UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-09253

Wells Fargo Funds Trust

(Exact name of registrant as specified in charter)

525 Market St., San Francisco, CA 94105

(Address of principal executive offices) (Zip code)

Catherine Kennedy

Wells Fargo Funds Management, LLC

525 Market St., San Francisco, CA 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-222-8222

Date of fiscal year end: January 31

Registrant is making a filing for 8 of its series:

Wells Fargo 100% Treasury Money Market Fund, Wells Fargo Cash Investment Money Market Fund, Wells Fargo Government Money Market Fund, Wells Fargo Heritage Money Market Fund, Wells Fargo Money Market Fund, Wells Fargo Municipal Cash Management Money Market Fund, Wells Fargo National Tax-Free Money Market Fund, and Wells Fargo Treasury Plus Money Market Fund.

Date of reporting period: January 31, 2021

ITEM 1. REPORT TO STOCKHOLDERS

| ■ | Wells Fargo 100% Treasury Money Market Fund |

| 1 | The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-value-weighted index with each stock's weight in the index proportionate to its market value. You cannot invest directly in an index. |

| 2 | The Morgan Stanley Capital International (MSCI) All Country World Index (ACWI) ex USA Index (Net) is a free-float-adjusted market-capitalization-weighted index that is designed to measure the equity market performance of developed and emerging markets, excluding the United States. Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. You cannot invest directly in an index. |

| 1 | The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-value-weighted index with each stock's weight in the index proportionate to its market value. You cannot invest directly in an index. |

| 3 | The MSCI Emerging Markets (EM) Index (Net) is a free-float-adjusted market-capitalization-weighted index that is designed to measure equity market performance of emerging markets. You cannot invest directly in an index. |

| 1 | The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-value-weighted index with each stock's weight in the index proportionate to its market value. You cannot invest directly in an index. |

| 4 | The Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable-rate mortgage pass-throughs), asset-backed securities, and commercial mortgage-backed securities. You cannot invest directly in an index. |

| 1 | The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-value-weighted index with each stock's weight in the index proportionate to its market value. You cannot invest directly in an index. |

| 5 | The Bloomberg Barclays Global Aggregate ex-USD Index (unhedged) is an unmanaged index that provides a broad-based measure of the global investment-grade fixed-income markets excluding the U.S. dollar-denominated debt market. You cannot invest directly in an index. |

| 1 | The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-value-weighted index with each stock's weight in the index proportionate to its market value. You cannot invest directly in an index. |

| 6 | The Bloomberg Barclays Municipal Bond Index is an unmanaged index composed of long-term tax-exempt bonds with a minimum credit rating of Baa. You cannot invest directly in an index. |

| 1 | The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-value-weighted index with each stock's weight in the index proportionate to its market value. You cannot invest directly in an index. |

| 7 | The ICE BofA U.S. High Yield Index is a market-capitalization-weighted index of domestic and Yankee high-yield bonds. The index tracks the performance of high-yield securities traded in the U.S. bond market. You cannot invest directly in an index. Copyright 2021. ICE Data Indices, LLC. All rights reserved. |

President

Wells Fargo Funds

Jeffrey L. Weaver, CFA®‡

Laurie White

| Expense ratios1 (%) | ||||||

| Inception date | 1 year | 5 year | 10 year | Gross | Net 2 | |

| Class A (WFTXX) | 11-8-1999 | 0.14 | 0.67 | 0.34 | 0.62 | 0.60 |

| Administrator Class (WTRXX) | 6-30-2010 | 0.20 | 0.89 | 0.44 | 0.35 | 0.30 |

| Institutional Class (WOTXX)3 | 10-31-2014 | 0.24 | 0.97 | 0.49 | 0.23 | 0.20 |

| Service Class (NWTXX) | 12-3-1990 | 0.15 | 0.74 | 0.37 | 0.52 | 0.50 |

| Sweep Class | 6-30-2010 | 0.11 | 0.55 | 0.28 | 0.53 | 0.50 |

| Class A | Administrator

Class |

Institutional

Class |

Service

Class |

Sweep

Class | |

| 7-day current yield | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 |

| 7-day compound yield | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 |

| 30-day simple yield | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 |

| 30-day compound yield | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 |

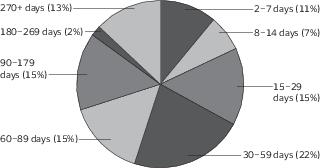

| Weighted average maturity as of January 31, 20215 |

| 50 days |

| Weighted average life as of January 31, 20216 |

| 102 days |

| ‡ | CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute. |

| 1 | Reflects the expense ratios as stated in the most recent prospectuses. The expense ratios shown are subject to change and may differ from the annualized expense ratios shown in the financial highlights of this report. |

| 2 | The manager has contractually committed through May 31, 2021, to waive fees and/or reimburse expenses to the extent necessary to cap total annual fund operating expenses after fee waivers at 0.60% for Class A, 0.30% for Administrator Class, 0.20% for Institutional Class, 0.50% for Service Class, and 0.50% for Sweep Class. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses (if any), and extraordinary expenses are excluded from the expense caps. The manager may also voluntarily waive or reimburse additional fees and expenses, and such voluntary waivers may be discontinued or modified at any time without notice. Without these reductions, the Fund’s seven-day current yield would have been -0.48%, -0.21%, -0.09%, -0.38%, and -0.39% for Class A, Administrator Class, Institutional Class, Service Class, and Sweep Class. Prior to or after the commitment expiration date, the caps may be increased or the commitment to maintain the caps may be terminated only with the approval of the Board of Trustees. The expense ratio paid by an investor is the net expense ratio (the total annual fund operating expenses after fee waivers) as stated in the prospectuses. |

| 3 | Historical performance shown for the Institutional Class shares prior to their inception reflects the performance of the Administrator Class shares, and includes the higher expenses applicable to the Administrator Class shares. If these expenses had not been included, returns for the Institutional Class shares would be higher. |

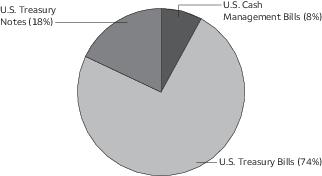

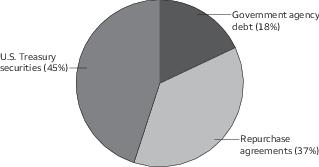

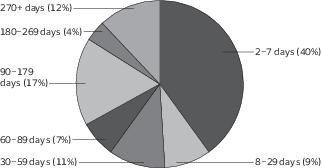

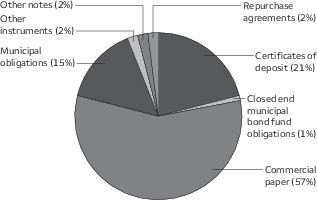

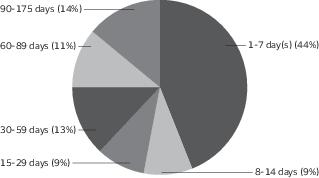

| 4 | Figures represent the percentage of the Fund's total investments. These amounts are subject to change and may have changed since the date specified. |

| 5 | Weighted Average Maturity (WAM): WAM is an average of the effective maturities of all securities held in the portfolio, weighted by each security’s percentage of total investments. The maturity of a portfolio security is the period remaining until the date on which the principal amount is unconditionally required to be paid, or in the case of a security called for redemption, the date on which the redemption payment is unconditionally required to be made. WAM calculations allow for the maturities of certain securities with demand features or periodic interest rate resets to be shortened. WAM is a way to measure a fund’s sensitivity to potential interest rate changes. WAM is subject to change and may have changed since the date specified. |

| 6 | Weighted Average Life (WAL): WAL is an average of the final maturities of all securities held in the portfolio, weighted by their percentage of total investments. The maturity of a portfolio security is the period remaining until the date on which the principal amount is unconditionally required to be paid, or in the case of a security called for redemption, the date on which the redemption payment is unconditionally required to be made. In contrast to WAM, the calculation of WAL allows for the maturities of certain securities with demand features to be shortened, but not the periodic interest rate resets. WAL is a way to measure a fund’s potential sensitivity to credit spread changes. WAL is subject to change and may have changed since the date specified. |

| 7 | The Core Personal Consumption Expenditures (PCE) Price Index measures the prices paid by U.S. consumers for domestic goods and services, excluding the prices of food and energy. You cannot invest directly into an index. |

| Beginning

account value 8-1-2020 |

Ending

account value 1-31-2021 |

Expenses

paid during the period1 |

Annualized

net expense ratio | |

| Class A | ||||

| Actual | $1,000.00 | $1,000.10 | $0.75 | 0.15% |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,024.38 | $0.76 | 0.15% |

| Administrator Class | ||||

| Actual | $1,000.00 | $1,000.10 | $0.75 | 0.15% |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,024.38 | $0.76 | 0.15% |

| Institutional Class | ||||

| Actual | $1,000.00 | $1,000.10 | $0.75 | 0.15% |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,024.38 | $0.76 | 0.15% |

| Service Class | ||||

| Actual | $1,000.00 | $1,000.10 | $0.75 | 0.15% |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,024.38 | $0.76 | 0.15% |

| Sweep Class | ||||

| Actual | $1,000.00 | $1,000.10 | $0.75 | 0.15% |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,024.38 | $0.76 | 0.15% |

| Interest

rate |

Maturity

date |

Principal | Value | ||

| U.S. Treasury securities: 97.33% | |||||

| U.S. Cash Management Bill ☼ | 0.04% | 3-30-2021 | $ 295,000,000 | $ 294,960,924 | |

