Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-09253

Wells Fargo Funds Trust

(Exact name of registrant as specified in charter)

525 Market St., San Francisco, CA 94105

(Address of principal executive offices) (Zip code)

Catherine Kennedy

Wells Fargo Funds Management, LLC

525 Market St., San Francisco, CA 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-222-8222

Date of fiscal year end: August 31

Registrant is making a filing for 9 of its series:

Wells Fargo Adjustable Rate Government Fund, Wells Fargo Conservative Income Fund, Wells Fargo Government Securities Fund, Wells Fargo High Yield Bond Fund, Wells Fargo Core Plus Bond Fund, Wells Fargo Short Duration Government Bond Fund, Wells Fargo Short-Term Bond Fund, Wells Fargo Short-Term High Yield Bond Fund, and Wells Fargo Ultra Short-Term Income Fund.

Date of reporting period: February 29, 2020

Table of Contents

ITEM 1. REPORT TO STOCKHOLDERS

Table of Contents

Wells Fargo Core Plus Bond Fund

Beginning on January 1, 2021, as permitted by new regulations adopted by the Securities and Exchange Commission, paper copies of the Wells Fargo Funds’ annual and semi-annual shareholder reports issued after this date will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Funds’ website, and you will be notified by mail each time a report is posted and provided with a website address to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically at any time by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by calling 1-800-222-8222 or by enrolling at wellsfargo.com/advantagedelivery.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports; if you invest directly with the Fund, you can call 1-800-222-8222. Your election to receive reports in paper will apply to all Wells Fargo Funds held in your account with your financial intermediary or, if you are a direct investor, to all Wells Fargo Funds that you hold.

Table of Contents

The views expressed and any forward-looking statements are as of February 29, 2020, unless otherwise noted, and are those of the Fund managers and/or Wells Fargo Asset Management. Discussions of individual securities, or the markets generally, or any Wells Fargo Fund are not intended as individual recommendations. Future events or results may vary significantly from those expressed in any forward-looking statements. The views expressed are subject to change at any time in response to changing circumstances in the market. Wells Fargo Asset Management and the Fund disclaim any obligation to publicly update or revise any views expressed or forward-looking statements.

Wells Fargo Core Plus Bond Fund | 1

Table of Contents

Letter to shareholders (unaudited)

| 1 | The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-value-weighted index with each stock’s weight in the index proportionate to its market value. You cannot invest directly in an index. |

| 2 | The Morgan Stanley Capital International (MSCI) All Country World Index (ACWI) ex USA Index (Net) is a free-float-adjusted market-capitalization-weighted index that is designed to measure the equity market performance of developed markets, excluding the United States. Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. You cannot invest directly in an index. |

| 3 | The MSCI Emerging Markets (EM) Index (Net) is a free-float-adjusted market-capitalization-weighted index that is designed to measure equity market performance of emerging markets. You cannot invest directly in an index. |

| 4 | The Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable-rate mortgage pass-throughs), asset-backed securities, and commercial mortgage-backed securities. You cannot invest directly in an index. |

| 5 | The Bloomberg Barclays Global Aggregate ex-USD Index is an unmanaged index that provides a broad-based measure of the global investment-grade fixed-income markets excluding the U.S. dollar-denominated debt market. You cannot invest directly in an index. |

| 6 | The Bloomberg Barclays Municipal Bond Index is an unmanaged index composed of long-term tax-exempt bonds with a minimum credit rating of Baa. You cannot invest directly in an index. |

| 7 | The ICE BofA U.S. High Yield Index is a market-capitalization-weighted index of domestic and Yankee high-yield bonds. The index tracks the performance of high-yield securities traded in the U.S. bond market. You cannot invest directly in an index. Copyright 2020. ICE Data Indices, LLC. All rights reserved. |

2 | Wells Fargo Core Plus Bond Fund

Table of Contents

Letter to shareholders (unaudited)

Wells Fargo Core Plus Bond Fund | 3

Table of Contents

Performance highlights (unaudited)

Investment objective

The Fund seeks total return, consisting of current income and capital appreciation.

Manager

Wells Fargo Funds Management, LLC

Subadviser

Wells Capital Management Incorporated

Portfolio managers

Christopher Y. Kauffman, CFA®‡

Jay N. Mueller, CFA®‡

Janet S. Rilling, CFA®‡, CPA

Michael J. Schueller, CFA®‡

Noah M. Wise, CFA®‡

Average annual total returns (%) as of February 29, 2020

| Including sales charge | Excluding sales charge | Expense ratios1 (%) | ||||||||||||||||||||||||||||||||

| Inception date | 1 year | 5 year | 10 year | 1 year | 5 year | 10 year | Gross | Net2 | ||||||||||||||||||||||||||

| Class A (STYAX) | 7-13-1998 | 5.47 | 3.19 | 4.13 | 10.41 | 4.14 | 4.61 | 0.91 | 0.74 | |||||||||||||||||||||||||

| Class C (WFIPX) | 7-13-1998 | 8.60 | 3.36 | 3.84 | 9.60 | 3.36 | 3.84 | 1.66 | 1.49 | |||||||||||||||||||||||||

| Class R6 (STYJX)3 | 10-31-2016 | – | – | – | 10.80 | 4.50 | 4.95 | 0.53 | 0.36 | |||||||||||||||||||||||||

| Administrator Class (WIPDX)4 | 7-30-2010 | – | – | – | 10.55 | 4.26 | 4.74 | 0.85 | 0.63 | |||||||||||||||||||||||||

| Institutional Class (WIPIX) | 7-18-2008 | – | – | – | 10.84 | 4.47 | 4.94 | 0.58 | 0.41 | |||||||||||||||||||||||||

| Bloomberg Barclays U.S. Aggregate Bond Index5 | – | – | – | – | 11.68 | 3.58 | 3.93 | – | – | |||||||||||||||||||||||||

Figures quoted represent past performance, which is no guarantee of future results, and do not reflect taxes that a shareholder may pay on an investment in a fund. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance shown without sales charges would be lower if sales charges were reflected. Current performance may be lower or higher than the performance data quoted, which assumes the reinvestment of dividends and capital gains. Current month-end performance is available on the Fund’s website, wfam.com.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses, or any taxes. It is not possible to invest directly in an index.

For Class A shares, the maximum front-end sales charge is 4.50%. For Class C shares, the maximum contingent deferred sales charge is 1.00%. Performance including a contingent deferred sales charge assumes the sales charge for the corresponding time period. Class R6, Administrator Class, and Institutional Class shares are sold without a front-end sales charge or contingent deferred sales charge.

Bond values fluctuate in response to the financial condition of individual issuers, general market and economic conditions, and changes in interest rates. Changes in market conditions and government policies may lead to periods of heightened volatility in the bond market and reduced liquidity for certain bonds held by the Fund. In general, when interest rates rise, bond values fall and investors may lose principal value. Interest rate changes and their impact on the Fund and its share price can be sudden and unpredictable. Loans are subject to risks similar to those associated with other below-investment-grade bond investments, such as risk of greater volatility in value, credit risk (for example, risk of issuer default), and risk that the loan may become illiquid or difficult to price. The use of derivatives may reduce returns and/or increase volatility. Certain investment strategies tend to increase the total risk of an investment (relative to the broader market). The Fund is exposed to foreign investment risk, high-yield securities risk, and mortgage and asset-backed securities risk. High-yield securities have a greater risk of default and tend to be more volatile than higher rated debt securities. Consult the Fund’s prospectus for additional information on these and other risks.

Please see footnotes on page 5.

4 | Wells Fargo Core Plus Bond Fund

Table of Contents

Performance highlights (unaudited)

| ‡ | CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute. |

| 1 | Reflects the expense ratios as stated in the most recent prospectuses, which include the impact of 0.01% in acquired fund fees and expenses. The expense ratios shown are subject to change and may differ from the annualized expense ratios shown in the financial highlights of this report, which do not include acquired fund fees and expenses. |

| 2 | The manager has contractually committed through December 31, 2020, to waive fees and/or reimburse expenses to the extent necessary to cap total annual fund operating expenses after fee waivers at 0.73% for Class A, 1.48% for Class C, 0.35% for Class R6, 0.62% for Administrator Class, and 0.40% for Institutional Class. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses (if any), and extraordinary expenses are excluded from the expense cap. Prior to or after the commitment expiration date, the cap may be increased or the commitment to maintain the cap may be terminated only with the approval of the Board of Trustees. Without this cap, the Fund’s returns would have been lower. The expense ratio paid by an investor is the net expense ratio (the total annual fund operating expenses after fee waivers) as stated in the prospectuses. |

| 3 | Historical performance shown for the Class R6 shares prior to their inception reflects the performance of the Institutional Class shares, and includes the higher expenses applicable to the Institutional Class shares. If these expenses had not been included, returns for the Class R6 shares would be higher. |

| 4 | Historical performance shown for the Administrator Class shares prior to their inception reflects the performance of the Institutional Class shares and has been adjusted to include the higher expenses applicable to the Administrator Class shares. |

| 5 | The Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment-grade, U.S. dollar–denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable-rate mortgage pass-throughs), asset-backed securities, and commercial mortgage-backed securities. You cannot invest directly in an index. |

| 6 | The ten largest holdings, excluding cash, cash equivalents and any money market funds, are calculated based on the value of the investments divided by total net assets of the Fund. Holdings are subject to change and may have changed since the date specified. |

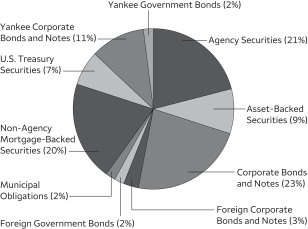

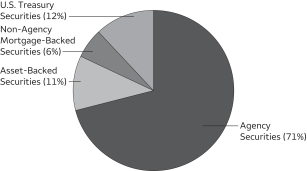

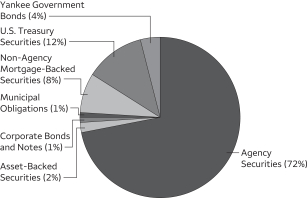

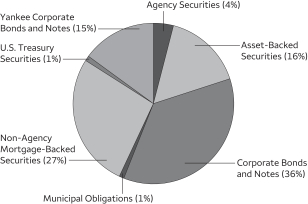

| 7 | Amounts are calculated based on the total long-term investments of the Fund. These amounts are subject to change and may have changed since the date specified. |

Wells Fargo Core Plus Bond Fund | 5

Table of Contents

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and contingent deferred sales charges (if any) on redemptions and (2) ongoing costs, including management fees, distribution (12b-1) and/or shareholder servicing fees, and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the six-month period and held for the entire period from September 1, 2019 to February 29, 2020.

