UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

(Amendment No. 1)

For the quarterly period ended

For the transition period from __________ to __________

Commission file number

(Exact name of registrant as specified in its charter)

| 4832 | ||||

|

State or other jurisdiction of incorporation or organization |

Primary Standard Industrial Classification Number |

IRS Employer Identification Number |

Tel:

(Address and telephone number of principal executive offices)

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12

months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days.

Indicate by check mark whether the registrant

has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405

of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | o | x | |

| Large accelerated filer | o | Smaller reporting company | |

| Emerging growth company |

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant

is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o

Securities registered pursuant to Section 12(b) of the Act: None

State the number of shares outstanding of each of the issuer’s classes of common equity, as of the latest practicable date: common shares, $0.001 par value, issued and outstanding as of May 20, 2024.

EXPLANATORY NOTE

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain information included in this Quarterly Report on Form 10-Q and other filings of the Registrant under the Securities Act of 1933, as amended (the “Securities Act”), and the Securities Exchange Act of 1934, as amended (the “Exchange Act”), as well as information communicated orally or in writing between the dates of such filings, contains or may contain “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. Forward-looking statements in this Quarterly Report on Form 10-Q, including without limitation, statements related to our plans, strategies, objectives, expectations, intentions and adequacy of resources, are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Such statements are subject to certain risks, trends and uncertainties that could cause actual results to differ materially from expected results. Among these risks, trends and uncertainties are the availability of working capital to fund our operations, the competitive market in which we operate, the efficient and uninterrupted operation of our computer and communications systems, our ability to generate a profit and execute our business plan, the retention of key personnel, our ability to protect and defend our intellectual property, the effects of governmental regulation, and other risks identified in the Registrant’s filings with the Securities and Exchange Commission from time to time.

In some cases, forward-looking statements can be identified by terminology such as “may,” “will,” “should,” “could,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of such terms or other comparable terminology. Although the Registrant believes that the expectations reflected in the forward-looking statements contained herein are reasonable, the Registrant cannot guarantee future results, levels of activity, performance or achievements. Moreover, neither the Registrant, nor any other person, assumes responsibility for the accuracy and completeness of such statements. The Registrant is under no duty to update any of the forward-looking statements contained herein after the date of this Quarterly Report on Form 10-Q.

| 2 |

KUBER RESOURCES CORPORATION

QUARTERLY REPORT ON FORM 10-Q

TABLE OF CONTENTS

| Page | ||||

| PART I FINANCIAL INFORMATION: | ||||

| Item 1. | Consolidated Financial Statements (Unaudited) | 4 | ||

| Consolidated Balance Sheets as of March 31, 2024 (Unaudited) and December 31, 2023 | 5 | |||

| Consolidated Statements of Operations for the Three Months Ended March 31, 2024 and 2023 (Unaudited) | 6 | |||

| Consolidated Statements of Changes in Stockholders’ Deficit for the Three Months Ended March 31, 2024 and 2023 (unaudited) | 7 | |||

| Consolidated Statements of Cash Flows for the Three Months Ended March 31, 2024 and 2023 (unaudited) | 8 | |||

| Notes to the Unaudited Consolidated Financial Statements (Unaudited) | 9 | |||

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 24 | ||

| Item 3. | Quantitative and Qualitative Disclosures About Market Risk | 28 | ||

| Item 4. | Controls and Procedures | 28 | ||

| PART II OTHER INFORMATION: | ||||

| Item 1. | Legal Proceedings | 29 | ||

| Item 1A. | Risk Factors | 29 | ||

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds | 30 | ||

| Item 3. | Defaults Upon Senior Securities | 30 | ||

| Item 4. | Submission of Matters to a Vote of Securities Holders | 30 | ||

| Item 5. | Other Information | 30 | ||

| Item 6. | Exhibits | 31 | ||

| Signatures | 32 | |||

| 3 |

PART 1 – FINANCIAL INFORMATION

Item 1. Financial Statements

The accompanying interim consolidated financial statements of KUBER RESOURCES CORPORATION. (“the Company”, “we”, “us” or “our”), have been prepared without audit pursuant to the rules and regulations of the Securities and Exchange Commission. Certain information and footnote disclosures normally included in financial statements prepared in accordance with United States generally accepted principles have been condensed or omitted pursuant to such rules and regulations.

The interim consolidated financial statements should be read in conjunction with the company’s latest annual financial statements.

In the opinion of management, the consolidated financial statements contain all material adjustments, consisting only of normal adjustments considered necessary to present fairly the financial condition, results of operations, and cash flows of the Company for the interim periods presented.

| 4 |

Kuber Resources Corporation

Consolidated Balance Sheets

As of March 31, 2024 and December 31, 2023

| March 31, | December 31, | |||||||

| 2024 | 2023 | |||||||

| (Unaudited) | ||||||||

| ASSETS | ||||||||

| Current Assets | ||||||||

| Cash and cash equivalents | $ | $ | ||||||

| Accounts receivable, net | ||||||||

| Advances to suppliers | ||||||||

| Due from related parties | ||||||||

| Other receivables and current assets | ||||||||

| Total Current Assets | ||||||||

| Non-Current Assets | ||||||||

| Property, plant and equipment, net | ||||||||

| Intangible assets, net | ||||||||

| Operating lease right of use asset | ||||||||

| Total Non-Current Assets | ||||||||

| Total Assets | ||||||||

| LIABILITIES AND SHAREHOLDERS’ EQUITY | ||||||||

| Current Liabilities | ||||||||

| Accounts payable and accrued expenses | ||||||||

| Other payables | ||||||||

| Due to related parties | ||||||||

| Taxes payable | ||||||||

| Advances from customers | ||||||||

| Operating lease liabilities - current | ||||||||

| Total Current Liabilities | ||||||||

| Non-Current Liabilities | ||||||||

| Operating lease liabilities - non-current | ||||||||

| Total Non-Current Liabilities | ||||||||

| Total Liabilities | ||||||||

| Shareholders’ Equity | ||||||||

| Series A Convertible Preferred stock, par value $ per share; shares authorized; shares issued and outstanding at March 31, 2024 and December 31, 2023, respectively | ||||||||

| Series B Convertible Preferred stock, par value $ per share; shares authorized; shares issued and outstanding at March 31, 2024 and December 31, 2023, respectively | ||||||||

| Preferred stock, par value $ per share; shares authorized; shares issued and outstanding at March 31, 2024 and December 31, 2023, respectively | ||||||||

| Common stock, par value $ per share; shares authorized; shares issued and outstanding at March 31, 2024 and December 31, 2023 respectively | ||||||||

| Additional paid-in capital | ||||||||

| Statutory reserves | ||||||||

| Accumulated deficit | ( | ) | ( | ) | ||||

| Accumulated other comprehensive loss | ( | ) | ( | ) | ||||

| Total Equity | ||||||||

| Total Liabilities and Shareholders’ Equity | $ | $ | ||||||

The accompanying notes are an integral part of these consolidated financial statements.

| 5 |

Kuber Resources Corporation

Consolidated Statements of Income and Comprehensive Income

For the three months ended March 31, 2024 and 2023

(Unaudited)

| Three Months Ended | ||||||||

| March 31, | March 31, | |||||||

| 2024 | 2023 | |||||||

| Revenues, net | $ | $ | ||||||

| Cost of revenues | ||||||||

| Gross profit | ||||||||

| Operating expenses | ||||||||

| Selling and marketing expense | ||||||||

| General and administrative expenses | ||||||||

| Total Operating expenses | ||||||||

| Income from operations | ( | ) | ||||||

| Other income (expense) | ||||||||

| Interest income(expense) | ( | ) | ||||||

| Total other income (expenses), net | ( | ) | ||||||

| Income (loss) before income tax | ( | ) | ||||||

| Income tax expense | ||||||||

| Net income (loss) | ( | ) | ||||||

| Weighted average shares outstanding | ||||||||

| Basic | ||||||||

| Earnings (Loss) per share | ||||||||

| Basic | ||||||||

| Other comprehensive income (loss): | ||||||||

| Net income (loss) | ( | ) | ||||||

| Other comprehensive income (loss): | ||||||||

| Foreign currency translation (loss) income | ( | ) | ||||||

| Total comprehensive income (loss) | ( | ) | ||||||

The accompanying notes are an integral part of these consolidated financial statements.

