purchaser, orally or in writing, bid and offer quotations and information regarding broker and salesperson compensation, make a written determination that the penny stock is a suitable investment for the purchaser, and obtain the purchaser's written agreement to the purchase. Consequently, the rule may affect the ability of broker-dealers to sell our securities and also may affect the ability of purchasers of our stock to sell their shares in the secondary market. It may also cause fewer broker dealers to make a market in our stock.

Many brokers choose not to participate in penny stock transactions. Because of the penny stock rules, there is less trading activity in penny stock and you are likely to have difficulty selling your shares.

In addition to the “penny stock” rules promulgated by the SEC, the Financial Industry Regulatory Authority (“FINRA”) has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low-priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer's financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our stock and have an adverse effect on the market for our shares.

|

Item 1B.

|

We are currently delinquent in our reporting requirements and, if we fail to file all our required reports in a timely manner the SEC may, without further notice, bring an administrative proceeding against us to revoke our registration under the Securities Act of 1934.

|

Item 2.

|

Office Premises

We conduct our activities from our principal and technical office located at Mision Santa Ana 5232, Fracc. Las Misiones CP 82133, Mazatlan, Sinaloa, Mexico. We believe that these offices are adequate for our purposes. The telephone number is +1 (669) 980-9176. Management believes that this space will meet our needs for the next 12 months. We do not own any real property or significant assets.

Mining and Exploration Properties

Our strategy is to concentrate our efforts on: (i) existing operations where an infrastructure already exists; (ii) properties presently being developed and/or in advanced stages of exploration which have potential for additional discoveries; and (iii) grass-roots exploration opportunities.

We are currently concentrating our property exploration activities in Mexico.

Our properties are in the exploration stage only and are without a known body of mineral reserves. Development of the properties will follow only if satisfactory exploration results are obtained. Mineral exploration and development involves a high degree of risk and few properties that are explored are ultimately developed into producing mines. There is no assurance that our mineral exploration and development activities will result in any discoveries of commercially viable bodies of mineralization. The long-term profitability of our operations will be, in part, directly related to the cost and success of our exploration programs, which may be affected by a number of factors. Please refer to “Item 1A. Risk Factors.”

We currently have an interest in six (6) properties and are currently focusing our efforts on our properties located in northern Guerrero State, Mexico. We have conducted only preliminary exploration activities to date and may discontinue such activities and dispose of the properties if further exploration work is not warranted.

Former Properties

Russian Federation

Haldeevskaya License

On August 30, 2004, we signed a Joint Activity Agreement with OOO Science Industrial Corporation Geosphera (“Geosphera”), a company registered in Russia, to form a partnership to explore the Haldeevskaya license located in the Tomsk district of the Tomsk region of the Russian Federation, 25 km east of the city of Tomsk. Geosphera will earn a 51% interest in the partnership by contributing the license for the Haldeevskaya area and the geological data. The license and the geological data have been valued at $52,000. The terms of the agreement provided that we were to earn a 49% interest in the partnership by paying $50,000. However, we increased its interest in the partnership to 80% (Geosphera - 20%) by funding $350,000 of exploration expenditures on the licensed property in 2004. Geosphera was the manager of the project.

Pursuant to the terms of the Joint Activity Agreement, and for the purpose of conducting further financing and exploration work, a company, HaldeyGold Ltd. (“HaldeyGold”), was registered with the Ministry of the Russian Federation for Taxes and Levies on January 19, 2005. The Haldeevskaya mineral exploration license along with all relevant geological data was transferred by the partnership to HaldeyGold on March 16, 2005. We had an 80% (Geosphera 20%) interest in HaldeyGold.

On April 22, 2005, December 31, 2005, July 7, 2006 and December 29, 2006, we and Geosphera agreed to amend the Haldeevskaya Joint Activity Agreement dated August 30, 2004 resulting in a revision of the 2006 exploration expenditure commitment from $460,000 to $289,743 and the 2005 exploration expenditure commitment from $300,000 to $250,000. We also agreed to fund $400,000 toward the 2007 HaldeyGold exploration budget. No funds were spent on the HaldeyGold project in 2007. Our investment in the HaldeyGold partnership interest is as follows: Capital invested - $981,387, Exploration expenses incurred - $796,261, write-down of investment in partnership interest - $185,126.