Actual Expenses

The “Actual” line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the “Actual” line under the heading entitled “Expenses paid during period” for your applicable class of shares to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The “Hypothetical” line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) and contingent deferred sales charges. Therefore, the “Hypothetical” line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Beginning account value 9-1-2019 |

Ending account value 2-29-2020 |

Expenses paid during the period¹ |

Annualized net expense ratio |

|||||||||||||

| Class A |

||||||||||||||||

| Actual |

$ | 1,000.00 | $ | 1,029.21 | $ | 3.58 | 0.71 | % | ||||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,021.33 | $ | 3.57 | 0.71 | % | ||||||||

| Class C |

||||||||||||||||

| Actual |

$ | 1,000.00 | $ | 1,025.48 | $ | 7.45 | 1.48 | % | ||||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,017.50 | $ | 7.42 | 1.48 | % | ||||||||

| Class R6 |

||||||||||||||||

| Actual |

$ | 1,000.00 | $ | 1,030.98 | $ | 1.77 | 0.35 | % | ||||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,023.12 | $ | 1.76 | 0.35 | % | ||||||||

| Administrator Class |

||||||||||||||||

| Actual |

$ | 1,000.00 | $ | 1,029.75 | $ | 3.13 | 0.62 | % | ||||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,021.78 | $ | 3.12 | 0.62 | % | ||||||||

| Institutional Class |

||||||||||||||||

| Actual |

$ | 1,000.00 | $ | 1,030.74 | $ | 2.02 | 0.40 | % | ||||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,022.87 | $ | 2.01 | 0.40 | % | ||||||||

| 1 | Expenses paid is equal to the annualized net expense ratio of each class multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year divided by the number of days in the fiscal year (to reflect the one-half-year period). |

6 | Wells Fargo Core Plus Bond Fund

Table of Contents

Portfolio of investments—February 29, 2020 (unaudited)

| Interest rate |

Maturity date |

Principal | Value | |||||||||||||

| Agency Securities: 20.16% | ||||||||||||||||

| FHLB |

3.00 | % | 9-1-2034 | $ | 1,535,186 | $ | 1,591,004 | |||||||||

| FHLMC |

3.50 | 10-1-2049 | 17,010,824 | 17,672,360 | ||||||||||||

| FHLMC |

4.00 | 5-1-2049 | 8,443,162 | 8,911,419 | ||||||||||||

| FHLMC |

3.00 | 12-1-2049 | 8,238,813 | 8,490,132 | ||||||||||||

| FHLMC |

3.50 | 6-15-2042 | 2,853,992 | 2,956,375 | ||||||||||||

| FHLMC |

3.50 | 12-1-2045 | 2,846,097 | 3,012,908 | ||||||||||||

| FHLMC |

3.50 | 12-1-2045 | 915,328 | 968,473 | ||||||||||||

| FHLMC (12 Month LIBOR +1.33%) ± |

3.52 | 1-1-2036 | 13,158 | 13,613 | ||||||||||||

| FHLMC |

4.00 | 6-1-2044 | 2,086,820 | 2,258,802 | ||||||||||||

| FHLMC |

5.00 | 6-1-2036 | 199,928 | 226,222 | ||||||||||||

| FHLMC |

5.00 | 8-1-2040 | 187,560 | 210,217 | ||||||||||||

| FHLMC |

5.50 | 8-1-2038 | 45,959 | 52,840 | ||||||||||||

| FHLMC |

5.50 | 12-1-2038 | 432,633 | 497,340 | ||||||||||||

| FHLMC |

5.50 | 6-1-2040 | 686,412 | 776,648 | ||||||||||||

| FHLMC |

6.75 | 9-15-2029 | 5,910,000 | 8,733,824 | ||||||||||||

| FHLMC |

8.00 | 2-1-2030 | 168 | 197 | ||||||||||||

| FHLMC Series 2015-SC01 Class 1A |

3.50 | 5-25-2045 | 678,847 | 692,599 | ||||||||||||

| FHLMC Series 3774 Class AB |

3.50 | 12-15-2020 | 16,215 | 16,306 | ||||||||||||

| FHLMC Series K020 Class X1 ±±(c) |

1.37 | 5-25-2022 | 12,621,381 | 325,232 | ||||||||||||

| FHLMC Series T-42 Class A5 |

7.50 | 2-25-2042 | 1,305,170 | 1,619,910 | ||||||||||||

| FHLMC Series T-57 Class 2A1 ±± |

4.04 | 7-25-2043 | 38,590 | 42,541 | ||||||||||||

| FHLMC Series T-59 Class 2A1 ±± |

3.89 | 10-25-2043 | 198,856 | 233,421 | ||||||||||||

| FNMA |

3.50 | 3-1-2048 | 11,685,345 | 12,299,197 | ||||||||||||

| FNMA (12 Month LIBOR +1.61%) ± |

2.49 | 5-1-2046 | 1,174,831 | 1,208,387 | ||||||||||||

| FNMA (12 Month LIBOR +1.61%) ± |

2.53 | 3-1-2046 | 1,034,108 | 1,065,303 | ||||||||||||

| FNMA |

3.00 | 11-1-2045 | 1,793,422 | 1,875,993 | ||||||||||||

| FNMA |

3.00 | 12-1-2045 | 4,484,307 | 4,690,947 | ||||||||||||

| FNMA |

3.00 | 12-1-2046 | 2,123,302 | 2,216,355 | ||||||||||||

| FNMA |

3.00 | 11-1-2047 | 7,535,477 | 7,813,405 | ||||||||||||

| FNMA |

3.00 | 4-1-2048 | 5,234,489 | 5,411,466 | ||||||||||||

| FNMA %% |

3.00 | 3-12-2050 | 8,000,000 | 8,239,062 | ||||||||||||

| FNMA |

3.02 | 2-1-2026 | 3,127,689 | 3,364,213 | ||||||||||||

| FNMA |

3.27 | 7-1-2022 | 1,174,220 | 1,221,110 | ||||||||||||

| FNMA |

3.48 | 3-1-2029 | 987,090 | 1,113,798 | ||||||||||||

| FNMA |

3.50 | 10-1-2043 | 961,048 | 1,019,052 | ||||||||||||

| FNMA |

3.50 | 4-1-2045 | 232,202 | 245,591 | ||||||||||||

| FNMA |

3.50 | 8-1-2045 | 5,125,352 | 5,420,911 | ||||||||||||

| FNMA |

3.50 | 8-1-2049 | 19,361,918 | 20,099,987 | ||||||||||||

| FNMA |

3.62 | 3-1-2029 | 443,000 | 506,348 | ||||||||||||

| FNMA |

3.63 | 3-1-2029 | 1,250,000 | 1,426,109 | ||||||||||||

| FNMA |

3.77 | 3-1-2029 | 988,519 | 1,136,800 | ||||||||||||

| FNMA |

3.77 | 3-1-2029 | 1,077,784 | 1,238,444 | ||||||||||||

| FNMA (1 Year Treasury Constant Maturity +2.27%) ± |

3.90 | 1-1-2036 | 37,907 | 40,277 | ||||||||||||

| FNMA |

3.95 | 9-1-2021 | 392,658 | 403,818 | ||||||||||||

| FNMA (12 Month LIBOR +1.73%) ± |

3.99 | 9-1-2036 | 12,800 | 13,394 | ||||||||||||

| FNMA |

4.00 | 2-1-2046 | 419,594 | 450,092 | ||||||||||||

| FNMA |

4.00 | 4-1-2046 | 2,234,376 | 2,399,293 | ||||||||||||

| FNMA |

4.00 | 6-1-2048 | 5,293,390 | 5,616,972 | ||||||||||||

| FNMA %% |

4.00 | 3-12-2050 | 6,165,000 | 6,494,178 | ||||||||||||

| FNMA (12 Month LIBOR +1.78%) ± |

4.23 | 8-1-2036 | 20,033 | 21,149 | ||||||||||||

| FNMA (1 Year Treasury Constant Maturity +2.26%) ± |

4.39 | 8-1-2036 | 587,112 | 622,466 | ||||||||||||

| FNMA |

4.50 | 11-1-2048 | 4,914,144 | 5,257,691 | ||||||||||||

| FNMA |

5.00 | 1-1-2024 | 38,176 | 40,376 | ||||||||||||

| FNMA |

5.00 | 2-1-2036 | 21,227 | 24,007 | ||||||||||||

| FNMA |

5.00 | 6-1-2040 | 72,584 | 81,660 | ||||||||||||

| FNMA |

5.00 | 8-1-2040 | 1,274,465 | 1,433,818 | ||||||||||||

Wells Fargo Core Plus Bond Fund | 7

Table of Contents

Portfolio of investments—February 29, 2020 (unaudited)