| 6 |

Kuber Resources Corporation

Consolidated Statements of Changes in Shareholders’ Equity

For the three months ended March 31, 2024 and 2023

(Unaudited)

| Series A Convertible | Series B Convertible | Accumulated | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Preferred Stock | Preferred Stock | Preferred Stock | Common Stock | Additional | other | |||||||||||||||||||||||||||||||||||||||||||||||

| Number of | Number of | Number of | Number of | Paid-in | Statutory | Accumulated | Comprehensive | |||||||||||||||||||||||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | Shares | Amount | Shares | Amount | Capital | Reserve | Deficit | Income | Total | ||||||||||||||||||||||||||||||||||||||||

| For the Three Months Ended March 31, 2023 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance at December 31, 2022 | $ | $ | $ | $ | $ | $ | $ | ( | ) | $ | $ | |||||||||||||||||||||||||||||||||||||||||

| Common stock issued for services | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net income | ( | ) | ( | ) | ||||||||||||||||||||||||||||||||||||||||||||||||

| Balance at March 31, 2023 | ( | ) | ||||||||||||||||||||||||||||||||||||||||||||||||||

| For the Three Months Ended March 31, 2024 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance at December 31, 2023 | ( | ) | ( | ) | ||||||||||||||||||||||||||||||||||||||||||||||||

| Net income | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Appropriations to statutory reserves | ( | ) | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Foreign currency translation adjustment | ( | ) | ( | ) | ||||||||||||||||||||||||||||||||||||||||||||||||

| Balance at March 31, 2024 | ( | ) | ( | ) | ||||||||||||||||||||||||||||||||||||||||||||||||

The accompanying notes are an integral part of these consolidated financial statements.

| 7 |

Kuber Resources Corporation

Consolidated Statements of Cash Flows

For the three months ended March 31, 2024 and 2023

(Unaudited)

| Three Months Ended | ||||||||

| March 31, | March 31, | |||||||

| 2024 | 2023 | |||||||

| CASH FLOW FROM OPERATING ACTIVITIES | ||||||||

| Net income | $ | $ | ( | ) | ||||

| Adjustments to reconcile net loss to net cash (used in) operating activities: | ||||||||

| Depreciation and amortization expense | ||||||||

| Amortization of operating lease ROU assets | ||||||||

Impairment of assets | ||||||||

| Shares issued for services | ||||||||

| Changes in assets and liabilities: | ||||||||

| Accounts receivable | ( | ) | ||||||

| Due from relates parties | ||||||||

| Prepaid expense | ||||||||

| Deposits | ( | ) | ||||||

| Customer advances | ( | ) | ||||||

| Account payable and accrued expenses | ||||||||

| Other payable | ||||||||

| Loan payable - related party | ||||||||

| Contract liability | ( | ) | ||||||

| Operating lease liabilities | ( | ) | ( | ) | ||||

| Net cash provided by (used in) operating activities | ( | ) | ||||||

| CASH FLOW FROM FINANCING ACTIVITIES | ||||||||

| Proceeds from (Repayment to) related party | ( | ) | ||||||

| Net cash provided by (used in) financing activities | ( | ) | ||||||

| Effect of exchange rate changes on cash and cash equivalents | ( | ) | ||||||

| NET INCREASE IN CASH AND CASH EQUIVALENTS | ||||||||

| CASH AND CASH EQUIVALENTS, beginning of period | ||||||||

| CASH AND CASH EQUIVALENTS, end of period | $ | $ | ||||||

| - | ||||||||

| SUPPLEMENTAL CASH FLOW INFORMATION: | ||||||||

| Income taxes paid | $ | $ | ||||||

| Non-cash financing and investing activities: | ||||||||

| Recognized ROU assets through lease liabilities | $ | |||||||

The accompanying notes are an integral part of these consolidated financial statements.

| 8 |

KUBER RESOURCES CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED MARCH 31, 2024 AND 2023

(Unaudited)

Note 1 – Organization and Nature of Business

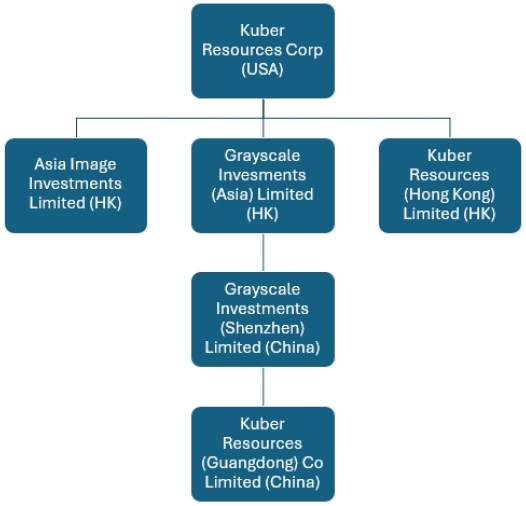

Kuber Resources Corporation formerly known as Uonlive Corporation (“KUBR” or the “Company”) was incorporated under the laws of the State of Nevada on January 29, 1998 as Weston International Development Corporation. On July 28, 1998, its name was changed to Txon International Development Corporation. On September 15, 2000, the Company changed its name to China World Trade Corporation. On July 2, 2008, the Company further changed its name to Uonlive Corporation.

The Company ceased its former operations in early 2015. The Company has fully impaired all assets since the shutdown of its operations in 2015 and has recorded the effects of this impairment as part of its discontinued operations.

On June 15, 2018, the eight judicial District Court of Nevada appointed Small Cap Compliance, LLC as custodian for Uonlive Corporations., proper notice having been given to the officers and directors of Uonlive Corporation and there was no opposition.

On September 10, 2019, the Company filed a certificate of revival with the state of Nevada, appointing Raymond Fu as, President, Secretary, Treasurer and Director.

On March 2, 2020, the Company entered into a Definitive Share Agreement whereby Raymond Fu, the sole shareholder of Asia Image Investment Limited (“Asia Image”), relinquished all his shares in Asia Image and acquired 100,000 shares of the Company. Consequently, Asia Image became a wholly-owned subsidiary of the Company.

Since the major shareholder of the Company retained control of both the Company and Asia Image, the share exchange was accounted for as a reverse merger. As such, the Company recognized the assets and liabilities of Asia Image, acquired in the Reorganization, at their historical carrying amounts.

On November 7, 2022, the Company acquired all shares of Kuber Resources (Hong Kong) Limited ("Kuber HK") from GRL21 Nominee Limited for one Hong Kong dollar (HKD1.00). Consequently, Kuber HK became a wholly-owned subsidiary of the Company. Kuber HK, formerly known as Star Wise Limited, was established in Hong Kong on October 21, 2022. It officially changed its name to Kuber Resources (Hong Kong) Limited on November 1, 2022, which has not commenced any operations since its inception. The acquisition of Kuber HK aims to diversify the Company's business portfolio beyond its current focus on international commodities trading conducted by Asia Image Limited.

On December 8, 2022, the Company filed Articles of Amendment (the “Articles of Amendment”) to its Articles of Incorporation, as amended, with the Secretary of Nevada to change the Company’s corporate name to Kuber Resources Corporation (the “Name Change”). In connection with the Name Change, the Company’s has changed its ticker symbol from “UOLI” to the new ticker symbol “KUBR” (the “Symbol Change”). There is no change in the CUSIP number of the Company’s common stock in connection with the Name Change and Symbol Change. As previously reported, the majority of issued and outstanding shares approved the Name Change and Symbol Change on September 15, 2022 by written consent.

