UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2019

OR

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 000-31615

DURECT CORPORATION

(Exact name of registrant as specified in its charter)

|

Delaware |

94-3297098 |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

10260 Bubb Road

Cupertino, CA 95014

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (408) 777-1417

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class |

Trading Symbol(s) |

Name of Each Exchange on Which Registered |

|

Common Stock $0.0001 par value per share

|

DRRX

|

The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ☐ NO ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15 of the Act. YES ☐ NO ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period than the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES ☒ NO ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). YES ☒ NO ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

☐ |

|

Accelerated filer |

☒ |

|

Non-accelerated filer |

☐ |

|

Smaller reporting company |

☒ |

|

Emerging growth company |

☐ |

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). YES ☐ NO ☒

The aggregate market value of the voting stock held by non-affiliates of the registrant was approximately $105,942,850 as of June 30, 2019 based upon the closing sale price on The Nasdaq Global Market reported for such date. Shares of Common Stock held by each officer and director and by each person who may be deemed to be an affiliate have been excluded. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

There were 195,818,780 shares of the registrant’s Common Stock issued and outstanding as of February 28, 2020.

DOCUMENTS INCORPORATED BY REFERENCE

Part III incorporates information by reference from the definitive Proxy Statement for the 2020 annual meeting of stockholders, which is expected to be filed not later than 120 days after the Registrant’s fiscal year ended December 31, 2019.

ANNUAL REPORT ON FORM 10-K

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2019

TABLE OF CONTENTS

|

|

|

|

|

Page |

|

|

|

|

|

|

|

ITEM 1. |

|

|

1 |

|

|

|

|

|

|

|

|

ITEM 1A. |

|

|

21 |

|

|

|

|

|

|

|

|

ITEM 1B. |

|

|

46 |

|

|

|

|

|

|

|

|

ITEM 2. |

|

|

46 |

|

|

|

|

|

|

|

|

ITEM 3. |

|

|

46 |

|

|

|

|

|

|

|

|

ITEM 4. |

|

|

46 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ITEM 5. |

|

|

47 |

|

|

|

|

|

|

|

|

ITEM 6. |

|

|

49 |

|

|

|

|

|

|

|

|

ITEM 7. |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

50 |

|

|

|

|

|

|

|

ITEM 7A. |

|

|

64 |

|

|

|

|

|

|

|

|

ITEM 8. |

|

|

66 |

|

|

|

|

|

|

|

|

ITEM 9. |

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

|

95 |

|

|

|

|

|

|

|

ITEM 9A. |

|

|

95 |

|

|

|

|

|

|

|

|

ITEM 9B. |

|

|

97 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ITEM 10. |

|

|

97 |

|

|

|

|

|

|

|

|

ITEM 11. |

|

|

97 |

|

|

|

|

|

|

|

|

ITEM 12. |

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

97 |

|

|

|

|

|

|

|

ITEM 13. |

|

Certain Relationships and Related Transactions, and Director Independence |

|

97 |

|

|

|

|

|

|

|

ITEM 14. |

|

|

97 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ITEM 15. |

|

|

97 |

|

|

|

|

|

|

|

|

|

103 |

|||

|

|

|

|

|

|

|

ITEM 16. |

|

|

104 |

|

|

|

|

|

|

|

|

|

105 |

|||

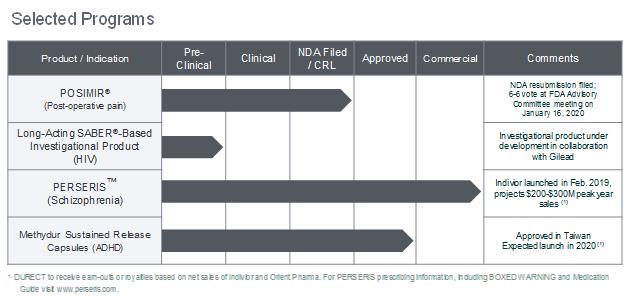

Overview

We are a biopharmaceutical company with research and development programs broadly falling into two categories: (i) new chemical entities derived from our Epigenetic Regulator Program, in which we attempt to discover and develop molecules which have not previously been approved and marketed as therapeutics, and (ii) proprietary pharmaceutical programs, in which we apply our formulation expertise and technologies largely to active pharmaceutical ingredients whose safety and efficacy have previously been established but which we aim to improve in some manner through a new formulation. We also manufacture and sell osmotic pumps used in laboratory research, design, develop and manufacture a wide range of standard and custom biodegradable polymers and excipients for pharmaceutical and medical device clients for use as raw materials in their products.

Our product pipeline currently consists of multiple investigational drug candidates in development. DUR‑928, a new chemical entity in Phase 1 and Phase 2 development for two different indications, is the lead candidate in DURECT’s Epigenetic Regulator Program. An endogenous, orally bioavailable, small molecule, DUR-928 has been shown in preclinical studies to play an important regulatory role in lipid homeostasis, inflammation, and cell survival. Human applications may include acute organ injury such as alcoholic hepatitis (AH) and acute kidney injury (AKI) and chronic metabolic diseases such as nonalcoholic steatohepatitis (NASH), nonalcoholic fatty liver disease (NAFLD), and other liver diseases. DURECT’s proprietary drug delivery technologies are designed to enable new indications and enhanced attributes for small-molecule and biologic drugs. One late-stage development program in this category is POSIMIR® (bupivacaine extended-release solution), an investigational analgesic product intended to deliver bupivacaine to provide up to 3 days of pain relief after surgery. Another program in this category is an early-stage long-acting injectable HIV product utilizing our SABER® technology, which is in development under a July 2019 license agreement with Gilead.

As a result of the assignment of certain patent rights, DURECT receives single digit sales-based earn-out payments from U.S. net sales of Indivior’s PERSERIS™ (risperidone) drug for schizophrenia, which was approved in July 2018. Indivior commenced the full commercial launch of PERSERIS in February 2019 and Indivior has indicated that it expects 2020 sales in the range of $15-$25 million. In addition, in September 2018, our licensee, Orient Pharma informed us that it had obtained marketing authorization for Methydur Sustained Release Capsules from the Ministry of Health and Welfare in Taiwan. Methydur Sustained Release Capsules are indicated for the treatment of attention deficit hyperactivity disorder (ADHD) and will be available in three strengths (22 mg, 33 mg and 44 mg) in Taiwan. Orient Pharma has stated that it expects to make Methydur Sustained Release Capsules commercially available in Taiwan in 2020, while seeking a partner in China and pursuing regulatory approvals in selected other countries in Southeast Asia where it has commercialization rights and a commercialization presence. We will receive a single digit royalty on sales of Methydur Sustained Release Capsules by Orient Pharma and retain rights to this product in markets not specifically licensed to Orient Pharma.

A central aspect of our business strategy involves advancing multiple product candidates at one time, which is enabled by leveraging our resources with those of corporate collaborators. Thus, certain of our programs are currently licensed to corporate collaborators on terms which typically call for our collaborator to fund all or a substantial portion of future development costs and then pay us milestone payments based on specific development or commercial achievements plus royalties on product sales. At the same time, we have retained the rights to other programs, which are the basis of potential future collaborations and which over time may provide a pathway for us to develop our own commercial, sales and marketing organization.

NOTE: POSIMIR®, SABER®, CLOUDTM, ORADUR™, ALZET ® and LACTEL® are trademarks of DURECT Corporation. Other trademarks referred to belong to their respective owners. Full prescribing information for PERSERIS, including BOXED WARNING and Medication Guide can be found at www.perseris.com.

1

Epigenetic Regulator Program and New Chemical Entities

Epigenetic regulation involves biochemical modification of either DNA itself or proteins that are intimately associated with DNA. These modifications lead to changes in gene expression that facilitate downstream biological effects.