| Interest rate |

Maturity date |

Principal | Value | |||||||||||||

| Agency Securities (continued) | ||||||||||||||||

| FNMA |

5.50 | % | 11-1-2023 | $ | 28,071 | $ | 29,535 | |||||||||

| FNMA |

5.50 | 8-1-2034 | 76,199 | 87,129 | ||||||||||||

| FNMA |

5.50 | 2-1-2035 | 22,984 | 26,295 | ||||||||||||

| FNMA |

5.50 | 8-1-2038 | 99,415 | 108,146 | ||||||||||||

| FNMA |

5.50 | 8-1-2038 | 180,263 | 196,047 | ||||||||||||

| FNMA |

6.00 | 10-1-2037 | 423,203 | 495,501 | ||||||||||||

| FNMA |

6.00 | 11-1-2037 | 27,205 | 31,972 | ||||||||||||

| FNMA |

6.50 | 7-1-2036 | 19,201 | 22,427 | ||||||||||||

| FNMA |

6.50 | 7-1-2036 | 10,139 | 11,960 | ||||||||||||

| FNMA |

6.50 | 11-1-2036 | 4,455 | 5,155 | ||||||||||||

| FNMA |

6.63 | 11-15-2030 | 5,015,000 | 7,572,291 | ||||||||||||

| FNMA |

7.00 | 12-1-2022 | 72,684 | 74,403 | ||||||||||||

| FNMA |

7.00 | 7-1-2036 | 10,384 | 11,347 | ||||||||||||

| FNMA |

7.00 | 11-1-2037 | 4,266 | 4,834 | ||||||||||||

| FNMA |

7.50 | 5-1-2038 | 1,882 | 1,903 | ||||||||||||

| FNMA Series 2002-T12 Class A3 |

7.50 | 5-25-2042 | 5,543 | 6,762 | ||||||||||||

| FNMA Series 2003-W08 Class 4A ±± |

4.27 | 11-25-2042 | 113,974 | 119,944 | ||||||||||||

| FNMA Series 2003-W14 Class 2A ±± |

4.00 | 6-25-2045 | 78,920 | 83,809 | ||||||||||||

| FNMA Series 2003-W14 Class 2A ±± |

4.42 | 1-25-2043 | 198,309 | 208,200 | ||||||||||||

| FNMA Series 2004-W11 Class 1A3 |

7.00 | 5-25-2044 | 957,044 | 1,091,994 | ||||||||||||

| FNMA Series 2004-W15 Class 1A3 |

7.00 | 8-25-2044 | 469,587 | 563,152 | ||||||||||||

| GNMA |

3.00 | 11-20-2045 | 3,543,604 | 3,698,295 | ||||||||||||

| GNMA %% |

3.00 | 3-23-2050 | 8,420,000 | 8,699,570 | ||||||||||||

| GNMA |

3.50 | 9-20-2047 | 2,738,044 | 2,881,824 | ||||||||||||

| GNMA |

3.50 | 12-20-2047 | 5,784,797 | 6,056,694 | ||||||||||||

| GNMA |

4.00 | 12-20-2047 | 3,143,837 | 3,326,649 | ||||||||||||

| GNMA |

4.50 | 8-20-2049 | 1,544,114 | 1,625,468 | ||||||||||||

| GNMA |

5.00 | 7-20-2040 | 502,722 | 561,992 | ||||||||||||

| GNMA |

7.50 | 12-15-2029 | 608 | 685 | ||||||||||||

| GNMA Series 2008-22 Class XM ±±(c) |

1.11 | 2-16-2050 | 832,744 | 21,996 | ||||||||||||

| Overseas Private Investment Corporation |

2.12 | 3-20-2024 | 4,635,000 | 4,744,604 | ||||||||||||

| STRIPS ¤ |

0.00 | 5-15-2039 | 4,670,000 | 3,418,777 | ||||||||||||

| STRIPS ¤ |

0.00 | 8-15-2039 | 12,360,000 | 9,005,797 | ||||||||||||

| STRIPS ¤ |

0.00 | 5-15-2044 | 9,270,000 | 6,017,953 | ||||||||||||

| TVA |

5.88 | 4-1-2036 | 6,400,000 | 9,887,248 | ||||||||||||

| Total Agency Securities (Cost $223,625,860) |

234,514,410 | |||||||||||||||

|

|

|

|||||||||||||||

| Asset-Backed Securities: 9.20% |

||||||||||||||||

| Ally Auto Receivables Trust Series 2019-1 Class A3 |

2.91 | 9-15-2023 | 4,945,000 | 5,044,842 | ||||||||||||

| California Republic Auto Receivables Trust Series 2017-1 Class A4 |

2.28 | 6-15-2022 | 2,805,661 | 2,812,131 | ||||||||||||

| Daimler Trucks Retail Trust Series 2018-1 Class A3 144A |

2.85 | 7-15-2021 | 1,386,724 | 1,390,884 | ||||||||||||

| Daimler Trucks Retail Trust Series 2018-1 Class A4 144A |

3.03 | 11-15-2024 | 5,000,000 | 5,059,583 | ||||||||||||

| Dell Equipment Finance Trust Series 2018-1 Class A2A 144A |

2.97 | 10-22-2020 | 1,540,133 | 1,541,739 | ||||||||||||

| Drive Auto Receivables Trust Series 2018-3 Class B |

3.37 | 9-15-2022 | 382,428 | 382,758 | ||||||||||||

| Educational Services of America Series 2015-1 Class A (1 Month LIBOR +0.80%) 144A ± |

2.43 | 10-25-2056 | 895,643 | 891,330 | ||||||||||||

| Enterprise Fleet Financing Trust Series 2017-2 Class A2 144A |

1.97 | 1-20-2023 | 1,522,405 | 1,523,252 | ||||||||||||

| Exeter Automobile Receivables Trust Series 2018-1A Class C1 144A |

3.03 | 1-17-2023 | 3,250,000 | 3,271,381 | ||||||||||||

| Five Guys Funding LLC Series 17-1A Class A2 144A |

4.60 | 7-25-2047 | 1,597,925 | 1,700,560 | ||||||||||||

| Flagship Credit Auto Trust Series 2019-4 Class A 144A |

2.17 | 6-17-2024 | 4,530,701 | 4,563,515 | ||||||||||||

| Ford Credit Auto Owner Trust Series 2017-A Class A4 |

1.92 | 4-15-2022 | 2,600,000 | 2,606,416 | ||||||||||||

| GM Financial Consumer Automobile Receivables Trust Series 2017-2A Class A3 144A |

1.86 | 12-16-2021 | 2,471,237 | 2,473,738 | ||||||||||||

| Hertz Vehicle Financing LLC Series 2015-1A Class A 144A |

2.73 | 3-25-2021 | 5,000,000 | 5,003,302 | ||||||||||||

| Hertz Vehicle Financing LLC Series 2018-2A Class A 144A |

3.65 | 6-27-2022 | 1,800,000 | 1,846,519 | ||||||||||||

8 | Wells Fargo Core Plus Bond Fund

Table of Contents

Portfolio of investments—February 29, 2020 (unaudited)

| Interest rate |

Maturity date |

Principal | Value | |||||||||||||

| Asset-Backed Securities (continued) | ||||||||||||||||

| Hertz Vehicle Financing LLC Series 2019-1A Class A 144A |

3.71 | % | 3-25-2023 | $ | 3,308,000 | $ | 3,450,575 | |||||||||

| Honda Auto Receivables Owner Trust Series 2016-4 Class A4 |

1.36 | 1-18-2023 | 4,998,000 | 4,997,306 | ||||||||||||

| Honda Auto Receivables Owner Trust Series 2017-1 Class A4 |

2.05 | 6-21-2023 | 4,634,000 | 4,650,432 | ||||||||||||

| MMAF Equipment Finance LLC Series 2017-AA Class A4 144A |

2.41 | 8-16-2024 | 1,975,000 | 2,004,760 | ||||||||||||

| MMAF Equipment Finance LLC Series 2019-A Class A2 144A |

2.84 | 1-10-2022 | 1,641,222 | 1,651,751 | ||||||||||||

| Oscar US Funding Trust Series 2016-2A Class A4 144A |

2.99 | 12-15-2023 | 4,140,018 | 4,163,358 | ||||||||||||

| SLM Student Loan Trust Series 2004-1 Class A4 (3 Month LIBOR +0.26%) ± |

2.05 | 10-27-2025 | 1,139,468 | 1,136,380 | ||||||||||||

| South Carolina Student Loan Corporation Series 2014-1 Class A1 (1 Month LIBOR +0.75%) ± |

2.41 | 5-1-2030 | 2,746,969 | 2,749,356 | ||||||||||||

| Student Loan Consolidation Center Series 2011-1 Class A (1 Month LIBOR +1.22%) 144A± |

2.85 | 10-25-2027 | 1,161,697 | 1,165,192 | ||||||||||||

| TCF Auto Receivables Owner Trust Series 2016-1A Class A4 144A |

2.03 | 2-15-2022 | 764,382 | 764,595 | ||||||||||||

| Towd Point Asset Funding LLC Series 2019-HE1 Class A1 (1 Month LIBOR +0.90%) 144A± |

2.53 | 4-25-2048 | 2,667,511 | 2,674,902 | ||||||||||||

| Towd Point Asset Trust Series 2018-SL1 Class A (1 Month LIBOR +0.60%) 144A± |

2.23 | 1-25-2046 | 2,408,546 | 2,398,079 | ||||||||||||

| Toyota Auto Receivables Owner Trust Series 2017-D Class A4 |

2.12 | 2-15-2023 | 8,088,000 | 8,175,456 | ||||||||||||

| Toyota Auto Receivables Owner Trust Series 2018-D Class A3 |

3.18 | 3-15-2023 | 5,995,000 | 6,119,094 | ||||||||||||

| Toyota Auto Receivables Owner Trust Series 2019- B Class A2A |

2.59 | 2-15-2022 | 6,121,136 | 6,149,838 | ||||||||||||

| Volvo Financial Equipment LLC Series 2018-AA Class A (1 Month LIBOR +0.52%) 144A± |

2.18 | 7-17-2023 | 2,590,000 | 2,597,961 | ||||||||||||

| Westlake Automobile Receivables Trust Series 2019-1A Class A2A 144A |

3.06 | 5-16-2022 | 1,161,021 | 1,166,345 | ||||||||||||

| Westlake Automobile Receivables Trust Series 2019-2A A2A 144A |

2.57 | 2-15-2023 | 5,348,385 | 5,381,407 | ||||||||||||

| Wheels SPV LLC Series 2018-1A Class A2 144A |

3.06 | 4-20-2027 | 822,079 | 828,015 | ||||||||||||

| World Omni Automobiles Lease Securitization Trust Series 2018-B Class A3 |

3.19 | 12-15-2021 | 4,516,000 | 4,586,689 | ||||||||||||

| Total Asset-Backed Securities (Cost $106,206,309) |

106,923,441 | |||||||||||||||

|

|

|

|||||||||||||||

| Corporate Bonds and Notes: 22.18% |

||||||||||||||||

| Communication Services: 1.98% |

||||||||||||||||

| Diversified Telecommunication Services: 0.32% | ||||||||||||||||

| AT&T Incorporated |

4.75 | 5-15-2046 | 1,975,000 | 2,328,617 | ||||||||||||

| AT&T Incorporated |

5.65 | 2-15-2047 | 1,050,000 | 1,384,835 | ||||||||||||

| 3,713,452 | ||||||||||||||||

|

|

|

|||||||||||||||

| Media: 0.84% | ||||||||||||||||

| Charter Communications Operating LLC |

5.38 | 4-1-2038 | 705,000 | 809,888 | ||||||||||||

| Charter Communications Operating LLC |

6.48 | 10-23-2045 | 655,000 | 842,383 | ||||||||||||

| Comcast Corporation |

4.70 | 10-15-2048 | 1,800,000 | 2,361,898 | ||||||||||||

| Diamond Sports Group LLC 144A |

5.38 | 8-15-2026 | 70,000 | 64,541 | ||||||||||||

| Diamond Sports Group LLC 144A |

6.63 | 8-15-2027 | 70,000 | 56,700 | ||||||||||||

| Discovery Incorporated |

5.30 | 5-15-2049 | 735,000 | 890,491 | ||||||||||||

| Discovery Incorporated |

6.35 | 6-1-2040 | 1,550,000 | 2,059,895 | ||||||||||||

| Nexstar Broadcasting Incorporated 144A |

5.63 | 7-15-2027 | 45,000 | 46,577 | ||||||||||||

| Ziggo Bond Company BV 144A |

3.38 | 2-28-2030 | 2,500,000 | 2,659,140 | ||||||||||||

| 9,791,513 | ||||||||||||||||

|

|

|

|||||||||||||||

| Wireless Telecommunication Services: 0.82% | ||||||||||||||||

| Crown Castle Towers LLC 144A |

3.22 | 5-15-2042 | 2,600,000 | 2,660,895 | ||||||||||||

| SBA Tower Trust 144A |

3.72 | 4-9-2048 | 1,968,000 | 2,043,556 | ||||||||||||

| Sprint Spectrum Company 144A |

4.74 | 9-20-2029 | 3,930,000 | 4,204,904 | ||||||||||||

| Sprint Spectrum Company 144A |

5.15 | 9-20-2029 | 530,000 | 596,544 | ||||||||||||

| 9,505,899 | ||||||||||||||||

|

|

|

|||||||||||||||

Wells Fargo Core Plus Bond Fund | 9

Table of Contents

Portfolio of investments—February 29, 2020 (unaudited)