The Financial Industry Regulatory Authority (“FINRA”) announced the effectiveness of the Name Change and Symbol Change on December 9, 2022, which became effective in the market and for trading under the new name and ticker symbol on Monday, December 12, 2022.

The Name Change and Symbol Change do not affect the rights of the Company’s security holders. The Company’s common stock will continue to be quoted on OTC Markets. Following the Name Change, the stock certificates, which reflect the former name of the Company, will continue to be valid and need not be exchanged. Any certificates reflecting the Name Change will be issued in due course as old stock certificates are tendered for exchange or transfer to the Company’s transfer agent.

On September 18, 2023, the Company acquired all shares of Grayscale Investment (Asia) Limited ("Grayscale HK") from unrelated parties for two Hong Kong dollars (HKD 2.00) per share, along with its subsidiary. Consequently, Grayscale HK became a fully-owned subsidiary of the Company. Grayscale HK was established in Hong Kong on September 31, 2021, which has not commenced any operations since its inception. Grayscale Investment (ShenZhen) Limited ("Grayscale WOFE") was established on November 1, 2021, as a wholly foreign-owned entity in the People’s Republic of China ("PRC"). Grayscale WOFE is wholly owned by Grayscale HK.

| 9 |

The aforementioned transaction has been accounted for in accordance with the provisions of ASC 805, Business Combinations, and the related fair value adjustments have been recorded as of the acquisition date. The Company did not record any goodwill or intangible assets related to the transaction, as the acquisition consideration equaled the fair value of the identifiable net assets acquired.

On October 17, 2023, the Company through its wholly owned subsidiary, incorporated Kuber Resources (Guangdong) Co., Ltd. (“Kuber Guangdong") as a wholly owned subsidiary of Graysacle WOFE in Guangdong, PRC. Kuber Guangdong’s scope of business includes manufacturing, sales and distribution of wood panels, as well as providing formaldehyde treatment services.

KUBR and its subsidiaries Asia Image, Kuber HK, Grayscale HK, Grayscale WOFE, Kuber Guangdong shall be collectively referred throughout as the “Company”.

Note 2 – Summary of significant accounting policies

Basis of Presentation

The financial statements of the Company have been prepared in accordance with generally accepted accounting principles in the United States of America (“US GAAP”).

The Company has elected a fiscal year end of December 31.

Principles of Consolidation

The Company prepares its consolidated financial statements on the accrual basis of accounting. The accompanying consolidated financial statements include the accounts of the Company and its wholly owned subsidiary. All intercompany accounts, balances and transactions have been eliminated in the consolidation.

Interim Financial Statements

The accompanying unaudited financial statements have been prepared in accordance with generally accepted accounting principles (GAAP) applicable to interim financial information and the requirements of Form 10-Q and Rule 8-03 of Regulation S-X of the Securities and Exchange Commission. Accordingly, they do not include all of the information and disclosure required by accounting principles generally accepted in the United States of America for complete financial statements. Interim results are not necessarily indicative of results for a full year. In the opinion of management, all adjustments considered necessary for a fair presentation of the financial position and the results of operations and cash flows for the interim periods have been included. These interim financial statements should be read in conjunction with the audited financial statements for the year ended December 31, 2023. Not all disclosures required by generally accepted accounting principles for annual financial statements are presented. The interim financial statements follow the same accounting policies and methods of computations as the audited financial statements for the year ended December 31, 2023.

Use of Estimates

The preparation of the financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amount of revenues and expenses during the reporting period. Management makes its best estimate of the outcome for these items based on information available when the financial statements are prepared. Actual results could differ from those estimates.

Functional and presentation currency

The functional currency of the Company is the currency of the primary economic environment in which the Company operates.

The currency in which companies in China operate is the Chinese Yuan (“RMB”). The RMB is not freely convertible into the US dollar and may be subject to PRC currency restrictions for payments, including the distributions of dividends or retained earnings to the Company by its subsidiaries or its variable interest entities.

Transactions in currencies other than the entity’s functional currency are recorded at the rates of exchange prevailing on the date of the transaction. At the end of each reporting period, monetary items denominated in foreign currencies are translated at the rates prevailing at the end of the reporting periods. Exchange differences arising on the settlement of monetary items and on translation of monetary items at period-end are included in income statement of the period.

| 10 |

For the purpose of presenting these financial statements, the Company’s assets and liabilities are expressed in US$ at the exchange rate on the balance sheet date, stockholder’s equity accounts are translated at historical rates, and income and expense items are translated at the weighted average exchange rate during the period. The resulting translation adjustments are reported under accumulated other comprehensive income (loss) in the stockholder’s equity (deficits) section of the balance sheets.

Exchange rate used for the translation as follows:

| US$ to RMB | Period End | Average | ||||||

| March 31, 2024 | ||||||||

| December 31, 2023 | N/A | |||||||

| March 31, 2023 | ||||||||

| US$ to HKD | Period End | Average | ||||||

| March 31, 2024 | ||||||||

| December 31, 2023 | N/A | |||||||

| March 31, 2023 | ||||||||

Cash and Cash Equivalents

For purposes of reporting within the statements of cash flows, the Company considers all cash on hand, cash accounts not subject to withdrawal restrictions or penalties, and all highly liquid debt instruments purchased with a maturity of three months or less to be cash and cash equivalents.

| 11 |

Accounts Receivables

Accounts receivables are recorded at the net value less estimates for expected credit losses. Management regularly reviews outstanding accounts and provides an allowance for doubtful accounts. When collection of the original invoice amounts is no longer probable, the Company will either partially or fully write-off the balance against the allowance for doubtful accounts.

Property and Equipment & Depreciation

Property and equipment are stated at historical cost net of accumulated depreciation. Expenditures that improve the functionality of the related asset or extend the useful life are capitalized. When property and equipment is retired or otherwise disposed of, the related gain or loss is included in operating income. Leasehold improvements are depreciated on the straight-line method over the shorter of the remaining lease term or estimated useful life of the asset. Property and equipment are depreciated on a straight-line basis over the following periods:

| Leasehold improvements | |

| Office furniture and equipment |

Intangible Assets & Amortization

Intangible assets are stated at historical cost net of accumulated amortization. Intangible assets are depreciated on a straight-line basis over the following periods:

| Intellectual Property License |

Impairment of Long-Lived Assets

The Company has adopted Accounting Standards Codification subtopic 360-10, Property, Plant and Equipment (“ASC 360-10”). ASC 360-10 requires that long-lived assets and certain identifiable intangibles held and used by the Company be reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. The Company evaluates its long-lived assets for impairment annually or more often if events and circumstances warrant. Events relating to recoverability may include significant unfavorable changes in business conditions, recurring losses, or a forecasted inability to achieve breakeven operating results over an extended period. The Company evaluates the recoverability of long-lived assets based upon forecasted undiscounted cash flows. Should impairment in value be indicated, the carrying value of intangible assets will be adjusted, based on estimates of future discounted cash flows resulting from the use and ultimate disposition of the asset. ASC 360-10 also requires assets to be disposed of be reported at the lower of the carrying amount or the fair value less costs to sell.

Impairment

loss on property and equipment was $

Contract Liability

The Company records customer advances as liabilities when consideration is received in advance of the transfer of goods. These advances are recognized as revenue when the performance obligations associated with the advance are satisfied. These advances relate to the advance payment for orders of goods placed by the customers.

The Company accounts for stock-based compensation in accordance with ASC 718 Compensation - Stock Compensation (“ASC 718”). ASC 718 addresses all forms of share-based payment (“SBP”) awards including shares issued under employee stock purchase plans and stock incentive shares. Under ASC 718 awards result in a cost that is measured at fair value on the awards’ grant date, based on the estimated number of awards that are expected to vest and will result in a charge to operations.

