AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ON MARCH 24, 2016

1933 Act No. 333-

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM N-14

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

Pre-Effective Amendment No. []

Post-Effective Amendment No. [ ]

(Check appropriate box or boxes)

WELLS FARGO FUNDS TRUST

(Exact Name of Registrant as Specified in Charter)

525 Market Street

San Francisco, California 94105

(Address of Principal Executive Offices)

(800) 222-8222

(Registrant's Telephone Number)

C. David Messman

Wells Fargo Funds Management, LLC

525 Market Street, 12th Floor

San Francisco, California 94105

(Name and Address of Agent for Service)

With a copy to:

Marco E. Adelfio, Esq.

Goodwin Procter LLP

901 New York Avenue, N.W.

Washington, D.C. 20001

It is proposed that this filing will be declared effective on April 25, 2016 pursuant to Rule 488.

No filing fee is required under the Securities Act of 1933 because an indefinite number of shares of beneficial interest in the Registrant has previously been registered pursuant to Rule 24f-2 under the Investment Company Act of 1940, as amended.

WELLS FARGO FUNDS TRUST

PART A

PROSPECTUS/PROXY STATEMENT

Wells Fargo Asset Management (logo) Important proxy information In February 2016, the Wells Fargo Funds Board of Trustees approved mergers of three Wells Fargo Funds into other funds within the family. The mergers are subject to approval by shareholders of the merging funds. Please read the following information. The enclosed document is a prospectus/proxy statement with proposals concerning certain Wells Fargo Funds. As a shareholder of one or more of these funds, you are being asked to approve a merger of your fund into an acquiring Wells Fargo Fund. The following

information highlights the principal aspects of the proposal, which is subject to a vote by shareholders of the merging funds. We encourage you to read the full text of the enclosed prospectus/proxy statement. What am I being asked to vote on? As a shareholder of a merging fund, you are being asked to approve a merger into an acquiring Wells Fargo Fund. The funds’ Board of Trustees believes that these mergers will benefit the current shareholders of the funds and unanimously recommend that you

vote to approve them. In each merger, the merging fund will transfer all of its assets and liabilities to the acquiring fund in exchange for the same class of shares. The mergers are expected to be tax-free exchanges for U.S. federal income tax purposes. Immediately following

the mergers, you will hold shares of the applicable acquiring fund with a total dollar value approximately equal to the total dollar value of the merging fund shares that you held before the closing. The merging funds and the corresponding acquiring funds are listed

in the table below: Merging fund Acquiring fund High Income Fund High Yield Bond Fund Small/Mid Cap Value Fund Small Cap Value Fund WealthBuilder Equity Portfolio WealthBuilder Tactical Equity Portfolio1 1. The Wells Fargo WealthBuilderSM Tactical Equity Portfolio will be renamed the Wells Fargo WealthBuilderSM Equity Portfolio following the merger. Why has the Board of Trustees recommended that I vote in favor of the merger? Among the factors the Board considered in recommending the mergers were the following: The investment objectives and principal investment strategies of the merging and acquiring funds are comparable. The mergers will eliminate duplicative expenses and may reduce associated operational costs. Shareholders will not bear the expenses incurred by the funds in connection with the mergers. The mergers are expected to be tax-free for U.S. federal income tax purposes. How do I vote my shares? We understand that your time is valuable, and our intention is not to burden you with paperwork. The voting process takes only a few minutes. You may vote using any of the three methods below: By phone: <insert number>. Agents are available to record your vote Monday through Friday, from XX a.m. to XX p.m., Eastern Time. You will need the control number found on the enclosed proxy card. Online: www.proxyonline.com. You will need the control number found on the enclosed proxy card to log in. By mail: Sign, date, and mail the enclosed proxy card in the prepaid-postage return envelope provided. Whom should I call with questions about the voting process? If you have any questions about the proposal or related proxy materials, please call your investment professional, trust officer, or Wells Fargo Funds at 1-800-222-8222—24 hours a day, 7 days a week. If you

have any questions about voting your proxy, you may call our proxy solicitor, XXXXXXX, at XXX-XXX-XXXX. [back cover] Wells Fargo Asset Management (logo) Wells Fargo Asset Management is a trade name used by the asset management businesses of Wells Fargo & Company. Wells Fargo Funds Management, LLC, a wholly owned subsidiary of Wells Fargo & Company, provides investment advisory and administrative

services for Wells Fargo Funds. Other affiliates of Wells Fargo & Company provide subadvisory and other services for the funds. The funds are distributed by Wells Fargo Funds Distributor, LLC, Member FINRA, an affiliate of Wells Fargo & Company.

241889 04-16 NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE © 2016 Wells Fargo Funds Management, LLC. All rights reserved.

WELLS FARGO FUNDS TRUST

525 Market Street, 12th Floor

San Francisco, CA 94105

1.800.222.8222

May 2, 2016

Dear Shareholder,

On February 17-18, 2016, the investment manager to the Wells Fargo Funds, Wells Fargo Funds Management, LLC ("Funds Management"), proposed to the Board of Trustees of Wells Fargo Funds Trust, the mergers outlined in the table below. The Board of Trustees approved the proposed mergers and the related Agreement and Plan of Reorganization, subject to approval by shareholders of each Target Fund shown in the table below.

As a result, you are invited to vote on a proposal to merge your Target Fund into the corresponding Acquiring Fund shown in the table below (each, a "Merger" and collectively, the "Mergers"). The Board of Trustees has unanimously approved the Mergers and recommends that you vote FOR the proposals.

|

Target Fund |

Acquiring Fund |

||

|

Wells Fargo Small/Mid Cap Value Fund |

Wells Fargo Small Cap Value Fund |

||

|

Wells Fargo WealthBuilder Equity Portfolio |

Wells Fargo WealthBuilder Tactical Equity Portfolio1 |

||

|

Wells Fargo High Income Fund |

Wells Fargo High Yield Bond Fund |

| 1 | The Wells Fargo WealthBuilder Tactical Equity Portfolio will be renamed Wells Fargo WealthBuilder Equity Portfolio following the Merger. |

This is a general summary of how each Merger, if approved by shareholders, will work:

Each Target Fund will transfer all of its assets to the corresponding Acquiring Fund.

Each Acquiring Fund will assume all of the liabilities of the corresponding Target Fund.

The corresponding Acquiring Fund will issue new shares that will be distributed to you in an amount equal to the value of your Target Fund shares.

You will become a shareholder of the corresponding Acquiring Fund and will have your investment managed in accordance with the Acquiring Fund's investment strategies.

You will not incur any sales charges or similar transaction charges as a result of the Merger.

It is expected that the Merger will not be a taxable event to the Target Fund, the Acquiring Fund or their shareholders for U.S. federal income tax purposes.

Details about your Target Fund's and its corresponding Acquiring Fund's investment objectives, principal investment strategies,

management, past performance, principal risks, fees, and expenses, along with additional information about the Merger, are

contained in the attached prospectus/proxy statement. Please read it carefully.

A special meeting of each Target Fund's shareholders will be held on June 28, 2016 at the office of the Wells Fargo Funds,

525 Market Street, San Francisco, California, 94105. Although you are welcome to attend the meeting in person, you do not

need to do so in order to vote your shares. If you do not expect to attend the meeting, please complete, date, sign and return

the enclosed proxy card in the postage-paid envelope provided. You may also vote by other means, such as by telephone or internet,

by following the voting instructions outlined in your proxy card. If your Target Fund does not receive your vote after several

weeks, you may receive a telephone call from Proxy Solicitor requesting your vote. Proxy Solicitor has been retained to act as our proxy solicitor and will receive approximately $_____ as compensation for seeking shareholder votes and answering shareholder questions. That cost and any other expenses of the

Mergers will be paid by Funds Management or one of its affiliates, and so will not be borne by shareholders of any Fund. If

you have any questions about the Mergers or the proxy card, please call Proxy Solicitor at Number (toll-free).

Remember, your vote is important to us, no matter how many shares you own. Please take this opportunity to vote. Thank you

for taking this matter seriously and participating in this important process.