| U.S. Cash Management Bill ☼ | 0.05 | 5-18-2021 | 45,000,000 | 44,988,075 | |

| U.S. Cash Management Bill ☼%% | 0.08 | 7-6-2021 | 90,000,000 | 89,970,355 | |

| U.S. Cash Management Bill ☼ | 0.09 | 4-27-2021 | 190,000,000 | 189,959,626 | |

| U.S. Cash Management Bill ☼ | 0.09 | 5-4-2021 | 95,000,000 | 94,977,422 | |

| U.S. Cash Management Bill ☼ | 0.09 | 5-11-2021 | 45,000,000 | 44,988,491 | |

| U.S. Cash Management Bill ☼ | 0.09 | 5-25-2021 | 90,000,000 | 89,974,434 | |

| U.S. Cash Management Bill ☼ | 0.09 | 6-1-2021 | 95,000,000 | 94,970,708 | |

| U.S. Cash Management Bill ☼ | 0.09 | 6-8-2021 | 90,000,000 | 89,971,425 | |

| U.S. Cash Management Bill ☼ | 0.09 | 6-15-2021 | 45,000,000 | 44,984,841 | |

| U.S. Cash Management Bill ☼ | 0.09 | 6-22-2021 | 90,000,000 | 89,968,099 | |

| U.S. Cash Management Bill ☼ | 0.09 | 6-29-2021 | 50,000,000 | 49,980,883 | |

| U.S. Cash Management Bill ☼ | 0.10 | 4-6-2021 | 95,000,000 | 94,982,604 | |

| U.S. Cash Management Bill ☼ | 0.10 | 4-20-2021 | 95,000,000 | 94,979,417 | |

| U.S. Cash Management Bill ☼ | 0.11 | 4-13-2021 | 95,000,000 | 94,980,327 | |

| U.S. Treasury Bill ☼## | 0.08 | 2-2-2021 | 577,920,000 | 577,918,637 | |

| U.S. Treasury Bill ☼ | 0.08 | 2-23-2021 | 815,000,000 | 814,958,212 | |

| U.S. Treasury Bill ☼ | 0.08 | 3-11-2021 | 770,000,000 | 769,932,299 | |

| U.S. Treasury Bill ☼ | 0.08 | 3-18-2021 | 480,000,000 | 479,950,038 | |

| U.S. Treasury Bill ☼ | 0.08 | 4-29-2021 | 485,000,000 | 484,900,542 | |

| U.S. Treasury Bill ☼ | 0.08 | 6-17-2021 | 65,000,000 | 64,979,382 | |

| U.S. Treasury Bill ☼ | 0.09 | 2-9-2021 | 780,000,000 | 779,984,887 | |

| U.S. Treasury Bill ☼ | 0.09 | 2-18-2021 | 735,000,000 | 734,968,129 | |

| U.S. Treasury Bill ☼ | 0.09 | 3-9-2021 | 335,000,000 | 334,968,855 | |

| U.S. Treasury Bill ☼ | 0.09 | 3-23-2021 | 280,000,000 | 279,963,958 | |

| U.S. Treasury Bill ☼ | 0.09 | 3-25-2021 | 480,000,000 | 479,939,665 | |

| U.S. Treasury Bill ☼ | 0.09 | 4-8-2021 | 525,000,000 | 524,912,715 | |

| U.S. Treasury Bill ☼ | 0.09 | 4-15-2021 | 475,000,000 | 474,909,764 | |

| U.S. Treasury Bill ☼ | 0.09 | 5-20-2021 | 235,000,000 | 234,933,489 | |

| U.S. Treasury Bill ☼ | 0.09 | 6-24-2021 | 95,000,000 | 94,964,905 | |

| U.S. Treasury Bill ☼ | 0.09 | 7-8-2021 | 45,000,000 | 44,981,749 | |

| U.S. Treasury Bill ☼ | 0.09 | 7-15-2021 | 45,000,000 | 44,981,344 | |

| U.S. Treasury Bill ☼ | 0.09 | 7-22-2021 | 50,000,000 | 49,977,913 | |

| U.S. Treasury Bill ☼ | 0.09 | 7-29-2021 | 45,000,000 | 44,980,531 | |

| U.S. Treasury Bill ☼ | 0.09 | 1-27-2022 | 20,000,000 | 19,981,700 | |

| U.S. Treasury Bill ☼ | 0.10 | 2-4-2021 | 1,113,780,000 | 1,113,773,988 | |

| U.S. Treasury Bill ☼ | 0.10 | 2-11-2021 | 635,000,000 | 634,982,539 | |

| U.S. Treasury Bill ☼ | 0.10 | 2-25-2021 | 485,000,000 | 484,971,983 | |

| U.S. Treasury Bill ☼ | 0.10 | 3-2-2021 | 720,000,000 | 719,958,188 | |

| U.S. Treasury Bill ☼ | 0.10 | 3-4-2021 | 530,000,000 | 529,958,365 | |

| U.S. Treasury Bill ☼ | 0.10 | 3-16-2021 | 330,000,000 | 329,965,607 | |

| U.S. Treasury Bill ☼ | 0.10 | 4-1-2021 | 525,000,000 | 524,916,712 | |

| U.S. Treasury Bill ☼ | 0.10 | 5-6-2021 | 190,000,000 | 189,952,132 | |

| U.S. Treasury Bill ☼ | 0.10 | 5-13-2021 | 195,000,000 | 194,946,302 | |

| U.S. Treasury Bill ☼ | 0.10 | 5-27-2021 | 45,000,000 | 44,986,344 | |

| U.S. Treasury Bill ☼ | 0.10 | 6-3-2021 | 95,000,000 | 94,969,415 | |

| U.S. Treasury Bill ☼ | 0.10 | 6-10-2021 | 45,000,000 | 44,984,681 | |

| U.S. Treasury Bill ☼ | 0.10 | 7-1-2021 | 95,000,000 | 94,961,250 | |

| U.S. Treasury Bill ☼ | 0.11 | 2-16-2021 | 725,000,000 | 724,973,664 | |

| U.S. Treasury Bill ☼ | 0.11 | 12-30-2021 | 90,000,000 | 89,910,314 | |

| U.S. Treasury Bill ☼ | 0.12 | 4-22-2021 | 485,000,000 | 484,899,688 | |

| U.S. Treasury Bill ☼ | 0.12 | 12-2-2021 | 50,000,000 | 49,951,022 | |

| U.S. Treasury Bill ☼ | 0.14 | 10-7-2021 | 20,000,000 | 19,981,056 | |

| U.S. Treasury Bill ☼ | 0.14 | 11-4-2021 | 85,000,000 | 84,908,767 |

| Interest

rate |

Maturity

date |

Principal | Value | ||

| U.S. Treasury securities (continued) | |||||

| U.S. Treasury Note (U.S. Treasury 3 Month Bill Money Market Yield+0.06%) ± | 0.14% | 7-31-2022 | $ 210,000,000 | $ 209,992,739 | |

| U.S. Treasury Note (U.S. Treasury 3 Month Bill Money Market Yield+0.06%) ± | 0.14 | 10-31-2022 | 400,000,000 | 399,986,396 | |

| U.S. Treasury Note (U.S. Treasury 3 Month Bill Money Market Yield+0.11%) ± | 0.19 | 4-30-2022 | 738,000,000 | 738,100,821 | |

| U.S. Treasury Note (U.S. Treasury 3 Month Bill Money Market Yield+0.14%) ± | 0.22 | 4-30-2021 | 340,000,000 | 339,981,072 | |

| U.S. Treasury Note (U.S. Treasury 3 Month Bill Money Market Yield+0.15%) ± | 0.23 | 1-31-2022 | 365,000,000 | 364,885,436 | |

| U.S. Treasury Note (U.S. Treasury 3 Month Bill Money Market Yield+0.22%) ± | 0.30 | 7-31-2021 | 170,000,000 | 169,989,103 | |

| U.S. Treasury Note (U.S. Treasury 3 Month Bill Money Market Yield+0.30%) ± | 0.38 | 10-31-2021 | 310,000,000 | 310,103,538 | |

| U.S. Treasury Note | 1.13 | 2-28-2021 | 85,000,000 | 85,043,479 | |

| U.S. Treasury Note | 1.50 | 8-31-2021 | 20,000,000 | 20,156,781 | |

| U.S. Treasury Note | 1.75 | 11-30-2021 | 50,000,000 | 50,681,359 | |

| U.S. Treasury Note | 1.88 | 11-30-2021 | 40,000,000 | 40,586,767 | |

| U.S. Treasury Note | 2.00 | 2-28-2021 | 45,000,000 | 45,036,428 | |

| U.S. Treasury Note | 2.00 | 8-31-2021 | 48,000,000 | 48,527,421 | |

| U.S. Treasury Note | 2.00 | 11-15-2021 | 30,000,000 | 30,447,769 | |

| U.S. Treasury Note | 2.13 | 9-30-2021 | 85,000,000 | 86,119,243 | |

| U.S. Treasury Note | 2.25 | 2-15-2021 | 85,000,000 | 85,054,724 | |

| U.S. Treasury Note | 2.25 | 3-31-2021 | 40,000,000 | 40,095,155 | |

| U.S. Treasury Note | 2.38 | 3-15-2021 | 20,000,000 | 20,045,198 | |

| U.S. Treasury Note | 2.38 | 4-15-2021 | 30,000,000 | 30,120,857 | |

| U.S. Treasury Note | 2.50 | 2-28-2021 | 20,000,000 | 20,014,055 | |

| U.S. Treasury Note | 2.50 | 1-15-2022 | 20,000,000 | 20,455,586 | |

| U.S. Treasury Note | 2.63 | 7-15-2021 | 20,000,000 | 20,223,173 | |

| U.S. Treasury Note | 2.88 | 11-15-2021 | 50,000,000 | 51,083,089 | |

| U.S. Treasury Note | 3.63 | 2-15-2021 | 30,000,000 | 30,023,705 | |

| Total U.S. Treasury securities (Cost $18,556,432,256) | 18,556,432,256 | ||||

| Total investments in securities (Cost $18,556,432,256) | 97.33% | 18,556,432,256 | |||

| Other assets and liabilities, net | 2.67 | 508,952,830 | |||

| Total net assets | 100.00% | $19,065,385,086 |

| ## | All or a portion of this security is segregated for when-issued securities. |

| ± | Variable rate investment. The rate shown is the rate in effect at period end. |