Revenue Recognition

The Company recognizes revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the Company expects to receive in exchange for those goods or services as per the contract with the customer. As a result, the Company accounts for revenue contracts with customers by applying the requirements of Accounting Standards Codification Topic 606, Revenue from Contracts with Customers, which includes the following steps:

| ● | Identify the contract(s), and subsequent amendments with the customer. |

| ● | Identify all the performance obligations in the contract and subsequent amendments. |

| ● | Determine the transaction price for completing performance obligations. |

| 12 |

| ● | Allocate the transaction price to the performance obligations in the contract. |

| ● | Recognize the revenue when, or as, the Company satisfies a performance obligation. |

The Company considers contract modification as a change in the scope or price (or both) of a contract that is approved by the parties. The parties describe contract modification as a change order, a variation, or an amendment. A contract modification exists when the parties to the contract approve a modification that either creates new or changes existing enforceable rights and obligations of the parties to the contract. The Company assumes a contract modification when approved in writing, by oral agreement, or implied by the customary business practice of the customer. If the parties to the contract have not approved a contract modification, the Company continues to apply the guidance to the existing contract until the contract modification is approved. The Company recognizes contract modification in various forms – including but not limited to partial termination, an extension of the contract term with a corresponding increase in price, adding new goods and/or services to the contract, with or without a corresponding change in price, and reducing the contract price without a change in goods or services promised.

Sales of goods

The Company manufactures wood panels which it sells to customers.

Revenue recognition occurs upon the following events: when a customer places an order, payment is received, and the goods are delivered to or drop-shipped to and accepted by the customer. Provisions are made for estimated sales returns based on historical return rates and experience which are immaterial. The Company may record contract liabilities, such as customer advances, when payments are received from customers prior to delivery or acceptance of goods by customers.

Formaldehyde treatment services

The Company provides formaldehyde removal services.

Revenue recognition occurs when (or as) the Company satisfies its performance obligations by providing the formaldehyde removal services to the customer and collectability can be reasonably assured. This typically occurs when the services are completed and the customer is able to use and benefit from them. The Company may record contract liabilities, such as customer advances, when payments are received from customers prior to delivery or acceptance of goods by customers. If the contract includes multiple performance obligations, the transaction price should be allocated to each obligation based on its relative standalone selling price.

Advertising Costs

All costs related to advertising are expensed in the period incurred. Advertising costs charged to operations were $nil and $nil, for the three months ended March 31, 2024 and 2023, respectively.

Provision for Income Taxes

The provision for income taxes is determined using the asset and liability method. Under this method, deferred tax assets and liabilities are calculated based upon the temporary differences between the consolidated financial statement and income tax bases of assets and liabilities using the enacted tax rates that are applicable in each year.

The Company utilizes a two-step approach to recognizing and measuring uncertain tax positions (“tax contingencies”). The first step is to evaluate the tax position for recognition by determining if the weight of available evidence indicates it is more likely than not that the position will be sustained on audit, including resolution of related appeals or litigation processes. The second step is to measure the tax benefit as the largest amount, which is more than 50% likely to be realized upon ultimate settlement.

The Company considers many factors when evaluating and estimating its tax positions and tax benefits, which may require periodic adjustments, and which may not accurately forecast actual outcomes. The Company includes interest and penalties related to tax contingencies in the provision of income taxes in the consolidated statements of operations. Management of the Company does not expect the total amount of unrecognized tax benefits to change in the next twelve months significantly.

The Company computes basic and diluted earnings per share amounts in accordance with ASC Topic 260, Earnings per Share. Basic earnings per share is computed by dividing net income (loss) available to common shareholders by the weighted average number of common shares outstanding during the reporting period. Diluted earnings per share reflects the potential dilution that could occur if stock options and other commitments to issue common stock were exercised or equity awards vest resulting in the issuance of common stock that could share in the earnings of the Company.

| 13 |

There are potential dilutive shares of common stock from the Series A preferred stock and Series B preferred stock. The potentially dilutive instruments were excluded as such shares would be anti-dilutive in a period in which a net loss is recorded.

Contingencies

Certain conditions may exist as of the date the financial statements are issued, which could result in a loss to the Company which will be resolved when one or more future events occur or fail to occur. The Company’s management assesses such contingent liabilities, and such assessment inherently involves judgment. In assessing loss contingencies arising from legal proceedings pending against the Company or unasserted claims that may rise from such proceedings, the Company’s management evaluates the perceived merits of any legal proceedings or unasserted claims as well as the perceived merits of the amount of relief sought or expected to be sought.

If the assessment of a contingency indicates it is probable a material loss will be incurred and the amount of the loss can be reasonably estimated, then the estimated loss is accrued in the Company’s financial statements. If the assessment indicates a material loss contingency is not probable but is reasonably possible, or is probable but cannot be estimated, then the nature of the contingent liability, together with an estimate of the range of possible loss if determinable and material would be disclosed.

Fair Value Measurements

Fair value accounting establishes a framework for measuring fair value and expands disclosure about fair value measurements. Fair value, which is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. This framework provides a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value into three levels as follows:

| - | Level 1 inputs to the valuation methodology are quoted prices (unadjusted) for identical assets or liabilities in active markets. |

| - | Level 2 inputs to the valuation methodology include quoted prices for similar assets and liabilities in active markets, and inputs that are observable for the assets or liabilities, either directly or indirectly, for substantially the full term of the financial instruments. |

| - | Level 3 inputs to the valuation methodology are unobservable and significant to the fair value. |

The Company’s financial instruments consisted of cash, accounts payable, contract liabilities and loan from a shareholder. The estimated fair value of those balances approximates the carrying amount due to the short maturity of these instruments.

Segment Reporting

ASC 280, Segment Reporting, establishes standards for companies to report in the financial statements information about operating segments, products, services, geographic areas, and major customers. Operating segments are defined as components of an enterprise engaging in businesses activities for which separate financial information is available that is regularly evaluated by the Company’s chief operating decision makers in deciding how to allocate resources and assess performance. The Company’s chief operating decision maker (“CODM”) has been identified as the Chief Executive Officer, who reviews consolidated results including revenue, gross profit and operating profit at a consolidated level only. The Company does not distinguish between markets for the purpose of making decisions about resources allocation and performance assessment. Therefore, the Company has only one operating segment and one reportable segment.

Recent Accounting Pronouncements

In November 2023, the FASB issued ASU 2023-07, Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures, which requires disclosure of incremental segment information on an annual and interim basis, primarily through enhanced disclosures of significant segment expenses. The guidance will be effective for fiscal years beginning after December 15, 2023, and interim periods within fiscal years beginning after December 15, 2024 and requires retrospective application to all periods presented upon adoption, with early adoption permitted. The Company is currently evaluating the impact that the adoption of this guidance will have on its consolidated financial statements and related disclosures.

In December 2023, the FASB issued ASU 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures, which requires disclosure of incremental income tax information within the rate reconciliation and expanded disclosures of income taxes paid, among other disclosure requirements. The guidance will be effective for fiscal years beginning after December 15, 2024, with early adoption permitted. The Company is currently evaluating the impact that the adoption of this guidance will have on its consolidated financial statements and related disclosures.

| 14 |

Note 3- Going Concern

The Company has an accumulated deficit of $

Note 4 – Accounts receivables, net

Accounts receivables, net is comprised of the following:

March 31, 2024 | December 31, 2023 | |||||||

| Accounts receivables | ||||||||

| Allowance for doubtful accounts | ||||||||

| Total, net | ||||||||

Bad debt expense (recoveries) was $nil and $nil for the three months ended March 31, 2024 and 2023, respectively.

