N-14

As filed with the Securities and Exchange Commission on June 30, 2017

Securities Act File No. 333-_________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-14

|

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 |

X |

|

|

|

|

Pre-Effective Amendment No. |

|

|

|

|

|

Post-Effective Amendment No. |

|

Viking Mutual Funds

(Exact name of Registrant as Specified in Charter)

|

1 North Main Street, Minot, North Dakota |

|

58703 |

|

(Address of principal offices) |

|

(Zip code) |

Registrant’s Telephone Number, Including Area Code 701-852-5292

Shannon D. Radke, 1 North Main Street, Minot, ND 58703

(Name and Address of Agent for Service)

With Copies to:

Deborah B. Eades, Vedder Price, P.C., 222 North LaSalle Street, Suite 2600, Chicago, Illinois 60603

Approximate Date of Proposed Public Offering As soon as practicable after this Registration Statement becomes effective under the Securities Act of 1933, as amended

Title of Securities Being Registered: Class A Shares of beneficial interest with a par value of $0.001 per share of the Kansas Municipal Fund, Maine Municipal Fund, Nebraska Municipal Fund, New Hampshire Municipal Fund, and Oklahoma Municipal Fund, each a series of the Registrant.

It is proposed that this filing will become effective on July 30, 2017 pursuant to Rule 488 under the Securities Act of 1933, as amended.

No filing fee is required because of reliance on Section 24(f) and an indefinite number of shares have previously been registered pursuant to Rule 24f-2 under the Investment Company Act of 1940.

Integrity managed portfolios

Kansas Municipal Fund

Maine Municipal Fund

Nebraska Municipal Fund

New Hampshire Municipal Fund

Oklahoma Municipal Fund

(each, a “Fund” and collectively, the “Funds”)

One Main

Street North

Minot, North Dakota 58703

800-601-5593

July [•], 2017

Dear Shareholder:

On behalf of the Board of Trustees of Integrity Managed Portfolios, a Massachusetts business trust (the “Integrity Trust”), we are pleased to invite you to a joint special meeting of shareholders (the “Special Meeting”) of the Funds to be held on Thursday, September 21, 2017 at 3 p.m., Central Time, at the offices of the Integrity Trust, One Main Street North, Minot, North Dakota, 58703.

At the Special Meeting, you will be asked to approve an Agreement and Plan of Reorganization by and between the Integrity Trust, on behalf of your Fund, and Viking Mutual Funds, a Delaware statutory trust (the “Viking Trust”), pursuant to which your Fund will change its domicile from a series of a Massachusetts business trust to a series of a Delaware statutory trust (each, a “Reorganization” and collectively, the “Reorganizations”) through a reorganization into a corresponding series of Viking Mutual Funds. The purpose of the Reorganizations is to consolidate all municipal funds managed by Viking Fund Management, LLC under a single corporate entity and to standardize disclosure of such funds.

Your Fund’s portfolio managers, service providers, fee and expense structure, and net asset value will not change as a result of the Reorganizations. The costs of the Reorganizations will not be borne by the Funds or their shareholders. Each Reorganization is intended to qualify as a tax-free reorganization for federal income tax purposes. Accordingly, shareholders are not expected to recognize any gain or loss for federal income tax purposes as a direct result of the Reorganization of their Fund.

The Board of Trustees of the Integrity Trust believes that the proposed Reorganization for Each Fund is in the best interests of each Fund and recommends that you vote FOR the proposed Reorganization of your Fund.

We have enclosed a Joint Proxy Statement/Prospectus that describes each Reorganization proposal in greater detail, as well as important information about the Viking Trust and the new series established to effect the Reorganizations. Your vote is extremely important, so please read the entire Joint Proxy Statement/Prospectus and then complete, sign and date the enclosed proxy card and return it in the enclosed postage-paid return envelope. Alternatively, you may vote by telephone, facsimile or via the Internet. Please contact Integrity Fund Services, LLC (shareholder services) at (800) 601-5593 or (701) 857-0230 with any questions. You may also vote in person at the Special Meeting.

Your Vote Is Important. If we do not hear from you after a reasonable amount of time, you may receive a telephone call reminding you to vote your shares.

We appreciate your participation and urge you to cast your vote as soon as possible. Thank you for your consideration of this important proposal.

|

|

Sincerely, /s/Shannon D. Radke |

Integrity managed portfolios

Kansas Municipal Fund

Maine Municipal Fund

Nebraska Municipal Fund

New Hampshire Municipal Fund

Oklahoma Municipal Fund

(each, a “Fund” and collectively, the “Funds”)

One Main Street North

Minot, North Dakota 58703

800-601-5593

NOTICE OF JOINT SPECIAL MEETING OF SHAREHOLDERS

To be held on September 21, 2017

NOTICE IS HEREBY GIVEN that a joint special meeting of shareholders of the Funds will be held on Thursday, September 21, 2017, at 3 p.m., Central Time, at the offices of Integrity Managed Portfolios (the “Integrity Trust”), One Main Street North, Minot, North Dakota, 58703, and any adjournment or postponement thereof (the “Special Meeting”).

At the Special Meeting, shareholders of each Fund will be asked to consider a proposal to change its domicile through approval of an Agreement and Plan of Reorganization (the “Plan”) by and between the Integrity Trust, on behalf of the Fund, and Viking Mutual Funds, a Delaware statutory trust, on behalf of a newly formed series corresponding to such Fund (each, a “Reorganization” and collectively, the “Reorganizations”).

The enclosed materials, including the Joint Proxy Statement/Prospectus, provide additional information about the Reorganizations. A form of the Plan is attached as Exhibit A to the Joint Proxy Statement/Prospectus. This notice and related Joint Proxy Statement/Prospectus are first being mailed to shareholders of each Fund on or about August 8, 2017. Shareholders of record of each Fund as of the close of business on July 25, 2017 are entitled to receive notice of and to vote at the Special Meeting and at any adjournment(s) or postponement(s) thereof. Shareholders may vote in person or by proxy.

Even if you expect to attend the Special Meeting, shareholders are requested to complete, sign, date and return the enclosed proxy card in the enclosed envelope, which needs no postage if mailed in the United States. Shareholders may also authorize a proxy by telephone, facsimile or via the Internet. Instructions for the proper execution of the proxy card are set forth immediately following this notice or, with respect to telephone, facsimile or Internet voting, on the enclosed proxy card. It is important that you vote promptly.

Important Notice Regarding the Availability of Proxy Materials for the Special Meeting to be held on September 21, 2017: The Notice of Joint Special Meeting of Shareholders, Joint Proxy Statement/Prospectus, annual and semi-annual reports and form of proxy are available on the Internet at integrityvikingfunds.com/Documents. For more information, shareholders may contact Integrity Managed Portfolios at 800-276-1262.

|

|

By Order of the Board of Trustees of Integrity Managed Portfolios Brent M. Wheeler |

INSTRUCTIONS FOR SIGNING PROXY CARDS

The following general rules for signing proxy cards may be of assistance to you and avoid the time and expense in validating your vote if you fail to sign your proxy card properly.

1. Individual Accounts: Sign your name exactly as it appears in the registration on the proxy card.

2. Joint Accounts: Either party may sign, but the name of the party signing should conform exactly to the name shown in the registration on the proxy card.

3. All Other Accounts: The capacity of the individual signing the proxy card should be indicated unless it is reflected in the form of registration. For example:

|

Registration |

Valid Signature |

|

Corporate Accounts |

|

|

(1) ABC Corp................................................................................................... |

ABC Corp. |

|

(2) ABC Corp................................................................................................... |

John Doe, Treasurer |

|

(3) ABC Corp. c/o John Doe, Treasurer...................................................... |

John Doe |

|

(4) ABC Corp. Profit Sharing Plan............................................................... |

John Doe, Trustee |

|

Trust Accounts |

|

|

(1) ABC Trust................................................................................................... |

Jane B. Doe, Trustee |

|

(2) Jane B. Doe, Trustee u/t/d 12/28/78...................................................... |

Jane B. Doe |

|

Custodial or Estate Accounts |

|

|

(1) John B. Smith, Cust. f/b/o John B. Smith, Jr. UGMA......................... |

John B. Smith |

|

(2) Estate of John B. Smith........................................................................... |

John B. Smith, Jr., Executor |

Every shareholder’s vote is important!