DURECT’s Epigenetic Regulator Program involves a multi-year collaborative effort with the Department of Internal Medicine at Virginia Commonwealth University (VCU), the VCU Medical Center and the McGuire VA Medical Center. The knowledge base supporting this program is a result of more than 30 years of lipid research by Shunlin Ren, M.D., Ph.D., Professor of Internal Medicine at the VCU Medical Center. The lead compound from this program, DUR-928, is an endogenous, orally bioavailable, small molecule that modulates the gene expression of various nuclear receptors that play important regulatory roles in lipid homeostasis, inflammation, and cell survival. Under a license with VCU, we hold the exclusive royalty-bearing worldwide right to develop and commercialize DUR-928 and related molecules discovered in the program.

The biological activity of DUR-928 has been demonstrated in over a dozen different animal disease models involving three animal species. Some of these models represent acute organ injuries (e.g., endotoxin shock, acute oxidative damage, ischemic-reperfusion kidney injury, and stroke models) and several represent chronic metabolic disorders involving hepatic lipid accumulation and dysfunction (e.g., NASH and NAFLD).

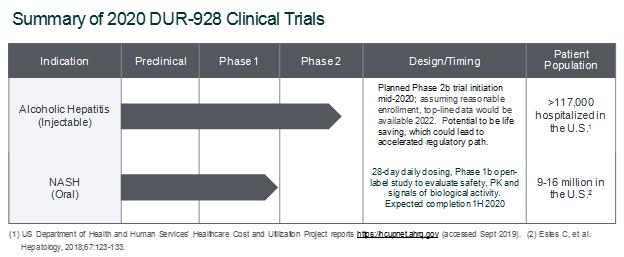

Our major product research and development efforts for DUR-928 are set forth in the following table:

In pharmacokinetic and toxicology studies conducted in mice, hamsters, rats, rabbits, dogs, minipigs and monkeys, DUR-928 has been found to be tolerable and safe by all routes of administration tested to date. These results support the use of DUR-928 in the completed, ongoing and planned human safety, pharmacokinetics (PK), proof-of-concept, and efficacy trials. The chronic toxicity of DUR-928 was further assessed in a 6-month oral study in rats and in a 9-month oral study in dogs. These studies were completed successfully and support human clinical trials of DUR-928 of any duration.

2

Acute Organ Injury Program with Injectable DUR-928

Market Opportunity. Alcoholic hepatitis (AH) is an acute form of alcoholic liver disease (ALD) associated with long-term heavy intake of alcohol, and often occurs after a recent period of increased alcohol consumption. AH is typically characterized by recent onset jaundice and hepatic failure. An analysis of 77 studies published between 1971 and 2016, which included data from a total of 8,184 patients, showed the overall mortality from AH was 26% at 28 days. According to the most recent data provided by the Agency for Healthcare Research and Quality (AHRQ), a part of the US Department of Health and Human Services (HHS), there were over 117,000 hospitalizations for patients with alcoholic hepatitis in 2016. From a recent publication analyzing the mortality and costs associated with alcoholic hepatitis, the cost per patient is estimated at over $50,000 in the first year. ALD is one of the leading causes of liver transplants in the US, each of which cost over $800,000. Acute kidney injury (AKI), a sudden loss of kidney function due to renal failure or injury, affects approximately 2.8 million patients per year in the United States and is associated with increased mortality, prolonged hospital stays, kidney dialysis and progression to chronic kidney disease. There are various forms of acute organ injury affecting the liver, the kidney or other organs for which we are or may seek to develop DUR-928.

Clinical Program. In 2019, we completed a Phase 2a clinical trial evaluating intravenously infused DUR-928 in patients with moderate and severe AH. This was an open label, dose escalation (30, 90 and 150 mg), multi-center U.S. study, originally designed to be conducted in two sequential parts. Part A included patients with moderate AH and Part B included patients with severe AH. Severity of AH was determined by the Model of End-Stage Liver Disease (MELD) scores, a common scoring system to assess the severity and prognosis of AH patients; moderate was defined as MELD 11-20 and severe as MELD 21-30.

In the Phase 2a trial, dose escalation was permitted following review of safety and pharmacokinetic (PK) results of the prior dose level by a Dose Escalation Committee (DEC). The target number of patients for the study was 4 per dose group. Final enrollment included 19 patients with moderate and severe AH, who were administered DUR-928 intravenously at three different doses. Eight patients (four moderate and four severe) were dosed at 30mg, seven patients (three moderate and four severe) were dosed at 90mg and four patients (all severe) were dosed at 150mg. After being discharged on day two, one patient did not return for the scheduled day seven and day 28 follow-up visits; therefore Lille, bilirubin and MELD data reported below are based on 18 patients. The objectives of this study included assessment of safety, PK and pharmacodynamic (PD) signals, including liver biochemistry, biomarkers, and prognostic scores, including the Lille score, following DUR-928 treatment.

In November 2019, DURECT announced the results from our Phase 2a clinical trial of DUR-928 in alcoholic hepatitis (AH), presented as a late-breaking oral presentation at The Liver Meeting®. The study results were also selected for inclusion in the ‘Best of The Liver Meeting’ summary slide presentation in the alcohol-related liver disease category.

All 19 patients treated with DUR-928 in this trial survived the 28-day follow-up period and there were no drug-related serious adverse events. Patients treated with DUR-928 had a statistically significant reduction from baseline in bilirubin at day 7 and 28 and MELD at day 28. Lille scores were also statistically significantly lower than those from a well-matched group of patients in a contemporary ongoing trial as well as several published historical controls. 74% of all DUR-928 treated patients and 67% of those with severe AH were discharged from the hospital within four days of receiving a single dose of DUR-928.

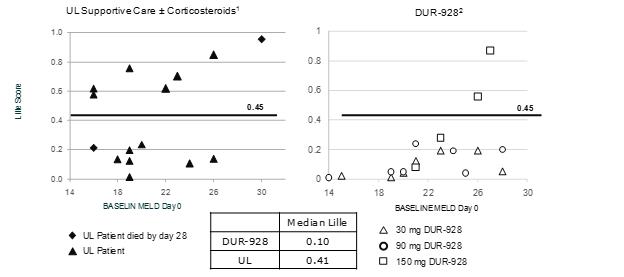

Lille

Lille scores are used in clinical practice to help determine the prognosis and response of AH patients after seven days of treatment. The lower the Lille score, the better the prognosis. Patients with a Lille score below 0.45 have a six-month survival rate of 85% compared to those with Lille scores above 0.45, who have only a 25% six-month survival rate.1 The chart below shows the Lille scores for individual AH patients treated with DUR-928 plotted as a function of their baseline MELD scores. In our study, the median Lille score for patients treated with DUR-928 was 0.10. The median Lille score among a cohort of 15 patients treated with standard of care at the University of Louisville (UL) was 0.41 (shown as historical control).

|

|

1 |

Louvet A et al. Hepatology 2007; 45: 1348-54. |

3

The chart below shows individual patient Lille scores plotted as a function of their baseline MELD scores.

|

|

1) |

Our advisor, Dr. Craig McClain from the University of Louisville (UL), shared anonymized data from his study, in which 15 AH patients with initial MELD scores ranging from 15-30 received either supportive care alone (n=8 moderate AH patients) or supportive care with corticosteroids (n=7 severe AH patients). Two of the UL control patients died by day 28. |

|

|

2) |

One patient in the DUR-928 group did not return for the day 7 or 28 visit. All 19 patients, including this one, treated with DUR-928 in this trial survived the 28-day follow-up period. |

|

|

3) |

Lille scores in the DUR-928 group were significantly lower than that of the UL patients (p=0.01; Wilcoxon's Rank Sum Test). |