Note 5 - Property and equipment, net

Property and equipment, net comprised of the following:

March 31, 2024 | December 31, 2023 | |||||||

| At Cost: | ||||||||

| Equipment | ||||||||

| Leasehold Improvement | ||||||||

| Furniture and fixtures | ||||||||

| Less: Accumulated depreciation | ( | ) | ( | ) | ||||

| Total, net | ||||||||

Depreciation

expenses was $

Note 6 – Intangible assets, net

Intangible asset, net comprised of the following:

March 31, 2024 | December 31, 2023 | |||||||

| At Cost: | ||||||||

| Intellectual Property License | ||||||||

| Less: Accumulated amortization | ( | ) | ( | ) | ||||

| Total, net | ||||||||

Amortization

expenses was $

| 15 |

The intellectual property license comprises of a five-year non-exclusive license to utilize certain intellectual property pertaining to wood panel manufacturing within China.

Note 7 – Related party transactions

Related parties receivables comprised of the following:

March 31, 2024 | December 31, 2023 | |||||||

| Shenzhen Junfeng Wood Chain Network Technology Co., Ltd. | ||||||||

| Total | ||||||||

Amounts receivable from Shenzhen Junfeng Wood Chain Network Technology Co., Ltd., where Mr. Li JiYong serves as the legal representative, comprise of loans receivables.

The balances above are unsecured, non-interest bearing and it is repayable on demand.

Related parties payables comprised of the following:

March 31, 2024 | December 31, 2023 | |||||||

| Mr. Li JiYong | ||||||||

| Uonlive (HK) Ltd | ||||||||

| Mr. Raymond Fu | ||||||||

| Jinyang (HK) Assets Mgt. Ltd | ||||||||

| Mr. Wang QingJian | ||||||||

| Total | ||||||||

Amounts payable to Mr. Li JiYong, the legal Representative of the Company, comprise of advances made to the Company for working capital purposes.

Amounts payable to Uonlive (HK) Ltd., with Mr. Raymond Fu as an indirect beneficial owner, comprise of advances made to the Company for working capital purposes.

Amounts payable to Mr. Raymond Fu, CEO, director and controlling shareholder of the Company, comprise advances made to the Company for working capital purposes.

Amounts payable to Jinyang (HK) Assets Management Ltd., with Mr. Raymond Fu as the beneficial owner, comprise of advances made to the Company for working capital purposes.

Amounts payable to Mr. Wang QingJian, COO of the Company, comprise of amounts payable for formaldehyde removal services.

The balances above are unsecured, non-interest bearing and it is repayable on demand.

Note 8 – Equity

Series A Convertible Preferred Stock

The Company has designated and is authorized to issue shares are Series A Convertible Preferred Stock, $ par value.

As of March 31, 2024 and December 31, 2023, the Company has Series A Convertible preferred shares issued and outstanding.

Series B Convertible Preferred Stock

The Company has designated and is authorized to issued shares of Series B Convertible Preferred Stock, $ par value.

Each share of Series B convertible Preferred Stock

shall have a par value of $0.001 per share.

| 16 |

Each share of Series B Convertible Preferred Stock

shall be convertible into

In the event of any liquidation, dissolution or winding up of the Corporation, either voluntary or involuntary, subject to the rights of any existing series of Preferred Stock or to the rights of any series of Preferred Stock which may from time to time hereafter come into existence, the holders of the Series B Preferred Stock shall be entitled to receive, prior and in preference to any distribution of any of the assets of the Corporation to the holders of Common Stock by reason of their ownership thereof, an amount per share equal to the price per share actually paid to the Corporation upon the initial issuance of the Series B Preferred Stock (each, the “the Original Issue Price”) for each share of Series B Preferred Stock then held by them, plus declared but unpaid dividends. Unless the Corporation can establish a different Original Issue Price in connection with a particular sale of Series B Preferred Stock, the Original issue price shall be $ per share for the Series B Preferred Stock. If, upon the occurrence of any liquidation, dissolution or winding up of the Corporation, the assets and funds thus distributed among the holders of the Series B Preferred Stock shall be insufficient to permit the payment to such holders of the full aforesaid preferential amounts, then, subject to the rights of any existing series of Preferred Stock or to the rights of any series of Preferred Stock which may from time to time hereafter come into existence, the entire assets and funds of the corporation legally available for distribution shall be distributed ratably among the holders of the each series of Preferred Stock in proportion to the preferential amount each such holder is otherwise entitled to receive.

The Series B Preferred Stock shares are nonredeemable other than upon the mutual agreement of the Company and the holder of shares to be redeemed, and even in such case only to the extent permitted by this Certificate of Designation, the Corporation’s Articles of Incorporation and applicable law.

Series B Preferred Stock shall be convertible, at the option of the holder thereof, at any time after the date of issuance of such share, at the office of the Corporation or any transfer agent for such stock, into such number of fully paid and nonassessable shares of Common Stock as is determined by dividing the Original Issue Price of the Series B Preferred Stock by the Series B Conversion Price applicable to such share, determined as hereafter provided, in effect on the date the certificate is surrendered for conversion.

As of March 31, 2024 and December 31, 2023, the Company has 150,000 shares of Series B Convertible preferred shares issued and outstanding, respectively.

Preferred Stock

The Company has authorized shares of Preferred Stock, $ par value.

As of March 31, 2024 and December 31, 2023, the Company has shares of Preferred stock issued and outstanding, respectively.

Common stock

The Company is authorized to issue 1,000,000,000 shares are Common Stock, $0.001 par value.

On February 22, 2023, the Company issued shares of common stock

valued at $ per share to certain individuals for consulting services valued at $

On March 30, 2023, the Company issued shares of common stock

valued at $ per share to certain individuals for consulting services valued at $

As of March 31, 2024 and December 31, 2023, the Company has and shares of common stock issued and outstanding, respectively.

Additional paid-in capital

On October 16, 2023, the Company entered into a five-year non-exclusive license agreement with Shenzhen Junfeng Wood Chain Net Technology ("the Licensor") granting the Company the right to utilize specific intellectual property ("IP") related to wood panel manufacturing within China. The IP is owned by Mr. Li JiYong, who is also a director of the Company; and the Licensor, Shenzhen Junfeng Wood Chain Net Technology is owned by Mr Li.

The fair value of the intellectual property has been determined to be RMB 15.35 million. This valuation was derived from revenues associated with wood panel manufacturing activities, utilizing key assumptions such as the non-renewal of the current licensing agreement and the application of the average net margin of the Building Products sector in a discounted cash flow (DCF) valuation model, as well as the revenue figures provided by management for Kuber Resources (Guangdong) Co. Ltd. The Company recognized a total of $2,170,638 as a capital contribution for the intellectual property.

| 17 |

Note 9 – Income taxes

The Company provides for income taxes under FASB ASC 740, Accounting for Income Taxes. FASB ASC 740 requires the use of an asset and liability approach in accounting for income taxes. Deferred tax assets and liabilities are recorded based on the differences between the financial statement and tax bases of assets and liabilities and the tax rates in effect currently.

FASB ASC 740 requires the reduction of deferred tax assets by a valuation allowance, if, based on the weight of available evidence, it is more likely than not that some or all of the deferred tax assets will not be realized. In the Company’s opinion, it is uncertain whether they will generate sufficient taxable income in the future to fully utilize the net deferred tax asset. Accordingly, a valuation allowance equal to 100% of the deferred tax asset has also been recorded resulting in no net deferred tax asset.

| 18 |

United States

Net operation losses

(“NOLs”) can carry forward indefinitely up to offset 80% of taxable income after CARES Act effect on December 31, 2017. The

cumulative tax is calculated by multiplying a

Hong Kong

Companies incorporated in Hong Kong are subject to Hong Kong Profits Tax on the taxable income as reported in its statutory financial statements adjusted in accordance with relevant Hong Kong tax laws. The applicable tax rate for the first Hong Kong Dollar (“HKD$”) 2 million of assessable profits is 8.25% and assessable profits above HKD$ 2 million will continue to be subject to the rate of 16.5% for corporations in Hong Kong, effective from the year of assessment 2018/2019. Before that, the applicable tax rate was 16.5% for corporations in Hong Kong. The Company did not make any provisions for Hong Kong profit tax as there were no assessable profits derived from or earned in Hong Kong since inception. Additionally, payments of dividends by the subsidiary incorporated in Hong Kong to the Company are not subject to any Hong Kong withholding tax.

