UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 2

to

FORM 10

GENERAL FORM FOR REGISTRATION OF SECURITIES

Pursuant to Section 12(b) or (g) of The Securities Exchange Act of 1934

| UONLIVE CORPORATION |

| (Exact name of registrant as specified in its charter) |

| Nevada | 87-0629754 | |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

|

1107, Lippo Centre Tower 1, 89 Queensway, Admiralty, Hong Kong |

00000 | |

| (Address of principal executive office) | (Zip Code) |

Registrant’s telephone number including area code: +852 2392 2326

Securities to be registered pursuant to Section 12(b) of the Act:

| None | None | |

| (Title of class) | Name of each exchange on which each class is to be registered |

Securities to be registered pursuant to Section 12(g) of the Act:

| Common Stock, par value $0.001 per share | None | |

| (Title of class) | Name of each exchange on which each class is to be registered |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☒ |

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

TABLE OF CONTENTS

| ITEM 1. | BUSINESS. | 1 |

| ITEM 1A. | RISK FACTORS. | 6 |

| ITEM 2. | FINANCIAL INFORMATION. | 15 |

| ITEM 3. | PROPERTIES. | 18 |

| ITEM 4. | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT. | 19 |

| ITEM 5. | DIRECTORS AND EXECUTIVE OFFICERS. | 20 |

| ITEM 6. | EXECUTIVE COMPENSATION. | 22 |

| ITEM 7. | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE. | 22 |

| ITEM 8. | LEGAL PROCEEDINGS. | 22 |

| ITEM 9. | MARKET PRICE OF AND DIVIDENDS ON THE REGISTRANT’S COMMON EQUITY AND RELATED STOCKHOLDER MATTERS. | 23 |

| ITEM 10. | RECENT SALES OF UNREGISTERED SECURITIES. | 23 |

| ITEM 11. | DESCRIPTION OF REGISTRANT’S SECURITIES TO BE REGISTERED. | 23 |

| ITEM 12. | INDEMNIFICATION OF DIRECTORS AND OFFICERS. | 25 |

| ITEM 13. | FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA. | 26 |

| ITEM 14. | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE. | 27 |

| ITEM 15. | FINANCIAL STATEMENTS AND EXHIBITS. | 27 |

EXPLANATORY NOTE

Uonlive Corporation is filing this General Form for Registration of Securities on Form 10, or this “registration statement,” to register its common stock, par value $0.001 per share (“Common Stock”), pursuant to Section 12(g) of the Securities Exchange Act of 1934. Unless otherwise mentioned or unless the context requires otherwise, when used in this registration statement, the terms “Company,” “we,” “us,” “our” and “UOLI” refer to Uonlive Corporation.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This following information specifies certain forward-looking statements of management of our Company. Forward-looking statements are statements that estimate the happening of future events and are not based on historical fact. Forward-looking statements may be identified by the use of forward-looking terminology, such as may, shall, could, expect, estimate, anticipate, predict, probable, possible, should, continue, or similar terms, variations of those terms, or the negative of those terms. The forward-looking statements specified in the following information have been compiled by our management on the basis of assumptions made by management and considered by management to be reasonable. Our future operating results, however, are impossible to predict and no representation, guaranty, or warranty is to be inferred from those forward-looking statements.

The assumptions used for purposes of the forward-looking statements specified in the following information represent estimates of future events and are subject to uncertainty as to possible changes in economic, legislative, industry, and other circumstances. As a result, the identification and interpretation of data and other information and their use in developing and selecting assumptions from and among reasonable alternatives require the exercise of judgment. To the extent that the assumed events do not occur, the outcome may vary substantially from anticipated or projected results, and, accordingly, no opinion is expressed on the achievability of those forward-looking statements.

The market data and other statistical information contained in this registration statement are based on internal Company estimates of our past experience in the industry, general market data, and public information which was not commissioned by us for this filing.

| i |

History of Our Company

We were incorporated in the State of Nevada on January 29, 1998 under the name Weston International Development Corporation to conduct any lawful business, to exercise any lawful purpose and power, and to engage in any lawful act or activity for which corporations may be organized under the General Corporation Laws of Nevada. On July 28, 1998, its name was changed to Txon International Development Corporation.

On August 14, 2000, pursuant to a share exchange agreement dated August 10, 2000, by and among Main Edge International Limited (“Main Edge”), Virtual Edge Limited (“Virtual Edge”), Richard Ford, Jeanie Hildebrand and Gary Lewis, we acquired from Main Edge all of the shares of Virtual Edge (the “Acquisition”) in exchange for an aggregate of 1,961,175 shares of our common stock, which shares equaled 75.16% of Txon International’s issued and outstanding shares after giving effect to the Acquisition. On September 15, 2000, Txon International Development Corporation changed its name to China World Trade Corporation (“CWTD”).

On March 28, 2008, CWTD entered into a Share Exchange Agreement (the “Exchange Agreement”) by and among CWTD, William Tsang (“Tsang”), Uonlive Limited, a corporation organized and existing under the laws of the Hong Kong SAR of the People’s Republic of China (“Uonlive”), Tsun Sin Man Samuel, Chairman of Uonlive (“Tsun”), Hui Chi Kit, Chief Financial Officer of Uonlive (“Hui”), Parure Capital Limited, a corporation organized and existing under the laws of the British Virgin Islands and parent of Uonlive (“Parure Capital”). Upon closing of the share exchange transaction contemplated under the Exchange Agreement, Tsun and Hui transferred all of their share capital in Parure Capital to CWTD in exchange for an aggregate of 150,000,000 shares of common stock of the Registrant and 500,000 shares of Series A Convertible Preferred Stock of the Registrant, which is convertible after six months from the date of issuance into 100 shares of common stock of the Registrant, thus causing Parure Capital to become a direct wholly-owned subsidiary of the Registrant.

On July 2, 2008, the proposal to amend the articles of incorporation to change the name of the corporation to Uonlive Corporation was approved by the action of a majority of all shareholders entitled to vote on the record date and by CWTD’s Board of Directors. CWTD desired to change its name to truly reflect its new business as a holding company for Uonlive Limited, and possibly other companies that may be acquired in the future by the company (the “Company” or “Uonlive”).

On May 15, 2009, the Company approved the 1 for 100 reverse split of its common stock.

The Company initially ceased operations in early 2015. The Company has fully impaired all assets since the shutdown of its operations in 2015 and recorded the effects of this impairment as part of its discontinued operations.

On May 2, 2017, Parure Capital was struck off the BVI Register of Companies for non-payment of annual fees. Therefore, Parure Capital was no longer a subsidiary of the Company.

On June 15, 2018, the Eighth Judicial District Court of Nevada appointed Small Cap Compliance, LLC (“Custodian”) as custodian for Uonlive Corporations., proper notice having been given to the officers and directors of Uonlive Corporation. There was no opposition.

On June 20, 2018, the Custodian appointed Rhonda Keaveney as CEO, Secretary, Treasurer and Director of the Company.

On August 7, 2018, the Company filed a certificate of reinstatement with the state of Nevada.

On September 7, 2018, the Company authorized the issuance of 1,000,000 shares of Convertible Series B Preferred Stock. Each one Convertible Series B Preferred Stock was entitled to be converted into 1,000 shares of common stock. Also, each one Convertible Series B Preferred Stock was entitled to 1,000 votes of common stock. 150,000 shares of Convertible Series B Preferred Stock were issued to Chuang Fu Qu Kuai Lian Technology (Shenzhen) Limited giving Chuang Fu Qu Kuai Lian Technology (Shenzhen) Limited the voting control of the Company.

| 1 |

Also on September 7, 2018, Raymond Fu was appointed as President, Chief Executive Officer, Secretary, Treasurer and member of our Board of Directors of the Company and Rhonda Keaveney resigned as Chief Executive Officer, Treasurer, Secretary, and member from the Board of Directors.