| ☼ | Zero coupon security. The rate represents the current yield to maturity. |

| %% | The security is purchased on a when-issued basis. |

| Assets | |

|

Investments in unaffiliated securities, at amortized

cost |

$ 18,556,432,256 |

|

Cash |

7,187 |

|

Receivable for investments

sold |

1,179,830,416 |

|

Receivable for

interest |

7,123,834 |

|

Receivable for Fund shares

sold |

4,983,987 |

|

Receivable from

manager |

1,071,187 |

|

Prepaid expenses and other

assets |

386,266 |

|

Total

assets |

19,749,835,133 |

| Liabilities | |

|

Payable for investments

purchased |

584,960,256 |

|

Payable for when-issued

transactions |

89,970,355 |

|

Payable for Fund shares

redeemed |

6,536,635 |

|

Administration fees

payable |

1,447,073 |

|

Distribution fee

payable |

69,537 |

|

Dividends

payable |

69,213 |

|

Trustees’ fees and expenses

payable |

1,364 |

|

Accrued expenses and other

liabilities |

1,395,614 |

|

Total

liabilities |

684,450,047 |

|

Total net

assets |

$19,065,385,086 |

| Net assets consist of | |

|

Paid-in

capital |

$ 19,065,313,538 |

|

Total distributable

earnings |

71,548 |

|

Total net

assets |

$19,065,385,086 |

| Computation of net asset value per share | |

|

Net assets – Class

A |

$ 202,999,162 |

|

Shares outstanding – Class

A1 |

202,991,821 |

|

Net asset value per share – Class

A |

$1.00 |

|

Net assets – Administrator

Class |

$ 493,676,791 |

|

Shares outstanding – Administrator

Class1 |

493,659,387 |

|

Net asset value per share – Administrator

Class |

$1.00 |

|

Net assets – Institutional

Class |

$ 12,321,170,027 |

|

Shares outstanding – Institutional

Class1 |

12,320,799,272 |

|

Net asset value per share – Institutional

Class |

$1.00 |

|

Net assets – Service

Class |

$ 5,225,755,103 |

|

Shares outstanding – Service

Class1 |

5,225,597,960 |

|

Net asset value per share – Service

Class |

$1.00 |

|

Net assets – Sweep

Class |

$ 821,784,003 |

|

Shares outstanding – Sweep

Class1 |

821,754,646 |

Net

asset value per share – Sweep

Class |

$1.00 |

| 1 | The Fund has an unlimited number of authorized shares. |

| Investment income | |

|

Interest |

$ 67,693,113 |

| Expenses | |

|

Management

fee |

26,185,220 |

| Administration fees | |

|

Class

A |

672,428 |

|

Administrator

Class |

528,300 |

|

Institutional

Class |

9,778,393 |

|

Service

Class |

6,237,197 |

|

Sweep

Class |

222,099 |

| Shareholder servicing fees | |

|

Class

A |

763,011 |

|

Administrator

Class |

528,236 |

|

Service

Class |

12,993,938 |

|

Sweep

Class |

1,850,802 |

| Distribution fee | |

|

Sweep

Class |

2,204,284 |

|

Custody and accounting

fees |

395,207 |

|

Professional

fees |

53,354 |

|

Registration

fees |

211,324 |

|

Shareholder report

expenses |

54,767 |

|

Trustees’ fees and

expenses |

18,958 |

|

Other fees and

expenses |

162,438 |

|

Total

expenses |

62,859,956 |

| Less: Fee waivers and/or expense reimbursements | |

|

Fund-level |

(2,756,365) |

|

Class

A |

(891,263) |

|

Administrator

Class |

(584,325) |

|

Institutional

Class |

(3,687,064) |

|

Service

Class |

(13,065,569) |

|

Sweep

Class |

(3,275,269) |

|

Net

expenses |

38,600,101 |

|

Net investment

income |

29,093,012 |

|

Net realized gains on

investments |

159,636 |

|

Net increase in net assets resulting from

operations |

29,252,648 |

| Year

ended January 31, 2021 |

Year

ended January 31, 2020 | |||

| Operations | ||||

|

Net investment

income |

$ 29,093,012 | $ 220,324,593 | ||

|

Net realized gains on

investments |

159,636 | 1,197,710 | ||

|

Net increase in net assets resulting from

operations |

29,252,648 | 221,522,303 | ||

| Distributions to shareholders from | ||||

| Net investment income and net realized gains | ||||

|

Class

A |

(473,676) | (5,743,559) | ||

|

Administrator

Class |

(1,039,690) | (11,061,889) | ||

|

Institutional

Class |

(21,057,299) | (141,126,498) | ||

|

Service

Class |

(6,608,812) | (56,995,623) | ||

|

Sweep

Class |

(614,373) | (6,082,256) | ||

|

Total distributions to

shareholders |

(29,793,850) | (221,009,825) | ||

| Capital share transactions | Shares | Shares | ||

| Proceeds from shares sold | ||||

|

Class

A |

879,783,683 | 879,783,683 | 1,190,400,202 | 1,190,400,202 |

|

Administrator

Class |

1,892,103,152 | 1,892,103,152 | 2,451,512,619 | 2,451,512,619 |

|

Institutional

Class |

42,133,377,022 | 42,133,377,022 | 25,146,673,331 | 25,146,673,331 |

|

Service

Class |

22,226,504,129 | 22,226,504,129 | 18,262,618,012 | 18,262,618,012 |

|

Sweep

Class |

7,128,257,353 | 7,128,257,353 | 4,752,687,515 | 4,752,687,515 |

| 74,260,025,339 | 51,803,891,679 | |||

| Reinvestment of distributions | ||||

|

Class

A |

497,162 | 497,162 | 5,712,034 | 5,712,034 |

|

Administrator

Class |

828,749 | 828,749 | 6,629,965 | 6,629,965 |

|

Institutional

Class |

12,824,015 | 12,824,015 | 90,583,672 | 90,583,672 |

|

Service

Class |

2,348,163 | 2,348,163 | 17,911,478 | 17,911,478 |

|

Sweep

Class |

638,970 | 638,970 | 6,057,655 | 6,057,655 |

| 17,137,059 | 126,894,804 | |||

| Payment for shares redeemed | ||||

|

Class

A |

(1,145,613,117) | (1,145,613,117) | (1,111,780,649) | (1,111,780,649) |

|

Administrator

Class |

(1,953,668,446) | (1,953,668,446) | (2,595,952,750) | (2,595,952,750) |

|

Institutional

Class |

(37,389,255,328) | (37,389,255,328) | (24,969,710,678) | (24,969,710,678) |

|

Service

Class |

(21,233,428,405) | (21,233,428,405) | (16,846,608,441) | (16,846,608,441) |

|

Sweep

Class |

(6,849,965,760) | (6,849,965,760) | (4,634,944,630) | (4,634,944,630) |

| (68,571,931,056) | (50,158,997,148) | |||

|

Net increase in net assets resulting from capital share

transactions |

5,705,231,342 | 1,771,789,335 | ||

|

Total increase in net

assets |

5,704,690,140 | 1,772,301,813 | ||

| Net assets | ||||

|

Beginning of

period |

13,360,694,946 | 11,588,393,133 | ||

|

End of

period |

$ 19,065,385,086 | $ 13,360,694,946 | ||

| Year ended January 31 | |||||

| Class A | 2021 | 2020 | 2019 | 2018 | 2017 |

|

Net asset value, beginning of

period |

$1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

|

Net investment

income |

0.00 1 | 0.02 | 0.01 | 0.00 1 | 0.00 1 |

|

Net realized gains (losses) on

investments |

0.00 1 | 0.00 1 | (0.00) 2 | (0.00) 2 | 0.00 1 |

|

Total from investment

operations |

0.00 1 | 0.02 | 0.01 | 0.00 1 | 0.00 1 |

| Distributions to shareholders from | |||||

|

Net investment

income |

(0.00) 1 | (0.02) | (0.01) | (0.00) 1 | (0.00) 1 |

|

Net realized

gains |

(0.00) 1 | (0.00) 1 | (0.00) 1 | (0.00) 1 | (0.00) 1 |

|

Total distributions to

shareholders |

(0.00) 1 | (0.02) | (0.01) | (0.00) 1 | (0.00) 1 |

|

Net asset value, end of

period |

$1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

|

Total

return |

0.14% | 1.54% | 1.35% | 0.32% | 0.01% |

| Ratios to average net assets (annualized) | |||||

|

Gross

expenses |

0.61% | 0.63% | 0.71% | 0.79% | 0.79% |

|

Net

expenses |

0.31% 3 | 0.60% | 0.62% | 0.64% | 0.36% |

|

Net investment

income |

0.15% | 1.49% | 1.35% | 0.31% | 0.00% |

| Supplemental data | |||||

|

Net assets, end of period (000s

omitted) |

$202,999 | $468,360 | $384,013 | $291,246 | $363,639 |

| 1 | Amount is less than $0.005. |

| 2 | Amount is more than $(0.005) |

| 3 | During the year ended January 31, 2021, class-level expenses were voluntarily waived by the investment manager. Without this voluntary waiver, the net expense ratio would have been 0.29% higher. |

| Year ended January 31 | |||||

| Administrator Class | 2021 | 2020 | 2019 | 2018 | 2017 |

|

Net asset value, beginning of

period |

$1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

|

Net investment

income |

0.00 1 | 0.02 | 0.02 | 0.01 | 0.00 1 |

|

Net realized gains (losses) on

investments |

0.00 1 | 0.00 1 | (0.00) 2 | (0.00) 2 | 0.00 1 |

|

Total from investment

operations |

0.00 1 | 0.02 | 0.02 | 0.01 | 0.00 1 |

| Distributions to shareholders from | |||||

|

Net investment

income |

(0.00) 1 | (0.02) | (0.02) | (0.01) | (0.00) 1 |

|

Net realized

gains |

(0.00) 1 | (0.00) 1 | (0.00) 1 | (0.00) 1 | (0.00) 1 |

|

Total distributions to

shareholders |

(0.00) 1 | (0.02) | (0.02) | (0.01) | (0.00) 1 |

|

Net asset value, end of

period |

$1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

|

Total

return |

0.20% | 1.84% | 1.67% | 0.67% | 0.07% |

| Ratios to average net assets (annualized) | |||||

|

Gross

expenses |

0.34% | 0.36% | 0.44% | 0.52% | 0.52% |

|

Net

expenses |

0.22% 3 | 0.30% | 0.30% | 0.30% | 0.30% |

|

Net investment

income |

0.19% | 1.85% | 1.63% | 0.65% | 0.06% |

| Supplemental data | |||||

|

Net assets, end of period (000s

omitted) |

$493,677 | $554,447 | $692,247 | $914,471 | $1,226,947 |

| 1 | Amount is less than $0.005. |

| 2 | Amount is more than $(0.005) |

| 3 | During the year ended January 31, 2021, class-level expenses were voluntarily waived by the investment manager. Without this voluntary waiver, the net expense ratio would have been 0.08% higher. |