PRC

Effective on January 1, 2008, the PRC Enterprise Income Tax Law, EIT Law, and Implementing Rules impose a unified enterprise income tax rate of 25% on all domestic-invested enterprises and foreign investment enterprises in PRC, unless they qualify under certain limited exceptions. As such, starting from January 1, 2008, the Company’s subsidiaries in PRC are subject to an enterprise income tax rate of 25%. NOLs can typically carried forward for a certain number of years (usually five years) to offset against future taxable income.

The following table summarizes the taxable income (loss) before income taxes by jurisdiction:

| Three Months Ended March 31, | ||||||||

| 2024 | 2023 | |||||||

| United States | $ | ( | ) | $ | ( | ) | ||

| Hong Kong | ( | ) | ||||||

| China | ||||||||

| Total taxable income (loss) | $ | $ | ( | ) | ||||

As of December 31, 2022, the Company maintained a valuation allowance against certain deferred tax assets to reduce the total to an amount management believed was appropriate. Realization of deferred tax assets is dependent upon sufficient future taxable income during the periods when deductible temporary differences and carryforwards are expected to be available to reduce taxable income.

The following table summarizes a reconciliation of income tax rates for operations, calculated at the statutory tax rate to total income tax expense (benefit):

| Three Months Ended March 31, |

||||||||

| 2024 | 2023 | |||||||

| Income (Loss) before income tax expenses | $ | $ | ( |

) | ||||

| Income tax expenses (benefits) computed at statutory tax rates | ||||||||

| Foreign tax rate differential | ||||||||

| Effect of deductible research and development expenses | ||||||||

| Effect of temporary differences | ||||||||

| Effect of change in valuation allowance | ||||||||

| Income tax expenses (benefits) | $ | $ | ||||||

| 19 |

Note 10 – Concentrations, Risks, and Uncertainties

| a) | Credit risk |

Cash deposits with banks are held in financial institutions in China, which deposits are not federally insured. Cash deposits with banks of which at times may exceed federally insured limits. Accordingly, the Company has a concentration of credit risk related to the uninsured part of bank deposits. The Company has not experienced any losses in such accounts and believes it is not exposed to significant credit risk.

| b) | Concentration |

The Company has a concentration risk related to suppliers and customers. The inability of the company to maintain existing relationships with suppliers or to establish new relationships with customers in the future may have a negative impact on the company’s ability to obtain goods sold to customers in a price advantageous and timely manner. If the Company is unable to obtain ample supply of goods from existing suppliers or alternative sources of supply, the Company may be unable to satisfy the orders from its customers, which may have a material adverse impact on revenue.

For the March 31, 2024, one customer

accounted for

As of March 31, 2024, two customers

accounted for

For the March 31, 2024, one supplier

accounted for

As of March 31, 2024, one supplier

accounted for

| c) | Unissued VAT invoices |

The products that are sold by the Company in PRC are subject to value-added tax (“VAT“) at a rate of 6% of the gross sales price or at a rate approved by the Chinese local government. This VAT may be offset by VAT paid on purchase of raw materials included in the cost of producing the finished goods sold.

During the quarter ended March 31, 2024, due to

the rules imposed by local authorities on newly established companies, which limited the issuance of VAT invoices per month. Consequently,

the Company was not able to issue VAT invoices for all its sales. During the quarter ended March 31, 2024, the Company had issued a total

of $84,497 in VAT invoices for its sales, leaving $

The local authority may require the Company to rectify the issue above by demanding payments and submitting the relevant filings within a specified time period. If the Company fails to do so within the specified time period, the local authority may impose a monetary fine on it and may also apply to the local people’s court for enforcement.

If the Company receives any notice from the local authority, the Company will be required respond to the notice and pay all amounts due to the government, including any administrative penalties that may be imposed, which would require the Company to divert its financial resources which may impact its resources, if any, to make such payments. Additionally, any administrative costs in excess of the payments, if material, may impact the Company's operating results.

As of today, the Company has not received any notice from the local housing authority or any claim from our current and former employees.

| d) | Restriction on cash disbursement on bank account |

As a newly established business, the Company experienced restrictions imposed by the bank on new bank accounts by limiting its deposits and disbursements. In order to avoid disruption to the business operations, the Company has engaged a related party, Shenzhen Junfeng Wood Chain Network Technology Co., Ltd., to collect sales revenues on behalf of the Company. These funds are then deposited or transferred to the Company's bank account on a regular basis, ensuring the continued liquidity necessary for operational activities.

As of March 31, 2024, the Company had an outstanding receivable of

$

| 20 |

Management continuously evaluates the impact of these restrictions on the Company's cash management and operational efficiency. Despite the challenges posed by the restriction on cash disbursement, the Company remains committed to ensuring the uninterrupted conduct of its business activities.

It is important to note that the amounts receivable from the related party are subject to periodic reconciliation and may fluctuate over time based on sales activities and remittance schedules.

| 21 |

Note 11 - Leases

Operating Lease

The Company has three operating leases for its office space and manufacturing equipment and facility.

Operating lease right-of-use

assets and liabilities are recognized at commencement date based on the present value of lease payments over the lease term. The discount

rate used to calculate present value is incremental borrowing rate or, if available, the rate implicit in the lease. The Company determines

the incremental borrowing rate for each lease based primarily on its lease term which is approximately

Operating lease expenses

were $

The components of lease expense and supplemental cash flow information related to leases for the period are as follows:

| Three Months Ended March 31, | ||||||||

| 2024 | 2023 | |||||||

| Lease cost | ||||||||

| Operating lease cost | $ | $ | ||||||

| Other Information | ||||||||

| Cash paid for amounts included in the measurement of lease liabilities | $ | $ | ||||||

| Weighted average remaining lease term – operating leases (in years) | - | |||||||

| Average discount rate – operating lease | % | - | % | |||||

The supplemental balance sheet information related to leases is as follows:

| March 31, 2024 | December 31, 2023 | |||||||

| Operating leases | ||||||||

| Right-of-use assets, net | $ | $ | ||||||

| Operating lease liabilities | $ | $ | ||||||

The undiscounted future minimum lease payment schedule as follows:

| For the year ending December 31, | ||||

| 2024 (nine months remaining) | ||||

| 2025 | ||||

| 2026 | ||||

| Thereafter | ||||

| Total undiscounted lease payments | ||||

| Less: interest | ( |

) | ||

| Total lease liabilities | ||||

| 22 |

Note 12 – Subsequent Event

In accordance with ASC 855 the Company’s management reviewed all material events through the date these financial statements were available to be issued, there were no material subsequent events.

| 23 |

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Forward looking statement notice

Statements made in this Form 10-Q that are not historical or current facts are “forward-looking statements” made pursuant to the safe harbor provisions of Section 27A of the Securities Act of 1933 (the “Act”) and Section 21E of the Securities Exchange Act of 1934. These statements often can be identified by the use of terms such as “may,” “will,” “expect,” “believe,” “anticipate,” “estimate,” “approximate” or “continue,” or the negative thereof. We intend that such forward-looking statements be subject to the safe harbors for such statements. We wish to caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. Any forward-looking statements represent management’s best judgment as to what may occur in the future. However, forward-looking statements are subject to risks, uncertainties and important factors beyond our control that could cause actual results and events to differ materially from historical results of operations and events and those presently anticipated or projected. We disclaim any obligation subsequently to revise any forward-looking statements to reflect events or circumstances after the date of such statement or to reflect the occurrence of anticipated or unanticipated events.