On December 6, 2018, the Eighth Judicial District Court of Nevada discharged Small Cap Compliance, LLC as custodian for Uonlive Corporations.

On April 10, 2019, pursuant to an Acquisition Agreement, the Company contracted to acquire 80% of the issued and outstanding capital stock of Truly Organic Limited, a Hong Kong based company (“Truly Organic”), specializing in organic agriculture certification consulting in South East Asia. However, Truly Organic was unable to provide financial statements capable of being audited by a PCAOB independent public accountant, as required in the Acquisition Agreement. Therefore, such acquisition did not close.

On January 13, 2020, Edwin Lun, the existing secretary of the Board of Directors resigned. On January 13, 2020, the Board of Directors accepted his resignation. Also on January 13, 2020, (i) Timothy Chee Yau Lam was appointed and consented to act as the new secretary of the Board of Directors and a member of the Board of Directors of the Company, (ii) Kwok Fai Thomas Yip was appointed and consented to act as a member of the Board of Directors of the Company, and (iii) Chi Wai Michael Woo was appointed and consented to act as a member of the Board of Directors of the Company.

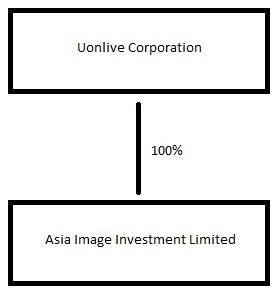

On March 2, 2020, pursuant to a Definitive Share Exchange Agreement, Uonlive Corporation (the “Company”) acquired 100% of the issued and outstanding capital stock of Asia Image Investing Limited (“Asia Image”), a Hong Kong based company, specializing in trade, distribution, and consulting in Hong Kong in the tea industry. The Company issued 100,000 shares of common stock, representing 4.8% of the Company’s outstanding shares of common stock, calculated post-issuance in exchange for the 100% issued and outstanding capital stock of Asia Image Investing Limited.

Corporate Structure

On March 2, 2020, the Company entered into a Definitive Share Agreement whereby Mr. Raymond Fu, the sole shareholder of Asia Image Investment Limited, relinquished all his shares in Asia Image and acquired 100,000 shares of the Company. Consequently, Asia Image became a wholly-owned subsidiary of the Company.

| 2 |

As reflected in the accompanying financial statements, the Company has no source of revenues and needs additional cash resources to maintain its operations. The Company’s ability to continue as a going concern is dependent on its ability to raise additional capital or obtain necessary debt financing. These factors raise substantial doubt about our ability to continue as a going concern. As discussed elsewhere, our current business plan is to seek and identify a privately-held operating company desiring to become a publicly held company by combining with us through a reverse merger or acquisition type transaction. We cannot predict when, if ever, we will be successful in this venture and, accordingly, we may be required to cease operations at any time, if we do not have sufficient working capital to pay our operating costs for the next 12 months and we will require additional funds to pay our legal, accounting and other fees associated with our Company and its filing obligations under United States federal securities laws, as well as to pay our other accounts payable generated in the ordinary course of our business.

On October 27, 2020, the Company appointed AJSH & Co LLP, a PCOAB registered firm as its independent registered accounting firm who performed the Company’s audit for the period ended December 31, 2019 and December 31, 2018.

AJSH & Co LLP also performed the audit for Asia Image Investment Limited for the periods ended December 31 2019, and December 31, 2018.

Business Overview

Previously, our main business had been operating an online radio station targeted at younger audience. However, we are in the period of transitioning into operating our business to the tea industry. We are a trading, distribution, and consultancy company with experience in China products with a focus on tea planting and sales, research and development. The company’s business scope includes partnering with tea plantations for tea production, such as Dongguan Gongxiang Tea Food Company Ltd and sales as well as agricultural tourism. Our production is focused primarily in pu-er tea.

We have experience in the China market and can leverage off that experience to bring together the various traditional products with customers using e-distribution channels. Our revenue streams are generated from the sale of such products throughout China.

We are expanding our business model by connecting traditional products through e-channels and using technological innovation as a driving force to connect end users to increase sales. The company intends to continuously expand the market share in the various products that it is involved in. It is committed to grow into one of the larger market players in the sphere.

We seek to grow our business by pursing the following strategies:

| • | Increasing our customer base by using various e-distribution channels |

| • | offering high quality traditional products for repeat business |

| • | Expanding our lead generation services enabling the business to better engage their customers |

| • | Building our own custom e-channel distribution channel |

| • | Creating cross-selling synergies between the various suit of products and services being sold to the customers |

| • | Using a scalable business model to eliminate certain barriers and rapid growth |

Industry Overview

The tea industry in China is a thriving market. The aggregate Revenue in the industry amounts to USD 92,684,000,000 of sales as at April 2020 and is expected to grow annually by 5.8%1.

Pursuant to statista.com, tea is the most consumed hot drink worldwide and the most consumed non-alcoholic beverage overall. It is especially important in Asia and Eastern Europe as well as in the United Kingdom. It serves the purpose of both caffeination and hydration. In China, tea has a much higher degree of prestige with upscale specialty products. Depending on the quality of the tea, a kilogram of tea in China can go for upwards of USD 100,0002.

1 Figures provided by Statista - https://www.statista.com/topics/4688/tea-industry-in-china/

2 See 1 above.

| 3 |

Given the prevalence of tea in China, combining it together with e-distribution channels can increase the industry growth and sales of the product.

Our Strategy

We intend to modernize and enhance the experience of China products by distributing our products through e-distribution channels. In addition to tea, the company plans on expanding into other areas and industries such as poultry breeding and sales, fruit seedling planting and sales.

Our business objective is to generate revenues based on the sale of the products and to maintain and grow a customer base based upon our internal database.

Our target market is the China consumer market as well as corporate clients. Given the importance of tea culture within China, being a consumable, this product becomes a staple for meetings in board rooms and at home as an everyday product.

The Company seeks to leverage management’s experience to expand its consumer base, starting with corporate clients.

Potential competitors

There will be an abundance of competitors in the market, given the highly competitive environment we operate in, from both existing competitors and new market entrants. The Company’s competitors include Urban Tea Inc., Maiji (“麦吉”), Luosennina (“罗森尼娜”), NAYUKI (“奈雪的茶”), and Chayanyuese (“茶颜悦色”), all of which are located in the Hunan province. However, given that this is a consumable product that is used daily, the market should able to absorb all such products.

Products

Currently our tea plantation partners offer a wide range of tea drinks. The products are focused on not only their taste but also their aesthetic presentation and health benefits. Our products are currently being offered via our managed stores. The product is produced, packaged and ready for consumption by our tea plantation partners in China.

Our goal is to be a leading brand of tea beverages in each city in which we currently and intend to operate, by selling the finest quality tea beverages and related products, as well as complementary food offerings, and by providing each customer with a pleasant and comfortable environment. The current products being offered by our tea plantation partners are being sold in Fujian, in China.

The main product being sold is Yunnan Chi Tse Beeng Cha, which is a type of pu-er tea.

Seasonality

The industry for the sale of tea-based beverages goes through a peak season from April to October, while the rest of the year is off-season. Moreover, seasonality includes adverse weather conditions and ordering during festive seasons, specifically Chinese New Year, where many of the factories may be closed. We have implemented a few measures to mitigate the impact of such seasonal fluctuations in sale, such as taking reserve stock to be sold during the off-season. As pu-er tea can be aged, keeping pu-er tea stock not only increases our inventory, but is also a good investment for later sales.

| 4 |

Management, Culture and Training

We are guided by a philosophy that recognizes customer service and the importance of delivering optimal performance.