As shown below, 100% of patients in the 30 mg and 90 mg DUR-928 dosing groups were treatment responders based on their Lille scores. 89% of the overall DUR-928 patient population were treatment responders. Patients with severe AH, as defined by Maddrey’s Discriminant Function >32 or MELD 21-30, and baseline serum bilirubin above 8 mg/dL, had similarly high response rates to DUR-928 treatment.

|

AH Patient Category |

n1 |

Responders (Lille<0.45) |

Lille Median (Quartile) |

|

All Patients2 30 or 90 mg DUR-9283 |

18 14 |

89% 100% |

0.10 (0.04, 0.20) 0.05 (0.04, 0.19) |

|

DF>32 (SAH)2, 4 30 or 90 mg DUR-9283 |

15 11 |

87% 100% |

0.19 (0.05, 0.22) 0.12 (0.05, 0.19) |

|

MELD 21-302 30 or 90 mg DUR-9283 |

12 8 |

83% 100% |

0.19 (0.11, 0.25) 0.19 (0.10, 0.19) |

|

Baseline bilirubin >8mg/dl2 30 or 90 mg DUR-9283 |

11 8 |

82% 100% |

0.10 (0.05, 0.20) 0.10 (0.05, 0.19) |

|

|

1) |

One patient did not return for Day 7 and 28 visits; |

|

|

2) |

Including patients receiving 30, 90 and 150 mg of DUR-928; |

|

|

3) |

Excluding patients receiving 150 mg of DUR-928. |

|

|

4) |

Maddrey’s Discriminant Function (DF) is calculated using the patient’s prothrombin time and serum bilirubin level. DF was introduced in 1978 as a predictor of significant mortality risk for AH patients. A DF>32 identified AH patients with a 30-day mortality rate of ≥50%. |

4

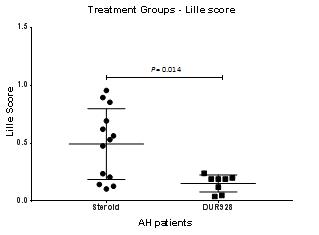

The Lille scores of patients treated with DUR-928 in this trial were also significantly lower than several selected published historical studies (Hepatology 2007, 45:1348-1354; Gut 2011, 60:255-260), in which patients had similar baseline bilirubin, albumin, creatinine, prothrombin time and DF scores, and were treated with standard of care with or without corticosteroids. Of course, due to the historical nature of these studies, such comparisons should be taken cautiously.

A sub-group analysis was conducted to compare severe AH patients in the 30 mg and 90 mg dosing groups (n=8) with well-matched severe AH patients (n=13) who received corticosteroids for 28 days in a contemporaneous study at the University of Louisville (UL). Patients shown below in the UL steroid group had a mean baseline MELD of 24.46 and mean baseline Maddrey’s DF score of 62.98. The 8 patients in the DUR-928 group had baseline mean MELD of 24.50 and mean baseline Maddrey’s DF score of 61.25. All patients treated with DUR-928 survived the 28-day follow up period, while 3 patients in the UL steroid group died within the first 28 days.

The steroid group in the above graph includes the 7 severe AH patients treated with steroids from the UL group shown in the MELD vs Lille graph above plus an additional 6 severe AH patients subsequently treated in the UL study.

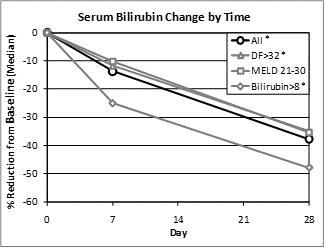

Bilirubin

Bilirubin is formed by the breakdown of red blood cells in the body. The level of total bilirubin in the blood is an indication of how the liver is functioning. In this trial, patients treated with DUR-928 had a significant early reduction from baseline in bilirubin by day 7. Patients with more elevated bilirubin at baseline (serum bilirubin >8 mg/dL) had a median reduction from baseline of 25% by day 7 and 48% by day 28.

*p<0.05 compared to baseline (Wilcoxon's Signed Rank Test)

5

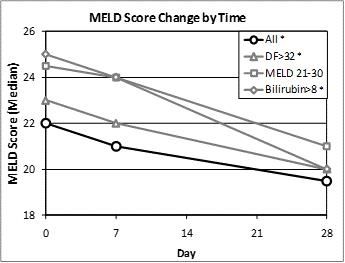

MELD is another common scoring system used to assess the severity and prognosis of AH patients. Patients with MELD scores of 11-20 are classified as having moderate AH and patients with MELD scores of 21-30 are classified as having severe AH. As with Lille scores, the lower the MELD score, the better the prognosis for the AH patient. In this study (shown in the chart below), the median reduction from baseline in MELD among all DUR-928 treated patients was >2 points and among those with baseline bilirubin levels >8 mg/dL was 5 points by day 28.

*p<0.05 compared to baseline (Wilcoxon's Signed Rank Test)

MELD is calculated based on (a) bilirubin, (b) serum creatinine (sCr), and (c) International Normalized Ratio (INR), which is a measure of prothrombin time.

Safety and Pharmacokinetics

In the Phase 2a study, DUR-928 was well tolerated at all doses tested. There were no drug-related serious adverse events and only three adverse events designated as possibly related to DUR-928: one occurrence of moderate generalized pruritus, one mild rash and one grade two alkaline phosphatase. There were no discontinuations, early withdrawals or termination of study drug or study participation due to adverse events. All patients treated with DUR-928 survived through the 28-day follow-up period. Drug exposures were dose proportional and were not affected by the severity of the disease.

We are working with the FDA and our advisors to finalize the design of a multi-center, international, randomized, double blind, placebo-controlled Phase 2b clinical trial of DUR-928 in AH patients. We are planning to initiate the trial in mid-2020 and, based on our current working assumptions related to trial design, number of clinical trial sites and enrollment rates, top-line data for this trial may be available in 2022.

Phase 1 trials of DUR-928 administered through injection have supported the development of DUR-928 in AH. The initial Phase 1 trial in healthy subjects was a single-site, randomized, double-blinded, placebo-controlled, single-ascending-dose study that evaluated the safety, tolerability and PK of intramuscular (IM) injected DUR-928. The 24-subject study (16 healthy volunteers on the drug and 8 on placebo) of four escalating dose levels resulted in dose proportional systemic exposure of DUR-928 with peak plasma concentrations greater than 1000-fold higher than endogenous levels. DUR-928 was well-tolerated at all dose levels, with no serious treatment-related adverse events reported. We also conducted a multiple-dose study involving 10 healthy subjects, in which participants received IM-injected DUR-928 for 5 consecutive days (8 subjects on the drug, 2 on placebo) using the next to highest dose from the single dose study. No serious treatment related adverse events were reported, no subjects withdrew from the study, no accumulation in plasma concentrations were observed with repeat dosing, and the pain scores and injection site reactions were minimal. We also conducted a single-ascending dose intravenous (IV) infusion study with 16 healthy subjects and observed no treatment-related serious adverse events. The systemic exposure following IV infusion was dose proportional.

A Phase 1 drug-drug interaction study conducted in healthy subjects demonstrated that neither orally administered nor intravenously injected DUR-928 at doses tested affected the safety and PK of midazolam, a drug metabolized by CYP3A4, which is one of the important enzymes associated with clinically relevant drug-drug interactions.

6

We have also conducted a Phase 1b study with injected DUR-928 in patients with impaired kidney function (stage 3 and 4 chronic kidney disease (CKD)) and matched control subjects (MCS), matched by age, body mass and gender with normal kidney function. This study was a single-site, open-label, single-ascending-dose study in two successive cohorts (first a low dose of 30 mg and then a high dose of 120 mg) evaluating safety and PK of intramuscular injected DUR-928. The low dose cohort consisted of 6 patients with CKD and 3 MCS; the high dose cohort consisted of 5 CKD patients and 3 MCS. In this trial, DUR-928 was well tolerated among all subjects and the PK parameters between the kidney function impaired patients and the MCS were comparable. The results of this Phase 1b trial were presented at Kidney Week 2018 in San Diego.