The Haldeevskaya exploration license (expired on December 31, 2007) covers an area of 576 km2 (57,600ha) and is located approximately 16 kilometres NE from Tomsk via paved highway. Excellent infrastructure is currently in place, including, maintained tarmac access roads, high tension power lines at 500 kilowatts per line, gravel vehicular access roads over the project area with close-spaced, 100 metre, cut lines over the target areas. The area is also close to the railheads in Tomsk, with links to the Trans Siberian Railway, and all infrastructures associated with a regional centre.

Geology of Haldeevskaya area is represented by the mid Devonian volcanogenic-sedimentary sediments of the Mitrofan suite, terrigenous sediments of the Jurginsk, Pachinsk, Salamat suites of upper Devonian, and the Yarsk, Lagernosadsk stratus of the lower Carboniferous age. The rock formations are deformed into the linear folds with the north-north-eastern strike and they are cut by the series of longitudinal, lateral and diagonal fractures of different type and order. The area is located at the front zone of the Tomsk thrust above the granitoid intrusions that are inferred by geophysics. Dolerite and Monzonite dikes intrude Paleozoic rocks forming the series of dike zones with a north-western trend with an echelon-like arrangement of some dikes and their groups. Mineralization is focussed into areas associated with the thrusting. Towards the end of 19th and first half of the 20th centuries the region was one of the most prolific gold mining spots in Russia. The coarse gold was panned from the Tom river and the numerous drainage systems around the city of Tomsk. In late 1980 Geosphera made its first gold discoveries in hard rock. As a result of the geochemical and geophysical surveys a series of 6 highly prospective gold soil anomalies have been outlined Of the 6 large anomalies the area currently considered the most perspective are the Semiluzhenskoye, Verkhnekamensk and Sukhorechenskoye prospects. The Verkhnekamensk anomaly is located in the eastern part of the Haldeiskaja license on the tectonic contact between the clay shales and volcanics. As a result of the litho-geochemical, geological and geophysical studies, conducted by us, two mineralized zones of east-west strike have been outlined and plotted at 1:20,000. These zones were traced across the area for 3 kilometres with widths ranging from 250 to 700 meters. Within these zones 3 anomalies were found and appear prospective for gold mineralization. The first diamond drilling program has outlined vast areas of hydrothermal alteration, preliminary mineralogical investigations have discovered free gold in drill core from the upper part of the mineralization zone.

The Haldeevskaya exploration licence has expired on December 31, 2007.

Tugojakovsk License

On June 17, 2005, as amended December 31, 2005, July 7, 2006 and December 29, 2006, we signed a Joint Activity Agreement to form a partnership to explore the Tugojakovsk Project, located in the Tomsk Oblast Region of the Russian Federation. Under the terms of the agreement: (1) we acquired an 80% share of the project in exchange for contributing $126,440 in 2005; and (2) we committed to finance the project in 2006 by providing $329,375 in accordance with an approved budget. We committed to finance the project in 2007 by providing $400,000 in accordance with an approved budget. Geosphera’s ownership interest cannot be reduced below 20%. Geosphera will contribute the license for Tugojakovsk and all geological information on this subsoil area which is owned by Geosphera, as well as professional knowledge, skills and business contacts.

Pursuant to the terms of the Joint Activity Agreement, a company will be registered in the Russian Federation in order to conduct further financing and exploration work on the Tugojakovsk license area. Once the joint venture company is registered with the Ministry of the Russian Federation for Taxes and Levies, the Partnership will transfer the Tugojakovsk mineral exploration license along with all relevant geological data to the new joint venture company. We will have an 80% (Geosphera 20%) interest in the new company. The new company was not registered.

Our investment in the Tugojakovks project is as follows: Capital invested - $453,821, Exploration expenses incurred - $453,821.

The Tugojakovsk exploration license (expired December 1, 2009) covers an area of 164 km2 (16,400ha) and is located 25 kilometres SE from the regional centre of Tomsk via paved highway. An excellent infrastructure is in place including excellent sealed roads, close access to railheads and the infrastructure associated with the regional centre of Tomsk.