Please complete, sign, date and return your

proxy card today!

Your proxy vote is important!

The information in this Joint Proxy Statement/Prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the U.S. Securities and Exchange Commission is effective. This Joint Proxy Statement/Prospectus is not an offer to sell these securities, and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion—Dated: June 30, 2017

JOINT PROXY STATEMENT OF

INTEGRITY MANAGED PORTFOLIOS

Kansas Municipal Fund

Maine Municipal Fund

Nebraska Municipal Fund

New Hampshire Municipal Fund

Oklahoma Municipal Fund

(each, a “Fund” and collectively, the “Funds”)

One Main Street North

Minot, North Dakota 58703

800-601-5593

and

PROSPECTUS OF

VIKING MUTUAL FUNDS

One Main Street North

Minot, North Dakota 58703

800-601-5593

July [•], 2017

This Joint Proxy Statement/Prospectus is being furnished to shareholders of the Funds. Each Fund is series of Integrity Managed Portfolios, a Massachusetts business trust (the “Integrity Trust”). The Board of Trustees of the Integrity Trust has called a joint special meeting of shareholders of the Funds to be held at the offices of the Integrity Trust, One Main Street North, Minot, North Dakota, 58703, on September 21, 2017 at 3 p.m., Central time, and any adjournment or postponement thereof (the “Special Meeting”). This Joint Proxy Statement/Prospectus and the enclosed proxy are first being sent to shareholders of the Funds on or about August 8, 2017.

Shareholders of record of each Fund as of the close of business on July 25, 2017 (the “Record Date”) are entitled to notice of and are eligible to vote at the Special Meeting. At the Special Meeting, shareholders of each Fund will be asked to consider a proposal to change its domicile (each a “Reorganization” and collectively, the “Reorganizations”) through approval of an Agreement and Plan of Reorganization (the “Plan”) by and between the Integrity Trust, on behalf of the Fund, and Viking Mutual Funds, a Delaware statutory trust (the “Viking Trust”), on behalf of a newly formed series corresponding to such Fund (each, a “Successor Fund” and collectively, the “Successor Funds”). The purpose of the Reorganizations is to consolidate the municipal funds managed by Viking Fund Management, LLC (“Viking Management” or the “Adviser”) under a single entity for consistency and administrative efficiency. As part of the Reorganizations, the investment policies, restrictions and disclosure of the Funds will be standardized and aligned with those of the other municipal funds managed by the Adviser. Your Fund’s portfolio managers or management of your Fund will not change as a result of the Reorganizations and standardization of policies and disclosure. Your Fund’s service providers and fee and expense structure will remain the same.

The Reorganizations are expected to be completed on October 27, 2017, or as soon as practicable thereafter.

The Board of Trustees of the Integrity Trust and the Viking Trust is comprised of the same individual board members (the “Board of Trustees” or the “Board”). At a joint meeting held on May 18, 2017, the Board of Trustees of the Integrity Trust and the Viking Trust approved the Plan. A form of the Plan is included as Exhibit A to this Joint Proxy Statement/Prospectus.

This Joint Proxy Statement/Prospectus, which you should read carefully and retain for future reference, presents the information that you should know about the Funds and the Reorganizations. This document also serves as a prospectus for the offering and issuance of the shares of each Successor Fund to be issued in the Reorganizations. The Statement of Additional Information (“SAI”) dated July [·], 2017 relating to this Joint Proxy Statement/Prospectus and the Reorganizations has been filed with the U.S. Securities and Exchange Commission (the “SEC”) and is incorporated by reference into this Joint Proxy Statement/Prospectus (meaning that it is legally considered to be part of this Joint Proxy Statement/Prospectus).

Additional information concerning the Funds is contained in the documents described below, all of which have been filed with the SEC. Each document is incorporated by reference into this Joint Proxy Statement/Prospectus only insofar as it relates to the Funds. No other parts of such documents are incorporated by reference herein. The series of the Viking Trust being established for the purposes of completing the Reorganizations have not yet commenced operations as of the date of this Joint Proxy Statement/Prospectus.

|

Information About the Funds: |

How to Obtain this Information: |

|

Prospectus, dated November 30, 2016, as supplemented through the date of this Joint Proxy Statement/Prospectus (File Nos. 811-06153; 033-36324) |

On file with the SEC (www.sec.gov) (Accession No. 0000866841-16-000094 filed November 28, 2016) |

|

Statement of Additional Information, dated November 30, 2016, as supplemented through the date of this Joint Proxy Statement/Prospectus (File Nos. 811-06153; 033-36324) |

On file with the SEC (www.sec.gov) (Accession No. 0000866841-16-000094 filed November 28, 2016) |

|

Annual Report for Integrity Managed Portfolios, for the fiscal year ended July 31, 2016 (File Nos. 811-06153) |

On file with the SEC (www.sec.gov) (Accession No. 0000866841-16-000087 filed October 3, 2016) |

|

Semi-Annual Report for Integrity Managed Portfolios, for the period ended January 31, 2017 (File Nos. 811-06153) |

On file with the SEC (www.sec.gov) (Accession No. 0000866841-17-000015 filed April 6, 2017) |

You can also obtain copies of any of the above-referenced documents without charge on the EDGAR database on the SEC’s Internet site at http://www.sec.gov. Copies are available for a fee by electronic request at the following e-mail address: publicinfo@sec.gov, or from the Public Reference Section, Securities and Exchange Commission, Washington, D.C. 20549-1520. Copies of above-referenced documents relating to the Funds may also be obtained upon oral or written request without charge by calling 800-601-5593, on the Funds’ website at integrityvikingfunds.com/Documents or by writing to Integrity Managed Portfolios at P.O. Box 759, Minot, ND 58702.

THE SECURITIES AND EXCHANGE COMMISSION HAS NOT DETERMINED THAT THE INFORMATION IN THIS JOINT PROXY STATEMENT/PROSPECTUS IS ACCURATE OR ADEQUATE, NOR HAS IT APPROVED OR DISAPPROVED THESE SECURITIES. ANYONE WHO TELLS YOU OTHERWISE IS COMMITTING A CRIMINAL OFFENSE.

|

TABLE OF CONTENTS |

|

|

|

|

|

|

Page |

|

Synopsis |

1 |

|

Principal Risks |

10 |

|

Information About the Reorganizations |

15 |

|

The Funds’ Management |

20 |

|

Investing in the Funds |

23 |

|

Shareholders’ Rights |

26 |

|

Voting Information Concerning the Joint Special Meeting |

32 |

|

Additional Information About the Funds’ Investment Strategies |

34 |

|

Fund Shares |

35 |

|

How to Buy Fund Shares |

38 |

|

How to Sell Fund Shares |

43 |

|

Fund Account Policies |

45 |

|

Dealer Compensation |

48 |

|

Certain Fees Paid to Financial Intermediaries |

49 |

|

Distributions and Taxes |

50 |

|

Additional Information |

53 |

|

Financial Statements and Experts |

56 |

|

Financial Highlights |

56 |

|

EXHIBIT A: Form of Agreement and Plan of Reorganization |

A-1 |

|

EXHIBIT B: Fundamental Investment Restrictions |

B-1 |

|

EXHIBIT C: Control Persons and Principal Holders of Securities |

C-1 |

This Synopsis provides a brief overview of the key features of the Reorganizations, the Funds and the Successor Funds. The Synopsis is qualified in its entirety by the more detailed information contained in the remainder of this Joint Proxy Statement/Prospectus, which you should read carefully and retain for future reference, and in the documents incorporated by reference herein. The description of the Reorganizations is qualified by reference to the full text of the Agreement and Plan of Reorganization, a form of which is included as Exhibit A to this Joint Proxy Statement/Prospectus.