Passion for Tea. We seek to recruit, hire, train, retain and promote qualified, knowledgeable and enthusiastic business partners who share our passion for tea and strive to deliver an extraordinary retail experience to our customers.

| · | Extensive Training. We have specific training and certification requirements for potential business partners, including undergoing food handlers’ certification and foundational training. This process helps ensure that all team members educate our customers and execute our standards accurately and consistently. As team members progress to the assistant manager and manager levels, they undergo additional weeks of training in sales, operations and management. |

Business and Strategic Partners

Currently, we are strategically aligned with Dongguan Gongxiang Tea Food Company Ltd, which is a tea plantation in Fujian that supplies the products mentioned above.

Licenses, Permits and Government Regulations

PRC Legal System

The PRC legal system is a civil law system based on the PRC Constitution and is made up of written laws, regulations and directives. Unlike in the US where the law built partly upon decisions of common law cases, court cases in the PRC do not constitute binding precedents. The governmental directives are organized in the following hierarchy.

The National People’s Congress of the PRC (“NPC”) and the Standing Committee of the NPC are empowered by the PRC Constitution to exercise the legislative power of the state. The NPC has the power to amend the PRC Constitution and to enact and amend primary laws governing the state organs and civil and criminal matters. The Standing Committee of the NPC is empowered to interpret, enact and amend laws other than those required to be enacted by the NPC.

The State Council of the PRC is the highest organ of state administration and has the power to enact administrative rules and regulations. Ministries and commissions under the State Council of the PRC are also vested with the power to issue orders, directives and regulations within the jurisdiction of their respective departments. Administrative rules, regulations, directives and orders promulgated by the State Council and its ministries and commissions must not be in conflict with the PRC Constitution or the national laws and, in the event that any conflict arises, the Standing Committee of the NPC has the power to annul such administrative rules, regulations, directives and orders.

At the regional level, the people’s congresses of provinces and municipalities and their standing committees may enact local rules and regulations and the people’s government may promulgate administrative rules and directives applicable to their own administrative area. These local laws and regulations may not be in conflict with the PRC Constitution, any national laws or any administrative rules and regulations promulgated by the State Council.

Rules, regulations or directives may be enacted or issued at the provincial or municipal level or by the State Council of the PRC or its ministries and commissions in the first instance for experimental purposes. After sufficient experience has been gained, the State Council may submit legislative proposals to be considered by the NPC or the Standing Committee of the NPC for enactment at the national level.

Governmental Regulations in Relation to the Company’s Businesses

Regulations Related to Retail

There are no separate mandatory legal provisions on the retail business model in the PRC. Companies and individual businesses may engage is the retail business as long as they have registered with the commerce departments in accordance with the laws such as the Regulation on Individual Industrial and Commercial Households and Administration of the Registration of Enterprises As Legal Persons, and include “retail” in the business scope on their business license.

| 5 |

RISK FACTORS

Risks Relating to Our Business and Industry.

Our limited operating history may not be indicative of our future growth or financial results and we may not be able to sustain our historical growth rates.

Our limited operating history may not represent our future growth or financial performance. There is no guarantee that we will be able to maintain historical growth rates in the future. Our growth rate may decline for a variety of possible reasons, some of which we have no control over, including reducing customer spending, increasing competition, declining growth in China’s tea industry, the emergence of alternative business models, or government policies or overalls, changes in economic conditions. We will continue to expand our product range to bring greater convenience to our customers and increase our customer base and transaction volume. However, the implementation of our expansion plan will be affected by uncertainty. For the above reasons, the total number of goods sold and the number of customers may not increase at the rate we expect. In addition, because our business model is innovative in China’s tea sales industry, it adds to the difficulty of assessing our business and future prospects based on our past operations or financial performance.

Our limited operating experience and limited brand recognition in other regions of the PRC may limit our expansion strategy and

cause our business and growth to suffer.

Our future growth depends, to a considerable extent, on our expansion efforts in different provinces of other regions in the PRC. Our current operations are based largely in the Fujian province. We have a limited number of customers and limited experience in operating outside of Fujian province. We may also encounter difficulty expanding in other regions’ markets because of limited brand recognition. In particular, we have no assurance that our marketing efforts will prove successful outside of the narrow geographic regions in which they have been used. In addition, we may encounter challenges in certain regions in establishing consumer awareness and loyalty or interest in our products and our brand. The expansion into other regions may also present competitive, merchandising, forecasting and distribution challenges that are different from or more severe than those we currently face. Failure to develop new markets outside of Hunan or disappointing growth outside of Hunan may harm our business and results of operations.

A widespread health epidemic could adversely affect our business.

Our business could be severely affected by a widespread regional, national or global health epidemic such as the recent outbreak of COVID-19. A widespread health epidemic may cause customers to avoid public gathering places such as our stores or otherwise change their shopping behaviors. Additionally, a widespread health epidemic could adversely affect our business by disrupting production of products to our stores and by affecting our ability to appropriately staff our stores.

As we continue to grow rapidly, we will continue to encounter challenges in implementing our managerial, operating and financial strategies to keep up with our growth. The major challenges in managing our business growth include, among other things:

| ● | Controlling incurred costs in a competitive environment. |

| ● | Ensuring that our third-party suppliers continue to meet our quality and other standards and meet our future operational needs. |

| ● | Attracting, training and retaining a growing workforce to support our operations. |

| 6 |

| ● | If we fail to acquire new customers or retain existing customers in a cost-effective manner, our |

| ● | Failure to maintain the quality of our products could have a material and adverse effect on our reputation, financial condition and results of operations. |

| ● | Overall, we face fierce competition in the Chinese tea industry, and our products are not proprietary products. If we fail to compete effectively, we may lose market share and customers, and our business, financial condition and results of operations may be materially and adversely affected. |

| ● | The growth of our business will depend to a certain extent on our recognition of the brand, and any failure to maintain, protect and enhance our brand will limit our ability to expand or retain our customer base, which will be our business, financial situation And performance has a significant adverse impact on operations. |

Maintaining, protecting and enhancing the recognition of our brand is critical to our business and market position.

We believe that maintaining and enhancing our brand image, particularly in new markets where we have limited brand recognition, is important to maintaining and expanding our customer base. Our ability to successfully integrate new stores into their surrounding communities, to expand into new markets or to maintain the strength and distinctiveness of our brand in our existing markets will be adversely impacted if we fail to connect with our target customers. Many factors, some of which are beyond our control, are important to maintaining, protecting and enhancing our brand. These factors include but not limited to our ability to:

| ● | Maintain the quality and attractiveness of the products we offer. |

| ● | Develop and launch services that meet customer needs. |

| ● | Provide a superior customer experience. |

| ● | Increase brand awareness through marketing and branding campaigns. |

| ● | Maintain good relationships with our suppliers and partners. |

We face significant competition from other specialty tea and beverage retailers and retailers of grocery products, which could adversely affect us and our growth plans.

The Chinese tea market is highly fragmented. We compete directly with a large number of relatively small independently owned tea retailers and a number of regional and national tea retailers, as well as retailers of grocery products, including loose-leaf tea and tea bags and other beverages. We compete with these retailers on the basis of taste, quality and price of product offered, atmosphere, location, customer service and overall customer experience. We must spend considerable resources to differentiate our customer experience. Some of our competitors may have greater financial, marketing and operating resources than we do. Therefore, despite our efforts, our competitors may be more successful than us in attracting customers. In addition, as we continue to drive growth in our category in Hunan, our success, combined with relatively low barriers to entry, may encourage new competitors to enter the market. As we continue to expand geographically, we expect to encounter additional regional and local competitors.

