Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-09255

Wells Fargo Variable Trust

(Exact name of registrant as specified in charter)

525 Market St., San Francisco, CA 94105

(Address of principal executive offices) (Zip code)

C. David Messman

Wells Fargo Funds Management, LLC

525 Market St., San Francisco, CA 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-222-8222

| Date of fiscal year end: | December 31, 2011 | |

| Date of reporting period: | December 31, 2011 | |

Table of Contents

| ITEM 1. | REPORT TO SHAREHOLDERS |

Table of Contents

Wells Fargo Advantage VT Discovery FundSM

Annual Report

December 31, 2011

Table of Contents

Reduce clutter. Save trees.

Sign up for electronic delivery of prospectuses and shareholder reports at www.wellsfargo.com/advantagedelivery

| 2 | ||||

| 5 | ||||

| 9 | ||||

| 10 | ||||

| Financial Statements |

||||

| 15 | ||||

| 16 | ||||

| 17 | ||||

| 18 | ||||

| 19 | ||||

| 24 | ||||

| 25 | ||||

| 28 | ||||

The views expressed and any forward-looking statements are as of December 31, 2011, unless otherwise noted, and are those of the Fund managers and/or Wells Fargo Funds Management, LLC. Discussions of individual securities, or the markets generally, or any Wells Fargo Advantage Fund are not intended as individual recommendations. Future events or results may vary significantly from those expressed in any forward-looking statements; the views expressed are subject to change at any time in response to changing circumstances in the market. Wells Fargo Funds Management, LLC, disclaims any obligation to publicly update or revise any views expressed or forward-looking statements.

NOT FDIC INSURED ¡ NO BANK GUARANTEE ¡ MAY LOSE VALUE

Table of Contents

NOT FDIC INSURED ¡ NO BANK GUARANTEE ¡ MAY LOSE VALUE

Not part of the annual report.

Table of Contents

Wells Fargo Advantage Funds offers more than 110 mutual funds across a wide range of asset classes, representing over $216 billion in assets under management, as of December 31, 2011.

| Equity Funds | ||||

| Asia Pacific Fund |

Global Opportunities Fund |

Premier Large Company Growth Fund | ||

| C&B Large Cap Value Fund |

Growth Fund |

Small Cap Opportunities Fund | ||

| C&B Mid Cap Value Fund |

Health Care Fund |

Small Cap Value Fund | ||

| Capital Growth Fund |

Index Fund |

Small Company Growth Fund | ||

| Common Stock Fund |

International Equity Fund |

Small Company Value Fund | ||

| Disciplined U.S. Core Fund |

International Value Fund |

Small/Mid Cap Core Fund | ||

| Discovery Fund† |

Intrinsic Small Cap Value Fund |

Small/Mid Cap Value Fund | ||

| Diversified Equity Fund |

Intrinsic Value Fund |

Social Sustainability Fund† | ||

| Diversified International Fund |

Intrinsic World Equity Fund |

Special Mid Cap Value Fund | ||

| Diversified Small Cap Fund |

Large Cap Core Fund |

Special Small Cap Value Fund | ||

| Emerging Growth Fund |

Large Cap Growth Fund |

Specialized Technology Fund | ||

| Emerging Markets Equity Fund |

Large Company Value Fund |

Strategic Large Cap Growth Fund | ||

| Endeavor Select Fund† |

Omega Growth Fund |

Traditional Small Cap Growth Fund | ||

| Enterprise Fund† |

Opportunity Fund† |

Utility and Telecommunications Fund | ||

| Equity Value Fund |

Precious Metals Fund |

|||

| Bond Funds | ||||

| Adjustable Rate Government Fund |

Inflation-Protected Bond Fund |

Short-Term Bond Fund | ||

| California Limited-Term Tax-Free Fund |

Intermediate Tax/AMT-Free Fund |

Short-Term High Yield Bond Fund | ||

| California Tax-Free Fund |

International Bond Fund |

Short-Term Municipal Bond Fund | ||

| Colorado Tax-Free Fund |

Minnesota Tax-Free Fund |

Strategic Municipal Bond Fund | ||

| Government Securities Fund |

Municipal Bond Fund |

Total Return Bond Fund | ||

| High Income Fund |

North Carolina Tax-Free Fund |

Ultra Short-Term Income Fund | ||

| High Yield Bond Fund |

Pennsylvania Tax-Free Fund |

Ultra Short-Term Municipal Income Fund | ||

| Income Plus Fund |

Short Duration Government Bond Fund |

Wisconsin Tax-Free Fund | ||

| Asset Allocation Funds | ||||

| Asset Allocation Fund |

WealthBuilder Equity Portfolio† |

Target 2020 Fund† | ||

| Conservative Allocation Fund |

WealthBuilder Growth Allocation Portfolio† |

Target 2025 Fund† | ||

| Diversified Capital Builder Fund |

WealthBuilder Growth Balanced Portfolio† |

Target 2030 Fund† | ||

| Diversified Income Builder Fund |

WealthBuilder Moderate Balanced Portfolio† |

Target 2035 Fund† | ||

| Growth Balanced Fund |

WealthBuilder Tactical Equity Portfolio† |

Target 2040 Fund† | ||

| Index Asset Allocation Fund |

Target Today Fund† |

Target 2045 Fund† | ||

| Moderate Balanced Fund |

Target 2010 Fund† |

Target 2050 Fund† | ||

| WealthBuilder Conservative Allocation Portfolio† |

Target 2015 Fund† |

Target 2055 Fund† | ||

| Money Market Funds | ||||

| 100% Treasury Money Market Fund |

Heritage Money Market Fund† |

National Tax-Free Money Market Fund | ||

| California Municipal Money Market Fund |

Money Market Fund |

Prime Investment Money Market Fund | ||

| Cash Investment Money Market Fund |

Municipal Cash Management Money Market Fund |

Treasury Plus Money Market Fund | ||

| Government Money Market Fund |

Municipal Money Market Fund |

|||

| Variable Trust Funds1 | ||||

| VT Discovery Fund† |

VT Intrinsic Value Fund |

VT Small Cap Growth Fund | ||

| VT Index Asset Allocation Fund |

VT Omega Growth Fund |

VT Small Cap Value Fund | ||

| VT International Equity Fund |

VT Opportunity Fund† |

VT Total Return Bond Fund |

An investment in a money market fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the Wells Fargo Advantage Money Market Funds seek to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in a money market fund.

| 1. | The Variable Trust Funds are generally available only through insurance company variable contracts. |

| † | In this report, the Wells Fargo Advantage Discovery FundSM, Wells Fargo Advantage Endeavor Select FundSM, Wells Fargo Advantage Enterprise FundSM, Wells Fargo Advantage Opportunity FundSM, Wells Fargo Advantage Social Sustainability FundSM, Wells Fargo Advantage WealthBuilder Conservative Allocation PortfolioSM, Wells Fargo Advantage WealthBuilder Equity PortfolioSM, Wells Fargo Advantage WealthBuilder Growth Allocation PortfolioSM, Wells Fargo Advantage WealthBuilder Growth Balanced PortfolioSM, Wells Fargo Advantage WealthBuilder Moderate Balanced PortfolioSM, Wells Fargo Advantage WealthBuilder Tactical Equity PortfolioSM, Wells Fargo Advantage Dow Jones Target Today FundSM, Wells Fargo Advantage Dow Jones Target 2010 FundSM, Wells Fargo Advantage Dow Jones Target 2015 FundSM, Wells Fargo Advantage Dow Jones Target 2020 FundSM, Wells Fargo Advantage Dow Jones Target 2025 FundSM, Wells Fargo Advantage Dow Jones Target 2030 FundSM, Wells Fargo Advantage Dow Jones Target 2035 FundSM, Wells Fargo Advantage Dow Jones Target 2040 FundSM, Wells Fargo Advantage Dow Jones Target 2045 FundSM, Wells Fargo Advantage Dow Jones Target 2050 FundSM, Wells Fargo Advantage Dow Jones Target 2055 FundSM, Wells Fargo Advantage Heritage Money Market FundSM, Wells Fargo Advantage VT Discovery FundSM, and Wells Fargo Advantage VT Opportunity FundSM are referred to as the Discovery Fund, Endeavor Select Fund, Enterprise Fund, Opportunity Fund, Social Sustainability Fund, WealthBuilder Conservative Allocation Portfolio, WealthBuilder Equity Portfolio, WealthBuilder Growth Allocation Portfolio, WealthBuilder Growth Balanced Portfolio, WealthBuilder Moderate Balanced Portfolio, WealthBuilder Tactical Equity Portfolio, Target Today Fund, Target 2010 Fund, Target 2015 Fund, Target 2020 Fund, Target 2025 Fund, Target 2030 Fund, Target 2035 Fund, Target 2040 Fund, Target 2045 Fund, Target 2050 Fund, Target 2055 Fund, Heritage Money Market Fund, VT Discovery Fund, and VT Opportunity Fund, respectively. |

Not part of the annual report.