Sincerely,

Karla Rabusch

President

Wells Fargo Funds

WELLS FARGO FUNDS TRUST

525 Market Street, 12th Floor

San Francisco, CA 94105

1.800.222.8222

May 2, 2016

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS TO BE HELD ON JUNE 28, 2016

A Special Meeting (the "Meeting") of Shareholders of each Target Fund, each a series of Wells Fargo Funds Trust (the "Trust"), as set forth in the table below, will be held at the offices of Wells Fargo Funds, 525 Market Street, San Francisco, California 94105 on June 28, 2016 at 10:00 a.m., Pacific time.

|

Target Fund |

Acquiring Fund |

||

|

Wells Fargo Small/Mid Cap Value Fund |

Wells Fargo Small Cap Value Fund |

||

|

Wells Fargo WealthBuilder Equity Portfolio |

Wells Fargo WealthBuilder Tactical Equity Portfolio1 |

||

|

Wells Fargo High Income Fund |

Wells Fargo High Yield Bond Fund |

| 1 | The Wells Fargo WealthBuilder Tactical Equity Portfolio will be renamed Wells Fargo WealthBuilder Equity Portfolio following the Merger. |

With respect to each Target Fund, the Meeting is being held for the following purposes:

To consider and act upon an Agreement and Plan of Reorganization (the "Plan") dated as of A&P Date, providing for the reorganization of the Target Fund, including the acquisition of all of the assets of the Target Fund by the corresponding Acquiring Fund in exchange for shares of the Acquiring Fund (the "Acquisition Shares") and the assumption by the Acquiring Fund of all of the liabilities of the Target Fund. The Plan also provides for the prompt distribution of the Acquisition Shares to shareholders of the corresponding Target Fund in liquidation of the Target Fund.

To transact any other business which may properly come before the Meeting or any adjournment(s) thereof.

Any adjournment(s) of the Meeting will be held at the above address. The Board of Trustees of the Trust has fixed the close of business on April 15, 2016 as the record date (the "Record Date") for the Meeting. Only shareholders of record as of the close of business on the Record Date will be entitled to this notice, and to vote at the Meeting or any adjournment(s) thereof.

IT IS IMPORTANT THAT PROXY CARDS BE RETURNED PROMPTLY. ALL SHAREHOLDERS ARE URGED TO COMPLETE, DATE, SIGN AND RETURN WITHOUT DELAY THEIR ENCLOSED PROXY CARD IN THE ENCLOSED POSTAGE-PAID ENVELOPE, OR TO VOTE USING ONE OF THE OTHER METHODS DESCRIBED AT THE END OF THE PROSPECTUS/PROXY STATEMENT SO THAT YOUR SHARES MAY BE REPRESENTED AT THE MEETING. YOUR PROMPT ATTENTION TO THE ENCLOSED PROXY CARD WILL HELP TO AVOID THE EXPENSE OF FURTHER SOLICITATION.

By order of the Board of Trustees,

C. David Messman

Secretary

WELLS FARGO FUNDS TRUST

525 Market Street, 12th Floor

San Francisco, CA 94105

1.800.222.8222

May 2, 2016

PROSPECTUS/PROXY STATEMENT

This prospectus/proxy statement contains information you should know before voting on the proposed merger (the "Merger") of your Target Fund into the corresponding Acquiring Fund as set forth and defined in the table below, each of which is a series of Wells Fargo Funds Trust (the "Trust"), a registered open-end management investment company. If approved, the Merger will result in your receiving shares of the Acquiring Fund in exchange for your shares of the Target Fund.

|

Target Fund |

Acquiring Fund |

||

|

Wells Fargo Small/Mid Cap Value Fund |

Wells Fargo Small Cap Value Fund |

||

|

Wells Fargo WealthBuilder Equity Portfolio |

Wells Fargo WealthBuilder Tactical Equity Portfolio1 |

||

|

Wells Fargo High Income Fund |

Wells Fargo High Yield Bond Fund |

| 1 | The Wells Fargo WealthBuilder Tactical Equity Portfolio will be renamed Wells Fargo WealthBuilder Equity Portfolio following the Merger. |

The Target Funds and Acquiring Funds listed above are collectively referred to as the "Funds."

Please read this prospectus/proxy statement carefully and retain it for future reference. Additional information concerning each Fund and Merger has been filed with the Securities and Exchange Commission (the "SEC").

The prospectuses, statements of additional information and annual reports of each Target Fund and each Acquiring Fund are incorporated into this document by reference and are legally deemed to be part of this prospectus/proxy statement. Copies of these documents pertaining to either a Target Fund or an Acquiring Fund are available upon request without charge by writing to Wells Fargo Funds, P.O. Box 8266, Boston, MA 02266-8266, calling 1.800.222.8222 or visiting the Wells Fargo Funds website at wellsfargofunds.com.

You may also view or obtain these documents from the SEC: by phone at 1.800.SEC.0330 (duplicating fee required); in person or by mail at Public Reference Section, Securities and Exchange Commission, 100 F Street, N.E., Washington, D.C. 20549-0213 (duplicating

fee required); by email at publicinfo@sec.gov (duplicating fee required); or by internet at www.sec.gov.

The SEC has not approved or disapproved these securities or determined if this prospectus/proxy statement is truthful or complete.

Any representation to the contrary is a criminal offense.

The shares offered by this prospectus/proxy statement are not deposits of a bank, and are not insured, endorsed or guaranteed

by the FDIC or any government agency and involve investment risk, including possible loss of your original investment.

Prospectus/Proxy Statement

Table of Contents

Overview

This section summarizes the primary features and consequences of each Merger. This summary is qualified in its entirety by reference to the information contained elsewhere in this prospectus/proxy statement, in the Merger SAI, in each Fund's prospectus, in each Fund's financial statements contained in its annual report, in each Fund's SAI, and in the related Agreement and Plan of Reorganization (the "Plan"), a form of which is attached as Exhibit A hereto.

Key Features of the Mergers

The Plan sets forth the key features of the relevant Merger covered thereby and generally provides for the following:

the transfer of all of the assets of the Target Fund to the corresponding Acquiring Fund in exchange for new shares of the Acquiring Fund;

the assumption by the Acquiring Fund of all of the liabilities of the corresponding Target Fund;

the liquidation of the Target Fund by distributing the shares of the corresponding Acquiring Fund to the Target Fund's shareholders; and

the assumption of the costs of the Merger by Wells Fargo Funds Management, LLC ( the "Manager") or one of its affiliates.

The Mergers are scheduled to take place on or about July 22, 2016. For a more complete description of the Mergers, see the section entitled "Merger Information - Agreement and Plan of Reorganization," as well as Exhibit A.

Reasons for the Proposals and Board of Trustees Recommendation

At a meeting held on February 17-18, 2016, the Board of Trustees of the Trust (the "Board"), including a majority of Trustees

who are not "interested persons" of each Target Fund, as that term is defined in the Investment Company Act of 1940, as amended

(the "1940 Act")(the "Independent Trustees"), considered and unanimously approved the Merger of each Target Fund.

Prior to approving the Mergers, the Board received the recommendation that the Mergers be approved from the Manager. In recommending

the approval of the Mergers to the Board, the Manager noted that it considered various factors, including asset size, performance

and profitability. The Manager indicated to the Board that the proposal to merge each Target Fund into its respective Acquiring

Fund is intended to further rationalize the product offerings of the Wells Fargo fund family by combining funds with identical

investment objectives and similar principal investment strategies into a single combined fund.

Before approving the Mergers, the Board reviewed, among other things, information about the Funds and the Mergers. This included,

among other things, a comparison of various factors, such as the relative sizes of the Funds, the performance records of the

Funds, and the expenses of the Funds (including pro forma expense information of each Acquiring Fund following the Mergers), as

well as the similarities and differences between the Funds' investment objectives, principal investment strategies and specific

portfolio characteristics.

The Board, including all of the Independent Trustees, has concluded that each Merger would be in the best interests of each

Target Fund, and that existing shareholders' interests will not be diluted as a result of the Merger. Accordingly, the Board

is submitting a Plan to each Target Fund's shareholders and unanimously recommended its approval. The Board has also approved

the Plan on behalf of each Acquiring Fund.