Changes in the beverage environment and retail landscape could impact our financial results.

The beverage environment is rapidly evolving as a result of, among other things, changes in consumer preferences; shifting consumer tastes and needs; changes in consumer lifestyles; and competitive product and pricing pressures. In addition, the beverage retail landscape is dynamic and constantly evolving, not only in emerging and developing marketplaces, where modern trade is growing at a faster pace than traditional trade outlets, but also in developed marketplaces, where discounters and value stores, as well as the volume of transactions through e-commerce, are growing at a rapid pace. If we are unable to successfully adapt to the rapidly changing environment and retail landscape, our share of sales, volume growth and overall financial results could be negatively affected.

| 7 |

We may increasingly become the target of public scrutiny, including complaints against regulators, negative media coverage, and malicious allegations, all of which can seriously damage our reputation and have a significant adverse impact on our business and prospects.

Any negative publicity or regulations would have a material adverse effect on our ability to generate revenue and to continue to grow. It could reduce our customer base significantly.

A major disruption in the operation of third-party vendors and partners could disrupt our operations.

Our utilization of third-party delivery services for shipments is subject to risks, including increases in fuel prices, which would increase our shipping costs, and employee strikes and inclement weather, which may impact third parties’ abilities to provide delivery services that adequately meet our shipping needs. If we change shipping companies, we could face logistical difficulties that could adversely affect deliveries, and we would incur costs and expend resources in connection with such change. Moreover, we may not be able to obtain terms as favorable as those we receive from the third-party transportation providers that we currently use, which in turn would increase our costs and thereby adversely affect our operating results. Our limited operational control of third-party suppliers and other business partners, and any significant disruption to operations may adversely affect our operations. For example, a severe disruption in the operation of our tea leaf suppliers may result in a shortage of our products, and a major disruption in the operation of the Internet Service Provider may affect the operation of our applications. If we are unable to resolve the impact of disruptions to the operation of third-party vendors or service providers, our business operations and financial results may be materially and adversely affected.

We are subject to regulations, and future regulations may impose additional requirements and obligations on our business or otherwise materially and adversely affect our business, reputation, financial condition and results of operations.

We are subject to regulations regarding a variety of aspects of the Company’s business including taxation, environmental and safety. Changes or additions to such regulations would cause a material increase in the Company’s overhead.

Currently, Raymond Fu has significant control and voting power in all matters submitted to our stockholders for approval.

Currently, our an officer and director of the Company, Raymond Fu, owns approximately 98% of the voting power of our outstanding capital stock. As a result, Raymond Fu has significant control and voting power in all matters submitted to our stockholders for approval including:

• Election of our board of directors;

• Removal of any of our directors;

• Amendment of our Certificate of Incorporation or bylaws;

• Adoption of measures that could delay or prevent a change in control or impede a merger, takeover or other business combination involving us.

As a result of his ownership, Raymond Fu is able to influence all matters requiring stockholder approval, including the election of directors and approval of significant corporate transactions. In addition, the future prospect of sales of significant amounts of shares held by Raymond Fu could affect the market price of our common stock if the marketplace does not orderly adjust to the increase in shares in the market and the value of your investment in our company may decrease. Raymond Fu’s stock ownership may discourage a potential acquirer from making a tender offer or otherwise attempting to obtain control of us, which in turn could reduce our stock price or prevent our stockholders from realizing a premium over our stock price.

Because we may be deemed a shell company, it will likely be difficult for us to obtain additional financing by way of private offerings of our securities or retain qualified employees or advisers.

We may be deemed a “shell company” within the meaning of Rule 405, promulgated pursuant to Securities Act, because we have nominal assets and nominal operations. Accordingly, the holders of securities purchased in private offerings of our securities we make to investors will not be able to rely on the safe harbor from being deemed an underwriter under SEC Rule 144 in order to resell their securities. This will likely make it more difficult for us to attract additional capital through subsequent unregistered offerings because purchasers of securities in such unregistered offerings will not be able to resell their securities in reliance on Rule 144, a safe harbor on which holders of restricted securities usually rely to resell securities. Furthermore, if we are deemed a “shell company,” we will be unable to utilize Form S-8 as a registration statement for automatic effectiveness for employees or advisers, thereby hampering our ability to hire or retain qualified employees or advisers.

| 8 |

If we are deemed a shell company, the shares we issue, if any, will be restricted from resale under Rule 144.

These shares are currently restricted from trading under Rule 144. They will only be available for resale, within the limitations of Rule 144, to the public if:

(i) We are no longer a shell company as defined under section 12b-2 of the Exchange Act. A “shell company” is defined as a company with no or nominal operations, and with no or nominal assets or assets consisting solely of cash and cash equivalents;

(ii) We have filed all Exchange Act reports required for at least 12 consecutive months; and

(iii) If applicable, at least one year has elapsed from the time that we file current Form 10-type of information on Form 8-K or other report changing our status from a shell company to an entity that is not a shell company.

Risks associated with doing business in China

Changes in China’s economic, political or social conditions or government policies may have a material adverse effect on our business and operations.

Substantially all of our assets and operations are located in China. Accordingly, our business, financial condition, results of operations and prospects may be influenced to a significant degree by political, economic and social conditions in China generally. The Chinese economy differs from the economies of most developed countries in many respects, including the level of government involvement, level of development, growth rate, control of foreign exchange and allocation of resources. Although the Chinese government has implemented measures emphasizing the utilization of market forces for economic reform, the reduction of state ownership of productive assets, and the establishment of improved corporate governance in business enterprises, a substantial portion of productive assets in China is still owned by the government. In addition, the Chinese government continues to play a significant role in regulating industry development by imposing industrial policies. The Chinese government also exercises significant control over China’s economic growth through allocating resources, controlling payment of foreign currency-denominated obligations, setting monetary policy and providing preferential treatment to particular industries or companies.

| 9 |

While the Chinese economy has experienced significant growth over past decades, growth has been uneven, both geographically and among various sectors of the economy. Any adverse changes in economic conditions in China, in the policies of the Chinese government or in the laws and regulations in China could have a material adverse effect on the overall economic growth of China. Such developments could adversely affect our business and operating results, lead to a reduction in demand for our products and adversely affect our competitive position. The Chinese government has implemented various measures to encourage economic growth and guide the allocation of resources. Some of these measures may benefit the overall Chinese economy, but may have a negative effect on us. For example, our financial condition and results of operations may be adversely affected by government control over capital investments or changes in tax regulations. In addition, in the past the Chinese government has implemented certain measures, including interest rate adjustment, to control the pace of economic growth. These measures may cause decreased economic activity in China, which may adversely affect our business and operating results.

The PRC legal system is a civil law system based on written statutes. Unlike the common law system, prior court decisions under the civil law system may be cited for reference but have limited precedential value. Therefore, the Company’s susceptibility to such laws is unknown.

In 1979, the PRC government began to promulgate a comprehensive system of laws, rules and regulations governing economic matters in general. The overall effect of legislation over the past three decades has significantly enhanced the protections afforded to various forms of foreign investment in China. However, China has not developed a fully integrated legal system, and recently enacted laws, rules and regulations may not sufficiently cover all aspects of economic activities in China or may be subject to significant degrees of interpretation by PRC regulatory agencies. In particular, because these laws, rules and regulations are relatively new, and because of the limited number of published decisions and the nonbinding nature of such decisions, and because the laws, rules and regulations often give the relevant regulator significant discretion in how to enforce them, the interpretation and enforcement of these laws, rules and regulations involve uncertainties and can be inconsistent and unpredictable. In addition, the PRC legal system is based in part on government policies and internal rules, some of which are not published on a timely basis or at all, and which may have a retroactive effect. As a result, we may not be aware of our violation of these policies and rules until after the occurrence of the violation.