Chronic Liver Disease Program with Orally Administered DUR-928

Market Opportunity. Non-alcoholic fatty liver disease (NAFLD) is the most common form of chronic liver disease in both children and adults. It is estimated that NAFLD affects approximately 30% to 40% of adults and 10% of children in the United States. Non-alcoholic steatohepatitis (NASH), a more severe and progressive form of NAFLD, is one of the most common chronic liver diseases worldwide, with an estimated prevalence of 3-5% globally. No drug is currently approved for treatment of NAFLD or NASH. Moreover, alcoholic fatty liver disease (AFLD), including its more advanced stage, alcoholic steatohepatitis (ASH), develops in approximately 90% of individuals who drink more than 60 grams/day of alcohol, but may occur in individuals who drink less, and is a major contributor to the global burden of liver cirrhosis. In addition to these liver diseases, there are a number of orphan liver diseases for which we may seek to develop DUR-928.

Clinical Program. In March 2019 we began enrolling patients in a Phase 1b randomized and open-label clinical study being conducted in the U.S. to evaluate safety, pharmacokinetics and signals of biological activity of DUR-928 in NASH patients with stage 1-3 fibrosis. DUR-928 (at doses of 50 mg QD, 150 mg QD and 300 mg BID) is administered orally for 28 consecutive days with approximately 20 patients per dose group for a total of approximately 60 patients in the trial as shown below. Key endpoints include safety and pharmacokinetics (PK), clinical chemistry and biomarkers (e.g., bilirubin, lipids, liver enzymes, CK-18s, and inflammatory cytokines) as well as liver fat content by imaging and liver stiffness. We are currently finalizing enrollment in this trial and expect all patients to complete their dosing and follow up visits in the first half of 2020. We plan to announce top line study results following completion of the trial.

We have completed multiple Phase I trials in healthy subjects with orally administered DUR-928. These included single-ascending-dose and multiple-ascending-dose studies as well as a food effect study. In all of these studies DUR-928 was well-tolerated at all dose levels, with no serious treatment-related adverse events reported. Dose related increases in plasma concentrations were observed and no accumulation in plasma concentrations or food effects were observed with repeat dosing.

We also conducted a Phase 1b trial in cirrhotic and non-cirrhotic NASH patients and matched control subjects (MCS) (matched by age, body mass index and gender with normal liver function) utilizing orally administered DUR-928. This was an open-label, single-ascending-dose safety and PK study conducted in Australia in two successive dose cohorts (first a low dose of 50 mg and then a high dose of 200 mg). Both cohorts consisted of 10 NASH patients and 6 MCS. Data from this study was presented at the International Liver Congress™ 2017 organized by the European Association for the Study of the Liver (EASL) in Amsterdam on April 22, 2017. All patients and MCS in this study tolerated DUR-928 well. One patient (with a prior history of arrhythmia and an ongoing viral infection) in the high dose cohort experienced a serious adverse event (shortness of breath), which occurred without unusual biochemical changes and resolved without intervention but was considered possibly treatment related by the physician due to its temporal association with dosing. In both low and high dose cohorts, the PK parameters were comparable between the NASH patients and the MCS. In addition, the systemic exposure following the low and high doses of DUR-928 was dose dependent.

7

While this study was not designed to assess efficacy, we observed statistically significant reductions from baseline of several biomarkers after both doses of DUR-928. A single oral dose of DUR-928 significantly reduced the levels of both full-length and cleaved cytokeratin-18 (CK-18), bilirubin, hsCRP, and IL-18 in these subjects. The mean decrease of full-length CK-18 (a generalized cell death marker) at the measured time point of greatest effect (12 hours after dosing) was 33% in the low dose cohort and 41% in the high dose cohort. The mean decrease of cleaved CK-18 (a cell apoptosis marker) at the measured time point of greatest effect (12 hours after dosing) was 37% in the low dose cohort and 47% in the high dose cohort. The mean reduction of total bilirubin (a liver function marker) at the measured time point of greatest effect (12 hours after dosing) was 27% in the low dose cohort and 31% in the high dose cohort. The mean decrease of high sensitivity C-Reactive Protein (hsCRP) (a marker of inflammation) at the measured time point of greatest effect (24 hours after dosing) was 8% in the low dose cohort and 13% in the high dose cohort. The mean decrease of IL-18 (an inflammatory mediator) at the measured time point of greatest effect (8 hours after dosing) was 4% in the low dose cohort and 8% in the high dose cohort.

Collectively, the biological signals observed in NASH patients plus results from our animal and cell culture studies suggest potential therapeutic activity of DUR-928 for patients with liver diseases. However, additional studies are required to evaluate the safety and efficacy of DUR-928, and there is no assurance that these biomarker effects will be associated with clinically relevant benefits, or that DUR-928 will demonstrate safety or efficacy in treating liver diseases in our ongoing or future trials.

Skin Inflammatory Disorder Program with Topical DUR-928

Clinical program. Following an exploratory Phase 1b trial in psoriasis patients (9 evaluable patients) in Australia, we conducted a Phase 2a, randomized, double-blind, vehicle-controlled proof-of-concept clinical trial, in which DUR-928 was applied topically once-daily for 28 days in patients with mild to moderate plaque psoriasis. The trial was conducted at multiple clinical sites in the U.S., and twenty-two patients completed the study. Patients served as their own controls, applying DUR-928 to the plaque on one arm and the vehicle (placebo) to a similar plaque on the other arm. After the treatment period, patients were followed for an additional four weeks. The primary efficacy endpoint was change in local psoriasis severity index (LPSI) scores from baseline in the DUR-928-treated plaques compared to that in the vehicle-treated plaques. In January 2020, we announced that DUR-928 did not demonstrate a benefit over vehicle (placebo) based on Investigator’s Global Assessment (IGA) or LPSI scores, or in any of the secondary analyses. However, at the end of the 4-week daily application period, plaques in both the DUR-928 and vehicle treatment groups were significantly improved over baseline with respect to both IGA and LPSI scores. In fact, 90% of plaques in both groups had at least a 1 point reduction in LPSI score after the 4-week daily application period. Daily topical application of DUR-928 was well tolerated with no meaningful differences in adverse events between the treatment and vehicle (placebo) groups. There were no AEs attributed to the study drug. Based on the top-line data, we do not plan to continue development of topical DUR-928 in psoriasis at this time and will focus our near term development activities on alcoholic hepatitis and NASH.

8

Additional Proprietary Pharmaceutical Programs

POSIMIR® (bupivacaine extended-release solution)

POSIMIR is our investigational post-operative pain relief depot product that utilizes our patented SABER® technology. POSIMIR is designed to be administered directly into the surgical site to deliver bupivacaine for up to three days after surgery, which we believe coincides with the time period of the greatest need for post-surgical pain control in most patients.

Status. In April 2013, we submitted an NDA as a 505(b)(2) application, which relied in part on the FDA’s findings of safety and effectiveness of a reference drug. In February 2014, we received a Complete Response Letter (CRL) from the FDA. Based on the CRL and subsequent communications with the FDA, we conducted a new Phase 3 clinical trial (the PERSIST trial) consisting of patients undergoing laparoscopic cholecystectomy (gallbladder removal) surgery to further evaluate the benefits and risks of POSIMIR. In October 2017, we reported that the PERSIST trial did not meet its primary efficacy endpoint. While results trended in favor of POSIMIR versus the comparator, they did not achieve statistical significance. After carefully reviewing the existing POSIMIR data and evaluating the feedback we had received from the FDA, including the CRL and other correspondence, we submitted a full response to the CRL to the FDA in June 2019 seeking FDA approval of POSIMIR. In October 2019, the FDA notified the Company that its resubmission for POSIMIR would be discussed at a meeting of the Anesthetic and Analgesic Drug Products Advisory Committee (AADPAC). The FDA had previously assigned a user fee goal date of December 27, 2019; a new user fee goal date has not been assigned. At the AADPAC meeting, six advisory committee members voted to recommend that the efficacy, safety, and overall risk-benefit profile of POSIMIR support approval, while six did not support approval based on the information presented. Although the FDA considers the recommendations of the AADPAC, the recommendations by the panel are non-binding. The final decision regarding pending regulatory actions for a product is made by the FDA. Since the Advisory Committee meeting, we have continued to interact with FDA as they continue their review.