Background

The Integrity Trust and the Viking Trust are part of the Integrity Viking Funds complex, which includes (1) the Funds and the Successor Funds; (2) two series of Viking Mutual Funds; and (3) five series of The Integrity Funds (collectively, the “Integrity/Viking Funds”), each of which are managed by Viking Management. The Integrity Trust and Viking Trust have the same Board of Trustees and officers. The Adviser and its affiliates provide investment advisory, distribution, fund administration and transfer agency services to all of the Integrity/Viking Funds. The Integrity Trust became part of the Integrity Viking Funds complex in July 2009 and was previously managed by Integrity Money Management Inc. The Integrity Trust is a Massachusetts business trust, while the Viking Trust is a Delaware statutory trust. Because the Integrity Trust and the Viking Trust were originally parts of different legacy organizations, there are differences in the governing documents applicable to each Trust, as well as differences in the wording of the investment policies, restrictions, and disclosure applicable to Funds, which are part of the Integrity Trust, and the other municipal funds managed by the Adviser, which are part of the Viking Trust. The Adviser and the Board of the Integrity Trust and the Viking Trust believe it is desirable to consolidate all of the municipal funds managed by the Adviser under a single corporate entity and to standardize the investment policies, restrictions and disclosures of the municipal funds managed by the Adviser.

At the Special Meeting, shareholders will be asked to approve an Agreement and Plan of Reorganization by and between the Integrity Trust, on behalf of your Fund, and the Viking Trust, on behalf the corresponding Successor Fund, pursuant to which your Fund will change its domicile from a series of a Massachusetts business trust to a series of a Delaware statutory trust through a reorganization into a corresponding series of the Viking Trust (each, a “Reorganization” and collectively, the “Reorganizations”). The purpose of the Reorganizations is to consolidate all municipal funds managed by the Adviser under a single corporate entity and to standardize disclosure of such funds in order to achieve operational and administrative efficiencies.

Fees and Expenses

The tables below describe the fees and expenses that you may pay if you buy and hold shares of each Fund, currently and as a series of the Viking Trust following the Reorganization. The Successor Funds will continue the operations of the Funds in all respects and there will be no changes in fees and expenses as a result of the Reorganizations.

No sales charge will be imposed on the Class A shares of the Successor Fund received in connection with the Reorganization. In addition, you may qualify for sales charge discounts for Class A shares if you and your family invest, or agree to invest in the future, at least $100,000 or more in the Funds. More information about these and other discounts is available from your financial professional and in the sections entitled “Fund Shares” on page [•] of this Joint Proxy Statement/Prospectus and “Buying and Selling Shares” on page [·] of the SAI relating to this Joint Proxy Statement/Prospectus.

SHAREHOLDER FEES

(fees paid directly from your investment)

|

|

Kansas Municipal Fund (Current; Post Reorganization) |

Maine Municipal Fund (Current; Post Reorganization) |

Nebraska Municipal Fund (Current; Post Reorganization) |

New Hampshire Municipal Fund (Current; Post Reorganization) |

Oklahoma Municipal Fund (Current; Post Reorganization) |

|

|

|

|

|

|

|

|

Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of the offering price) (1) |

2.50% |

2.50% |

2.50% |

2.50% |

2.50% |

|

Maximum Deferred Sales Charge (Load) (as a percentage of the lesser of purchase price or redemption proceeds for purchases of $500,000 or more) (2) |

1.00% |

1.00% |

1.00% |

1.00% |

1.00% |

|

Maximum Sales Charge (Load) Imposed on Reinvested Dividends |

None |

None |

None |

None |

None |

|

Redemption Fee (as a percentage of amount redeemed, if applicable) |

None |

None |

None |

None |

None |

|

Exchange Fee |

None |

None |

None |

None |

None |

ANNUAL FUND OPERATING EXPENSES

(expenses that you pay each year as a percentage of the value of your investment)

|

|

Kansas Municipal Fund (Current; Post Reorganization) |

Maine Municipal Fund (Current; Post Reorganization) |

Nebraska Municipal Fund (Current; Post Reorganization) |

New Hampshire Municipal Fund (Current; Post Reorganization) |

Oklahoma Municipal Fund (Current; Post Reorganization) |

|

|

|

|

|

|

|

|

Management Fees |

0.50% |

0.50% |

0.50% |

0.50% |

0.50% |

|

Distribution and Service (12b-1) Fees |

0.25% |

0.25% |

0.25% |

0.25% |

0.25% |

|

Other Expenses |

0.43% |

0.54% |

0.45% |

0.92% |

0.44% |

|

Acquired Fund Fees and Expenses(3) |

0.00% |

0.01% |

0.01% |

0.01% |

0.00% |

|

Total Annual Fund Operating Expenses |

1.18% |

1.30% |

1.21% |

1.68% |

1.19% |

|

Fee Waivers and Expense Reimbursements(4) |

(0.20)% |

(0.31)% |

(0.22)% |

(0.69)% |

(0.21)% |

|

Total Annual Fund Operating Expenses (after Fee Waivers and Expense Reimbursements)(4) |

0.98% |

0.99% |

0.99% |

0.99% |

0.98% |

|

|

|

|

|

(1) |

No sales charge will be imposed on the Class A shares of the Successor Fund received in connection with the Reorganization. |

|

|

|

|

|

|

(2) |

A deferred sales charge of 1% applies to certain redemptions of Class A shares made within twenty-four months of purchase if the shares were purchased without an initial sales charge as part of an investment of $500,000 or more. If you hold load-waived Class A shares of the Fund, the Successor Fund will look to the date of purchase of your Fund shares for purposes of assessing deferred sales charges on shares received in the Reorganization. |

|

|

|

|

|

|

(3) |

The Total Annual Fund Operating Expenses may not correlate with the ratio of expenses to average net assets in the Fund’s financial highlights, which reflect the operating expenses of the Fund and do not include acquired fund fees and expenses. |

|

|

|

|

|

|

(4) |

The Adviser has contractually agreed to waive its management fee and reimburse expenses (other than taxes, brokerage fees, commissions, extraordinary or non-recurring expenses and acquired fund fees and expenses) through November 29, 2018 so that the net annual operating expenses of the Fund do not exceed 0.98% of the Fund’s average daily net assets. This expense limitation agreement may only be terminated or modified prior to November 29, 2018 with the approval of the Fund’s Board of Trustees. |

|

Expense Examples. The examples below are intended to help you compare the cost of investing in the Fund, currently and as a series of the Viking Trust following the Reorganization. The Successor Fund is a continuation of the Fund; there are no changes in fees and expenses. The examples assume that you invest $10,000 in each Fund and then sell all of your shares at the end of each period indicated below. The examples also assume that your investment has a 5% annual return, that operating expenses (before fee waivers and expense reimbursements) remain the same and the expense limitation agreement for the Successor Fund will be in place for the first year. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

|

If shares are redeemed: |

1 Year |

3 Years |

5 Years |

10 Years |

|

Kansas Municipal Fund |

$348 |

$602 |

$882 |

$1,713 |

|

Maine Municipal Fund |

$349 |

$629 |

$937 |

$1,853 |

|

Nebraska Municipal Fund |

$349 |

$609 |

$896 |

$1,749 |

|

New Hampshire Municipal Fund |

$349 |

$710 |

$1,109 |

$2,293 |

|

Oklahoma Municipal Fund |

$348 |

$604 |

$886 |

$1,725 |

Fund Performance

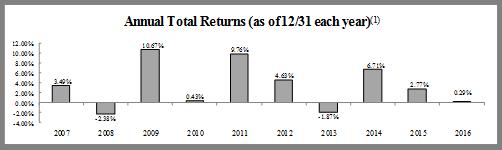

Each Successor Fund is newly created solely for the purpose of completing the Reorganization, and therefore has no performance history. The existing Funds will be the accounting and performance survivor of the Reorganization, and each Successor Fund will adopt the corresponding Fund’s performance history. The bar charts and the performance tables below provide some indication of the risks of an investment in a Successor Fund by showing how the existing Fund’s performance has varied from year to year and by showing how the Fund’s average annual returns compare with a broad measure of market performance. The bar chart and the highest/lowest quarterly returns that follow do not reflect the Fund’s sales charges, and if these charges were reflected, the returns would be less than those shown. The Fund’s past performance, before and after taxes, does not necessarily represent how the Successor Fund will perform in the future. Updated performance information for the Funds is available on the Funds’ website at integrityvikingfunds.com or by calling 800-276-1262.