Table of Contents

| 2 | Wells Fargo Advantage VT Discovery Fund | Letter to Shareholders |

Table of Contents

| Letter to Shareholders | Wells Fargo Advantage VT Discovery Fund | 3 |

With inflation in check, the Federal Reserve (Fed) held its target range for the federal funds rate—a proxy for short-term interest rates—steady at 0% to 0.25%. Following its August 9 meeting, the Federal Open Market Committee (FOMC) issued a statement explaining that economic conditions were likely to warrant exceptionally low levels for the federal funds rate through at least mid-2013. In addition, the Fed carried out its second round of quantitative easing (QE2) in an effort to promote a more robust economic expansion. The stimulus program was completed as scheduled in June 2011. In September, the Fed launched yet another stimulus program—dubbed “Operation Twist”—that is designed to keep intermediate- and longer-term yields relatively low. The goal with keeping longer-term rates low is to encourage lending activity to spark business investments and home purchases, which, in turn, may provide support for a more sustainable economic recovery.

Market volatility was a dominant theme throughout most of 2011.

Despite pockets of turbulence sparked by the natural disasters in Japan and geopolitical turmoil in North Africa and the Middle East, the U.S. equity market performed very well from January through April of 2011. Some upbeat economic news, better-than-expected corporate profits, and investor enthusiasm about QE2 were among the catalysts for the market’s four-month advance.

In May and June, the market climate shifted to one of anxiety over the increasingly fragile state of the U.S. and global economies. As spring gave way to summer, investors not only worried that the U.S. might be on the brink of recession, they also feared that Europe’s sovereign debt problems could spiral out of control if a Greek default triggered financial contagion across the continent. In July and August, investor sentiment was further undermined by partisan wrangling over the federal debt ceiling and the Standard & Poor’s downgrade of the U.S. credit rating. The barrage of unsettling headlines led to heightened market volatility and sharply falling stock prices in the third quarter of 2011. Although volatility persisted into the fourth quarter, the market was able to rebound amid improved economic data and hopes for a resolution to the European crisis.

For the full 12-month period, the S&P 500 Index1 of large-cap stocks achieved a total return of 2.1%. The Russell Midcap® Index2 and the Russell 2000® Index3 of small-cap stocks lost 1.6% and 4.2%, respectively. International stocks fared worse than their U.S. counterparts, with the MSCI EAFE Index4 shedding 14.8%.

| 1. | The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-value weighted index with each stock's weight in the index proportionate to its market value. You cannot invest directly in an index. |

| 2. | The Russell Midcap® Index measures the performance of the 800 smallest companies in the Russell 1000 Index, which represent approximately 25% of the total market capitalization of the Russell 1000® Index. You cannot invest directly in an index. |

| 3. | The Russell 2000® Index measures the performance of the 2,000 smallest companies in the Russell 3000® Index, which represents approximately 8% of the total market capitalization of the Russell 3000 Index. You cannot invest directly in an index. |

| 4. | The Morgan Stanley Capital International Europe, Australasia, and Far East (“MSCI EAFE”) Stock Index is an unmanaged group of securities widely regarded by investors to be representations of the stock markets of Europe, Australasia, and the Far East. You cannot invest directly in an index. Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indexes or any securities or financial products. This report is not approved, reviewed or produced by MSCI. |

Table of Contents

| 4 | Wells Fargo Advantage VT Discovery Fund | Letter to Shareholders |

Table of Contents

| Performance Highlights (Unaudited) | Wells Fargo Advantage VT Discovery Fund | 5 |

Table of Contents

| 6 | Wells Fargo Advantage VT Discovery Fund | Performance Highlights (Unaudited) |

MANAGER’S DISCUSSION

Fund highlights

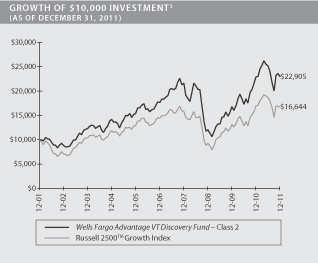

| n | The Fund outperformed its benchmark, the Russell 2500™ Growth Index, over the 12-month period that ended December 31, 2011. |

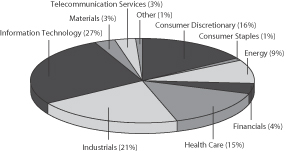

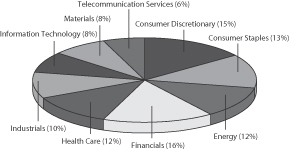

| n | Effective stock selection in the health care and information technology (IT) sectors contributed to performance, while consumer discretionary positioning and a lack of exposure to consumer staples were slight headwinds. |

| n | Equity prices ebbed and flowed with a “risk on/risk off” mentality throughout the year, driven largely by investors’ reactions to the news flow out of Europe. |

| n | In the current market environment, we remain dedicated to our bottom-up stock selection process in seeking to maintain an optimal risk/reward balance. |

Macro-driven volatility limited equity market returns for 2011.

The year began on a high note as the equity market continued its rally from late 2010 amid greater confidence in the sustainability of the U.S. economic recovery. While there were pockets of turbulence sparked by the geopolitical turmoil in North Africa and the Middle East and natural disasters in Japan, the market performed well through April 2011.

In the late spring and summer, however, investors’ spirits began to dampen as a string of discouraging economic data reignited fears of a recession. Investor confidence was further damaged by bickering over the federal debt ceiling, the downgrade of the U.S. credit rating by Standard & Poor’s, and the risk of financial contagion in Europe. Despite continued strength in corporate profits, investors’ intense focus on the negative macro headlines, particularly out of Europe, led to heightened market volatility and a broad-based sell-off in equities during the third quarter. Although volatility persisted into the fourth quarter, most of the major equity indexes rebounded and managed to finish 2011 with either modest gains or relatively mild losses.

Effective stock selection and merger and acquisition activity enabled the Fund to outperform its benchmark.

Effective stock selection in the health care and IT sectors contributed significantly to the Fund’s outperformance during the period. In health care, Pharmasset Incorporated’s innovative treatment for hepatitis C and HealthSpring Incorporated’s strong position in the health insurance industry were recognized by strategic buyers, as both stocks were acquired at sizable premiums. Meanwhile, Alexion Pharmaceuticals Incorporated, broadened the indications of use and geographic distribution for its rare-disease therapies. In IT, the acquisitions of both NetLogic Microsystems Incorporated, and SuccessFactors Incorporated, commanded healthy premiums, while the solid fundamentals of our holdings in the internet software and services and semiconductor industries also contributed to outperformance.

Stock selection in the consumer discretionary sector and a lack of exposure to consumer staples were performance headwinds. Shutterfly Incorporated, a leading online photo provider, was the largest individual detractor due to the impact of increased pricing competition on the company’s results during the busy holiday season. Investors’ rotation into more defensive market segments enabled many consumer staples stocks to outperform the market. In keeping with our stock selection discipline, we generally avoided the sector, as we found few consumer staples companies with growth profiles that met our criteria.

Table of Contents

| Performance Highlights (Unaudited) | Wells Fargo Advantage VT Discovery Fund | 7 |

Time has shown that the best response to volatile, irrational markets is to be adaptive in your thinking but consistent in your investment process. Accordingly, while we have continued to execute our time-tested process, we have taken advantage of the opportunity to upgrade the quality of the portfolio by exchanging stocks with lower earnings visibility (meaning that we find it difficult to project future earnings) for those with higher earnings visibility. The challenge is to construct a portfolio with the optimal balance of secular and cyclical growth exposures. We believe that our “surround the company” approach has allowed us to achieve such balance and that the portfolio should be well positioned to outperform once company-specific fundamentals reassert themselves as the primary driver of equity returns.

On the negative side, a European recession looks increasingly likely and could be a source of market turmoil, especially given its implications for export-dependent China. After years of inflating financial and real estate markets, China may need to use other means of stimulus. In addition, ongoing political gamesmanship and fiscal austerity in developed nations could slow global economic growth.

Considering all of these factors, we expect moderate U.S. economic growth in 2012 and a trendless market characterized by bouts of volatility. In such an environment, we believe that balanced portfolio positioning is the most prudent approach.

