Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-09253

Wells Fargo Funds Trust

(Exact name of registrant as specified in charter)

525 Market St., San Francisco, CA 94105

(Address of principal executive offices) (Zip code)

Catherine Kennedy

Wells Fargo Funds Management, LLC

525 Market St., San Francisco, CA 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-222-8222

Date of fiscal year end: April 30, 2020

Registrant is making a filing for 1 of its series: Wells Fargo Absolute Return Fund.

Date of reporting period: April 30, 2020

Table of Contents

| ITEM 1. | REPORT TO STOCKHOLDERS |

Table of Contents

Wells Fargo Absolute Return Fund

Beginning on January 1, 2021, as permitted by new regulations adopted by the Securities and Exchange Commission, paper copies of the Wells Fargo Funds’ annual and semi-annual shareholder reports issued after this date will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Funds’ website, and you will be notified by mail each time a report is posted and provided with a website address to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically at any time by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by calling 1-800-222-8222 or by enrolling at wellsfargo.com/advantagedelivery.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports; if you invest directly with the Fund, you can call 1-800-222-8222. Your election to receive reports in paper will apply to all Wells Fargo Funds held in your account with your financial intermediary or, if you are a direct investor, to all Wells Fargo Funds that you hold.

Table of Contents

The views expressed and any forward-looking statements are as of April 30, 2020, unless otherwise noted, and are those of the Fund managers and/or Wells Fargo Asset Management. Discussions of individual securities, or the markets generally, or any Wells Fargo Fund are not intended as individual recommendations. Future events or results may vary significantly from those expressed in any forward-looking statements. The views expressed are subject to change at any time in response to changing circumstances in the market. Wells Fargo Asset Management and the Fund disclaim any obligation to publicly update or revise any views expressed or forward-looking statements.

INVESTMENT PRODUCTS: NOT FDIC INSURED ◾ NO BANK GUARANTEE ◾ MAY LOSE VALUE

Wells Fargo Absolute Return Fund | 1

Table of Contents

Letter to shareholders (unaudited)

| 1 | The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-value-weighted index with each stock’s weight in the index proportionate to its market value. You cannot invest directly in an index. |

| 2 | The Morgan Stanley Capital International (MSCI) All Country World Index (ACWI) ex USA Index (Net) is a free-float-adjusted market-capitalization-weighted index that is designed to measure the equity market performance of developed markets, excluding the United States. Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. You cannot invest directly in an index. |

| 3 | The MSCI Emerging Markets (EM) Index (Net) is a free-float-adjusted market-capitalization-weighted index that is designed to measure equity market performance of emerging markets. You cannot invest directly in an index. |

| 4 | The Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable-rate mortgage pass-throughs), asset-backed securities, and commercial mortgage-backed securities. You cannot invest directly in an index. |

| 5 | The Bloomberg Barclays Global Aggregate ex-USD Index is an unmanaged index that provides a broad-based measure of the global investment-grade fixed-income markets excluding the U.S. dollar-denominated debt market. You cannot invest directly in an index. |

| 6 | The Bloomberg Barclays Municipal Bond Index is an unmanaged index composed of long-term tax-exempt bonds with a minimum credit rating of Baa. You cannot invest directly in an index. |

| 7 | The ICE BofA U.S. High Yield Index is a market-capitalization-weighted index of domestic and Yankee high-yield bonds. The index tracks the performance of high-yield securities traded in the U.S. bond market. You cannot invest directly in an index. Copyright 2020. ICE Data Indices, LLC. All rights reserved. |

2 | Wells Fargo Absolute Return Fund

Table of Contents

Letter to shareholders (unaudited)

Wells Fargo Absolute Return Fund | 3

Table of Contents

Letter to shareholders (unaudited)

4 | Wells Fargo Absolute Return Fund

Table of Contents

This page is intentionally left blank.

Table of Contents

Performance highlights (unaudited)

Investment objective

The Fund seeks a positive total return.

Manager

Wells Fargo Funds Management, LLC

Portfolio managers

Ben Inker, CFA®‡1

John Thorndike*1

Average annual total returns (%) as of April 30, 2020

| Including sales charge | Excluding sales charge | Expense ratios2 (%) | ||||||||||||||||||||||||||||||||

| Inception date | 1 year | 5 year | 10 year | 1 year | 5 year | 10 year | Gross | Net3 | ||||||||||||||||||||||||||

| Class A (WARAX)4 | 3-1-2012 | -12.33 | -1.32 | 1.94 | -6.99 | -0.15 | 2.54 | 1.53 | 1.53 | |||||||||||||||||||||||||

| Class C (WARCX)5 | 3-1-2012 | -8.73 | -0.90 | 1.77 | -7.73 | -0.90 | 1.77 | 2.28 | 2.28 | |||||||||||||||||||||||||

| Class R (WARHX)6 | 9-30-2015 | – | – | – | -7.10 | -0.36 | 2.49 | 1.78 | 1.78 | |||||||||||||||||||||||||

| Class R6 (WARRX)7 | 10-31-2014 | – | – | – | -6.57 | 0.31 | 2.93 | 1.10 | 1.10 | |||||||||||||||||||||||||

| Administrator Class (WARDX)8 | 3-1-2012 | – | – | – | -6.85 | -0.05 | 2.68 | 1.45 | 1.41 | |||||||||||||||||||||||||

| Institutional Class (WABIX)9 | 11-30-2012 | – | – | – | -6.65 | 0.20 | 2.88 | 1.20 | 1.17 | |||||||||||||||||||||||||

| MSCI ACWI Index (Net)10 | – | – | – | – | -4.96 | 4.37 | 6.94 | – | – | |||||||||||||||||||||||||

| Bloomberg Barclays U.S. TIPS 1-10 Year Index11 | – | – | – | – | 6.16 | 2.41 | 2.58 | – | – | |||||||||||||||||||||||||

| CPI12 | – | – | – | – | 0.33 | 1.62 | 1.63 | – | – | |||||||||||||||||||||||||

Figures quoted represent past performance, which is no guarantee of future results, and do not reflect taxes that a shareholder may pay on an investment in a fund. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance shown without sales charges would be lower if sales charges were reflected. Current performance may be lower or higher than the performance data quoted, which assumes the reinvestment of dividends and capital gains. Current month-end performance is available on the Fund’s website, wfam.com.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses, or any taxes. It is not possible to invest directly in an index.

For Class A shares, the maximum front-end sales charge is 5.75%. For Class C shares, the maximum contingent deferred sales charge is 1.00%. Performance including a contingent deferred sales charge assumes the sales charge for the corresponding time period. Class R, Class R6, Administrator Class, and Institutional Class shares are sold without a front-end sales charge or contingent deferred sales charge.

Absolute return funds are not intended to outperform stocks and bonds in strong markets, and there is no guarantee of positive returns or that the Fund’s objectives will be achieved. Stock values fluctuate in response to the activities of individual companies and general market and economic conditions. Bond values fluctuate in response to the financial condition of individual issuers, general market and economic conditions, and changes in interest rates. Changes in market conditions and government policies may lead to periods of heightened volatility in the bond market and reduced liquidity for certain bonds held by the Fund. In general, when interest rates rise, bond values fall and investors may lose principal value. Interest rate changes and their impact on the Fund and its share price can be sudden and unpredictable. Borrowing money to purchase securities or to cover short positions magnifies losses and incurs expenses. Short selling is generally considered speculative, has the potential for unlimited loss, and may involve leverage. Alternative investments, such as commodities and merger arbitrage strategies, are speculative and entail a high degree of risk. Foreign investments are especially volatile and can rise or fall dramatically due to differences in the political and economic conditions of the host country. The Fund will indirectly be exposed to all of the risks of an investment in the underlying funds and will indirectly bear expenses of the underlying funds. The use of derivatives may reduce returns and/or increase volatility. Certain investment strategies tend to increase the total risk of an investment (relative to the broader market). The Fund is exposed to asset-backed securities risk, non-diversified funds risk, geographic risk, and smaller company securities risk. Consult the Fund’s prospectus for additional information on these and other risks.

Please see footnotes on pages 7-8.