Kansas Municipal Fund

|

|

|

|

|

(1) |

The Fund’s calendar year-to-date total return as of March 31, 2017 was 0.89%. |

|

|

Best Quarter (3rd Quarter, 2009): 5.10% |

Worst Quarter (4th Quarter, 2010): (3.97%) |

Average Annual Total Returns

For the periods ended December 31, 2016

|

Kansas Municipal Fund |

1 Year |

5 Years |

10 Years |

|

Return before taxes |

(2.21%) |

1.94% |

3.10% |

|

Return after taxes on distributions |

(2.21%) |

1.94% |

3.10% |

|

Return after taxes on distributions and sale of fund shares |

(1.01%) |

2.16% |

3.14% |

|

Bloomberg Barclays Capital Municipal Bond Index(1) (reflects no deduction for fees, expenses or taxes) |

0.25% |

3.28% |

4.25% |

|

|

|

|

|

(1) |

The Bloomberg Barclays Capital Municipal Bond Index is an unmanaged index that includes investment-grade, tax-exempt, and fixed-rate bonds with maturities greater than two years selected from issues larger than $75 million. |

|

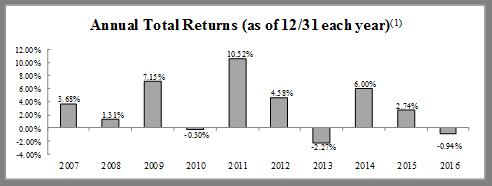

Maine Municipal Fund

|

|

|

|

|

(1) |

The Fund’s calendar year-to-date total return as of March 31, 2017 was 0.50%. |

|

|

Best Quarter (3rd Quarter, 2009): 4.22% |

Worst Quarter (4th Quarter, 2010): (4.95%) |

Average Annual Total Returns

For the periods ended December 31, 2016

|

Maine Municipal Fund |

1 Year |

5 Years |

10 Years |

|

Return before taxes |

(3.46%) |

1.45% |

2.92% |

|

Return after taxes on distributions |

(3.45%) |

1.45% |

2.92% |

|

Return after taxes on distributions and sale of fund shares |

(1.01%) |

2.16% |

3.14% |

|

Bloomberg Barclays Capital Municipal Bond Index(1) (reflects no deduction for fees, expenses or taxes) |

0.25% |

3.28% |

4.25% |

|

|

|

|

|

(1) |

The Bloomberg Barclays Capital Municipal Bond Index is an unmanaged index that includes investment-grade, tax-exempt, and fixed-rate bonds with maturities greater than two years selected from issues larger than $75 million. |

|

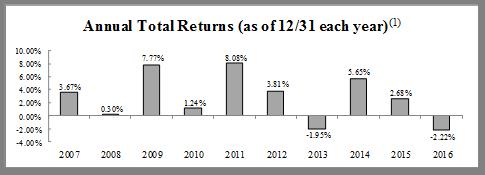

Nebraska Municipal Fund

|

|

|

|

|

(1) |

The Fund’s calendar year-to-date total return as of March 31, 2017 was 0.78%. |

|

|

Best Quarter (3rd Quarter, 2009): 5.04% |

Worst Quarter (4th Quarter, 2010): (4.00%) |

Average Annual Total Returns

For the periods ended December 31, 2016

|

Nebraska Municipal Fund |

1 Year |

5 Years |

10 Years |

|

Return before taxes |

(3.07%) |

1.91% |

2.98% |

|

Return after taxes on distributions |

(3.06%) |

1.91% |

2.98% |

|

Return after taxes on distributions and sale of fund shares |

(1.73%) |

2.11% |

3.02% |

|

Bloomberg Barclays Capital Municipal Bond Index(1) (reflects no deduction for fees, expenses or taxes) |

0.25% |

3.28% |

4.25% |

|

|

|

|

|

(1) |

The Bloomberg Barclays Capital Municipal Bond Index is an unmanaged index that includes investment-grade, tax-exempt, and fixed-rate bonds with maturities greater than two years selected from issues larger than $75 million. |

|

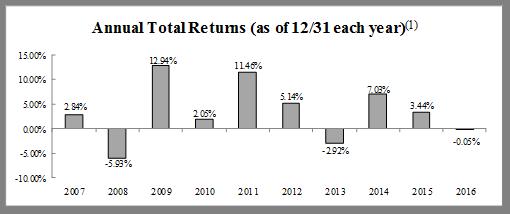

New Hampshire Municipal Fund

|

|

|

|

|

(1) |

The Fund’s calendar year-to-date total return as of March 31, 2017 was 0.51%. |

|

|

Best Quarter (3rd Quarter, 2009): 4.34% |

Worst Quarter (4th Quarter, 2016): (4.60%) |

Average Annual Total Returns

For the periods ended December 31, 2016

|

New Hampshire Municipal Fund |

1 Year |

5 Years |

10 Years |

|

Return before taxes |

(4.68%) |

1.03% |

2.59% |

|

Return after taxes on distributions |

(4.67%) |

1.03% |

2.59% |

|

Return after taxes on distributions and sale of fund shares |

(3.05%) |

1.36% |

2.64% |

|

Bloomberg Barclays Capital Municipal Bond Index(1) (reflects no deduction for fees, expenses or taxes) |

0.25% |

3.28% |

4.25% |

|

|

|

|

|

(1) |

The Bloomberg Barclays Capital Municipal Bond Index is an unmanaged index that includes investment-grade, tax-exempt, and fixed-rate bonds with maturities greater than two years selected from issues larger than $75 million. |

|

Oklahoma Municipal Fund

|

|

|

|

|

(1) |

The Fund’s calendar year-to-date total return as of March 31, 2017 was 0.85%. |

|

|

Best Quarter (3rd Quarter, 2009): 6.77% |

Worst Quarter (3rd Quarter, 2008): (4.94%) |

Average Annual Total Returns

For the periods ended December 31, 2016

|

Oklahoma Municipal Fund |

1 Year |

5 Years |

10 Years |

|

Return before taxes |

(2.53%) |

1.94% |

3.18% |

|

Return after taxes on distributions |

(2.53%) |

1.94% |

3.18% |

|

Return after taxes on distributions and sale of fund shares |

(1.36%) |

2.09% |

3.16% |

|

Bloomberg Barclays Capital Municipal Bond Index(1) (reflects no deduction for fees, expenses or taxes) |

0.25% |

3.28% |

4.25% |

|

|

|

|

|

(1) |

The Bloomberg Barclays Capital Municipal Bond Index is an unmanaged index that includes investment-grade, tax-exempt, and fixed-rate bonds with maturities greater than two years selected from issues larger than $75 million. |

|

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. The return after taxes on distributions and sale of Fund shares may exceed the return before taxes due to an assumed tax benefit from any losses on a sale of Fund shares at the end of the measurement period. If you hold your Fund shares through a tax-advantaged arrangement, such as an individual retirement account or a 401(k) plan, the after-tax returns do not apply to your situation.

Investment Process and Risks

As discussed above, the purpose of the Reorganizations is to conform the disclosure of the principal investment strategies, principal risks, investment restrictions and other disclosures of the municipal funds managed by the Adviser. The investment objective and principal investment strategies of each Successor Fund are described below, which are substantially the same as the existing Fund’s investment objective and strategies except as noted. References to state personal income taxes refer to the state set forth in each Fund’s name.