The geology of Tugojakovsk area is represented by the sedimentary rock formations of Carboniferous age composed of carbonaceous shales, siltstones and sandstones united under the common term “black shale.” The rocks are deformed into linear folds and cut by the series of longitudinal, lateral and diagonal faults. The dolerite and monzonite dikes intrude Palaeozoic rocks forming a series of dike zones controlling quartz stock works with gold mineralization.

The Baturinsk occurrence, located within the Tugojakovsk license is composed of a series silicified shear zones (mylonite zones) consisting of numerous, locally intense, small quartz veinlets carrying gold. The surrounding geological units are composed of mineralised carbonaceous shales. In 2006 there have been drilled 1,900 metres of core drilling. The gold mineralization zone, which is available on surface, was not intercepted by the drill holes. We made the decision to discontinue further expenditures on this licence area (Report 10-K of 2006).

The Tugojakovsk exploration license expired on December 1, 2009.

Republic of Kazakhstan

Maykubinsk Exploration and Mining License

Astana is an important regional centre for the project infrastructure both as an international airport and as the location of all the exploration/mining authorities.

Through our wholly-owned subsidiary, Dostyk (sold in 2010), we held a high potential Maykubinsk exploration and mining license (the “Maykubinsk License”) located in Pavlodar Oblast Region in Kazakhstan. According to Kazakhstan Mining Law an exploration and mining licence (also called a Contract with the Government) could be obtained by any private or corporate body, including those with 100% of foreign ownership, through an open tender published by government. If the licence is already issued then it could be acquired through direct negotiations with the owner and re-registered by State authorities. We acquired Dostyk from Eureka Mining Ltd (“Eureka”), a UK based public company.

The Dostyk acquisition steps were as follows:

We acquired 100% of the shares of Dostyk through a share purchase agreement with Eureka in following steps and conditions:

|

|

·

|

On January 27, 2007, we were granted 51% interest in Dostyk in return for a commitment to spend US$300,000 for exploration pursuant to the Maykubinsk Licence;

|

|

|

·

|

We obtained the rights to a further 20% interest in Dostyk by spending an additional US$700,000 for exploration pursuant to the Maykubinsk Licence;

|

|

|

·

|

We obtained the rights to a further 19% interest in Dostyk by spending an additional US$1,000,000 for exploration pursuant to the Maykubinsk Licence, to increase our interest in Dostyk to 90%; and

|

|

|

·

|

We paid Eureka US$400,000 to obtain the remaining 10% interest in Dostyk.

|

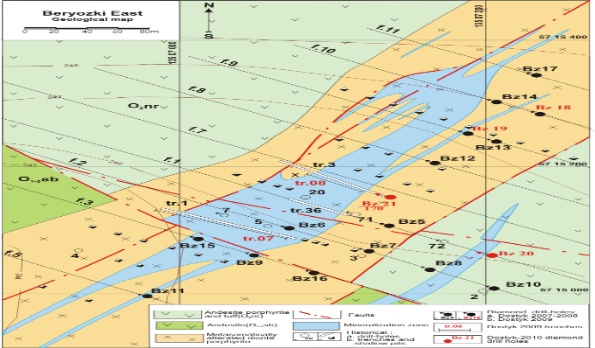

Figure 2

The Dostyk property (figure 2) originally covered an area of 14,000 square kilometres (1,400,000ha) in northern Kazakhstan in a region which has been producing gold and base metals (including zinc, copper, nickel and lead) for decades in various geological environments. Geologically the area comprises granites, granodiorite and monzonite with associated continental volcanogenic formations, island arc formations and mafic and felsic intrusives. Currently, over 130 known mineral occurrences occur on the property, and we had selected 2 targets as the focus of our 2009 exploration campaign.

The licence area has a well-developed infrastructure including a network of railways and power lines that service the needs of the entire country and parts of the Urals in neighbouring Russia. Access to any of the exploration prospects is available through the year by sealed, gravel or dirt roads of good quality. Water sources are represented by number of abandoned coaleries and fresh water lakes in vicinity to exploration prospects.