In total, we have completed 16 clinical studies in the POSIMIR program, in seven different surgical procedures, including inguinal hernia repair, shoulder surgery (primarily subacromial decompression), appendectomy, abdominal hysterectomy, open laparotomy, laparoscopic cholecystectomy, and laparoscopic colectomy. The incision lengths treated ranged from a few centimeters for laparoscopic portals, to open laparotomy incisions of up to 35 cm. The seriousness of the surgery ranged from day surgery hernia repair in relatively healthy patients to major abdominal surgery for colon cancer in elderly patients with substantial co-morbidity who were often hospitalized for a week or more. The safety experience from this variety of procedures and patients was designed to allow for extrapolation of the safety and efficacy data to a broad surgical population. Our POSIMIR clinical development program has been devised to establish the safety and efficacy of POSIMIR for the treatment of post-surgical pain for up to 3 days. POSIMIR has not been approved by the FDA for marketing in the U.S. for any indication.

9

Market Opportunity. According to data published by the Center for Disease Control and Prevention, there are approximately 72 million ambulatory and inpatient surgical procedures performed annually in the U.S. Insufficient postoperative pain control remains a significant problem, with studies indicating that roughly 65% of patients experience moderate-to-extreme pain after surgery. The current standard of care for post-surgical pain includes a variety of opiate and non-opiate analgesics and muscle relaxants. While systemic opioids can effectively reduce post-surgical pain, they commonly cause side effects including drowsiness, constipation, nausea and vomiting, and cognitive impairment. Post-surgical pain also can be treated effectively with local anesthetics; however, their usefulness often is limited by their short duration of action.

Long-Acting SABER-Based Investigational Product (HIV)

In July 2019, we entered into a license agreement with Gilead, pursuant to which we granted Gilead the exclusive worldwide rights to develop and commercialize a long-acting injectable HIV product utilizing DURECT’s SABER technology. Gilead also received exclusive access to the SABER platform for HIV and Hepatitis B Virus (HBV) and the exclusive option to license additional SABER-based products directed to HIV and HBV.

Under the terms of the Gilead Agreement, Gilead made an upfront payment to us of $25 million, with the potential for up to an additional $75 million in development and regulatory milestones, up to an additional $70 million in sales-based milestones, as well as tiered single-digit royalties on product sales for a defined period. Gilead has the exclusive option to license additional SABER-based products directed to HIV and HBV for an additional $150 million per product in upfront, development, regulatory and sales-based milestones as well as tiered single-digit royalties on sales. In September 2019, the Company earned a $10 million development milestone payment from Gilead which was received in October 2019. The Gilead Agreement contains customary representations, warranties and indemnification provisions. The term of the agreement is for the duration of Gilead’s obligation to pay royalties for product sales, and the agreement provides each party with specified termination rights, including the right of Gilead to terminate at will with advance notice to us and of each party to terminate the agreement upon material breach by the other party.

We are performing specified development activities with Gilead funding certain portions of the development program. The lead formulation is currently being re-formulated and will undergo additional pre-clinical development work.

PERSERIS™(risperidone)

In September 2017, we entered into an agreement with Indivior, under which we assigned to Indivior certain patents that may provide further intellectual property protection for PERSERIS, Indivior’s extended-release injectable suspension for the treatment of schizophrenia in adults. In consideration for such assignment, Indivior made an upfront non-refundable payment to DURECT of $12.5 million. Indivior also paid a $5 million milestone payment to DURECT in August 2018 following the FDA approval of PERSERIS. Under the terms of the agreement with Indivior, DURECT receives quarterly earn-out payments that are based on a single digit percentage of U.S. net sales of PERSERIS into 2026.

Indivior commercially launched PERSERIS in the U.S. in February 2019. While Indivior has disclosed guidance for $15 to $25 million sales in 2020 for PERSERIS, there can be no assurance such revenues will be achieved.

ORADUR-ADHD Program

In collaboration with Orient Pharma, we developed a drug candidate based on our ORADUR technology for the treatment of ADHD. This drug candidate is intended to provide once-a-day dosing with added tamper resistant characteristics to address common methods of abuse and misuse of these types of drugs. In August 2009, we entered into a development and license agreement, as amended, with Orient Pharma, a diversified multinational pharmaceutical, healthcare and consumer products company with headquarters in Taiwan, under which we granted to Orient Pharma development and commercialization rights in certain defined Asian and South Pacific countries to ORADUR-Methylphenidate ER. We retain rights to North America, Europe and all other countries not specifically licensed to Orient Pharma.

10

In September 2018, Orient Pharma informed us that it had obtained marketing authorization for Methydur Sustained Release Capsules from the Ministry of Health and Welfare in Taiwan. Methydur Sustained Release Capsules are indicated for the treatment of ADHD and will be available in three strengths (22 mg, 33 mg and 44 mg) in Taiwan. Orient Pharma also has stated that it expects to make Methydur Sustained Release Capsules commercially available in Taiwan in 2020, while seeking a partner in China and pursuing regulatory approvals in selected other countries in Southeast Asia where it has commercialization rights and a commercialization presence. We will receive a single digit royalty on sales of Methydur Sustained Release Capsules by Orient Pharma and retain rights to this product in markets not specifically licensed to Orient Pharma.

Drug Delivery Technologies and Programs

Our drug delivery technologies are designed to deliver the right drug to the right place, in the right amount and at the right time to treat a variety of chronic, acute and episodic diseases and conditions. We aim to improve therapy for a given disease or patient population by controlling the rate and duration of drug administration. In addition, if advantageous for the therapy, our technologies can target the delivery of the drug to its intended site of action.

Our technologies are suitable for providing long-term drug therapy because they can often store highly concentrated, stabilized drugs in a small volume and protect the drug from degradation by the body. This, in combination with the ability to continuously deliver desired doses of a drug, can extend the therapeutic value of a wide variety of drugs, including, in some cases, those which would otherwise be ineffective, too unstable, too potent or cause adverse side effects. In some cases, delivering the drug directly to the intended site of action can improve efficacy while minimizing unwanted side effects elsewhere in the body, which often limit the long-term use of many drugs. Our pharmaceutical systems may thus provide better therapy for chronic diseases or conditions, or for certain acute conditions where longer drug dosing is required or advantageous, by replacing multiple injection therapy or oral dosing, improving drug efficacy, reducing side effects and ensuring dosing compliance. Our technology may thereby improve patients’ quality of life by eliminating more repetitive treatments, reducing dependence on caregivers and allowing patients to lead more independent lives.

We currently have several major active drug delivery technology platforms:

The SABER and CLOUD Bioerodible Injectable Depot Systems

Our bioerodible injectable depot systems include our SABER and CLOUD platform technologies. SABER uses a high viscosity base component, such as sucrose acetate isobutyrate (SAIB), to provide controlled release of a drug. When the high viscosity SAIB is formulated with drug, biocompatible excipients and other additives, the resulting formulation is easily injectable with standard syringes and needles. After injection of a SABER formulation, the excipients diffuse away over time, leaving a viscous depot which provides controlled sustained release of drug. CLOUD is a class of bioerodible injectable depot technology which generally does not contain SAIB but includes various other release rate modifying excipients and/or bioerodible polymers to achieve the delivery of drugs for periods of days to months from a single injection.