Investment Objective. Each Successor Fund seeks the highest level of current income that is exempt from federal and the applicable state’s personal income taxes and is consistent with preservation of capital, except the New Hampshire Municipal Fund, which seeks the highest level of current income that is exempt from federal and New Hampshire state interest and dividend tax and is consistent with the preservation of capital. With respect to the existing Maine Municipal Fund and the existing New Hampshire Municipal Fund, such income need not be exempt from the alternative minimum tax.

Principal Investment Strategies. To pursue its objective, each Successor Fund normally invests at least 80% of its net assets (including any borrowings for investment purposes) in municipal securities that pay interest free from (a) federal income tax, including the federal alternative minimum tax, and (b) state personal income taxes. The existing Funds may invest without limit in securities subject to the alternative minimum tax but have not historically invested in such securities to any greater extent than other municipal funds managed by the Adviser.

Municipal bonds are debt securities issued by or on behalf of states, territories, and possessions of the United States and their political subdivisions, agencies, authorities, and instrumentalities. The two general classifications of municipal bonds are “general obligation” and “revenue” bonds. General obligation bonds are secured by the issuer’s pledge of its faith, credit, and taxing power for the payment of principal and interest. Revenue bonds are payable only from the revenues derived from a particular facility or class of facilities or, in some cases, from the proceeds of a special excise tax or other specific revenue source.

The investment manager actively manages the Funds’ portfolios by selecting securities that it believes will provide the best balance between risk and return within a Fund’s range of allowable investments. The investment manager will consider selling a security with deteriorating credit or limited upside potential compared to other available bonds.

The Successor Funds may invest up to 30% of net assets in U.S. territorial obligations (including qualifying obligations of Puerto Rico, the U.S. Virgin Islands, and Guam), the interest on which is exempt from federal and state personal income taxes. The existing Kansas Fund and Nebraska Fund may each invest up to 15% of net assets in such obligations.

The Successor Funds may invest up to 20% of net assets in private activity bonds (which are revenue bonds that finance privately operated facilities), the interest on which is a tax preference item for purposes of the federal alternative minimum tax. The Successor Fund may invest more than 25% of its net assets in municipal securities that finance similar types of projects, such as education, healthcare, housing, industrial development, transportation, utilities, or pollution control. Economic, business, political, or other changes can affect all securities of a similar type.

Currently, each existing Fund will not invest more than 10% of its net investment assets in municipal securities that represent lease obligations. The Successor Funds are not subject to this restriction.

All of the municipal securities in which the Successor Funds invest are rated investment grade (BBB- or higher) at the time of purchase by a nationally recognized statistical rating service such as S&P Global Ratings or Moody’s Investors Service, Inc. or are of comparable quality as determined by the Funds’ investment manager. If, subsequent to the purchase of a municipal security, the rating of a municipal security falls below investment grade, the Fund will not be required to dispose of the security. The Funds will not invest more than 30% of their assets in unrated municipal securities.

Under normal circumstances, the Funds will maintain an average stated maturity at between five and twenty-five years.

During unusual market or other conditions, a Successor Fund may temporarily depart from its investment objective and invest up to 100% of its assets in short-term U.S. Government obligations, cash, and cash equivalents. During such times, the Successor Funds may be unable to pursue its investment objective. In addition, interest on these short-term investments may be taxable.

The Successor Funds will not buy securities on margin, sell securities short, use commodities or futures contracts, or use derivative securities of any kind. The existing Funds have the ability to engage in derivative transactions, but have not historically engaged in derivatives since becoming a part of the Integrity/Viking Funds.

In addition, the Successor Funds will adopt the standardized fundamental restrictions of other municipal funds managed by the Adviser, which are similar to the fundamental investment restrictions of the existing Funds. See Exhibit B.

Principal Risks. Each Fund has substantially similar principal risks to those of its corresponding Successor Fund, as each pair of Funds has substantially similar investment objectives and principal investment strategies. An investment in each Fund is subject to municipal securities and single state risks, interest rate risk, income risk, liquidity risk, maturity risk, credit risk, call risk, extension risk, inflation risk and tax risk, among others. For more information on the Funds’ principal risks, see the section entitled “Principal Risks” following the Synopsis.

Investment Adviser

Viking Fund Management, LLC is the investment adviser to the Funds and will continue to manage each Successor Fund after completion of its Reorganization. The portfolio management team responsible for the day-to-day management of each Fund, consists of Monte L. Avery, Shannon D. Radke, and Joshua D. Larson. The portfolio management team will remain the same for each Successor Fund following its Reorganization.

Buying, Selling, and Exchanging Fund Shares

The procedures for buying, selling, and exchanging Fund shares will not change as a result of the Reorganizations. You may buy, sell, and exchange shares of a Fund on any day that the NYSE is open. Additional information regarding procedures for buying, selling, and exchanging Fund shares is provided in the section entitled “Investing in the Funds.”

Portfolio Turnover

A Fund pays transaction costs, such as brokerage commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect a Fund’s performance. During the fiscal year ended July 31, 2016, the Funds’ portfolio turnover rates were 12.10%, 1.88%, 7.47%, 23.42% and 10.58% of the average value of the portfolio for the Kansas Fund, Maine Fund, Nebraska Fund, New Hampshire Fund and Oklahoma Fund, respectively. Each Successor Fund will continue the operations of its corresponding existing Fund and no portfolio turnover is expected solely as a result of the Reorganizations.

Tax Information Relating to the Reorganizations

Each Reorganization is intended to qualify as a tax-free reorganization for federal income tax purposes. Accordingly, shareholders are not expected to recognize any gain or loss for federal income tax purposes as a direct result of the Reorganization of their Fund. Additional information is provided in the section entitled “Material Federal Income Tax Consequences.”

Principal Risks

Risk is inherent in all investing. Investing in the Funds involves risk, including the risk that you may receive little or no return on your investment or that you may even lose part or all of your investment. An investment in the Funds is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Before you invest in a Fund, you should consider its principal risks. Below is additional information about certain of the principal risks applicable to each Successor Fund, which are the same as those of the corresponding existing Fund. In addition, the existing Funds were subject to the risks of investing in derivatives. The term “Fund” below refers to the existing Fund and the Successor Fund following the Reorganization.

General Risk: Each Fund’s net asset value, yield and total return will fluctuate based upon changes in the value of its portfolio securities. The market value of securities in which a Fund invests is based upon the market’s perception of the underlying value and is not necessarily an objective measure of the securities’ values. There is no assurance that a Fund will achieve its investment objective. An investment in a Fund is not by itself a complete or balanced investment program.

Non-Diversification Risk: Each Fund is non-diversified and as such, may invest more than 5% of its assets in the obligations of any issuer. Because a relatively high percentage of a Fund’s assets may be invested in the municipal securities of a limited number of issuers, the Fund is exposed to greater market risk, as its portfolio securities may be more susceptible to any single economic, business, political, or regulatory occurrence than the portfolio securities of a diversified fund. In addition, because of the relatively small number of issuers of municipal securities in the respective state, the Funds are more likely to invest a higher percentage of their assets in the securities of a single issuer than an investment company that invests in a broad range of tax-exempt securities. As a result, the Funds are subject to greater risks of loss if an issuer is unable to make interest or principal payments or if the market value of such securities declines.

Each Fund also may invest in the securities of issuers of municipal securities in U.S. territories and possessions. As a result, to the extent they invest in such securities, the Funds will be more susceptible to economic, political, or regulatory developments that could adversely affect issuers in a U.S. territory or possession and therefore the value of the Funds’ portfolios.

Municipal Volatility Risk: The market values of municipal securities owned by a Fund may decline, at times sharply and unpredictably. Market values of municipal securities are affected by a number of different factors, including tax, legislative and political changes, changes in interest rates, the credit quality of municipal securities issuers, and general economic and market conditions. Lower-quality municipal securities may suffer larger price declines and more volatility than higher-quality municipal securities in response to negative issuer-specific developments or general economic news. During times of low demand or decreased liquidity in the municipal securities market, prices of municipal securities, particularly lower-quality municipal securities, may decline sharply, without regard to changes in interest rates or issuer-specific credit-related events. Such periods of decreased liquidity may occur when dealers that make a market in municipal securities are unable or unwilling to do so, particularly during periods of economic or financial distress.