Financial information contained in this quarterly report and in our unaudited interim financial statements is stated in United States dollars and are prepared in accordance with United States generally accepted accounting principles.

In March 2020, the World Health Organization categorized Coronavirus Disease 2019 (“COVID-19”) as a pandemic, and the President of the United States declared the COVID-19 outbreak a national emergency. The services we provide are currently designated an essential critical infrastructure business under the President’s COVID-19 guidance, the continued operation of which is vital for national public health, safety and national economic security. The extent of the impact of the COVID-19 outbreak on our operational and financial performance will depend on certain developments, including the duration and spread of the outbreak, its impact on our customers and vendors, and the range of governmental and community reactions to the pandemic, which are uncertain and cannot be fully predicted at this time.

Management’s Plan of Operation

The following discussion contains forward-looking statements. Forward-looking statements give our current expectations or forecasts of future events. You can identify these statements by the fact that they do not relate strictly to historical or current facts. They use of words such as “anticipate”, “estimate”, “expect”, “project”, “intend”, “plan”, “believe”, and other words and terms of similar meaning in connection with any discussion of future operating or financial performance. From time to time, we also may provide forward-looking statements in other materials we release to the public.

Overview

The Company’s current business objective is to operate as a holding company with its subsidiaries operating in the wood treatment, tea and precious metals industry, including acting as a distributor and trader. We intend to use the Company’s limited personnel and financial resources in connection with such activities.

On November 7, 2022, the Company purchased from GRL21 Nominee Limited all the shares of Kuber Resources (Hong Kong) Limited for one Hong Kong dollar (HKD1.00). Accordingly, Kuber Resources (Hong Kong) Limited became a fully-owned subsidiary of the Company as at November 7, 2022. Kuber Resources (Hong Kong) Limited (previously known as Star Wise Limited) is a company incorporated in Hong Kong on October 21, 2022. It changed its name to Kuber (Resources (Hong Kong) Limited on 1 November 2022 and concurrently filed its notification of commencement of Business by Corporation on the same day. It had not traded and/or otherwise operated until after it had been purchased by the Company on November 7, 2022. The purpose of obtaining Kuber Resources (Hong Kong) Limited is to start an additional line of business outside of the international commodities trade currently undertaken by Asia Image Limited.

On September 18, 2023, the Company acquired all shares of Grayscale Investment (Asia) Limited ("Grayscale HK") from unrelated parties for two Hong Kong dollars (HKD 2.00) per share, along with its subsidiary. Consequently, Grayscale HK became a fully-owned subsidiary of the Company. Grayscale HK was established in Hong Kong on September 31, 2021, which has not commenced any operations since its inception. Grayscale Investment (ShenZhen) Limited ("Grayscale WOFE") was established on November 1, 2021, as a wholly foreign-owned entity in the People’s Republic of China ("PRC"). Grayscale WOFE is wholly owned by Grayscale HK.

On October 17, 2023, the Company through its wholly owned subsidiary, incorporated Kuber Resources (Guangdong) Co., Ltd. (“Kuber Guangdong") as a wholly owned subsidiary of Graysacle WOFE in Guangdong, PRC. Kuber Guangdong’s scope of business includes manufacturing, sales and distribution of wood panels, as well as providing formaldehyde treatment services.

| 24 |

Recent developments

On September 18, 2023, Kuber Resources Corp. (the “Company”) purchased from Zhong Jia Ping and Deng Xiaobo all the shares of Grayscale Investment (Asia) Limited, a Hong Kong company, for two Hong Kong dollars (HKD2.00). Accordingly, Grayscale Investment (Asia) Limited became a fully-owned subsidiary of the Company as at September 18, 2023. Grayscale Investment (Asia) Limited had not traded and/or otherwise operated as at the time it had been purchased by the Company on September 18, 2023. However, Grayscale Investment (Asia) Limited in turn holds all the shares of Grayscale Investment (Shenzhen) Co Limited, a Shenzhen, China company, which also had not traded and/or otherwise operated. Accordingly, Grayscale Investment (Shenzhen) Co Limited as at September 18, 2023 also became a fully-owned subsidiary of the Company.

The purpose of obtaining Grayscale Investment (Asia) Limited was to start an additional line of business outside of the international commodities trade currently undertaken by Asia Image Limited and consulting services provided by Kuber Resources (Hong Kong) Limited.

On October 16, 2023, Grayscale Investment (Shenzhen) Co Limited entered into an agreement with Shenzhen Junfeng Woodlink Network Technology Co Ltd. whereby Grayscale Investment (Shenzhen) Co Limited would arrange to incorporate a new company in Guangdong, China to operate a wood panel treatment business.

On October 17, 2023, Kuber Resources (Guangdong) Co Limited was incorporated in Guangdong, China and Grayscale Investment (Shenzhen) Co Limited became its founder and 100% beneficial shareholder. Accordingly, Kuber Resources (Guangdong) Co Limited is a fully-owned subsidiary of the Company as at October 17, 2023. Kuber Resources (Guangdong) Co Limited’s operations are focused on the service and treatment of wood panels.

Results of operations

The following comparative analysis on results of operations was based primarily on the comparative financial statements, footnotes and related information for the periods identified below and should be read in conjunction with the financial statements and the notes to those statements that are included elsewhere in this report.

Results Of Operations During the Three Months Ended March 31, 2024 as Compared to the Three Months Ended March 31, 2023

Revenue

For the three months ended March 31, 2024 and 2023, the Company generated $1,262,073 of revenue and $33,182 revenue, respectively, representing an increase of $1,228,891.

| 25 |

On October 17, 2023, the Company acquired a fully-owned subsidiary of Kuber Resources (Guangdong) Co Limited whose operations are focused on the service and treatment of wood panels. Revenues from formaldehyde treatment services were $1,239,095 and $nil for the three months ended March 31, 2024 and 2023, respectively.

Cost of Revenue

For the three months ended March 31, 2024 and 2023, the Company generated cost of revenue of $121,503 and $nil cost of revenue, respectively. The cost of revenue is related to the formaldehyde treatment services.

For the three months ended March 31, 2024 and 2023, the gross profit was $1,140,570 or 90.4% and $33,182 or 100%, respectively.

Expenses

For the three months ended March 31, 2024 and 2023, we incurred operating expenses of $308,283 and $41,206, respectively. The increase in operating expenses is mainly due to the merger of Kuber Resources (Guangdong) Co Limited in October 2023 and Grayscale Investment (Asia) Limited in September 2023. The Company has incurred additional operation cost for formaldehyde treatment services in 2024.

| 26 |

Net Loss

For the three months ended March 31, 2024 and 2023, we incurred net income of $610,657 and a net loss of $9,397, respectively.

The significant increase in net income during the three months ended March 31, 2024 is mainly due to the increase of formaldehyde treatment services.

Liquidity and capital resources

Currently, we are relying on sales of our products. Currently, we pay costs associated with running a business on a day-to-day basis.

As of March 31, 2024, we had current assets of $4,698,588 as compared to $3,473,299 as of December 31, 2023. We have cash of $156,471 and $143,860 as of March 31, 2024 and December 31, 2023, respectively.

To the extent that our capital resources are insufficient to meet current or planned operating requirements, we will seek additional funds through equity or debt financing, collaborative or other arrangements with corporate partners, licensees or others, and from other sources, which may have the effect of diluting the holdings of existing shareholders. The Company has no current arrangements with respect to, or sources of, such additional financing and we do not anticipate that existing shareholders will provide any portion of our future financing requirements.