| Interest rate |

Maturity date |

Principal | Value | |||||||||||||

| Consumer Discretionary: 1.45% | ||||||||||||||||

| Automobiles: 0.70% | ||||||||||||||||

| General Motors Company |

5.95 | % | 4-1-2049 | $ | 1,985,000 | $ | 2,172,762 | |||||||||

| Hyundai Capital America 144A |

2.65 | 2-10-2025 | 5,810,000 | 5,919,695 | ||||||||||||

| 8,092,457 | ||||||||||||||||

|

|

|

|||||||||||||||

| Hotels, Restaurants & Leisure: 0.27% | ||||||||||||||||

| Las Vegas Sands Corporation |

3.90 | 8-8-2029 | 3,000,000 | 3,170,104 | ||||||||||||

|

|

|

|||||||||||||||

| Multiline Retail: 0.34% | ||||||||||||||||

| Macy’s Retail Holdings Incorporated |

3.45 | 1-15-2021 | 3,940,000 | 3,980,058 | ||||||||||||

|

|

|

|||||||||||||||

| Specialty Retail: 0.14% | ||||||||||||||||

| Asbury Automotive Group Incorporated 144A |

4.50 | 3-1-2028 | 84,000 | 84,168 | ||||||||||||

| Asbury Automotive Group Incorporated 144A |

4.75 | 3-1-2030 | 1,522,000 | 1,548,635 | ||||||||||||

| 1,632,803 | ||||||||||||||||

|

|

|

|||||||||||||||

| Consumer Staples: 0.77% |

| |||||||||||||||

| Beverages: 0.19% | ||||||||||||||||

| Anheuser-Busch InBev Worldwide Incorporated |

4.60 | 4-15-2048 | 1,810,000 | 2,164,116 | ||||||||||||

|

|

|

|||||||||||||||

| Food & Staples Retailing: 0.16% | ||||||||||||||||

| Kroger Company |

5.40 | 1-15-2049 | 1,500,000 | 1,903,439 | ||||||||||||

|

|

|

|||||||||||||||

| Food Products: 0.12% | ||||||||||||||||

| Kraft Heinz Foods Company 144A |

4.88 | 10-1-2049 | 1,430,000 | 1,401,599 | ||||||||||||

|

|

|

|||||||||||||||

| Tobacco: 0.30% | ||||||||||||||||

| Altria Group Incorporated |

5.95 | 2-14-2049 | 1,090,000 | 1,383,879 | ||||||||||||

| BAT Capital Corporation |

3.56 | 8-15-2027 | 1,510,000 | 1,594,069 | ||||||||||||

| Reynolds American Incorporated |

7.00 | 8-4-2041 | 450,000 | 570,486 | ||||||||||||

| 3,548,434 | ||||||||||||||||

|

|

|

|||||||||||||||

| Energy: 3.45% | ||||||||||||||||

| Energy Equipment & Services: 0.19% | ||||||||||||||||

| Diamond Offshore Drilling Incorporated |

7.88 | 8-15-2025 | 1,250,000 | 876,563 | ||||||||||||

| Hilcorp Energy Company 144A |

6.25 | 11-1-2028 | 1,900,000 | 1,382,288 | ||||||||||||

| 2,258,851 | ||||||||||||||||

|

|

|

|||||||||||||||

| Oil, Gas & Consumable Fuels: 3.26% | ||||||||||||||||

| Antero Midstream Partners LP 144A |

5.75 | 1-15-2028 | 1,300,000 | 892,385 | ||||||||||||

| Antero Resources Corporation |

5.38 | 11-1-2021 | 1,900,000 | 1,584,125 | ||||||||||||

| Apache Corporation « |

5.35 | 7-1-2049 | 2,250,000 | 2,290,469 | ||||||||||||

| Archrock Partners LP 144A |

6.88 | 4-1-2027 | 1,300,000 | 1,320,371 | ||||||||||||

| Baker Hughes LLC |

2.77 | 12-15-2022 | 1,870,000 | 1,911,943 | ||||||||||||

| Boardwalk Pipelines LP |

4.80 | 5-3-2029 | 1,620,000 | 1,721,149 | ||||||||||||

| Buckeye Partners LP |

4.13 | 12-1-2027 | 1,300,000 | 1,254,110 | ||||||||||||

| Carrizo Oil & Gas Incorporated |

6.25 | 4-15-2023 | 1,300,000 | 1,098,526 | ||||||||||||

| Cheniere Energy Partners LP 144A |

4.50 | 10-1-2029 | 220,000 | 210,386 | ||||||||||||

| Crestwood Midstream Partners LP 144A |

5.63 | 5-1-2027 | 1,300,000 | 1,202,435 | ||||||||||||

| Denbury Resources Incorporated 144A |

9.25 | 3-31-2022 | 1,250,000 | 1,000,000 | ||||||||||||

| Energy Transfer Operating Partners LP |

5.25 | 4-15-2029 | 905,000 | 1,016,378 | ||||||||||||

| Energy Transfer Operating Partners LP |

6.13 | 12-15-2045 | 1,330,000 | 1,500,402 | ||||||||||||

| EnLink Midstream Partners LP |

5.45 | 6-1-2047 | 1,100,000 | 797,170 | ||||||||||||

10 | Wells Fargo Core Plus Bond Fund

Table of Contents

Portfolio of investments—February 29, 2020 (unaudited)

| Interest rate |

Maturity date |

Principal | Value | |||||||||||||

| Oil, Gas & Consumable Fuels (continued) | ||||||||||||||||

| Enterprise Products Operating LLC |

2.80 | % | 1-31-2030 | $ | 2,960,000 | $ | 3,023,094 | |||||||||

| Enviva Partners LP 144A |

6.50 | 1-15-2026 | 575,000 | 598,012 | ||||||||||||

| EQT Corporation |

3.90 | 10-1-2027 | 4,955,000 | 3,233,138 | ||||||||||||

| EQT Corporation |

7.00 | 2-1-2030 | 1,750,000 | 1,303,750 | ||||||||||||

| Gulfport Energy Corporation |

6.38 | 5-15-2025 | 1,250,000 | 396,875 | ||||||||||||

| Indigo Natural Resources LLC 144A |

6.88 | 2-15-2026 | 1,225,000 | 1,044,313 | ||||||||||||

| Murphy Oil Corporation |

5.88 | 12-1-2027 | 1,300,000 | 1,268,904 | ||||||||||||

| Nabors Industries Incorporated |

4.63 | 9-15-2021 | 198,000 | 197,010 | ||||||||||||

| Oasis Petroleum Incorporated 144A |

6.25 | 5-1-2026 | 1,250,000 | 768,750 | ||||||||||||

| Occidental Petroleum Corporation « |

4.40 | 8-15-2049 | 1,570,000 | 1,493,711 | ||||||||||||

| QEP Resources Incorporated |

5.38 | 10-1-2022 | 650,000 | 592,719 | ||||||||||||

| Rockies Express Pipeline LLC 144A |

5.63 | 4-15-2020 | 2,250,000 | 2,256,908 | ||||||||||||

| Southern Star Central Corporation 144A |

5.13 | 7-15-2022 | 1,189,000 | 1,204,732 | ||||||||||||

| Southwestern Energy Company « |

7.75 | 10-1-2027 | 1,250,000 | 946,875 | ||||||||||||

| Whiting Petroleum Corporation |

1.25 | 4-1-2020 | 2,000,000 | 1,785,000 | ||||||||||||

| 37,913,640 | ||||||||||||||||

|

|

|

|||||||||||||||

| Financials: 7.04% |

| |||||||||||||||

| Banks: 2.16% | ||||||||||||||||

| Bank of America Corporation |

2.02 | 2-13-2026 | 5,000,000 | 5,038,550 | ||||||||||||

| Bank of America Corporation (3 Month LIBOR +0.94%) ± |

3.86 | 7-23-2024 | 1,310,000 | 1,401,624 | ||||||||||||

| Bank of America Corporation |

3.95 | 4-21-2025 | 1,170,000 | 1,277,014 | ||||||||||||

| Bank of America Corporation (3 Month LIBOR +3.90%) ± |

6.10 | 12-29-2049 | 2,590,000 | 2,871,300 | ||||||||||||

| Citigroup Incorporated (U.S. SOFR +1.15%) ± |

2.67 | 1-29-2031 | 5,250,000 | 5,383,472 | ||||||||||||

| Citigroup Incorporated (3 Month LIBOR +4.52%) ± |

6.25 | 12-29-2049 | 1,030,000 | 1,144,155 | ||||||||||||

| JPMorgan Chase & Company |

2.97 | 1-15-2023 | 2,550,000 | 2,617,953 | ||||||||||||

| JPMorgan Chase & Company (3 Month LIBOR +3.25%) ± |

5.15 | 12-29-2049 | 3,625,000 | 3,641,313 | ||||||||||||

| PNC Financial Services (3 Month LIBOR +3.30%) ± |

5.00 | 12-29-2049 | 565,000 | 597,488 | ||||||||||||

| Santander Holdings USA Incorporated |

3.24 | 10-5-2026 | 1,125,000 | 1,168,151 | ||||||||||||

| 25,141,020 | ||||||||||||||||

|

|

|

|||||||||||||||

| Capital Markets: 1.08% | ||||||||||||||||

| Blackstone Holdings Finance Company LLC 144A |

2.50 | 1-10-2030 | 5,500,000 | 5,760,901 | ||||||||||||

| Blackstone Holdings Finance Company LLC 144A |

5.00 | 6-15-2044 | 1,015,000 | 1,313,313 | ||||||||||||

| Goldman Sachs Group Incorporated (3 Month LIBOR +0.82%) ± |

2.88 | 10-31-2022 | 1,910,000 | 1,947,817 | ||||||||||||

| Morgan Stanley |

3.70 | 10-23-2024 | 3,235,000 | 3,517,712 | ||||||||||||

| 12,539,743 | ||||||||||||||||

|

|

|

|||||||||||||||

| Consumer Finance: 0.99% | ||||||||||||||||

| ERAC USA Finance LLC 144A |

4.50 | 2-15-2045 | 1,695,000 | 2,009,368 | ||||||||||||

| Ford Motor Credit Company LLC |

3.20 | 1-15-2021 | 2,890,000 | 2,909,139 | ||||||||||||

| General Motors Financial Company Incorporated |

5.65 | 1-17-2029 | 1,330,000 | 1,516,591 | ||||||||||||

| PACCAR Financial Corporation |

2.30 | 8-10-2022 | 3,000,000 | 3,069,745 | ||||||||||||

| Synchrony Financial |

2.85 | 7-25-2022 | 2,000,000 | 2,045,226 | ||||||||||||

| 11,550,069 | ||||||||||||||||

|

|

|

|||||||||||||||

| Diversified Financial Services: 1.01% | ||||||||||||||||

| Private Export Funding Corporation |

2.80 | 5-15-2022 | 9,000,000 | 9,326,205 | ||||||||||||

| WEA Finance LLC 144A |

2.88 | 1-15-2027 | 2,390,000 | 2,468,006 | ||||||||||||

| 11,794,211 | ||||||||||||||||

|

|

|

|||||||||||||||

| Insurance: 1.80% | ||||||||||||||||

| Athene Global Funding 144A |

2.95 | 11-12-2026 | 3,550,000 | 3,738,820 | ||||||||||||

Wells Fargo Core Plus Bond Fund | 11

Table of Contents

Portfolio of investments—February 29, 2020 (unaudited)