For further information about the considerations of the Board, please see the section entitled "Board Considerations."

Merger Summary (Objectives, Strategies, Risks, Performance, Expense, Management and Tax Information)

The following section provides a comparison between the Funds with respect to their investment objectives, principal investment strategies, fundamental investment policies, risks, performance records, and expenses. It also provides information about what the management and share class structure of your Acquiring Fund will be after the Merger. The information below is only a summary; for more detailed information, please see the rest of this prospectus/proxy statement and each Fund's prospectus(es) and SAI. In this section, percentages of a Fund's "net assets" are measured as percentages of net assets plus borrowings for investment purposes. References to "we" in the principal investment strategy discussion for a Fund generally refer to the Manager or the sub-adviser.

WELLS FARGO SMALL/MID CAP VALUE FUND INTO WELLS FARGO SMALL CAP VALUE FUND

Share Class Information

The following table illustrates the share class of the Acquiring Fund you will receive as a result of the Merger in exchange for your Target Fund shares.

|

If you own this class of shares of the Target Fund: |

You will receive this class of shares of the Acquiring Fund: |

||||

|

Class A |

Class A |

||||

|

Class C |

Class C |

||||

|

Administrator Class |

Administrator Class |

||||

|

Institutional Class |

Institutional Class |

The Acquiring Fund shares you will receive as a result of the Merger will have the same total value as the total value of

your Target Fund shares as of the close of business on the business day immediately prior to the Merger.

The procedures for buying, selling and exchanging shares of the Funds are identical. For additional information see the section

entitled "Buying, Selling and Exchanging Fund Shares." Additional information on how you can buy, sell or exchange shares

of each Fund is available in the Fund's prospectuses and SAI.

Investment Objective and Strategy Comparison

The following section compares the investment objectives, principal investment strategies and fundamental investment policies of the Funds. The investment objectives of the Funds may be changed without shareholder approval.

The Funds' investment objectives are identical in that both Funds seek long-term capital appreciation. One difference between the wording of the Funds' investment strategies is that the Wells Fargo Small/Mid Cap Value Fund has a policy of investing at least 80% of its net assets in equity securities of small-and medium-capitalization companies, while the Wells Fargo Small Cap Value Fund has a policy of investing at least 80% of its net assets in equity securities of small capitalization companies, although both Funds define such companies as companies with market capitalizations within the range of the Russell 2500TM Index (which were approximately $13.3 million to $23. 2 billion, as of February 29, 2016). Each Fund may also invest up to 30% of its total assets in equity securities of foreign issuers, including ADRs and similar investments.

|

Target Fund |

Acquiring Fund |

||||

|

INVESTMENT OBJECTIVES |

|||||

|

The Fund seeks long-term capital appreciation. |

The Fund seeks long-term capital appreciation. |

||||

|

PRINCIPAL INVESTMENT STRATEGIES |

|||||

|

Under normal circumstances, we invest at least 80% of the Fund's net assets in equity securities of small- to medium-capitalization companies and up to 30% of the Fund's total assets in equity securities of foreign issuers, including ADRs and similar investments. |

Under normal circumstances, we invest at least 80% of the Fund's net assets in equity securities of small-capitalization companies and up to 30% of the Fund's total assets in equity securities of foreign issuers, including ADRs and similar investments. |

||||

|

We invest principally in equity securities of small-and medium capitalization companies, which we define as companies with market capitalizations within the range of the Russell 2500TM Index at the time of purchase. The market capitalization range of the Russell 2500TM Index was $103 million to $11.52 billion as of June 30, 2015, and is expected to change frequently. We may also invest in equity securities of foreign issuers through ADRs and similar investments. |

We invest principally in equity securities of small-capitalization companies, which we define as companies with market capitalizations within the range of the Russell 2500TM Index at the time of purchase. The market capitalization range of the Russell 2500TM Index was $103 million to $11.52 billion as of June 30, 2015, and is expected to change frequently. We may also invest in equity securities of foreign issuers including ADRs and similar investments. |

||||

|

As a hedging strategy, the Fund may write put and call options, meaning that the Fund sells an option to another party giving that party the right to either sell a stock to (put) or buy a stock from (call) the Fund at a predetermined price in the future. Whether or not this hedging strategy is successful depends on a variety of factors, particularly our ability to predict movements of the price of the hedged stock. Furthermore, we may use options to enhance return. |

As a hedging strategy, the Fund may write put and call options, meaning that the Fund sells an option to another party giving that party the right to either sell a stock to (put) or buy a stock from (call) the Fund at a predetermined price in the future. Whether or not this hedging strategy is successful depends on a variety of factors, particularly our ability to predict movements of the price of the hedged stock. Furthermore, we may use options to enhance return. |

||||

|

We employ a multi-faceted investment process that consists of quantitative idea generation and rigorous fundamental research. This process involves identifying companies that we believe exhibit attractive valuation characteristics and warrant further research. We then conduct fundamental research to find securities in small- and medium-capitalization companies with a positive dynamic for change that could move the price of such securities higher. The positive dynamic may include a change in management team, a new product or service, corporate restructuring, an improved business plan, a change in the regulatory environment, or the right time for the industry in its market cycle. |

We employ a multi-faceted investment process that consists of quantitative idea generation and rigorous fundamental research. This process involves identifying companies that we believe exhibit attractive valuation characteristics and warrant further research. We then conduct fundamental research to find securities in small-capitalization companies with a positive dynamic for change that could move the price of such securities higher. The positive dynamic may include a change in management team, a new product or service, corporate restructuring, an improved business plan, a change in the regulatory environment, or the right time for the industry in its market cycle. |

||||

|

We typically sell a security when its fundamentals deteriorate, its relative valuation versus the peer group and market becomes expensive, or for risk management considerations. We believe the combination of buying the securities of undervalued small and medium capitalization companies with positive dynamics for change limits our downside risk while allowing us to potentially participate in significant upside appreciation in the price of such securities. |

We typically sell a security when its fundamentals deteriorate, its relative valuation versus the peer group and market becomes expensive, or for risk management considerations. We believe the combination of buying the securities of undervalued small-capitalization companies with positive dynamics for change limits our downside risk while allowing us to potentially participate in significant upside appreciation in the price of such securities. |

||||

|

We may actively trade portfolio securities, which may lead to higher transaction costs that may affect the Fund's performance. |

We may actively trade portfolio securities, which may lead to higher transaction costs that may affect the Fund's performance. |

||||

|

In addition, active trading of portfolio securities may lead to higher taxes if your shares are held in a taxable account. |

In addition, active trading of portfolio securities may lead to higher taxes if your shares are held in a taxable account. |

||||

The fundamental investment policies of the Funds are identical. For a comparative chart of fundamental investment policies, please see Exhibit B.

Principal Risk Comparison

The principal risks of the Target Fund are identical to those of the Acquiring Fund due to the similarity of the Target Fund's and the Acquiring Fund's investment objectives and principal investment strategies.

The below table compares the principal risk factors of the Target Fund with those of the Acquiring Fund. These risks are described in the section entitled "Risk Descriptions."

|

Target Fund |

Acquiring Fund |

||||

|

Derivatives Risk |

Derivatives Risk |

||||

|

Foreign Investment Risk |

Foreign Investment Risk |

||||

|

Investment Style Risk |

Investment Style Risk |

||||

|

Management Risk |

Management Risk |

||||

|

Market Risk |

Market Risk |

||||

|

Options Risk |

Options Risk |

||||

|

Smaller Company Securities Risk |

Smaller Company Securities Risk |

Each Fund has other investment policies, practices and restrictions which, together with the Fund's related risks, are set forth in the Fund's prospectuses and SAI.

Fund Performance Comparison

The following bar charts and tables illustrate how each Fund's returns have varied from year to year and compare each Fund's

returns with those of one or more broad-based securities indexes. Past performance (before and after taxes) is not necessarily

an indication of future results. Current month-end performance information is available for the Funds by visiting the Wells

Fargo Funds website at wellsfargofunds.com.

For additional information about the performance history of the Funds, please see Exhibit C.