6 | Wells Fargo Absolute Return Fund

Table of Contents

Performance highlights (unaudited)

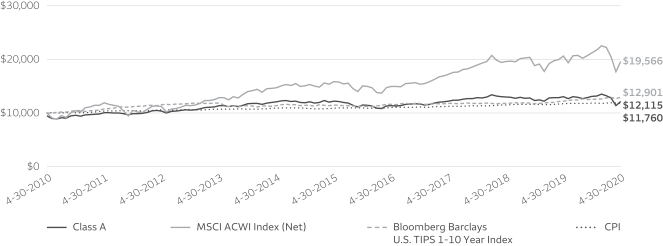

| Growth of $10,000 investment as of April 30, 202013 |

|

|

| ‡ | CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute. |

| * | Mr. Thorndike became a portfolio manager on July 1, 2019. |

| 1 | The Fund invests substantially all of its investable assets directly in GMO Benchmark-Free Allocation Fund, an investment company advised by Grantham, Mayo, Van Otterloo & Co. LLC (GMO). Mr. Inker and Mr. Thorndike have been responsible for coordinating the portfolio management of GMO Benchmark-Free Allocation Fund since 2003 and 2019, respectively. |

| 2 | Reflects the expense ratios as stated in the most recent prospectuses, which include the impact of 0.84% in acquired fund fees and expenses and underlying GMO fees. The expense ratios shown are subject to change and may differ from the annualized expense ratios shown in the financial highlights of this report, which do not include the expenses of GMO Benchmark-Free Allocation Fund and other acquired fund fees and expenses. |

| 3 | The manager has contractually committed through August 31, 2020, to waive fees and/or reimburse expenses to the extent necessary to cap total annual fund operating expenses after fee waivers at 0.71% for Class A, 1.46% for Class C, 0.96% for Class R, 0.28% for Class R6, 0.57% for Administrator Class, and 0.33% for Institutional Class. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses (if any, including the expenses of GMO Benchmark-Free Allocation Fund), and extraordinary expenses are excluded from the expense cap. Prior to or after the commitment expiration date, the cap may be increased or the commitment to maintain the cap may be terminated only with the approval of the Board of Trustees. Without this cap, the Fund’s returns would have been lower. The expense ratio paid by an investor is the net expense ratio (the total annual fund operating expenses after fee waivers) as stated in the prospectuses. |

| 4 | Historical performance shown for the Class A shares prior to their inception is based on the performance of the Class III shares of GMO Benchmark- Free Allocation Fund. The inception date of the GMO Benchmark-Free Allocation Fund Class III shares is July 23, 2003. Returns for the Class III shares do not reflect the GMO Benchmark-Free Allocation Fund’s current fee arrangement and have been adjusted downward to reflect the higher expense ratios applicable to the Class A shares at its inception. The ratio for the Class A shares was 1.66%. |

| 5 | Historical performance shown for the Class C shares prior to their inception is based on the performance of the Class III shares of GMO Benchmark- Free Allocation Fund. The inception date of the GMO Benchmark-Free Allocation Fund Class III shares is July 23, 2003. Returns for the Class III shares do not reflect the GMO Benchmark-Free Allocation Fund’s current fee arrangement and have been adjusted downward to reflect the higher expense ratios applicable to the Class C shares at its inception. The ratio for the Class C shares was 2.41%. |

| 6 | Historical performance shown for the Class R shares prior to their inception reflects the performance of the Administrator Class shares, and have been adjusted to reflect the Class R share expenses. |

| 7 | Historical performance shown for the Class R6 shares prior to their inception reflects the performance of the Institutional Class shares, and includes the higher expenses applicable to the Institutional Class shares. If these expenses had not been included, returns for the Class R6 shares would be higher. |

| 8 | Historical performance shown for the Administrator Class shares prior to their inception is based on the performance of the Class III shares of GMO Benchmark-Free Allocation Fund. The inception date of the GMO Benchmark-Free Allocation Fund Class III shares is July 23, 2003. Returns for the Class III shares do not reflect the GMO Benchmark-Free Allocation Fund’s current fee arrangement and have been adjusted downward to reflect the higher expense ratios applicable to the Administrator Class shares at its inception. The ratio for the Administrator Class shares was 1.50%. |

| 9 | Historical performance shown for the Institutional Class shares prior to their inception reflects the performance of the Administrator Class shares, and includes the higher expenses applicable to the Administrator Class shares. If these expenses had not been included, returns for the Institutional Class shares would be higher. |

| 10 | The Morgan Stanley Capital International (MSCI) All Country World Index (ACWI) Index (Net) is a free-float-adjusted market-capitalization-weighted index that is designed to measure the equity market performance of developed and emerging markets. Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indexes or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. You cannot invest directly in an index. |

| 11 | The Bloomberg Barclays U.S. Treasury Inflation-Protected Securities (TIPS) 1-10 Year Index is an unmanaged index of U.S. Treasury securities with maturities of less than 10 years and more than 1 year. You cannot invest directly in an index. |

Wells Fargo Absolute Return Fund | 7

Table of Contents

Performance highlights (unaudited)

| 12 | The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. You cannot invest directly in an index. |

| 13 | The chart compares the performance of Class A shares for the most recent ten years with the performance of the MSCI ACWI Index (Net), Bloomberg Barclays U.S. TIPS 1-10 Year Index, and the CPI. The chart assumes a hypothetical investment of $10,000 in Class A shares and reflects all operating expenses and assumes the maximum initial sales charge of 5.75%. |

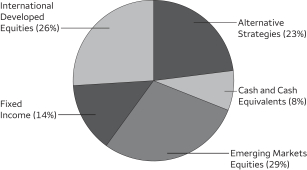

| 14 | The holdings, excluding cash, cash equivalents and any money market funds, are calculated based on the value of the investments held by GMO Benchmark-Free Allocation Fund divided by total net assets of the Fund. Holdings are subject to change and may have changed since the date specified. |

| 15 | The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-value-weighted index with each stock’s weight in the index proportionate to its market value. You cannot invest directly in an index. |

| 16 | The MSCI Europe, Australasia, Far East (EAFE) Index (Net) is a free-float-adjusted market-capitalization-weighted index that is designed to measure the equity market performance of developed markets, excluding the United States and Canada. You cannot invest directly in an index. |

| 17 | The MSCI Emerging Markets (EM) Index (Net) is a free-float-adjusted market-capitalization-weighted index that is designed to measure equity market performance of emerging markets. You cannot invest directly in an index. |

| 18 | Portfolio allocation represents the portfolio allocation of the GMO Benchmark-Free Allocation Fund, which is calculated based on the investment exposures of the underlying GMO funds. Portfolio allocation is subject to change and may have changed since the date specified. |

| 19 | The Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable-rate mortgage pass-throughs), asset-backed securities, and commercial mortgage-backed securities. You cannot invest directly in an index. |

8 | Wells Fargo Absolute Return Fund

Table of Contents

Performance highlights (unaudited)

MANAGER’S DISCUSSION

Fund highlights

| ∎ | The Fund underperformed the MSCI ACWI Index (Net), the Bloomberg Barclays U.S. TIPS 1–10 Year Index, and the CPI for the 12-month period that ended April 30, 2020. |

| ∎ | Investments in equities in non-U.S. emerging and developed markets detracted as non-U.S. equities declined and trailed U.S. stocks. Investments in alternatives also detracted from performance. |

| ∎ | The Fund’s fixed-income and cash/cash-plus allocations contributed to performance. |

Emerging market equities and alternatives detracted.

Investments in emerging markets detracted most from portfolio returns on an absolute basis. Country and sector selection helped modestly, but the overall direction of the decline hurt performance. The value bias of our equity portfolios also acted as a detractor, as value stocks underperformed growth stocks globally. Alternative strategies delivered a modestly negative return on the year, but they acted as a diversifier and hedge against the global risk collapse. The special opportunities, fixed-income absolute return, and merger arbitrage all delivered positive absolute returns, while some of the spread trades and the systematic global macro strategy detracted. Our credit-oriented strategies suffered at the hands of the coronavirus risk sell-off.

decimated both the demand and the supply side of a normal economic equation. Global equities, represented by the MSCI ACWI Index (Net), went down 5.0%. U.S. stocks recorded losses of 0.9%, as measured by the S&P 500 Index15. Non-U.S. developed markets, as measured by the MSCI EAFE Index (Net)16, fell by 11.3%, while emerging markets fell 12.0%, as measured the MSCI EM Index (Net)17.

We made a number of portfolio allocation changes as valuations and market conditions changed.