| Year ended January 31 | |||||

| Institutional Class | 2021 | 2020 | 2019 | 2018 | 2017 |

|

Net asset value, beginning of

period |

$1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

|

Net investment

income |

0.00 1 | 0.02 | 0.02 | 0.01 | 0.00 1 |

|

Net realized gains (losses) on

investments |

0.00 1 | 0.00 1 | (0.00) 2 | (0.00) 2 | 0.00 1 |

|

Total from investment

operations |

0.00 1 | 0.02 | 0.02 | 0.01 | 0.00 1 |

| Distributions to shareholders from | |||||

|

Net investment

income |

(0.00) 1 | (0.02) | (0.02) | (0.01) | (0.00) 1 |

|

Net realized

gains |

(0.00) 1 | (0.00) 1 | (0.00) 1 | (0.00) 1 | (0.00) 1 |

|

Total distributions to

shareholders |

(0.00) 1 | (0.02) | (0.02) | (0.01) | (0.00) 1 |

|

Net asset value, end of

period |

$1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

|

Total

return |

0.24% | 1.95% | 1.77% | 0.77% | 0.17% |

| Ratios to average net assets (annualized) | |||||

|

Gross

expenses |

0.22% | 0.24% | 0.31% | 0.40% | 0.40% |

|

Net

expenses |

0.18% 3 | 0.20% | 0.20% | 0.20% | 0.20% |

|

Net investment

income |

0.17% | 1.92% | 1.79% | 0.78% | 0.18% |

| Supplemental data | |||||

|

Net assets, end of period (000s

omitted) |

$12,321,170 | $7,564,485 | $7,296,690 | $4,700,731 | $3,566,678 |

| 1 | Amount is less than $0.005. |

| 2 | Amount is more than $(0.005) |

| 3 | During the year ended January 31, 2021, class-level expenses were voluntarily waived by the investment manager. Without this voluntary waiver, the net expense ratio would have been 0.02% higher. |

| Year ended January 31 | |||||

| Service Class | 2021 | 2020 | 2019 | 2018 | 2017 |

|

Net asset value, beginning of

period |

$1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

|

Net investment

income |

0.00 1 | 0.02 | 0.01 | 0.00 1 | 0.00 1 |

|

Net realized gains (losses) on

investments |

0.00 1 | 0.00 1 | (0.00) 2 | (0.00) 2 | 0.00 1 |

|

Total from investment

operations |

0.00 1 | 0.02 | 0.01 | 0.00 1 | 0.00 1 |

| Distributions to shareholders from | |||||

|

Net investment

income |

(0.00) 1 | (0.02) | (0.01) | (0.00) 1 | (0.00) 1 |

|

Net realized

gains |

(0.00) 1 | (0.00) 1 | (0.00) 1 | (0.00) 1 | (0.00) 1 |

|

Total distributions to

shareholders |

(0.00) 1 | (0.02) | (0.01) | (0.00) 1 | (0.00) 1 |

|

Net asset value, end of

period |

$1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

|

Total

return |

0.15% | 1.64% | 1.46% | 0.46% | 0.01% |

| Ratios to average net assets (annualized) | |||||

|

Gross

expenses |

0.51% | 0.53% | 0.61% | 0.69% | 0.69% |

|

Net

expenses |

0.25% 3 | 0.50% | 0.50% | 0.50% | 0.36% |

|

Net investment

income |

0.12% | 1.58% | 1.45% | 0.45% | 0.00% |

| Supplemental data | |||||

|

Net assets, end of period (000s

omitted) |

$5,225,755 | $4,230,537 | $2,796,397 | $2,945,498 | $3,337,172 |

| 1 | Amount is less than $0.005. |

| 2 | Amount is more than $(0.005) |

| 3 | During the year ended January 31, 2021, class-level expenses were voluntarily waived by the investment manager. Without this voluntary waiver, the net expense ratio would have been 0.25% higher. |

| Year ended January 31 | |||||

| Sweep Class | 2021 | 2020 | 2019 | 2018 | 2017 |

|

Net asset value, beginning of

period |

$1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

|

Net investment

income |

0.00 1 | 0.01 | 0.01 | 0.00 1 | 0.00 1 |

|

Net realized gains (losses) on

investments |

0.00 1 | 0.00 1 | (0.00) 2 | (0.00) 2 | 0.00 1 |

|

Total from investment

operations |

0.00 1 | 0.01 | 0.01 | 0.00 1 | 0.00 1 |

| Distributions to shareholders from | |||||

|

Net investment

income |

(0.00) 1 | (0.01) | (0.01) | (0.00) 1 | (0.00) 1 |

|

Net realized

gains |

(0.00) 1 | (0.00) 1 | (0.00) 1 | (0.00) 1 | (0.00) 1 |

|

Total distributions to

shareholders |

(0.00) 1 | (0.01) | (0.01) | (0.00) 1 | (0.00) 1 |

|

Net asset value, end of

period |

$1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

|

Total

return |

0.11% | 1.34% | 1.13% | 0.18% | 0.01% |

| Ratios to average net assets (annualized) | |||||

|

Gross

expenses |

0.72% | 0.79% | 0.87% | 0.95% | 1.11% |

|

Net

expenses |

0.27% 3 | 0.79% | 0.83% | 0.77% | 0.36% |

|

Net investment

income |

0.08% | 1.30% | 1.14% | 0.16% | 0.00% |

| Supplemental data | |||||

|

Net assets, end of period (000s

omitted) |

$821,784 | $542,866 | $419,046 | $481,702 | $672,256 |

| 1 | Amount is less than $0.005. |

| 2 | Amount is more than $(0.005) |

| 3 | During the year ended January 31, 2021, class-level expenses were voluntarily waived by the investment manager. Without this voluntary waiver, the net expense ratio would have been 0.23% higher. |

| ■ | Level 1 – quoted prices in active markets for identical securities |

| ■ | Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| ■ | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

| Quoted

prices (Level 1) |

Other

significant observable inputs (Level 2) |

Significant

unobservable inputs (Level 3) |

Total | |

| Assets | ||||

| Investments in: | ||||

| U.S. Treasury securities | $0 | $18,556,432,256 | $0 | $18,556,432,256 |

| Average daily net assets | Management fee |

| First $5 billion | 0.150% |

| Next $5 billion | 0.140 |

| Over $10 billion | 0.130 |

| Class-level

administration fee | |

| Class A | 0.22% |

| Administrator Class | 0.10 |

| Institutional Class | 0.80 |

| Service Class | 0.12 |

| Sweep Class | 0.03 |

| Expense ratio caps | |

| Class A | 0.60% |

| Administrator Class | 0.30 |

| Institutional Class | 0.20 |

| Service Class | 0.50 |

| Sweep Class | 0.50 |

Wells Fargo Funds Trust:

| Name

and year of birth |

Position

held and length of service* |

Principal occupations during past five years or longer | Current

other public company or investment company directorships |

| William

R. Ebsworth (Born 1957) |

Trustee,

since 2015 |

Retired. From 1984 to 2013, equities analyst, portfolio manager, research director and chief investment officer at Fidelity Management and Research Company in Boston, Tokyo, and Hong Kong, and retired in 2013 as Chief Investment Officer of Fidelity Strategic Advisers, Inc. where he led a team of investment professionals managing client assets. Prior thereto, Board member of Hong Kong Securities Clearing Co., Hong Kong Options Clearing Corp., the Thailand International Fund, Ltd., Fidelity Investments Life Insurance Company, and Empire Fidelity Investments Life Insurance Company. Audit Committee Chair and Investment Committee Chair of the Vincent Memorial Hospital Endowment (non-profit organization). Mr. Ebsworth is a CFA® charterholder. | N/A |

| Jane

A. Freeman (Born 1953) |

Trustee,

since 2015; Chair Liaison, since 2018 |

Retired. From 2012 to 2014 and 1999 to 2008, Chief Financial Officer of Scientific Learning Corporation. From 2008 to 2012, Ms. Freeman provided consulting services related to strategic business projects. Prior to 1999, Portfolio Manager at Rockefeller & Co. and Scudder, Stevens & Clark. Board member of the Harding Loevner Funds from 1996 to 2014, serving as both Lead Independent Director and chair of the Audit Committee. Board member of the Russell Exchange Traded Funds Trust from 2011 to 2012 and the chair of the Audit Committee. Ms. Freeman is also an inactive Chartered Financial Analyst. | N/A |

| Isaiah

Harris, Jr. (Born 1952) |

Trustee,

since 2009; Audit Committee Chair, since 2019 |

Retired. Chairman of the Board of CIGNA Corporation since 2009, and Director since 2005. From 2003 to 2011, Director of Deluxe Corporation. Prior thereto, President and CEO of BellSouth Advertising and Publishing Corp. from 2005 to 2007, President and CEO of BellSouth Enterprises from 2004 to 2005 and President of BellSouth Consumer Services from 2000 to 2003. Emeritus member of the Iowa State University Foundation Board of Governors. Emeritus Member of the Advisory Board of Iowa State University School of Business. Advisory Board Member, Palm Harbor Academy (private school). Mr. Harris is a certified public accountant (inactive status). | CIGNA Corporation |

| Judith

M. Johnson (Born 1949) |

Trustee,

since 2008 |

Retired. Prior thereto, Chief Executive Officer and Chief Investment Officer of Minneapolis Employees Retirement Fund from 1996 to 2008. Ms. Johnson is an attorney, certified public accountant and a certified managerial accountant. | N/A |

| David

F. Larcker (Born 1950) |

Trustee,

since 2009 |

James Irvin Miller Professor of Accounting at the Graduate School of Business (Emeritus), Stanford University, Director of the Corporate Governance Research Initiative and Senior Faculty of The Rock Center for Corporate Governance since 2006. From 2005 to 2008, Professor of Accounting at the Graduate School of Business, Stanford University. Prior thereto, Ernst & Young Professor of Accounting at The Wharton School, University of Pennsylvania from 1985 to 2005. | N/A |

| Name

and year of birth |

Position

held and length of service* |

Principal occupations during past five years or longer | Current

other public company or investment company directorships |

| Olivia

S. Mitchell (Born 1953) |

Trustee,

since 2006; Nominating and Governance Committee Chair, since 2018 |

International Foundation of Employee Benefit Plans Professor, Wharton School of the University of Pennsylvania since 1993. Director of Wharton’s Pension Research Council and Boettner Center on Pensions & Retirement Research, and Research Associate at the National Bureau of Economic Research. Previously, Cornell University Professor from 1978 to 1993. | N/A |