Municipal Securities and Single State Risks: The values of municipal securities held by a Fund may be adversely affected by local political and economic conditions and developments. Adverse conditions in an industry significant to a local economy could have a correspondingly adverse effect on the financial condition of local issuers. Other factors that could affect municipal securities include a change in the local, state or national economy, demographic factors, ecological or environmental concerns, statutory limitations on the issuer’s ability to increase taxes, and other developments generally affecting the revenue of issuers (for example, legislation or court decisions reducing state aid to local governments or mandating additional services).

To the extent that a Fund invests a significant portion of its assets in the securities of issuers located in a given state or U.S. territory or possession, it will be disproportionately affected by political and economic conditions and developments in that state, territory or possession. In addition, economic, political or regulatory changes in that state, territory or possession could adversely affect municipal bond issuers in that state, territory or possession and therefore the value of a Fund’s investment portfolio.

The Funds may invest in bonds of municipal issuers located in Puerto Rico. In recent years, municipal securities issued by Puerto Rico and its agencies and instrumentalities have been subject to multiple credit downgrades as a result of Puerto Rico’s ongoing fiscal challenges and uncertainty about the ability to make full repayment on these obligations. More recently, certain issuers of Puerto Rican municipal securities have failed to make payments on obligations that have come due, and additional missed payments or defaults may occur in the future.

Interest Rate Risk: Debt securities held by a Fund will fluctuate in value with changes in interest rates. Interest rate risk is the risk that the value of the Fund’s portfolio will decline because of rising market interest rates (bond prices generally move in the opposite direction of interest rates). Given that interest rates in the U.S. are currently at, or near, historical lows, a Fund may be subject to greater risk of rising interest rates than would otherwise be the case. Longer-term debt securities are generally more sensitive to interest rate changes. Rising interest rates also may lengthen the duration of debt securities with call features, since exercise of the call becomes less likely as interest rates rise, which in turn will make the securities more sensitive to changes in interest rates and result in even steeper price declines in the event of further interest rate increases. Additionally, a Fund may buy variable rate obligations. When interest rates fall, the yields on these securities decline. Callable bonds that a Fund may buy are more likely to be called when interest rates fall, and a Fund might then have to reinvest the proceeds of the called instrument in other securities that have lower yields, reducing its income.

Income Risk: Income risk is the risk that the income from the Fund’s portfolio will decline because of falling market interest rates. This can occur when the Fund invests the proceeds from its new share sales or from matured or called bonds at market interest rates that are below the portfolio’s current earnings rate. If a Fund invests in inverse floating rate securities, whose income payments vary inversely with changes in short-term market rates, the Fund’s income may decrease if short-term interest rates rise.

Liquidity Risk: Liquidity risk is the risk that a Fund may not be able to sell a holding in a timely manner at a desired price. Liquidity risk may result from the lack of an active market, the reduced number of traditional market participants, or the reduced capacity of traditional market participants to make a market in securities. The secondary market for certain municipal securities tends to be less developed and liquid than many other securities markets, which may adversely affect a Fund’s ability to sell such municipal securities at attractive prices. Moreover, inventories of municipal securities held by brokers and dealers have decreased in recent years, lessening their ability to make a market in these securities. This reduction in market making capacity has the potential to decrease a Fund’s ability to buy or sell bonds, and increase bond price volatility and trading costs, particularly during periods of economic or market stress. As a result, a Fund may be forced to accept a lower price to sell a security, to sell other securities to raise cash, or to give up an investment opportunity, any of which could have a negative effect on performance. If a Fund needed to sell large blocks of securities to raise cash (such as to meet heavy shareholder redemptions), those sales could further reduce the securities’ prices and hurt performance.

Maturity Risk: Generally, longer-term securities are more susceptible to changes in value as a result of interest-rate changes than are shorter-term securities.

Credit Risk: Credit risk is the risk that an issuer (or insurer or other credit enhancer) of a bond is unable or unwilling to meet its obligation to make interest and principal payments due to changing financial or market conditions. Economic downturns often result in reduced levels of taxes collected and revenues earned for municipalities. This, in turn, lessens the financial strength of a municipality and increases the credit risk of the securities it issues.

Changes in the credit quality of the insurer or other credit provider could affect the value of the security and the Fund’s share price. Generally, lower rated bonds provide higher current income but are considered to carry greater credit risk than higher rated bonds. The ratings of a rating agency represent its opinion as to the credit quality of the debt securities it undertakes to rate and do not evaluate market risk. Ratings are not absolute standards of credit quality; consequently, debt securities with the same maturity, duration, coupon, and rating may have different yields. Rating agencies may fail to make timely changes in credit ratings and an issuer’s current financial condition may be better or worse than a rating indicates. In the event that rating agencies assign different ratings to the same security, the Fund’s investment adviser may rely on the higher rating. In addition, not all securities are rated. Credit risks associated with certain particular classifications of municipal securities include:

General Obligation Bonds—Timely payments depend on the issuer’s credit quality, ability to raise tax revenues, and ability to maintain an adequate tax base.

Revenue Bonds—Payments depend on the money earned by the particular facility or class of facilities, or the amount of revenues derived from another source.

Private Activity Bonds—Municipalities and other public authorities issue private activity bonds to finance development of facilities for use by a private enterprise. The private enterprise pays the principal and interest on the bond, and the issuer does not pledge its full faith, credit and taxing power for repayment.

Municipal Insurance Risk: Although not required, the Funds may invest in securities covered by insurance. Municipal bond insurance generally seeks to guarantee a bond’s scheduled payment of interest and repayment of principal. This type of insurance may be obtained by either (i) the issuer at the time the bond is issued (primary market insurance); or (ii) another party after the bond has been issued (secondary market insurance).

Both primary and secondary market insurance generally seek to guarantee timely and scheduled repayment of principal and payment of interest on a municipal security in the event of default by the issuer, and generally cover a municipal security to its maturity.

Municipal security insurance does not insure against market fluctuations in a Fund’s share price or guarantee the value of a municipal security. In addition, a municipal security insurance policy generally will not cover: (i) repayment of a municipal security before maturity (redemption), (ii) prepayment or payment of an acceleration premium (except for a mandatory sinking fund redemption) or any other provision of a bond indenture that advances the maturity of the bond or (iii) nonpayment of principal or interest caused by negligence or bankruptcy of the paying agent. A mandatory sinking fund redemption may be a provision of a municipal security issue whereby part of the municipal security issue may be retired before maturity.

Downgrades and withdrawal of ratings from insurers of municipal securities have substantially limited the availability of insurance sought by issuers of municipal securities thereby reducing the supply of insured municipal securities. Because of the consolidation among insurers of municipal securities, to the extent that a Fund invests in insured municipal securities, it is subject to the risk that credit risk may be concentrated among fewer insurers and the risk that events involving one or more insurers could have a significant adverse effect on the value of the securities insured by an insurer and on the municipal markets as a whole.

Call Risk: Call risk is the likelihood that a security will be prepaid (or “called”) before maturity. An issuer is more likely to call its bonds when interest rates are falling, because the issuer can issue new bonds with lower interest payments. If a bond is called, the Fund may have to replace it with a lower-yielding security.

Extension Risk: Extension risk is the risk that an issuer will exercise its right to pay principal on an obligation held by the Fund later than expected. This may happen during a period of rising interest rates. Under these circumstances, the value of the obligation will decrease and the Fund will suffer from the inability to invest in higher yielding securities.

Portfolio Strategy Risk: The investment adviser’s skill in choosing appropriate investments for the Fund will determine in part the Fund’s ability to achieve its investment objective.

Inflation Risk: Inflation risk is the risk that the value of assets or income from investments will be less in the future as inflation decreases the value of money. As inflation increases, the value of the Funds’ assets can decline as can the value of the Funds’ distributions.