Much of the activity was in March and April 2020, as equity, credit, and bond prices moved dramatically in response to the coronavirus. Overall, our equity allocation increased to 55%. We added to our emerging equity positions and our developed ex-U.S. positions and we instituted a cyclical focus strategy in early April.

Our alternatives allocation declined throughout the year to end at 23%, as more traditional risk assets became more attractive from a valuation perspective during the risk sell-off. We sold out of our MSCI EAFE Index (Net) versus S&P 500 Index position and we trimmed our fixed-income absolute return strategy.

Please see footnotes on pages 7-8.

Wells Fargo Absolute Return Fund | 9

Table of Contents

Performance highlights (unaudited)

The overall exposure to our fixed-income allocation decreased to 14% as we sold off our TIPS position, essentially taking profits as real rates declined. We added to high-yield bonds modestly.

The portfolio’s allocation to cash/cash-plus increased 5%.

Going forward, we see value in international stocks (primarily emerging market value and developed ex-U.S. equities), credit, and select alternative strategies.

We believe that equity markets, especially emerging markets, are priced to deliver double-digit real rates of return. Further, their currencies are some of the weakest we have seen in decades, so we could see additional returns coming from currency appreciation. We maintain a value bias wherever we own stocks, as the valuation disparity between growth and value is some of the widest we have witnessed in our investing careers.

Our outlook for U.S. and developed ex-U.S. sovereign debt, as well as TIPS, remains negative to muted, at best. It is important to note that in the U.S, government bond yields are basically the lowest we have seen in the history of the country.

Alternative strategies offer a diversifying way to pursue returns with less duration than traditional stocks and bonds. They remain an important part of the portfolio as we use them to generate returns in nontraditional manners.

Please see footnotes on pages 7-8.

10 | Wells Fargo Absolute Return Fund

Table of Contents

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and contingent deferred sales charges (if any) on redemptions and (2) ongoing costs, including management fees, distribution (12b-1) and/or shareholder servicing fees, and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the six-month period and held for the entire period from November 1, 2019 to April 30, 2020.

Actual expenses

The “Actual” line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the “Actual” line under the heading entitled “Expenses paid during period” for your applicable class of shares to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The “Hypothetical” line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) and contingent deferred sales charges. Therefore, the “Hypothetical” line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Wells Fargo Absolute Return Fund (excluding GMO Benchmark-Free Allocation Fund and its underlying fund expenses) |

Beginning account value 11-1-2019 |

Ending account value 4-30-2020 |

Expenses paid during the period¹ |

Annualized net expense ratio |

||||||||||||

| Class A |

||||||||||||||||

| Actual |

$ | 1,000.00 | $ | 928.46 | $ | 3.26 | 0.68 | % | ||||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,021.48 | $ | 3.42 | 0.68 | % | ||||||||

| Class C |

||||||||||||||||

| Actual |

$ | 1,000.00 | $ | 924.43 | $ | 6.84 | 1.43 | % | ||||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,017.75 | $ | 7.17 | 1.43 | % | ||||||||

| Class R |

||||||||||||||||

| Actual |

$ | 1,000.00 | $ | 928.12 | $ | 3.84 | 0.80 | % | ||||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,020.89 | $ | 4.02 | 0.80 | % | ||||||||

| Class R6 |

||||||||||||||||

| Actual |

$ | 1,000.00 | $ | 930.12 | $ | 1.20 | 0.25 | % | ||||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,023.62 | $ | 1.26 | 0.25 | % | ||||||||

| Administrator Class |

||||||||||||||||

| Actual |

$ | 1,000.00 | $ | 928.98 | $ | 2.73 | 0.57 | % | ||||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,022.03 | $ | 2.87 | 0.57 | % | ||||||||

| Institutional Class |

||||||||||||||||

| Actual |

$ | 1,000.00 | $ | 930.19 | $ | 1.58 | 0.33 | % | ||||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,023.22 | $ | 1.66 | 0.33 | % | ||||||||

| 1 | Expenses paid is equal to the annualized net expense ratio of each class multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year divided by the number of days in the fiscal year (to reflect the one-half-year period). |

Wells Fargo Absolute Return Fund | 11

Table of Contents

Fund expenses (unaudited)

| Wells Fargo Absolute Return Fund (including GMO Benchmark-Free Allocation Fund and its underlying fund expenses) |

Beginning account value 11-1-2019 |

Ending account value 4-30-2020 |

Expenses paid during the period¹ |

Annualized net expense ratio |

||||||||||||

| Class A |

||||||||||||||||

| Actual |

$ | 1,000.00 | $ | 928.46 | $ | 7.14 | 1.49 | % | ||||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,017.45 | $ | 7.47 | 1.49 | % | ||||||||

| Class C |

||||||||||||||||

| Actual |

$ | 1,000.00 | $ | 924.43 | $ | 10.72 | 2.24 | % | ||||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,013.72 | $ | 11.22 | 2.24 | % | ||||||||

| Class R |

||||||||||||||||

| Actual |

$ | 1,000.00 | $ | 928.12 | $ | 7.72 | 1.61 | % | ||||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,016.86 | $ | 8.07 | 1.61 | % | ||||||||

| Class R6 |

||||||||||||||||

| Actual |

$ | 1,000.00 | $ | 930.12 | $ | 5.09 | 1.06 | % | ||||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,019.59 | $ | 5.32 | 1.06 | % | ||||||||

| Administrator Class |

||||||||||||||||

| Actual |

$ | 1,000.00 | $ | 928.98 | $ | 6.62 | 1.38 | % | ||||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,018.00 | $ | 6.92 | 1.38 | % | ||||||||

| Institutional Class |

||||||||||||||||

| Actual |

$ | 1,000.00 | $ | 930.19 | $ | 5.47 | 1.14 | % | ||||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,019.19 | $ | 5.72 | 1.14 | % | ||||||||

| 1 | Expenses paid is equal to the annualized net expense ratio of each class multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year divided by the number of days in the fiscal year (to reflect the one-half-year period). |

12 | Wells Fargo Absolute Return Fund

Table of Contents

Portfolio of investments—April 30, 2020

| Shares | Value | |||||||||||||||

| Investment Companies: 98.13% | ||||||||||||||||

| GMO Benchmark-Free Allocation Fund Class MF (l) |

93,011,881 | $ | 2,259,258,586 | |||||||||||||

|

|

|

|||||||||||||||

| Total Investment Companies (Cost $2,238,667,883) |

2,259,258,586 | |||||||||||||||

|

|

|

|||||||||||||||

| Total investments in securities (Cost $2,238,667,883) | 98.13 | % | 2,259,258,586 | |||||

| Other assets and liabilities, net |

1.87 | 43,072,519 | ||||||

|

|

|

|

|

|||||

| Total net assets | 100.00 | % | $ | 2,302,331,105 | ||||

|

|

|

|

|

|||||

| (l) | The issuer of the security is an affiliated person of the Fund as defined in the Investment Company Act of 1940. |

Investments in Affiliates

An affiliated investment is an investment in which the Fund owns at least 5% of the outstanding voting shares of the issuer or as a result of other relationships, such as the Fund and the issuer having the same investment manager. Transactions with issuers that were either affiliated persons of the Fund at the beginning of the period or the end of the period were as follows:

| Shares, beginning of period |

Shares purchased |

Shares sold |

Shares, end of period |

Net realized gains |

Capital gain distributions from affiliated investment companies |

Net change in unrealized gains (losses) |

Dividends from affiliated investment companies |

Value, end of period |

% of net assets |

|||||||||||||||||||||||||||||||

| Investment Companies | ||||||||||||||||||||||||||||||||||||||||

| GMO Benchmark-Free Allocation Fund Class MF |

142,644,949 | 4,694,853 | (54,327,921 | ) | 93,011,881 | $ | 13,381,916 | $ | 977,687 | $ | (314,690,632 | ) | $ | 107,475,080 | $ | 2,259,258,586 | 98.13 | % | ||||||||||||||||||||||

The accompanying notes are an integral part of these financial statements.