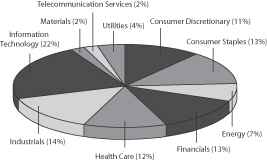

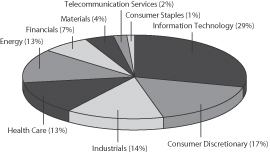

| 4. | The ten largest equity holdings are calculated based on the value of the securities divided by total net assets of the Fund. Holdings are subject to change and may have changed since the date specified. |

| 5. | Sector distribution is subject to change and is calculated based on the total long-term investments of the Fund. |

Table of Contents

| 8 | Wells Fargo Advantage VT Discovery Fund | Performance Highlights (Unaudited) |

AVERAGE ANNUAL TOTAL RETURN (%) (AS OF DECEMBER 31, 2011)

| Expense Ratios6 | ||||||||||||||||||||||||||||

| Inception Date | 6 Months* | 1 Year | 5 Year | 10 Year | Gross | Net6,7 | ||||||||||||||||||||||

| Class 2 |

05/08/1992 | (8.75 | ) | 0.42 | 5.39 | 8.64 | 1.23% | 1.16% | ||||||||||||||||||||

| Russell 2500™ Growth Index |

(10.72 | ) | (1.57 | ) | 2.89 | 5.23 | ||||||||||||||||||||||

| * | Returns for periods of less than one year are not annualized. |

Figures quoted represent past performance, which is no guarantee of future results and do not reflect the deduction of taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted and assumes the reinvestment of dividends and capital gains. Current month-end performance is available by calling 1-866-765-0778. Performance figures of the Fund do not reflect fees charged pursuant to the terms of variable life insurance policies and variable annuity contracts.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses or any taxes. It is not possible to invest directly in an index.

Stock fund values fluctuate in response to the activities of individual companies and general market and economic conditions. Smaller-company stocks tend to be more volatile and less liquid than those of larger companies. The use of derivatives may reduce returns and/or increase volatility. Certain investment strategies tend to increase the total risk of an investment (relative to the broader market). This Fund is exposed to foreign investment risk. Consult the Fund’s prospectus for additional information on these and other risks.

Please refer to the prospectus provided by your participating insurance company for detailed information describing the separate accounts for information regarding surrender charges, mortality and expense risk fees and other charges that may be assessed by the participating insurance companies.

| 6. | Reflects the expense ratios as stated in the most recent prospectus. |

| 7. | The Adviser has committed through April 30, 2012 to waive fees and/or reimburse expenses to the extent necessary to cap the Fund’s Total Annual Fund Operating Expenses After Fee Waiver, excluding certain expenses, at 1.15% for Class 2. Without this cap, the Fund’s returns would have been lower. |

Table of Contents

| Fund Expenses (Unaudited) | Wells Fargo Advantage VT Discovery Fund | 9 |

As a shareholder of the Fund, you incur ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the six-month period and held for the entire period from July 1, 2011 to December 31, 2011.

Actual Expenses

The “Actual” line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the “Actual” line under the heading entitled “Expenses Paid During Period” for your applicable class of shares to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The “Hypothetical” line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any separate account charges assessed by participating insurance companies. Therefore, the “Hypothetical” line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these separate account charges assessed by participating insurance companies were included, your costs would have been higher.

| Beginning Account Value 07-01-2011 |

Ending Account Value 12-31-2011 |

Expenses Paid During the Period¹ |

Net Annual Expense Ratio |

|||||||||||||

| Class 2 |

||||||||||||||||

| Actual |

$ | 1,000.00 | $ | 912.47 | $ | 5.54 | 1.15 | % | ||||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,019.41 | $ | 5.85 | 1.15 | % | ||||||||

| 1. | Expenses paid is equal to the annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year divided by the number of days in the fiscal year (to reflect the one-half year period). |

Table of Contents

| 10 | Wells Fargo Advantage VT Discovery Fund | Portfolio of Investments—December 31, 2011 |

| Security Name | Shares | Value | ||||||||||

| Common Stocks: 98.32% |

||||||||||||

| Consumer Discretionary: 16.24% |

||||||||||||

| Auto Components: 1.38% | ||||||||||||

| BorgWarner Incorporated†« |

21,200 | $ | 1,351,288 | |||||||||

|

|

|

|||||||||||

| Automobiles: 1.28% | ||||||||||||

| Tesla Motors Incorporated†« |

44,088 | 1,259,153 | ||||||||||

|

|

|

|||||||||||

| Diversified Consumer Services: 1.18% | ||||||||||||

| Weight Watchers International Incorporated |

21,100 | 1,160,711 | ||||||||||

|

|

|

|||||||||||

| Hotels, Restaurants & Leisure: 2.40% | ||||||||||||

| Arcos Dorados Holdings Incorporated |

43,517 | 893,404 | ||||||||||

| Buffalo Wild Wings Incorporated† |

21,600 | 1,458,216 | ||||||||||

| 2,351,620 | ||||||||||||

|

|

|

|||||||||||

| Household Durables: 1.30% | ||||||||||||

| Tempur-Pedic International Incorporated† |

24,200 | 1,271,226 | ||||||||||

|

|

|

|||||||||||

| Internet & Catalog Retail: 0.68% | ||||||||||||

| Shutterfly Incorporated†« |

29,500 | 671,420 | ||||||||||

|

|

|

|||||||||||

| Media: 0.69% | ||||||||||||

| National Cinemedia Incorporated« |

54,195 | 672,018 | ||||||||||

|

|

|

|||||||||||

| Specialty Retail: 3.53% | ||||||||||||

| Ross Stores Incorporated |

21,400 | 1,017,142 | ||||||||||

| Vitamin Shoppe Incorporated† |

29,200 | 1,164,496 | ||||||||||

| Williams-Sonoma Incorporated |

33,300 | 1,282,050 | ||||||||||

| 3,463,688 | ||||||||||||

|

|

|

|||||||||||

| Textiles, Apparel & Luxury Goods: 3.80% | ||||||||||||

| Deckers Outdoor Corporation†« |

16,400 | 1,239,348 | ||||||||||

| Michael Kors Holdings Limited |

6,667 | 181,676 | ||||||||||

| Under Armour Incorporated† |

15,800 | 1,134,282 | ||||||||||

| Vera Bradley Incorporated†« |

36,400 | 1,173,900 | ||||||||||

| 3,729,206 | ||||||||||||

|

|

|

|||||||||||

| Consumer Staples: 1.36% |

||||||||||||

| Food Products: 1.36% | ||||||||||||

| Hain Celestial Group Incorporated†« |

36,300 | 1,330,758 | ||||||||||

|

|

|

|||||||||||

| Energy: 9.30% |

||||||||||||

| Energy Equipment & Services: 3.71% | ||||||||||||

| Atwood Oceanics Incorporated†« |

25,300 | 1,006,687 | ||||||||||

| Nabors Industries Limited† |

46,900 | 813,246 | ||||||||||

| Oil States International Incorporated†« |

23,900 | 1,825,243 | ||||||||||

| 3,645,176 | ||||||||||||

|

|

|

|||||||||||

| Oil, Gas & Consumable Fuels: 5.59% | ||||||||||||

| Approach Resources Incorporated† |

33,541 | 986,441 | ||||||||||

| Cabot Oil & Gas Corporation |

12,700 | 963,930 | ||||||||||

Table of Contents

| Portfolio of Investments—December 31, 2011 | Wells Fargo Advantage VT Discovery Fund | 11 |