The SABER technology is the basis of POSIMIR (described above). The SABER technology is also utilized in our long-acting HIV program with Gilead and our ophthalmic program with Santen Pharmaceutical Co., Ltd. (Santen), as well as in feasibility programs.

The SABER technology is also the basis for SucroMate™ Equine, an injectable animal health drug utilizing our SABER technology to deliver the peptide deslorelin. This was the first FDA approved SABER injectable product when it was launched in 2011 by CreoSalus, Inc.

The ORADUR Sustained Release Gel Cap Technology

We believe that our ORADUR sustained release technology can transform short-acting oral capsule dosage forms into sustained release oral products. Products based on our ORADUR technology can take the form of an easy to swallow capsule that uses a high-viscosity base component such as sucrose acetate isobutyrate (SAIB) to provide controlled release of active ingredients for an extended period of time. Oral dosage forms based on the ORADUR gel-cap may also have the added benefit of being less prone to abuse (e.g., by crushing and then snorting, smoking, injecting or extracting by mixing with alcohol or water). These properties have the potential to make ORADUR-based products an attractive option for pharmaceutical companies that seek to develop abuse-deterrent oral products.

The ORADUR technology is the basis of our ORADUR-Methylphenidate ER program (described above).

11

Our objective is to develop multiple pharmaceutical products that address significant unmet medical needs and improve patients’ quality of life. To achieve this objective, our strategy includes the following key elements:

Focus on Areas with the Potential for Significant Value Creation. We view patients, physicians, the healthcare system, payers, and strategic partners, as all being important stakeholders in our company. We believe that developing the products in our pipeline, which may address significant unmet medical needs and may create value for our stakeholders, also has the potential to create value for our shareholders.

Apply our Drug Development Expertise to New Chemical Entities Derived from our Epigenetic Regulator Program. We have assembled a core team of employees with considerable experience in drug development, and it is our intent to leverage their capabilities by developing pharmaceuticals derived from our Epigenetic Regulator Program. We believe that these new chemical entities may have utility in acute organ injuries such as AH and AKI, in various orphan diseases, and for several metabolic diseases such as NASH, NAFLD and other liver conditions. We believe that these product candidates may be of interest to other pharmaceutical companies and that it may be possible to license the rights to certain products, formulations, indications or territories from this program while retaining the rights to other product candidates, formulations, indications or territories for either our own development and commercialization or for licensing at a later stage of development.

Focus on Certain Acute Indications, Chronic Debilitating Medical Conditions and Certain Local Pain Conditions. Many of the diseases and disorders that present great challenges to medicine include acute organ injury, metabolic disorders, pain management, CNS disorders, cardiovascular disease, ophthalmic conditions and other chronic diseases. Our current efforts focus on exploiting our Epigenetic Regulator Program through which we have identified new chemical entities that may have utility in conditions such as acute organ injuries and chronic metabolic/lipid disorders and on using our versatile drug delivery platform technologies to develop products that improve current treatment options.

Diversify Risk by Pursuing Multiple Programs in Development. In order to reduce the risks inherent in pharmaceutical product development, we have diversified our product pipeline such that, between our own programs and those where we have collaborated, we have multiple programs with the potential to generate significant value. We believe that having multiple programs in development helps mitigate the negative consequences to us of any setbacks or delays in any one of our programs.

Enable Product Development Through Strategic Agreements. We believe that entering into selective strategic collaborations and other arrangements with respect to our product development programs and technology can enhance the success of our product development and commercialization, leverage the value of our intellectual property portfolio, mitigate our risk and enable us to better manage our operating costs. Additionally, such collaborations and arrangements enable us to leverage investment by third parties and reduce our net cash burn, while retaining significant economic rights.

Build Our Own Commercial Organization. In the future, we may elect to build our own commercial, sales and marketing capability in order to capture more of the economic value of certain products that we may develop. If we choose to enter into third-party collaborations to commercialize our pharmaceutical product candidates, we may in the future enter into these alliances under circumstances that allow us to participate in the sales and marketing of these products.

Strategic Agreements

We have entered into the following strategic collaboration and other key agreements:

Virginia Commonwealth University Intellectual Property Foundation. We have entered into an exclusive in-license and research and development agreement with the Virginia Commonwealth University Intellectual Property Foundation regarding the new chemical entities under development through our Epigenetic Regulator Program, including DUR-928. Under this licensing arrangement, we have agreed to undertake certain efforts to bring licensed products to market, pay for prosecution of related patents and report on progress to VCU. In addition, we are obligated to pay low single-digit percentage patent royalties on net sales of licensed products, subject to annual minimum payments and additional milestone payments. This license includes rights to seven patent families. We may terminate this agreement at any time by written notice, and VCU may terminate this agreement by written notice if there is an uncured material breach.

12

Gilead Sciences, Inc. In July 2019, we entered into a license agreement (the “Gilead Agreement”) with Gilead Sciences, Inc. (“Gilead”). Pursuant to the Gilead Agreement, we granted Gilead the exclusive worldwide rights to develop and commercialize a long-acting injectable HIV product utilizing our SABER® technology. Gilead also received exclusive access to the SABER platform for HIV and Hepatitis B Virus (HBV) and the exclusive option to license additional SABER-based products directed to HIV and HBV.

Under the terms of the Gilead Agreement, Gilead made an upfront payment to us of $25 million, with the potential for up to an additional $75 million in development and regulatory milestones, up to an additional $70 million in sales-based milestones, as well as tiered single-digit royalties on product sales for a defined period. Gilead has the exclusive option to license additional SABER-based products directed to HIV and HBV for up to an additional $150 million per product in upfront, development, regulatory and sales-based milestones as well as tiered single-digit royalties on sales. In September 2019, we earned a $10 million development milestone payment from Gilead; this payment was received in October 2019. The Gilead Agreement contains customary representations, warranties and indemnification provisions. The term of the Gilead Agreement is for the duration of Gilead’s obligation to pay royalties for product sales under the Gilead Agreement. The Gilead Agreement provides each party with specified termination rights, including the right of Gilead to terminate at will with advance notice to us and each party to terminate the Gilead Agreement upon material breach of the Gilead Agreement by the other party.

We are performing specified development activities with Gilead funding certain portions of the development program. The lead formulation is currently being re-formulated and will undergo additional pre-clinical development work.

Indivior UK Ltd. In September 2017, we entered into a patent purchase agreement (the “Indivior Agreement”) with Indivior. Pursuant to the Indivior Agreement, we assigned to Indivior certain patents that may provide further intellectual property protection for PERSERIS, Indivior’s once-monthly injectable risperidone product for the treatment of schizophrenia. In consideration for such assignment, Indivior made an upfront non-refundable payment to us of $12.5 million, and also agreed to make an additional $5 million payment to us contingent upon FDA approval of PERSERIS, as well as quarterly earn-out payments based on a single digit percentage of U.S. net sales for certain products covered by the assigned patent rights, including PERSERIS. The assigned patent rights include granted patents extending into at least 2026. We also receive a non-exclusive right under the assigned patents to develop and commercialize certain risperidone-containing products and products that do not contain risperidone or buprenorphine. The agreement contains customary representations, warranties and indemnities of the parties. We received the non-refundable payment of $12.5 million from Indivior in September 2017 and recognized this amount as revenue from sale of intellectual property rights in the year ended December 31, 2017 as we did not have any continuing obligations under the purchase agreement. In July 2018, Indivior announced that the FDA had approved the NDA for PERSERIS thereby triggering the $5.0 million payment, which was received by DURECT in August 2018. Indivior launched PERSERIS in the U.S. in February 2019.