Wells Fargo Absolute Return Fund | 13

Table of Contents

Statement of assets and liabilities—April 30, 2020

| Assets |

||||

| Investments in affiliated investment companies, at value (cost $2,238,667,883) |

$ | 2,259,258,586 | ||

| Cash |

44,100,042 | |||

| Receivable for investments sold |

5,899,958 | |||

| Receivable for Fund shares sold |

2,033,271 | |||

|

|

|

|||

| Total assets |

2,311,291,857 | |||

|

|

|

|||

| Liabilities |

||||

| Payable for Fund shares redeemed |

7,262,365 | |||

| Management fee payable |

359,536 | |||

| Administration fees payable |

277,101 | |||

| Distribution fees payable |

154,211 | |||

| Shareholder report expenses payable |

636,469 | |||

| Trustees’ fees and expenses payable |

5,402 | |||

| Accrued expenses and other liabilities |

265,668 | |||

|

|

|

|||

| Total liabilities |

8,960,752 | |||

|

|

|

|||

| Total net assets |

$ | 2,302,331,105 | ||

|

|

|

|||

| Net assets consist of |

||||

| Paid-in capital |

$ | 2,770,296,272 | ||

| Total distributable loss |

(467,965,167 | ) | ||

|

|

|

|||

| Total net assets |

$ | 2,302,331,105 | ||

|

|

|

|||

| Computation of net asset value and offering price per share |

||||

| Net assets – Class A |

$ | 297,590,336 | ||

| Shares outstanding – Class A1 |

29,430,870 | |||

| Net asset value per share – Class A |

$10.11 | |||

| Maximum offering price per share – Class A2 |

$10.73 | |||

| Net assets – Class C |

$ | 254,484,827 | ||

| Shares outstanding – Class C1 |

25,564,635 | |||

| Net asset value per share – Class C |

$9.95 | |||

| Net assets – Class R |

$ | 26,818 | ||

| Shares outstanding – Class R1 |

2,597 | |||

| Net asset value per share – Class R |

$10.33 | |||

| Net assets – Class R6 |

$ | 25,362,917 | ||

| Shares outstanding – Class R61 |

2,508,036 | |||

| Net asset value per share – Class R6 |

$10.11 | |||

| Net assets – Administrator Class |

$ | 60,846,470 | ||

| Shares outstanding – Administrator Class1 |

5,993,888 | |||

| Net asset value per share – Administrator Class |

$10.15 | |||

| Net assets – Institutional Class |

$ | 1,664,019,737 | ||

| Shares outstanding – Institutional Class1 |

164,570,667 | |||

| Net asset value per share – Institutional Class |

$10.11 | |||

| 1 | The Fund has an unlimited number of authorized shares. |

| 2 | Maximum offering price is computed as 100/94.25 of net asset value. On investments of $50,000 or more, the offering price is reduced. |

The accompanying notes are an integral part of these financial statements.

14 | Wells Fargo Absolute Return Fund

Table of Contents

Statement of operations—year ended April 30, 2020

| Investment income |

||||

| Dividends from affiliated investment companies |

$ | 107,475,080 | ||

|

|

|

|||

| Expenses |

||||

| Management fee |

6,749,338 | |||

| Administration fees |

||||

| Class A |

762,377 | |||

| Class C |

715,496 | |||

| Class R |

218 | |||

| Class R6 |

8,947 | |||

| Administrator Class |

116,547 | |||

| Institutional Class |

3,154,244 | |||

| Shareholder servicing fees |

||||

| Class A |

907,580 | |||

| Class C |

851,675 | |||

| Class R |

259 | |||

| Administrator Class |

222,994 | |||

| Distribution fees |

||||

| Class C |

2,554,069 | |||

| Class R |

224 | |||

| Custody and accounting fees |

23,098 | |||

| Professional fees |

37,994 | |||

| Registration fees |

157,736 | |||

| Shareholder report expenses |

293,660 | |||

| Trustees’ fees and expenses |

21,370 | |||

| Other fees and expenses |

109,876 | |||

|

|

|

|||

| Total expenses |

16,687,702 | |||

| Less: Fee waivers and/or expense reimbursements |

||||

| Administrator Class |

(32,707 | ) | ||

| Institutional Class |

(667,590 | ) | ||

|

|

|

|||

| Net expenses |

15,987,405 | |||

|

|

|

|||

| Net investment income |

91,487,675 | |||

|

|

|

|||

| Realized and unrealized gains (losses) on investments |

||||

| Net realized gains on |

||||

| Affiliated investment companies |

13,381,916 | |||

| Capital gain distributions from affiliated investment companies |

977,687 | |||

|

|

|

|||

| Net realized gains on investments |

14,359,603 | |||

| Net change in unrealized gains (losses) on investments |

(314,690,632 | ) | ||

|

|

|

|||

| Net realized and unrealized gains (losses) on investments |

(300,331,029 | ) | ||

|

|

|

|||

| Net decrease in net assets resulting from operations |

$ | (208,843,354 | ) | |

|

|

|

|||

The accompanying notes are an integral part of these financial statements.

Wells Fargo Absolute Return Fund | 15

Table of Contents

Statement of changes in net assets

| Year ended April 30, 2020 |

Year ended April 30, 2019 |

|||||||||||||||

| Operations |

||||||||||||||||

| Net investment income |

$ | 91,487,675 | $ | 123,856,825 | ||||||||||||

| Net realized gains on investments |

14,359,603 | 26,963,415 | ||||||||||||||

| Net change in unrealized gains (losses) on investments |

(314,690,632 | ) | (179,971,678 | ) | ||||||||||||

|

|

|

|||||||||||||||

| Net decrease in net assets resulting from operations |

(208,843,354 | ) | (29,151,438 | ) | ||||||||||||

|

|

|

|||||||||||||||

| Distributions to shareholders from net investment income and net realized gains |

||||||||||||||||

| Class A |

(9,515,886 | ) | (10,217,417 | ) | ||||||||||||

| Class C |

(5,326,006 | ) | (8,345,831 | ) | ||||||||||||

| Class R |

0 | (6,474 | ) | |||||||||||||

| Class R6 |

(902,716 | ) | (1,041,756 | ) | ||||||||||||

| Administrator Class |

(2,075,107 | ) | (3,430,512 | ) | ||||||||||||

| Institutional Class |

(71,689,413 | ) | (93,999,805 | ) | ||||||||||||

|

|

|

|||||||||||||||

| Total distributions to shareholders |

(89,509,128 | ) | (117,041,795 | ) | ||||||||||||

|

|

|

|||||||||||||||

| Capital share transactions |

Shares | Shares | ||||||||||||||

| Proceeds from shares sold |

||||||||||||||||

| Class A |

4,671,061 | 50,858,864 | 7,986,972 | 88,301,273 | ||||||||||||

| Class C |

591,736 | 6,399,495 | 2,053,878 | 22,241,720 | ||||||||||||

| Class R |

1,073 | 11,764 | 2,443 | 26,736 | ||||||||||||

| Class R6 |

1,034,300 | 11,116,006 | 1,651,351 | 18,478,280 | ||||||||||||

| Administrator Class |

947,480 | 10,476,640 | 1,232,710 | 13,729,288 | ||||||||||||

| Institutional Class |

25,838,753 | 281,518,141 | 58,718,519 | 650,893,240 | ||||||||||||

|

|

|

|||||||||||||||

| 360,380,910 | 793,670,537 | |||||||||||||||

|

|

|

|||||||||||||||

| Reinvestment of distributions |

||||||||||||||||

| Class A |

765,410 | 8,641,478 | 861,308 | 8,966,213 | ||||||||||||

| Class C |

407,464 | 4,539,140 | 715,485 | 7,340,871 | ||||||||||||

| Class R |

0 | 0 | 24 | 250 | ||||||||||||

| Class R6 |

60,641 | 683,427 | 85,080 | 884,829 | ||||||||||||

| Administrator Class |

174,757 | 1,980,001 | 323,161 | 3,373,803 | ||||||||||||

| Institutional Class |

5,261,407 | 59,348,673 | 7,292,254 | 75,839,442 | ||||||||||||

|

|

|

|||||||||||||||

| 75,192,719 | 96,405,408 | |||||||||||||||

|

|

|

|||||||||||||||

| Payment for shares redeemed |

||||||||||||||||

| Class A |

(13,226,374 | ) | (140,904,801 | ) | (16,897,784 | ) | (186,680,701 | ) | ||||||||

| Class C |

(13,728,996 | ) | (145,764,194 | ) | (20,754,440 | ) | (224,380,231 | ) | ||||||||

| Class R |

(22,063 | ) | (241,798 | ) | (11,290 | ) | (125,330 | ) | ||||||||

| Class R6 |

(1,441,527 | ) | (15,854,425 | ) | (2,978,729 | ) | (32,635,193 | ) | ||||||||

| Administrator Class |

(5,579,018 | ) | (60,101,012 | ) | (9,742,126 | ) | (108,442,042 | ) | ||||||||

| Institutional Class |

(125,711,938 | ) | (1,345,767,943 | ) | (174,060,644 | ) | (1,913,506,164 | ) | ||||||||

|

|

|

|||||||||||||||

| (1,708,634,173 | ) | (2,465,769,661 | ) | |||||||||||||

|

|

|

|||||||||||||||

| Net decrease in net assets resulting from capital share transactions |

(1,273,060,544 | ) | (1,575,693,716 | ) | ||||||||||||

|

|

|

|||||||||||||||

| Total decrease in net assets |

(1,571,413,026 | ) | (1,721,886,949 | ) | ||||||||||||

|

|

|

|||||||||||||||

| Net assets |

||||||||||||||||

| Beginning of period |

3,873,744,131 | 5,595,631,080 | ||||||||||||||

|

|

|

|||||||||||||||

| End of period |

$ | 2,302,331,105 | $ | 3,873,744,131 | ||||||||||||

|

|

|

|||||||||||||||

The accompanying notes are an integral part of these financial statements.