Any administrative and court proceedings in China may be protracted, resulting in substantial costs and diversion of resources and management attention. Since PRC administrative and court authorities have significant discretion in interpreting and implementing statutory and contractual terms, it may be more difficult to evaluate the outcome of administrative and court proceedings and the level of legal protection we enjoy than in more developed legal systems. These uncertainties may impede our ability to enforce the contracts we have entered and could materially and adversely affect our business, financial condition and results of operations.

Chinese law prohibits or restricts companies belonging to foreign countries from operating some certain businesses.

According to Chinese law, some businesses are not allowed to be operated by the companies whose ownership is not a Chinese company. We are a US company registered in Nevada. Each company in our organization chart is a subsidiary. The legality and effectiveness of this control method are accorded with Chinese laws and regulations. Catalogue of Guidance for Foreign Investment Industries (Revised in 2017): Directory of restricted foreign investment industries has deleted and Canceled the restriction for foreign ownership or investment of Wholesale, retail and logistic distribution of automobiles. Before modification, according to Catalogue of Guidance for Foreign Investment Industries (2002 Edition): Directory of restricted foreign investment industries "VI. 2.Wholesale and Retail Trade,", the wholesale and retail of automobiles is restricted for foreign ownership or investment. Therefore, according to Catalogue of Guidance for Foreign Investment Industries (Revised in 2017) and Foreign investment access negative list (2018) issued by the Chinese government with legal effect. The businesses in the wholesale, retail and logistic distribution of automobiles that the company is engaged in does not require any permission from PRC regulatory authorities. Our business is also in accordance with the provisions of Chinese laws and is not prohibited or restricted.

| 10 |

We may be subject to liability for placing advertisements with content that is deemed inappropriate or misleading under PRC laws.

According to Chinese law, if any advertisement issued by the company infringes the rights and interests of a third party, the company shall bear the liability for compensation, which may cause our financial loss. Of course, the company top management team has prepared knowledge and solution for this.

Any failure by our subsidiaries or their equity holders to perform their obligations under the contractual arrangements would have a material adverse effect on our business, financial condition and results of operations.

The contractual arrangements are governed by PRC law and provide for the resolution of disputes through arbitration or court proceedings in China. Accordingly, these contracts would be interpreted in accordance with PRC law and any disputes would be resolved in accordance with PRC legal procedures. The legal system in the PRC is not as developed as in some other jurisdictions, such as the United States. As a result, uncertainties in the PRC legal system could limit our ability to enforce the contractual arrangements. Under PRC law, if the losing parties fail to carry out the arbitration awards or court judgments within a prescribed time limit, the prevailing parties may only enforce the arbitration awards or court judgments in PRC courts, which would require additional expense and delay. If we cannot enforce the contractual arrangements, we may not be able to exert effective control over the subsidiaries, and our ability to conduct our business, as well as our financial condition and results of operations, may be materially and adversely affected.

We may be subject to additional contributions of social insurance and housing fund and late payments and fines imposed by relevant governmental authorities. Non-compliance with labor-related laws and regulations of the PRC may have an adverse impact on our financial condition and results of operation.

In accordance with the PRC Social Insurance Law and the Regulations on the Administration of Housing Fund and other relevant laws and regulations, China establishes a social insurance system and other employee benefits including basic pension insurance, basic medical insurance, work-related injury insurance, unemployment insurance, maternity insurance, housing fund, and a handicapped employment security fund, or collectively the Employee Benefits. An employer shall pay the Employee Benefits for its employees in accordance with the rates provided under relevant regulations and shall withhold the social insurance and other Employee Benefits that should be assumed by the employees. For example, an employer that has not made social insurance contributions at a rate and based on an amount prescribed by the law, or at all, may be ordered to rectify the non-compliance and pay the required contributions within a stipulated deadline and be subject to a late fee of up to 0.05% or 0.2% per day, as the case may be. If the employer still fails to rectify the failure to make social insurance contributions within the stipulated deadline, it may be subject to a fine ranging from one to three times of the amount overdue.

Under the Social Insurance Law and the Regulations on the Administration of Housing Fund, PRC subsidiaries shall register with local social insurance agencies and register with applicable housing fund management centers and establish a special housing fund account in an entrusted bank. Both PRC subsidiaries and their employees are required to contribute to the Employee Benefits.

As the interpretation and implementation of labor-related laws and regulations are still evolving, we cannot assure you that our employment practice does not and will not violate labor-related laws and regulations in China, which may subject us to labor disputes or government investigations. If we are deemed to have violated relevant labor laws and regulations, we could be required to provide additional compensation to our employees and our business, financial condition and results of operations could be materially and adversely affected.

The equity holders, directors and executive officers of the subsidiaries, as well as our employees who execute other strategic initiatives may have potential conflicts of interests with the Company.

If any of the equity holders, directors and executive officers of the Company’s subsidiaries, as well as our employees who execute other strategic initiatives, have a conflict of interests with the Company, they may bring an opportunity elsewhere. Thereby, the Company would lose out on the business.

Under PRC law, legal documents for corporate transactions, including agreements and contracts are executed using the chop or seal of the signing entity or with the signature of a legal representative whose designation is registered and filed with relevant PRC industry and commerce authorities.

To ensure the use of our seals and seals, we have established internal control procedures and rules for the use of these seals and seals. If a seal and seal are to be used, the responsible person will submit an application through our office automation system, and the application will be verified and approved by an authorized employee in accordance with our internal control procedures and rules. In addition, in order to maintain the physical security of the seals, we usually store them in a secure location that only authorized employees can access. Although we monitor these authorized employees, these procedures may not be sufficient to prevent all abuse or negligence. Our employees are at risk of abuse of authority. For example, any employee who acquires, abuses or misappropriates our seals and seals or other controlling intangible assets for any reason, we may suffer from disruption of normal business operations, and we may have to take a company Or legal action, this can cost a lot of time and money. Resolve and transfer resources for managing resources.

| 11 |

Future inflation in China may inhibit our ability to conduct business in China.

In recent years, the Chinese economy has experienced periods of rapid expansion and highly fluctuating rates of inflation. During the past ten years, the rate of inflation in China has been as high as 20.7% and as low as -2.2%. These factors have led to the adoption by the Chinese government, from time to time, of various corrective measures designed to restrict the availability of credit or regulate growth and contain inflation. High inflation may in the future cause the Chinese government to impose controls on credit and/or prices, or to take other action, which could inhibit economic activity in China, and thereby harm the market for our products and our company.

Claims against the Company or its management may be hard to initiate and to enforce. Even if successful, claims against the Company or its management may be nearly impossible to collect upon.

While the Company’s service of process provider, INCSMART.BIZ, INC., is located at 2616 Willow Wren Dr., North Las Vegas, NV, 89084, USA, there is no guarantee that service of process can be successfully completed against the Company or its management, as they are based in China. Even with successful service of process to INCSMART.BIZ, INC., you may be unable to enforce a court judgment against the Company or its management, as they have no property in the United States, to which such judgment could be attached.

Courts in China may not enforce a judgment against the Company or its management that was obtained in the United States, nor may such courts hear a claim based on U.S. federal securities laws.

Even if you are able to obtain a judgement against the Company or its management in the United States, it may not be enforced by the courts in China based upon the civil liability provisions of the U.S. federal securities law. Furthermore, you may be unable to bring a claim directly in China, based upon U.S. federal securities, even though your investment and the public filings of the Company are governed by U.S. federal securities laws.