| Interest rate |

Maturity date |

Principal | Value | |||||||||||||

| Insurance (continued) | ||||||||||||||||

| Axis Specialty Finance LLC |

4.90 | % | 1-15-2040 | $ | 5,105,000 | $ | 5,053,950 | |||||||||

| Brighthouse Financial Incorporated |

4.70 | 6-22-2047 | 1,955,000 | 1,977,198 | ||||||||||||

| Guardian Life Insurance Company 144A |

3.70 | 1-22-2070 | 1,500,000 | 1,692,583 | ||||||||||||

| Guardian Life Insurance Company 144A |

4.85 | 1-24-2077 | 1,045,000 | 1,421,438 | ||||||||||||

| National Life Global Insurance Company (3 Month LIBOR +3.31%) 144A± |

5.25 | 7-19-2068 | 1,668,000 | 2,016,786 | ||||||||||||

| PartnerRe Finance II Incorporated (3 Month LIBOR +2.33%) ± |

3.91 | 12-1-2066 | 1,345,000 | 1,156,297 | ||||||||||||

| Transatlantic Holdings Incorporated |

8.00 | 11-30-2039 | 2,329,000 | 3,879,209 | ||||||||||||

| 20,936,281 | ||||||||||||||||

|

|

|

|||||||||||||||

| Health Care: 1.68% |

| |||||||||||||||

| Biotechnology: 0.33% | ||||||||||||||||

| AbbVie Incorporated 144A |

2.95 | 11-21-2026 | 3,625,000 | 3,800,429 | ||||||||||||

|

|

|

|||||||||||||||

| Health Care Providers & Services: 1.35% | ||||||||||||||||

| Anthem Incorporated |

3.70 | 9-15-2049 | 1,000,000 | 1,026,545 | ||||||||||||

| CommonSpirit Health |

2.95 | 11-1-2022 | 1,250,000 | 1,283,408 | ||||||||||||

| CommonSpirit Health |

3.82 | 10-1-2049 | 1,810,000 | 1,943,899 | ||||||||||||

| CVS Health Corporation |

4.78 | 3-25-2038 | 1,375,000 | 1,621,617 | ||||||||||||

| Dignity Health |

3.81 | 11-1-2024 | 2,000,000 | 2,177,997 | ||||||||||||

| Highmark Incorporated 144A |

6.13 | 5-15-2041 | 710,000 | 947,676 | ||||||||||||

| Magellan Health Incorporated |

4.90 | 9-22-2024 | 2,710,000 | 2,777,750 | ||||||||||||

| WellPoint Incorporated |

3.13 | 5-15-2022 | 3,804,000 | 3,927,459 | ||||||||||||

| 15,706,351 | ||||||||||||||||

|

|

|

|||||||||||||||

| Industrials: 1.29% |

| |||||||||||||||

| Airlines: 0.20% | ||||||||||||||||

| Delta Airlines Pass-Through Certificates Series 2015-B |

4.25 | 1-30-2025 | 2,169,243 | 2,339,228 | ||||||||||||

|

|

|

|||||||||||||||

| Building Products: 0.09% | ||||||||||||||||

| Builders Firstsource Incorporated 144A |

5.00 | 3-1-2030 | 1,000,000 | 1,000,480 | ||||||||||||

|

|

|

|||||||||||||||

| Industrial Conglomerates: 0.33% | ||||||||||||||||

| Carlisle Companies Incorporated |

2.75 | 3-1-2030 | 2,750,000 | 2,750,618 | ||||||||||||

| General Electric Company |

4.63 | 1-7-2021 | 1,060,000 | 1,087,768 | ||||||||||||

| 3,838,386 | ||||||||||||||||

|

|

|

|||||||||||||||

| Machinery: 0.00% | ||||||||||||||||

| Harsco Corporation 144A |

5.75 | 7-31-2027 | 20,000 | 19,700 | ||||||||||||

|

|

|

|||||||||||||||

| Trading Companies & Distributors: 0.13% | ||||||||||||||||

| Fortress Transportation & Infrastructure Investors LLC 144A |

6.50 | 10-1-2025 | 1,500,000 | 1,571,250 | ||||||||||||

|

|

|

|||||||||||||||

| Transportation Infrastructure: 0.54% | ||||||||||||||||

| Toll Road Investors Partnership II LP 144A¤ |

0.00 | 2-15-2027 | 1,050,000 | 796,004 | ||||||||||||

| Toll Road Investors Partnership II LP 144A¤ |

0.00 | 2-15-2026 | 5,630,000 | 4,594,188 | ||||||||||||

| Toll Road Investors Partnership II LP 144A¤ |

0.00 | 2-15-2028 | 1,150,000 | 836,863 | ||||||||||||

| 6,227,055 | ||||||||||||||||

|

|

|

|||||||||||||||

| Information Technology: 1.74% |

| |||||||||||||||

| Communications Equipment: 0.19% | ||||||||||||||||

| Motorola Solutions Incorporated |

4.60 | 2-23-2028 | 2,000,000 | 2,258,665 | ||||||||||||

|

|

|

|||||||||||||||

12 | Wells Fargo Core Plus Bond Fund

Table of Contents

Portfolio of investments—February 29, 2020 (unaudited)

| Interest rate |

Maturity date |

Principal | Value | |||||||||||||

| Electronic Equipment, Instruments & Components: 0.32% | ||||||||||||||||

| Arrow Electronics Incorporated |

3.88 | % | 1-12-2028 | $ | 1,000,000 | $ | 1,055,015 | |||||||||

| Corning Incorporated |

3.90 | 11-15-2049 | 2,500,000 | 2,639,202 | ||||||||||||

| 3,694,217 | ||||||||||||||||

|

|

|

|||||||||||||||

| Semiconductors & Semiconductor Equipment: 0.46% | ||||||||||||||||

| Broadcom Corporation |

3.88 | 1-15-2027 | 1,500,000 | 1,573,058 | ||||||||||||

| Qualcomm Incorporated |

3.00 | 5-20-2022 | 3,700,000 | 3,833,567 | ||||||||||||

| 5,406,625 | ||||||||||||||||

|

|

|

|||||||||||||||

| Software: 0.40% | ||||||||||||||||

| Citrix Systems Incorporated |

3.30 | 3-1-2030 | 2,425,000 | 2,438,568 | ||||||||||||

| Symantec Corporation |

4.20 | 9-15-2020 | 2,145,000 | 2,154,657 | ||||||||||||

| 4,593,225 | ||||||||||||||||

|

|

|

|||||||||||||||

| Technology Hardware, Storage & Peripherals: 0.37% | ||||||||||||||||

| Apple Incorporated |

2.95 | 9-11-2049 | 1,270,000 | 1,334,431 | ||||||||||||

| Apple Incorporated |

4.65 | 2-23-2046 | 990,000 | 1,316,809 | ||||||||||||

| Diamond 1 Finance Corporation 144A |

8.35 | 7-15-2046 | 1,175,000 | 1,596,480 | ||||||||||||

| 4,247,720 | ||||||||||||||||

|

|

|

|||||||||||||||

| Materials: 0.37% |

| |||||||||||||||

| Containers & Packaging: 0.37% | ||||||||||||||||

| Flex Acquisition Company Incorporated 144A |

6.88 | 1-15-2025 | 1,000,000 | 972,520 | ||||||||||||

| WRKCo Incorporated |

3.90 | 6-1-2028 | 3,000,000 | 3,304,157 | ||||||||||||

| 4,276,677 | ||||||||||||||||

|

|

|

|||||||||||||||

| Real Estate: 1.61% |

| |||||||||||||||

| Equity REITs: 1.61% | ||||||||||||||||

| Federal Realty Investment Trust |

3.63 | 8-1-2046 | 915,000 | 974,701 | ||||||||||||

| Highwoods Realty LP |

3.05 | 2-15-2030 | 4,420,000 | 4,602,830 | ||||||||||||

| Omega Healthcare Investors Incorporated |

4.50 | 1-15-2025 | 2,130,000 | 2,321,798 | ||||||||||||

| Omega Healthcare Investors Incorporated |

5.25 | 1-15-2026 | 1,700,000 | 1,951,138 | ||||||||||||

| Sabra Health Care LP / Sabra Capital Corporation |

4.80 | 6-1-2024 | 2,000,000 | 2,162,820 | ||||||||||||

| Tanger Properties LP |

3.75 | 12-1-2024 | 1,600,000 | 1,689,160 | ||||||||||||

| Welltower Incorporated |

4.25 | 4-1-2026 | 4,465,000 | 5,022,295 | ||||||||||||

| 18,724,742 | ||||||||||||||||

|

|

|

|||||||||||||||

| Utilities: 0.80% |

| |||||||||||||||

| Electric Utilities: 0.80% | ||||||||||||||||

| Basin Electric Power Cooperative 144A |

4.75 | 4-26-2047 | 1,315,000 | 1,612,139 | ||||||||||||

| Firstenergy Corporation |

2.05 | 3-1-2025 | 5,590,000 | 5,667,854 | ||||||||||||

| ITC Holdings Corporation |

2.70 | 11-15-2022 | 673,000 | 694,161 | ||||||||||||

| Oglethorpe Power Corporation |

5.05 | 10-1-2048 | 1,060,000 | 1,345,859 | ||||||||||||

| 9,320,013 | ||||||||||||||||

|

|

|

|||||||||||||||

| Total Corporate Bonds and Notes (Cost $249,353,172) |

|

258,062,452 | ||||||||||||||

|

|

|

|||||||||||||||

Wells Fargo Core Plus Bond Fund | 13

Table of Contents

Portfolio of investments—February 29, 2020 (unaudited)

| Interest rate |

Maturity date |

Principal | Value | |||||||||||||

| Foreign Corporate Bonds and Notes: 2.63% |

| |||||||||||||||

| Consumer Discretionary: 0.28% |

| |||||||||||||||

| Auto Components: 0.10% | ||||||||||||||||

| HP Pelzer Holding GmbH 144A |

4.13 | % | 4-1-2024 | EUR | 1,200,000 | $ | 1,152,524 | |||||||||

|

|

|

|||||||||||||||

| Automobiles: 0.18% | ||||||||||||||||

| Peugeot SA Company |

2.00 | 3-20-2025 | EUR | 1,800,000 | 2,107,509 | |||||||||||

|

|

|

|||||||||||||||

| Consumer Staples: 0.69% |

| |||||||||||||||

| Food & Staples Retailing: 0.15% | ||||||||||||||||

| Tasty Bondco 1 SA 144A |

6.25 | 5-15-2026 | EUR | 1,600,000 | 1,726,578 | |||||||||||

|

|

|

|||||||||||||||

| Food Products: 0.38% | ||||||||||||||||

| Danone SA (5 Year EUR Swap +1.43%) ± |

1.75 | 12-31-2099 | EUR | 2,600,000 | 2,884,622 | |||||||||||

| Sigma Holdings Company BV 144A« |

5.75 | 5-15-2026 | EUR | 1,500,000 | 1,540,838 | |||||||||||

| 4,425,460 | ||||||||||||||||

|

|

|

|||||||||||||||

| Household Products: 0.16% | ||||||||||||||||

| Energizer Gamma Acquisition BV 144A |

4.63 | 7-15-2026 | EUR | 1,600,000 | 1,832,557 | |||||||||||

|

|

|

|||||||||||||||

| Energy: 0.63% |

| |||||||||||||||

| Oil, Gas & Consumable Fuels: 0.63% | ||||||||||||||||

| Eni SpA |

1.13 | 9-19-2028 | EUR | 3,200,000 | 3,786,856 | |||||||||||

| Petroleos Mexicanos |

3.75 | 2-21-2024 | EUR | 1,000,000 | 1,157,509 | |||||||||||

| Total SA (5 Year EUR Swap +3.78%) ± |

3.88 | 12-29-2049 | EUR | 2,000,000 | 2,349,096 | |||||||||||

| 7,293,461 | ||||||||||||||||

|

|

|

|||||||||||||||

| Financials: 0.48% |

| |||||||||||||||

| Banks: 0.31% | ||||||||||||||||

| Bankia SA (5 Year EUR Swap +5.82%) ± |

6.00 | 12-31-2099 | EUR | 1,200,000 | 1,364,800 | |||||||||||

| Caixa Geral de Depositos SA (5 Year EUR Swap +10.93%) ± |

10.75 | 12-31-2099 | EUR | 1,800,000 | 2,293,050 | |||||||||||

| 3,657,850 | ||||||||||||||||

|

|

|

|||||||||||||||

| Diversified Financial Services: 0.17% | ||||||||||||||||

| LKQ European Holdings BV Company 144A |

3.63 | 4-1-2026 | EUR | 1,800,000 | 1,996,843 | |||||||||||

|

|

|

|||||||||||||||

| Industrials: 0.25% |

| |||||||||||||||

| Commercial Services & Supplies: 0.10% | ||||||||||||||||

| Paprec Holding SA 144A |

4.00 | 3-31-2025 | EUR | 1,200,000 | 1,199,950 | |||||||||||

|

|

|

|||||||||||||||

| Road & Rail: 0.15% | ||||||||||||||||

| Europcar Groupe SA 144A |

4.13 | 11-15-2024 | EUR | 1,800,000 | 1,756,804 | |||||||||||

|

|

|

|||||||||||||||

| Real Estate: 0.30% |

| |||||||||||||||

| Real Estate Management & Development: 0.30% | ||||||||||||||||

| Akelius Residential Property AB (EUR ICE Swap +3.49%) ± |

3.88 | 10-5-2078 | EUR | 2,500,000 | 2,884,070 | |||||||||||

| ATF Netherlands BV |

1.50 | 7-15-2024 | EUR | 500,000 | 579,678 | |||||||||||

| 3,463,748 | ||||||||||||||||

|

|

|

|||||||||||||||

| Total Foreign Corporate Bonds and Notes (Cost $32,100,991) |

|

30,613,284 | ||||||||||||||

|

|

|

|||||||||||||||

| Foreign Government Bonds: 1.99% | ||||||||||||||||

| Bonos y Obligaciones del Estado 144A |

0.25 | 7-30-2024 | EUR | 8,850,000 | 9,958,589 | |||||||||||

14 | Wells Fargo Core Plus Bond Fund

Table of Contents

Portfolio of investments—February 29, 2020 (unaudited)