Tax Risk: Tax risk is the risk that income from municipal bonds held by a Fund could be declared taxable because of, for example, unfavorable changes in tax laws, adverse interpretations by the Internal Revenue Service or state tax authorities, or noncompliant conduct of a bond issuer. Moreover, a portion of the Funds’ otherwise exempt-interest dividends may be taxable to those shareholders subject to the alternative minimum tax. In addition, proposals have been made to restrict or eliminate the federal income tax exemption for interest on municipal securities, and similar proposals may be introduced in the future. Proposed “flat tax” and “value added tax” proposals would also have the effect of eliminating the tax preference for municipal securities. Some of these proposals would apply to interest on municipal securities issued before the date of enactment, which would adversely affect their value to a material degree. If such a proposal were enacted, the availability of municipal securities for investment by the Funds and the value of the Funds’ portfolios would be adversely affected.

Municipal Sector Risk: Each Fund may invest over 25% of its assets in municipal securities whose revenues derive from similar types of projects including health care, housing, utilities, and education. Each Fund bears the risk that economic, political or regulatory developments could adversely affect these industries and consequently, the value of a Fund’s portfolio.

Risks of Health Care Revenue Bonds: The Fund may invest in health care revenue bonds. The health care sector is subject to regulatory action by a number of private and governmental agencies, including federal, state, and local governmental agencies. A major source of revenues for the health care sector is payments from the Medicare and Medicaid programs. As a result, the sector is sensitive to legislative changes and reductions in governmental spending for such programs. Numerous other factors may affect the sector, such as general economic conditions; demand for services; expenses (including malpractice insurance premiums); and competition among health care providers. In addition, various factors may adversely affect health care facility operations, including adoption of national, state and/or local health care reform measures; medical and technological advances which dramatically alter the need for health services or the way in which such services are delivered; changes in medical coverage which alter the traditional fee-for-service revenue stream; and efforts by employers, insurers and governmental agencies to reduce the costs of health care insurance and health care services.

Risks of Electric Utility Revenue Bonds: The Fund may invest in electric utility revenue bonds. The electric utilities industry has been experiencing increased competitive pressures. Additional risks associated with electric utility revenue bonds include: (a) the availability and costs of fuel; (b) the availability and costs of capital; (c) the effects of conservation on energy demand; (d) the effects of rapidly changing environmental, safety, and licensing requirements, and other federal, state and local regulations; (e) timely and sufficient rate increases; and (f) opposition to nuclear power.

Risks of Gas Utility Revenue Bonds: The Fund may invest in gas utility revenue bonds. Gas utilities are subject to the risks of supply conditions and increased competition from other providers of utility services. In addition, gas utilities are affected by gas prices, which may be magnified to the extent that a gas company enters into long-term contracts for the purchase or sale of gas at fixed prices, since such prices may change significantly and to the disadvantage of the gas utility in the open market. Gas utilities are particularly susceptible to supply and demand imbalances due to unpredictable climate conditions and other factors and are subject to regulatory risks as well.

Risks of Water and Sewer Revenue Bonds: The Fund may invest in water and sewer revenue bonds. Issuers of water and sewer bonds face public resistance to rate increases, costly environmental litigation and federal environmental mandates. In addition, the lack of water supply due to insufficient rain, run-off, or snow pack may be a concern.

Risks of Transportation Revenue Bonds: The Fund may invest in transportation revenue bonds. Transportation debt may be issued to finance the construction of airports, toll roads, highways, or other transit facilities. Airport bonds are dependent on the general stability of the airline industry and on the stability of a specific carrier who uses the airport as a hub. Air traffic generally follows broader economic trends and is also affected by the price and availability of fuel. Toll road bonds are also affected by the cost and availability of fuel as well as toll levels, the presence of competing roads and the general economic health of an area. Fuel costs and availability also affect other transportation-related securities, as does the presence of alternate forms of transportation, such as public transportation.

Risks of Educational Revenue Bonds: The Fund may invest in educational revenue bonds. These include municipal securities that are obligations of issuers which are, or which govern the operation of, schools, colleges and universities and whose revenues are derived mainly from ad valorem taxes, or for higher education systems, from tuition, dormitory revenues, grants and endowments. Litigation or legislation pertaining to ad valorem taxes may affect sources of funds available for the payment of school bonds. College and university obligations may be affected by the possible inability to raise tuitions and fees sufficiently to cover increased operating costs, the uncertainty of continued receipt of federal grants and state funding and new government or legislation or regulations which may adversely affect the revenues or costs of such issuers. In addition, student loan revenue bonds, which are generally offered by state (or substate) authorities or commissions and backed by pools of student loans, may be affected by numerous factors, including the rate of student loan defaults, seasoning of the loan portfolio, student repayment deferral periods of forbearance, potential changes in federal legislation, and state guarantee agency reimbursement.

Risks of Housing Revenue Bonds: The Fund may invest in housing revenue bonds. Housing revenue bonds are generally issued by a state, county, city, local housing authority, or other public agency. They generally are secured by the revenues derived from mortgages purchased with the proceeds of the bond issue. It is extremely difficult to predict the supply of available mortgages to be purchased with the proceeds of an issue or the future cash flow from the underlying mortgages. Consequently, there are risks that proceeds will exceed supply, resulting in early retirement of bonds, or that homeowner repayments will create an irregular cash flow. Many factors may affect the financing of multi-family housing projects, including acceptable completion of construction, proper management, occupancy and rent levels, economic conditions, and changes to current laws and regulations.

Cybersecurity Risk: As the use of technology has become more prevalent in the course of business, the Funds have become potentially more susceptible to operational and financial risks through breaches in cybersecurity. These risks include theft, loss, misuse, improper release, corruption and destruction of, or unauthorized access to, confidential or highly restricted data relating to a Fund and its shareholders; and compromises or failures to systems, networks, devices and applications relating to the operations of a Fund and its service providers. Cybersecurity issues may result in, among other things, financial losses to a Fund and its shareholders; the inability of a Fund to transact business with its shareholders or to engage in portfolio transactions; delays or mistakes in the calculation of a Fund’s net asset value or other materials provided to shareholders; the inability to process transactions with shareholders or other parties; violations of privacy and other laws; regulatory fines, penalties and reputational damage; and compliance and remediation costs, legal fees and other expenses. A Fund’s service providers, financial intermediaries, entities in which a Fund invests and parties with which a Fund engages in portfolio or other transactions also may be adversely impacted by cybersecurity risks, resulting in losses to a Fund or its shareholders. There can be no guarantee that any risk management systems established to address to reduce cybersecurity risks will succeed, and the Funds cannot control such systems put in place by service providers, issuers or other third parties whose operations may affect the Funds and/or their shareholders.

Valuation Risk: The sales price a Fund could receive for any particular portfolio investment may differ from the Fund’s valuation of the investment, particularly for securities that trade in thin or volatile markets or that are valued using a fair value methodology. Investors who purchase or redeem Fund shares on days when a Fund is holding fair-valued securities may receive fewer or more shares or lower or higher redemption proceeds than they would have received if the Fund had not fair-valued the security or had used a different valuation methodology.

Information About the Reorganizations

Reasons for the Reorganizations

The Adviser and the Board of Trustees of the Integrity Trust and the Viking Trust believe that consolidating the Funds under the same corporate entity as other municipal mutual funds for which the Adviser also serves as investment adviser and which also utilize the same service providers as the Funds has the potential to provide operating and administrative efficiencies. As part of the Reorganizations, the investment policies, restriction and disclosure of the Funds will be standardized to align with other municipal funds managed by the Adviser.

Board Approval of the Reorganizations

The primary purpose of the proposed Reorganizations is to seek future economies of scale and to eliminate certain costs associated with operating two different business entities that are organized under the laws of different states. In unanimously approving each Reorganization, the Board requested and evaluated such information as it reasonably believed necessary to make the determinations that the proposed Reorganization would be in the best interest of each Fund and that the interests of each Fund’s shareholders would not be diluted as a result of the Reorganization. The key factors considered by the Board are described below:

The Adviser has informed the Board that it believes that by reorganizing all of the assets of each Fund into its corresponding Successor Fund, the Successor Funds should be able to realize certain operating efficiencies by eliminating certain costs associated with operating two different business entities that are organized under the laws of different states.