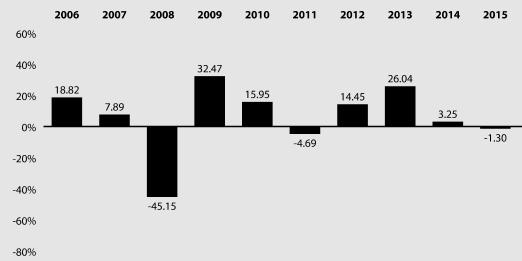

Calendar Year Total Returns for Class A Shares (%) for the Target Fund

|

Highest Quarter: 3rd Quarter 2009 |

+25.43% |

|

|

Lowest Quarter: 4th Quarter 2008 |

-30.55% |

|

Average Annual Total Returns for the Target Fund for the periods ended 12/31/2015 (Returns reflect applicable sales charges) |

||||||

|

|

Inception Date of Share Class |

1 Year |

5 Year |

10 Year |

||

|

Class A (before taxes) |

7/31/2007 |

-10.20% |

-0.38% |

1.67% |

||

|

Class A (after taxes on distributions) |

7/31/2007 |

-10.60% |

-2.22% |

0.50% |

||

|

Class A (after taxes on distributions and the sale of Fund Shares) |

7/31/2007 |

-5.46% |

-0.39% |

1.31% |

||

|

Class C (before taxes) |

7/31/2007 |

-6.52% |

0.05% |

1.55% |

||

|

Administrator Class (before taxes) |

4/8/2005 |

-4.52% |

1.06% |

2.56% |

||

|

Institutional Class (before taxes) |

8/31/2006 |

-4.41% |

1.24% |

2.74% |

||

|

Russell 2500™ Value Index (reflects no deduction for fees, expenses, or taxes) |

-5.49% |

9.23% |

6.51% |

|||

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state, local or foreign taxes. Actual after-tax returns depend on an investor's tax situation and may differ from those shown, and after-tax returns shown are not relevant to tax-exempt investors or investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) Plans or Individual Retirement Accounts. After-tax returns are shown only for the Class A shares. After-tax returns for the Class C, Administrator Class and Institutional Class shares will vary.

Calendar Year Total Returns for Class A Shares (%) for the Acquiring Fund

|

Highest Quarter: 3rd Quarter 2009 |

+21.91% |

|

|

Lowest Quarter: 4th Quarter 2008 |

-24.91% |

|

Average Annual Total Returns for the Acquiring Fund for the periods ended 12/31/2015 (Returns reflect applicable sales charges) |

||||||

|

|

Inception Date of Share Class |

1 Year |

5 Year |

10 Year |

||

|

Class A (before taxes) |

11/30/2000 |

-15.85% |

0.92% |

3.82% |

||

|

Class A (after taxes on distributions) |

11/30/2000 |

-21.75% |

-2.02% |

1.91% |

||

|

Class A (after taxes on distributions and the sale of Fund Shares) |

11/30/2000 |

-4.14% |

0.81% |

3.18% |

||

|

Class B (before taxes) |

11/30/2000 |

-16.37% |

0.99% |

3.89% |

||

|

Class C (before taxes) |

11/30/2000 |

-12.39% |

1.36% |

3.66% |

||

|

Administrator Class (before taxes) |

7/30/2010 |

-10.54% |

2.32% |

4.64% |

||

|

Institutional Class (before taxes) |

7/31/2007 |

-10.34% |

2.54% |

4.83% |

||

|

Russell 2000® Value Index (reflects no deduction for fees, expenses, or taxes) |

-7.47% |

7.67% |

5.57% |

|||

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state, local or foreign taxes. Actual after-tax returns depend on an investor's tax situation and may differ from those shown, and after-tax returns shown are not relevant to tax-exempt investors or investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) Plans or Individual Retirement Accounts. After-tax returns are shown only for the Class A shares. After-tax returns for Class C, Administrator Class and Institutional Class shares will vary.

Shareholder Fee and Fund Expense Comparison

This section compares the fees and expenses you pay if you buy, hold, and sell shares of the Target Fund and the Acquiring Fund.

For information about the share class of the Acquiring Fund that you will receive in connection with the Merger, please see the section entitled "Share Class Information" above.

The following table entitled "Shareholder Fees" allows you to compare the maximum sales charges of the Funds and includes a Pro Forma column that shows you what the sales charges will be, assuming the Merger takes place. The sales charges for each class of shares of the Target Fund are identical to those of the corresponding class of shares of the Acquiring Fund. The Target Fund shareholders will not pay any front-end or deferred sales charges in connection with the Merger.

You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in the aggregate in specified classes of Wells Fargo Funds. More information about these and other discounts is available in the "Buying, Selling and Exchanging Fund Shares" section of this prospectus/proxy statement and from your financial professional and in the Funds' prospectuses.

The following tables entitled "Annual Fund Operating Expenses" allow you to compare the annual operating expenses of the Funds. The total annual fund operating expenses for both Funds set forth in the following tables are based on the actual expenses incurred for each Fund's fiscal year ended March 31, 2015. The pro forma expense table shows you what the total annual fund operating expenses (before and after waiver) would have been for the Acquiring Fund for the twelve-month period ended September 30, 2015, assuming the Merger had taken place at the beginning of that period.

Shareholder Fees (fees paid directly from your investment)

|

Class A Shareholders |

||||||

|

|

Target Fund |

Acquiring Fund |

Pro Forma |

|||

|

Maximum sales charge (load) imposed on purchases |

5.75% |

5.75% |

5.75% |

|||

|

Maximum deferred sales charge (load) |

None1 |

None |

None |

|||

|

Class C Shareholders |

||||||

|

Maximum sales charge (load) imposed on purchases (as a percentage of the offering price) |

None |

None |

None |

|||

|

Maximum deferred sales charge (load) (as a percentage of offering price) |

1.00% |

1.00% |

1.00% |

|||

|

Institutional Class Shareholders |

||||||

|

Maximum sales charge (load) imposed on purchases |

None |

None |

None |

|||

|

Maximum deferred sales charge (load) (as a percentage of offering price) |

None |

None |

None |

|||

|

Administrator Class Shareholders |

||||||

|

Maximum sales charge (load) imposed on purchases |

None |

None |

None |

|||

|

Maximum deferred sales charge (load) (as a percentage of offering price) |

None |

None |

None |

|||

| 1 | Investments of $1 million or more are not subject to a front-end sales charge but generally will be subject to a deferred sales charge of 1.00% if redeemed within 18 months from the date of purchase. |

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

|

Target Fund |

|||||||||||||

|

|

Management Fees |

Distribution (12b-1) Fees |

|

Other Expenses |

|

Acquired Fund Fees and Expenses |

|

Total Annual Fund Operating Expenses1 |

|

Waiver of Fund Expenses |

|

Total Annual Fund Operating Expenses After Fee Waiver2 |

|

|

Class A |

0.80% |

0.00% |

0.62% |

0.01% |

1.43% |

(0.07)% |

1.36% |

||||||

|

Class C |

0.80% |

0.75% |

0.62% |

0.01% |

2.18% |

(0.07)% |

2.11% |

||||||

|

Administrator Class |

0.80% |

0.00% |

0.54% |

0.01% |

1.35% |

(0.19)% |

1.16% |

||||||

|

Institutional Class |

0.80% |

0.00% |

0.29% |

0.01% |

1.10% |

(0.14)% |

0.96% |

||||||

| 1 | Expenses have been adjusted as necessary from amounts incurred during the Fund's most recent fiscal year to reflect current fees and expenses. |

| 2 | The Manager has contractually committed through July 31, 2016, to waive fees and/or reimburse expenses to the extent necessary to cap the Fund's Total Annual Fund Operating Expenses After Fee Waiver at 1.35% for Class A, 2.10% for Class C, 1.15% for Administrator Class, and 0.95% for Institutional Class. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses and extraordinary expenses are excluded from the cap. After this time, the cap may be increased or the commitment to maintain the cap may be terminated only with the approval of the Board of Trustees. |