16 | Wells Fargo Absolute Return Fund

Table of Contents

(For a share outstanding throughout each period)

| Year ended April 30 | ||||||||||||||||||||

| CLASS A | 2020 | 2019 | 2018 | 2017 | 2016 | |||||||||||||||

| Net asset value, beginning of period |

$11.15 | $11.40 | $10.90 | $10.25 | $11.15 | |||||||||||||||

| Net investment income |

0.29 | 1 | 0.27 | 1 | 0.19 | 1 | 0.08 | 1 | 0.11 | |||||||||||

| Net realized and unrealized gains (losses) on investments |

(1.04 | ) | (0.24 | ) | 0.51 | 0.65 | (0.88 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total from investment operations |

(0.75 | ) | 0.03 | 0.70 | 0.73 | (0.77 | ) | |||||||||||||

| Distributions to shareholders from |

||||||||||||||||||||

| Net investment income |

(0.29 | ) | (0.28 | ) | (0.20 | ) | (0.08 | ) | (0.01 | ) | ||||||||||

| Net realized gains |

0.00 | 0.00 | 0.00 | 0.00 | (0.12 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total distributions to shareholders |

(0.29 | ) | (0.28 | ) | (0.20 | ) | (0.08 | ) | (0.13 | ) | ||||||||||

| Net asset value, end of period |

$10.11 | $11.15 | $11.40 | $10.90 | $10.25 | |||||||||||||||

| Total return2 |

(6.99 | )% | 0.42 | % | 6.45 | % | 7.15 | % | (6.82 | )% | ||||||||||

| Ratios to average net assets (annualized) |

||||||||||||||||||||

| Gross expenses3 |

0.69 | % | 0.69 | % | 0.68 | % | 0.67 | % | 0.68 | % | ||||||||||

| Net expenses3 |

0.69 | % | 0.69 | % | 0.68 | % | 0.67 | % | 0.68 | % | ||||||||||

| Net investment income |

2.68 | % | 2.43 | % | 1.67 | % | 0.78 | % | 0.87 | % | ||||||||||

| Supplemental data |

||||||||||||||||||||

| Portfolio turnover rate |

4 | % | 5 | % | 5 | % | 2 | % | 8 | % | ||||||||||

| Net assets, end of period (000s omitted) |

$297,590 | $415,011 | $516,085 | $586,785 | $1,185,631 | |||||||||||||||

| 1 | Calculated based upon average shares outstanding |

| 2 | Total return calculations do not include any sales charges. |

| 3 | Ratios do not reflect net expenses of GMO Benchmark-Free Allocation Fund, Class MF. Including net expenses allocated from GMO Benchmark-Free Allocation Fund, Class MF, the ratios would be increased by the following amounts: |

| Year ended April 30, 2020 |

0.61 | % | ||

| Year ended April 30, 2019 |

0.60 | % | ||

| Year ended April 30, 2018 |

0.60 | % | ||

| Year ended April 30, 2017 |

0.59 | % | ||

| Year ended April 30, 2016 |

0.59 | % |

The accompanying notes are an integral part of these financial statements.

Wells Fargo Absolute Return Fund | 17

Table of Contents

Financial highlights

(For a share outstanding throughout each period)

| Year ended April 30 | ||||||||||||||||||||

| CLASS C | 2020 | 2019 | 2018 | 2017 | 2016 | |||||||||||||||

| Net asset value, beginning of period |

$10.96 | $11.19 | $10.70 | $10.05 | $11.01 | |||||||||||||||

| Net investment income |

0.12 | 0.19 | 1 | 0.10 | 1 | 0.00 | 1 | 0.01 | 1 | |||||||||||

| Net realized and unrealized gains (losses) on investments |

(0.95 | ) | (0.24 | ) | 0.50 | 0.65 | (0.85 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total from investment operations |

(0.83 | ) | (0.05 | ) | 0.60 | 0.65 | (0.84 | ) | ||||||||||||

| Distributions to shareholders from |

||||||||||||||||||||

| Net investment income |

(0.18 | ) | (0.18 | ) | (0.11 | ) | 0.00 | 0.00 | ||||||||||||

| Net realized gains |

0.00 | 0.00 | 0.00 | 0.00 | (0.12 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total distributions to shareholders |

(0.18 | ) | (0.18 | ) | (0.11 | ) | 0.00 | (0.12 | ) | |||||||||||

| Net asset value, end of period |

$9.95 | $10.96 | $11.19 | $10.70 | $10.05 | |||||||||||||||

| Total return2 |

(7.73 | )% | (0.31 | )% | 5.60 | % | 6.47 | % | (7.59 | )% | ||||||||||

| Ratios to average net assets (annualized) |

||||||||||||||||||||

| Gross expenses3 |

1.44 | % | 1.44 | % | 1.43 | % | 1.42 | % | 1.43 | % | ||||||||||

| Net expenses3 |

1.44 | % | 1.44 | % | 1.43 | % | 1.42 | % | 1.43 | % | ||||||||||

| Net investment income |

1.71 | % | 1.78 | % | 0.88 | % | 0.04 | % | 0.08 | % | ||||||||||

| Supplemental data |

||||||||||||||||||||

| Portfolio turnover rate |

4 | % | 5 | % | 5 | % | 2 | % | 8 | % | ||||||||||

| Net assets, end of period (000s omitted) |

$254,485 | $419,656 | $629,813 | $765,561 | $1,207,967 | |||||||||||||||

| 1 | Calculated based upon average shares outstanding |

| 2 | Total return calculations do not include any sales charges. |

| 3 | Ratios do not reflect net expenses of GMO Benchmark-Free Allocation Fund, Class MF. Including net expenses allocated from GMO Benchmark-Free Allocation Fund, Class MF, the ratios would be increased by the following amounts: |

| Year ended April 30, 2020 |

0.61 | % | ||

| Year ended April 30, 2019 |

0.60 | % | ||

| Year ended April 30, 2018 |

0.60 | % | ||

| Year ended April 30, 2017 |

0.59 | % | ||

| Year ended April 30, 2016 |

0.59 | % |

The accompanying notes are an integral part of these financial statements.