| Interest rate |

Maturity date |

Principal | Value | |||||||||||||

| Foreign Government Bonds (continued) | ||||||||||||||||

| Brazil |

10.00 | % | 1-1-2025 | BRL | 8,600,000 | $ | 2,219,363 | |||||||||

| Italy Buoni Poliennali del Tesoro |

0.05 | 4-15-2021 | EUR | 3,500,000 | 3,870,031 | |||||||||||

| Nota do Tesouro Nacional Notes |

10.00 | 1-1-2029 | BRL | 8,000,000 | 2,155,319 | |||||||||||

| Spain |

0.75 | 7-30-2021 | EUR | 4,430,000 | 4,974,655 | |||||||||||

| Total Foreign Government Bonds (Cost $23,903,996) |

|

23,177,957 | ||||||||||||||

|

|

|

|||||||||||||||

| Loans: 0.33% |

| |||||||||||||||

| Communication Services: 0.23% |

| |||||||||||||||

| Media: 0.23% | ||||||||||||||||

| Ancestry.com Incorporated (1 Month LIBOR +3.75%) ±‡ |

5.36 | 10-19-2023 | $ | 1,209,533 | 1,112,771 | |||||||||||

| Diamond Sports Group LLC (1 Month LIBOR +3.25%) ± |

4.88 | 8-24-2026 | 1,695,750 | 1,543,133 | ||||||||||||

| 2,655,904 | ||||||||||||||||

|

|

|

|||||||||||||||

| Health Care: 0.10% |

| |||||||||||||||

| Health Care Providers & Services: 0.10% | ||||||||||||||||

| Surgery Center Holdings Incorporated (1 Month LIBOR +3.25%) ± |

4.86 | 9-2-2024 | 1,221,875 | 1,179,109 | ||||||||||||

|

|

|

|||||||||||||||

| Total Loans (Cost $4,137,373) |

|

3,835,013 | ||||||||||||||

|

|

|

|||||||||||||||

| Municipal Obligations: 1.79% |

| |||||||||||||||

| California: 0.33% |

| |||||||||||||||

| Airport Revenue: 0.18% | ||||||||||||||||

| San Jose CA Series B (AGM Insured) |

6.60 | 3-1-2041 | 2,000,000 | 2,097,780 | ||||||||||||

|

|

|

|||||||||||||||

| Transportation Revenue: 0.15% | ||||||||||||||||

| Alameda CA Corridor Transportation Authority CAB Refunding Bond Subordinated Series B (Ambac Insured) ¤ |

0.00 | 10-1-2028 | 2,115,000 | 1,704,986 | ||||||||||||

|

|

|

|||||||||||||||

| 3,802,766 | ||||||||||||||||

|

|

|

|||||||||||||||

| Illinois: 0.98% |

| |||||||||||||||

| GO Revenue: 0.66% | ||||||||||||||||

| Cook County IL Series B (BAM Insured) |

6.36 | 11-15-2033 | 1,745,000 | 2,524,404 | ||||||||||||

| Illinois Taxable Pension « |

5.10 | 6-1-2033 | 3,040,000 | 3,556,800 | ||||||||||||

| Will County IL Lincoln-Way Community High School District #210 Unrefunded CAB (AGM Insured) ¤ |

0.00 | 1-1-2025 | 1,820,000 | 1,664,991 | ||||||||||||

| 7,746,195 | ||||||||||||||||

|

|

|

|||||||||||||||

| Tax Revenue: 0.32% | ||||||||||||||||

| Chicago IL Transit Authority Taxable Pension Funding Series A |

6.90 | 12-1-2040 | 1,075,000 | 1,573,736 | ||||||||||||

| Metropolitan Pier & Exposition Authority Illinois CAB McCormick Place Expansion Project Series 2010-B1 (AGM Insured) ¤ |

0.00 | 6-15-2026 | 1,975,000 | 1,804,044 | ||||||||||||

| Metropolitan Pier & Exposition Authority Illinois CAB McCormick Place Expansion Project Series 2012-B ¤ |

0.00 | 12-15-2051 | 765,000 | 295,772 | ||||||||||||

| 3,673,552 | ||||||||||||||||

|

|

|

|||||||||||||||

| 11,419,747 | ||||||||||||||||

|

|

|

|||||||||||||||

| Maryland: 0.08% |

| |||||||||||||||

| Education Revenue: 0.08% | ||||||||||||||||

| Maryland Health & HEFAR Green Street Academy Series B 144A |

6.75 | 7-1-2023 | 975,000 | 987,149 | ||||||||||||

|

|

|

|||||||||||||||

Wells Fargo Core Plus Bond Fund | 15

Table of Contents

Portfolio of investments—February 29, 2020 (unaudited)

| Interest rate |

Maturity date |

Principal | Value | |||||||||||||

| Michigan: 0.12% |

| |||||||||||||||

| Miscellaneous Revenue: 0.12% | ||||||||||||||||

| Michigan Finance Authority Local Government Loan Program Project Series E |

7.19 | % | 11-1-2022 | $ | 1,235,000 | $ | 1,344,816 | |||||||||

|

|

|

|||||||||||||||

| Pennsylvania: 0.28% |

||||||||||||||||

| Health Revenue: 0.07% | ||||||||||||||||

| Quakertown PA General Authority USDA Loan Anticipation Notes Series 2017-B |

3.80 | 7-1-2021 | 900,000 | 900,288 | ||||||||||||

|

|

|

|||||||||||||||

| Miscellaneous Revenue: 0.21% | ||||||||||||||||

| Commonwealth of Pennsylvania Financing Authority Series A |

4.14 | 6-1-2038 | 1,995,000 | 2,414,708 | ||||||||||||

|

|

|

|||||||||||||||

| 3,314,996 | ||||||||||||||||

|

|

|

|||||||||||||||

| Total Municipal Obligations (Cost $17,577,554) |

|

20,869,474 | ||||||||||||||

|

|

|

|||||||||||||||

| Non-Agency Mortgage-Backed Securities: 19.05% | ||||||||||||||||

| Agate Bay Mortgage Loan Trust Series 2015-3 Class B3 144A ±± |

3.62 | 4-25-2045 | 2,106,257 | 2,179,338 | ||||||||||||

| ALM Loan Funding Series 2015-16A Class AAR2 (3 Month LIBOR +0.90%) 144A ± |

2.73 | 7-15-2027 | 1,850,000 | 1,850,339 | ||||||||||||

| American Money Management Corporation Series 2015-16A Class AR (3 Month LIBOR +1.26%) 144A ± |

3.10 | 4-14-2029 | 3,000,000 | 3,000,336 | ||||||||||||

| American Money Management Corporation Series 2016-19A Class AR (3 Month LIBOR +1.14%) 144A ± |

2.97 | 10-16-2028 | 2,750,000 | 2,750,176 | ||||||||||||

| Angel Oak Mortgage Trust I LLC Series 2019-3 Class A1 144A ±± |

2.93 | 5-25-2059 | 1,074,509 | 1,081,801 | ||||||||||||

| Banc of America Funding Corporation Series 2016-R1 Class A1 144A ±± |

2.50 | 3-25-2040 | 517,540 | 521,242 | ||||||||||||

| BDS Limited Series 2018-FL2 Class A (1 Month LIBOR +0.95%) 144A ± |

2.61 | 8-15-2035 | 1,326,686 | 1,325,030 | ||||||||||||

| Benefit Street Partners CLO Limited Series 2014-IVA Class A1RR (3 Month LIBOR +1.25%) 144A ± |

3.07 | 1-20-2029 | 1,000,000 | 1,000,375 | ||||||||||||

| Benefit Street Partners CLO Limited Series 2016-10A Class A1R (3 Month LIBOR +1.14%) 144A ± |

2.97 | 1-15-2029 | 3,500,000 | 3,502,828 | ||||||||||||

| BlueMountain CLO Limited Series 2012-2A Class AR2 (3 Month LIBOR +1.05%) 144A± |

2.74 | 11-20-2028 | 935,000 | 935,229 | ||||||||||||

| BlueMountain CLO Limited Series 2013-1A Class A1R2 (3 Month LIBOR +1.23%) 144A ± |