|

Acquiring Fund (Pre-Merger) |

|

|

|

|||||||||||||||

|

|

Management Fees |

Distribution (12b-1) Fees |

|

Other Expenses |

|

Acquired Fund Fees and Expenses |

|

Total Annual Fund Operating Expenses1 |

|

Waiver of Fund Expenses |

|

Total Annual Fund Operating Expenses After Waiver Fee Waiver2 |

||||||

|

Class A |

0.81% |

0.00% |

0.49% |

0.02% |

1.32% |

(0.02)% |

1.30% |

|||||||||||

|

Class C |

0.81% |

0.75% |

0.49% |

0.02% |

2.07% |

(0.02)% |

2.05% |

|||||||||||

|

Administrator Class |

0.81% |

0.00% |

0.41% |

0.02% |

1.24% |

(0.14)% |

1.10% |

|||||||||||

|

Institutional Class |

0.81% |

0.00% |

0.16% |

0.02% |

0.99% |

(0.09)% |

0.90% |

|||||||||||

| 1 | Expenses have been adjusted as necessary from amounts incurred during the Fund's most recent fiscal year to reflect current fees and expenses. |

| 2 | The Manager has contractually committed through July 31, 2016, to waive fees and/or reimburse expenses to the extent necessary to cap the Fund's Total Annual Fund Operating Expenses After Fee Waiver at 1.28% for Class A, 2.03% for Class B, 2.03% for Class C, 0.83% for Class R6, 1.08% for Administrator Class, and 0.88% for Institutional Class. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses and extraordinary expenses are excluded from the cap. After this time, the cap may be increased or the commitment to maintain the cap may be terminated only with the approval of the Board of Trustees. |

|

Acquiring Fund (Pro Forma) |

||||||||||||||

|

|

Management Fees |

|

Distribution (12b-1) Fees |

|

Other Expenses |

|

Acquired Fund Fees and Expenses |

|

Total Annual Fund Operating Expenses1 |

|

Waiver of Fund Expenses |

|

Total Annual Fund Operating Expenses After Fee Waiver2 |

|

|

Class A |

0.82% |

0.00% |

0.50% |

0.02% |

1.34% |

(0.04)% |

1.30% |

|||||||

|

Class C |

0.82% |

0.75% |

0.50% |

0.02% |

2.09% |

(0.04)% |

2.05% |

|||||||

|

Administrator Class |

0.82% |

0.00% |

0.42% |

0.02% |

1.26% |

(0.16)% |

1.10% |

|||||||

|

Institutional Class |

0.82% |

0.00% |

0.17% |

0.02% |

1.01% |

(0.11)% |

0.90% |

|||||||

| 1 | Expenses have been adjusted as necessary from amounts incurred during the Fund's most recent fiscal year to reflect current fees and expenses. |

| 2 | The Manager has contractually committed through July 31, 2017, to waive fees and/or reimburse expenses to the extent necessary to cap the Fund's Total Annual Fund Operating Expenses After Fee Waiver at 1.28% for Class A, 2.03% for Class C, 1.08% for Administrator Class, and 0.88% for Institutional Class. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses and extraordinary expenses are excluded from the cap. After this time, the cap may be increased or the commitment to maintain the cap may be terminated only with the approval of the Board of Trustees. |

Examples of Fund Expenses

The examples below are intended to help you compare the costs of investing in the Target Fund with the costs of investing in the Acquiring Fund, both before and after the Merger, and are for illustration only. The example assumes a $10,000 initial investment, 5% annual total return, and that operating expenses remain the same as in the tables above. To the extent that the Manager is waiving fees or reimbursing expenses, the example assumes that such waiver or reimbursement will only be in place through the date noted above. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

Target Fund |

|

||||||||||||||

|

|

If you sold your shares, you would pay: |

|

If you held your shares, you would pay: |

|

|||||||||||

|

After: |

Class A |

Class C |

Administrator Class |

Institutional Class |

Class C |

||||||||||

|

1 Year |

$706 |

$314 |

$118 |

$98 |

$214 |

||||||||||

|

3 Years |

$995 |

$675 |

$409 |

$336 |

$675 |

||||||||||

|

5 Years |

$1,305 |

$1,163 |

$721 |

$593 |

$1,163 |

||||||||||

|

10 Years |

$2,184 |

$2,508 |

$1,607 |

$1,328 |

$2,508 |

||||||||||

|

Acquiring Fund (Pre-Merger) |

|

|||||||||||||||

|

|

If you sold your shares, you would pay: |

|

If you held your shares, you would pay: |

|

||||||||||||

|

After: |

Class A |

Class C |

Administrator Class |

Institutional Class |

Class B |

Class C |

||||||||||

|

1 Year |

$700 |

$308 |

$112 |

$92 |

$208 |

$208 |

||||||||||

|

3 Years |

$967 |

$647 |

$380 |

$306 |

$647 |

$647 |

||||||||||

|

5 Years |

$1,255 |

$1,112 |

$668 |

$538 |

$1,112 |

$1,112 |

||||||||||

|

10 Years |

$2,072 |

$2,398 |

$1,488 |

$1,205 |

$2,116 |

$2,398 |

||||||||||

|

Acquiring Fund (Pro Forma) |

|||||||||||||||

|

|

If you sold your shares, you would pay: |

|

If you held your shares, you would pay: |

|

|||||||||||

|

After: |

Class A |

Class C |

Administrator Class |

Institutional Class |

Class C |

||||||||||

|

1 Year |

$700 |

$308 |

$112 |

$92 |

$208 |

||||||||||

|

3 Years |

$971 |

$651 |

$384 |

$311 |

$651 |

||||||||||

|

5 Years |

$1,263 |

$1,120 |

$676 |

$547 |

$1,120 |

||||||||||

|

10 Years |

$2,092 |

$2,418 |

$1,509 |

$1,226 |

$2,418 |

||||||||||

The Target Fund and Acquiring Fund have each adopted a distribution plan pursuant to Rule 12b-1 under the 1940 Act (a "Distribution Plan") for Class C shares. Under each Distribution Plan, Class C shares charge an annual fee of 0.75%. Each Fund has a shareholder servicing fee of up to 0.25% for each class of shares.

Portfolio Turnover. The Target Fund and Acquiring Fund pay transaction costs, such as commissions or dealer mark-ups, when each Fund buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in the annual fund operating expenses or in the example, affect each Fund's performance. During the most recent fiscal year, the Target Fund's portfolio turnover rate was 33% of the average value of its portfolio and the Acquiring Fund's portfolio turnover rate was 9% of the average value of its portfolio.

Fund Management Information

The following table identifies the manager, sub-adviser and portfolio manager(s) for the Acquiring Fund. Following completion of the Merger, Wells Capital Managment Incorporated ("Wells Capital Managment") will serve as sub-adviser to the Acquiring Fund. Further information about the management of the Acquiring Fund can be found under the section entitled "Management of the Fund."

|

Wells Fargo Small Cap Value Fund |

||

|

Adviser |

Wells Fargo Funds Management, LLC |

|

|

Sub-Adviser |

Wells Capital Management Incorporated |

|

|

Portfolio Managers, Title/Managed Since |

I. Charles Rinaldi, Portfolio Manager / 1997 |

|

Tax Information

It is expected that the Merger will qualify as a tax-free "reorganization" for U.S. federal income tax purposes. A receipt

of an opinion substantially to that effect from Pepper Hamilton LLP, tax counsel to the Acquiring Fund, is a condition to

the obligation of the Funds to consummate the Merger. As a tax-free reorganization, the Merger will not be taxable to the

Acquiring Fund, the Target Fund or their shareholders for U.S. federal income tax purposes. Even though the Merger is expected

to be tax-free, because the Merger will end the tax year of the Target Fund, the Merger may accelerate taxable distributions

from the Target Fund to its shareholders.

The cost basis and holding period of the Target Fund shares will carry over to the shares of the Acquiring Fund you receive

as a result of the Merger, in each case for U.S. federal income tax purposes. At any time prior to the consummation of the

Merger, a shareholder may redeem shares, usually resulting in recognition of a gain or loss for U.S. federal income tax purposes

to the redeeming shareholder if the shareholder holds the shares in a taxable account.