| Timothy

J. Penny (Born 1951) |

Trustee,

since 1996; Chair, since 2018 |

President and Chief Executive Officer of Southern Minnesota Initiative Foundation, a non-profit organization, since 2007. Member of the Board of Trustees of NorthStar Education Finance, Inc., a non-profit organization, since 2007. | N/A |

| James

G. Polisson (Born 1959) |

Trustee,

since 2018 |

Retired. Chief Marketing Officer, Source (ETF) UK Services, Ltd, from 2015 to 2017. From 2012 to 2015, Principal of The Polisson Group, LLC, a management consulting, corporate advisory and principal investing company. Chief Executive Officer and Managing Director at Russell Investments, Global Exchange Traded Funds from 2010 to 2012. Managing Director of Barclays Global Investors from 1998 to 2010 and Global Chief Marketing Officer for iShares and Barclays Global Investors from 2000 to 2010. Trustee of the San Francisco Mechanics’ Institute, a non-profit organization, from 2013 to 2015. Board member of the Russell Exchange Traded Fund Trust from 2011 to 2012. Director of Barclays Global Investors Holdings Deutschland GmbH from 2006 to 2009. Mr. Polisson is an attorney and has a retired status with the Massachusetts and District of Columbia Bar Associations. | N/A |

| Pamela

Wheelock (Born 1959) |

Trustee,

since January 2020; previously Trustee from January 2018 to July 2019 |

Board member of the Destination Medical Center Economic Development Agency, Rochester, Minnesota since 2019. Interim President of the McKnight Foundation from January to September 2020. Acting Commissioner, Minnesota Department of Human Services, July 2019 through September 2019. Human Services Manager (part-time), Minnesota Department of Human Services, October 2019 through December 2019. Chief Operating Officer, Twin Cities Habitat for Humanity from 2017 to 2019. Vice President of University Services, University of Minnesota from 2012 to 2016. Prior thereto, on the Board of Directors, Governance Committee and Finance Committee for the Minnesota Philanthropy Partners (Saint Paul Foundation) from 2012 to 2018, Interim Chief Executive Officer of Blue Cross Blue Shield of Minnesota from 2011 to 2012, Chairman of the Board from 2009 to 2012 and Board Director from 2003 to 2015. Vice President, Leadership and Community Engagement, Bush Foundation, Saint Paul, Minnesota (a private foundation) from 2009 to 2011. Executive Vice President and Chief Financial Officer, Minnesota Sports and Entertainment from 2004 to 2009 and Senior Vice President from 2002 to 2004. Executive Vice President of the Minnesota Wild Foundation from 2004 to 2008. Commissioner of Finance, State of Minnesota, from 1999 to 2002. Currently Board Chair of the Minnesota Wild Foundation since 2010. | N/A |

| Name

and year of birth |

Position

held and length of service |

Principal occupations during past five years or longer |

| Andrew

Owen (Born 1960) |

President,

since 2017 |

Executive Vice President of Wells Fargo & Company and Head of Affiliated Managers, Wells Fargo Asset Management, since 2014. In addition, Mr. Owen is currently President, Chief Executive Officer and Director of Wells Fargo Funds Management, LLC since 2017. Prior thereto, Executive Vice President responsible for marketing, investments and product development for Wells Fargo Funds Management, LLC, from 2009 to 2014. |

| Jeremy

DePalma (Born 1974) |

Treasurer,

since 2012 (for certain funds in the Fund Complex); since 2021 (for the remaining funds in the Fund Complex) |

Senior Vice President of Wells Fargo Funds Management, LLC since 2009. Senior Vice President of Evergreen Investment Management Company, LLC from 2008 to 2010 and head of the Fund Reporting and Control Team within Fund Administration from 2005 to 2010. |

| Michelle

Rhee (Born 1966) |

Chief

Legal Officer, since 2019 |

Secretary of Wells Fargo Funds Management, LLC and Chief Legal Counsel of Wells Fargo Asset Management since 2018. Deputy General Counsel of Wells Fargo Bank, N.A. since 2020 and Assistant General Counsel of Wells Fargo Bank, N.A. from 2018 to 2020. Associate General Counsel and Managing Director of Bank of America Corporation from 2004 to 2018. |

| Catherine

Kennedy (Born 1969) |

Secretary,

since 2019 |

Vice President of Wells Fargo Funds Management, LLC and Senior Counsel of the Wells Fargo Legal Department since 2010. Vice President and Senior Counsel of Evergreen Investment Management Company, LLC from 1998 to 2010. |

| Michael

H. Whitaker (Born 1967) |

Chief

Compliance Officer, since 2016 |

Chief Compliance Officer of Wells Fargo Asset Management since 2016. Senior Vice President and Chief Compliance Officer for Fidelity Investments from 2007 to 2016. |

P.O. Box 219967

Kansas City, MO 64121-9967

A300/AR300 01-21

| ■ | Wells Fargo Cash Investment Money Market Fund |

| 1 | The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-value-weighted index with each stock's weight in the index proportionate to its market value. You cannot invest directly in an index. |

| 2 | The Morgan Stanley Capital International (MSCI) All Country World Index (ACWI) ex USA Index (Net) is a free-float-adjusted market-capitalization-weighted index that is designed to measure the equity market performance of developed and emerging markets, excluding the United States. Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. You cannot invest directly in an index. |

| 1 | The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-value-weighted index with each stock's weight in the index proportionate to its market value. You cannot invest directly in an index. |

| 3 | The MSCI Emerging Markets (EM) Index (Net) is a free-float-adjusted market-capitalization-weighted index that is designed to measure equity market performance of emerging markets. You cannot invest directly in an index. |

| 1 | The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-value-weighted index with each stock's weight in the index proportionate to its market value. You cannot invest directly in an index. |

| 4 | The Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable-rate mortgage pass-throughs), asset-backed securities, and commercial mortgage-backed securities. You cannot invest directly in an index. |

| 1 | The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-value-weighted index with each stock's weight in the index proportionate to its market value. You cannot invest directly in an index. |

| 5 | The Bloomberg Barclays Global Aggregate ex-USD Index (unhedged) is an unmanaged index that provides a broad-based measure of the global investment-grade fixed-income markets excluding the U.S. dollar-denominated debt market. You cannot invest directly in an index. |

| 1 | The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-value-weighted index with each stock's weight in the index proportionate to its market value. You cannot invest directly in an index. |

| 6 | The Bloomberg Barclays Municipal Bond Index is an unmanaged index composed of long-term tax-exempt bonds with a minimum credit rating of Baa. You cannot invest directly in an index. |

| 1 | The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-value-weighted index with each stock's weight in the index proportionate to its market value. You cannot invest directly in an index. |

| 7 | The ICE BofA U.S. High Yield Index is a market-capitalization-weighted index of domestic and Yankee high-yield bonds. The index tracks the performance of high-yield securities traded in the U.S. bond market. You cannot invest directly in an index. Copyright 2021. ICE Data Indices, LLC. All rights reserved. |

President

Wells Fargo Funds

Wells Capital Management Singapore

Jeffrey L. Weaver, CFA®‡

Laurie White

| Excluding sales charge | Expense ratios1 (%) | ||||||

| Inception date | 1 year | 5 year | 10 year | Gross | Net 2 | ||

| Administrator Class (WFAXX) | 7-31-2003 | 0.32 | 1.11 | 0.56 | 0.36 | 0.33 | |

| Institutional Class (WFIXX) | 10-14-1987 | 0.41 | 1.24 | 0.64 | 0.24 | 0.20 | |

| Select Class (WFQXX) | 6-29-2007 | 0.49 | 1.31 | 0.71 | 0.20 | 0.13 | |

| Service Class (NWIXX) | 10-14-1987 | 0.26 | 0.96 | 0.49 | 0.53 | 0.45 | |

| Administrator

Class |

Institutional

Class |

Select

Class |

Service

Class | |

| 7-day current yield | 0.01 | 0.01 | 0.02 | 0.01 |

| 7-day compound yield | 0.01 | 0.01 | 0.02 | 0.01 |

| 30-day simple yield | 0.01 | 0.01 | 0.04 | 0.01 |

| 30-day compound yield | 0.01 | 0.01 | 0.04 | 0.01 |

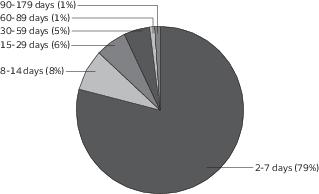

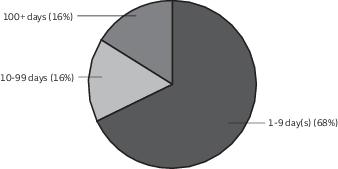

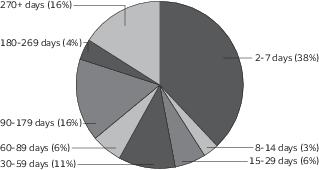

| Weighted average maturity as of January 31, 20214 |

| 9 days |

| Weighted average life as of January 31, 20215 |

| 10 days |

| ‡ | CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute. |

| 1 | Reflects the expense ratios as stated in the most recent prospectuses. The expense ratios shown are subject to change and may differ from the annualized expense ratios shown in the financial highlights of this report. |

| 2 | The manager has contractually committed through May 31, 2021, to waive fees and/or reimburse expenses to the extent necessary to cap total annual fund operating expenses after fee waivers at 0.33% for Administrator Class, 0.20% for Institutional Class, 0.13% for Select Class, and 0.45% for Service Class. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses (if any), and extraordinary expenses are excluded from the expense caps. The manager may also voluntarily waive or reimburse additional fees and expenses, and such voluntary waivers may be discontinued or modified at any time without notice. Without these reductions, the Fund’s seven-day current yield would have been -0.23%, -0.11%, -0.07%, and -0.38% for Administrator Class, Institutional Class, Select Class, and Service Class. Prior to or after the commitment expiration date, the caps may be increased or the commitment to maintain the caps may be terminated only with the approval of the Board of Trustees. The expense ratio paid by an investor is the net expense ratio (the total annual fund operating expenses after fee waivers) as stated in the prospectuses. |