3.05 | 1-20-2029 | 1,935,000 | 1,935,726 | ||||||||||||

| Bunker Hill Loan Depositary Trust Series 2019-3 Class A1 144A |

2.72 | 11-25-2059 | 3,698,321 | 3,737,221 | ||||||||||||

| BX Trust Series 2019-OC11 Class A 144A |

3.20 | 12-9-2041 | 4,975,000 | 5,446,205 | ||||||||||||

| Cascade Funding Mortgage Trust Series 2018- RM2 Class A 144A ±± |

4.00 | 10-25-2068 | 526,920 | 550,118 | ||||||||||||

| CD Commercial Mortgage Trust Series 2017-6 Class A5 |

3.46 | 11-13-2050 | 1,035,000 | 1,147,040 | ||||||||||||

| CIFC Funding Limited Series 2012-2RA Class A1 (3 Month LIBOR +0.80%) 144A ± |

2.62 | 1-20-2028 | 2,525,000 | 2,525,045 | ||||||||||||

| Citigroup Commercial Mortgage Trust 2017-MDRA Class A 144A |

3.66 | 7-10-2030 | 2,000,000 | 2,062,848 | ||||||||||||

| CNH Equipment Trust Series 2019-A Class A2 |

2.96 | 5-16-2022 | 2,505,423 | 2,521,533 | ||||||||||||

| Colt Funding LLC Series 2018-3 Class A1 144A ±± |

3.69 | 10-26-2048 | 1,361,360 | 1,367,583 | ||||||||||||

| Colt Funding LLC Series 2019-1 Class A1 144A ±± |

3.71 | 3-25-2049 | 1,534,412 | 1,561,686 | ||||||||||||

| Commercial Mortgage Trust Series 2014-CR15 Class A2 |

2.93 | 2-10-2047 | 295,009 | 295,388 | ||||||||||||

| Credit Suisse Mortgage Trust Series 2013 Class B4 144A ±± |

3.42 | 4-25-2043 | 4,122,101 | 4,211,780 | ||||||||||||

| Credit Suisse Mortgage Trust Series 2018 Class A1 144A ±± |

4.13 | 7-25-2058 | 1,614,535 | 1,628,350 | ||||||||||||

| Crown Point Limited Series 2015-3A Class A1AR (3 Month LIBOR +0.91%) 144A ± |

2.74 | 12-31-2027 | 1,969,190 | 1,969,731 | ||||||||||||

| Crown Point Limited Series 2018-6A Class A1 (3 Month LIBOR +1.17%) 144A ± |

2.99 | 10-20-2028 | 3,500,000 | 3,500,406 | ||||||||||||

| CSAIL Commercial Mortgage Trust Series 2015-C4 Class A1 |

2.01 | 11-15-2048 | 75,548 | 75,490 | ||||||||||||

| CSMLT Trust Series 2015-1 Class B4 144A ±± |

3.88 | 5-25-2045 | 4,686,162 | 4,875,119 | ||||||||||||

| Deephaven Residential Mortgage Series 2019-2A Class A1 144A ±± |

3.56 | 4-25-2059 | 1,950,218 | 1,971,218 | ||||||||||||

| Deephaven Residential Mortgage Series 2019-4A Class A1 144A ±± |

2.79 | 10-25-2059 | 2,846,381 | 2,863,618 | ||||||||||||

| DLL Securitization Trust Series 2019-MT3 Class A1 144A |

2.06 | 10-20-2020 | 3,916,039 | 3,920,335 | ||||||||||||

| Dryden Senior Loan Fund Series 2013-28A Class A2LR (3 Month LIBOR +1.65%) 144A ± |

3.34 | 8-15-2030 | 4,000,000 | 4,000,652 | ||||||||||||

16 | Wells Fargo Core Plus Bond Fund

Table of Contents

Portfolio of investments—February 29, 2020 (unaudited)

| Interest rate |

Maturity date |

Principal | Value | |||||||||||||

| Non-Agency Mortgage-Backed Securities (continued) | ||||||||||||||||

| Financial Asset Securitization Incorporated Series 1997-NAM2 Class B2 † |

8.00 | % | 7-25-2027 | $ | 17,926 | $ | 931 | |||||||||

| FirstKey Mortgage Trust Series 2014-1 Class A2 144A ±± |

3.00 | 11-25-2044 | 193,659 | 193,308 | ||||||||||||

| GCAT Series 2019-NQM1 Class A1 144A |

2.99 | 2-25-2059 | 3,280,188 | 3,313,536 | ||||||||||||

| GCAT Series 2019-NQM2 Class A1 144A |

2.86 | 9-25-2059 | 4,342,547 | 4,388,452 | ||||||||||||

| GCAT Series 2019-RPl1 Class A1 144A ±± |

2.65 | 10-25-2068 | 4,654,188 | 4,719,086 | ||||||||||||

| Gilbert Park CLO Series 2017-1A Class B (3 Month LIBOR +1.60%) 144A ± |

3.43 | 10-15-2030 | 3,000,000 | 3,000,060 | ||||||||||||

| Great Wolf Trust Series 2019-WOLF Class A (1 Month LIBOR +1.03%) 144A ± |

2.69 | 12-15-2036 | 2,350,000 | 2,350,004 | ||||||||||||

| Goldman Sachs Mortgage Securities Trust Series 2019-GSA1 Class C ±± |

3.81 | 11-10-2052 | 500,000 | 534,233 | ||||||||||||

| Goldman Sachs Mortgage Securities Trust Series 2019- PJ1 Class A6 144A ±± |

4.00 | 8-25-2049 | 691,359 | 699,073 | ||||||||||||

| Homeward Opportunities Fund I Trust Series 2019-1 Class A1 144A ±± |

3.45 | 1-25-2059 | 1,915,764 | 1,937,099 | ||||||||||||

| Hospitality Mortgage Trust Series 2019 Class A (1 Month LIBOR +1.00%) 144A ± |

2.66 | 11-15-2036 | 2,718,220 | 2,714,954 | ||||||||||||

| JPMorgan Mortgage Trust Series 2014-2 Class B4 144A ±± |

3.40 | 6-25-2029 | 1,215,000 | 1,265,679 | ||||||||||||

| JPMorgan Mortgage Trust Series 2020-1 Class A15 144A ±± |

3.50 | 6-25-2050 | 5,560,973 | 5,691,172 | ||||||||||||

| JPMorgan Chase Commercial Mortgage Securities Trust Series 2012-C8 Class ASB |

2.38 | 10-15-2045 | 2,070,793 | 2,099,092 | ||||||||||||

| JPMorgan Chase Commercial Mortgage Securities Trust Series 2019-MFP Class A (1 Month LIBOR +0.96%) 144A ± |

2.62 | 7-15-2036 | 5,000,000 | 4,999,995 | ||||||||||||

| Lendmark Funding Trust Series 2018-1A Class A 144A |

3.81 | 12-21-2026 | 2,685,000 | 2,755,504 | ||||||||||||

| Lendmark Funding Trust Series 2018-2A Class A 144A |

4.23 | 4-20-2027 | 600,000 | 627,106 | ||||||||||||

| LoanCore Limited Series 2018-CRE1 Class A (1 Month LIBOR +1.13%) 144A ± |

2.79 | 5-15-2028 | 3,000,000 | 3,002,814 | ||||||||||||

| Mach One Trust Commercial Mortgage Backed Series 2004-1 Class X 144A ±±(c) |

0.78 | 5-28-2040 | 62,017 | 0 | ||||||||||||

| Mello Warehouse Securitization Series 2019-1 Class A (1 Month LIBOR +0.80%) 144A ± |

2.43 | 6-25-2052 | 3,115,000 | 3,117,080 | ||||||||||||

| Metlife Securitization Trust 2019-1A Class A1A 144A ±± |

3.75 | 4-25-2058 | 2,417,373 | 2,548,267 | ||||||||||||

| Mill City Mortgage Trust Series 2019 Class M2 144A ±± |

3.25 | 7-25-2059 | 4,592,000 | 4,756,362 | ||||||||||||

| Morgan Stanley Bank of America Merrill Lynch Trust Series 2016-C30 Class B ±± |

3.31 | 9-15-2049 | 610,000 | 639,996 | ||||||||||||

| Morgan Stanley Capital I Series 2004-RR2 Class X 144A ±±(c) |

0.35 | 10-28-2033 | 3,349 | 12 | ||||||||||||

| Neuberger Berman Limited Series 2015-20A Class AR (3 Month LIBOR +0.80%) 144A ± |

2.63 | 1-15-2028 | 1,575,000 | 1,575,187 | ||||||||||||

| New Residential Mortgage Loan Trust Series 2018-NQM1 Class A1 144A ±± |

3.99 | 11-25-2048 | 2,068,789 | 2,105,984 | ||||||||||||

| New Residential Mortgage Loan Trust Series 2019-RPL3 Class M1 144A ±± |

3.25 | 7-25-2059 | 5,000,000 | 5,177,146 | ||||||||||||

| Octagon Investment Partners Series 2017-1A Class B1 (3 Month LIBOR +1.70%) 144A ± |

3.52 | 7-20-2030 | 1,000,000 | 1,000,053 | ||||||||||||

| Ondeck Asset Securitization Trust LLC Series 2018-1A Class A 144A |

3.50 | 4-18-2022 | 5,020,000 | 5,035,789 | ||||||||||||

| Onslow Bay Financial LLC Series 2020 Class A21 144A ±± |

3.50 | 12-25-2049 | 4,347,209 | 4,459,967 | ||||||||||||

| OZLM Funding Limited Series 2014-8A Class A2RR (3 Month LIBOR +1.80%) 144A ± |

3.64 | 10-17-2029 | 5,400,000 | 5,380,771 | ||||||||||||

| Palmer Square Loan Funding Limited Series 2019-2A Class A1 (3 Month LIBOR +0.97%) 144A ± |

2.79 | 4-20-2027 | 2,586,103 | 2,586,931 | ||||||||||||

| Residential Mortgage Loan Trust Series 2020-1 Class M1 144A ±± |

3.24 | 2-25-2024 | 5,000,000 | 5,074,920 | ||||||||||||

| Shellpoint Company Originator Trust Series 2016-1 Class B2 144A ±± |

3.62 | 11-25-2046 | 6,089,664 | 6,401,493 | ||||||||||||

| Sound Point CLO Limited Series 2013-2RA Class A1 (3 Month LIBOR +0.95%) 144A ± |

2.78 | 4-15-2029 | 2,825,000 | 2,798,007 | ||||||||||||

| Starwood Mortgage Residential Trust Series 2019-1 Class A1 144A ±± |

2.94 | 6-25-2049 | 2,831,384 | 2,864,401 | ||||||||||||

| Starwood Mortgage Residential Trust Series 2019-INV1 Class A1 144A ±± |

2.61 | 9-27-2049 | 3,225,687 | 3,234,024 | ||||||||||||

| TCW CLO 2017-1 Limited Series 2017-1A Class BR (3 Month LIBOR +1.55%) 144A%% ± |

3.30 | 7-29-2029 | 5,545,000 | 5,536,677 | ||||||||||||

| TCW CLO 2019-1 AMR Limited Series 2019-1A Class A (3 Month LIBOR +1.44%) 144A ± |

3.13 | 2-15-2029 | 4,210,000 | 4,213,153 | ||||||||||||

| Towd Point Mortgage Trust Series 2015-1 Class A3 144A ±± |

3.25 | 10-25-2053 | 5,000,000 | 5,133,518 | ||||||||||||

| Towd Point Mortgage Trust Series 2015-4 Class A2 144A ±± |

3.75 | 4-25-2055 | 2,675,000 | 2,773,421 | ||||||||||||

| Towd Point Mortgage Trust Series 2017-4 Class A1 144A ±± |

2.75 | 6-25-2057 | 2,357,508 | 2,415,140 | ||||||||||||

| Towd Point Mortgage Trust Series 2019- MH1 Class A1 144A ±± |

3.00 | 11-25-2058 | 1,986,684 | 2,016,107 | ||||||||||||

Wells Fargo Core Plus Bond Fund | 17

Table of Contents

Portfolio of investments—February 29, 2020 (unaudited)

| Interest rate |

Maturity date |

Principal | Value | |||||||||||||

| Non-Agency Mortgage-Backed Securities (continued) | ||||||||||||||||

| Towd Point Mortgage Trust Series 2019-4 Class M1 144A ±± |

3.50 | % | 10-25-2059 | $ | 4,000,000 | $ | 4,260,032 | |||||||||

| Towd Point Mortgage Trust Series 2019-SJ3 Class A1 144A ±± |

3.00 | 11-25-2059 | 4,602,415 | 4,635,908 | ||||||||||||

| UBS Commercial Mortgage Trust Series 2017-C5 Class A5 |

3.47 | 11-15-2050 | 1,140,000 | 1,263,914 | ||||||||||||

| UBS Commercial Mortgage Trust Series 2018-NYCH Class A (1 Month LIBOR +0.85%) 144A ± |