| Security Name | Shares | Value | ||||||||||

| Oil, Gas & Consumable Fuels (continued) | ||||||||||||

| Concho Resources Incorporated† |

13,900 | $ | 1,303,125 | |||||||||

| Gulfport Energy Corporation† |

23,900 | 703,855 | ||||||||||

| Pioneer Natural Resources Company |

11,800 | 1,055,864 | ||||||||||

| SandRidge Energy Incorporated† |

57,200 | 466,752 | ||||||||||

| 5,479,967 | ||||||||||||

|

|

|

|||||||||||

| Financials: 4.07% |

||||||||||||

| Capital Markets: 2.25% | ||||||||||||

| Affiliated Managers Group Incorporated† |

17,100 | 1,640,745 | ||||||||||

| LPL Investment Holdings Incorporated† |

18,691 | 570,823 | ||||||||||

| 2,211,568 | ||||||||||||

|

|

|

|||||||||||

| Diversified Financial Services: 0.77% | ||||||||||||

| MSCI Incorporated† |

22,800 | 750,804 | ||||||||||

|

|

|

|||||||||||

| Real Estate Management & Development: 1.05% | ||||||||||||

| CBRE Group Incorporated† |

67,900 | 1,033,438 | ||||||||||

|

|

|

|||||||||||

| Health Care: 15.02% |

||||||||||||

| Biotechnology: 3.62% | ||||||||||||

| Alexion Pharmaceuticals Incorporated† |

26,100 | 1,866,150 | ||||||||||

| Cubist Pharmaceuticals Incorporated† |

31,400 | 1,244,068 | ||||||||||

| Inhibitex Incorporated† |

40,000 | 437,600 | ||||||||||

| 3,547,818 | ||||||||||||

|

|

|

|||||||||||

| Health Care Equipment & Supplies: 2.40% | ||||||||||||

| Alere Incorporated† |

38,998 | 900,464 | ||||||||||

| Gen-Probe Incorporated† |

13,700 | 809,944 | ||||||||||

| HeartWare International Incorporated†« |

9,400 | 648,600 | ||||||||||

| 2,359,008 | ||||||||||||

|

|

|

|||||||||||

| Health Care Providers & Services: 3.77% | ||||||||||||

| AmerisourceBergen Corporation |

25,200 | 937,188 | ||||||||||

| Catalyst Health Solutions Incorporated† |

18,900 | 982,800 | ||||||||||

| MEDNAX Incorporated† |

23,900 | 1,721,039 | ||||||||||

| Team Health Holdings LLC† |

2,413 | 53,255 | ||||||||||

| 3,694,282 | ||||||||||||

|

|

|

|||||||||||

| Health Care Technology: 1.37% | ||||||||||||

| athenahealth Incorporated†« |

27,300 | 1,340,976 | ||||||||||

|

|

|

|||||||||||

| Life Sciences Tools & Services: 1.84% | ||||||||||||

| Bruker BioSciences Corporation†« |

71,700 | 890,514 | ||||||||||

| Covance Incorporated† |

20,078 | 917,966 | ||||||||||

| 1,808,480 | ||||||||||||

|

|

|

|||||||||||

| Pharmaceuticals: 2.02% | ||||||||||||

| BioMarin Pharmaceutical Incorporated†« |

30,357 | 1,043,674 | ||||||||||

| Impax Laboratories Incorporated†« |

46,600 | 939,922 | ||||||||||

| 1,983,596 | ||||||||||||

|

|

|

|||||||||||

Table of Contents

| 12 | Wells Fargo Advantage VT Discovery Fund | Portfolio of Investments—December 31, 2011 |

| Security Name | Shares | Value | ||||||||||

| Industrials: 20.38% |

||||||||||||

| Aerospace & Defense: 4.66% | ||||||||||||

| Transdigm Group Incorporated† |

29,600 | $ | 2,832,128 | |||||||||

| Triumph Group Incorporated |

29,800 | 1,741,810 | ||||||||||

| 4,573,938 | ||||||||||||

|

|

|

|||||||||||

| Commercial Services & Supplies: 0.96% | ||||||||||||

| Verisk Analytics Incorporated Class A† |

23,394 | 938,801 | ||||||||||

|

|

|

|||||||||||

| Machinery: 6.65% | ||||||||||||

| AGCO Corporation† |

5,100 | 219,147 | ||||||||||

| Chart Industries Incorporated†« |

28,100 | 1,519,367 | ||||||||||

| Graco Incorporated |

44,900 | 1,835,961 | ||||||||||

| Robbins & Myers Incorporated |

25,200 | 1,223,460 | ||||||||||

| Wabtec Corporation |

14,810 | 1,035,960 | ||||||||||

| Westport Innovations Incorporated†« |

20,600 | 684,744 | ||||||||||

| 6,518,639 | ||||||||||||

|

|

|

|||||||||||

| Road & Rail: 5.04% | ||||||||||||

| Hertz Global Holdings Incorporated† |

112,200 | 1,314,984 | ||||||||||

| Kansas City Southern† |

53,400 | 3,631,734 | ||||||||||

| 4,946,718 | ||||||||||||

|

|

|

|||||||||||

| Trading Companies & Distributors: 1.79% | ||||||||||||

| WESCO International Incorporated†« |

33,200 | 1,759,932 | ||||||||||

|

|

|

|||||||||||

| Transportation Infrastructure: 1.28% | ||||||||||||

| Wesco Aircraft Holdings Incorporated† |

89,449 | 1,251,392 | ||||||||||

|

|

|

|||||||||||

| Information Technology: 26.45% |

||||||||||||

| Communications Equipment: 2.46% | ||||||||||||

| Acme Packet Incorporated† |

34,600 | 1,069,486 | ||||||||||

| F5 Networks Incorporated† |

8,400 | 891,408 | ||||||||||

| Ubiquiti Networks Incorporated†« |

24,986 | 455,495 | ||||||||||

| 2,416,389 | ||||||||||||

|

|

|

|||||||||||

| Electronic Equipment, Instruments & Components: 1.02% | ||||||||||||

| Trimble Navigation Limited† |

23,100 | 1,002,540 | ||||||||||

|

|

|

|||||||||||

| Internet Software & Services: 6.18% | ||||||||||||

| Angie’s List Incorporated†« |

39,179 | 630,782 | ||||||||||

| DealerTrack Holdings Incorporated† |

37,589 | 1,024,676 | ||||||||||

| Equinix Incorporated†« |

19,463 | 1,973,548 | ||||||||||

| LogMeIn Incorporated†« |

23,979 | 924,390 | ||||||||||

| Mercadolibre Incorporated« |

19,000 | 1,511,260 | ||||||||||

| 6,064,656 | ||||||||||||

|

|

|

|||||||||||

| IT Services: 3.26% | ||||||||||||

| Gartner Incorporated† |

55,700 | 1,936,689 | ||||||||||

| ServiceSource International Incorporated† |

80,427 | 1,261,900 | ||||||||||

| 3,198,589 | ||||||||||||

|

|

|

|||||||||||

Table of Contents

| Portfolio of Investments—December 31, 2011 | Wells Fargo Advantage VT Discovery Fund | 13 |

| Security Name | Shares | Value | ||||||||||||

| Semiconductors & Semiconductor Equipment: 4.47% | ||||||||||||||

| Atmel Corporation† |

85,800 | $ | 694,980 | |||||||||||

| Avago Technologies Limited |

52,100 | 1,503,606 | ||||||||||||

| Ceva Incorporated†« |

21,400 | 647,564 | ||||||||||||

| EZchip Semiconductor Limited† |

19,800 | 560,934 | ||||||||||||

| Microchip Technology Incorporated« |

26,600 | 974,358 | ||||||||||||

| 4,381,442 | ||||||||||||||

|

|

|

|||||||||||||

| Software: 9.06% | ||||||||||||||

| Aspen Technology Incorporated†« |

92,300 | 1,601,405 | ||||||||||||

| Broadsoft Incorporated†« |

49,600 | 1,497,920 | ||||||||||||

| Fortinet Incorporated† |

57,234 | 1,248,274 | ||||||||||||

| Qlik Technologies Incorporated† |

44,938 | 1,087,500 | ||||||||||||

| Red Hat Incorporated† |

20,300 | 838,187 | ||||||||||||

| SuccessFactors Incorporated†« |

25,338 | 1,010,226 | ||||||||||||

| TIBCO Software Incorporated† |

67,100 | 1,604,361 | ||||||||||||

| 8,887,873 | ||||||||||||||

|

|

|

|||||||||||||

| Materials: 2.67% |

||||||||||||||

| Chemicals: 2.67% | ||||||||||||||

| Airgas Incorporated |

33,500 | 2,615,680 | ||||||||||||

|

|

|

|||||||||||||

| Telecommunication Services: 2.83% |

||||||||||||||

| Diversified Telecommunication Services: 1.16% | ||||||||||||||

| Iridium Communications Incorporated†« |

147,900 | 1,140,309 | ||||||||||||

|

|

|

|||||||||||||

| Wireless Telecommunication Services: 1.67% | ||||||||||||||

| SBA Communications Corporation Class A†« |

38,100 | 1,636,774 | ||||||||||||

|

|

|

|||||||||||||

| Total Common Stocks (Cost $92,653,238) |

96,449,873 | |||||||||||||

|

|

|

|||||||||||||

| Principal | ||||||||||||||

| Other: 0.49% |

||||||||||||||

| Gryphon Funding Limited, Pass-Through Entity(a)(i)(v) |

$ 626,739 | 175,487 | ||||||||||||

| VFNC Corporation, Pass-Through Entity, 0.30%(a)(i)(v)144A± |

713,417 | 306,769 | ||||||||||||

| Total Other (Cost $230,573) |

482,256 | |||||||||||||

|

|

|

|||||||||||||

| Yield | Shares | |||||||||||||

| Short-Term Investments: 29.28% | ||||||||||||||

| Investment Companies: 29.28% | ||||||||||||||

| Wells Fargo Advantage Cash Investment Money Market Fund, Institutional Class(l)(u) |