18 | Wells Fargo Absolute Return Fund

Table of Contents

Financial highlights

(For a share outstanding throughout each period)

| Year ended April 30 | ||||||||||||||||||||

| CLASS R | 2020 | 2019 | 2018 | 2017 | 20161 | |||||||||||||||

| Net asset value, beginning of period |

$11.12 | $11.37 | $10.82 | $10.22 | $10.19 | |||||||||||||||

| Net investment income (loss) |

0.12 | 0.27 | 0.12 | 0.13 | (0.05 | )2 | ||||||||||||||

| Net realized and unrealized gains (losses) on investments |

(0.91 | ) | (0.26 | ) | 0.55 | 0.57 | 0.26 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total from investment operations |

(0.79 | ) | 0.01 | 0.67 | 0.70 | 0.21 | ||||||||||||||

| Distributions to shareholders from |

||||||||||||||||||||

| Net investment income |

0.00 | (0.26 | ) | (0.12 | ) | (0.10 | ) | (0.06 | ) | |||||||||||

| Net realized gains |

0.00 | 0.00 | 0.00 | 0.00 | (0.12 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total distributions to shareholders |

0.00 | (0.26 | ) | (0.12 | ) | (0.10 | ) | (0.18 | ) | |||||||||||

| Net asset value, end of period |

$10.33 | $11.12 | $11.37 | $10.82 | $10.22 | |||||||||||||||

| Total return3 |

(7.10 | )% | 0.21 | % | 6.21 | % | 6.91 | % | 2.10 | % | ||||||||||

| Ratios to average net assets (annualized) |

||||||||||||||||||||

| Gross expenses4 |

0.91 | % | 0.85 | % | 0.93 | % | 0.93 | % | 0.93 | % | ||||||||||

| Net expenses4 |

0.91 | % | 0.85 | % | 0.93 | % | 0.93 | % | 0.93 | % | ||||||||||

| Net investment income (loss) |

0.21 | % | 2.42 | % | 0.85 | % | 1.40 | % | (0.92 | )% | ||||||||||

| Supplemental data |

||||||||||||||||||||

| Portfolio turnover rate |

4 | % | 5 | % | 5 | % | 2 | % | 8 | % | ||||||||||

| Net assets, end of period (000s omitted) |

$27 | $262 | $368 | $756 | $56 | |||||||||||||||

| 1 | For the period from September 30, 2015 (commencement of class operations) to April 30, 2016 |

| 2 | Calculated based upon average shares outstanding |

| 3 | Returns for periods of less than one year are not annualized. |

| 4 | Ratios do not reflect net expenses of GMO Benchmark-Free Allocation Fund, Class MF. Including net expenses allocated from GMO Benchmark-Free Allocation Fund, Class MF, the ratios would be increased by the following amounts: |

| Year ended April 30, 2020 |

0.61 | % | ||

| Year ended April 30, 2019 |

0.60 | % | ||

| Year ended April 30, 2018 |

0.60 | % | ||

| Year ended April 30, 2017 |

0.59 | % | ||

| Year ended April 30, 20161 |

0.59 | % |

The accompanying notes are an integral part of these financial statements.

Wells Fargo Absolute Return Fund | 19

Table of Contents

Financial highlights

(For a share outstanding throughout each period)

| Year ended April 30 | ||||||||||||||||||||

| CLASS R6 | 2020 | 2019 | 2018 | 2017 | 2016 | |||||||||||||||

| Net asset value, beginning of period |

$11.15 | $11.41 | $10.91 | $10.26 | $11.18 | |||||||||||||||

| Net investment income |

0.35 | 0.34 | 0.31 | 1 | 0.14 | 1 | 0.10 | 1 | ||||||||||||

| Net realized and unrealized gains (losses) on investments |

(1.05 | ) | (0.27 | ) | 0.45 | 0.64 | (0.82 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total from investment operations |

(0.70 | ) | 0.07 | 0.76 | 0.78 | (0.72 | ) | |||||||||||||

| Distributions to shareholders from |

||||||||||||||||||||

| Net investment income |

(0.34 | ) | (0.33 | ) | (0.26 | ) | (0.13 | ) | (0.08 | ) | ||||||||||

| Net realized gains |

0.00 | 0.00 | 0.00 | 0.00 | (0.12 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total distributions to shareholders |

(0.34 | ) | (0.33 | ) | (0.26 | ) | (0.13 | ) | (0.20 | ) | ||||||||||

| Net asset value, end of period |

$10.11 | $11.15 | $11.41 | $10.91 | $10.26 | |||||||||||||||

| Total return |

(6.57 | )% | 0.86 | % | 6.97 | % | 7.67 | % | (6.42 | )% | ||||||||||

| Ratios to average net assets (annualized) |

||||||||||||||||||||

| Gross expenses2 |

0.26 | % | 0.26 | % | 0.25 | % | 0.25 | % | 0.24 | % | ||||||||||

| Net expenses2 |

0.26 | % | 0.26 | % | 0.25 | % | 0.25 | % | 0.24 | % | ||||||||||

| Net investment income |

3.05 | % | 2.64 | % | 2.69 | % | 1.37 | % | 0.99 | % | ||||||||||

| Supplemental data |

||||||||||||||||||||

| Portfolio turnover rate |

4 | % | 5 | % | 5 | % | 2 | % | 8 | % | ||||||||||

| Net assets, end of period (000s omitted) |

$25,363 | $31,838 | $46,753 | $14,636 | $8,274 | |||||||||||||||

| 1 | Calculated based upon average shares outstanding |

| 2 | Ratios do not reflect net expenses of GMO Benchmark-Free Allocation Fund, Class MF. Including net expenses allocated from GMO Benchmark-Free Allocation Fund, Class MF, the ratios would be increased by the following amounts: |

| Year ended April 30, 2020 |

0.61 | % | ||

| Year ended April 30, 2019 |

0.60 | % | ||

| Year ended April 30, 2018 |

0.60 | % | ||

| Year ended April 30, 2017 |

0.59 | % | ||

| Year ended April 30, 2016 |

0.59 | % |

The accompanying notes are an integral part of these financial statements.

20 | Wells Fargo Absolute Return Fund

Table of Contents

Financial highlights

(For a share outstanding throughout each period)

| Year ended April 30 | ||||||||||||||||||||

| ADMINISTRATOR CLASS | 2020 | 2019 | 2018 | 2017 | 2016 | |||||||||||||||

| Net asset value, beginning of period |

$11.18 | $11.43 | $10.92 | $10.27 | $11.18 | |||||||||||||||

| Net investment income |

0.27 | 1 | 0.27 | 1 | 0.19 | 1 | 0.07 | 1 | 0.14 | 1 | ||||||||||

| Net realized and unrealized gains (losses) on investments |

(1.01 | ) | (0.24 | ) | 0.53 | 0.68 | (0.91 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total from investment operations |

(0.74 | ) | 0.03 | 0.72 | 0.75 | (0.77 | ) | |||||||||||||

| Distributions to shareholders from |

||||||||||||||||||||

| Net investment income |

(0.29 | ) | (0.28 | ) | (0.21 | ) | (0.10 | ) | (0.02 | ) | ||||||||||

| Net realized gains |

0.00 | 0.00 | 0.00 | 0.00 | (0.12 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total distributions to shareholders |

(0.29 | ) | (0.28 | ) | (0.21 | ) | (0.10 | ) | (0.14 | ) | ||||||||||

| Net asset value, end of period |

$10.15 | $11.18 | $11.43 | $10.92 | $10.27 | |||||||||||||||

| Total return |

(6.85 | )% | 0.48 | % | 6.62 | % | 7.31 | % | (6.85 | )% | ||||||||||

| Ratios to average net assets (annualized) |

||||||||||||||||||||

| Gross expenses2 |

0.61 | % | 0.60 | % | 0.60 | % | 0.59 | % | 0.58 | % | ||||||||||

| Net expenses2 |

0.57 | % | 0.57 | % | 0.57 | % | 0.57 | % | 0.57 | % | ||||||||||

| Net investment income |

2.42 | % | 2.44 | % | 1.70 | % | 0.72 | % | 1.31 | % | ||||||||||

| Supplemental data |

||||||||||||||||||||

| Portfolio turnover rate |

4 | % | 5 | % | 5 | % | 2 | % | 8 | % | ||||||||||

| Net assets, end of period (000s omitted) |

$60,846 | $116,871 | $212,965 | $287,532 | $1,409,516 | |||||||||||||||

| 1 | Calculated based upon average shares outstanding |

| 2 | Ratios do not reflect net expenses of GMO Benchmark-Free Allocation Fund, Class MF. Including net expenses allocated from GMO Benchmark-Free Allocation Fund, Class MF, the ratios would be increased by the following amounts: |

| Year ended April 30, 2020 |

0.61 | % | ||

| Year ended April 30, 2019 |

0.60 | % | ||

| Year ended April 30, 2018 |

0.60 | % | ||

| Year ended April 30, 2017 |

0.59 | % | ||

| Year ended April 30, 2016 |

0.59 | % |

The accompanying notes are an integral part of these financial statements.