Risks Related to the Market for our Stock

The OTC and share value

Our Common Stock trades over the counter, which may deprive stockholders of the full value of their shares. Our stock is quoted via the Over-The-Counter (“OTC”) Pink Sheets. Therefore, our Common Stock is expected to have fewer market makers, lower trading volumes, and larger spreads between bid and asked prices than securities listed on an exchange such as the New York Stock Exchange or the NASDAQ Stock Market. These factors may result in higher price volatility and less market liquidity for our Common Stock.

Low market price

A low market price would severely limit the potential market for our Common Stock. Our Common Stock may trade at a price below $5.00 per share, subjecting trading in the stock to certain Commission rules requiring additional disclosures by broker-dealers. These rules generally apply to any non-NASDAQ equity security that has a market price share of less than $5.00 per share, subject to certain exceptions (a “penny stock”). Such rules require the delivery, prior to any penny stock transaction, of a disclosure schedule explaining the penny stock market and the risks associated therewith and impose various sales practice requirements on broker-dealers who sell penny stocks to persons other than established customers and institutional or wealthy investors. For these types of transactions, the broker-dealer must make a special suitability determination for the purchaser and have received the purchaser’s written consent to the transaction prior to the sale. The broker-dealer also must disclose the commissions payable to the broker-dealer, current bid and offer quotations for the penny stock and, if the broker-dealer is the sole market maker, the broker-dealer must disclose this fact and the broker-dealer’s presumed control over the market. Such information must be provided to the customer orally or in writing before or with the written confirmation of trade sent to the customer. Monthly statements must be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks. The additional burdens imposed upon broker-dealers by such requirements could discourage broker-dealers from effecting transactions in our Common Stock.

| 12 |

Lack of market and state blue sky laws

Investors may have difficulty in reselling their shares due to the lack of market or state Blue Sky laws. The holders of our shares of Common Stock and persons who desire to purchase them in any trading market that might develop in the future should be aware that there may be significant state law restrictions upon the ability of investors to resell our shares. Accordingly, even if we are successful in having the shares available for trading on the OTC, investors should consider any secondary market for our securities to be a limited one. We intend to seek coverage and publication of information regarding our Company in an accepted publication which permits a “manual exemption.” This manual exemption permits a security to be distributed in a particular state without being registered if the company issuing the security has a listing for that security in a securities manual recognized by the state. However, it is not enough for the security to be listed in a recognized manual. The listing entry must contain (1) the names of issuers, officers, and directors, (2) an issuer’s balance sheet, and (3) a profit and loss statement for either the fiscal year preceding the balance sheet or for the most recent fiscal year of operations. We may not be able to secure a listing containing all of this information. Furthermore, the manual exemption is a non-issuer exemption restricted to secondary trading transactions, making it unavailable for issuers selling newly issued securities. Most of the accepted manuals are those published in Standard and Poor’s, Moody’s Investor Service, Fitch’s Investment Service, and Best’s Insurance Reports, and many states expressly recognize these manuals. A smaller number of states declare that they “recognize securities manuals” but do not specify the recognized manuals. The following states do not have any provisions and therefore do not expressly recognize the manual exemption: Alabama, Georgia, Illinois, Kentucky, Louisiana, Montana, South Dakota, Tennessee, Vermont, and Wisconsin.

Accordingly, our shares of Common Stock should be considered totally illiquid, which inhibits investors’ ability to resell their shares.

Penny stock regulations

We will be subject to penny stock regulations and restrictions and you may have difficulty selling shares of our Common Stock. The Commission has adopted regulations which generally define so-called “penny stocks” to be an equity security that has a market price less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exemptions. We anticipate that our Common Stock will become a “penny stock”, and we will become subject to Rule 15g-9 under the Exchange Act, or the “Penny Stock Rule”. This rule imposes additional sales practice requirements on broker-dealers that sell such securities to persons other than established customers. For transactions covered by Rule 15g-9, a broker-dealer must make a special suitability determination for the purchaser and have received the purchaser’s written consent to the transaction prior to sale. As a result, this rule may affect the ability of broker-dealers to sell our securities and may affect the ability of purchasers to sell any of our securities in the secondary market.

For any transaction involving a penny stock, unless exempt, the rules require delivery, prior to any transaction in a penny stock, of a disclosure schedule prepared by the Commission relating to the penny stock market. Disclosure is also required to be made about sales commissions payable to both the broker-dealer and the registered representative and current quotations for the securities. Finally, monthly statements are required to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stock.

We do not anticipate that our Common Stock will qualify for exemption from the Penny Stock Rule. In any event, even if our Common Stock were exempt from the Penny Stock Rule, we would remain subject to Section 15(b)(6) of the Exchange Act, which gives the Commission the authority to restrict any person from participating in a distribution of penny stock, if the Commission finds that such a restriction would be in the public interest.

| 13 |

Rule 144 Risks

Sales of our Common Stock under Rule 144 could reduce the price of our stock. There are 1,996,355 issued and outstanding shares of our Common Stock held by affiliates that Rule 144 of the Securities Act defines as restricted securities.

These shares will be subject to the resale restrictions of Rule 144, should we hereinafter cease being deemed a “shell company”. In general, persons holding restricted securities, including affiliates, must hold their shares for a period of at least six months, may not sell more than 1.0% of the total issued and outstanding shares in any 90-day period, and must resell the shares in an unsolicited brokerage transaction at the market price. The availability for sale of substantial amounts of Common Stock under Rule 144 could reduce prevailing market prices for our securities.

No audit or compensation committee

Because we do not have an audit or compensation committee, stockholders will have to rely on our entire Board of Directors, none of which are independent, to perform these functions. We do not have an audit or compensation committee comprised of independent directors. Indeed, we do not have any audit or compensation committee. These functions are performed by our Board of Directors as a whole. No members of our Board of Directors are independent directors. Thus, there is a potential conflict in that Board members who are also part of management will participate in discussions concerning management compensation and audit issues that may affect management decisions.

Security laws exposure

We are subject to compliance with securities laws, which exposes us to potential liabilities, including potential rescission rights. We may offer to sell our shares of our Common Stock to investors pursuant to certain exemptions from the registration requirements of the Securities Act, as well as those of various state securities laws. The basis for relying on such exemptions is factual; that is, the applicability of such exemptions depends upon our conduct and that of those persons contacting prospective investors and making the offering. We may not seek any legal opinion to the effect that any such offering would be exempt from registration under any federal or state law. Instead, we may elect to relay upon the operative facts as the basis for such exemption, including information provided by investor themselves.

If any such offering did not qualify for such exemption, an investor would have the right to rescind its purchase of the securities if it so desired. It is possible that if an investor should seek rescission, such investor would succeed. A similar situation prevails under state law in those states where the securities may be offered without registration in reliance on the partial preemption from the registration or qualification provisions of such state statutes under the National Securities Markets Improvement Act of 1996. If investors were successful in seeking rescission, we would face severe financial demands that could adversely affect our business and operations. Additionally, if we did not in fact qualify for the exemptions upon which we have relied, we may become subject to significant fines and penalties imposed by the Commission and state securities agencies.

No cash dividends

Because we do not intend to pay any cash dividends on our Common Stock, our stockholders will not be able to receive a return on their shares unless they sell them. We intend to retain any future earnings to finance the development and expansion of our business. We do not anticipate paying any cash dividends on shares of our Common Stock in the foreseeable future. Unless we pay dividends, our stockholders will not be able to receive a return on their shares unless they sell them. There is no assurance that stockholders will be able to sell shares of our Common Stock when desired.