0.04 | % | 1,383,165 | 1,383,165 | ||||||||||

| Wells Fargo Securities Lending Cash Investments, LLC(v)(l)(u)(r) |

0.12 | 27,344,177 | 27,344,177 | |||||||||||

| Total Short-Term Investments (Cost $28,727,342) |

28,727,342 | |||||||||||||

|

|

|

|||||||||||||

| Total Investments in Securities | ||||||||

| (Cost $121,611,153)* | 128.09 | % | 125,659,471 | |||||

| Other Assets and Liabilities, Net |

(28.09 | ) | (27,559,978 | ) | ||||

|

|

|

|

|

|||||

| Total Net Assets | 100.00 | % | $ | 98,099,493 | ||||

|

|

|

|

|

Table of Contents

| 14 | Wells Fargo Advantage VT Discovery Fund | Portfolio of Investments—December 31, 2011 |

| † | Non-income earning security. |

| « | All or a portion of this security is on loan. |

| (a) | Security is fair valued by the Management Valuation Team, and in certain instances by the Board of Trustees, in accordance with procedures approved by the Board of Trustees. |

| (i) | Illiquid security for which the designation as illiquid is unaudited. |

| (v) | Security represents investment of cash collateral received from securities on loan. |

| 144A | Security that may be resold to “qualified institutional buyers” under Rule 144A or security offered pursuant to Section 4(2) of the Securities Act of 1933, as amended. |

| ± | Variable rate investment. |

| (l) | Investment in an affiliate. |

| (u) | Rate shown is the 7-day annualized yield at period end. |

| (r) | The investment company is exempt from registration under Section 3(c)(7) of the 1940 Act. |

| * | Cost for federal income tax purposes is $122,437,848 and net unrealized appreciation (depreciation) consists of: |

| Gross unrealized appreciation |

$ | 10,258,147 | ||

| Gross unrealized depreciation |

(7,036,524 | ) | ||

|

|

|

|||

| Net unrealized appreciation |

$ | 3,221,623 |

The accompanying notes are an integral part of these financial statements.

Table of Contents

| Statement of Assets and Liabilities—December 31, 2011 | Wells Fargo Advantage VT Discovery Fund | 15 |

| Assets |

||||

| Investments |

||||

| In unaffiliated securities (including securities on loan), at value |

$ | 96,932,129 | ||

| In affiliated securities, at value |

28,727,342 | |||

|

|

|

|||

| Total investments, at value (see cost below) |

125,659,471 | |||

| Receivable for investments sold |

916,076 | |||

| Receivable for Fund shares sold |

21,923 | |||

| Receivable for dividends |

18,330 | |||

| Receivable for securities lending income |

22,332 | |||

| Prepaid expenses and other assets |

604 | |||

|

|

|

|||

| Total assets |

126,638,736 | |||

|

|

|

|||

| Liabilities |

||||

| Payable for investments purchased |

786,651 | |||

| Payable for Fund shares redeemed |

52,316 | |||

| Payable upon receipt of securities loaned |

27,574,750 | |||

| Advisory fee payable |

58,922 | |||

| Distribution fees payable |

22,469 | |||

| Due to other related parties |

10,681 | |||

| Accrued expenses and other liabilities |

33,454 | |||

|

|

|

|||

| Total liabilities |

28,539,243 | |||

|

|

|

|||

| Total net assets |

$ | 98,099,493 | ||

|

|

|

|||

| NET ASSETS CONSIST OF |

||||

| Paid-in capital |

$ | 99,684,137 | ||

| Accumulated net realized losses on investments |

(5,632,962 | ) | ||

| Net unrealized gains on investments |

4,048,318 | |||

|

|

|

|||

| Total net assets |

$ | 98,099,493 | ||

|

|

|

|||

| COMPUTATION OF NET ASSET VALUE PER SHARE1 |

||||

| Net assets – Class 2 |

$ | 98,099,493 | ||

| Shares outstanding – Class 2 |

4,590,157 | |||

| Net asset value per share – Class 2 |

$21.37 | |||

| Total investments, at cost |

$ | 121,611,153 | ||

|

|

|

|||

| Securities on loan, at value |

$ | 26,863,306 | ||

|

|

|

|||

| 1. | The Fund has an unlimited number of authorized shares. |

The accompanying notes are an integral part of these financial statements.

Table of Contents

| 16 | Wells Fargo Advantage VT Discovery Fund | Statement of Operations—Year Ended December 31, 2011 |

| Investment income |

||||

| Dividends* |

$ | 337,927 | ||

| Income from affiliated securities |

2,711 | |||

| Securities lending income, net |

83,600 | |||

|

|

|

|||

| Total investment income |

424,238 | |||

|

|

|

|||

| Expenses |

||||

| Advisory fee |

754,752 | |||

| Administration fees |

||||

| Fund level |

53,911 | |||

| Class 2 |

86,257 | |||

| Distribution fees |

||||

| Class 2 |

269,554 | |||

| Custody and accounting fees |

18,913 | |||

| Professional fees |

35,419 | |||

| Shareholder report expenses |

37,856 | |||

| Trustees’ fees and expenses |

10,578 | |||

| Other fees and expenses |

4,250 | |||

|

|

|

|||

| Total expenses |

1,271,490 | |||

| Less: Fee waivers and/or expense reimbursements |

(35,032 | ) | ||

|

|

|

|||

| Net expenses |

1,236,458 | |||

|

|

|

|||

| Net investment loss |

(812,220 | ) | ||

|

|

|

|||

| REALIZED AND UNREALIZED GAINS (LOSSES) ON INVESTMENTS |

||||

| Net realized gains on investments |

27,863,306 | |||

| Net change in unrealized gains (losses) on investments |

(26,402,344 | ) | ||

|

|

|

|||

| Net realized and unrealized gains (losses) on investments |

1,460,962 | |||

|

|

|

|||

| Net increase in net assets resulting from operations |

$ | 648,742 | ||

|

|

|

|||

| * Net of foreign dividend withholding taxes of |

$5,954 | |||

The accompanying notes are an integral part of these financial statements.

Table of Contents

| Statements of Changes in Net Assets | Wells Fargo Advantage VT Discovery Fund | 17 |

| Year Ended December 31, 2011 |

Year Ended December 31, 2010 |

|||||||||||||||

| Operations |

||||||||||||||||

| Net investment loss |

$ | (812,220 | ) | $ | (661,558 | ) | ||||||||||

| Net realized gains on investments |

27,863,306 | 15,071,192 | ||||||||||||||

| Net change in unrealized gains (losses) on investments |

(26,402,344 | ) | 14,985,606 | |||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net increase in net assets resulting from operations |

648,742 | 29,395,240 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Shares | Shares | |||||||||||||||

| Capital share transactions |

||||||||||||||||

| Proceeds from shares sold – Class 2 |

665,598 | 14,494,199 | 796,770 | 1 | 14,304,397 | 1 | ||||||||||

| Payment for shares redeemed – Class 2 |

(1,279,927 | ) | (27,798,666 | ) | (1,076,715 | )1 | (19,068,998 | )1 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net decrease in net assets resulting |

(13,304,467 | ) | (4,764,601 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total increase (decrease) in net assets |

(12,655,725 | ) | 24,630,639 | |||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net assets |

||||||||||||||||

| Beginning of period |

110,755,218 | 86,124,579 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| End of period |

$ | 98,099,493 | $ | 110,755,218 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Undistributed net investment income |

$ | 0 | $ | 0 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| 1. | After the close of business on July 16, 2010, existing shares of the Fund were renamed Class 2 shares. |

The accompanying notes are an integral part of these financial statements.