2.51 | 2-15-2032 | 2,930,000 | 2,923,609 | ||||||||||||

| Venture Limited Series 2018 Class 35A 144A |

4.40 | 10-22-2031 | 2,000,000 | 2,023,510 | ||||||||||||

| Verus Securitization Trust Series 2019-1 Class A1 144A ±± |

3.40 | 12-25-2059 | 1,994,300 | 2,015,948 | ||||||||||||

| Verus Securitization Trust Series 2019-2 Class A1 144A ±± |

3.21 | 5-25-2059 | 3,692,321 | 3,731,085 | ||||||||||||

| Voya CLO Limited Series 2015-2A Class AR (3 Month LIBOR +0.97%) 144A ± |

2.78 | 7-23-2027 | 2,900,000 | 2,900,142 | ||||||||||||

| West CLO Limited Series 2014-2A Class A1 (3 Month LIBOR +0.87%) 144A ± |

2.71 | 1-16-2027 | 1,423,776 | 1,423,212 | ||||||||||||

| Whitehorse Limited Series 2014-1A Class AR (3 Month LIBOR +0.90%) 144A ± |

2.66 | 5-1-2026 | 1,025,202 | 1,025,594 | ||||||||||||

| Total Non-Agency Mortgage-Backed Securities (Cost $219,663,869) |

|

221,653,244 | ||||||||||||||

|

|

|

|||||||||||||||

| U.S. Treasury Securities: 7.20% | ||||||||||||||||

| TIPS |

1.38 | 2-15-2044 | 3,098,334 | 4,011,402 | ||||||||||||

| U.S. Treasury Bond |

1.50 | 2-15-2030 | 1,100,000 | 1,137,469 | ||||||||||||

| U.S. Treasury Bond ¤ |

0.00 | 11-15-2027 | 1,795,000 | 1,643,122 | ||||||||||||

| U.S. Treasury Bond |

0.13 | 1-15-2030 | 11,895,708 | 12,370,414 | ||||||||||||

| U.S. Treasury Bond |

2.00 | 2-15-2050 | 5,015,000 | 5,415,021 | ||||||||||||

| U.S. Treasury Bond |

2.25 | 8-15-2049 | 600,000 | 682,008 | ||||||||||||

| U.S. Treasury Bond |

2.38 | 11-15-2049 | 3,745,000 | 4,371,556 | ||||||||||||

| U.S. Treasury Bond |

2.88 | 8-15-2045 | 2,495,000 | 3,115,631 | ||||||||||||

| U.S. Treasury Bond |

3.00 | 11-15-2044 | 7,545,000 | 9,583,918 | ||||||||||||

| U.S. Treasury Bond |

3.00 | 5-15-2045 | 8,145,000 | 10,373,739 | ||||||||||||

| U.S. Treasury Bond |

3.00 | 2-15-2047 | 5,555,000 | 7,167,686 | ||||||||||||

| U.S. Treasury Bond |

4.25 | 11-15-2040 | 4,560,000 | 6,771,778 | ||||||||||||

| U.S. Treasury Note |

1.75 | 11-15-2029 | 16,265,000 | 17,173,553 | ||||||||||||

| Total U.S. Treasury Securities (Cost $77,794,492) |

|

83,817,297 | ||||||||||||||

|

|

|

|||||||||||||||

| Yankee Corporate Bonds and Notes: 10.41% |

| |||||||||||||||

| Communication Services: 0.66% |

| |||||||||||||||

| Diversified Telecommunication Services: 0.16% | ||||||||||||||||

| Telefonica Emisiones SAU |

5.21 | 3-8-2047 | 1,485,000 | 1,823,694 | ||||||||||||

|

|

|

|||||||||||||||

| Interactive Media & Services: 0.29% | ||||||||||||||||

| Tencent Holdings Limited 144A |

3.98 | 4-11-2029 | 3,000,000 | 3,399,885 | ||||||||||||

|

|

|

|||||||||||||||

| Wireless Telecommunication Services: 0.21% | ||||||||||||||||

| Vodafone Group plc |

4.25 | 9-17-2050 | 2,270,000 | 2,511,063 | ||||||||||||

|

|

|

|||||||||||||||

| Consumer Discretionary: 0.43% |

| |||||||||||||||

| Automobiles: 0.43% | ||||||||||||||||

| Fiat Chrysler Automobiles NV |

4.50 | 4-15-2020 | 4,945,000 | 4,950,538 | ||||||||||||

|

|

|

|||||||||||||||

| Consumer Staples: 0.65% |

| |||||||||||||||

| Beverages: 0.28% | ||||||||||||||||

| Fomento Economico SA |

3.50 | 1-16-2050 | 3,080,000 | 3,254,706 | ||||||||||||

|

|

|

|||||||||||||||

| Tobacco: 0.37% | ||||||||||||||||

| Imperial Brands Finance plc 144A |

3.50 | 7-26-2026 | 4,055,000 | 4,256,139 | ||||||||||||

|

|

|

|||||||||||||||

| Energy: 0.91% |

| |||||||||||||||

| Energy Equipment & Services: 0.04% | ||||||||||||||||

| Valaris plc |

5.75 | 10-1-2044 | 1,500,000 | 458,445 | ||||||||||||

|

|

|

|||||||||||||||

18 | Wells Fargo Core Plus Bond Fund

Table of Contents

Portfolio of investments—February 29, 2020 (unaudited)

| Interest rate |

Maturity date |

Principal | Value | |||||||||||||

| Oil, Gas & Consumable Fuels: 0.87% | ||||||||||||||||

| Aker BP ASA 144A |

3.00 | % | 1-15-2025 | $ | 3,500,000 | $ | 3,543,944 | |||||||||

| Baytex Energy Corporation 144A |

5.63 | 6-1-2024 | 2,000,000 | 1,800,000 | ||||||||||||

| Comision Federal de Electricidad 144A |

4.75 | 2-23-2027 | 1,140,000 | 1,231,211 | ||||||||||||

| EnCana Corporation |

6.50 | 2-1-2038 | 836,000 | 918,021 | ||||||||||||

| Petroleos Mexicanos Company 144A |

6.84 | 1-23-2030 | 1,870,000 | 1,954,150 | ||||||||||||

| Transocean Incorporated |

7.50 | 4-15-2031 | 1,250,000 | 743,750 | ||||||||||||

| 10,191,076 | ||||||||||||||||

|

|

|

|||||||||||||||

| Financials: 6.63% |

| |||||||||||||||

| Banks: 4.17% | ||||||||||||||||

| ABN AMRO Bank NV 144A |

4.75 | 7-28-2025 | 1,800,000 | 2,003,381 | ||||||||||||

| Banco Bradesco 144A |

2.85 | 1-27-2023 | 3,205,000 | 3,189,937 | ||||||||||||

| Banco de Bogota SA 144A |

4.38 | 8-3-2027 | 1,110,000 | 1,181,884 | ||||||||||||

| Banco del Estado de Chile 144A |

2.70 | 1-9-2025 | 4,165,000 | 4,210,815 | ||||||||||||

| Banco do Brasil SA 144A |

4.63 | 1-15-2025 | 1,615,000 | 1,709,881 | ||||||||||||

| Banco General SA 144A |

4.13 | 8-7-2027 | 1,035,000 | 1,097,411 | ||||||||||||

| Banco Internacional del Peru 144A |

3.25 | 10-4-2026 | 1,600,000 | 1,620,320 | ||||||||||||

| Banco Mercantil del Norte SA (5 Year Treasury Constant Maturity +4.97%) 144A ± |

6.75 | 12-31-2099 | 1,565,000 | 1,655,003 | ||||||||||||

| Banco Safra SA 144A |

4.13 | 2-8-2023 | 1,695,000 | 1,733,138 | ||||||||||||

| Banco Santander Mexico (5 Year Treasury Constant Maturity +3.00%) 144A ± |

5.95 | 10-1-2028 | 1,700,000 | 1,838,142 | ||||||||||||

| Banco Santander SA |

4.25 | 4-11-2027 | 1,600,000 | 1,780,344 | ||||||||||||

| Bancolombia SA |

3.00 | 1-29-2025 | 5,700,000 | 5,697,150 | ||||||||||||

| Banistmo SA 144A |

3.65 | 9-19-2022 | 1,160,000 | 1,165,812 | ||||||||||||

| Bank of New Zealand 144A |

2.00 | 2-21-2025 | 4,000,000 | 4,054,747 | ||||||||||||

| Banque Ouest Africaine de Developpement 144A |

5.00 | 7-27-2027 | 2,520,000 | 2,731,630 | ||||||||||||

| BBVA Bancomer SA 144A |

7.25 | 4-22-2020 | 283,000 | 284,064 | ||||||||||||

| BPCE SA 144A |

5.15 | 7-21-2024 | 1,725,000 | 1,903,512 | ||||||||||||

| Danske Bank 144A |

5.38 | 1-12-2024 | 1,705,000 | 1,910,994 | ||||||||||||

| Deutsche Bank AG (5 Year USD Swap +2.55%) ± |

4.88 | 12-1-2032 | 1,750,000 | 1,665,948 | ||||||||||||

| Itau Unibanco Holding SA 144A |

3.25 | 1-24-2025 | 3,510,000 | 3,486,132 | ||||||||||||

| Perrigo Finance plc |

4.90 | 12-15-2044 | 1,500,000 | 1,614,931 | ||||||||||||

| Perrigo Finance Unlimited Company |

4.38 | 3-15-2026 | 1,365,000 | 1,488,455 | ||||||||||||

| Sumitomo Mitsui Financial Group Incorporated |

2.44 | 10-19-2021 | 500,000 | 507,685 | ||||||||||||

| 48,531,316 | ||||||||||||||||

|

|

|

|||||||||||||||

| Capital Markets: 0.13% | ||||||||||||||||

| Credit Suisse Group Funding Limited (3 Month LIBOR +1.20%) 144A ± |

3.00 | 12-14-2023 | 1,485,000 | 1,529,635 | ||||||||||||

|

|

|

|||||||||||||||

| Diversified Financial Services: 1.33% | ||||||||||||||||

| AerCap Ireland Limited |

2.88 | 8-14-2024 | 3,655,000 | 3,723,250 | ||||||||||||

| Banco Nacional de Comercio Exterior SNC 144A |

4.38 | 10-14-2025 | 2,350,000 | 2,517,461 | ||||||||||||

| Brookfield Finance Incorporated |

3.90 | 1-25-2028 | 2,475,000 | 2,741,993 | ||||||||||||

| Corporacion Financiera de Desarrollo SA (3 Month LIBOR +5.61%) 144A ± |

5.25 | 7-15-2029 | 1,185,000 | 1,267,962 | ||||||||||||

| UBS Group Funding Switzerland AG 144A |

3.49 | 5-23-2023 | 1,165,000 | 1,211,008 | ||||||||||||

| UBS Group Funding Switzerland AG (5 Year USD Swap +4.87%) ± |

7.00 | 12-29-2049 | 1,650,000 | 1,834,394 | ||||||||||||

| WPP Finance Limited 2010 |

3.75 | 9-19-2024 | 2,054,000 | 2,209,457 | ||||||||||||

| 15,505,525 | ||||||||||||||||

|

|

|

|||||||||||||||

| Insurance: 0.77% | ||||||||||||||||

| Fairfax Financials Holdings Limited |

4.85 | 4-17-2028 | 2,780,000 | 3,121,474 | ||||||||||||

| Sompo International Holdings Limited |