Following shareholder approval of the Merger but before the Closing Date, the Target Fund expects to sell a substantial portion

of its portfolio securities in connection with repositioning its portfolio in anticipation of the Merger. These transactions

will result in additional transaction costs to the Target Fund and may result in increased taxable distributions to shareholders

of the Target Fund.The actual tax impact of such sales will depend on the difference between the price at which such portfolio

assets are sold and the Target Fund's basis in such assets. Any net realized capital gain from sales that occur prior to the

Merger will be distributed to the Target Fund's shareholders as capital gain distributions (to the extent of the excess of

net long-term capital gain over net short-term capital loss) and/or ordinary dividends (to the extent of the excess of net

short-term capital gain over net long-term capital loss) during or with respect to the year of sale (after reduction by any

available capital loss carryforwards), and such distributions will be taxable to shareholders. This portfolio turnover would

be in addition to the portfolio turnover that would be experienced by the Acquiring Fund following the Merger in connection

with its normal investment operations. As of December 31, 2015 ,the Target Fund had net unrealized gains of $11.6 million.

For net capital losses realized in taxable years beginning before January 1, 2011, U.S. federal income tax law permits registered

investment companies ("RICs"), such as the Funds, to carry forward a net capital loss to offset its capital gain, if any,

realized during the eight years following the year of the loss. For net capital losses realized in taxable years beginning

on or after January 1, 2011, a Fund is permitted to carry forward a net capital loss to offset its capital gain indefinitely.

The Target Fund may be presently entitled to significant net capital loss carryforwards for U.S. federal income tax purposes,

as detailed in "Material U.S. Federal Income Tax Consequences of the Mergers." The Merger will cause the tax year of the Target

Fund to close, which may result in an earlier expiration of net capital loss carryforwards than would otherwise occur.

Certain other U.S. federal income tax consequences are discussed below under "Material U.S. Federal Income Tax Consequences of the Mergers."

WELLS FARGO WEALTHBUILDER EQUITY PORTFOLIO INTO WELLS FARGO WEALTHBUILDER TACTICAL EQUITY PORTFOLIO

Share Class Information

The following table illustrates the share class of the Acquiring Fund you will receive as a result of the Merger in exchange for your Target Fund shares.

|

If you own this class of shares of the Target Fund: |

You will receive this class of shares of the Acquiring Fund: |

||||

|

Single Class |

Single Class |

The Acquiring Fund shares you will receive as a result of the Merger will have the same total value as the total value of

your Target Fund shares as of the close of business on the business day immediately prior to the Merger. Following the merger

the Wells Fargo WealthBuilder Tactical Equity Portfolio will change its name to the Wells Fargo WealthBuilder Equity Portfolio.

The procedures for buying, selling and exchanging shares of the Funds are identical. For additional information see the section

entitled "Buying, Selling and Exchanging Fund Shares." Following the Merger, foreign shareholders will not be able to make

additional investments into the Acquiring Fund or into any other funds within the Wells Fargo fund family. Additional information

on how you can buy, sell or exchange shares of each Fund is available in the Fund's prospectus and SAI.

Investment Objective and Strategy Comparison

The following section compares the investment objectives, principal investment strategies and fundamental investment policies of the Funds. The investment objectives of the Funds may be changed without shareholder approval.

The Funds' investment objectives are identical in that both Funds seek long-term capital appreciation with no emphasis on income. One difference between the Funds' investment strategies is that the Wells Fargo WealthBuilder Tactical Equity Portfolio makes tactical allocations among various Underlying Funds and employs both quantitative analysis and qualitative judgment in doing so, while the Wells Fargo WealthBuilder Equity Portfolio does not. Quantitative analysis involves the use of proprietary asset allocation models, which employ various valuation techniques. Qualitative judgments are made based on assessments of a number of factors, including economic conditions, corporate earnings, monetary policy, market valuations, investor sentiment, and market technicals. Changes to effective allocations in the Wells Fargo WealthBuilder Tactical Equity Portfolio may be implemented with index futures contracts or by buying and selling Underlying Funds, or both. Wells Fargo WealthBuilder Tactical Equity Portfolio may invest up to 10% of the Fund's net assets in bond or alternative-style asset classes (through investment in Underlying Funds). Wells Fargo WealthBuilder Equity Portfolio's allocation across equity styles remains constant.

|

Target Fund |

Acquiring Fund |

||||

|

INVESTMENT OBJECTIVES |

|||||

|

The Portfolio seeks long-term capital appreciation with no emphasis on income. |

The Portfolio seeks long-term capital appreciation with no emphasis on income. |

||||

|

PRINCIPAL INVESTMENT STRATEGIES |

|||||

|

The Portfolio is a fund-of-funds that invests in various affiliated mutual funds, unaffiliated mutual funds, and exchange-traded funds ("Underlying Funds") to pursue its investment objective. We seek to achieve the Portfolio's investment objective by investing at least 80% of the Portfolio's net assets in equity securities (through investments in Underlying Funds). The Portfolio is a diversified equity investment that consists of Underlying Funds that employ different and complementary investment styles to provide potential for growth. These equity styles include large company, small company and international. |

The Portfolio is a fund-of-funds that invests in various affiliated mutual funds, unaffiliated mutual funds, and exchange-traded funds ("Underlying Funds") to pursue its investment objective. We seek to achieve the Portfolio's investment objective by investing at least 80% of the Portfolio's net assets in equity securities (through investments in Underlying Funds). The Portfolio is a diversified equity investment that consists of Underlying Funds that employ different and complementary investment styles to provide potential for growth. These equity styles include large company, small company, and international. |

||||

|

The Portfolio's allocation across equity styles remains constant. |

Not in the Fund's strategy. |

||||

|

Not in the Fund's strategy. |

Additionally, we may invest up to 10% of the Portfolio's net assets in bond or alternative-style asset classes (through investment in Underlying Funds). |

||||

|

Not in the Fund's strategy. |

We employ both quantitative analysis and qualitative judgments in making tactical allocations among various Underlying Funds. Quantitative analysis involves the use of proprietary asset allocation models, which employ various valuation techniques. Qualitative judgments are made based on assessments of a number of factors, including economic conditions, corporate earnings, monetary policy, market valuations, investor sentiment, and market technicals. Changes to effective allocations in the Portfolio may be implemented with index futures contracts or by buying and selling Underlying Funds, or both. |

||||

|

Depending on market conditions, some equity asset classes will perform better than others. The Portfolio's broad diversification across equity styles may help to reduce the overall impact of poor performance in any one equity asset class. |

Depending on market conditions, some equity asset classes will perform better than others. The Portfolio's broad diversification across equity styles and the use of tactical allocation between equity styles may help to reduce the overall impact of poor performance in any one equity asset class. |

||||

|

We may actively trade portfolio securities, which may lead to higher transaction costs that may affect the Portfolio's performance. |

We may actively trade portfolio securities, which may lead to higher transaction costs that may affect the Portfolio's performance. |

||||

|

In addition, active trading of portfolio securities may lead to higher taxes if your shares are held in a taxable account. |

In addition, active trading of portfolio securities may lead to higher taxes if your shares are held in a taxable account. |

||||

The fundamental investment policies of the Funds are identical. For a comparative chart of fundamental investment policies, please see Exhibit B.

Principal Risk Comparison

The principal risks of the Target Fund are substantially similar, but not identical, to those of the Acquiring Fund due to the similarity of the Target Fund's and the Acquiring Fund's investment objectives and principal investment strategies. Because the Acquiring Fund may invest up to 10% of its assets in alternative-style asset classes while the Target Fund may not, the Acquiring Fund is subject to alternative investment risk, derivatives risk and futures contracts risk as principal investment risks while the Target Fund is not.