Table of Contents

| 18 | Wells Fargo Advantage VT Discovery Fund | Financial Highlights |

(For a share outstanding throughout each period)

| Year Ended December 31, | ||||||||||||||||||||

| Class 21 | 2011 | 2010 | 2009 | 2008 | 2007 | |||||||||||||||

| Net asset value, beginning of period |

$ | 21.28 | $ | 15.70 | $ | 11.19 | $ | 20.11 | $ | 16.44 | ||||||||||

| Net investment loss |

(0.18 | ) | (0.13 | ) | (0.11 | ) | (0.11 | ) | (0.15 | ) | ||||||||||

| Net realized and unrealized gains (losses) on investments |

0.27 | 5.71 | 4.62 | (8.81 | ) | 3.82 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total from investment operations |

0.09 | 5.58 | 4.51 | (8.92 | ) | 3.67 | ||||||||||||||

| Net asset value, end of period |

$21.37 | $21.28 | $15.70 | $11.19 | $20.11 | |||||||||||||||

| Total return |

0.42 | % | 35.54 | % | 40.30 | % | (44.36 | )% | 22.32 | % | ||||||||||

| Ratios to average net assets (annualized) |

||||||||||||||||||||

| Gross expenses |

1.18 | % | 1.26 | % | 1.35 | % | 1.27 | % | 1.21 | % | ||||||||||

| Net expenses |

1.15 | % | 1.15 | % | 1.15 | % | 1.15 | % | 1.15 | % | ||||||||||

| Net investment loss |

(0.75 | )% | (0.71 | )% | (0.61 | )% | (0.63 | )% | (0.72 | )% | ||||||||||

| Supplemental data |

||||||||||||||||||||

| Portfolio turnover rate |

113 | % | 101 | % | 208 | % | 166 | % | 135 | % | ||||||||||

| Net assets, end of period (000’s omitted) |

$98,099 | $110,755 | $86,125 | $113,149 | $238,894 | |||||||||||||||

| 1. | After the close of business on July 16, 2010, existing shares of the Fund were renamed Class 2 shares. |

The accompanying notes are an integral part of these financial statements.

Table of Contents

| Notes to Financial Statements | Wells Fargo Advantage VT Discovery Fund | 19 |

1. ORGANIZATION

Wells Fargo Variable Trust (the “Trust”), a Delaware statutory trust organized on March 10, 1999, is an open-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). These financial statements report on Wells Fargo Advantage VT Discovery Fund (the “Fund”) which is a diversified series of the Trust.

2. SIGNIFICANT ACCOUNTING POLICIES

The following significant accounting policies, which are consistently followed in the preparation of the financial statements of the Fund, are in conformity with U.S. generally accepted accounting principles which require management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Securities valuation

Investments in equity securities are valued each business day as of the close of regular trading on the New York Stock Exchange, which is usually 4:00 p.m. (Eastern Time). Securities which are traded on a national or foreign securities exchange are valued at the last reported sales price, except that securities listed on The Nasdaq Stock Market, Inc. (“Nasdaq”) are valued at the Nasdaq Official Closing Price (“NOCP”), and if no NOCP is available, then at the last reported sales price. If no sales price is shown on the Nasdaq, the bid price will be used. In the absence of any sale of securities listed on the Nasdaq, and in the case of other securities (including U.S. Government obligations, but excluding debt securities maturing in 60 days or less), the price will be deemed “stale” and the valuations will be determined in accordance with the Fund’s Fair Value Procedures.

Fixed income securities with maturities exceeding 60 days are valued based on available evaluated prices received from an independent pricing service approved by the Board of Trustees which may utilize both transaction data and market information such as yield, prices of securities of comparable quality, coupon rate, maturity, type of issue, trading characteristics and other market data. If valuations are not available from the pricing service or values received are deemed not representative of market value, values will be obtained from a third party broker-dealer or determined based on the Fund’s Fair Value Procedures.

Debt securities of sufficient credit quality with original maturities of 60 days or less generally are valued at amortized cost which approximates fair value. The amortized cost method involves valuing a security at its cost, plus accretion of discount or minus amortization of premium over the period until maturity.

Investments in open-end mutual funds and non-registered investment companies are generally valued at net asset value.

Investments which are not valued using any of the methods discussed above, are valued at their fair value, as determined by procedures established in good faith and approved by the Board of Trustees.

Security loans

The Fund may lend its securities from time to time in order to earn additional income in the form of fees or interest on securities received as collateral or the investment of any cash received as collateral. The Fund continues to receive interest or dividends on the securities loaned. The Fund receives collateral in the form of cash or securities with a value at least equal to the value of the securities on loan. The value of the loaned securities is determined at the close of each business day and any additional required collateral is delivered to the Fund on the next business day. In a securities lending transaction, the net asset value of the Fund will be affected by an increase or decrease in the value of the securities loaned and by an increase or decrease in the value of the instrument in which collateral is invested. The amount of securities lending activity undertaken by the Fund fluctuates from time to time. In the event of default or bankruptcy by the borrower, the Fund may be prevented from recovering the loaned securities or gaining access to the collateral or may experience delays or costs in doing so. In addition, the investment of any cash collateral received may lose all or part of its value. The Fund has the right under the lending agreement to recover the securities from the borrower on demand.

The Fund lends its securities through an unaffiliated securities lending agent. Cash collateral received in connection with its securities lending transactions is invested in Wells Fargo Securities Lending Cash Investments, LLC (the “Cash Collateral Fund”). The Cash Collateral Fund is exempt from registration under Section 3(c)(7) of the 1940 Act and is managed by

Table of Contents

| 20 | Wells Fargo Advantage VT Discovery Fund | Notes to Financial Statements |

Wells Fargo Funds Management LLC (“Funds Management”) and is sub-advised by Wells Capital Management Incorporated (“Wells Capital Management”). Funds Management receives an advisory fee starting at 0.05% and declining to 0.01% as the average daily net assets of the Cash Collateral Fund increase. All of the fees received by Funds Management are paid to Wells Capital Management for its services as sub-adviser. The Cash Collateral Fund seeks to provide a positive return compared to the daily Fed Funds Open rate by investing in high-quality, U.S. dollar-denominated short-term money market instruments. Cash Collateral Fund investments are fair valued based upon the amortized cost valuation technique. Income earned from investment in the Cash Collateral Fund is included in securities lending income on the Statement of Operations.

For Wells Fargo Advantage Funds that participated in securities lending activity prior to February 13, 2009, certain structured investment vehicles purchased in a joint account by the former securities lending agent defaulted or were impaired. Certain of the Wells Fargo Advantage Funds still hold ownership interest in these structured investment vehicles, which have since been restructured as pass-through securities. If the Fund holds an ownership interest in such pass-through securities, information regarding this ownership interest can be found in the Portfolio of Investments under the category “Other”.

Security transactions and income recognition

Securities transactions are recorded on a trade date basis. Realized gains or losses are reported on the basis of identified cost of securities delivered.

Dividend income is recognized on the ex-dividend date. Dividend income is recorded net of foreign taxes withheld where recovery of such taxes is not assured.

Distributions to shareholders

Distributions to shareholders from net investment income and net realized gains, if any, are recorded on the ex-dividend date. Such distributions are determined in conformity with income tax regulations, which may differ from generally accepted accounting principles.

The timing and character of distributions made during the period from net investment income or net realized gains may differ from their ultimate characterization for federal income tax purposes. To the extent that these differences are permanent in nature, such amounts are reclassified within the capital accounts based on their federal tax-basis treatment. Temporary differences do not require reclassifications. The primary permanent differences causing such reclassifications are due to net operating losses and recognition of partnership income. At December 31, 2011, as a result of permanent book-to-tax differences, the following reclassification adjustments were made on the Statement of Assets and Liabilities:

| Paid-in Capital |

Undistributed Net Investment Loss |

Accumulated Net Realized Losses on Investments |

||||||||

| $ | (768,203 | ) | $ | 812,220 | $ | (44,017 | ) | |||

Federal and other taxes

The Fund intends to continue to qualify as a regulated investment company by distributing substantially all of its investment company taxable income and any net realized capital gains (after reduction for capital loss carryforwards) sufficient to relieve it from all, or substantially all, federal income taxes. Accordingly, no provision for federal income taxes was required.

The Fund’s income and federal excise tax returns and all financial records supporting those returns for the prior three fiscal years are subject to examination by the federal and Delaware revenue authorities.

Under the recently enacted Regulated Investment Company Modernization Act of 2010, the Fund is permitted to carry forward capital losses incurred in taxable years which began after December 22, 2010 for an unlimited period. However, any losses incurred are required to be utilized prior to the losses incurred in pre-enactment taxable years. As a result of this ordering rule, pre-enactment capital loss carryforwards may be more likely to expire unused. Additionally, post-enactment capital losses that are carried forward will retain their character as either short-term or long-term capital losses rather than being considered all short-term as under previous law.

Table of Contents

| Notes to Financial Statements | Wells Fargo Advantage VT Discovery Fund | 21 |

As of December 31, 2011, the Fund had net capital loss carryforwards, which are available to offset future net realized capital gains, in the amount of $4,806,267 expiring in 2017.