No assurance can be given that additional financing will be available when needed or that such financing will be available on terms acceptable to the Company. If adequate funds are not available, we may be required to delay or terminate expenditures for certain of its programs that it would otherwise seek to develop and commercialize. This would have a material adverse effect on the Company.

Operating Activities

Net cash used in operating activities for the three months ended March 31, 2024 was $198,825, and provided by operating activities was $20,056 for the three months ended March 31, 2023, respectively.

The net cash used in operating activities for the three months ended March 31, 2024 was primarily related to increase in accounts receivables, decrease in customer advance with an offset by net income of $610,657, increase in accounts payable and other payable.

The net cash provided by operating activities for the three months ended March 31, 2023 was primarily related to shares issued for services of $30,177, increase in account payable and accrued expenses, offset by increase in deposit and decrease in contract liability.

Investing Activities

There were no investing activities for the three months ended March 31, 2024, loan to related party was in the amount of $10,205 for the three months ended March 31, 2023.

Financing Activities

We received a total of $211,570 in financing, consisting of $211,570 related to related party debt during the fiscal three months ended March 31, 2024. We had no financing activities during the fiscal three months ended March 31, 2023.

Off-Balance Sheet Arrangements

As of March 31, 2024, we did not have any off-balance sheet arrangements as defined in Item 303(a)(4)(ii) of Regulation S-K promulgated under the Securities Act of 1934.

| 27 |

Contractual Obligations and Commitments

As of March 31, 2024, we did not have any contractual obligations.

ITEM 3. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

This item is not applicable as we are currently considered a smaller reporting company.

ITEM 4. CONTROLS AND PROCEDURES

Evaluation of Disclosure Controls and Procedures

Our CEO and CFO have evaluated the effectiveness of our disclosure controls and procedures (as defined in Rule 13a-15(e) and 15d-15(e) under the Exchange Act) as of the end of the period covered by this document. Based on the evaluation, they have concluded that our disclosure controls and procedures are not effective in timely alerting them to material information relating to us that is required to be included in our periodic SEC filings and ensuring that information required to be disclosed by us in the reports we file or submit under the Act is accumulated and communicated to our management, including our chief financial officer, or person performing similar functions, as appropriate to allow timely decisions regarding required disclosure. Our disclosure controls and procedures were not effective as of March 31, 2024 due to the material weaknesses as disclosed in the Company’s Annual Report on Form 10-12G filed with the SEC.

Limitations of the Effectiveness of Disclosure Controls and Internal Controls

Our management, including our Principal Executive Officer and Principal Financial Officer, does not expect that our disclosure controls and internal controls will prevent all error and all fraud. A control system, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance that the objectives of the control system are met. Further, the design of a control system must reflect the fact that there are resource constraints, and the benefits of controls must be considered relative to their costs. Because of inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues and instances of fraud, if any, within the Company have been detected. These inherent limitations include the realities that judgments in decision-making can be faulty, and that breakdowns can occur because of a simple error or mistake. Additionally, controls can be circumvented by the individual acts of some persons, by collusion of two or more people, or by management override of the control.

The design of any system of controls is also based in part upon certain assumptions about the likelihood of future events, and there can be no assurance that any design will succeed in achieving our stated goals under all potential future conditions; over time, a control may become inadequate because of changes in conditions, or the degree of compliance with the policies or procedures may deteriorate. Because of inherent limitations in a cost-effective control system, misstatements due to error or fraud may occur and not be detected.

Changes in Internal Control over Financial Reporting

There have been no changes in our internal control over financial reporting subsequent to March 31, 2024, which were identified in connection with our management’s evaluation required by paragraph (d) of rules 13a-15 and 15d-15 under the Exchange Act, that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

| 28 |

PART II. OTHER INFORMATION

ITEM 1. LEGAL PROCEEDINGS

We know of no material, existing or pending legal proceedings against our Company, nor are we involved as a plaintiff in any material proceeding or pending litigation. There are no proceedings in which any of our directors, officers or affiliates, or any registered or beneficial shareholder, is an adverse party or has a material interest adverse to our interest.

ITEM 1A. RISK FACTORS

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information required under this item.

THE EFFECTS OF THE RECENT COVID-19 CORONAVIRUS PANDEMIC ARE NOT IMMEDIATELY KNOWN, BUT MAY ADVERSELY AFFECT OUR BUSINESS, RESULTS OF OPERATIONS, FINANCIAL CONDITION, LIQUIDITY, AND CASH FLOW.

Presently, the impact of COVID-19 has not shown any imminent adverse effects on our business. This notwithstanding, it is still unknown and difficult to predict what adverse effects, if any, COVID-19 can have on our business, or against the various aspects of same, or how COVID-19 will continue to effect the world as the virus case numbers rise and fall.

As of the date of this Quarterly Report, COVID-19 coronavirus has been declared a pandemic by the World Health Organization, has been declared a National Emergency by the United States Government. COVID-19 coronavirus caused significant volatility in global markets. The spread of COVID-19 coronavirus has caused public health officials to recommend precautions to mitigate the spread of the virus, especially as to travel and congregating in large numbers. In addition, certain countries, states and municipalities have enacted, quarantining and “shelter-in-place” regulations which severely limit the ability of people to move and travel and require non-essential businesses and organizations to close. While some places have lessened their “shelter-in-place” restrictions and travel bans, as they are removed there is no certainty that an outbreak will not occur, and additional restrictions imposed again in response.

It is unclear how such restrictions, which will contribute to a general slowdown in the global economy, will affect our business, results of operations, financial condition and our future strategic plans. Shelter-in-place and essential-only travel regulations could negatively impact us. The current status of COVID-19 coronavirus closures and restrictions could negatively impact our ability to receive funding from our existing capital sources as each business is and has been affected uniquely.

If any of our employees, consultant, customers, or visitors were to become infected we could be forced to close our operations temporarily as a preventative measure to prevent the risk of spread which could also negatively impact our ability to receive funding from our existing capital sources as each business is and has been affected uniquely

In addition, our headquarters are located in Hong Kong, China which experienced restrictions on individuals and business shutdowns as the result of COVID-19. It is unclear at this time how these restrictions will be continued and/or amended as the pandemic evolves. We are hopeful that COVID-19 closures will have only a limited effect on our operations.

| 29 |

GENERAL SECURITIES MARKET UNCERTAINTIES RESULTING FROM THE COVID-19 PANDEMIC.

Since the outset of the pandemic the United States and worldwide national securities markets have undergone unprecedented stress due to the uncertainties of the pandemic and the resulting reactions and outcomes of government, business and the general population. These uncertainties have resulted in declines in all market sectors, increases in volumes due to flight to safety and governmental actions to support the markets. As a result, until the pandemic has stabilized, the markets may not be available to the Company for purposes of raising required capital. Should we not be able to obtain financing when required, in the amounts necessary to execute on our plans in full, or on terms which are economically feasible we may be unable to sustain the necessary capital to pursue our strategic plan and may have to reduce the planned future growth and/or scope of our operations.

ITEM 2. UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS

None

ITEM 3. DEFAULTS UPON SENIOR SECURITES

None

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITIES HOLDERS

None

ITEM 5. OTHER INFORMATION

During the three months ended March 31, 2024, no director or officer of the Company adopted or terminated a “Rule 10b5-1 trading

arrangement” or “non-Rule 10b5-1 trading arrangement,”

as each term is defined in Item 408(a) of Regulation S-K.

| 30 |

ITEM 6. EXHIBITS

The following exhibits are included as part of this report by reference:

*Pursuant to Regulation S-T, this interactive data file is deemed not filed or part of a registration statement or prospectus for purposes of Sections 11 or 12 of the Securities Act of 1933, is deemed not filed for purposes of Section 18 of the Securities Exchange Act of 1934, and otherwise is not subject to liability under these sections.

| 31 |

SIGNATURES