Santen Pharmaceutical Co., Ltd. In December 2014, we and Santen entered into a definitive agreement (the “Santen Agreement”). Pursuant to the Santen Agreement, we have granted Santen an exclusive worldwide license to our proprietary SABER formulation platform and other intellectual property to develop and commercialize a sustained release product utilizing our SABER technology to deliver an ophthalmology drug. Santen controls and funds the development and commercialization program, and the parties have established a joint management committee to oversee, review and coordinate the development activities of the parties under the Agreement.

In connection with the license agreement, Santen paid us a non-refundable upfront fee of $2.0 million in cash and agreed to make contingent cash payments to us of up to $76.0 million upon the achievement of certain milestones, of which $13.0 million are development-based milestones (none of which has been achieved as of December 31, 2019), and $63.0 million are commercialization-based milestones including milestones requiring the achievement of certain product sales targets (none of which has been achieved as of December 31, 2019). Santen will also pay for certain of our costs incurred in the development of the licensed product. If the product is commercialized, we would also receive a tiered royalty on annual net product sales ranging from single-digit to the low double digits, determined on a country-by-country basis. Santen may terminate the Agreement without cause at any time upon prior written notice, and either party may terminate the Agreement upon certain circumstances including a material uncured breach. As of December 31, 2019, the cumulative aggregate payments received by us under this agreement were $3.3 million. In January 2018, we were notified by Santen that due to a shift in near term priorities, Santen has elected to reallocate research and development resources and put our program on pause until further notice. While the main program is on pause, the parties are working together on a limited set of research and development activities funded by Santen.

13

Sandoz AG. In May 2017, the Company and Sandoz AG (“Sandoz”) entered into a license agreement to develop and market POSIMIR in the United States. POSIMIR is the Company’s investigational post-operative pain relief depot that utilizes the Company’s patented SABER technology to deliver bupivacaine to provide up to three days of pain relief after surgery. Under terms of the agreement, Sandoz made an upfront payment of $20 million and the Company was eligible for additional milestone and royalty payments. In May 2018, the Company and Sandoz entered into an amendment to the license agreement, under which, among other things, both parties’ termination provisions were modified. In January 2019, Sandoz AG provided notice that it was returning to DURECT all of its U.S. development and commercialization rights to POSIMIR. The parties are in dispute with regard to Sandoz’s obligation to pay a termination fee to DURECT. DURECT has initiated a formal dispute resolution process related to the termination fee.

Commercial Product Lines

ALZET

The ALZET product line consists of miniature, implantable osmotic pumps and accessories used for research in mice, rats and other laboratory animals. These pumps are neither approved nor intended for human use. ALZET pumps continuously deliver drugs, hormones and other test agents at controlled rates from one day to six weeks without the need for external connections, frequent handling or repeated dosing. In laboratory research, these infusion pumps can be used for systemic administration when implanted under the skin or in the body. They can be attached to a catheter for intravenous, intracerebral, or intra-arterial infusion or for targeted delivery, where the effects of a drug or test agent are localized in a particular tissue or organ. The wide use and applications of the ALZET product line is evidenced by the more than 19,000 scientific references that now exist.

LACTEL Absorbable Polymers

We currently design, develop and manufacture a wide range of standard and custom biodegradable polymers based on lactide, glycolide and caprolactone under the LACTEL brand for pharmaceutical and medical device clients for use as raw materials in their products. These materials are manufactured and sold by us directly from our facility in Alabama and are used by us and our third-party customers for a variety of controlled-release and medical-device applications, including several FDA-approved commercial products.

Marketing and Sales

Historically, we have established strategic distribution and marketing alliances for our product candidates to leverage the established sales organizations that certain pharmaceutical companies have in markets we are targeting. In the future, we may elect to build our own commercial, sales and marketing capability in order to capture more of the economic value of certain products that we may develop. If we choose to enter into third-party collaborations to commercialize our pharmaceutical product candidates, we may in the future enter into these alliances under circumstances that allow us to participate in the sales and marketing of these products. We will continue to pursue strategic alliances and collaborators from time to time consistent with our strategy to leverage the established sales organizations of third-party collaborators.

We market and sell our ALZET and LACTEL product lines through a direct sales force in the U.S. and through a network of distributors outside of the U.S.

Suppliers

As needed, we purchase sucrose acetate isobutyrate, a raw material for our ORADUR and SABER-based pharmaceutical systems, including Methydur Sustained Release Capsules, POSIMIR, and SucroMate, from Eastman Chemical Company. We expect that we will continue to be able to obtain sufficient supply of these raw materials to meet our needs for the foreseeable future. We do not have in place long term supply agreements with respect to all of the components of any of our pharmaceutical product candidates, however, and are subject to the risk that we may not be able to procure all required components in adequate quantities with acceptable quality, within acceptable time frames or at reasonable cost.

Customers

Our product revenues principally are derived from sales of the ALZET product line to academic and pharmaceutical industry researchers, the LACTEL product lines to pharmaceutical and medical device customers, and from the sale of certain key excipients that are included in Methydur Sustained Release Capsules, SucroMate and other products. Until such time that we are able to bring our pharmaceutical product candidates to market, if at all, we expect these to be our principal sources of product revenue. We also receive revenue from collaborative research and development arrangements with our third-party collaborators. In 2019, Gilead accounted for 58% of the Company’s total revenue. In 2018, Indivior and Gilead accounted for 27% and 14% of our total revenues, respectively. In 2017, Sandoz and Indivior accounted for 41% and 25% of our total revenues, respectively.

14

The process for manufacturing our pharmaceutical product candidates is technically complex, requires special skills, and must be performed in qualified facilities. We have entered into development and commercial manufacturing agreements with third parties for the manufacture of DUR-928 and POSIMIR. In addition, we have a small multi-discipline manufacturing facility in California that we have used to manufacture research and clinical supplies of several of our pharmaceutical product candidates under GMP, including DUR-928 and POSIMIR. In the future, we may develop additional manufacturing capabilities for our pharmaceutical product candidates and components to meet our demands and those of our third-party collaborators by contracting with third party manufacturers and by potentially constructing additional manufacturing space at our current facilities in California and/or Alabama. We manufacture our ALZET product line and certain key components for POSIMIR and Methydur at one of our California facilities and our LACTEL product line at our Alabama facility.

Patents and Proprietary Rights

Our success depends in part on our ability to obtain patents, to protect trade secrets, to operate without infringing upon the proprietary rights of others and to prevent others from infringing on our proprietary rights. Our policy is to seek to protect our proprietary position by, among other methods, filing U.S. and foreign patent applications related to our proprietary molecules and technology, inventions and improvements that are important to the development of our business. As of February 28, 2020, we owned or exclusively in-licensed over 40 unexpired issued U.S. patents and over 185 unexpired issued foreign patents (which include granted European patent rights that have been validated in various EU member states). In addition, we have over 40 pending U.S. patent applications and over 145 foreign applications pending in Europe, Australia, Japan, Canada and other countries.

Proprietary rights relating to our planned and potential products will be protected from unauthorized use by third parties only to the extent that they are covered by valid and enforceable patents or are effectively maintained as trade secrets. Patents owned by or licensed to us may not afford protection against competitors, and our pending patent applications now or hereafter filed by or licensed to us may not result in patents being issued. In addition, the laws of certain foreign countries may not protect our intellectual property rights to the same extent as do the laws of the U.S.

The patent positions of biopharmaceutical companies involve complex legal and factual questions and, therefore, their enforceability cannot be predicted with certainty. Our patents or patent applications, or those licensed to us, if issued, may be challenged, invalidated or circumvented, and the rights granted thereunder may not provide proprietary protection or competitive advantages to us against competitors with similar technology. Furthermore, our competitors may independently develop similar technologies or duplicate any technology developed by us. Because of the extensive time required for development, testing and regulatory review of a potential product, it is possible that, before any of our products can be commercialized, any related patent may expire or remain in existence for only a short period following commercialization, thus reducing any advantage of the patent, which could adversely affect our ability to protect future product development and, consequently, our operating results and financial position.