3. FAIR VALUATION MEASUREMENTS

Fair value measurements of investments are determined within a framework that has established a fair value hierarchy based upon the various data inputs utilized in determining the value of the Fund’s investments. The three-level hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1) and the lowest priority to significant unobservable inputs (Level 3). The Fund’s investments are classified within the fair value hierarchy based on the lowest level of input that is significant to the fair value measurement. The inputs are summarized into three broad levels as follows:

| n | Level 1 – quoted prices in active markets for identical securities |

| n | Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| n | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

The inputs or methodologies used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

As of December 31, 2011, the inputs used in valuing the Fund’s assets, which are carried at fair value, were as follows:

| Investments in Securities | Quoted Prices (Level 1) |

Significant Other Observable Inputs (Level 2) |

Significant Unobservable Inputs (Level 3) |

Total | ||||||||||||

| Equity securities |

||||||||||||||||

| Common stocks |

$ | 96,449,873 | $ | 0 | $ | 0 | $ | 96,449,873 | ||||||||

| Other |

0 | 0 | 482,256 | 482,256 | ||||||||||||

| Short-term investments |

||||||||||||||||

| Investment companies |

1,383,165 | 27,344,177 | 0 | 28,727,342 | ||||||||||||

| $ | 97,833,038 | $ | 27,344,177 | $ | 482,256 | $ | 125,659,471 | |||||||||

Further details on the major security types listed above can be found in the Portfolio of Investments.

Transfers in and transfers out are recognized at the end of the reporting period. For the year ended December 31, 2011, the Fund did not have any significant transfers into/out of Level 1 and Level 2.

The following is a reconciliation of assets in which significant unobservable inputs (Level 3) were used in determining fair value:

| Other | ||||

| Balance as of December 31, 2010 |

$ | 794,517 | ||

| Accrued discounts (premiums) |

0 | |||

| Realized gains (losses) |

0 | |||

| Change in unrealized gains (losses) |

(42,696 | ) | ||

| Purchases |

0 | |||

| Sales |

(269,565 | ) | ||

| Transfers into Level 3 |

0 | |||

| Transfers out of Level 3 |

0 | |||

| Balance as of December 31, 2011 |

$ | 482,256 | ||

| Change in unrealized gains (losses) |

$ | (171,839 | ) | |

Table of Contents

| 22 | Wells Fargo Advantage VT Discovery Fund | Notes to Financial Statements |

4. TRANSACTIONS WITH AFFILIATES AND OTHER EXPENSES

Advisory fee

The Trust has entered into an advisory contract with Funds Management, an indirect wholly owned subsidiary of Wells Fargo & Company (“Wells Fargo”). The adviser is responsible for implementing investment policies and guidelines and for supervising the sub-adviser, who is responsible for day-to-day portfolio management of the Fund.

Pursuant to the contract, Funds Management is entitled to receive an annual advisory fee starting at 0.70% and declining to 0.55% as the average daily net assets of the Fund increase. For the year ended December 31, 2011, the advisory fee was equivalent to an annual rate of 0.70% of the Fund’s average daily net assets.

Funds Management may retain the services of certain sub-advisers to provide daily portfolio management to the Fund. The fees related to sub-advisory services are borne directly by Funds Management and do not increase the overall fees paid by the Fund. Wells Capital Management, an affiliate of Funds Management, is the sub-adviser to the Fund and is entitled to receive a fee from Funds Management at an annual rate starting at 0.45% and declining to 0.35% as the average daily net assets of the Fund increase.

Administration and transfer agent fees

The Trust has entered into an administration agreement with Funds Management. Under this agreement, for providing administrative services, which includes paying fees and expenses for services provided by the transfer agent, sub-transfer agents, omnibus account servicers and record-keepers, Funds Management is entitled to receive from the Fund an annual fund level administration fee starting at 0.05% and declining to 0.03% as the average daily net assets of the Fund increase and for Class 2 shares, a class level administration fee of 0.08% of its average daily net assets.

Funds Management has contractually waived and/or reimbursed advisory and administration fees to the extent necessary to maintain certain net operating expense ratios for the Fund. Waiver of fees and/or reimbursement of expenses by Funds Management were made first from fund level expenses on a proportionate basis and then from class specific expenses.

Distribution fees

The Trust has adopted a Distribution Plan for Class 2 shares of the Fund pursuant to Rule 12b-1 under the 1940 Act. Distribution fees are charged to Class 2 shares and paid to Wells Fargo Funds Distributor, LLC, the principal underwriter, at an annual rate of 0.25% of its average daily net assets.

5. INVESTMENT PORTFOLIO TRANSACTIONS

Purchases and sales of investments, excluding U.S. Government obligations (if any) and short-term securities (securities with maturities of one year or less at purchase date), for the year ended December 31, 2011 were $121,272,749 and $134,327,960, respectively.

6. BANK BORROWINGS

The Trust and Wells Fargo Funds Trust (excluding the money market funds) are parties to a $150,000,000 revolving credit agreement with State Street Bank and Trust Company, whereby the Fund is permitted to use bank borrowings for temporary or emergency purposes, such as to fund shareholder redemption requests. Interest under the credit agreement is charged to the Fund based on a borrowing rate equal to the higher of the Federal Funds rate in effect on that day plus 1.25% or the overnight LIBOR rate in effect on that day plus 1.25%. In addition, under the credit agreement, the Fund pays an annual commitment fee equal to 0.10% of the unused balance, which is allocated pro rata. Prior to September 6, 2011, the revolving credit agreement was for $125,000,000 and the annual commitment fee paid by the Fund was 0.125% of the unused balance. For the year ended December 31, 2011, the Fund paid $216 in commitment fees.

For the year ended December 31, 2011, there were no borrowings by the Fund under the agreement.

7. DISTRIBUTIONS TO SHAREHOLDERS

As of December 31, 2011, the components of distributable earnings on a tax basis were as follows:

| Unrealized Gains (Losses) |

Capital Loss Carryforward |

|||||

| $ | 3,221,623 | $ | (4,806,267 | ) | ||

Table of Contents

| Notes to Financial Statements | Wells Fargo Advantage VT Discovery Fund | 23 |

8. INDEMNIFICATION

Under the Trust’s organizational documents, the officers and directors are indemnified against certain liabilities that may arise out of performance of their duties to the Trust. Additionally, in the normal course of business, the Trust may enter into contracts with service providers that contain a variety of indemnification clauses. The Trust’s maximum exposure under these arrangements is dependent on future claims that may be made against the Fund and, therefore, cannot be estimated.

9. NEW ACCOUNTING PRONOUNCEMENTS

In May 2011, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) No. 2011-04 “Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and IFRSs”. ASU No. 2011-04 amends FASB ASC Topic 820, Fair Value Measurements and Disclosures, to establish common requirements for measuring fair value and for disclosing information about fair value measurements in accordance with GAAP. The ASU is effective prospectively for interim and annual periods beginning after December 15, 2011. Management expects that adoption of the ASU will result in additional disclosures in the financial statements, as applicable.

In April 2011, FASB issued ASU No. 2011-03 “Reconsideration of Effective Control for Repurchase Agreements”. ASU No. 2011-03 amends FASB ASC Topic 860, Transfers and Servicing, specifically the criteria required to determine whether a repurchase agreement (repo) and similar agreements should be accounted for as sales of financial assets or secured borrowings with commitments. ASU No. 2011-03 changes the assessment of effective control by focusing on the transferor’s contractual rights and obligations and removing the criterion to assess its ability to exercise those rights or honor those obligations. This could result in changes to the way entities account for certain transactions including repurchase agreements, mortgage dollar rolls and reverse repurchase agreements. The ASU will become effective on a prospective basis for new transfers and modifications to existing transactions as of the beginning of the first interim or annual period beginning on or after December 15, 2011. Management has evaluated the impact of adopting the ASU and expects no significant changes.

Table of Contents

| 24 | Wells Fargo Advantage VT Discovery Fund | Report of Independent Registered Public Accounting Firm |

BOARD OF TRUSTEES AND SHAREHOLDERS OF WELLS FARGO VARIABLE TRUST:

We have audited the accompanying statement of assets and liabilities, including the portfolio of investments, of the Wells Fargo Advantage VT Discovery Fund (the “Fund”), one of the funds constituting the Wells Fargo Variable Trust, as of December 31, 2011, and the related statement of operations for the year then ended, statements of changes in net assets for each of the years in the two-year period then ended, and the financial highlights for each of the years in the five-year period then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2011, by correspondence with custodian and brokers, or by other appropriate auditing procedures. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of the Wells Fargo Advantage VT Discovery Fund as of December 31, 2011, the results of its operations for the year then ended, changes in its net assets for each of the years in the two-year period then ended, and the financial highlights for each of the years in the five-year period then ended, in conformity with U.S. generally accepted accounting principles.