Delayed adoption of accounting standards

We have delayed the adoption of certain accounting standards through an opt-in right for emerging growth companies. We have elected to use the extended transition period for complying with new or revised accounting standards under Section 102(b)(2) of the Jobs Act, which allows us to delay the adoption of new or revised accounting standards that have different effective dates for public and private companies until those standards apply to private companies. As a result of this election, our financial statements may not be comparable to companies that comply with public company effective dates.

| 14 |

Management’s Plan of Operation

The following discussion contains forward-looking statements. Forward-looking statements give our current expectations or forecasts of future events. You can identify these statements by the fact that they do not relate strictly to historical or current facts. They use of words such as “anticipate”, “estimate”, “expect”, “project”, “intend”, “plan”, “believe”, and other words and terms of similar meaning in connection with any discussion of future operating or financial performance. From time to time, we also may provide forward-looking statements in other materials we release to the public.

Overview

The Company’s current business objective is to seek operate in the tea industry, including acting as a distributor. We intend to use the Company’s limited personnel and financial resources in connection with such activities.

Results Of Operations During The Year Ended December 31, 2019 As Compared To The Year Ended December 31, 2018

Revenue

For the year ended December 31, 2019 and 2018, the Company generated no revenue.

| 15 |

Expenses

For the year ended December 31, 2019, the Company incurred no operating expenses. For the year ended December 31, 2018, we incurred operating expenses in the amount of $30,000 which consisted of professional fees. The decrease is due to no activity.

Net Loss

For the year months ended December 31, 2019 we incurred a net loss of $0. We had net loss of $30,000 for the year ended December 31, 2018. The decrease is due to no activity during the 2019 fiscal year.

Results Of Operations for the Three Months Ended September 30, 2020 As Compared To The Three Months Ended September 30, 2019

Revenue

For the three months ended September 30, 2020 and the three months ended September 30, 2019, the Company generated no revenue.

| 16 |

Expenses

For the three months ended September 30, 2020, the Company incurred operating expenses of $3,522 consisting of $3,000 in and accounting fees as well as general and administrative expenses of $522. For the three months ended September 30, 2019, we incurred no operating expenses.

Net Loss

For the three months ended September 30, 2020 we incurred a net loss of $3,522. We had net loss of $0 for the three months ended September 30, 2019. The increase is due to no activity during the 2019 fiscal year and accounting fees incurred during the three months ended September 2020.

Results Of Operations for the Nine Months Ended September 30, 2020 As Compared To The Nine Months Ended September 30, 2019

Revenue

For the nine months ended September 30, 2020 and the nine months ended September 30, 2019, the Company generated no revenue.

Expenses

For the nine months ended September 30, 2020, the Company incurred operating expenses consisting of $68,479 in consulting, legal and accounting fees as well as general and administrative expenses of $1,466. For the nine months ended September 30, 2019, we incurred no operating expenses.

Net Loss

For the nine months ended September 30, 2020 we incurred a net loss of $69,946 We had net loss of $0 for the nine months ended September 30, 2019. The increase is due to no activity during the 2019 fiscal year and our reverse recapitalization with Asia Image in March 2020.

Liquidity

Currently, we are relying on sales of our products. Currently, we pay costs associated with running a business on a day to day basis.

As of December 31, 2019, we had no cash on hand and current liabilities of $167,554. As of December 31, 2018, we had no cash on hand and current liabilities of $167,554.

As of September 30, 2020, we had $54,378 in cash on hand and current liabilities of $319,391. As of September 30, 2019, we had no cash on hand and current liabilities of $167,554.

To the extent that our capital resources are insufficient to meet current or planned operating requirements, we will seek additional funds through equity or debt financing, collaborative or other arrangements with corporate partners, licensees or others, and from other sources, which may have the effect of diluting the holdings of existing shareholders. The Company has no current arrangements with respect to, or sources of, such additional financing and we do not anticipate that existing shareholders will provide any portion of our future financing requirements.

No assurance can be given that additional financing will be available when needed or that such financing will be available on terms acceptable to the Company. If adequate funds are not available, we may be required to delay or terminate expenditures for certain of its programs that it would otherwise seek to develop and commercialize. This would have a material adverse effect on the Company.

Off-Balance Sheet Arrangements

As of December 31, 2019 and 2018, we did not have any off-balance sheet arrangements as defined in Item 303(a)(4)(ii) of Regulation S-K promulgated under the Securities Act of 1934.

| 17 |

As of September 30, 2020 and 2019, we did not have any off-balance sheet arrangements as defined in Item 303(a)(4)(ii) of Regulation S-K promulgated under the Securities Act of 1934.

Contractual Obligations and Commitments

As of December 31, 2019 and 2018, we did not have any contractual obligations. As of September 30, 2020 and 2019, we did not have any contractual obligations.

Critical Accounting Policies

Our significant accounting policies are described in the notes to our financial statements for the years ended December 31, 2019 and 2018, and are included elsewhere in this registration statement.

Our significant accounting policies are described in the notes to our financial statements for the years ended September 30, 2020 and 2019, and are included elsewhere in this registration statement.

Our mailing address is 1107, Tower 1, Lippo Centre, 89 Queensway, Admiralty, Hong Kong.

| 18 |

ITEM 4. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT.

The following table sets forth as of December 31, 2018 and December 31, 2019 the number of shares of the Company’s common stock and preferred stock owned on record or beneficially by each person known to be the beneficial owner of 5% or more of the issued and outstanding shares of the Company’s voting stock, and by each of the Company’s directors and executive officers and by all its directors and executive officers as a group.

List of Common stockholder

| Name of Shareholder | Affiliation with Company |

Address (State / Country) |

Number of Shares |

Holding % | Note |

| Continental Worldwide Holdings Pvt Ltd | N/A | Hong Kong | 100,000 | 5.01% | |

| Dragon Ace Gobal Limited | N/A | Hong Kong | 700,000 | 35.06% | |

| Stanford Gobal Capital Limited | N/A | Hong Kong | 550,000 | 27.55% | |

| Standford Gobal Capital Limited | N/A | Hong Kong | 150,000 | 7.51% | |

| Chi Hung Tsang | N/A | Hong Kong | 121,713 | 6.10% | |

| Raymond Fu | President / CEO/ Secretary / Treasurer / Director | Hong Kong | 0 | 0% | |

| Rhonda Keaveney | CEO/ Secretary/ Treasurer/ Director | Arizona / United States of America | 0 | 0% |

List of Preference Shareholders-

| Name of Shareholder | Affiliation with Company |

Address (State / Country) |

Number of Shares |

Holding % | Nature of Preference shares |

Notes |

| Dragon Ace Gobal Limited | N/A | Hong Kong | 250,000 | 38.46% | Series A | |

| Standford Gobal Capital Limited | N/A | Hong Kong | 250,000 | 38.46% | Series A | |

| Chuang Fu Qu Kuai Lian Technology (Shenzhen) Limited | N/A | Hong Kong | 150,000 | 23.08% | Series B | 2 |

The following table sets forth as of March 1, 2021 the number of shares of the Company’s common stock and preferred stock owned on record or beneficially by each person known to be the beneficial owner of 5% or more of the issued and outstanding shares of the Company’s voting stock, and by each of the Company’s directors and executive officers and by all its directors and executive officers as a group.