The Adviser has also informed the Board that it believes that the proposed Delaware statutory trust provides the most flexible and cost-efficient method of operating the Funds for the benefit of the Funds’ shareholders. Counsel to the Trusts also noted that a Delaware statutory trust form would benefit the Funds’ Board and the Funds’ shareholders by providing greater certainty regarding their personal liabilities for Fund obligations.

The Board also considered that: (a) the investment objective, policies and restrictions of each Successor Fund are substantially the same as those of the corresponding Fund; (b) each Successor Fund will be managed by the same personnel and in accordance with the same investment strategies and techniques utilized by the management of the corresponding Fund immediately prior to the Reorganization; (c) fees and expenses would remain the same; (d) all service providers will remain the same; and (e) each Fund would be the accounting and performance survivor of its Reorganization, such that the accounting and performance records would continue. The Board also considered the fact that the Reorganizations were expected to qualify as tax-free reorganizations for federal income tax purposes.

Agreement and Plan of Reorganization

The following summary is qualified in its entirety by reference to the Plan, a form of which is set forth in Exhibit A. The Plan provides that all of the assets of each Fund will be transferred to the corresponding Successor Fund solely in exchange for Class A voting shares of beneficial interest of the Successor Fund, as described in the Plan, and the assumption by the Successor Fund of all the liabilities of the corresponding Fund. The Reorganizations are expected to close on October 27, 2017, or such other date as may be agreed upon by the parties (the “Closing Date”).

With respect to each Reorganization of a Fund into the corresponding Successor Fund, the Plan provides that the net asset value of each Class A share of each Successor Fund will be equal to the net asset value per share of the corresponding Fund as of the close of business on the New York Stock Exchange (“NYSE”) on the Closing Date (the “Valuation Time”). For each Reorganization, the Plan provides that the computation of net asset value will be made in accordance with valuation procedures of the Funds adopted by the Board of Trustees. Shareholders will receive the number of shares of the Successor Fund with the same aggregate value as they held in the Fund as of the Valuation Time.

Each Reorganization is subject to the satisfaction or, to the extent legally permissible, waiver of the conditions set forth in the Plan, including but not limited to the truth and correctness in all material respects of each party’s representations and warranties as set forth in the Plan, delivery of opinions of counsel, effectiveness of the registration statement with respect to the Successor Fund Shares of which this Joint Proxy Statement/Prospectus is a part, approval of the Plan by the Board of Trustees and by shareholders of the existing Fund. The Plan may be terminated (1) by the mutual agreement of the parties to the Plan; (2) at or prior to the Closing by either party (a) because of a breach by the other party of any representation, warranty or agreement contained in the Plan to be performed at or prior to the Closing, if not cured within 30 days of notification of such breach and prior to the closing, or (b) because a condition in the Plan expressed to be precedent to the obligations of the terminating party has not been met or waived and it reasonably appears that it will not or cannot be met; or (3) due to a determination by the Board that the consummation of the Reorganization is not in the best interests of the existing Fund or Successor Fund. The Plan may be amended, modified or supplemented only in writing by the parties to the Plan.

The Adviser is obligated under the Plan to pay the expenses associated with each Reorganization, regardless of whether the Reorganization is consummated. The costs of the Reorganizations will not be borne by the Funds or their shareholders. No sales load, contingent deferred sales charge, commission, redemption fee or other transactional fee will be charged by any Successor Fund as a result of, or in connection with, the Reorganizations.

Description of the Securities to be Issued

Shareholders of each Fund as of the Closing will receive full and fractional Class A shares of the corresponding Successor Fund in accordance with the terms of the Plan. The shares of each Successor Fund to be issued in connection with the Reorganizations will be validly issued, fully paid and non-assessable when issued. Shares of the Successor Fund to be issued in a Reorganization will have no preemptive or other rights to subscribe for such shares, and no share certificates will be issued.

Material Federal Income Tax Consequences

The following discussion summarizes the material U.S. federal income tax consequences of the Reorganizations that are applicable to you as a Fund shareholder. It is based on the Internal Revenue Code of 1986, as amended (the “Code”), applicable U.S. Treasury regulations, judicial authority, and administrative rulings and practice, all as of the date of this Joint Proxy Statement/Prospectus and all of which are subject to change, including changes with retroactive effect. The discussion below does not address any state, local, or foreign tax consequences of the Reorganizations. Your tax treatment may vary depending upon your particular situation. You also may be subject to special rules not discussed below if you are a certain kind of shareholder, including, but not limited to: an insurance company; a tax-exempt organization; a financial institution or broker-dealer; a person who is neither a citizen nor resident of the United States or an entity that is not organized under the laws of the United States or a political subdivision thereof; a holder of Fund shares as part of a hedge, straddle, or conversion transaction; a person who does not hold Fund shares as a capital asset at the time of the Reorganization; or an entity taxable as a partnership for U.S. federal income tax purposes.

Each Reorganization is intended to qualify for federal income tax purposes as a tax-free reorganization under Section 368(a) of the Code. As a condition to the closing of each Reorganization, the Fund and the corresponding Successor Fund will receive an opinion from the law firm of Vedder Price P.C. substantially to the effect that, on the basis of the existing provisions of the Code, U.S. Treasury regulations issued thereunder, current administrative rules, pronouncements and court decisions, and certain representations, qualifications, and assumptions, for federal income tax purposes:

(i) The transfer by the Fund of all its assets to the Successor Fund in exchange solely for shares of the Successor Fund and the assumption by the Successor Fund of all the Fund’s liabilities, immediately followed by the pro rata distribution of all the shares of the Successor Fund so received by the Fund to the Fund’s shareholders in complete liquidation of the Fund and the termination of the Fund as soon as practicable thereafter, will constitute a “reorganization” within the meaning of Section 368(a)(1) of the Code, and the Successor Fund and the existing Fund will each be “a party to a reorganization,” within the meaning of Section 368(b) of the Code, with respect to the Reorganization.

(ii) No gain or loss will be recognized by the Successor Fund upon the receipt of all the assets of the Fund solely in exchange for Successor Fund shares and the assumption by the Successor Fund of all the Fund’s liabilities.

(iii) No gain or loss will be recognized by the Fund upon the transfer of all its assets to the Successor Fund solely in exchange for Successor Fund shares and the assumption by the Successor Fund of all the Fund’s liabilities or upon the distribution (whether actual or constructive) of the Successor Fund shares so received to the Funds shareholders solely in exchange for such shareholders’ shares of the Fund in complete liquidation of the Fund.

(iv) No gain or loss will be recognized by the Funds shareholders upon the exchange, pursuant to the Reorganization, of all their shares of the Fund solely for Successor Fund shares.

(v) The aggregate basis of the Successor Fund shares received by each Fund shareholder pursuant to the Reorganization will be the same as the aggregate basis of the shares of the Fund exchanged therefor by such shareholder.

(vi) The holding period of the Successor Fund shares received by each Fund shareholder in the Reorganization will include the period during which the shares of the Fund exchanged therefor were held by such shareholder, provided such shares of the Fund were held as capital assets at the effective time of the Reorganization.

(vii) The basis of the assets of the Fund received by the Successor Fund will be the same as the basis of such assets in the hands of the Fund immediately before the effective time of the Reorganization.

(viii) The holding period of the assets of the Fund received by the Successor Fund will include the period during which such assets were held by the Fund.

No opinion will be expressed as to (1) the effect of a Reorganization on a Successor Fund, a Fund or any Fund shareholder with respect to any asset (including without limitation any stock held in a passive foreign investment company as defined in Section 1297(a) of the Code) as to which any unrealized gain or loss is required to be recognized for federal income tax purposes (a) at the end of a taxable year or upon the termination thereof, or (b) upon the transfer of such asset regardless of whether such transfer would otherwise be a non-taxable transaction under the Code, or (2) any other federal tax issues (except those set forth above) and all state, local or foreign tax issues of any kind.