Boston, Massachusetts

February 24, 2012

Table of Contents

| Other Information (Unaudited) | Wells Fargo Advantage VT Discovery Fund | 25 |

PROXY VOTING INFORMATION

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities is available without charge, upon request, by calling 1-800-222-8222, visiting our Web site at www.wellsfargo.com/advantagefunds, or visiting the SEC Web site at www.sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is available without charge on the Fund’s Web site at www.wellsfargo.com/advantagefunds or by visiting the SEC Web site at www.sec.gov.

PORTFOLIO HOLDINGS INFORMATION

The complete portfolio holdings for the Fund are publicly available on the Fund’s Web site (www.wellsfargo.com/advantagefunds) on a monthly, 30-day or more delayed basis. In addition, top ten holdings information for the Fund is publicly available on the Fund’s Web site on a monthly, seven-day or more delayed basis. The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q, which is available without charge by visiting the SEC Web site at www.sec.gov. In addition, the Fund’s Form N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC, and at regional offices in New York City, at 233 Broadway, and in Chicago, at 175 West Jackson Boulevard, Suite 900. Information about the Public Reference Room may be obtained by calling 1-800-SEC-0330.

Table of Contents

| 26 | Wells Fargo Advantage VT Discovery Fund | Other Information (Unaudited) |

BOARD OF TRUSTEES

The following table provides basic information about the Board of Trustees (the “Trustees”) of the Trust and Officers of the Trust. This table should be read in conjunction with the Prospectus and the Statement of Additional Information1 of the Fund. Each of the Trustees and Officers listed below acts in identical capacities for the Wells Fargo Advantage family of funds, which consists of 138 funds comprising the Wells Fargo Funds Trust, Wells Fargo Variable Trust, Wells Fargo Master Trust and four closed-end funds (collectively the “Fund Complex”). All of the Trustees are also Members of the Audit and Governance Committees of each Trust in the Fund Complex. The mailing address of each Trustee and Officer is 525 Market Street, 12th Floor, San Francisco, CA 94105. Each Trustee and Officer serves an indefinite term, however, each Trustee serves such term until reaching the mandatory retirement age established by the Trustees.

Independent Trustees

| Name and Year of Birth |

Position Held and Length of Service |

Principal Occupations During Past Five Years | Other Directorships During | |||

| Peter G. Gordon (Born 1942) |

Trustee, since 1998; Chairman, since 2005 (Lead Trustee since 2001) | Co-Founder, Retired Chairman, President and CEO of Crystal Geyser Water Company. Trustee Emeritus, Colby College | Asset Allocation Trust | |||

| Isaiah Harris, Jr. (Born 1952) |

Trustee, since 2009 | Retired. Prior thereto, President and CEO of BellSouth Advertising and Publishing Corp. from 2005 to 2007, President and CEO of BellSouth Enterprises from 2004 to 2005 and President of BellSouth Consumer Services from 2000 to 2003. Emeritus member of the Iowa State University Foundation Board of Governors. Emeritus Member of the Advisory Board of Iowa State University School of Business. Mr. Harris is a certified public accountant. | CIGNA Corporation; Deluxe Corporation; Asset Allocation Trust | |||

| Judith M. Johnson (Born 1949) |

Trustee, since 2008 | Retired. Prior thereto, Chief Executive Officer and Chief Investment Officer of Minneapolis Employees Retirement Fund from 1996 to 2008. Ms. Johnson is an attorney, certified public accountant and a certified managerial accountant. | Asset Allocation Trust | |||

| Leroy Keith, Jr. (Born 1939) |

Trustee, since 2010 | Chairman, Bloc Global Services (development and construction). Trustee of the Evergreen Funds from 1983 to 2010. Former Managing Director, Almanac Capital Management (commodities firm), former Partner, Stonington Partners, Inc. (private equity fund), former Director, Obagi Medical Products Co. and former Director, Lincoln Educational Services. | Trustee, Virtus Fund Complex (consisting of 40 portfolios as of 12/31/11); Asset Allocation Trust | |||

| David F. Larcker (Born 1950) |

Trustee, since 2009 | James Irvin Miller Professor of Accounting at the Graduate School of Business, Stanford University, Director of Corporate Governance Research Program and Senior Faculty of The Rock Center for Corporate Governance since 2006. From 2005 to 2008, Professor of Accounting at the Graduate School of Business, Stanford University. Prior thereto, Ernst & Young Professor of Accounting at The Wharton School, University of Pennsylvania from 1985 to 2005. | Asset Allocation Trust | |||

| Olivia S. Mitchell (Born 1953) |

Trustee, since 2006 | International Foundation of Employee Benefit Plans Professor, Wharton School of the University of Pennsylvania since 1993. Director of Wharton’s Pension Research Council and Boettner Center on Pensions & Retirement Research, and Research Associate at the National Bureau of Economic Research. Previously, Cornell University Professor from 1978 to 1993. | Asset Allocation Trust |

Table of Contents

| Other Information (Unaudited) | Wells Fargo Advantage VT Discovery Fund | 27 |

| Name and Year of Birth |

Position Held and Length of Service |

Principal Occupations During Past Five Years | Other Directorships During | |||

| Timothy J. Penny (Born 1951) |

Trustee, since 1996 | President and CEO of Southern Minnesota Initiative Foundation, a non-profit organization, since 2007 and Senior Fellow at the Humphrey Institute Policy Forum at the University of Minnesota since 1995. Member of the Board of Trustees of NorthStar Education Finance, Inc., a non-profit organization, since 2007. | Asset Allocation Trust | |||

| Michael S. Scofield (Born 1943) |

Trustee, since 2010 | Served on the Investment Company Institute’s Board of Governors and Executive Committee from 2008-2011 as well the Governing Council of the Independent Directors Council from 2006-2011 and the Independent Directors Council Executive Committee from 2008-2011. Chairman of the IDC from 2008-2010. Institutional Investor (Fund Directions) Trustee of Year in 2007. Trustee of the Evergreen Funds (and its predecessors) from 1984 to 2010. Chairman of the Evergreen Funds from 2000-2010. Former Trustee of the Mentor Funds. Retired Attorney, Law Offices of Michael S. Scofield and former Director and Chairman, Branded Media Corporation (multi-media branding company). |

Asset Allocation Trust | |||

| Donald C. Willeke (Born 1940) |

Trustee, since 1996 | Principal of the law firm of Willeke & Daniels. General Counsel of the Minneapolis Employees Retirement Fund from 1984 until its consolidation into the Minnesota Public Employees Retirement Association on June 30, 2010. Director and Vice Chair of The Free Trust (non-profit corporation). Director of the American Chestnut Foundation (non-profit corporation). | Asset Allocation Trust |

Officers

| Name and Year of Birth |

Position Held and Length of Service |

Principal Occupations During Past Five Years | ||||

| Karla M. Rabusch (Born 1959) |

President, since 2003 | Executive Vice President of Wells Fargo Bank, N.A. and President of Wells Fargo Funds Management, LLC since 2003. Senior Vice President and Chief Administrative Officer of Wells Fargo Funds Management, LLC from 2001 to 2003. | ||||

| C. David Messman (Born 1960) |

Secretary, since 2000; Chief Legal Counsel, since 2003 | Senior Vice President and Secretary of Wells Fargo Funds Management, LLC since 2001. Vice President and Managing Senior Counsel of Wells Fargo Bank, N.A. since 1996. | ||||

| Kasey Phillips (Born 1970) |

Treasurer, since 2009 | Senior Vice President of Wells Fargo Funds Management, LLC since 2009. Senior Vice President of Evergreen Investment Management Company, LLC from 2006 to 2010. Treasurer of the Evergreen Funds from 2005 to 2010. | ||||

| David Berardi (Born 1975) |

Assistant Treasurer, since 2009 | Vice President of Wells Fargo Funds Management, LLC since 2009. Vice President of Evergreen Investment Management Company, LLC from 2008 to 2010. Assistant Vice President of Evergreen Investment Services, Inc. from 2004 to 2008. Manager of Fund Reporting and Control for Evergreen Investment Management Company, LLC from 2004 to 2010. | ||||

| Jeremy DePalma (Born 1974) |