List of Common stockholder

| Name of Shareholder | Affiliation with Company |

Address (State / Country) |

Number of Shares |

Holding % | Note |

| Uonlive (Hong Kong) Limited | Hong Kong | 650,000,000 | 99% | 1 | |

| Raymond Fu | President / CEO/ Secretary / Treasurer / Director | Hong Kong | 100,000 | 0.015 % | |

| Timothy Lam Chee Yau | Secretary, Director | Hong Kong | 0 | 0 | |

| Thomas Yip Kwok Fai | Director | Hong Kong | 0 | 0 | |

| Michael Woo Chi Wai | Director | Hong Kong | 0 | 0 |

| 19 |

List of Preference shareholders-

| Name of Shareholder | Affiliation with Company |

Address (State / Country) |

Number of Shares |

Holding % | Nature of Preference shares |

Note |

| Dragon Ace Gobal Limited | N/A | Hong Kong | 250,000 | 21.37% | Series A | |

| Standford Gobal Capital Limited | N/A | Hong Kong | 250,000 | 21.37% | Series A | |

| Chuang Fu Qu Kuai Lian Technology (Shenzhen) Limited | N/A | Hong Kong | 150,000 | 12.82% | Series B | 2 |

| Uonlive (Hong Kong) Limited | Hong Kong | 520,000 | 44.44% | Series A | 3 |

1 Raymond Fu is the indirect beneficial owner of 650,000,000 of common stock of the Company through Uonlive (Hong Kong) Limited, of which Raymond Fu is the indirect beneficial owner of 99% of its share capital.

2 Raymond Fu is the indirect beneficial owner of 150,000 of preference shares of Company through Chuang Fu Qu Kuai Lian Technology (Shenzhen) Limited.

3 Raymond Fu is the indirect beneficial owner of 520,000 of preference shares of the Company through Uonlive (Hong Kong) Limited.

ITEM 5. DIRECTORS AND EXECUTIVE OFFICERS.

| Name | Age | Position(s) | ||

| Raymond Fu | 52 | President, Treasurer, CEO, Secretary, Director | ||

| Timothy Lam Chee Yau | 36 | Secretary, Director | ||

| Thomas Yip Kwok Fai | 61 | Director | ||

| Michael Woo Chi Wai | 52 | Director | ||

| Rhonda Keaveney | 53 | Prior CEO, Secretary, Treasurer, and Director |

FU, RAYMOND

Mr. Raymond Fu has more than 20 years of professional experience in operations, management and M&A in the finance industry. From 1993 until 2005, Mr Fu worked various roles at Triplenic Holdings Limited (now known as Fujian Group Limited (HKEX:181)), including as an executive director where he helped the group grow from a market value of 1 billion HKD to 300 billion HKD. From 2005 to present, Mr Fu has held his role as an executive director of Asia Image Investment Limited.

Mr Fu is also currently serving as the sole director and controlling shareholder of Uonlive (Hong Kong) Limited, a company incorporated in Hong Kong, since its incorporation on 22 May 2020. He is also the sole director and a shareholder of Chuang Fu Capital Equity CCI Capital Limited, a Hong Kong company, since its incorporation on 4 December 2018. Chuang Fu Capital Equity CCI Capital Limited is the sole shareholder of Chuang Fu Qu Kuai Technology (Shenzhen) Limited, a company incorporated in Shenzhen, China.

Mr. Fu has served in various public positions including President of the Lions Club and Honorary President of the New Territories Manufacturer's Association.

LAM, CHEE YAU TIMOTHY

Timothy was admitted as a lawyer in New South Wales, Australia in 2007. He is also admitted and a qualified lawyer in New Zealand and Hong Kong. Since 2019, he has been a Partner in a Hong Kong law firm and has experience across multiple jurisdictions including USA, Hong Kong, Australia, China, New Zealand, Thailand, Cayman Islands and the BVI. Timothy has worked in both domestic and international firms in Australia and Hong Kong.

Timothy has a Bachelors in Arts (Philosophy), Bachelors in Law, Masters in Law (Corporate and Finance), Masters in Industrial Property, Masters in Applied Law (Commercial Litigation), Masters in Strategic Public Relations, Masters in Buddhist Studies and is currently completing his Masters in Buddhist Counselling.

Timothy has advised and acted for multiple listed companies in Hong Kong and Australia. He has also advised listed company board members on their obligations and has also advised high level corporate and governmental staff as to their duties in their roles.

Timothy is a Member of the Hong Kong Law Society, a Member of the NSW Law Society, a Governor to the Board of the Children’s Cancer Foundation and a Fellow of the Hong Kong Institute of Directors. He has acted on multiple boards in private companies in Australia and Hong Kong.

| 20 |

YIP, KWOK FAI THOMAS

Thomas has over 40 years’ working experience spanning across numerous industries. He first started in the 1970’s as a Business Coordinator for the Taikoo Royal Insurance Co Ltd. He has since worked across various companies at managerial and director levels including sitting on the Board of Directors for various Hong Kong companies and USA listed companies.

From 1988 to 1993, Thomas worked as a manager for Gibbs Insurance Consultants (HSBC Insurance Brokers (Asia) Limited. From 1993 to 2001, Thomas worked as a Deputy General Manager for Sime Hoggs Robinson Insurance Brokers Limited. From 2001 to 2005, Thomas worked as an Assistant Director to Health Lambert (Hong Kong) Limited. From 2005 to 2012, Thomas worked as an Executive Director for Willis Hong Kong Limited.

Since 2012, Thomas is currently serving as a Managing Director for Seascope Risk Services (HK) Limited.

Thomas obtained his MBA from the European University in 2017 and is a member of the Chinese Institute of Certificated Financial Planners and a Member of the Chinese Institute of Registered Financial Analysts. Thomas is also an executive committee member of the Professional Insurance Brokers Association, the Founder and CEO of Bassac Insurance Broker Co Ltd (a Licensed Broker in Cambodia), a Senior Consultant and Compliance Officer to Right Choice Insurance Broker Co Ltd ( a Licensed Broker in China), an Association Executive Committee Member of the China Grater Bay Area Standards Association Ltd, and a operation officer and licence holder of Tangent Asia Pacific Finance Ltd (a HK Licensed Money Lender).

| 21 |

WOO, CHI WAI MICHAEL

Michael is a consultant and has over 20 years of specialized experience working for international financial institutions and large corporate enterprises. His experience spans across working for various listed companies in multi-jurisdictions including the USA, Singapore, Hong Kong, Australia and China. From 1997 to 1999, Michael joined the Australian listed company Zhongxiang Construction Group (ASX:CIH) as a deputy manager of project financing. In 2003 to 2008, Michael joined Hong Kong First Asia Financial Group (now known as National Investment Limited HKEX:1227) as a partner of the global capital markets team. From 2009 to 2013, Michael Joined the China Minmetals Securities as the International Capital Markets Operations Director. From 2017 to 2019, Michael joined the HSBC Financial Group Co., Ltd as a Chief Strategy Officer. He has been involved in multiple large-scale deals which include raising over 1 billion dollars’ worth of capital. He has also experience in managing companies at various levels including acting as a director for various company boards.

KEAVENEY, RHONDA

Ms. Keaveney holds a Juris Doctor degree and a Master Certificate in Project Management. She has extensive knowledge in the areas of FINRA corporate filings, OTC Markets filings, and SEC compliance filings. She has had over 20 years working with small cap companies. She is the owner of Small Cap Compliance, LLC which was the Custodian of the Company between June 15, 2018 until its discharge on December 5, 2018. From June 13, 2018 until September 7, 2018, Rhonda was the CEO, Secretary, Treasurer and Director of the Company. She resigned all positions from the Company on September 7, 2018.

ITEM 6. EXECUTIVE COMPENSATION.

No executive compensation was paid during the fiscal years ended December 31, 2019 and 2018. The Company has no employment agreement with any of its officers and directors.

ITEM 7. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE.

On June 15, 2018, the eight judicial District Court of Nevada appointed Small Cap Compliance, LLC as custodian for Uonlive Corporation., proper notice having been given to the officers and directors of Uonlive Corporation. There was no opposition.