Wells Fargo Absolute Return Fund | 21

Table of Contents

Financial highlights

(For a share outstanding throughout each period)

| Year ended April 30 | ||||||||||||||||||||

| INSTITUTIONAL CLASS | 2020 | 2019 | 2018 | 2017 | 2016 | |||||||||||||||

| Net asset value, beginning of period |

$11.15 | $11.41 | $10.92 | $10.27 | $11.19 | |||||||||||||||

| Net investment income |

0.33 | 1 | 0.31 | 1 | 0.24 | 0.14 | 0.11 | 1 | ||||||||||||

| Net realized and unrealized gains (losses) on investments |

(1.04 | ) | (0.25 | ) | 0.50 | 0.63 | (0.84 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total from investment operations |

(0.71 | ) | 0.06 | 0.74 | 0.77 | (0.73 | ) | |||||||||||||

| Distributions to shareholders from |

||||||||||||||||||||

| Net investment income |

(0.33 | ) | (0.32 | ) | (0.25 | ) | (0.12 | ) | (0.07 | ) | ||||||||||

| Net realized gains |

0.00 | 0.00 | 0.00 | 0.00 | (0.12 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total distributions to shareholders |

(0.33 | ) | (0.32 | ) | (0.25 | ) | (0.12 | ) | (0.19 | ) | ||||||||||

| Net asset value, end of period |

$10.11 | $11.15 | $11.41 | $10.92 | $10.27 | |||||||||||||||

| Total return |

(6.65 | )% | 0.76 | % | 6.78 | % | 7.58 | % | (6.51 | )% | ||||||||||

| Ratios to average net assets (annualized) |

||||||||||||||||||||

| Gross expenses2 |

0.36 | % | 0.36 | % | 0.35 | % | 0.35 | % | 0.33 | % | ||||||||||

| Net expenses2 |

0.33 | % | 0.33 | % | 0.33 | % | 0.33 | % | 0.32 | % | ||||||||||

| Net investment income |

3.00 | % | 2.82 | % | 2.07 | % | 1.19 | % | 1.05 | % | ||||||||||

| Supplemental data |

||||||||||||||||||||

| Portfolio turnover rate |

4 | % | 5 | % | 5 | % | 2 | % | 8 | % | ||||||||||

| Net assets, end of period (000s omitted) |

$1,664,020 | $2,890,106 | $4,189,647 | $4,091,536 | $4,346,360 | |||||||||||||||

| 1 | Calculated based upon average shares outstanding |

| 2 | Ratios do not reflect net expenses of GMO Benchmark-Free Allocation Fund, Class MF. Including net expenses allocated from GMO Benchmark-Free Allocation Fund, Class MF, the ratios would be increased by the following amounts: |

| Year ended April 30, 2020 |

0.61 | % | ||

| Year ended April 30, 2019 |

0.60 | % | ||

| Year ended April 30, 2018 |

0.60 | % | ||

| Year ended April 30, 2017 |

0.59 | % | ||

| Year ended April 30, 2016 |

0.59 | % |

The accompanying notes are an integral part of these financial statements.

22 | Wells Fargo Absolute Return Fund

Table of Contents

1. ORGANIZATION

Wells Fargo Funds Trust (the “Trust”), a Delaware statutory trust organized on March 10, 1999, is an open-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). As an investment company, the Trust follows the accounting and reporting guidance in Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946, Financial Services – Investment Companies. These financial statements report on the Wells Fargo Absolute Return Fund (the “Fund”) which is a diversified series of the Trust.

The Fund invests all of its investable assets in the GMO Benchmark-Free Allocation Fund (the “Benchmark-Free Allocation Fund”), an investment company managed by Grantham, Mayo, Van Otterloo & Co. LLC (“GMO”). Benchmark-Free Allocation Fund is a fund-of-funds and gains its investment exposures primarily by investing in GMO Implementation Fund. In addition, Benchmark-Free Allocation Fund may invest in other GMO Funds (together with GMO Implementation Fund, the “underlying GMO funds”), whether currently existing or created in the future. These underlying GMO funds may include, among others, GMO High Yield Fund, GMO Emerging Country Debt Fund, GMO Opportunistic Income Fund, GMO Special Opportunities Fund, and the GMO Alternative Funds. GMO Implementation Fund is permitted to invest in any asset class and may engage in merger arbitrage. Benchmark-Free Allocation Fund also may invest directly in securities (including other underlying funds) and derivatives. As of April 30, 2020, the Fund owned 30% of Benchmark-Free Allocation Fund. Because the Fund invests all of its assets in Benchmark-Free Allocation Fund, the shareholders of the Fund bear the fees and expense of Benchmark-Free Allocation Fund, which are not included in the Statement of Operations, but are incurred indirectly because they are considered in the calculation of the net asset value of Benchmark-Free Allocation Fund. As a result, the Fund’s actual expenses may be higher than those of other mutual funds that invest directly in securities.

2. SIGNIFICANT ACCOUNTING POLICIES

The following significant accounting policies, which are consistently followed in the preparation of the financial statements of the Fund, are in conformity with U.S. generally accepted accounting principles which require management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Securities valuation

All investments are valued each business day as of the close of regular trading on the New York Stock Exchange (generally 4 p.m. Eastern Time), although the Fund may deviate from this calculation time under unusual or unexpected circumstances.

The Fund values its investment in Benchmark-Free Allocation Fund at net asset value. The valuation of investments in securities and the underlying funds held by Benchmark-Free Allocation Fund is discussed in the annual report of Benchmark-Free Allocation Fund, which is included in the mailing of this shareholder report. An unaudited Statement of Assets and Liabilities and an unaudited Schedule of Investments for Benchmark-Free Allocation Fund as of April 30, 2020 have also been included as Appendix I in this report for your reference.

Investment transactions and income recognition

Investment transactions in Benchmark-Free Allocation Fund are recorded on a trade date basis. Realized gains and losses resulting from investment transactions in Benchmark-Free Allocation Fund are determined on the identified cost basis.

Income dividends and capital gain distributions from Benchmark-Free Allocation Fund are recorded on the ex-dividend date. Capital gain distributions from Benchmark-Free Allocation Fund are treated as realized gains.

Distributions to shareholders

Distributions to shareholders from net investment income and any net realized gains are recorded on the ex-dividend date and paid at least annually. Such distributions are determined in accordance with income tax regulations and may differ from U.S. generally accepted accounting principles. Dividend sources are estimated at the time of declaration. The tax character of distributions is determined as of the Fund’s fiscal year end. Therefore, a portion of the Fund’s distributions made prior to the Fund’s fiscal year end may be categorized as a tax return of capital at year end.

Federal and other taxes

The Fund intends to continue to qualify as a regulated investment company by distributing substantially all of its investment company taxable income and any net realized capital gains (after reduction for capital loss carryforwards) sufficient to relieve it from all, or substantially all, federal income taxes. Accordingly, no provision for federal income taxes was required.

Wells Fargo Absolute Return Fund | 23

Table of Contents

Notes to financial statements

The Fund’s income and federal excise tax returns and all financial records supporting those returns for the prior three fiscal years are subject to examination by the federal and Delaware revenue authorities. Management has analyzed the Fund’s tax positions taken on federal, state, and foreign tax returns for all open tax years and does not believe that there are any uncertain tax positions that require recognition of a tax liability.

As of April 30, 2020, the aggregate cost of all investments for federal income tax purposes was $2,300,836,638 and the unrealized gains (losses) consisted of:

| Gross unrealized gains |

$ | 0 | ||

| Gross unrealized losses |

(41,578,052 | ) | ||

| Net unrealized losses |

$ | (41,578,052 | ) | |

As of April 30, 2020, the Fund had capital loss carryforwards which consist of $3,231,220 in short-term capital losses and $483,523,717 in long-term capital losses.

Class allocations

The separate classes of shares offered by the Fund differ principally in applicable sales charges, distribution, shareholder servicing, and administration fees. Class specific expenses are charged directly to that share class. Investment income, common fund-level expenses, and realized and unrealized gains (losses) on investments are allocated daily to each class of shares based on the relative proportion of net assets of each class.

3. FAIR VALUATION MEASUREMENTS

Fair value measurements of investments are determined within a framework that has established a fair value hierarchy based upon the various data inputs utilized in determining the value of the Fund’s investments. The three-level hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3). The Fund’s investments are classified within the fair value hierarchy based on the lowest level of input that is significant to the fair value measurement. The inputs are summarized into three broad levels as follows:

| ∎ | Level 1 – quoted prices in active markets for identical securities |

| ∎ | Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| ∎ | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

The inputs or methodologies used for valuing investments in securities are not necessarily an indication of the risk associated with investing in those securities.

At April 30, 2020, the Fund’s investment in Benchmark-Free Allocation Fund was measured at fair value using Level 1 inputs. For the year ended April 30, 2020, the Fund did not have any transfers into/out of Level 3.