The economy of the region is predicated on mining, power generation and agriculture. Mining consists of giant coal mining at Karaganda, Ekibastuz and Maikube, mining of polymetallic, gold-rich volcanogenic massive sulphide deposits at Abyz, Maikain, Alpys and Souvenir. Roads and trails criss-cross the region to serve the agriculture and mining areas. Numerous high-tension power lines radiate out of several power generation stations in Ekibastuz to serve Kazakhstan and for power export to Russia.

Regional Geology and mineralization

Central Kazakhstan’s geological structure is represented by strong folded and dislocated Cambrian-Ordovician submarine volcanic and sedimentary rocks, covered by Silurian-Devonian sediments and Devonian felsitic volcanic suites with a whole series of stocks, dikes and sills of various ages. Late Paleozoic rocks are represented by Carboniferous and Jurassic marine and continental suites.

Mineral deposits are related in time and space to the various lithologies:

|

|

·

|

Gold-rich volcanogenic massive sulphide deposits associated with Ordovician submarine volcanic rocks.

|

|

|

·

|

Porphyry gold-copper deposits associated with altered sub-volcanic dioritic intrusives presumable of Ordovician age.

|

|

|

·

|

Epithermal gold deposits associated with quartz veins and quartz-sulphide stockworks in Ordovician, Devonian and Permian intrusives of diorite to granite composition.

|

|

|

·

|

Lead-zinc mineralization associated with Silurian-Devonian siltstone and carbonate beds.

|

|

|

·

|

Coal deposits associated with Carboniferous marine and deltaic sedimentary rocks.

|

|

|

·

|

Titanium and zirconium-rich sands in Late Carboniferous beach sands.

|

|

|

·

|

Bauxite and nickel laterite deposits formed from modern weathering of Paleozoic limestones and Cambrian ultramafic rocks.

|

License and Contract commitments

The Maykubinsk Licence (license #785) was for an original area of 14,000 square kilometres (1,400,000ha) in Central Kazakhstan was issued on January 8, 1996. In accordance with new legislation the Maykubinsk Licence was converted on October 11, 2001 to Subsoil Contract # 759 with exploration and mining rights valid until Jan 8 2021. We can extend the mining term until full depletion of mineral resources. The Maykubinsk Licence was issued to Dostyk. The exploration term expired on December 31, 2009, and Dostyk currently submitted to the Kazakhstan Authorities an application for exploration extension until December 2011.

In accordance with Kazakhstan regulations, an exploration ground proved to be barren for further exploration should be returned to the state by end of each year. At the end of 2008, Dostyk had retained 2,774 sq. km (274,400ha) of exploration ground. The remaining territory will be returned to the state by December 2011, except for areas which Dostyk would claim as commercial discoveries i.e. those prospects on which Kazakh style resources of C1-C2 categories would be proved. No maintenance or any other fees and payments are required to retain the Maykubinsk Licence. No production sharing arrangements have been entered into relating to the property controlled by. A royalty interest is payable to be the State once Dostyk goes into production. The royalty rate for mineral deposits in Kazakhstan range from 0.3% to 3.0% in different projects and is subject to a feasibility study and direct negotiations with the State authority. We are the sole owner of Dostyk, i.e. nobody has any claims or interest in Dostyk except for us.

In order to retain exploration and mining rights and to convert the exploration licence/contract into a mining licence Dostyk should by end of the exploration term, December 31, 2010, submit and prove to the State Resources Commission of Kazakhstan a Report of C1-C2 Mineral Resources. By doing so, Dostyk will receive exclusive and irrevocable rights for mining of the mineral resources proved with the government of Kazakhstan.

The surface of the Maykubinsk Licence area is represented by poor-quality pastoral ground with quite spare life stock on it. According to Kazakhstan law, the sub-soil contract prevails above surface agricultural or other facilities. However, Dostyk is required every year to obtain an exploration permit from local authorities.

Exploration Work 2009

The exploration work has been supervised by Kinta’s Mining Management Pty Ltd, an Australian company, providing exploration and mineral resource service in Central Asia.

The quality control of drilling, sampling, assaying has been carried out on site by Micromine Ltd, an Australian Resource company and by Alex Stewart Laboratories, an internationally accredited UK company with laboratory in Kyrgyzstan. Dostyk assays 100% of its samples in this lab.