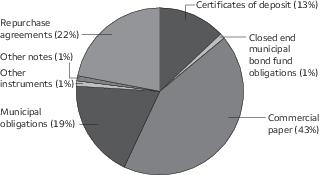

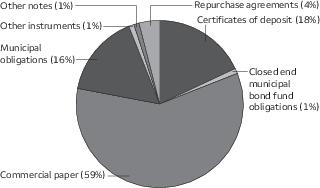

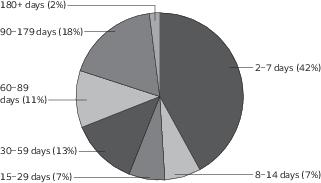

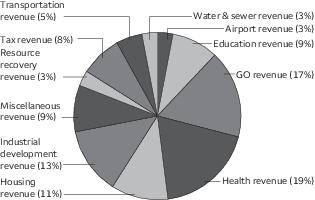

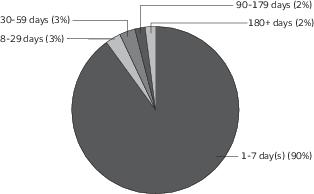

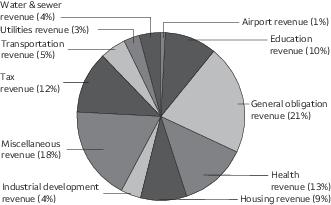

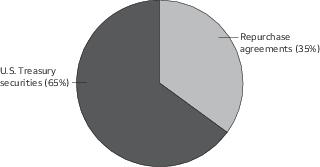

| 3 | Figures represent the percentage of the Fund's total investments. These amounts are subject to change and may have changed since the date specified. |

| 4 | Weighted Average Maturity (WAM): WAM is an average of the effective maturities of all securities held in the portfolio, weighted by each security’s percentage of total investments. The maturity of a portfolio security is the period remaining until the date on which the principal amount is unconditionally required to be paid, or in the case of a security called for redemption, the date on which the redemption payment is unconditionally required to be made. WAM calculations allow for the maturities of certain securities with demand features or periodic interest rate resets to be shortened. WAM is a way to measure a fund’s sensitivity to potential interest rate changes. WAM is subject to change and may have changed since the date specified. |

| 5 | Weighted Average Life (WAL): WAL is an average of the final maturities of all securities held in the portfolio, weighted by their percentage of total investments. The maturity of a portfolio security is the period remaining until the date on which the principal amount is unconditionally required to be paid, or in the case of a security called for redemption, the date on which the redemption payment is unconditionally required to be made. In contrast to WAM, the calculation of WAL allows for the maturities of certain securities with demand features to be shortened, but not the periodic interest rate resets. WAL is a way to measure a fund’s potential sensitivity to credit spread changes. WAL is subject to change and may have changed since the date specified. |

| Beginning

account value 8-1-2020 |

Ending

account value 1-31-2021 |

Expenses

paid during the period1 |

Annualized

net expense ratio | |

| Administrator Class | ||||

| Actual | $1,000.00 | $ 999.78 | $1.21 | 0.24% |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,023.93 | $1.22 | 0.24% |

| Institutional Class | ||||

| Actual | $1,000.00 | $ 999.98 | $0.96 | 0.19% |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,024.18 | $0.97 | 0.19% |

| Select Class | ||||

| Actual | $1,000.00 | $1,000.30 | $0.65 | 0.13% |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,024.48 | $0.66 | 0.13% |

| Service Class | ||||

| Actual | $1,000.00 | $ 999.78 | $1.16 | 0.23% |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,023.98 | $1.17 | 0.23% |

| Interest

rate |

Maturity

date |

Principal | Value | ||

| Certificates of deposit: 12.95% | |||||

| ABN Amro Bank NV | 0.10% | 2-2-2021 | $ 25,000,000 | $ 25,000,000 | |

| Australia & New Zealand Banking Group Limited | 0.07 | 2-1-2021 | 30,000,000 | 30,000,000 | |

| HSBC Bank USA NA | 0.10 | 2-1-2021 | 30,000,000 | 30,000,000 | |

| Mizuho Bank Limited | 0.08 | 2-1-2021 | 20,000,000 | 20,000,000 | |

| Norinchukin Bank | 0.30 | 5-20-2021 | 2,000,000 | 2,000,696 | |

| Oversea-Chinese Banking | 0.21 | 3-1-2021 | 4,000,000 | 4,000,275 | |

| Rabobank Netherlands (New York) | 0.07 | 2-1-2021 | 25,000,000 | 25,000,000 | |

| Sumitomo Mitsui Banking Corporation (1 Month LIBOR+0.10%) ± | 0.23 | 4-7-2021 | 8,000,000 | 8,000,890 | |

| Sumitomo Mitsui Trust NY | 0.27 | 5-18-2021 | 5,000,000 | 5,001,375 | |

| Toronto Dominion Bank | 1.30 | 2-26-2021 | 5,000,000 | 5,004,591 | |

| UBS AG Stamford Branch (1 Month LIBOR+1.25%) ± | 1.38 | 2-10-2021 | 7,000,000 | 7,002,885 | |

| Total Certificates of deposit (Cost $161,000,000) | 161,010,712 |

| Closed end municipal bond fund obligations: 1.05% | |||||

| Invesco Dynamic Credit Opportunities Fund Variable Rate Demand Preferred Shares Series W-7 (60 shares) 0.36% 144A§øø | 6,000,000 | 6,000,000 | |||

| Nuveen Short Duration Credit Opportunities Fund Taxable Fund Preferred Shares Series A (7,000 shares) 0.36% 144Aø | 7,000,000 | 7,000,000 | |||

| Total Closed end municipal bond fund obligations (Cost $13,000,000) | 13,000,000 |

| Commercial paper: 42.73% | |||||

| Asset-backed commercial paper: 22.44% | |||||

| Alinghi Funding Company LLC 144A☼ | 0.10 | 2-2-2021 | 30,000,000 | 29,999,567 | |

| Alpine Securitization LLC (1 Month LIBOR+0.09%) 144A± | 0.21 | 7-16-2021 | 4,000,000 | 4,000,000 | |

| Anglesea Funding LLC 144A | 0.17 | 5-17-2021 | 8,000,000 | 8,000,287 | |

| Anglesea Funding LLC (1 Month LIBOR+0.11%) 144A± | 0.24 | 3-15-2021 | 8,000,000 | 8,000,282 | |

| Anglesea Funding LLC (1 Month LIBOR+0.11%) 144A± | 0.24 | 3-19-2021 | 4,000,000 | 4,000,421 | |

| Barton Capital Corporation 144A☼ | 0.10 | 2-2-2021 | 25,000,000 | 24,999,639 | |

| Bennington Sark Capital Company 144A☼ | 0.10 | 2-2-2021 | 10,000,000 | 9,999,856 | |

| Bennington Sark Capital Company 144A☼ | 0.16 | 2-4-2021 | 10,000,000 | 9,999,783 | |

| Cedar Spring Capital Corporation 144A☼ | 0.15 | 2-16-2021 | 18,002,000 | 18,000,614 | |

| Chesham Finance Limited 144A☼ | 0.10 | 2-1-2021 | 20,000,000 | 19,999,783 | |

| Chesham Finance Limited 144A☼ | 0.10 | 2-1-2021 | 10,000,000 | 9,999,892 | |

| Collateralized Commercial Paper Flex Company LLC 144A☼ | 0.25 | 2-16-2021 | 3,000,000 | 2,999,769 | |

| Collateralized Commercial Paper V Company LLC ☼ | 0.25 | 2-3-2021 | 8,000,000 | 7,999,856 | |

| Collateralized Commercial Paper V Company LLC ☼ | 0.25 | 2-11-2021 | 5,000,000 | 4,999,738 | |

| Collateralized Commercial Paper V Company LLC ☼ | 0.25 | 2-16-2021 | 3,000,000 | 2,999,769 | |

| Columbia Funding Company 144A☼ | 0.26 | 3-2-2021 | 3,000,000 | 2,999,571 | |

| Columbia Funding Company 144A☼ | 0.26 | 3-3-2021 | 3,000,000 | 2,999,555 | |

| Columbia Funding Company 144A☼ | 0.26 | 3-4-2021 | 2,000,000 | 1,999,692 | |

| Concord Minutemen Capital Company 144A☼ | 0.29 | 2-12-2021 | 12,000,000 | 11,999,309 | |

| Institutional Secured Funding LLC 144A☼ | 0.18 | 2-2-2021 | 20,000,000 | 19,999,558 | |

| Institutional Secured Funding LLC 144A☼ | 0.18 | 2-4-2021 | 10,000,000 | 9,999,645 | |

| Ionic Capital Management LLC ☼ | 0.24 | 2-5-2021 | 3,000,000 | 2,999,895 | |

| Manhattan Asset Funding Company LLC 144A☼ | 0.21 | 2-9-2021 | 5,000,000 | 4,999,786 | |

| Manhattan Asset Funding Company LLC 144A☼ | 0.21 | 2-11-2021 | 10,000,000 | 9,999,476 |

| Interest

rate |

Maturitydate | Principal | Value | ||

| Asset-backed commercial paper (continued) | |||||

| Mountcliff Funding LLC 144A☼ | 0.14% | 2-1-2021 | $ 21,000,000 | $ 20,999,773 | |

| Nieuw Amsterdam Receivables Corporation 144A☼ | 0.22 | 2-10-2021 | 5,000,000 | 4,999,785 | |

| Ridgefield Funding Company 144A☼ | 0.25 | 2-12-2021 | 10,000,000 | 9,999,436 | |

| Versailles CDS LLC (1 Month LIBOR+0.10%) 144A± | 0.23 | 5-19-2021 | 5,000,000 | 5,000,000 | |

| Versailles CDS LLC ☼ | 0.25 | 2-1-2021 | 4,000,000 | 3,999,945 | |

| 278,994,682 | |||||

| Financial company commercial paper: 11.74% | |||||

| Banco Santander SA (1 Month LIBOR+0.24%) 144A± | 0.38 | 2-1-2021 | 4,000,000 | 4,000,080 | |

| Citigroup Global Markets Incorporated 144A☼ | 0.08 | 2-1-2021 | 10,000,000 | 9,999,925 | |