Because patent applications in the U.S. are typically maintained in secrecy for at least 18 months after filing and since publication of discoveries in the scientific or patent literature often lag behind actual discoveries, we cannot be certain that we were the first to make the inventions covered by each of our issued or pending patent applications or that we were the first to file for protection of inventions set forth in such patent applications.

Our planned or potential products may be covered by third-party patents or other intellectual property rights, in which case we would need to obtain a license to continue developing or marketing these products. Any required licenses may not be available to us on acceptable terms, if at all. If we do not obtain any required licenses, we could encounter delays in product introductions while we attempt to design around these patents, or could find that the development, manufacture or sale of products requiring such licenses is foreclosed. Litigation may be necessary to defend against or assert such claims of infringement, to enforce patents issued to us, to protect trade secrets or know-how owned by us, or to determine the scope and validity of the proprietary rights of others. In addition, interference, derivation, post-grant oppositions, and similar proceedings may be necessary to determine rights to inventions in our patents and patent applications. Litigation or similar proceedings could result in substantial costs to and diversion of effort by us, and could have a material adverse effect on our business, financial condition and results of operations. These efforts by us may not be successful.

15

We may rely, in certain circumstances, on trade secrets to protect our technology. However, trade secrets are difficult to protect. We seek to protect our proprietary technology and processes, in part, by confidentiality agreements with our employees and certain contractors. There can be no assurance that these agreements will not be breached, that we will have adequate remedies for any breach, or that our trade secrets will not otherwise become known or be independently discovered by competitors. To the extent that our employees, consultants or contractors use intellectual property owned by others in their work for us, disputes may also arise as to the rights in related or resulting know-how and inventions.

Government Regulation

The Food and Drug Administration. The FDA and comparable regulatory agencies in state and local jurisdictions and in foreign countries impose substantial requirements upon the development, manufacture and marketing of pharmaceutical products. These agencies and other federal, state and local entities regulate research and development activities and the testing, manufacture, quality control, safety, effectiveness, labeling, storage, distribution, record keeping, approval, advertising and promotion of our products. We believe that our products in development will be regulated as drugs by the FDA rather than as biologics or devices.

The process required by the FDA under the new drug provisions of the Federal Food, Drug and Cosmetics Act (the Act) before our products in development may be marketed in the U.S. generally involves the following:

|

|

• |

preclinical laboratory and animal tests; |

|

|

• |

submission of an Investigational New Drug (IND) application which must become effective before clinical trials may begin; |

|

|

• |

adequate and well-controlled human clinical trials to establish the safety and efficacy of the proposed pharmaceutical products candidates in their intended uses; and |

|

|

• |

FDA approval of a new drug application. |

Section 505 of the Act describes three types of new drug applications: (1) an application that contains full reports of investigations of safety and effectiveness (section 505(b)(1)); (2) an application that contains full reports of investigations of safety and effectiveness but where at least some of the information required for approval comes from studies not conducted by or for the applicant and for which the applicant has not obtained a right of reference (section 505(b)(2)); and (3) an application that contains information to show that the proposed product is identical in active ingredient, dosage form, strength, route of administration, labeling, quality, performance characteristics and intended use, among other things, to a previously approved product (section 505(j)). We expect that most of the Drug Delivery Program product candidates will be evaluated for approval after submission of a new drug application under section 505(b)(2) and that our drug candidates deriving from our Epigenetic Regulator Program will be evaluated for approval after submission of a new drug application under section 505(b)(1).

The testing and approval process require substantial time, effort, and financial resources, and we cannot be certain that any approval will be granted on a timely basis, if at all. Even though several of our pharmaceutical products candidates utilize active drug ingredients that are commercially marketed in the United States in other dosage forms, we need to establish safety and effectiveness of those active ingredients in the formulation and dosage forms that we are developing.

Preclinical tests include laboratory evaluation of the product, its chemistry, formulation and stability, as well as animal studies to assess the potential safety and efficacy of the pharmaceutical product candidate. We then submit the results of the preclinical tests, together with manufacturing information and analytical data, to the FDA as part of an IND, which must become effective before we may begin human clinical trials. Each subsequent new clinical protocol must also be submitted to the FDA under the IND. An IND automatically becomes effective 30 days after receipt by the FDA, unless the FDA, within the 30-day time period, raises concerns or questions about the conduct of the trials as outlined in the IND and imposes a clinical hold. In such a case, the IND sponsor and the FDA must resolve any outstanding concerns before clinical trials can begin. Our submission of an IND may not result in FDA authorization to commence clinical trials. Further, an independent Institutional Review Board at each medical center proposing to conduct the clinical trials must review and approve any clinical study as well as the related informed consent forms and authorization forms that permit us to use individually identifiable health information of study participants.

16

Human clinical trials are typically conducted in three sequential phases which may overlap:

|

|

• |

Phase 1: The drug is initially introduced into healthy human subjects or patients and tested for safety, dosage tolerance, absorption, metabolism, distribution and excretion. |

|

|

• |

Phase 2: Involves clinical trials in a limited patient population to identify possible adverse effects and safety risks, to determine the efficacy of the product for specific targeted diseases and to determine dosage tolerance and optimal dosage. |

|

|

• |

Phase 3: When Phase 2 clinical trials demonstrate that a dosage range of the product is effective and has an acceptable safety profile, Phase 3 clinical trials are undertaken to further evaluate dosage, clinical efficacy and to further test for safety in an expanded patient population, at multiple, geographically dispersed clinical study sites. |

In the case of products for severe diseases, such as chronic pain, or life-threatening diseases such as cancer, the initial human testing is often conducted in patients with disease rather than in healthy volunteers. Since these patients already have the target disease or condition, these studies may provide initial evidence of efficacy traditionally obtained in Phase 2 trials, and thus these trials are frequently referred to as Phase 1/2 clinical trials or Phase 1b trials. We cannot be certain that we will successfully complete Phase 1, Phase 2 or Phase 3 clinical trials of our pharmaceutical products in development within any specific time period, if at all. Furthermore, the FDA or the Institutional Review Board or the sponsor may suspend clinical trials at any time on various grounds, including a finding that the subjects or patients are being exposed to an unacceptable health risk. During the clinical development of products, sponsors frequently meet and consult with the FDA in order to ensure that the design of their studies will likely provide data both sufficient and relevant for later regulatory review; however, no assurance of approvability can be given by the FDA.

The results of product development, preclinical studies and clinical studies are submitted to the FDA as part of a new drug application, or NDA, for approval of the marketing and commercial shipment of the product. Submission of an NDA may require the payment of a substantial user fee to the FDA, and although the agency has defined user fee goals for the time in which to respond to sponsor applications, there can be no assurance that the FDA will act in any particular timeframe. The FDA may deny a new drug application if the applicable regulatory criteria are not satisfied or may require additional clinical trials be conducted. Even if such data is submitted, the FDA may ultimately decide that the new drug application does not satisfy the criteria for approval. Once issued, the FDA may withdraw product approval if compliance with regulatory standards is not maintained or if safety problems occur after the product reaches the market. Requirements for additional Phase 4 studies (post approval marketing studies) to confirm safety and effectiveness in a broader commercial use population may be imposed as a condition of marketing approval. In addition, the FDA requires surveillance programs to monitor approved products which have been commercialized, and the agency has the power to require changes in labeling or to prevent further marketing of a product based on the results of these post-marketing programs. Any comparative claims comparing a product to other dosage forms or competitive products typically need to be supported by two adequate and well-controlled head-to-head clinical trials.