The below table compares the principal risk factors of the Target Fund with those of the Acquiring Fund. These risks are described in the section entitled "Risk Descriptions."

|

Target Fund |

Acquiring Fund |

||||

|

Not subject to Alternative Investment Risk |

Alternative Investment Risk |

||||

|

Not subject to Derivatives Risk |

Derivatives Risk |

||||

|

Emerging Markets Risk |

Emerging Markets Risk |

||||

|

Foreign Investment Risk |

Foreign Investment Risk |

||||

|

Not subject to Futures Contracts Risk |

Futures Contracts Risk |

||||

|

Investment Style Risk |

Investment Style Risk |

||||

|

Management Risk |

Management Risk |

||||

|

Market Risk |

Market Risk |

||||

|

Smaller Company Securities Risk |

Smaller Company Securities Risk |

||||

|

Underlying Funds Risk |

Underlying Funds Risk |

Each Fund has other investment policies, practices and restrictions which, together with the Fund's related risks, are set forth in the Fund's prospectuses and SAI.

Fund Performance Comparison

The following bar charts and tables illustrate how each Fund's returns have varied from year to year and compare each Fund's

returns with those of one or more broad-based securities indexes. Past performance (before and after taxes) is not necessarily

an indication of future results. Current month-end performance information is available for the Funds by visiting the Wells

Fargo Funds website at wellsfargofunds.com.

For additional information about the performance history of the Funds, please see Exhibit C.

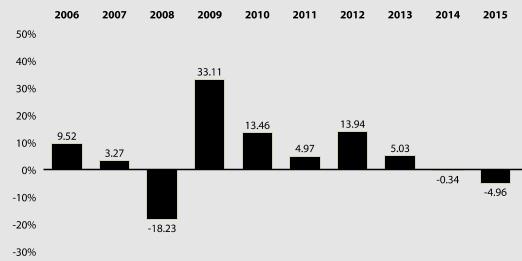

Calendar Year Total Returns for Shares (%) of the Target Fund as of 12/31 each year

|

Highest Quarter: 2nd Quarter 2009 |

+20.19% |

|

|

Lowest Quarter: 4th Quarter 2008 |

-24.40% |

|

Average Annual Total Returns for the Target Fund for the periods ended 12/31/2015 |

||||||

|

|

Inception Date of Share Class |

1 Year |

5 Year |

10 Year |

||

|

Equity Portfolio (before taxes) |

10/1/1997 |

-2.73% |

6.58% |

3.64% |

||

|

Equity Portfolio (after taxes on distributions) |

10/1/1997 |

-2.73% |

6.58% |

3.30% |

||

|

Equity Portfolio (after taxes on distributions and the sale of Fund Shares) |

10/1/1997 |

-1.54% |

5.16% |

2.88% |

||

|

WealthBuilder Equity Composite Blended Index (reflects no deduction for fees, expenses, or taxes) |

-1.35% |

8.79% |

6.09% |

|||

|

Russell 3000® Index (reflects no deduction for fees, expenses, or taxes) |

0.48% |

12.18% |

7.35% |

|||

|

MSCI ACWI Index ex USA (Net) (reflects no deduction for fees, expenses, or taxes) |

-5.66% |

1.06% |

2.92% |

|||

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state, local or foreign taxes. Actual after-tax returns depend on an investor's tax situation and may differ from those shown, and after-tax returns shown are not relevant to tax-exempt investors or investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) Plans or Individual Retirement Accounts.

Calendar Year Total Returns for Shares (%) of the Acquiring Fund as of 12/31 each year

|

Highest Quarter: 2nd Quarter 2009 |

+22.95% |

|

|

Lowest Quarter: 4th Quarter 2008 |

-25.88% |

|

Average Annual Total Returns for the Acquiring Fund for the periods ended 12/31/2015 |

||||||

|

|

Inception Date of Share Class |

1 Year |

5 Year |

10 Year |

||

|

Tactical Equity Portfolio (before taxes) |

10/1/1997 |

-2.78% |

6.65% |

4.07% |

||

|

Tactical Equity Portfolio (after taxes on distributions) |

10/1/1997 |

-2.78% |

6.65% |

3.73% |

||

|

Tactical Equity Portfolio (after taxes on distributions and the sale of Fund Shares) |

10/1/1997 |

-1.57% |

5.22% |

3.22% |

||

|

Wealthbuilder Tactical Equity Composite Index (reflects no deduction for fees, expenses, or taxes) |

-1.35% |

8.79% |

6.09% |

|||

|

Russell 3000® Index (reflects no deduction for fees, expenses, or taxes) |

0.48% |

12.18% |

7.35% |

|||

|

MSCI ACWI Index ex USA (Net) (reflects no deduction for fees, expenses, or taxes) |

-5.66% |

1.06% |

2.92% |

|||

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state, local or foreign taxes. Actual after-tax returns depend on an investor's tax situation and may differ from those shown, and after-tax returns shown are not relevant to tax-exempt investors or investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) Plans or Individual Retirement Accounts.

Shareholder Fee and Fund Expense Comparison

This section compares the fees and expenses you pay if you buy, hold, and sell shares of the Target Fund and the Acquiring Fund. For information about the share class of the Acquiring Fund that you will receive in connection with the Merger, please see the section entitled "Share Class Information" above.

The following table entitled "Shareholder Fees" allows you to compare the maximum sales charges of the Funds and includes a Pro Forma column that shows you what the sales charges will be, assuming the Merger takes place. The sales charges for each class of shares of the Target Fund are identical to those of the corresponding class of shares of the Acquiring Fund. The Target Fund shareholders will not pay any front-end or deferred sales charges in connection with the Merger.

You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in the aggregate in specified classes of Wells Fargo Funds. More information about these and other discounts is available in the "Buying, Selling and Exchanging Fund Shares" section of this prospectus/proxy statement and from your financial professional and in the Funds' prospectuses.

The following tables entitled "Annual Fund Operating Expenses" allow you to compare the annual operating expenses of the Funds. The total annual fund operating expenses for both Funds set forth in the following tables are based on the actual expenses incurred for each Fund's most recent fiscal year ended May 31, 2015. The pro forma expense table shows you what the total annual fund operating expenses (before and after waiver) would have been for the Acquiring Fund for the twelve-month period ended November 30, 2015, assuming the Merger had taken place at the beginning of that period.

Shareholder Fees (fees paid directly from your investment)

|

|

|

Target Fund |

|

Acquiring Fund |

|

Pro Forma |

||||

|

Maximum sales charge (load) imposed on purchases (as a percentage of the offering price) |

1.50% |

1.50% |

1.50% |

|||||||

|

Maximum deferred sales charge (load) (as a percentage of offering price) |

None1 |

None1 |

None1 |

| 1 | Investments of $1 million or more are not subject to a front-end sales charge but generally will be subject to a deferred sales charge of 1.00% if redeemed within one year from the date of purchase. |

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

|

Target Fund |

|||||||||||||

|

|

Management Fees |

Distribution (12b-1) Fees |

|

Other Expenses |

|

Acquired Fund Fees and Expenses |

|

Total Annual Fund Operating Expenses1 |

|

Waiver of Fund Expenses |

|

Total Annual Fund Operating Expenses After Fee Waiver2 |

|

|

Single Class |

0.25% |

0.75% |

0.56% |

0.79% |

2.35% |

(0.06)% |

2.29% |

||||||

| 1 | Expenses have been adjusted as necessary from amounts incurred during the Fund's most recent fiscal year to reflect current fees and expenses. |

| 2 | The Manager has contractually committed through September 30, 2016, to waive fees and/or reimburse expenses to the extent necessary to cap the Fund's Total Annual Fund Operating Expenses After Fee Waiver at 1.50% for the Portfolio. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses, and extraordinary expenses are excluded from the cap. After this time, the cap may be increased or the commitment to maintain the cap may be terminated only with the approval of the Board of Trustees. |

|

Acquiring Fund (Pre-Merger) |

|||||||||||||

|

|

Management Fees |

Distribution (12b-1) Fees |

|

Other Expenses |

|

Acquired Fund Fees and Expenses |

|

Total Annual Fund Operating Expenses1 |

|

Waiver of Fund Expenses |

|

Total Annual Fund Operating Expenses After Waiver Fee Waiver2 |

|

|

Single Class |

0.25% |

0.75% |

0.50% |

0.79% |

2.29% |

0.00% |

2.29% |

||||||

| 1 | Expenses have been adjusted as necessary from amounts incurred during the Fund's most recent fiscal year to reflect current fees and expenses. |