| Credit Agricole SA ☼ | 0.07 | 2-1-2021 | 30,000,000 | 29,999,798 | |

| Erste Finance LLC 144A☼ | 0.07 | 2-1-2021 | 30,000,000 | 29,999,567 | |

| Federation des Caisses 144A☼ | 0.10 | 2-4-2021 | 30,000,000 | 29,999,550 | |

| Nationwide Building Society 144A☼ | 0.17 | 2-9-2021 | 4,000,000 | 3,999,829 | |

| Nationwide Building Society 144A☼ | 0.17 | 2-23-2021 | 8,000,000 | 7,999,161 | |

| Swedbank AB ☼ | 0.09 | 2-1-2021 | 20,000,000 | 19,999,843 | |

| Swedbank AB ☼ | 0.09 | 2-3-2021 | 10,000,000 | 9,999,865 | |

| 145,997,618 | |||||

| Other commercial paper: 8.55% | |||||

| BNG Bank NV 144A☼ | 0.21 | 3-15-2021 | 2,400,000 | 2,399,610 | |

| Caisse des Depots 144A☼ | 0.15 | 2-8-2021 | 25,000,000 | 24,999,347 | |

| COFCO Capital Corporation ☼ | 0.21 | 2-23-2021 | 3,000,000 | 2,999,646 | |

| COFCO Capital Corporation ☼ | 0.22 | 2-9-2021 | 5,000,000 | 4,999,763 | |

| European Investment Bank ☼ | 0.14 | 2-17-2021 | 15,000,000 | 14,999,232 | |

| Nederlandse Waterschapsbank NV 144A☼ | 0.10 | 2-2-2021 | 7,000,000 | 6,999,925 | |

| Nederlandse Waterschapsbank NV 144A☼ | 0.14 | 2-4-2021 | 12,000,000 | 11,999,802 | |

| Nederlandse Waterschapsbank NV 144A☼ | 0.14 | 2-25-2021 | 7,000,000 | 6,999,375 | |

| NRW Bank 144A☼ | 0.10 | 2-3-2021 | 18,000,000 | 17,999,775 | |

| NRW Bank 144A☼ | 0.18 | 2-24-2021 | 4,000,000 | 3,999,636 | |

| Province of Alberta 144A☼ | 0.21 | 2-8-2021 | 8,000,000 | 7,999,800 | |

| 106,395,911 | |||||

| Total Commercial paper (Cost $531,388,651) | 531,388,211 | ||||

| Municipal obligations: 17.97% | |||||

| Arizona: 0.40% | |||||

| Variable rate demand notes ø: 0.40% | |||||

| Arizona Health Facility Authority Floater Series 2015 XF 2050 (Health revenue, Morgan Stanley Bank LIQ) 144A | 0.07 | 1-1-2037 | 5,000,000 | 5,000,000 | |

| California: 4.80% | |||||

| Other municipal debt : 0.40% | |||||

| California Series B-4 (Education revenue) | 0.14 | 3-3-2021 | 5,000,000 | 5,000,000 | |

| Variable rate demand notes ø: 4.40% | |||||

| California Tender Option Bond Trust Receipts/Certificates Los Angeles Community College District Series 2016-TXG002 (GO revenue, Bank of America NA LIQ) 144A | 0.28 | 8-1-2049 | 5,000,000 | 5,000,000 | |

| Mizuho Floater Residual Trust Various States Series 2020-MIZ9040 (Housing revenue, Mizuho Capital Markets LLC LIQ) 144A | 0.15 | 10-15-2038 | 5,000,000 | 5,000,000 |

| Interest

rate |

Maturitydate | Principal | Value | ||

| Variable rate demand notes ø(continued) | |||||

| Mizuho Tender Option Bond Trust Receipts/Floater Certificates Series 2019-MIZ9003 (Tax revenue, Mizuho Capital Markets LLC LOC, Mizuho Capital Markets LLC LIQ) 144A | 0.24% | 3-1-2036 | $ 1,700,000 | $ 1,700,000 | |

| San Francisco CA City & County Certificate of Participation Series B001 (Miscellaneous revenue, Morgan Stanley Bank LIQ) 144A | 0.23 | 11-1-2041 | 8,000,000 | 8,000,000 | |

| San Francisco CA City & County Housing Revenue Block 8 Tower Apartments Series H1 (Housing revenue, Bank of China LOC) | 0.11 | 11-1-2056 | 6,000,000 | 6,000,000 | |

| San Francisco CA City & County Housing Revenue Block 8 Tower Apartments Series H2 (Housing revenue, Bank of China LOC) | 0.10 | 11-1-2056 | 9,000,000 | 9,000,000 | |

| University of California Revenue Various Taxable Series Z-1 (Education revenue) | 0.10 | 7-1-2041 | 20,000,000 | 20,000,000 | |

| 54,700,000 | |||||

| Colorado: 1.83% | |||||

| Variable rate demand notes ø: 1.83% | |||||

| Colorado HFA MFHR Class II Series B (Housing revenue, FHLB SPA) | 0.17 | 5-1-2052 | 16,730,000 | 16,730,000 | |

| Colorado Southern Ute Indian Tribe Reservation Series 2007 (Miscellaneous revenue) 144A | 0.09 | 1-1-2027 | 6,000,000 | 6,000,000 | |

| 22,730,000 | |||||

| Delaware: 0.24% | |||||

| Variable rate demand notes ø: 0.24% | |||||

| Tender Option Bond Trust Receipts Floater Series 2020 TPG015 (Miscellaneous revenue, Bank of America NA LIQ) 144A | 0.46 | 2-1-2038 | 3,000,000 | 3,000,000 | |

| Georgia: 1.61% | |||||

| Variable rate demand notes ø: 1.61% | |||||

| Macon-Bibb County GA Industrial Authority Kumho Tire Georgia Incorporated Series A (Industrial development revenue, Korea Development Bank LOC) | 0.22 | 12-1-2022 | 8,000,000 | 8,000,000 | |

| Macon-Bibb County GA Industrial Authority Kumho Tire Georgia Incorporated Series A (Industrial development revenue, Korea Development Bank LOC) | 0.22 | 12-1-2022 | 12,000,000 | 12,000,000 | |

| 20,000,000 | |||||

| Kentucky: 0.32% | |||||

| Variable rate demand notes ø: 0.32% | |||||

| Daviess County KY Waste Disposal Facility Revenue Scott Paper Company Project B (Industrial development revenue) | 0.09 | 12-1-2023 | 4,000,000 | 4,000,000 | |

| Maine: 2.01% | |||||

| Variable rate demand notes ø: 2.01% | |||||

| Maine State Housing AMT Purchase Variable Refunding Bond Series D2 (Housing revenue, TD Bank NA SPA) | 0.06 | 11-15-2046 | 25,000,000 | 25,000,000 |

| Interest

rate |

Maturitydate | Principal | Value | ||

| Michigan: 0.50% | |||||

| Variable rate demand notes ø: 0.50% | |||||

| Michigan State Housing Development AMT Refunding Bond Series B (Housing revenue, Industrial & Commercial Bank of China Limited SPA) | 0.14% | 6-1-2038 | $ 6,270,000 | $ 6,270,000 | |

| New Hampshire: 0.89% | |||||

| Variable rate demand notes ø: 0.89% | |||||

| New Hampshire Business Finance Authority CJ Foods Manufacturing Beaumont Corporation Series A (Industrial development revenue, Kookmin Bank LOC) 144A | 0.22 | 10-1-2028 | 11,000,000 | 11,000,000 | |

| New Jersey: 0.78% | |||||

| Variable rate demand notes ø: 0.78% | |||||

| Tender Option Bond Trust Receipts Series 2017-XI0052 (Miscellaneous revenue, Barclays Bank plc LOC, Barclays Bank plc LIQ) 144A | 0.07 | 6-15-2042 | 9,725,000 | 9,725,000 | |

| New York: 1.05% | |||||

| Other municipal debt : 1.05% | |||||

| Long Island Power Authority Series 2015-GR1A (Utilities revenue, TD Bank NA LOC) | 0.17 | 2-19-2021 | 5,000,000 | 5,000,084 | |

| New York Dormitory Authority Personal Income Tax Revenue Series B (Tax revenue) | 5.00 | 3-31-2021 | 8,000,000 | 8,065,437 | |

| 13,065,521 | |||||

| Oregon: 0.16% | |||||

| Variable rate demand notes ø: 0.16% | |||||

| Portland OR Portland International Airport (Airport revenue, Bank of China LOC) | 0.09 | 7-1-2026 | 2,000,000 | 2,000,000 | |

| Other: 3.38% | |||||

| Variable rate demand notes ø: 3.38% | |||||

| JPMorgan Chase Puttable Tax-Exempt Receipts/Derivative Inverse Tax-Exempt Receipts & Custodial Receipts Trust Series 5039 (Miscellaneous revenue, JPMorgan Chase & Company LIQ, JPMorgan Chase & Company LOC) | 0.22 | 11-16-2022 | 15,000,000 | 15,000,000 | |

| Taxable Municipal Funding Trust Various States Floaters Series 2019-014 (GO revenue, Barclays Bank plc LOC) 144A | 0.42 | 9-1-2027 | 13,045,000 | 13,045,000 | |

| Taxable Municipal Funding Trust Various States Floaters Series 2019-019 (GO revenue, Barclays Bank plc LOC) 144A | 0.42 | 12-1-2030 | 250,000 | 250,000 | |

| Taxable Municipal Funding Trust Various States Floaters Series 2020-008 (GO revenue, Barclays Bank plc LOC) 144A | 0.42 | 5-1-2024 | 3,710,000 | 3,710,000 |

| Interest

rate |

Maturitydate | Principal | Value | ||

| Variable rate demand notes ø(continued) | |||||

| Taxable Municipal Funding Trust Various States Floaters Series 2020-012 (GO revenue, Barclays Bank plc LOC) 144A | 0.16% | 9-1-2030 | $ 5,000,000 | $ 5,000,000 | |

| Taxable Municipal Funding Trust Various States Floaters Series 2020-11 (GO revenue, Barclays Bank plc LOC) 144A | 0.42 | 9-1-2030 | 4,980,000 | 4,980,000 | |

| 41,985,000 | |||||

| Total Municipal obligations (Cost $223,466,507) | 223,475,521 | ||||

| Other instruments: 1.23% | |||||

| Altoona Blair County Development Corporation 144A§øø | 0.16 | 4-1-2035 | 12,000,000 | 12,000,000 | |