During the year ended December 31, 2009, we expended $623,794 relating to the Dostyk project.

The funds were spent on the Berezki East Prospect and the Quartzite Gorka Prospect represented by gold-copper porphyry mineralization zones. The main exploration expenditures were diamond drilling (11 drill holes for 3,350 meters) and assays. The breakdown of the costs is shown in the table below.

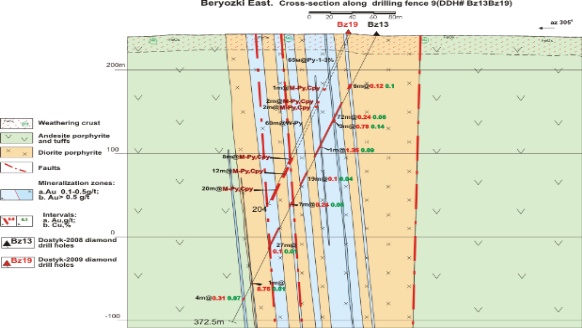

Berezki East Prospect (figures 3 & 4), we continued extension drilling on Northern and Southern flanks targeting deeper levels of mineralization zone. As a result of the 2009 drilling program, the mineralization has been extended on strike for further 340 meters and in depth direction to 300 meters. The total explored length of the zone is 650 meters by average width 25 to 30 meters by grade 1.06g/t of gold and 0.14% of copper.

Figure 3

Figure 4

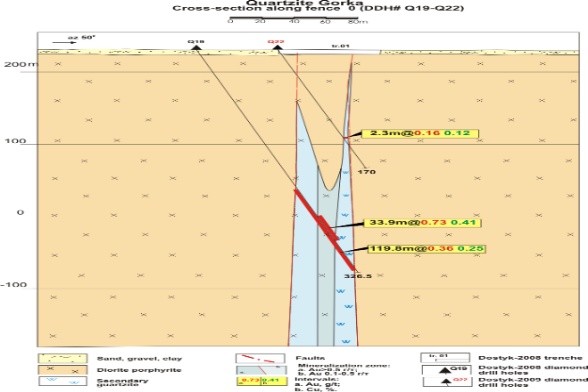

In 2009, we continued the exploration program on the Quartzite Gorka Prospect (figures 5 & 6), targeting the western extension of gold-copper mineralization zone and its extension to depth direction. 5 holes have been drilled for a total of 1,520 meters. The drilling results have revealed a pinch out of mineralization in northwest direction with reduced zone width zone and decreased values of the gold (0.3g/t) and copper (0.1%).

Figure 5

Figure 6

The following tables delineate the work done, and associated costs, for the two properties in 2009:

| Berezki East | |||||

|

Type of work

|

Volume

|

US$

|

|||

|

Drill holes

|

drill holes

|

6

|

|||

|

Meters drilled

|

m

|

1,830

|

183,000

|

||

|

samples treatment

|

sample

|

1,750

|

|||

|

Fire assays

|

assay

|

1,710

|

41,000

|

||

|

IP assays

|

assay

|

1,050

|

|||

|

Metallurgical test

|

34,000

|

||||

|

Data processing & administration

|

59,000

|

||||

|

Wages -geological staff

|

49,000

|

||||

|

Berezki East total

|

366,000

|

||||

|

Budget 2010

|

3 drill holes for 1300m, 1,100 assays

|

200,000

|

|||

| Quartzite Gorka | |||||

|

Type of work

|

Volume

|

US$

|

|||

|

Drill holes

|

drill holes

|

5

|

|

||

|

Meters drilled

|

m

|

1,520

|

152,000

|

||

|

Samples treatment

|

sample

|

1,430

|

|||

|

Fire assays

|

assay

|

1,400

|

22,000

|

||

|

IP assays

|

assay

|

1,050

|

|||

|

Data processing & administration

|

61,000

|

||||

|

Wages - geological staff

|

48,000

|

||||

|

Quartzite Gorka total

|

283,000

|

||||

|

Budget 2010

|

4 drill holes for 1400m, 1,200 assays

|

300,000

|

|||

During December 2009, we agreed to sell its ownership interest in its Kazakhstan subsidiary to a third party for $1,500,000. The only significant asset owned by the subsidiary is the mineral exploration license described in these financial statements. The agreement for the sale of the subsidiary for less than the $2,509,597 carrying value of the subsidiaries’ mineral property was an indication that the value of the mineral property has been impaired and capitalized costs of $1,009,597 were written off in 2009. The sale was concluded in 2010 and the purchase price of $1,500,000 was received in 2010.