| 2 | The Manager has contractually committed through September 30, 2016, to waive fees and/or reimburse expenses to the extent necessary to cap the Fund's Total Annual Fund Operating Expenses After Fee Waiver at 1.50% for the Portfolio. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses, and extraordinary expenses are excluded from the cap. After this time, the cap may be increased or the commitment to maintain the cap may be terminated only with the approval of the Board of Trustees. |

|

Acquiring Fund (Pro Forma) |

|

|

||||||||||||

|

|

Management Fees |

|

Distribution (12b-1) Fees |

|

Other Expenses |

|

Acquired Fund Fees and Expenses |

|

Total Annual Fund Operating Expenses1 |

|

Waiver of Fund Expenses |

|

Total Annual Fund Operating Expenses After Fee Waiver2 |

|

|

Single Class |

0.25% |

0.75% |

0.49% |

0.76% |

2.25% |

0.00% |

2.25% |

|||||||

| 1 | Expenses have been adjusted as necessary from amounts incurred during the Fund's most recent fiscal year to reflect current fees and expenses. |

| 2 | The Manager has contractually committed through September 30, 2017, to waive fees and/or reimburse expenses to the extent necessary to cap the Fund's Total Annual Fund Operating Expenses After Fee Waiver at 1.50% for the Portfolio. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses, and extraordinary expenses are excluded from the cap. After this time, the cap may be increased or the commitment to maintain the cap may be terminated only with the approval of the Board of Trustees. |

Examples of Fund Expenses

The examples below are intended to help you compare the costs of investing in the Target Fund with the costs of investing in the Acquiring Fund, both before and after the Merger, and are for illustration only. The example assumes a $10,000 initial investment, 5% annual total return, and that operating expenses remain the same as in the tables above. To the extent that the Manager is waiving fees or reimbursing expenses, the example assumes that such waiver or reimbursement will only be in place through the date noted above. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

Target Fund |

||

|

|

|

|

|

After: |

||

|

1 Year |

$379 |

|

|

3 Years |

$867 |

|

|

5 Years |

$1,381 |

|

|

10 Years |

$2,791 |

|

|

Acquiring Fund (Pre-Merger) |

||

|

|

|

|

|

After: |

||

|

1 Year |

$379 |

|

|

3 Years |

$855 |

|

|

5 Years |

$1,357 |

|

|

10 Years |

$2,736 |

|

|

Acquiring Fund (Pro Forma) |

||

|

|

|

|

|

After: |

||

|

1 Year |

$375 |

|

|

3 Years |

$843 |

|

|

5 Years |

$1,337 |

|

|

10 Years |

$2,696 |

|

The Target Fund and Acquiring Fund have each adopted a distribution plan pursuant to Rule 12b-1 under the 1940 Act (a "Distribution Plan"). Under each Distribution Plan, a Fund charges an annual fee of 0.75%. Each Fund also has a shareholder servicing fee of up to 0.25%.

Portfolio Turnover. The Target Fund and Acquiring Fund pay transaction costs, such as commissions or dealer mark-ups, when each Fund buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in the annual fund operating expenses or in the example, affect each Fund's performance. During the most recent fiscal year, the Target Fund's portfolio turnover rate was 24% of the average value of its portfolio and the Acquiring Fund's portfolio turnover rate was 27% of the average value of its portfolio.

Fund Management Information

The following table identifies the manager, sub-adviser and portfolio manager(s) for the Acquiring Fund. Following completion of the Merger, Wells Capital Managment Incorporated ("Wells Capital Managment") will serve as sub-adviser to the Acquiring Fund. Further information about the management of the Acquiring Fund can be found under the section entitled "Management of the Fund."

|

Wells Fargo WealthBuilder Tactical Equity Portfolio |

||

|

Adviser |

Wells Fargo Funds Management, LLC |

|

|

Sub-adviser |

Wells Capital Management Incorporated |

|

|

Portfolio Manager, Title/Managed Since |

Kandarp R. Acharya, CFA, FRM, Portfolio Manager / 2013 |

|

Tax Information

It is expected that the Merger will qualify as a tax-free "reorganization" for U.S. federal income tax purposes. A receipt

of an opinion substantially to that effect from Pepper Hamilton LLP, tax counsel to the Acquiring Fund, is a condition to

the obligation of the Funds to consummate the Merger. As a tax-free reorganization, the Merger will not be taxable to the

Acquiring Fund, the Target Fund or their shareholders for U.S. federal income tax purposes. Even though the Merger is expected

to be tax-free, because the Merger will end the tax year of the Target Fund, the Merger may accelerate taxable distributions

from the Target Fund to its shareholders.

The cost basis and holding period of the Target Fund shares will carry over to the shares of the Acquiring Fund you receive

as a result of the Merger, in each case for U.S. federal income tax purposes. At any time prior to the consummation of the

Merger, a shareholder may redeem shares, usually resulting in recognition of a gain or loss for U.S. federal income tax purposes

to the redeeming shareholder if the shareholder holds the shares in a taxable account.

It is not anticipated that a substantial portion of the securities held by the Target Fund will be disposed of in connection

with the Merger to align the securities portfolio of the Target Fund with the securities portfolio of the Acquiring Fund.

Any realignment could result in additional portfolio transaction costs to the Target Fund and increased taxable distributions

to shareholders of the Target Fund. The actual tax impact of such sales will depend on the difference between the price at

which such portfolio assets are sold and the Target Fund's basis in such assets. Any net realized capital gain from sales

that occur prior to the Merger will be distributed to the Target Fund's shareholders as capital gain distributions (to the

extent of the excess of net long-term capital gain over net short-term capital loss) and/or ordinary dividends (to the extent

of the excess of net short-term capital gain over net long-term capital loss) during or with respect to the year of sale (after

reduction by any available capital loss carryforwards), and such distributions will be taxable to shareholders. This portfolio

turnover would be in addition to the portfolio turnover that would be experienced by the Acquiring Fund following the Merger

in connection with its normal investment operations. As of December 31, 2015, the Target Fund had net unrealized gains of

$16.7 million.

For net capital losses realized in taxable years beginning before January 1, 2011, U.S. federal income tax law permits RICs to carry forward a net capital loss to offset its capital gain, if any, realized during the eight years following the year of the loss. For net capital losses realized in taxable years beginning on or after January 1, 2011, a Fund is permitted to carry forward a net capital loss to offset its capital gain indefinitely. The Target Fund may be presently entitled to significant net capital loss carryforwards for U.S. federal income tax purposes, as detailed in "Material U.S. Federal Income Tax Consequences of the Mergers." The Merger will cause the tax year of the Target Fund to close, which may result in an earlier expiration of net capital loss carryforwards than would otherwise occur.

Certain other U.S. federal income tax consequences are discussed below under "Material U.S. Federal Income Tax Consequences of the Mergers."

WELLS FARGO HIGH INCOME FUND INTO WELLS FARGO HIGH YIELD BOND FUND

Share Class Information

The following table illustrates the share class of the Acquiring Fund you will receive as a result of the Merger in exchange for your Target Fund shares.

|

If you own this class of shares of the Target Fund: |

You will get this class of shares of the Acquiring Fund: |

||||

|

Class A |

Class A |

||||

|

Class B |

Class B |

||||

|

Class C |

Class C |

||||

|

Administrator Class |

Administrator Class |

||||

|

Institutional Class |

Institutional Class |

||||

The Acquiring Fund shares you will receive as a result of the Merger will have the same total value as the total value of

your Target Fund shares as of the close of business on the business day immediately prior to the Merger.

The procedures for buying, selling and exchanging shares of the Funds are identical. For additional information see the section

entitled "Buying, Selling and Exchanging Fund Shares." Additional information on how you can buy, sell or exchange shares

of each Fund is available in the Fund's prospectuses and SAI.

Investment Objective and Strategy Comparison

The following section compares the investment objectives, principal investment strategies and fundamental investment policies of the Funds. The investment objectives of the Funds may be changed without shareholder approval.