| Morris Family Insurance Trust §øø | 0.15 | 10-1-2059 | 3,350,000 | 3,350,000 | |

| Total Other instruments (Cost $15,350,000) | 15,350,000 | ||||

| Other notes: 2.25% | |||||

| Corporate bonds and notes: 2.25% | |||||

| Cellmark Incorporated Taxable Notes Series 2018A § | 0.15 | 6-1-2038 | 7,000,000 | 7,000,000 | |

| Jets Stadium Development LLC Series A-4B 144A§ | 0.18 | 4-1-2047 | 10,000,000 | 10,000,000 | |

| Jets Stadium Finance 144A§ | 0.18 | 4-1-2047 | 5,000,000 | 5,000,000 | |

| SSAB AB Series A §øø | 0.15 | 6-1-2035 | 6,000,000 | 6,000,000 | |

| Total Other notes (Cost $28,000,000) | 28,000,000 | ||||

| Repurchase agreements^^: 21.80% | |||||

| Standard Chartered Bank, dated 1-29-2021, maturity value $155,000,775 (1) | 0.06 | 2-1-2021 | 155,000,000 | 155,000,000 | |

| TD Securities USA LLC, dated 1-29-2021, maturity value $116,025,580 (2) | 0.06 | 2-1-2021 | 116,025,000 | 116,025,000 | |

| Total Repurchase agreements (Cost $271,025,000) | 271,025,000 | ||||

| Total investments in securities (Cost $1,243,230,158) | 99.98% | 1,243,249,444 | |||

| Other assets and liabilities, net | 0.02 | 220,893 | |||

| Total net assets | 100.00% | $1,243,470,337 |

| ± | Variable rate investment. The rate shown is the rate in effect at period end. |

| 144A | The security may be resold in transactions exempt from registration, normally to qualified institutional buyers, pursuant to Rule 144A under the Securities Act of 1933. |

| § | The security is subject to a demand feature which reduces the effective maturity. |

| øø | The interest rate is determined and reset by the issuer periodically depending upon the terms of the security. The rate shown is the rate in effect at period end. |

| ø | Variable rate demand notes are subject to a demand feature which reduces the effective maturity. The maturity date shown represents the final maturity date of the security. The interest rate is determined and reset by the issuer daily, weekly, or monthly depending upon the terms of the security. The rate shown is the rate in effect at period end. |

| ^^ | Collateralized by: |

| (1) U.S. government securities, 0.00% to 6.25%, 3-25-2021 to 1-1-2051, fair value including accrued interest is $158,195,152. | |

| (2) U.S. government securities, 1.50% to 5.00%, 11-1-2032 to 2-1-2051, fair value including accrued interest is $119,505,750. | |

| ☼ | Zero coupon security. The rate represents the current yield to maturity. |

| Abbreviations: | |

| AMT | Alternative minimum tax |

| FHLB | Federal Home Loan Bank |

| GO | General obligation |

| HFA | Housing Finance Authority |

| LIBOR | London Interbank Offered Rate |

| LIQ | Liquidity agreement |

| LOC | Letter of credit |

| MFHR | Multifamily housing revenue |

| SPA | Standby purchase agreement |

| Assets | |

|

Investments in unaffiliated securities, at value (cost

$972,205,158) |

$ 972,224,444 |

|

Investments in repurchase agreements, at value (cost

$271,025,000) |

271,025,000 |

|

Cash |

57,105 |

|

Receivable for

interest |

435,221 |

|

Receivable for Fund shares

sold |

235,050 |

|

Prepaid expenses and other

assets |

50,022 |

|

Total

assets |

1,244,026,842 |

| Liabilities | |

|

Payable for Fund shares

redeemed |

246,799 |

|

Management fee

payable |

99,630 |

|

Administration fees

payable |

72,557 |

|

Custodian and accounting fee

payable |

43,063 |

|

Professional fees

payable |

34,414 |

|

Shareholder servicing fees

payable |

30,595 |

|

Trustees’ fees and expenses

payable |

1,372 |

|

Accrued expenses and other

liabilities |

28,075 |

|

Total

liabilities |

556,505 |

|

Total net

assets |

$1,243,470,337 |

| Net assets consist of | |

|

Paid-in

capital |

$ 1,243,797,745 |

|

Total distributable

loss |

(327,408) |

|

Total net

assets |

$1,243,470,337 |

| Computation of net asset value per share | |

|

Net assets – Administrator

Class |

$ 93,800,974 |

|

Shares outstanding – Administrator

Class1 |

93,750,137 |

|

Net asset value per share – Administrator

Class |

$1.0005 |

|

Net assets – Institutional

Class |

$ 457,106,256 |

|

Shares outstanding – Institutional

Class1 |

456,857,222 |

|

Net asset value per share – Institutional

Class |

$1.0005 |

|

Net assets – Select

Class |

$ 588,297,820 |

|

Shares outstanding – Select

Class1 |

587,940,770 |

|

Net asset value per share – Select

Class |

$1.0006 |

|

Net assets – Service

Class |

$ 104,265,287 |

|

Shares outstanding – Service

Class1 |

104,198,367 |

Net

asset value per share – Service

Class |

$1.0006 |

| 1 | The Fund has an unlimited number of authorized shares. |

| Investment income | |

|

Interest |

$10,257,860 |

| Expenses | |

|

Management

fee |

2,467,192 |

| Administration fees | |

|

Administrator

Class |

105,323 |

|

Institutional

Class |

572,811 |

|

Select

Class |

288,093 |

|

Service

Class |

123,871 |

| Shareholder servicing fees | |

|

Administrator

Class |

105,319 |

|

Service

Class |

258,057 |

|

Custody and accounting

fees |

120,906 |

|

Professional

fees |

43,743 |

|

Registration

fees |

57,422 |

|

Shareholder report

expenses |

11,922 |

|

Trustees’ fees and

expenses |

18,795 |

|

Other fees and

expenses |

15,433 |

|

Total

expenses |

4,188,887 |

| Less: Fee waivers and/or expense reimbursements | |

|

Fund-level |

(605,272) |

|

Administrator

Class |

(52,951) |

|

Institutional

Class |

(71,995) |

|

Select

Class |

(288,093) |

|

Service

Class |

(166,069) |

|

Net

expenses |

3,004,507 |

|

Net investment

income |

7,253,353 |

| Realized and unrealized gains (losses) on investments | |

|

Net realized losses on

investments |

(352,632) |

|

Net change in unrealized gains (losses) on

investments |

(257,569) |

|

Net realized and unrealized gains (losses) on

investments |

(610,201) |

|

Net increase in net assets resulting from

operations |

6,643,152 |

| Year

ended January 31, 2021 |

Year

ended January 31, 2020 | |||

| Operations | ||||

|

Net investment

income |

$ 7,253,353 | $ 36,632,698 | ||

|

Net realized gains (losses) on

investments |

(352,632) | 34,071 | ||

|

Net change in unrealized gains (losses) on

investments |

(257,569) | 127,430 | ||

|

Net increase in net assets resulting from

operations |

6,643,152 | 36,794,199 | ||

| Distributions to shareholders from | ||||

| Net investment income and net realized gains | ||||

|

Administrator

Class |

(367,268) | (2,407,953) | ||

|

Institutional

Class |

(3,236,653) | (14,579,571) | ||

|

Select

Class |

(3,408,258) | (17,436,431) | ||

|

Service

Class |

(275,245) | (2,226,786) | ||

|

Total distributions to

shareholders |

(7,287,424) | (36,650,741) | ||

| Capital share transactions | Shares | Shares | ||

| Proceeds from shares sold | ||||

|

Administrator

Class |

117,756,578 | 117,828,491 | 166,638,886 | 166,722,945 |

|

Institutional

Class |

1,779,808,479 | 1,781,045,245 | 1,831,980,290 | 1,832,914,828 |

|

Select

Class |

1,623,159,099 | 1,624,541,813 | 1,684,650,000 | 1,685,556,431 |

|

Service

Class |

622,882,821 | 623,346,385 | 602,544,349 | 602,908,075 |

| 4,146,761,934 | 4,288,102,279 | |||

| Reinvestment of distributions | ||||

|

Administrator

Class |

349,014 | 349,206 | 2,313,623 | 2,314,813 |

|

Institutional

Class |

3,231,274 | 3,233,176 | 14,345,607 | 14,353,032 |

|

Select

Class |

3,203,697 | 3,205,915 | 17,299,112 | 17,308,618 |

|

Service

Class |

277,096 | 277,277 | 2,160,753 | 2,162,060 |

| 7,065,574 | 36,138,523 | |||

| Payment for shares redeemed | ||||

|

Administrator

Class |

(142,515,034) | (142,594,551) | (186,852,404) | (186,947,329) |

|

Institutional

Class |

(2,180,435,890) | (2,181,933,989) | (1,509,798,838) | (1,510,574,286) |

|

Select

Class |

(2,043,656,029) | (2,044,615,162) | (1,431,658,767) | (1,432,436,357) |

|

Service

Class |

(621,166,999) | (621,629,116) | (652,883,191) | (653,275,838) |

| (4,990,772,818) | (3,783,233,810) | |||

|

Net increase (decrease) in net assets resulting from capital share

transactions |

(836,945,310) | 541,006,992 | ||

|

Total increase (decrease) in net

assets |

(837,589,582) | 541,150,450 | ||

| Net assets | ||||

|

Beginning of

period |

2,081,059,919 | 1,539,909,469 | ||

|

End of

period |

$ 1,243,470,337 | $ 2,081,059,919 | ||

| Year ended January 31 | |||||

| Administrator Class | 2021 | 2020 | 2019 | 2018 | 2017 |

|

Net asset value, beginning of

period |

$1.0006 | $1.0005 | $1.0005 | $1.0004 | $1.0000 |

|

Net investment

income |

0.0033 | 0.0202 | 0.0189 | 0.0096 | 0.0029 |

|

Net realized and unrealized gains (losses) on

investments |

(0.0001) | 0.0001 | 0.0000 1 | 0.0001 | 0.0004 |

|

Total from investment

operations |

0.0032 | 0.0203 | 0.0189 | 0.0097 | 0.0033 |

| Distributions to shareholders from | |||||

|

Net investment