4. TRANSACTIONS WITH AFFILIATES

Management fee

Wells Fargo Funds Management, LLC (“Funds Management”), an indirect wholly owned subsidiary of Wells Fargo & Company (“Wells Fargo”), is the manager of the Fund and provides advisory and fund-level administrative services under an investment management agreement. Under the investment management agreement, Funds Management is responsible for, among other services, implementing the investment objectives and strategies of the Fund and providing fund-level administrative services in connection with the Fund’s operations. As compensation for its services under the investment management agreement, Funds Management is entitled to receive a management fee at the following annual rate based on the Fund’s average daily net assets:

| Average daily net assets | Management fee | |||

| First $1 billion |

0.225 | % | ||

| Next $4 billion |

0.200 | |||

| Next $5 billion |

0.175 | |||

| Next $10 billion |

0.165 | |||

| Over $20 billion |

0.160 | |||

24 | Wells Fargo Absolute Return Fund

Table of Contents

Notes to financial statements

For the year ended April 30, 2020, the management fee was equivalent to an annual rate of 0.21% of the Fund’s average daily net assets.

Administration fees

Under a class-level administration agreement, Funds Management provides class-level administrative services to the Fund, which includes paying fees and expenses for services provided by the transfer agent, sub-transfer agents, omnibus account servicers and record-keepers. As compensation for its services under the class-level administration agreement, Funds Management receives an annual fee which is calculated based on the average daily net assets of each class as follows:

| Class-level administration fee |

||||

| Class A, Class C, Class R |

0.21 | % | ||

| Class R6 |

0.03 | |||

| Administrator Class, Institutional Class |

0.13 | |||

Waivers and/or expense reimbursements

Funds Management has contractually waived and/or reimbursed management and administration fees to the extent necessary to maintain certain net operating expense ratios for the Fund. When each class of the Fund has exceeded its expense cap, Funds Management has waived fees and/or reimbursed expenses from fund-level expenses on a proportionate basis and then from class specific expenses. When only certain classes exceed their expense caps, waivers and/or reimbursements are applied against class specific expenses before fund-level expenses. Funds Management has committed through August 31, 2020 to waive fees and/or reimburse expenses to the extent necessary to cap the Fund’s expenses (excluding expenses of Benchmark-Free Allocation Fund and acquired fund fees and expenses) at 0.71% for Class A shares, 1.46% for Class C shares, 0.96% for Class R shares, 0.28% for Class R6 shares, 0.57% for Administrator Class shares, and 0.33% for Institutional Class shares. Prior to or after the commitment expiration date, the cap may be increased or the commitment to maintain the cap may be terminated only with the approval of the Board of Trustees.

Distribution fees

The Trust has adopted a distribution plan for Class C and Class R shares of the Fund pursuant to Rule 12b-1 under the 1940 Act. Distribution fees are charged to Class C and Class R shares and paid to Wells Fargo Funds Distributor, LLC (“Funds Distributor”), the principal underwriter, at an annual rate of 0.75% of the average daily net assets of Class C shares and 0.25% of the average daily net assets of Class R shares.

In addition, Funds Distributor is entitled to receive the front-end sales charge from the purchase of Class A shares and a contingent deferred sales charge on the redemption of certain Class A shares. Funds Distributor is also entitled to receive the contingent deferred sales charges from redemptions of Class C shares. For the year ended April 30, 2020, Funds Distributor received $18,268 from the sale of Class A shares and $142 in contingent deferred sales charges from redemptions of Class C shares. No contingent deferred sales charges were incurred by Class A shares for the year ended April 30, 2020.

Shareholder servicing fees

The Trust has entered into contracts with one or more shareholder servicing agents, whereby Class A, Class C, Class R, and Administrator Class of the Fund are charged a fee at an annual rate of 0.25% of the average daily net assets of each respective class. A portion of these total shareholder servicing fees were paid to affiliates of Wells Fargo.

5. INVESTMENT TRANSACTIONS

For the year ended April 30, 2020, the Fund made aggregate purchases and sales of $126,025,916 and $1,392,622,530, respectively, in its investment in Benchmark-Free Allocation Fund.

6. BANK BORROWINGS

The Trust (excluding the money market funds), Wells Fargo Master Trust and Wells Fargo Variable Trust are parties to a $280,000,000 revolving credit agreement whereby the Fund is permitted to use bank borrowings for temporary or emergency purposes, such as to fund shareholder redemption requests. Interest under the credit agreement is charged to the Fund based on a borrowing rate equal to the higher of the Federal Funds rate in effect on that day plus 1.25% or the overnight LIBOR rate in effect on that day plus 1.25%. In addition, an annual commitment fee equal to 0.25% of the unused balance is allocated to each participating fund.

For the year ended April 30, 2020, there were no borrowings by the Fund under the agreement.

Wells Fargo Absolute Return Fund | 25

Table of Contents

Notes to financial statements

7. DISTRIBUTIONS TO SHAREHOLDERS

The tax character of distributions paid was $89,509,128 and $117,041,795 of ordinary income for the years ended April 30, 2020 and April 30, 2019, respectively.

As of April 30, 2020, the components of distributable earnings on a tax basis were as follows:

| Undistributed ordinary income |

Unrealized losses |

Capital loss carryforward | ||

| $60,367,822 | $(41,578,052) | $(486,754,937) | ||

8. INDEMNIFICATION

Under the Fund’s organizational documents, the officers and Trustees have been granted certain indemnification rights against certain liabilities that may arise out of performance of their duties to the Fund. The Fund has entered into a separate agreement with each Trustee that converts indemnification rights currently existing under the Fund’s organizational documents into contractual rights that cannot be changed in the future without the consent of the Trustee. Additionally, in the normal course of business, the Fund may enter into contracts with service providers that contain a variety of indemnification clauses. The Fund’s maximum exposure under these arrangements is dependent on future claims that may be made against the Fund and, therefore, cannot be estimated.

9. NEW ACCOUNTING PRONOUNCEMENT

In August 2018, FASB issued Accounting Standards Update (“ASU”) No. 2018-13, Fair Value Measurement (Topic 820) Disclosure Framework—Changes to the Disclosure Requirements for Fair Value Measurement. ASU 2018-13 updates the disclosure requirements for fair value measurements by modifying or removing certain disclosures and adding certain new disclosures. The amendments are effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2019. Early adoption is permitted. Management has adopted the removal and modification of disclosures early, as permitted, and will adopt the additional new disclosures at the effective date.

10. CORONAVIRUS (COVID-19) PANDEMIC

On March 11, 2020, the World Health Organization announced that it had made the assessment that coronavirus disease 2019 (“COVID-19”) is a pandemic. The impacts of COVID-19 are adversely affecting the entire global economy, individual companies and investment products, and the market in general. There is significant uncertainty around the extent and duration of business disruptions related to COVID-19 and the impacts may be short term or may last for an extended period of time. The risk of further spreading of COVID-19 has led to significant uncertainty and volatility in the financial markets. The value of the Fund and the securities in which the Fund invests have generally been adversely affected by impacts caused by COVID-19.

26 | Wells Fargo Absolute Return Fund

Table of Contents

Report of independent registered public accounting firm

TO THE SHAREHOLDERS OF THE FUND AND BOARD OF TRUSTEES WELLS FARGO FUNDS TRUST:

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities of Wells Fargo Absolute Return Fund (the Fund), one of the funds constituting Wells Fargo Funds Trust, including the schedule of investments, as of April 30, 2020 , the related statement of operations for the year then ended, the statements of changes in net assets for each of the years in the two-year period then ended, and the related notes (collectively, the financial statements) and the financial highlights for each of the years in the five-year period then ended. In our opinion, the financial statements and financial highlights present fairly, in all material respects, the financial position of the Fund as of April 30, 2020, the results of its operations for the year then ended, the changes in its net assets for each of the years in the two-year period then ended, and the financial highlights for each of the years in the five-year period then ended, in conformity with U.S. generally accepted accounting principles.

Basis for Opinion

These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement, whether due to error or fraud. Our audits included performing procedures to assess the risks of material misstatement of the financial statements and financial highlights, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements and financial highlights. Such procedures also included confirmation of securities owned as of April 30, 2020, by correspondence with the transfer agent. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements and financial highlights. We believe that our audits provide a reasonable basis for our opinion.