Current Properties

Mexico

We hold six (6) mining concessions located in Guerrero State, Mexico. They are 100% owned by our Mexican subsidiary, Exploraciones Cigma, S.A. de C.V. The concessions define two Projects, the El Violín Project and the Pinzan Morado Project. The El Violín Project is centered on geographic co-ordinates 99º18’W, 17º20’ N and has a surface area of 4098 hectares. It is located 230 km south-southeast of Mexico City, D.F., and about 30 km southeast of Chilpancingo de Los Bravos, the State capital. The Pinzan Morado Project is centered on geographic co-ordinates 100º49’W, 18º18’ N, has a surface area of 91,559 hectares and is located 165 km northwest of Chilpancingo.

Mining Concessions that define the “El Violín” Project, Municipios of Mochitlán and Quechultenango, Guerrero, Mexico (1:50,000 INEGI map sheets E14C38, E14C39).

|

Concession

|

Title Number

|

File Number

|

Title Date

|

Surface area in Ha.

|

|

|

La Huerta

|

231940

|

033/09856

|

05/23/08

|

1470.0246

|

|

|

La Pastoria

|

232204

|

033/09857

|

07/04/08

|

1207.8195

|

|

|

Lupita

|

232725

|

033/09832

|

10/15/08

|

1420.1978

|

|

|

Total

|

4098.0419

|

||||

Mining Concessions that define the “Pinzan Morado” Project, Municipios of Coyuca de Catalán and Zirándaro Guerrero, Mexico (1:50 000 INEGI map sheets E14A74, E14A84). The concessions are subject to a 1.5% NSR, payable to Exploraciones La Plata, S.A. de C.V., the Mexican subsidiary of Alphamin.

|

Concession

|

Title Number

|

File Number

|

Title Date

|

Surface area in Ha.

|

|

|

Aurora II

|

235480

|

033/09795

|

12/04/09

|

1946.6488

|

|

|

Aurora

|

238662

|

033/09787

|

10/11/11

|

89558.6322

|

|

|

Aurora Fraccion I

|

238663

|

033/09787

|

10/11/11

|

54.1121

|

|

|

Total

|

91,559.3931

|

||||

El Violín

El Violín overlaps part of the Mixteca Terrane of Southern Mexico. The basement of the Mixteca Terrane is the polydeformed Paleozoic Acatlán Metamorphic Complex. The metamorphic rocks are unconformably overlain by the Middle Jurassic Chapolapa Formation which consists of two members: (i) the Green Member, mainly consisting of andesitic volcanic rocks, and (ii) the Purple Member which consists of conglomerates, breccias, rhyolite tuff-breccias, dacite, zinc-rich massive sulfides, iron formations, slate and sandstone. The Purple Member grades upwards and laterally into Tecocoyunca Group sediments, consisting of conglomerate, redbed sandstone and mudstone. The Middle Jurassic rocks are unconformably overlain by conglomerates, limestones, sandstones and tuffs of the Early Cretaceous Zicapa Formation. These grade upwards into reef limestones of the Morelos Formation. Uplift in the latest Cretaceous-Tertiary resulted in deposition of Mexcala red bed sediments unconformably on top of the Morelos Limestone, and intrusion of continental granites with their related porphyry systems.

In 2001, the Servicio Geologico Mexicano published 1:50,000 geological maps and geochemical surveys for 1:50,000 maps E14C38 and E14C39. In 2007, El Violín Project was explored by Alphamin for porphyry systems (Lupita concession) and zinc-rich massive sulfide deposits (La Huerta and Pastoría concessions). Work completed includes stream sediment geochemistry, soil geochemistry, prospecting and rock geochemistry. Prior to the financial crisis of 2008, several promising targets for further exploration, including drilling, were identified.

Pinzan Morado